- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Elina Geller is a former Travel Writer at NerdWallet specializing in airline and hotel loyalty programs and travel insurance. Her passion for travel rewards began in 2011 when she flew first class to London and Amsterdam on British Airways and used hotel points to stay in both cities. In 2019, Elina founded TheMissMiles, a travel rewards coaching business. Elina's work has been featured by AwardWallet. She’s a certified public accountant with degrees from the London School of Economics and Fordham University.

Meghan Coyle started as a web producer and writer at NerdWallet in 2018. She covers travel rewards, including industry news, airline and hotel loyalty programs, and how to travel on points. She is based in Los Angeles.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

Allianz offers four different annual/multi-trip plans.

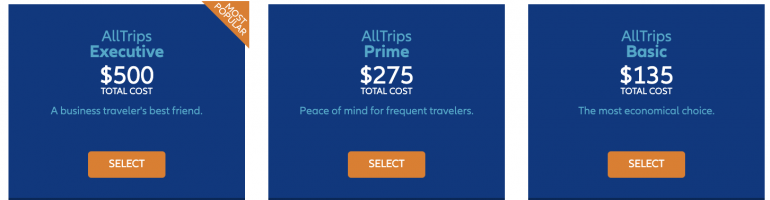

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

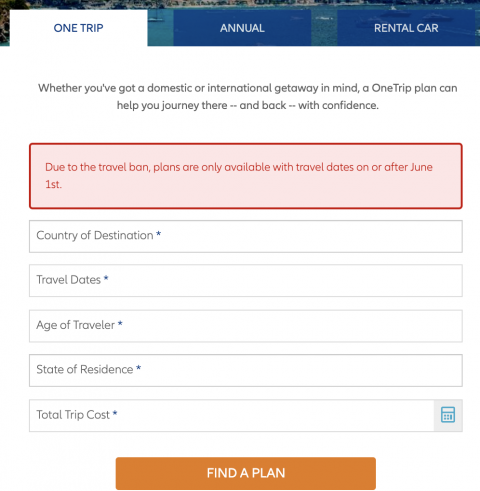

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

- Comprehensive travel insurance plans

- Emergency medical travel insurance plans

- Non-medical travel insurance plans

- Annual comprehensive travel insurance plans

- Annual emergency medical travel insurance plans

- Visitor to Canada travel insurance plans

- Seeking medical treatment

- How to file a claim

- Access Claims Portal

- Complaint resolution process

- Understanding travel insurance

- Choosing travel insurance

- Before your trip

- On your trip

- Travel Tips

- Get a quote online

Am I covered if I have to cancel or interrupt my trip due to COVID-19?

Allianz Global Assistance declared COVID-19 to be a known event for Trip Cancellation and Trip Interruption benefits on March 11, 2020. This known event declaration applies specifically to claims resulting from Global Affairs Canada travel advisories against non-essential travel (Level 3) or all travel (Level 4) due to COVID-19. As a result of the known event declaration, customers who purchased their policy on or after March 11, 2020 are not covered for Trip Cancellation and Trip Interruption claims related to COVID-19.

An exception to this known event declaration relates to claims if a customer becomes ill due to COVID-19 in their home province before departure, or at their destination during their trip. In these scenarios, a client can still claim for their non-refundable trip costs under Trip Cancellation (before departure) or Trip Interruption (after departure) benefits.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Allianz Trip Insurance

Protect your travel experience

Read about Allianz Trip Insurance’s COVID-19 insurance coverage limitations and accommodations.

U.S. coverage alert Opens another site in a new window that may not meet accessibility guidelines.

Top reasons to buy trip insurance

- Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more

- Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you

- 24-hour emergency assistance to help you solve medical and other travel-related problems on the go

Types of trip insurance plans

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle.

All insurance is recommended / offered / sold by 3rd party, Allianz Global Assistance, not American Airlines. Underwriter: Jefferson Insurance Company or BCS Insurance Company. AGA Service Company is the licensed producer and administrator of these plans. AGA Service Company is a licensed producer in all 50 states plus the District of Columbia.

Get a quote Opens another site in a new window that may not meet accessibility guidelines.

Trip insurance benefits

Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more.

Reimburses the unused, non-refundable portion of your trip and increased transportation costs it takes for you to return home early or to continue your trip due to a covered illness, injury, and more.

Reimburses expenses related to covered emergency medical or dental care incurred on your trip.

Provides benefits for medically necessary transportation to the nearest appropriate medical facility following a covered injury or illness.

Reimburses extra meals and accommodations you may need if your flight is delayed for 6 or more hours for a covered reason.

Reimburses you if your luggage is lost, damaged or stolen during your trip—keeping your travel plans on track.

Reimburses the purchase of essential items if your luggage is delayed for more than 24 hours.

Turn your trip into a VIP experience. Our travel experts can give you destination information, make restaurant reservations, find tickets to shows, and more.

Help is just a phone call away. Our team of multilingual problem solvers is available to help you with medical and other travel-related emergencies.

Provides primary coverage with no deductible.

Review period

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Plans are non-refundable after this period.

Additional assistance

Coverage by country of residence.

- Frequently asked questions

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]

Email [email protected]

PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage already provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Rental Car Protector is not available to KS and TX residents, except when purchased as a separate policy and is not available in all countries or for all cars. This coverage does not provide liability insurance or comply with any financial responsibility law, or any other law mandating motor vehicle coverage and does not cover you for any injury to another party. Additionally:

California Residents: We are doing business in California as Allianz Global Assistance Insurance Agency, License # 0B01400. California offers a toll-free consumer hotline at 1-800-927-4357.

New York Residents: The licensed producer represents the insurer for purposes of the sale. Compensation paid to the producer may depend on the policy selected, or the producer’s expenses, volume of business, or profitability. The purchaser may request and obtain information about the producer’s compensation, except as otherwise provided by law.

Maryland Residents: The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The Commissioner may be contacted to file a complaint at: Maryland Insurance Administration, ATTN: Consumer Complaint Investigation Property/Casualty, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202.

Texas Residents: Before deciding whether to purchase this insurance plan, you may wish to determine whether your own automobile insurance or credit card agreement provides you coverage for rental vehicle damage or loss and determine the amount of deductible under your own insurance coverage. The purchase of this insurance plan is not mandatory. This coverage is not all inclusive, which means it does not cover such things as personal injury, personal liability, or personal property. It does not cover you for damages to other vehicles or property. It does not cover you for any injury to any other party.

Plan charge includes the cost of insurance benefits and assistance services. See your Plan Details for more information, or call Allianz Global Assistance at 800-284-8300.

AGA Service Company dba Allianz Global Assistance (AGA) compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency.

*Terms, conditions, and exclusions apply, including for pre-existing conditions. Plans may not be available to residents of all states. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured’s state of residence. AGA Service Company is the licensed producer and administrator of these plans.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Get a Quote

Last-minute cancellations. Travel delays. Rental car accidents. When the unexpected happens, you can rely on Allianz Travel Insurance to help make things right.

Whether you're planning a road trip, camping getaway or vacation rental, a OneTrip plan can help you journey there — and back — with confidence.

Get affordable protection for all your trips — family vacations and weekend getaways alike — for a full 365 days.

Enjoy peace of mind on your next road trip. Get robust rental car coverage for a fraction of what you'll typically pay at the rental counter.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Why Do I Need Travel Insurance?

Because your trip is too important to leave to chance. For a small fraction of your trip costs, you can count on travel insurance to save the day when things go awry.

- If you have to cancel your trip for a covered reason, travel insurance can reimburse you for your prepaid, non-refundable trip costs. Without insurance, you could lose the money you paid for your vacation rental, car rental, hotel, flights and more.

- If you experience a covered medical emergency , travel insurance can help ensure you get high-quality care and reimburse you for covered medical costs. Without insurance, you may have to pay out of pocket.

- If your rental car gets damaged, lost or stolen , travel insurance can pay for the loss. Without insurance, you could get hit with a huge bill.

- If you face an unexpected crisis, travel insurance connects you to 24-Hour Hotline Assistance for expert help and advice. Without insurance, you’re on your own.

- If your travel plans are affected by COVID-19, many of our travel protection plans now include the Epidemic Coverage Endorsement, which adds covered reasons to select benefits for certain losses related to COVID-19 and any future epidemic. Benefits vary by plan and by state of residence, and are not available in all jurisdictions. Learn more in our COVID-19 FAQ .

WHICH PLAN IS RIGHT FOR ME?

OneTrip Travel Insurance Plans

If you're the type who plans one big getaway a year, a OneTrip plan can offer benefits to help you breathe easier -- like trip cancellation, luggage protection, emergency medical benefits, and more. And all plans come with 24-Hour Assistance in case you need expert travel help along the way.

Annual Travel Insurance Plans

Frequent traveler? An AllTrips annual travel insurance plan may be a great fit. You can get the protection you need for all the trips you take in a full year -- domestic or international, leisure or business -- all under one convenient plan.

Rental Car Insurance Plans

If you're hitting the road in a rental car, OneTrip Rental Car Protector can provide primary protection for covered collision, loss, and damage, along with 24- hour emergency assistance. It's an affordable alternative to using your personal insurance, or overpriced options at the rental counter.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

What our customers say

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

How do you choose travel insurance that covers COVID-19?

Oct 26, 2021 • 5 min read

COVID-19 has made it more important to check the health coverage on your travel insurance © Maskot/Getty Images

After 18 months of pandemic-related travel restrictions, you may be itching to act on your pent-up wanderlust—but the situation and the rules are still continuously evolving. So before you go anywhere, it’s best to have a travel insurance plan that protects the investment you’ve made in a long-awaited trip.

A robust travel insurance plan will reimburse pre-paid trip costs and non-refundable deposits if you have to cancel or interrupt your trip, encounter trip delays, experience baggage loss or require medical expense and medical evacuation. Your policy will also reimburse “covered reasons” in your plan, such as death, illness or injury, serious family emergencies, unplanned jury duty, military deployment, acts of terrorism, or your travel supplier going out of business.

But COVID-19 has added an additional checklist to your usual insurance needs—it’s now important to check to ensure your travel insurance plan includes coverage for COVID-19 medical expenses, and losses related to illness. Your policy should also cover quarantine costs if you need to self-isolate after testing positive for the virus.

What do I look for in COVID-19 insurance coverage?

When you’re shopping for a travel insurance plan that covers COVID-19, you need to do your research and read the fine print of your plan.

Look for a travel insurance product that will protect your non-refundable, prepaid expenses if you have to cancel your trip due to illness caused by COVID-19. Your policy should also cover emergency medical treatment and emergency medical transportation. With regard to COVID-19 coverage, be sure your policy covers medical care, medicine, hospitalization and quarantine expenses.

“The type of coverage you should look for depends on you, your needs, travel dates, and the type of trip you’re taking,” says Sasha Gainullin, CEO of battleface , a travel insurance carrier. He says some travel insurance companies have now excluded COVID-19 coverage because it has been labeled a “known/foreseeable event”, while others may exclude pandemics altogether.

“It’s important to search for plans that include medical and quarantine expenses as well—this will be critical in the event you become ill and need to receive treatment while traveling,” continues Gainullin.

One additional tip is to confirm there are no exclusions based on the destinations you’re traveling to—this can happen with countries under government-issued travel warnings, Gainullin says.

“If a traveler feels uncertain, I recommend speaking with the travel insurance company directly. They can review the policy details with you, answer all of your questions, and confirm all of your required coverage options are included,” he adds.

Is getting coverage dependent on vaccination?

While it’s a good idea to be fully vaccinated before traveling, vaccination is not required to purchase a travel insurance policy, says Daniel Durazo, spokesperson with Allianz Partners USA.

What are the medical costs that are covered by travel insurance?

Travel insurance can cover the cost of both medical treatment and emergency medical transportation. A US health insurance plan, as well as Medicare, generally will not cover overseas medical expenses, so it’s best to check with your personal health insurance provider if any global coverage is available.

“While losing the cost of a trip due to an unexpected cancellation would be painful, paying for expensive emergency medical treatment or emergency medical transportation can be financially devastating,” Durazo says.

Under a travel insurance plan, medical costs could range doctor visits, pharmacy expenses, imaging costs and covering a hospital stay if required. Other expenses that can be covered are transportation to medical care and medicine.

Read more: Will my health insurance cover getting COVID-19 while traveling in the US—or abroad?

What about covering an unexpected quarantine due to COVID-19?

Many international destinations are now requiring that visitors purchase travel insurance coverage for an unexpected quarantine. Allianz Travel Insurance has added coverage to many of its products that includes reimbursement for quarantine-related accommodations if you or a traveling companion is individually-ordered to quarantine while on their trip, says Durazo.

This coverage typically covers the cost of additional food, lodging and transportation while quarantined. In addition, trip interruption and travel delay benefits on certain Allianz plans also provide coverage if you or your travel companion is denied boarding by your travel carrier due to suspicion of illness.

The benefits for quarantine coverage vary from carrier to carrier. For example, on select Trawick International plans, they offer $2,000 in quarantine benefits and for an additional charge, and you can increase it up to $7,000.

What about pre-flight COVID-19 testing?

Your plan may provide coverage for flights if you are turned away at a border for not passing a health inspection. Foster says Trawick’s travel insurance plans that cover COVID-19 would cover the expenses if you could not pass your pre-health inspection. Also, the plan would cover the costs of the failure of your PCR test to return to the United States, such as having to quarantine abroad.

It’s important to note that the actual cost of the PCR test is not covered by your policy, just the loss associated with the negative test.

Read more: PCR tests for travel: everything you need to know

Some destinations require COVID-specific insurance coverage—how do I comply with those restrictions?

Before any international travel, you should check the country where you are headed to make sure you comply with insurance coverage requirements. Countries like Spain, Turks and Caicos and Thailand are among the nations that mandate COVID-19 insurance coverage.

“You first must check the countries’ specific COVID regulations for entry into the country. Some countries require travelers to provide proof of travel insurance that covers COVID-19 related expenses purchased from a third party,” explains Foster. Providing proof coverage is key; so travelers need to ensure they receive documentation from their insurance provider that their policy covers COVID-19 related expenses to show customs officials, she says.

Should you arrive in a country that requires proof of insurance to cover COVID-19 medical expenses and quarantine costs, and you don’t hold a policy, you will not be granted entry.

For more information on COVID-19 and travel, check out Lonely Planet's Health Hub .

You may also like: What happens if I'm denied entry to a country on arrival? What is a vaccine passport and do I need one to travel? What is the IATA Travel Pass and do I need it to travel?

Explore related stories

Destination Practicalities

Mar 28, 2023 • 3 min read

Here’s all you need to know about getting a traveler visa to visit China now that “zero COVID” has come and gone.

Sep 12, 2022 • 4 min read

Jun 15, 2024 • 9 min read

Jun 15, 2024 • 6 min read

Jun 15, 2024 • 17 min read

Jun 14, 2024 • 6 min read

Jun 14, 2024 • 7 min read

Jun 14, 2024 • 21 min read

Do you want to install app?

Add a shortcut to your home screen: Share button at the bottom of the browser. Scroll left (if needed) to find the Add to Home Screen button.

Allianz Travel Protection

Don’t just wing it. Protect your trip to enjoy peace of mind and enhance your experience. JetBlue has been proud to partner with Allianz Global Assistance for over a decade because they’re the gold standard in the travel insurance and assistance industry. Every year, millions of people trust them to protect their travel plans, ticket purchases, and more.

Helpful links

Covid-19 coverage information, why travelers choose protection, why choose allianz travel protection, allianz travel protection benefits basics, easier claims for quicker payments, review period.

Selecting travel protection when booking your flights is the easiest way to keep you and your budget safe.

- No one wants to lose their vacation investment if they have to cancel a trip, and they don’t want minor mishaps to ruin their time away from home.

- Medical emergencies overseas can be really expensive and many personal health insurance policies (like Medicare) don’t provide coverage outside the U.S.

- Help is only a phone call away. Allianz Global Assistance’s award-winning team of experts is always available to help solve travel problems.

We’ve made it easy to add Allianz Travel Protection during the booking process.

“I was extremely impressed with the ease of filing my claim, and very happy with the outcome. Travel insurance was well worth it. I recommend it to everyone. Thank you.” JetBlue customer, New York, Nov. 2022.

Allianz Travel Protection is an insurance plan with award-winning assistance that can protect you and your budget from unexpected travel problems and emergencies. In most cases, this means providing reimbursement for covered financial losses after you file a claim and it has been approved. These losses can be minor, like a delayed suitcase, or significant, like a last-minute trip cancellation or a medical emergency overseas.

Allianz Travel Protection can protect you before and during your trip—keeping you, your loved ones, and your travel budget safe. Benefits vary by plan and these are brief descriptions. Please read your plan documents for details.

Allianz Global Assistance continues to streamline the claims process. They simplified the claim form to make it easier to complete, and they added a claim button to the TravelSmart™ app—allowing you to file a claim on the go from your smartphone.

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Premiums are non-refundable after this period.

Was this page helpful?

- Sublimit will apply.

Terms, conditions, and exclusions apply. Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected].

Get To Know Us

- Our Company

- Partner Airlines

- Travel Agents

- Sponsorships

- Web Accessibility

- Contract of Carriage

- Canada Accessibility Plan

- Tarmac Delay Plan

- Customer Service Plan

- Human Trafficking

- Canada: Forced/Child Labor Report

- Optional Services and Fees

JetBlue In Action

- JetBlue for Good

- Sustainability

- Diversity, Equity & Inclusion

Stay Connected

- Download the JetBlue mobile app

- Commercial Motor Vehicle

- Roadside Assistance

- Public Liability

- General Property

- Management Liability

- Small business

- Tradies and contractors

- Retailers insurance

- Professional service providers

- Health and beauty professionals

- Real estate

- Cafés and restaurants

- NSW stamp duty exemption

- ACT | NT | TAS | WA claims

- NSW forms and resources

- VIC forms and resources

- ACT | NT | TAS | WA forms and resources

- Workplace mental health

- Training & webinars

- Compare Travel Insurance

- Caravan and Trailer

- Cyclone support

- Flood support

- Storm support

- Bushfire support

- Extreme Weather Claims

- Customer counselling program

- Financial hardship

- Scam warning

- Family violence support

- Deceased estates

- Financial institutions

- Insurance brokers

- Partner News Hub

- The Allianz Hub

- Login to My Allianz

- Make a payment

- Retrieve a quote

- Retrieve life application

- Travel Insurance

- Choose your plan

What is travel insurance?

Travel insurance is designed to cover you for a range of unexpected events that could happen when you’re travelling overseas or in Australia. Allianz Travel Insurance can cover costs like travel delays or emergency medical treatment, or the cost of replacing items that were lost or stolen during your trip. 1

We have Basic, Comprehensive, Domestic, and Multi-Trip Plans to choose from, with varying levels of cover to help you when you need it most. Our plans are available for singles, duos or families. Read through our Product Disclosure Statement (PDS) for detailed information about our plans to see which level of cover is right for you.

Find the right cover for your trip

Basic Travel Insurance

- Overseas emergency assistance 1

- Overseas medical and hospital expenses 1

- Personal Liability 1

Comprehensive Travel Insurance

- Overseas emergency assistance, medical and hospital expenses 1

- Unexpected trip cancellation 3

- Loss of or damage to luggage and personal effects 1

- COVID-19 benefits 2

Domestic Travel Insurance

- Travel delay expenses 1

- Rental vehicle excess 1

Multi-Trip Travel Insurance

Additional cover options.

For an additional premium, you can choose to add an Adventure Pack, Cruise Pack, or Snow Pack to eligible plans. Increased Item Limits Cover can also be added to insure your luggage, personal effects or valuables should something happen to them while travelling.

You have the option to vary the base excess when you buy your policy (premium adjustment will apply depending on the excess selected). The choice is yours.

Website review and travel remediation

Choose what suits your needs, single cover, family plan, ready to get started, frequently asked questions.

Without travel insurance, you run the risk of incurring some significant expenses that may take years to pay off.

If you’re travelling overseas, travel insurance is an important consideration for unexpected medical bills and hospitalisation. Other unforeseen expenses could include the replacement of lost or stolen luggage, delays or cancellations to your trip, and many other unfortunate scenarios.

We don’t cover medical expenses under our Domestic Travel Insurance policy. However, you may wish to take out insurance for domestic flight changes or cancellations, lost or stolen baggage, or rental vehicle excess. Refer to the Product Disclosure Statement (PDS) for more information.

Travel insurance may cover you for a range of unexpected events that may affect your trip, such as emergency medical assistance if you become ill or injured while travelling overseas, including arranging your evacuation if needed.

Other incidents that travel insurance may cover include costs due to unexpected delays and cancellations, rental vehicle excess, and personal liability. You also have the option to purchase additional cover for activities such as adventure sports or skiing, although this isn’t available on all plans.

Cover limits vary from insurance provider to insurance provider, as do policy terms, conditions, limits and exclusions, so it’s important to read the Product Disclosure Statement to make sure you fully understand what’s covered, the limits applying to the policy, and to make sure the policy is appropriate for your needs.

The length of your Travel Insurance policy is largely dependent on the travel dates you supply. When obtaining a quote, or buying a policy, you’ll be prompted to enter in your departure and return dates – this will be the period of cover for all benefits except the cancellation benefit, which begins from the date your policy is issued.

The period of cover is also shown on your Certificate of Insurance, which is sent to you at the time of purchase. You may want to extend the length of your holiday abroad (and therefore need an extension of your period of cover) and you may be able to do this within specified timeframes.

If you think you may travel more than once a year, you may wish to consider a Multi-Trip policy . Different start and end dates apply, refer to the Product Disclosure Statement for full details.

It’s up to you when you buy Allianz Travel Insurance, however, keep in mind these three things:

- You can buy our Travel Insurance up to 12 months in advance.

- You must buy Allianz Travel Insurance before you start your journey. Your journey starts when any traveller named on the Certificate of Insurance leaves home or work in Australia to begin travel.

- Depending on the plan you choose you may have trip cancellation cover, which covers unexpected trip cancellation, rescheduling or shortening from the date your Certificate of Insurance is issued. So, consider buying our Travel Insurance as soon as you’ve booked and paid for some or all your trip as you may be covered for such events before you depart.

Yes, if you change your mind after you buy your Travel Insurance policy, you may cancel it within 14 days of your Certificate of Insurance being issued.

You’ll be given a full refund of the premium you’ve paid, provided you’ve not started your journey and don’t intend to make a claim or exercise any other right under your policy.

When considering which policy is right for you, make sure you consider your needs, as well as your financial situation. Reading the Product Disclosure Statement and Target Market Determination (TMD) is a good place to start as they will give you more detail, so you can decide if the plan is right for you.

Allianz Travel Insurance offers a number of travel insurance plans – Basic , Comprehensive , Domestic , Non-Medical or Multi-Trip Travel Insurance . You can see more detailed information on our Compare Cover Options page .

This product has a general exclusion, with limited exceptions, against epidemics and pandemics. That means we don’t cover claims that arise from, or are related to, an epidemic or pandemic.

However, you’re covered under selected benefits in this product if, during your period of cover, you’re positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19.

Refer to the Product Disclosure Statement to see which benefits offer cover in the event that you contract a sickness recognised as an epidemic or pandemic, and the terms, conditions, limits and exclusions that apply.

Note: There is no cover under any benefit of this policy if your claim arises because you did not follow advice or a warning that has been issued by the Australian Government or a reliable mass media source. This applies even if an Australian government has given you permission to travel, or you fall under a specific exemption where there is otherwise a travel ban in place.

If you have any questions call us on 13 1000 .

If you need to shorten your journey while travelling, or are prevented from travelling due to a COVID-19 border closure or mandatory quarantine period, you may be entitled to receive a partial or full refund on your premium. Refer to the Product Disclosure Statement for more information.

Eligibility criteria applies. Contact us on 1800 440 806 or email us .

There is no cover under any benefit of this policy if your claim arises because you didn’t follow an advice or warning that a reasonable person would have been aware of, that has been issued by the Australian government (when a ‘reconsider your need to travel’ or ‘do not travel’ alert is in place), which can be found on Smartraveller ; or which was published in a reliable mass media source.

Before buying travel insurance, and while you’re travelling, check Smartraveller and Allianz Partners for travel alerts or advisories for your intended destination(s).

Note: This applies even if an Australian government has given you permission to travel, or you fall under a specific exemption where there is otherwise a travel ban in place.

Tip: Subscribe to Smartraveller to get travel alerts and advisory updates by email.

Refer to General Exclusions in the Product Disclosure Statement for a full list of exclusions.

If you have any questions, call us on 13 1000 .

A general exclusion, sometimes referred to as a policy exclusion or exclusion, is an exclusion that applies to all policy benefits.

Should a general exclusion apply, your travel insurance policy won’t provide cover for the specified event, activities or circumstances.

Refer to General Exclusions in the Product Disclosure Statement provided at the time of purchase for a full list of exclusions.

We're here to help

Give us a call, or send us a message, follow us on, *conditions apply.

- Terms, conditions, exclusions, limits and applicable sub-limits apply. Refer to the Product Disclosure Statement for full details.

- Policy terms, conditions, limits, exclusions, and sub-limits apply to particular types of losses, premium refunds (full or partial) or claims. This product has a general exclusion, with limited exceptions, against epidemics and pandemics. That means we don’t cover claims that arise from, or are related to, an epidemic or pandemic. However, you’re covered under selected benefits in this product if, during your period of cover, you’re positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19. Refer to the Product Disclosure Statement to see which benefits offer cover in the event you contract a sickness recognised as an epidemic or pandemic, and the terms, conditions, limits and exclusions that apply.

- Terms, conditions, limits, exclusions and sub-limits apply. Cancellation cover is only available on Comprehensive, Domestic and Multi-Trip Plans. Refer to Cancellation and General Exclusions sections of the Product Disclosure Statement for full details.

- Car Insurance

- CTP Insurance

- Home & Contents Insurance

- Building Insurance

- Landlord Insurance

- Life Insurance

- Caravan Insurance

- Boat Insurance

- Small Business Insurance

- Business Insurance Pack

- Workers' Compensation

- Renewals / Payments

- Manage Your Policy

- Policy Documents

- Customer Support

- How we help

- Sustainability

- Partnerships

- Work with us

Any advice here does not take into account your individual objectives, financial situation or needs. Terms, conditions, exclusions, limits and applicable sub-limits apply. Before making a decision about this insurance, please consider the relevant Product Disclosure Statement (PDS)/Policy Wording and Supplementary PDS (if applicable). Where applicable, the PDS/Policy Wording, Supplementary PDS and Target Market Determination (TMD) for this insurance are available on this website.

Travel Insurance is issued and managed by AWP Australia Pty Ltd ABN 52 097 227 177 AFS Licence No. 245631, trading as Allianz Global Assistance (AGA) as agent of the insurer Allianz Australia Insurance Limited ABN 15 000 122 850 AFS Licence No. 234708 (Allianz). Travel Insurance is underwritten by the insurer Allianz. Terms, conditions, exclusions, limits and applicable sub-limits apply.

^The 5% off Travel Insurance ‘TRAVEL5’ discount is available from 12:01am AEST 06/05/2024 until 11:59pm AEST 30/06/2024 by entering the valid promo code. The discount applies to new policy purchases and is based on standard premium rates (including optional extras). It applies automatically upon successful input of the promo code and applies to any changes, upgrades or amendments made to the policy prior to commencement of the journey. The discount may apply to changes made after commencement of the journey, contact Allianz Global Assistance to find out more. Not to be used in conjunction with any other offer.

We don’t provide advice based on any consideration of your objectives, financial situation or needs. Before making a decision, please consider the Product Disclosure Statement available on this website. If you purchase this insurance, AGA will receive a commission that is a percentage of the premium. Ask us for more details before we provide you with any services on this product.

- International group corporate website

- Allianz Partners Hong Kong

- Allianz Partners Australia

- Allianz Partners Austria

- Allianz Partners Brazil

- Allianz Partners Belgium - Nederlands

- Belgique - Français

- Brasil - Espanhol

- Allianz Partners Colombia - Español

- Česká republika

- Allianz Partners Deutschland

- Allianz Partners España

- Allianz Partners France

- Allianz Partners Greece

- Allianz Partners Indonesia - English

- Allianz Partners Ireland

- Allianz Partners Italia

- Allianz Partners Malaysia

- Allianz Partners México

- Allianz Partners New Zealand

- Nordic & Baltics

- Allianz Partners Portugal

- Allianz Partners Singapore

- Allianz partners Thailand

- Allianz Partners Switzerland - English

- Allianz Partners Switzerland - Deutsch

- Allianz Partners Turkiye

- Allianz Partners UK

- WGEA Employer Statement

- Roadside Assistance

- Easy living

- Emergency Home Assistance

- In the news

- Sustainability

Westpac Complimentary Credit Card Insurance and COVID-19 (Coronavirus) FAQ

Information for westpac eligible cardholders regarding covid-19.

Information on this page is correct as of 30 June 2022 .

Stay up to date on Travel Information for COVID-19 from the Department of Foreign Affairs and Trade (DFAT) Smartraveller website and World Health Organisation (WHO) and Department of Home Affairs .

Always consult the smartraveller.gov.au website prior to any travel. In addition to visas, COVID-19 testing, and proof of vaccination requirements, many countries now have compulsory insurance and medical cover proof conditions. Check with the nearest embassy, consulate or immigration department of the destination you are entering. If you require additional documentation regarding the complimentary international travel insurance policy due to international entry requirements, please contact us on 1800 091 710.

From 30 June 2022, if during the period of your cover, you (and your spouse/dependents, if they’re eligible for cover) are positively diagnosed as suffering a sickness recognised as an epidemic or pandemic (such as COVID-19), cover may be available under the following sections:

- 1.1 Overseas Emergency Assistance

- 1.2 Overseas Emergency Medical

- 1.4 Medical Evacuation & Repatriation

- 2.1 Cancellation

- 3.1 Additional Expenses

If your travel companion is positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, such as COVID-19, which impacts your journey, cover may be available to you under the following sections:

Note, you won’t be covered while travelling against advice or warnings issued by the Australian government and you did not take reasonable care to avoid contracting the sickness, for example by delaying travel to the country listed in a warning.

The above is a summary only, please refer to Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet for eligibility criteria, full terms, conditions, limits and exclusions.

A General Exclusion for epidemic/pandemic applies for all claims relating to any epidemic/pandemic outside of the select benefits in the applicable policy information booklet Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet . Please note, terms, conditions, limits and exclusions apply.

To receive a formal outcome, Eligible Westpac Cardholders must submit a claim.

Eligible Westpac travellers who meet the eligibility criteria should be aware that other General Exclusions have the potential to apply.

What is a General Exclusion?

A General Exclusion is an exclusion which will be applied across all sections of an insurance policy, and applies regardless of when eligibility for cover was gained. Should a General Exclusion apply, this means that your complimentary credit card travel insurance excludes cover for the event, activities or circumstances (specified in the exclusion) that causes your claim.

To understand what is excluded from the Westpac Complimentary Insurance covers, please refer to Part D – Excesses & General Exclusions section and the section specific exclusions of the relevant Westpac Policy Information Booklet for which your eligible Westpac card is applicable under: Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet .

Other exclusions may apply depending upon the circumstances of an individual claim. General Exclusions include but are not limited to:

- by the Australian government (when a ‘Reconsider your need to travel’ or ‘Do not travel’ alert is in place), which can be found on www.smartraveller.gov.au ; or

- which was published in a reliable mass media source.

- any interference with your travel plans by any government, government regulation or prohibition or intervention or official authority. For example, if Smartraveller has a warning, ‘Do not travel’ or ‘Reconsider your need to travel’ due to the risk of COVID-19 infection for a destination, and a cardholder chooses to ignore the warning and is infected with COVID-19, cover may be excluded. Or if a government closes its borders to inbound travellers due to COVID-19 and you are unable to enter and follow your planned travel across the closed border, cover may be excluded.

What if a Westpac Eligible Cardholder has booked travel and needs to cancel due to contracting COVID-19?

If you are unable to travel as a result of contracting COVID-19, Cancellation cover may be provided to eligible travellers, if you or your travel companion are positively diagnosed as suffering a sickness recognised as an epidemic or pandemic such as COVID-19, and cover is expressly included under the Cancellation section of the relevant Westpac Policy Information Booklet for which your eligible Westpac card is applicable under: Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet . If you are unable to travel as a result of an Epidemic or Pandemic related event which does not include you or your travel companion being positively diagnosed as suffering a sickness recognised as an epidemic or pandemic, for example a border closure, there may be no provision to claim as a general exclusion for epidemic and pandemic applies. A General Exclusion for epidemic/pandemic applies for all claims relating to any epidemic/pandemic outside of the cancellation benefits in the applicable policy information booklet. Please note, terms, conditions, limits and exclusions apply.

You therefore need to consider your own personal circumstances. We are not able to provide you with a cover decision before submitting a claim. To receive a formal outcome, Westpac Eligible Cardholders must submit a claim.

You should also contact your travel agent or travel service provider (airline, cruise line or Tour Company, etc) as they may be able to support you in obtaining refunds, credits or travel re-scheduling.

Can Westpac Eligible Cardholders make a claim for consideration?

Every Westpac Eligible Cardholder can submit a claim and have their individual circumstances considered in accordance with the eligibility criteria which includes the terms, conditions, limits and exclusions that apply as set out in the Westpac Credit Cards Complimentary Insurance Policy Information Booklet and Westpac Business Credit Cards Complimentary Insurance Policy Information Booklet .

If you would like to claim, we encourage you to claim online via insurance.agaassistance.com.au/westpac

Call the Allianz Global Assistance Claims team

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The Best Travel Medical Insurance of 2024

Allianz Travel Insurance »

Seven Corners »

GeoBlue »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Medical Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- Seven Corners

Buying travel insurance is a smart move for any type of trip, but you may not need a policy that covers everything under the sun. If you don't need coverage for trip cancellations or delays because you're relying on your travel credit card to offer these protections, for example, you may find you only need emergency medical coverage that works away from home.

Still, travel medical coverage varies widely based on included benefits, policy limits and more. If you're comparing travel insurance plans and hoping to find the best option for unexpected medical expenses, read on to learn which policies we recommend.

Frequently Asked Questions

The term travel insurance usually describes a comprehensive travel insurance policy that includes coverage for medical expenses as well as trip cancellations and interruptions, trip delays, lost baggage, and more. Meanwhile, travel medical insurance is coverage that focuses on paying for emergency medical expenses and other related care.

Travelers need international health insurance if they're visiting a place where their own health coverage will not apply. This typically includes all international trips away from home since U.S. health plans limit coverage to care required in the United States.

Note that if you don't have travel health insurance and you become sick or injured abroad, you'll be responsible for paying back any health care costs you incur.

Many travel insurance policies cover emergency medical expenses you incur during a covered trip. However, the included benefits of each policy can vary widely, and so can the policy limits that apply.

If you're looking for a travel insurance policy that offers sufficient protection for unexpected medical expenses, you'll typically want to choose a plan with at least $100,000 in coverage for emergency medical care and at least that much in protection for emergency medical evacuation and transportation.

However, higher limits can provide even more protection from overseas medical bills, which can become pricey depending on the type of care you need. As just one example, Allianz says the average cost of emergency medical evacuation can easily reach up to $200,000 or more depending on where you’re traveling.

Your U.S. health insurance policy almost never covers medical expenses incurred abroad. The same is true for most people on Medicare and especially Medicaid. If you want to ensure you have travel medical coverage that applies overseas, you should purchase a travel insurance plan with adequate limits for every trip. Read the U.S. News article on this topic for more information.

The cost of travel medical insurance can vary depending on the age of the travelers, the type of coverage purchased, the length of the trip and other factors. You can use a comparison site like TravelInsurance.com to explore different travel medical insurance plans and their cost.

- Allianz Travel Insurance: Best Overall

- Seven Corners: Best for Families

- GeoBlue: Best for Expats

- WorldTrips: Best Cost

Coverage for preexisting conditions is available as an add-on

Easy to purchase as needed for individual trips

Relatively low limits for medical expenses

No coverage for trip cancellations or trip interruption

- Up to $50,000 in emergency medical coverage

- Up to $250,000 in emergency medical evacuation coverage

- Up to $2,000 in coverage for baggage loss and damage

- Up to $600 in baggage delay insurance

- Up to $1,000 for travel delays

- Up to $10,000 in travel accident insurance

- 24-hour hotline assistance

- Concierge services

SEE FULL REVIEW »

Purchase comprehensive medical coverage worth up to $5 million

Coverage for families with up to 10 people

Low coverage amounts for trip interruption

Medical coverage options vary by age

- Up to $5 million in comprehensive medical coverage

- Up to $500,000 in emergency evacuation coverage

- Up to $10,000 in coverage for incidental trips to home country

- Up to $25,000 in coverage for terrorist activity

- Up to $500 in accidental dental emergency coverage

- Up to $100 per occurrence in coverage for emergency eye exams

- $50,000 in coverage for local burial or cremation

- 24/7 travel assistance

- Up to $25,000 in coverage for accidental death and dismemberment per traveler

- Up to $500 for loss of checked baggage

- Up to $5,000 for trip interruptions

- Up to $100 per day for trip delays

- Up to $50,000 for personal liability

Qualify for international health insurance with no annual or lifetime caps

Use coverage within the U.S. with select providers

Deductible from $500 to $10,000 can apply

Doesn't come with any nonmedical travel insurance benefits

- Up to $250,000 in coverage for emergency medical evacuation

- Up to $25,000 for repatriation of mortal remains

- $50,000 in coverage for accidental death and dismemberment

High limits for medical insurance and emergency medical evacuation

Covers multiple trips over a period of up to 364 days

Deductible of $250 required for each covered trip

Copays required for medical care received in the U.S.

- Up to $1,000,000 of maximum coverage

- Up to $1,000,000 for emergency medical evacuation

- Up to $10,000 for trip interruptions

- Up to $1,000 for lost checked luggage

- Up to $100 per day for travel delays

- Up to $25,000 in personal liability coverage

- Medical coverage for eligible expenses related to COVID-19

- Ability to add coverage for your spouse and/or child(ren)

- Repatriation of remains coverage up to overall limit

- Up to $5,000 for local burial or cremation

- $10,000 to $50,000 for common carrier accidental death

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

How to Get Airport Wheelchair Assistance (+ What to Tip)

Suzanne Mason and Rachael Hood

From planning to arrival, get helpful tips to make the journey easier.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Single Trip

- Annual Multi-Trip

- Winter Sports & Ski

Collision Damage Waiver

- Sport & Leisure

- Medical Conditions

- Travel Insurance for Non-UK Residents

- Group Travel Insurance

- Travel Insurance for Couples

- Covid-19 travel insurance

- About Our Travel Insurance

- Holiday Cancellation Insurance

- Emergency Medical Assistance Cover

- Emergency Medical Cover for Travel Insurance

- Repatriation Insurance

- Baggage Cover

- Travel Insurance for Under 18s

- Comprehensive

- What's Covered

- Excluded Vehicles

- Range Rover

- Car Hire Excess Insurance

- Policy Information

- File a Claim

- Insurance Glossary

- Coronavirus - Annual Multi-trip Policy

Travel Insurance

Travel safe. With Confidence.

- Unlimited access to HealthHero - our 24/7 video or telephone GP helpline based in the UK

- Specific COVID-19 cover for cancellations and medical treatment abroad

- A global insurance provider to protect you and loved ones health when travelling in the UK, Europe and Worldwide

What is travel insurance?

Whether you're heading to snowy slopes or beautiful beaches, going abroad is an exciting experience.

Although accidents can happen while you're away, the best travel insurance policies provide you with peace of mind; with travel insurance from Allianz Assistance, you'll be covered for many unforeseen costs incurred whilst you're away. This could include medical expenses including medical emergency, delays, cancellations, lost or stolen property and more.

Our holiday insurance can be used to cover medical expenses, trip cancellation, delays, lost or stolen baggage and personal liability. When you choose Allianz Assistance travel insurance for your trip, there’s no more wondering ‘what if?.’ There’s a policy for most types of travel so, whether you’re heading on a family holiday, a last-minute business trip or jetting off on a few city breaks, we’ve got you covered. Below is some more information about our products, for which Terms and Conditions apply. Please visit the policy information hub for full details.

You could spend months planning and looking forward to your holidays, and Allianz Assistance travel insurance helps you to protect your investment. There's no need to worry about whether emergency medical treatment or delayed flights will affect your trip, because we offer the support you need to handle the unexpected. Plus, with three different levels of cover to choose from, you're likely to find the right travel insurance for you.

Choose the plan that suits you and you’ll be protected for your holiday. The type of travel insurance you need will depend on the countries you’re visiting, the activities you’ll be doing and the length of your trip. We offer Single Trip and Annual Multi-Trip travel insurance, and can provide cover for Backpackers too.

Popular Types of Travel Insurance

We'll help you find a travel insurance plan that covers the 'what ifs?' for your next trip. Just select your type of travel from the options below.

Terms and conditions apply.

- Cover all your trips this year with one affordable annual multi-trip insurance policy.

Single-Trip

- Perfect for those that only travel occasionally whether here in the UK, Europe or Worldwide.

- Gap year, career break, or just a wander? Ideal cover for overseas or adventure travel.

How to ensure you have the right cover

Does your bank or credit card company provide cover.

Many bank accounts and credit cards come with some level of travel insurance cover. While some may be comprehensive, they may not cover you for everything you have planned whilst you’re away, particularly if you have adventurous plans or unusual excursions booked. For example, you might not be covered for emergency medical costs you could incur if you have na accident or need medical treatment.

Make sure you look into the travel insurance policy that you have before every trip, to make sure it’s suitable for you and your plans.

Purchasing a holiday using a credit card means you are often protected by Consumer Protection cover. In most cases, it allows you to get your money returned to you if your provider defaults and you cannot travel.

Are you covered by ABTA or ATOL?

If you have booked a holiday through a tour operator or travel agent, it may be worth checking if you are covered by ABTA (Association of British Travel Agents) or ATOL (Air Travel Organiser’s License). This type of cover means that your package holiday is protected if, for example, the travel company providing your holiday arrangements or the travel agent themselves fail financially or close down.

Your travel agents will be able to tell you if your holiday is ABTA or ATOL protected. Alternatively, use the links provided to check your cover at home.

What is an EHIC or GHIC and what can it offer you?

Having a European Health Insurance Card (EHIC) or Global Health Insurance Card (GHIC) will entitle you to the government-provided healthcare of the European Union country you are visiting and lowering the medical expenses you would normally expect to pay.

Although this is a good addition to take on holiday, a European Health Insurance Card or Global Health Insurance Card should not be seen as a replacement for travel insurance which could provide you with further protection and peace of mind whilst you are abroad. Our travel insurance policies can protect you against many unforeseen eventualities.

Is emergency medical treatment covered?

Dicsover our products to choose a travel policy that's right for you.

Annual Multi-Trip Travel Insurance

Single Trip Travel Insurance

Backpacker Travel Insurance

Ski & Winter Sports Travel Insurance

Business Travel Insurance

Family Travel Insurance

Travel Insurance for Seniors

Travel Insurance for Medical Conditions

Golf Travel Insurance

Cruise Travel Insurance

Do I need travel insurance?

Travel insurance is always worthwhile when you're heading abroad, even if you're visiting a relatively safe location like mainland Europe or somewhere close by. After all, the unexpected can still happen: your flight could be cancelled, you could eat something that disagrees with you or you could be targeted by thieves.

It's also important to know that, if you're travelling to Europe your GHIC card doesn't cover all of your medical needs and many of the most expensive services like repatriation (bringing you back home if you've had an accident or need emergency medical care) aren't covered. Plus, your GHIC only covers you for basic health treatments; you won't be protected against things like holiday cancellation, and loss or theft of your belongings.

Sadly, even on the shortest holidays, accidents can happen. When you have holiday insurance, we can help to reduce your worries around medical costs, flight delays, lost items and thefts, leaving you to enjoy your holiday and create precious memories.