Home Compare Savings Accounts Guide to Spaceship Voyager, the micro-investing platform

Guide to Spaceship Voyager, the micro-investing platform

If you’re wanting to get into the stock market, Spaceship Voyager could help you to start investing.

By Alex Brewster

on 18 Mar 2021

With savings account rates at historically low levels, Australians are flooding into the stock market to get a better return on their savings.

In just under three years, more than 125,000 Aussies have started using Spaceship Voyager. While past performance is not indicative of future performance, the app has delivered solid returns to many of its customers in the past year.

Find out how Spaceship Voyager works, what it costs, and if it may be right for you.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- A high-interest online savings account with no monthly fees, easy withdrawals and award-winning digital banking

- No withdrawal notice periods or interest rate penalties

Total interest earned $1,001

All products with a link to a product provider’s website have a commercial marketing relationship between us and these providers. These products may appear prominently and first within the search tables regardless of their attributes and may include products marked as promoted, featured or sponsored. The link to a product provider’s website will allow you to get more information or apply for the product. By de-selecting “Show online partners only” additional non-commercialised products may be displayed and re-sorted at the top of the table. For more information on how we’ve selected these “Sponsored”, “Featured” and “Promoted” products, the products we compare, how we make money, and other important information about our service, please click here . Rates correct as of May 18, 2024. View disclaimer.

What is Spaceship Voyager?

Spaceship Voyager is a micro-investing app designed for people inexperienced with investing to get started in the stock market. There is no minimum investment on Spaceship, meaning customers can invest as little as $1, removing the fear many prospective investors have over forking out large amounts of their hard-earned cash.

As opposed to a human financial adviser that gives personal investment advice based on your circumstances, Spaceship Voyager offers a more automated method of investing through it’s technology. While this takes a lot of the guesswork out of investing, it does make it less personalised. However, this can also be much cheaper than consulting a professional, which may make it a more attractive method of investing to those just getting started or people with less disposable income.

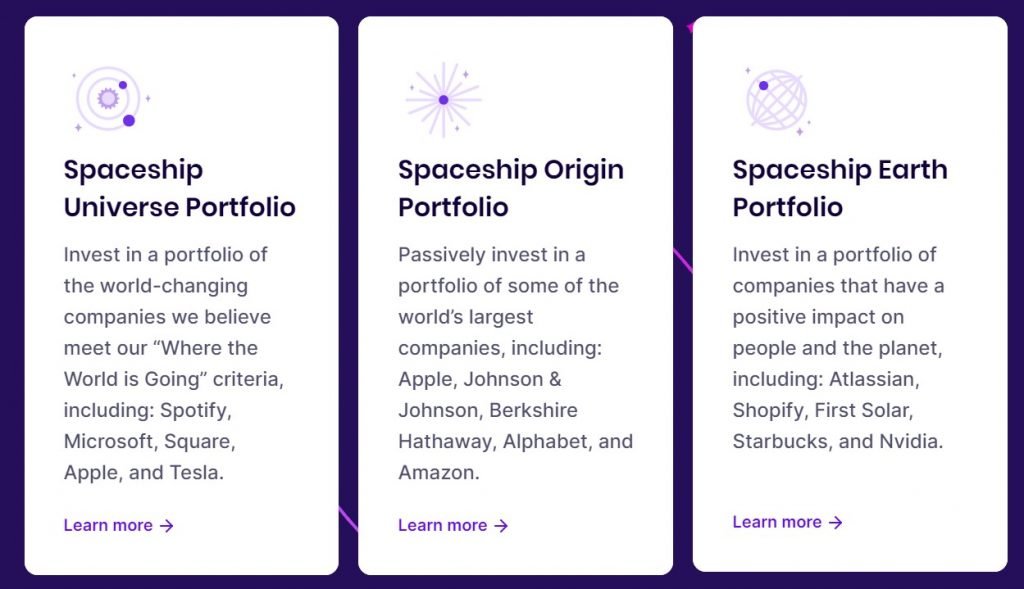

Investors can choose to invest in three different portfolios, with the ability to deposit lump sums or set up regular weekly, fortnightly, or monthly top-ups.

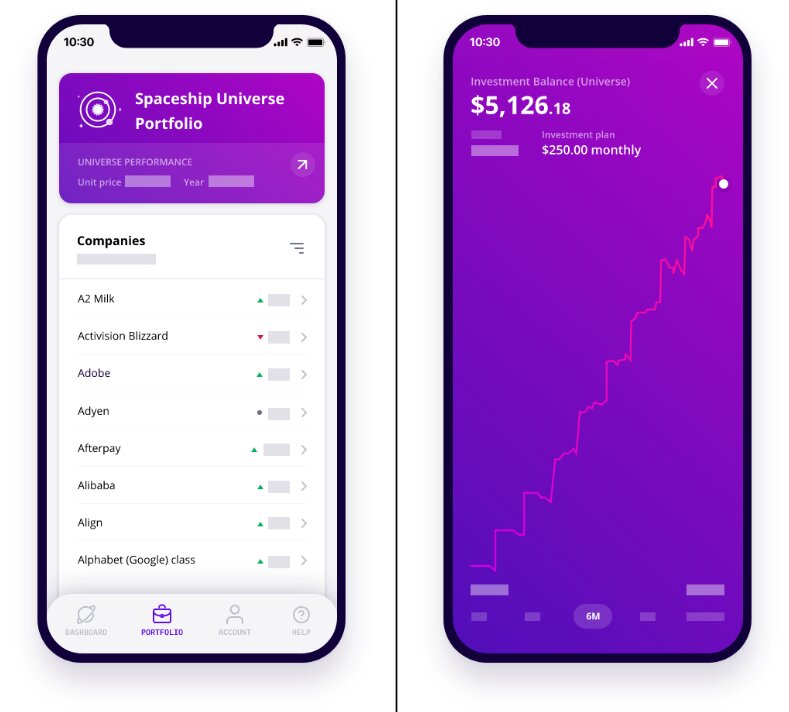

You can track the progress of your portfolios through the app and link to an external bank account to deposit and withdraw money.

Source: Spaceship

How do you invest with Spaceship Voyager?

Spaceship Voyager allows you to invest in three different portfolios, each made up of shares from various different companies from countries across the world like Australia, the US, China, and Argentina. You cannot customise the investment portfolios. The three portfolios are:

Spaceship Universe Portfolio

Spaceship Universe Portfolio is an actively selected fund of 70-100 companies Spaceship believes satisfies its “where the world is going” (WWG) criteria. The WWG methodology analyses each company’s competitive advantage, and future product or service growth potential. The fund boasts household name US companies like Facebook, Tesla, Apple, and Microsoft, and other prominent Australian companies like Afterpay, Zip, and Seek.

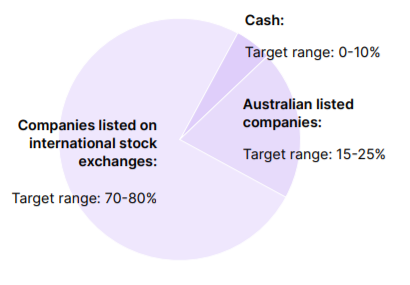

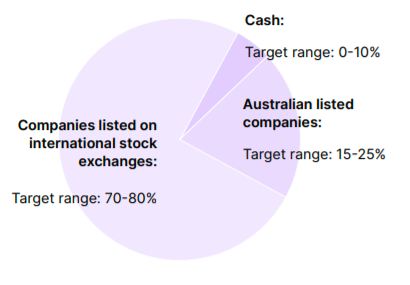

The fund’s assets are typically invested within the following asset allocation ranges:

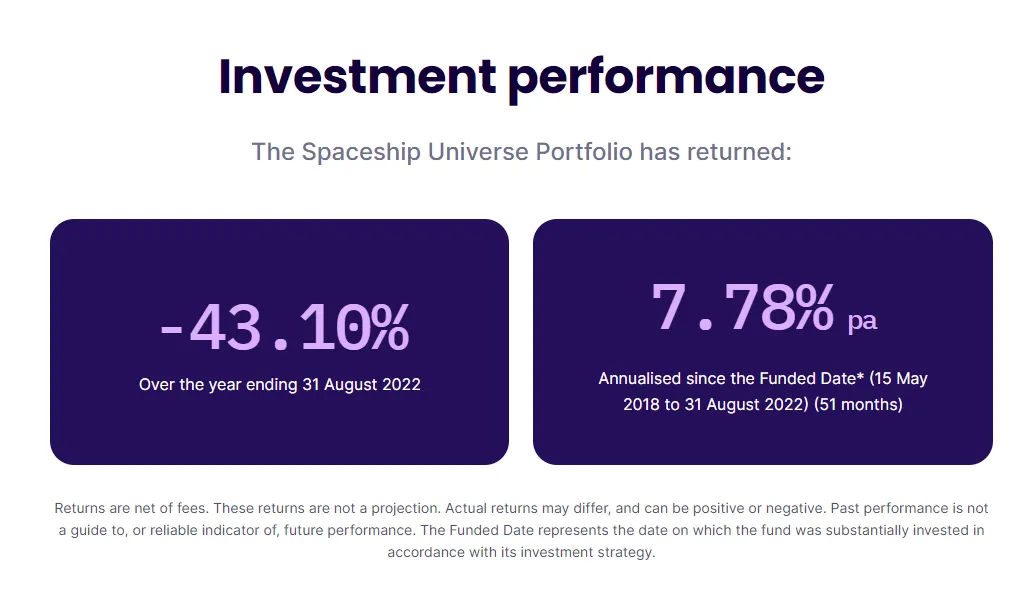

Over the year ending 31 January 2021, the fund achieved a return of 47.84%. In the 32 months from the portfolio’s ‘funded date' on 15 May 2018 till 31 January 2021, it has achieved an annualised return of 29.46% p.a. These returns are net of fees and may seem impressive, but keep in mind the mantra past performance is not a reliable indicator of future performance .

Spaceship has labelled the risk profile for the fund as high as there is higher risk and volatility associated with it compared to some other funds, but with that comes the potential for higher returns in the long term compared to lower-risk investments. The minimum suggested timeframe of investment for this fund is seven years, which means you should be willing to part with any money you invest in this portfolio for at least seven years.

Spaceship Origin Portfolio

Spaceship Origin Portfolio is a passive index fund made up of the top 100 Australian listed companies and top 100 international listed companies as measured by market capitalisation. Spaceship implements an equal-weighted index to decide which companies to include in the fund, rather than a market-weight index, which increases exposure to smaller companies, minimising the influence of larger companies.

The fund features Australian companies like Coles, Commonwealth Bank, BHP, and News Corp, and US companies like Nike, Netflix, McDonald’s, Astra Zeneca, and Amazon.

Over the year ending 31 January 2021, the fund returned 2.71%. Since the funded date, 15 May 2018 till 31 January 2021, the fund has achieved an annualised return of 10.05% p.a.

Again, these returns are net of fees and past performance is not a reliable indicator of future performance.

The Origin Portfolio has the same high-risk profile as the Universe Portfolio, and the minimum suggested timeframe for holding this investment is also seven years.

Spaceship Earth Portfolio

Spaceship Earth Portfolio is an actively selected fund of 30 to 50 companies that are considered to have a positive impact on people and the planet, in areas like poverty, climate change, and quality education. The fund uses a negative screening process to exclude companies involved in activities like:

Fossil fuels

Animal cruelty

Human rights abuse

Tobacco and alcohol

Firearms, and controversial and conventional weapons

Nuclear power

The fund also uses the WWG criteria in conjunction with this process to select which companies to include. Companies featured in the fund include Atlassian, Lululemon, Shopify, Adobe, Etsy, Cloudflare, Visa, Square, and Starbucks.

Spaceship Earth was launched in November 2020 and as a result, no investment performance data is yet available.

As with the previous two portfolios, the fund is labelled high-risk and the minimum suggested timeframe for holding investment is seven years.

How much does it cost to invest with Spaceship Voyager?

There are no sign-up fees with Spaceship Voyager, and zero fees on the first $5,000 invested. Investors are charged a percentage of their balance for amounts greater than $5,000, which you can see in the table below. There are also no brokerage fees, withdrawal fees or exit fees.

Who can use Spaceship Voyager?

Spaceship chief executive, Andrew Moore, said Spaceship Voyager was an easy to use, low-cost app, suited to anyone who wanted to get into investing who may have been previously daunted by the prospect.

“Spaceship may suit those who want access to a low-cost, app-based investment product with a focus on global equities,” Mr Moore told Savings.com.au.

“With Spaceship Voyager, you can start investing in a managed fund - with anywhere from 30 to 200 companies - in just a few minutes. We think that appeals to many people, whether you’re just starting out or you’ve invested before.”

Mr Moore said the three different portfolios gave customers a way to invest in a diversified managed fund of global equities.

“Our Spaceship Universe Portfolio has a focus on forward-thinking companies, often with a tech tilt, while our Spaceship Origin Portfolio invests in some of the world’s largest companies by market cap.

“Our latest fund is the Spaceship Earth Portfolio – for Australians who want to invest and have a positive impact on people and the planet.”

What are the benefits of using Spaceship Voyager?

Some of the main benefits of using Spaceship Voyager include:

Easy to use app

No minimum investment amount

Investment in Australian and overseas markets

Curated news and resources to inform you about your investment

Ability to set up weekly, fortnightly, monthly investment top-ups

Mr Moore said Spaceship’s focus was centred on giving Australians a best-in-class investment app.

“In the COVID-19 era, it has never been more important for Australians to be able to make the most of their hard-earned cash. We believe that the key to building wealth over the long term is in time in the market, not timing the market.

“It’s not about jumping in and out of investments in the space of a day. We’re investors not traders. Customers can’t trade options or short stocks with us.”

What are the risks of using Spaceship Voyager?

As with any investment, there are risks to using Spaceship Voyager. These include:

Market risk: Share markets rise and fall, and while the goal of the app is to increase your wealth, if the market falls, your investment may too.

No customisation: Although there is a large range of companies within each portfolio, there are only three portfolios to choose from. You also have no say over what companies are included in the portfolios and cannot customise the portfolios.

Currency risk: The portfolios contain companies from all over the globe. Consequently, fluctuations in exchange rates may negatively affect your investment.

Liquidity risk: It can often take time to access the funds in your account, so if you need quick cash, you may not be able to access your funds for a few days.

How to start using Spaceship Voyager

If you think Spaceship Voyager may be for you, here’s how to get started:

Download the app and create an account or sign up online.

Decide which portfolio you want to invest in. You’ll then be required to submit an application with proof of ID. You must be an Australian resident to use Spaceship.

Link your bank account and transfer funds to make your first investment. Spaceship will send you a confirmation of your investment, along with the number of units you purchased, the entry price of them and the date they were issued.

Continue to invest either by making lump sum payments as you see fit, or setting up recurring investment top-ups.

Withdraw as you see fit. You can request a full or partial withdrawal of your investment at any time, which will be processed during the current or next business day.

Savings.com.au’s two cents

Spaceship Voyager makes it relatively easy to invest and may be suitable for people who don’t have the knowledge, time, or money to seriously invest. It’s still vital you do your own research and keep an eye on how your investments are performing.

All investments come with inherent risks, and while Spaceship has delivered solid returns since its inception, this may not be the case in the future.

Only invest what you can afford to lose.

Photo by Matt Benson on Unsplash

Alex Brewster

Alex joined Savings.com.au as a finance journalist in 2019. He enjoys covering in-depth economical releases and breaking down how they might affect the everyday punter. He is passionate about providing Australians with the information and tools needed to make them financially stable for their futures.

Related Guides

How to prepare if your fixed home loan rate is expiring

With record-low fixed home loan interest rates beginning to expire, how can you prepare for interest rate uncertainty that lies around the corner?

How to choose a block of land for your house build

To the untrained eye, a plot of land on one side of the street may not look so different to the one right opposite. Yet, hidden obstacles lurk beneath the soil or in nearby council offices that could hinder your house build.

Why your home loan application can be rejected after pre-approval

What are the maximum interest-only periods on home loans?

When is the right time to buy your second property?

The 10 best budgeting and savings apps for Australians in 2024

Recourse loans & non-recourse loans explained

Why do house prices seem to appreciate faster than units?

Melbourne housing forecast: Suburbs to watch in 2024

When should I upgrade my car?

Australia's rental crisis: how did it come to this?

How to sell an investment property

The richest 1% club: the dollar bills you need to make it

Expert shares their credit card tips for summer travel

Property expert's eight tips to 'get comfortable with auctions'

6 home renovation projects that may increase your re-sale value

What are the top tax apps?

Get news & tips delivered

By subscribing you agree to our privacy policy

© 2024 Savings.com.au · AFSL and Australian Credit License Number 515843

The entire market was not considered in selecting the above products. Rather, a cut-down portion of the market has been considered. Some providers' products may not be available in all states. To be considered, the product and rate must be clearly published on the product provider's web site. Savings.com.au, yourmortgage.com.au, yourinvestmentpropertymag.com.au, and Performance Drive are part of the Infochoice group. In the interests of full disclosure, the Infochoice Group are associated with the Firstmac Group. Read about how Infochoice Group manages potential conflicts of interest , along how we get paid .

Savings.com.au Pty Ltd ACN 161 358 363 operates as an Australian Financial Services Licensee and an Australian Credit Licensee Number 515843. Savings.com.au is a general information provider and in giving you general product information, Savings.com.au is not making any suggestion or recommendation about any particular product and all market products may not be considered. If you decide to apply for a credit product listed on Savings.com.au, you will deal directly with a credit provider, and not with Savings.com.au. Rates and product information should be confirmed with the relevant credit provider. For more information, read Savings.com.au's Financial Services and Credit Guide (FSCG). The information provided constitutes information which is general in nature and has not taken into account any of your personal objectives, financial situation, or needs. Savings.com.au may receive a fee for products displayed.

Explore the Infochoice Group network: InfoChoice · Your Mortgage · Your Investment Property · Performance Drive

Our company, Savings.com.au, has obtained accreditation as a data recipient for the Consumer Data Right (CDR). You can view our CDR policy by clicking on this link .

Be Savings Smart.

Subscribe to our newsletter.

Is Spaceship Voyager the best low-cost investment app for beginners?

By David Boyd | Verified by Yvonne Taylor | Updated 20 Jul 2022

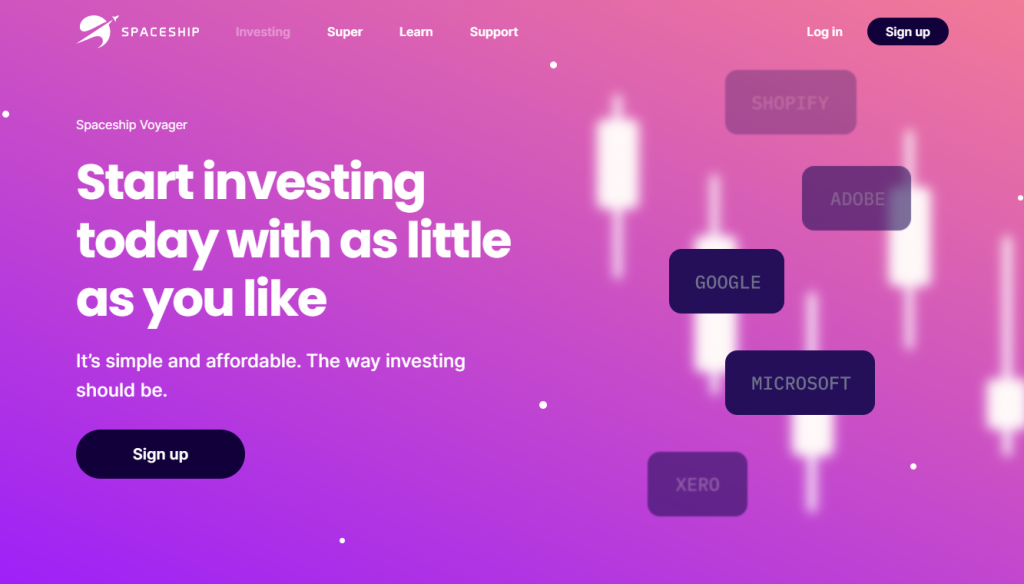

- Choose one of three portfolios and let experts devise your investment strategy.

- No minimum investment, and no fees if your total portfolio balance is less than $100.

- Low $2.50 monthly fee for total portfolio balances over $100.

Spaceship Voyager could be what you are looking for if you'd like to dabble in the stock market but don't know much about investment strategy and would prefer to leave it to the experts.

Getting involved in the stock market has become more and more popular in the last few years – but it can be expensive and risky.

This is why investment apps such as Spaceship Voyager exist. The app is specifically designed for newbies, to help them build up their investment portfolios and access the best advice for getting started.

But is it any good, and will you be an expert by the end of it? In this app review we examine the details and consider the pros and cons, so that you can decide if it's the right choice for you.

In this review

What is spaceship voyager, how spaceship voyager works, available investment portfolios, how much does it cost, who is spaceship voyager designed for, pros and cons, alternatives to spaceship voyager, comparisons.

Spaceship Voyager is an app specifically designed for non-expert individuals to create and grow an investment portfolio while receiving valuable advice.

An investment platform can be intimidating for anyone, but this one is quite straightforward, and the technology will act as your personal financial advisor.

Fortunately, you don't need to invest much to get started. You can deposit as little as $1 and choose between three managed funds to invest in stocks in Australia and around the world.

Spaceship Voyager takes all the complicated parts of creating an investment fund and simplifies them.

- Download the app. It's free to download. Or set up your account online.

- Sign up. This part isn't too difficult, you just need to pop your data into the form and away you go.

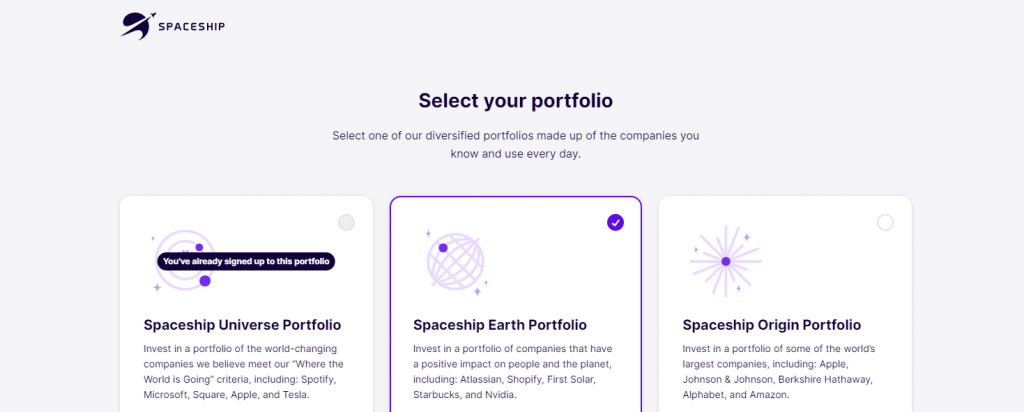

- Choose a portfolio. You can choose between three separate portfolios, depending on how much risk you want to take and how much money you hope to make from the investments.

- Pair up with your bank account/savings account. When you are ready to start, you just need to pair the app up with your bank account so that your investments can be funded. This makes transferring money quick and easy.

Spaceship Voyager investment offers you the option of picking from three different types of portfolio to suit your needs. Which one is right for you will depend on whether you are looking for major global players who have been around for a long time, or want to invest in high-tech companies, or prefer ethical investments.

In fact, you don't have to choose one portfolio to the exclusion of the other two. You can invest in one, two, or all three portfolios.

Spaceship Origin Portfolio

The Spaceship Origin Portfolio is an index fund investing in listed Australian and global shares in amounts according to their market capitalisation. You will be investing in the top 100 Australian and top 100 international companies. Apple , Berkshire Hathaway , Alphabet and Amazon are among the companies that this portfolio invests in.

This portfolio will offer you the opportunity to invest in both the biggest companies in the world, and those local to Australia. Your fees will not be sky high and you can invest in comfort, knowing that the companies you invest in are on a much more stable path.

Spaceship Universe Portfolio

The Universe Portfolio offers a chance to invest in companies hand-picked by the Spaceship Voyager team. They all meet the app's 'Where the world is going' criteria, and include global public companies and large public companies in Australia.

Companies under this umbrella include Spotify, Microsoft and Tesla . The portfolio's past returns have been high, but as always there is no guarantee about future returns.

Spaceship Earth Portfolio

If you are looking to invest in companies that are kind to the planet as well as the sharemarket, then this may be the portfolio for you.

The Spaceship Earth Portfolio, the newest kid on the block, allows you to invest in 50 of the leading companies that are not linked to high levels of pollution, animal cruelty, nuclear power, weapons, gambling, tobacco or alcohol.

This means that you can invest while knowing that you are having a positive impact on the planet and ethically sourcing returns. In a world where we are all being more conscious about how ethical our actions are, this will suit a lot of new investors.

Did you know you can check your credit score on Finty ? It's free and you can check as often as you like.

You won't need much money at all to start creating your Spaceship Voyager portfolio. In fact, you can deposit as little as $1 from the start, and add to it whenever you wish. You can also choose to set up regular weekly, fortnightly or monthly cash top-ups to your investment fund, which makes it a 'set and forget' investment if that's the way you want to play. But if you want to keep track of how your fund is performing you can check out your portfolio and the company profiles provided, with just a tap in the app.

For portfolios with a balance of less than $100, there are no fees payable at all – nothing for depositing funds, withdrawing funds, brokerage or exit fees. Zero, zip, zilch.

But in most cases your portfolio balance will be more than $100. When your balance reaches this stage, you'll be charged a flat monthly fee of $2.50 per account. This means that if you're investing in more than one of the three available portfolios (Origin, Universe, Earth) you will pay only one monthly fee, and no other fees for brokerage, depositing and withdrawing.

This flat fee replaces Spaceship Voyager's previous fees charged as a percentage of portfolio balances, and while the new fee structure is not so good for investors with low balances, it's beneficial for anyone with a healthy and growing portfolio.

For example, if you have $5,000 invested, the fee of $2.50 per month/$30 per year amounts to 0.6% of your balance. But if you have a balance of $10,000, the percentage declines to 0.3%.

These fees are a lot lower than many other investment apps in the industry.

Investing with Spaceship Voyager is mostly aimed towards anyone new to the sharemarket. If you are an investor with little experience with using a trading account and no knowledge of investment strategy, then this may be the right app for you.

The app will advise you throughout the entire process, giving you the best chance to build a successful portfolio. It will talk you through currency risk, interest rate risk, liquidity risk and more.

Spaceship is just one of many apps you can use to streamline your finances and get started with investing. Check out our review of the top personal finance apps for Aussies here .

- Choice of portfolios so that you can select risk, performance history and company type invested in, to suit your preference.

- Low fee structure. Zero for balances below $100, and $30 p.a. (charged at $2.50 per month) for accounts with a total balance of $100 or more.

- No personal expertise required , since the companies you invest in are chosen by experts for each portfolio type.

- Handy app that you can use on your phone and access anywhere.

- Auto top-up option so that you can invest small amounts on a regular basis.

- Regular content updates by the investment team.

- No entry or exit fees, and you can begin with as little as $1.

- Investment choice is restricted to three funds, rather than individual companies.

- There is no guarantee of continuing high returns , so past performance is not necessarily an indicator of future growth.

- Foreign currency risk. Portfolios include investment in overseas shares, and since Spaceship does not hedge against currency exposure (one of the reasons why its fees are so low), your portfolio value could be impacted by currency fluctuations (both negatively and positively).

- Foreign country risks , since your portfolio includes investment in foreign countries which may become financially or politically unsettled.

There are many investment apps competing for your business, and Spaceship Voyager may or may not be the best one for you. Consider these alternatives before you make your final decision:

- Stake . Allows you to invest in US stocks you select yourself. Trades do not incur brokerage fees, but other fees apply.

- Superhero. Trade in over 2,500 ASX-listed products for a flat $5 fee, starting with an investment as low as $100.

- SelfWealth . Invest in companies on the ASX, NASDAQ and NYSE, for a flat fee of $9.50 per trade.

- Pearler . Online trading platform for long-term investors. It includes automated investment top-ups and assists with investment goal-setting. Transaction fees start at $9.50.

- Stockspot . Similar to Spaceship in that you choose a portfolio to invest in (in this case according to your selected risk level) and investment is automated. Invests in ETFs (Exchange Traded Funds) only, with monthly fees starting at $5.50.

- CMC Markets . Trade commission-free in US, UK and Canadian stocks. Low $11 or 0.1% fee for Australian trades, declining the more trades you make in a month. High fees for trades in other countries.

See how Spaceship Voyager compares against other micro investment apps.

- CommSec Pocket vs Spaceship Voyager

- Raiz vs Spaceship Voyager

- Stake vs Spaceship Voyager

Disclaimer: We put our customer’s needs first. The views expressed in this article are those of the writer’s alone and do not constitute financial advice. Advertisers cannot influence editorial content. However, Finty and/or the writer may have a financial interest in the companies mentioned. Finty is committed to providing factual, honest, and accurate information that is compliant with governing laws and regulations. Do your own due diligence and seek professional advice before deciding to invest in one of the products mentioned. For more information, see Finty’s editorial guidelines and terms and conditions .

Advertiser disclosure

At Finty we want to help you make informed financial decisions. We do this by providing a free comparison service as well as product reviews from our editorial staff.

Some of the products and services listed on our website are from partners who compensate us. This may influence which products we compare and the pages they are listed on. Partners have no influence over our editorial staff.

For more information, please read our editorial policy and find out how we make money .

Finty members get

I don't want rewards

I want rewards

Disclaimer: You need to be logged in to claim Finty Rewards. If you proceed without logging in, you will not be able to claim Finty Rewards at a later time. In order for your rewards to be paid, you must submit your claim within 45 days. Please refer to our T&Cs for more information.

- Price Tracker

- Advertising & Partnership

- Press Release

- Editorial Policy

- Policy & Regulation

- Blockchain Guide

- Trading Guide

- Bitcoin Guide

- Ethereum Guide

- CoinSpot Review

- Swyftx Review

- Binance Australia Review

- MEXC Review

- BitMart Exchange Review

- Bybit Australia Review

- CoinSpot Mastercard Review

- CoinSpot vs Swyftx vs Binance

- Coinspot vs Binance

- Crypto.com vs. Binance

- CoinSpot vs Kraken

- Swyftx vs Coinbase

- Ethereum Price Predictions

- Bitcoin Price Predictions

- Submit Press Release

- Submit Querry

- Submit Guest Post

- Crypto Wiki

Home » Spaceship Voyager Review 2024: What Are Its Risks?

Spaceship Voyager Review 2024: What Are Its Risks?

You might also like

3commas review, myetherwallet review, cmc markets review 2024: pros, cons & is it safe.

Spaceship Voyager is a micro-investing platform tailor-made for retail investors seeking to grow their portfolio effortlessly. Geared towards passive growth, it opens the doors for everyone with its no minimum investment policy, allowing you to embark on your investment journey with as little as $1. Unlike CommSec Pocket , Spaceship Voyager grants investors access to top ETFs at low fees. Start your investment adventure today with Spaceship Voyager and watch your wealth soar!

What Is Spaceship Voyager?

Spaceship Voyager is a user-friendly micro-investing platform designed for individuals new to investing, providing an easy entry into the stock market. With no minimum investment requirement, even as little as $1 can be invested, alleviating the fear of committing large sums of money.

Spaceship Voyager employs an automated technology-driven approach to offer personalised advice, reducing guesswork in investing. However, this method proves significantly more cost-effective than consulting a professional, making it an appealing choice for beginners or those with limited disposable income.

Investors can select from three distinct portfolios and have the flexibility to deposit lump sums or establish regular weekly, fortnightly, or monthly top-ups. Spaceship Voyager empowers users to monitor portfolio progress and seamlessly link an external bank account for convenient deposits and withdrawals.

Spaceship Voyager Investment Portfolios

Spaceship Voyager presents three diversified portfolios, each comprising shares from a wide array of companies spanning various countries worldwide, including Australia, the US, China, and Argentina.

Spaceship Universe Portfolio

Spaceship Universe Portfolio is a thoughtfully curated fund comprising 70-100 carefully chosen companies that align with Spaceship’s forward-looking vision called “where the world is going” (WWG) criteria. To make selections, the WWG methodology assesses each company’s competitive advantage and potential for future product or service growth. The portfolio includes renowned US companies like Facebook, Tesla, Apple, and Microsoft and prominent Australian companies like Afterpay, Zip, and Seek.

Regarding asset allocation, the fund typically invests within specific ranges as follows:

Over the one year ending on 31 January 2021, the fund impressively achieved a return of 47.84%. During the 32 months from the portfolio’s “funded date” on 15 May 2018 to 31 January 2021, it reached an annualised return of 29.46% p.a. These returns, while notable, should be considered alongside the reminder that past performance may not reliably indicate future performance.

Spaceship designates the risk profile for this fund as high due to its increased risk and volatility compared to some other funds. But it also presents the potential for higher long-term returns than lower-risk investments. Investing in this fund requires a minimum suggested timeframe of seven years, indicating a commitment to retaining your investment for at least that duration.

Spaceship Origin Portfolio

Spaceship Origin Portfolio is a passive index fund that comprises the top 100 Australian listed companies and the top 100 international listed companies based on market capitalisation. To determine which companies to include, Spaceship employs an equal-weighted index approach rather than a market-weighted index. This unique strategy enhances exposure to smaller companies while reducing the influence of larger ones.

The fund encompasses well-known Australian companies like Coles, Commonwealth Bank, BHP, and News Corp and prominent US companies like Nike, Netflix, McDonald’s, AstraZeneca, and Amazon.

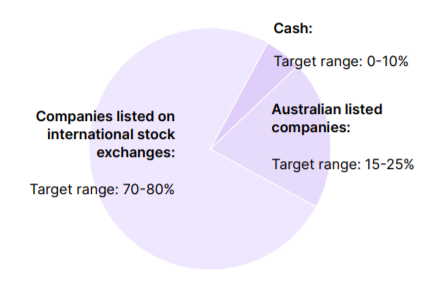

Regarding asset allocation, the fund’s investments typically fall within the following ranges:

Over the one year ending on 31 January 2021, the fund achieved a return of 2.71%. From its funded date on 15 May 2018 until 31 January 2021, the fund displayed an annualised return of 10.05% p.a.

Like the Universe Portfolio, the Origin Portfolio carries a high-risk profile, and holding this investment for a minimum period of seven years is recommended.

Spaceship Earth Portfolio

Spaceship Earth Portfolio is an actively managed fund comprising 30 to 50 carefully selected companies that positively impact society and the environment. These companies are focused on critical areas such as poverty alleviation, climate change mitigation, and quality education.

To ensure alignment with these goals, the fund employs a negative screening process, excluding companies involved in activities related to fossil fuels, animal cruelty, human rights abuse, tobacco and alcohol, gambling, firearms, controversial and conventional weapons, and nuclear power. This approach is complemented by the WWG criteria, aiding in selecting companies for inclusion.

The fund’s portfolio features reputable companies such as Atlassian, Lululemon, Shopify, Adobe, Etsy, Cloudflare, Visa, Square, and Starbucks.

No investment performance data is available because Spaceship Earth was launched in November 2020. However, the fund is categorised as high-risk, and it is recommended to maintain investments for a minimum period of seven years, similar to the previous two portfolios. By investing in the Spaceship Earth Portfolio, you can play a part in shaping a better future for both humanity and the planet.

Other Features of Spaceship Voyager

Spaceship super.

In 2017, Spaceship debuted as Spaceship Super, an innovative superannuation fund. Over time, the fund expanded its offerings to include an investment platform beyond superannuation. The underlying concept remains consistent, with the super fund aligning its values with the forward-looking vision of “where the world is going.”

As the super industry is highly competitive, Spaceship Super faces challenges due to its lack of an established track record in performance and relatively higher fees than other competitors. For those seeking a superannuation fund, exploring alternative options that offer more favourable benefits may be worthwhile.

Transparency

The Spaceship Voyager website offers transparent and comprehensive information about your investments. Unlike many managed funds that obscure their holdings, Spaceship reveals every company it invests in, providing complete transparency. Each company is listed with its performance chart, ensuring you have clear visibility into your portfolio.

While you won’t find specific allocation percentages for each company, you can quickly access performance numbers as they are listed alphabetically. Even during challenging times, like the negative returns experienced in 2022, Spaceship boldly presents the performance figures in prominent display, ensuring you clearly understand your investment’s performance.

Market Updates & Education

Periodically, Spaceship updates the changes made to their active portfolios – Universe and Earth – including the rationale behind these decisions. These updates serve as valuable insights into the team’s efforts to construct a robust and dependable portfolio on your behalf.

The provided information is genuinely helpful in gaining a deeper understanding of the investment process. It sheds light on the fluctuations experienced and emphasises the significance of focusing on long-term growth, imparting a clearer perspective on the journey of investing.

Spaceship Voyager Fee Structure

Spaceship Voyager implements a simple fee structure for its users. For those with a portfolio balance of $100 or more, a monthly fee of $2.5 is charged, encompassing all three portfolios. Each portfolio incurs a management fee calculated as a percentage of the net asset value.

The Spaceship Universe and Earth portfolios carry an annual management fee of 0.50%, while the Spaceship Origin Portfolio is charged at 0.15% per year. All fees and costs include GST and net of reduced input tax credits.

The management fee for each portfolio is calculated as a percentage of the net asset value (your balance). Investing an amount that can yield a return exceeding the incurred fees is generally recommended to ensure your investment remains cost-effective.

For instance, let’s consider an investor with $1000 invested in the Spaceship app, paying a management fee of 0.50% per year (Earth or Universe portfolio). The annual cost of the portfolio would amount to $35. Therefore, a desirable investment amount would generate a return of more than $29 per year, which equates to a 2.9% return for a $1000 investment.

To illustrate how fees may vary with different investment amounts such as $1000, $10,000, or $50,000, here is a breakdown of the annual costs for each portfolio based on their respective management fees:

Spaceship Universe/Earth (0.50% management fee):

- $1000 investment: $35 per year

- $10,000 investment: $350 per year

- $50,000 investment: $1750 per year

Spaceship Origin (0.15% management fee):

- $1000 investment: $15 per year

- $10,000 investment: $150 per year

- $50,000 investment: $750 per year

Please note that these figures are based on the management fees associated with each portfolio and provide an overview of the potential costs for different investment amounts.

As you can see, the cost of having a portfolio in Spaceship increases with the amount you invest. The clear and favourable option here is the Origin portfolio, which boasts the lowest fees while still delivering commendable performance.

Let’s crunch the numbers for a $50,000 investment in the Universe or Earth portfolios. The percentage cost of fees for these portfolios comes to 0.548%, creeping beyond the low-cost range. In my book, anything under 0.50% per year qualifies as low cost.

On the other hand, the Origin portfolio incurs fees at a rate of only 0.198% per year, making it an obvious choice for the most economical Spaceship portfolio.

Spaceship Voyager’s Target Users

According to Spaceship’s CEO, Andrew Moore, Spaceship Voyager is a user-friendly and cost-effective solution for anyone interested in investing, especially those who may have been hesitant about it in the past.

“Spaceship Voyager provides easy access to a low-cost, app-based investment product with a global equities focus,” stated Mr Moore. He emphasised that the platform enables users to begin investing in a managed fund of 30 to 200 companies within minutes, appealing to beginners and experienced investors alike.

Mr Moore explained that the three distinct portfolios offered by Spaceship cater to different investment preferences. The Spaceship Universe Portfolio emphasises forward-thinking companies, often with a tech-oriented approach.

Meanwhile, the Spaceship Origin Portfolio invests in some of the world’s largest companies based on market capitalisation.

The latest addition to their range is the Spaceship Earth Portfolio, ideal for Australians seeking to impact both people and the planet through their investments positively.

Concerns With Spaceship Voyager

Like any investment platform, using Spaceship and investing in their select portfolios has inherent risks. Some of these risks include, but are not limited to:

- Market Risks: The Spaceship Universe portfolio, closely tied to top tech stocks in the US, is subject to market volatility and political uncertainty. Investing in high-growth tech stocks can carry significant risks.

- Stock Risks: As the Spaceship portfolios are hand-picked, investors need more flexibility to add or remove specific stocks. This lack of active management may pose risks associated with limited control over the portfolio’s composition.

- Liquidity Risks: Spaceship Voyager caters to small investors, and there may be more suitable platforms for large-scale investments. For substantial investments, traditional brokerages like CommSec may be more appropriate.

While Spaceship offers promising investment opportunities, it is crucial to be aware of these risks and consider your individual investment goals and risk tolerance before making any decisions.

How To Get Started With Spaceship Voyager

If you’re considering using Spaceship Voyager, follow these simple steps to get started:

- Download the app or sign up online to create your account.

- Choose the portfolio you wish to invest in. As an Australian resident, you must apply with proof of ID.

- Link your bank account and transfer funds for your initial investment. Afterwards, Spaceship will send you a confirmation detailing the number of units purchased, their entry price, and the issuance date.

- Continue investing by making lump sum payments whenever you prefer or setting up recurring investment top-ups.

- Whenever you need, you can withdraw your funds. Request a full or partial withdrawal, which will be processed during the current or next business day.

With these steps, you’ll be on your way to starting your investment journey with Spaceship Voyager.

Alternatives To Spaceship Voyager

As you explore different investment apps to find the best fit for your needs, consider these alternative options alongside Spaceship Voyager:

- CMC Markets: Offers commission-free trading in US, UK, and Canadian stocks, with a low $11 or 0.1% fee for Australian trades, reducing with higher trade volumes. Note that trades in other countries may incur higher fees.

- Pearler: An online trading platform tailored for long-term investors, featuring automated investment top-ups and assistance with investment goal-setting. Transaction fees begin at $9.50.

- SelfWealth: Enables investment in companies listed on ASX, NASDAQ, and NYSE with a flat fee of $9.50 per trade.

- Stake: Allows you to handpick US stocks for investment without incurring brokerage fees, but other fees may apply.

- Stockspot: Similar to Spaceship, it allows you to select a portfolio based on your desired risk level, with automated investments in ETFs (Exchange Traded Funds). Monthly fees start at $5.50.

- Superhero: Offers trading over 2,500 ASX-listed products for a flat $5 fee, with a minimum investment starting at $100.

By considering these alternatives, you can make an informed decision that aligns with your investment goals and preferences. Each platform offers unique features and fee structures, allowing you to choose the one that best suits your investment strategy.

Spaceship Voyager FAQs

What is the minimum investment.

Spaceship Voyager is ideal for beginners in investing. With a minimum deposit of $5 and the freedom to add funds as desired, it provides a fee-free trial until reaching $100. Setting up recurring investments allows for a “Set & forget” approach, making investing in the stock market easy.

Can I select more than one portfolio with Spaceship?

Spaceship now enables multiple portfolio investments, allowing you to invest in all three if desired, unlike the previous restriction of one per account. Their website offers transparency, displaying all included stocks for each option and easily digestible performance data for your research convenience.

Can I withdraw money from my Spaceship account?

To withdraw funds from your investment, use the Spaceship app to request a withdrawal. Alternatively, reach out via email at [email protected] , the Help tab in the app, or the live chat on the website’s lower right corner.

How are unit prices calculated in Spaceship Voyager?

The unit price of each portfolio is determined by dividing the fund’s net asset value by the number of units in the fund. As the market value of the net assets fluctuates, the unit price will also vary. The portfolios invest in international stock markets, and the unit price for a business day is calculated after 11 am on the next business day, as those markets typically close the following morning.

How are my investment returns calculated?

Your investment return is determined by the change in the unit price of the chosen fund (Origin, Universe, or Earth) from when you acquired units to when you redeem them for cash upon withdrawal. For instance, if you invest $1,000 at a unit price of $1.00, you receive 1,000 units. If the unit price increases to $1.20 in two years, your investment would be worth $1,200, reflecting a 20% gain.

The Bottom Line

Spaceship Voyager offers new investors an excellent and cost-effective opportunity to begin their journey. With well-diversified portfolios containing high-quality assets, the platform minimises overall volatility. We highly recommend the Spaceship Voyager app for all aspiring investors looking to build their portfolios.

Lucas N is Coin Culture's managing editor for people and market, covering opinon, interview and market analysis. He owns Near, Aurora and Chainlink

Recommended For You

In recent years, automated trading bots have become prevalent among traders. Who wouldn't fantasise about a lifestyle where you can unwind on a beach, enjoying Piña Coladas while...

MyEtherWallet, created by the renowned software provider MyEtherWallet, stands out as a robust cryptocurrency wallet solution. Established in 2015 and headquartered in Los Angeles, USA, this software caters...

CMC Markets enjoys a solid global reputation for its exceptional trading experience, competitive pricing and diverse instruments. Whether you're a seasoned trader or just starting in the world...

Quantum AI Review 2024: Is Quantum AI Legit or Scam?

The cryptocurrency market's popularity has surged recently, partly driven by the convenience of crypto trading bots. Quantum AI is among the leading bots, aiming to enhance trading ease...

IC Markets Review 2024: Platforms, Fees & Security

With the volatile nature of the forex market, traders seek reliability and safety for their investments. IC Markets offers automated trading solutions, using intelligent algorithms to trade currencies...

HEX Coin Price 2024: Is HEX A Good Investment?

Most popular.

Cryptocurrency Regulations in Australia: A Brief Overview 2024

Blockfi partners with coinbase for fund distribution, shutting down web platform, mastercard launches ‘next generation’ blockchain payments startup program, iota introduces “iota 2.0” testnet, shifts to proof of stake, guide to crypto twitter: influencers, traders and ventures 2023, recommended.

- Memecoin Launcher Pump.fun Claims Ex-Employee Behind $1.9M Exploit

- Solana Restaking Protocol Solayer Soft-Launches Deposits

- Coinbase Targets Australia’s Self-Managed Pension Funds: Bloomberg

Your Australian news source for all things cryptocurrency. Coin Culture is an independent media outlet that aims to provide an Aussie take on crypto, digital assets, and investing.

Top articles

Browse by tag, recent posts.

© 2023 CoinCulture. All rights reserved.

Welcome Back!

Login to your account below

Remember Me

Retrieve your password

Please enter your username or email address to reset your password.

Add New Playlist

- Select Visibility - Public Private

In this guide

Your reviews

Ask a question, spaceship voyager review.

Spaceship Voyager (Index Portfolio) isn't available on Finder right now.

This fully digital investment platform makes investing your savings easy and convenient.

Spaceship is a popular investment app that offers small automated deposits into managed stock portfolios.

- Consider Spaceship if you want to easily invest small amounts into the stock market without paying high fees.

- Look elsewhere if you want to buy or trade individual stocks or ETFs.

Many people think it's complicated, expensive and time-consuming to invest. But thanks to better education and savvy innovation, investing has never been more accessible and affordable.

What is Spaceship Voyager?

Robo-advice wealth management uses technology to give professional investment advice and investment management without the need to pay a human financial advisor. This has revolutionised not only how we invest in the stock market, but also who can invest in the stock market.

Spaceship Voyager is one of these providers. Their user-friendly app is for “the next generation of newcomers and experts” and allows you to invest your savings into curated investment portfolios.

You can select from two different investment portfolios, and set up regular top ups each week, fortnight or month. Then you let Spaceship Voyager take care of the rest.

Our Spaceship Voyager video review

What portfolios can I choose with Spaceship Voyager?

The platform offers a choice of two portfolios: an index fund called the Spaceship Index Portfolio and a managed share fund called the Spaceship Universe Portfolio.

Both the Spaceship Index Portfolio and the Spaceship Universe Portfolio invest directly in the companies that make up each fund rather than investing via exchange traded funds (ETFs).

Spaceship Index Portfolio

The Index Portfolio is a passive index fund made up of 100 listed Australian shares and 100 listed global shares, chosen using an equal-weighted index of the largest companies by market capitalisation. By using an equal-weighted index rather than a market-weighted index, it reduces the influence of large companies and increases exposure to smaller companies.

The following is the target asset allocation for the Index Portfolio:

- Global large public companies 75% (70-80% range)

- Australian large public companies 20% (15-25% range)

- Cash 5% (0-10% range)

As an example, current holdings as of June 2018 include companies such as Berkshire Hathaway, Boeing, Coca-Cola, Intel, Johnson & Johnson, JPMorgan, Microsoft, Procter & Gamble, Samsung, Toyota, Visa, Walt Disney, Westfield and Woolworths.

Spaceship Universe Portfolio

The Universe Portfolio is an actively selected fund made up of shares in 100 Australian and global companies that are carefully handpicked by Spaceship’s investment team to meet its “Where the World is Going” (WWG) criteria.

The WWG methodology evaluates, among other factors, a company’s competitive advantage, management and risk of disruption from technology. A low WWG rating indicates that a company’s profits are more susceptible to competition and technology disruption over time.

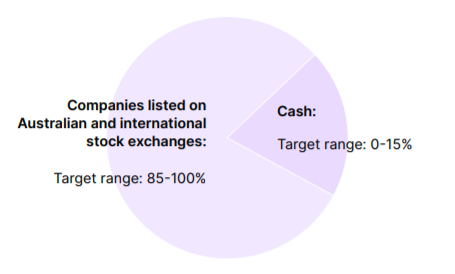

The following is the target asset allocation for the Universe Portfolio:

- Global large public companies 70% (65-75% range)

- Australian large public companies 25% (20-30% range)

Current holdings as of June 2018 include Afterpay, Apple, Baidu, Facebook, Kogan, Netflix, Nvidia, Redbubble, Softbank, Tencent, Tesla, Twitter, Workday, Xero and Zillow.

Can I customise the investment portfolios?

No, you cannot customise the investment portfolios. The fund is a unit trust, so when you invest in the fund, your money is pooled together with other investors and invested in the investment portfolio. You acquire units in the fund and each unit represents a proportionate beneficial interest in the fund’s asset as a whole.

What are the fees to invest with Spaceship Voyager?

Management costs are calculated on gross asset value of the portfolio and accrued daily. It is payable in arrears on a monthly basis as follows:

There are no contribution fees, brokerage fees, withdrawal fees or exit fees charged for either portfolio.

Benefits of investing with Spaceship Voyager

- Transparent . You can easily view your portfolio holdings through your Spaceship account.

- Low fees . You will only have to pay one competitive management fee to run a portfolio.

- Simple structure . Investment portfolios are chosen for you using expert methodology.

- Low barriers to get started . There is no minimum investment amount and there are no entry fees.

- More global and sector exposure . Australia is dominated by companies in the resources and financial industries, so by investing globally, you benefit from increased industry diversification.

- Curated news . An in-house content team delivers content about companies in your portfolio, so you can learn more about your investment.

- Regular investment top-ups . You can set up a regular investment plan to automatically top up your investments each week, fortnight or month. This way, you don’t need to think about your investments and you can “set and forget”.

What are the risks to consider?

All investments carry risk, and the following risks are not unique to Spaceship Voyager alone. Different investment strategies may carry different levels of risk depending on the assets that make up the strategy. Assets with the highest long-term returns may also have the highest levels of short-term risk.

- Market risk . This is the risk of negative returns resulting from unfavourable investment market conditions. Unit values reflect the market value of the assets in the portfolio and consequently may rise and fall in line with market variations.

- Country risk . There is a risk that a country where assets are located could become politically or economically unstable. This risk is generally higher in countries classified as emerging markets.

- Foreign currency risk . Investing in global companies exposes the portfolio to foreign exchange rate movements. Spaceship does not use currency hedging to manage the impact of this risk. When foreign currencies fall in value relative to the Australian dollar, this can have an adverse impact on investment returns.

- Inflation risk . Changes in inflation may impact the value of your investment as inflation reduces the purchasing power of assets or income over time.

- Interest rate risk . This is the risk of investment losses resulting from an increase in interest rates.

- Liquidity risk . This is the risk that you may not be able to convert your investments into cash on a timely basis with little or no loss of capital. During extreme market volatility, Spaceship Capital may choose to suspend redemptions and defer payments for a period of time to protect investors.

How do I get started?

Spaceship Voyager is a fully digital investment product, which means setting up, investing and withdrawing must be done electronically through your Spaceship customer account.

- Create an account via the app or online

- Choose which portfolio you would like to invest in and submit an application. This will include complying with anti-money laundering requirements and providing identification information. You must be an Australian resident to apply.

- Transfer funds to make an initial investment (there is no minimum initial investment for either portfolio). You will receive confirmation of your investment through your Spaceship account. That confirmation will set out the number of units issued to you, the entry price of those units and the date the units were issued.

- Additional investments can be made on an ad hoc basis or you can establish a recurring investment plan. No minimum amount applies to additional investments.

- You can ask to withdraw all or part of your investment at any time through your Spaceship customer account, but it will only be processed during the business day. No minimum amount applies to withdrawals.

Compare with other brokers

- Spaceship Voyager information page

- Spaceship Voyager Universe Portfolio information PDF

- Spaceship Voyager Earth Portfolio information PDF

- Spaceship Voyager Origin Portfolio information PDF

- Spaceship Voyager Universe Portfolio TMD

- Spaceship Voyager Earth Portfolio TMD

- Spaceship Voyager Origin Portfolio TMD

To ask a question simply log in via your email or create an account .

Alison Finder

Hi there, looking for more information? Ask us a question.

Error label

You are about to post a question on finder.com.au :

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy .

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Alison Banney

Alison Banney is the money editorial manager at Finder. She covers all areas of personal finance, and her areas of expertise are superannuation, banking and saving. She has written about finance for 10 years, having previously worked at Westpac and written for several other major banks and super funds. See full profile

- Robo Advice

- Micro-Investing

- Risk Profiling

- QuietGrowth

- Raiz Invest

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Spaceship Voyager Review: To The Moon or Engine Failure?

- December 28, 2020

- Last Updated: 1 year ago

Spaceship Voyager Review: Spaceship Voyager offers 3 portfolios to investors looking to set-and-forget.

Twenty-twenty has compounded the continued success of microinvesting apps like Raiz , CommSec Pocket and Spaceship Voyager as millennial investors zealously pour their spare change and more into these low-cost investing platforms.

A reason for this may include one of Spaceship Voyager’s portfolios managing more than 54% in returns in the year ending November 2020, making microinvesting sound like a misnomer.

This begs the question: What’s the catch with the rise in adoption of microinvesting apps and are they a sustainable investing strategy?

If you’re here for a free $5 to start off your Spaceship Voyager investing journey, sign up with my code S8307GS7QC or use my referral link.

For an in-depth breakdown of its features and fees and my personal opinion, read on for one of the most comprehensive Spaceship Voyager reviews on the internet.

Contents – click to jump!

What is spaceship voyager & microinvesting, is spaceship voyager a secure investment.

- The Portfolios

Will I receive dividends from investing in Spaceship Voyager?

How do deposits and withdrawals work, what about competitors, wrapping up.

Spaceship launched in 2016, but did not make available to the public its microinvesting platform, ‘Spaceship Voyager’ until 2018.

It also has a superannuation product known as ‘Spaceship Super’ which kickstarted its business in 2017 and hit 100k users in November 2020.

It is backed by venture-capital firms like Sequoia (the only venture investor in WhatsApp, a Series B investor in Google ), NEA , billionaire tycoon Li-Ka Shing’s Horizons Ventures , and others.

Spaceship raised around AUD 20m during its 2017 Series A funding and about AUD 41m in total during 3 rounds of funding from various investors.

According to Spaceship, microinvesting is ‘when you invest using small amounts of money regularly. ‘

It is an investing model that is used to make investing more accessible to the general public through an easy to use UI, low investment costs and the ability to invest in tiny parcels.

Spaceship Voyager is a microinvesting platform that allows users to pick from one of three managed portfolios and regularly dollar-cost average into the fund as a diversified investment strategy.

The funds hold a variety of both US (NYSE, NASDAQ) and Australian (ASX) stocks to expose investors to a broad range of sectors both locally and internationally.

Spaceship Capital Limited, a registered company with an Australian Business Number (ABN) both issues and is the responsible entity for the portfolios/funds.

All three portfolios have registered Australian Registered Scheme Numbers (ARSNs), which are issued to managed investment schemes like Spaceship Voyager.

That’s why we’ve employed physical, electronic, and procedural safeguards—including 256-bit encryption and Secure Sockets Layer (SSL) — to keep your money and personal information safe. We’ve also appointed an external custodian to hold the fund’s assets. The custodian is the legal owner of the assets, but not the beneficial owner. Spaceship FAQ

However, the odd thing is although they mention the use of a custodian for investors’ assets, they fail to state exactly who they are using as a custodian. Would you trust your money with a custodian you do not even know the name of?

UPDATE 29 Dec 2020: Spaceship has confirmed they use a reputable broker, Interactive Brokers (IB) as their custodian via their live chat support.

Although this is good news, I expected it to be at least mentioned once in their reference guide or product disclosure statement – needing to ask support for something so important is not the way in my opinion.

@Spaceship you need to update your documents!

On the safety of the investment itself – that you’ll have to figure out for yourself based on your risk preferences and perspectives on value.

The Portfolios – Which one to invest in?

Spaceship Voyager has three portfolios: Universe, Origin and the recently launched Earth.

One thing to note about these portfolios is that they all consist only of equities and cash. This means while you are diversified in companies from various sectors and industries, you will be solely investing in stocks and cash (0-10% allocation for Universe/Origin & 0-15% allocation for Earth).

The portfolios do not hold any bonds, money market funds, Bitcoin or commodities (eg gold & silver).

The portfolios are also not exchange traded funds (ETFs) as they are not traded on a stock exchange. It is more like a mutual fund, where the price of the fund/portfolio is updated once daily.

What do you get by investing?

By investing into a particular fund/portfolio, you will receive ‘units’ in the fund/portfolio. These units represent a proportionate beneficial interest in the fund/portfolio’s assets as a whole.

Having a beneficial interest in the assets means your share of the assets as a whole is held on trust for you by Spaceship – while they retain the legal title, you retain the beneficial title and can enforce it against them.

Spaceship Voyager’s most popular portfolio, Universe, is actively managed by portfolio managers who invest in stocks that meet their ‘Where the World is Going’ criteria, which includes major tech companies like:

Along with smaller companies like:

- Ping An Healthcare & Technology

- Pro Medicus

To check out the full list of companies Universe is invested in and the allocations, click here.

The Universe Portfolio has done immensely well over the course of its lifetime since its launch in 2018, having returned over 54% in the year ending November 2020 and over 30% p.a. since its inception in May 2018 till November 2020 (these figures have taken into account fees).

Of course, this year’s returns have been propelled greatly by the great tech boom and recovery that occurred since March 2020, with companies like Tesla and Square returning around 644% and 278% YTD respectively (both of which are part of the Universe portfolio).

A key thing to note is that while past performance is not an assurance of future returns, looking at the companies providing the returns and why they did is key to intelligent and informed investing.

Credit where credit is due: one of my favourite parts about Spaceship Voyager are the little nuggets of information they provide with each investment – the profile, what they like about it and the risks.

Although, I do wish they made it more comprehensive – if you’re listening Spaceship, I want more financial report numbers and competitor analysis!

Origin is Spaceship Voyager’s somewhat passively managed portfolio – because of its thesis to invest top companies globally by market capital through a ‘rules-based investment strategy that identifies companies with large market capitalisations and applies an equal weighting within each asset allocation’.

Thus, despite it being actively managed, it takes has stricter rules to follow, which makes it more akin to index investing rather than an actively managed portfolio.

The rules are:

- Origin aims to gain exposure to the top 100 Australian listed companies and top 100 international listed companies as measured by market capitalisation.

- Companies within Origin are subject to eligibility and accessibility requirements, including whether we can access the relevant stock exchange.

- Origin applies an equal-weighted investment approach within each asset allocation to support diversification and broad sector participation.

- Origin is generally rebalanced on a quarterly basis.

- During a quarter, investment weightings may fluctuate due to changes in the market value of companies.

- Spaceship maintains the ability to invest in more or less than the target number of companies (i.e. we may invest in more or less than 200 companies).

It still holds leading stocks like CSL and Microsoft while investing in safer dividend stocks like Coca-Cola and Visa.

To check out the full list of companies Origin is invested in and the allocations, click here.

Since its inception in May 2018 up till Nov 2020, the portfolio has returned close to 11% p.a. but delivered somewhat lacklustre performance during the year ending Nov 2020, with a performance of only 5.62% , which underperformed compared to the S&P500 which returned approximately 18.6% during the same period, but outperformed the ASX200 which dropped 1%.

This is a lower risk portfolio compared to both Earth and Universe because it has fixed asset allocations which disallow one company’s performance to affect the overall returns by a substantial degree.

The downside however, is that if a few companies do extremely well, the benefit is limited by others going through a rough patch and by nature, its own allocation size.

The new kid on the block is the Earth portfolio, which launched on Spaceship Voyager in November 2020.

Named ‘Earth’ to show its commitment to sustainable investing, it uses the investing approach introduced in Universe (‘Where the World is Going’), coupled with what it claims to be ‘sustainable investing criteria’ which states that investments have to be ‘socially and environmentally acceptable’ and must ‘contribute towards one or more of the UN SDGs’.

To check out the full list of companies Earth is invested in and the allocations, click here.

I would imagine it would not be difficult to find a company that contributes to at least one United Nations Sustainable Development Goal (SDG) – almost every company that is investable by Spaceship Voyager’s standards (exceeding AUD 150m) will definitely at least contribute to ‘Goal 8 – Decent work and Economic growth’.

Greenwashing?

Both the reference guide and product disclosure statement (PDS) are provide nebulous or unsatisfying definitions or qualifications of what Spaceship deems to be sustainable investing, which is deeply troubling for a public product which is marketed to many individuals who may invest based on superficiality rather than careful thought.

While Spaceship Voyager may mean well, I think there should be clearer explanations and guidelines showcased in its PDS or reference guide for a portfolio marketed solely on its focus on sustainability and ethical considerations. (This blogpost does provide more detail about how they crafted the Earth portfolio and probably does a better job than both the PDS and reference guide combined).

For example, Earth currently has a 2.53% allocation to Starbucks (NASDAQ: SBUX), which is not so favourably looked upon by Ethical Consumer, an independent guide on ethical shopping.

Furthermore, it also has an allocation of the same percentage to Lululemon (NASDAQ: LULU) which has been accused of underpaying and overworking its workers in the past.

This just begs the question of how thorough Spaceship actually is with its investment research in the sustainable and ethical space, despite having continuous assessment and removal on the violation of the sustainable criteria.

The Caveat + Workaround

As of December 2020, investors do not have a straightforward process to sign up for more than one portfolio under the same account.

Each investor is limited to one portfolio, and is locked into that portfolio after choosing without the ability to switch between different portfolios or add new ones.

While Spaceship is working on bringing multiple portfolio support, there is a workaround where you can have multiple portfolios under the same account by opening another account with the same email you used initially, but with ‘+new portfolio name’ before the @.

For example:

- 1st portfolio on signup: Universe (email: [email protected] )

- 2nd portfolio that you want to sign up for: Earth (email should be: [email protected] )

By doing this, your second/third portfolio will be under the same account.

Portfolios Summary

The portfolios are benchmark agnostic and have no mention of any benchmarks in either the PDS or reference guide. This makes it harder to put into perspective its returns.

However, one should note that funds like Universe share many holdings with the NASDAQ-100 , which has returned over 50% in the year ending November 2020 (compared to Universe’s ~54% ).

A quick comparison summary of the 3 portfolios:

Spaceship’s fee comparison table:

Short answer: Technically no, but yes.

Long answer: Managed funds do not pay out dividends. Rather, they pay distributions, which are paid annually (yearly within 90 days of 30 June in Spaceship Voyager’s case).

Distributions include:

- Income earned from holding (dividends from the individual stocks)

- Capital gains from the disposal of the fund/portfolio’s assets during the year, taking into account taxable gains and losses.

- Foreign income and foreign income tax offsets

- Franked dividends/franking credits

- Tax deferred distributions.

Spaceship Voyager can only be funded through direct debits from your linked bank account, which has to be linked to Spaceship Voyager when you register for an account.

After linking, you can either manually add a one-off investment or set up an investment plan on a weekly, fortnightly or monthly basis.

If you chose to do a one-off investment, after you lock-in your amount you will receive units of the fund/portfolio you have chosen within 1 business day, if you invested before 5pm the previous day.

However, if you choose to go with a recurring investment plan, ensure your bank’s transaction account has the sufficient funds to go through with each recurring transaction!

Perhaps set-up an auto transfer from your saver to your transaction account with Up Bank so you won’t have to remember to replenish the transaction account after an expensive night out.

Withdrawals work pretty much the same way as deposits do, but in reverse – Spaceship will credit your linked account with any withdrawals (although in my experience it took longer than a business day).

All withdrawals and deposits are free of charge.

If you know the microinvesting space, competitors that come to mind are probably Raiz and CommSec Pocket .

However in this comparison, I’ll include the lesser known microinvesting wildcard from the fund behemoth, Vanguard – the Vanguard Personal Investor (VPI).

For a better mobile experience with the table below, please switch to landscape mode.

There is no doubt Spaceship Voyager has had a phenomenal year – beating out all of its microinvesting rivals in 2020 returns.

However, there has never been a better opportunity to restate the old saying that ‘past performance is not a good indicator of future returns’.

This is especially true as Spaceship has recommended a holding period of 7 years and all of Spaceship Voyager’s portfolios are relatively young at just under 2 years old – anything could happen in the years that follow.

Nevertheless, this doesn’t mean that their performance this year should be discounted – it just means that one should not expect the gravy train to continue on consistently forever.

If you’re looking for a platform that allows you to regularly invest in smaller amounts and you’re willing to take on the higher risks of investing in a fund that allocates solely to growth stocks, then you may want to take a look at Spaceship Voyager.

This platform is a fantastic choice for individuals looking to dollar-cost average while staying hands-off with their investments but still seeking high capital growth.

However, if you have a more conservative risk profile but still wanting to be hands-off, you might want to look at index fund investing on a brokerage or check out a less risky Raiz portfolio with bond allocations.

If you’re looking for a way to expose yourself to some Bitcoin through microinvesting, the Raiz Sapphire portfolio may be something of interest – however I personally would not bother as the fees are unjustifiably high and would recommend buying Bitcoin from a cryptocurrency exchange instead (eg Binance & Australian exchange Independent Reserve ).

For those of you who are more hands-on with investing – I should not even need to explain to you why Spaceship is not for you. Perhaps, in the future if Spaceship allows users to start customizing their portfolios while still keeping costs low it may be worth a second look.

As for VPI, I would not bother with either considering the fees are cutthroat . You’d be better off saving and buying through an actual brokerage instead as VPI will eat through your investments faster than you can say, ‘I started investing!’. Their funds on the other hand, I would highly recommend to index and managed fund investors (eg VGS, VDHG, VTS, VAN0722AU).

An alternative can be found in CommSec Pocket if you’d like to buy ETF units instead to have more control over the variety of stocks your portfolio, but paying AUD 2 on an AUD 50 trade is a bad idea (that’s 4% in fees!). You’d probably want to at the very least invest AUD 200 (1% fee) each time for the platform to be even worth looking at.

Now back to Spaceship Voyager:

In the few queries I have had with Spaceship Voyager support – the response has been friendly and efficient. The best part is you can access support through an easy to use chat-like interface within the ‘help’ section of the app.

Spaceship also offers educational blogposts on its blog, Spaceship Learn which illuminates readers on several subjects like personal finance, investing and using the platform.

The title poses the question, ‘to the moon or engine failure?’

It seems that Spaceship has a clear course set for the moon and beyond – this year Spaceship has really taken off with hitting 100k users and massive returns with its Universe portfolio – no small feat for a homegrown startup out of Sydney.

While it is far from a complete engine failure like Vanguard’s Personal Investor, it still has a few asteroids to steer clear of before it reaches its goal, and only time will tell whether it will ever reach the moon or surpass it.

Whether you’re a newbie looking to start their microinvesting voyage or an investing guru curious about Spaceship Voyager, there’s no better way to test out a platform than by jumping into the deep end and downloading the app (you’ll even get AUD 5 if you use my referral!).

Related Posts

Is Stake Black Worth It?

Save on Stake for steak instead?

Micro-investing with macro returns?

Beem It Review: For Forgetful Friends

More than automatically reminding your friends they owe you

Revolut Australia Review: ‘Superapp’ or Subpar app?

Revolutionary or redundant?

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.