- Trip Interruption

What is Trip Interruption travel insurance?

Trip Interruption provides reimbursement for prepaid and non-refundable trip payments if a portion of a trip is missed, or the traveler must return home early due to unforeseen circumstances, including illness, injury, or death.

Trip Interruption is a post-departure benefit that can reimburse a traveler’s unused trip costs if they need to interrupt their trip for a covered reason. The most common covered reason is unforeseen illness, injury, or death of the traveler, a traveling companion, or a non-traveling family member. Other common covered reasons include terrorism , inclement weather , or a natural disaster, among others.

Most comprehensive policies that offer Trip Cancellation also include Trip Interruption at no extra cost.

Trip Interruption will cover between 100% and 200% of the total trip cost, depending on the policy. This benefit may cover more than the total trip cost because it can cover additional transportation expenses incurred to return home. Some policies with Trip Interruption only provide coverage for a return flight home.

Is Trip Interruption the same as Trip Cancellation?

Trip Interruption and Trip Cancellation are not the same benefit. Although they are similar, Trip Interruption is a post-departure benefit while Trip Cancellation is a pre-departure benefit. This means that Trip Cancellation can provide reimbursement if you need to cancel your trip before you leave while Trip Interruption can provide reimbursement of your trip costs if you need to interrupt your trip after you depart. These trip costs can include prepaid, non-refundable hotel accommodations, flights, and tours or entry tickets.

Trip Cancellation is a pre-departure benefit. If an unforeseen incident such as an illness or injury, death in the immediate family, or a serious weather event occurs before a traveler leaves home for a trip and prevents them from traveling altogether, Trip Cancellation can reimburse the non-refundable trip costs they lose from the cancellation.

Similarly, Trip Interruption offers coverage for the same unforeseen circumstances, but this coverage is a post-departure benefit. This means coverage is not available until after a traveler leaves for their trip. For example, if a traveler experiences a covered event and misses a portion of their trip or must return home early, then the non-refundable trips costs that they’ve missed can be reimbursed.

What could cause my trip to be cut short?

Every policy has a list of events that can be covered under Trip Interruption. If a traveler’s trip is impacted for one of these reasons, they can be covered. These policies can include an illness or injury, a death in the family, inclement weather at home or at the traveler’s destination, or the theft or loss of an important travel document such as a passport.

How much does Trip Interruption cover?

Trip Interruption covers at least 100% of the prepaid, non-refundable trip costs that are missed from having a trip interrupted early. Some policies can cover the additional costs for the traveler’s flight home, and pay up to 150-200% of the total trip cost.

Please be aware that coverage and eligibility requirements for this benefit differ by policy. The tables below show the providers that offer Trip Interruption coverage.

Looking for a policy with Trip Interruption coverage?

Enter your trip information on our custom quote form . Once you receive your results, select the Trip Interruption filter to find the best policy for your trip with the coverage that you need.

Trip Interruption by Provider

- Travel Delay

- Hurricane & Weather

- Missed Connection

- Cancel For Any Reason

- Cancel for Covid-19 Sickness

- Trip Cancellation

- Financial Default

- Employment Layoff

- Cancel For Medical Reasons

- Cancel For Work Reasons

- Interruption For Any Reason

- Medical Coverage for Covid-19

- Emergency Medical

- Pre-Existing Condition

- Co-Insurance

- Medical Deductible

- Home Country Coverage

- Medical Evacuation & Repatriation

- Non-Medical Evacuation

- Extension Of Coverage

- Baggage Delay

- Baggage & Personal Items Loss

- 24 Hour AD&D

- Flight Only AD&D

- Common Carrier AD&D

- Sports & Activities

- Sports Equipment Loss

- Sports Equipment Delay

- Sports Weather Loss

- Search & Rescue

- Sports Fees

- Rental Car Damage

- Money Back Guarantee

- 24 Hour Assistance Service

- Identity Theft

- Renewable Policy

- Maximum Trip Length

- Maximum Number of Trips

- Additional Benefits

Additional Information

- AM Best Ratings

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Trip Cancellation Insurance: Covered Reasons Explained

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

What Is Trip Interruption Insurance?

Mike Simons / Getty Images

What, Exactly, Is Trip Interruption Insurance?

Trip interruption insurance covers you if you become ill, are injured, or die after your travel begins. Trip interruption insurance also covers you if a family member or travel companion gets sick, is injured, or dies once your trip has commenced. Depending on which coverage you choose, your travel insurance policy's trip interruption clause may reimburse you for all or part of the prepaid cost of your trip, or it may just pay enough to cover the change fees for your airfare home.

Trip Interruption Insurance Specifics

Most policies specify that you (or the ill or injured party) must see a doctor and obtain a letter from him or her stating that you are too ill or disabled to continue your travel. You must get the doctor's letter before you cancel the rest of your trip. If you do not do this, your trip interruption claim may be rejected.

The definition of "travel companion" may include the requirement that the companion must be listed on a travel contract or other registration document. In some cases, the companion must also intend to share accommodations with you. Some insurance companies will pay all or even 150 percent of your nonrefundable trip deposits and trip costs.

Others will pay up to a certain amount, typically $500, to cover the cost of changing your return airline, train, or bus ticket so you can get home. In either case, the trip interruption must be the result of a covered reason, such as illness, death in the family, or a situation that seriously threatens your personal safety. These covered reasons will be listed on your travel insurance policy certificate.

Trip interruption coverage may also protect you against a whole host of problems, provided they take place after your trip begins. These problems may include weather issues, terrorist attacks , civil unrest , strikes, jury duty, an accident en route to your trip departure point, and more. The list of covered events varies from policy to policy. Carefully read the policy certificate before you pay for travel insurance.

Trip Interruption Insurance Tips

Before you buy a policy, be sure you understand what kind of documentation you will need in order to make a claim. Save all paperwork related to your trip, including contracts, receipts, tickets, and emails, in case your trip is interrupted, and you need to file a claim with your travel insurance provider.

Travel insurance providers will not cover known events, such as named tropical storms, named winter storms, or volcanic eruptions. Once a storm has a name or an ash cloud has formed, you will not be able to buy a policy that covers trip interruptions caused by that event.

Find out how "imminent threat to your personal safety" is defined by your travel insurance provider. Some policies will not cover imminent threats unless the US Department of State issues a Travel Warning regarding that threat. In nearly all cases, the Travel Warning must be issued after the start date of your trip.

Look for a policy that covers situations that are likely to arise at your destination. For example, if you are traveling to Florida in August, you should look for trip interruption insurance that covers delays caused by hurricanes.

Carefully read your entire insurance policy certificate before paying for trip interruption insurance. If you do not understand the certificate, call, or email the insurance provider and ask for clarification.

If you think you might need to cut your trip short for a reason that is not listed on your policy, consider buying Cancel For Any Reason coverage, too.

What Is the Difference Between Trip Interruption and Travel Delay Insurance?

Some travel insurance providers classify situations caused by everything except illness, injury, or death as "travel delay" rather than "trip interruption," so you must look at both types of travel insurance as you investigate possible insurance policy options. You may decide that you need only one of these types of coverage, or you may discover that you need both. If you are confused, do not hesitate to call your insurance agency or contact your online travel insurance provider. It is far better to clear up questions or concerns before your trip.

Nationwide Travel Insurance: The Complete Guide

Travelex Insurance: The Complete Guide

Flight Insurance That Protects Against Delays and Cancellations

Traveling Safely in Greece

Does Travel Insurance Cover Earthquakes?

What Is Trip Cancellation Insurance?

What Documents Do I Need for Mexico Travel?

AIG Travel Insurance: The Complete Guide

The Best Credit Cards for Travel Insurance

Air Travel and Damaged Baggage

How to Get Your Miles Back After Canceling an Award Flight

Asia Travel

Should You Buy Collision Damage Waiver Insurance for Your Rental Car?

Vacation Countdown: 17 Smart Things to Do Before Leaving Home

Know What to Expect if Your Flight Gets Delayed or Canceled

Driving in Mexico: What You Need to Know

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

What is trip interruption insurance.

Booking a vacation often comes with a lot of “what ifs.” What if I get sick and test positive for COVID-19 before boarding my flight? What if a hurricane is forecast to make landfall in south Florida the day my cruise is departing Miami?

Trip cancellation and interruption insurance can be an effective way to mitigate those worries, knowing you would be covered if something extraordinary happens that either curtails or cancels your trip.

Read on to know more about the different types of trip coverage provided through credit card issuers and travel insurers.

How does trip interruption insurance work?

Trip interruption insurance can reimburse travelers for expenses associated with covered situations that can unexpectedly cut your trip short. It provides reimbursement for prepaid, unused and non-refundable travel expenses, such as plane tickets, hotel stays or cruise line reservations.

How do I get trip interruption insurance?

Many credit card issuers offer some form of trip interruption insurance as a benefit to their customers, as well as an incentive for cardmembers to book travel using their cards. If you are unsure if your credit card issuer offers this benefit, you can call the toll-free number on the back of your card or go online to find out.

Credit card travel insurance vs. insurance company policies

Travel policies for both trip cancellation and interruption are regulated insurance products sold online by travel insurance issuers. Credit card-based trip interruption coverage, which is often capped at a few thousand dollars of reimbursement, should not be viewed as a substitute for these insurance policies. Some credit card products also cap their trip interruption payouts at $1,500 per person and $6,000 or less for the whole family for each trip and/or limit their coverage to prepaid passenger fares, such as plane tickets or cruise line fares. For this reason, some travelers will purchase travel insurance policies for coverage in excess of the basic coverage their card issuer offers.

What’s covered by trip interruption insurance?

Here are several situations in which trip interruption insurance may be applicable:

- A severe weather event such as a hurricane or flood striking your booked vacation destination or cancelling flights to it—as well as mandatory evacuations prior to a hurricane making landfall

- Severe weather or wildfires destroying your primary residence while you are traveling

- Accidental death or bodily injury for a passenger on an airline or cruise line, as well as any serious illness for you, your direct family member, or your traveling companion during your trip

- Active duty or reservist members of the military receiving documented orders that cut short their vacation—where the spouse traveling with them is also covered

- An organized airline employee strike that leads to the cancellation of your flight

Please note that in order for coverage to apply, you must first notify the common carrier such as the airline or cruise line that interrupted your trip and request whatever refund, miles or other compensation they are prepared to offer. You will need to do this before submitting a claim to your insurer or credit card Benefit Administrator.

What isn’t covered by trip interruption insurance?

There are many situations that can arise including common occurrences that usually aren’t covered by trip interruption insurance.

- Any trip interruption due to a change in plans by you and your traveling companion or failure to obtain passports or the necessary visas in time before departure

- Trips interrupted due to a traveler or their traveling companion’s pre-existing medical conditions

- Financial insolvency with default of an airline or cruise line on its obligations

- Acts of war whether declared or undeclared or an armed rebellion in a destination country

- Any trip lasting over 60 days

For the full list of what is and isn’t covered by trip interruption insurance provided through booking travel using your credit card, check your cardmember benefit guide. For any active purchased travel insurance policy, read the terms and conditions carefully.

What’s the difference between trip interruption insurance and trip cancellation coverage?

Trip interruption is often confused with trip cancellation insurance, but there are key differences between the two, notably the scope of coverage based on the timing of events. Trip interruption coverage starts on the day of your scheduled departure and ends on the day of your scheduled return home. Trip cancellation coverage begins once you’ve booked a trip using a credit card that offers this type of benefit, or from the day you purchase a travel insurance policy to protect your upcoming itinerary.

Examples of the differences between trip cancellation and interruption coverage

With trip interruption coverage, you can file a claim for reimbursement if a covered event happens after you leave for your trip. With trip cancellation coverage, you can file a claim for reimbursement if forced to cancel a trip for a covered reason prior to departure.

Interruption coverage to reimburse the cost of a ticket change fee to get home could apply if a passenger makes their initial flight, but the same pilots’ strike cancels their connecting flight.

Although it is not a substitute for travel cancellation insurance, trip interruption insurance can reimburse travelers for prepaid non-refundable land, air or cruise arrangements that are not used, as well as change fees and ground transportation. Terms and conditions apply to trip interruption provided as a credit card benefit, so read terms and conditions carefully.

- card travel tips

What to read next

Credit card basics hyatt hotels to stay at in louisville, kentucky.

Learn about the top Hyatt hotels to book in Louisville, Kentucky.

credit card basics The guide to the Chase Sapphire Terrace in Austin

Learn about the new Chase Sapphire Terrace at Austin-Bergstrom International Airport, including features, operating hours, and how to get in.

rewards and benefits Guide to the Chase Sapphire Lounge at LaGuardia Airport

The Sapphire Lounge at LaGuardia can be a calm place to unwind and relax before your flight. Learn about the features and amenities of the Sapphire airport lounge at LGA airport.

credit card basics How to find your frequent flyer number

How do you find your frequent flyer number? Learn several ways you may be able to track down your number so you can use it when booking that flight.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Loans for Bad Credit

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Same-day Car Insurance

- Best Pet Insurance

- Pet Insurance Cost

- Cheapest Pet Insurance

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

Understanding Trip Interruption Coverage: Benefits and Tips (2024)

Get a free quote for trip interruption travel insurance by clicking below.

in under 2 minutes

with our comparison partner, Squaremouth

Amelia Canty is a U.K.-based writer. Her specialities include all things travel, covering everything from destination guides to more technical travel issues such as insurance queries. As a big foodie, you will often find Amelia sampling the latest restaurants for food and drinks with friends when she’s not writing.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Nobody wants to cut a vacation short, but sometimes accidents or emergencies happen. In these situations, the last thing you want to worry about is the money you could lose and the vacation time that slipped away.

Imagine you and a traveling companion are on vacation at a luxury resort in Mexico, and one of you trips and severely sprains an ankle. You can no longer enjoy your vacation as planned, nor can you partake in your prepaid activities. All you want is to get home, get comfortable and see a doctor.

Trip interruptions often bring expense, particularly if you have to pay for new flights while losing money from deposits for previous non-refundable bookings. This is where trip interruption travel insurance coverage comes in.

Why Trust MarketWatch Guides

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

Companies Reviewed

Quotes Collected

Rating Factors

What Is Trip Interruption Coverage?

If a traveler has to cut a trip short, trip interruption coverage offers the chance to seek financial reimbursement for unused, pre-paid and non-refundable travel expenses. An example of when trip interruption coverage would apply is if a traveler suffered a serious injury while on vacation, or if a government ordered an evacuation of an area the traveler is visiting.

Trip interruption coverage differs from other types of travel insurance as it covers travelers post-departure. This type of insurance coverage is perfect for expensive trips. Fortunately, most comprehensive travel insurance plans offer it.

How Does Trip Interruption Coverage Work?

Trip interruption coverage exists to cover you for any unexpected or uncontrollable circumstances that may force a premature return home from your trip. Examples include a serious injury, illness, a family emergency back home, quarantine, evacuation or an early departure. Anything that prohibits you from continuing your trip as intended should be protected by trip interruption coverage.

Insurance offers travelers reimbursement of some or all the prepaid or unused money from a trip cut short for covered reasons. Covered reasons include:

- Rental cars

Sometimes insurance covers added costs incurred from the cancellation, such as an early flight home.

What Does Trip Interruption Insurance Cover?

Covered reasons for guaranteeing trip interruption insurance vary from policy to policy. They’re typically defined as uncontrollable and unexpected circumstances.

Examples include a serious illness or injury, required quarantine or evacuation, severe weather, a family emergency at home, natural disasters or a terror-related attack, or a legal obligation such as jury duty, which prevents continued participation in the trip.

The amount of coverage can also differ. Some policies cover 100% to 200% of the total trip cost. Others cap coverage at a predetermined amount, and if customers want more protection, they can buy it as an add-on.

Imagine you’re in the position of having a severely sprained ankle on a romantic vacation. You can no longer do the things you planned and want to get back home to receive treatment for your injury before it worsens.

Trip interruption insurance would protect you for an unused hotel stay, your original return flight, the cost of new plane tickets, and additional transportation costs (taxis, Ubers or a rental car). You’re fully covered to fly back because you can’t continue the vacation as you intended.

Once you decide to return home, notify your insurance provider. Consult your travel insurance policy to confirm that you’re acting within the policy’s declaration times and other protocols. If you don’t abide by the protocol, you risk giving up a reimbursement.

Trip Interruption Insurance vs. Trip Cancellation Insurance

Trip cancellation insurance refers to pre-departure situations where you’re forced to cancel a trip before it starts for covered reasons. Trip interruption insurance deals with cancellations mid-trip from any situation that arises post-departure.

The reasons that are covered under trip cancellation coverage are largely the same as trip interruption coverage, with a few exceptions in each policy.

Trip Interruption Insurance vs. Trip Delay Insurance

Trip interruptions are when you need coverage for a trip unexpectedly cut short, and you return home for several covered reasons. Trip delay insurance covers travel plans that have been delayed, such as a late or canceled flight, which created a domino effect on other travel plans and reservations.

Coverage exists to reimburse you for the extra costs of rearranging your travel plans. If you have had a flight canceled or missed a connecting flight because of a covered delay and had to make alternative arrangements to catch up with a cruise or a travel group , you would be reimbursed for some or all of the additional costs.

Both types of insurance cover costs lost because of events that happened that are beyond your control. But with trip delay coverage, you wouldn’t be covered if you forgot to renew your passport or arrived late at an airport, triggering your travel losses.

How Much Does Trip Interruption Coverage Cost?

Most basic travel insurance policies cost between 5% and 10% of a trip’s total cost. A good travel insurance policy will be comprehensive and include trip interruption coverage. If it doesn’t, consider the price of adding a specific trip interruption rider and any other coverage you want.

Here are some examples of travel insurance quotes with basic trip interruption coverage for a 30-year-old man traveling from Alabama to Mexico for a week, costing $1,000.

A Travelsafe classic travel insurance plan would cost $60, which includes trip interruption coverage up to 150% of the non-refundable insured trip cost and $1,000 toward a return plane ticket, $500 for unused shore excursions and $150 for traveling companion hospitalization (limited to five days).

A Seven Corners trip protection choice plan would cost $65, which includes trip interruption coverage up to 150% of the insured trip cost, as well as $1000 toward your return airfare. You can also buy interruption-for-any-reason coverage for an extra $1.95 within 20 days of your trip, whereby Seven Corners will reimburse you for trip interruptions outside of the covered reasons list.

Each travel insurance company supplies a comprehensive list alongside each policy of the covered reasons.

Benefits of Trip Interruption Coverage

Although intended to be exciting and enjoyable, traveling can be stressful and unpredictable. Trip interruption coverage protects travelers from the unexpected, giving you peace of mind for circumstances that are beyond your control.

If your trip ends early for an unavoidable reason, can you comfortably deal with the inevitable financial consequences? Or would it add to the already emotional stress of the unfortunate circumstances?

Trip interruption coverage acts as a traveler’s safety net in the worst-case scenarios.

How To Get Trip Interruption Insurance

To obtain trip interruption insurance, you will need to purchase travel insurance with the appropriate coverage. You can also apply for a premium travel credit card with trip insurance benefits. To find travel insurance, you can compare providers online or ask your tour provider for recommendations.

If you prefer to go directly through a travel insurance provider, we recommend obtaining quotes from multiple travel insurance providers to compare coverage and cost. You can refer to our guide to the best travel insurance providers to get started. To get a quote, you will have to fill in basic information, including travel dates and your destination. You then can go through each policy and evaluate which offers the most appropriate coverage for your travel needs.

Factors To Consider When Choosing Trip Interruption Coverage

When evaluating travel insurance companies and their policies, there are certain things to inspect. Policies have varying coverage amounts, exclusions and conditions you must be aware of.

If you and a traveling companion must return from a trip unexpectedly, your insurance coverage policy would determine whether some or all of the unused portion of your accommodation cost would be reimbursed to you. It also varies from policy to policy how much, if any, additional transportation expenses will be covered, such as your new return flight or taxis to and from the airport.

Certain policies also cover you for all or some of any extra trip expenses on your way home, such as a necessary hotel stay. But your insurance provider may have specific limits on hotel expenses or may only cover certain types of accommodations.

The Bottom Line

Trip interruption insurance can be a saving grace if something unexpected happens on your vacation. Nobody wants to think about planning for the worst. But if something happens and forces you to cut your trip short, you want travel protection for you and your family and the knowledge that you won’t face unmanageable financial consequences and unnecessary emotional stress.

Frequently Asked Questions About Trip Interruption Coverage

What is a trip interruption benefit.

The benefit of trip interruption coverage is that it protects travelers post-departure. If you or your traveling companion fall ill or suffer a serious injury that prohibits further participation in your vacation — or any other covered reason — you would be reimbursed for the unused portion of your accommodation and extra travel expenses you could incur.

What is the difference between trip interruption and trip delay insurance?

Trip interruption insurance covers you for when your trip is unexpectedly cut short, and you return home for a reason that’s covered by your policy.

Trip delay insurance refers to travel plans that were delayed, such as a late or canceled flight, thereby having a domino effect on the rest of your travel plans. You would be covered for any added travel expenses you have incurred because of the delay.

What are valid reasons for trip cancellation insurance?

Covered reasons vary from policy to policy. They’re usually defined as reasons that are unexpected and outside of your control. Examples include:

- A serious illness or injury that stops you from traveling

- You’re called for jury duty

- The government advises against traveling to your destination country

- An immediate family member falls ill or dies

If you have questions about this page, please reach out to our editors at [email protected] .

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Protect Your Travel Plans: Trip Cancellation Insurance Explained and the 5 Best Policies

Jessica Merritt

Editor & Content Contributor

88 Published Articles 495 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

153 Published Articles 759 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3192 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

The 5 best trip cancellation insurance policies, what is trip cancellation insurance, how trip cancellation insurance works, is trip cancellation insurance worth it, what trip cancellation insurance costs, choosing trip cancellation insurance , final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

You’ve booked your flight, hotel, and tours and are ready to go on your trip — but what happens if you can’t make it? Unexpected circumstances can pop up that force you to cancel your trip, such as illness or natural disasters. If you can’t get refunds from travel suppliers, trip cancellation insurance can help.

Let’s look at what trip cancellation covers, whether you need a trip cancellation policy, and what you should know before shopping for a plan.

You’ll have plenty of options if you want a cheap, standalone trip cancellation policy, comprehensive travel coverage, or Cancel for Any Reason (CFAR) coverage.

Consider these trip cancellation insurance policies that offer good value and coverage, quoted for a 35-year-old visiting Mexico on a $1,500 trip in September 2023:

Best Cheap Trip Cancellation Insurance: battleface

We were quoted just $20 for a battleface Discovery Plan with trip cancellation benefits up to $1,500. But that’s all it offers — you won’t get trip interruption coverage, medical coverage, evacuation, loss or delay, or other benefits offered by comprehensive travel insurance plans.

Best Extensive Trip Cancellation Reasons: IMG

IMG’s iTravelnsured Travel Essential plan isn’t CFAR coverage, but it has multiple covered reasons for cancellation. You’re covered for foreign and domestic terrorism, financial default, medical reasons, and accommodations made uninhabitable. Our $35.92 quote offered up to 100% of the total trip cost for trip cancellation and 125% for trip interruption.

Best Comprehensive Trip Cancellation Coverage: TinLeg

TinLeg’s Basic travel insurance plan covers up to 100% of your total trip cost for trip cancellation , but you’ll also get other major travel insurance coverages. This plan we were quoted $41 for offers trip interruption, travel delay, baggage delay, emergency medical, evacuation and repatriation, and more.

Best Layoff Protection: Aegis

Like the battleface plan, Aegis Go Ready Trip Cancellation insurance covers up to 100% of your trip cost if you need to cancel — but not much else. But a big value-add is employment layoff coverage , which allows you to get reimbursed if you need to cancel your trip due to involuntary layoff or termination of employment. We were quoted $45 for this plan.

Best Cancel for Any Reason: Seven Corners

The Seven Corners Trip Protection Basic plan offers optional CFAR coverage, which reimburses up to 75% of your trip cost for reasons not otherwise covered by your policy. Regular trip cancellation and interruption coverage offer reimbursement of up to 100% of your trip cost. Our quoted cost for this plan came to $58.

Trip cancellation insurance is a type of travel insurance. With trip cancellation coverage, you can get reimbursement for nonrefundable prepaid travel expenses if you need to cancel your trip before departure. Trip cancellation is one of the main coverage areas for travel insurance, the other being medical emergency coverage.

Many comprehensive travel insurance policies offer trip cancellation coverage; standalone trip cancellation insurance is less common than comprehensive travel policies. Travel credit cards may offer trip cancellation coverage as a cardholder benefit, as well.

Trip cancellation insurance kicks in if you must cancel your trip due to unforeseen circumstances such as an illness, injury, or other covered reasons. You can get reimbursed for nonrefundable expenses if you have travel cancellation insurance and need to cancel your trip.

Covered nonrefundable expenses typically include:

- Hotels and vacation rentals

- Rental cars

Travel insurance policies with trip cancellation coverage often include trip interruption benefits. Similar to trip cancellation coverage, trip interruption benefits can help you recoup your costs if you need to delay or cut your trip short due to covered reasons.

When To Buy Trip Cancellation Insurance

You can usually purchase trip cancellation insurance up to the day before your scheduled departure. Still, you’ll get more value if you purchase insurance as soon as you make your first trip deposit . That way, your travel plans are covered from the start.

Trip Cancellation Insurance Covered Reasons

Unless you opt for Cancel for Any Reason travel insurance, trip cancellation insurance only applies to covered cancellation reasons. For example, you can’t use trip cancellation insurance to cancel your trip for a refund because there’s rain forecasted for your beach vacation. But, you could get reimbursement if a named hurricane forms after you purchased your policy.

Common reasons covered by trip cancellation insurance include:

- Death, including the death of a family member or traveling companion

- Government travel warnings or evacuation orders for your destination

- Home damage or burglary

- Illness, injury, or quarantine that makes you or a covered travel companion unfit to travel

- Legal obligations such as jury duty or subpoena

- Natural disasters such as hurricanes, earthquakes, or floods affect travel operations at your destination

- Terrorist incidents at home or your destination

- Travel supplier cancellation

- Unexpected military duty

- Unexpected pregnancy complications

- Unexpected work obligations

These are common covered reasons for trip cancellation insurance, but policies vary in coverage . Reviewing the terms and conditions of your trip cancellation insurance is a good idea so you understand what’s covered.

You should also understand what’s explicitly not covered. For example, changing your mind is not a covered reason on a standard trip cancellation insurance policy. And trip cancellation insurance typically doesn’t cover foreseeable events, routine health treatments, substance abuse, sporting events, mental health, acts of war, self-harm, or dangerous activities such as skydiving.

Cancel for Any Reason Trip Cancellation Coverage

Need to expand your list of covered cancellation reasons? Cancel for Any Reason trip cancellation insurance is an option.

You can use CFAR to cancel your trip for reasons not covered by trip cancellation insurance, such as changing your mind, fear of travel, unexpected obligations, weather, or budget concerns.

The catch? You’ll pay more for CFAR coverage , and it only reimburses up to 50% to 75% of your nonrefundable travel expenses. Generally, trip cancellation insurance offers 100% reimbursement for covered expenses.

The other main stipulation is that you’ll need to purchase your coverage within a specified period , usually within 10 to 21 days of your first trip deposit. And to get reimbursement under CFAR, you must cancel your travel within the cancellation timeframe, usually at least 48 hours from your scheduled departure.

Annual Travel Insurance

Most annual travel insurance policies, also known as multi-trip policies, cover trip cancellation for multiple trips taken within the policy period, usually 12 months. You’ll also typically get coverage for medical expenses.

Trip Cancellation vs. Trip Interruption

Trip cancellation insurance covers your nonrefundable travel expenses if you have to cancel before departure, while trip interruption covers your trip costs after departure . For example, trip interruption coverage kicks in if you get injured while traveling and have to go home early.

Trip cancellation insurance can be worth it if you have nonrefundable travel expenses and there’s a risk you’ll have to cancel your travel due to unforeseen events. It offers financial protection if you’re traveling to a destination with potential risks such as natural disasters or political instability — or if you have risk factors at home, such as unpredictable work commitments or family members with health conditions that could interfere with travel.

If you plan an expensive trip with nonrefundable bookings or deposits, trip cancellation is probably worth it. But if your travel is inexpensive, or most of your travel expenses are refundable, you might not need trip cancellation insurance.

Consider the cost of insurance, the likelihood you’ll need to cancel, and the cost of nonrefundable travel at stake when you decide if trip cancellation is worth it.

A basic travel insurance policy with trip cancellation coverage generally costs between 5% to 10% of your trip costs . So a travel insurance policy for a $5,000 trip would cost $250 to $500. Your costs will be higher if you opt for CFAR coverage.

Factors that influence how much your trip cancellation insurance costs include traveler age, trip expenses, trip length, coverage options, and how many people you need to cover.

A comprehensive travel insurance policy with emergency medical or lost baggage coverage and trip cancellation coverage can offer additional value.

If you’re mainly concerned with trip cancellation coverage, look for cheap travel insurance policies that still offer this coverage, but have either nonexistent or low coverage limits for other coverage areas, such as lost baggage or medical evacuation .

Credit Cards With Trip Cancellation Insurance

You might not have to pay for trip cancellation insurance if you have the right credit card. Some credit cards offer trip cancellation and interruption coverage as a cardholder benefit.

Credit cards with trip cancellation coverage generally provide between $2,000 to $10,000 per person in trip cancellation benefits, often covering trip interruption.

For example, the Capital One Venture X Rewards Credit Card offers cardholders $2,000 in trip cancellation or interruption benefits per person. With the Chase Sapphire Reserve ® , cardholders get up to $10,000 per person in trip cancellation coverage with a maximum of $20,000 per trip and a $40,000 limit per 12-month period.

If your nonrefundable travel costs exceed the covered benefit offered by your credit card, you may prefer to purchase separate trip cancellation insurance.

If you only need trip cancellation and interruption coverage, your credit card may have adequate protection benefits.

Consider these factors as you shop for a trip cancellation insurance policy:

- Cost: Compare policy premiums and consider how the cost fits into your overall travel budget.

- Coverage Amount: Your trip cancellation coverage should cover all of your nonrefundable prepaid trip expenses. But a policy with too much coverage could be more costly than necessary.

- Policy Limits: Know the policy’s limits, including deductibles, exclusions, and limitations.

- Covered Reasons: A policy that offers a variety of covered cancellation reasons offers the most protection.

- CFAR Coverage: Understand whether CFAR coverage is included in the policy and its additional cost.

- Reputation and Customer Service: Read travel insurance reviews to learn about the experiences policyholders have had, whether they’re good or bad.

- Refund Policies: Understand what happens if you cancel your policy before the trip.

Travel insurance comparison sites such as Squaremouth make it easy to enter your trip details and get quotes from multiple insurance providers.

Trip cancellation coverage can provide valuable peace of mind if you’re concerned about losing nonrefundable prepaid travel expenses. It can be worth it if there’s a chance you’ll have to cancel your travel plans, and you’ll lose money on nonrefundable costs. Before you choose a trip cancellation policy, consider factors including cost, coverage, and cancellation reasons, and look at what’s covered with any credit cards you hold.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

What is trip cancellation insurance for.

Trip cancellation coverage offers financial protection if you need to cancel or interrupt your trip due to unexpected circumstances. You can get reimbursement for nonrefundable prepaid expenses related to covered travel if you have to cancel your trip.

Is trip cancellation covered in travel insurance?

Most travel insurance policies cover trip cancellation coverage. Other common coverage areas include trip interruption and medical emergencies.

Does trip insurance cover cancellation for any reason?

Travel insurance can offer CFAR coverage, usually as an optional add-on. You can select a CFAR policy if you want more flexibility in canceling your trip and receiving reimbursement.

When should I buy trip cancellation insurance?

It’s best to purchase trip cancellation as soon as you have any money at risk on your trip, usually as soon as you book travel. Buying trip cancellation insurance after booking covers you for unexpected circumstances that could cause you to cancel your trip.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- 2024 Buyer's Guide

- Trip Interruption

Trip Interruption Coverage

Post departure trip investment coverage in the event you have to curtail or interrupt your trip, flight, or cruise due to a covered reason.

Trip Interruption Protection

Very similar coverage to trip cancellation . It is a type of coverage that provides for reimbursement of unused, non-refundable fees that you've paid because you interrupt (post departure) your trip due to a covered reason . Coverage can also include reimbursement for airfare to return home.

Some common "covered reasons" are:

- injury , illness , or death of the traveler, the traveler's traveling companion , and family members .

- weather conditions however, coverage is very specific and many plans limit coverage to weather that causes your common carrier to be delayed for a specific number of hours.

- your home or destination made uninhabitable due to natural disaster.

Possible pitfalls

- pre-existing medical conditions - are excluded unless you qualify for the " waiver of pre-existing conditions ".

- not a covered reason - covered reasons are specific and your reason for cancelling has to be one of them .

- nonrefundable fees should be in writing when you pay your money and paid prior to your departure..

Start Your Quote for your next Trip here

Click here to find your plan

Facts: Family of 4 are on a European trip when word reaches them that an elderly parent has passed away. They have to return home 1/2 way through their trip. The remainder of their tour is nonrefundable and they find that the airline requires an additional fee to change their tickets to the new return date.

Result: Trip interruption coverage provided a refund of the unused portion of their tour and for the additional airfare to return home.

Recommended Travel Insurance Plans

All other available plans.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Trip Cancellation Insurance Explained

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is trip cancellation insurance?

Covered reasons for trip cancellation, what is not covered by trip cancellation insurance, cancel for any reason trip insurance, is trip cancellation insurance expensive, different ways to get trip cancellation insurance, which insurance coverage is best for me.

When booking travel, particularly expensive trips consisting of nonrefundable reservations, it makes sense to consider trip cancellation insurance since it can protect your deposit if your plans do not materialize due to unforeseen events. However, not every reason for canceling a trip will qualify for coverage, so you’ll want to familiarize yourself with the basics of trip cancellation insurance.

Trip cancellation coverage can be purchased as part of a comprehensive travel insurance policy , or you can receive it for free when you hold certain premium credit cards. The benefit is designed to protect prepaid, nonrefundable reservations, including flights, hotel reservations and other bookings if the trip is canceled due to an extraordinary circumstance. Each policy will state exactly which events are considered valid reasons for cancellations.

With COVID-19 still affecting travel plans, you’ll want to pay close attention to which reasons for cancellation due to the pandemic are valid. For example, wanting to cancel a trip you booked a while ago because your destination now has rising COVID-19 numbers and you’re afraid to travel is not likely a valid reason.

If you want to be able to cancel a trip for truly any reason, consider the Cancel For Any Reason supplemental upgrade when purchasing your insurance policy. CFAR will allow you to get up to 75% of your trip investment back as long as the trip is cancelled at least two days before departure.

» Learn more: Does my travel insurance cover the coronavirus?

Imagine you’ve booked a two-week vacation to Italy costing $5,000 ($1,000 flight, $3,500 hotel and $500 excursions), all of which is nonrefundable. Then, a week before your departure date, you fall and break your leg.

So, what does trip cancellation insurance cover?

If you have trip cancellation insurance, you’ll be able to get your entire prepaid, nonrefundable trip cost back (as long as the entire amount was insured), since injuries that necessitate medical treatment and prevent you from taking your trip qualify as a covered reason.

Other covered reasons include death of your traveling companion, inclement weather that results in disrupted service, jury duty, terrorist incident, job termination and other extraordinary events.

Although this is not an entire list of all the covered reasons, generally the cancellation must be due to unforeseen circumstances to qualify for a reimbursement. Review the fine print of your policy for the details of exactly which reasons are covered. When seeking reimbursement, you’ll need to submit claims to the insurance provider to substantiate your claim.

Although a wide range of reasons allow you to receive your prepaid, nonrefundable travel expenses back in the event of a trip cancellation, there are important exclusions to know about.

Trip cancellation insurance will not cover losses arising from self-harm, foreseeable events, acts of war, taking part in activities considered dangerous (e.g., skydiving, bungee jumping, endurance races, etc.), a felony, childbirth, dental treatment and more.

» Learn more: How to find the best travel insurance

So what if you want the flexibility to cancel your trip for reasons other than those covered by your policy? For that, you're going to need the CFAR insurance mentioned above.

CFAR is often available as an add-on to travel insurance policies, and while it can come in handy if you want to cancel your trip just because, you're not likely to get all your money back.

Most CFAR policies will only reimburse 75% of your nonrefundable travel expenditures.

» Learn more: Best travel insurance with Cancel For Any Reason Coverage

The price of trip cancellation insurance can vary based on the traveler’s age, destination, length of trip, cost of trip and insurance company.

Using the same $5,000, two-week trip to Italy as mentioned above, a search of policies on SquareMouth (a NerdWallet partner) ranged from $115 to $470, representing 2.3% to 9.4% of the total trip cost.

» Learn more: How much is travel insurance?

All policies provide 100% coverage of the trip cost, however the more expensive plans usually have higher limits on benefits like medical evacuation.

If you’re only looking for trip cancellation coverage and no other protections, a policy equating to 2.3% of the total trip expenses seems reasonable.

On your travel credit card

Trip cancellation coverage can be included as part of a comprehensive travel insurance plan or offered as a benefit on premium travel credit cards.

For example, the Chase Sapphire Reserve® will reimburse you or your immediate family members up to $10,000 per trip. The Business Platinum Card® from American Express and many other American Express cards also offer up to $10,000 in trip cancellation coverage. Terms apply.

These premium cards also offer other insurance benefits like trip interruption coverage, emergency assistance services, trip delay and more.

If you travel often and typically purchase trip cancellation coverage, consider applying for one of the cards that offer complimentary travel insurance . Not only will you get trip insurance benefits, but you will also get other travel perks and statement credits that can partly offset the annual fee.

Supplement by purchasing policies out-of-pocket

If the coverage limits offered on the cards aren’t sufficient or you’re looking for more protections (e.g., coverage for emergency medical expenses), you’d be better off with a travel insurance . Although you’d incur an additional cost for purchasing a comprehensive plan, you’d have many more benefits not commonly found in the insurance policies offered by the credit cards.

A comprehensive trip cancellation policy is likely to cover canceled flights so long as the flight or flights are nonrefundable and are a part of the total, prepaid expenses covered by your policy. Insurance provided by travel cards typically includes trip delay or cancellation coverage so long as you used that card to pay for your flight reservations.

If you're forced to cancel your trip due to extraordinary circumstances beyond your control, travel insurance will provide coverage for some or all of your nonrefundable travel expenditures, depending on your policy. Covered events will vary, so be sure to review the terms of any plan you intend to purchase.

Trip cancellation insurance is available for purchase from a wide range of companies and is often included as a benefit on travel credit cards. Under certain circumstances, it provides coverage for prepaid travel expenses in the event that you cannot complete your trip as planned.

A comprehensive trip cancellation policy is likely to cover canceled flights so long as the flight or flights are nonrefundable and are a part of the total, prepaid expenses covered by your policy.

Insurance provided by travel cards

typically includes trip delay or cancellation coverage so long as you used that card to pay for your flight reservations.

If you’re going on a trip consisting of costly flights, hotel reservations and excursions and would like to protect your prepaid, nonrefundable deposit but do not need any other coverage, a minimally priced trip cancellation insurance policy is a good choice.

If you have a premium travel credit card , check if you already have trip cancellation insurance as a benefit before you purchase a policy.

However, if you’re looking for additional coverage like travel medical insurance , and/or a basic plan doesn’t have adequate limits, consider a comprehensive travel insurance policy from providers such as AAA , Allianz , and AIG . Read NerdWallet's full analysis of the best travel insurance companies here .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Trip Interruption Benefits

What is trip interruption.

Trip Interruption offers coverage if a trip is disrupted or cut short due to unforeseen circumstances such as sicknesses, severe weather conditions, or other eligible events that are out of the traveler's control. Trip Interruption Coverage typically covers expenses such as the cost of additional transportation, accommodation, and other expenses incurred because of the interruption. The exact coverage and benefits vary depending on the insurance policy.

Is Trip Interruption necessary?

Whether Trip Interruption insurance is necessary or not depends on several factors, including the type of trip you're taking, the cost of the trip, and your personal risk tolerance. The Trip Interruption benefit can provide coverage for unexpected events such as sickness, weather-related cancellations, and other eligible events that can cause you to interrupt your trip. Trip Interruption also allows travelers to rejoin their trip after an interruption has occurred. In general, having a trip interruption is a personal decision that should be based on the traveler's specific needs and circumstances. However, it's always a good idea to consider trip interruption coverage, especially if the trip involves a significant investment of time and resources. This can help to protect against financial losses if the trip is interrupted for a covered reason.

What Qualifies as Trip Interruption

1. Sickness, accidental injury, or death that results in medically imposed restrictions as certified by a physician during your trip preventing your continued participation in the trip A physician must advise to cancel the trip on or before the scheduled return date 2. If a family member or traveling companion booked to travel with you incurs sickness, accidental injury, or death. A & B must occur: a.) While you are on Your trip b.) Requires necessary treatment at the time of interruption, certified by a physician that results in medically imposed restrictions to prevent that person’s continued participation on the trip 3. In case of sickness, injury, or death of a non-traveling family member 4. The death or Hospitalization of Your Host at the Destination during Your trip 5. If you are terminated or laid off from your full-time employment by your company through no fault of your own, one year or more after starting employment, during your trip 6. You transfer your employment more than 250 miles away from your home during the trip. This applies if you have been employed by the transferring employer since your policy's effective date and the transfer requires you to relocate your home 7. If your previously approved military leave is revoked or you experience a military reassignment during the trip 8. If you, your traveling companion, or a family member who is military personnel is called to provide aid or relief in the event of a natural disaster (excluding war) 9. Severe weather causes the complete cessation of services for at least 48 consecutive hours of the common carrier (e.g., airline), preventing you from reaching your destination. Note: This benefit does not apply if the natural disaster was predicted or a storm was named before you purchased this policy 10. If a natural disaster at your destination renders your accommodations uninhabitable 11. If a terrorist incident occurs in your departure city or in a city listed on your trip itinerary during your trip, and the travel supplier does not offer a substitute itinerary. Note: This does not cover flight connections or transportation arrangements to reach your destination. The scheduled departure date must be within 15 months from your policy's effective date. Terrorist incidents that occur on an in-flight aircraft are not covered 12. If you or your traveling companion are victims of a felonious assault during the trip 13. If you or your traveling companion are hijacked, quarantined, required to serve on a jury, or subpoenaed if your home is made uninhabitable by a natural disaster or experience a burglary at your principal place of residence during the trip 14. You or Your Traveling Companion are directly involved in a traffic accident en route to departure. Note: This must be substantiated by a police report obtained by you and presented along with other claim forms and documentation. 15. If a travel supplier goes bankrupt or defaults during your trip, resulting in a complete halt of their services. However, these benefits will only be provided if there is no other transportation option available. If there is an alternative way to reach your destination, the benefits will be limited to covering the change fee required to transfer to another airline. Note: This coverage applies only if your scheduled departure date is within 15 months from the start date of your insurance policy 16. Strike that causes complete cessation of services of the common carrier affecting you or your traveling companion who is scheduled to travel. Note: Strike must last for at least forty-eight (48) consecutive hours File for a free quote

Do I need Trip Interruption coverage?

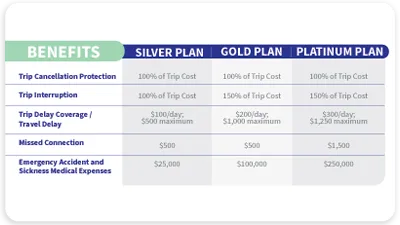

Having trip interruption coverage is a savvy idea. It offers coverage for multiple reasons to help you get your trip back on track. All three of AXA’s travel plans include Trip Interruption coverage, maximum coverage per person is up to:

Maximum Benefit: 100% of Trip Cost Reasonable Expenses Per Day: $100

Maximum Benefit: 150% of Trip Cost Reasonable Expenses Per Day: $100

Maximum Benefit: 150% of Trip Cost Reasonable Expenses Per Day: $100

Receive a free quote within minutes, and decide which plan fits best for your travel needs!

Why choose axa travel protection.

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include: • Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency • 24/7 global team of travel experts that offers assistance and assurance while traveling

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Trip Interruption Insurance FAQs

How much does trip interruption cost.

- Length of Stay

- Destination

- Type of Trip

- Number of Travelers

- Extent of Guarantees

What types of vacations does Trip Interruption apply to?

When does trip interruption coverage begin.

- Trip Interruption coverage begins when a specific travel package has been selected

- Trip Interruption coverage will begin on the day after the required premium for such coverage is received by the authorized representative

When does Trip Interruption coverage end?

- The scheduled return date as stated on the travel tickets

- The date and time you return to your origination point if prior to the scheduled return date

- The date and time you deviate from, leave, or change the original trip itinerary (unless due to unforeseen and unavoidable circumstances covered by the policy)

- If you extend the return date, coverage will terminate at 11:59 P.M., local time, at your location on the scheduled return date unless otherwise authorized by the Company in advance of the scheduled return date

- When your trip exceeds ninety (90) days

- The return date as stated on your purchase confirmation

How to get a Travel Protection Quote?

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation protection, our team of travel experts will help you choose the right coverage.

Agent Information

← Return to Blog

What Is Interruption for Any Reason Travel Insurance?

Becky Hart | Jan 8, 2024

Share Twitter share

You might have heard of Cancel for Any Reason coverage , but are you familiar with Interruption for Any Reason? Like CFAR, Interruption for Any Reason, also known as IFAR, offers you more flexibility to adjust your travel plans when the unexpected happens. If you’re looking for more ways to protect your money, IFAR could be the right solution for you.

What Is a Trip Interruption?

Before we get too deep into travel insurance, let’s chat quickly about trip interruption. What does it mean to interrupt your trip?

Most often, trip interruption is when you decide to end your trip and come home early. You might also need to interrupt your trip, then rejoin it a bit later. Alternatively, trip interruption can also include starting your trip later than planned.

For example, let’s say you’re vacationing in the Caribbean. Four days into your one-week trip, the NOAA Hurricane Center issues a hurricane warning for your destination. Your trip interruption insurance coverage would likely reimburse you for insured expenses related to returning home early because of the hurricane .

In these types of scenarios, there’s the potential to lose prepaid trip expenses because you altered your itinerary. With an interruption, you might not have used your airfare or part of a hotel reservation. Your ability to recover some of those expenses could come down to whether you have travel insurance.

Trip Interruption Insurance Coverage

In general, trip protection often includes coverage for:

- The prepaid, nonrefundable trip expenses that have gone unused if you must interrupt your trip. Trip protection can also cover trip cancellation and trip delay.

- Medical expenses if you get sick or hurt during your trip.

- Reimbursement for baggage and personal belongings that get lost, stolen, damaged, or destroyed during your trip.

Trip interruption can be helpful if you have to change your travel plans like we mentioned above. To be reimbursed for those prepaid, nonrefundable trip payments you weren’t able to use, the interruption must be triggered by a covered reason stated in your plan document. These covered reasons, or triggers, can vary from one company to the next, and from one plan to the next.

Common trip interruption covered reasons

There are typically many other triggers as well, such as inclement weather and strikes. It’s worth looking into the details when considering a plan. Knowing what’s covered and what isn’t can make a big difference if you need to make a claim later.

The trip interruption benefit triggers above might be the most common reasons you’d need to interrupt your trip, but they aren’t the only reasons. For example, what if you're in the Bahamas and a big storm moves in? If it’s not a named hurricane, it might not meet the criteria to be a trip interruption trigger. But that doesn’t mean you want to sit around on a rainy island. In a situation like this, Interruption for Any Reason coverage could help.

What is the Optional Interruption for Any Reason Travel Insurance Benefit?

IFAR is an optional benefit you can add to certain (not all) trip protection plans that allows you to interrupt your trip for any reason not otherwise covered.

Instead of being limited to interrupting your trip for a specific list of triggers, you can now interrupt your trip for any reason you want. In our rainy Caribbean example above, you could use IFAR to be reimbursed for a portion of your insured trip costs that have gone unused because you chose to come home early and avoid the storm. Without IFAR, you’d lose those unused expenses plus be responsible for the cost of new flights or other transportation to return home ahead of schedule.

Why Do I Need the IFAR Travel Insurance Add-On?

The unexpected can happen at any time. We all get worried about whether we’ll have to cancel our trip, but unfortunate events can happen after we’ve already left, too. With the IFAR add-on, you can interrupt your trip while saving a portion of your investment.

If you’re concerned an unusual event could make you need or want to come home early, Interruption for Any Reason is a great option to consider. With IFAR, you’ll still be protected even if you don’t meet the requirement of a specific trip interruption trigger.

How Can IFAR Help Me?

Let’s say you’re traveling in Europe, and as you’re concluding the part of your trip that took you through Germany, you hear about an outbreak of bed bugs in many Paris hotels. France is the next stop on your itinerary, but now you’re not sure you want to risk it, no matter how romantic the City of Light sounds.

Bed bugs are not a covered reason in most trip protection plans, so if you decided to cut your trip short and return home early, those expenses would not be covered by your travel insurance. But if you have IFAR, you could get a portion of those unused insured trip expenses back.

This is just one hypothetical example. It’s important to remember that each plan can vary. Still, other scenarios where Interruption for Any Reason can help include:

- Personal reasons or family issues

- An argument with a travel companion

- Changing your mind about travel or your destination

- Feeling unsafe due to political unrest or the state of the economy

How Does Interruption for Any Reason Coverage Work?

IFAR offers great flexibility, but it’s still important to understand how it works. If you add the benefit but don’t use it correctly, your claim could be denied.

Expect to pay more to get more.

If you choose to add IFAR, you will pay more for your insurance. This additional expense is relatively small, typically increasing the cost of your trip protection plan by 3% to 12%. This increased cost is because your plan now covers a wider range of situations.

Know the required time frame.

You must buy the Interruption for Any Reason travel insurance add-on within a specified time limit. This is generally within the plan’s stated time period from the date you made your first trip payment.

Seven Corners Trip Protection plans require benefits like IFAR and CFAR to be purchased within 20 days of your initial trip deposit. So if you booked a nonrefundable deep-sea fishing excursion on March 1 for your Caribbean vacation, you must add IFAR by March 20. If you add reservations to your trip later and have more expenses you want to insure, you can update your coverage within 15 days of making those new deposits.

Interrupt your trip during the required time frame.

Your trip interruption must occur 48 hours or more after your scheduled departure date in order to be covered. Only after those 48 hours can IFAR reimburse you for the unused portions of your insured trip expenses and additional transportation expenses.

Understand reimbursement is limited.