Members can access discounts and special features

Sign in to pay your way with Scene+ points, any payment card, or a mix of both on flights, hotels, car rentals and more. Plus you can earn points, even when you pay with points!

Scene+ travel, powered by expedia.

Earn and redeem points with Scene+ Travel, Powered by Expedia while getting access to member-exclusive deals. Around the world or close to home, it’s up to you. Plus: Earn on the cost of your trip, even when you pay with points!

Travel Rewards: Now you are getting somewhere

Earn 3 points for every $1 you spend on your hotels, car rentals and things to do with Scene+ Travel, Powered by Expedia.

See your points take off

Spend 100 points for every $1 toward eligible flights, hotels, car rentals and more with Scene+ Travel. You'll even earn on the cost of your trip when you pay with points!

Explore for rewards

One-stop-shop for searching millions of properties, 500+ airlines, hundreds of car rental companies, and more, with full flexibility and no blackout dates.

Want to earn points faster?

Pay for your travel with an eligible Scotiabank credit or debit card to earn Scene+ points on every dollar you spend.

Rewards your way

Scene+TM is Canada's leading lifestyle rewards program. As a Scene+ member, you get so many rewards, in so many places. Including groceries, movies, travel, shopping, dining, and more, it's never been easier to earn and redeem rewards your way.

Not a member?

Join Scene+TM today!

Earn points faster and take-off sooner

Choose from a range of Scotiabank credit cards — each with their own unique Scene+ and travel benefits.

Scotiabank Passport® Visa Infinite* Card

- Offer: Earn up to $1,100 † in value in the first 12 months, including up to 35,000 bonus Scene+ TM points and annual fee waived on your first supplementary card. 1

- Earn up to 3X the Scene+ points when you spend $1 on eligible grocery, dining and entertainment purchases. 2

- Pay no foreign transaction fees - save 2.5% on all your foreigncurrency purchases. 3

- Complimentary Visa Airport Companion Program membership and 6 lounge visits. 4

- Annual fee 5 : $150

- Interest rates 5 : 20.99% purchases / 22.99% cash advances

- View more card benefits

Scotiabank® Scene+ TM Visa* Card

- Offer: Earn up to 5,000 bonus Scene+ points within your first year. 6

- Earn up to 2X the Scene+ points on every purchase. 7

- Save up to 25% off base rates at participating AVIS locations and at participating Budget locations in Canada and the U.S. 8

- Annual fee 5 : $0

Scotiabank® Gold American Express®* Card

- Offer: Earn up to $650^ in value in the first 12 months, including up to 40,000 bonus Scene+ points. 9

- Earn up to 6X the Scene+ points on eligible grocery, dining and entertainment purchases. 10

- Pay no foreign transaction fee and save 2.5%. 3

- Enjoy a preferred discount on the Priority Pass TM membership and access over 1200 VIP lounges around the world. 11

- Annual fee 5 : $120

Frequently Asked Questions

How do i use my scene+ points to book travel.

You can earn and redeem when you book your next trip with Scene+ Travel. Earn 3 points for every $1 you spend on your hotels, car rentals, and things to do when booked through Scene+ Travel, Powered by Expedia, even when you pay with your points. Redeem in increments of 100 points for $1 toward your flights, hotel or car rental when you book with Scene+ Travel, Powered by Expedia.

Which Scotiabank bank accounts are eligible for Scene+?

The Ultimate Package, Preferred Package, Student Banking Advantage® Plan and Getting There Savings Program for Youth are eligible for the Scene+ program.

Which Scotiabank Credit Cards are eligible for Scene+?

The following Scotiabank Credit Cards are eligible for the Scene+ program: Scotiabank®* Scene+TM Visa* Card (and Scotiabank®* Scene+TM Visa* Card for Students) Scotiabank Passport®* Visa Infinite* Card Scotiabank®* Gold American Express® Scotiabank®* Platinum American Express® Scotiabank®* American Express® Scotiabank Passport®* Visa Infinite Business* Card

I have a Scotiabank bank account, but I am not earning Scene+ points. How can I begin earning points?

If you would like to begin earning Scene+ points with your debit card, you will need to ensure that you have a Scene+ ScotiaCard debit card that is linked to one of four Scene+ eligible bank accounts: Ultimate Package Preferred Package Student Banking Advantage Plan Getting There Savings Program for Youth To switch your bank account, visit your nearest branch or call us at 1.800.4SCOTIA. If you already have an eligible account but you do not have a Scene+ ScotiaCard, you can change your card by visiting a branch or by following these steps: Sign in to Scotia OnLine From your Account page, select Manage My Accounts Select Profile Select Replace or change ScotiaCard

Terms and Conditions:

† Savings and reward potential in first 12 months based on the following card usage and offers:

$350 in travel rewards (35,000 bonus Scene+ points) when you spend $1,000 within your first 3 months (to earn 25,000 points) and when you spend $40,000 within your first 12 months (to earn an additional 10,000 points);

$50 supplementary card fee waiver on your first supplementary card;

$104 in foreign transaction fee savings based on average first year annual foreign spend per account (save the 2.5% foreign transaction fee typically charged by other card issuers);

$287 in travel rewards (28,733 Scene+ points) on everyday purchases based on average annual first year spend per account with an average spend of 19% in 2x accelerator categories.

$343 value with a complimentary Visa Airport Companion Program Membership and 6 lounge passes (annual membership plus one free visit of approx. CAD$134/USD$99 plus 5 lounge passes at CDN$42/USD$31 per pass). Currency conversion as at March 30, 2023.

Potential First Year Value = up to $1,132

Actual savings and rewards earned will depend on individual card usage and eligibility for applicable offers. Conditions apply.

^ Savings and reward potential in first 12 months based on the following card usage and offers:

$400 in travel rewards (40,000 bonus Scene+ points) when you spend $1,000 within your first 3 months (to earn 20,000 points) and when you spend $7,500 within your first 12 months (to earn an additional 20,000 points);

$33 in foreign transaction fee savings based on average first year annual foreign spend per account (save the 2.5% foreign transaction fee typically charged by other card issuers);

$247 in travel rewards (24,709 Scene+ points) on everyday purchases based on average annual first year spend on the Account with an average spend of 21% in 5x accelerator and 7% in 3X accelerator categories.

Potential First Year Value = up to $680

1 Offer Description and Conditions : The 25,000 Bonus Scene+ Points (the “Offer”) applies only to new Scotiabank Passport Visa Infinite credit card accounts (“Accounts”) that are opened by October 31, 2023 subject to the conditions below. Offer may be changed, cancelled or extended at any time without notice and cannot be combined with any other offers.

Plus, as a Scotiabank Passport Visa Infinite credit cardholder you are always eligible to earn an annual 10,000 Scene+ point bonus when you spend at least $40,000 in everyday eligible purchases annually on your Scotiabank Passport Visa Infinite account. Conditions apply - see below for further details.

25,000 Bonus Scene+ Point Offer Description and Conditions : To qualify for the 25,000 bonus Scene+ points (the “Bonus Offer”), you must have at least $1,000 in eligible purchases posted to your new Account within the first 3 months of the Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges. The 25,000 Bonus Offer points will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days following the qualifying $1,000 in eligible purchases being posted to your Account within 3 months from the Account open date, provided the Account is open and in good standing. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account. Bonus Offer applies to new Accounts only opened by October 31, 2023.

10,000 Annual Bonus Scene+ Point Conditions : As a Scotiabank Passport Visa Infinite credit cardholder you can earn an annual Scene+ point bonus starting at 10,000 Scene+ points when you make at least $40,000 in eligible purchases annually on your Account each year (12-months). Annual period starts from the Account open date and resets every 12 months thereafter. You will earn 2,000 bonus Scene+ points for every additional $10,000 in eligible purchases thereafter in that same year, after the $40,000 annual spend has been reached. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

The Annual bonus Scene+ points will be credited within approximately 2-3 business days after you have met the $40,000 annual spend threshold on the Account and within approximately 2-3 business days after you have met each additional $10,000 annual spend threshold on the Account, provided your Account is open and in good standing (as defined above).

Offer Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank small business credit cardholders are also eligible for the Offer.

Rates and Fees : The current annual fee is $150 for the primary card, $0 for the first additional card and $50 for each additional card thereafter. The current preferred annual interest rates for this Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are subject to change.

2 You are awarded three (3) Scene+ Points for every eligible $1.00 purchase made at Sobeys, Safeway, participating IGA, Foodland, Foodland & Participating Co-ops, FreshCo, Chalo! FreshCo, Thrifty Foods, Rachelle Béry, Les Marchés Tradition, Voilà by Sobeys, Voilà by Safeway and Voilà par IGA locations charged and posted to the Scotiabank Passport Visa Infinite Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores. You are awarded two (2) Scene+ Points for every eligible $1.00 purchase on all other grocery (not listed above), dining, entertainment, and daily transit purchases charged and posted to the Scotiabank Passport Visa Infinite Account (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). See below for the Spend Threshold that applies to this Accelerated Earn Rate. You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank Passport Visa Infinite Account (the “Regular Earn Rate”).

Merchant classifications – Visa network Purchases must be made at merchants classified through the Visa network with a Merchant Category Code (“MCC”) that identifies them in the Visa network in the “grocery store”, “dining”, “entertainment”, or “transit” category. Purchases at merchants where these categories are not their primary business do not qualify. Some merchants may (1) provide other goods or services; or (ii) have separate merchants located on their premises that may not be classified with an MCC under the Accelerated Earn Rate categories and such purchases will not earn the Accelerated Earn Rate as applicable. The Accelerated Earn Rates for the Scotiabank Passport Visa Infinite Account applies to the first $50,000 in purchases charged to that Scotiabank Passport Visa Infinite account annually at merchants qualifying for the Accelerated Earn Rate under the “MCC” categories of grocery, dining, entertainment and daily transit purchases as more particularly described above), with the annual period calculated on a 12-month basis. Annual period starts from the Scotiabank Passport Visa Infinite Card Account open date and resets every 12 months thereafter. Once you exceed the applicable annual spend (purchase) threshold, you will continue earning Scene+ Points at the Regular Earn Rate of one (1) Scene+ Point per $1.00 in purchases charged and posted to the Scotiabank Passport Visa Infinite Card.. Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplusrewards for full program details. All dollar amounts are in Canadian currency unless otherwise stated.

3 We will not charge you Foreign Transaction Fees on foreign currency transactions including purchases, only the exchange rate applies. The term “Foreign Transaction Fees” is a substitute for “Foreign Currency Conversion” as described in the Disclosure Statement for this Card. This fee relates to the 2.5% mark-up that is typically charged by credit card issuers in addition to the exchange rate. See the Foreign Currency Conversion section of the Disclosure Statement for this Card for full details. Rates and fees are subject to change.

4 Primary Cardholders with a valid Scotiabank Passport Visa Infinite Card account (the “Account”) have access to participating lounges within the Visa Airport Companion Program (“Program”), hosted and managed by DragonPass International Ltd. Cardholders must enroll for this benefit either through the Visa Airport Companion App (available to download for free) or on the Program Website ( visaairportcompanion.ca ) using a valid Card on the Account. Upon enrollment, 6 complimentary lounge visits will be available for the Primary Cardholder per membership year; the complimentary visits can be used by any Cardholder for themselves and for their accompanying guests at participating lounges (however, Primary Cardholder must be present for each such use). Lounge visits are counted on a per person per visit basis (e.g. lounge access by a Cardholder and one accompanying guest will count as two (2) visits). All additional visits beyond complimentary visits are subject to a fee of $32 USD (subject to change) per person per visit. Applicable lounge access fees will be charged to the Card connected to the Cardholders’ Program membership (i.e. the Card enrolled in Program).

To view a full list of participating airport lounges, their facilities, opening times and restrictions Cardholders can visit the Program App and Website . To view the full Terms and Conditions for the Program, including DragonPass Terms of Use and Privacy Policy and Visa’s Privacy Policy that apply to the Program, visit the Visa Airport Companion Program App or Website .

The Program services and benefits are provided by DragonPass and applicable third party offer providers and neither Visa nor the

Bank of Nova Scotia is responsible for the Program or any claims or damages arising from participation in the Program.

Unless the Program membership is suspended or cancelled, the Program membership and any included complimentary lounge visits (if applicable) will automatically renew annually on the anniversary date (based on date when the Cardholder enrolled for the Program). Program membership will be cancelled if your Scotiabank Passport Visa Infinite Card is cancelled. If your Scotiabank Passport Visa Infinite Card is renewed or replaced, remember to update your card details within the Visa Airport Companion Program (either on the App or on the Program Website ).

Access upon presentation of a valid and enrolled Scotiabank Passport Visa Infinite Card, while available in most lounges within the Visa Airport Companion Program, is subject to availability.

5 For current rates and information on fees and interest cost, call 1-888-882-8958. Interest rates, annual fees and features are subject to change without notice. Learn more about credit card fees and interest rates.

6 Offer Description and Conditions: The 5,000 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank Scene+ Visa credit card accounts (excluding Scene Student Visa cards) (“Account”) opened by October 31, 2023 and is subject to the below terms and conditions. Offer may be changed, cancelled or extended without notice at any time and cannot be combined with any other offers.

5,000 Bonus Scene+ Point Offer Description and Conditions: To be eligible for 5,000 bonus Scene+ points (the “5,000 Point Bonus”), you must open a new Account by October 31, 2023 and have at least $750 in eligible purchases posted to your new Account in the first 3 months of the Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

The 5,000 Point Bonus will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days after the qualifying $750 in eligible purchases being posted to your Account within the first 3 months of Account open date, provided the Account is open and in good standing. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account.

Eligibility and Exclusions: Individuals who are currently or were previously primary or secondary cardholders of a Scotiabank personal credit card in the past 2 years, including those that switch from an existing Scotiabank personal credit card, as well as employees of Scotiabank, are not eligible for the Offer. Subject to the above exclusions, Scotiabank small business credit cardholders are also eligible for the Offer.

Rates and Fees: There is currently no annual fee for the primary card and no fee for each additional card. The current preferred annual interest rates for the Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are subject to change.

7 Regular Earn Rate: You are awarded one (1) Scene+ Point for every $1.00 in all purchases of goods and services charged to the Scotiabank Scene+ Visa Account (the “Account”).

Accelerated Earn Rates: You will earn accelerated earn rates on the following eligible purchases charged to the Account:

Grocery Stores

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase made at Sobeys, Safeway, participating IGA, Foodland, Foodland & participating Co-op, FreshCo, Chalo! FreshCo, Thrifty Foods, Rachelle Béry, Les Marchés Tradition, Voilà by Sobeys, Voilà by Safeway and Voilà par IGA locations charged and posted to the Scotiabank Scene+ Visa Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores.

Home Hardware Stores

You are awarded two (2) Scene+ Points for every eligible $1.00 purchase made at eligible Home Hardware, Home Building Centre, Home Hardware Building Centre, Home Furniture locations in Canada and online at homehardware.ca charged and posted to the Scotiabank Scene+ Visa Account. The list of eligible locations may be changed from time to time without notice. See full list of eligible locations across Canada at Scotiabank.com/participatingstores.

You are awarded two (2) Scene+ Points for every $1.00 purchase made at Cineplex theaters, the Cineplex App and online at cineplex.com charged and posted to the Account.

Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers, and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplus for full program details.

All dollar amounts are in Canadian currency unless otherwise stated.

8 The savings of up to 25% applies to Avis and Budget base rates and is applicable only to the time and mileage charges of the rental. All taxes, fees (including but not limited Air Conditioning Excise Recovery Fee, Concession Recovery Fee, Vehicle License Recovery Fee, Energy Recovery Fee, Tire Management Fee, and Frequent Traveler Fee) and surcharges (including but not limited to Customer Facility Charge and Environmental Fee Recovery Charge) are extra. The Bank of Nova Scotia is not responsible for, and provides no representations, warranties or conditions regarding this offer or any Avis or Budget products or services, including Avis Preferred Plus membership and services and those obtained under this offer, which are governed solely by Avis’ terms and conditions. Avis Preferred Plus membership and services are provided by Avis.

9 Offer Description and Conditions: The 40,000 Bonus Scene+ Points Offer (the “Offer”) applies only to new Scotiabank Gold American Express credit card accounts (“Accounts”) opened by October 31, 2023 and is subject to the conditions below. Offer may be changed, cancelled or extended without notice at any time and cannot be combined with any other offers.

40,000 Bonus Scene+ Point Offer Description and Conditions: To be eligible for 20,000 bonus Scene+ points (the “20,000 Point Bonus”), you must open a new Account by October 31, 2023 and have at least $1,000 in eligible purchases posted to your new Account in the first 3 months of the Account open date. To be eligible for an additional 20,000 bonus Scene+ points (the “Annual 20,000 Point Bonus”), you must have at least $7,500 in eligible purchases posted to your new Account in your first year (12 months) of Account open date. Eligible purchases include purchases (less any refunds, returns or other similar credits) but do not include payments, cash advances (including balance transfers or cash-like transactions), interest, fees or other charges.

The 20,000 Point Bonus will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days after the qualifying $1,000 in eligible purchases being posted to your Account within the first 3 months of Account open date, provided the Account is open and in good standing. The Annual 20,000 Point Bonus will be credited to the primary cardholder’s Scene+ account within approximately 2-3 business days after you have met the $7,500 annual spend threshold on the Account, provided your Account is open and in good standing. The Account is considered in good standing if it is not past due or over limit and the Cardholder(s) is not in breach of the Revolving Credit Agreement that applies to the Account.

Rates and Fees: The current annual fee is $120 for the primary card and $29 for each additional card. The current preferred annual interest rates for the Account are: 20.99% on purchases and 22.99% on cash advances (including balance transfers and cash-like transactions). All rates, fees, features and benefits are subject to change.

10 You are awarded six (6) Scene+ Points for every eligible $1.00 CAD purchase made at Sobeys, participating IGA, Safeway, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Co-Op locations charged and posted to the Scotiabank Gold American Express Account. This list of eligible grocers may be changed from time to time without notice. See full list of participating merchants across Canada at scotiabank.com/participatingstores.

You are awarded five (5) Scene+ Points for every eligible $1.00 CAD purchase on all other grocery (not listed above), dining, and entertainment charged and posted to the Scotiabank Gold American Express Account. You are awarded three (3) Scene+ Points for every eligible $1.00 CAD purchase in gas, public transit and select streaming services purchases charged and posted to the Scotiabank Gold American Express Account (the earn rates for each of the above categories and merchants are referred to as the “Accelerated Earn Rates”). You are awarded one (1) Scene+ Point for every $1.00 in all other purchases of goods and services charged to the Scotiabank Gold American Express Account (the “Regular Earn Rate”).

You will earn the accelerated Scene+ Points (6X, 5X or 3X as applicable) under the Scene+ program if you make purchases in Canadian currency only. For purchases that are made in foreign currency, you will only earn 1 Scene+ Point for every $1 charged to the Scotiabank American Express® credit card once that foreign currency has been converted into Canadian dollars.

Merchant classifications – American Express network Purchases must be made at merchants classified through the American Express network with a Merchant Category Code (“MCC”) that identifies them in the American Express network in the “grocery”, “dining”, “entertainment”, “gas”, “streaming service” or “transit” category. Purchases at merchants where these categories are not their primary business do not qualify. Some merchants may (i) provide other goods or services; or (ii) have separate merchants located on their premises that may not be classified with an MCC under the Accelerated Earn Rate categories and such purchases will not earn the Accelerated Earn Rate as applicable. The Accelerated Earn Rates for the Scotiabank Gold American Express Card applies to the first $50,000 in purchases charged to the Scotiabank Gold American Express Account annually at merchants qualifying for the Accelerated Earn Rate, calculated annually from January 1st to December 31st each year. Once you exceed the applicable annual spend threshold, you will continue earning points at the Regular Earn Rate of one (1) Scene+ Point per $1.00 in purchases charged and posted to the Scotiabank Gold American Express Account. Eligibility: Only purchases earn Scene+ Points. Cash advances (including Balance Transfers and Cash-Like Transactions), fees, interest or other charges, returns, refunds or other similar credits to your Account do not qualify for Scene+ Points. Scene+ Points will not be posted to an Account that is not in good standing when purchases are made or when a statement is issued, or if the Account is not open when a statement is issued. See your Scene+ Points terms at www.scotiabank.com/sceneplusrewards for full program details. All dollar amounts are in Canadian currency unless otherwise stated.

11 Priority Pass™ membership includes access to airport lounges participating in the Priority Pass program. Certain terms, conditions and exclusions apply. Unless cancelled, Priority Pass membership automatically renews on its anniversary date. Priority Pass membership will be cancelled if your Scotiabank Gold American Express Card is cancelled. For complete Priority Pass terms and conditions, please visit prioritypass.com/Conditions-of-use .

® Registered trademarks of The Bank of Nova Scotia. American Express is a registered trademark of American Express. This credit card program is issued and administered by the Bank of Nova Scotia under license from American Express

™ Scene+ and the Icon Design are trademarks of Scene Plus IP Corporation, used under license

* Visa Int. / Licensed User

How to use Scene+ points to reduce travel costs

by Anne Betts | Mar 21, 2024 | Travel Hacking | 32 comments

Updated March 21, 2024

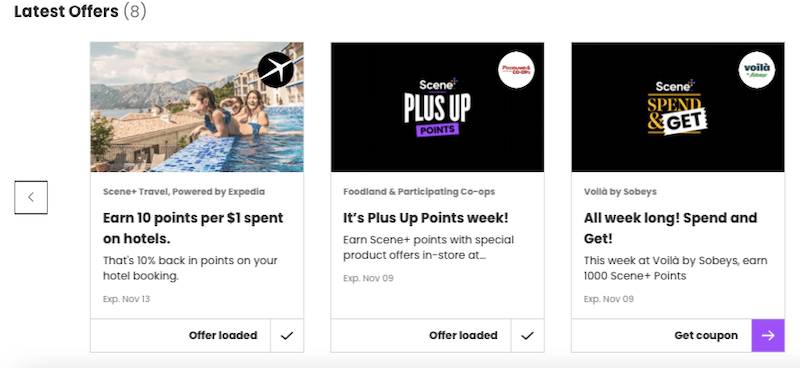

What’s the best use of Scene+? Is Scene+ a useful program for travelling the world on miles and points? How does Scene+ work and what are the ways to use Scene+ points to reduce travel costs ? How does it measure up against the former Scotia Rewards program? How does it compare to other fixed-point reward programs? These questions and more hopefully will be answered in this guide to Scene+.

Table of Contents

Scene+ loyalty program

How to earn scene+ points, current scene+ credit card offers, other scene+ credit cards, what’s the best use scene+ points, 1. scene+ travel, how to redeem using ‘apply points to travel’, what qualifies as a travel purchase , refundable bookings, 1. several ways to earn scene+, 2. enhanced earning on travel purchases, 3. convenient system to cancel refundable bookings, 4. discounted annual fee, 5. no forex fee, 6. one-tier redemption value, 7. twelve months to redeem points, 8. excellent online redemption process, 9. access to rebates on credit card applications, 10. user-friendly scene+ app, 1. no way to extract greater value, 2. limited number of travel expenses, 3. points can’t be transferred to airline or hotel loyalty programs, 4. a rocky transition to the new program, 5. cineplex booking fee, final verdict.

Scene+ is the result of a merger between two former programs: Scotiabank’s Scotia Rewards and Cineplex’s SCENE with an effective date of December 13, 2021. In June 2022, grocery giant Empire joined as a third partner with a plan to replace Air Miles with Scene+ as its loyalty program.

Scene+ is a third-party program operated by Scene Limited Partnership (owned by Scotia Loyalty Ltd., a subsidiary of The Bank of Nova Scotia), Galaxy Entertainment Inc. (a subsidiary of Cineplex Entertainment LP), and Empire Company Ltd., the parent company of stores that include Sobeys, Safeway, Foodland, IGA, FreshCo, Needs,Thrifty, and Lawtons Drugs.

As such, Scotiabank no longer has an in-house loyalty program. This means that Scene+ points earned on Scotiabank credit cards reside in a third-party account. If the credit card that earned Scene+ points is cancelled, the points remain in the member’s Scene+ account, pooled with points earned on other Scotia banking products or a Scene+ Membership Card.

However, there are rules regarding activity. A Scene+ account may be closed, and points forfeited, without any earning or redeeming activity during any 24-consecutive-month period. But a member with a Scene+ Scotiabank product (a credit card or debit card in good standing) is exempt from account closure.

The Scene+ program offers several earning opportunities. These include:

- sign-up bonuses associated with credit cards that earn Scene+ points

- everyday spending on a choice of seven credit cards earning Scene+ points

- purchases using a debit card associated with Scotiabank’s banking packages (Preferred Package, Ultimate Package, Private Banking, Student Banking Advanced Plan, Getting There Savings Program for Youth)

- purchases at partners such as *Empire stores (e.g., Sobeys and Safeway) and Home Hardware

- movie and entertainment purchases at Cineplex theatres or online at the Cineplex store

- cashback in points by shopping through the rebate portal, Rakuten

- dining at partners that include East Side Mario’s, Harvey’s, Kelsey’s, Montana’s, and Swiss Chalet

- booking hotel stays and car rentals through Scene+ Travel (powered by Expedia)

- purchases of games and eats at Playdium and The Rec Room

Another advantage of the merged program is that it’s possible to double-dip on earning at partner locations when using a Scene+ credit card and Scene+ Membership Card. Dining purchases at Swiss Chalet, for example, earn one point for every $3 spent and five points per dollar with the dining multiplier on the Scotiabank Gold American Express Card. Special offers increase the earning power.

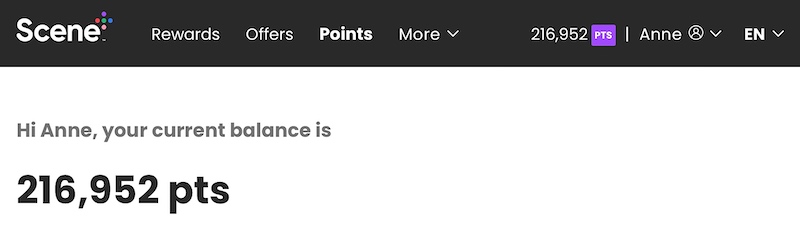

It pays to check your Scene+ account on a regular basis for current offers from Scene+ partners.

*Empire stores include Sobeys, Sobeys Liquor, IGA, Safeway, Safeway Liquor, Foodland, FreshCo, Voilà by Sobeys, Voilà by IGA, Voilà by Safeway, Chalo! FreshCo, Thrifty Foods, IGA West, Les Marchés Tradition, Rachelle Béry, and Needs Convenience. In the Atlantic, Scene+ points can be earned at Lawtons Drugs that’s owned by Empire.

And of course, Scotiabank customers using select Scotiabank credit cards can ‘double dip’ by paying for purchases with a Scotiabank credit card that earns Scene+ points. At Empire grocery stores, the multipliers are higher.

- Scotiabank Gold American Express Card earns 6 points per dollar

- Scotiabank Passport Visa Infinite Card earns 3 points per dollar

- Scotiabank American Express Card earns 3 points per dollar

The latest promotion on the Scotiabank Passport Visa Infinite Card sees a return of an annual fee waiver in the first year (a saving of $150). The sign-up bonus is

- an attractive 30,000 Scene+ on spending $1,000 in the first three months

- an unattractive 10,000 Scene+ points on spending $40,000 each year

Besides having worldwide acceptance as a Visa card, attractive features of the Scotiabank Passport Visa Infinite include

- an accelerated earning rate of x3 at Empire stores

- accelerated earning rates of x2 on eligible grocery, transit, ride share, dining, and entertainment (applicable worldwide)

- no foreign transaction fees (2.5%)

- complimentary Visa Airport Companion membership and six lounge visits per year

The offer is available until July 1, 2024. Applying through the Great Canadian Rebates portal sweetens the deal with a $30 rebate.

The current promotion on the popular Scotiabank Gold American Express Card is in effect July 1, 2024. Unfortunately, it doesn’t have an annual fee waiver in the first year. The annual fee is $120, or $79 for seniors, that can be offset by applying through a rebate portal. The current rebate at Great Canadian Rebates is $125.

The Scotiabank Gold American Express Card earns:

- 20,000 Scene+ on a $1,000 spend in the first three months

- additional 20,000 Scene+ on a $7,500 spend in the first year

- 6 Scene+ per dollar spent at Empire grocery stores

- 5 Scene+ per dollar spent on groceries (at grocery stores other than Empire), dining, food delivery, and entertainment

- 3 Scene+ per dollar spent on gas, transit, and select streaming services

- 1 Scene+ per dollar spent on everything else

There’s no FOREX (foreign transaction) fee on purchases in a foreign currency.

Like most banks, Scotia offers a banking package where the annual fee on a credit card can be waived every year. For more information see the Ultimate Package bank account.

In addition to the Scotiabank Gold American Express Card, the other Scene+ credit cards are:

- Scotiabank Passport Visa Infinite Card

- Scotiabank Passport Visa Infinite Business Card

- Scotiabank Platinum American Express Card

- Scotiabank American Express Card

- ScotiaGold Passport Visa Card

- SCENE Visa Card

- SCENE Visa Card for Students

What’s the value of a Scene+ point?

Scene+ can be redeemed for Apple and Best Buy merchandise and gift cards, dining, movie tickets, and Scotiabank credit card account credits. Unless there are special offers, these types of redemptions are at a lesser value than when redeemed for travel.

The exception is at participating grocery stores where 1,000 points can be redeemed for $10 off grocery purchases. This is a value of one cent per point.

Travel redemptions are consistently valued at one cent per point (i.e., 10,000 points = $100). This applies to Scene+ Travel bookings, and those booked independently through other providers.

Much like the former Scotia Rewards Program, there are two ways to redeem points for travel. An advantage over the former program is that the minimum threshold of 5,000 points ($50) no longer exists.

Scene+ Travel replaces the former in-house Scotia Rewards Travel Service. The new service under the auspices of Expedia operates in much the same way as ExpediaForTD, the portal for members of the TD Rewards program. Points can be redeemed against any travel booked via the portal.

Charge the full amount to your credit card, or against the points balance in your account. Or, use the part-points-part-charge option.

2. ‘Apply Points to Travel’

This operates much the same way as it did under the former Scotia Rewards Program. It’s for bookings with travel providers other than Scene+ Travel.

Charge a purchase to your credit card and wait for it to post to your account. Points can then be redeemed against the purchase. This includes taxes, booking fees, airport fees, and travel insurance premiums.

A cardholder has 12 months from the posting date of the purchase to apply the points.

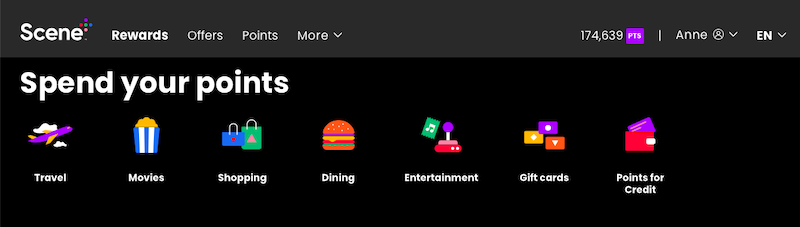

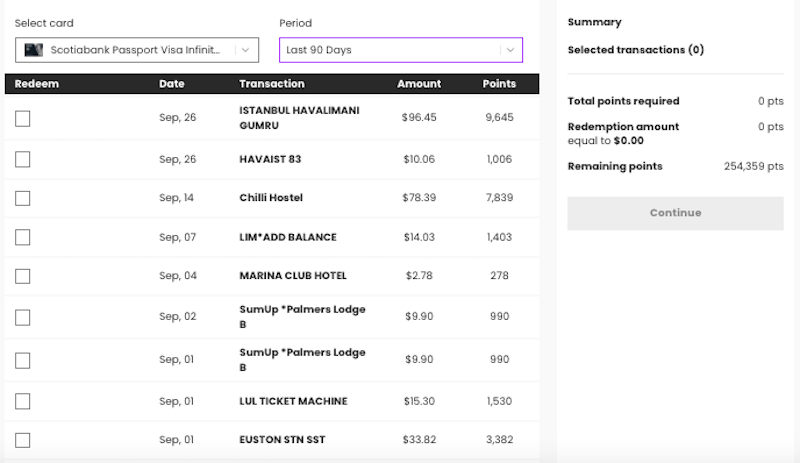

Log into your Scene+ account and navigate your way to > Rewards > Travel (under Spend your points) > Apply Points to Travel

A drop-down menu will list the credit cards attached to your Scene+ account. Clicking on each credit card will reveal any purchases coded as travel in the period you select.

For example, in my case, all travel purchases charged to my Scotiabank Passport Visa Infinite Card in the last 90 days appear as a list. They include a visa for Turkey, airport bus, hostel accommodation, transit card purchase and initial load, train ticket, scooter account top-up, and a drink at a hotel.

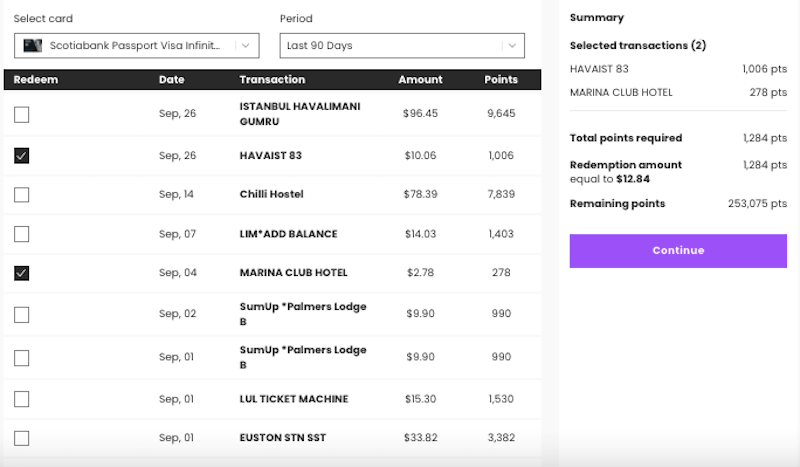

I can redeem Scene+ points for specific charges by selecting each one. The Summary box to the right shows me my selected charges, the total number of points I’ve chosen to redeem, the monetary value of those points, and the remaining points in my Scene+ account.

Clicking the Continue button takes me to a confirmation page, and the information that the monetary value of my redemption will be credited to my credit card account in two to three days. A confirmation email with the same information is received within seconds.

To be eligible for redemption, the charge needs to be recognized as a travel purchase with merchant codes or identifiers set by the Visa network as:

- airlines and air carriers, airports, flying fields, and airport terminals

- lodgings, hotels, motels, resorts, trailer parks, and campgrounds

- passenger railways, bus lines, steamship, and cruise lines

- travel agencies and tour operators

- automobile rental agencies, and motor home/recreational vehicle rentals

These were the same identifiers previously used by the Scotia Rewards Program.

Based on previous experience, I’ve found that charges for passenger railways, bus lines, and tour operators could be inconsistently included or excluded as candidates for redemption.

For example, Queensland Rail travel between Brisbane and Maryborough West in Australia was eligible as a travel redemption. A journey of a similar distance with Irish Rail between Dublin and Galway wasn’t.

Also, when a purchase is coded as entertainment, it’s excluded from the list of travel charges. This has an impact on tours. For example, tours of Dublin’s Kilmainham Gaol and Belfast Titanic were coded as entertainment. As a result, they didn’t appear on the list of eligible travel redemptions. Admission to Dublin’s Christ Church Cathedral for a self-guided tour wasn’t coded as entertainment, but it appeared on the list of possible travel redemptions.

Another observation concerned dining purchases if they were purchased at a hotel or while travelling by train. They appeared as travel purchases on my account and were therefore eligible as a travel redemption.

There are many reasons to make refundable bookings. One issue to consider is whether you prefer to be refunded in points or cash if you need to cancel.

If you book through Scene+ Travel and make a booking using points, your cancelled booking will be refunded in points rather than cash. If you prefer a cash refund, you should book through a platform other than Scene+ Travel (e.g., Expedia) using your Scotiabank credit card and prepay in full. Once the charge posts to your account as a travel purchase, use the ‘Apply Points to Travel’ feature and select the transaction for redemption. The points value of the charge will be deducted from your Scene+ points balance and the cash value of the charge will post to your account within a few business days.

Then, cancel the refundable booking. I find the online process at Expedia using the Virtual Assistant is user-friendly and efficient. The charge will be refunded to your credit card account within five business days.

Ten attractive features of the Scene+ program

When combined with Scotiabank’s best features, the Scene+ program offers several advantages.

In addition to opportunities to earn points with Scene+ partners, Scotiabank has seven credit cards in the Scene+ family. Several of them offer points multipliers for various types of category spending.

The best points multiplier is on spending using the popular Scotiabank Gold American Express Card. It earns 5 points per dollar on groceries, dining, and entertainment and 3 points on gas, daily transit, and select streaming services. (The multiplier increases to 6 points per dollar at Empire grocery stores.)

Only purchases in Canadian funds are eligible for the points multiplier, but there have been reports of cases where the multiplier has been applied while travelling abroad. In my view, t he best use of the Scotiabank Gold American Express Card is to use it exclusively for the x5 multiplier (x6 at Empire grocery stores). Even for gas, purchase gas gift cards at a grocery store for the x5 or x6 multiplier, and gift cards of other merchants you support.

For moviegoers, the Scene Visa Card (or the Scene Visa Card for Students) may be useful as a no-fee ‘forever card’ to build and anchor a person’s credit history. It earns x5 on purchases at Cineplex theatres or at cineplex.com, but its value to someone without a lengthy credit history is that it could help elevate a credit score and a person’s credit worthiness.

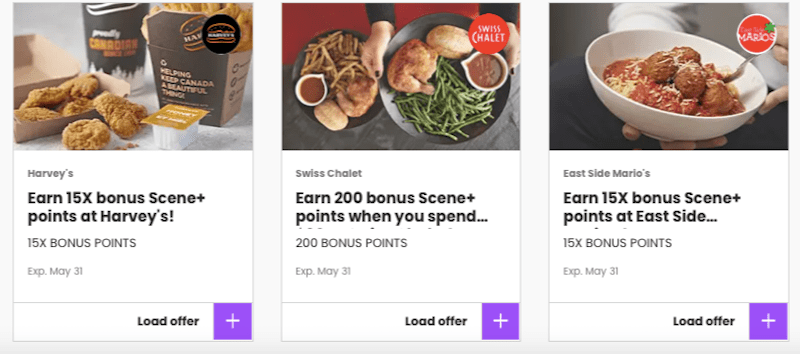

Scene+ credit cards earn 3 points per dollar (pre-taxes and fees) on hotel and car rental bookings at Scene+ Travel. The occasional offer such as x10 points on hotel bookings in the fall of 2022 boost earning efforts. This is in addition to the points earned on the respective credit card.

Refundable bookings at Scene+ Travel are conveniently and efficiently processed by Expedia’s Virtual Agent. Clicking on the Customer Support link at the bottom of the confirmation email takes you to your Scene+ account login and then to the Virtual Agent where you’ll be prompted to enter your itinerary number or the last four digits of the credit card used for the booking. Once the Virtual Agent locates the booking, one click cancels it and an email arrives within seconds confirming the cancellation.

Scotiabank offers discounted annual fees for seniors. The Scotiabank Gold American Express Card has a fee of $79 (as opposed to $120). The ScotiaGold Passport Visa Card’s fee is $65 (compared to $110).

Scotiabank is to be applauded for being the first of the big-five banks to offer a no-FOREX-fee credit card to its Scotiabank Passport Visa Infinite Card. I suspect that dropping the 2.5% fee cuts into a lucrative profit margin but clearly it’s been worth it. Otherwise, Scotia wouldn’t have added this feature to the popular Scotiabank Gold American Express Card. Needless to say, it came with an annual fee increase from $99 to $120 and the downgrading of several benefits.

To help you decide if a no-FOREX-fee credit card is the best credit card to have while travelling abroad, see Is a no-FOREX-fee credit card always the best choice for international travel?

Unlike other programs (e.g., TD Rewards), there’s no loss of value between using Scene+ Travel and other travel providers. The flexibility to book travel with any provider without any devaluation of points means cardholders can search for the best deal and use a vendor of their choice.

Dealing directly with a provider can be beneficial. In the case of flight delays and overbooked or cancelled flights, it’s my experience that service is better if the booking was made directly with the airline. For hotel bookings, it’s usually necessary to have booked directly with the hotel’s booking service to earn loyalty points and other loyalty program benefits.

(For AirBnB bookings, if you’re chasing Avios points, consider booking through the British Airways Executive Club portal to earn x3 Avios points on each pre-tax £1/€1/$1 spend on accommodation or experiences, plus what you earn on your credit card of choice.)

Having 12 months to use the ‘Apply Points to Travel’ route means you don’t need to have the points when you book. You can accumulate the necessary points using the welcome bonus and points multipliers with your Scene+ credit card, and then redeem them when it’s to your advantage.

The online system for post-purchase redemptions is user-friendly and efficient.

Scotiabank regularly uses affiliate partners that offer rebates on approved credit card applications. For example, the Great Canadian Rebates (GCR) rebate of $150 on the popular Scotiabank Gold American Express Card is very appealing.

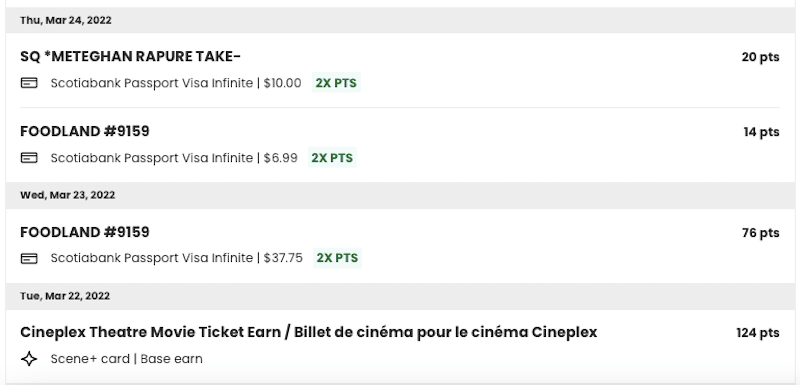

Offers are loaded on the app and the Scene+ membership card is within easy reach to take advantage of earning opportunities. Tapping on an account holder’s points total reveals points-earning activity by date and credit card, with multipliers. A quick glance reveals if points and multipliers have been correctly applied.

The Scene+ app mirrors essential account information available at the Scene+ site.

Five shortcomings of the Scene+ program

Unlike CIBC Aventura, RBC Avion Rewards, and American Express Membership Rewards, at the present time, Scene+ doesn’t have a flight reward chart where it’s possible to extract a value greater than one cent per point.

For more information on the CIBC Rewards (Aventura) program, see When travelling the world on miles and points, is the CIBC Aventura program worth it?

The system of merchant codes and travel identifiers is mostly restricted to flights, accommodation, transit, car rentals, cruises, and travel packages. Attractions, tours, and sundry travel purchases are mostly excluded. In this respect, TD Rewards can be redeemed for a broader range of travel expenses.

For more information on the TD Rewards program, see: When travelling the world on miles and points, is the TD Rewards program worth it?

There are no conversion partners where it might be possible to extract a greater value than one cent per point on travel redemptions.

Based on the comments in various miles-and-points forums, far too many people had negative experiences with the transition to the Scene+ program. Missing points, missing multipliers, and other anomalies have resulted in reports of people who, in frustration, stopped using Scene+ credit cards until such time as the glitches were resolved. While some issues have been addressed, not all problems have been resolved. Thankfully, Scene+ has a callback system based on a caller’s place in the callback queue.

Also, Scene+ is yet to expand its two-factor authentication to include email. Members with a physical SIM card and local number (or eSIM data-only package) while travelling abroad cannot receive a text or call to a Canadian number that temporarily doesn’t exist or is not in service. Unlike Aeroplan, I can receive an email to confirm my identity and log into my account to manage bookings. This isn’t possible with Scene+ and renders it less useful while travelling.

In June 2022, Cineplex undermined the convenience of online bookings by introducing a non-refundable booking fee $1.50 per movie ticket. The fee is discounted for Scene+ members (to $1.00 per ticket), and waived for CineClub members enrolled in Cineplex’s monthly subscription service. It doesn’t apply to movie tickets purchased at the theatre.

1. The x5 points multiplier on groceries, dining, and entertainment (x6 at Empire grocery stores) helps make the Scotiabank Gold American Express Card a useful keeper card for many cardholders, and a strong earner of Scene+ points.

2. The addition of Empire is exciting news for Scene+ members who find value in the Scene+ program and now earn points on grocery and drug store purchases at stores under the Empire umbrella. The points boost from x5 to x6 on purchases at Empire grocery stores on the Scotiabank Gold American Express Card is welcome news indeed.

3. The flexibility in redeeming Scene+ for purchases from any travel provider with no loss in value makes it a very attractive fixed value program. In this respect, it has the edge on the TD Rewards Program that has a two-tier redemption structure.

4. The ease of redeeming points online is a welcome user-friendly feature. Having 12 months to do so adds to the appeal.

5. Scene+ points are handy for a variety of travel expenses such as budget flights or those that aren’t part of a primary airline alliance/frequent flyer program. They’re useful for ground transportation, ferries, and miscellaneous accommodation that are outside existing airline and hotel loyalty programs. When used strategically, they can play a beneficial role in reducing out-of-pocket travel expenses.

6. The program has excellent potential as one of several secondary programs in a diversified miles-and-points portfolio. As such, it can be used to complement frequent flyer and hotel loyalty programs that are capable of generating a much greater value than one cent per point.

As far as I can see, the new Scene+ program is greater than the sum of its former parts. With no obvious signs of devaluation, it replaces Scotia Rewards as my favourite fixed-point program.

If you found this post helpful, please share it by selecting one or more social media buttons. Do you collect Scene+ points? If so, what’s your experience with the program? Please share your thoughts in the comments. Thank you.

Might you be interested in my other miles-and-points posts?

- When travelling the world on miles and points, is the CIBC Aventura program worth it?

- Is a no-FOREX-fee credit card always the best choice for international travel?

- Finding Aeroplan flights: a step-by-step guide

- Meeting Minimum Spend Requirements to travel the world on miles and points

- Lounge and flight review of United Airlines’ Polaris experience

- Does the BMO Air Miles World Elite MasterCard deserve a place in your wallet?

- Travelling the world on miles and points. Is the TD Rewards program worth it?

- Why the Best Western loyalty program is good for travellers

- What is the best credit card for trip cancellation, trip interruption and flight delay insurance for trips on points?

Care to pin for later?

32 Comments

Hi Anne Great article on a card I do not have yet. One question. It says that the points credit may not show up for up to two statements. Does this mean interest is charged for those two months, then credited back or is the credit in the system but just not showing? I would hate to leave any balance on a card even when a credit will eventually come.

Hi John. The credit appeared on my account much faster, and there’s no interest involved. Here’s an example using the Spirit of Queensland train fare. I charged it to my credit card in January and the $371.38 charge appeared on my next statement. Each monthly balance is paid in full so by the time I took the train in March, it had already been paid. When I returned from Australia in April, I redeemed 37,138 points and the credit voucher for $371.38 appeared in my account within a matter of days. That put my credit card account in the black at the end of April, and each subsequent charge on my credit card was deducted from that credit. Had I chosen to close the account with a credit, I could have asked for a cheque, or had it transferred to my no-fee Scotia credit card. Does this help answer your question?

Anne, hi. I have the same question on how many days are taken from the date of post-purchase redemption request to a date of showing up in a credit card account. The UP-TO 2 statement periods is really scaring me. You said that it took only several days in your example. Based on your experience , is a week realistic?

Hi Seong. Thanks for dropping by. My experience involved just a few days. It’s my sense banks are over cautious with their “up-to” advertised long periods for points, refunds, buddy passes and the like to be posted. I should think a week is a reasonable expectation despite the stated two statement periods.

Hi Anne, as March 8 2023, the Apply Points to travel Button seems to be gone as an option to redeem existing points. The only way left is to purchase a new trip through their portal powered by Expedia!

Hi Anne, Although in theory the merger of ScenePlus and ScotiaRewards seems to be an excellent program, it is having some serious startup problems : missing points, missing multiplier points, as well as points double-posted including double-posted points for returns. Calculating an accurate points total is almost impossible. A month and a half after the merger the problems have not yet been resolved. Phoning in to rectify the points balance involves wait times of up to four hours plus. All of this for a points program that that involves annual fees. Disappointed? You bet.

Agreed, there have been lots of complaints, especially on multipliers. I’m fortunate in that my Scotia Rewards all converted to Scene+ but I’m taking a break from using Scene+ credit cards until there are reports that the glitches have been fixed. Some reports indicate a commitment to have it fixed sometime in February. Fingers crossed, as I quite like this as a secondary program.

Hello, Anne. Although the merger of ScenePlus and ScotiaRewards appears to be a great programme in theory, it has a number of major initial issues, including missing points, missing multiplier points, and double-posted points, including double-posted points for returns. It’s nearly impossible to calculate an exact point total. The issues have not been resolved a month and a half after the merger. Calling in to correct the points balance can take up to four hours or more. All of this for the sake of a points programme with annual payments. Disappointed? Yes, absolutely.

Hello, Anne. I have the same issue about how long it takes from the time a post-purchase redemption request is submitted to the time the funds appear in a credit card account. I’m terrified of the UP-TO 2 statement periods. In your example, you mentioned it just took a few days. Is a week realistic based on your experience?

A week was realistic with the former Scotia Rewards program. I’m yet to make a redemption from the new Scene+ program.

Hi Anne, thanks for the review. The lack of Forex fees is a big win for me and anybody who uses their VISA abroad. However I noticed that booking travel although is ‘powered by’ Expedia, doesn’t offer the same benefits as using Expedia directly. i.e. must book flights and hotels separately, no packages or package discounts are available. I even did a head-to-head comparison for an upcoming trip to Miami and found the Expedia website price cheaper than via Scene+ Travel, which is very frustrating.

Thank you for this breakdown Anne. I have the Scotia Gold Amex and waiting for the Scotia passport in the mail. Im have no experience in this program and my question is, do my points combine from both cards or do I end up with 2 separate Scene+ accounts?

Marlene, your points combine in the same Scene+ account. You’ll see your total points and a breakdown of the points from your feeder cards. Many people have experienced problems with points being posted correctly, including multipliers, so it’s a good practice to check your points during these early months of the new program.

Greetings, I have a Scotiabank Passport Infinite card I’ve been using in the United States but I don’t seem to be accumulating scene rewards points. Are US dollar spends eligible for points? Tried to connect with Scenes.ca but don’t have time to wait for the estimated 1 hour and 45 minutes.

Yes, the Passport Visa Infinite earns Scene+ on foreign purchases, both base points and the multiplier. It sounds like you’re one of several people experiencing glitches during the transition from Scotia Rewards to Scene+.

This was really helpful – thank you so much! I was struggling to find information on the new program and you’ve summarized it in a very user-friendly way.

Hello. Do you know if AirBnB bookings can be redeemed as part of the Points for Travel program? Is it considered an Eligible Travel Expense?

Hi Cathy. AirBnB is a recognized accommodation provider by the Visa network so it should appear on your list of eligible travel redemptions on your Scotiabank credit card account that earns Scene+ points.Good luck.

Unlike with Scotia Rewards, booking airfare through the new Scene+ system is a complete horror show. People assisting with bookings are incompetent and most do not have adequate English language skills.

I have had exactly the same experience. Very disappointing after receiving consistently excellent service through the previous program.

Where can I find the redeem Scene+ points for travel purchases already made button. I can see my points balance but can’t seem to find the button to redeem. Thanks

It should be in your Scotia account (not Scene+). Any purchases coded as travel should appear as eligible for redemption.

The apply points to travel is not operating at all like it used to with scotia rewards. I made several purchases in the last 6 months of airlines, hotels, taxis, etc. and none of them show up in the list for redemption. It’s really frustrating. Also I used to get double points with my card on any travel bookings before and now it’s just regular points. And living overseas it used to also allow me to get bonus points on restaurants/ entertainment that wasn’t exclusively in Canada. Now not..

Says you need to phone if you want to apply “partial” redemption, as it isn’t yet available in the app. But when you live overseas calling doesn’t work. Overall just a huge disappointment since switching.

Thanks a lot for your summary – so useful. I’ve had a Scotiabank visa infinite since earlier this year. My question is, I have about 60000 scene + points. I’ve incurred hundreds of dollars of travel expenses within the last 6 months. Is there any downside to simply using the “apply points to travel” option and cashing everything out? Am I missing out on any potential better use of the points? Doesn’t seem like it to me, but I’m new to this program, so just wanted to ask an expert. Thanks!

Hi Jonathan. Unless there are special offers, I’m assuming travel redemptions at a penny a point offer the best return. The only downside I can think of to NOT using the points now against recent travel expenses is the possibility of a devaluation. I like to think that’s not likely in the near future given the need to attract members and build confidence in the Scene+ program.

My mother just got her visa infinite scene card in the mail and she is ready to collect points. After reading this I’m a little concerned. We planned on paying our travel agency with the card to earn points, but I’m starting to see that won’t work. Will we earn points for booking tours and whatnot when not using the travel portal? Do you earn points with every purchase?

Thanks for the help

Yes, you earn points with every purchase. So is it the Scotiabank Passport Visa Infinite Card? If so, the earning rate is 1 point for every $ spent, except it increases to 2 points per $ on groceries, dining, entertainment, and daily transit. So if you pay your travel agent $500, 500 points will be earned on the purchase. Does this help?

I just got a new Scene+ card from my local Foodland store. When I went to register it I was not happy that I was expected to enter a credit card number as well to complete the process. I found that very suspicious and unless I can be convinced that it is necessary I won’t bother with the card.

Scene is terrible to deal with, please if you are reading this DO NOT GET ANY SCENE CARD! I ordered a 100 dollar gift card that never came. I have called and emailed for months and they will not return my points, so I’m out 100 dollars. All banks have points now, go to one that works, scene is garbage.

It is March 2023 and Scene+ still is in a mess. It is unclear whether they give 3x points for flights and hotels (as they advertise) or 1 point for every dollar spent. Just got back from Europe where all travel and hotels were paid for using Scotiabank Infinite Passport card and only 1 point/$spent appears on statement. The call centre staff are, for the most part, absolutely useless. Why is it called Powered by Expedia? Do you have to book through Expedia?

Thanks for this information. I’ve been trying to confirm with Scotia Passport Visa Infinite Card that even foreign purchases earn points (1 point per dollar). Is that your understanding? Purchases made around the world still earn points? Thank you!

Yes, the Scotia Passport Visa Infinite earns points on all foreign transactions. It also earns points on the multiplier categories. So if you use the card in any country on dining or groceries, it earns x2 points. If you link it to your Uber account, you’ll earn x2 on the ride-share category. All the best.

Trackbacks/Pingbacks

- 25 Tips on earning Aeroplan miles - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Why the Best Western loyalty program is good for travellers - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Lounge and flight review of United Airlines’ Polaris experience | Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Minimizing Aeroplan taxes, fees and surcharges - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Finding Aeroplan flights: a step-by-step guide - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- What is the best credit card with trip cancellation, trip interruption and flight delay insurance for trips on points - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Is the BMO Air Miles World Elite MasterCard a good deal? - Packing Light Travel - […] What’s the best use of Scotia Rewards? […]

- Travel the world on miles and points by meeting Minimum Spend Requirements - Packing Light Travel - […] What’s the best use of Scotia Rewards? Travel the world on miles and points […]

- When travelling the world on miles and points, is the TD Rewards program worth it? - Packing Light Travel - […] What’s the best use of Scotia Rewards if travelling the world on miles and points […]

- Is a no-FOREX-fee credit card always the best choice for international travel? - Packing Light Travel - […] What’s the best use of Scotia Rewards for travelling the world on miles and points […]

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search this site

Welcome to Packing Light Travel. I'm Anne, a dedicated carry-on traveller. For information on the site, please see the About page.

Book: The Ernie Diaries

Packing Light

Join the mailing list for updates, and access to the Resource Library.

You have Successfully Subscribed!

Connect on instagram, if you find this information useful, subscribe to the newsletter and free access to packing lists, checklists, and other tools in packing light travel's resource library..

Your email address will never be shared. Guaranteed.

Pin It on Pinterest

Help Centre

- Popular questions

- Credit cards

- Travel & insurance

How do I find out if I can change or cancel my flight?

If you booked travel with the Scotia Rewards Travel Centre before December 13, 2021, you can reach the Scotia Rewards Travel Service at 1-866-586-2805. Follow the prompts for travel to make changes to your booking (select 1 for travel, select 2 for travel booked before December 13, 2021).

If you booked on or after December 13, 2021, please contact the Scene+ Travel service at 1-866-586-2805 for help with your request.

Related Articles

Where can I download the Scene+ app?

Where can I see my Scene+ rewards and account history?

What happens if I close my Scene+ bank account or credit card?

Have a question, lost your Scene+ membership card, or forgot your Scene+ number or password?

What is Scene+?

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

35 Comments

Thanks Barry,

Appreciate the info. Just got to figure how many cards I want to carry.

Great article. Contains the in-depth evaluation/comparison of rewards programs for which I’ve been waiting for a while so thanks for being the first to do it (at least that I’ve seen).

One thing missing for me is the inclusion of the annual fees for the credit card(s) you’d use to earn points in each of these programs to enable a quick cost vs. benefit. For example, AMEX may be #1 on the benefits side but the Platinum card has an annual fee of $699 whereas the RBC Visa Infinite Avion is only $120/year.

The other big thing is the ease of actually getting the flights you want when redeeming points. This is the principal reason why I quit CIBC to go to Scotia (that plus the no forex fees on Scotia’s Passport VISA) – I could never find anything usable when I tried to use my CIBC points. No one at CIBC ever told me I could find what I wanted on Expedia and then book that over the phone. However, I realize that quantifying this element in a semi-meaningful way would be impossible without spending countless hours trying to book a sample package of flights/hotels/vacations on each program.

Good point about the annual fees, I should make an edit. I try to avoid including the fees since some people look at the fee and just get turned off. I wanted to explain what the value of the different programs are without putting a price on it.

Hey Barry, To expand on my reasoning for leaving the CIBC Aventura program (and why I think it’s a terrible program), here’s an example that is very representative of my past experiences. I wanted to book a hotel room I found on Expedia.ca for $217.14 (incl. taxes/fees) for 2 nights. When I called CIBC Rewards, the same room was going to cost me 25,730 or the equivalent of $257.30. That would have given me 0.84% value on the nominal 1 point/$1 in purchases I had made on the card over the past several years. And that is just one example. At least with Scotia rewards, I know I’m going to get a full 1% in value every time by redeeming my points for travel-related purchases I’ve made in the past few months – it’s the closest thing to a cash-back card I’ve been able to find in the travel rewards space, and I get no forex fees, 2 more airport lounge visits per year and all of the same VISA Infinite benefits I got with the CIBC Aventura card. For me, the two programs are miles apart – it’s not even close.

Yes, the ability to redeem on any travel you find on your own with Scotiabank is a huge thing for many people.

Hello. You should correct the td rewards points to x9 for purchase bought through Expedia for Td

When I wrote it, I meant 3X the points than your regular earn rate e.g. Expedia for TD gives you 9 points, but regular purchases gives you 3 points. I can see where the confusion is and will update the article. Thanks for flagging it.

Hi, Enjoyed your article as far as it went. Currently have travel and medical insurance through BMO world elite MasterCard and wondered if you have any comparable data with other bank cards. Thanks, C. Durant

Hi C. Durant,

These two articles may be of interest.

https://www.moneywehave.com/how-credit-card-travel-insurance-works-when-booking-a-flight-on-points-or-miles/ https://www.moneywehave.com/the-best-credit-cards-with-travel-insurance/

[…] Rewards is a popular program better known under the CIBC Aventura name. Although I rank the CIBC Rewards program behind American Express Membership Rewards and RBC Rewards, CIBC Rewards […]

[…] MomentumPLUS Savings account, then the monthly fee will be waived1. Scotia Rewards is one of the best bank travel rewards programs in Canada so make sure you choose that over SCENE points as your bonus when you open a new […]

This is a great article and I agree with your rankings 100%. For Canadians today I don’t think there’s a better combination of using American Express as your primary card and using Avion where your Amex isn’t accepted. This is the best perks and most flexible rewards redemption plan out there. I myself use the American Express Platinum as my primart, the RBC Avion VISA Infinite Privelege for anywhere that doesn’t accept Amex. I also carry an mbna Alaska World Elite MC for retailers (Costco, etc) that only take MasterCard.

I hope HSBC decide to add aeroplan to their transfer partner one day

If the average point value for BMO is 71 cents, doesn’t that crush the other programs in terms of value?

It depends on how you look at things. 4 of the programs have a higher base value for their points. BMO Rewards points are worth more than TD Rewards and HSBC, but BMO Rewards has less flexibility with their points.

One thing I would add to your RBC Rewards section is the fact the fixed rewards chart is only available to RBC card users who have Avion. If you use an RBC Rewards+, Signature Rewards, you don’t get access to this chart. This is precisely been my strategy for me is to use Signature Rewards VISA at a lower annual fee to accumulate points. Once I earn enough, to switch to Infinite to either transfer to the airline partners or to use the fixed reward chart. Once complete, switch back

Good point, and a very interesting strategy.

This article was great – I’ve been reading others that you’ve written trying to learn a little more about travel points. I’m super new to this, and quite honestly a dumb dumb when it comes to redeeming points. I have an RBC Infinite Visa which sounds like it’s a great card to have. I’m starting an e-commerce platform and will be making some very large purchases soon so I would like to charge to the most valuable card possible. I love eating out – restaurants and drinks and UBER when travelling in different cities. My family and I go to Amsterdam every year to visit my sister and travel to surrounding countries while we’re there. I’ll likely be purchasing all tickets with my points and would like the flights /travel experience be as comfortable as possible (lounges, luggage perks/priority check) for my parents – I’m curious to know if you would recommend the AMEX Cobalt or the Scotiabank AMEX or if there is another you would recommend instead? Apologies for long and winded comment – thanks so much for the help!

FUnny, I have family in Amsterdam too and try to get there as often as I can.

As for your questions. It sort of depends on how much you’ll be charging to your credit cards. American Express has the best points program and some of the best business credit cards. However, this only works to your advantage if vendors you use accept Amex.

The Amex Platinum Business Card gives you 1.25X the points on all purchases and lots of travel benefits e.g. unlimited lounge access. However, the Amex Cobalt gives you a high earn rate on eats and travel (including Uber), so that’s a good choice too.

If you’re charging 10K+ a month, you’re probably better off with a business card. If it’s $5K-$7K, go with the Amex Cobalt. Note that the Platinum Card gives you a bonus if you use a referral link. The Cobalt bonus is the same if you use a referral link or the regular link.

As for your RBC Rewards points. They’re still pretty good, but if you can eventually collect just American Express points, you’ll be better off due to their flexibility.

Love Amsterdam – one my favourite places to travel, my sister has a rental agency there if your family ever needs help finding a place!

Amazing – thanks so much for the speedy response and the insight! in the first month, it’ll be about 15-20K for inventory, shipping supplies, repurchases will be dependent on monthly traffic. So maybe the Cobalt? How does one get a referral link?

Thanks again Barry!

Yes, Amsterdam is one of my favourite cities. The last time I was there I stayed in Amsterdam west and then the Marriott. Now that I travel with my daughter, finding apartments are more appealing. Please send me a link to her company.

The American Express Cobalt card is a regular credit card, if you can get a limit of 20K+, it could be worth it. That said, it might better to get an American Express Platinum Business Card for business expenses and travel benefits.

You could then get the Cobalt Card for personal expenses such as food and drink since the earn rate is higher. You can transfer your points to Aeroplan with both cards, so you’ll have plenty of flexibility.

Oh amazing! I’ll do that then. Thanks so much for all the help Barry, you’ve been great!

Absolutely her agency is more for relocation/permanent residency – just in case, you can find her site here http://amsterdamlifehomes.com/ , name is Lyna.

I’ve shared a couple of your articles with a some of friends of mine as I found them insightful, detailed and easy to follow. Great work!

Feel free to use my referral links =D

Also, thanks for your sister’s website.

Oh perfect!! Thanks Barry and no problem! She has a few friends who Airbnb so feel free to contact me as well and I can connect you guys.

Take into consideration earn rate and BMO easily becomes the most valuable. You get 2-3 points for every dollar spent compared to RBC 1 point. All things considered BMO World elite is a much much better credit card than RBC.

It’s clumsy to just to look at redemption rate only…many bloggers on this are making the same mistakes.

The earn rate is just part of the equation. How you can burn your points is just as important. While the BMO World Elite has some higher multipliers, the base earn rate is one of the lowest for a premium travel credit card. BMO Rewards also forces you to use their travel portal, so it’s less valuable than other programs.

I personally favour American Express Membership Rewards since there are multiple ways to use your points and you can transfer your points to Airline and hotel partners. Plus, the American Express Cobalt Card has arguably the best earn rate of all cards out there.

Both earn rate and redemption are equally important which is exactly my point. More specifically, I’m comparing #7 ranked BMO with #2 ranked RBC. I hold both cards by the way.

Here’s some simple math so majority can understand the implications.

If you spend $100,000

BMO RBC Basic Earn Rate 2 1 Accumulated Points 200,000 100,000 Redemption Rate for Travel Spending 0.67 1 Cost of Tickets Covered $1,340 1,000

Difference profit with BMO $340

Note: Ignore the options 1.25 points earn rate for RBC for travel or the 3 points with BMO for travel. Just work with basic earn rate for simplification.

It is clear BMO is better for the dollar spent. Add in much better insurance (MUCH better) + lounge access and its not even close.

I know people will say “Redemption Schedule” RBC. Has anyone actually used that to their benefit? It’s one of the biggest scams…its almost ALWAYS better to use their fixed 100 points for dollar conversion. So people need to stop saying redemption schedule as a benefit and see it as a unusable scam.

As for BMO portal, again please use it first. It covers all flights you would find on google. Never had an issues to find the lowest priced flight on google and then finding it on BMO portal. Its really easy to use and straight forward as well.

As for your American Express comment, yes that’s true. There are better travel cards but comparing it within the big banks….BMO World Elite is pretty much the best travel card.

Don’t trust me. Just try it and you will see.

BMO just announced that the BMO World Elite Mastercard will now earn just 1 point per $1 spend for the base rate, so the value has gone down significantly.

As for your initial analysis, you’re not wrong. But here’s my counter argument and why I personally rank RBC Rewards higher. With RBC, you can get a value of 2 cents per point for the fixed points program. You can also transfer your points to Cathay and BA. If you used your points for business flights, you could get an even higher value.

I use the redemption schedule quite a bit for short haul flights e.g. Toronto to Ottawa or New York.

I’m not disagreeing with you. I’m just saying everyone has a different value and uses their points for different reasons.

Hey, love the info!

Looking to get into the travel card space and stuck between getting an AMEX PLAT (mainly due to the sign up bonus & perks) paired with the cobalt for everyday purchases along with HSBC WEMC for non amex stores.

2nd option is RBC Avion infinite privilege with RBC ION+ do you think having the 3x multiplier on everything and the covert to Avion Elite rewards.