Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3265 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

What are traveler’s checks, how to buy and use traveler’s checks, what to do if traveler’s checks are stolen, best ways to use traveler’s checks, cons of using traveler’s checks, other alternatives, money tips for traveling abroad, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

You can still buy and use traveler’s checks in the U.S. and other countries.

Where To Buy Traveler’s Checks

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

How To Use Traveler’s Checks

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.

If you don’t comply, you could experience delays or even have your claim denied. After you’ve reported your missing check, your provider will void it and issue you a new check.

Some issuers even pledge to get replacement checks out to you within 24 hours !

The following are situations when you might consider using traveler’s checks:

1. No Access to Credit or Debit Card

If you don’t have a credit card or a debit card tied to your bank account, a traveler’s check could be a safe alternative to simply carrying lots of cash abroad.

This tip also applies if your particular credit or debit card isn’t accepted abroad. This is more likely to happen if your card is something other than a Visa or Mastercard , as those credit cards claim the widest global network.

2. Limited Access to ATMs

In many places, you can easily get cash in the local currency at an ATM once you arrive. This wouldn’t be a problem in Europe, for example, but ATMs are rare in some parts of the world. In addition, ATMs can malfunction, networks can be down, and machines might even run out of cash.

Traveler’s checks allow you to get local currency at participating banks, hotels, and other foreign locations without regard for these potential problems.

3. Access Good Exchange Rates

Buying traveler’s checks can help you avoid bad exchange rates. If you decide to exchange currency once you arrive, you might not get the best conversion rates by doing this at the airport.

By purchasing traveler’s checks before you leave, you can lock in a set amount at the current exchange rate.

Read our guide for the best places to exchange currency .

4. Avoid Common Credit or Debit Fees

If your credit or debit card charges a foreign transaction fee , you can be charged a fee every time you make a purchase with your card in a foreign country. If your card also charges ATM fees, these fees can add up quickly.

To avoid these fees, it might make sense to use traveler’s checks. Although there may be a fee involved when you purchase or cash a traveler’s check, it might still be less than other fees your credit or debit card may charge.

Hot Tip: If your card charges a foreign transaction fee, it will typically be 3% of each purchase you make.

5. As an Added Safety Measure

If you’re traveling to a potentially unsafe region, traveler’s checks keep your money secure. Even if you’re in a relatively safe place, anyone who enters your room or has access to your bags could search for your money.

The main benefit of traveler’s checks is that they reduce your risk of theft or loss. Since they can’t be cashed without your signature and often require a photo ID, they are less appealing to thieves or pickpockets. They can also be easily replaced if you provide the issuer with the proper information.

Here are some reasons that might discourage you from using traveler’s checks:

1. Limited Availability for Use

In much of Europe and Asia, traveler’s checks are no longer widely accepted and cannot be easily cashed — even at the banks that issued them.

This means that cashing in traveler’s checks might require hunting down a bank branch or hotel that accepts them during business hours.

Bottom Line: Those relying solely on traveler’s checks may find that they are unable to cash them in many remote or rural locations.

2. Not All Banks Offer Them

Certain major banks, such as Bank of America, no longer offer traveler’s checks at all. This might mean ordering traveler’s checks online well in advance of your travel plans or having to find a new bank that offers them.

3. Potential for Additional Fees

If a company does offer traveler’s checks, it typically charges fees for both buying and cashing in a traveler’s check. While some banks offer them for free if you are a customer, others charge between 1% to 3% of the total purchase amount.

Check the math for your own situation, but using traveler’s checks could actually cost more than using an ATM or credit card abroad.

4. Bulky Paperwork

Not only are traveler’s checks a hassle to carry, but most companies also require that you keep proof of purchase for the checks to verify the check numbers if they are lost or stolen.

Both of these just add up to keeping track of additional paperwork.

Obviously, traveler’s checks aren’t your only option when it comes to obtaining foreign currency. Here are some other options you should consider.

Cash is convenient and relatively easy to exchange. You can bring money from home into a foreign bank or currency exchange location almost anywhere in the world. It can be easily exchanged without the worry of multiple bank fees or ATM fees adding up.

Hot Tip: Be aware: if you exchange your money in tourist areas, you might be hit with a bad exchange rate.

On the downside, carrying paper money is a risk since it can’t be replaced if stolen.

A debit card can be used at an ATM to collect cash. While not all ATM machines (especially in more rural places) accept foreign debit cards, you will find that most do.

Depending on your bank, you might even have to pay both an out-of-network ATM and an international ATM fee for this convenience.

Hot Tip: An out-of-network ATM fee is typically between $2 to $3.50 per transaction in 2021 and a typical international ATM fee can range from $2 to $7 per transaction (plus a 3% conversion fee), depending on your bank and card.

Most restaurants and stores accept foreign debit cards, but carrying a form of backup currency is always wise . Additionally, foreign transaction fees can add up quickly if you are using your debit card frequently.

Credit Card

Like debit cards, credit cards are small and easy to carry. Mastercard, Visa, and more recently, American Express , are widely accepted in other countries, so you can rest easy knowing you will be able to complete your purchases. You can also limit fees by getting a credit card with no foreign transaction fees .

A credit card also comes with fraud protection. You can dispute fraudulent charges and get them removed from your account if reported timely.

Hot Tip: While you can use a credit card for ATM transactions, you will be hit with a cash advance fee . It’s best to avoid doing this, if possible.

Prepaid Card

If you have difficulty getting approved for a credit card , a prepaid card could be a good alternative. You simply load the card with money from your bank account and use it as a debit card at an ATM or as a credit card at merchants and hotels.

While prepaid cards are locked with a PIN number, they can sometimes be difficult to use at ATM machines. Additionally, fees for foreign currency transactions can be as high as 7% , depending on the card.

Hot Tip: Booking hotels, airfare, or activities online will require either a credit card, debit card, or prepaid card.

Do Your Research

Know which types of currency are accepted at your destination and how much of each type (if any) you should bring. Especially be aware of any cash you might need on arrival (to obtain a visa , exchange upon arrival, etc.) in case you can’t immediately locate an ATM or a currency exchange office.

Carry a mix of cash, cards, and maybe even traveler’s checks. Ideally, the cards you bring with you shouldn’t have foreign transaction fees or ATM fees . Having some variety also helps if one of your cards isn’t accepted or your cash is lost or stolen.

Tell Your Bank You Are Traveling

Always be sure to let your bank and credit card issuers know where you’re going and when so that your card isn’t declined when you try to make a purchase due to unusual activity.

If you exchange money at your bank, you will likely also get a better exchange rate.

Don’t Keep All of Your Money in 1 Place

Keep some of your currency or an extra card locked in your hotel room’s safe or in a money belt . In the terrible instance that you lose your purse or wallet, you would still have immediate access to additional money.

We’ve shown that traveler’s checks aren’t necessarily the most convenient way to take currency abroad, but depending on if you have limited access to debit or credit cards or they aren’t accepted where you are traveling, it might be worth it to bring some along.

Overall, if you’ve decided that traveler’s checks can be of use to you, taking some, along with some cash and a debit, credit, or prepaid card, may just be the smartest way to travel.

Frequently Asked Questions

Can you still buy traveler's checks.

While many larger banks are no longer offering traveler’s checks, they are still available at American Express and other smaller banks and credit unions. It is worth asking if your bank offers them and at what cost.

How much does it cost to buy traveler's checks?

While some banks offer them for free if you are a customer, others charge between 1% and 3% of the purchase amount.

What is the purpose of a traveler's check?

A traveler’s check offers a safer option than carrying around money. There are multiple safeguards in place to prevent fraud and if the checks are lost or stolen, they can be easily replaced.

Can you cash old traveler's checks?

Traveler’s checks do not expire. You can cash them in at any time — typically even at banks that don’t offer them for sale. This means you can go to your own bank and redeem your traveler’s checks.

To do this, date them, fill out the “Pay To” field (to your bank), and countersign in the presence of the cashier . Any unused value will be returned to you in cash.

Can I buy traveler's checks online?

American Express is the only large bank that offers traveler’s checks online. Its website offers a step-by-step process to order them.

You should check with your local bank or credit union to see if they might also offer this benefit.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![travellers cheques accept IHG One Rewards Traveler Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2023/06/IHGOneTravelerCard.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

All about traveler’s checks, plus modern alternatives

January 18, 2024 | 1 min video

Getting ready to travel? One thing to think about is how you’ll make purchases while you’re away. Traveler’s checks aren’t as common as they used to be. So you might want to consider modern alternatives that may offer the advantages of traveler’s checks and more.

Read on to learn more about the ins and outs of traveler’s checks. And find out about other options—for example, credit cards, prepaid cards and mobile wallets—that could help make the most of your trip.

Key takeaways

- Traveler’s checks are paper documents that can be exchanged for local currency or used to buy goods and services abroad.

- Traveler’s checks feature unique serial numbers, making them replaceable if they’re lost or stolen.

- Fees may apply when purchasing and exchanging traveler’s checks.

- There are modern alternatives to traveler’s checks that you may find more convenient.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is a traveler’s check?

A traveler’s check is a paper document you can use for making purchases when you’re traveling, typically in other countries. It can be used as cash or a regular check.

Traveler’s checks—you may also see them referred to as “cheques”—are generally printed with a unique serial number. This means you may be able to get a refund if your checks are lost or stolen. The checks are usually available in set denominations—$20 and $50, for example.

How do traveler’s checks work?

Traveler’s checks may be accepted at participating merchants like hotels, restaurants and stores. Just keep in mind that there could be fewer participating merchants than there used to be.

When you purchase your checks, you may notice that they have a space for two signatures:

- First signature: You might be asked to sign each of your traveler’s checks when you buy them. If not, you may want to sign them as soon as possible.

- Second signature: You’ll usually sign your traveler’s checks again when you’re making purchases.

This dual signature method is meant to provide extra security and ensure that only the purchaser is able to use them. The merchant can verify that the second signature matches the first.

How to cash in traveler’s checks

You can use traveler’s checks like cash to pay for goods and services at participating merchants. You’ll typically sign the check in front of the merchant at the time of the purchase.

While traveling, you may also be able to redeem your traveler’s checks for local currency at financial institutions or your hotel.

Potential fees associated with traveler’s checks

It’s possible that certain fees may apply to traveler’s checks. For example, you may need to pay a fee when you purchase them or when you exchange them for currency once you get to your destination. There might also be a fee for depositing unused checks into your bank account.

Where to get traveler’s checks

While traveler’s checks might be harder to find than they used to be, they’re still available. You may be able to purchase them at some banks, credit unions and travel-related service organizations.

Pros and cons of traveler’s checks

Take a look at some of the potential pros and cons of traveler’s checks:

When to use a traveler’s check

You might consider using traveler’s checks in certain situations, including:

- When you don’t have a credit or debit card. Some people may prefer to travel using modern payment options like credit and debit cards. But if you don’t have either, you may find traveler’s checks to be an acceptable alternative.

- When you can’t access an ATM. If you find yourself in a place that doesn’t have an ATM on every corner, you can instead use your checks at merchants that accept them.

- When you want to exchange them for local currency. When you get to where you’re going, you might want to have some local currency on hand. You may be able to exchange your traveler’s checks for currency at certain banks or other financial institutions.

Modern alternatives to traveler’s checks

There are a number of alternatives to traveler’s checks—options you may find faster, easier and more convenient. Here are a few to consider when you’re comparing your choices:

Credit cards

Carrying a credit card may be easier than carrying traveler’s checks. Plus, credit cards can be helpful for making large and online travel purchases like plane tickets and hotel reservations. That’s especially true with travel credit cards , which you could use to earn rewards on travel-related purchases.

Some credit cards may also come with benefits that could be useful while traveling. They might include things like protection from unauthorized charges and the ability to use a mobile app to track your purchases .

Keep in mind that foreign transaction fees may come into play when you use your credit card overseas. While this fee might vary between credit card companies, it could generally be in the range of 1%-3% of your purchase. You may also be charged a currency conversion fee. This fee is often part of a foreign transaction fee.

Some companies don’t charge foreign transaction fees. For example, none of Capital One’s U.S.-issued credit cards charge this fee. View important rates and disclosures .

If you’re traveling with your credit card, your credit card issuer may want to be alerted before you go. That’s because it might flag your purchases as fraudulent if it notices purchases made in an unfamiliar location. Thanks to the added security of its chip cards, Capital One doesn’t require this notification.

See if you’re pre-approved

Check for pre-approval offers with no risk to your credit score.

Debit cards

When you’re traveling, a debit card can be just as easy to carry around as a credit card. And like a credit card, it can help protect against fraud.

The big difference: A credit card lets you “borrow” money for purchases, while a debit card uses the money in your checking account to make purchases.

It may be helpful to carry a debit card when you’re visiting a country that generally favors cash transactions. In that case, you could use your debit card at an ATM to get cash once you’ve reached your destination. And that may be safer than bringing cash with you and exchanging it for local currency once you’ve arrived.

Keep in mind that you could be charged ATM fees when you use a debit card abroad. According to the Consumer Financial Protection Bureau (CFPB), some banks and credit unions don’t charge customers a fee for using their ATMs. But they might charge you if you’re not a customer—and that could be in addition to a fee charged by the operator of the ATM.

Also, be mindful that some banks may charge a foreign transaction fee when you make purchases abroad with a debit card. You may also be charged a currency conversion fee—often, this fee is folded into the foreign transaction fee.

Some banks, though, don’t charge foreign transaction fees. For example, Capital One doesn’t charge this fee for its 360 Checking account .

If you take a debit card on your travels, your bank may ask you to notify it beforehand. That’s because it could notice transactions made in an unfamiliar location and potentially freeze your account. Capital One doesn’t require this notification , thanks to the added security of your chip card.

Prepaid cards

Like credit cards and debit cards, prepaid cards may be easier to carry around than cash. They may also offer some protection against loss, theft or fraud once you register them.

But with a prepaid card, you don’t “borrow” money like you do with a credit card—or use money from your checking account, like with a debit card. Instead, you typically add money to a prepaid card before using it.

According to the CFPB, there are a few ways you can add funds to a prepaid card. For example, you can transfer money from your checking account or load funds at some retailers or financial institutions.

You might be charged one or more fees for using a prepaid card. The CFPB notes that if you get your prepaid card from a retailer, you should find a summary of fees on the card’s packaging. If you get your card from a different provider—online or over the phone, for example—the provider needs to share this information on paper or electronically.

Mobile wallet

You’ll probably have your phone with you when you’re traveling, right? Using a mobile wallet to make purchases is another modern alternative to traveler’s checks.

A mobile wallet is essentially a digital version of your real wallet. Depending on the wallet, you may be able to store things like credit cards, debit cards, prepaid cards, boarding passes, hotel reservations, event tickets and other types of personal data.

Mobile wallets can be convenient, allowing you to make quick and easy payments using your phone or other mobile device when you’re on the go. And they typically use advanced technology that prevents your actual account numbers from being stored in the wallet.

There are lots of mobile wallets to choose from. Researching your options could help you see which will work best while you’re traveling. Keep in mind, some merchants might not take mobile wallet payments.

Traveler’s checks in a nutshell

Traveler’s checks can be a helpful way to pay for things abroad, but there are also more modern options available today, like credit cards, debit cards, prepaid cards and mobile wallets. And with a travel credit card, you could earn rewards on your travel-related purchases.

Ready to upgrade the way you pay before your next trip? Compare Capital One travel credit cards today to find the best option for you, no matter where you’re headed.

Related Content

How do travel credit cards work.

article | February 8, 2024 | 7 min read

Should you send a credit card travel notice?

article | April 25, 2024 | 3 min read

What you should know about foreign transaction fees

article | May 23, 2024 | 7 min read

- Search Search Please fill out this field.

What Is a Traveler’s Check?

- How It Works

- Where to Get Traveler's Checks

- Where to Cash Traveler's Checks

- Pros and Cons

- Alternatives to Traveler's Checks

The Bottom Line

- Personal Finance

Traveler's Check: What It Is, How It's Used, Where to Buy

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Eliana Rodgers

A traveler’s check (sometimes spelled "cheque") is a once-popular but now largely outmoded medium of exchange utilized as an alternative to hard currency and intended to aid tourists. The product is typically used by people on vacation in foreign countries. It offers a safe way to travel overseas without the risks associated with losing cash. The issuing party, usually a bank, provides security against lost or stolen checks.

Traveler’s checks have increasingly been supplanted by credit cards and prepaid debit cards.

Key Takeaways

- Traveler’s checks are a form of payment issued by financial institutions.

- These paper cheques are generally used by people when traveling to foreign countries.

- They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash.

- If your traveler's check is lost or stolen it can readily be replaced.

- Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards.

How Traveler’s Checks Work

A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash. Major financial service institutions issue traveler’s checks, and banks and credit unions sell them, though their ranks have significantly dwindled today.

A traveler’s check is similar to a regular check because it has a unique check number or serial number. When a customer reports a check stolen or lost, the issuing company cancels that check and provides a new one.

They come in several fixed denominations in a variety of currencies, making them a safeguard in countries with fluctuating exchange rates , and they do not have an expiration date. They are not linked to a customer’s bank account or line of credit and do not contain personally identifiable information, therefore eliminating the risk of identity theft. They operate via a dual signature system. You sign them when you purchase them, and then you sign them again when you cash them, which is designed to prevent anyone other than the purchaser from using them.

Many banks, hotels, and retailers used to accept them as cash, although some banks charged fees to cash them. However, with the rising worldwide use of credit cards and prepaid debit cards—such as the Visa TravelMoney card, which offers zero liability for its unauthorized use—it is getting much harder to find institutions that will cash traveler’s checks.

History of Traveler’s Checks

James C. Fargo, the president of the American Express Company, was a wealthy, well-known American who was unable to get checks cashed during a trip to Europe. In 1891, a company employee, Marcellus F. Berry, believed that the solution for taking money overseas required a check with the signature of the bearer and devised a product for it. American Express and Visa still use the British spelling on their products.

Where to Get Traveler's Checks

Companies that still issue traveler's checks today include Visa and AAA . They often come with a purchase fee. AAA now offers members pre-paid international Visa cards instead of paper checks.

In the U.S., they are available primarily from American Express locations. You can also buy traveler's checks online from the American Express website, but you need to be registered with an account. Visa offers traveler's checks at Citibank locations nationwide, as well as at several other banks.

American Express, Visa, and AAA are among the companies that still issue traveler’s checks.

Where to Cash Traveler's Checks

If you want to convert your traveler's checks into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account.

Advantages and Disadvantages of Traveler's Checks

Traveler's checks are handy for tourists who do not want to risk losing their cash or having it stolen while abroad. Because traveler's checks can be reported lost or stolen and the funds replaced, they provide peace of mind. This was particularly a concern before credit cards and ATMs were widespread and affordable worldwide for most travelers. At the same time, these paper checks are now a bit outdated and come with a fee to purchase, making them potentially more expensive and cumbersome than using plastic or electronic payments.

Replaced if lost or stolen

Widely accepted around the world

Convenient to use

They don't expire

Must have the physical check to use it

Incurs a fee to purchase

Limited number of issuers today

Alternatives to Traveler's Checks

The most obvious alternative is to use a credit or debit card issued by a bank that works worldwide and charges low or no foreign exchange fees on purchases or ATM withdrawals. If your bank doesn't allow for this or charges high fees, then prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account, which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection, but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home. Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive, so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

For U.S. citizens living abroad for extended periods, maintaining checking and other bank accounts in the United States provides several advantages, and many checking accounts are friendly for foreign transactions .

Where Do You Buy Traveler's Checks?

You can buy still buy traveler's checks from Visa and a handful of other financial institutions. To buy them, visit a location or check the website of an issuing institution. You may need a photo ID in order to set up an account.

How Do You Cash Traveler's Checks?

Some hotels, resorts, and currency traders will cash traveler's checks in exchange for local currency. However, with the rising prevalence of credit and debit cards fewer locations cash traveler's checks.

What Do You Do With Traveler's Checks?

Traveler's checks are a secure way of carrying money while abroad. Many businesses in the tourism industry will cash traveler's checks, and they can also be deposited into a bank account. Because the checks can be easily replaced, they have a lower risk of theft or loss. However, traveler's checks have fallen out of favor due to the increased convenience of credit cards and prepaid debit cards.

Traveler's checks were once a popular way to carry money while vacationing abroad. They are sold in fixed denominations, and can be used for purchases or cashed like an ordinary check. Traveler's checks can be easily replaced, making them less risky than carrying large amounts of cash. However, they have fallen out of favor due to the convenience of using credit or debit cards.

Sparks, Evan. “ Nine Young Bankers Who Changed America: Marcellus Flemming Berry .” ABA Banking Journal, June 26, 2017.

Time Magazine. " Travel (April, 1956): The Host with the Most ."

American Express. " Travelers Cheques ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1214857151-7489c879345246b0bacefaf1d88a3738.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Traveler’s checks: What are they, and are they still used?

Traveler’s checks still exist, but there are plenty of other options while traveling..

In this guide

- What are traveler’s checks?

- Pros and cons of traveler’s checks

- 3 alternatives to traveler’s checks

Bottom line

Banking guides

We compare the following brands

Maybe you were told to consider traveler’s checks when planning a vacation overseas. But the truth is that traveler’s checks are largely a thing of the past, and you probably won’t need them overseas if you have a debit or credit card that can be used internationally.

What are traveler’s checks?

Traveler’s checks are a form of payment you can use while traveling to foreign countries. They’re like a personal check that’s in the local currency of the country you’re traveling to.

In most cases, you head to your bank and exchange your cash for the traveler’s check before you go on your trip, usually for a small bank fee and a currency conversion fee . They spend like cash in places that accept them, and during the purchase, you need to provide your ID and match the signature. Also, issuers can cancel uncashed checks and issue you new ones if lost or stolen — unlike cash or personal checks — so they’re safer in that way.

Are traveler’s checks still used?

Traveler’s checks are considered outdated. They’ve fallen out of style, similar to personal checks, in that some merchants may still accept them, but you still have a better chance they’ll prefer debit or credit instead.

Traveler’s checks could be helpful in a few specific situations and may be a little safer than carrying cash while traveling, but you’re probably OK to skip them.

Pros and cons of traveler’s checks

Traveler’s checks have their upsides, but thanks to modern payment methods, they’re just not as useful or convenient as they used to be.

- They’re replaceable . Traveler’s checks can be canceled or replaced by the original issuer if they’re lost or stolen, and often, you can grab the replacement at a travel agency when you’re overseas.

- Safer than other payment methods . Because they aren’t directly tied to a personal bank account, there’s no risk of someone using these checks to steal your identity.

- No expiration date . These checks don’t expire, whereas personal or payroll checks tend to be only good for 180 days. If you don’t use a traveler’s check, it can be redeemed or saved for a later date.

- Not as widely accepted . Compared to debit and credit, you’re unlikely to find a merchant that still accepts these checks unless you’re in a tourist-y area.

- Likely a fee to get them . Some banks charge a fee to issue traveler’s checks, and you’ll probably have to pay a currency conversion fee as well.

- Not super convenient . When using a traveler’s check, you’ll have to sign and prove your identity, which is great for security but not so great for speed.

3 alternatives to traveler’s checks

If you don’t want to bring cash on your trip, you have three main options.

1. Credit cards without foreign transaction fees

Credit cards can be incredibly convenient when traveling due to their wide acceptability — and you can earn cashback or travel points with the right card. Many credit cards charge foreign transaction fees, but many cards skip it, such as the Chase Sapphire Preferred® Card and Capital One Quicksilver Cash Rewards Credit Card (Terms apply, see rates & fees ).

But you’ll want to avoid using credit cards at an ATM, because you’ll likely pay a high cash advance APR and extra fees.

2. International debit cards

Quite a few debit cards are designed to be used internationally, such as the Wise and Revolut . Wise offers a significantly lower currency conversion rate, starting at just 0.43%, whereas most other banks charge around a 3% foreign transaction fee and a 1% currency conversion fee. Revolut also offers fewer fees when purchasing overseas, as well as certain allowances for free currency conversions.

3. International prepaid debit cards

Perhaps one of the most convenient options — aside from cash — international prepaid debit cards let you load up cash and spend it overseas. There are usually more fees than regular debit cards, such as a card purchase fee, reload fees and ATM fees. But if you just want a simple card without the hassle of setting up a new checking account and don’t mind paying a few extra fees, these might be your option.

A few examples include the PayPal Prepaid Mastercard and the international ECARD prepaid card .

You can purchase traveler’s checks if you don’t want to bring cash or worry about foreign transaction fees abroad. But outside of tourist-heavy areas, hotels or some restaurants, you may not be able to use them.

There’s also a good chance that the debit card or credit card you already have can be used overseas, but just be sure to let your provider know you’re traveling to avoid getting flagged for fraud, and ask about foreign transaction and currency conversion fees so you’re not caught off guard by your next bank statement.

Bethany Hickey

Bethany Hickey is a personal finance writer at Finder, specializing in banking, lending, insurance, and crypto. Bethany’s expertise in personal finance has garnered recognition from esteemed media outlets, such as Nasdaq, MSN, Yahoo Finance, GOBankingRates, SuperMoney, AOL and Newsweek. Her articles offer practical financial strategies to Americans, empowering them to make decisions that meet their financial goals. Her past work includes articles on generational spending and saving habits, lending, budgeting and managing debt. Before joining Finder, she was a content manager where she wrote hundreds of articles and news pieces on auto financing and credit repair for CarsDirect, Auto Credit Express and The Car Connection, among others. Bethany holds a BA in English from the University of Michigan-Flint, and was poetry editor for the university’s Qua Literary and Fine Arts Magazine. See full profile

More guides on Finder

Banks like PNC, SoFi, HSBC, US Bank, Axos, KeyBank, Fifth Third Bank and more offer instant fund availability with mobile check deposit.

Both SoFi and Discover Bank are rewarding and free, but SoFi lets you invest online. The best bank for you will depend on what features are most important to you.

Wells Fargo is a Big Four bank, but SoFi’s free online checking and savings accounts boast competitive interest rates, savings round-ups and easy ATM access.

SoFi is better than Chase for savings and checking accounts, but Chase is the better pick for credit cards.

Some of the top alternatives to a SoFi bank account include Current, Varo, Axos, PNC, Ally, Discover, One and Greenlight.

Feeling money stress? Try 8 strategies to solve financial challenges

Top online banks like Chime include Varo, SoFi, Current, Axos, Capital One, Step, Dave, Fizz and Honeydue. See how these banks compare here.

A breakdown of every bank collapse since 2000.

Ideal for current Fifth Third Bank customers looking for a low-cost prepaid card.

Instant sign-up bonuses with no deposit are not typically offered. However, these bank account bonuses have easy requirements.

Ask a Question

Click here to cancel reply.

2 Responses

Hey, I have traveler’s cheque issued by Thomas Cook Agency, how can I withdraw it?

Thanks for getting in touch with finder. I hope all is well with you. :)

To encash your traveler’s check, you would need to find a bank or currency exchange that accepts your check. Once you found one, you need to present your check, present valid ID and sign the needed document.

I hope this helps. Should you have further questions, please don’t hesitate to reach us out again.

Have a wonderful day!

Cheers, Joshua

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

About the author:

After 4-1/2 years of covering European travel topics for About.com, Durant and Cheryl Imboden co-founded Europe for Visitors in 2001. The site has earned "Best of the Web" honors from Forbes and The Washington Post .

For more information, see About Europe for Visitors , press clippings , and reader testimonials .

Photo copyright © Stefan Klein.

Find out more about sending money to your location of choice.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Unlock efficient global money movement for your business.

A Guide to Travellers Cheques

Once a foreign currency staple, this form of prepaid funds has existed for hundreds of years, designed as a way to allow payment from one person to another across currencies. As the financial services sector continues to shift to online solutions , we look at how, where and why travellers cheques are used, as we discuss the relevance of this form of currency.

What are travellers cheques?

The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day.

A safe and convenient method of payment for anyone travelling to foreign territories, these pre-printed cheques hold a fixed amount which can be used worldwide across a range of currencies. Designed to facilitate payments from one person to another, using different currencies, travellers cheques were initially seen as a more practical way for individuals to carry their spending money.

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two decades.

How do you use travellers cheques?

When you first receive your travellers cheques, you will be required to sign each one before use, as a way of verifying your signature. Each cheque will have a fixed value (usually $20, $50, $100, $500 etc.) as well as a unique serial number which can typically be found in the top right corner.

It is important to take note of these serial numbers as they will be referenced in any case of lost or stolen cheques. Unlike cash, if anything happens to your travellers cheques, the original vendor will be able to issue a refund for the exact same value. This added level of security is why this payment method was seen as revolutionary when first introduced.

As well as signing upon receipt, you will also need to sign each travellers cheque when used by a retailer or exchanged for cash. The act of signing your name as a form of security is somewhat outdated, given the modern technologies in place nowadays.

When accepted by retailers, a travellers cheque will be treated like local currency, which means you should receive any change in the standard, local currency.

Where can I get travellers cheques?

Due to dwindling demand, travellers cheques are not as readily available as they once were. However, they can still be acquired from some banks and financial institutions, post offices and currency exchange offices, like Travelex.

One thing to note is you may be required to settle the handling, commission or cash-in fees that often accompany travellers cheques, and these can be expensive, amounting to 2 - 3% in some cases. This cost is another reason they are no longer as frequently used.

Where can I use travellers cheques?

Generally, travellers cheques are still accepted all over the world, albeit harder to find vendors selling them and retailers accepting them as legal tender. Consider your destination before deciding on this form of travel money: if you are travelling to major cities there is more chance of you finding somewhere to cash your cheques or use them for in-store purchases. However, more remote destinations may not be equipped or able to accept this type of funds.

How safe are travellers cheques?

The original blueprint for travellers cheques was a paper payment method which could be used as foreign currency but was more secure than handling cash. At the height of its popularity, travellers cheques were generally considered much safer than cash due to the added security of their unique serial numbers, meaning customers could cancel and replace cheques if need be. These numerical codes were a money-back guarantee for anyone whose cheques were misplaced, destroyed or stolen. Another added benefit, if your travellers cheques are intercepted, you will not be vulnerable to bank fraud, as they are in no way connected to your bank account, unlike credit or debit cards.

Financial security measures have evolved greatly since the inception of travellers cheques, however, with the introduction of PIN codes, two-factor authentication, fingerprint touch ID and facial recognition, to name a few forms of fintech security commonly available now. With this in mind, the concept of a travellers cheque no longer measures up in terms of fraud protection and data encryption.

Travellers cheque vs. Cashiers cheque: What is the difference?

In terms of appearance, a travellers cheque looks nearly identical to a standard issue cashier's cheque: but are they similar in any other ways?

A cashiers cheque is issued by a bank or financial institution and is designed to be processed quickly, by the individual whose name is printed on the cheque. Conversely, a travellers cheque is for use overseas, is loaded with prepaid foreign currency - usually USD or GBP - and does not have a name or account number printed on it, although it does require a signature. Because travellers cheques do not have any bank details printed on them, they are deemed safer than cashiers cheques in terms of potential for fraudulent use. In addition to this, they are paid for when printed, meaning it is not possible for a travellers cheque to bounce.

What are the alternatives?

Credit or debit cards.

If you are worried about travellers cheques not being widely accepted where you are going, then this form of travel money will offer more flexibility. Using your regular bank cards overseas provides a record of spending and offers maximum convenience, but there are also some frequently flagged concerns. Primarily these concerns focus on the sky-high fees and below-average exchange rates related to using your debit or credit card abroad. This isn’t always the case, however, as many banks and financial institutions offer travel credit cards, tailored to suit the needs of frequent flyers.

Travel money cards

Prepaid travel money cards are the modern equivalent to travellers cheques and have become very popular. This is largely due to the fact that they are totally separate from your regular bank account, allowing users to spend their balance freely without the worry of potential fraud or overspending. Preloaded with funds, travel money cards often help limit additional currency exchange charges. In addition to this, in spite of fluctuating currency rates, these cards let customers lock-in a favourable exchange rate ahead of time.

International bank accounts

If you are headed overseas for a sustained period of time, it could be more convenient and cost-effective to open a bank account in your destination country. You would be subject to the relevant security and eligibility checks but this decision pays off if you are making regular international money transfers or being paid in a different currency by foreign clients. Find out more about this option by reading our guide: How to Open a Bank Account Overseas.

Due to the growing alternative digital payment methods available nowadays, it seems this age-old travel money no longer measures up in terms of accessibility, cost and convenience. When travellers cheques were originally launched, ATM withdrawals were not commonplace for travellers, and digital point of sale systems had not been invented. Nowadays, it is easy to access local currency using an assortment of different payment methods such as debit or credit cards, travel money cards or money transfer apps .

The best option for anyone who is reluctant to use their debit or credit card overseas, would be to use a prepaid travel money card. Prepaid travel money cards are a safer and more widely used alternative to travellers cheques, and customers do not need to seek out a bank to use them, are not required to sign for each transaction and security measures in place are far more advanced. This method enables customers to secure multiple foreign currencies, locking in the optimum exchange rate for your currency pairing ahead of your trip abroad. Use our comparison tool to ensure you receive the most competitive exchange rates for your international money needs.

Related content

Related content.

- A Guide to Travel Money Cards Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals. May 3rd, 2024

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. May 3rd, 2024

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! May 22nd, 2024

.jpg)

- Millennial Guide For Baby Boomers & Generation X We looked over the stats for the past few years, and found that out of £1.5 billion payments abroad, 1 in 5 debit cards payments are made by the UK residents travelling abroad and credit card payments made outside the UK has increased in recent years, reaching 467 million payments. May 3rd, 2024

Contributors

April Summers

- Search Search Please fill out this field.

- Checking Accounts

How Traveler's Checks Work in the Modern World

Can You Still Buy Traveler's Checks?

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

- What Are Traveler’s Checks?

Best Ways to Use Traveler’s Checks

Evolution of traveler’s checks, how to use traveler’s checks, frequently asked questions (faqs).

Traveler’s checks, once a necessity for traveling abroad, can keep your money safe. While modern alternatives accomplish most of what traveler’s checks do, those checks are far from useless. Traveler’s checks probably don’t need to be your primary resource in areas with an ATM in every town (or on every corner), but they make for an excellent backup plan.

What Are Traveler’s Checks, Anyway?

That’s a fair question in the modern world. Traveler’s checks are paper documents that can be used like standard paper checks and cash. Traditionally, travelers carried these checks to get cash in local currency and pay merchants. Issuers print checks in varying denominations, and checks can be replaced quickly if lost or stolen. With the spread of digital payment options and ATMs, traveler’s checks have become less popular and more difficult to use.

Here are situations when you might want to use traveler's checks.

Low-Tech Access to Cash

In many places, you can get cash in local currency at an ATM , but they're rare in some areas of the world. What’s more, ATMs can malfunction , communication networks might be down, and machines occasionally run out of cash. Traveler’s checks allow you to get local currency at banks, hotels, and foreign exchange offices with a familiar piece of paper. That said, converting a traveler’s check to cash can be challenging and time-consuming.

Added Security

Traveler’s checks keep your money secure. Recipients are supposed to watch you countersign and compare signatures carefully when you use a traveler’s check, making them lose value when lost or stolen. Credit and debit cards provide similar protection, but they are more attractive to thieves who often use them successfully before you disable the stolen cards. You can replace lost or stolen traveler’s checks or get a refund from the issuer. On extended trips, you can keep traveler’s checks on hand for emergencies without risking large financial losses.

Currency Control

Buying traveler’s checks in your destination country’s currency helps you avoid surprises when it comes to exchange rates. You might not get the best conversion rates at home, but you can at least secure a portion of what you need at current rates.

Traveler’s checks aren’t what they used to be. Banks, hotels, and even merchants were once accustomed to taking traveler’s checks from foreigners. Nowadays, you may not be able to find anybody willing to accept a traveler’s check (or the process will be harder than in days past).

Prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account , which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection , but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home.

Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive , so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

As an alternative, if you already have credit or debit cards that you rarely use, reserve those cards for foreign travel. Be sure to test the card if it’s been dormant, check with the card issuer before you leave home, and monitor your accounts after you return.

Contact your card issuer before you travel. Otherwise, your purchases may be flagged as fraudulent, which could cause your account to be frozen.

You can still buy traveler’s checks in the U.S. and other countries. In the U.S., checks are available primarily from American Express , but you may need to do some legwork to get your hands on new checks.

Here are a few tips for using traveler's checks.

- Keep purchase records separate from the checks: If checks get lost or stolen, you’ll need to provide proof of purchase and check numbers to get a refund. Leave those details with a friend or online for remote access.

- Sign the checks immediately after you get them: Follow the issuer’s instructions to find out where to sign (and only sign once). You’ll sign the checks again when you use them to make a purchase or get cash.

- Fill in the payee and date when you’re ready to use a check: Be sure that the payee actually accepts traveler’s checks before you do so.

- Sign the check again when you complete your payment: The person or business you’re paying must be present to watch you sign. This ensures that the signatures are valid as both signatures must match.

- Traveler’s checks don’t expire: You can either keep them for future use or deposit them into your bank account once you’re home.

- If checks get lost or stolen, contact the issuer immediately: You may be able to get replacement checks locally, and the issuer needs to know which checks are potential fraud risks.

Where can I buy traveler's checks?

Most traveler's checks in the U.S. are issued by American Express, but you can also buy them through various small banks and credit unions throughout the country. Call your bank, or check online to see whether it offers this service.

What do traveler's checks cost?

You'll usually have to pay a service charge of between 1% and 4% for traveler's checks. Fees typically will be higher if you purchase from an institution where you don't already have an account.

What are the differences among a traveler's check, a cashier's check, and a money order?

Traveler's checks, cashier's checks , and money orders are all issued by banks and can be used as cash or personal-check substitutes for purchases in the U.S. However, traveler's checks are the best choice if you're traveling outside the country. They're designed to be accepted anywhere in the world, come in small denominations, and can be easily replaced if lost. They're also fairly secure, because you don't sign them a second time until you're in the presence of the recipient. However, they are becoming less common and are not as widely accepted as they once were.

American Express. " Online Travelers Cheques Redemption: Frequently Asked Questions ."

Consumer Financial Protection Bureau. " What Is the Difference Between a Prepaid Card, a Credit Card, and a Debit Card? "

Visa. " Visa TravelMoney Prepaid ."

Mastercard. " Prepaid Travel Card by Mastercard ."

Federal Trade Commission. " When a Company Declines Your Credit or Debit Card ."

American Express. " Acceptance of American Express Travelers Cheques ," Page 2.

American Express. " American Express Travelers Cheques ."

Frommer's. " Traveler's Checks ."

If You Have Old Traveler's Checks Lying Around, Here's Why You Should Cash Them ASAP

By Jason Cochran

03/07/2023, 6:15 PM

For a long time, the standard advice about traveler's checks has been conditional: You can still buy them, but be prepared for them to be refused at many places.

Traveler's checks hail from an era before ATMs, credit cards, prepaid debit cards, and digital wallets, when travelers had to bring large sums of money with them to pay for their adventures. The traveler's check enabled people to remain well-funded without the risk of carrying actual cash.

But we no longer need to carry ready funds wherever we go. We have digital payments. And as that global technology has grown, the systems that handle archaic proxy forms of payment such as traveler's checks have vanished.

Many former issuers of traveler's checks, such as Thomas Cook, Bank of America, Chase, and AAA, have either discontinued their traveler's check programs or gone out of business altogether.

Yet there are still some consumers out there who seek out this form of payment out of familiarity.

American Express acts like they're still worthwhile. ("Travelers Cheques mean peace of mind," the Amex website promises .) So does Visa , which issues them through its banking partners.

Don't succumb. You could end up stuck with the checks after you get back home.

Previously, if you still had some traveler's checks in your possession after a trip, you could redeposit them in your bank account. After all, they never expire.

But now big financial institutions have changed the rules.

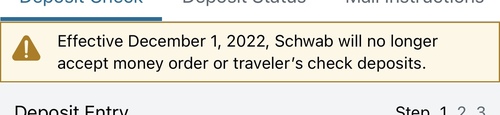

Last December, Charles Schwab, a major player in consumer investing, announced that it would no longer accept traveler's checks as deposits. (The company also announced it would no longer accept mobile deposits of money orders.) The warning was quietly slipped into a tiny box in the Charles Schwab app.

Financial institutions, like airlines, tend to imitate one another's consumer products. Your bank may follow suit, if it hasn't already.

In Chase's case, sales of traveler's checks were halted in 2015, but Chase still accepts them on deposit for now.

Many banks, though, will simply refer you back to the company that originally underwrote the transaction, so getting your cash might involve detective work and mailing the old checks to Europe to petition for a refund.

Yet a lot of online travel tips still present traveler's checks as an uncommon-but-viable option.

A 2022 post by First Republic Bank sold them as "still a worthy option to consider," and a 2022 post from Capital One warned there may be a fee to deposit unused traveler's checks, but didn't mention that many banks aren't even capable of doing that anymore.

I tested ChatGPT with a question about how to obtain traveler's checks for a vacation. Because the A.I. software is fed by all the bad information online, the chatbot told me traveler's checks "have become less common in recent years," but then nonetheless proceeded to instruct me how and where to buy some.

ChatGPT never warned me that I could potentially have trouble cashing the leftovers after my trip ends.

If you research more carefully, you can find stories of people who run across old traveler's checks but have a hard time locating anyone to redeem them—even at the buyer's own bank or the institution named on the check.

If you can't use traveler's checks easily and you can't easily get your money back afterward, they're not what I'd call a viable option anymore.

One statistic that's frequently cited online states that more than $1 billion in unredeemed traveler's checks are still circulating. Many of those checks are leftovers from long-ago vacations that came in under budget or vestiges of well-meaning grandparents who assumed buying traveler's checks as gifts was as safe as buying a bond.

Although that $1 billion figure may not be accurate, there's still no doubt that heaps of old traveler's checks are out there, forgotten in the backs of closets, sock drawers, and safe deposit boxes. The avenues for getting the value back out of the checks are swiftly closing.

So it's time to call it. Traveler's checks should never be used.

More to the point, if you have any old traveler's checks somewhere, get the value back out of them as soon as possible.

And don't buy any more ever again. Not unless you want to run the risk of locking your hard-earned money into pieces of paper.

When it comes to travel, any company that is still issuing traveler's checks probably shouldn't be. Consider them dead.

- All Regions

- Australia & South Pacific

- Caribbean & Atlantic

- Central & South America

- Middle East & Africa

- North America

- Washington, D.C.

- San Francisco

- New York City

- Los Angeles

- Arts & Culture

- Beach & Water Sports

- Local Experiences

- Food & Drink

- Outdoor & Adventure

- National Parks

- Winter Sports

- Travelers with Disabilities

- Family & Kids

- All Slideshows

- Hotel Deals

- Car Rentals

- Flight Alerts

- Credit Cards & Loyalty Points

- Cruise News

- Entry Requirements & Customs

- Car, Bus, Rail News

- Money & Fees

- Health, Insurance, Security

- Packing & Luggage

- -Arthur Frommer Online

- -Passportable

- Road Trip Guides

- Alaska Made Easy

- Great Vacation Ideas in the U.S.A.

- Best of the Caribbean

- Best of Mexico

- Cruise Inspiration

- Best Places to Go 2024

Travellers Cheques

Everything you need to know about travellers cheques and their alternatives., they’re easy to use, they’re safe, they’re accepted worldwide, they don’t expire, so why aren’t people using travellers cheques as much anymore, travel money card, travel insurance, travelex info, join the conversation, customer support.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Acceptable Identification at the TSA Checkpoint

Adult passengers 18 and older must show valid identification at the airport checkpoint in order to travel.

- Beginning May 7, 2025, if you plan to use your state-issued ID or license to fly within the U.S., make sure it is REAL ID compliant . If you are not sure if your ID complies with REAL ID, check with your state department of motor vehicles.

- State-Issued Drivers License or State-Issued ID

- U.S. passport

- U.S. passport card

- DHS trusted traveler cards (Global Entry, NEXUS, SENTRI, FAST)

- U.S. Department of Defense ID, including IDs issued to dependents

- Permanent resident card

- Border crossing card

- An acceptable photo ID issued by a federally recognized , Tribal Nation/Indian Tribe

- HSPD-12 PIV card

- Foreign government-issued passport

- Canadian provincial driver's license or Indian and Northern Affairs Canada card

- Transportation worker identification credential

- U.S. Citizenship and Immigration Services Employment Authorization Card (I-766)

- U.S. Merchant Mariner Credential

- Veteran Health Identification Card (VHIC)

In coordination with its DHS counterparts, TSA has identified acceptable alternate identification for use in special circumstances at the checkpoint.

A weapon permit is not an acceptable form of identification. A temporary driver's license is not an acceptable form of identification.

Beginning May 7, 2025, if you plan to use your state-issued ID or license to fly within the U.S., make sure it is REAL ID compliant . If you are not sure if your ID complies with REAL ID, check with your state department of motor vehicles.

Learn more about flying with a REAL ID .

TSA currently accepts expired ID up to a year after expiration, for the above listed forms of identification. DHS has extended the REAL ID enforcement deadline to May 7, 2025. Learn more about REAL ID on TSA’s REAL ID webpage.

TSA does not require children under 18 to provide identification when traveling within the United States. Contact the airline for questions regarding specific ID requirements for travelers under 18.

Forgot Your ID?

In the event you arrive at the airport without valid identification, because it is lost or at home, you may still be allowed to fly. The TSA officer may ask you to complete an identity verification process which includes collecting information such as your name, current address, and other personal information to confirm your identity. If your identity is confirmed, you will be allowed to enter the screening checkpoint. You will be subject to additional screening, to include a patdown and screening of carry-on property.

You will not be allowed to enter the security checkpoint if your identity cannot be confirmed, you choose to not provide proper identification or you decline to cooperate with the identity verification process.

TSA recommends that you arrive at least two hours in advance of your flight time.

Names With Suffixes

TSA accepts variations on suffixes on boarding passes and ID. Suffixes are not required on boarding passes. If there is a suffix on the boarding pass, and there is not one on the ID or vice versa, that is considered an acceptable variation.

If your identity cannot be verified, you will not be allowed to enter the screening checkpoint.

Security Alert May 17, 2024

Worldwide caution, update may 10, 2024, information for u.s. citizens in the middle east.

- Travel Advisories |

- Contact Us |

- MyTravelGov |

Find U.S. Embassies & Consulates

Travel.state.gov, congressional liaison, special issuance agency, u.s. passports, international travel, intercountry adoption, international parental child abduction, records and authentications, popular links, travel advisories, mytravelgov, stay connected, legal resources, legal information, info for u.s. law enforcement, replace or certify documents, before you go.

Learn About Your Destination

While Abroad

Emergencies

Share this page:

Crisis and Disaster Abroad: Be Ready

What the Department of State Can and Can't Do in a Crisis

Information for U.S. Citizens about a U.S. Government-Assisted Evacuation

Traveler's Checklist

Safety and Security Messaging

Best Practices for Traveler Safety

Staying Connected

Smart Traveler Enrollment Program (STEP)

Traveler Information

LGBTQI+ Travelers

Adventure Travel

High-Risk Area Travelers

Travelers with Dual Nationality

Journalist Travelers

Faith-Based Travelers

Pilgrimage Travelers (Hajj and Umrah)

U.S. Students Abroad

Cruise Ship Passengers

Women Travelers

Travelers with Disabilities

Older Travelers

U.S. Volunteers Abroad

Travelers with Pets

Travelers With Firearms

Travel Agents

Travel Safety - Race and Ethnicity

U.S. Travelers in Europe's Schengen Area

Your Health Abroad

Insurance Coverage Overseas

Driving and Road Safety Abroad

Customs and Import Restrictions

Information for U.S. Citizens in Russia – Travel Options Out of Russia

Lodging Safety

Paris 2024 Olympics and Paralympics

Learn about your destination

Making plans to travel abroad? Read our Traveler’s Checklist , to find out:

- Specific information about your destination

- What documents you will need

- How to get overseas insurance coverage

- Where to sign up for our free Smart Traveler Enrollment Program

Sometimes – in spite of good planning – things can still go wrong. Prepare for the unexpected by reading about how to plan for a crisis overseas.

Additional Tips for Traveling Abroad

Downloadable Traveler’s Checklist PDF card

Travelers with Special Considerations

Enroll in STEP

Subscribe to get up-to-date safety and security information and help us reach you in an emergency abroad.

Recommended Web Browsers: Microsoft Edge or Google Chrome.

Make two copies of all of your travel documents in case of emergency, and leave one with a trusted friend or relative.

External Link

You are about to leave travel.state.gov for an external website that is not maintained by the U.S. Department of State.

Links to external websites are provided as a convenience and should not be construed as an endorsement by the U.S. Department of State of the views or products contained therein. If you wish to remain on travel.state.gov, click the "cancel" message.

You are about to visit:

Finding The Check Number On A Travelers Check

- Last updated Jun 06, 2024

- Difficulty Beginner

- Category Travel

Are you planning on using a travelers check for your upcoming trip, but don't know how to find the check number? No worries, we've got you covered! In this guide, we will walk you through the step-by-step process of locating the check number on a travelers check. Whether you're a first-time traveler or a seasoned adventurer, this information will ensure that you have all the knowledge you need to make the most of your travelers checks. So grab your pen and paper, and let's get started on finding that elusive check number!

What You'll Learn

Introduction to traveler's checks and the importance of check numbers.

- How to Locate the Check Number on a Traveler's Check?

Understanding the Significance of Check Numbers for Security and Tracking

Common questions and answers about check numbers on traveler's checks.