- Trending Stocks

- IRFC INE053F01010, IRFC, 543257

- BHEL INE257A01026, BHEL, 500103

- Bharat Elec INE263A01024, BEL, 500049

- Rattan Power INE399K01017, RTNPOWER, 533122

- SBI INE062A01020, SBIN, 500112

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Loans

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Loans

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- REA Advanced Technical Charts

- International

- Go pro @₹99

- Elections 2024

- T20 WC 2024

- Personal Finance

- Moneycontrol /

- Household & Personal Products /

- QUARTERLY RESULTS

+147.05 (+0.65%)

+492.30 (+0.66%)

Safari Industries (India) Ltd.

BSE: 523025 | NSE: SAFARI | Represents Equity.Intra - day transactions are permissible and normal trading is done in this category Series: EQ | ISIN: INE429E01023 | SECTOR: Household & Personal Products Household & Personal Products

- Portfolio | Watchlist

- Set SMS Alert

- Today's L/H

- F&O Quote

- Historical Prices

- Pre Opening Session Prices

- Technical Chart

- Moving Average

- Pivot Table

- Moving Averages

- Board meetings

- Announcements

- Mgmt Interviews

- Research reports

- Balance sheet

- Profit & Loss

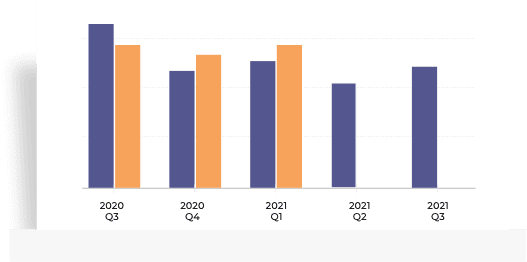

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Financial Graphs

- Directors report

- Chairman's speech

- Auditors report

- Top Public SH

- Large deals

- Competition

- Latest price

- Stock Performance

- Total assets

- Fund Manager holdings

Prev. Close

2014.20 (5)

2018.85 (1)

2015.95 (2)

2017.50 (19)

- Result in New Format

- Result in Old Format

- Consolidated

Results of Safari Ind

Safari Ind Standalone March 2024 Net Sales at Rs 365.05 crore, up 20.83% Y-o-Y

Safari Ind Consolidated December 2023 Net Sales at Rs 388.30 crore, up 28.12% Y-o-Y

Safari Ind Standalone December 2023 Net Sales at Rs 387.93 crore, up 28.12% Y-o-Y

Safari Ind Consolidated September 2023 Net Sales at Rs 370.02 crore, up 17.51% Y-o-Y

Safari Industries Q4 PAT seen up 9.3% YoY to Rs. 41.6 cr: Prabhudas Lilladher

Safari Industries (India) Q3 PAT seen up 19.9% YoY to Rs. 41.3 cr: Prabhudas Lilladher

Safari industries Q1 PAT seen up 40.6% YoY to Rs. 37.4 cr: Prabhudas Lilladher

Safari Industries Q4 PAT seen up 155.7% YoY to Rs. 29.9 cr: Prabhudas Lilladher

Safari Ind: Stellar Q1; buy for earnings visibility despite the run-up

Good quarter from Safari – market weakness could be an opportunity to buy

Results of Household & Personal Products Sector

Quick links.

- Stock Views

- Brokerage Reports

Corporate Action

- Board Meetings

Information

- Company History

- Listing Info

- Large Deals

- Shareholding

- Top Shareholders

- Promoter Holding

- Balance Sheet

- Nine Monthly Results

Annual Report

- Directors Report

- Chairman's Speech

- Auditors Report

- Notes to Accounts

- Finished Goods

- Raw Materials

- Board of Directors

Peer Comparison

- Price Performance

- Total Assets

- Price of SBI on previous budgets

Related Searches

You got 30 day’s trial of.

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

- Sector: Plastics

- Industry: Luggage

Safari Industries (India) Share Price

- 2,019.50 49.35 ( 2.51 %)

- Volume: 19,680

- 2,016.10 47.60 ( 2.41 %)

- Volume: 864

- Last Updated On: 06 Jun, 2024, 01:38 PM IST

Safari Industries (Indi...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

Safari Ind share price insights

Company delivered ROE of 21.34% in year ending 31 Mar, 2024 outperforming its 5 year avg. of 17.31%. (Source: Consolidated Financials)

Company has spent less than 1% of its operating revenues towards interest expenses and 6.3% towards employee cost in the year ending 31 Mar, 2024. (Source: Consolidated Financials)

5 day moving crossover appeared yesterday. Average price gain of 4.95% within 7 days of this signal in last 5 years.

Stock gave a 3 year return of 481.12% as compared to Nifty Midcap 100 which gave a return of 93.08%. (as of last trading session)

Safari Industries (India) Ltd. share price moved up by 2.51% from its previous close of Rs 1,970.15. Safari Industries (India) Ltd. stock last traded price is 2,019.50

Insights Safari Ind

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 0.00

- EPS - TTM (₹) 4.15

- Dividend Yield (%) -

- VWAP (₹) 1,992.68

- PB Ratio (x) -

- MCap (₹ Cr.) 1,296.01

- Face Value (₹) 2.00

- BV/Share (₹) -

- Sectoral MCap Rank 15

- 52W H/L (₹) 2,315.00 / 1,371.02

- MCap/Sales -

- PE Ratio (x) 54.75

- EPS - TTM (₹) 36.05

- Dividend Yield (%) 0.20

- VWAP (₹) 1,989.89

- PB Ratio (x) 11.71

- MCap (₹ Cr.) 9,626.16

- BV/Share (₹) 168.86

- Sectoral MCap Rank 4

- 52W H/L (₹) 2,299.97 / 1,371.80

- MCap/Sales 5.43

Safari Ind Share Price Returns

Et stock screeners top score companies.

Check whether Safari Ind belongs to analysts' top-rated companies list?

Safari Ind News & Analysis

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations, 2011

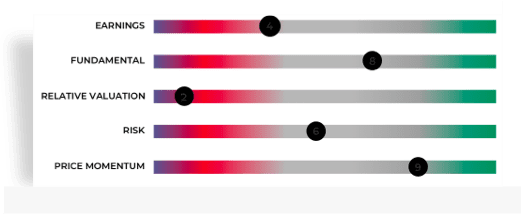

Safari Ind Share Analysis

Unlock stock score, analyst' ratings & recommendations.

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

Safari Ind Share Recommendations

Recent recos.

Mean Recos by 7 Analysts

That's all for Safari Ind recommendations. Check out other stock recos.

Analyst Trends

Safari ind financials.

- Income (P&L)

Balance Sheet

Employee & Interest Expense

All figures in Rs Cr, unless mentioned otherwise

Increase in Cash from Investing

ROE Outperforming 5 Year Average

Financial Insights Safari Ind

Company has used Rs 345.3 cr for investing activities which is an YoY increase of 396.51%. (Source: Consolidated Financials)

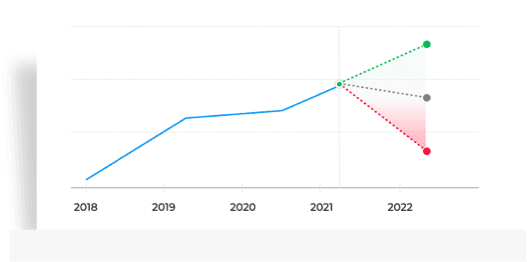

Safari Ind Share Price Forecast

Get multiple analysts’ prediction on safari ind.

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

Peer Comparison

Safari ind stock performance, ratio performance.

Stock Returns vs Nifty Midcap 100

Choose from Peers

Choose from Stocks

Peers Insights Safari Ind

Safari ind shareholding pattern, total shareholdings, mf ownership, hdfc small cap direct-g, equity: small cap.

Amount Invested (in Cr.)

% Change (MoM basis)

DSP Small Cap Direct-G

Sundaram small cap direct-g.

MF Ownership as on 30 April 2024

Top Searches:

Corporate actions, safari ind board meeting/agm, safari ind dividends, about safari ind.

Safari Industries (India) Ltd., incorporated in the year 1980, is a Small Cap company (having a market cap of Rs 1,296.01 Crore) operating in Plastics sector. Safari Industries (India) Ltd. key Products/Revenue Segments include Luggage Items and Scrap for the year ending 31-Mar-2023. For the quarter ended 31-03-2024, the company has reported a Consolidated Total Income of Rs 370.48 Crore, down 5.48 % from last quarter Total Income of Rs 391.96 Crore and up 21.32 % from last year same quarter Total Income of Rs 305.39 Crore. Company has reported net profit after tax of Rs 43.19 Crore in latest quarter. The company’s top management includes Mr.Sudhir Jatia, Mr.Dalip Sehgal, Mr.Gaurav Sharma, Mr.Piyush Goenka, Mr.Punkajj Lath, Mr.Rahul Kanodia, Mr.Sumeet Nagar, Mrs.Vijaya Sampath, Mr.Vineet Poddar, Mr.Rameez Shaikh. Company has Lodha & Co. as its auditors. As on 31-03-2024, the company has a total of 4.88 Crore shares outstanding. Show More

Sudhir Jatia

Dalip Sehgal

Gaurav Sharma

Piyush Goenka

Punkajj Lath

Rahul Kanodia

Sumeet Nagar

Vijaya Sampath

Vineet Poddar

Rameez Shaikh

- Walker Chandiok & Co. LLP Lodha & Co.

Key Indices Listed on

Nifty 500, S&P BSE SmallCap, S&P BSE Consumer Discretionary, + 6 more

302-303, A Wing,The Qube,CTS No. 1498,Mumbai, Maharashtra - 400059

http://www.safaribags.com

More Details

- Chairman's Speech

- Company History

- Directors Report

- Background information

- Company Management

- Listing Information

- Finished Products

FAQs about Safari Ind share

- 1 Week: Safari Ind share price moved up by 0.97%

- 1 Month: Safari Ind share price moved down by 0.73%

- 3 Month: Safari Ind share price moved down by 0.21%

- 6 Month: Safari Ind share price moved down by 2.32%

- 2. Which are the key peers to Safari Ind? Within Plastics sectorSafari Ind and VIP Industries Ltd. are usually compared together by investors for analysis.

- 3. What is the CAGR of Safari Ind? The CAGR of Safari Ind is 47.45.

- 4. What is 52 week high/low of Safari Ind share price? In last 52 weeks Safari Ind share had a high price of Rs 2,315.00 and low price of Rs 1,371.02

- Promoter holding have gone down from 47.23 (30 Jun 2023) to 45.73 (31 Mar 2024)

- Domestic Institutional Investors holding has gone up from 16.57 (30 Jun 2023) to 19.15 (31 Mar 2024)

- Foreign Institutional Investors holding has gone up from 12.3 (30 Jun 2023) to 13.14 (31 Mar 2024)

- Other investor holding have gone down from 23.9 (30 Jun 2023) to 21.98 (31 Mar 2024)

- 6. What is the PE & PB ratio of Safari Ind? The PE ratio of Safari Ind stands at 54.65, while the PB ratio is 11.66.

- 7. Who's the chairman of Safari Ind? Sudhir Jatia is the Chairman & Managing Director of Safari Ind

- Stock's PE is 0.00

- 9. What are the Safari Ind quarterly results? Total Revenue and Earning for Safari Ind for the year ending 2024-03-31 was Rs 1564.30 Cr and Rs 175.81 Cr on Consolidated basis. Last Quarter 2024-03-31, Safari Ind reported an income of Rs 370.48 Cr and profit of Rs 43.19 Cr.

- 11. Is Safari Ind giving dividend? Safari Industries (India) Ltd. announced an equity dividend of 125% on a face value of 2.0 amounting to Rs 2.5 per share on 26 Oct 2023. The ex dividend date was 10 Nov 2023.

- 12. What's the market capitalization of Safari Ind? Within the Plastics sector, Safari Ind stock has a market cap rank of 4. Safari Ind has a market cap of Rs 9,598.36 Cr.

Trending in Markets

- F&O Stocks

- Gold Price Today

- Sensex Today

- Smallcap Funds

- Stocks in news

- Adani Group Stocks

- RVNL Share Price

- GSM Foils Share Price

Safari Ind Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

Super Investors

- Account

- Consolidated Standalone

- Share Holding

- Balance Sheet

- Corp. Action

Safari Industries(I) share price

NSE: SAFARI BSE: 523025 SECTOR: Household & Personal Products 81k 209 17

Price Summary

₹ 2017.25

₹ 1970.1

₹ 2299.98

₹ 1371.8

Ownership Stable

Valuation expensive, efficiency optimal, financials very stable, company essentials.

₹ 9831.96 Cr.

₹ 9777.98 Cr.

₹ 163.23

₹ 85.97 Cr.

₹ 31.99 Cr.

₹ 31.68

Add Your Ratio

Your Added Ratios

These are the brands of Safari Industries (India) Ltd.

Index Presence

The company is present in 10 Indices.

NIFTYMIDSMALL400

NIFTYSMALLCAP250

NY500MUL50:25:25

NIFTYTOTALMCAP

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Sales Growth

Profit growth, debt/equity, price to cash flow, interest cover ratio, cfo/pat (5 yr. avg.).

Share Holding Pattern

Promoter pledging %, strengths.

- The company has shown a good profit growth of 57.3839444087358 % for the Past 3 years.

- The company has shown a good revenue growth of 21.1193333182196 % for the Past 3 years.

- Company is virtually debt free.

- Company has a healthy Interest coverage ratio of 27.1341424889849 .

- Company’s PEG ratio is 0.163952254718059 .

- The company has an efficient Cash Conversion Cycle of 32.0198390586822 days.

- Company has a healthy liquidity position with current ratio of 2.37780750599846 .

- The company has a good cash flow management; CFO/PAT stands at 1.12376212397547 .

- The company has a strong degree of Operating leverage, Average Operating leverage stands at 3.39000624628467 .

Limitations

- The company is trading at a high EV/EBITDA of 37.478 .

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), cash flows (all figures are in crores.), corporate actions dividend bonus rights split.

Ashish Kacholia

Holding Value: 181.449 Cr.

As of March2024

Investors Details Promoter Investors

Annual reports.

- Annual Report 2021 20 Jul 2021

- Annual Report 2019 9 Jan 2020

- Annual Report 2018 9 Jan 2020

- Annual Report 2017 2 Apr 2021

Ratings & Research Reports

- Credit Report By: CRISIL 9 Jan 2020

- Credit Report By:CRISIL 9 Dec 2023

- Credit Report By: CRISIL 5 Jun 2021

- Credit Report By:CRISIL 30 Apr 2022

- Credit Report by:CRISIL 15 Jun 2020

- Research IDBI Capital 24 May 2022

- Research IDBI Capital 23 Nov 2021

- Research IDBI Capital 19 Aug 2021

- Research IDBI Capital 15 Feb 2024

- Research IDBI Capital 11 Nov 2022

- Research Angel Broking 9 Jan 2020

Company Presentations

Company News

Safari industries(i) stock price analysis and quick research report. is safari industries(i) an attractive stock to invest in.

Stock investing requires careful analysis of financial data to determine a company's true net worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement, which can be time-consuming and cumbersome.

Examining a company's financial ratios is an easier way to determine its performance, which can help to make sense of the overwhelming amount of information in its financial statements.

Safari Industries(I) stock price today is Rs 1978.05 . Here are a few indispensable ratios that should be a part of every investor’s research process, or, in simpler words, how to analyse Safari Industries(I) .

PE ratio : Price to Earnings ratio, which indicates how much an investor is willing to pay for a share for every rupee of earnings. A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). Safari Industries(I) has a PE ratio of 62.4443602613884 which is high and comparatively overvalued .

Share Price : - The current share price of Safari Industries(I) is Rs 1978.05 . One can use valuation calculators of ticker to know if Safari Industries(I) share price is undervalued or overvalued.

Return on Assets (ROA) : - Return on Assets measures how effectively a company can earn a return on its investment in assets. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. Safari Industries(I) has ROA of 20.7119510610918 % which is a good sign for future performance. (higher values are always desirable)

Current ratio : - The current ratio measures a company's ability to pay its short-term liabilities with its short-term assets. A higher current ratio is desirable so that the company could be stable to unexpected bumps in business and economy. Safari Industries(I) has a Current ratio of 2.37780750599846 .

Return on equity : - ROE measures the ability of a firm to generate profits from its shareholders' investments in the company. In other words, the return on equity ratio shows how much profit each rupee of common stockholders’ equity generates. Safari Industries(I) has a ROE of 33.2344196238094 % .(higher is better)

Debt to equity ratio : - It is a good metric to check out the capital structure along with its performance. Safari Industries(I) has a Debt to Equity ratio of 0.0771 which means that the company has low proportion of debt in its capital.

Sales growth : - Safari Industries(I) has reported revenue growth of 71.7365791531742 % which is fair in relation to its growth and performance.

Operating Margin : - This will tell you about the operational efficiency of the company. The operating margin of Safari Industries(I) for the current financial year is 14.9632474930922 % .

Dividend Yield : - It tells us how much dividend we will receive in relation to the price of the stock. The current year dividend for Safari Industries(I) is Rs 3.5 and the yield is 0.2032 % .

Earnings Per Share : - It tells us how much profit is allocated to to each outstanding share of a common stock. The latest EPS of Safari Industries(I) is Rs 31.677 . The higher the EPS, the better it is for investors.

One can find all the Financial Ratios of Safari Industries(I) in Ticker for free. Also, one can get the intrinsic value of Safari Industries(I) by using Valuation Calculators, which are available with a Finology ONE subscription.

Brief about Safari Industries(I)

Safari industries (india) ltd. financials: check share price, balance sheet, annual report and quarterly results for company analysis.

Welcome to the stock analysis page of Safari Industries (India) Ltd. Here, we will provide a comprehensive overview of the company's share price, balance sheet, annual report, dividend, quarterly result, stock price, price chart, news, concall, transcripts, investor presentations, promoters, and shareholders.

Safari Industries (India) Ltd. Share Price

The share price of Safari Industries (India) Ltd. is an essential factor for long-term stock investors. By carefully analyzing the share price, investors can make informed decisions regarding their investment strategies. Our pre-built screening tools can assist investors in evaluating Safari Industries' historical and current share price trends. A stock's share price is determined by a range of factors, such as market sentiment, financial performance, and general economic conditions.

Safari Industries (India) Ltd. Balance Sheet

Analyzing the balance sheet of Safari Industries (India) Ltd. is crucial for evaluating its financial health and stability. The balance sheet provides insights into the company's assets, liabilities, and shareholder's equity. It enables investors to assess the company's ability to meet its financial obligations and generate profits in the long run.

Safari Industries (India) Ltd. Annual Report

Safari Industries (India) Ltd. provides annual reports that offer a comprehensive overview of the company's financial performance and strategic objectives. These reports are downloadable on our website. By analyzing the annual reports, investors can gain valuable insights into the company's growth prospects, market position, and future plans.

Safari Industries (India) Ltd. Dividend

Investors often look for companies that offer consistent and attractive dividend payouts. Safari Industries (India) Ltd. understands this sentiment and provides updates on its dividend policies. By evaluating the dividend history, investors can assess the company's commitment to shareholder returns and potential income generation opportunities.

Safari Industries (India) Ltd. Quarterly Result

The quarterly results of Safari Industries (India) Ltd. capture the company's financial performance over a specific three-month period. These results highlight the revenue, expenses, and profitability of the company. By analyzing the quarterly reports, investors can understand the company's short-term performance and identify trends that may impact its long-term prospects.

Safari Industries (India) Ltd. Stock Price

Monitoring the stock price of Safari Industries (India) Ltd. is crucial for investors as it reflects market sentiment and investor confidence in the company. By utilizing our pre-built screening tools, investors can track the historical and real-time stock price movements of Safari Industries to make informed investment decisions. Our website provides pre-built screening tools to help investors analyze stock prices and performance.

Safari Industries (India) Ltd. Price Chart

Our website provides interactive and visually appealing price charts for Safari Industries (India) Ltd. These charts offer an easy-to-understand graphical representation of the stock's performance over time. Investors can analyze historical price patterns and identify potential buying or selling opportunities based on their preferred investment strategies.

Safari Industries (India) Ltd. News

Timely and accurate news updates assist investors in staying informed about the latest developments and events related to Safari Industries (India) Ltd. Our website provides up-to-date news articles and market insights that can help investors make informed decisions and stay ahead of market trends.

Safari Industries (India) Ltd. Concall Transcripts

Safari Industries (India) Ltd. conducts conference calls (concalls) to discuss its financial results and provide insights into the company's performance. We provide transcripts of these calls on our website so that investors can access the information shared during these important interactions and gain a deeper understanding of the company's strategies and outlook.

Safari Industries (India) Ltd. Investor Presentations

Safari Industries (India) Ltd. regularly conducts investor presentations to communicate its business strategies, plans, and financial performance to shareholders and potential investors . These presentations provide valuable insights into the company's growth prospects and investment opportunities. Investors can access these presentations on our website to stay updated and well-informed.

Safari Industries (India) Ltd. Promoters

The promoters of Safari Industries (India) Ltd. play a vital role in shaping the company's direction and success. Investors often analyze the credentials, experience, and track record of the promoters to gauge their commitment and alignment with shareholder interests. Understanding the promoters' vision and strategies can provide valuable insights for long-term investors.

Safari Industries (India) Ltd. Shareholders

Understanding the shareholder base of Safari Industries (India) Ltd. is essential for investors. By analyzing the major shareholders and institutional investors, investors can gain insights into the confidence and support of these entities in the company. This information can be crucial in assessing the company's growth potential and long-term prospects.

To enhance your analysis, we provide premium features tools, including DCF Analysis, BVPS Analysis, Earnings multiple approaches, and DuPont analysis. These tools are designed to provide deeper insights into the company's financial performance and valuation.

We believe that by providing comprehensive information, analysis tools, and valuable resources, investors can make informed decisions and navigate the stock market with confidence. You can download the annual reports and quarterly results of Safari Industries (India) Ltd. from our website to aid your analysis further.

Ratio Delete Confirmation

- SECTOR : TEXTILES APPARELS & ACCESSORIES

- INDUSTRY : OTHER APPARELS & ACCESSORIES

- SAFARI INDUSTRIES (INDIA) LTD.

Safari Industries (India) Ltd. NSE: SAFARI | BSE: 523025

/100 Valuation Score : 20 /100 Momentum Score : 45 /100 "> Expensive Performer

Safari Industries (India) Ltd. Live Share Price Today, Share Analysis and Chart

2017.50 47.35 ( 2.40 %)

47.15% Gain from 52W Low

28,394 NSE+BSE Volume

NSE 06 Jun, 2024 1:57 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

SWOT Analysis

Safari Industries (India) Ltd. Live Price Chart

Earnings conference calls, investor presentations and annual reports, annual reports, credit ratings, safari industries (india) ltd. faq, how is safari industries (india) ltd. today, safari industries (india) ltd. today is trading in the green, up by 2.40% at 2017.50., how has safari industries (india) ltd. performed historically, safari industries (india) ltd. is currently trading up 2.40% on an intraday basis. in the past week the stock fell -0.25%. stock has been down -2.06% in the past quarter and rose 43.98% in the past year. you can view this in the overview section..

Bonus Shares: Luggage manufacturer to issue free shares, pay 125% dividend — Check details here

The company will issue 2.37 crore bonus shares of face value of ₹2 each to eligible shareholders as of the record date, which will be determined later..

Technical Trends

Long term considers price movement over the last 6 months, short term considers price movement over the last 1-2 weeks.

- Moderately Bearish

- Moderately Bullish

Insight: Trends unavailable at the moment.

Q2 Results Highlights

Quarterly - safari industries india q2 results, equity quick links.

- Top Gainers

- Price Shockers

- Volume Shockers

- 52 Week High

- 52 Week Low

- Active Stocks

- Only Buyers

- Only Sellers

- Mid Cap Stocks

- Large Cap Stocks

- Small Cap Stocks

FROM MARKETS

- Stock market news

- Commodities

RELATED LINKS

- Safari Industries India share price

- Safari Industries India Profit Loss

- Safari Industries India Balance Sheet

- Safari Industries India Cashflow

- Safari Industries India Q1 Results

- Safari Industries India Q3 Results

- Safari Industries India Q4 Results

Recommended For You

Trending stocks, subscribe to our newsletter.

Get daily newsletters around different themes from livemint.

Trending Now In Market

01 kronox lab sciences ipo day 3: gmp, review to subscription status. apply or not, 02 buy or sell: vaishali parekh recommends three stocks to buy today — june 6, 03 nifty 50, sensex today: what to expect from indian stock market in trade on june 6, wait for it….

Log in to our website to save your bookmarks. It'll just take a moment.

Site reindexed 12/16/21

For issues regarding the history of fair oaks, the fair oaks historical society or this website, email to: and we'll make sure your comment or inquiry gets to the right person in our society, or snail-mail to: fair oaks historical society p.o. box 2044 fair oaks, ca 95628 location: 10340 fair oaks blvd (next door to the sunflower drive-in) hours: tuesday, thursday and saturdays 10am to 2pm phone: (916) 844-7103.

Rancho Cordova

West sacramento, results transformation center - university, central sacramento, location: 2951 sunrise boulevard, suite 150. rancho cordova, ca 95742 telephone: (916) 631-6393 email: [email protected], location: 2521 west taron court, suite 100. elk grove, ca 95757 telephone: (916) 683-0995 email: [email protected], location: 109 15th street, west sacramento, ca 95691 telephone: (916) 371-2496 email: [email protected], location: 985 enterprise dr, sacramento, ca 95825 telephone: (916) 929-2732 email: [email protected], location: 8345 folsom boulevard, suite 101. sacramento, ca 95826 telephone: (916) 383-0123 email: [email protected], location: 1101 national drive, suite a. sacramento, ca 95834 telephone: (916) 928-4200 email: [email protected], location : 670 greenbrae drive, suite 140. sparks, nv 89431 telephone : (775) 360-5776 email : [email protected], location : 6823 lonetree boulevard, suite 101. rocklin, ca 95765 telephone : (916) 771-2412 email : [email protected], location: 8975 double diamond parkway, suite 7, reno, nv 89521 telephone: (775) 870-1691 email: [email protected], location: 380 roseville square, roseville, ca 95678 telephone: (916) 771-4219 email: [email protected], location: 330 plaza drive folsom, ca 95630 telephone: (916) 936-4850 email: [email protected].

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

First Quarter Summary Results

Revenues for the quarter decreased $181 million or 9% compared to the same period in the prior year primarily due to the sale of the logistics and supply chain management business ("Supply Chain Business") ($188 million) in the prior year and contract completions, partially offset by ramp up in volume on existing and new contracts. Adjusting for the impact of the divestiture of the Supply Chain Business, revenues grew 0.4%.

Operating income as a percentage of revenues decreased from the comparable prior year period primarily due to the sale of the Supply Chain Business in the prior year, a gain recognized from the deconsolidation of FSA in the prior year period, and contract completions, partially offset by ramp up in volume on existing and new contracts.

Adjusted EBITDA (1) as a percentage of revenues for the quarter decreased to 9.0% from 9.3% for the same period in the prior year primarily due to contract completions, partially offset by ramp up in volume on existing and new contracts.

Diluted earnings per share for the quarter was $1.48 compared to $1.79 in the prior year quarter. Adjusted diluted earnings per share (1) for the quarter was $1.92 compared to $2.14 in the prior year quarter. The weighted-average diluted shares outstanding during the quarter decreased to 52.1 million from 54.8 million during the prior year quarter.

Effective February 3, 2024, the first day of fiscal 2025, SAIC completed a business reorganization which replaced its previous two operating sectors with five customer facing business groups supported by the enterprise organizations, including the Innovation Factory. The five business groups represent SAIC's operating segments and have been aggregated into two reportable segments (Defense and Intelligence, and Civilian) given the similarity in economic and qualitative characteristics, and based on the nature of the customers they serve. See "Schedule 4 - Segment Operating Results" for reportable segment results.

Cash Generation and Capital Deployment

Cash flows provided by operating activities for the first quarter increased $16 million compared to the prior year quarter, primarily due to higher cash provided by the Master Accounts Receivable Purchase Agreement ("MARPA Facility") in the current year, partially offset by higher incentive-based compensation payments in the current year and other changes in working capital.

During the quarter, SAIC deployed $107 million of capital, consisting of $81 million of plan share repurchases, $20 million in cash dividends, and $6 million of capital expenditures.

Quarterly Dividend Declared

As previously announced, subsequent to quarter end, the Company's Board of Directors declared a cash dividend of $0.37 per share of the Company's common stock payable on July 26, 2024 to stockholders of record on July 12, 2024. SAIC intends to continue paying dividends on a quarterly basis, although the declaration of any future dividends will be determined by the Board of Directors each quarter and will depend on earnings, financial condition, capital requirements and other factors.

Backlog and Contract Awards

Net bookings for the quarter were approximately $2.6 billion, which reflects a book-to-bill ratio of 1.4 and a trailing twelve months book-to-bill ratio of 1.0. SAIC’s estimated backlog at the end of the quarter was approximately $23.6 billion. Of the total backlog amount, approximately $3.5 billion was funded.

Notable New Awards:

U.S. Space Force: During the quarter, SAIC was awarded a five-year (one year base, plus four, one-year option periods), $444 million contract to support Digital Transformation, Acquisition, Modernization and Modification (DTAMM) for the U.S. Space Force's Space Systems Command and Space Launch Deltas (SLDs) 30 and 45. SAIC will support the modernization of the space launch range instrumentation. The efforts will support an accelerated national launch cadence across the Eastern Range (ER) and Western Range (WR) including Cape Canaveral Space Force Station and Patrick Space Force Base in Florida and Vandenberg Space Force Base in California. Experts from SAIC and partners will collaborate to modernize antiquated instrumentation and processes to enable a faster and more integrated launch environment. SAIC remains at the forefront of national priorities to explore, secure and influence space by leveraging industry expertise and legacy in this domain. In addition to DTAMM, SAIC's work facilitates future unmanned spacecraft, earth science data-collecting satellites, space-ground systems for military joint all-domain command and control and more.

Office of the Under Secretary of Defense for Research and Engineering: During the quarter, SAIC was awarded a five-year (one year base, plus four, one-year option periods), approximately $90 million contract by the Office of the Under Secretary of Defense for Research and Engineering (OUSD(R&E)) to modernize business operations. Through this contract, SAIC will partner with OUSD(R&E) to modernize its policies and procedures through SAIC's data management, knowledge management and strategic planning capabilities. Enhancements will include an increase in data reuse and the reduction of internal organizational operational delivery times.

U.S. Navy: During the quarter, SAIC was awarded a five-year (one year base, plus four, one-year option periods), $92 million contract to provide professional support services in the areas of sustainment, engineering, test and evaluation, logistics, research and development, and ancillary facilities in direct support of Underseas Sensors Branches at the Naval Surface Warfare Center and Crane Division.

Special Operations Command: During the quarter, SAIC was awarded a significant modernization role on the recently awarded $2.8 billion SOCOM SITEC 3 EOM contract as part of Peraton's winning team. SAIC will support the SOCOM mission by contributing to the modernization and sustainment of the IT, networks and infrastructure to support their 80,000 users. SAIC will provide enterprise-wide IT services and the SOF Information Environment to support the SOF global battle space. The contract will impact core services for users in more than 80 countries.

Notable Recompete Awards:

National Aeronautics and Space Administration (NASA): During the quarter, SAIC was awarded a $494 million seven year (one year base, plus six, one-year option periods) single-award indefinite delivery, indefinite quantity (IDIQ) recompete contract by NASA to enable safe and reliable exploration of space through the Safety and Mission Assurance Engineering Contract III (SMAEC) program. Performing work at the Johnson Space Center in Houston, Texas and the White Sands Test Facility, N.M., SAIC will work on next-gen space missions like Orion, the lunar Gateway, the International Space Station and human space flight. Consistent with the Company’s policy, the Company included $350 million of the IDIQ ceiling in bookings and backlog which represents its current estimate of expected delivery on the contract.

U.S. Navy: During the quarter, SAIC was awarded a six-year (one year base, plus five, one-year option periods), approximately $120 million recompete to support the Navy's afloat and ashore wargaming and fleet readiness. This effort will support the Tactical Training Group Pacific (TTGP), Expeditionary Warfare Training Group Pacific (EWTGPAC), Carrier Strike Group 15 (CSG-15), and Commander, Naval Air Forces Pacific (CNAP) through professional technical services providing FST and LVC wargame development and execution, as well as SME classroom instruction in warfighting doctrine and TTPs utilizing government furnished training systems and facilities, both afloat and shore.

U.S. Space and Intelligence Community: During the quarter, SAIC was awarded approximately $706 million of contract awards by space and intelligence community organizations. These awards represent a combination of new business and recompetes.

Other Notable News:

SAIC launched a multi-year growth strategy at 2024 Investor Day and met with key analysts and shareholders to share the company’s new vision for strategic growth to increase its value for customers and stakeholders. SAIC has committed to growing the company through a phased approach that focuses on building the company's portfolio and go-to-market approach, enhancing the brand and further developing a winning culture.

SAIC appointed Srinivas “Srini” Attili as executive vice president, Civilian Business Group, effective May 6, 2024. In this role, Mr. Attili will report to Chief Executive Officer Toni Townes-Whitley and will further extend SAIC’s position as a leader across Civilian markets through innovation and revenue growth.

SAIC was recognized as a Leader in the IDC MarketScape: U.S. National Government Professional Security Services 2024 Vendor Assessment. The report highlights the evolving challenges in cybersecurity due to emerging technologies, expanding attack surfaces and a significant shortage of skilled cybersecurity professionals. SAIC's Trust Resilience ™ cybersecurity solution provides the most advanced commercial technology to address security gaps and deliver cybersecurity across any enterprise. It aligns to all major zero trust governance models, reduces cyber risks, prevents system disruptions and guards against data loss.

Fiscal Year 2025 Guidance

Management reaffirms fiscal year 2025 guidance which represents the Company's views as of June 3, 2024.

Webcast Information

SAIC management will discuss operations and financial results in an earnings conference call beginning at 10:00 a.m. Eastern time on June 3, 2024. The conference call will be webcast simultaneously to the public through a link on the Investor Relations section of the SAIC website ( http://investors.saic.com ). We will be providing webcast access only – “dial-in” access is no longer available. Additionally, a supplemental presentation will be available to the public through links to the Investor Relations section of the SAIC website. After the call concludes, an on-demand audio replay of the webcast can be accessed on the Investor Relations website.

SAIC® is a premier Fortune 500® technology integrator focused on advancing the power of technology and innovation to serve and protect our world. Our robust portfolio of offerings across the defense, space, civilian and intelligence markets includes secure high-end solutions in mission IT, enterprise IT, engineering services and professional services. We integrate emerging technology, rapidly and securely, into mission critical operations that modernize and enable critical national imperatives.

We are approximately 24,000 strong; driven by mission, united by purpose, and inspired by opportunities. SAIC is an Equal Opportunity Employer, fostering a culture of diversity, equity and inclusion, which is core to our values and important to attract and retain exceptional talent. Headquartered in Reston, Virginia, SAIC has annual revenues of approximately $7.4 billion. For more information, visit saic.com . For ongoing news, please visit our newsroom.

GAAP to Non-GAAP Guidance Reconciliation

The Company does not provide a reconciliation of forward-looking adjusted diluted EPS to GAAP diluted EPS, adjusted EBITDA margin to GAAP net income or transaction-adjusted free cash flow and free cash flow to GAAP net cash flows from operating activities due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Because certain deductions for non-GAAP exclusions used to calculate net income and cash flows from operating activities may vary significantly based on actual events, the Company is not able to forecast GAAP diluted EPS, GAAP net income or GAAP net cash flows from operating activities with reasonable certainty. The variability of the above charges may have an unpredictable and potentially significant impact on our future GAAP financial results.

Forward-Looking Statements

Certain statements in this release contain or are based on “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by words such as “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “guidance,” and similar words or phrases. Forward-looking statements in this release may include, among others, estimates of future revenues, operating income, earnings, earnings per share, charges, total contract value, backlog, outstanding shares and cash flows, as well as statements about future dividends, share repurchases and other capital deployment plans. Such statements are not guarantees of future performance and involve risk, uncertainties and assumptions, and actual results may differ materially from the guidance and other forward-looking statements made in this release as a result of various factors. Risks, uncertainties and assumptions that could cause or contribute to these material differences include those discussed in the “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Legal Proceedings” sections of our Annual Report on Form 10-K, as updated in any subsequent Quarterly Reports on Form 10-Q and other filings with the SEC, which may be viewed or obtained through the Investor Relations section of our website at www.saic.com or on the SEC’s website at www.sec.gov . Due to such risks, uncertainties and assumptions you are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date hereof. SAIC expressly disclaims any duty to update any forward-looking statement provided in this release to reflect subsequent events, actual results or changes in SAIC’s expectations. SAIC also disclaims any duty to comment upon or correct information that may be contained in reports published by investment analysts or others.

First Quarter Defense and Intelligence Results

Revenues for the quarter decreased $161 million or 10% compared to the same period in the prior year primarily due the sale of the Supply Chain Business ($188 million) in the prior year, and contract completions. This was partially offset by ramp up in volume on existing and new contracts. Adjusting for the impact of the divestiture, revenues grew 1.9%.

Operating income and adjusted operating income (1) as a percentage of revenues decreased from the comparable prior year period primarily due to the sale of the Supply Chain Business in the prior year.

First Quarter Civilian Results

Revenues for the quarter decreased $20 million or 5% compared to the same period in the prior year primarily due to reduced volume partially offset by new contracts.

Operating income and adjusted operating income (1) as a percentage of revenues decreased from the comparable prior year period primarily due to reduced volume.

First Quarter Corporate Results

Operating loss and adjusted operating loss (1) for the quarter increased $1 million from the comparable prior year period primarily due to the gain recognized from the deconsolidation of FSA in the prior year period, partially offset by lower selling, general and administrative expenses.

Exhibit 99.2

SCIENCE APPLICATIONS INTERNATIONAL CORPORATION UNAUDITED HISTORICAL FINANCIAL MEASURES

Effective February 3, 2024, the first day of fiscal 2025, SAIC completed a business reorganization which replaced its previous two operating sectors with five customer facing business groups supported by the enterprise organizations, including the Innovation Factory. The five business groups represent SAIC's operating segments and have been aggregated into two reportable segments (Defense and Intelligence, and Civilian) given the similarity in economic and qualitative characteristics, and based on the nature of the customers they serve.

The Defense and Intelligence segment provides a diverse portfolio of national security solutions to the defense and intelligence departments and agencies of the United States Government.

The Civilian segment provides solutions to the civilian markets, encompassing federal, state, and local governments, in order to deliver services for citizen well-being and protecting lives. This includes integrating solutions into a spectrum of public service missions that impact travel, trade, health and the economy.

We have prepared unaudited historical consolidated financial information based on the new reporting structure set forth below, which includes certain non-GAAP measures. Management believes that these non-GAAP measures provide another representation of the results of operations and financial condition.

Unaudited Historical Financial Measures

The following table presents revenues for fiscal 2024 and twelve months ended fiscal 2023 under the new segment structure (in millions):

The following table presents operating income for fiscal 2024 and twelve months ended fiscal 2023 under the new segment structure (in millions):

The following tables present the reconciliation of operating income by reportable segment to non-GAAP operating income for fiscal 2024 and twelve months ended fiscal 2023 under the new segment structure (in millions):

Investor Relations: Joe DeNardi +1.703.488.8528 [email protected]

Media: Thais Hanson +1.703.676.8215 [email protected]

IMAGES

COMMENTS

Safari Industries Q4 PAT seen up 155.7% YoY to Rs. 29.9 cr: Prabhudas Lilladher 23.08.2018 Safari Ind: Stellar Q1; buy for earnings visibility despite the run-up

Safari Industries (India) Quarterly Results: Get the key information of Safari Industries (India) Q1, Q2, Q3 and Q4 results, previous Quarterly Results, Quarterly Earnings and comparison on Economic Times. ... Date Sources:Live BSE and NSE Quotes Service: TickerPlant | Corporate Data, F&O Data & Historical price volume data: Dion Global ...

The standalone and consolidated financial results of Safari Industries (India) Limited ( the 'Holding Company') and its wholly owned subsidiaries,namely,Safari Manufacturing Limited and Safari Lifestyles ... Date: 09 August 2023 Chartered Accountants Offices in Bengaluru, Chandiga-h, Chennai, Gurugram, Hyderabad, Kochi, Kolkata, Mlmbai, New ...

Get the latest Safari Industries (India) Ltd (SAFARI) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

1. We have rev iewed the accompanying statement of unaud ited financ ial results of Safari Industries (India) Limited ("the Company") for the quarter ended 30 th June , 2021. The statement is the respons ibil ity of the Company's Management and has been approved by the Board of Directors .

safari SAFARI INDUSTRIES (INDIA) LIMITED Registered Office: 302-303, A Wing, The Qube, CTS No 1498, A/2, M V. Road, Marol, Andheri (East), Mumbai 400059, (T) +912240381888; (F) +91 22 40381850 ... to Date Financial Results of Safari Industries (India) Limited pursuant to the Regulation 33 of the SEBI ...

1. We have reviewed the accompanying statement of unaudited financial results Safari Industries (India) Limited ("the Company") for the quarter ended 30 th June , 2022 . The statement is the responsibility of Company 's Management and has been approved by the Board of Directors . Our responsibility is to issue a

safari SAFARI INDUSTRIES (INDIA) LIMITED Registered Office: 302-303, A Wing, The Qube, CTS No. 1498, A/2, M.V. Road, Maro!, Andheri (Easl), Mumbai 400059, (T) +912240381888; (F) +91 22 40381850 ... The standalone and consolidated financial results of Safari Industries (India) Limited ( the 'Holding Company') and its wholly owned subsidiaries ...

safari SAFARI INDUSTRIES (INDIA) LIMITED Registered Office: 302-303, A Wing, The Qube, CTS No 1498, A12, M V Road, Marol, Andheri (East), Mumbai 400059, (T) +912240381888; (F) +912240381850 Email id: investor@safari in, Website: www safaribags com, CIN: L25200MH1980PLC022812 Statement of Unaudited Financial Results for the quarter and half year ended 30th September, 2021

SAFARI INDUSTRIES (INDIA) LIMITED ... (East), Mumbai 400059, (T) +912240381888; (F) +91 22 40381850 Email Id : [email protected], Website www.safaribags com, CIN L25200MH19B0PLC022812 ... in preparation above results _ The impact of the global pandemic may be different from that estimated as at date approval results Considering the continuing ...

Quarterly & Annual Financial Results of Safari Industries _india_ Ltd Check latest quarterly results and compare financial performance over past years. Get latest Standalone, Consolidated and Segment wise financial results. ... This RSS feeds allow you to stay up to date with the latest SENSEX values on continuous basis. Subscribe to this feed ...

The Yearly Results page of Safari Industries (India) Ltd. presents the key annual result items, its comparison with the sector peers and its Annual Results for the last five years. TOTAL INCOME 28.11 %

Safari Ind Share Price Today (31 May, 2024): Safari Ind Stock Price (₹ 1967.15) Live NSE/BSE updates on The Economic Times. Check out why Safari Ind share price is down today. Get all details on Safari Industries (India) shares news and analysis, Forecasts, Dividend, balance sheet, profit & loss, Quarterly results, annual report information, and more

Safari Industries (India) Ltd. Share Price Today: CLOSE 1964.15, HIGH 1996.95, LOW: 1942.8. Get latest balance sheet, annual reports, quarterly results, and price chart.

Safari Industries (India) Ltd's revenue jumped 21.32% since last year same period to ₹370.48Cr in the Q4 2023-2024. On a quarterly growth basis, Safari Industries (India) Ltd has generated -5.48% fall in its revenue since last 3-months. Safari Industries (India) Ltd's net profit jumped 13.42% since last year same period to ₹43.19Cr in ...

In the past week the stock fell -2.48%. stock has been down -1.25% in the past quarter and rose 43.13% in the past year. You can view this in the overview section. Safari Industries (India) Ltd. live share price at 3:31 p.m. on May 31, 2024 is Rs 1967.15. Explore financials, technicals, Deals, Corporate actions and more.

Safari Industries will credit the bonus shares to eligible members within two months from the date of the board's approval on or before December 31, 2023. Additionally, the company has also approved an interim dividend worth ₹2.5 per share for financial year 2024. Record date for this has been fixed as November 10, 2023.

SAFARI Q2 Results: Check out Safari Industries India Q2 Result news, Safari Industries India Q2 Earnings result updates and highlights. | SAFARI Q2 Results 2024. Trending Today.

Official MapQuest website, find driving directions, maps, live traffic updates and road conditions. Find nearby businesses, restaurants and hotels. Explore!

The Historical Society conducts research, records oral histories, has published a booklet: The Early Years of Fair Oaks, and has reproduced a 1900 map of Fair Oaks. Located at 10340 Fair Oaks Blvd., our History Center was established as a repository and museum of Fair Oaks artifacts. Fair Oaks History. Fair Oaks was part of the original 1844 ...

Location: 2951 Sunrise Boulevard, Suite 150.Rancho Cordova, CA 95742 Telephone: (916) 631-6393 Email: [email protected]

13 customer reviews of Safari Chiro. One of the best Chiropractors, Healthcare business at 6216 Main Ave, Orangevale CA, 95662 United States. Find Reviews, Ratings, Directions, Business Hours, Contact Information and book online appointment.

The following deposit requirements will be effective for all shipments of organic soybean meal from India entered, or withdrawn from warehouse, for consumption on or after the date of publication of the final results of this administrative review, as provided for by section 751(a)(2)(C) of the Act: (1) the cash deposit rate for the companies ...

First Quarter of Fiscal Year 2025: Summary Operating Results Three Months Ended May 3, 2024. Percent. change May 5, 2023 (in millions, except per share amounts)