- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to AmEx Platinum Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When does the AmEx Platinum travel insurance kick in?

Amex platinum travel insurance benefits and limits, how to make an amex travel insurance claim, what if the card’s insurance benefits are insufficient, the platinum card® from american express travel insurance, recapped.

Travel insurance can provide peace of mind when you’re away from home, especially when you’ve spent significant money on your vacation. Although you can choose to buy a separate travel insurance policy, not everyone wants or needs to do so.

Many travel credit cards offer complimentary insurance for a variety of occurrences. The Platinum Card® from American Express offers travel insurance with a suite of benefits for eligible travelers, including coverage for trip interruption, rental car damage and lost luggage.

Let’s take a look at travel insurance on The Platinum Card® from American Express , its limits and the benefits it provides.

» Learn more: What is travel insurance?

So, does The Platinum Card® from American Express have travel insurance? The short answer to this is yes, but you’ll need to meet specific requirements for it to apply.

To get coverage from your card, you’ll need to use it to pay for your trip in its entirety. This is true whether you’re looking to utilize the trip insurance or the rental car insurance — you must pay for the full cost with The Platinum Card® from American Express .

Be aware of coverage limitations if you’re traveling using points or miles. While it’s possible to receive benefits when using your card to pay the taxes and fees on a reward redemption, coverage may not always apply.

You may still be covered for trip interruption, delay, and cancellation insurance when using points or frequent flyer miles.

However, rental car and baggage insurance only apply when you’ve used your card to pay for the full cost of whatever you’re buying — no points allowed. The exception is if you redeem American Express Membership Rewards to pay for some or all of the booking.

» Learn more: How does credit card travel insurance work?

We’ve included a breakdown of all the insurance benefits and other travel protections provided by The Platinum Card® from American Express .

Trip cancellation protection

The trip cancellation insurance you’ll receive will pay for any nonrefundable losses you incur due to a covered event.

Given the current climate, you may also be wondering: does The Platinum Card® from American Express travel insurance cover COVID? It can, depending on the reason you need to cancel. Covered events include quarantine imposed by a physician or illness for you, your family members or a traveling companion.

Other eligible events include a change in military orders, inclement weather or jury duty.

If you need to cancel your trip, AmEx will provide up to $10,000 per trip and a maximum of $20,000 every 12 months. Terms apply.

» Learn more: The guide to American Express travel insurance

Trip interruption coverage

As with trip cancellation protection, trip interruption insurance will reimburse you for nonrefundable losses by a covered event.

If your trip is interrupted, American Express will cover you for prepaid land, air and sea travel bookings you’ve missed. They’ll also pay for the cost of an economy-class ticket on the most direct route to rejoin your covered trip (or take you home).

The maximum benefit you’ll receive is $10,000 per trip and up to $20,000 every 12 months. Terms apply.

Trip delay insurance

As it sounds, trip delay insurance will reimburse you for expenses incurred when your trip doesn’t go as scheduled. In the case of The Platinum Card® from American Express , coverage kicks in after you’ve been delayed by at least six hours for a covered reason.

Covered purchases may include food, toiletries, lodging, medication and other personal use items. You’ll be reimbursed for up to $500 on a covered trip and can make two claims within a 12-month period. Terms apply.

Rental car insurance

The Platinum Card® from American Express provides secondary rental car insurance . This means it’ll kick in after other claims — like those made to your personal insurance — have been paid. To activate coverage, you’ll need to decline the insurance offered by the rental car company.

AmEx will provide up to $75,000 due to damage or theft of the rental vehicle, but be aware that the policy doesn’t provide liability insurance.

It’ll also give you up to $1,000 per person (max of $2,000) for personal property lost in the incident and up to $5,000 for accidental injury. Finally, you’ll receive up to $300,000 for accidental death or dismemberment, though the rates will vary depending on the severity of your injuries.

This rental car insurance is valid worldwide with a few notable exceptions, including Australia, Italy and New Zealand. Terms apply.

» Learn more: Credit cards that provide travel insurance

Baggage coverage

Cardholders and their families are eligible for baggage insurance provided they’ve paid for the fare using The Platinum Card® from American Express . This benefit is only for lost baggage; delayed luggage is not protected.

Coverage limits vary depending on whether you’ve checked your bag or carried it on:

Checked bags: Up to $2,000 per person.

Carry-on: Up to $3,000 per person.

Note also that checked baggage is only covered when you’re actually traveling with a common carrier. Meanwhile, carry-on luggage is also covered when traveling to and from or waiting at the terminal.

There are also specific limits for high-risk items such as jewelry and electronic equipment. For these items, you’ll receive a maximum of $1,000 per person per trip. Terms apply.

» Learn more: Baggage insurance explained

Premium Global Assist

What else does The Platinum Card® from American Express travel insurance cover? Although this last benefit isn’t technically a type of travel insurance, it’s worth including as it can offer help while you travel.

AmEx’s Premium Global Assist hotline is a 24/7 service that can assist you in various ways, such as helping you get a new passport, finding translation services and even arranging for emergency medical evacuation.

Although using Premium Global Assist is free, the services that you may end up using are not necessarily covered by AmEx.

There are exceptions to this — if you need repatriation of mortal remains, emergency medical evacuation or if a child under 16 is left without care, AmEx will provide aid at no additional cost. Terms apply.

To file a claim, you’ll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you’re using:

Trip cancellation, interruption or delay insurance: Within 60 days, call 844-933-0648.

Baggage insurance: Within 30 days, call 800-228-6855 or online .

Rental car insurance: Within 30 days, call 800-338-1670 or online .

» Learn more: The guide to AmEx Platinum rental car benefits

If The Platinum Card® from American Express travel insurance doesn’t seem like it’ll be enough for your trip, or if its coverage doesn’t include features that you’d like to have, consider purchasing a separate travel insurance policy before you travel.

Several companies allow you to compare various policies for any vacation and modify inclusions as you shop.

» Learn more: How much is travel insurance?

The travel insurance offered by The Platinum Card® from American Express includes some pretty generous benefits for travelers, especially since it’s complimentary (the $695 annual fee notwithstanding). Terms apply.

If you want to take advantage of this insurance, pay for your trip using your AmEx card and double-check any other stated requirements before heading out to ensure coverage.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Your guide to Amex's travel insurance coverage

Update : Some offers mentioned below are no longer available. View the current offers here .

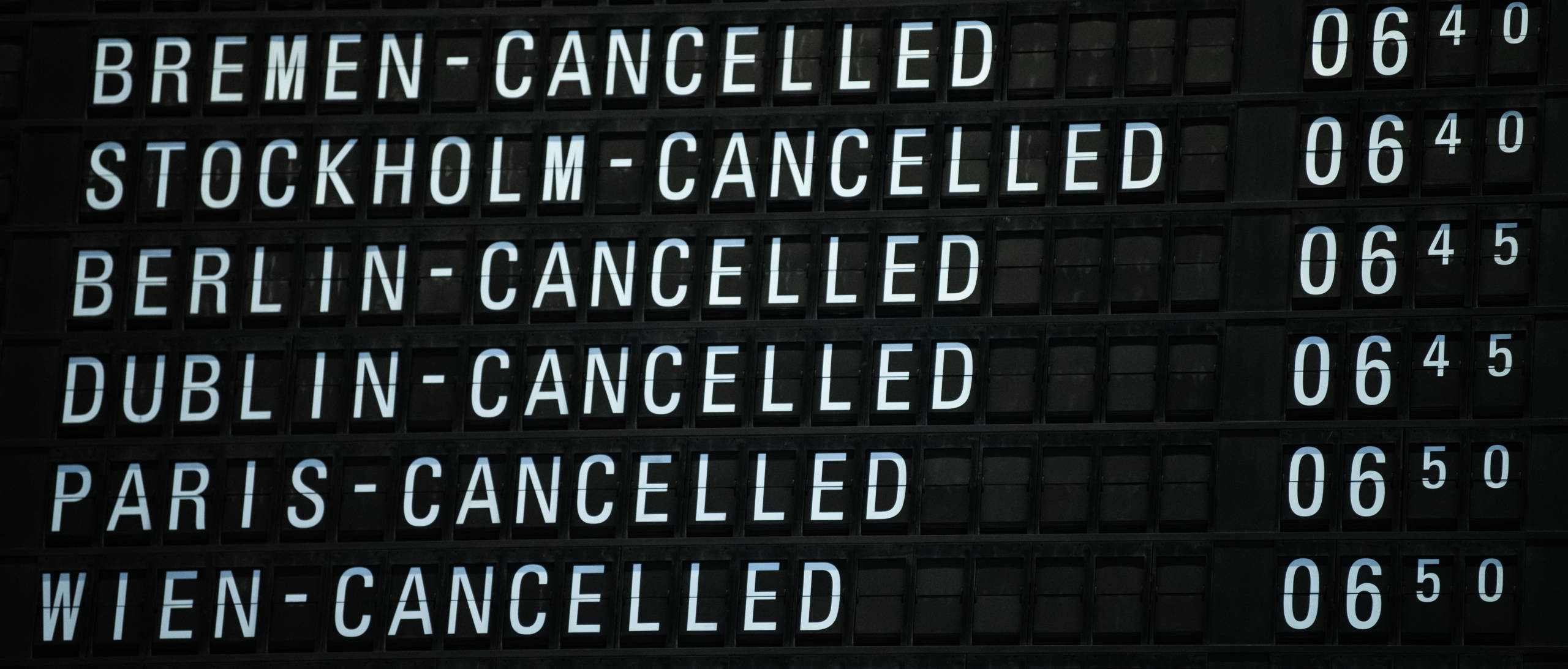

American Express premium credit cards offer some of the best perks in the credit card space. While lounge access and travel credits are typically the highlights of these cards, some of the lesser-known benefits, such as trip delay reimbursement and trip cancellation and interruption insurance, are becoming hot topics as the coronavirus pandemic continues to impact the travel industry.

Want more credit card news and advice from TPG? Sign up for our daily newsletter!

As a result, many TPG readers have sent in questions about Amex's travel insurance protections. As travel restrictions change, policies and best practices will likely change as well. But this guide will walk you through which Amex credit cards have these benefits, what's currently covered and how you can file a successful claim.

Related: Best credit cards for trip cancellation and interruption insurance

Amex cards offering trip delay, cancellation or interruption insurance

Here is an overview of the Amex cards that offer trip delay reimbursement, trip cancellation/interruption insurance or both:

The information for the Hilton Aspire Amex card and American Express Corporate Platinum Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: The best credit cards with travel insurance

What is covered by trip cancellation and interruption insurance?

You can find the full terms and conditions of what is generally covered on your respective card in your Guide to Benefits, which can be found through your online account. I'll use the Delta SkyMiles® Reserve as an example.

Here is a rundown of the "covered losses" provided by Amex's trip cancellation and interruption insurance:

- Accidental bodily injury or loss of life or sickness of either the eligible traveler, traveling companion or a family member of the eligible traveler or traveling companion

- Inclement weather, which prevents a reasonable and prudent person from traveling or continuing on a covered trip

- The eligible traveler or his or her spouse's change in military orders

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts, either of which cannot be postponed or waived

- The eligible traveler or traveling companion's dwelling made uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Book carefully if you have multiple Amex cards that offer travel protections

Amex also provides an extensive list of things that are not covered by trip cancellation/interruption insurance:

- Pre-existing conditions

- The eligible traveler's suicide, attempted suicide or intentionally self-inflicted injury

- A declared or undeclared war

- Mental or emotional disorders, unless hospitalized

- The eligible traveler's participation in a sporting activity for which he or she receives a salary or prize money

- The eligible traveler's being intoxicated at the time of an accident. Intoxication is defined by the laws of the jurisdiction where such accident occurs

- The eligible traveler being under the influence of any narcotic or other controlled substance at the time of an accident, unless the narcotic or other controlled substance is taken and used as prescribed by a Physician

- The eligible traveler's commission or attempted commission of any illegal or criminal act, including but not limited to any felony

- The eligible traveler parachuting from an aircraft

- The eligible traveler engaging or participating in a motorized vehicular race or speed contest

- Dental treatment except as a result of accidental bodily injury to sound, natural teeth

- Any non-emergency treatment or surgery, routine physical examinations

- Hearing aids, eyeglasses or contact lenses

- One-way travel that does not have a return destination

- A counterfeit scheduled airline or train ticket; or a scheduled airline or train ticket which is charged to a fraudulently issued or fraudulently used eligible card.

- Any occurrence while the eligible traveler is incarcerated

- Loss due to intentional acts by the eligible traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

- Any expenses that are not authorized and reimbursable by the eligible traveler's employer if the eligible traveler makes the purchases with a commercial card

If you do find yourself canceling or cutting a covered trip short, here are the basic guidelines provided by Amex on what types of expenses are covered for trip cancellation/interruption:

"If a Covered Loss causes an Eligible Traveler's Trip Interruption, we will reimburse you for the nonrefundable amount paid to a Travel Supplier with your Eligible Card for the following: 1. The forfeited, non-refundable, pre-paid land, air and sea transportation arrangements that were missed; and 2. Additional transportation expenses that the Eligible Traveler incurs less any available refunds, not to exceed the cost of an economy-class air ticket by the most direct route for the Eligible Traveler to rejoin his or her places of origin.

If a Covered Loss causes an Eligible Traveler to temporarily postpone transportation by Common Carrier for a Covered Trip and a new departure date is set, we will reimburse you for the following: 1. The additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled Covered Trip by the most direct route); and 2. The unused, non-refundable land, air, and sea arrangements paid to a Travel Supplier with your Eligible Card."

What is covered by trip delay insurance?

Trip delay coverage provides reimbursement for reasonable additional expenses incurred when your trip is delayed due to a covered hazard for more than six hours.

Coverage is limited to $500 per trip and cardmembers are only eligible for two claims each 12 consecutive month period.

Amex outlines what is not covered, which includes the following:

- Covered losses that are made public or known to the eligible traveler prior to the departure for the covered trip

- An eligible traveler's expenses paid prior to the covered trip

Filing a claim

When you have a delay or trip cancellation/interruption that you think qualifies for coverage, you can file a claim by calling Amex at 1-844-933-0648 within 60 days of the covered loss.

Trip delay reimbursement requires the following documentation:

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss

- Receipts - Acceptable documentation includes the following:

- A statement from the common carrier that the covered trip was delayed

- Charge receipt

- Copies of common carrier ticket(s)

- Receipts for travel expenses

Trip cancellation/interruption insurance requires slightly different documentation.

- Proof of loss – You must furnish written proof of loss to Amex within 180 days after the date of your loss. Acceptable documentation includes:

- Court subpoenas, orders to report for active duty, physician orders, etc.

- Copies of your common carrier tickets and travel supplier receipt

- Your eligible card billing statement showing the charges for the covered trip

- Copy of travel supplier's cancelation policy

After Amex receives notice of your claim, instructions will be sent on how to send the proof. Typically, you have up to 180 days to file a claim after a delay or cancellation.

Proof of flight delay or cancellation

One of the documents required to file for trip delay reimbursement is a verification form that outlines the reason for the delay or cancellation by the carrier. You can typically get this at the airport when the delay or cancellation is announced, but keep in mind that it may require a supervisor. Each U.S. major airline also has a process for requesting this information after the fact.

Here is an overview of the process that major U.S. airlines require for you to receive a delay or cancellation verification form:

Amex cards that offer car rental insurance

Unfortunately, no American Express credit cards offer primary car rental coverage, although most offer secondary coverage. You can see the entire list of cards that offer secondary car rental protection on the American Express website . However, all American Express credit cards offer an optional "Premium Car Rental Protection policy" that can be added to rentals made using the card for a small fee.

Read our guide on when to use American Express' Premium Car Rental Protection for more details on this coverage option.

You can add Premium Car Rental Protection to any American Express card . TPG has a guide of the best American Express cards , but here are some of the best cards in terms of the return you could receive when renting a car. Note, the estimated return rate for these cards is based on TPG's latest valuations:

- Hilton Honors American Express Aspire Card: $450 annual fee (see rates and fees); 4.2% return on car rentals booked directly from car rental companies; no foreign transaction fees (see rates and fees)

- The Blue Business® Plus Credit Card from American Express: $0 annual fee (see rates and fees); 4% return on general spending on the first $50,000 in purchases per calendar year and 1x thereafter; 2.7% foreign transaction fee (see rates and fees)

- The Amex EveryDay® Preferred Credit Card from American Express: $95 annual fee; 3% return on general spending in billing cycles where you make 30+ purchases; 2.7% foreign transaction fee

The information for the Amex EveryDay Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer baggage insurance

If you're a frequent traveler, you've likely run into this situation at some point (it's the worst). Over the years, airlines have been working on improving the baggage system by introducing live bag tracking. Regardless, it's still a smart idea to have some protections in place, like baggage insurance.

Related: Everything you need to know about Amex's baggage insurance plan

This is why you need to pay attention to the benefits each of your travel rewards cards offers. Nearly all of Amex's premium rewards cards offer baggage insurance. You can check out the full list of cards and details on American Express's website.

The types of losses it covers: You're covered for losses resulting from damaged, stolen or lost baggage, including both carry-on and checked bags.

When you're covered: To be eligible for coverage, you have to travel on a common carrier, which Amex defines as any air, land or water vehicle (other than a personal or rental vehicle) that is licensed to carry passengers for hire and available to the public. Your rental car, as well as taxis and ride-share services such as Uber and Lyft, would be excluded from this protection.

To receive coverage, you also need to pay for the entire fare with an eligible American Express card or by using Membership Rewards points to book tickets through Amex Travel . Trips booked with miles from other sources — even the cobranded Delta SkyMiles cards from Amex — are excluded. Your trip also isn't covered if you used a combination of miles and dollars unless the miles came from a Membership Rewards transfer. This is a welcome change. A few years ago, a TPG staffer found out the hard way that Amex's policy didn't cover frequent flyer mile awards.

Who's covered: This policy covers both primary and additional cardholders, as well as cardmembers' spouses or domestic partners and any dependent children under 23 years old. In addition, travelers must be permanent residents of one of the 50 states, Washington, D.C., Puerto Rico and the U.S. Virgin Islands.

How much it covers: Most American Express credit cards will cover replacement costs for checked bags and their contents up to $500 per person, although so-called "high-risk items" are only covered for a maximum of $250. These items include jewelry, sporting equipment, photographic or electronic equipment, computers and audio/visual equipment. Carry-on bags are covered for up to $1,250, which is good to know since your belongings could be stolen from the overhead bins.

You'll enjoy additional coverage if you use The Platinum Card from American Express, The Business Platinum Card from American Express, the Platinum Card from American Express Exclusively for Mercedes-Benz and Morgan Stanley-branded Platinum Card (but not the Delta SkyMiles® Platinum American Express Card).

The information for the Amex Platinum Mercedes-Benz and Morgan Stanley Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex cards that offer medical assistance

One of the lesser known benefits of some of Amex's most premium cards is its Premium Global Assistance. This benefit can quite literally be a lifesaver if you or an immediate family member run into any unexpected issues or accident on your trip. For example, this service can help you arrange emergency medical referrals.

All Amex cards have access to Amex's Global Assist Hotline, but the Premium Global Assist Hotline and higher level of coverage are reserved exclusively for the Amex's premium cards:

- The Platinum Card from American Express

- The Business Platinum Card from American Express

- American Express Corporate Platinum Card

- Hilton Honors Aspire Card from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Marriott Bonvoy Brilliant® American Express® Card

- American Express Centurion Card

- American Express Business Centurion Card

The information for the Amex Centurion and Amex Business Centurion cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Having a card with trip insurance can save you hundreds of dollars when unexpected hiccups happen in your travel plans. Still, it can be confusing to know what is covered and the right documentation you need to file a claim.

Nothing is worse than getting through an entire claims process only to be denied or have to start over because you don't have the required documentation for the insurance provider. Before you start filing a claim, make sure you have the documents listed above. Keep in mind that a provider may ask for additional documentation related to the incident, so you may have to collect receipts and other forms to help your case.

If you're starting to travel again, it's also a good idea to consider booking refundable travel . Some airlines and hotels even waive cancelation fees and/or change fees for certain fares, which can make last-minute adjustments in the case of emergencies.

Additional reporting by Stella Shon and Madison Blancaflor.

For rates and fees of the Amex Platinum card, please click here. For rates and fees of the Amex Gold card, please click here. For rates and fees of the Amex Business Gold card, please click here. For rates and fees of the Amex Green card, please click here. For rates and fees of the Hilton Aspire card, please click here. For rates and fees of the Amex Blue Business Plus card, click here. For rates and fees of the Marriott Bonvoy Brilliant card, click here. For rates and fees of the Delta SkyMiles Reserve card, please click here. For rates and fees of the Delta SkyMiles Reserve Business card, please click here. For rates and fees of the Delta SkyMiles Platinum card, please click here. For rates and fees of the Amex Business Platinum card, click here.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Why the Amex Platinum Is the Only Card I’ll Use To Book Flights

Carissa Rawson

Senior Content Contributor

263 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Stella Shon

News Managing Editor

92 Published Articles 648 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

The amex platinum card earns me the most points, the amex platinum card has excellent travel insurance, amex’s global lounge collection is industry-leading, amex points are my favorite flexible currency, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Although I’m not technically a digital nomad, I fly enough to qualify as one.

With trips taking me on roughly 100 flights per year, I’ve done a lot of research when it comes to booking airfare.

Though I have plenty of credit cards to spare, The Platinum Card ® from American Express always finds its way to the front when it comes time to pay — here’s why.

There are plenty of credit cards that earn bonus points on travel , and especially airfare. However, the Amex Platinum card personally beats out others, despite its $695 annual fee ( rates & fees ).

This is because it earns 5x American Express Membership Rewards points per $1 spent (up to $500,000 per year) on flights booked directly with the airline or via AmexTravel.com .

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

If you travel often, you know that booking with a third party , such as Expedia, Priceline, Orbitz, or even an issuer’s travel portal, can save you some money. But it can also lead to huge amounts of headache s if your flight needs to be changed or canceled or if there are crazy delays and you need to be rerouted.

This is because booking through a third-party agency makes them responsible for your ticket rather than the airline, so they need to be the middleman.

Compare the Amex Platinum card’s earning rates to other premium travel rewards cards :

- Chase Sapphire Reserve ® : 5x points per $1 spent on Chase Travel; 3x points on all other travel purchases

- Capital One Venture X Rewards Credit Card : 5x miles per $1 spent on airfare booked with Capital One Travel,

In order to earn these elevated rewards, you’ll need to book your flights with either issuer’s travel portal, which means you’ll be using a third party. That opens you up to issues in the event your travel plans change, which mine often do.

While the Amex Platinum card does have a limit on your 5x earnings up to $500,000 annually, I’ve never even come close to hitting the cap. This means that I’m always able to book directly with the airline while still earning the most rewards.

I’ll admit that I’m not the biggest proponent of travel insurance . I know that it’ll protect you if you get injured, lose your bags, or have travel delays, but purchasing a policy goes against my “spend as little as possible” ethos when it comes to travel.

That’s another reason why I love the Amex Platinum card and use it for my flights. As a premium travel card, it offers complimentary travel insurance . For it to kick in, I need to pay for my travel with my card and it will apply in eligible scenarios.

What kind of travel insurance is offered? A lot:

- Rental car insurance (secondary)

- Trip cancellation and interruption insurance

- Trip delay insurance

- Baggage insurance plan

- Premium Global Assist Hotline (emergency medical evacuation and emergency medical transport)

There are two things that really stand out when it comes to the Amex Platinum card’s travel insurance: emergency medical evacuation and emergency medical transport as part of the Premium Global Assist Hotline. Neither of these has a cap, which isn’t something you’ll find often, even when purchasing a policy.

There is only one exception where I’ll use a card other than the Amex Platinum card to pay for my flights, and that’s when I’ve booked an award flight.

This is because Amex has limitations on its baggage insurance plan for award flights, whereas competitors, such as the travel insurance on the Chase Sapphire Reserve card , do not. In this case, the Amex Platinum card won’t cover lost luggage unless you’ve paid the ticket in cash or you’ve used Amex Membership points for your flight. Other award flights outside of this don’t count :

“Other loyalty programs (i.e. non-American Express) do not qualify on purchases redeemed in part or full or pre-arranged travel cost,” according to the terms of baggage insurance plan on the Amex Platinum card. “An example would be common carrier frequent flyer miles point redemption.”

I’m not a snob about a lot of things, but airport lounge access is certainly one of them. I know that as more credit cards offer lounge access, they can be crowded.

That’s one reason I value the Global Lounge Collection offered by Amex’s high-end cards.

This collection includes a Priority Pass Select membership (upon enrollment), Centurion Lounges, Escape — The Centurion Studio lounges, Plaza Premium lounges, Lufthansa lounges (when flying Lufthansa), Delta SkyClubs (when flying Delta), and more.

That’s far more than you’ll get with other credit cards and lessens the chance that you’ll find yourself in a standing-room-only situation.

This is probably not the most popular opinion, but I think Amex Membership Rewards beat out Chase Ultimate Rewards , Capital One Miles , Citi ThankYou points , and Bilt Rewards .

While each currency has their own strengths and weaknesses, Amex points fit my travel style better than the others. Sure, I love that Chase has World of Hyatt (and it’s where I use my points most often) and that Citi transfer to Choice at double Amex’s rate, but Amex has more usable transfer partners .

I’ll be even more unpopular and say that I’ll often transfer Amex points over to Hilton Honors at a 1:2 ratio, especially when they’re offering a transfer bonus . This isn’t usually a good idea, but I spend my Hilton points at high-end resorts such as the Conrad Maldives and the Conrad Bora Bora , where I can easily net 5-10 cents in value per point. That makes it worth it for me.

Other transfer partners that I frequently use include:

- ANA MileageClub : For low-cost business class flights to Europe

- Avianca LifeMiles : For Lufthansa first class

- Virgin Atlantic Flying Club : For first and business class redemptions on ANA

- Qantas Frequent Flyer : For cheap Air Tahiti Nui flights to French Polynesia

Beyond transfer partners and the Amex Platinum card, I also find Amex points easier to earn . This is due to a variety of reasons, including their robust lineup of Amex point-earning cards , Amex Offers (upon enrollment), and their Rakuten partnership.

I’m not going to throw out all my other credit cards in favor of the Amex Platinum card — I love points and miles too much ever to let that happen. But there’s certainly a strong case for it sticking around in my wallet.

Sure, it offers lots of statement credits (enrollment required for some benefits) and other perks. But I’ll keep the Amex Platinum card to book my airfare. And it’ll stay that way until someone else can match the high earnings and travel insurance offerings, which I don’t anticipate happening anytime soon.

For the car rental loss and damage insurance benefit of the Amex Platinum card, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip delay insurance benefit of the Amex Platinum card, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the baggage insurance plan benefit of the Amex Platinum card, eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the premium global assist hotline benefit of the Amex Platinum card, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Was this page helpful?

About Carissa Rawson

Carissa served in the U.S. Air Force where she developed her love for travel and new cultures. She started her own blog and eventually joined The Points Guy. Since then, she’s contributed to Business Insider, Forbes, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Bahasa Indonesia

- Eastern Europe

- Moscow Oblast

Elektrostal

Elektrostal Localisation : Country Russia , Oblast Moscow Oblast . Available Information : Geographical coordinates , Population, Area, Altitude, Weather and Hotel . Nearby cities and villages : Noginsk , Pavlovsky Posad and Staraya Kupavna .

Information

Find all the information of Elektrostal or click on the section of your choice in the left menu.

- Update data

Elektrostal Demography

Information on the people and the population of Elektrostal.

Elektrostal Geography

Geographic Information regarding City of Elektrostal .

Elektrostal Distance

Distance (in kilometers) between Elektrostal and the biggest cities of Russia.

Elektrostal Map

Locate simply the city of Elektrostal through the card, map and satellite image of the city.

Elektrostal Nearby cities and villages

Elektrostal weather.

Weather forecast for the next coming days and current time of Elektrostal.

Elektrostal Sunrise and sunset

Find below the times of sunrise and sunset calculated 7 days to Elektrostal.

Elektrostal Hotel

Our team has selected for you a list of hotel in Elektrostal classified by value for money. Book your hotel room at the best price.

Elektrostal Nearby

Below is a list of activities and point of interest in Elektrostal and its surroundings.

Elektrostal Page

- Information /Russian-Federation--Moscow-Oblast--Elektrostal#info

- Demography /Russian-Federation--Moscow-Oblast--Elektrostal#demo

- Geography /Russian-Federation--Moscow-Oblast--Elektrostal#geo

- Distance /Russian-Federation--Moscow-Oblast--Elektrostal#dist1

- Map /Russian-Federation--Moscow-Oblast--Elektrostal#map

- Nearby cities and villages /Russian-Federation--Moscow-Oblast--Elektrostal#dist2

- Weather /Russian-Federation--Moscow-Oblast--Elektrostal#weather

- Sunrise and sunset /Russian-Federation--Moscow-Oblast--Elektrostal#sun

- Hotel /Russian-Federation--Moscow-Oblast--Elektrostal#hotel

- Nearby /Russian-Federation--Moscow-Oblast--Elektrostal#around

- Page /Russian-Federation--Moscow-Oblast--Elektrostal#page

- Terms of Use

- Copyright © 2024 DB-City - All rights reserved

- Change Ad Consent Do not sell my data

IMAGES

VIDEO

COMMENTS

When you book and pay for your travel with your American Express Card, you'll get domestic and overseas Travel Insurance 1 - covering from lost baggage to emergency medical expenses. ... David Jones American Express Platinum Card Insurance: The insurance on American Express Cards is subject to terms, conditions and exclusions (such as ...

With the David Jones American Express Platinum Card you get access to a range of complimentary insurance including: Travel Insurance 8 when booking a trip with your Card. To be eligible, you must be an Australian resident, be 79 years of age or younger when making your qualifying travel purchase and your trip must commence and end in Australia.

David Jones American Express Platinum Card. Even more rewarding. Unlock a world of unique experiences and benefits. APPLY NOW. Enjoy 30,000 Membership Reward Points 6. ... Complimentary Travel Insurance 13: Card Purchase Cover 13 (Protecting goods for 90 days if they are lost or stolen)

the David Jones American Express Platinum Card Account in Australia Activation of buyer's advantage cover: Cover is effective when You purchase Eligible Products on the David Jones American Express Platinum Card Account in Australia. Important: Additional Card Members are not covered for Travel Insurance benefi ts (see table adjacent).

For the trip cancellation and interruption insurance coverage benefit of The Platinum Card® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card.

David Jones American Express Platinum Card Members get access to complimentary international travel insurance 8, when booking a trip with your Card. To be eligible, you must be an Australian resident, be 79 years of age or younger when making your qualifying travel purchase and your trip must commence and end in Australia 8 .

The annual fee. The David Jones American Express Card has an annual fee of $ 99 and includes all of our standard benefits. The David Jones American Express Platinum Card has an annual fee of $ 295 and includes all the benefits of the David Jones American Express Card, plus a range of premium extras such as more points 2 for your spend at David ...

• Pregnancy & Travel Insurance Benefits 3 • Exclusions Within This Policy 3 • Age Limits •4 • Excluded Sports And Activities 4 ... David Jones American Express Platinum Card. About this Policy This Policy sets out important information about the insurance benefits available to Card Members, Additional Card Members, their Spouses ...

On American Express's Website. ¹The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month ...

The David Jones American Express Platinum Card has an annual fee of $ 295 and includes all the benefits of the David Jones American Express Card, plus a range of premium extras such as more points 2 for your spend at David Jones, added complimentary benefits such as Complimentary Travel Insurance 8.

How to make an AmEx travel insurance claim. To file a claim, you'll need to contact your benefit administrator. The phone number and timeframe will vary according to the type of insurance you ...

David Jones Platinum American Express credit card: key facts. Grade/tier: Platinum; Card type: American Express; Loyalty program: Qantas Frequent Flyer or David Jones Membership Rewards (DJMR) Qantas Points earned per dollar (Qantas Frequent Flyer option): Purchases at David Jones: 3 Major supermarkets and petrol stations: 2.25 Everywhere else ...

Rewards. Coverage. The Platinum Card® from American Express. $695 (see rates & fees) 5x on flights booked directly or with Amex Travel (on up to $500,000 per calendar year), 5x on hotels booked through Amex Travel. Terms apply. Trip cancellation, interruption and delay Insurance.

The new insurance Terms and Conditions on your David Jones American Express Card will replace your previous Terms and Conditions document. The new Terms and Conditions will apply to all claim events occurring on or after 15 March 2022. Summary Only. Information on this page is a summary of the key changes.

Interest rates, fees and charges apply. You must be over 18 years to apply. Terms and conditions apply. For full terms and conditions please see the David Jones American Express Cardmember Agreement. Cards are offered, issued and administered by American Express Australia Limited. Receive complimentary standard delivery to any address within ...

American Express Velocity Platinum Card — Insurance PDS: David Jones-branded cards: David Jones American Express Platinum Card — Insurance PDS: Disclaimer: American Express Card insurance PDS links are provided as a guide only, and may change without notice. Always refer to your American Express account for the latest insurance PDS.

Card Details. Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal ...

When you use your Delta SkyMiles® Platinum American Express Card for eligible purchases with U.S. Resy restaurants, you can earn up to $10 each month in statement credits after enrolling through your Card account. $120 Rideshare Credit New. Get rewarded to and from the airport. Enroll and earn up to $10 in statement credits each month after ...

However, the Amex Platinum card personally beats out others, despite its $695 annual fee ( rates & fees ). This is because it earns 5x American Express Membership Rewards points per $1 spent (up to $500,000 per year) on flights booked directly with the airline or via AmexTravel.com. BEST LOUNGE ACCESS. Terms Apply / Rates & Fees.

Elektrostal Geography. Geographic Information regarding City of Elektrostal. Elektrostal Geographical coordinates. Latitude: 55.8, Longitude: 38.45. 55° 48′ 0″ North, 38° 27′ 0″ East. Elektrostal Area. 4,951 hectares. 49.51 km² (19.12 sq mi) Elektrostal Altitude.

Heat-ex is located in Elektrostal. Heat-ex is working in General contractors, Heating installation and repair activities. You can contact the company at 8 (495) 505-21-45.You can find more information about Heat-ex at heat-ex.ru.

Elektrostal , lit: Electric and Сталь , lit: Steel) is a city in Moscow Oblast, Russia, located 58 kilometers east of Moscow. Population: 155,196 ; 146,294 ...

In 1954, Elemash began to produce fuel assemblies, including for the first nuclear power plant in the world, located in Obninsk. In 1959, the facility produced the fuel for the Soviet Union's first icebreaker. Its fuel assembly production became serial in 1965 and automated in 1982. 1. Today, Elemash is one of the largest TVEL nuclear fuel ...