After slow end to 2022, the business travel outlook is turning more positive for 2023

There is a growing sense that lower levels of business flying are here to stay, with many still expecting top executives to set corporate flying reduction targets, driven by cost savings, changing travel habits and sustainability needs.

Messaging regarding the recovery of the business travel segment remains mixed.

Since the onset of the COVID-19 pandemic, a number of the industry's leading voices have claimed that business travel will never fully recover due to changing working habits - namely, remote working and digital nomadism; company cost reduction; and a growing awareness of environmental issues.

Indeed, international business travel has been recovering at a much slower rate than leisure tourism.

- Recovery in business travel slowed in 2H2022...but rapid recovery is expected for 2023.

- Confidence in business travel nearly fully recovered to the levels from before the COVID-19 pandemic.

- Suppliers are highly optimistic about the outlook for business travel; higher spend trend echoed by travel buyers and procurement professionals.

- Customer meetings and new business prospects to hold weight of business travel investment.

- A large part of the recovery in US business travel spending has been due to the growth of prices - such as for airfares, car rentals and accommodation.

- COVID-19 has produced a range of changes that have modified the landscape of demand for business travel globally.

- Hybrid and remote working arrangements have persisted for a large proportion of workforces globally.

- Additional layers of corporate travel approvals and duty of care arrangements introduced during the pandemic have proved stubborn to remove.

- Sustainability considerations are also weighing much more heavily on travel activity.

Recovery in business travel slowed in 2H2022...

The global recovery in business travel experienced a pause over much of 2H2022.

After a rapid bounce-back of business travel during 1H2022, the expectation had largely been that the sector would have a continued, if steady, recovery over the second half of the year. However, in the face of rising travel costs due to inflationary pressures, airline operational chaos across multiple regions, and wider concerns about the macroeconomic outlook - businesses revised their plans and travel and budgets were largely static.

This was clearly evident when listening to comments from some of the leading airlines in the US , where business travel recovery had been strong.

In early Dec-2022 United Airlines CEO Scott Kirby stated that business travel had "plateaued" in late 2022, adding that this was "indicative of pre-recessionary behaviour". Delta Air Lines President Glen Hauenstein reported at the start of Jan-2023 that corporate travel demand had been "steady" over 4Q2022, with domestic corporate sales recovering to 80% of 4Q2019 levels.

Alaska Airlines CEO Ben Minicucci reported that large Silicon Valley technology companies had largely "turned off" business travel in late 2022.

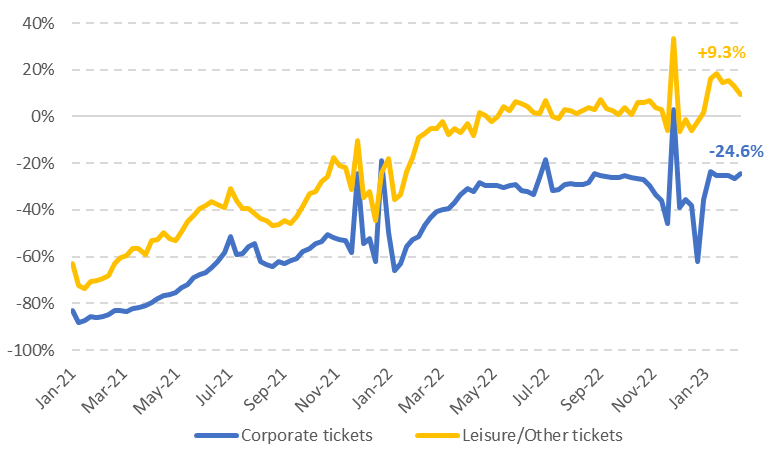

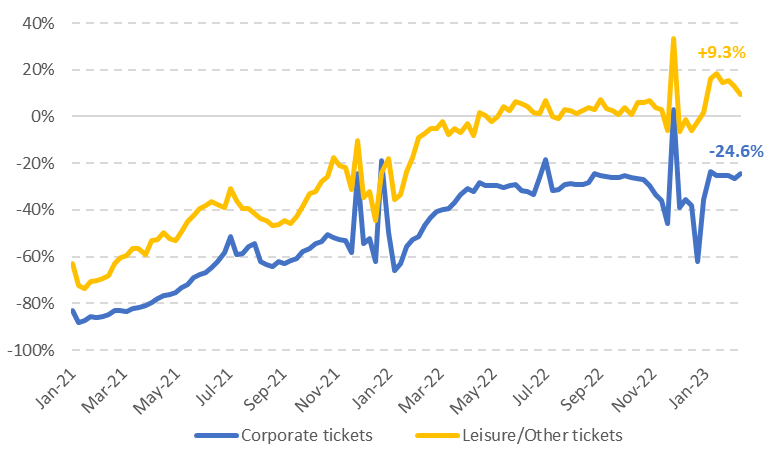

Airlines Reporting Corporation : US corporate and leisure ticket bookings (percentage vs 2019), 2021-2023

Source: Airlines Reporting Corporation .

...but rapid recovery expected for 2023

Despite the recent slowing performance, there is an increasing undercurrent of positive expectations for business travel for 2023.

Airlines, corporate travel management organisations, travel agencies and business travel associations are now pointing to a rapid recovery for 2023, particularly when it comes to business spending.

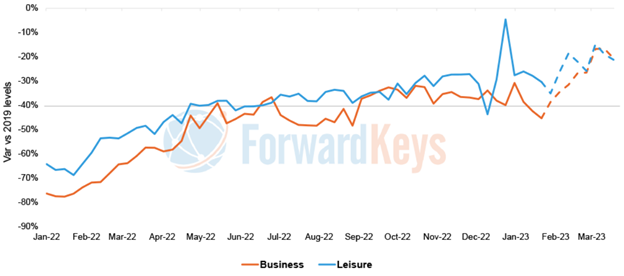

Global forward-ticketing data from Forward Keys indicates that after a slowing in business ticket sales over 2H2022, forward sales indicate that corporate air travel is due to accelerate through the early part of 2023.

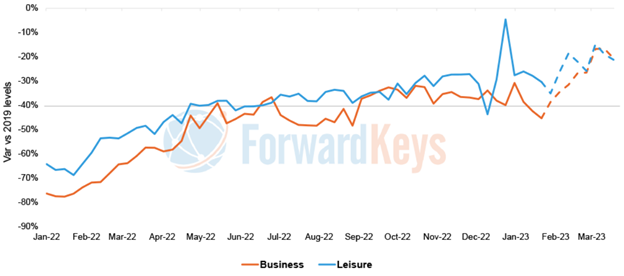

ForwardKeys: forward business and leisure air ticket data, 2022-2023

Source: ForwardKeys.

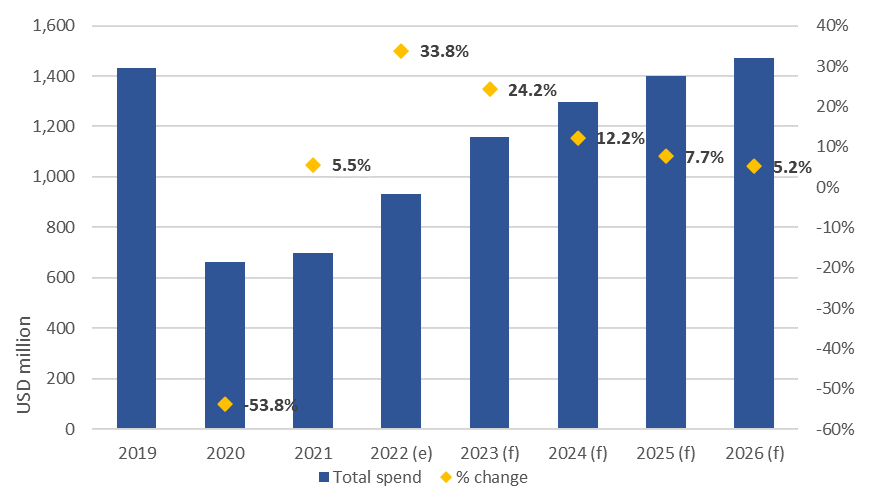

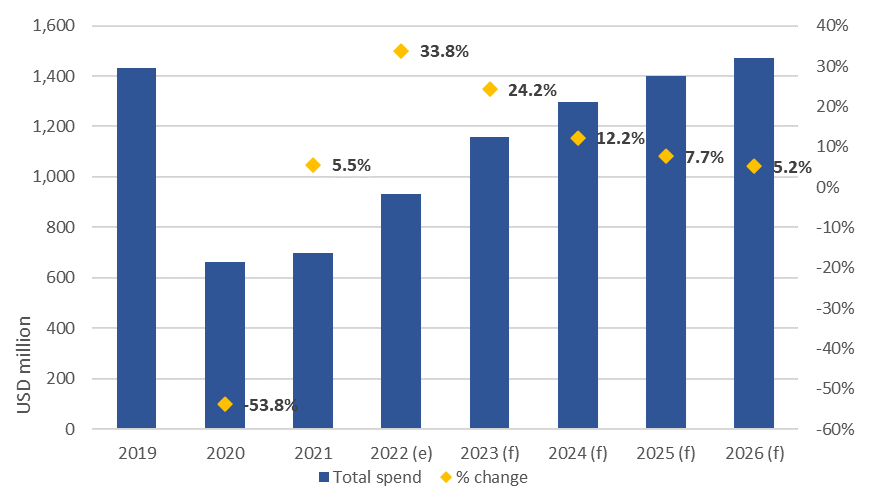

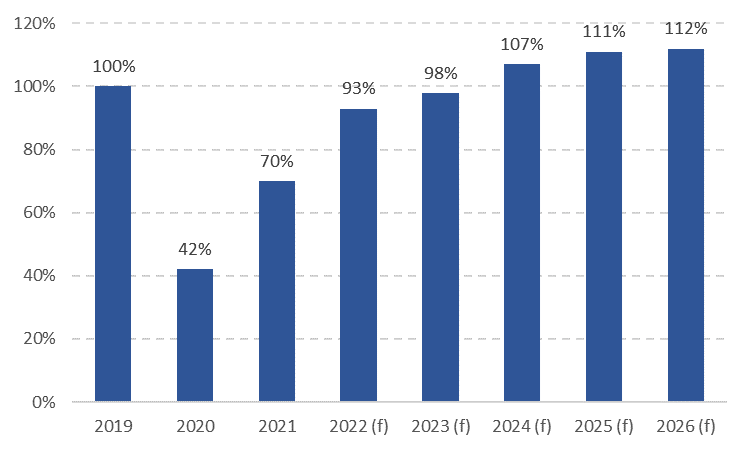

The Global Business Travel Association (GNTA) projects global business travel spending of just under USD1.2 trillion in 2023.

While this is still down, around USD273 billion down on 2019 levels (-19.1%), the outlook is for overall spending to increase 24.2% year-on-year for 2023.

GBTA : business travel spending outlook, 2019-2026

Source: Global Business Travel Association .

Confidence in business travel nearly fully recovered to levels before the pandemic

GBTA 's Business Travel Outlook Poll for 1Q2023 found expectations for business travel in 2023, with confidence nearly fully recovered to levels before the COVID pandemic.

Of travel buyers - 91% reported that they feel that employees at their company are now either 'somewhat willing' or 'very willing' to travel for work in the current environment.

This is up from just 64% of reported workers who were willing to travel in Feb-2022, and 86% in Oct-2022.

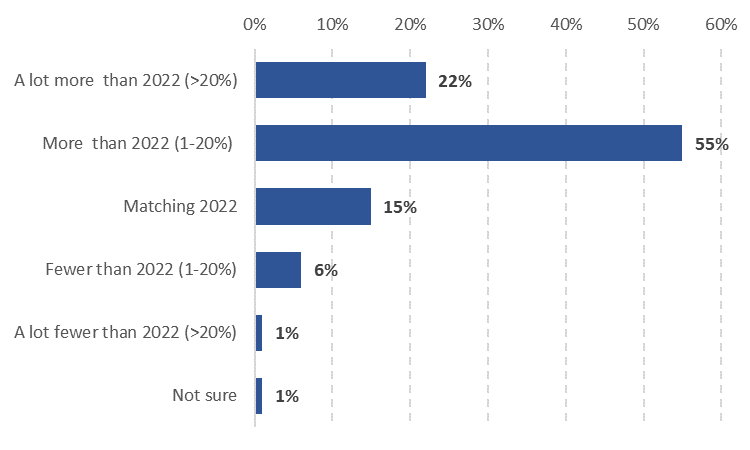

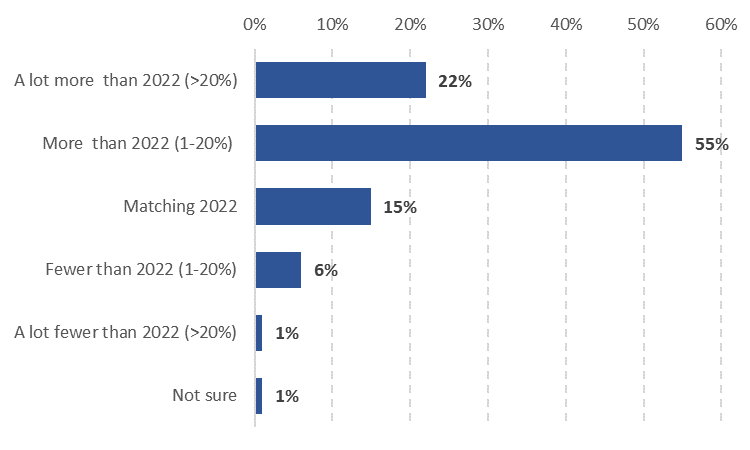

According to GBTA 's polling, 78% travel managers globally expect their companies will engage in more business travel in 2023.

Expectations about travel volumes increases are almost uniform between the North America , Latin America , Europe and the Asia Pacific regions.

Just 7% of travel managers expect reduced travel.

Reduced travel expectations are lowest with travel managers in North America (6%) and the Asia Pacific (7%), and higher with managers in Europe (10%) and Latin America (13%).

Travel buyer/procurement: professional expectations for 2023 business travel volumes

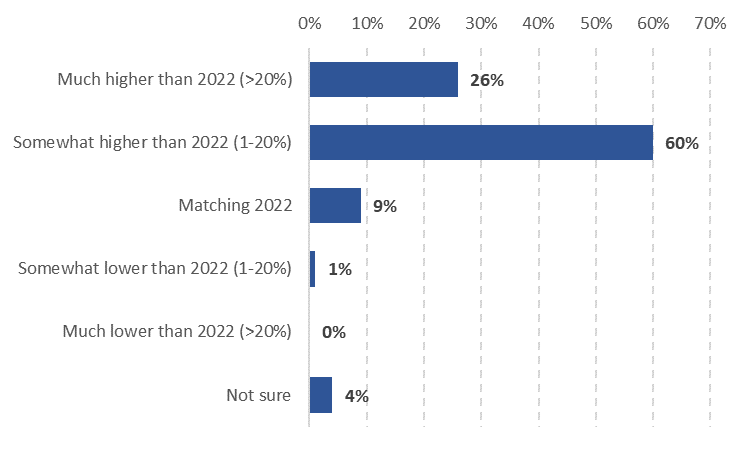

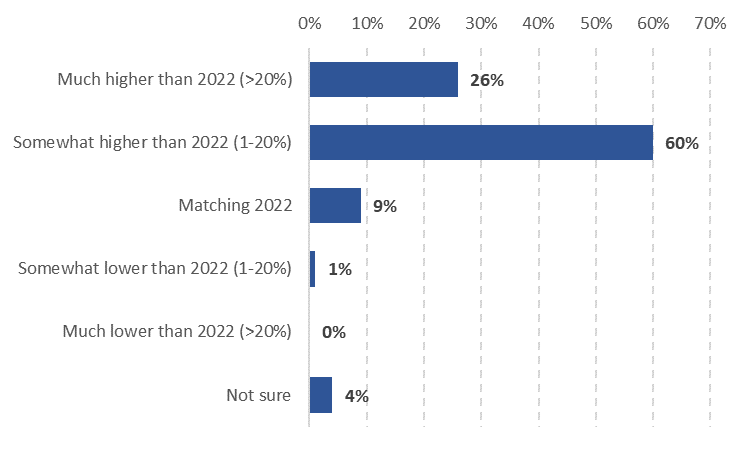

More travel suppliers expect increased spending on travel by their corporate customers

Further to this, GBTA 's data shows that 86% of travel suppliers expect spending on travel by their corporate customers will increase in 2023 - up from 80% in the association's Oct-2022 survey.

This confidence is high, regardless of region - all travel suppliers surveys in the Asia Pacific expect spending to be somewhat or much higher than it was in 2022, followed by 91% in Latin America , 90% in Europe and 85% in North America .

Just 1% expect reduced spending by corporate customers.

Travel supplier/travel management company: expectations for 2023 business travel spending

Suppliers are also highly optimistic about the outlook for business travel.

According to GBTA polling, 24% report feeling 'very optimistic' about the industry's path to recovery, and 65% are optimistic. Just 3% report they are pessimistic about the outlook.

Travel suppliers expectations about higher spend are echoed by travel buyers and procurement professionals. Of those polled, 46% expect a higher budget for travel programmes for 2023 when compared to 2022, while 41% expect budgets will be about the same as the previous year.

Customer meetings and new business prospects to hold weight of business travel investment

The key area for business travel spending in 2023 is expected to be for trips for sales staff or account managers to meet with customers or new business prospects.

On average, travel managers estimate that their companies will allocate 28% of their travel spend for these purposes in 2023. This is followed by spending on trips for internal company meetings (19%) and spending on attending conferences, trade shows and other industry events (18%).

North American business travel to return to close to normal in 2023

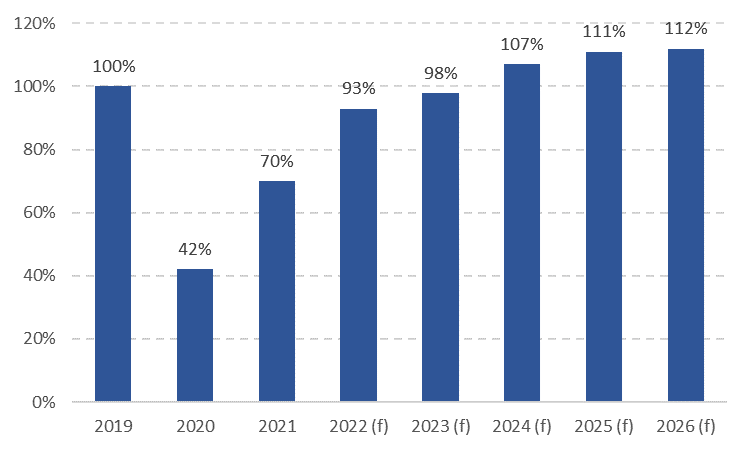

The US Travel Association (USTA) project that the volume of business travel by air will recover to around 98% of pre-pandemic levels in 2023, with recovery back above 100% in 2024.

Domestic travel is at or above pre-pandemic levels, but international arrivals are still in recovery mode.

For 2022, inbound arrivals by foreign nationals into the US were down 24% compared to 2109. This was chiefly due to the slow rebound of traffic from the Asia Pacific , as well as some sluggishness in the early part of the year in Europe and parts of Latin America .

As of the start of Feb-2023, arrivals from mainland China were down 97% when compared to 2019, and arrivals from Hong Kong were still down by 80%.

Inbound travel from Japan was down 41.6%, and from Australia it was down 30.4%.

From Europe , UK arrivals were down 18.5%, while arrivals from Italy were still 14.2% below pre-pandemic levels and German arrivals were down 7%. Of the main Latin American markets, arrivals from Brazil were still a third below 2019 levels.

USTA estimates for Dec-2022 were that US business travel spending would be USD97 billion, which was an increase of 3% compared to pre-pandemic levels.

US business travel forecast: volume, percentage of 2019 levels, 2019-2026

Source: US Travel Association.

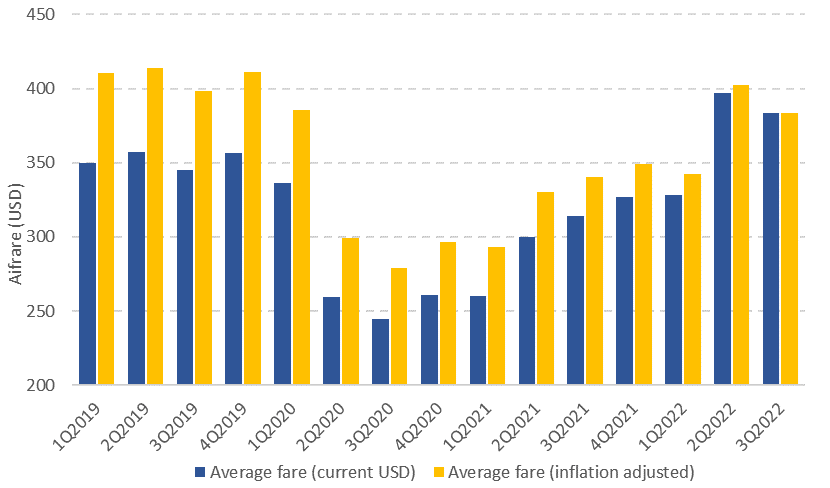

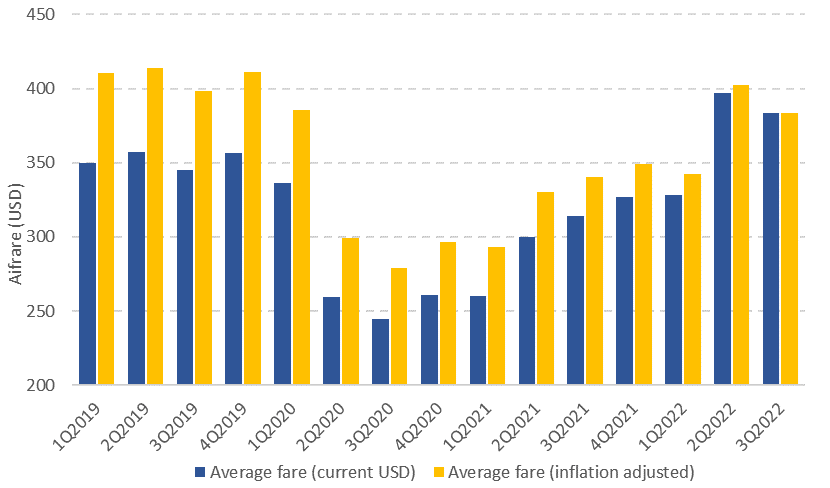

A large part of the recovery in US business travel spending has been due to the growth of prices, such as for airfares, car rentals and accommodation.

According to the USTA, airfares rose 28.5% year-on-year for the full year 2022.

US Bureau of Transport Statistics data shows US domestic fares averaged USD384 in 3Q2022. This is up from an (inflation adjusted) average domestic fare of USD279 in 3Q2020, an increase of 37.4% over the two-year period, and up 12.8% over the past 12 months.

US average domestic round trip airfares, by quarter, 1Q2019- 3Q2022

Source: US Bureau of Transportation Statistics.

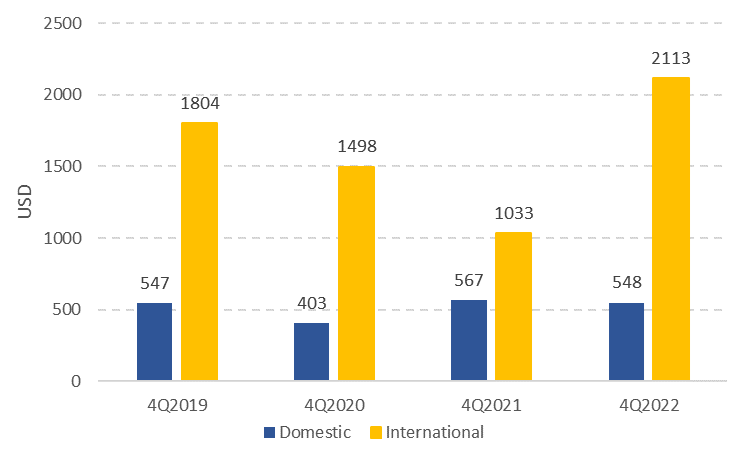

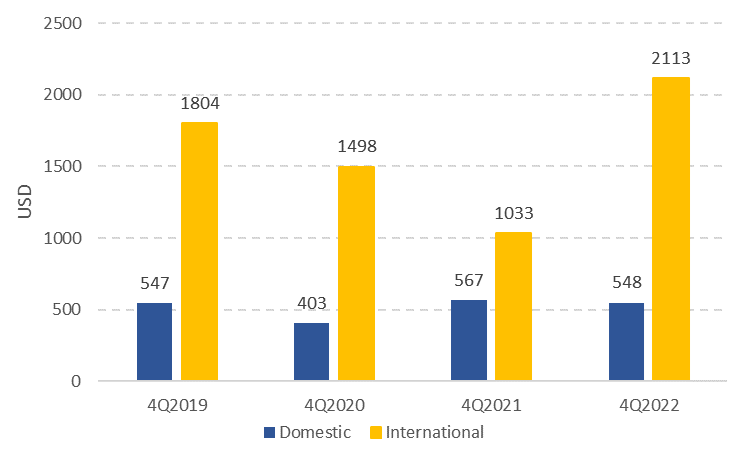

Data from the corporate travel solutions provider Emburse shows that average spend per round trip domestic business travel by air for 4Q2022 was USD548, putting it just ahead of 4Q2019 levels.

Spend per round trip on international business travel was significantly higher: USD2113 in 4Q2022, vs USD1804 in 4Q2019 (an increase of 17.1%).

Domestic and international air travel: average spend per round trip, 4Q2019-4Q2022

Source: Emburse.

New hope for full recovery in 2023

COVID-19 has produced a range of changes that have altered the landscape of demand for business travel globally - some of which have slowed the recovery, and others that are contributing to business travel coming back, albeit in modified form or with higher spending.

Hybrid and remote working arrangements have persisted for a large proportion of workforces globally, cutting into historical business travel volumes, while at the same time creating greater demand for 'bleisure' travel.

Although video conferencing technology became ubiquitous during the pandemic, enterprises continue to report strong demand for face-to-face meetings, particularly given the uncertainties in global supply chains and the need to train new staff working from remote locations.

Additional layers of corporate travel approvals and duty of care arrangements introduced during the pandemic have proved stubborn to remove - particularly in large corporations. The response has been to consolidate multiple smaller business trips into larger - and often more costly - single trips.

In this same vein, sustainability considerations are also weighing much more heavily on travel activity, but businesses have also shown greater willingness to spend money to be good corporate citizens and offset the impact of their travel.

Despite the structural trends and concerns about an economic slowdown in developed economies, business travel has renewed its upwards trend.

Although the recovery is happening more slowly than expected, and is still well below where most airlines would like it to be, there is renewed confidence in the recovery outlook for 2023.

Want More Analysis Like This?

- Business Travel

- Personal Travel

- Meetings & Events

- Account Management

- Travel Counselor

- Travel Policy

- Supplier Negotiations

- Gamification

- Performance

- Online Adoption

- Implementation

- Travel Analytics

- Unused Tickets

- Contract Optimization

- Hotel Consulting

- Travel Sourcing

- Travel Alerts

- Locate & Communicate

- Medical & Evacuation

- Online Booking

- 24-Hour Support

- International Tools

- Communications

- Travel Portal

- Global Services

- Find Your Solution

- Case Studies

- Featured Insights

- Concur Login

- GetThere Login

- NuTravel Login

- Invoices On-Demand

- Direct Data

- Visa/Passport

Navigator Blog > Shifting into Focus: 2022 Business Travel Forecast

Shifting into Focus: 2022 Business Travel Forecast

Like the temporary blur of a camera lens before it shifts into focus, the picture ahead for business travel in 2022 appears to be sharpening into a clear view despite a hazy start to the New Year.

Even as omicron variant concerns challenge an industry accustomed to COVID-19 setbacks , the year ahead promises rapid growth. Just how quickly and how far business travel will rebound depends on a variety of economic factors, including evolving variants, supply chain limitations, and staffing shortages. While companies and their travelers can’t control those elements, they can plan ahead and mitigate risk in their corporate travel programs. Below we take a look at where the industry is at today and where it’s heading next with our 2022 forecast.

Coronavirus Variants Projected to Lose Steam

The current wave of COVID-19 has spread so swiftly and pervasively that you would be hard pressed to find anyone working in the corporate sphere who has not been directly exposed or impacted. Yet, with case counts hitting a daily record of 1 million in the U.S. alone , there are now signs that the latest surge will peak in January before falling off at the end of the month.

Unlike past surges, which were characterized by a two-month cycle of peaks and subsequent lows , the far-reaching spread of omicron may finally break this pattern. In fact, scientists are already speculating that it may be the last “variant of concern” as omicron staves off less efficient mutations of the virus.

For businesses, this does not mean a COVID-free world, but it does mean a more a manageable, less threatening form of the virus for vaccinated individuals that occurs on a seasonal basis similar to the flu. Companies should consider this when making changes to their employee wellness and travel program policies. While the same rigorous standards of testing and protocol currently in place may not be required in the future, an overall attention to wellness and encouraging sick travelers to stay home will remain critical.

Navigating Supply Chain and Staffing Hurdles

COVID-19 has consumed the attention of businesses for so long that the full extent of the aftermath it will leave behind is only now becoming apparent. The constant change and uncertainty of the past two years have left organizational supply chains broken and staffing structures in disrepair.

Take for instance airlines, which have been forced to cancel tens of thousands of flights globally , due to staffing shortages exacerbated by the spread of omicron. While this scale of disruption threatens to wreak havoc on business travel, it can be tied directly to the rise and decline of COVID. According to the latest report from McKinsey & Company , as the virus recedes, so will the pandemic-induced changes to consumer demand and employment trends. Similarly, once the initial backlog created by supply chain disruptions is cleared, the economy can resume pace and even grow.

With this will come growing pains, similar to what business travelers experienced last summer , such as longer wait times and travel suppliers stretched thin. For businesses mapping out their travel for the year, plan in advance to lock in more favorable rates and conditions now before demand climbs later in the year and hampers buyer negotiating power. Add a safety net by booking with suppliers who offer flexible cancellation policies in case predictions regarding the slowing of COVID take longer than expected.

Business Travel Primed for Growth

Despite the temporary setback posed by omicron, experts are bullish on the outlook for business travel in 2022. Increasing vaccination rates, widely available booster shots, and a general eagerness by travelers to return to the road , all hint at a busy year for travel ahead.

Both the lodging and airline industries are planning accordingly. Delta Air Lines predicts its capacity will be at 90 percent of pre-pandemic levels by the end of 2022 , and CBRE projects U.S. occupancy levels will fall just short of 2019 levels . Recent research from a variety of sources seems to support these predictions. The U.S. Travel Association expects domestic business travel spending will reach 76 percent of 2019 levels this year , with a full recovery by 2024.

Although event cancellations and changes to travel plans are an inevitable part of the recovery process, more businesses are taking a measured “wait and see” approach with each new variant. A survey from GBTA reflects this shift in mindset, with poll respondents indicating their companies were less likely to pause travel plans due to omicron than they were the delta variant . Should a new variant emerge after omicron, it will likely pose less of a disruption to travel, at least not on a widespread scale.

Prepare Your Program

Is your travel program prepared for the next stage of growth and recovery? 2022 presents an opportunity for businesses to shift the focus of their travel programs from a reactive mode to an informed approach that prioritizes taking ownership of the factors they can control.

Direct Travel will be sponsoring a BTN webinar featuring key thought leaders and their insights on this topic, February 10 th at 1 p.m. ET. The webinar will explore how to keep your travelers apprised of the latest changes to travel, ways to prioritize the safety and security of employees on the road, and tips for negotiating with suppliers in the new environment. Subscribe to the Navigator blog to be updated when registration opens for the BTN webinar .

Subscribe to the Navigator Blog:

Copyright 2023 by Direct Travel | Privacy Statement | Terms Of Use | GDPR Privacy Notice

- Travel, Tourism & Hospitality ›

Business Travel

Global business travel - statistics & facts

Business travel costs, covid-19 impact on business travel, key insights.

Detailed statistics

Global business travel spending 2001-2022

World's best-rated destination countries for non-leisure tourists 2021

Growth rate of global business travel spending 2001-2026

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Global corporate travel market size 2020-2028

Meetings & Events

Global MICE industry size 2019-2030

Business Travel Spending

Countries with highest business travel spending 2023

Related topics

Recommended.

- Travel agency industry

- Tourism worldwide

- Online travel market

- COVID-19: impact on the tourism industry worldwide

- Coronavirus (COVID-19): impact on health and hygiene in the tourism industry worldwide

Recommended statistics

Business travel market.

- Premium Statistic Global corporate travel market size 2020-2028

- Basic Statistic Distribution of travel and tourism expenditure worldwide 2019-2022, by type

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Growth rate of global business travel spending 2001-2026

- Premium Statistic Countries with highest business travel spending 2023

- Premium Statistic World's main travel agencies 2020, by sales share

- Premium Statistic Expectations of business travel providers about revenue at their companies 2022

- Premium Statistic Buyers' expectations about business travel volume at their companies 2022

Market value of the business travel industry worldwide in 2020, with a forecast for 2028 (in billion U.S. dollars)

Distribution of travel and tourism expenditure worldwide 2019-2022, by type

Distribution of travel and tourism spending worldwide in 2019 and 2022, by type

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Percentage change in expenditure of business tourists worldwide from 2001 to 2022, with forecast until 2026

Leading business tourism markets worldwide in 2023, based on total travel spending (in billion U.S. dollars)

World's main travel agencies 2020, by sales share

Leading travel companies worldwide in 2020, by share of global sales

Expectations of business travel providers about revenue at their companies 2022

Expected change in revenue from business tourism for travel management companies worldwide as of January 2022

Buyers' expectations about business travel volume at their companies 2022

Expected change in the volume of business travel services purchased by travel managers at companies worldwide as of January 2022

Association meetings and events

- Premium Statistic Number of international organization meetings worldwide 2015-2021

- Premium Statistic Share of international organization meetings worldwide 2001-2020, by region

- Premium Statistic Outlook on event spaces available in hotels worldwide 2022

- Premium Statistic Hoteliers' predicted business event spend worldwide 2022

- Premium Statistic Preferred corporate events' setup worldwide 2023, by region

Number of international organization meetings worldwide 2015-2021

Number of meetings held by international associations worldwide from 2015 to 2021 (in 1,000s)

Share of international organization meetings worldwide 2001-2020, by region

Distribution of international association meetings held worldwide between 2001 and 2020, by region

Outlook on event spaces available in hotels worldwide 2022

Expectations of hoteliers on the availability of meeting spaces worldwide in 2022

Hoteliers' predicted business event spend worldwide 2022

Expected change on business meeting spend according to hoteliers worldwide in 2022

Preferred corporate events' setup worldwide 2023, by region

Favorite formats of business meetings planned worldwide in 2023, by region

Exhibitions and trade shows

- Premium Statistic COVID-19 impact on exhibitions and trade shows worldwide 2020

- Premium Statistic Operation of the global exhibition industry 2022-2023

- Premium Statistic Main influencing aspects to exhibit at trade shows 2020-2021

- Premium Statistic Challenges of the global exhibition and trade show industry 2022

- Premium Statistic Comparison between digital and live exhibitions by visitors worldwide 2021

- Premium Statistic Largest exhibition halls worldwide 2022, by gross hall capacity

COVID-19 impact on exhibitions and trade shows worldwide 2020

Key figures on the economic impact of the coronavirus (COVID-19) pandemic on the exhibition industry worldwide in 2020

Operation of the global exhibition industry 2022-2023

Operation of exhibitions and trade shows worldwide in 2022 and predictions for 1st half 2023

Main influencing aspects to exhibit at trade shows 2020-2021

Leading factors influencing the decision of exhibitors to participate in events and trade shows worldwide in Q2 2020 and Q2 2021

Challenges of the global exhibition and trade show industry 2022

Most important issues facing the exhibition industry worldwide as of December 2022

Comparison between digital and live exhibitions by visitors worldwide 2021

Opinions on virtual versus in-person exhibitions and trade shows according to visitors worldwide as of 2021

Largest exhibition halls worldwide 2022, by gross hall capacity

Largest exhibition halls worldwide as of February 2022, by gross hall capacity (in 1,000 square meters)

Destinations

- Premium Statistic World's best-rated destination countries for non-leisure tourists 2021

- Premium Statistic Countries planning the largest number of business events and trade fairs 2023

- Premium Statistic Main country destinations for business meetings 2022

- Premium Statistic World's main cities for MICE tourism 2020

- Premium Statistic World's highest-priced business travel destinations Q4 2022

- Premium Statistic Highest hotel expenses in business travel destinations Q4 2022

- Premium Statistic Inbound business travel volume in selected countries worldwide 2019

World's best-rated destination countries for non-leisure tourists 2021

Leading countries for non-leisure travel worldwide in 2021, based on the Travel and Tourism Development Index

Countries planning the largest number of business events and trade fairs 2023

Leading host countries for conferences and trade shows planned worldwide as of August 2023, by number of events

Main country destinations for business meetings 2022

Leading countries for association meetings and events worldwide in 2022, by number of in-person events

World's main cities for MICE tourism 2020

Leading cities for association meetings worldwide in 2020, by number of regional events

World's highest-priced business travel destinations Q4 2022

Most expensive cities for business tourism worldwide in 4th quarter 2022, by average daily costs (in U.S. dollars)

Highest hotel expenses in business travel destinations Q4 2022

Most expensive cities for business tourism worldwide in 4th quarter 2022, by daily hotel cost (in U.S. dollars)

Inbound business travel volume in selected countries worldwide 2019

Number of international business tourist arrivals in selected countries worldwide in 2019 (in millions)

Business travel amid COVID-19

- Premium Statistic COVID-19: main barriers for international business tourism worldwide 2022

- Basic Statistic Impact of COVID-19 travel restrictions on business outcomes 2022

- Premium Statistic Change in business travel bookings for travel suppliers 2021-2022

- Premium Statistic Tourism professionals' outlook for global business travel 2022-2023

- Premium Statistic Employees' disposition towards business travel worldwide 2020-2023

- Premium Statistic Most stressful factors of flying for work purposes 2022, by travel phase

- Premium Statistic Change in interest in bleisure travel by global corporate travel managers 2023

COVID-19: main barriers for international business tourism worldwide 2022

Leading obstacles for international business travel amid coronavirus (COVID-19) pandemic according to companies worldwide as of January 2022

Impact of COVID-19 travel restrictions on business outcomes 2022

Perceived effect of government travel restrictions amid the coronavirus (COVID-19) pandemic on companies worldwide as of February 2022

Change in business travel bookings for travel suppliers 2021-2022

Change in travel bookings from corporate customers reported by travel suppliers worldwide from February 2021 to September 2022

Tourism professionals' outlook for global business travel 2022-2023

Opinion of travel suppliers and travel management companies on the path to recovery from COVID-19 of the business travel industry worldwide from January 2022 to January 2023

Employees' disposition towards business travel worldwide 2020-2023

Willingness of employees to take business trips according to travel managers worldwide from November 2020 to January 2023

Most stressful factors of flying for work purposes 2022, by travel phase

Main stress aspects of a business air trip according to travelers worldwide as of March 2022, by stage of the trip

Change in interest in bleisure travel by global corporate travel managers 2023

Increase in interest of employees in combining business trips with leisure activities according to business travel buyers worldwide as of October 2023

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

At Morgan Stanley, we lead with exceptional ideas. Across all our businesses, we offer keen insight on today's most critical issues.

Personal Finance

Learn from our industry leaders about how to manage your wealth and help meet your personal financial goals.

Market Trends

From volatility and geopolitics to economic trends and investment outlooks, stay informed on the key developments shaping today's markets.

Technology & Disruption

Whether it’s hardware, software or age-old businesses, everything today is ripe for disruption. Stay abreast of the latest trends and developments.

Sustainability

Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics.

Diversity & Inclusion

Multicultural and women entrepreneurs are the cutting-edge leaders of businesses that power markets. Hear their stories and learn about how they are redefining the terms of success.

Wealth Management

Investment Banking & Capital Markets

Sales & Trading

Investment Management

Morgan Stanley at Work

Sustainable Investing

Inclusive Ventures Group

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals.

We have global expertise in market analysis and in advisory and capital-raising services for corporations, institutions and governments.

Global institutions, leading hedge funds and industry innovators turn to Morgan Stanley for sales, trading and market-making services.

We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions.

We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

We provide comprehensive workplace financial solutions for organizations and their employees, combining personalized advice with modern technology.

We offer scalable investment products, foster innovative solutions and provide actionable insights across sustainability issues.

From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success.

Core Values

Giving Back

Sponsorships

Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Underpinning all that we do are five core values.

Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back.

Morgan Stanley leadership is dedicated to conducting first-class business in a first-class way. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years.

The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

Morgan Stanley is differentiated by the caliber of our diverse team. Our culture of access and inclusion has built our legacy and shapes our future, helping to strengthen our business and bring value to clients.

Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research.

At Morgan Stanley, giving back is a core value—a central part of our culture globally. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best asset—Morgan Stanley employees.

As a global financial services firm, Morgan Stanley is committed to technological innovation. We rely on our technologists around the world to create leading-edge, secure platforms for all our businesses.

At Morgan Stanley, we believe creating a more equitable society begins with investing in access, knowledge and resources to foster potential for all. We are committed to supporting the next generation of leaders and ensuring that they reflect the diversity of the world they inherit.

Why Morgan Stanley

How We Can Help

Building a Future We Believe In

Get Started

Stay in the Know

For 88 years, we’ve had a passion for what’s possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

At Morgan Stanley, we focus the expertise of the entire firm—our advice, data, strategies and insights—on creating solutions for our clients, large and small.

We have the experience and agility to partner with clients from individual investors to global CEOs. See how we can help you work toward your goals—even as they evolve over years or generations.

At Morgan Stanley, we put our beliefs to work. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give back—all to contribute to a future that benefits our clients and communities.

Meet one of our Financial Advisors and see how we can help you.

Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

- Opportunities

- Technology Professionals

Experienced Financial Advisors

We believe our greatest asset is our people. We value our commitment to diverse perspectives and a culture of inclusion across the firm. Discover who we are and the right opportunity for you.

Students & Graduates

A career at Morgan Stanley means belonging to an ideas-driven culture that embraces new perspectives to solve complex problems. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

Experienced Professionals

At Morgan Stanley, you’ll find trusted colleagues, committed mentors and a culture that values diverse perspectives, individual intellect and cross-collaboration. See how you can continue your career journey at Morgan Stanley.

At Morgan Stanley, our premier brand, robust resources and market leadership can offer you a new opportunity to grow your practice and continue to fulfill on your commitment to deliver tailored wealth management advice that helps your clients reach their financial goals.

- Dec 21, 2022

2023 Outlook: Business Travel Bounces Back

Corporate travel budgets are recovering to pre-covid levels, our new survey finds. see where companies are spending in the year ahead..

After grinding to a near halt during the COVID-19 pandemic, business trips—and profits for hotels and airlines catering to higher-paying corporate clients—are bouncing back even beyond pre-pandemic levels, per a recent survey from Morgan Stanley Research.

Despite higher airfares and room rates, the survey of 100 global corporate travel managers found that many respondents believe their company's travel expenditures are already back to pre-pandemic levels and will continue to grow. The biggest demand is coming from small companies, which means lower-cost airlines may benefit the more than their bigger peers.

“Travel budgets are expected to see a noticeable improvement in 2022, with 2023 nearly back to ‘normal,’” says Ravi Shanker, an equity analyst covering North American transportation. “Most interesting is that nearly half of the respondents expect 2023 budgets to increase versus 2019 overall. And of those that expect an increase in budgets, the majority believe 2023 budgets will be between 6% to 10% higher than 2019.”

Overall travel budgets show an improvement over previous surveys, with 2023 budgets expected to be 98% of 2019 levels on average.

Survey Highlights

- Smaller companies lead demand for corporate travel. More than two-thirds (68%) of companies with under $1 billion in annual revenue expect travel budgets to increase next year, versus just 41% of companies with annual revenues over $16 billion. Similarly, 32% of smaller companies said travel budgets had returned to pre-pandemic levels compared with 23% of big firms. “This trend could likely favor low-cost carriers, as smaller enterprises tend to be more localized and require less long-haul travel,” says Shanker. “However, the legacy carriers with strong corporate exposure should see gains as well.”

Nearly a quarter of both large and small companies say their firms are already back to pre-COVID travel levels, and 34% anticipate a full recovery by the end of 2023.

ESG Rate of Change

Holiday budgets hit by inflation, seeing a peak for food prices.

- Airfares are higher, but that’s not a drag on bookings. On average, corporate airfares are expected to be about 9% higher than pre-pandemic prices. “Clearly the expected increase in corporate airfares is not having a major impact on corporate travel as passenger volume is expected to be basically flat versus 2019,” says Shanker.

- Room rates will continue to rise, though not as fast as they have recently. As of this October, market room rates had spiked 20% to 25% over 2019. Next year they will rise even more, though by an average of just 8%, say respondents (9% in the U.S. and U.K.; 5% to 6% in Latin America, Asia and Africa).

- Hotels face economic and competitive headwinds. While overall travel budgets are growing, companies are cutting costs by trading down when it comes to accommodations. (Historically, budget hotels outperform upscale lodging in tough economic times.) Alternative sources of accommodation also threaten traditional hotels, with 31% of respondents saying they intend to use short-term rental services in the next year.

- Virtual meetings aren’t going away. Almost 18% of corporate travel will be replaced with virtual meetings, falling slightly to 17% in 2024, suggesting a degree of permanence in the shift with companies recognizing the benefits of virtual meetings ranging from cost savings to lower carbon footprints. Expect companies providing collaboration software to gain from this shift.

For more Morgan Stanley Research insights and analysis on global travel, ask your Morgan Stanley representative or Financial Advisor for the full reports, “Global Corporate Travel Survey: Snapping Back" (Nov. 8, 2022) and “Global Corporate Travel Survey: 2023 Travel Budgets Nearly Back to 2019 Levels, but ~20% of Meetings Could Still Shift to Virtual” (Nov. 8. 2022). Morgan Stanley Research clients can access the reports directly here and here . Plus more Ideas from Morgan Stanley’s thought leaders.

Sign up to get Morgan Stanley Ideas delivered to your inbox.

*Invalid email address

Thank You for Subscribing!

Would you like to help us improve our coverage of topics that might interest you? Tell us about yourself.

Dividends: A Volatility Shield

Dividend-paying stocks with steady distribution growth can offer outsized contributions to long-term portfolio returns.

Global Outlook: Tech & Beyond

Disruption in connected advertising, a digital-driven economic boom in India and more trends in tech, media and telecom.

Building Credit for Immigrants

Wemimo Abbey and Samir Goel present credit solutions for immigrants financially marginalized by America’s credit validation system.

- Share full article

Advertisement

Supported by

Travel’s Theme for 2022? ‘Go Big’

With Omicron cases ebbing, the industry is looking for a significant rebound in spring and summer. Here’s what to expect, in the air, at the rental car counter and beyond.

By The New York Times

As governments across the world loosen coronavirus restrictions and shift their approach to accepting Covid-19 as a manageable part of everyday life, the travel industry is growing hopeful that this will be the year that travel comes roaring back.

Travel agents and operators have reported a significant increase in bookings in recent weeks for the upcoming spring and summer seasons. The World Travel & Tourism Council (W.T.T.C.), which represents the global travel and tourism industry, projects that travel and tourism in the United States will reach prepandemic levels in 2022, contributing nearly $2 trillion to the U.S. economy. The council also anticipates outbound travel from the United States will increase; it projects bookings over the Easter holiday period to be up by 130 percent over last year.

“Our latest forecast shows the recovery significantly picking up this year as infection rates subside and travelers continue benefiting from the protection offered by the vaccine and boosters,” said Julia Simpson, the president and chief executive officer of the W.T.T.C. “As travel restrictions ease and consumer confidence returns, we expect a welcome release of pent-up travel and demand.”

While uncertainty remains over the course of the pandemic and government policies on mask mandates and testing requirements for travel, the industry is seeing a strong desire among travelers to take big bucket list trips this year, particularly to far-flung international destinations and European cities.

“Travel is no longer just about ‘going somewhere,’” said Christie Hudson, a senior public relations manager for Expedia. “Coming out of such a long period of constraints and limitations, 2022 will be the year we wring every bit of richness and meaning out of our experiences.”

Here are some of the trends you can expect to see.

Air Travel: Fewer restrictions, but for now the masks stay on

Flying in 2022 looks poised to be much like flying in 2021: reminiscent of prepandemic normal at times, infuriating at others. A primary difference is that there will be more people on planes and in airports — 150 percent as many passengers are expected to fly this year as did last year, according to The International Air Transport Association , which represents nearly 300 airlines.

In terms of where you can fly, you’ll have more options than last year. Destinations that have long been closed to most travelers, including Australia, the Philippines and Bali, have started reopening. Airlines have been gradually adding back old routes and expanding with new ones. In the spring, American Airlines, for example, plans to add six new routes from Boston. JetBlue will soon fly direct from New York City’s John F. Kennedy International Airport to Kansas City and Puerto Vallarta, Mexico, among other locations.

You’ll still need to check the latest entry requirements before flying internationally. There are currently more than 100,000 health and travel restrictions in place, according to Meghan Benton , a research director at the Migration Policy Institute, which tracks them. Though that’s around the same number as a year ago, she noted, there has been a move away from quarantines and outright bans of nonessential visitors toward vaccination and testing requirements. Recently, a growing number of destinations, including Britain, have also reconsidered the merits of entry testing.

That flight for a summer getaway could cost less than it did before the pandemic. Fares are down 18 percent from 2019, according to Airlines for America, which represents seven major airlines. In January, the cost of international airfares purchased hit an all-time low since Hopper, a booking app, began tracking them in 2014. Predicting whether, when and where they will rise is harder than it was before the pandemic, however, as new variants, evolving health threats, travel restrictions and pandemic psychology have upended traditional pricing patterns. Fortunately, most airlines are continuing to waive flight change fees on all but basic economy flights, said Brett Snyder, the founder of Cranky Flier , an airline industry site.

When flying in the United States, everyone will need to wear a mask until at least late March. That’s when the federal mask mandate is set to expire. It has been extended before and could be extended again. Dr. Anthony Fauci, the White House’s chief medical adviser, is among those who have said that masks on planes should be here to stay. Gary Leff, who writes about air travel for View from the Wing, a site focused on air travel, said he agrees with the betting markets , which predict that the mask mandate will go away by the November midterm elections. Regardless, there will be more alcohol in the air. On Feb. 16, Southwest will serve drinks for the first time in two years. — Heather Murphy

Lodging: Hotels fight back, sometimes with robots

This may be the year travelers return to hotels. In a report for the American Hotel & Lodging Association, Oxford Economics, an economic forecasting company, expects total bookings to nearly equal 2019 stays, though a significant source of revenue — more than roughly $48 billion spent before the pandemic on food and drink, meeting spaces and more — will largely remain missing, given the continued slump in business meetings and group events.

Leisure travelers have kept the industry afloat and in certain areas — especially mountain and coastal destinations — vacation business is booming. With record demand, rates rose at escapist resorts like the Chebeague Island Inn in Maine even in the traditional off-season months.

Now, corporate lodging specialists like Level Hotels & Furnished Suites , which has high-rise apartments in four cities including Seattle, are going after leisure travelers, touting amenities like fitness centers. And why not? During the pandemic, many travelers discovered the privacy offered by rental residences. According to AirDNA , which analyzes the short-term rental market, vacation home bookings were up between 30 and 60 percent in small cities and resort destinations compared to 2019, though big-city rentals are down about 25 percent.

Urban hotels hope to compete for digital nomads by adding stylish extended-stay properties, social attractions and better work spaces. Denver’s Catbird hotel offers ergonomic studios with kitchenettes, plus a rooftop bar and rental gear, including scooters, ukuleles and air fryers. The Hoxton chain’s Working From co-working spaces are attached to its hotels in Chicago and London.

Adapting to lean times, many hotels have outsourced operations beyond laundry and landscaping, into food and recreational services. The new app-based service Breeze works with hotels to provide room service either from on-site restaurants or neighboring ones.

The pandemic has also hastened the adoption of automation in hotels — such as keyless check-in, digital staff communication and room delivery by robots — as a cost-effective response to the labor shortage.

“High tech is the new high touch,” said Chekitan Dev, the Singapore Tourism Distinguished Professor of marketing and management at Cornell University’s hotel school.

Hotel sustainability initiatives look to go further than “towel-washing optional” offers.

Hilton plans to introduce what it says is the country’s first net-zero hotel this year with the solar-powered Hotel Marcel New Haven, Tapestry Collection in New Haven, Conn. SCP Hotels , which operates seven hotels around the country, aims to go zero-waste in 2022.

The industry’s focus on leisure travelers may inspire new diversions. A hotel that can no longer afford to employ 50 servers in its events department might use the space to hold a yoga class or a talk by a local designer, according to Vikram Singh, an independent hotel consultant. “These are the experiences people remember more than whether the pillow was soft,” he said. — Elaine Glusac

Rental Cars: Still pricey, and hard to get

This time last year, Jonathan Weinberg, the founder and chief executive of AutoSlash , an online service that makes and tracks discount car rentals, noticed that rental vehicles were unexpectedly scarce and overpriced for the mid-February Presidents’ Day break, an early indication of the post-vaccine travel rebound.

In 2022, it’s looking worse. A Feb. 1 search in Phoenix for the upcoming holiday weekend showed all the major car rental companies were sold out and just two smaller agencies, Sixt and Nu, had cars, starting at $130 a day, more than twice what they might have been prepandemic.

“Even last year, we didn’t see inventory this tight until a week or so out,” Mr. Weinberg said.

It’s possible that consumers have heeded the advice to book cars early after last year’s shortages. But rental agencies still haven’t been able to expand their fleets — thanks largely to slowdowns in automotive manufacturing — and the anticipated return of travel after Omicron suggests more car trouble ahead.

“It doesn’t look like it’s going to improve at all in the next year,” said Mike Taylor, the senior travel analyst at J.D. Power, a market research company, noting that in addition to higher prices, renters may be getting older cars with high mileage.

According to the travel search engine Kayak , rental car rates last summer peaked in July at a national average of $119 a day. Currently, the national average is about $66, or 27 percent higher than last year at this time, and a 41 percent increase over 2019 for the same period. Searches have more than doubled compared to this time last year.

“Road-tripping is a more predictable way of travel these days, where you can avoid crowds and unexpected delays,” said Matt Clarke, the vice president of North American marketing for Kayak, which recently added search results from companies like Kyte , a car rental company that delivers cars to consumers, and Turo , a car-sharing site.

Such alternatives may have benefited from the rental car crunch. In the first nine months of 2021, revenue at Turo grew more than 200 percent, compared to the same period in 2020, according to a recent filing to go public.

“For many travelers, Turo was the least crazy option from a price standpoint,” said Turo’s chief executive Andre Haddad.

For now, car-sharing sites are better bets for finding electric vehicles, although Hertz announced in the fall that it would have 100,000 E. V.s by the end of this year. At Turo, E.V. listings have grown from about 200 in 2014 to more than 27,000 in 2021.

“We’re already seeing activity for March and April, and that is not normal,” said Ryan Hagler, a Maui resident who uses Turo to rent 10 vehicles, including six Teslas, which start around $80 a day. “I’m assuming it’s going to be pretty busy this year.” — Elaine Glusac

Destinations: Cities are back

This March, Virginia Devlin of Chicago is headed to New York City with her daughter, a musical theater student, to celebrate two years’ worth of missed birthday trips. They’ll see Broadway shows and visit Chinatown for dim sum. Tracy Lippes, of Short Hills, N.J., is ready to go to Paris. “I can’t wait to stay in a beautiful hotel, shop, visit museums and eat at great restaurants,” Ms. Lippes said of her March trip. Greg Siskind, an immigration attorney in Memphis, is thrilled to have an in-person conference in London next month, and plans to arrive a few days early to enjoy the city with his adult daughters.

Yes, city travel is back. After more than two years of avoiding urban centers, travelers are eager to return to their favorite metropolis and swan dive into the sights, bites and sounds of a city that is not their own.

“It was a lift to everyone when the U.K. dumped Covid mandates on Jan. 26,” said Henley Vazquez, a co-founder of FORA, a travel agency in New York City . “Bookings are spiking for classic European destinations, particularly Paris and London. Clients want to reconnect with special hotels and restaurants and simply bask in the culture.”

In the United States, Shawna Owen, the president of Huffman Travel , a Chicago-based agency that specializes in luxury and family travel, is planning long weekend trips to New York City. “New York is buzzing again and clients are excited to dine at hot spots and enjoy the city’s dynamism.”

Underscoring the New York-is-back trend, the travel booking site Skyscanner reports that New York City is its top booked domestic destination so far in 2022 and the online travel agency Expedia has had a 13 percent increase in searches for New York City.

As for Europe, Paris and London are the top searched international destinations on Scott’s Cheap Flights , a service that tracks flight deals. Hotel searches on Expedia jumped 62 percent for London and 51 percent for Paris since Jan. 1, and the mobile app Hopper reports that London and Paris clock in as two of the most searched international destinations for spring 2022.

With restrictions easing, Four Seasons Hotels and Resorts reported an 80 percent increase in its bookings in Paris, London and New York from December to Jan. 16.

In London, the luxury travel outfit, Noteworthy , has seen bookings of its private tours to iconic British sites increase 145 percent in February over the same time in 2021. “ The Queen’s Platinum Jubilee has definitely been a tourist draw,” said Nicola Butler, the company’s owner and managing director. — Amy Tara Koch

Resorts: All-inclusives, beyond the beach

A new breed of domestic resort is pioneering an almost all-inclusive model, taking the guesswork out of where to eat and what to do. Why “almost?” These properties don’t include alcoholic beverages in their nightly rate, and, perhaps fittingly, boast enviable wine and spirits collections. A major catalyst for the trend: pandemic-scarred travelers wary of leaving the grounds of a resort once they arrive, according to Erina Pindar, the managing director of SmartFlyer , a luxury travel agency. “The almost all-inclusive is incredibly popular,” she said, “we expect demand to continue to be strong.”

Hotels.com reports that searches for this type of resort have increased significantly compared with the same time frame in 2019. “After the stress of the last few years,” said Mel Dohmen, a Hotels.com spokeswoman, “travelers are looking for stays where they can be doted on.”

“Our clients see these resorts as a hassle-free option,” said Jennifer Doncsecz, president of the travel agency V.I.P. Vacations .

The San Ysidro Ranch in Montecito, Calif., long beloved by luminaries like Winston Churchill and Vivien Leigh, pivoted to an almost-all inclusive model in 2020. In addition to folding the cost of meals into the nightly rate, which starts at $2,495, it did away with extraneous charges like resort fees and parking. “We figured, with all the charges we’ve gotten rid of, what are people going to spend money on? Wine,” said Ian Williams, the Ranch’s general manager. “We’ve had no complaints. This past year has been our busiest ever.”

Given the complications caused by the pandemic, Mr. Williams and his team sought to streamline the travel process. “We want guests to check out and spend their trip home talking about what an amazing vacation they had,” he said, “not some miscellaneous charge on their bill.”

Beachside buffets and watered down margaritas might rule at the traditional all-inclusive; not at the Ranch. “Every guest, if they want the Wagyu for dinner, fine,” said Mr. Williams. “Caviar? Great. Maine lobster? No problem.”

When High Hampton , a Cashiers, N.C., resort that dates back to 1933, remodeled in 2020, it folded breakfast and dinner into its nightly rate, which starts at $595, “because it removes that pressure of where to dine next,” said Scott Greene, the resort’s general manager. (The amber-lit, oak-paneled dining room is always the right answer.)

The same logic has long been in place at Blackberry Farm and Blackberry Mountain , two resorts in Walland, Tenn. Breakfast, lunch and dinner are included in the nightly rate — $845 and up at the Farm, $1,395 and up at the Mountain —- along with all the snacks in the minibar. “We’re exceeding prepandemic occupancy,” said Matt Alexander, Blackberry’s president. SmartFlyer saw a 327-percent increase in revenue from bookings at the two properties in 2021 as compared to 2019. — Sheila Yasmin Marikar

Wellness: Sexual healing

Sexual wellness is one of the fastest growing corners of the global wellness industry, with travel increasingly part of the experience. More hotel brands and relationship therapists are offering couples retreats and beachfront sessions with intimacy coaches and guided anatomical explorations to meet the needs of travelers seeking greater couple satisfaction and personal pleasure.

“People still have stigma around couples therapy and coming to therapy, but nobody ever had a problem going on vacation,” said Marissa Nelson, a sex therapist who runs retreats in Barbados, Hawaii, St. Lucia and Washington, D.C., through her company IntimacyMoons (seven days in St. Lucia starts at $7,500). She also offers virtual sessions; even when retreats were shut down in 2020, she noticed couples were traveling — to Airbnbs or on road trips — before logging on to work with her.

Travel is a powerful tool for unlocking intimacy, said Shlomo Slatkin, a rabbi and certified relationship therapist. His company, The Marriage Restoration Project , focuses on married couples. In the past year, in response to a growing demand to combine therapy and travel, he has introduced his first destination retreats — which cost between $4,000 and $5,000 and take place in Costa Rica, Mexico and Miami.

“Going away is really powerful, because changing the relationship requires a paradigm shift,” he said. “The lockdowns brought out a lot of maintenance issues in relationships that need to be addressed.”

Tara Skubella, a tantric guide, works with both couples and single women. Tantra, a spiritual philosophy with roots in medieval India, includes practices like tantric sex, and Ms. Skubella offers services, including chakra work, which focuses on energy points in the body. Her retreats in Costa Rica and Colorado (starting at $499) have been mostly sold out since 2020, she said.

“It seems very aligned to Covid and breaking out of isolation,” she said. “Society is realizing tantra isn’t only about sex, but about inner connection and healing.”

In March, the hotelier St. Regis will launch a retreat with the sex coach Bibi Brzozka on intimacy, conscious sexuality and emotional awareness at the St. Regis Punta Mita Resort in Mexico ($2,680). In April, Six Senses Ibiza will host Pleasure Principles — Journey of Women’s Sexual Wellness , a six-night stay focusing on female sexual empowerment ($4,500). They are the first sexuality-focused retreats for both brands. — Debra Kamin

Family Travel: Going on the edu-vacation

After two years of quarantines and classroom closures, millions of children across the country have fallen behind in class . And parents, eager for lesson plans that can supplement learning, are now seeking experiences with an educational bent when they travel.

“Previously, families didn’t ask in advance about what educational activities are available at the resorts. Now they do,” said Chitra Stern, founder and chief executive of the family-friendly Martinhal resorts in Portugal. Nearly half of her new bookings, Ms. Stern said, now include questions about on-site educational opportunities for children. Last year, the luxury resorts began partnering with the United Lisbon International School to offer a two-week educational summer camp for its younger guests at Martinhal Lisbon. Courses, which are available for children ages 3 to 17, begin at 440 euros (around $500).

After a pandemic dip, enrollments are on the rise for family-learning itineraries with the tour operator Road Scholar , which produces educational travel programs for all ages. Options for children and their caregivers, which start at $699 per adult and $449 per child, include combining history and geography with spotting grizzlies in the Canadian Rockies , or learning French while taking a scavenger hunt through Paris’s Louvre .

And noting an uptick in children road tripping with their parents, the Colorado Tourism Office last summer launched Schoolcations , a series of free itineraries based on Colorado road trips and designed for grades K-5.

There are also more opportunities to learn back at the hotel. Family Coppola Hideaways — a group of retreats owned by the film director Francis Ford Coppola — now offers the Coppola Curriculum at its properties in Belize and Guatemala. Half-day lessons cost $150 per day for children and include courses in science (like counting bird species) and art (like local textile looming). In Florida, Isla Bella Beach Resort and Oceans Edge Resort & Marina now partner with Marine Science Camp for classes with marine scientists, geared to elementary school children (free for hotel guests). In California, attendance at the Artisans in Residence program at Carmel Valley Ranch — taught in the apiary, organic garden and goat creamery, and starting at $85 for adults and $65 for children — has doubled.

For some, a desire for extra credit also means going for an extra splurge. At the luxury travel agency Black Tomato , bucket-list family travel now accounts for 55 percent of bookings, with the majority of requests falling into what the company defines as BFG travel: Big Family Get-Togethers. So the company has rolled out a family-focused education track, Field Trip , which begins at around $5,800 per person; courses include a physics lesson at the CERN laboratory in Switzerland and a social studies-focused hike through Bhutan’s Gangtey Valley to meet a revered monk.

“Thematically, for 2022 family bookings, it’s all about intrepid adventure mixed with cultural immersion, ecological outdoor experiences, intrepid luxury hotels and even pop-up glamping setups — definitely bucket-list and remote,” said Tom Marchant, Black Tomato’s owner and co-founder. — Debra Kamin

Cruises: Smaller boats and luxury destinations

After two years of devastating losses and a tentative restart last June, the cruise industry has faced a challenging start to 2022, as the highly transmissible Omicron variant of the coronavirus caused cases to surge onboard ships, forcing some cruise lines to cancel voyages and change itineraries.

But demand for future cruises is still high, especially among dedicated cruise fans. A recent survey on cruiser sentiment by the online review site Cruise Critic found that 52 percent of the 6,400 cruisers surveyed were currently looking to book a cruise, with 40 percent hoping to set sail in the next six months.

A 2022 report on the outlook for the industry, published in January by the Cruise Lines International Association, the industry’s trade group, highlighted how major companies are bouncing back from the pandemic despite recent hurdles.

More than 75 percent of CLIA member ships have returned to service, with 100 percent expected to restart operations by August 2022. Additionally, 16 new cruise ships from major lines like Carnival, MSC, Royal Caribbean and Disney will launch in 2022.

One of the biggest cruise trends for 2022 is luxury expedition voyages, appealing to a growing number of travelers throughout the pandemic because they typically sail on smaller ships and steer away from crowded destinations.

“The itineraries vary pretty significantly from those of the larger, more mainstream lines,” said Colleen McDaniel, the editor in chief of Cruise Critic. “Due to their size, luxury ships are able to sail to more remote destinations — so even if you’re sailing in the Caribbean, your ports of call will likely be further removed from the masses, and likely somewhere you might have never been before.”

Smaller river and expedition cruises are also expected to become more popular this year as cruisers seek out big bucket-list destinations and more sustainable ways to travel. Responding to the demand, Hurtigruten, a Norwegian line that specializes in expedition cruises, has added new itineraries to its Galápagos Islands excursions, offering a range of small-ship carbon-neutral expedition sailings that will cover the full span of the remote 19-island archipelago.

“A very positive trend we’ve seen throughout the pandemic is that travelers are increasingly eco-conscious; meaning they do their homework on brands, including cruise ships, to make sure they align with their personal values.” said Daniel Skjeldam, the chief executive of Hurtigruten Group.

The company is also expanding its grand expedition cruise program, offering three unique cruises from the North to South Pole after the success of two similar sold-out sailings scheduled for the fall. The itineraries include destinations like Alaska, Iceland, Greenland, the Northwest Passage sea route, South America and Antarctica.

“After having been isolated for two years, people really want to do something they really can look forward to,” Mr. Skjeldam said. “Something perhaps more active and interesting than their normal prepandemic holiday.” — Ceylan Yeginsu

52 Places for a Changed World

The 2022 list highlights places around the globe where travelers can be part of the solution.

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places for a Changed World for 2022.

An earlier version of this article mischaracterized Kyte, a car rental business. Kyte is a car rental company that delivers cars to consumers; it is not a car-sharing website.

How we handle corrections

Come Sail Away

Love them or hate them, cruises can provide a unique perspective on travel..

Cruise Ship Surprises: Here are five unexpected features on ships , some of which you hopefully won’t discover on your own.

Icon of the Seas: Our reporter joined thousands of passengers on the inaugural sailing of Royal Caribbean’s Icon of the Seas . The most surprising thing she found? Some actual peace and quiet .

Th ree-Year Cruise, Unraveled: The Life at Sea cruise was supposed to be the ultimate bucket-list experience : 382 port calls over 1,095 days. Here’s why those who signed up are seeking fraud charges instead.

TikTok’s Favorite New ‘Reality Show’: People on social media have turned the unwitting passengers of a nine-month world cruise into “cast members” overnight.

Dipping Their Toes: Younger generations of travelers are venturing onto ships for the first time . Many are saving money.

Cult Cruisers: These devoted cruise fanatics, most of them retirees, have one main goal: to almost never touch dry land .

Business travel picks up, bolstering outlook for US airlines

- Medium Text

Make sense of the latest ESG trends affecting companies and governments with the Reuters Sustainable Switch newsletter. Sign up here.

Reporting by Rajesh Kumar Singh; Editing by Leslie Adler

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Ukraine attacked eight Russian regions with dozens of long-range strike drones, setting ablaze a fuel depot and hitting three power substations in a major attack early on Saturday, an intelligence source in Kyiv told Reuters.

Business Chevron

Tesla cuts prices in China, Germany, and around globe after US cuts

Tesla has cut prices in a number of its major markets - including in China and Germany - after price cuts in the United States - as it grapples with falling sales and an intensifying price war for electric vehicles (EVs), especially against cheaper Chinese EVs.

After slow end to 2022, the business travel outlook is turning more positive for 2023

There is a growing sense that lower levels of business flying are here to stay, with many still expecting top executives to set corporate flying reduction targets, driven by cost savings, changing travel habits and sustainability needs.

Messaging regarding the recovery of the business travel segment remains mixed.

Since the onset of the COVID-19 pandemic, a number of the industry's leading voices have claimed that business travel will never fully recover due to changing working habits - namely, remote working and digital nomadism; company cost reduction; and a growing awareness of environmental issues.

Indeed, international business travel has been recovering at a much slower rate than leisure tourism.

Recovery in business travel slowed in 2H2022...

The global recovery in business travel experienced a pause over much of 2H2022.

After a rapid bounce-back of business travel during 1H2022, the expectation had largely been that the sector would have a continued, if steady, recovery over the second half of the year. However, in the face of rising travel costs due to inflationary pressures, airline operational chaos across multiple regions, and wider concerns about the macroeconomic outlook - businesses revised their plans and travel and budgets were largely static.

This was clearly evident when listening to comments from some of the leading airlines in the US, where business travel recovery had been strong.

In early Dec-2022 United Airlines CEO Scott Kirby stated that business travel had "plateaued" in late 2022, adding that this was "indicative of pre-recessionary behaviour". Delta Air Lines President Glen Hauenstein reported at the start of Jan-2023 that corporate travel demand had been "steady" over 4Q2022, with domestic corporate sales recovering to 80% of 4Q2019 levels.

Alaska Airlines CEO Ben Minicucci reported that large Silicon Valley technology companies had largely "turned off" business travel in late 2022.

Airlines Reporting Corporation: US corporate and leisure ticket bookings (percentage vs 2019), 2021-2023

Source: Airlines Reporting Corporation.

...but rapid recovery expected for 2023

Despite the recent slowing performance, there is an increasing undercurrent of positive expectations for business travel for 2023.

Airlines, corporate travel management organisations, travel agencies and business travel associations are now pointing to a rapid recovery for 2023, particularly when it comes to business spending.

Global forward-ticketing data from Forward Keys indicates that after a slowing in business ticket sales over 2H2022, forward sales indicate that corporate air travel is due to accelerate through the early part of 2023.

ForwardKeys: forward business and leisure air ticket data, 2022-2023

Source: ForwardKeys.

The Global Business Travel Association (GNTA) projects global business travel spending of just under USD1.2 trillion in 2023.

While this is still down, around USD273 billion down on 2019 levels (-19.1%), the outlook is for overall spending to increase 24.2% year-on-year for 2023.

GBTA: business travel spending outlook, 2019-2026

Source: Global Business Travel Association.

Confidence in business travel nearly fully recovered to levels before the pandemic

GBTA's Business Travel Outlook Poll for 1Q2023 found expectations for business travel in 2023, with confidence nearly fully recovered to levels before the COVID pandemic.

Of travel buyers - 91% reported that they feel that employees at their company are now either 'somewhat willing' or 'very willing' to travel for work in the current environment.

This is up from just 64% of reported workers who were willing to travel in Feb-2022, and 86% in Oct-2022.

According to GBTA's polling, 78% travel managers globally expect their companies will engage in more business travel in 2023.

Expectations about travel volumes increases are almost uniform between the North America, Latin America, Europe and the Asia Pacific regions.

Just 7% of travel managers expect reduced travel.

Reduced travel expectations are lowest with travel managers in North America (6%) and the Asia Pacific (7%), and higher with managers in Europe (10%) and Latin America (13%).

Travel buyer/procurement: professional expectations for 2023 business travel volumes

More travel suppliers expect increased spending on travel by their corporate customers

Further to this, GBTA's data shows that 86% of travel suppliers expect spending on travel by their corporate customers will increase in 2023 - up from 80% in the association's Oct-2022 survey.

This confidence is high, regardless of region - all travel suppliers surveys in the Asia Pacific expect spending to be somewhat or much higher than it was in 2022, followed by 91% in Latin America, 90% in Europe and 85% in North America.

Just 1% expect reduced spending by corporate customers.

Travel supplier/travel management company: expectations for 2023 business travel spending

Suppliers are also highly optimistic about the outlook for business travel.

According to GBTA polling, 24% report feeling 'very optimistic' about the industry's path to recovery, and 65% are optimistic. Just 3% report they are pessimistic about the outlook.

Travel suppliers expectations about higher spend are echoed by travel buyers and procurement professionals. Of those polled, 46% expect a higher budget for travel programmes for 2023 when compared to 2022, while 41% expect budgets will be about the same as the previous year.

Customer meetings and new business prospects to hold weight of business travel investment

The key area for business travel spending in 2023 is expected to be for trips for sales staff or account managers to meet with customers or new business prospects.

On average, travel managers estimate that their companies will allocate 28% of their travel spend for these purposes in 2023. This is followed by spending on trips for internal company meetings (19%) and spending on attending conferences, trade shows and other industry events (18%).

North American business travel to return to close to normal in 2023

The US Travel Association (USTA) project that the volume of business travel by air will recover to around 98% of pre-pandemic levels in 2023, with recovery back above 100% in 2024.

Domestic travel is at or above pre-pandemic levels, but international arrivals are still in recovery mode.

For 2022, inbound arrivals by foreign nationals into the US were down 24% compared to 2109. This was chiefly due to the slow rebound of traffic from the Asia Pacific, as well as some sluggishness in the early part of the year in Europe and parts of Latin America.

As of the start of Feb-2023, arrivals from mainland China were down 97% when compared to 2019, and arrivals from Hong Kong were still down by 80%.

Inbound travel from Japan was down 41.6%, and from Australia it was down 30.4%.

From Europe, UK arrivals were down 18.5%, while arrivals from Italy were still 14.2% below pre-pandemic levels and German arrivals were down 7%. Of the main Latin American markets, arrivals from Brazil were still a third below 2019 levels.

USTA estimates for Dec-2022 were that US business travel spending would be USD97 billion, which was an increase of 3% compared to pre-pandemic levels.

US business travel forecast: volume, percentage of 2019 levels, 2019-2026

Source: US Travel Association.

A large part of the recovery in US business travel spending has been due to the growth of prices, such as for airfares, car rentals and accommodation.

According to the USTA, airfares rose 28.5% year-on-year for the full year 2022.

US Bureau of Transport Statistics data shows US domestic fares averaged USD384 in 3Q2022. This is up from an (inflation adjusted) average domestic fare of USD279 in 3Q2020, an increase of 37.4% over the two-year period, and up 12.8% over the past 12 months.

US average domestic round trip airfares, by quarter, 1Q2019- 3Q2022

Source: US Bureau of Transportation Statistics.

Data from the corporate travel solutions provider Emburse shows that average spend per round trip domestic business travel by air for 4Q2022 was USD548, putting it just ahead of 4Q2019 levels.

Spend per round trip on international business travel was significantly higher: USD2113 in 4Q2022, vs USD1804 in 4Q2019 (an increase of 17.1%).

Domestic and international air travel: average spend per round trip, 4Q2019-4Q2022

Source: Emburse.

New hope for full recovery in 2023

COVID-19 has produced a range of changes that have altered the landscape of demand for business travel globally - some of which have slowed the recovery, and others that are contributing to business travel coming back, albeit in modified form or with higher spending.

Hybrid and remote working arrangements have persisted for a large proportion of workforces globally, cutting into historical business travel volumes, while at the same time creating greater demand for 'bleisure' travel.

Although video conferencing technology became ubiquitous during the pandemic, enterprises continue to report strong demand for face-to-face meetings, particularly given the uncertainties in global supply chains and the need to train new staff working from remote locations.

Additional layers of corporate travel approvals and duty of care arrangements introduced during the pandemic have proved stubborn to remove - particularly in large corporations. The response has been to consolidate multiple smaller business trips into larger - and often more costly - single trips.

In this same vein, sustainability considerations are also weighing much more heavily on travel activity, but businesses have also shown greater willingness to spend money to be good corporate citizens and offset the impact of their travel.

Despite the structural trends and concerns about an economic slowdown in developed economies, business travel has renewed its upwards trend.

Although the recovery is happening more slowly than expected, and is still well below where most airlines would like it to be, there is renewed confidence in the recovery outlook for 2023.

- north america

- latin america

- south pacific

- business travel

- corporate travel

- work culture

- sustainability

- forwardkeys

- duty of care

- travel buyers

- the americas

- travel managers

- work from anywhere

- work from home

I spent $2,000 for 7 nights in a 179-square-foot room on one of the world's largest cruise ships. Take a look inside my cabin.