- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

6 Best Travel Cards for Philippines

Getting an international travel card before you travel to Philippines can make it cheaper and more convenient when you spend in Philippine Peso. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to PHP for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to Philippines, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

6 best travel money cards for Philippines:

Let's kick off our roundup of the best travel cards for Philippines with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Philippines.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Philippines. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to Philippines or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in PHP, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in PHP when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Philippines, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in Philippines with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to PHP instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in Philippines and globally. Monzo accounts are designed for holding USD only - but you can spend in PHP and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in Philippines. While these cards don’t usually let you hold a balance in PHP, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

PayPal travel card

PayPal has a debit card you can link to your PayPal balance account, to spend in Philippines as well as locally, in person and online. One advantage of PayPal is that there are lots of easy ways to add money in USD - but bear in mind that when you spend in PHP you’ll likely pay a foreign transaction fee of 2.5%. ATM fees apply when you make out of network withdrawals, too, which can push up the costs depending on how you use your card.

PayPal travel cards aren’t connected to your checking account which makes them a handy and secure way to spend, particularly if you already have a PayPal balance account.

PayPal features

Paypal travel card pros and cons.

- Globally accepted card

- Easy ways to top up your PayPal balance including cash and check

- Popular and reliable provider

- Use your card for spending online easily as well

- 2.5 USD fee for out of network ATM withdrawals

- 2.5% fee when you spend in a foreign currency

- Other charges may apply depending on how you fund and use your account

How to apply for a PayPal card

Here’s how to apply for a PayPal account and order a travel card in the US:

Visit the PayPal website or download the app

Click Get Sign up or log into your existing account

Add your personal details to create an account, or tap Request a card if you already have a PayPal account

Follow the prompts to order your card

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Philippines or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Philippines. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Philippines

We've picked out 6 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Philippines include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in PHP can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Philippines

The best travel debit card for Philippines really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in PHP.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Philippines. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

When you’re planning your trip to Philippines, bear in mind that cash is still a primary payment method, and many merchants and public service providers won’t accept a card. You’ll want a travel card which allows low cost cash withdrawals so you’ve always got some PHP in your pocket - and you can also keep hold of your card as a convenient back up in case of emergency too. Choose a card with no ongoing fees and no inactivity costs, so you can use it for your next trip abroad to get the most possible use out of it.

Ways to pay in Philippines

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Philippines cash is a very popular payment method. While you may find cards are accepted in major hotels and chain stores or very busy tourist areas, many merchants prefer cash. Make sure you’ve always got some PHP in cash in your wallet by making ATM withdrawals with your travel card whenever you need to.

Which countries use PHP?

You’ll find that PHP can only be used in Philippines. If you don’t travel to Philippines frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or Revolut which lets you leave your money in USD and convert at the point of payment with no penalty.

What should you be aware of when travelling to Philippines

You’re sure to have a great time in Philippines - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Philippines before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Cash is a widespread payment method - so you’ll need some PHP in your pocket when you travel to Philippines. You can sort out your travel money by visiting an exchange office here in the US, or you can wait until you arrive and make an ATM withdrawal in PHP at the airport when you land. Bear in mind that currency exchange at exchange offices at the airport, either in the US or in Philippines can be expensive - so if you’re carrying USD in cash and need to exchange it, head into a town centre to do so.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Philippines

Ultimately the best travel card for your trip to Philippines will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Philippines

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Philippines.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / PHP rate to calculate how much Philippine Peso you would receive when exchanging / spending $4,000 USD. The card provider offering the most PHP is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Money in the Philippines

ATMs, Credit Cards, Traveler's Checks, and Tips for Philippine Money

:max_bytes(150000):strip_icc():format(webp)/greg-rodgers-adventure-ed92646b25f247049e53af6d36f6c15f.jpg)

TripSavvy / Marina Li

Managing money in the Philippines while traveling is simple enough, however, there are a few caveats of which you should be aware.

As when entering any new country for the first time, knowing a little about the currency beforehand helps to avert scams that target newbies .

The Philippine Peso

The Philippine peso (currency code: PHP) is the official currency of the Philippines. The colorful notes come in denominations of 20, 50, 100, 200 (not common), 500, and 1,000. The peso is further divided into 100 centavos, however, you'll rarely deal with or encounter these fractional amounts.

Prices in Philippine pesos are denoted by the following symbols:

- "₱" (official)

Currency printed before 1967 has the English word "peso" on it. After 1967, the Filipino word "piso" (no, it isn't referring to the Spanish word for "floor") is used instead.

U.S. dollars are sometimes accepted as an alternative form of payment and work well as emergency cash. Carrying U.S. dollars while traveling in Asia is a good idea for emergencies. If paying a price quoted in dollars rather than pesos, know the current exchange rate .

Tip: While traveling in the Philippines, you'll end up with a pocketful of heavy coins, usually 1-peso, 5-peso, and 10-peso coins — keep them! Coins come in handy for small tips or paying jeepney drivers.

Banks and ATMs in the Philippines

Outside of larger cities, functioning ATMs can be frustratingly difficult to find. Even on popular islands such as Palawan, Siquijor , Panglao, or others in the Visayas, there may only be one international-networked ATM located in the main port city. Err on the safe side and stock up on cash before arriving on smaller islands.

Using ATMs attached to banks is always the safest. You stand a much better chance of recovering a card if it is captured by the machine. Also, ATMs in lit areas near banks are less likely to have a card-skimming device installed by thieves. Identity theft is a growing problem in the Philippines.

Bank of the Philippine Islands (BPI), Banco de Oro (BDO), and Metrobank usually work best for foreign cards. Limits vary, but many ATMs will only dispense up to 10,000 pesos per transaction, and up to 50,000 pesos per account, per day. You may be charged a fee of up to 200 pesos per transaction (around US $4), so take as much cash as possible during each transaction.

Tip: To avoid ending up with only 1,000-peso banknotes which are often difficult to break, end your requested amount with 500 so that you at least receive one 500-peso note (e.g., ask for 9,500 rather than 10,000).

Traveler's Checks in the Philippines

Traveler's checks are rarely accepted for exchange in the Philippines. Plan on using your card in ATMs to get local currency.

For additional security , diversify your travel money. Bring a few denominations of U.S. dollars and hide a $50 inside a very unlikely place (get creative!) in your luggage.

Using Credit Cards in the Philippines

Credit cards are mostly only useful in bigger cities such as Manila and Cebu. They'll also work in busy tourist areas such as Boracay .

Credit cards come in handy for booking short domestic flights and for paying in upscale hotels. You can also pay for diving courses by credit card. For daily transactions, plan to depend on cash. Many businesses charge an extra commission of up to 10% when you pay with plastic.

MasterCard and Visa are the most accepted credit cards in the Philippines.

Tip: Remember to notify your ATM and credit card banks so they can place a travel alert on your account, otherwise they may deactivate your card for suspected fraud.

Hoard Your Small Change

Acquiring and hoarding small change is a popular game in Southeast Asia that everyone plays. Breaking large 1,000-peso notes — and sometimes 500-peso notes — fresh from the ATM can be a real challenge in small places.

Build up a good stock of coins and smaller denomination bills for paying drivers and others who often claim not to have change — they hope you will let them keep the difference. Using large denomination notes on buses and for small amounts is considered bad form.

Always try to pay with the largest banknote that someone will accept. In a pinch, you can break large denominations in busy bars, fast food restaurants, some minimarts, or try your luck in a grocery or department store.

Haggling is the name of the game for much of the Philippines. Good negotiation skills will go a long way to helping you to save money.

Tipping in the Philippines

Unlike the etiquette for tipping in much of Asia , the rules for tipping in the Philippines are a little murky. Although gratuity generally isn't "required," it is greatly appreciated — sometimes even expected — in many circumstances. In general, try to reward people with a small token of appreciation who go the extra mile to help you out (e.g., the driver who carries your bags all the way to your room).

It is common to round up fares for drivers and maybe even give them a little something extra for friendly service. Don't tip taxi drivers who initially balked at your request to turn on the meter . Many restaurants tack a 10 percent service fee onto bills, which may or may not simply be used to pay the staff's low salary. You can leave a few extra coins on the table to show thanks for great service.

As always, choosing whether to tip or not requires a bit of instinct that comes with time. Always filter the choice through the rules of saving face to ensure that no one is caused embarrassment.

Currency in Egypt: Everything You Need to Know

Whether to Use Cash, Credit, or Debit While Traveling

A Traveler's Guide to the Yen

The Complete Guide to Money and Currency in Peru

The Currency in Kuala Lumpur

Essential Info for First-Time Visitors to the Philippines

Ho Chi Minh City Guide: Planning Your Trip

The Currencies of Ireland

What's the Best Way to Bring Spending Money to the UK?

Money in Germany

Your Trip to the Czech Republic: The Complete Guide

9 Tips for Using Your ATM card in Europe

Money Suggestions for Travelers in Vietnam

Exchanging Currency in France

Exchanging Money in Mexico

How to Exchange Money in China

Multi-currency Philippine Peso card

Travelling from Australia to Philippines? Spend effortlessly in Philippine Pesos (PHP) with a multi-currency card.

40+ million worldwide customers use Revolut

Revolut offers so much more than a travel card. Exchange currencies, send money abroad, and hold 30+ local currencies in-app. These are just some reasons why our customers rely on us for their travel spending.

How can I spend in Philippine Pesos with a multi-currency card?

How to get your multi-currency card

Get your card and spend in Philippine Pesos

Get revolut.

Join 40+ million people worldwide saving when they spend abroad with Revolut.

Order your card

- Order your multi-currency card. Top up your balance in AUD or 30+ other currencies.

Spend like a local

Start spending in Philippine Pesos.

Why should I get a multi-currency Philippine Peso card?

Where is the multi-currency Philippine Peso card available?

Spend confidently in Philippine Pesos with your multi-currency card

Trusted by travellers

How to save money when spending in Philippine Pesos

Tips for saving money in Philippines

Don't exchange at airports or at home.

No need to exchange cash before you travel — use your travel money card to spend or withdraw money from an ATM.

Choose PHP as the local currency

Choose the local currency when spending with your card in shops and restaurants.

Save with a travel money card

Spend in Philippine Pesos like a local.

How to avoid unwanted ATM fees

Need to make PHP withdrawals in Philippines?

Philippine Peso ATM withdrawals with no Revolut withdrawal fee¹

No revolut atm fees for withdrawals up to a$350, or 5 withdrawals per rolling month, no revolut atm fees for withdrawals up to a$700 per rolling month, no revolut atm fees for withdrawals up to a$1,400 per rolling month.

What are you waiting for?

Spend in Philippine Pesos when you travel with your multi-currency card

Rating as of 3 May 2024

14K Reviews

2.8M Reviews

Need a little more help?

Multi-currency Philippine Peso card FAQs

Is it better to use a travel money card rather than cash in philippines.

There is no 'best' way to spend in Philippines, but here are some tips to help you save money:

- Don’t exchange cash at the airport. It may be cheaper to withdraw money from an ATM in Philippine Pesos with your multi-currency card.

- Don't carry more cash than you need. When you return home from Philippines, you’ll have to re-convert this cash back to AUD.

- Always choose PHP as the local currency when spending with your card in shops and restaurants.

- Download the Revolut app, then sign up to get instant notifications on what you spend and manage your balance.

Are travel money cards safe and secure?

Where can i spend in php with my multi-currency card, how much can i pay using my multi-currency philippine peso card, how can i avoid unwanted atm fees in philippines.

There are tons of benefits to spending in Philippine Pesos with your multi-currency card. Let’s look at a few:

- Send and spend in Philippine Pesos and 150+ other currencies, with a great exchange rate and low fees.

- No need to exchange or carry cash. Pay in Philippine Pesos with your multi-currency card, either contactless or with chip and PIN.

- No need to wait for your physical card to arrive. Instantly add your card to Google Pay or Apple Pay.

- Create single-use virtual cards for safe online shopping or travel bookings.

- Enjoy no-cost ATM withdrawals up to A$1,400 monthly, depending on your plan.

- Get instant payment notifications to keep track of how much you spend.

- Stay in control of your card’s security, with card freezing and spending limit controls.

- Easily manage your spending around the world with the free Revolut app.

How do I get a multi-currency card to spend in Philippine Pesos?

To order your Revolut debit card and start spending in Philippine Pesos, simply:

- Download the Revolut app for free on your Android or iPhone and sign up.

- Get your card in the post or add it to Google Pay or Apple Pay to use it immediately.

- Start spending like a local in Philippine Pesos.

The content of this page is for general information purposes only and does not constitute financial advice. If you have any questions about your personal circumstances, please seek professional and independent advice. Revolut is not a financial adviser. ¹Withdraw cash from an ATM using your Revolut card at no cost, up to the limits of your plan. After you hit these limits, we charge a small fee. Currency exchange fees, third-party fees, and monthly account fees may apply. If you’re withdrawing from an ATM in a currency you don’t hold in your wallet, this will involve a conversion. Exchange fees above your conversion limits will also apply for that conversion. You may also be charged a fee by the ATM owner when you withdraw funds. ²Canstar 2023 Outstanding Value, Travel Money Card award received June 2023 for Standard and Premium accounts.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

3 Best Travel Cards for Philippines

Getting an international travel card before you travel to Philippines can make it cheaper and more convenient when you spend in Philippine Peso. You'll be able to easily top up your card in CAD before you leave Canada, to convert seamlessly to PHP for secure and flexible spending and withdrawals.

This guide walks through our picks of the 3 best travel cards available for anyone from Canada heading to Philippines, like Wise, BMO or KOHO. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

3 best travel money cards for Philippines:

Let's kick off our roundup of the best travel cards for Philippines with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from Canada:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Philippines.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Philippines. Wise accounts can hold 40+ currencies, so you can top up in CAD easily from your bank or using your card. Whenever you travel, to Philippines or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in PHP, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in PHP when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 days to arrive (you can use your virtual card right away)

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in Canada:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Confirm your mailing address, and your card will be on the way, and should arrive in 14 days

BMO travel card

If you’re looking for a card from a major bank for spending in Philippines, you may be considering BMO. There are a few different card options which may appeal to travellers, including a prepaid card which allows you to top up in CAD and spend in PHP with a foreign transaction fee. This is a useful product when overseas as it’s not linked to your normal bank account - but the fees do push up costs overall.

Alternatively, check out the BMO credit card options - these are helpful if you want to spread the costs of your travel over a few months, but can also come with their own fees and charges.

BMO features

Bmo travel card pros and cons.

- Selection of cards including credit and prepaid options

- Not linked to your everyday account which can be more secure when spending overseas

- Various perks available depending on the card you pick

- Full range of banking services available

- 2.5% foreign transaction fee for prepaid card

- 6.95 CAD annual fee for prepaid card - credit cards are also likely to have an annual fee

- ATM fees and cash advance charges apply

How to apply for a BMO card

Here’s how to apply for a BMO account and order a travel card in Canada:

Visit the BMO website or app

Select the card you want - for a prepaid Mastercard there’s no credit check, spo ordering is quick and easy

Tap Apply now and complete the details as prompted

Pay any annual fee required

Your card will be mailed to you

KOHO travel card

KOHO has several different cards which could be handy for spending in Philippines. There are basic KOHO card options which have a foreign transaction fee of 1.5%, or you can choose to upgrade to a card with a monthly fee which may mean your foreign transaction fee is either waived or reduced. You’ll need to top up a balance in CAD, and there’s no option to switch over to PHP before you travel - but you can easily keep an eye on all your transactions and the applied exchange rates in the KOHO app.

KOHO features

Koho travel card pros and cons.

- Various cards available depending on your needs

- Widely accepted

- Some accounts offer extra perks like no foreign transaction fee or cash back

- Virtual cards available

- 1.5% foreign transaction fee for the basic card

- ATM fees apply when overseas, which vary depending on the ATM operator

- Some accounts have monthly fees

How to apply for a KOHO card

Here’s how to apply for a KOHO account and order a travel card in Canada:

Visit the KOHO website or app

Select the card you want to apply for

Tap Open account and complete the details as prompted

Your card will be mailed to you once your account has been verified and any required fee has been settled

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your Canadian dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Philippines or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app, although you can also often add money in person by visiting a branch, if the card provider has in-person branches.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Philippines. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday CAD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Philippines

We've picked out 3 great travel cards available in Canada - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Philippines include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in PHP can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences. If you're looking for a low cost card with the mid-market rate, which you can use in 150+ countries, the Wise card may be a good fit. If you'd prefer to pay a monthly fee to get higher no-fee transaction limits, take a look at Wise. And if you need to get a card in a hurry, check out a travel card from a provider with a physical branch network, or your high-street bank.

What makes a good travel card for Philippines

The best travel debit card for Philippines really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in PHP.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for Philippines. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

When you’re planning your trip to Philippines, bear in mind that cash is still a primary payment method, and many merchants and public service providers won’t accept a card. You’ll want a travel card which allows low cost cash withdrawals so you’ve always got some PHP in your pocket - and you can also keep hold of your card as a convenient back up in case of emergency too. Choose a card with no ongoing fees and no inactivity costs, so you can use it for your next trip abroad to get the most possible use out of it.

Ways to pay in Philippines

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Philippines cash is a very popular payment method. While you may find cards are accepted in major hotels and chain stores or very busy tourist areas, many merchants prefer cash. Make sure you’ve always got some PHP in cash in your wallet by making ATM withdrawals with your travel card whenever you need to.

Which countries use PHP?

You’ll find that PHP can only be used in Philippines. If you don’t travel to Philippines frequently it’s worth thinking carefully about how much to exchange so you’re not left with extra foreign currency after your trip. Or pick a travel card from a provider like Wise or KOHO which lets you leave your money in CAD and convert at the point of payment with no penalty.

What should you be aware of when travelling to Philippines

You’re sure to have a great time in Philippines - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to Philippines before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Cash is a widespread payment method - so you’ll need some PHP in your pocket when you travel to Philippines. You can sort out your travel money by visiting an exchange office here in Canada, or you can wait until you arrive and make an ATM withdrawal in PHP at the airport when you land. Bear in mind that currency exchange at exchange offices at the airport, either in Canada or in Philippines can be expensive - so if you’re carrying CAD in cash and need to exchange it, head into a town centre to do so.

3. Get clued up on any health or safety concerns - get travel insurance before you leave Canada so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for Philippines

Ultimately the best travel card for your trip to Philippines will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Philippines

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise card - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, BMO or KOHO.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Philippines.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their CAD / PHP rate to calculate how much Philippine Peso you would receive when exchanging / spending $5,000 CAD. The card provider offering the most PHP is displayed at the top, the next highest below that, and so on.

The rates were collected at 15:54:21 GMT on 19 February 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Guide to Travel Bank Cards in the Philippines for E-prepaid and Credit Cards: What's the best bank account for travelling abroad ?

One of the most important aspects of traveling is your finances. It’s role is so big that it can make or break a trip. Which is why it is crucial that you choose the right financial tools available in the market to help you get the best deals without breaking the bank.

In the Philippines, different banks offer different tools for people like me who love to travel. Banks offer credit cards with miles reward for every use so you can earn free trips, there are also some who offer prepaid credit cards which you can use for booking stuff online which is the most convenient way nowadays. In this article, I will show you a few of the most travel-friendly banks in the Philippines and how to choose the best credit card or e-prepaid card for your travels abroad .

1. Bank of the Philippine Islands (BPI)

Amore Visa Prepaid

BPI offers Amore Prepaid Card which is a prepaid credit card powered by Visa! You can use this card both here and abroad and can be reloaded for up to P100,000.00. You can apply for as low as P200.00 for the Amore Visa Prepaid PayWave and only P250 for the Amore Visa Prepaid Beep, at any BPI branch. Just fill up the online application form here and have your card ready for pick at your chosen branch!

You may also avail of the card at any of the following Ayala Malls Concierge:

TriNoma (located at ground floor near McDonald’s)

Alabang Town Center (upper ground floor, Activity Center)

Glorietta 3 (ground floor, beside Cinderella)

Market! Market! (ground floor near Lighters Galore)

Ayala Center Cebu (ground floor, rotunda area)

All you have to bring is 1 valid government issued identification card and you the fee and you’re good to go! This card is valid for 4 years and does not have any required maintaining balance and may be reloaded through over-the-counter transaction or through their BPI Online Service and BPI Mobile App. Such a breeze right?

BPI SkyMiles Mastercard

BPI SKyMiles Mastercard , on the other hand, is a credit card offer in partnership with Delta Air. This is BPI’s response “to the needs of the aspiring and frequent global travelers”. Cardholders automatically earn miles as they spend anywhere using their card. Every P45 spent earns one (1) SkyMiles miles, which means that the more you shop using a BPI SkyMiles card, the more miles you’ll earn which can used to travel to over 900 cities, 160 countries at 6 continents through Delta Air Lines and its SkyMiles Airline partners (the airfare must be charged to this card to claim the miles).

To apply, one must have an annual income of P180,000.00, with Income Tax Return (ITR) as proof, and filled up application form which you can fill up online here ! Another bonus this card gives is that the SkyMiles are transferable so you can gift it to a loved one if you want to! Ain't that nice?!

2. EastWest Bank

EastWest Prepaid Card

For an application fee of only P100.00, EastWest Bank offers a prepaid Visa credit card that would allow you to pay for dining, shopping, fuel, groceries, utility bills and online purchases. For as long as the merchant or establishment that you are transacting with accepts VISA as a payment option, whether here or abroad, you will be able to use your Prepaid Card for payment. This card may be reloaded at any EastWest Bank branch without any extra fee.

To apply, All you need to do is visit any EastWest Bank store and follow the simple steps below:

Approach an EastWest sales officer and inquire about the Prepaid Card.

Fully accomplish an EastWest Prepaid Card application form.

Present at least one (1) valid government issued identification card.

Pay a minimal card application fee of P100.

Load your Prepaid Card with any amount between Php 100 to Php 100,000 and it will be credited to your prepaid card for immediate use.

EastWest Travel Money Card

Another offering from EastWest Bank is its Travel Money Card which is a multi-currency card. Yes, you can load up to six different currencies in just one card - US Dollar, Euro, British Pound, Hong Kong Dollar, Australian Dollar and Japanese Yen! Awesome, right? Oh, did I also mention that they exchange rate is locked-in for the currencies you have loaded. No need to worry about fluctuating exchange rates or to look for money exchange counter to give you the best deal on your rates. You can also withdraw in local currencies from all VISA-affiliated ATMs abroad. So so so great!

To apply for one, just visit any EastWest branch and follow the simple steps below:

Fully accomplish the EastWest Travel Money application form.

Present at least one (1) government-issued identification card.

Pay a card application fee of P500.00

Load your card with any of the six currencies purchased from EastWest.

To reload, you must personally visit any EastWest bank branch and fill out Purchase of Foreign Currency Application form and present this to the assigned EastWest personnel together with one (1) valid government-issued identification card.

3. UnionBank

UnionBank GetGo Rewards Card is in partnership with Cebu Pacific. Every P30.00 spent awards you with 1 GetGo point which you can accumulate and use to book discounted flights with Cebu Pacific! Cardholders are also treated to exclusive seat sale promos and early alerts for cheap flights! You just have to fill up the application form online and upload a government issued ID and ITR here !

4. Philippine National Bank (PNB)

Probably the most generous among the cards here is PNB’s Mabuhay Miles Master Card. Once you’re approved, PNB will give you a 2,000 Mabuhay Miles as a welcoming gift! Mabuhay Miles can be used to book domestic and international flights with the Philippine Airlines. And that’s not all, once you reach P100,000.00 worth of transaction with Philippine Airlines, you will be rewarded an additional 10,000 Mabuhay Miles! Additional travel perks include exclusive 5% discount on select PAL international flights, with P30.00 to 1 Mabuhay Miles point ratio!

5. Banco De Oro (BDO)

Banco De Oro is the largest bank in the Philippines (in terms of assets) and one of their offerings is a Mastercard Cash Card which is a prepaid credit card that can be used both in the Philippines and abroad! You can get one with these few simple steps:

Get your card for only P150

No need to open a Checking or Savings Account

No minimum maintaining balance

Available at any BDO branch nationwide

The Cash Card is reloadable at any BDO branches nationwide or through their BDO Mobile App with only a minimum fee of P15.00 for every cash reload.

6. Philippine Savings Bank (PSBank)

Another prepaid card that you can use is PS Bank’s Prepaid Mastercard which you can use to book flights and hotel rooms online! Just reload at any PS Bank branches nationwide or through PS Bank online and you’re good to go! To apply, just comply with the following requirements:

Completely filled-out bank forms:

Customer Information Sheet (CIS) for Individual Clients

Signature Card

Signing Instructions and Acknowledgement of Receipt

Presentation of at least one (1) primary ID or two (2) valid secondary IDs, one of which with photo and signature.

7. Metrobank

Metrobank’s YAZZ card is a prepaid Visa card that can be used to shop at accredited VISA establishments worldwide including internet transactions. The YAZZ Reloadable VISA Card is available in all CD-R King, Family Mart, National Bookstore, Robinsons Department Store and at the SM Store, SM Hypermarket, SM Supermarket and SM Savemore. Convenient? Yasssss!!!

SWIPE RESPONSIBLY!

There you go! Choose from these options the best partner for your next travel! A little reminder though that having a credit card is a responsibility, so swipe responsibly!

Compare rates and fees for your money transfers.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Helpful tools to ensure you get the best rates on money transfers.

A Guide to Travel Money Cards

Often deemed the cheapest way to spend money abroad , travel money cards are deemed a failsafe option for many travellers. Given the rapid growth of the financial services sector, we want to find out if travel money cards are still as cutting edge as they once were, by comparing them to the new alternatives. Our job is to identify the best international money transfer services and payment providers in the industry: will travel money cards make the cut?

What are travel money cards?

Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals.

We recommend finding a travel money card which lets you lock-in a favourable exchange rate and supports multiple currencies on one card, to make sure you are securing a flexible and cost-effective deal.

How do you use a travel money card?

Using a travel money card should be straightforward and stress-free. Simply load funds onto the card before you leave, and once abroad, you will be able to reload funds and change currencies using the website or associated money transfer app . The card can be used to make withdrawals, in-store purchases and book travel arrangements.

Where can I get a travel money card?

Travel money cards are available from different retailers and can be purchased and preloaded online, over the phone or in-store, depending on the brand. In the UK, popular brands include Travelex and the Post Office.

Where can I use a travel money card?

Again, this depends on the brand and where you get your money travel card from. Available currencies vary from card to card but commonly used currencies include US Dollars, UK Pound sterling, Euros, Japanese Yen and New Zealand Dollars. Make sure you check with the provider before ordering a travel money card.

How secure are travel money cards?

Generally, travel money cards are considered a lot safer than handling multiple currencies in cash, or travellers cheques, as your provider will be able to cancel it if need be. Furthermore, some of the best travel money cards employ an equivalent level of security to traditional debit cards, including a PIN code, touch ID and face recognition.

Many consider it safer to use a travel money card abroad than a debit card, as they are not associated with your bank account and therefore cannot be linked if lost or stolen.

Travel money cards vs. Credit cards: What is the difference?

One of the biggest advantages of using a travel money card is that your chosen currency is preloaded before you arrive in the foreign country and you won’t be charged conversion fees. This means you are able to benefit from the most favourable exchange rates, locking it in ahead of time and using the funds at a later date.

Most people who use their credit card abroad do it because it is more convenient. The cost of this convenience, however, can sometimes amount to 3 - 5% per use, depending on the transaction and financial institution. Making a foreign ATM withdrawal with your credit card can incur flat-fees of $5 and up, each time.

This being said, there are some excellent traveller credit cards on the market, so we would recommend users compare exchange rates and transfer fees offered by each provider before making a decision on which card is more beneficial.

If you're planning on using your credit card, we suggest you take a look at our credit card wire transfer guide.

What are the alternatives to travel money cards?

Multi-currency accounts.

International money transfer companies are often tailoring their products and services to meet the needs of their customers. Wise , offers a multi-currency account designed with “international people" in mind. This savvy travel credit card is aimed at frequent flyers who want to spend in various currencies in over 200 countries. Wise is a reliable company to trust with your overseas spending habits.

Challenger banks

More and more alternative service providers are popping up around the world, many of them offering reputable banking features for the modern traveller. In a bid to distinguish themselves from traditional banks, challenger banks are scrapping fees on foreign exchange and international spending. Monzo customers, for example, can benefit from free international ATM withdrawals as well as fee-free spending overseas.

We hope this guide to travel money cards has enlightened you and helped you make a decision about whether this is a suitable payment method for your next trip overseas. We appreciate the value of your hard-earned cash and want all our customers to benefit from the best possible rates when dealing with international payments. Use our comparison tool today to make sure you are offered the most desirable exchange rate for your currency.

Related Content

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. May 3rd, 2024

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! May 3rd, 2024

.jpg)

- A Guide to Travellers Cheques The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day. May 3rd, 2024

- Millennial Guide For Baby Boomers & Generation X We looked over the stats for the past few years, and found that out of £1.5 billion payments abroad, 1 in 5 debit cards payments are made by the UK residents travelling abroad and credit card payments made outside the UK has increased in recent years, reaching 467 million payments. May 3rd, 2024

Contributors

April Summers

Peso Lab - Money Guide for Filipinos

Top Visa Mastercard Prepaid Cards Philippines

Prepaid cards are gaining more and more popularity. They’re easy to acquire and convenient to use. You can use them to pay in booking your flights, dining and shopping cashless, making purchases online, and buying tickets without the hassle of background check of credit cards. They’re accepted as payment in many stores especially online and/or those that are located abroad.

So what is it a prepaid card and how can you get one? And how is it different from other cards issued by Philippine banks such as a gift card or credit card? This article is going to talk about why it can be another seamless payment option for your many purchases in virtual or physical business establishments.

What is a Prepaid Card?

A prepaid card has the convenience of the debit card and credit card as an acceptable mode of payment in leading stores and businesses nationwide and internationally without the hassle of opening an account of the former and the background check of the latter. It comes in varieties that bear different payment gateway logos such as BancNet, Mastercard and Visa. Hence, it can be utilized to pay bills and cashless shopping in stores or wherever electronic payments are accepted like restaurants, groceries, parks, booking flights, department stores, amusement centers, e-commerce websites, etc.

It is similar to a gift card. The only difference is that it is reloadable multiple times and the only way it can be rendered useless is when it has reached the expiry date. See below the table that spells out the difference between these cards.

How to Buy and Use the Prepaid Card?

You can purchase prepaid card from banks. Others are offered by businesses such as GCash, PayMaya, Smart Money, PayPal and Cebu Pacific. Purchase cost can vary. To be able to use it, you need to put money into it at the outlet, branch via over-the-counter transaction, through deposit ATM (such as the yellow machines of BPI for instance), phone banking or through internet banking via online electronic fund transfer from your bank account.

Once it’s funded, it can now be used as mode payment and can be re-loaded when the balance gets nearly depleted. It can be used in card swipe machine found in point-of-sale (POS) terminals in grocery and shops. And online when you’re booking flights or paying for services, you’d be required to input the information on the card.

- Account number

To keep track of the remaining balance on the card, banks might have an online link or SMS notification where you can make a quick balance inquiry. Alternatively, some banks allow you to know the balance via an ATM, through bank inquiry, or calling a dedicated customer service hotline.

Advantages of Prepaid Cards

What are the benefits when you have a prepaid card?

- Easy purchase . You can buy a prepaid card from your preferred bank that issue them. A bank account is not necessary, so there are no background checks or documents that are required. Generally, you’ll be asked to present at least one valid identification card . The transaction usually takes minutes, and the card can be had within days or weeks depending on your location and the bank’s turnaround time.

- Reload . If your bank offers and has a robust online portal, loading the card with funds may be easy. You can just transfer money from your bank account to your card. No need to go a bank or use an ATM. Another popular choice is to go to loading stations.

- No maintaining balance . The card is not tied to a deposit account. There is no required maintaining balance so you’re not penalized with any charges when the fund falls below a certain level. And it can go on stretches of time that it has minimal or does not have any amount in it (zero balance) without incurring any fees.

- Convenience . It is very easy because you don’t have bring around wads of bills especially when you’re about to purchase big-ticket items. Besides, it is a good (and in a few situations even better) cash substitute. It is durable and easily fits in wallets and pockets. Many businesses accept them as payment.

- Widely accepted. The prepaid card, depending on the BancNet, Visa or Mastercard logo, is an accepted form of payment in many virtual or real business establishments. Just make sure that your fund is enough or exceeds the amount of the product or service you’re about to purchase.

- Rebates and perks. Some prepaid cards allow you to accumulate points in exchange for rebates, perks, and other privileges.

Disadvantages of Prepaid Cards

And what are the risks and disadvantages when using prepaid cards?

- Withdrawal issues. By the time your money is loaded into it, either you get charged when you want to get it back or you’re not allowed to convert it back to cash, and the only way to use your fund is to spend it.

- Expiry . It is only valid up to a certain number of years. Others also charge an amount on third and fourth year of validity. Once it expires, it loses the ability to transact. Any remaining balance can be transferred over to a new card subject to terms and conditions.

- Purchase cost . You can purchase the prepaid card from the banks or any participating retailers at a cost. Upon the card’s expiry, it cannot be renewed. Instead, a new card has to be purchased.

- Transaction fees . It has many miscellaneous fees on various transactions. There can be a loading fee whenever you put money into it, withdrawal charges when you get the money back, a fee when you want to know its remaining balance, etc. Aside from that, there may be fees associated with purchases made on stores from abroad, and that’s on top of paying whatever is currency exchange rate at the time of transaction

- No interest . Because it is not considered a bank account, its balance does not earn any interest and is not covered with insurance through the Philippine Deposit Insurance Corporation.

- Loading limit . You’re restricted from putting too much money into it. Some cards allow balances from ₱10,000 up to ₱100,000, which then makes it necessary to reload. This can be an issue with frequent big purchases that deplete the balance quickly.

What is the Cheapest Prepaid Card?

Which prepaid cards are free? As indicated in the table below, the cost of getting PSBank Prepaid Mastercard and PNB Prepaid Mastercard is zero as it is waived when you load it up with at least ₱500 initial fund. Five other cards can be acquired for ₱100: EastWest Prepaid Card, Equicom Cash Card, LANDBANK Cash Card, SMART Money Card and UCPB VISA eMoney Card.

Which Prepaid Card Does not Allow Withdrawal?

Of all the prepaid cards, only BPI Amore Visa Card does not have the functionality to allow funds to be withdrawn via ATM or over-the-counter transaction.

Top Prepaid Cards in the Philippines

The prepaid cards that are included in this article are those cards that bear either Visa or Mastercard. They’re issued by banks and other financial institutions such as GCash, USSC, PayMaya, and Bayad Center. Some of them have functionalities that are extended beyond bills payment and cashless shopping.

Most of them can be used as ATM card with the ability to withdraw funds, as loyalty card, and as rewards card. These cards are arranged in alphabetical order.

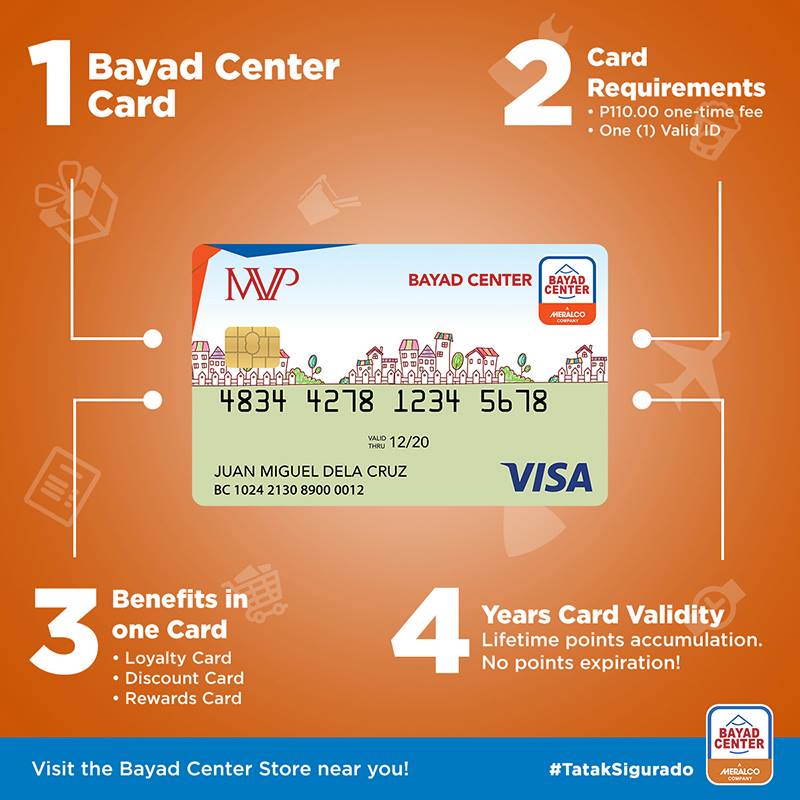

1. Bayad Center Card

The Bayad Center Card is a Visa logo-bearing card that you can purchase at any Bayad Center location nationwide for ₱110. It is multi-functional. As a loyalty card, you can earn points for when paying bills (1 point per bill payment). As a rewards card, you can enjoy rewards, discounts, and other perks in many business establishments. When link to a PayMaya account, you can use it to send/receive money from other Bayad Center cardholders as well as withdraw from any BancNet ATMs. And lastly, it can be used as payment wherever Visa is accepted.

How to get the Bayad Center Card

- Prepare ₱110 and valid ID.

- Visit any Bayad Center branch .

- Fill out the form, load up the card with funds and you can already use it.

2. BDO Cash Card

You can shop with BDO Cash Card wherever Mastercard is accepted. It comes in three varieties: pre-embossed (maximum loading limit of ₱10,000 with dormancy after 180 days without activity), retail embossed (₱25,000 and dormancy at 360 days), and corporate embossed (₱100,000 and dormancy at 360 days). Any financial transaction such as reloading or withdrawal can lift the dormant state.

There are also limits set for any purchases depending on the electronic channel that they’re made from.

How to buy BDO Cash Card?

- Prepare ₱150 and one valid ID.

- Visit any BDO branch nationwide and fill out the form.

- Wait for 3-5 business days for delivery within Metro Manila and 5-7 business days outside the capital.

3. BPI ePay Mastercard

The BPI ePay Mastercard is one of two prepaid cards offered by the Bank of the Philippine Islands. You can have one for only ₱150, and there are no fees for balance inquiry or re-loading of funds. Withdrawal is permitted subject to a fee. With validity of four years, you’d be required to pay ₱99 each for the last two years. Whenever the card expires and it has remaining balance that you want to transfer over to the new card, a monthly maintenance fee computed starting on 121st day from expiry date is charged.

How to buy the BPI ePay Mastercard?

- Drop by any BPI branch or fill out the online application form .

- Present one valid ID.

- Pay ₱150 for the card.

- Wait for the delivery of the card as notified through SMS.

- Go to the branch that you’ve selected as drop-off and claim your card.

4. BPI Amore Visa Prepaid Card

BPI Amore Visa Prepaid Card is the other prepaid card that is powered by Visa. It is up for grabs for ₱200, and with an additional ₱50 you can activate beep services for MRT, LRT, and BGC bus rides. It has a validity of four years, with a charge of ₱99 on the third and fourth year. Re-loading and balance inquiry are free. However, you can’t make any withdrawals.

Cardholders can earn points for every ₱200 spent in a single transaction. You can inquire about your points via SMS, and the instructions are found on rewards programs that also contain a catalog of discounts. Moreover, you’re entitled for other perks such as free access to Ayala Malls Customer Lounge, 5% off on movie tickets, and invitation to exclusive cardholder events (subject to terms).

How to buy the BPI Visa Prepaid Card?

- Pay ₱200 for the card or ₱250 with beep service.

5. CEB GetGo Prepaid Card

The CEB GetGo Prepaid Card issued by the Cebu Pacific through the GetGo program combines the features of a loyalty card and the convenience of a prepaid card. It can hold nine currencies such as Philippine Peso (PHP), United States Dollars (USD), Singapore Dollars (SGD), HongKong Dollars (HKD), Australian Dollars (AUD), Japanese Yen (JPY), Euro (EUR) British Pound (GBP), and Canadian Dollars (CAD). However, only Philippine peso can be used when loading up the card.

Additionally, every 1 reward point is earned for every ₱100 spending. and the accumulated points which can be used to avail of discounts when booking flights with Cebu Pacific and shopping or dining at other participating business establishments. You can also transfer funds to other Ceb GetGo Prepaid Cards for a fee of ₱20.

How to buy Ceb GetGo Prepaid Cards

- Prepare ₱150 and valid ID.

- Visit any of the following businesses: Robinsons Department Store, Ministop, Select 711 stores, FamilyMart and NCCC Malls.

- Fill out the form.

- Load the card. Fees that vary with the loading store apply.

6. Equicom Cash Card

The Equicom Cash Card is a Visa card issued by the Equicom bank. The dormant state starts on the 13th month without activity and automatically activates the maintenance fee of ₱200 every month until the fund is depleted.

How to apply for Equicom Cash Card

- Visit any Equicom bank branches nationwide.

- Load the card and then you can use it.

7. EastWest Prepaid Card

The East West Prepaid Card has a Visa logo and is accepted in many major online and real stores. Aside from online shopping and paying bills, it can be used to accept remittance from other countries. A registration using the card number is also optional for online banking. ATM withdrawal and POS purchases per day is ₱50k, while the limit for ATM withdrawal per transaction is set at ₱20k. Renewal of the card also comes free subject to terms and conditions.

How to order the EastWest Prepaid Card

- Prepare ₱100 and valid ID.

- Visit any EastWest Bank branch nationwide.

- Delivery of the card through the branch is three days in Metro Manila and five banking days otherwise.

8. GCash Mastercard

The GCash Mastercard is a prepaid card that you can use to cash out money in 20,000 partner ATMs in the Philippines. Just like the others, it can be utilized to pay for shopping on virtual or physical stores.

How to order the GCash Mastercard?