Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Airline Loyalty Rewards

British Airways Executive Club Loyalty Program Review

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

BritishAirways.com

Executive Club

London Heathrow Airport (LHR), London Gatwick Airport (LGW), London City Airport (LCY)

- Reward Flight Finder

1.25 cents per point

- Galleries First Lounge, Concorde Room

- List of U.S. British Airways Lounges & Locations, Hours & More

- How To Access British Airways Lounges

- Best Ways To Earn British Airways Avios

- How To Earn Avios With the British Airways Avios eStore

- Best Ways To Redeem British Airways Avios

- Best Ways To Book British Airways First Class With Points

- Best Ways To Book British Airways Business Class With Points

- Best Ways To Use 10,000 (or Fewer) British Airways Avios

- Guide to the British Airways Travel Together Ticket

- How to Upgrade to Business and First Class on British Airways Flights

- British Airways Review – Seats, Amenities & More

- Guide to British Airways’ Direct Routes from the U.S.

- British Airways Boarding Groups & Process

- British Airways Baggage Fees

British Airways Overview

British Airways’ mileage program is Executive Club , and Avios is the reward currency.

You can collect Avios not only on British Airways flights, but also through partner airline flights, hotel stays, car rentals, credit card use, and even online shopping and dining.

You can also purchase Avios if you are short of a reward, share them with a Household Account, or transfer them to friends for a fee.

Joining British Airways Executive Club

Joining the British Airways frequent flyer program is easy and free. Sign up online and begin collecting and redeeming Avios immediately.

How To Sign In to Your British Airways Executive Club Account

Sign in on the British Airways homepage . You’ll need to enter your login ID and PIN/password.

Viewing Your Account Activity

You can manage your account on the My Executive Club page.

Points Expiration

To prevent your Avios from expiring, all you need to do is earn, spend or buy Avios just once every 36 months.

British Airways Mileage Program

British Airways Executive Club has 4 status tiers:

- Blue (general member)

Executive Club Blue:

- Earn and redeem Avios and Tier Points

- No travel benefits

- Member-only offers

Executive Club Bronze:

All Blue benefits, plus:

- 25% Avios bonus

- Priority check-in and boarding

- Free seat selection 7 days prior to departure

Executive Club Silver:

- All Bronze benefits, plus:

- 50% Avios bonus

- Free seat selection at booking

- Additional baggage allowance

- Business class lounge access, including preflight dining at the Boston (BOS), Chicago (ORD), New York (JFK), and Washington, D.C. (IAD) lounges

Executive Club Gold:

- All Silver benefits, plus:

- 100% Avios bonus

- First class lounge access, including preflight dining at the Boston (BOS), Chicago (ORD), New York (JFK), and Washington, D.C. (IAD) lounges

- First class check-in

- Additional reward flight availability

- Reaching 2,500 Tier Points: 1 companion upgrade voucher

- Reaching 3,500 Tier Points: 2 companion upgrade vouchers

Executive Club Gold Guest List:

Strictly speaking, BA’s Gold Guest List is not a Tier of its own. However, it does have some distinctive benefits, so it’s definitely important to include here.

You must already hold Gold status and have earned 5,000 Tier Points in a membership year and 3,000 Tier Points in each year thereafter. That’s a lot of flying!

Its benefits are as follows:

- Concorde Room access at London Heathrow Terminal 5 and New York JFK Terminal 7

- You may gift 1 Gold status and 2 Silver statuses to others

- You can force open reward availability for 5 seats, twice per year, so long as A, B, D, and T fare classes are still available

- Eligibility to invite a second guest to BA departure lounges, and a first guest to the Arrivals lounge

- Hilton Honors Diamond status

Hot Tip: Check out our full list of U.S. British Airways lounges , as well as our guide on how to access British Airways lounges .

Value of British Airways Executive Club Elite Status

Many travelers aspire to Executive Club Gold for access to BA first class lounges and Oneworld Emerald status for partner airline first class lounges. Even with Gold, however, you do not get the flight upgrades that are a treasured perk of many competitor programs.

Executive Club Silver is primarily distinguished for business lounge access. Executive Club Bronze is a typical entry-level elite status. At these levels, some travelers opt into alternate Oneworld programs such as American Airlines AAdvantage .

Earning British Airways Executive Club Elite Status

To reach each level of Executive Club status, you must earn a set number of Tier Points each year:

- Bronze: 300 Tier Points (or take 25 BA flights)

- Silver: 600 Tier Points (or take 50 BA flights)

- Gold: 1500 Tier Points

- Gold Guest List: 5,000 Tier Points (3,000 thereafter to retain)

However, British Airways has temporarily reduced the number of Tier Points needed to offset the many months of lost travel due to the pandemic.

The new thresholds are as follows:

- Bronze: 225 Tier Points (or take 18 BA flights)

- Silver: 450 Tier Points (or take 37 BA flights)

- Gold: 1125 Tier Points

- Gold Guest List: 3,750 Tier Points (2,250 thereafter to retain)

Hot Tip: See our article “ Coronavirus (COVID-19): Airline Elite Status Extensions, Changes, and Updates ” for full details on Executive Club updates for 2021 and beyond.

See the Executive Club Tier Points guide and calculator to estimate how your flights on British Airways and partners will earn Tier Points (or not).

Lifetime Executive Club Gold

Reaching Lifetime Gold status with British Airways is the ultimate accolade. Achieving it means earning a staggering 35,000 Tier Points.

There is no lifetime status for Bronze or Silver. Some dedicated flyers go on “Tier Points runs,” which are the BA equivalent of mileage runs.

Oneworld Status

With Bronze, Silver, and Gold status you also receive a corresponding Oneworld status (Ruby, Sapphire, or Emerald) and the associated benefits when flying with Oneworld partner airlines.

How To Earn Avios

There are tons of ways to earn Avios that you can redeem for flights on British Airways or one of its partners.

Earn Avios by Flying BA

Every time you fly with British Airways or any of its partner carriers, you will collect a minimum of 125 Avios per flight.

Unlike the U.S. where miles earned are progressively becoming more monetary-based, this means you can still make “mileage runs” and earn extra Avios by having many transfers on your itinerary without having to break the bank.

Your Avios and Tier Points earnings depend on travel class and fare class.

Executive Club elite status members earn even more Avios: 25% bonus for Bronze, 50% bonus for Silver, and 100% bonus for Gold.

Earn Avios by Flying BA’s Partner Airlines

British Airways is a member of the Oneworld alliance which means that you can earn Avios by flying with other members like Alaska Airlines and Iberia. You can also earn Avios by flying with non-Oneworld airlines including Aer Lingus, Air Baltic, LATAM, and some Loganair flights.

Each partner is subject to its own Avios and Tier Points earning rules. It gets complicated, so check carefully .

Earn Avios With Credit Cards

There is only 1 British Airways-branded credit card in the U.S.: the British Airways Visa card . You will earn 5x Avios per $1 spent with British Airways, Aer Lingus, Iberia, and LEVEL during your first 12 months of card membership. This reduces to 3x Avios per $1 thereafter.

Cardholders will earn a bonus of 3x Avios per $1 spent on stays booked directly with hotels within the first 12 months of ownership. This reduces to 2x Avios per $1 thereafter.

All other purchases will earn 1 Avios per $1 spent.

British Airways also has partnered with 4 transferable points programs. These partnerships make it easy to transfer points to your Executive Club account whenever you need some Avios for an award booking.

You can use American Express transfer partners , Chase Ultimate Rewards transfer partners , Capital One miles , and Marriott Bonvoy points to British Airways Executive Club. Both Amex and Chase points currencies transfer to Avios at a 1:1 transfer ratio. Capital One miles transfer to Avios at a 2:1.5 ratio.

Marriott Bonvoy points transfer to Avios at a 3:1 ratio. If you transfer a chunk of 60,000 Marriott Bonvoy points, you’ll even get an additional 5,000 Avios.

Other Ways To Earn Avios

See our article on the best ways to earn lots of British Airways Avios for many opportunities to earn Avios with British Airways’ travel and retail partners. Plus, earn even more when shopping with the British Airways Avios eStore shopping portal .

Branded and Partnered Credit Cards

There are a number of credit cards that can help you earn lots of Avios that can be redeemed for amazing flights.

British Airways Visa Signature ® Card

The most simple method is using Chase’s co-branded British Airways Visa card .

This card is great for British Airways frequent flyers, and traveling couples will find great value in the Travel Together Ticket.

The British Airways Visa Signature ® Card is a stellar option for travelers who regularly travel with the airline. From all of the Avios the card helps you earn, to a 10% discount off cash tickets, and the award flight statement credits, you can get tons of value out of the card each year.

- 3x Avios per $1 on British Airways, Aer Lingus, Iberia, and LEVEL purchases

- 2x Avios per $1 on hotel accommodations purchased directly through hotels

- 1x Avios per $1 on all other purchases

- 10% off British Airways flights starting in the U.S. (when booking through the designated website)

- Travel Together Ticket after $30,000 in card spend in a calendar year

- Up to $600 in award flight statement credits each year

- No foreign transaction fees

- Baggage delay insurance

- Lost luggage insurance

- Purchase protection

- Extended warranty protection

- $95 annual fee

- Does not earn transferable rewards

- Limited time offer! Earn 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening. Plus, 5x Avios on up to $10k in gas, grocery stores, and dining purchases for first 12 months!

- Earn 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL.

- Earn 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel.

- 10% off British Airways flights starting in the US when you book through the website provided in your welcome materials.

- Every calendar year you make $30,000 in purchases on your British Airways Visa card, you’ll earn a Travel Together Ticket good for two years.

- Pay no foreign transaction fees when you travel abroad.

- Simply tap to pay with your contactless British Airways Visa Signature Card. Just look for the contactless symbol at checkout. It’s fast, easy and secure!

- Member FDIC

Financial Snapshot

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Airline Credit Cards

- Best Sign Up Bonuses

Rewards Center

British Airways Executive Club

- The Best Ways to Use 10,000 British Airways Avios

- Ways to Use British Airways Avios Without Huge Fuel Surcharges

This co-branded card offers its owners one of the most valuable perks in the airline loyalty world: the British Airways Travel Together Ticket .

Once it’s earned, you can redeem it for a buy-one-get-one-free international award ticket . In other words, you would be spending 100,000 Avios on a redemption for 2 people rather than 200,000.

Chase Ultimate Rewards Credit Cards

Earning Chase Ultimate Rewards might be the best way to find your way to a ton of Avios. Chase cards have plenty of bonus categories to boost your Avios account.

Recommended Chase Cards (Personal)

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- 3x points on dining purchases, online grocery purchases, and select streaming services

- 2x points on all other travel worldwide

- $50 annual credit on hotel stays booked through the Chase Travel portal

- 6 months of complimentary Instacart+ (activate by July 31, 2024), plus up to $15 in statement credits each quarter through July 2024

- Excellent travel and car rental insurance

- 10% annual bonus points

- No foreign transaction fees

- 1:1 point transfer to leading airline and hotel loyalty programs like United MileagePlus and World of Hyatt

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Credit Cards

- Travel Rewards Credit Cards

Chase Ultimate Rewards

- The Chase Sapphire Preferred 80k or 100k Bonus Offer

- Benefits of the Chase Sapphire Preferred

- Chase Sapphire Preferred Credit Score Requirements

- Military Benefits of the Chase Sapphire Preferred

- Chase Freedom Unlimited vs Sapphire Preferred

- Chase Sapphire Preferred vs Reserve

- Amex Gold vs Chase Sapphire Preferred

Chase Sapphire Reserve ®

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- 5x points on airfare booked through Chase Travel SM

- 3x points on all other travel and dining purchases; 1x point on all other purchases

- $300 annual travel credit

- Priority Pass airport lounge access

- TSA PreCheck, Global Entry, or NEXUS credit

- Access to Chase Luxury Hotel and Resort Collection

- Rental car elite status with National and Avis

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- APR: 22.49%-29.49% Variable

- Chase Sapphire Reserve 100k Bonus Offer

- Chase Sapphire Reserve Benefits

- Chase Sapphire Reserve Airport Lounge Access

- Chase Sapphire Reserve Travel Insurance Benefits

- Chase Sapphire Reserve Military Benefits

- Amex Gold vs Chase Sapphire Reserve

- Amex Platinum vs Chase Sapphire Reserve

Chase Freedom Unlimited ®

This all-purpose cash-back card offers great bonus categories, including bonus points for every purchase you make!

The Chase Freedom Unlimited ® is easily one of the best cash-back credit cards on the market. There aren’t many no-annual-fee credit cards that offer multiple great bonus categories like 5% back on travel purchased through Chase, 3% back on dining and drugstore purchases, and 1.5% back on all other purchases.

When paired with other Chase cards in the Ultimate Rewards family, you can transfer that cash back into points if you wish – making it one of the most lucrative cards in your wallet.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- 5% back on travel purchased through Chase Travel

- 3% back on dining and drugstore purchases

- 1.5% back on all other purchases

- No annual fee

- Earn big on travel purchased through Chase Travel

- Everyday bonus on dining and drugstores

- Straightforward cash-back on all other purchases

- Ability to pool points

- 3% foreign transaction fee

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited ® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- APR: 0% Intro APR for 15 months on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- Foreign Transaction Fees: 3% of each transaction in U.S. dollars

- Cash Back Credit Cards

- No Annual Fee Cards

- Benefits of the Chase Freedom Unlimited

- Chase Freedom Unlimited Requirements and Credit Score

- Car Rental Benefits of the Chase Freedom Unlimited

- Chase Freedom Unlimited vs Chase Freedom Flex

- Amex Blue Cash Everyday vs Chase Freedom Unlimited

- Best 0% Interest Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Bills and Utilities

- Best Instant Use Credit Cards

Chase Freedom Flex℠

The Freedom Flex card is an excellent no-annual-fee card that still earns big with 5% cash-back on travel and other bonus categories.

The Chase Freedom Flex℠ sure does pack quite a punch — especially for a no-annual-fee card.

The Freedom Flex card is an incredible option for those looking for a well-rounded cash-back card, or a powerful point-earner when paired with a premium card in the Ultimate Rewards family.

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- Powerful cash-back earner: 5% back on quarterly categories and travel purchases through Chase Ultimate Rewards, 3% back on dining and drugstore purchases, and 1% back on all other purchases

- Excellent cell phone insurance

- Mastercard World Elite benefits

- 3% foreign transaction fees in U.S. dollars

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% cash back on travel purchased through Chase Ultimate Rewards ® , our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- No annual fee - You won't have to pay an annual fee for all the great features that come with your Freedom Flex℠ card

- Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more.

- APR: 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- Benefits of the Chase Freedom Flex

- Amex Blue Cash Everyday vs Chase Freedom Flex

- Best 5% Cash Back Credit Cards

- Best Credit Cards for Cell Phone Protection

- Best Chase Credit Cards

If you’re a business owner, see our list of recommended Chase business credit cards .

American Express Membership Rewards Credit Cards

Like Chase, earning Membership Rewards is a quick way to get your hands on tons of Avios thanks to tons of bonus categories.

Recommended American Express Cards

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

American Express ® Gold Card

This is the best card for food lovers who dine out at restaurants (worldwide), order take-out and want big rewards at U.S. supermarkets!

The American Express ® Gold Card is a game-changer.

With this card, you can earn 4x Membership Rewards points at restaurants and you’ll also earn 4x Membership Rewards points at U.S. supermarkets on up to $25,000 per calendar year in purchases, then 1x.

There isn’t another card on the market that offers a 1-2 punch like this. Of course, there are several other benefits of the Gold Card as well, including extra monthly dining rewards and more.

- 4x points per dollar at restaurants, plus takeout and delivery in the U.S.

- 4x points per dollar at U.S. supermarkets, up to $25,000 per calendar year in purchases; and 1x thereafter

- 3x points per dollar on flights purchased directly from airlines or at Amex Travel

- Up to $120 annual dining credit: up to $10 monthly statement credit when you pay with the Amex Gold card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com , Milk Bar and select Shake Shack locations

- Up to $120 in annual Uber Cash : get $10 monthly in Uber Cash for Uber Eats orders or Uber rides in the U.S. when you add your Gold Card to your Uber account

- No foreign transaction fees (see rates and fees )

- Access to Amex’s The Hotel Collection

- Access to American Express transfer partners

- $250 annual fee (see rates and fees )

- No lounge access

- Earn 60,000 Membership Rewards ® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards ® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards ® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards ® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express ® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Find the Amex Gold 75k or 90k Welcome Bonus Offer

- Benefits of the Amex Gold

- Upgrade Amex Gold to Amex Platinum

- Amex Gold Benefits for Military

- Amex Gold vs Blue Cash Preferred

- Amex Platinum vs Amex Gold

- Amex Gold vs Delta Gold

Business owners can review our list of the best Amex business cards .

Marriott Bonvoy Credit Cards

Earning Marriott Bonvoy points is another great way to get some Avios. The transfer bonus of 5,000 Avios for every transfer of 60,000 Marriott Bonvoy points just makes it even better.

Recommended Marriott Bonvoy Cards

Marriott Bonvoy Bold ® Credit Card

A great option for Marriott hotel fans who want a no annual fee card and automatic Marriott Bonvoy elite status.

Casual travelers who like to frequent properties that are part of the Marriott Bonvoy collection of brands may want to consider the Marriott Bonvoy Bold ® Credit Card.

The Marriott Bold card rewards cardholders for Marriott stays and gives them a boost towards Marriott Bonvoy elite status.

- Up to 14x points per $1 on Marriott purchases

- 2x points per $1 on travel purchases

- 15 Elite Night Credits each year (automatically gives you Silver Elite status)

- Lower point earn rate than other Marriott Bonvoy cards

- Marriott Bonvoy Silver Elite status is the lowest status tier

- Earn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening.

- Pay no annual fee with the Marriott Bonvoy Bold ® Credit Card from Chase ® !

- Earn up to 14X total points per $1 spent at thousands of hotels participating in Marriott Bonvoy ® with the Marriott Bonvoy Bold ® Card.

- 1X point for every $1 spent on all other purchases.

- Your points don't expire as long as you make purchases on your card every 24 months.

- APR: 21.49%–28.49% Variable

- Hotel Credit Cards

Marriott Bonvoy

- Marriott Transfer Partners

- Best Credit Cards for Marriott Loyalists

- Best Marriott Credit Cards

Marriott Bonvoy Boundless ® Credit Card

Marriott loyalists will love this card's annual free night award, automatic elite status, and up to 17x points per $1 on Marriott hotel stays.

If you’re a frequent traveler and a Marriott loyalist, there’s a lot to love about the Marriott Bonvoy Boundless ® Credit Card . The card comes packed with several great benefits like a free hotel night once a year, automatic Silver Elite status (with a fast-track to Gold Elite status), and multiple options for redeeming points.

- Earn big when you use your card at thousands of participating Marriott Bonvoy hotels

- Earn big at grocery stores, gas stations, and dining

- Automatic Silver Elite Status

- 1 Free Night Award each cardmember anniversary (valued up to 35,000 points)

- One year complimentary DoorDash DashPass subscription

- Marriott Silver status is the lowest status tier

- Earn 3 Free Night Awards (each night valued up to 50,000 points) after qualifying purchases.

- Earn 3X points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining.

- Earn 1 Elite Night Credit towards Elite Status for every $5,000 you spend.

- 1 Free Night Award (valued up to 35,000 points) every year after account anniversary.

- Earn up to 17X total points per $1 spent at thousands of hotels participating in Marriott Bonvoy ® with the Marriott Bonvoy Boundless ® Card.

- Receive 15 Elite Night Credits annually, automatic Silver Elite status, and path to Gold Status when you spend $35,000 on purchases each calendar year.

- No Foreign Transaction Fees. Your points don't expire as long as you make purchases on your card every 24 months.

- The 75,000 or 100,000 Bonus Point Offer for the Marriott Boundless

- 23 Valuable Benefits of the Marriott Bonvoy Boundless Credit Card

- Best Hotel Credit Cards for Free Nights

Marriott Bonvoy Bevy™ American Express ® Card

The Marriott Bonvoy Bevy card gives you automatic Marriott elite status and helps you earn more Marriott Bonvoy points on your everyday purchases.

The Marriott Bonvoy Bevy™ American Express ® Card , the latest mid-tier offering in the Marriott Bonvoy lineup of cards, offers cardholders automatic elite status and ways to earn more Marriott Bonvoy points on each of their stays and daily purchases.

- 6x points per $1 at hotels participating in Marriott Bonvoy

- 4x points per $1 at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases per calendar year, then 2X points)

- 2x points per $1 on all other purchases

- Complimentary Marriott Bonvoy Gold Elite status

- 15 Elite Night Credits per year

- 1,000 bonus points per paid stay

- 1 Free Night Award (up to 50,000 points) when you spend $15,000 on the card in a year

- $250 annual fee ( rates and fees )

- Free Night Award certificate is not an automatic benefit

- Earn 155,000 Marriott Bonvoy bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership.

- Earn 6X Marriott Bonvoy ® points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy.

- Earn 4X points at restaurants worldwide and U.S. supermarkets (on up to $15,000 in combined purchases at restaurants and U.S. supermarkets per calendar year, then 2X points).

- Earn 2X points on all other eligible purchases.

- Marriott Bonvoy 1K Bonus Points Per Stay: Earn 1,000 Marriott Bonvoy ® bonus points per paid eligible stay booked directly with Marriott for properties participating in Marriott Bonvoy.

- With complimentary Marriott Bonvoy Gold Elites status, earn up to 2.5X points from Marriott Bonvoy ® on eligible hotel purchases with the 25% Bonus Points on stays benefit, available for Qualifying Rates.

- Marriott Bonvoy Bevy Free Night Award: Earn 1 Free Night Award after spending $15,000 on eligible purchases on your Marriott Bonvoy Bevy™ Card in a calendar year. Award can be used for one night (redemption level at or under 50,000 Marriott Bonvoy ® points) at a hotel participating in Marriott Bonvoy ® . Certain hotels have resort fees.

- 15 Elite Night Credits: Each calendar year with your Marriott Bonvoy Bevy™ American Express Card ® you can receive 15 Elite Night Credits toward the next level of Marriott Bonvoy ® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express. Terms apply.

- Plan It ® is a payment option that lets you split up purchases of $100 or more into equal monthly installments with a fixed fee. Plus, you'll still earn rewards the way you usually do.

- $250 Annual Fee.

- Terms apply.

- APR: 20.99%-29.99% Variable

Marriott Bonvoy Brilliant ® American Express ® Card

A premium card for Marriott fans who want perks like an annual statement credit and Free Night Award, plus a fast track to Marriott elite status.

The Marriott Bonvoy Brilliant ® American Express ® Card is a premium card designed with road warriors and Marriott Bonvoy loyalists in mind.

So is the card a worthwhile addition to your wallet?

- 6x points per $1 at hotels participating in Marriott Bonvoy program

- 3x points per $1 on flights booked directly with airlines and restaurants worldwide

- 25 Elite Night Credits each year

- Priority Pass Select membership upon enrollment

- Global Entry or TSA PreCheck application fee statement credit

- Annual Free Night Award after card renewal

- Complimentary Platinum Elite status

- Steep annual fee of $650 ( rates and fees )

- 6x points per $1 is the same earn rate offered with lower annual fee alternatives like the Marriott Bonvoy Bevy™ American Express ® Card

- Earn 185,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

- $300 Brilliant Dining Credit: Each calendar year, get up to $300 (up to $25 per month) in statement credits for eligible purchases made on the Marriott Bonvoy Brilliant ® American Express ® Card at restaurants worldwide.

- With Marriott Bonvoy Platinum Elite status, you can receive room upgrades, including enhanced views or suites, when available at select properties and booked with a Qualifying Rate.

- Earn 6X Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in Marriott Bonvoy ® . 3X points at restaurants worldwide and on flights booked directly with airlines. 2X points on all other eligible purchases.

- Free Night Award: Receive 1 Free Night Award every year after your Card renewal month. Award can be used for one night (redemption level at or under 85,000 Marriott Bonvoy points) at hotels participating in Marriott Bonvoy ® . Certain hotels have resort fees.

- Each calendar year after spending $60,000 on eligible purchases on your Marriott Bonvoy Brilliant ® American Express ® Card, you will be eligible to select a Brilliant Earned Choice Award benefit. You can only earn one Earned Choice Award per calendar year. See https://www.choice-benefit.marriott.com/brilliant for Award options.

- $100 Marriott Bonvoy Property Credit: Enjoy your stay. Receive up to a $100 property credit for qualifying charges at The Ritz-Carlton ® or St. Regis ® when you book direct using a special rate for a two-night minimum stay using your Card.

- Fee Credit for Global Entry or TSA PreCheck ® : Receive either a statement credit every 4 years after you apply for Global Entry ($100) or a statement credit every 4.5 years after you apply for a five-year membership for TSA PreCheck ® (up to $85 through a TSA PreCheck official enrollment provider) and pay the application fee with your Marriott Bonvoy Brilliant ® American Express ® Card. If approved for Global Entry, at no additional charge, you will receive access to TSA PreCheck.

- Each calendar year with your Marriott Bonvoy Brilliant ® American Express ® Card you can receive 25 Elite Night Credits toward the next level of Marriott Bonvoy ® Elite status. Limitations apply per Marriott Bonvoy member account. Benefit is not exclusive to Cards offered by American Express. Terms apply.

- Enroll in Priority Pass™ Select, which offers unlimited airport lounge visits to over 1,200 lounges in over 130 countries, regardless of which carrier or class you are flying. This allows you to relax before or between flights. You can enjoy snacks, drinks, and internet access in a quiet, comfortable location.

- No Foreign Transaction Fees on international purchases.

- With Cell Phone Protection, you can be reimbursed, the lesser of, your repair or replacement costs following damage, such as a cracked screen, or theft for a maximum of $800 per claim when your cell phone line is listed on a wireless bill and the prior month's wireless bill was paid by an Eligible Card Account. A $50 deductible will apply to each approved claim with a limit of 2 approved claims per 12-month period. Additional terms and conditions apply. Coverage is provided by New Hampshire Insurance Company, an AIG Company.

- $650 Annual Fee.

- Best Credit Cards with Priority Access

Capital One Miles Credit Cards

You can earn Capital One miles and redeem them for Avios at a 2:1.5 ratio.

Recommended Capital One Miles Cards

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Travel Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

Capital One VentureOne Rewards Credit Card

The card offers unlimited miles at 1.25x per $1 and no annual fee. When you consider the flexible rewards, frequent travelers come out on top.

Interested in a travel rewards credit card without one of those pesky annual fees? Then say hello to the Capital One VentureOne Rewards Credit Card.

In addition to no annual fee, the Capital One VentureOne card offers no foreign transaction fees.

But is this card worth its salt, or is it merely a shell of the more popular Capital One Venture card?

- No annual fee ( rates & fees )

- Ability to use transfer partners

- Fraud coverage

- Weak earn rate at 1.25x miles per $1 spent on all purchases

- No luxury travel or elite benefits

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

- APR: 19.99% - 29.99% (Variable),0% intro on purchases for 15 months

- Benefits of the Capital One VentureOne Card

- Capital One Venture X Card vs. Capital One VentureOne Card [Detailed Comparison]

- Capital One Platinum Card vs. VentureOne and Venture Cards [Detailed Comparison]

- Best Virtual Credit Cards

- Best Instant Approval Credit Cards

- Capital One Transfer Partners

- easyJet Review – Seats, Amenities, Customer Service, Baggage Fees, & More

- The 5 Best First Credit Cards For Beginners [April 2024]

Other Hotel Partner Credit Cards

A few hotel programs will let you transfer points to British Airways. However, this is almost always a poor use of hotel points.

Unless you are really in a bind, save your hotel points for hotel award stays at your destination.

How To Redeem Avios

Now that we’ve listed the best ways to use Avios, let’s talk about some other details. British Airways Executive Club is significantly different from traditional airline frequent flyer programs. By learning how spending Avios works, you can have fantastic travel experiences!

Traditional airline award charts are priced by geographic region, meaning the miles price is fixed regardless of distance or flight connections in that region. This gives you the traditional 25,000-mile U.S. domestic round-trip award ticket familiar to many travelers.

British Airways has a distance- and segment-based award chart, and understanding it is crucial to get value from flight awards.

Each Avios award redemption is priced by distance for every segment of a trip; prices add up fast!

New York (JFK) to Chicago (ORD) in economy nonstop, for example, is 9,000 Avios.

If no nonstop is available and you need to connect in Cleveland (CLE), the price almost doubles to 15,000 Avios since each segment is priced separately. New York (JFK) to Cleveland (CLE) is 7,500, and Cleveland (CLE) to Chicago (ORD) is another 7,500. Avios charges you for both!

How Much Do British Airways Avios Award Flights Cost?

British Airways no longer publishes an award chart. Instead, you can check out our table below for the most up-to-date redemption costs.

While we’re talking about the overall “cost” of Avios award flights, we should remind you here that in addition to the amount of Avios, you’ll have to pay an additional cash amount that includes taxes, fees, and carrier charges.

There are 4 types of prices, and each varies based on flight distance:

- British Airways flights have peak and off-peak prices

- Iberia flights have peak and off-peak prices that differ slightly from British Airways flights

- Single-partner awards are 1 price with no peak or off-peak dates

- Multi-partner awards are priced by total trip distance

Flights under 650 miles start at 4,750 Avios, except in North America where they start at 7,500 Avios.

List of Alliance and Non-Alliance Airline Partners

British Airways partners with many different airline frequent flyer programs; below are the members of Oneworld alliance. BA is also partners with Aer Lingus .

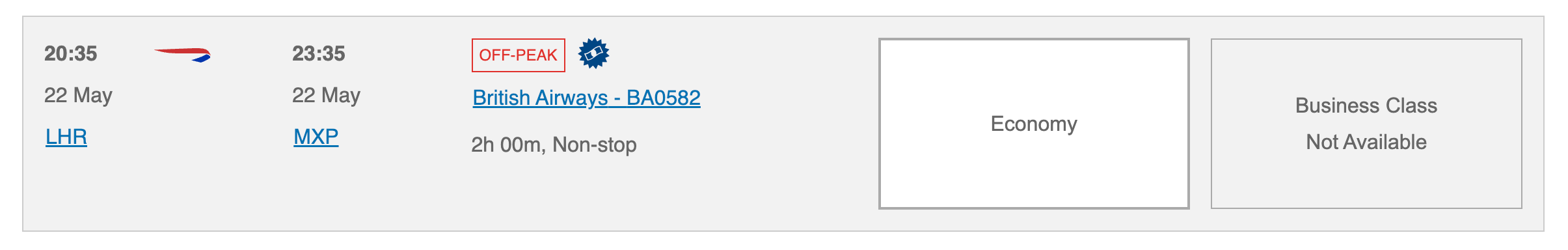

Peak or Off-Peak Dates

British Airways has peak and off-peak dates published every year. Our article, Airline Peak & Off-peak Award Charts: The Ultimate Guide , has these dates across all applicable airlines, including BA.

First vs. Business Class

Not all airlines or flights have all classes of service.

Beware of domestic “first class” flights that are not worth the price! If you were to fly from New York (JFK) to San Francisco (SFO) on an American Airlines narrow-body Airbus A320, paying 51,500 Avios for “domestic first” instead of 13,000 Avios in economy probably isn’t worth it .

In contrast, some of the coolest Avios awards are for short first or business class flights that grant you access to incredible airline lounges. This may be the cheapest way to experience Cathay Pacific’s The Wing in Hong Kong (HKG) or the Qantas International First Lounge in Sydney (SYD).

Multi-Carrier Award Flights

Multi-carrier means a combination of 2 airlines on a single ticket, and these awards have their own chart.

These awards are expensive , and you’ll most likely do better by booking separate airlines on separate tickets.

The multi-carrier Avios price is the same regardless of connections, one-way, or round-trip: only total distance matters . However, taxes, fees, and carrier charges vary widely, so beware!

In general, premium economy is 1.5 times the economy price, business is 2 times economy, and first class is 3 times economy.

What Is Reward Flight Saver?

The British Airways Reward Flight Saver can save you cash on British Airways Europe flights and Comair flights.

Your account must have earned Avios in the past 12 months to be eligible for Reward Flight Saver.

With Reward Flight Saver, award flights on British Airways within Europe and Comair in Africa are charged reduced, flat fees. This is in lieu of other taxes and surcharges.

Reward Flight Saver is automatically applied on qualifying itineraries.

Here’s an example:

Thanks to BA’s Reward Flight Saver, you can pay as little as 8,000 Avios for a one-way flight in Club Europe from London to Barcelona (BCN). Passengers are given the option of selecting an Avios and cash combination that best suits their individual wallet.

Hot Tip: At first glance, paying just 70 cents for the 20,000 Avios option might appear to be a steal. However, given Upgraded Points’ valuation of Avios at 1.25 cents per Avios, it puts the total for that option at $250.70, whereas the lowest Avios/highest cash option comes in at a true value of around $200.

What Is Part Payment?

British Airways and some partner airlines may have several payment options that allow you to use a combination of Avios and cash.

If you want to use fewer Avios or don’t have enough to complete a booking, you can choose an option that includes more cash.

Here are the Avios and cash options for London (LHR) to Doha (DOH) with Qatar Airways as an example:

British Airways Avios and cash gives you options to save Avios or save cash. A similar option is available when booking cash tickets to save money by using some Avios.

Hot Tip: Do the math before deciding whether to use your Avios to save money on a flight. In this example, as the amount of money you can save increases, the amount of Avios required to save the money increases disproportionately. This means that the “£10 off with 1,000 Avios” option gives you a value of 1.3 cents per Avios whereas the “£165 off with 38,500” option Avios gives you a value of just 0.4 cents per Avios.

Beware of Surcharges on British Airways Flights

Extremely high fees are added to the Avios award price of many British Airways flights. Exceptions are flights within Europe that qualify for Reward Flight Saver. In recent times, British Airways has also brought down the fees on other long-haul flights, including transatlantic.

In some extreme cases, it’s not unheard for the cash component of a British Airways award redemption to be as much as directly buying a cash ticket!

The highest of the fees are often those tagged on to redemptions in premium cabins.

If we take a British Airways flight from London (LHR) to Cape Town (CPT) in Club World (business class) as an example, it would cost 62,500 Avios and a whopping $561 !

Bottom Line: As a general rule of thumb, short-distance, nonstop flights on partner airlines offer the best Avios value. You may also consider our guide on ways to use British Airways Avios without huge fuel surcharges .

Where To Search for British Airways Avios Award Flights

You can search for British Airways award flights and most airline partners (with the exception of Air Baltic and Loganair) on ba.com . For Aer Lingus, you can search avios.com or aerlingus.com .

Hot Tip: Be cautious searching for awards directly on other airline partner websites. Some awards may only be available to their own members, not to partners. For American Airlines, you can only use Avios to book what American shows as MileSAAver awards, not AAnytime awards.

Start 355 Days in Advance

Awards are available up to 355 days before departure, and there are no award holds or waitlists.

Hot Tip: British Airways can book partner awards up to 355 days before departure, but American Airlines is only 330. With British Airways, you can access awards weeks before American Airlines members can!

How To Search for British Airways Rewards

Start at ba.com , navigate to Book, then Book a flight with Avios .

When the search screen says You can break your journey with stopovers , select No, I want to continue without stopovers .

This will search partner flights in addition to British Airways flights.

When searching British Airways rewards flights, select no stopover unless you want to visit London.

Flights may not display on ba.com for various reasons:

- Certain partner airlines are not searched

- “Route unavailable” means the website is not programmed for that route

- Multi-connection flight options are not searched

Online Booking Problems? Call and Waive the Fee

Even if you can’t find an award on the website, the good news is that if an award is available, you can call in to have British Airways agents book it!

Ask the agent to waive the $25 phone booking fee since the flight is unavailable online. They will usually do so if you ask.

Bottom Line: Many award flights are available online. If not, call to book and ask to waive the $25 booking fee since it is not available online!

How To Get a Free London Stopover

When flying British Airways, you have the option of a free stopover in London.

When the award search screen says You can break your journey with stopovers , select, I want to break my journey and choose my stopovers .

Your London stopover can be a few days or even several months.

Given that the pricing for a stopover is the same as booking the same route with a small transfer at Heathrow on the same day, it makes just as much sense to book 2 separate flights if you are planning on staying in London.

Bottom Line: To minimize fees, the best London stopover value is between 2 U.K. or European cities near to London rather than long-haul flights.

Use British Airways Executive Club Household Accounts to Pool Avios

You can form a British Airways Executive Club Household Account where you and up to 6 people at the same address can become a Household to pool Avios. You can even add your kids and have them start earning Avios from an early age.

Awards are deducted proportionally from the Household common pool of Avios, and each household member is able to earn Tier Points and progress through the tiers of the Executive Club.

There are some important restrictions about Household Accounts:

- 1 person is the Head of Household who can add/remove members or change the address (1 address change allowed per 6 months)

- You cannot redeem rewards for members not in the Household, except for up to 5 people added to the Friends and Family list (changes are only allowed once per 6 months; from the first change you have 24 hours to complete all changes before the 6-month freeze)

- Household Accounts cannot use the Combine My Avios tool to move Avios between BA and Iberia; instead, you’ll need an avios.com account

- Members must be 18 years old before being able to spend Avios

Bottom Line: Without a Household Account, British Airways charges fees to transfer Avios to another member (Gold members can transfer for free). The maximum you can transfer in a year is 162,000 Avios, and those are capped at 27,000 Avios per recipient. At $290 per 27,000 Avios to transfer, that is absurd!

Low Cancel Fees = Flexibility!

Avios award tickets have some of the lowest booking fees among major airlines and there are no last-minute ticketing fees!

Change or cancellation fees for those departing North America are relatively low: $55. If the cash portion of your Avios award ticket is less than $55, then you only forfeit the cash amount you paid . You don’t pay the full $55 unless your ticket’s fees were $55 or more.

Note that the phone fee is an extra $25 if you don’t change or cancel online.

A U.S. domestic nonstop on American Airlines is only charged $5.60 taxes. If you later cancel, you only lose $5.60… a small price to pay for flexibility!

Quick Guide to Iberia Avios

In 2010, Spanish airline Iberia Airlines merged with British Airways to give you another excellent way to avoid British Airways’ fuel surcharges.

You can also transfer Amex Membership Rewards , Chase Ultimate Rewards , Capital One miles , and Marriott Bonvoy points to British Airways Executive Club and then to Iberia Plus.

If you want to transfer your Avios from BA to Iberia, sign up for an Iberia Plus account. To transfer, your Iberia account must be at least 90 days old and have earned Avios to make a successful transfer from British Airways.

After 90 days from Iberia account opening, log in to your British Airways Executive Club account, click on Manage My Account , and select Combine My Avios from the drop-down and then again on the next page.

Select Iberia Plus from the list of programs and enter your Iberia Plus number and PIN.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One VentureOne Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Bold ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Marriott Bonvoy Boundless ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the Marriott Bonvoy Bevy™ American Express ® Card, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here .

Frequently Asked Questions

What is british airways executive club.

Executive Club is British Airways’ frequent flyer program.

Why should I join British Airways Executive Club? What are the benefits?

BA Executive Club is free to join.

You can earn points, called Avios, that can be redeemed for travel on BA, its airline partners, and for other things.

Elite status levels in the Executive Club are Blue, Bronze, Silver, and Gold.

Benefits of status include earning additional bonus miles while flying, discounts on in-flight purchases, priority check in, free bags, lounge access, standby access, seat assignments, and more.

What are Avios?

Avios is the name of the points currency used by British Airways Executive Club. Avios is now the points currency of additional airlines including Aer Lingus, Qatar Airways, and Iberia, though each program remains separate and has its own elite status and award options.

What are Tier Points?

Tier Points are earned on British Airways and partner flights. Executive Club elite status is earned by Tier Points: 300 for Bronze, 600 for Silver, 1,500 for Gold. Use the Avios and Tier Points Calculator to find out how much you will earn for your flight.

Is there a British Airways credit card?

Yes. We’ve reviewed the British Airways Visa card . You can also transfer Amex Membership Rewards , Chase Ultimate Rewards , Capital One miles , and Marriott Bonvoy points to BA Executive Club.

How do I join the BA Executive Club?

You can sign up for the club by using this link .

What is the BA Executive Club login?

You can sign in to your Executive Club account here .

Who are the BA Executive Club partners?

BA is a member of the Oneworld alliance , so partners include all of these airlines and more . BA also has partnerships with Aer Lingus, Air Baltic, LATAM, and Loganair.

Was this page helpful?

About Alex Miller

Founder and CEO of Upgraded Points, Alex is a leader in the industry and has earned and redeemed millions of points and miles. He frequently discusses the award travel industry with CNBC, Fox Business, The New York Times, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

An excellent use of Avios: British Airways’ Reward Flight Saver redemptions

Avios, the rewards currency of the British Airways Executive Club program, are easy to earn and redeem even if you don't travel to the United Kingdom.

Long-haul premium cabin redemptions booked through the Executive Club program can also require significant fees, taxes and surcharges, making this currency appear less valuable.

However, Reward Flight Savers are a fantastic use of Avios, as they allow you to pay less than $1 per flight in fees, taxes and surcharges. That's about as close to free travel as you can get.

Reward Flight Savers are available on all British Airways-operated flights worldwide in all cabins except first class.

Related: Lower fuel surcharges: Reward Flight Saver rolled out on all British Airways flights

Reward Flight Saver basics

Reward Flight Savers are priced per flight, not per journey. So, if you are flying from Edinburgh, Scotland, to Geneva via London on British Airways, the award is priced based on the distance per segment. Since you'll have a stopover in London, it may be more convenient and a better value to book a paid ticket on another airline with a direct flight.

As well as having the Avios available in your Executive Club account, you must have earned at least 1 Avios in the 12 months before booking in order to take advantage of Reward Flight Saver.

Reward Flight Savers can be especially valuable for last-minute flights, as their fixed prices keep costs low. I have regularly used Reward Flight Savers for flights less than 650 miles a few days in advance when revenue fares were more than $200. That's a fantastic use, based on TPG's Avios valuation .

Reward Flight Saver awards are marked with a blue starburst with a bank note icon above the flight number.

Reward Flight Saver for short-haul flights

Reward Flight Savers are an especially great deal for short-haul flights operated by British Airways to or from the U.K. and within the Caribbean . You will need just 50 British pence (about $0.62) per flight plus Avios for flights less than 2,000 miles.

This is a great option if you are Avios rich. Remember, all Avios redemptions include free checked luggage . You can also use any elite benefits with Oneworld partner airlines like American Airlines .

You can also elect to pay more cash and fewer Avios, if you wish. To get the best redemption value for your Avios, the sweet spot on short-haul redemptions is choosing the 17.50 British pounds ($21.90) option in economy or 25 British pounds ($31.30) in business class.

Reward Flight Savers for long-haul flights

Standard Avios pricing for long-haul flights on British Airways can allow you to fly to Europe in business class for as little as 50,000 Avios each way. There's only one catch: There are very high carrier-imposed fuel surcharges .

If you instead choose the Reward Flight Saver option, you will pay more Avios in exchange for reducing the surcharges to a more reasonable level.

Whether you want to part with more cash or more Avios, the choice is yours.

Here's how the Reward Flight Saver pricing breaks down on two popular routes from the U.S. to Europe with return flights on off-peak dates.

Related: British Airways' Club Suites don't disappoint: On board a retrofitted 777 from London to New York

How to earn Avios

Credit cards.

The easiest way to earn a meaningful number of Avios for everyday spending is by applying for the British Airways Visa Signature Card .

This card — issued by Chase and therefore subject to the 5/24 rule — currently offers 75,000 Avios after you spend $5,000 on purchases within the first three months from account opening. TPG values Avios at 1.5 cents each, making the full bonus worth $1,125.

The British Airways Visa Signature has a $95 annual fee and earns 3 Avios per dollar spent on purchases with British Airways, Aer Lingus, Iberia and Level. Plus, you can earn 2 Avios per dollar spent on hotel accommodations when purchased directly with the hotel. All other purchases earn 1 Avios per dollar spent.

Transferable rewards cards

Savvy TPG readers know that we usually recommend sticking with cards that earn transferable points because of their added flexibility. This strategy still applies if you're trying to accrue Avios. British Airways is a transfer partner of Capital One , Chase Ultimate Rewards , American Express Membership Rewards , Bilt Rewards and Marriott Bonvoy , making Avios one of the easiest currencies to earn .

Most points transfer from Chase, Bilt and Amex at a 1:1 ratio (in addition to occasional transfer bonuses of up to 40%). Meanwhile, Marriott points transfer to Avios at a 3:1 ratio. Plus, you'll get a 5,000-Avios bonus for every 60,000 Marriott points transferred.

The following cards currently offer strong welcome bonuses that you could easily convert to Avios:

- American Express® Gold Card : Earn 60,000 Membership Rewards points after you spend $6,000 on purchases in the first six months of account opening. Terms apply.

- The Platinum Card® from American Express : Earn 80,000 Membership Rewards points after you spend $8,000 on purchases within the first six months of card membership. Check to see if you're targeted for a 125,000-point welcome offer through CardMatch (offer subject to change at any time). Terms apply.

- Capital One Venture Rewards Credit Card : Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening.

- Capital One Venture X Rewards Credit Card : Earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening.

- Chase Sapphire Preferred Card : Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Chase Sapphire Reserve : Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Ink Business Preferred Credit Card : Earn 100,000 bonus points after you spend $8,000 on purchases in the first three months from account opening.

You can also purchase Avios, which sometimes go on sale .

Bottom line

British Airways rightfully has a bad reputation for its surcharges on redemptions in all classes. The airline has addressed this by allowing Executive Club members to use more Avios in exchange for lower surcharges by way of Reward Flight Savers. On short-haul flights, the option of paying less than a dollar plus Avios on a full-service airline across Europe is tough to beat.

For longer-haul flights, travelers with large Avios balances may wish to take advantage of this option to lower the cash cost of their next redemption.

- Book Travel

- Credit Cards

How Does British Airways Reward Flight Saver Pricing Work?

British Airways Executive Club is one of the most accessible loyalty programs in the Oneworld ecosystem. However, when it comes to redeeming Avios for flights with British Airways, the taxes, fees, and carrier-imposed surcharges are often prohibitively high.

In This Post

What is british airways reward flight saver pricing, how to book british airways reward flight saver flights, how to maximize british airways reward flight saver pricing, is british airways reward flight saver pricing a good deal.

Reward Flight Saver pricing is a feature available through British Airways Executive Club , whereby you can choose to redeem more Avios and pay less in taxes, fees, and surcharges on British Airways flights.

This feature can be useful if you’d like to make a redemption for a British Airways flight, but you don’t want to incur the high prices that typically come with doing so.

For example, the standard cost for an off-peak one-way flight in business class with British Airways from Toronto to London is 50,000 Avios plus $865 (CAD) in taxes, fees, and surcharges.

However, with Reward Flight Saver pricing, the same flight prices out at 80,000 Avios plus $350 (CAD) in taxes and fees.

In other words, Reward Flight Saver pricing lets you pay an extra 30,000 Avios to save over $500 (CAD) in taxes and fees.

It’s worth noting that you can still choose to pay the standard rate for the flight, since you can customize the amount of Avios you’d like to apply towards a booking on the check-out page.

If Reward Flight Saver pricing is available on your flight, it shows up as the default option, which we’ll explore in depth below.

Reward Flight Saver pricing was introduced to long-haul flights with British Airways in late 2022 ; however, it’s been available on short-haul flights within Europe, and on British Airways’s short-haul fifth-freedom routes, for quite some time.

Reward Flight Saver pricing can apply to all long- and short-haul routes operated by British Airways in economy, premium economy, and business class, which British Airways refers to as World Traveller, World Traveller Plus, and Club World, respectively.

Unfortunately, Reward Flight Saver pricing isn’t available for flights in British Airways First Class .

To be eligible for Reward Flight Saver pricing, you must have collected at least one Avios in the past 12 months. Otherwise, there aren’t any other requirements to unlock the feature.