- Customer Service

- En Español

Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N.A. or any of its affiliates; and, may be subject to investment risk, including possible loss of value.

SECURITIES AND OTHER INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT; NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; NOT GUARANTEED BY TD BANK, N.A. OR ANY OF ITS AFFILIATES; AND, MAY BE SUBJECT TO INVESTMENT RISK, INCLUDING POSSIBLE LOSS OF VALUE.

Based on average store hour data pulled in January 2024 of Top Banks (as defined below) in metropolitan statistical areas in which TD Bank operates ("TD MSAs"), excluding drive-thru hours and hours of locations in retail stores (such as grocery stores). Top banks are the top 20 banks by total deposits across TD MSAs, the top five banks by store share (or by total deposits, if store share is equal) in each TD MSA, and any bank with greater or equal store share compared to TD Bank in each TD MSA ("Top Banks").

©2022 TD Bank, N.A. All Rights Reserved.

- Customer Service

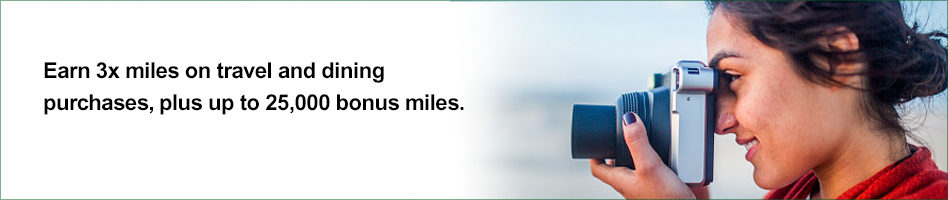

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

Bonus miles offer.

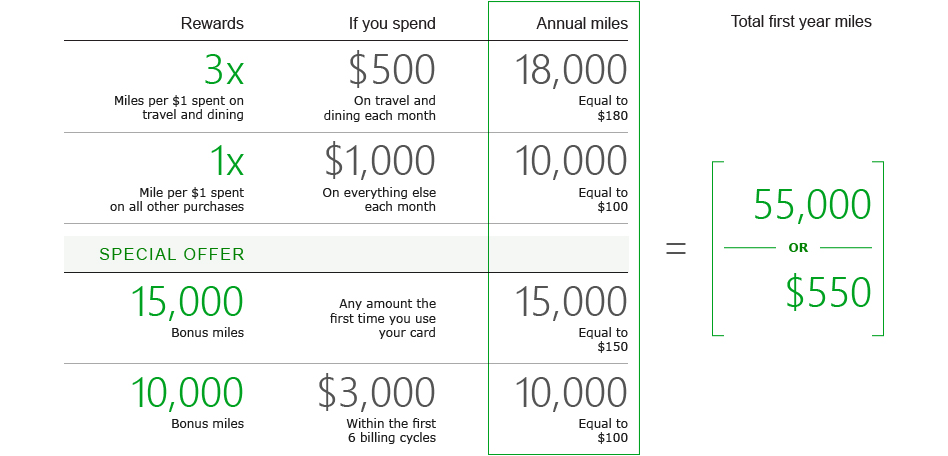

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- 简体中文

- 繁體中文

Register View Details

EasyWeb Online Banking

- About Online Banking View Details

WebBroker Online Investing

- About Online Investing View Details

- Video Tour WebBroker Video Tour

- EasyWeb WebBroker U.S. Banking Login

- Enter term and click to search

Update: Transitioning Aeroplan Customers

Watch your mail! Get the details

We’re here to help you

- Credit Cards

- Can I see my transactions online?

- How can I identify transactions I don't recognize?

- Why do I have to answer this security question?

- When will TD Canada Trust process my bill payment?

- How do I transfer money to another TD Canada Trust customer?

- How do I place Travel Watch Notifications on my TD Cards online?

Top EasyWeb FAQs:

- Login and Support

- Online Security

- Manage Accounts

- Transfers between TD Accounts

- Sending Money

- Cross Border Banking

- Profile and Settings

Tell me about:

- Direct Deposit Details

- Branch Transit

- Order Cheques

- Change Password

- Change address

- Intereact e-Transfer

- Change Address

- Interac e-Transfer

- Visa Direct Transfer

- Wire Transfer

- Make a Stop Payment

- Add Travel Notification

- Lost or Stolen Card

Top WebBroker FAQs:

- Login and Online Security

- Exchange Subscriber Agreements

- Placing Trades

- Fixed Income

- Fund Transfers and F/X

Top FAQs about:

- Account Opening and Transfers

- Account Maintenance

- Commissions and Fees

- Statements and Documents

- Forms and Applications

- Corporate Actions

- Margin Requirements

Other Trading Platforms FAQs:

- Advanced Dashboard

- thinkorswim

- How do I download the TD app?

- What is TD Mobile Deposit?

- How do I deposit a cheque with TD Mobile Deposit?

- How do I add an Interac e-Transfer recipient?

- What is TD MySpend?

- What is TD Mobile Payment?

- Which TD Canada Trust Cards are eligible to use with Apple Pay?

- How do I set up Apple Pay on my IOS device?

- Can I complete a Foreign Exchange transfer on my TD App?

- Is Quick Access safe?

- Where can I find my account number and information about direct deposit / debit?

- How do I identify my branch transit number?

- How do I receive a wire transfer to my account?

- How do I send a wire transfer from my account?

- How do I order cheques?

- What is your institution number?

- How do I open an account?

- How do I get a free account?

- What is the minimum amount of money I need to open a bank account?

- Can anyone open a bank account?

- What are the interest rates on your accounts?

- How do I get my account balance?

- What should I do if I do not understand a fee on my account?

- How do I access my account history?

- How do I find out what my daily and weekly withdrawal limits are?

- How do I open a U.S. Chequing Account?

- How do I make a stop payment?

- What Safety Deposit Boxes do you offer?

- Can I view my credit card statement on EasyWeb?

- How do I make a payment to my TD credit card?

- What should I do if my credit card is lost or stolen?

- If I have limited credit history, can I still apply for a TD credit card?

- What types of credit cards do you offer?

- What should I do to apply for a credit card?

- How is foreign currency exchange calculated when I use my TD Canada Trust Credit Card abroad?

- How do I notify you of an address change?

- Do you offer Visa gift or pre-paid cards?

- How do I qualify for a mortgage?

- How do I apply for a Home Equity Line of Credit?

- What are closing costs?

- What mortgages do you offer?

- How do I make a payment to my mortgage?

- What are the different types of mortgage security?

- When can I early renew without prepayment charge?

- Is it better to refinance my existing mortgage or get a Home Equity Line of Credit?

- Where can I find mortgage rates?

- What is a Home Equity Line of Credit?

- What will my CMHC fees be?

- Investor Relations

- Codes of Conduct and Public Commitments

- Career Centre

- Press Releases

- Resolving Your Problem, Concern or Complaint

Do you have a question? Ask us!

- Bank Accounts

- TD Credit Cards

- ???????????

- ?????????????

- ????????????

- ?????????? - ??????

- ???????????????????????

- ??????????????????????????

- ????????????????

- What is the WebBroker Identification Plus feature and why do I need it?

- How does it work?

- Can I choose not to enroll?

- Can I defer my registration?

- Can I access my accounts from multiple computers?

- Can two people log in from the same computer?

- Can I change my security questions?

- What if I forget the answers to my WebBroker IdentificationPlus questions?

- What happens if I'm locked out of WebBroker?

- Are the answers to my security questions case sensitive?

- How does this work with EasyWeb IdentificationPlus?

Need more information? Learn more about TD Direct Investing .

- ?????????????????/??????

- ??????????????

- ???????????????????

- ?????????????????

- ????EasyWeb????????????????

- ???????????????

- ??????????,??????

- ?????????????????,?????????????

- ?????,????????

- ??????Visa????????

- ???????(Closing Cost)????

- ??????????????????????

- ???????????,?????????????,???????

- ??????????(Home Equity Line ofCredit)????

- ??????????(CMHC)??????

- ???????????? - ??????

- ?????????????????????????

- ?????????????????????/??????

- ?????EasyWeb ??????????????????

- ????????????,??????

- ??????????????????,???????????

- ???Visa????????

- ????????????????????

- ??????????????????,?????????

- ?????????????(Home Equity Line of Credit)?

- ????????????(CMHC)??????

More ways to connect with TD

We can quickly provide you with the help you need. We're only a phone call away.

Banking 1-866-222-3456 (EasyLine 24/7)

TD Direct Investing 1-800-465-5463

View our Telephone Directory

Two convenient ways to find us Find a TD Canada Trust branch near you Find a TD Wealth location, Financial Planner, or Investment Advisor near you 2017 Holiday Schedule

Have a general question? Text us at TDHELP (834357) .

We will answer during texting hours, 6 AM - 11 PM EST. 7 days a week.

Please keep each text message limited to 136 characters. There may be delays in sending and receiving text messages due to carrier issues.

Expand More on Text Us

Conversations are retained for quality, legal and regulatory purposes. For your own security and safety, never send personal or confidential information (account numbers, pin numbers, usernames, passwords or any other confidential information) by text. Standard text messaging rates will apply.

We're Social

Join with us in conversation. Talk to us and we'll talk to you.

You ask, TD Helps answers Ask an expert online today.

Discover more ways to connect, 7 days a week.

Want to send us a confidential email? Sign in to EasyWeb .

If you would like to send us a general email, please click on the following links.

For your own security and safety, never send your account or pin numbers, usernames, passwords or any other confidential information by email.

TD Canada Trust Email Contacts

- Report Email and Other Fraud

- TD Mobile Applications

- TD Green Machines (ATM)

- Personal Investing

- Personal Credit

- Business Banking

- General Inquiries

- Travel Medical Insurance

- TD Mutual Funds

Investment Email Contacts

Want to know more about investing? Write to us for more information!

- TD Wealth Financial Planning

- TD Wealth Private Investment Advice

TD Wealth Private Wealth Management

- Private Banking

- Private Investment Advice

- Private Investment Counsel

- Private Trust

For questions and comments about WebBroker, TalkBroker and TeleMax, contact our Electronic Brokerage Services

- Book Travel

- Credit Cards

Best ways to earn:

Best ways to redeem:.

TD Rewards Points are the primary currency touted by the largest bank in Canada, Toronto-Dominion Bank. TD Rewards are a proprietary currency, belonging solely to TD and tied exclusively to TD credit cards .

TD Rewards is a fixed-value points currency, meaning that points can be redeemed in a number of ways at a fixed value. TD Rewards Points are particularly useful to offset the cost of incidental travel purchases, such as independent hotels, short-term rentals, and vacations, to further minimize your out-of-pocket travel expenses.

Earning Points via Signup Bonuses

The only way to earn TD Rewards is from the bank itself, via its suite of personal TD Rewards-earning credit cards.

- The TD Rewards Visa* Card is the no-fee card, which typically comes with a small signup bonus.

- The TD Platinum Travel Visa* Card is the entry-level product among the TD Rewards cards. The card frequently puts on first-year annual fee rebate promotions along with a modest welcome bonus, which typically ranges between 15,000–50,000 TD Rewards Points.

- The TD First Class Travel® Visa Infinite* Card is the flagship TD Rewards product from TD. The card frequently offers first-year annual fee rebates, along with a sizeable welcome bonus of 20,000–135,000 TD Rewards Points.

Earning Points via Daily Spending

Beyond signup offers, you can earn TD Rewards Points through daily spending on the above credit cards. The earning rates are as follows:

- 4 TD Rewards Points† per dollar spent on eligible Expedia® for TD purchases†

- 3 TD Rewards Points† per dollar spent on eligible groceries and dining purchases†

- 2 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1 TD Rewards Point† per dollar spent on all other eligible purchases†

- 6 TD Rewards Points† per dollar spent on eligible Expedia® for TD†

- 4.5 TD Rewards Points† per dollar spent on eligible groceries and dining†

- 3 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 1.5 TD Rewards Points† per dollar spent on all other eligible purchases†

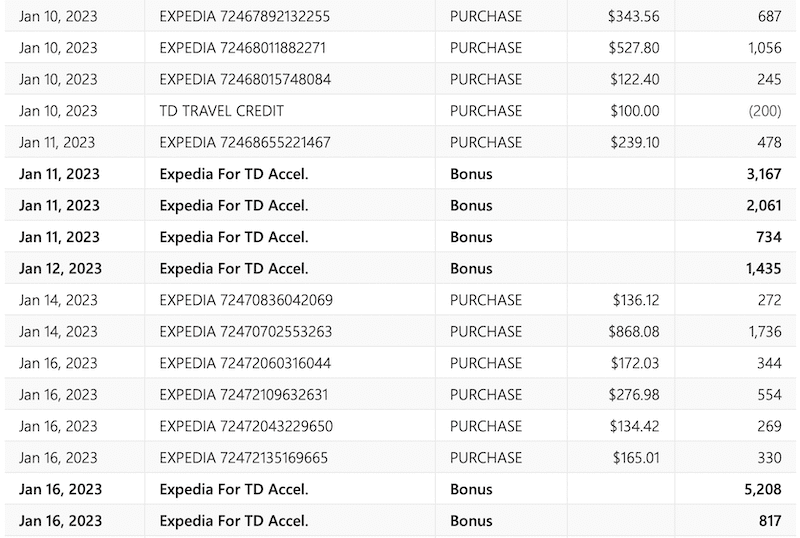

- 8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD†

- 6 TD Rewards Points† per dollar spent on eligible groceries and restaurant purchases†

- 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account†

- 2 TD Rewards Points† per dollar spent on all other eligible purchases†

Purely from an earning perspective, the TD First Class Travel® Visa Infinite* Card stands out as the strongest card.

This is especially true for anyone who books a significant component of their trips on Expedia, as you can earn an effective 4% return on your purchases.

Redeeming TD Rewards Points

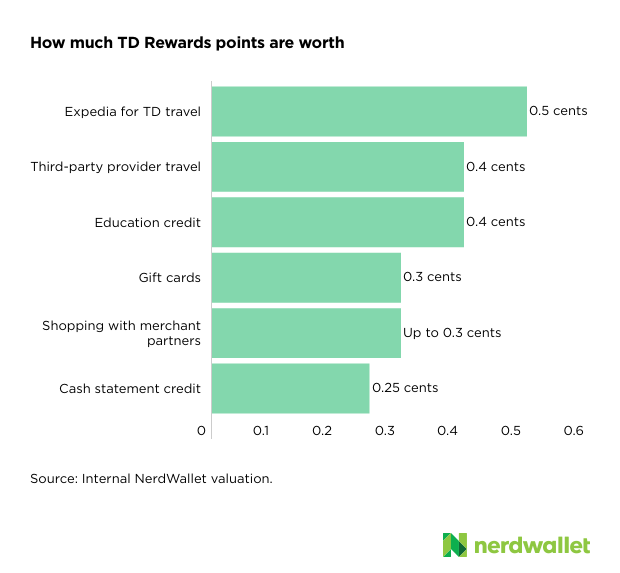

The TD Rewards program offers various redemption possibilities, with different levels of value attached to each one.

Expedia® for TD

The best redemption value for TD Rewards comes by redeeming them on the dedicated redemption portal Expedia® for TD. By redeeming points this way, you’ll get 0.5 cents per point (cpp), which is the best way to use TD Rewards Points.

Expedia® for TD is essentially the same platform as the regular Expedia, except you log in with your TD credentials so you can redeem points.

Simply sign in to your TD Rewards account, click “Expedia for TD” under the “Redeem” tab, and then click through to the Expedia for TD portal.

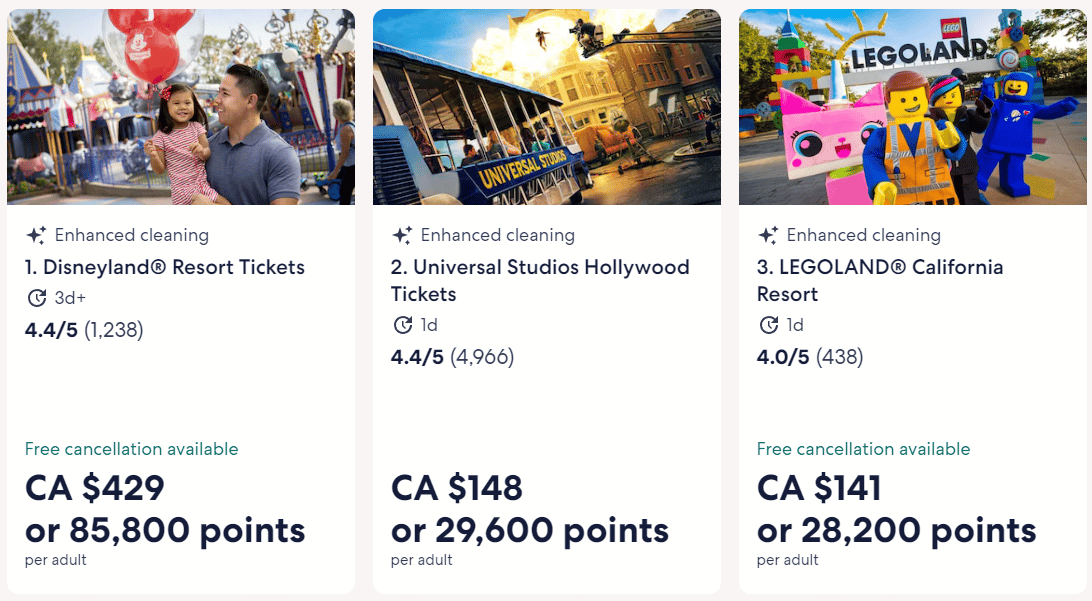

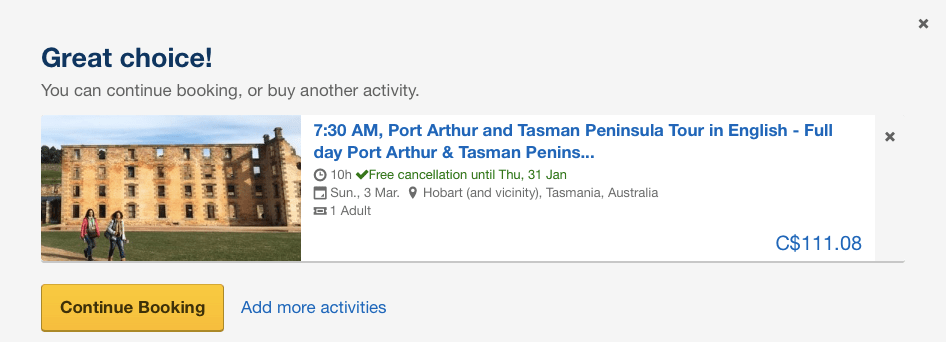

As with regular Expedia purchases, you can book flights, hotels, car rentals, and other travel purchases. Importantly, Expedia also offers cruises, tours, and Disney tickets, among other things.

As these travel expenses are typically quite difficult to book with points, using TD Rewards Points at a fixed value of 0.5 cents per point is an excellent redemption opportunity, and could end up saving you a significant amount of cash out-of-pocket.

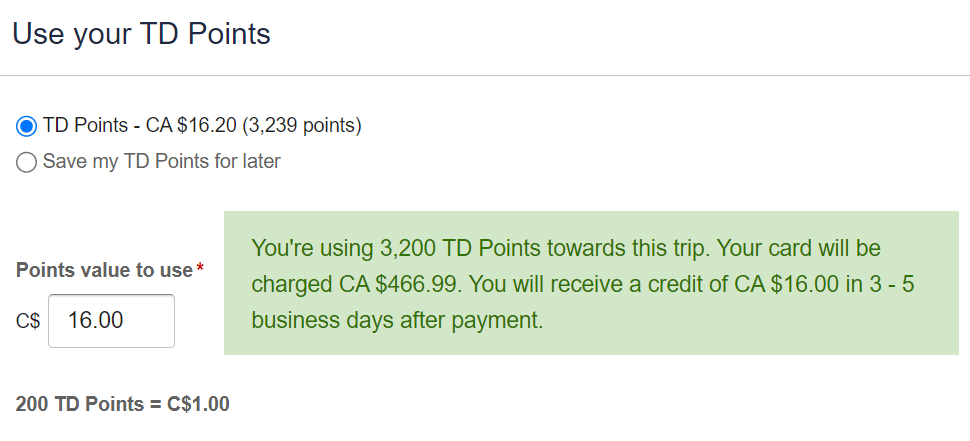

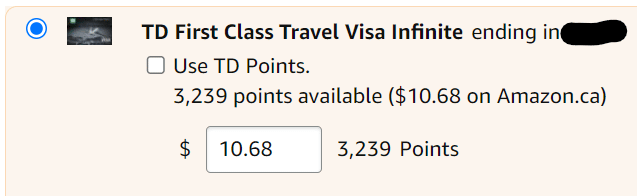

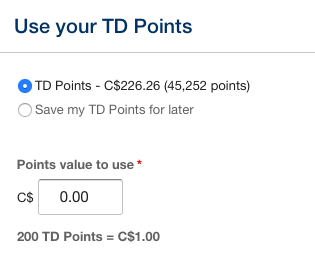

The minimum redemption is 200 points ($1), and you can choose to redeem your points in $50 increments. You’re able to make purchases in any combination of points and cash.

Once you’ve chosen your desired purchase on Expedia for TD, look for “Use your TD Points” on the checkout page. Just select the number of points you’d like to redeem at 0.5cpp, and then proceed with your purchase.

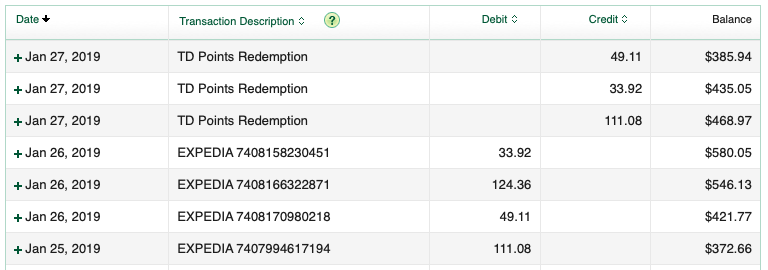

The credit posts in three to five days after the purchase, so be patient and keep an eye on your account.

If you’re using your TD Rewards Points on Expedia® For TD to redeem for hotels, or car rentals, the usual warnings of using an online travel agency apply.

You won’t earn any hotel status benefits or accrue elite qualifying nights at hotels. For car rentals, you won’t earn things like Hertz points or free rentals through National Free Days.

This doesn’t apply to airfare, though, as you’ll still accrue the same amount of elite qualifying miles, segments, and dollars. As long as you have your frequent flyer number attached to your booking or add it in at the check-in counter, your travel should count towards elite status qualification.

One major thing to note about using Expedia to book airfare is that any and all changes and cancellations must be pursued through the third-party booking agency, and can’t be done through the airline.

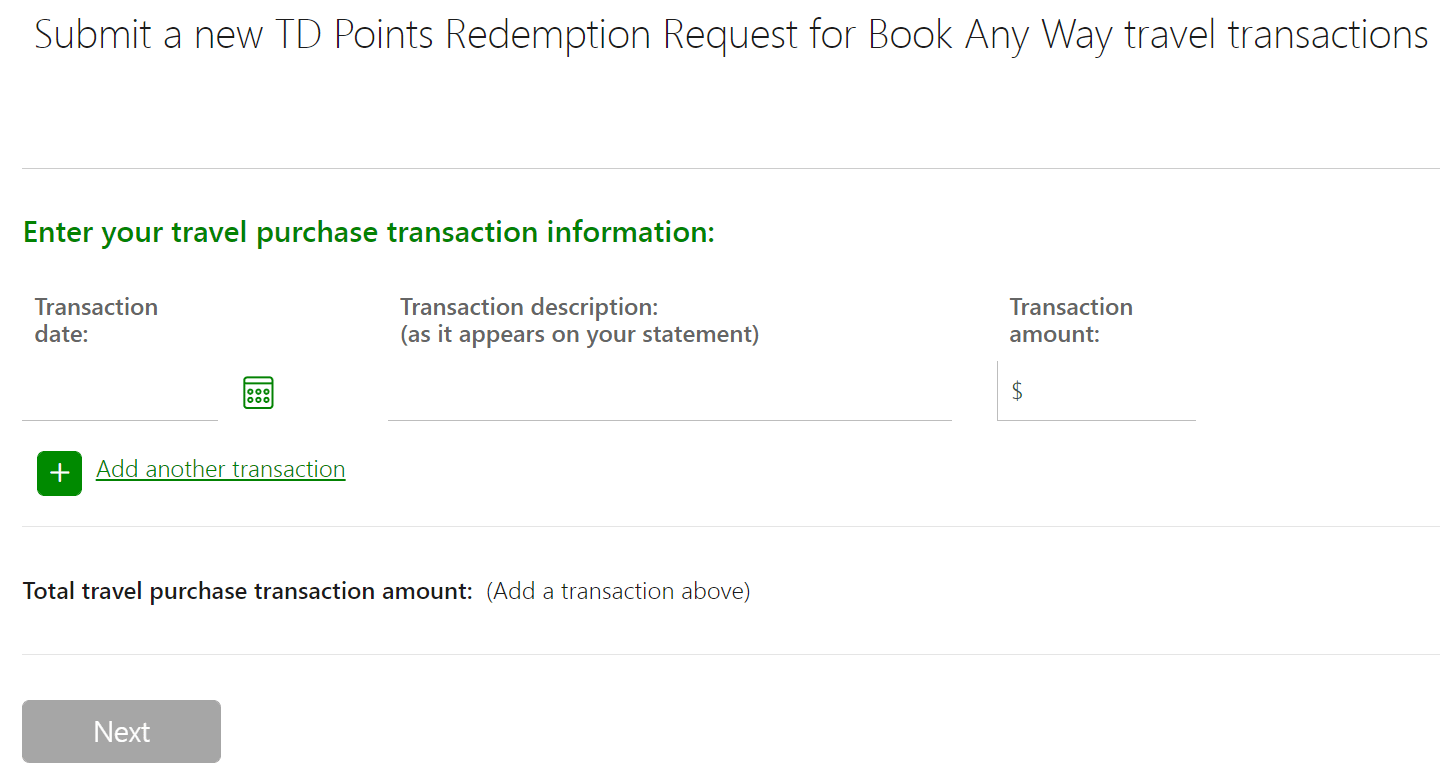

Book Any Way

The second-best way to redeem TD points is for non-Expedia travel, where you can redeem at a respectable 0.4 cents per point. The minimum redemption is 250 points ($1).

This ratio is maintained for the first $1,200 of a single travel purchase, and will be 0.5 cents per point (200 points = $1) thereafter.

Booking non-Expedia travel using TD points is called “Book Any Way Travel” and can be booked by using the TD Rewards website or by calling 1-800-983-8472.

Calling has a few distinct advantages, such as the ability to redeem your points for non-conventional travel items, such as gas, attractions, various hotel expenses, RV rentals, and even Airbnbs.

To redeem TD Rewards points through “Book Any Way Travel”, select “Book Any Way Travel” from the “Redeem” tab on the TD Rewards website.

On the next screen, fill in the information about the transaction against which you’d like to redeem points. Note that you can only redeem TD Rewards points for “Book Any Way Travel” after the purchase has posted on your account.

You’ll need to note down the transaction date, its description, and the amount before proceeding. You can submit multiple transactions at once.

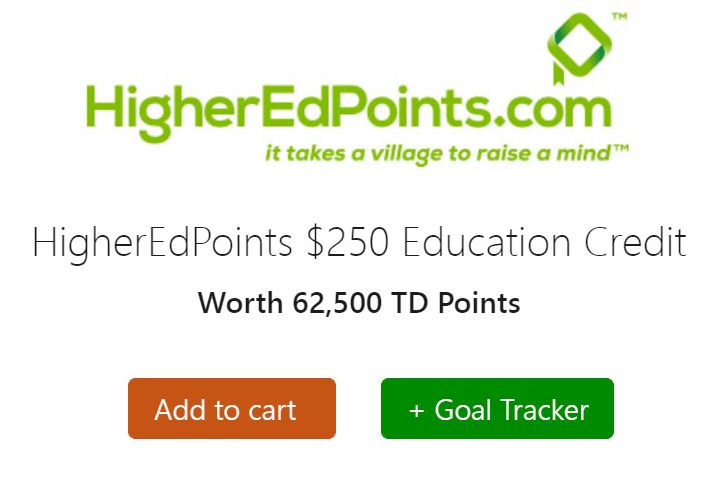

Higher Education

Using TD Rewards Points towards higher education is also a decent option, at a redemption value of 0.4 cents per point (250 points = $1). You’re able to use your TD Rewards Points to pay for tuition and/or student loans, in increments of $250 (62,500 points).

First, check if your institution participates on the TD website , and then you can buy HigherEdPoints Education Credits with your TD Rewards Points.

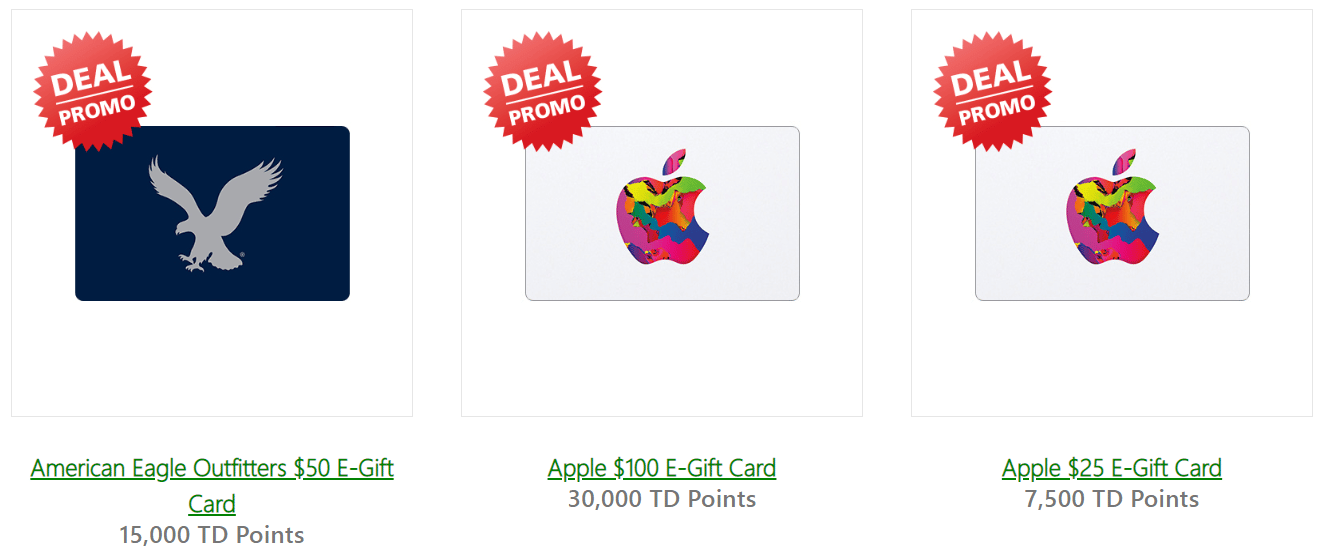

If you want to use your TD Rewards Points towards shopping expenses, you can redeem your points towards gift cards at a flat value of 0.25 cents per point (400 points = $1).

This is objectively a lower-value redemption than travel; however, as long as you’re redeeming points for higher value than your costs (which is usually the annual fee), you’re keeping cash in your pocket.

Gift Cards & Merchandise

There are sometimes discounts which offer gift cards for 25% off, so you can redeem at 0.33 cents per point. If you plan on redeeming TD Rewards for gift cards, it’s best to wait for one of these promotions prior to doing so.

The same value of 0.25 cents per point is offered for merchandise purchases, which are listed on the TD Rewards website . As with gift cards, there are sometimes sales where you can redeem for up to 0.3–0.4 cents per point.

As always, check if the item you’re redeeming for is on sale for a lower price on another platform to calculate your redemption value.

There’s also the option of redeeming TD Rewards Points at 0.33 cents per point through a partnership with Amazon.ca.

First, you’ll have to enroll by linking your TD Rewards-earning credit card with your Amazon account. Once you’ve done this, you can apply TD Rewards Points.

At the check-out page on Amazon, change the payment method to your linked TD Rewards credit card, where you’ll see the balance of points available. You can cover the rest of the purchase with your credit card.

Statement Credit

Finally, the last way to use your TD Rewards Points is to redeem for statement credit directly, also at a rate of 0.25 cents per point.

It sounds like the same rate as gift cards and merchandise, but keep in mind that those have occasional sales, while statement credits always remain at 0.25 cents per point.

This makes it the lowest-value way of redeeming your TD Rewards Points, and if you plan to use your points towards a statement credit, you’re better off with a cash back card .

Without a doubt, using Expedia® For TD at a rate of 0.5 cents per point (200 points = $1) is the best value redemption for TD Rewards Points.

For most travellers, this should suffice just fine, as Expedia offers tours, Disney park tickets, and a plethora of other travel possibilities aside from the usual flights, hotels, and car rentals.

TD Rewards Points are a great way to save money on miscellaneous travel expenses, and the regular high signup bonuses and respectable earning rates make it quite easy to rack up the points.

† Terms and conditions apply. Refer to the TD website for the most current information.

Hi, is it possible to sell my TD points to someone in exchange for cash? I am getting older and I doubt I will ever use it for travel. I have a lot of points. Any help would be appreciated. Thanks

Hi Judy. I don’t think TD points are transferable to other people, however you CAN redeem them for a cash (statement credit). You will get 0.25 cents per point, so for example if you have 100,000 TD points, that should be a credit of $250 . You may also be able to redeem them for non-travel rewards that will give you more value for your points. If you do decide on the statement credit, this can be done from TD Easyweb when viewing your TD Visa details. You might have to sign up or sign-in to ‘TD Rewards’ for the other options. Hope this helps!

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Credit cards

Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Keph Senett on January 4, 2022 Estimated reading time: 6 minutes

Expedia For TD: How to maximize your TD travel rewards credit card

Book your flights, hotels and accommodation through the Expedia For TD travel portal to make the most of the travel rewards you earn with your TD Visa.

You’ve surely heard of travel site Expedia, and you’ve heard of TD Bank. But have you ever booked travel through the Expedia For TD website? The program, which marries the travel service with the banking brand, delivers substantial earnings and deals to travellers who book through their branded portal and pay with a TD credit card . Let’s take a look at how the program works, and how to reap the most rewards.

About Expedia For TD

Expedia For TD is a segment of the TD Rewards environment, so the “currency” you’re collecting is TD Rewards Points that can be redeemed for merchandise, gift cards, cash and, importantly, travel. Another major benefit of the TD travel program is that it’s flexible. It allows you to use your Points to book your flights, hotels, cruises and excursions directly with any provider you choose. You can use your Points for these purchases, even up to 90 days after the fact. (However, when you book through Expedia For TD, points must be redeemed at the time of purchase.)

When you log into Expedia For TD , you’ll see a TD-branded version of the Expedia site. Here, you can redeem your TD Rewards Points for flights, hotels, car rentals and more, but the real incentives come by way of redemption rate, flexibility and earnings. If you redeem through Expedia For TD, no matter what you book, your redemption rate is $0.005 per point.** This is better than the rate you’d get by cashing in on other non-travel rewards. Additionally, you can collect within the TD Rewards environment and outside of it simultaneously. So, when you use Points on purchases at Expedia For TD, you can still collect from your separate airline rewards program. Finally, using the portal assigns bonus points to TD credit cardholders, which can multiply—sometimes dramatically—the number of Points you earn on travel purchases. Conveniently, you don’t have to wait until you’ve racked up thousands of Points to redeem: you can start using your Points as soon as you’ve accumulated 200. There’s even a dedicated 24/7 support line to help you make your bookings.

Are there any drawbacks I should watch out for?

Expedia For TD advertises a price guarantee, but you should be aware that it is time-limited. The company will refund the difference on a flight and hotel package within 24 hours of booking, or a hotel rate up to 48 hours prior to check-in.

The best Expedia For TD credit cards in Canada

Td first class travel visa infinite card, td rewards visa card.

- Annual fee: $139 (annual fee rebate—conditions apply to qualify)

- Earn rates: Up to 8 TD Rewards points per $1 on travel; 6 points per $1 on groceries and restaurants; 4 points per $1 on recurring bills; and 2 points per $1 on all other purchases

- Welcome offer: You can earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024. Plus, you get an annual birthday bonus of 10% of your previous year’s points (up to 10,000 points).

- Annual income requirement: Personal income of $60,000 or household income of $100,000

- Point value: 1 TD Rewards point = $0.005 when redeemed for travel via Expedia For TD or $0.004 when redeemed through other providers and websites

- Recommended credit score for approval: 725 or higher

- Interest rates: 20.99% on purchases, 22.99% on cash advances, 22.99% on balance transfers

Expedia For TD is available to you if you hold any TD Rewards credit card, but the TD First Class Travel Visa Infinite Card gets our recommendation for its high earn rate and bonus points potential. The First Class Travel Visa Infinite Card also includes an excellent suite of travel insurance benefits including medical, trip interruption and automotive, and while it fails to offer airport lounge access, it does entitle you to a discount. However, these perks don’t come cheap. The First Class Travel Visa Infinite Card has a minimum annual income requirement of $60,000 and carries an annual fee of $139, though new applicants can have the first year fee rebated (along with the $50 fee for an additional cardholder).

While this is a solid travel rewards card , new applicants in particular will benefit greatly from the welcome bonus. TD clients with an All-Inclusive banking account may be able to get the $139 annual fee rebated on an ongoing basis, so it’s worth speaking with a representative before you sign up. Frequent travellers who are comfortable shopping through the ExpediaforTD.com portal will get the highest earn rate on travel spends and, at a return of 4.5% (8 points per $1) when redeemed for travel spends, the savings will be noticeable. The included insurance package can also help you save a bundle.

- Annual fee: $0

- Earn rates: 4 TD Rewards points per $1 spent on travel purchases made through Expedia for TD , 3 points per $1 on groceries and at restaurants, 2 points per $1 on recurring bill payments, and 1 point on all other purchases

- Welcome offer: You can earn a value of $50 in TD Rewards Points to use on eligible Amazon.ca purchases, plus no Annual Fee. Conditions Apply. Account must be approved by January 6, 2025.

- Recommended credit score: 660 or higher

- Interest rates: 19.99% on purchases, 22.99% on cash advances and 22.99% on balance transfers

- This offer is not available for residents of Quebec.

If you’re annual fee-averse, consider the TD Rewards Visa, which will help you bump up your TD Rewards Points by offering 4 points per $1 spent at Expedia For TD, 3 points per $1 spent on groceries and restaurants, 2 points per $1 spent on recurring bills, and 1 point per $1 everywhere else. Though not quite as generous in rewards as the other cards in this article, the 4 points: $1 ratio on travel purchases through the online portal results in a return far better than available on most other no-fee cards. This card does not include travel insurance, but it gives cardholders a discount at Avis and Budget car rentals.

Which card is the best option for me?

Every card in the TD Travel Rewards program is worth a look, but the best option will depend on you. If you want to avoid an annual fee you’ll benefit from the TD Rewards Visa, and if you’re willing to pay the $139 annual fee and the minimum income of $60,000 doesn’t disqualify you, the First Class Travel Visa Infinite Card is an effective way to cash in on the program. But the TD Platinum Travel Visa also does a good job with no income requirement and a lower annual fee. Choose the card that makes the most sense for you.

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

About Keph Senett

Comments cancel reply.

Your email address will not be published. Required fields are marked *

I am unable to reach Expedia for TD to cancel flights due to the Coronavirus. I have held on for many hours with music playing and with no music. Can you advise how to speak to customer service? I am currently out of the country (Canada) and just don’t know how to go about this if TD for Expedia 18772226492 are taking many hours of my holding on and not answering my call. I am aware there must be many people wanting to Angel their flights. This is my third day of trying to reach them

Cancel their flights

I waited on hold for six hours. When my call was answered, the representative was more than helpful. Hard to wait on hold, but worth the effort in these trying times.

The TD business travel is no longer same as first class They reduced to 3 points per dollar

Related Articles

Auto Insurance

Compare car insurance quotes from Canadian providers

Comparing auto insurance quotes online can help you find the best coverage at a low cost.

Making sense of the markets this week: June 23, 2024

Are lower housing prices on the way? Plus, CPI basket makeover, National Bank shareholders digest their rich meal, and...

The best no-fee credit cards in Canada for 2024

These cards have no annual fee and still boast perks like cash back, travel insurance and more.

Credit Cards

The best student credit cards in Canada for 2024

As a student, it’s good to build a credit history while earning rewards for groceries, flights, movies and more....

The best credit cards for instant approval in Canada for 2024

Find out instantly if you’re approved for one of these credit cards. In some cases, you can use the...

How much income do I need to qualify for a mortgage in Canada?

The best credit cards for bad credit in Canada for 2024

If you want to improve your credit score you’ll have to show you can handle credit responsibly—and, used properly,...

Moving? Don’t miss these lucrative tax deductions on your moving expenses

You can ease the financial pain of a costly move by deducting those expenses from your employment, self-employment or...

The best credit cards for airport lounge access in Canada for 2024

If you want to make your travels a little more comfortable, airport lounge access is key. Here are the...

Buying your first home in Canada? Here’s what to look for in a home inspection

Sponsored By

National Bank of Canada

How to use TD Rewards points to reduce travel costs

by Anne Betts | Mar 21, 2024 | Travel Hacking | 5 comments

Updated March 21, 2024

Is the TD Rewards program worth it? How does the program work? What are the various ways to use TD Rewards points to reduce travel costs ? What qualifies as a travel cost?

After several years of earning and redeeming TD Rewards points for travel, I’ve found the program to be beneficial. Here is my review.

Table of Contents

What are TD Rewards Points?

Td rewards credit cards, td first class travel visa infinite card, what are td rewards worth, (i) expedia for td, (ii) book any way, what qualifies as book any way travel, (i) expedia for td, is the td first class travel visa infinite worth it, what i like, what i don’t like.

TD refers to the Toronto-Dominion Bank. TD’s propriety loyalty program is called TD Rewards. The rewards currency is TD Rewards Points. To improve readability, I’ll refer to the points as ‘TD Rewards.’

TD Rewards can’t be converted to any other loyalty currency, or transferred to another loyalty program. It used to be possible to convert TD Rewards to Aeroplan on a product switch to a TD Aeroplan-branded card at a rate of 4:1. However, since April 2019, this is no longer the case.

Points don’t expire as long as your TD Rewards-earning credit card account is in good standing. If you close your credit card account (and don’t have another TD Rewards-earning credit card), you’ll have 90 days to redeem any points left in the account. But, if you lose access to Expedia For TD, they’ll be redeemable at the lower ‘book any way’ value.

As a general rule, points in any in-house program should be redeemed or transferred to another credit card earning the same rewards currency before cancelling or product switching a card.

How to earn TD Rewards

TD Rewards can be earned from a credit card sign-up bonus, through everyday spend on the credit card, and the occasional promotion.

TD offers four credit cards earning TD Rewards:

- TD Platinum Travel Visa Card

- TD Rewards Visa Card

- TD Business Travel Visa Card

TD offers very few points-earning promotions.

The best way to stay abreast of these opportunities is via promotional emails from TD.

For travellers, the best of the three personal credit cards is the First Class Travel Visa Infinite, last overhauled on October 30, 2022.

TD offers promotions on the TD First Class Travel Visa Infinite with elevated sign-up bonuses. For example a promotion ending March 4, 2024 included an annual fee waiver ($139) in the first year and a sign-up bonus of up to 135,000 points. The current promotion ending June 4, 2024 has a sign-up bonus of up to 100,000 points:

- 20,000 points after the first purchase

- 80000 points after spending $5,000 within 180 days of account opening

According to the terms and conditions, the offer isn’t available to customers who have activated and/or closed a TD First Class Travel Visa Infinite Account in the last 12 months. However, this may or may not be enforced. Also, a product switch from a lower-tier card may be eligible for the full promotional benefits.

The TD First Class Travel Visa Infinite also includes:

- a birthday bonus of 10% of the points earned in the 12 months preceding the primary cardholder’s birthday (up to a maximum of 10,000 points)

- an annual TD Travel Credit of $100 each calendar year on certain bookings (hotel, motel, lodging, vacation rental, or vacation package) of $500 or more at Expedia for TD in cash, points, or a combination of points and cash.

- a free Uber One membership for 12 months

The earning rate on the TD First Class Travel Visa Infinite is:

- 8 points per dollar for travel booked online or by phone at Expedia for TD

- 6 points per dollar spent on groceries and at restaurants

- 4 points per dollar on regular recurring payments

- 2 points per dollar on all other purchases

There’s a $25,000 cap on spending at the accelerated rates. After that threshold is reached, the earning rate decreases to the base rate of 2 points per dollar.

At first glance, the earning rate on the TD First Class Visa Infinite looks very attractive. That’s because many reward programs can be redeemed at one cent per point (e.g., 10,000 points = $100). With TD Rewards, the best possible redemption rate is 0.5 cents per point (e.g., 10,000 points = $50).

TD’s in-house travel portal is called Expedia For TD, operated by Expedia.

There are two ways to redeem TD Rewards for travel purchases:

- Expedia for TD

- ‘Book Any Way’

Each has a different redemption value.

For travel booked through Expedia For TD, points are valued at $0.05 (200 points = $1).

For the most part, Expedia for TD mirrors what’s available on Expedia. However, there are gaps in the inventory. Also, some folks have reported higher prices on Expedia for TD, compared to what’s posted on Expedia.

For what it’s worth, that hasn’t been my experience. For example, a search for a specific hotel in Halifax revealed the best price at Expedia when compared with other booking sites.

The (almost) same price for the same property appeared at Expedia for TD.

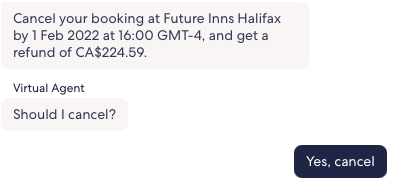

‘Book Any Way’ covers travel purchased from travel providers other than Expedia For TD. This allows you to book and redeem points for travel products that don’t appear on Expedia. This includes the option to book last-minute deals or discounted travel at prices that are cheaper than what’s listed at Expedia.

However, TD Rewards are valued at $0.04 (250 = $1) on the first $1,200 of a Book Any Way travel purchase. The value increases to $0.05 (200 = $1) for any amount that is over $1,200 on the same purchase. This is useful for ‘big-ticket’ bookings such as vacation packages or apartment rentals.

Keep in mind that when purchasing from a provider other than Expedia For TD:

- you’re earning x2 TD Rewards Points (instead of x8 at Expedia for TD); and

- you’re redeeming at a lower value of $0.04 (instead of $0.05).

The program has a broad view of what qualifies as travel. Flights, accommodation, cruises, vacation packages (usual stuff) are eligible. Expenses such as theatre tickets, golf fees, resort excursions, restaurant bills, gasoline, taxi fares, and parking may qualify if they’re incurred while travelling.

How to redeem TD Rewards for travel

The most convenient way is to book online by signing in to TD Rewards, and entering the Expedia For TD portal to shop for travel.

When you’re ready to make a decision, one click takes you to your chosen travel product.

Another click takes you to the payment page with helpful pre-populated fields showing the name of the cardholder, credit card, TD Rewards account balance, and its monetary value.

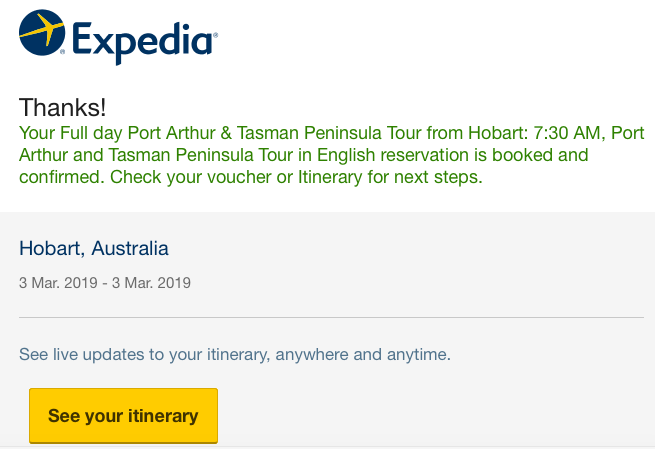

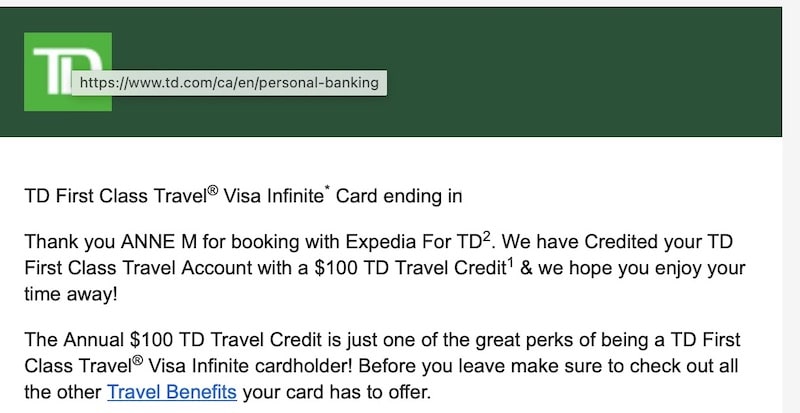

Within moments, an email arrives from Expedia for TD with the booking confirmation and details.

With the “use points” option, the entire travel purchase, including taxes and fees, will be charged to your credit card. But, because you used TD Rewards Points, you’ll receive a credit on your credit card statement within 5 days after the charge, equal to the number of points used.

For the best return, anything appearing at Expedia should be booked online through Expedia For TD and redeemed in this way. Another option is to book by telephone (at Expedia for TD). The points multiplier of x8 for using Expedia For TD will be earned on each booking. Travel purchases and their respective statement credits will appear as separate line items.

- Make a travel-related purchase using the credit card earning TD Rewards.

- Wait until the charge posts to your credit card account.

- Call TD Rewards within 90 days of the transaction date of the purchase, and ask to have points applied.

- The points will be deducted from your points balance available at the time the points are redeemed, not the transaction date of the purchase.

- The amount credited towards the purchase will be equal to the value of the points redeemed. If there are insufficient points available to cover the entire amount, the remaining cost will be posted on the account for payment.

Both redemption routes (Expedia For TD and Book Any Way) allow payment in any combination of points and cash.

Note: Travel usually delivers the best rate of return. However, TD Rewards can be redeemed for merchandise (at an average of 0.23 cents per point), gift cards (0.25), tuition, or paying down a student loan debt (0.4), or as a credit against your credit card account (0.25). These redemption values are shared with thanks to Credit Card Genius for their research and analysis.

If the following applies to you, I say YES :

- You purchase a considerable amount of travel through Expedia (for TD).

- You’re likely to make a single purchase of $500 or more at Expedia for TD to earn the annual travel credit of $100.

- You like the idea of offsetting a variety of travel costs with various rewards programs.

- You’re not loyal to any particular hotel brand and you use a variety of accommodation that’s bookable through Expedia (for TD).

- You’re able to tap into a fee waiver and decent sign-up bonus.

- You have a TD All-Inclusive Banking Package. This requires a minimum daily balance of $5,000 in your account. It entitles you to a $29.95 monthly fee rebate ($22.45 for seniors aged 60 or older). It includes an annual fee rebate of your choice of one of five select TD credit cards. The TD First Class Travel Visa Infinite is one of the cards. The rebate covers the fees for the primary cardholder and one supplementary cardholder.

- You can make use of the travel insurance benefits.

- You use Expedia sparingly. You don’t use it enough to justify paying the annual fee of $139 (beginning in the second year under a -first-year-free promotion).

- Most of your flights are award bookings using frequent flyer miles or points. When you do purchase a revenue ticket, you book flights directly with an airline because of better service in the event of booking irregularities, flight cancellations, and overbooked flights.

- You’re a member of one or more hotel loyalty programs. You book directly with the respective program to earn loyalty points, status credits, and other benefits.

- The other credit cards in your wallet have superior earning power on everyday-spend categories such as groceries, gas, transit, and dining, and/or earn flexible points that are convertible to other reward programs offering better redemption values.

Is the TD Rewards program worth it?

The TD Rewards program shouldn’t be viewed as a frequent flyer program but one where it’s possible to cut trip costs by redeeming points for miscellaneous travel expenses.

For a personal credit card, I believe the best of the bunch is the TD First Class Travel Visa Infinite Card. What did I think of TD Rewards and the TD First Class Travel Visa Infinite Card?

- When used exclusively for travel bookings at Expedia for TD, the TD First Class Travel Visa Infinite Card offers an appealing return of 4%. Otherwise, a mixture of earn rates puts the return somewhere between 1% and 4%.

- For the most part, Expedia has a solid reputation. The company carries some weight in the travel world and could be a useful ally if things don’t go as planned with a small, independent tour operator. However, I’d never use Expedia for expensive long-haul flights. Overbooked flights, delays, cancellations, and other disruptions can put passengers in a zone where neither the airline nor the OTA (Online Travel Agency) will provide assistance.

- I like Expedia For TD’s large inventory of accommodation options, including hostels and apartments, at a variety of price points. I’ve also been impressed by the attractiveness of refundable bookings. For example, the same property at Booking might be refundable up to a month out, whereas at Expedia, it might be refundable up until the day before arrival. This limits reliance on trip cancellation insurance.

- TD’s recent overhaul of the TD First Class Travel Visa Infinite that included a $100 annual travel credit is a welcome benefit. It requires a purchase of $500 or more at Expedia for TD once in a calendar year (that is relatively easy to accomplish when booking accommodation). Triggering the credit requires no intervention on a cardholder’s part as as an email and secure message from TD arrives within 48 hours. This effectively reduces the annual fee of $139 to $39, a compelling reason to keep the card.

- There’s also the option to book tours and experiences. Other propriety programs (e.g., AMEX Travel) don’t offer a similar range and variety of travel products.

- I love the online system for booking travel at Expedia For TD, and redeeming points against the purchase. It involves inserting a minimal amount of information, and a few clicks to complete the process. Within seconds, the booking confirmation arrives by email.

- Anything appearing at Expedia for TD is bookable online from anywhere in the world. Expedia For TD’s online booking process is convenient, user-friendly, and efficient.

- The same applies to the online process for changing a reservation or using Expedia for TD’s Virtual Assistant to cancel refundable bookings. Sign in, select the booking, hit the cancel button, and receive notification that the refund will be sent within 48 hours.

- The range of travel expenses redeemable as Book any Way travel is impressive.

- With the accelerated earn rate of 6 points per dollar resulting in a 3% return on groceries and dining, I’ve appreciated having the TD First Class Travel Visa Infinite Card in my wallet at restaurants that don’t accept American Express (Cobalt and Scotiabank Gold cards that both earn x5 points on dining).

- TD has a no-fee credit card (TD Rewards Visa Card) that earns TD Rewards. This presents an option to product switch from the TD First Class Travel Visa Infinite (or any other credit card earning TD Rewards) to protect your points and keep a TD Rewards account active.

- TD has a generous approach to product switches that encourage clients to try different credit card products. Some switches provide access to full promotional benefits. In addition, there are cases where clients have been able to hold more than one TD First Class Travel Visa Infinite Card at the same time.

- For credit card cancellations and product switches, TD offers prorated refunds of annual fees.

- The TD All-Inclusive Banking Package presents an option to obtain an annual fee rebate.

- TD’s EasyWeb account management system is efficient and user friendly. After product switching or applying for a new TD credit card, I’ve had the card, with the credit card number, appear in my account within a few hours. On a product switch, the ‘switched-from’ card can be used the following business day to earn points in the ‘switched-to’ card’s rewards program. This is handy to start working on the new card’s Minimum Spend Requirement without having to wait for the new card to arrive by mail.

- There will be others who don’t agree but in my opinion, of the ‘big five,’ TD has the best customer service. For the most part, I’ve found Customer Service Representatives to be helpful, patient, and well informed. Those I’ve dealt with have been more than willing to follow up on requests, listen to, and consider, my interpretation of terms and conditions when it differs from theirs, and seek information from advisors and supervisors.

- To extract maximum value on travel purchases and redemptions, customers need to use Expedia For TD. When purchasing travel from other providers (at an earn rate of 2 points per dollar), and redeeming points using ‘Book any Way’ at the lower redemption value, each point is valued at only 0.8 cents (or 0.8% return).

- At the present time, the program doesn’t have a flight rewards chart where it could be possible, as with other reward programs, for members to extract greater value when redeeming points for flights. For example, the CIBC Rewards (Aventura) Flight Reward Chart offers the potential of a 2.2% return.

- For more information on the CIBC Rewards program, see When travelling the world on miles and points, is the CIBC Aventura program worth it?

- Expedia for TD’s Virtual Assistant works well on uncomplicated bookings such as obtaining a refund before the fully refundable date. However, in the case of complications, the Virtual Assistant is hopeless. For example, in Warsaw, the guide on a scooter tour was a no-show on the day of the tour (so it was past the refundable period) and trying to get the Virtual Assistant to retrieve the booking was impossible, despite inserting my answers to each question asked.

- As a rewards currency, TD Rewards has limited value. It’s not convertible to any other program, and it has a fixed maximum value of $0.05 per point.

- While obtaining a fee rebate is an attractive proposition, doing so on a TD Aeroplan-branded credit card might make more sense for Aeroplan account holders. Aeroplan is capable of delivering much greater value than TD’s fixed-value system.

- I’m not fond of having two-tiered redemption values for travel purchases. Other in-house programs such as Scene+ make no distinction between travel booked through the program’s travel portal, and that from another provider. Redemption values are the same.

- For more information on the Scene+ program, see What’s the best use of Scene+ when travelling the world on miles and points?

- If a customer has two credit cards earning TD Rewards, it’s possible to merge the points into one account but it must be done by an agent. Unlike other programs such as RBC Avion, it can’t be done online. And disappointingly, fewer than 10,000 TD Rewards cannot be moved from one account to the other.

- The TD First Class Travel Visa Infinite Card doesn’t stand out among its competitors. It’s competing with travel credit cards that offer lounge membership and complimentary passes, companion/buddy passes, NEXUS fee rebates, free checked baggage, concierge services, and no FX (foreign exchange) fees. However, as mentioned earlier, the annual $100 travel credit helps fill a much-needed gap in its attractiveness as a travel credit card.

- The insurance benefits are on par with other premium credit cards. Personally, I’ll never use them. For emergency medical insurance, an annual multi-trip plan from an insurer of my choice is a better fit for my age and travel style. The trip cancellation/interruption doesn’t apply because a covered trip is one where “the full cost has been charged to Your Account and/or using Your TD Points.” Like many other travellers, my trips are funded from a variety of sources using a mixture of miles, points, and cash.

- It’s both a blessing and a curse but I’ve been surprised by the types of charges flagged by TD’s fraud detection program. This results in a rejection of the charge and a freezing of my credit card until it’s sorted.

The fact that TD has hitched its rewards wagon to Expedia makes it an interesting proposition. I’m impressed with Expedia For TD’s online portal for booking and redeeming points for travel (and changing a reservation or cancelling via the Virtual Assistant), and the First Class Travel Visa Infinite’s x8 points multiplier on Expedia for TD bookings. For heavy Expedia users, it’s an attractive addition to a credit card portfolio.

I’ve been impressed by recent promotional offers with annual fee waivers and sign-up bonuses of up to 135,000 points. It demonstrates that TD is interested in attracting new customers. To keep them, TD could be more creative with additional travel benefits. Reinstating the option for cardholders to convert TD Rewards to Aeroplan would be a welcome start.

TD needs to increase the value of Book-any-Way redemptions, and introduce an online system for applying points against those purchases. While the Scene+ coding system for travel purchased from other providers isn’t perfect, their system is capable of presenting the vast majority of travel purchases to users for redeeming points online. TD needs to craft an online redemption system that’s as user-friendly as their booking system.

As a fixed value program, TD Rewards can’t match the value achievable with programs such as Aeroplan, British Airways’ Avios, and other frequent flyer programs. But, with the extensive inventory of travel products bookable at Expedia For TD, and the range of travel expenses redeemable as Book any Way travel, it can certainly occupy a very useful secondary corner of a diversified miles-and-points portfolio.

If you found this post helpful, please share it by choosing one of the social media buttons. Also, what do you think of the TD Rewards program? Please add your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- What’s the best use of Scene+ if travelling the world on miles and points

- When travelling the world on miles and points, is the CIBC Aventura program worth it?

- Is a no-FOREX-fee credit card always the best choice for international travel?

- What is the best credit card for trip cancellation, trip interruption and flight delay insurance for trips on points?

- Lounge and flight review of United Airlines’ Polaris experience

- Why the Best Western loyalty program is good for travellers

- Is the BMO Air Miles World Elite MasterCard a good deal?

- Finding Aeroplan flights: a step-by-step guide

- Travel the world on miles and points by meeting Minimum Spend Requirements

Pin for later?

I’m curious if the prices are jacked a bit through the TD Expedia site. For example, I looked at the Park Lane Hotel in Manhattan. For a five night stay in a 1 Queen Bed City View room, , TD Rewards Expedia site said it would be $2222.97, all taxes, fees all in. Looking at the same room through hotels.com or Trivago, I got the same room, all in price of $1723.72/$1743 respectively. When I apply my current Rewards amount of $836 against the $2222.97, I’m left paying $1386.97, which is only around $336 less, even though I used $836! Is Expedia always more expensive? I looked at more than a few other hotels and they are all much cheaper on hotels.com and Trivago.

Thanks for dropping by. While I never experienced price differences between Expedia and Expedia For TD, some people have reported differences, both in inventory and prices. I’ve just done a search for a five-night stay at the Park Lane Hotel in Manhattan (October 12 to 17) and found the same price at Expedia, Hotels and Booking. I couldn’t access Expedia for TD as I no longer have a TD Rewards credit card. Each of the three sites showed a regular price of $466/$468 and a discounted price of $372 for a total price of $1860. It sounds as though Expedia for TD hasn’t adjusted the regular price yet. What I would do is call Expedia for TD and ask them to match the Expedia price (if that’s what you find for your dates on expedia.ca). Good luck!

Excelent article!

Can you clarify when you got the $100 credit? The “in a calendar year” part confuses me. If I booked accommodations via ExpediaForTD over $500 for the first time this year (March 2023), will I get the $100 travel credit right away? within this year? or Jan 2024?

Trackbacks/Pingbacks

- Why the Best Western loyalty program is good for travellers - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- 25 Tips on earning Aeroplan miles - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What’s the best use of Scotia Rewards? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Lounge and flight review of United Airlines’ Polaris experience - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Minimizing Aeroplan taxes, fees and surcharges - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Finding Aeroplan flights: a step-by-step guide - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is the BMO Air Miles World Elite MasterCard a good deal? - Packing Light Travel - […] Is the TD Rewards program worth it? […]

- Is a no-FOREX-fee credit card always the best choice for international travel? - Packing Light Travel - […] Travelling the world on miles and points. Is the TD Rewards program worth it? […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

- $139 annual fee – First year free

- Earn 20,000 TD Rewards points after your first purchase

- 55,000 additional points when you spend $5,000 in the first 180 days

- Annual $100 travel credit (accommodations & vacation packages)

- Birthday bonus of up to 10,000 points

- Earn 8 points per $1 spent when you book on Expedia for TD

- Earn 6 points per $1 spent on groceries and dining

- Earn 4 points per $1 spent on recurring bills

- Earn 3 per $1 spent on all other purchases

The TD First Class Travel Visa Infinite is TD’s flagship credit card. It doesn’t earn you as many TD Rewards points as the TD Platinum Travel Visa card, but it’s arguably more popular. I suspect the reason it’s such a popular card is that you can get the annual fee waived every year if you have a TD All-inclusive plan. Even if you don’t have that plan, the annual fee for the first year is usually free.

The standard welcome bonus for cardholders is typically worth 20,000 points, but TD often runs promotions where you can earn an additional 40,000 – 80,000 TD Rewards points as long as you meet their minimum spend requirement. Since one TD Reward point is worth 0.5 cents each, that’s $500 in value you’re getting if the welcome bonus is worth up to 100,000 points. It’s definitely worth monitoring the current TD First Class Travel Visa Infinite offer as they can sometimes be incredibly valuable.

It’s worth mentioning that the TD First Class Travel Visa Infinite Card is one of the eligible TD credit cards that can earn you Starbucks Rewards partnership. All you need to do is login to your TD app, tap My TD Rewards, the select Starbucks from the partners list.

If you prefer a card with no annual fee, there’s the TD Rewards Visa Card . It earns you 2 TD Rewards Points for every $1 in grocery purchases, restaurant & fast food purchases.

Final thoughts

Despite the lack of redemption options with your points, TD Rewards is still a decent travel loyalty program. Points are easy to accumulate and are easy to use with no blackout dates. Without any transfer partners, TD will always be one of the less popular bank loyalty programs. Many consumers want options. Being partnered with Expedia is great, but giving consumers less value when they book their own travel is a bit ridiculous. Oddly enough, the TD mobile app doesn’t connect you right to Expedia for TD.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

We redeemed ours for Home Depot gift cards and got $175 off a Weber BBQ and now husband just got the card and we will book our interisland Hawaii flights with the bonus points. Straightforward program and easy to use.

Gift cards are such a low value, I’m surprised you guys used your points for that.

Great review Barry. However, I consider the combination of the Scotia Passport Visa Infinite and Scotia’s rewards program far superior because of the absence of foreign transaction fees. I think that’s paramount when selecting a travel rewards card (and its associated rewards program) because you are obviously interested in travel and presumably some portion of your travel is outside of Canada. If you’re retired like we are and spend a good portion of your year outside the country, those 2.5% (or higher) fees add up quickly and can dwarf the $100-$200 in annual card fees. The bottom line is everyone should run the numbers based on their own spending patterns to determine which card and rewards program will deliver the best value. In our case, it wasn’t even close.

In my ranking of all the programs, I have TD at #6 and Scotia at #3 so I agree with your assessment. Although TD doesn’t have a card with no forex fees, there are many cards without an annual fee and with no froex fees so I don’t consider that a major deal-breaker.

Hi Barry, I agree that it shouldn’t be a must-have “deal-breaker.” But I do believe forex fees is something people should definitely be taking into account when estimating total return value and comparing travel cards and travel rewards programs. For some who only spend two weeks outside Canada every year, it won’t make a big difference, but they shouldn’t ignore it.

I really love your articles.

Like Mike said, there are programs out there that are better than this for a lot of people. Really read the small print before choosing. I completely agree on that foreign exchange thing. It’s got me really looking at the Amazon credit card for Canada right now because TD is really biting me on that.

I’d love to see you write a piece comparing the travel dollar values of these ‘point collection programs’ (for example: td versus scotia versus pc).

Although maybe you have and I just haven’t found that article yet.

Although I haven’t compared any programs head to head, I do have reviews for almost every individual program. I also have a general article ranking all of the programs.

https://www.moneywehave.com/canadas-bank-travel-rewards-programs-ranked/

[…] TD Rewards is a good program and I recommend it to anyone who wants an easy program to understand. However, TD Rewards still ranks low compared to others for a few reasons. Although you can redeem 200 points for $1 off ExpediaForTD, you need 250 points for $1 when using the Book Any Way feature which decreases the value of your points. […]

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

Expedia for TD Review: What You Need to Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Put TD Rewards points to work through the Expedia for TD platform, an Expedia portal exclusively for TD credit cardholders that offers the highest redemption value possible for hard-earned TD points.

How does Expedia for TD work?

Is it worth getting expedia for td.

- How to earn TD rewards

How much are TD Rewards points worth?

How to redeem your points on expedia for td, does expedia for td price match, how to log in to expedia for td, pros and cons of expedia for td.

Expedia for TD is an Expedia platform for TD Bank credit cardholders.

TD cardmembers log into the Expedia for TD platform to browse travel deals and redemption options, which include vacation packages, accommodations, exclusive deals and more. TD points are worth more when redeemed through the Expedia for TD platform. Purchasing travel through the platform with a TD credit card earns accelerated TD points.

Expedia.ca vs. Expedia for TD

Expedia.ca is an online travel agency that can be used to book airfare, cruises, hotel accommodations, car rentals and more.

Expedia for TD is an Expedia platform exclusively for customers with credit cards that earn TD Rewards. TD cardholders who earn cash back or Aeroplan points with their cards can’t access the platform.

Other notable differences between Expedia for TD and Expedia.ca? The former offers accelerated TD Rewards points for money spent on travel purchases through Expedia for TD and a dedicated support team for TD customers, while the latter does not.

Outside this, Expedia for TD is not unlike its parent platform, Expedia.ca. Cardholders can browse and book flights, hotel stays, car rentals, cruise tickets and more.

TD Rewards points are most valuable when redeemed through Expedia for TD. The platform, accessed at expediafortd.com, also offers an accelerated earn rate of up to 9 TD Rewards points per $1 spent on travel bookings.

Additional Expedia for TD perks include its price-matching policy on hotels and travel packages and dedicated 24-hour customer support. There are a couple of drawbacks, though. The platform is only for TD credit cardholders who earn TD Rewards points. Plus, there are limitations to Expedia for TD’s price matching — time restrictions apply, and refunds are only issued on flight and hotel packages.

How to earn TD rewards

Some TD credit cards earn TD Rewards points. Earn rates vary.

TD credit cards that earn TD rewards

The following TD credit cards earn TD Rewards points:

- TD Rewards Visa Card.

- TD Platinum Travel Visa Card.

- TD First Class Travel Visa Infinite Card.

- TD Business Travel Visa Card.

For those interested in earning the most TD Rewards Points per dollar, the TD First Class Travel Visa Infinite Card and the TD Business Travel Visa Card carry the highest earn rates. This makes them the best cards for individuals and businesses, respectively.

TD credit cardholders will get the most bang for their buck by redeeming their TD Rewards points through Expedia for TD.

Expect to get around 0.25 to 0.5 cents per TD Rewards point, according to NerdWallet analysis.

The value of TD Rewards points varies depending on the redemption method, but TD Rewards points are at their most valuable when used to redeem travel offers through the Expedia for TD portal. Cardholders can expect to get 0.5 cents per TD Rewards point for travel purchases made through Expedia for TD.

Cardholders must have at least 200 TD Rewards Points — worth $1 — to make a redemption through the Expedia for TD portal.

To redeem your TD points on the Expedia for TD platform:

- Register your TD Rewards account on TD’s website.

- Log into Expedia for TD with your username and password.

- Find the travel offer you’d like to purchase.

- Book your offer through the online Expedia for TD portal or by phone.

- Redeem your TD Rewards Points when you book.

Expedia for TD redemption options

The Expedia for TD booking portal offers numerous redemption options:

- Car rentals.

- All-inclusive vacations.

- Train travel.

How to maximize TD Rewards points

Even if your TD points don’t entirely cover the cost of your booking through the Expedia for TD portal, paying the difference with your TD credit card earns you accelerated points — which gets you closer to another free or discounted travel experience.

Let’s say you book a $500 Air Canada round-trip flight to the Dominican Republic through the Expedia for TD portal. You use 50,000 TD Rewards points towards the booking. This reduces the cost of your trip by $250. You put the outstanding $250 balance on your TD credit card.

Since you can earn up to 9 TD Rewards points for $1 spent through the Expedia for TD portal, the $250 you put on your TD credit card earns you 2,250 TD Rewards Points — which is a value of $11.25 back in your pocket.

Looking for a travel rewards credit card?

We compared the best options in Canada.

Yes. Customers can take advantage of price matching through the Expedia for TD portal — also called Expedia’s Price Guarantee.

How does price matching work?

Expedia will refund the difference if you find cheaper travel packages or accommodations after booking through the Expedia for TD portal. But there are two important caveats. Expedia will only issue a refund if you find:

- A less expensive flight and hotel package within 24 hours of booking.

- A cheaper hotel rate up to 48 hours before check-in.

Pros and cons of Expedia for TD price matching

- Get refunded the difference between your booking and a cheaper travel deal.

- Limited to hotel stays and flight and hotel packages.

- Time restrictions apply.

Once you’ve registered your TD Rewards account on TD’s website, you can log in to Expedia for TD from:

- tdrewards.com.

- expediafortd.com.

Expedia for TD customer service

Expedia for TD has a dedicated support team for TD credit cardholders. The team can be reached by phone at 1-877-222-6492 24 hours a day.

3 tips for using Expedia for TD

Make the most of your TD Rewards points and the Expedia for TD platform with the following tips:

1. Book through Expedia for TD instead of TD’s “Book Any Way.”

Your TD Rewards points are worth 0.5 cents per point when redeemed for travel purchases booked through Expedia for TD. You can also book travel experiences through third-party travel websites and agencies — what TD calls its “Book Any Way” redemption option — but your points won’t go as far. Expect to receive 0.4 cents per point for the first $1,200 of any Book Any Way travel redemption request, and 0.5 cents per point for any amount over $1,200 for the same Book Any Way travel redemption.

2. Use your TD credit card to cover outstanding expenses from Expedia for TD bookings.

You’ll earn TD Rewards points at an accelerated rate when you use your TD credit card to cover outstanding expenses on the Expedia for TD platform. Different cards earn points at different rates:

- TD Rewards Visa earns 4 TD points for every $1 spent on travel purchases through the platform.

- TD Platinum Travel Visa earns 6 TD points for every $1 spent on travel purchases through the platform.

- TD First Class Travel Visa Infinite earns 8 TD points for every $1 spent on travel purchases through the platform.

- TD Business Travel Visa earns 9 TD points for every $1 spent on travel purchases booked online and 6 TD points for every $1 spent on travel purchases booked by phone through the platform.

3. Don’t wait to shop around.

Expedia for TD will only honour its price-matching policy under specific circumstances. If you’ve booked a flight and hotel package, you have just 24 hours to submit a refund request to Expedia for TD if you find a cheaper package. Hotel bookings have a more generous timeframe: Expedia for TD will issue a price-matching refund up to 48 hours before check-in.

- Redeem TD Rewards points for flights, hotel stays, car rentals, cruise tickets and more.

- Earn up to 9 TD Rewards points for every $1 spent on travel purchases through Expedia for TD.

- Receive an annual $100 travel credit when booking through Expedia For TD. (Limited to TD First Class Travel Visa Infinite Cardholders).

- Take advantage of Expedia’s price-matching policy to secure the lowest rates for hotels and hotel/flight packages.

- Dedicated Expedia For TD support team available 24 hours a day.

- Limited to TD credit cardholders who earn TD Rewards.

- Price matching limitations apply.

Frequently asked questions about Expedia for TD

TD points never expire so long as you remain a TD cardholder with an account in good standing. If you don’t earn or redeem any TD Rewards points for at least one year, your account will be deemed inactive. At this time, TD may close your account and offer you the opportunity to redeem your TD Rewards points by a specified date.

There’s no cost associated with accessing the Expedia for TD platform. The travel package options on Expedia for TD are no different than those offered on Expedia.ca, but only certain TD credit cardholders can gain access to it.

About the Author

Shannon Terrell is a lead writer and spokesperson for NerdWallet, where she writes about credit cards and personal finance. Previously, she was a writer, editor and video host for financial…

DIVE EVEN DEEPER

22 Best Credit Cards in Canada for June 2024

NerdWallet Canada’s picks for the best credit cards include top contenders across numerous card categories. Compare these options to find the ideal card for you.

Interest charges don’t need to be a mystery. Use our credit card interest calculator to see how much interest you’d owe if you carry a credit card balance.

18 Best Travel Credit Cards in Canada for June 2024

Explore the best travel credit cards in Canada for daily spending, flexible travel rewards, big welcome bonuses and more.

How to Choose a Travel Credit Card

With so many cards, rewards programs and benefits available, choosing the right travel credit card can be overwhelming. However, once you’ve got one in your wallet, you can reap the rewards on your next trip.

Exciting news for TD Rewards members