Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Compare rates and fees for your money transfers.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Helpful tools to ensure you get the best rates on money transfers.

A Guide to Travel Money Cards

Often deemed the cheapest way to spend money abroad , travel money cards are deemed a failsafe option for many travellers. Given the rapid growth of the financial services sector, we want to find out if travel money cards are still as cutting edge as they once were, by comparing them to the new alternatives. Our job is to identify the best international money transfer services and payment providers in the industry: will travel money cards make the cut?

What are travel money cards?

Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals.

We recommend finding a travel money card which lets you lock-in a favourable exchange rate and supports multiple currencies on one card, to make sure you are securing a flexible and cost-effective deal.

How do you use a travel money card?

Using a travel money card should be straightforward and stress-free. Simply load funds onto the card before you leave, and once abroad, you will be able to reload funds and change currencies using the website or associated money transfer app . The card can be used to make withdrawals, in-store purchases and book travel arrangements.

Where can I get a travel money card?

Travel money cards are available from different retailers and can be purchased and preloaded online, over the phone or in-store, depending on the brand. In the UK, popular brands include Travelex and the Post Office.

Where can I use a travel money card?

Again, this depends on the brand and where you get your money travel card from. Available currencies vary from card to card but commonly used currencies include US Dollars, UK Pound sterling, Euros, Japanese Yen and New Zealand Dollars. Make sure you check with the provider before ordering a travel money card.

How secure are travel money cards?

Generally, travel money cards are considered a lot safer than handling multiple currencies in cash, or travellers cheques, as your provider will be able to cancel it if need be. Furthermore, some of the best travel money cards employ an equivalent level of security to traditional debit cards, including a PIN code, touch ID and face recognition.

Many consider it safer to use a travel money card abroad than a debit card, as they are not associated with your bank account and therefore cannot be linked if lost or stolen.

Travel money cards vs. Credit cards: What is the difference?

One of the biggest advantages of using a travel money card is that your chosen currency is preloaded before you arrive in the foreign country and you won’t be charged conversion fees. This means you are able to benefit from the most favourable exchange rates, locking it in ahead of time and using the funds at a later date.

Most people who use their credit card abroad do it because it is more convenient. The cost of this convenience, however, can sometimes amount to 3 - 5% per use, depending on the transaction and financial institution. Making a foreign ATM withdrawal with your credit card can incur flat-fees of $5 and up, each time.

This being said, there are some excellent traveller credit cards on the market, so we would recommend users compare exchange rates and transfer fees offered by each provider before making a decision on which card is more beneficial.

If you're planning on using your credit card, we suggest you take a look at our credit card wire transfer guide.

What are the alternatives to travel money cards?

Multi-currency accounts.

International money transfer companies are often tailoring their products and services to meet the needs of their customers. Wise , offers a multi-currency account designed with “international people" in mind. This savvy travel credit card is aimed at frequent flyers who want to spend in various currencies in over 200 countries. Wise is a reliable company to trust with your overseas spending habits.

Challenger banks

More and more alternative service providers are popping up around the world, many of them offering reputable banking features for the modern traveller. In a bid to distinguish themselves from traditional banks, challenger banks are scrapping fees on foreign exchange and international spending. Monzo customers, for example, can benefit from free international ATM withdrawals as well as fee-free spending overseas.

We hope this guide to travel money cards has enlightened you and helped you make a decision about whether this is a suitable payment method for your next trip overseas. We appreciate the value of your hard-earned cash and want all our customers to benefit from the best possible rates when dealing with international payments. Use our comparison tool today to make sure you are offered the most desirable exchange rate for your currency.

Related Content

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. May 3rd, 2024

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! May 3rd, 2024

.jpg)

- A Guide to Travellers Cheques The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day. May 3rd, 2024

- Millennial Guide For Baby Boomers & Generation X We looked over the stats for the past few years, and found that out of £1.5 billion payments abroad, 1 in 5 debit cards payments are made by the UK residents travelling abroad and credit card payments made outside the UK has increased in recent years, reaching 467 million payments. May 3rd, 2024

Contributors

April Summers

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Travel / Travel Money Card / Fees and charges

Travel Money Card fees and charges

The Travel Money Card is not only convenient, it’s also affordable. Below are the fees and charges associated with your Travel Money Card – a small price to pay for peace of mind when travelling. If you have any questions regarding your Travel Money Card, please visit our support page .

We can help

Your questions answered

Get in touch

Visit your nearest branch

Things you should know

1 The cash withdrawal fee will not apply to cash withdrawals made in Australia.

2 This example is for illustrative purposes only.

3 Transfer is only available to an eligible Commonwealth Bank account in the same name. Any withdrawal or balance enquiry fee will come from the currency for which you are using your card. If this currency is not loaded on your card, the fee will be taken from the first (or sole) currency loaded on your card. Any SMS balance alert fee will come from the first (or sole) currency loaded on your card. As this advice has been prepared without considering your objectives, financial situation or needs, you should before acting on this advice, consider its appropriateness to your circumstances. The Product Disclosure Statement and Conditions of Use (PDF 302kb) issued by Commonwealth Bank of Australia ABN 48 123 123 124 for Travel Money Card should be considered before making any decision about this product. View our Financial Services Guide (PDF 160kb).

4 ATM balance enquiries are not available at all ATMs. 5 Fees may be charged by other parties involved in the delivery of the emergency funds.

Travel money card

Spend like a local and explore the globe with a travel debit card. Whether it's a virtual or a physical card, we've got all your travel money needs covered.

Need an international travel card? Take us all around the world

Exchange currencies, send money abroad, and keep 36 local currencies in-app. These are just some of the reasons why our customers love their travel debit cards.

Built-in security features

Set spending limits, get payment notifications, and freeze or unfreeze your card in-app.

Add it to Google Pay or Apple Pay

No need to wait for your physical card to arrive — spend instantly with a virtual card.

Withdraw without ATM fees

Get fee-free ATM withdrawals, up to £2,000 per rolling month, depending on your plan type.¹

Manage travel money in-app

Manage everything for your holiday money card in the Revolut app, from top-ups to transfers.

¹No ATM withdrawal fees within plan limits on a rolling monthly basis. Third-party providers may charge a withdrawal fee. Currency and ATM fair-usage fees apply. Currency exchange fees may apply. Weekend markups on currency exchange will apply. Plan fees and T&Cs apply.

Spend like a local in 150+ currencies

No ATM fees up to £2,000 per month²

²No ATM withdrawals fees within plan limits on a rolling monthly basis. Third-party providers may charge a withdrawal fee and ATM fair-usage fees. Weekend markups will apply.

Spend right away with Apple Pay or Google Pay

How to get your travel money card in the UK

Get your currency debit card in 3 steps

Get revolut.

Join 40+ million people worldwide saving when they spend abroad with Revolut.

Order your card

Order your free travel money card to spend in 150+ currencies. Delivery fees may apply.

Spend like a local

Start spending around the world. That's your travel money, sorted.

Get instant payment notifications

Spend with confidence

Built-in security measures

How to save money with travel currency cards

Tips for saving with a money travel card

Don't exchange at airports or at home.

Don’t exchange cash before you travel. Use your travel money card to spend or withdraw money from an ATM (just watch out for ATM fees).

Always choose the local currency

Choose the local currency when spending with your card in shops and restaurants.

Save on travel spending with a Revolut card

Spend in the local currency at competitive rates on your next trip from the UK.

For life, not just for holidays

This is not a prepaid card you just throw away after your trip. Trust us, you’ll want to use Revolut for future adventures and everyday spending.

Rating as of 19 May 2024

713K Reviews

2.8M Reviews

Spend your holiday money in 150+ currencies

Need a little more help?

Holiday money card FAQs

What is a travel money card, what currencies can i spend in when i use a travel money card, what are the limits for spending with a travel card, how can i manage my travel money card, is a travel money card safe and secure, how can i order a travel money card.

- Download the Revolut app : find it in the Apple or Google Play Store.

- Sign up for Revolut : apply for an account and verify your identity.

- Add a debit card : go to Cards and follow the instructions to start your order.

- Set your PIN : choose a PIN that you'll remember.

- Arrange delivery : enter your delivery address and select your delivery method before proceeding to checkout (delivery fees may apply).

Don’t worry, there's no need to wait for your physical card to arrive — you can also use virtual travel cards with Revolut. Just connect your card to Google Pay or Apple Pay, and use it immediately.

Is a travel money card better than travel money?

- Don’t exchange cash at the airport. It’s much cheaper to withdraw money from an ATM with your travel money card.

- Don't carry more cash than you need. When you return home from your trip, you’ll need to re-convert this cash back to GBP, which can take time and cost you in fees.

- Always choose the local currency when spending with your card in shops and restaurants.

- Sign up for Revolut so you can manage your balance and get instant notifications on what you spend.

What is the best bank to use when travelling abroad?

- exchanging currencies before you go or while you're there

- withdrawing money from ATMs

- using your card in shops, restaurants, and more

Traditional banks aren't your only option. Financial apps often have similar features to traditional banks without the hassle.

With Revolut, you can do everything in-app and save on your transactions and withdrawals abroad. You get ultimate flexibility and control over your money.

What's the difference between using prepaid travel cards and travel debit cards for spending abroad?

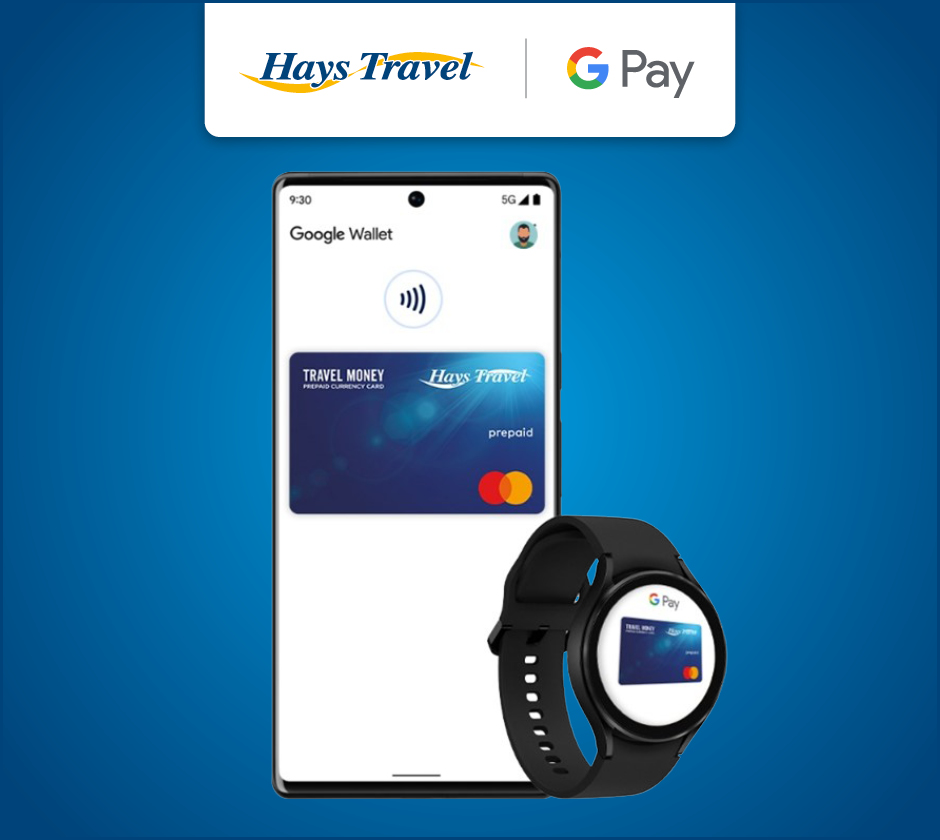

Hays Travel Money Card

The Hays Travel Mastercard® is free to use in millions of locations worldwide where Mastercard® Prepaid is accepted when you spend in a currency loaded on the card: including restaurants, bars, and shops. This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals, and also 24/7 phone support. Take your currency card with you on every holiday, simply top up and go! Just call into your local Hays Travel branch today to purchase your Hays Travel Prepaid Travel Money Card. *The Hays Travel Mastercard is only available to UK residents aged 18 or over. A valid Passport or Drivers Licence must be presented in the branch at the time of purchase.

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

- BUY IN BRANCH

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

The Hays Travel Currency Card app

The Hays Travel Currency Card App enables you to fully manage your travel card account and stay in control of your holiday finances at home and abroad. The app enables you to:

- Instantly top up multiple different currencies from anywhere in the world

- Check your real time balance

- Lock-in exchange rates when you top up and transfer money between currencies

- Keep track of your spending and view transactions

- Freeze/Unfreeze your card

- Check your card PIN

- Manage your personal details

Download our app here

Manage the card on the go via Hays Travel Currency Card App

My Account Portal

Available currencies.

- British Pounds

- Australian Dollar

- Canadian Dollar

- Czech Koruna

- Japanese Yen

- Mexican Peso

- New Zealand Dollar

- Polish Zloty

- Swedish Krona

- South African Rand

- Swiss Franc

- Turkish Lira

Useful links

- Card Services Support Numbers

- Terms and Conditions

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

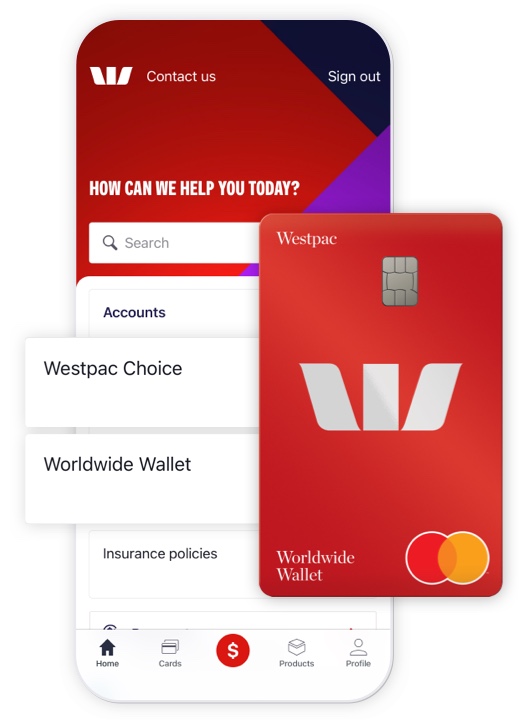

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

- Lost or stolen cards

- Online Banking – Personal

- Online Banking – Business

- Corporate Online

- Westpac Share Trading

- View all online services

- International & Travel

Travel money card

- Activate and manage your card Activate and manage your card

Are you an existing customer?

A smart and safe way to pay in foreign currencies

Features and benefits

- Travel and shop worry-free Lock in your budget by converting your loaded AUD ahead of time and feel safe and secure from fraudulent transactions with Mastercard Zero Liability protection.¹

- Lounge access if your flight is delayed You and a companion can get access to over 1,000 lounges² if your flight is delayed for 120 minutes or more. Visit the Mastercard Flight Delay Pass website to pre-register your flight. T&Cs apply.

- Convenient options for you Pick up cards from any branch and activate them online, or order online from home and receive your cards in 5-8 business days.

- Access unforgettable experiences and rewards Your Mastercard gives you access to Priceless ® Cities with unforgettable experiences in the cities where you live and travel.³ You can also get cashback when you shop overseas with your Worldwide Wallet, thanks to Mastercard Travel Rewards .⁴

How it works

Before you leave.

- Order a Worldwide Wallet online or pick one up in branch

- Activate your cards in Online Banking

- Transfer AUD to your card and convert into your choice of up to 10 currencies to lock in your rates.

While you’re away

Pay for things using the local currency loaded on your card

Avoid ATM fees at Global ATM Alliance partners 5

Reload your card as you go using the Westpac App, with no load or reload fees.

When you get home

- Convert leftover currency back to AUD or another available currency, with no unload fees

- Remember , you can avoid foreign transaction fees while shopping online by paying with your Worldwide Wallet.

Save on fees

- Avoid ATM withdrawal fees Through our Global ATM Alliance and overseas partner ATMs which you can easily find using the ATM locator in the Westpac App

- No foreign transaction fees Avoid a 3% foreign transaction fee whenever you use your Worldwide Wallet to shop online or in person.

- No load or unload fees Reload your account on the go, whenever you need.

- No account keeping fees You won’t pay any inactivity or account keeping fees, so any funds left in your account will be there ready for your next trip or purchase.

Other fees may apply. Read the Product Disclosure Statement (PDF 307KB) for full list of fees.

Like to shop online?

Use your Worldwide Wallet for online purchases in foreign currencies and avoid a 3% foreign transaction fee.

You can also shop worry-free from fraudulent transactions with Mastercard Zero Liability protection. 1

Complete visibility and control

All in one view

See your account balance and transactions in the Westpac App or in Online Banking.

Move money easily

Transfer money to and from your Worldwide Wallet and convert AUD into foreign currencies while you’re on the go in the Westpac App.

More ways to pay

Add your Worldwide Wallet to Google Pay™ or Samsung Pay™, or use your card to tap and go.

A spare card for peace of mind

Both cards give you access to the same funds and can be locked and unlocked instantly at your convenience via Online Banking or the Westpac App. 6

Add up to 11 currencies

Lock in your rate head of time by converting currency in advance.

You'll still be able to spend in currencies not listed here and avoid Westpac's 3% foreign transaction fee.

To view our latest rates, see our currency converter .

Order online or pick up in branch

Order online.

You can open your travel money card account online and we’ll mail your cards to your address in 5-8 business days.

Pick up in branch

If you need your cards within 8 business days its best to pick them up in branch and activate them online.

Already have your cards? Activate now

A Westpac Worldwide Wallet is a prepaid travel money card that can help you save on foreign transaction fees and give you control over your spending. With the Westpac Worldwide Wallet, there are no load, reload or unload fees, or ATM withdrawal fees at Westpac Group or select Westpac Group partner ATMs in Australia and Global ATM Alliance partners. 5

Before you shop or travel, you can also choose to convert your loaded AUD into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By locking in your exchange rate in advance and knowing exactly how much of a foreign currency is loaded on your card, the Westpac Worldwide Wallet can make it easy for you to stay on top of your spending. When you sign up to a Westpac Worldwide Wallet, you’ll also get access to exciting Mastercard travel and shopping perks - Flight Delay Pass , Mastercard Travel Rewards and Priceless Cities.

With the Westpac Worldwide Wallet, you can avoid a 3% foreign transaction fee when you shop online in available currencies.

You can shop safely by loading only what you need into any of the following currencies: USD, EUR, GBP, CAD, JPY, THB, ZAR, SGD, NZD and HKD. By knowing exactly how much of a foreign currency is loaded on your card, you can stay on top of your spending.

You’ll also benefit from Mastercard Zero Liability protection, 1 so you can shop worry-free from fraudulent transactions.

To apply for a Westpac Worldwide Wallet, you must be aged 14 years or older and be an existing Westpac customer who is registered for Online Banking. If you haven’t registered for Online Banking, see this helpful guide to learn how to get started. If you’re new to Westpac and would like to apply for a Worldwide Wallet, you’ll need to become a customer first by opening a Westpac savings or transaction account and meeting our identification requirements. You can visit westpac.com.au/aml for more information on how we identify you.

If you have insufficient funds to complete a transaction in a currency loaded on your account, or the transaction is in a currency not loaded on your account, the transaction will be automatically processed by drawing down from another currency in your account (provided that there are sufficient funds available in one or more other currencies to complete the transaction). Funds will be withdrawn according to the drawdown sequence, and the applicable exchange rate will apply. See the Product Disclosure Statement (PDF 307KB) for the drawdown sequence.

Yes, you can withdraw money or check your balance at overseas ATMs using your Worldwide Wallet. The balance displayed will be in the currency of the country you are visiting. You won’t pay an ATM withdrawal fee when using a Global ATM Alliance ATM. 5 However, fees may apply if you use an ATM outside of the Global ATM Alliance network.

If you have insufficient funds to complete a transaction in a currency loaded on your account, or the transaction is in a currency not loaded on your account, the transaction will be automatically processed by drawing down from another currency in your account (provided that there are sufficient funds available in one or more other currencies to complete the transaction). Funds will be withdrawn according to the drawdown sequence, and the applicable exchange rate will apply. See the Product Disclosure Statement (PDF 307KB) for the drawdown sequence.

We recommend you download our app as we may send you important notifications about your Worldwide Wallet while you are travelling. Using the Westpac App makes it easy for you to get these notifications while you’re on the go. You can also use the app to:

- Instantly transfer AUD between your savings and transaction Westpac account/s and your travel money card

- Convert between your loaded AUD and up to 10 different foreign currencies at any time to lock in your exchange rate

- View your currency balances and transactions

- Access your Worldwide Wallet account’s BSB and account number as well as your eStatements

- Block your card/s if they have been lost or stolen

If you’re new to the Westpac App, learn more about how to get started .

See all FAQs

Get started

Order online and have your cards delivered to you

Worldwide Wallet 24/7 support in Australia

1300 797 470

Find a branch

Visit a branch and pick up cards

Things you should know

Westpac Retail and Business Banking Financial Services Guide and Credit Guide (PDF 238KB)

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Trinidad Tobago Dollar TTD

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Euros and US dollars in 2 hours

Click and collect euros and US dollars in 2 hours. Terms and conditions apply

Today’s online rates

Rate correct as of 20/05/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

The nation needs a holiday, and Brits look set to flock abroad this year. The ...

Our annual survey of European ski resorts compares local prices for adults and ...

The nation needs a holiday. And, with the summer season already underway, new ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Currency Converter

Use our currency converter to convert over 190 currencies and 4 metals.

To get started enter the values below and calculate today’s exchange rates for any two currencies or metals.

Bankrate’s currency converter uses OANDA Rates™ which have been compiled from leading market data and are trusted by worldwide corporations and authorities.

Investing Disclosure

The investment information provided on this page is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Good, bad and ugly of currency exchange

By mitch strohm • bankrate.com.

If you're not careful, currency conversion fees can cost more than you expect. To get the best bang for your U.S. dollar abroad, update your knowledge of currency exchange.

According to Douglas Stallings, senior editor for Fodor's Travel, travelers need to be aware of currency exchange options abroad because of costs. "Many options carry extraordinary hidden fees, and some places are just more difficult to negotiate since they are more cash-based than the typical American is used to," Stallings says.

In lieu of foreign currency exchange desks at airports and major hotels, there are more convenient and cheaper ways to exchange currency, Stallings says. While some desks advertise "no-fee" exchanges, they still build in a hefty profit by offering a high rate.

Before your next trip, take a look at the best and worst methods of currency exchange by following Bankrate's "thumbs-up" or "thumbs-down" rating:

Credit card: Thumbs up

Credit cards offer some of the lowest currency exchange rates. Card companies base their exchange rates on wholesale prices offered to bigger institutions, so you're bound to get a fair rate. Foreign transaction fees are a different story.

"Most people have multiple credit cards, and each could have a different fee structure. You can save money on fees by making some calls before you go and knowing which cards to use," says Tom Meyers, editor in chief of EuroCheapo.com, a guide to budget travel in Europe.

Some major card companies have eliminated foreign transaction fees on all of their cards. Others are just offering a few cards without foreign fees.

In addition to cards without fees, think about getting a card with the latest technology. Maria Brusilovsky, spokeswoman for Travelex Currency Services, says chip and PIN technology is now the preferred way of making credit card and debit card transactions in Europe, and some vendors only accept chip and PIN cards.

The "chip" refers to a microchip embedded into the card to secure account information. The "PIN" refers to a personal identification number that the cardholder enters to authorize payment.

Debit card: Thumbs up

Using your debit card at ATMs is one recommended way to get cash when traveling abroad. "We consider the ATM to be the best choice in terms of convenience, exchange rates and fees," Meyers says.

Fees vary by institution. Some charge a flat rate, others charge a percentage, and still others charge both, Meyers says. To save money, keep ATM trips to a minimum.

"If your bank charges a flat rate for the withdrawal, you should certainly minimize your trips to the ATM by withdrawing larger sums each time you go," Meyers says.

And do your homework. Stallings says if you take money out of a bank that has a relationship with your bank, you may be able to avoid some fees.

Heads up: Meyers advises to call your bank before you go to ask about fee structures for ATM withdrawals. Each bank has its own fees for ATM debit card withdrawals.

Prepaid card: Neutral

Prepaid cards for foreign use are becoming more widespread. For example, one major card company has started to offer prepaid cards free of the typical recurring fees. It also snubs foreign transaction fees, and it charges the same rate as its regular credit card when converting currency.

Another company offers a prepaid chip and PIN card, which allows travelers to load up on euros or pounds and use it like a debit card. They can be a good option for Americans traveling without a card using chip and PIN technology.

Stallings says one upside to chip and PIN prepaid debit cards is they can be used in an automated payment machine to buy train tickets and to pay at unstaffed gas pumps and highway toll booths in Europe. You lock in the exchange rate at the time you load or reload it.

Prepaid cards are also convenient and safe since they reduce the need to carry as much currency and because a PIN is usually required to take out funds, Stallings says.

Heads up: Stallings warns that some prepaid debit cards can come with substantial fees, may not be usable everywhere and can leave you without funds if stolen. He advises to read the fine print before purchasing.

Airport or hotel exchange desk: Thumbs down

Airport exchange desks have some of the highest currency exchange rates, which means you pay more in dollars for conversion.

Meyers of EuroCheapo.com recommends walking straight past the currency exchange counter upon arrival or in the airport baggage claim area. "These companies pay a lot of money to rent those spaces, and they make it up through service fees and lousy exchange rates," he says.

Airport exchange desks depend on their convenience to make money. You'll be better off finding an ATM in the airport and using your debit card to get cash.

Hotel exchange desks are just as pricey but for a different reason. "The hotels that still offer this service usually give awful exchange rates because the entire process is a hassle for them," Meyers says.

Heads up: Don't be duped by the sign at the currency exchange counter claiming "no fees, no commissions." Meyers says they'll make their money through higher exchange rates, even if they don't charge you a direct fee.

Dynamic currency conversion: Thumbs down

Some credit card companies give U.S. consumers the option of paying in U.S. dollars or the local currency during a transaction abroad. It's called dynamic currency conversion. If you're not careful, dynamic currency conversion could cost you big time.

"Primarily in Europe, dynamic currency conversion allows your credit card purchase to be charged in your home currency. While this seems convenient, it is one of the worst deals in travel and should always be avoided," Fodor's Stallings says.

According to Meyers, it's always better to pay in the local currency when traveling. "The local bank there will convert it back into euros, and then your U.S.-based bank will convert it again into dollars. This adds an extra conversion, which is good for the banks but not for you," says Meyers.

The extra conversion means you will pay more in fees. "You basically pay twice for every dynamic currency conversion transaction -- once to your own bank for the privilege of using your card abroad and once to the company processing the transaction," Stallings says.

Heads up: According to Stallings, you should insist that your transaction be charged in the local currency or just pay in cash.

Traveler's checks: Thumbs down

Sales of traveler's checks are in decline as travelers adopt new technology and more convenient methods of payment, says Brusilovsky of Travelex Currency Services. According to the U.S. Federal Reserve, traveler's checks peaked in the 1990s but have declined in use ever since. At their peak, there were more than $9 billion in traveler's checks outstanding. Now, there are only about $4 billion.

But they can still provide a safety net, Meyers says. "Many businesses abroad still accept traveler's checks, if they're made out in euros," he says. But, if they are made out in dollars, you'll need to convert them at a bank or currency counter, which can mean a fee or a lousy conversion rate.

Heads up: A few hundred dollars in traveler's checks can be a good emergency fund if you have any trouble with your cards or lose your wallet, Meyers says.

Cash advance: Thumbs down

Getting a cash advance on your credit card is an easy way to break the bank, whether you're abroad or in the U.S.

Your card might offer a fair currency exchange rate, but the interest rate on cash advances can be high. Cash-advance interest rates are more than 20 percent on some cards, and the interest starts accruing as soon as you take out the advance. For example, one bank's reward card has a cash advance annual percentage rate, or APR, of 24.9 percent. There's also a fee tacked on for taking out the advance.

"Before you leave, call your bank and ask what it charges for cash advances abroad," Meyers says.

Heads up: If you're in a bind, it might be worthwhile to take a cash advance. Just make sure to pay it off before the interest has time to accrue.

CURRENCY CONVERTER RESOURCES

- Foreign transaction fee credit card chart

- 4 ways to minimize foreign currency risk

- Opening a foreign currency account

Cards, Loans & Savings

Car & home insurance, pet insurance, travel insurance, travel money card, life insurance, our travel money rate sale is on for, travel money, exchange rate calculator.

Nectar members get better rates on travel money*

Our travel money rate sale is now on

Ends 09:30am Thursday 23 May 2024. Only available on foreign currency bought online or by phone. Not available instore, on sterling, or on travel money card home delivery orders and reloads. Sale rates are calculated by reducing our margin on the rates you would otherwise get. Currency fluctuations may cause exchange rates to vary during the sale period.

- Europe - Euro (EUR)

- USA - U.S. Dollar (USD)

- United Arab Emirates - UAE Dirham (AED)

- Australia - Australian Dollar (AUD)

- Canada - Canadian Dollar (CAD)

- New Zealand - New Zealand Dollar (NZD)

- Switzerland - Swiss Franc (CHF)

- Thailand - Thai Baht (THB)

- Aland Islands - Euro (EUR)

- American Samoa - U.S. Dollar (USD)

- Andorra - Euro (EUR)

- Anguilla - East Caribbean Dollar (XCD)

- Antigua and Barbuda - East Caribbean Dollar (XCD)

- Austria - Euro (EUR)

- Bahrain - Bahraini Dinar (BHD)

- Barbados - Barbadian Dollar (BBD)

- Belgium - Euro (EUR)

- Bulgaria - Bulgarian Lev (BGN)

- Chile - Chilean Peso (CLP)

- China - Chinese Renminbi (CNY)

- Cook Islands - New Zealand Dollar (NZD)

- Costa Rica - Costa Rican Colon (CRC)

- Croatia - Euro (EUR)

- Cyprus - Euro (EUR)

- Czech Republic - Czech Koruna (CZK)

- Denmark - Danish Krone (DKK)

- Dominica - East Caribbean Dollar (XCD)

- Dominican Republic - Dominican Peso (DOP)

- Ecuador - U.S. Dollar (USD)

- El Salvador - U.S. Dollar (USD)

- Estonia - Euro (EUR)

- Faroe Islands - Danish Krone (DKK)

- Fiji - Fijian Dollar (FJD)

- Finland - Euro (EUR)

- France - Euro (EUR)

- French Guiana - Euro (EUR)

- French Southern Territories - Euro (EUR)

- Greece - Euro (EUR)

- Greenland - Danish Krone (DKK)

- Grenada - East Caribbean Dollar (XCD)

- Guadeloupe - Euro (EUR)

- Guam - U.S. Dollar (USD)

- Haiti - U.S. Dollar (USD)

- Holy See (Vatican City State) - Euro (EUR)

- Hong Kong - Hong Kong Dollar (HKD)

- Hungary - Hungarian Forint (HUF)

- Iceland - Icelandic Króna (ISK)

- Indonesia - Indonesian Rupiah (IDR)

- Ireland - Euro (EUR)

- Israel - Israeli New Sheqel (ILS)

- Italy - Euro (EUR)

- Jamaica - Jamaican Dollar (JMD)

- Japan - Japanese Yen (JPY)

- Jordan - Jordanian Dinar (JOD)

- Kenya - Kenyan Shilling (KES)

- Kiribati - Australian Dollar (AUD)

- Korea, Republic of - South Korean Won (KRW)

- Kuwait - Kuwaiti Dinar (KWD)

- Liechtenstein - Swiss Franc (CHF)

- Lithuania - Euro (EUR)

- Luxembourg - Euro (EUR)

- Malaysia - Malaysian Ringgit (MYR)

- Malta - Euro (EUR)

- Marshall Islands - U.S. Dollar (USD)

- Martinique - Euro (EUR)

- Mauritius - Mauritian Rupee (MUR)

- Mayotte - Euro (EUR)

- Mexico - Mexican Peso (MXN)

- Micronesia, Federated States of - U.S. Dollar (USD)

- Monaco - Euro (EUR)

- Montenegro - Euro (EUR)

- Montserrat - East Caribbean Dollar (XCD)

- Nauru - Australian Dollar (AUD)

- Netherlands - Euro (EUR)

- Niue - New Zealand Dollar (NZD)

- Norfolk Island - Australian Dollar (AUD)

- Northern Mariana Islands - U.S. Dollar (USD)

- Norway - Norwegian Krone (NOK)

- Oman - Omani Rial (OMR)

- Palau - U.S. Dollar (USD)

- Panama - U.S. Dollar (USD)

- Peru - Peruvian Nuevo Sol (PEN)

- Philippines - Philippine Peso (PHP)

- Pitcairn - New Zealand Dollar (NZD)

- Poland - Polish Zloty (PLN)

- Portugal - Euro (EUR)

- Puerto Rico - U.S. Dollar (USD)

- Qatar - Qatari Riyal (QAR)

- Saint Barthélemy - Euro (EUR)

- Saint Kitts and Nevis - East Caribbean Dollar (XCD)

- Saint Lucia - East Caribbean Dollar (XCD)

- Saint Martin (French part) - Euro (EUR)

- Saint Vincent and the Grenadines - East Caribbean Dollar (XCD)

- San Marino - Euro (EUR)

- Saudi Arabia - Saudi Riyal (SAR)

- Singapore - Singapore Dollar (SGD)

- Slovakia - Euro (EUR)

- Slovenia - Euro (EUR)

- South Africa - South African Rand (ZAR)

- Spain - Euro (EUR)

- Sweden - Swedish Krona (SEK)

- Taiwan - New Taiwan Dollar (TWD)

- Timor-Leste - U.S. Dollar (USD)

- Tokelau - New Zealand Dollar (NZD)

- Türkiye - Turkish New Lira (TRY)

- Turks and Caicos Islands - U.S. Dollar (USD)

- Tuvalu - Australian Dollar (AUD)

- Vietnam - Vietnamese Dong (VND)

- Virgin Islands, British - U.S. Dollar (USD)

- Virgin Islands, U.S. - U.S. Dollar (USD)

- No matches found

Exchange rates may vary depending on whether you buy instore, online or by phone.

^ Travel money cards are available on selected currencies only.

Buy travel money

Buy, exchange money and order foreign currency online, by phone, or at our bureaux.

How to get travel money with Sainsbury’s Bank

Need holiday money? Order currency online, by phone or visit a Sainsbury’s store with a bureau today. Or get a Sainsbury’s Bank Travel Money Card for easy and secure spending overseas.

There are various ways to buy travel money with Sainsbury’s Bank. Choose the method that’s easiest for you.

1. Buy currency online for home delivery. 2. Order currency online and collect instore. 4-hour click and collect available. T&Cs apply. 3. Buy currency via telephone. 4. Visit one of our bureaux to buy currency in a Sainsbury’s store.

Buy a prepaid travel money card

Our travel money card makes it safe and easy to manage and spend your holiday money. 1. Order for collection – Collect your travel money card from your nearest Sainsbury’s Bank bureau. 2. Order for delivery – We’ll send your travel money card straight to you. 3. Download the app or log in online – Check your balance, exchange between currencies, top up and manage your account.

Where can you get foreign currency with Sainsbury’s?

Get travel money delivered to you.

Order online or by phone and we’ll mail your holiday money to you securely via special delivery. Order more than £400 of foreign currency and get free delivery.

Collect travel money instore

Visit a store with an instore travel bureau to collect your travel money on your next weekly shop.

In a hurry? You can now order and collect Euros, US Dollars, and Travel Money Card pre-paid orders in as little as 4 hours with our click and collect travel money service^.

Click and collect currency the same day at a Sainsbury’s Bank travel money bureau when you:

- Order Euros, US Dollars, or a Travel Money Card

- Place your order on a Monday to Friday (excluding Bank Holidays), and

- Order at least 4hr before the bureau’s scheduled closure time

For orders made outside of this period, or for any other currency, you will be able to select your preferred collection date when placing your online order.

Get your travel money card delivered to you

We’ll send your travel money card straight to you, with your PIN arriving separately for security.

Visit one of our bureaux

We have stores with instore travel bureaux across the UK where you can pick up holiday money on the day.

Why use Sainsbury’s Bank for foreign currency

- Wide range of currencies, including USD and EUR We offer over 50 different foreign currencies, so it’s easy to get the holiday money you need.

- Nectar Prices Nectar members get better exchange rates both online, on the phone and at our bureaux. See our Nectar member benefits .*

- Currency buy-back Got holiday money left over when you get home? We’ll buy back most foreign currency, so you’re not out of pocket.

- Pick up your travel money in one of our stores Within travel bureaux across the UK, it’s convenient to pick up holiday money as you shop with Sainsbury’s Bank.

- Multiple ways to order and receive travel money Order online or by telephone, collect instore or receive holiday money by post – the choice is yours.

- 24/7 telephone assistance and online portal Our team are on hand to help with your travel money card any time of the day or night, no matter where you are in the world.

- Access to Western Union You can send an international money transfer instore with Western Union Money Transfer® services .

Choose your foreign currency

From Euro and US Dollar to Swedish Krona and Japanese Yen, we have more than 50 foreign currencies from all over the world.

Take a look at our most popular currencies.

Add to your travel money card to withdraw and spend on holiday.