sign up and keep track of your travel insurance events

Medical Evacuation and Repatriation: How Travel Insurance and Assistance Services Can Help

You never quite know when a medical emergency will arise during international travel, especially to high-risk destinations where illness and injury are more likely. You could ingest an intestinal parasite, contract a virus, or simply slip and fall.

Are you ready to foot the bill for a $100,000 emergency medical evacuation on your next trip? 40% of Americans can’t cover a $400 emergency expense , so chances are an emergency medical evacuation might hit your wallet harder than you’d like.

Luckily, you can get travel insurance and assistance services that can bring you out of harm’s way and to the nearest suitable medical facility if you encounter an emergency illness or injury during your trip.

Keep reading to learn more about medical evacuation (also known as medevac or medivac) and repatriation, why you should consider getting insurance that covers those events when you’re traveling, and how travel protection from Generali Global Assistance can help if you encounter such an emergency.

If you run into difficulties during your trip, travel assistance services are included in all Generali Global Assistance travel protection plans and available 24/7/365. For emergency assistance during your trip, call (877) 243-4135 in the U.S. or (240) 330-1529 collect worldwide.

See our COVID-19 Travel Insurance Guide with details about repatriation and evacuation.

What is Emergency Assistance and Transportation Coverage?

If you become critically sick or injured during your trip and no suitable local care is available, the Emergency Assistance and Transportation benefit provides coverage for you to be taken to the nearest medical facility that’s equipped to take care you.

What is repatriation?

Repatriation covers the costs of being transported home if deemed medically necessary after a medical emergency has been stabilized, or returning remains back to the U.S. if a covered traveler has died on their trip.

Medical repatriation: If someone is injured or becomes ill on their trip, medical repatriation will return them home or to the U.S. before or after they have been treated, depending on the situation. This includes medical transport if necessary.

Repatriation of remains: If the worst happens and a covered traveler dies on a trip outside of the U.S., this service will transport the remains back home.

Who needs Emergency Assistance and Transportation?

You never know if an emergency will render you unable to take yourself to the nearest medical facility that can treat you. Fortunately, Emergency Assistance and Transportation coverage can cover the expense of transporting you to a nearby facility for medical treatment. If you are traveling abroad, to a remote location, or cruising, or any other destination that would require evacuation via helicopter in the event of a medical emergency, make sure your travel protection plan includes Emergency Assistance and Transportation coverage and services.

International travelers should know even if you have a health insurance plan, primary medical insurance may not cover treatment outside of the United States. Leaving home without coverage could expose you to risk and cost you a bundle. For example, Medicare does not provide coverage outside of the country. Research your destination before you travel and find out if travel operators require a minimum amount of medical coverage to board.

How much coverage do I need?

Travel insurance with coverage for medical evacuation can help keep travelers from getting stuck with huge costs if seriously injured or sickened on a trip. According to the Centers for Disease Control and Prevention (CDC), medical evacuation by air ambulance can cost more than $100,000 and if you are traveling internationally or in a remote area the cost can be even greater. The CDC specifically highlights the high cost of medical evacuation from a cruise ship.

Generali Global Assistance travel protection plans include Emergency Assistance and Transportation coverage limits from $250,000 per person to $1 million per person, depending on the plan you choose.

Compare travel protection plans and features

Generali’s Emergency Assistance and Transportation Coverage

Our Standard, Preferred and Premium travel insurance Plans all contain varying levels of coverage for emergency medical evacuation, hospitalization and repatriation.

24/7/365 Emergency Assistance Service s are included with your purchase. In addition to emergency assistance, our plans include Emergency Assistance and Transportation coverage that can provide an air ambulance, commercial flight, or a transportation vehicle in the event of a medical emergency so you arrive at the nearest available facility in a timely manner.

If you’re traveling alone and hospitalized for more than seven days, coverage is included to fly one person of your choosing to accompany you. The plan also provides coverage for their lodging, meals, local transportation and telephone calls during this time (up to $10,000).

Medical repatriation: Once a medical evacuation happens, we monitor the situation and when you are well enough to travel, we use our network of resources to help you get home safely. For non-emergency situations, the plan provides coverage for medically necessary transportation to your place of residence or to an alternative U.S. city where you’ll have access to the care you need.

Repatriation of remains: Our plans provide coverage for the preparation and return of your remains to a funeral home in the U.S. or the option for a local burial if you die outside of the U.S.

Emergency Assistance and Transportation Coverage for Pre-existing Conditions

Travelers looking for Emergency Assistance and Transportation coverage for pre-existing medical conditions should purchase our Premium Plan prior to or within 24 hours of final payment for their trip, must be medically able to travel at the time of purchase and must insure all prepaid trip costs that are subject to cancellation penalties or restrictions to be eligible for coverage.

Also read: 5 Things Most People Get Wrong about Travel Insurance with Pre-Existing Conditions

Additional Travel Protection Features

When it comes to traveling smarter, planning ahead is key, especially if you’re going abroad. Medical and Dental coverage is a major reason why travelers get travel insurance , and combined with Trip Cancellation, Trip Interruption , and other valuable coverages, our plans let you rest easily with more peace of mind while away from home.

In addition to Emergency Assistance and Transportation, our plans offer a variety of other coverages and services - like a service that aids in the replacement of medication and eyeglasses on your trip - that traditional medical insurance plans usually don’t. For less severe medical attention, our plans include a Telemedicine Service, which instantly connects travelers with a network of physicians for information, advice, and treatment, and even prescriptions when appropriate.

The U.S. Department of State advises that international travelers buy travel insurance with Medical Coverage to help cover the cost of medical care when traveling internationally. To help protect you against unexpected medical fees you may incur, our plans include Medical and Dental coverage.

If you have any other questions about medical evacuation and repatriation or how a Generali travel protection plan can help during a medical emergency, you can speak to one of our representatives . We wish you safe travels!

Travel Resources

Average Customer Rating:

Thank you for visiting csatravelprotection.com

As part of the worldwide Generali Group we have rebranded our travel protection plans to Generali Global Assistance, offering the same quality travel insurance, emergency assistance and outstanding customer service as you've come to rely on for the last 25 years. Welcome to our new website!

Final step before you're signed up

Please verify that you're human.

Medical Evacuation Insurance |

Axa travel protection: travel medical expense and emergency evacuation insurance plan .

When exploring the world, the last thing you want to consider is a medical emergency. That is why AXA Travel Protection offers you reliable support when you need it most. Our travel coverage protects you against unexpected medical situations, including Emergency Evacuations and more. Let us delve into the details to understand how AXA Travel Protection has your back in times of need.

Covering Emergency Evacuations

Life is unpredictable, and accidents or sickness can strike even during your travels. That is why AXA Travel Protection provides coverage for emergency evacuations. If you suffer from an accidental injury or illness during your trip that requires immediate medical attention, we have you covered. We can pay benefits for the covered evacuation expenses incurred up to the maximum benefit mentioned in your policy.

What is included in Covered Evacuation Expenses?

AXA Travel Protection covers reasonable and customary expenses related to your Emergency Evacuation. This includes necessary transportation, medical services and supplies required during evacuation. We are committed to getting you to safety using the most direct and cost-effective route possible.

Transportation Details

Transportation arrangements are made with precision and care. We ensure that the attending physician recommends all transportation, complies with conveyance regulations, and is authorized in advance by us or our authorized travel assistance company.

What is an Emergency Evacuation?

In the event of an accidental injury or sickness that warrants immediate transportation from a location, Emergency Evacuation or Medical Emergency Evacuation is deployed to rescue or treat the patient. These services are designed to transport the affected individual to a suitable medical facility for treatment or rescue purposes.

Understanding Emergency Evacuation

Emergency Evacuation might sound daunting, but it is designed to ensure your well-being.Here is what it means:

Hospital-to-Hospital Transport: We have your back if your medical condition requires swift transfer from the initial hospital where you received treatment to the nearest hospital that can provide suitable medical care.

Returning Home for Further Treatment: If your situation demands it, we will organize transportation for you to return home after treatment so you can continue recovery or receive further medical attention.

Combination of Both: Sometimes, circumstances call for a variety of the above situations. We are here to make sure your evacuation needs are met.

Is Emergency Evacuation necessary?

Maximum Benefit: $1,000,000 Hospital Companion: $10,000 File for a Free Quote to see the full range of coverage details.

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Emergency Evacuation FAQs

Who should i call during an emergency evacuation.

If you experience a medical emergency during your travels, contact your local emergency services. Then call AXA’s 24/7 emergency services: 855-327-1442

Transportation of Minor Children and Hospital Companions

Your loved ones are important to us too. If you are expected to be in the hospital for over seven days following a covered emergency evacuation or if the worst occurs and you pass away during your trip, we will ensure the safe return of your unattended minor child(ren) (under the age of eighteen (18)) who accompanied you on the trip. They will be taken to the domicile of a person nominated by you or your next of kin, with an attendant if needed.

For those times when you find yourself alone in a hospital for more than seven consecutive days due to an accidental injury or sickness, we will arrange for a companion of your choice to visit you once.

This person will be provided with necessary transportation, authorized and organized by us while adhering to the applicable guidelines.

Why choose AXA Travel Protection

With a presence in over 30 countries worldwide, AXA provides assistance with a wide range of features that include:

- Extensive knowledge of local health risks and medical facilities to respond swiftly in the event of a medical emergency

- 24/7 global team of travel experts that offers assistance and assurance while traveling

How to get a Travel Protection Quote Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time Disclaimer: It is important to note that the specifics for Emergency Evacuation will depend on the policy selected, date of purchase, destination, and state of residency. Customers are advised to carefully review the terms and conditions of their policy, and to contact AXA Partners with any questions or concerns they may have.

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

- Medical Evacuation & Repatriation

- Medical Evacuation & Repatriation

What is Medical Evacuation & Repatriation travel insurance?

If you become critically ill or injured while traveling and local hospitals are unable to provide adequate treatment, the Medical Evacuation benefit can provide coverage for emergency medical evacuation services.

Most insurance plans with Medical Evacuation coverage will transport you, or an insured member of your party, to the nearest adequate medical facility. If the treating physician determines you should return to your home country to receive further medical attention, this benefit can also cover those transportation expenses.

Medical Evacuation is a benefit included in most travel insurance policies that provides coverage in the event of a medical emergency that requires an evacuation. Most Medical Evacuation policies can include coverage for the following:

- Transportation to the nearest adequate medical facility: If the facility you arrive at is unable to treat your condition, this benefit may cover the cost to transport you to another facility to receive medical services.

- Transportation back home: If the treating physician or medical professional believes it is in your best interest to return home for treatment, this benefit may cover the cost emergency transportation to back home.

- Hospital companion: If you are traveling alone, some Medical Evacuation policies can cover the cost of a round trip ticket for a close friend or family member to visit you in the hospital if your stay reaches the minimum length outlined in your policy, usually 7 days.

- Traveling companion: If you are traveling with a companion, this benefit may reimburse their hotel stay, meals, and transportation expenses so they can remain nearby while you receive treatment.

- Return of children: If you are traveling with children at the time of your hospitalization, this benefit may cover the cost to transport your children back home so they can be in the care of a close friend or relative while you are treated.

- Repatriation of remains: If you die during your trip, this benefit may cover the cost to return your remains to the city of the burial site, as well as cremation, embalming, and other necessary expenses.

Common Medical Evacuation Exclusions

Even the best travel insurance plans have limitations. While the Medical Evacuation benefit can be used in a wide-range of scenarios, below are some common exclusions you may find when comparing travel medical insurance.

- Pre-Existing Conditions: Most plans won’t cover claims relating to a pre-existing medical condition unless stated otherwise.

- Drug & Alcohol Abuse: Claims stemming from drug or alcohol abuse, including overdoses, will likely not be covered.

- Pregnancy: Routine pregnancy checkups and childbirth are typically not covered by travel protection.

- Medical Tourism: Traveling for the purpose of having an elective cosmetic or plastic surgery procedure may not be covered by your plan.

Be sure to check the policy details of your specific medical plan for a more detailed list of exclusions and limitations prior to departing for your trip.

Travel insurance companies offer a wide-range of Medical Evacuation coverage limits. On Squaremouth.com, plans offer anywhere between $50,000 to $2,000,000 in coverage per traveler.

For most international trips, we recommend at least $100,000 in emergency Medical Evacuation coverage. This is due to the potentially high cost of transporting you during an emergency situation, as well as the cost of receiving treatment abroad for medical emergencies. For more cruises or remote trips, we recommend a policy with at least $250,000 in Medical Evacuation coverage.

Most primary health insurance plans, such as Medicare or an employer sponsored plan, do not provide coverage outside the the United States . While your medical transport may be covered in the USA , it is not likely to be covered if you are planning international travel.

If you are planning travel overseas, consider purchasing a comprehensive travel insurance policy. These plans not only provide peace of mind, but also includes coverage for out of pocket medical expenses, cancellations, delays, and personal belongings.

Do Credit Cards Provide Coverage for Medical Evacuations?

No, credit cards do not typically provide insurance coverage for medical treatment or transportation while traveling. The cards that do offer coverage for medical care typically offer coverage limits that fall short of Squaremouth’s coverage recommendations.

Many travel credit cards do, however, include other valuable benefits, such as Trip Cancellation, Trip Interruption, and various travel assistance services.

A Medical Evacuation Membership is a type of service offered by various organizations, typically insurance companies or specialized assistance companies, that provides coverage and assistance for emergency medical evacuations. These memberships are designed to assist individuals who encounter medical emergencies while traveling or living abroad, particularly in remote or underdeveloped areas where access to adequate medical care may be limited.

Medical evacuation memberships typically cover the cost of transporting the individual to the nearest appropriate medical facility capable of providing the necessary treatment. This usually involves ground ambulance transportation and air ambulance services.

Unlike a travel insurance plan that covers you for the duration of your trip, a Medical Evacuation Membership involves an annual or short-term fee. One of the more well-known Medical Evacuation Membership programs is MedJet .

Please be aware that coverage and eligibility requirements for this benefit differ by policy. The tables below show the providers that offer Medical Evacuation & Repatriation coverage.

Looking for a policy with Medical Evacuation & Repatriation coverage?

Enter your trip information on our custom quote form . Once you receive your results, select the Medical Evacuation & Repatriation filter to find the best policy for your trip with the coverage that you need.

Medical Evacuation & Repatriation by Provider

- Travel Delay

- Hurricane & Weather

- Missed Connection

- Cancel For Any Reason

- Cancel for Covid-19 Sickness

- Trip Cancellation

- Trip Interruption

- Financial Default

- Employment Layoff

- Cancel For Medical Reasons

- Cancel For Work Reasons

- Interruption For Any Reason

- Medical Coverage for Covid-19

- Emergency Medical

- Pre-Existing Condition

- Co-Insurance

- Medical Deductible

- Home Country Coverage

- Non-Medical Evacuation

- Extension Of Coverage

- Baggage Delay

- Baggage & Personal Items Loss

- 24 Hour AD&D

- Flight Only AD&D

- Common Carrier AD&D

- Sports & Activities

- Sports Equipment Loss

- Sports Equipment Delay

- Sports Weather Loss

- Search & Rescue

- Sports Fees

- Rental Car Damage

- Money Back Guarantee

- 24 Hour Assistance Service

- Identity Theft

- Renewable Policy

- Maximum Trip Length

- Maximum Number of Trips

- Additional Benefits

Additional Information

- AM Best Ratings

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

What Does Travel Insurance Cover?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is covered by travel insurance

Extras you can add to a travel insurance policy, what does travel insurance not cover, how to pick the right policy for your trip, if you want to understand travel insurance coverage.

If something goes wrong during a trip, your savings account could take a serious hit if you don’t have travel insurance. Flight cancellations, lost baggage or an accident can throw a wrench into your carefully made plans and cost a lot to rectify.

On the other hand, knowing that your trip is protected can help put your mind at ease before, during and after a vacation. But exactly what does travel insurance cover? Let’s find out.

Most plans typically cover a range of trip protections, including accidental death and dismemberment, baggage delay or loss, emergency medical coverage and evacuation, trip cancellation, delay or interruption and more. Here's a closer look at each one.

Accidental death and dismemberment

Accidental death and dismemberment insurance provides coverage for death or losing a limb or eyesight as a result of an accident. Note that death from natural causes, illness or by suicide isn’t covered, so it’s not the same thing as a life insurance policy.

Baggage delay

Baggage delay insurance reimburses the cost of essentials, such as clothes, toiletries or a phone charger, that you may need to purchase if your bag is delayed. Your baggage must be delayed over a certain number of hours to receive coverage — typically the range is from six to 24 hours, depending on the policy.

Baggage loss

Insurance for baggage loss reimburses the cost of your suitcase and belongings should a checked bag become lost, stolen or damaged during a covered trip.

Emergency medical evacuation and repatriation

This benefit covers the cost associated with medical evacuation if you have a medical emergency and you can’t be treated at the facility closest to you. It will cover transport costs to another hospital or your home country, if necessary, and also includes transportation of remains.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Missed connection

A missed connection benefit covers extra expenses if a common carrier delay causes you to miss an organized tour or a cruise, for example, and you need to pay extra to catch up to it at the next port of call.

Reinstate frequent traveler awards

If you paid for a trip with airline miles or hotel points and it is subsequently canceled, this benefit will cover any fees required to redeposit your rewards back to your frequent traveler account.

Trip cancellation

Trip cancellation insurance reimburses you for prepaid nonrefundable costs if you must cancel a trip for a covered reason. Reasons that are typically covered include:

Sickness or death of a family member.

Financial insolvency.

Natural disaster.

Airline strike.

Inclement weather.

Military duty.

Stolen passport or visa.

Loss of employment.

Trip delay covers costs associated with transportation, meals or lodging should your common carrier be delayed, as well as reimbursement of any prepaid, nonrefundable expenses. Trip delay coverage takes effect after a specified period of time depending on the policy, but typically ranges from five to 12 hours.

» Learn more: What you need to know about Chase’s trip delay insurance

Trip interruption

Trip interruption insurance reimburses you for unused, nonrefundable costs in the event you must cut the trip short and return home for a covered reason, including a family member’s sickness or death, terrorism, inclement weather or a natural disaster, among others.

Travel insurance plans usually don’t include coverage for every possible thing that can go wrong, but you can add optional extras to your policy for an upcharge. Check to see if your plan has the following types of coverage, and if you think you need it, you can add it in or buy a more inclusive policy.

Cancel For Any Reason

If you change your mind and decide not to go on a trip you’ve booked, you typically can’t get reimbursed for prepaid, nonrefundable expenses — unless you purchase a cancel for any reason policy separately. Depending on the policy, you usually get a portion of your prepaid expenses back (typically 50% to 75%), but you must purchase the policy within 10 to 21 days of initial payment. Note that cancel for any reason isn’t the same as trip cancellation listed above.

Rental car collision damage waiver

If your rental car is damaged or stolen, rental car insurance will protect you from having to pay for the damage or theft. Many credit cards, such as the Chase Sapphire Preferred® Card or the Capital One Venture X Rewards Credit Card , offer rental car collision damage insurance, so check whether the cards you hold have this benefit before adding it to a policy.

Pre-existing conditions

If you need coverage for a pre-existing medical condition, you must purchase a policy within the time specified by the insurance provider to be eligible for a pre-existing conditions waiver (usually ten to 21 days). Make sure that the coverage amount you enter is equal to all prepaid, nonrefundable costs for your trip.

» Learn more: The best travel insurance companies right now

Quarantine accommodations

This coverage is often part of trip delay insurance, but some providers include it and some don’t. For example, the Safe Travels Voyager plan offered by Trawick International covers lodging expenses in case you get sick with COVID-19 and have to quarantine abroad before flying home safely.

» Learn more: Travel insurance may not cover COVID-19 — unless you upgrade

Travel insurance offers coverage for many situations, but not all. Some scenarios aren’t covered by a travel policy, including:

A named storm: Most travel plans protect you from hassles stemming from inclement weather. However, a policy needs to be purchased before a tropical storm or weather event is named. If you purchase coverage after a natural disaster has begun, it won’t be covered.

Activities performed under the influence: Drug and alcohol use are a notable exception to most travel policies. If you fall off an ATV because you drank a few alcoholic beverages or took drugs before operating a vehicle, you’re no longer covered.

Extreme sports: Some high-risk sports, such as bungee jumping, scuba diving or rock climbing, aren’t covered by a comprehensive travel insurance plan. However, you can buy a separate policy for the specific adrenaline activities you’re planning to do on your vacation from World Nomads , for example.

Fear of travel because of a pandemic or another reason: This is something that would be covered under a “cancel for any reason” add-on, but a general travel policy won’t cover fear of travel.

Medical tourism: Seeking dental work in Mexico or a hair transplant in Turkey? Keep in mind that your medical expenses for elective procedures aren’t covered by a plan with emergency medical coverage.

Pregnancy: If you want to cancel a trip because you’re pregnant, you can do so only if you purchased the plan before you became pregnant. Otherwise, it’s not a covered reason. Additionally, medical costs incurred while on a trip during pregnancy might or might not be covered (check with your insurance provider).

» Learn more: What to know before you buy travel insurance

The length of trip, your age and the destination all factor into how much a policy will cost. The coverage types and their limits also influence the price tag.

Types of coverage and limits

Take a look at the terms of each policy and determine the type of coverage you need the most. Compare the coverage details and limits with the cost. If you hold a travel credit card , familiarize yourself with its benefits as some of the trip protections might be redundant.

Single trip vs. annual plan

For frequent travelers, an annual plan offers the most bang for your buck — it costs less money versus purchasing insurance for multiple single trips. An annual policy covers long international trips as well as short domestic trips in between, so you can have peace of mind all year long. But everything isn’t always included in a multi-trip plan, the coverage limits are lower and you may not be covered for pre-existing conditions.

Individual vs. family

When shopping for a quote, include everyone traveling in your party and their ages before you submit the trip details. Note that some insurance providers include free coverage for children 21 and younger if a parent is the primary policyholder.

» Learn more: 10 best travel insurance companies

Because coverage varies among the different insurance providers and policies, make sure to read over the policy terms carefully, especially if you’re looking for a specific type or amount of coverage.

If you’re still not sure whether a specific event or activity would be covered, call the insurance company and chat with a customer service representative. It’s better to be aware of what’s covered and what isn’t before you need to (but hopefully don’t have to) file a claim.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

The Comprehensive Guide to Travel Insurance Benefits from Allianz Global Assistance

Trip Cancellation Benefits

Canceling a trip at the last minute can be really disappointing — and really expensive. Many hotels, vacation rental companies, tour operators, airlines and cruise lines won’t refund your money if you cancel too close to your departure date.

That’s when trip cancellation benefits can save the day. This crucial benefit can reimburse your prepaid, non-refundable expenses, up to the maximum benefit in your plan, if you must cancel your trip due to a covered reason.

The term “covered reason” is important! You’ll see it over and over again in your plan documents (and in this guide to travel insurance benefits). Travel insurance doesn’t cover every possible circumstance. “Covered reasons” are the specifically named situations or events for which you are covered in your plan. For trip cancellation, some common covered reasons include the serious illness or injury of an insured traveler or travel companion; the serious illness or injury of a family member; your home or your destination being rendered uninhabitable; and many more.

Available in : OneTrip Cancellation Plus Plan , OneTrip Basic Plan , OneTrip Prime Plan , OneTrip Premier Plan , AllTrips Prime , AllTrips Executive , and AllTrips Premier .

Travel insurance tip: The best time to buy insurance with trip cancellation benefits is immediately after making your travel arrangements. The earlier you buy insurance, the longer your coverage window.

Trip Interruption Benefits

Sometimes, your trip takes an unexpected detour: You trip and fracture your ankle. A hurricane slams your resort. Your tour bus crashes. Trip interruption benefits can reimburse your unused, prepaid, non-refundable expenses, up to the maximum benefit in your plan, when you’re forced to pause your trip or cut it short for a covered reason.

Trip interruption benefits also can reimburse you for extra covered expenses: additional accommodation fees (such as a single supplement fee from a cruise line, if your travel companion goes home early); transportation expenses you incur to continue your trip or return home; and additional accommodation and transportation expenses if the interruption prolongs your trip.

Travel insurance tip: If you get stranded due to a trip interruption, contact Assistance ! Our expert team can help you figure out the best way to continue your trip or get back home, and can assist you with making new travel arrangements.

Travel Delay Benefits

You never planned to spend the weekend in Buffalo, NY… but here you are, because a snowstorm closed the roads and delayed your road trip to Toronto. So you find a cozy inn and order a big breakfast — and your travel delay benefits can cover the costs.

When your trip comes to an unexpected standstill, travel delay benefits make things better. This benefit can reimburse you for your lost prepaid trip expenses, as well as additional expenses for meals, accommodation, communication, and transportation during a covered delay.

Travel insurance tip: If your plan includes SmartBenefits SM , you can opt to receive a fixed inconvenience payment of $100 per insured person, per day, for a covered travel delay (up to the maximum no-receipts limit). No receipts required — just proof of a covered delay. Learn more about SmartBenefits SM .

Assistance/Concierge Services

Assistance is the heart of what we do. Every Allianz travel insurance plan includes access to the 24-Hour Assistance Hotline, available anytime by using the Allyz ® TravelSmart app or by phone. Our team of multilingual problem solvers is available to help customers with all kinds of challenges: changes in travel plans, medical emergencies, lost travel documents, misplaced luggage, lost or stolen personal items, pet care needs, etc.

Some plans also include access to our concierges, who can answer requests ranging from the routine to the extraordinary. Concierge services can assist with restaurant reservations, event tickets, catering and event planning, sightseeing recommendations, special service referrals and much more.

Available in : Assistance is included in all Allianz travel insurance plans. Concierge services are included in the OneTrip Emergency Medical Plan , OneTrip Prime , OneTrip Premier , AllTrips Basic , AllTrips Prime , AllTrips Executive , and AllTrips Premier .

Travel insurance tip: Our concierge benefits are included in qualifying plans, but the customer is responsible for the cost of tickets, tours, catering, and other goods and services not covered by your travel insurance plan.

Pre-Existing Medical Condition Benefit

If you have a chronic illness or injury, or any other medical condition, can you still be eligible for travel protection? Yes! Travel insurance can cover losses related to a pre-existing medical condition , but you have to meet certain requirements.

Allianz Global Assistance defines a pre-existing medical condition as an injury, illness, or medical condition that, within the 120 days prior to and including the purchase date of your travel insurance plan, caused a person to seek medical examination, diagnosis, care, or treatment by a doctor; presented symptoms; or required a person to take medication prescribed by a doctor (unless the condition or symptoms are controlled by that prescription, and the prescription has not changed). You don’t need a formal diagnosis for your illness/injury to be considered a pre-existing medical condition.

If your travel insurance plan includes the Pre-Existing Medical Condition Exclusion Waiver, you can be covered for losses due to a pre-existing medical condition if you meet all of the following requirements:

- You purchased your plan within 14 days of making your first trip payment or first trip deposit;

- On the policy purchase date, you insured the full non-refundable cost of your trip with us. This includes trip arrangements that will become non-refundable or subject to cancellation penalties between the policy purchase date and the departure date. (If you incur additional non-refundable trip expenses after you purchase this policy, you must insure them with us within 14 days of their purchase. If you do not, those expenses will still be subject to the pre-existing medical condition exclusion.);

- You are a U.S. resident;

- You were medically able to travel on the day you purchased the plan.

All other contract terms and conditions apply.

Travel insurance for existing medical conditions might sound complicated. We’re here to help! Contact us if you have any questions about how your travel insurance benefits work, or about what’s covered.

You should know that your health does not affect the cost of travel insurance . When you get a quote, we don’t ask you any invasive personal questions. In most cases, we calculate the plan cost based on your trip expenses and your age.

Available in: OneTrip Cancellation Plus Plan , OneTrip Basic Plan , OneTrip Prime Plan , OneTrip Premier Plan , OneTrip Emergency Medical Plan , AllTrips Prime , AllTrips Executive , and AllTrips Premier .

Travel insurance tip: If you’re not sure you meet the standard of “medically able to travel” when you’re buying insurance, consult your healthcare provider first.

Emergency Medical Care/Transportation Benefits

Getting sick or injured when you’re far from home is a traveler’s nightmare. Will you get the care you need? Will you get hit with surprise medical bills? How will you get home?

Emergency medical benefits and emergency transportation benefits can give you the reassurance you need. Together, these benefits may be the most valuable part of your travel insurance plan. Medical providers overseas often do not accept American health insurance plans; instead, they require payment up front for services rendered. Without travel insurance, the cost of an emergency medical evacuation overseas can reach six figures in some parts of the world.

Emergency medical benefits can reimburse you for eligible costs of medical care for a sudden, unexpected illness, injury, or medical condition you experience while traveling. Emergency transportation benefits can pay for pre-approved, medically necessary transportation to the nearest appropriate hospital or other facility. These benefits also can pay for medical repatriation, which means your transportation home once you’re medically stable to travel.

Available in: OneTrip Basic Plan , OneTrip Prime Plan , OneTrip Premier Plan, OneTrip Emergency Medical Plan , AllTrips Basic , AllTrips Prime , AllTrips Executive , and AllTrips Premier .

Travel insurance tip: If you have a medical emergency while traveling, call Assistance — or use the free Allyz ® TravelSmart app — as soon as you can safely do so. We can help determine where you can best be treated, connect you with local medical providers, monitor your care, keep your family updated, and arrange your safe transport home.

Baggage Benefits

Some travelers think baggage insurance only helps when the airline loses your suitcase. It can actually do a lot more! “Baggage” isn’t just your luggage; it’s any personal property you take with you or acquire on your trip.

If your baggage is lost, damaged, or stolen while you are on your trip, your travel insurance plan can pay you the lowest of the following, up to the maximum benefit listed in your plan:

- The actual cash value of the baggage;

- The cost to repair damaged baggage;

- The cost to replace the lost, damaged, or stolen baggage.

Read the baggage benefits section of your plan documents before you go, so you understand what’s covered and what’s excluded. High-value items (such as jewelry or electronic equipment) are covered up to the maximum benefit for high-value items shown in your declarations.

If your baggage is delayed during your outbound trip, your baggage delay benefits can reimburse you for purchasing essential items you need until your baggage arrives. (The length of a covered delay is defined in your plan.)

If your plan includes SmartBenefits SM , you can opt to receive a fixed inconvenience payment of $100 per insured person, per day, for a covered baggage delay (up to the maximum no-receipts limit). No receipts required — just proof of a covered delay. Learn more about SmartBenefits SM .

Available in: OneTrip Basic Plan , OneTrip Prime Plan , OneTrip Premier Plan , OneTrip Rental Car Protector , OneTrip Emergency Medical Plan , AllTrips Basic Plan , AllTrips Executive Plan , AllTrips Premier Plan .

Travel insurance tip: It’s smart to document the items you bring on your trip, just in case. Snap some quick pictures as you pack. If you buy any new items for your trip, keep the receipts in case you need to file a claim.

Rental Car Benefits

You know how when you rent a car, the agent tries really hard to get you to buy extra insurance? Here’s a tip: You probably don’t need everything they’re selling. Here’s another tip: You do need collision protection — and the OneTrip Rental Car Protector is the affordable way to get it.

Rental car insurance from Allianz Global Assistance provides primary coverage for covered collision, loss and damage up to $50,000, along with 24-hour emergency assistance. This means that if your rental car is stolen, or is damaged in a covered accident or while it's left unattended, the cost can be covered up to $50,000. For just $11 per calendar day in most states, it’s a great deal!

Available in: OneTrip Rental Car Protector Plan , AllTrips Basic Plan , AllTrips Executive Plan , AllTrips Premier Plan (rental car coverage is not available with AllTrips plans in all states), and as an add-on to OneTrip plans.

Travel insurance tip: The OneTrip Rental Car Protector also includes up to $1,000 in trip interruption benefits and up to $1,000 in baggage loss/damage benefits. This makes it a great choice to protect weekend road trips.

Related Articles

- SmartBenefits Explained [VIDEO]

- Travel Insurance and COVID-19: The Epidemic Endorsement Explained

- Trip Cancellation Insurance: Covered Reasons Explained

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Does Travel Insurance Include Repatriation?

Yes, travel insurance includes repatriation as described within the medical evacuation coverage of your travel insurance plan.

Repatriation is the return of an insured traveler’s body home if they die while traveling. See our full review of repatriation coverage for more details.

The simple fact is that repatriating a person’s body is a complicated and expensive process. Local laws and regulations control how the body is to be handled and transported and there are often fees, expenses for embalming, costs for containers, and shipping costs not to mention the bureaucracy involved in transporting human remains.

Regardless of the situation, the family of the traveler is very much helped by a travel insurance company who can manage, negotiate, and pay for the repatriation.

What kinds of travel insurance plans include repatriation?

Many types of travel insurance plans (both package plans and travel medical plans) include this coverage, but it’s important to note that repatriation is nearly always bundled with the travel insurance plan’s medical evacuation coverage.

The travel insurance provider will coordinate, manage, and pay for the repatriation – not the traveler’s family. The travel insurance company will, however, communicate their plan and the progress to the family of the traveler.

What’s not included with repatriation coverage?

A travel insurance plan with repatriation coverage does not include funeral, burial, or cremation expenses. Nor does it include related containers such as urns or coffins. The travel insurance coverage focuses on the legal transportation of the body in an approved container to a funeral home near the traveler’s residence.

In essence, the traveler cannot be buried where they died using their travel insurance coverage – their body must be transported home instead.

See our full review of repatriation coverage for a list of plans and associated limits to understand how much coverage each company and plan provides.

DamianTysdal

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.

How does annual travel insurance work?

- 18 September 2013

How does travel insurance work?

- 17 September 2013

Why does travel insurance need the airline reimbursement for my lost bag?

Travel with peace-of-mind... compare quotes for free.

Medical Evacuation Insurance: Best Medical Repatriation Coverage

- July 20, 2023

- Travel resources

Vacations abroad can be marred by illness or injury, which becomes even more distressing when you are far from home. In such situations, immediate medical care, medical helicopter rescue insurance or airlift transportation might be necessary. To safeguard your wellbeing and against the financial burden of these emergencies, having a comprehensive travel insurance plan with medical evacuation insurance is crucial.

This review blog looks at the best medical evacuation insurance plans, as well as everything you need to know about medical evacuation and repatriation insurance.

Quick Answer: Best Medical Evacuation Insurance

Editors Choice

Global Rescue Insurance

Coverage for Trekkers

No limitation on altitude for coverage

Emergency medical coverage: to $100,000

2nd Best Choice

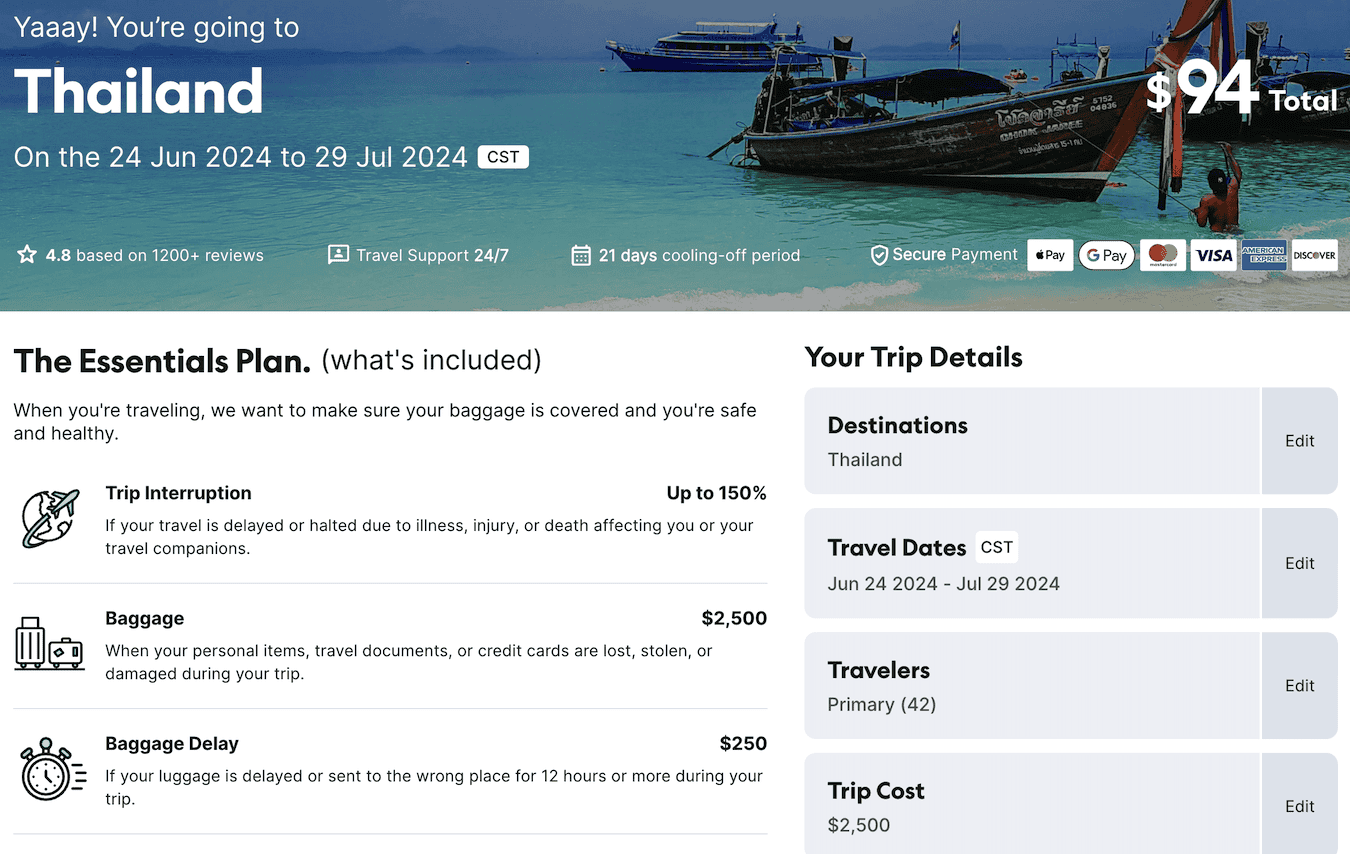

World Nomads Insurance

Coverage until 22,965 feet (7,000 meters)

Up to $500,000 in coverage

3rd Best Choice

Travelex Trekking Insurance

Coverage until 20,000 feet (6,000 meters)

Up to $1 million in coverage

Best Medical Evacuation Insurance Providers

The information below highlights our top three choices for medical evacuation and repatriation insurance which are perfect for trekkers and adventure sports enthusiasts. We must insist that you look through the policies and what they cover before you purchase one. Additionally, if you are looking for more traditional travel insurance, have a look at one our other blogs: best trekking travel insurance , and insurance for trekking in Nepal .

Our top three choices for medivac insurance:

1. Global Rescue Insurance:

Global Rescue Trekking Insurance is a well-known provider of rescue memberships in high-altitude and trekking circles. This plan is highly recommended by many of Nepal’s travel and expedition companies.

The most significant advantage for travelers with Global Rescue’s rescue and evacuation insurance is no elevation limit. Meaning that their policy covers you no matter where you are in the world – even Everest!

You can get a membership on short- or long-term basis (7, 14, or 30 days), making the plan extremely flexible and affordable! Their specialty is with medical rescue and reparation insurance, and does not cover travel cancellations, delays, baggage, or medical and dental expenses.

However, they do offer add-on travel insurance policy with IMG (IMG Signature Travel Insurance), which provides coverage for all these items in addition to your high-altitude and rescue/evacuation coverage.

Make sure to check out my Global Rescue Insurance review blog, it will go into depth about what the medical Helicopter evacuation coverage offers!

Main Features:

Medical evacuation from anywhere in the world

Emergency medical coverage — up to $100,000

Trip cancellation — up to $100,000

Lost luggage/baggage delay — up to $2,500

Up to 150% of trip cost insured for trip interruption

Pros and Cons of WorldTrips Hiking Insurance:

The following are a list of pros and cons, things that we love and hate about the insurance policy:

- Secure the value of your entire trip

- Industry’s most complete travel insurance products

- Field Rescue services from the point of injury or illness

- Face-to-face video consultations and advice about your diagnosis

- Will rescue you no matter where you are in the world

- Help determining the best possible treatment options

- Can be expensive depending on the travelers usage of the plan

- Have to buy an annual membership

- Emergency medical expense coverage of $100,000 is quite low when compared to other altitude insurance policies

1. World Nomads Insurance

As an entity, World Nomads has been recommended by well known companies in the travel industry such as Lonely Planet and National Geographic — add with the thousands of customer reviews from Trust Pilot that they have garnished over the years, it is easy to see the great reputation that World Nomads has.

They are also backed by secure, trusted, and specialist underwriters who provide travelers with great cover, 24-hour emergency assistance, and the highest levels of support and claims management!

Let’s first start with who World Nomads is. You can also read my full World Nomads Insurance Review to take a deep dive into the insurance provider.

Who are World Nomads?

Since 2002, World Nomads have been protecting, connecting and inspiring independent travelers.

They offer simple and flexible travel insurance and safety advice to help you travel.

Because they believe in giving back to the places we travel to, World Nomads also enables you to make a difference with a micro-donation when you buy a policy.

And they’ll help you plan your trip with free downloadable guides, travel tips, responsible travel insights and recommendations from their global community.

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Standard Plan until 19,685 feet (6,000 meters)

$500,000 in coverage

Trip cancellation insurance

Standard Plan until 22,965 feet (7,000 meters)

Emergency medical evacuation

Pros and Cons of World Nomads Insurance:

- Covers a Lot of Countries Worldwide

- High Coverage for Medical Expenses

- Flexible Prices

- Buy or Extend Anytime, Anywhere

- Perfect for adventure-loving travelers

- 24/7 customer service with online claims option

- Limited age coverage for seniors

- Coverage can differ depending on location and nationality

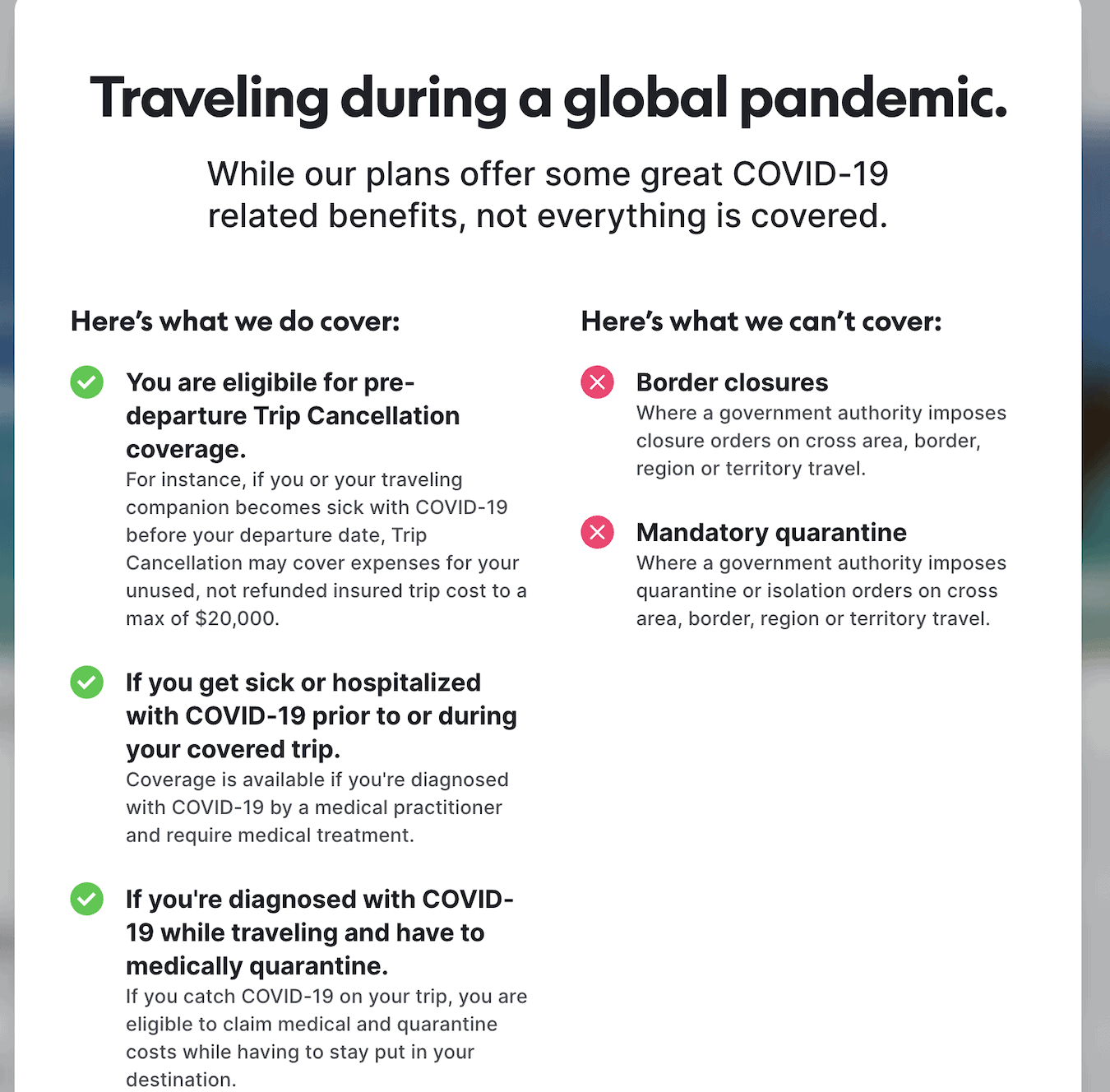

- Limited COVID coverage

2. Travelex Trekking Insurance:

Our third choice for insurance that provides medical evacuation and repatriation insurance is Travelex insurance. It is a great budget-friendly provider that offers affordable rates and coverage for families. Moreover, they offer plan extensions that will allow you to be insured while trekking at high elevations. They provide coverage on individual bases and will allow you to get trekking insurance up to 20,000 feet (6,000 meters) above sea level. This makes it great for climbers looking to hike up to Everest Base Camp trek in Nepal or other places around the world like the Alps, the Andes or Kilimanjaro!

Another great aspect that we like about the Travelex’s service, is that they have an app that you can download which will provide important information about the country you are traveling to. It will help keep you safe by providing real-time security alerts, information about food and water safety, as well as ATM locations!

If you are looking for a budget travel insurance plan that will cover the adventure sports aspect of your vacation no matter where you are in the world, Travelex will be a great fit for you! You can get a free quote from hen Travelex climbing insurance . You can also read our full Travelex Insurance review , to learn more about how they are one of the best trekking insurance providers!

Coverage upto 20,000 feet (6,000 meters) above sea level

Free coverage for children under 17

Can apply for pre-existing medical condition waivers

Travel delay coverage of $2,000

Pros and Cons of Travelex Trekking Insurance:

- The travel insurance will include free coverage for children under the age of 17 if they are with an adult that is covered by the insurance policy

- Offers an adventure sports upgrade, including for high elevation trekking

- You can upgrade the plan to get a “cancel for any reason”

- Medical expense coverage is primary, compared to some competitors’ secondary coverage.

- Provides great travel delay coverage. Providing USD $2,000 per person after an initial five-hour delay.

- “Cancel for any reason” coverage provides 50% reimbursement of the non-refundable deposits – which is lower than most travel insurance providers, who usually provide 75%

- The emergency medical expense coverage for the Travel Select plan is $50,000, compared to higher levels from top competitors.

- Baggage delay benefits only apply after an initial 12-hour wait – longer than most companies

What is emergency medical evacuation (Medevac) insurance?

Medical evacuation insurance is a common inclusion within comprehensive travel insurance policies, often referred to as emergency medical evacuation, medical evacuation, or repatriation insurance.

Coverage is designed to handle the expenses associated with emergency medical transportation in the event of a serious injury or illness while you are traveling – no matter where you are in the world. Should you encounter a medical emergency and the nearest appropriate treatment center is distant, this insurance may also cover the cost of transporting you back to your home.

There are differences between medical evacuation insurance and standard medical travel insurance which you should be aware of before deciding which coverage to purchase. The section below highlights these differences.

Medical Evacuation Insurance vs. Medical Travel Insurance:

While traveling, it is prudent to have both emergency medical evacuation coverage and travel medical insurance in place. These insurance products complement each other, offering distinct benefits for crucial services and treatments you may require during your travels.

While searching for the most suitable travel insurance plan, remember that medical evacuation coverage caters to the expenses involved in transporting you to receive proper medical care. This coverage applies whether it entails emergency helicopter rescue or plane journey to a local hospital or a medically-supported trip back to the United States from a non-U.S. hospital.

On the other hand, medical travel insurance covers emergency medical care you might need while away from home, encompassing procedures like surgeries, treatments, and medicines required for your recovery. This coverage can also address doctor’s bills, X-rays, lab tests, and other medical services necessary during your trip. Some travel medical insurance policies even provide a separate limit for dental expenses if an accident leads to dental trauma requiring treatment.

The main differences between Medical Evacuation Insurance and Medical Travel Insurance lie in their specific coverage and focus:

1. Coverage Scope:

- Medical Evacuation Insurance: This type of insurance primarily focuses on emergency transportation services, arranging for transportation to the nearest adequate medical facility in the event of a serious injury or illness during travel.

- Medical Travel Insurance: On the other hand, Medical Travel Insurance primarily covers the costs of medical treatment and expenses incurred during your trip. It addresses emergency medical care, doctor visits, hospitalization, prescription medications, and other related medical services required during your travels.

2. Main Purpose:

- Medical Evacuation Insurance: The main purpose of Medical Evacuation Insurance is to guarantee timely and effective evacuation in critical situations where local medical facilities may not be equipped to provide adequate care.

- Medical Travel Insurance: Medical Travel Insurance is designed to cover the costs of medical treatments and services while traveling, similar to health insurance coverage. It ensures that you have access to necessary medical care and alleviates the financial burden of unexpected medical expenses abroad.

3. Service Activation:

- Medical Evacuation Insurance: This insurance is typically activated when a qualified physician certifies that your injury or illness requires immediate evacuation for proper medical treatment. The insurance company arranges and coordinates the evacuation process to ensure your safety.

- Medical Travel Insurance: Medical Travel Insurance comes into play when you need medical attention during your trip. It covers the expenses incurred for medical treatments and services received while traveling.

In summary, Medical Evacuation Insurance centers on providing emergency transportation services, while Medical Travel Insurance concentrates on covering medical treatments and services during your journey. These two types of insurance can be complementary, offering a comprehensive safety net for travelers facing medical emergencies away from home.

What Does Medical Evacuation Insurance Cover?

In remote locations, medical evacuation expenses can be costly. Daniel Durazo , a spokesperson with Allianz Global Assistance had this to say:

“The cost of emergency medical transportation can run into the tens of thousands of dollars or more, and varies based on the traveler’s health condition, care required and their location.”

Lacking emergency medical evacuation (Medevac) insurance means you would be burdened with the full weight of these expenses in the event you require transportation via helicopter, plane, or ambulance to preserve your life.

An example of what you may have to pay depending on your location in the world are as follows:

Break Down of Medical Evacuation and Repatriation Insurance Coverage:

Here is a summary of what medical evacuation insurance typically covers:

1. Emergency transportation:

Reparation medical insurance can pay for the cost of emergency transportation to the nearest suitable treatment center if you encounter a serious illness or injury during your travels and require immediate medical attention. It may also cover the expenses for transporting you back to the U.S. if medically necessary. Additionally, if you need to return to the U.S. for further treatment or recovery after being treated abroad, the insurance can cover the flight home.

2. Medical escort services:

If you need specialized medical care during your flight home, medical evacuation insurance can cover the associated costs for arranging a medical professional to accompany you.

3. Travel expenses for a friend or family member:

If you are hospitalized due to a covered illness or injury, the insurance can pay for a round-trip flight for a friend or family member to stay with you during your hospitalization. There may be a minimum hospital-stay requirement to qualify for this benefit.

4. Costs for a bedside companion:

Some medical evacuation benefits include compensation for hotel stays, meals, and other reasonable expenses incurred by your traveling companion while staying near you during your hospitalization.

5. Repatriation of your children:

If you are hospitalized during your trip and traveling with your children, the insurance company can arrange for your children to fly back home or to another U.S.-based location. The benefits can cover the cost, minus any refunds for unused plane tickets. This benefit also typically has a minimum number of days of hospitalization required to file a claim.

6. Repatriation of remains:

In the unfortunate event of death during the trip, the cost of transporting the remains back home can be covered by the repatriation benefits included in your medical evacuation coverage.

When Do You Need Medical Evacuation and Repatriation Insurance?

Medical evacuation benefits can prove invaluable if you encounter a serious illness or suffer a severe injury during your trip, and the local hospitals lack the necessary resources to provide adequate treatment. Additionally, having the insurance company act as an intermediary in organizing transportation and medical services can be extremely beneficial during a medical emergency in a foreign land.

The travel medical insurance included in your travel insurance plan covers a range of expenses, including doctor and hospital bills, X-rays, lab work, medications, and other related costs, up to the limit specified in your medical coverage. It’s important to note that evacuation insurance and travel medical insurance come with separate coverage limits. For example, a comprehensive travel insurance plan might offer up to $500,000 for medical expenses and up to $1 million for evacuation.

Once you are well enough to travel, your travel insurance company can also cover the cost of your flight back home, ensuring you receive the necessary care and assistance throughout your journey.

Want more info about when you might need travel insurance, take a look at our why do I need travel insurance blog.

Do You Need Both Medical Evacuation and Travel Medical Insurance?

Having both medical evacuation travel insurance and travel medical insurance is a prudent decision when traveling abroad. According to Durazo from Allianz, purchasing travel insurance with emergency medical coverage and transportation benefits becomes crucial if you wish to avoid paying all your medical expenses out of pocket.

When traveling outside the U.S., obtaining travel medical expense insurance is often essential, as domestic health insurance plans might provide limited or no international coverage. It’s advisable to check with your health insurance company to determine if your plan offers global coverage and if it falls under the category of “out of network.” Additionally, senior travelers should be aware that Medicare is not accepted abroad.

How To Use Emergency Medical Evacuation (Medevac) Insurance?

To utilize medical evacuation insurance, typically, you will need an emergency evacuation prescribed by the attending physician at the location, certifying that the seriousness of your accidental injury or illness necessitates the evacuation.

Ideally, your travel insurance company should assist in arranging the medevac and approve it beforehand. However, if immediate approval is not feasible, informing your travel insurance company as soon as possible becomes essential.

Typically, to make use of your emergency medical evacuation insurance, you will should follow these steps:

1. Seek approval immediately:

If you encounter illness or injury during your trip and require emergency medical transportation, the first step is to obtain approval from your travel insurance provider before using the service. Each provider offers a 24-hour hotline that you, the in-house doctor, or a medical professional can call to expedite the process. It’s crucial to do this promptly.

2. Keep all receipts and bills:

Depending on your travel insurance plan, medical transportation bills may be paid directly by the insurance company or require upfront payment, followed by reimbursement later. In either case, it is essential to preserve all documents and receipts related to your incident or illness, including bills and paperwork that substantiate your medical expenses.

3. File a claim online or over the phone:

Upon returning home, contact your travel insurance provider to inquire about the status of your claims. You may need to submit a separate claim for the emergency medical evacuation and other services used from your plan, or you might only need to provide supporting documentation to utilize your coverage.

Stay Protected as you Travel with Medical Evacuation Insurance:

Medical evacuation insurance, also known as emergency medical evacuation insurance or travel insurance for medical evacuation, serves as a vital safety net for travelers venturing far from home. The coverage ensures prompt and efficient emergency transportation to the nearest appropriate medical facility, or even to your home country, should a serious injury or illness arise during their journey.

With the added benefit of medical evacuation and repatriation insurance, travelers can rest assured that they are financially protected when facing unforeseen medical crises abroad – even while trekking in Nepal and traveling in some of the most remote places in the world. By securing this comprehensive coverage and understanding the steps involved in utilizing it, travelers can embark on their adventures with peace of mind, knowing that they have a reliable support system in place should the need for emergency medical evacuation arise.

Leave a Reply Cancel Reply

Your email address will not be published. Required fields are marked *

Add Comment *

Save my name, email, and website in this browser for the next time I comment.

Post Comment

What is medical evacuation and repatriation insurance cover?

Medical evacuation and repatriation insurance covers the cost of travelling for medical treatment should it not be available locally. if an international worker or their dependants are ill or injured and the required medical treatment is not available locally, they are transferred to the nearest suitable medical facility., the vital role of international health insurance providers in times of crisis.

For expats and their families living or working in remote areas where there may not be easy access to medical facilities, the inclusion of medical evacuation and repatriation cover may be an important part of their health insurance

The international private medical insurance industry is experiencing a significant increase in medical evacuations and repatriations due, in part to the growing number of international companies with staff working overseas; workforces in remote and often hazardous regions (e.g. mining companies), together with the rise in climate-related natural disasters. With ever more companies seeking business opportunities overseas, employers recognise the compelling need to provide global healthcare cover for their staff. In many countries medical insurance is a legal requirement and domestic cover may not offer as comprehensive a level of cover as international private medical insurance (iPMI). Healthcare is a major concern for expats and their families and it is hugely reassuring for them to know that they are covered, regardless of location, by a health insurer who literally speaks their language. Medical evacuations are carried out when international workers or their dependants get ill or injured and the required medical treatment is not available locally, at which point they need to be taken to the nearest suitable medical facility. The countries from which Allianz Worldwide Care clients are most frequently evacuated include Mozambique, Libya and China, where specialist medical care is limited. South Africa and Germany are among the countries to which members are most commonly evacuated, due to the availability of centres of medical excellence and specialist care facilities. The difference between medical evacuations and medical repatriations is that for repatriations, the insured member is returned to their home country for treatment, where medically appropriate and possible.

The process

The challenges.

As one might expect, managing medical evacuations on a global basis is not without its challenges. Insurance companies have to overcome a range of potential obstacles such as failing, archaic or sometimes non-existent communication infrastructure, restricted air space, the impact of weather, or even political or rebel unrest. However, global providers are well prepared for these kinds of challenges and experience and determination are a formidable combination. We always strive to find the nearest medical centre but they may not always have the most suitable facilities. For example, a member that recently needed medical evacuation was located in Papua New Guinea, but while the capital Port Moresby was nearby, the hospital did not have the required medical facilities. Instead we had to evacuate the member to Cairns in Australia which was the nearest centre of excellence. To evacuate a member, we need a copy of their passport plus, where required, a visa or permit for the country to which they will be moved. Visa’s can be difficult to obtain, particularly given the very tight deadlines to which we are operating, but with a strong network of medical partners located all over the world, we are always able to assist the member.

To apply for an emergency visa, the following items are needed:

- Medical report by the treating physician including a justification for needing treatment in the chosen country.

- Invitation letter from the admitting medical facility in the chosen country, confirming the acceptance of the patient and willingness to provide treatment. (This letter should also include the estimated length of stay and estimated costs)

- Letter from either the insurer, patient’s family or patient’s employer confirming financial cover for the patient's transportation, medical and living expenses.

Following the application, there are two different scenarios that may occur:

- Emergency visa is issued on arrival.

- Emergency visa is issued after application - a representative or family member needs to attend a visa application centre or embassy and make an application on behalf of the patient.

We will have the experience, local partners, knowledge and emergency procedures in place to deal with the VISA application on behalf of the client, if support is needed. Technology has played a significant role in helping us to overcome many challenges, increasing the survival rates during evacuations. Advances in technology can be seen at every stage of the evacuation process, from communication, to portable medical equipment, to the air ambulance themselves, where technology allows them to fly at altitudes and speeds that minimise the risk of medical deterioration.

Five continents, hundreds of evacuations

Final thoughts, related articles.

Best countries to start a new life abroad in 2024

Planning a move abroad in 2024? Discover why Canada, Portugal, and Denmark are the top choices for expats seeking new opportunities, cultural experiences, and a fresh start.

Combatting SAD with indoor plants

Discover how indoor plants can combat Seasonal Affective Disorder (SAD) by improving mood, reducing stress, and purifying the air. Learn about the best houseplants to enhance your wellbeing.

Are supplements safe

Ten things you should know. Healthcare professionals often recommend supplements if you have certain health conditions, are at risk of certain conditions, or have a nutrient deficiency in your diet.

How to make friends and feel safe

Discover the top ten tips for making new friends safely. Learn how joining groups, taking classes, volunteering, and using social media can help you forge meaningful connections and enhance your wellbeing.

Managing Long-COVID Fatigue and Symptoms

Manage long-COVID symptoms with tips on pacing yourself, maintaining sleep schedules, exercising, eating well, staying hydrated, and seeking professional help. Boost your energy and well-being today.

Expat Guide to Living in Thailand

Thinking of relocating to Thailand? We have you covered with the most important things every expat should know about living in Thailand.

What are the benefits of cold water therapy?

Discover the surprising benefits of cold water therapy! From muscle recovery to mood enhancement, explore how icy plunges can boost your well-being.

What to Know About AI Mental Health Support

Thinking about using an AI mental health platform? Here are the pros, cons, and what you should consider.

How to Use a Virtual Health Assistant

Curious about how AI could help you to access healthcare? Here’s how using a virtual health assistant works.

How AI May Help You Live Longer

How can the average person live longer with AI? Accessing AI in healthcare is easier than you think.

The potential for AI in healthcare

Artificial intelligence in healthcare has the potential to transform the way we diagnose, treat and prevent diseases.

The Best Self-care Tips for Your Mental Health