- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

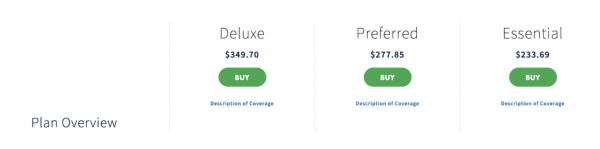

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

Personal Lines - Travel Guard

First notice of loss.

Overnight Mail:

AIG Attn: Travel Guard 3300 Business Park Dr Stevens Point WI 54482

Mailing Address: AIG Attn: Travel Guard Po Box 47 Stevens Point WI 54482

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

- AIG Travel Guard Overview

- AIG Travel Guard Plans

AIG Travel Guard Cost

How to file a claim with aig travel guard, compare aig travel guard, aig travel guard frequently asked questions.

- Why You Should Trust Us

AIG Travel Guard Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

AIG Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits. If you're looking for travel insurance, consider Travel Guard .

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation coverage of up to 100% of the cost, for all three plan levels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR covers up to 75% of total trip costs (maximum of $112,500 on some plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Medical coverage of up to $500,000 and evacuation of up to $1,000,000 per person

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes COVID coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Above average baggage loss and delay benefits

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical evacuation coverage

- con icon Two crossed lines that form an 'X'. Premiums may run slightly higher than competitors

Travel Guard is a well-established and highly rated name in the travel insurance industry. It offers three main coverage options to choose from, and in general its policies have above-average coverage for baggage loss and baggage delays, plus high medical evaluation coverage limits.

- Trip cancellation coverage for up to 100% of the trip cost

- Trip interruption coverage for up to 150% of the trip cost

- Preexisting medical conditions exclusions waiver must be purchased within 15 days of initial trip payment

- Annual travel insurance plan and Pack N' Go plan (for last-minute trips) available

AIG Travel Guard Travel Insurance Review

AIG Travel Guard is among the best travel insurance companies with impressive coverage limits, even with its basic plan, Travel Guard Essential. It's emergency medical evacuation coverage is particularly high, making Travel Guard a good choice for insuring cruises, as sea to land evacuations are often expensive.

Additionally, Travel Guard's Premium and Deluxe plans offer coverage that many of its competitors don't, such as its travel inconvenience coverage and ancillary evacuation coverage.

That said, Travel Guard is on the pricey side, compared with its competitors. While age is often a factor in your insurance premiums, Travel Guard tends to quote older travelers higher rates than its competitors. However, you often get what you pay for. In Travel Guard's case, you'll find that its coverage justifies its higher rates.

While great coverage is important, it's also crucial that an insurance company has a smooth claims process, which Travel Guard lacks, according to its customer reviews. Across 135 reviews on its Trustpilot page, AIG Travel Guard received an average of 1.2 stars, with 95% of reviewers giving the company one star. Surprisingly, AIG Travel Guard fares even worse with the Better Business Bureau, receiving an average of 1.08 stars out of five across 301 reviews.

Coverage Options Offered by AIG Travel Guard

AIG Travel Guard offers three primary plans: Travel Guard Essential, Travel Guard Preferred, and Travel Guard Deluxe. Each plan has different coverage limits and various types of protection.

Here's a look at what you'll get with each plan:

Depending on the policy you select, there are also additional coverages that my be included at no extra charge, like pre-existing conditions waiver, single occupancy fee coverage, worldwide travel and medical assistance services, and more. Be sure to check each policy closely to see what is and isn't covered.

Each of these plans also include coverage for one child under 17 as long as their travel costs are equal to or under the adult's cost. Additional coverages do not apply to the child.

AIG Travel Guard Pack N' Go Plan

In addition to these three primary plans, Travel Guard offers the Pack N' Go policy along with an Annual plan. This policy is for last-minute travelers who don't need trip cancellation coverage.

This plan includes:

- Trip interruption and trip delay ($200 per day maximum) up to $1,000

- Missed connection up to $500

- Baggage delay up to $200 and baggage coverage up to $1,000

- Medical expenses up to $25,000 and dental expenses up to $500

- Emergency evacuation and repatriation of remains up to $500,000.

AIG Travel Guard Annual Plan

Taking multiple trips throughout the year? Consider the Travel Guard Annual plan instead of purchasing a new policy for each adventure. This plan comes with coverage for:

- Trip interruption coverage up to $2,500

- Trip delay coverag e up to $1,500 ($150 per day maximum)

- Missed connection coverag e up to $500

- Baggage delay coverage up to $1,000 and lost/damaged baggage coverage up to $2,500

- Medical expenses coverage up to $50,000 and dental expenses up to $500

- Emergency evacuation coverage and repatriation of remains up to $500,000

- Accidental death and dismemberment coverage up to $50,000 and security evacuation up to $100,000

Additional Coverage Options from AIG Travel Guard

Like many other travel insurance providers, Travel Guard offers add-ons for an additional cost. These can be selected while you're purchasing your policy.

The availability of these add-ons depends on the policy you're buying. Note also that some are already included in the Preferred and Deluxe plans.

- Medical bundle — Increases coverage amounts for medical expenses and evacuation and adds hospital of choice and additional evacuation benefits.

- Security bundle — Provides various coverages for trip interruption or cancellation due to riot or civil disorder.

- Rental vehicle damage coverage — Reimburses a predetermined amount for physical damage to a rental car in the policy holder's name.

- Cancel for Any Reason Insurance (CFAR) — This is just what it sounds like. Cancel for any reason coverage will reimburse 75% of nonrefundable expenses when you cancel your trip for any reason, up to 48 hours before your scheduled departure. CFAR coverage is only available for Travel Guard's Deluxe and Preferred plans.

- Inconvenience bundle — Offers reimbursement for inconveniences like closed attractions, credit/debit card cancellation, hotel construction, and more.

- Pet bundle coverage — Daily travel benefit for boarding and medical expense coverage for illness or injury of dog or cat. Includes trip cancellation or interruption coverage if the pet is in critical condition or dies within seven days before the departure date.

- Adventure sports bundle — Removes the exclusions for adventure and extreme activities.

- Baggage bundle — Your baggage coverage with AIG becomes primary with increased coverage and baggage delay benefits.

- Wedding bundle — Provides trip cancellation coverage due to wedding cancellation (brides and grooms not covered).

- Name a family member bundle — One person can be named as a Family Member for the purpose of family member-related unforeseen event coverage.

How to Purchase and Manage Your AIG Policy

Getting a quote from AIG Travel Guard is quick and easy. Head to AIG website and enter basic information about the trip you're looking to cover. You'll get an instant quote for the insurance plans available for your trip, so it's easy to compare each option. Be prepared to provide information including:

- Your state of residence

- Date of birth

- The cost of your trip

- Travel dates

- Destination

- Method of travel

We ran a few simulations to offer examples of how much a Travel Guard policy might cost. You'll see that costs usually fall within 5-7% of the total trip cost, depending on the policy tier you choose.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Travel Guard travel insurance quotes:

- Travel Guard Essential: $86.96

- Travel Guard Preferred: $152.01

- Travel Guard Deluxe: $188.59

Premiums for Travel Guard's various single trip plans are between 2.8% and 6.3%, well within, and even below, the average cost of travel insurance .

A 30-year-old traveler from California is heading to Japan for two weeks, costing $4,000. The Travel Guard travel insurance quotes are:

- Travel Guard Essential: $198.77

- Travel Guard Preferred: $240.39

- Travel Guard Deluxe: $305.04

Premiums for Travel Guard's various single trip plans are between 5% and 7.6%, within the average cost for travel insurance.

A couple of 65-years of age looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following Travel Guard quotes:

- Travel Guard Essential: $471.10

- Travel Guard Preferred: $618.22

- Travel Guard Deluxe: $834.78

Premiums for Travel Guard's various single trip plans are between 7.9% and 13.9%, which is significantly higher than the average cost. That said, travel insurance is often more expensive as you get older.

AIG Travel Guard Annual Plan Cost

Getting a quote for the annual plan requires much less information, only asking for the intended policy start date, your state of residence, and how many people you plan to insure. Quotes from AIG remained at $259 per traveler, regardless of state of residence and number of travelers.

Filing a claim with Travel Guard is a straightforward process. You'll need your policy number and can either go to travelguard.com or call Travel Guard at 866-478-8222 to start the claim. Once submitted, you can check the status of your claim at claims.travelguard.com/status.

See how AIG Travel Guard stacks up against the competition and find the right travel insurance policy for you.

AIG Travel Guard vs. Nationwide Travel Insurance

Nationwide is a household name when it comes to insurance providers and one of the largest and most-recognized insurance providers in the US. Similarly to Travel Guard , Nationwide makes it easy to find coverage by offering just two single-trip plans: the Essential and Prime plan.

In addition, Nationwide offers plans specifically designed for cruises along with annual trip insurance for those who travel a lot throughout the year.

The Nationwide Essential Plan comes with trip cancellation coverage of up to $10,000, up to $250,000 in emergency medical evacuation, up to $150 per day reimbursement for travel delays of 6+ hours, and coverage for delayed or lost baggage.

In comparison, the Travel Guard Essential plan covers trip cancellations with up to $100,0000 in coverage, up to $150,000 in emergency medical evacuation expenses, up to $100 per day ($500 total) for trip delays of 12+ hours, along with lost or delayed baggage coverage.

The high-tier Prime Plan from Nationwide offers even more coverage, including trip cancellation up to $30,000, trip interruption coverage up to 200% of the trip cost (maximum of $60,000), missed connection and itinerary change coverage of $500 each, $250 per day for trip delays of 6+ hours, and up to $1 million in coverage for emergency medical evacuation

AIG's highest-tier Deluxe plan comes with trip cancellation coverage of up to $150,000, up to $1,000,000 in emergency medical evacuation, up to $200 per day ($1,000 maximum) reimbursement for travel delays of 12+ hours, and coverage for delayed or lost baggage.

As you can see, it's hard to compare apples to apples when comparing the two different insurance providers. But it helps to know the specifics of the coverages that matter most to you.

Read our Nationwide travel insurance review here.

AIG Travel Guard vs. Allianz Travel Insurance

With Allianz Travel Insurance , you can choose from 10 different insurance plans to find one that suits your needs. Like Travel Guard , it offers one-off policies for specific trips and an annual travel insurance plan for those who take multiple trips a year. Similar to AIG, too, the different plans offer varying levels of coverage.

Allianz's most popular single-trip option is the OneTrip Prime plan. This plan offers trip cancellation coverage up to $100,000, trip interruption coverage up to $150,000, emergency medical coverage for $50,000, coverage for baggage loss, theft, or damage up to $1,000, and up to $800 in travel delay coverage.

The most similar plan from Travel Guard is the mid-tier Travel Guard Preferred plan, which which you'll get up to $150,000 in trip cancellation coverage, trip interruption coverage up to $225,000, $50,000 in emergency medical coverage, coverage for baggage loss, theft, or damage up to $1,000, and travel delay coverage of up to $800.

A variety of factors will determine the final cost of any of these travel insurance policies. However, when comparing quotes with the same factors, Allianz tends to be cheaper. Additionally, Travel Guard seems to be more sensitive to the traveler's age. However, it's best to compare quotes using your specific personal and trip details to determine which policy is the best for you.

Read our Allianz travel insurance review here.

AIG Travel Guard vs. Credit Card Travel Insurance

Before purchasing a travel insurance plan, take a look at the coverage offered through your travel rewards credit cards. Some of the basic coverages you're looking for, like rental car insurance, may already be available through credit card travel protection .

The coverage you have on your credit card couple be sufficient if, for example, you're taking a road trip by car and you don't have any non-refundable trip expenses. It could also be enough if your health insurance covers you while you travel and you aren't overly worried about incurring additional medical expenses during your trip.

It's also worth remembering that credit card coverage is usually secondary versus the primary coverage you'd get with a travel insurance policy. Meaning you'll have to file a claim with the other applicable insurance (like through the airline travel provider) before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Depending on the single trip plan you choose, AIG Travel Guard offers $15,000-$100,000 in emergency medical expense coverage.

All three of Travel Guard's single trip policies offer pre-existing condition waivers as long as you purchase your policy within 15 days of your initial trip payment.

Travel Guard is the name used for AIG's travel insurance products, but AIG also offers other insurance products, like AIG Life Insurance .

Your coverage depends on the policy you buy, but all policies will cover (up to a specified limit) trip cancellation, interruption, delay, emergency medical expenses, lost and delayed baggage, and emergency evacuation.

Yes, Travel Guard plans cover trip cancellation and interruption due to illness, injury, or death of a family member. If your trip is delayed or canceled due to inclement weather, that's covered too. AIG Travel Guard's is also among the best CFAR travel insurance companies.

Why You Should Trust Us: How We Reviewed AIG Travel Guard

The policy that's best for you will be the one that offers the right amount and type of coverage, fits your budget, and is easy to use if you ever need it.

In reviewing Travel Guard , we looked at the company's travel insurance offerings and compared them to plans offered by the top travel insurance companies in the space. Factors considered included things like coverage options, claim limits, what's covered, available add-ons, and typical insurance policy costs. We also considered buyer preferences.

Read more about how Business Insider rates insurance providers .

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

AIG Travel Insurance: The Complete Guide

Everything you need to know before you buy AIG Travel insurance plans

:max_bytes(150000):strip_icc():format(webp)/joecortez_headshot-56a97f185f9b58b7d0fbf9ac.jpg)

For decades, AIG Travel , part of American International Group, Inc., has provided travel insurance options for many travelers. Marketed under Travel Guard, the company offers travel insurance solutions and travel-related services, including medical and security services, marketed to both leisure and business travelers around the globe.

If you have purchased a trip insurance plan in the past, it may have been provided by AIG Travel without you even knowing it: the company also creates custom policies for several smaller insurance brokers, airlines and even travel groups. Is AIG Travel the right company for your trip?

About AIG Travel

AIG Travel is a member of American International Group, Inc., a global insurance company that provides everything ranging from property casualty insurance, life insurance, retirement products, and other financial services. Travel Guard is the marketing name that AIG Travel uses to advertise its portfolio of products.

Today, the company is headquartered in Stevens Point, Wisc., and serves travelers in 80 countries and jurisdictions through eight wholly-owned global service centers in key regions, including Houston, Texas; Stevens Point, Wisc.; Kuala Lumpur, Malaysia; Mexico City, Mexico; Sofia, Bulgaria; Okinawa, Japan; Shoreham, England; and Guangzhou, China.

How Is AIG Travel Rated?

AIG Travel policies are underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., another subsidiary of AIG. As of June 2018, the policy writer has an A.M. Best A rating, putting them in the “Excellent” credit category with a stable outlook.

For customer service, AIG Travel is highly rated on three major travel insurance marketplaces online. With more than 400 reviews, AIG Travel has a five-star rating from TravelInsurance.com , with a 98 percent recommendation rate. Customers of InsureMyTrip.com give the company 4.56 stars (out of five). Although Squaremouth.com no longer offers AIG Travel policies anymore, previous customers gave the company 4.46 stars (out of five), with less than one percent negative reviews.

What Travel Insurance Does AIG Travel Offer?

AIG Travel offers four plans for consumers, based on their needs and travel plans: Basic, Silver, Gold, and Platinum. Although the Basic plan is not available direct through AIG Travel, it can be purchased through marketplaces like TravelInsurance.com. All travel insurance plans include travel medical assistance, worldwide travel assistance, LiveTravel® Emergency Assistance, and personal security assistance, but only take effect when travelers are at least 100 miles away from home.

Please note: All schedules of benefits are subject to change. For the most up-to-date coverage information, contact AIG Travel.

- Travel Guard Basic: Travel Guard Basic is the lowest level of coverage available through AIG Travel Guard, with the smallest benefits for trip cancellation , trip interruption , and trip delay. The basic plan offers 100 percent coverage of trip cancellation or trip interruption events (up to $100,000), but has very low coverage ceilings for return airfare due to trip interruption ($500 maximum), trip delay (maximum of $100 per day, up to $500), baggage loss ($500 before a $50 deductible) and baggage delay ($100 maximum). The basic plan includes an optional rental car damage policy for an additional price but does not include options for a pre-existing medical condition exclusion waiver or accidental death and dismemberment. Read the schedule of benefits here.

- Travel Guard Silver : Travel Guard Silver is the lowest level of coverage available directly through AIG Travel Guard. Described as “savvy coverage that helps give you peace of mind on a budget,” Travel Guard Silver offers more generous benefits for baggage delay and baggage loss ($750; $50 deductible) and accident sickness medical expenses ($15,000; $50 deductible). This plan also offers optional coverage for pre-existing medical condition exclusion waivers, trip cancellation or interruption due to financial default and additional flight coverage. Typically, travelers who elect to purchase Travel Guard Silver over Travel Guard basic can expect to pay around 2.5% more. Read the schedule of benefits here.

- Travel Guard Gold : The most popular plan offered by AIG Travel Guard, Travel Guard Gold balances insurance costs with benefits. The Gold plan offers more money for trip interruption (150 percent, up to $150,000 maximum), return airfare due to trip interruption (the greater of $750 or 150 percent of the trip cost) and trip delay coverage ($150 per day maximum, up to $750 total). This plan also introduces several additional benefits, including baggage and travel document loss (up to $1,000), baggage delay ($300) and missed connection coverage (up to $250). When purchasing within 15 days of the initial trip payment, travelers may also be covered for pre-existing condition waivers, trip cancellation or interruption due to financial default and primary coverage for accident sickness medical expenses. Optional coverage levels include Cancel for Any Reason insurance (up to 50 percent of insured trip costs), car rental collision coverage and upgrades for medical expense and emergency evacuation coverage. Before any optional coverage, expect to pay 20 percent more for Travel Guard Gold compared to Travel Guard Silver. Read the schedule of benefits here.

- Travel Guard Platinum : Travel Guard Platinum is the highest level of coverage offered by AIG Travel Guard, with the biggest benefit levels. In addition to trip cancellation and trip interruption benefits, travelers can receive up to $1,000 for return air travel due to trip interruption, trip delay benefits of up to $200 per day ($1,000 maximum) and up to $500 in missed connection benefits. Like Travel Guard Gold, travelers who purchase their policy within 15 days of their initial trip payment may also receive the pre-existing medical condition exclusion waiver, trip cancellation or interruption coverage due to financial default, primary accident sickness medical expense coverage and primary baggage and personal effects coverage. Optional policy add-ons include Cancel for Any Reason (up to 50 percent of insured trip costs), car rental collision coverage, and medical coverage upgrades. Because Travel Guard Platinum is the highest level of coverage available, it is also the most expensive: travelers should expect to pay between 50 and 60 percent more than Travel Guard Gold before any additional add-on coverage. Read the schedule of benefits here.

What Won't AIG Travel Cover?

While AIG Travel offers plans to cover many common travel issues, they will not necessarily cover everything. Excluded situations include:

- Self-inflicted injuries: If you are in crisis while traveling, there are ways to get help anywhere around the world. Note that mental health care may not be covered by your travel insurance plan .

- Pregnancy or childbirth: In many situations, pregnancy or childbirth are not covered under AIG Travel plans.

- Dangerous activities: Planning on mountaineering, going motor racing, or participating in a professional-level athletic event? All of these situations are not covered under AIG Travel plans.

- Baggage loss for items seized by governments or customs officials: Before you return home, be sure to understand what may (or may not) be allowed in your home country. If you believe your items were stolen by customs or Transportation Security Administration officials , there is a separate protocol for reporting those losses.

- Baggage loss for eyeglasses, sunglasses, or hearing aids: Loss or replacement of prescription vision wear is not covered by AIG Travel.

This is just an abbreviated list of situations that may not be covered under AIG Travel trip insurance plans. For a full list, refer to the schedule of benefits of each plan, which are linked in the above content.

How Do I File a Claim With AIG Travel?

Travelers who purchased an AIG Travel plan in the United States can start their claims online . After starting an account online, travelers can file claims for the most common situations, including trip cancellation, baggage loss, and trip delay. Policyholders can also find documentation requirements online , as well as receive updates online. Those who have questions about their policies or claims can call AIG Travel direct at +1-866-478-8222.

The online claims tool is only available for American travelers who purchased their travel insurance plans in the United States. All other travelers should contact AIG Travel directly via their provided telephone number to start the claims process.

Who Is AIG Travel Best For?

At the Basic and Silver levels, AIG Travel is a very basic-level travel insurance plan that may cover those who do not already have trip coverage through a credit card or otherwise have access to a trip insurance plan. Before considering either of these AIG Travel plans, be sure to check that you don't already have coverage through the credit card used to pay for your trip.

If you are planning a major international trip, or are going on a big trip aboard a cruise line, AIG Travel Gold and Platinum may offer better coverage than a credit card. With large benefit levels and coverage already built in for pre-existing conditions when purchased within the first 15 days of an initial travel payment, Gold and Platinum can be a better bet for those who are spending money on a big vacation and want to make sure their trip runs smoothly.

Travelex Insurance: The Complete Guide

The 8 Best Luggage Sets of 2024, Tested and Reviewed

Nationwide Travel Insurance: The Complete Guide

Flight Insurance That Protects Against Delays and Cancellations

The Best Credit Cards for Travel Insurance

The 14 Best Backpack Brands of 2024

Does Travel Insurance Cover Earthquakes?

Dealing With Lost, Damaged, or Stolen Luggage While Flying

What Are North American Airlines' Policies on Bereavement Fares?

8 Air Travel Rights You Didn’t Know You Have

Loss of Use Car Rental Insurance

Should You Buy Collision Damage Waiver Insurance for Your Rental Car?

How to Get Your Miles Back After Canceling an Award Flight

How to Get Free Breakfast at Hotels

Best Car Rental Companies of 2024

Etihad Gives All Passengers Free COVID-19 Insurance

A Comprehensive Guide To Checking Your Claim Status With Travel Guard

- Last updated May 11, 2024

- Difficulty Advanced

- Category Travel

Whether you're a frequent traveler or just taking a once-in-a-lifetime trip, having travel insurance is a wise decision. And when it comes to choosing a reliable and trusted travel insurance provider, Travel Guard is often at the top of the list. But what happens when you need to make a claim? How do you go about checking the status of your claim? In this comprehensive guide, we will walk you through the process of checking your claim status with Travel Guard, ensuring you have peace of mind throughout the entire claims process. So sit back, relax, and let us guide you through the steps to effectively manage your claim with Travel Guard.

What You'll Learn

Contacting travel guard for claim status updates, online options for checking your travel guard claim.

- What Information You'll Need to Check Your Claim Status?

Tips for Ensuring a Smooth Process When Checking Your Claim Status

If you've filed a claim with Travel Guard and are eager to know the status of your claim, there are several ways you can contact them for updates. Here are the steps to follow:

- Check your claim confirmation email: When you initially filed your claim, Travel Guard likely sent you a confirmation email. This email should contain a claim number or reference number. Make sure to have this information handy before reaching out to them.

- Visit the Travel Guard website: Go to the Travel Guard website (www.travelguard.com) and look for the "Claims" section. It is usually located in the main menu at the top of the page or in the footer. Click on this section to find more information about checking your claim status.

- Contact Travel Guard via phone: If you prefer to speak with a customer service representative directly, call Travel Guard's dedicated claims phone number. This number can typically be found in the "Contact Us" or "Claims" section of their website. When calling, be prepared to provide your claim number or reference number, as well as any other relevant information they might request.

- Send an email: If you don't need an immediate response, you can send an email to Travel Guard's claims department. Again, the email address can usually be found in the "Contact Us" or "Claims" section of their website. In your email, make sure to include your claim number or reference number, as well as your contact information.

- Use Travel Guard's online claims portal: Some travel insurance providers, including Travel Guard, have an online claims portal where you can view the status of your claim. To access this portal, go to the Travel Guard website and login to your account. Look for a section specifically for claims, where you should be able to see the progress of your claim.

- Check for updates via mail: If you have not received any updates on your claim and have chosen to communicate with Travel Guard via mail, keep an eye on your mailbox. They may send you written notifications about your claim status, including requests for additional information or updates on the progress of your claim.

Regardless of the method you choose to contact Travel Guard for claim status updates, it's important to be patient. Processing times can vary, especially during busy periods or if your claim requires further investigation. However, by following these steps, you should be able to stay informed about the progress of your claim with Travel Guard.

Do Freshman Softball Teams Travel with Varsity Players?

You may want to see also

If you've submitted a claim with Travel Guard, you're probably anxious to check on the status and see where things stand. Fortunately, Travel Guard offers convenient online options for checking the status of your claim. Here's a step-by-step guide on how to do it.

- Open your web browser and go to the Travel Guard website. You can find it by searching for "Travel Guard" in your preferred search engine.

- Once you're on the Travel Guard website, locate the "Claims" tab or menu option. It's usually located at the top of the page or in the main navigation menu.

- Click on the "Claims" tab to access the claims section of the website.

- In the claims section, you should see an option to check the status of your claim. It might be labeled as "Check Claim Status" or something similar. Click on this option to proceed.

- You will be prompted to provide certain information to access your claim status. This may include your claim number, policy number, or other identifying information. Make sure you have this information readily available before you proceed.

- Enter the required information in the provided fields and click the "Submit" button or similar option to continue.

- After submitting the required information, you should be directed to a page displaying the status of your claim. This status page will provide details on whether the claim is still being processed, approved, or if any additional information is needed from you.

- Take the time to review the information provided on the claim status page. If your claim is still being processed or if additional information is required, make note of any instructions or next steps provided. This will help ensure a timely resolution to your claim.

- If you have any questions or concerns about the status of your claim, you can contact Travel Guard directly for assistance. Look for a customer service phone number or email address on the claim status page or the Travel Guard website.

By following these steps, you can easily check the status of your claim with Travel Guard online. This allows you to stay informed and track the progress of your claim without the need to make unnecessary phone calls or wait for mail correspondence. Remember to have your claim information handy when accessing the online status checker, and be sure to reach out to Travel Guard if you have any questions or need additional assistance.

The Ultimate Guide to Traveling from London to Eastbourne

What information you'll need to check your claim status.

When you file a claim with Travel Guard, it's natural to want to know the status of your claim. Checking the status of your claim is quite easy and can be done online. Before you start, make sure you have the following information ready:

- Claim number: This is a unique identification number assigned to your claim when you file it. You should have received this number when you initially submitted your claim. In case you don't have it, you can reach out to Travel Guard customer service and they will provide it for you.

- Policy number: This is the number associated with your travel insurance policy. It can usually be found in your purchase confirmation email or in any documentation you received from Travel Guard when you purchased the policy.

Once you have both the claim number and policy number, follow these steps to check your claim status:

- Visit the Travel Guard website: Open your web browser and go to the official Travel Guard website.

- Navigate to the claims page: Look for the "Claims" or "Check Claim Status" tab on the website. Click on it to access the claims portal.

- Log in or create an account: If you already have an account with Travel Guard, enter your login credentials (usually your email address and password) to access your account. If you don't have an account, you will need to create one. Look for the "Create Account" or "Register" link and follow the prompts to set up your account.

- Enter your claim and policy numbers: Once logged in, you will be directed to the claims portal. Look for the appropriate field to enter your claim and policy numbers. Carefully enter these numbers to ensure they are accurate.

- Submit the information: After entering the required details, double-check everything for accuracy and click on the "Submit" or "Check Status" button.

- View your claim status: The website will now display the current status of your claim. It may show that your claim is being reviewed, requires additional documentation, or has been approved or denied. Take note of any instructions or further actions required from you.

If you encounter any issues or have questions about your claim status, it is always recommended to contact Travel Guard customer service directly. They will be able to provide you with the most accurate and up-to-date information regarding your claim.

Easy Steps to Check Army Travel Voucher Status

If you've filed a claim with Travel Guard for an incident that occurred during your trip, you may be wondering how to check on the status of your claim. Here are some tips to help you navigate the process and ensure a smooth experience:

- Keep all necessary documents handy: Before you can check on your claim status, it's essential to have all the necessary documents readily available. This includes your claim number, policy information, and any supporting documents you submitted when filing your claim, such as receipts, medical reports, or police reports.

- Use the online portal: Travel Guard offers an online portal where you can easily check the status of your claim. Visit the Travel Guard website and navigate to the claim status page. Enter your claim number and other requested information, and you should be able to view the current status of your claim.

- Contact customer service: If you prefer a more personal touch or if you encounter any difficulties with the online portal, you can always call Travel Guard's customer service. They will be able to provide you with real-time updates on the status of your claim and address any concerns you may have. It's important to have your claim number on hand when calling customer service for quicker assistance.

- Be patient: Remember that processing a claim can take some time, especially if there are complex issues involved. It's not uncommon for it to take several weeks or even longer to receive a resolution. So, try to be patient during this process. However, if you feel that your claim is taking an unusually long time or you have specific concerns, don't hesitate to reach out to customer service for updates or clarification.

- Check your email and mailbox regularly: Travel Guard will communicate with you via email or regular mail throughout the process. Be sure to check your email inbox regularly, including your spam folder, as sometimes important updates may end up there. Additionally, keep an eye on your mailbox for any physical mail related to your claim.

- Follow up if necessary: If you haven't received any updates on your claim after a reasonable amount of time, it's worth following up with Travel Guard. Check your claim status again through the online portal or contact customer service to inquire about the progress of your claim. Maintaining open lines of communication ensures that your claim doesn't fall through the cracks and can help speed up the process.

- Be prepared to provide additional information: There may be instances where the claims adjuster requires additional documentation or information to process your claim fully. If this happens, respond promptly and provide the requested information in a clear and organized manner. This will help expedite the evaluation of your claim and increase the chances of a favorable outcome.

By following these tips, you can have peace of mind knowing that you're actively monitoring the progress of your claim and taking the necessary steps to ensure a smooth and efficient process. Remember, Travel Guard's claim process is designed to assist you, so don't hesitate to reach out for assistance if needed.

Understanding the Options for Immigrants Traveling with a Visa in an Emergency

Frequently asked questions.

You can check the status of your claim with Travel Guard by logging into your account on their website and navigating to the claims center. There, you will be able to see the status of your claim and any updates.

The timeframe for receiving a claim status update from Travel Guard can vary depending on the complexity of the claim and the volume of claims they are currently handling. However, they strive to provide updates within 5-7 business days.

Yes, you can also check your claim status with Travel Guard over the phone by contacting their customer service representatives. They will be able to provide you with the most up-to-date information regarding your claim.

- Viajera Compulsiva Author Editor Reviewer

- Michaela Krajanova Author Reviewer Traveller

It is awesome. Thank you for your feedback!

We are sorry. Plesae let us know what went wrong?

We will update our content. Thank you for your feedback!

Leave a comment

Travel photos, related posts.

The Ultimate Guide to Traveling Solo in the Galapagos Islands

- May 08, 2024

Reasons to Consider Keeping Traveler's Chosen Weapon in Destiny 2

- May 12, 2024

The Benefits and Motivations Behind Parents Enrolling Kids in Traveling Sports Teams

- May 10, 2024

Exploring the Fun of Las Vegas for Solo Travelers

The Page Count of 'Travel Team' by Mike Lupica: Discover the Length of this Captivating Travel Sports Tale

How Much Does it Cost to Change a Traveler's Name on Norwegian Airlines?

- May 09, 2024

COMMENTS

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc. (Travel Guard). California lic. no.0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of the ...

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc . (Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of ...

Both of these numbers have 24/7 availability: U.S. toll-free, 1-855-203-5962. U.S. and international collect, 1-715-345-0505. If you need to file an AIG travel insurance claim, you can connect with a customer service agent online or over the phone. You can also reach AIG by mail at: Travel Guard.

If your policy number begins with 54, please use the following contact information: Claims ... Claims Phone: (800) 335-0611 Fax: (317) 575-2256 ... Mailing Address Seven Corners, Inc. Attn: Claims PO Box 211760 Eagan, MN 55121. Travel Guard. To submit a Travel Guard claim, please use the below contact information: Claim & 24 Hour Emergency ...

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

And There's More!needed to file a claim. ... actual number of days, regardless of the time of day. For example, if you are traveling June 1st, June 2nd and ... If you need to contact Travel Guard for questions or assistance during your trip, please call 1.715.345.0505.

Travel Guard's claim representatives offer world class care and are committed to delivering superior service to you, our valued customer. ... You must contact us at 866-878-0192 or collect at 416-646-3723 before seeking medical attention and a failure to call will result in your being responsible for 30% of any eligible expenses incurred unless ...

Coverage is offered by Travel Guard Group, Inc. (Travel Guard). California lic. no.0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, travelguard.com . CA DOI toll free number: 800-927-HELP .

Start your Claim online at https://claims.travelguard.com or by phone at (866) 478 - 8222. Submit claims documentation via email at [email protected] with your claim number in the subject line, via fax to 715-295-1113 with attention to your claim number, or via mail to: AIG Claims. Attn: your claim number. PO Box 47.

Add a Travel Guard travel insurance plan to your trip: At checkout or through 'Manage Reservation' on united.com or the United app. By calling a Travel Guard agent directly at 1-877-934-8308. About United. Products and services. Popular destinations. Protect your travel plans when something unexpectedly happens.

Contact Travel Guard Call us at: 866-648-8422. Hours of operation (Eastern): Monday - Friday 8 a.m. to 9 p.m. Saturday/Holidays 9 a.m. to 5 p.m. Address: Travel Guard Group Canada, Inc 120 Bremner Boulevard Suite 2200 ... Claims Strike List Alert List. Agent Information Agentlink Login

Attn: Travel Guard. 3300 Business Park Dr. Stevens Point WI 54482. Mailing Address: AIG. Attn: Travel Guard. Po Box 47. Stevens Point WI 54482. Report a claim, first notice of loss & find contact information for Personal Lines - Travel Guard.

Coverage is offered by Travel Guard Group, Inc. (Travel Guard). California lic. no.0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, travelguard.com . CA DOI toll free number: 800-927-HELP .

You'll need your policy number and can either go to travelguard.com or call Travel Guard at 866-478-8222 to start the claim. Once submitted, you can check the status of your claim at claims ...

Frequently Asked Questions about Travel Guard Insurance. We get it, travel insurance can be confusing. We hope these frequently asked questions help. If you still have questions, contact us at 1.800.826.5248 and our specially trained representatives will be happy to help.

If you have already purchased your travel insurance policy through Travel Guard or if you are still making your decision and want to find out more, you'll find an answer here. ... Get A Quote; Our Plans; Why Buy? Education Centre; Destinations; Customer Service. Customer Service; Contact Us; View My Policy; Claims; Travel News; HELP & SETTINGS ...

Travel Guard Basic: Travel Guard Basic is the lowest level of coverage available through AIG Travel Guard, with the smallest benefits for trip cancellation, trip interruption, and trip delay.The basic plan offers 100 percent coverage of trip cancellation or trip interruption events (up to $100,000), but has very low coverage ceilings for return airfare due to trip interruption ($500 maximum ...

Use the online portal: Travel Guard offers an online portal where you can easily check the status of your claim. Visit the Travel Guard website and navigate to the claim status page. Enter your claim number and other requested information, and you should be able to view the current status of your claim. Contact customer service: If you prefer a ...

The insured driver's name, address, phone number (Commercial Auto) The employer's tax ID number, the injured/ill employee's SSN and personnel file and any accident reports (Workers' Compensation) ... Contact Claims. 1-888-NEW-CLMS; [email protected]; 570-825-0611 (fax) Berkshire Hathaway GUARD P.O. Box 1368 Wilkes-Barre, PA 18703-1368 ...

By clicking submit, I certify that to the best of my knowledge the above claim information is true and accurate. Report a claim to 1-888-NEW-CLMS, [email protected] or by using the form below.