Digital Multi-Currency Accounts & Cards For Travel Spending: BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip

Singaporeans are always looking for ways to save cash—especially when travelling. This is where the digital multi-currency accounts come in.

The world of digital multi-currency accounts is constantly changing. Instarem’s Amaze card used to be lauded for its lucrative 1% cashback on top of your linked credit card , but it’s since replaced this with a loyalty points-based system. At the same time, it’s also slapped on some top-up fees for certain top-up methods. Meanwhile, YouTrip has finally added Google Pay compatibility —you can now add your YouTrip card to your Google Wallet and make seamless and secure payments.

So, with all these changes, how do we know which is the best? Here’s the lowdown on offerings from YouTrip, Instarem, BigPay, Revolut, and Wise (formerly TransferWise). Let’s review and compare them to see which is the best digital multi-currency account.

BigPay vs Instarem Amaze vs Revolut vs Wise (Formerly TransferWise) vs YouTrip: Which is the best multi-currency account?

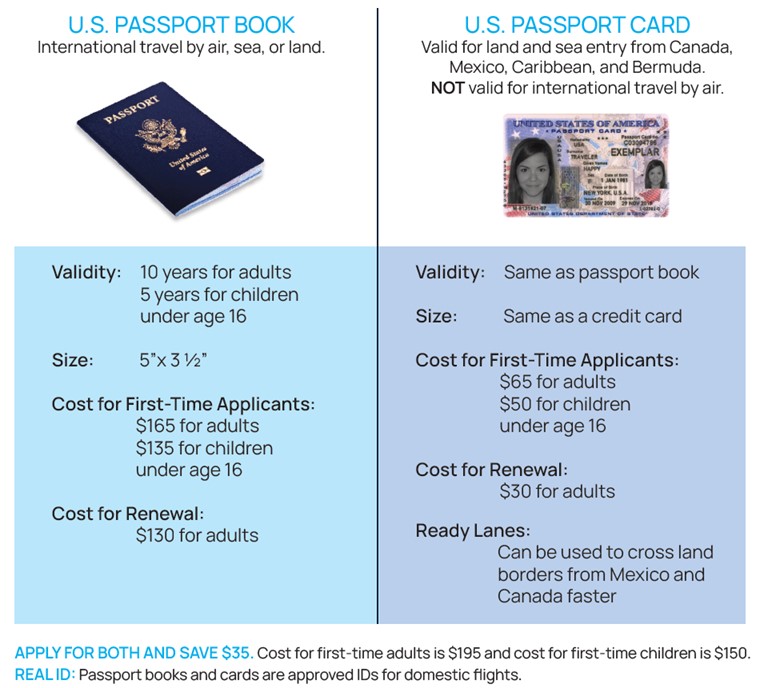

Swipe left to see the full table.

Best all-round digital multi-currency card: Instarem Amaze Card

The Instarem Amaze Card’s winning factor is the fact that you can earn Instarem rewards on top of your own credit or debit card cashback or rewards. All you have to do is link your credit or debit card (up to 5 cards) to your Amaze card or top up your Amaze wallet and spend away. This alone introduces a very enticing incentive for people to use the Instarem Amaze card while still spending on their existing cards.

How does the cashback work for the Instarem Amaze card?

The Amaze card used to give you 1% cashback, but has now switched to a loyalty points system with InstaPoints . When spending overseas on your Amaze card, you earn up to 1 InstaPoint for every 1 SGD-equivalent in foreign currency . There’s a minimum spend of 10 SGD (the equivalent in foreign currency) per transaction for you to earn InstaPoints on that transaction.

You’ll notice we said up to 1 InstaPoint. I dug through the Amaze Card T&Cs and found out that how many InstaPoints you earn depends on your payment method. Per SGD1 spent in foreign currency on your Amaze Card, you’ll earn

- 0.5 InstaPoints if your Amaze Card is linked to a credit or debit card.

- 1 InstaPoint if you’re topping up your Amaze Wallet on your Amaze Card.

Their website doesn’t spell out this distinction, it just says “T&Cs apply”. Sneaky, but we’re sneakier.

There’s also a cap of 500 InstaPoints you can earn per foreign currency transaction, and InstaPoints expire after 12 months . Do note that there are also certain categories excluded from Amaze Rewards , including healthcare, utilities, education, tolls, and postal services.

To redeem InstaPoints as cashback, do so directly on your Instarem App. Every 2,000 InstaPoints gets you SGD 20 cashback.

Pros—What we like about the Instarem Amaze Card:

- 1% cashback per quarter on top of your credit or debit card rewards.

- Googly Pay compatibility: Android users can add their Amaze card on Google Pay.

- No foreign currency conversion fees

- No annual, processing, or application fees

- The Instarem app automatically categorises your transactions into categories like “Food and Dining” and “Travel”. These days, we need all the help we can get staying organised.

- Since you can link up to 5 cards, the app also combines your cards into 1 and lets you track your spending across all of them regardless of the credit card provider.

Cons—What we don’t like about the Instarem Amaze Card:

- You can only link your Amaze Card to a Mastercard credit/debit card or to Google Pay . For other card associations like Visa or Amex, you have to top up your Amaze Wallet instead—which doesn’t let you earn rewards on the card you use for top-ups .

- At the same time, you only earn 1 InstaPoint per 1 SGD spend in foreign currency if you use the Amaze Wallet. If you link a card or use Google Pay, you earn half of that—0.5 InstaPoints per 1 SGD instead.

- You’ll incur a 1.5% fee when topping up your wallet using Visa cards. Top-ups using Mastercard and PayNow are free.

- Instarem charges you a fee of 2% (minimum S$0.50) for SGD transactions involving GrabPay, prepaid cards and other e-wallet top-ups. This applies to both using your Amaze card with your linked bank card as well as to Amaze wallet transactions. The saving grace is that this doesn’t apply to foreign currency transactions .

- However, to note, there’s a $100 cap on the cashback and a minimum spend requirement of $500per quarter.

- We found the linking service a bit wonky . Users have reported random declines or duplicate charges , including myself. To elaborate, I made a skincare haul on Guardian Singapore, had my S$238 charge reversed, and then recharged again.

- There is also no integration with Apple Pay, which is a shame.

Runner-up for the best digital multi-currency card: Revolut

I like no-commitment cards. Revolut gives us that option with 3 plans, the most basic of which is free. Here’s a quick comparison of the everyday benefits of all 3 cards:

And here’s a summary of their travel benefits:

For a noob traveller like me who doesn’t often leave Singapore’s sunny shores, I like the Standard plan. First of all, it’s completely free to get. Even the card delivery to your doorstep is free (assuming it’s your first Revolut card). Secondly, it provides one of the most essential service I’d be interested in during overseas trips—currency exchange (fee-free on weekdays), overseas spending, and overseas cash withdrawal.

The limit for cash withdrawal is $350 per month under the Standard plan. Admittedly, that’s not a very high limit. It’ll do if you’re strapped for cash overseas, but you can’t depend on this card for cash during long haul trips, like if you’re backpacking across Asia for a month. So at the other end of the spectrum, Revolut offers their $19.99/month Metal plan. This card lets you withdraw $1,050 per month overseas for free, on top of unlimited fee-free currency exchange on weekdays, unlimited fee-free international transfers (up to the allowed regulatory limit) and up to 1.5% cashback.

The Revolut Metal card costs S$19.99 a month or S$199 a year. Y ou get a discount if you pay upfront—it’s S$199 as opposed to S$239.98 if you were to pay monthly.

How does the Revolut card work?

Unlike the Instarem Amaze card, you can’t just link your credit card to your Revolut card and call it a day. The Revolut card works more like the Amaze Wallet—top up money, spend it later overseas directly using your card or by withdrawing cash from an ATM.

Unfortunately, there are charges for pumping money into your Revolut account—yes, even their free Standard plan has these fees :

The first top-up is free.

Comparing apple to apple, top-ups to the Amaze Wallet are free for Mastercard credit cards (0.62% for Revolut) and 1.5% for Visa (1.97% for Revolut). So as far as top-ups go, Amaze wins. But if you’re paying in cash, factor in Instarem’s 2% ATM withdrawal fee and Revolut’s 0.62% Mastercard top-up fee suddenly looks way more enticing.

Pros—What we like about the Revolut Card:

- Slickest UI

- Best integration with current phone payment methods, most notably Apple Pay and Google Pay.

- Free ATM withdrawals (up to $350, $700, or $1050 depending on your plan)

- Choice of 3 plans, including a basic Standard plan with no fees

- Premium and Metal plans come with other perks like airport lounge access and travel insurance coverage

- Fee-free currency exchange on weekdays. This is unlimited for Metal plan users, but capped at $5,000/month and $15,000/month for Standard and Premium plan users respectively. If you exceed this limist, Standard will be charged a 1% fee, while Premium customers will be charged a 0.5% fee.

- Up to 1.5% cashback on Revolut Metal card, capped at the monthly subscription fee of S$19.99.

Cons—What we don’t like about the Revolut Card:

- Surcharges to top up your Revolut account range from 0.30% to 2.08% depending on the card type.

- 1% currency exchange fee on weekends.

Overseas ATM withdrawal fee

Key Features

Spend in over 150 currencies

No fee on international ATM withdrawals, up to S$1,050 per month depending on the plan (subject to 5 withdrawals per month)

Send money domestically and internationally to 150+ countries (both bank transfer and instant card transfer)

Debit card with minimum top-up of S$20

In-app budgeting & analytics and Vault features to manager your savings

Ability to split bills easily with anyone

Free and instant P2P transfers to other Revolut users globally

Invest in 1000+ global company shares, 110+ crypto tokens, commodities with live watchlists, trading charts, market news and learn modules

Premium and Metal Add ons : Lower or no fees across multiple products (e.g., FX, Remittance, ATM, Crypto, Stocks, Commodities), Complimentary travel insurance, Customised metal card, Premium card with three exclusive designs, Priority customer service and LoungeKey Pass access to airport lounges around the world

Apply via MoneySmart and easy 5 minute setup via Revolut mobile app

Multi-currency features

Account opening / eligibility, fees and charges, other features, product documents, best free digital multi-currency card with rewards for those who don’t want sign up for more credit cards: bigpay.

BigPay is completely free to sign up and comes with no annual fees . Does Big sound familiar? It’s the subsidiary of low-cost Malaysian carrier, AirAsia, and that means you can use it to redeem discounted flights, meals from AirAsia food, travel insurance and even investments. For example, from now till 31 Dec, use BIGPAY5 to get 5% off AirAsia flights .

It’s quite useful too if you already have an AirAsia account—simply link them up to reap even more benefits with your BigPay card.

The kicker is that you will need to spend at least S$5 on any transaction to earn 1 BIG point, and there’s a limit of S$300 daily on Visa PayWave payments. Do note that chip + pin transactions are subject to the MAS yearly limit of S$30,000.

Pros—What we like about BigPay

- Free—no joining fee, annual fee, or account service fee

- First overseas ATM withdrawal is free

- AirAsia benefits

Cons—What we don’t like about BigPay

Essentially, its fees :

- Overseas ATM withdrawal fee: 2% after first withdrawal

- Currency conversion fee: Up to 1% + network charges

- Cross-border transaction fee: 0.5% + network charges

- Mastercard Debit: 0.6% (Domestic) / 3.05% (International)

- Mastercard Credit: 0.7% (Domestic) /3.30% (International)

- Visa Debit: 1.25% (Domestic) /2.5% (International)

- Visa Credit: 2.3% (Domestic) / 3% (International)

What about Wise (formerly TransferWise)?

Wise (formerly TransferWise)’s strength lies more in its ability to remit and hold multiple types of currencies as opposed to spending money through its e-wallet. This is shown by the fact that, out of all the digital multi currency account providers, it supports the most number of currencies to store and send, at over 50. The next highest is Revolut , which stands at a decent 36.

There is something I like about Wise that’s specific to my bad travel habits. I often underestimate the cash I need overseas and end up looking for a money exchanger or ATM. If you’re like me and don’t want to pay ATM withdrawal fees, Wise lets you withdraw up to $350 for free each month.

If you’re looking for loyalty points (like the Instarem Amaze card) or travel perks (like BigPay), Wise may disappoint you. The multi-currency card provides no special benefit to everyday consumers other than the ability to spend from the wallet. You’re better off using Wise to send money to your loved ones overseas, but it depends on the region that you’re sending to as well. Find out what I mean in this article about the best remittance services .

Pros—What we like about Wise

- Free overseas ATM withdrawals —Up to 2 withdrawals (less than $350) per month.

- No joining fee

- Highest number of currencies: 40+ different currencies in more than 175 countries.

- Transparent currency conversion fees that you can easily check online.

- Supports Apple Pay and Google Pay.

Cons—What we don’t like about Wise

- No cashback or reward benefits

Is YouTrip a good multi-currency card?

Yes, and no. Let’s talk about the “yes” parts first.

I think YouTrip’s biggest win is that it has no overseas transaction fees or currency exchange fees . Additionally, top-ups are free for Mastercard credit and debit cards as well as Visa debit cards . Recall that these will incur a 0.5-2% fee with Revolut. Instarem doesn’t charge a fee for Mastercard, but does charge 1.5% for Visa top-ups.

YouTrip’s withdrawal fees are also competitive. Your first S$400 for the month is free—slightly higher than that for Wise. After this, YouTrip will charge you a 2% withdrawal fee.

So, what’s not so good about YouTrip? For one thing, you can only store up to 10 currencies in its e-wallet.

Its rewards system is also a bit troublesome—you have to dig out your YouTrip card for its Y-number when you want to redeem something from its YouTrip Perks page . Granted, the mobile app does it for you, I find shopping on your desktop is a more comfortable experience because you can multitask, and compare prices between two tabs.

Better deals can also be had within the app, but it’s on a limited-time basis and not built into the functionality of the card unlike the above mentioned providers. Also, some users have reported that some of the promotions don’t work, like how this anonymous user has sent us a screen recording of a Shopee cashback deal leading to an error page, saying that the “Budget has been exhausted” .

However, if you already have a YouTrip card sitting in your wallet, make use of the 0% foreign transaction fee to buy stuff online in other currencies or link it to foreign mobile apps such as WeChat or Taobao.

Pros—What we like about YouTrip

- No overseas transaction fees

- No currency exchange fees

- Free top ups for Mastercard credit/debit cards and Visa debit cards

- First $400/month free ATM withdrawal

Cons—What we don’t like about YouTrip

- Limited to only 10 currencies

- Desktop experience is cumbersome

- No cashback benefits

Between mid-market rates, wholesale rates, and real-time exchange rates: what’s the difference?

As a consumer, this is not something that you should base your decision on. Essentially what those above mentioned terms are talking about is the constantly changing rates of foreign currencies, and you can check it through the tools provided by Visa , Mastercard and Reuters . The difference will mostly boil down to the nearest cent, as illustrated in the Instarem Amaze card review .

Does that mean I don’t have to exchange foreign currencies ever again?

For short trips and urban cities, you may be able to get away with not having the local currency in cash, and just rely on debit. In most cases though, I reckon you’d still want to make a trip to Change Alley or Mustafa Centre to prepare some cash on hand.

This is because many countries are still very dependent on cash and the limit of S$350 for Wise (formerly TransferWise) and S$1,050 for Revolut (with Metal Plan, S$350 otherwise) without fees may not be sufficient for long trips.

Don’t forget that you’d have to hunt down the right ATM terminal overseas to get fee-free withdrawals. Otherwise, admin/processing fees may apply.

Is using a digital multi currency account better than a bank’s?

Banks rely on legacy structures that are still in place, which can mean unfavourable exchange rates and high fees.

However, borderless multi-currency accounts like Instarem, Revolut and Wise (formerly TransferWise) are not tied to legacy structures like the SWIFT network and multiple bank partnerships. Therefore, they can provide much lower fees, up to 6 times cheaper for currency conversion and remittance.

Example: SGD to THB on 6 Dec 2023

*Before fees are applied.

As you can see, Wise’s rate is the closest to XE’s live rate. Factoring in Wise’s transfer fees of approximately 0.58%, converting S$1,000 costs $5.77, yielding a net of THB 26,060. Overall, that still yields the most.

A digital multi-currency account may be more convenient to apply for as well. Opening a bank account comes with requirements, one of which is to maintain a minimum balance. You don’t have to do that for electronic multi-currency accounts.

An irritating thing about using a multi-currency savings account is that you’d retain cents in various currencies that can’t be converted back after your travels.

With a digital multi-currency account like Wise, you can spend with your borderless Mastercard or Visa card and have the system choose the best existing currency to convert from. This gives you a chance to spend loose cents that you can’t convert back to Singapore Dollars.

That said, using a local multiplier savings account is convenient as you can use it to pay and withdraw money in Singapore seamlessly. You can also earn interest rates on certain foreign currencies.

In contrast, you can only withdraw up to $350 per month with no card fees overseas. This is with an electronic multi-currency account, and you can’t withdraw local currency in Singapore when the Payment Services Act was enforced in 2019.

That being said, the world is a lot different from what it used to be 3 years ago. Digital multi currency card accounts have caught up to the level of banks in terms of rewards and cashback promotions, whilst being on the bleeding edge of financial technology. Don’t miss out!

Know anyone who’s making travel plans? Share this article with them!

Related Articles

Comparing Digital Multi-Currency Accounts: Wise, YouTrip, Revolut, and Others

DBS Multiplier Account Review — Should You Switch Savings Account in 2022?

Withdrawing Cash Overseas When You Travel – What To Look Out For & Withdrawal Fees

9 Best Credit Cards in Singapore for Overseas Spending (2024)

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

The 5 best travel money cards for singapore in 2024.

Singapore is a vibrant place to visit with amazing nightlife, delicious food and a gateway to the rest of the world, it has a lot to offer visiting Australians.

In Singapore you are likely to pay for accommodation, food, transport and entertainment as well as withdraw cash from ATMs with your card.

We have looked at a number of best travel card for overseas in 2024 and have summarised their best points.

Best 6 Travel Money Cards for Singapore in 2024:

- Wise Travel Card - for the best exchange rates

- Revolut Travel Card for low fees

- Travelex Money Card - best all rounder

- HSBC Global Everyday Debit Card for ATM cash withdrawals

- Bankwest Breeze Platinum Credit Card for lowest interest rate

- ING One Low Rate Credit Card with no annual fee

Wise Travel Card - Best Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise Card charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is an excellent choice for people traveling to Singapore, offering a multitude of benefits tailored to international visitors. One of the key advantages is access to over 40 currencies at the interbank exchange rate, widely acknowledged as the most cost-effective globally. This is particularly useful for travelers coming to Singapore, as they can exchange their home currency for Singapore Dollars (SGD) at very competitive rates. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Revolut - Best Exchange Rates

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Money Card is a good all-rounder no matter if you are heading to the bustling streets of Hong Kong or visiting the serene Lantau Island.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as Wise or Revolut for travelling , the support network if the card is lost or stolen is very good. This service can be extremely useful when journeying across the cosmopolitan city of Hong Kong.

HSBC Everyday Global Travel Card - Best Travel Card by Bank

- Great exchange rate offered for Singapore dollars (SGD)

- No ATM fees at HSBC tellers

- No initial card, closure, account keeping or monthly fees

- No cross currency conversion fees

HSBC Everyday Global Travel Card

- 10 Currencies can be loaded are SGD, AUD, USD, EUR, GBP, CAD, JPY, NZD, HKD and CNY (currency restrictions on CNY)

- No maximum balance for any currency

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with payWave, Apple Pay or Google Pay for purchases under $100.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Travel Card offers a great exchange rate for Singapore dollars, ATMs, so you can withdraw cash without the hefty overseas ATM fees.

In addition it does not charge an ‘international transaction fee’ so you can spend in Singapore and online in Australia and not pay an additional 3%.

Finally, on top of the excellent currency exchange rate, there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling throughout Singapore.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places in Singapore.

ING One Low Rate Credit Card - No Annual Fee

- No annual fee

- Up to 45 days interest free on purchases

- Lowest cash advance interest rate of 11.99%

- Use instalment plans to pay off your purchases over time at a lower interest rate

ING One Low Rate Credit Card

- 11.99% interest rate on purchases

- Make payments from your mobile with pay with Apple Pay and Google Pay

- International ATM fee and Foreign currency conversion fee are waived when you deposit $1,000 into your Orange Everyday each month, and make 5+ card purchases that are settled. Otherwise they are the higher of 3% or at least $3

- Put repayments on auto payment each month to pay the minimum balance or full amount

The ING One Low Rate credit card is a great option to take to Singapore as it charges no annual fee and offers a low interest rate for purchases and cash advances of 11.99%. The cash advance interest rate is very low and about 50% less than most of its competitors who charge around 22% on cash advances.

Furthermore the ING One Low Rate credit card has no international transaction fees, so you can save money on your travels and when you buy goods from overseas. It's a handy backup card to have in your wallet when travelling through Singapore.

Learn more about the best credit, debit and prepaid cards for travel

Best Credit Card for Overseas Travel

International Prepaid Cards

Overseas Debit Card

The best travel card for Singapore is the Wise Multi Currency card for tap or swipe large transactions like accommodation and restaurants. Wise offers the best exchange rate for Singapore dollars globally and charges no international transaction fees.

HSBC Global and Citibank Plus cards are the best for ATM withdrawals and great exchange rates for Singapore dollars. Both these cards charge no international transaction fee and can be used within Australia without penalties.

The best credit cards for Singapore are the BankWest Platinum Breeze and ING One Low Rate as they have the lowest interest rates on the market with and charge no international transaction fees.

Yes, you should bring cash to Singapore and buy Singapore dollars before you travel to Singapore. It is one of the best ways to take money to Singapore. Having Singapore dollars on hand when you arrive at the airport will make your life a lot easier. The airport is also the most expensive place to exchange currency, so you will save a lot of money as well. Even though Singapore is card friendly, having cash on hand will always be handy for small purchases, tipping and paying for transport.

HSBC and Citibank have the best travel money cards for Singapore. Both have lots of ATMs within Singapore, both offer fantastic exchange rates for the Singapore dollar and both offer ‘no international transaction fees’.

A travel money card is more secure than cash because you need your pin to authorise transactions, if you lose cash you are unlikely to have it returned. If your travel money card is stolen, then you can report it lost or stolen online quickly. It is also less bulky to carry 2 or 3 cards than lots of cash.

The best prepaid cards for Singapore are Wise , HSBC and Citibank which offer the most competitive cards in the market. Other older style prepaid cards like Australia Post, Cash Passport, Travel Money Oz and Travelex have lots of charges like load, unload, inactivity, ATM withdrawals and initial card fees.

You can place money on your travel money card online and paying by direct debit from your bank account will cost you the least. Log in to your bank account, transfer your funds into the travel money card and the money should be there within 24 hours.

As a general rule, working out how much money to take to Singapore depends on where you go and your type of travel. If you travel on a budget to Singapore it can cost from $70 a day. If you travel in the middle range throughout Singapore it can cost from $150 per day. Finally if you travel with luxury throughout Singapore it can cost anywhere from $300 per day.

You can only use Singapore dollars in Singapore, you can not use Australian dollars or US dollars . The currency in Singapore is the Singapore dollar. There are 4 commonly used bank notes with different colours, they are $2, $5, $10, $50, $500 and $1,000. There are 5 coins, they are 5c, 10c, 20c, 50c and $1.

More Travel Card Guides

Learn more about the best travel money cards for your holiday destination.

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

The 6 Best Travel Money Cards for Singapore

Singapore isn’t a cheap destination. But using a travel money card can help cut the costs of your well earned break. Spend and withdraw conveniently, and pick from a great selection of travel money cards covering travel debit cards, prepaid travel cards and travel credit cards. All of these card types have their own features and fees - but where they’re similar is in that they have been optimised for travel use, which means you can often get great rates, low fees, and extra perks when you’re spending in Singapore.

Read on for all you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

Wise – good value debit card for Singapore

Before we get into details about different travel money card options, let’s start with the Wise card as a good all-round option that allows you to hold and spend Singapore dollars, as well as a diverse range of other world currencies.

Wise accounts can hold and exchange 40+ currencies, and you can get a linked Wise card for a one time delivery fee.

You can either top up your account in ringgit and switch to Singapore dollars before you travel, or you can let the card automatically switch currencies as required. As soon as you order your physical Wise card, you can also create a Wise virtual card, which means there’s no need to wait to spend - just add your virtual card to a wallet like Apple Pay and you’re good to go.

Wise uses the mid-market exchange rate for currency conversion, with low transparent fees from 0.43%. You can also get MYR and SGD bank account details, as well as local account details for up to 8 other currencies, to receive convenient payments to your Wise account .

Here are some of the advantages and disadvantages of using the Wise travel money debit card , to help you decide if it's suitable for you.

What is a travel money card?

A travel money card can be used for payments online and in stores, and for cash withdrawals, just like your regular bank card can be. However, with a travel money card you’ll find the features and fees have been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees. Some travel cards also have options to earn cashback and rewards when you use your card internationally.

6 travel money cards for Singapore compared

We’ll look at each of these card options in a little more detail in just a moment, but let’s start with an overview of how 6 top travel money cards for Singapore line up side by side:

As you can see, the features of different travel money cards can vary pretty widely. In general travel debit cards can be convenient and often fairly cheap to use, while travel credit cards can offer some nice perks like cashback or rewards - but do mean you might run into interest and late payment charges, depending on how you choose to pay.

Travel debit cards often let you top up a linked account online or through an app, so you can set your budget and can’t spend more than you intend. Travel credit cards on the other hand let you spend to your card limit, and then repay the amount over a few months if you’d prefer to. Which is best for you will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Broadly speaking, Malaysian customers are able to select a travel money card from either a regular bank or a specialist provider, which may be a travel debit card, travel prepaid card or a travel credit card. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards for Singapore

Travel debit cards are usually offered by specialist providers, with linked digital accounts you can use to hold and convert a currency balance. While different cards have their own features, travel debit cards can usually be topped up easily online and through an app, with the option to see your balance and get transaction notifications through your phone too. That makes it easier to keep on top of your money, no matter where in the world you are.

Travel debit card Option 1: Wise

There’s no fee to open a Wise account , and just a small delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.43% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account, no minimum balance requirement

- 13.7 MYR one time fee to get your Wise card

Physical and virtual cards available

2 withdrawals, to 1,000 MYR value per month for free, then 5 MYR + 1.75%

Hold SGD and 40+ other currencies, convert between them with the mid-market rate

Get local account details to receive MYR, SGD and 8 other currencies conveniently

Read our full Wise card review to learn more.

Travel debit card Option 2: BigPay

BigPay is a popular e-wallet and card available to residents in Singapore and Malaysia. You can get your card for a one time fee, and also access a virtual card for online and mobile payments. You won’t be able to hold foreign currencies in your account, but your MYR balance is switched to the currency you need when you’re abroad using the network exchange rate and a low foreign transaction fee of around 1%.

Popular e-wallet with lots of other features like bill payment and remittance

No annual fee and no credit check

Virtual card available as well as physical card

Relatively low foreign transaction fee of up to 1% depending on payment type

Earn AirAsia points when you spend

Pros and cons of using debit travel cards in Singapore

How much does a travel debit card cost.

There’s usually an issuance fee to pay to get your travel card, which may cover the physical card or the delivery for example. In most cases, this is a one off charge which can work out to be fairly good value if you use your card on an ongoing basis.

How to choose the best travel debit card for Singapore?

There’s no single best travel debit card for Singapore - it really all depends on your personal preferences and how you expect to transact. If you travel a lot you may prefer to get an account with mid-market currency exchange and a large selection of supported currencies as well as SGD and MYR, like Wise . On the other hand, BigPay is a popular local e-wallet and card, which has a fairly low 1% foreign transaction fee and other perks like help with budgeting and analysing your spending.

Is there a spending limit with a travel debit card in Singapore?

Different providers set their own limits for card use. Limits may apply daily, weekly or monthly, and can apply to different types of transactions. You might find you have a limit to the amount of ATM withdrawals you can make per day, for example, or the value of contactless payments - these limits are set for security and can sometimes be managed and changed in the provider’s app.

ATM Withdrawals

The costs of making ATM withdrawals does vary a lot based on the card you pick. Some - like Bigpay - have a flat fee, while others like Wise have a set limit for fee free withdrawals with low fees based on the withdrawal amount after that.

2. Prepaid Travel Cards for Singapore

With a prepaid travel card you’ll need to order a card and add funds, to pay merchants and make cash withdrawals. Prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely. Terms, conditions, features and fees do vary quite a bit, so compare a few before you pick

Prepaid travel card option 1: Enrich Money

The Enrich Money is issued by Malaysian Airlines in conjunction with Merchantrade, and allows you to top up conveniently in advance of spending globally. There are free top up options, and some which come with a fee - and once you have a balance in ringgit you can exchange it to the currency you need, from the selection of 20 supported currencies. You’ll earn rewards as you spend which you can convert to balance to spend with no foreign transaction fee to spend in supported currencies when you’re abroad.

Hold and spend 20 popular global and regional currencies

Visa network for easy spending and withdrawals

Manage your card in an app for ease and earn rewards you can convert to cash back

1.75% fee to spend an unsupported currency

Annual and card issuance fees apply, as well as a refundable deposit

Prepaid travel card option 2: Aeon Prepaid Mastercard

The Aeon Prepaid Mastercard can be used at home and abroad anywhere you see the Mastercard logo. You can top up in a variety of ways, including using cash at an Aeon location - fees may apply depending on the method you use to load funds. Once you have money on your card, you can also get extra benefits when you shop with Aeon partner merchants, and free ATM withdrawals at Aeon ATMs.

No annual fee and no minimum income requirement

Spend anywhere Mastercard is accepted

Relatively low 1% foreign transaction fee

Get discounts and rewards with partner merchants

Safe and convenient to use

Pros and cons of using prepaid travel cards in Singapore

How much does a prepaid card cost.

The costs of prepaid travel cards can vary quite a lot. There can also be a few fees to consider - the Enrich card for example, has an issuance fee, an annual fee and a returnable deposit that you’ll need to pay upfront. Double check the terms of the card you prefer so you know what to expect.

How to choose the best travel prepaid card for Singapore?

The best travel prepaid card for Singapore for you will depend entirely on your personal preference and what’s important to you. Enrich Money may be the natural choice if you use Malaysian Airlines a lot and want to hold a multi-currency balance for spending while earning rewards. The Aeon prepaid card is also a good bet with great global acceptance and no fees to make local ATM withdrawals when you’re in an Aeon location.

Prepaid travel card spending limit

Different prepaid travel cards set their own limits for spending and withdrawals, which can vary between currencies. You’ll need to check your card’s terms and conditions carefully to make sure you pick a provider which suits your needs.

ATM withdrawals with prepaid cards

Prepaid travel cards may charge a fee when you make an out of network or international ATM withdrawal. It’s common to find there are some options for fee free local withdrawals in Malaysia, but costs of about 10 MYR are often added when you’re overseas.

3. Travel Credit Cards for Singapore

Travel credit cards are similar to any other credit card, but with more international features, such as low or no foreign transaction fees or extra options to earn rewards when you’re abroad. In general, travel credit cards are safe and convenient but can be more expensive compared to using a debit card option. Before you select the right card for you it’s important to check the fees, rates, eligibility rules and interest rates which apply, so you can make sure it’s a good fit for you.

Travel credit card option 1: RHB Visa Signature

The RHB Signature credit card lets you earn cash back on spending, with a tiered system which rewards more the more you spend. Local spending can attract up to 6% cash back, while you’ll also get up to 2% cash back when you’re spending in Singapore. There’s no annual fee to pay with this card, and a relatively low 1% foreign transaction fee, which may make it an attractive pick for your next trip overseas.

Up to 2% cash back on foreign currency spending

80,000 MYR minimum annual income required

Free lounge access 5x per year, and discounts on additional lounge visits

Complimentary travel insurance

Variable interest rates which apply if you don’t pay off your bill in full

Travel credit card option 2: Maybank Visa Signature

The Maybank Visa Signature card is a premium card which has an annual fee of 550 MYR, but which offers 5x rewards on overseas spending, and lots of perks to make your trips abroad that bit easier. You’ll get access to fast track immigration clearance at airports, and can use the Visa concierge service for extra help when you need it - just bear in mind that the foreign transaction fee can be up to 2.25% which is on the higher side.

Annual fee waived in year one, then 550 MYR annually

5x Treats points for overseas spending, plus rewards when you spend at home

70,000 MYR to 100,000 MYR minimum income required

Airport speed pass to give you fast track immigration clearance in hundreds of airports

Travel insurance coverage and concierge services available

Pros and cons of using credit cards in Singapore

How much does a travel credit card cost.

The fees for your travel credit card can include several different charges - an annual fee, interest costs and penalties if you don’t pay on time for example. You can find some travel credit cards with no annual fee, but others which have more premium benefits are likely to have high fees so read the terms and conditions carefully before you choose.

How to choose the best travel credit card for Singapore?

Doing some research is the only way to pick the best travel credit card for Singapore for your own specific needs and preferences. Before you choose, make sure you weigh up the potential fees you’ll need to pay against the benefits and rewards you can earn to make sure it’s worthwhile, and bear in mind that you’ll run into interest charges if you don’t clear down your bill every month, too.

Which cards are accepted in Singapore?

Different cards are issued on their own card networks - and while all the cards we’ve covered in this guide are globally accepted, some networks are more popular in one country than they may be in another. Visa and Mastercard are usually a good bet for a card you want to use in Singapore - but it’s helpful to know that some other card networks like American Express and Discover are less popular.

Generally the best idea - in Singapore or anywhere else you may travel - is to have more than one means of payment with you, as a backup plan. For example you might want to take a credit card and a specialist travel money card which has been issued on a different network, plus a little cash, so that you always have options if your preferred payment method isn’t available.

Travel credit card spending limit

Your travel credit card spending limit will vary depending on the issuer’s policy. You’ll be notified of the details for your card when your application is approved.

ATM withdrawals with travel credit cards

ATM withdrawals made with a travel credit card will usually mean paying a cash advance fee of around 5% of the withdrawal value, and immediate interest. Interest is likely to be set at the top end of the range that applies to your card - often about 18%.

How much money do I need in Singapore?

Singapore isn’t a cheap destination - but as a close neighbour with some great attractions, it’s still a popular place for Malaysians to visit. The costs of your trip can vary a lot depending on what you’re up to, so set your budget carefully. Here are a few tips on pricing:

Compare the costs of your trip based on your specific plans, with Numbeo.com .

Conclusion: Which travel money card is best for Singapore?

If you’ve planned travel to Singapore you might want to get a travel money card for simple SGD spending. Travel money cards have different features, and can be picked up via banks or online specialists.

You could opt for a low cost travel debit card which comes with a linked account to hold a selection of currencies - Wise account . Or you might prefer a prepaid travel money card like the Aeon Prepaid Mastercard which has some nice perks if you’re frequently in Aeon locations. Finally, another option is to get a travel credit card either to earn cashback and rewards, or to avoid foreign transaction fees.

Use this guide to start your research and pick the right option for your specific needs.

FAQs - Best travel cards for Singapore 2024

There’s no single best card to use in Singapore. Which is right for you will depend on your preferences and spending patterns. One good option is to get a multi-currency account from a provider like Wise which you can use in Singapore and on future trips, too, as you’ll be able to hold, spend and exchange SGD and MYR alongside dozens of other major currencies.

Spending with your card is convenient when travelling in Singapore, but you’ll be best off having several different payment methods just in case your first choice isn’t supported. For example, you could choose 2 different debit or credit cards, issued on different networks, and you could also get some dollars in advance so you have some cash on you for those odd times when cards aren’t available.

You can usually make cash withdrawals with a credit card in Singapore at any ATM that supports your card network. You’ll often find that a fee applies, and you may start to accumulate interest on the withdrawn amount immediately. Travel money debit cards from providers like Wise can be a lower cost option for cash withdrawals in SGD.

You can use your Malaysian card anywhere you see the card network’s logo displayed. Visa and Mastercard networks are very well supported globally, including in Singapore, making these good options to look out for when you pick your travel debit card for Singapore.

Prepaid cards from reputable providers are safe to use at home and abroad. They aren’t linked to your main bank account which can offer extra peace of mind, and may also make it easier to manage your travel budget. However, you’ll need to check the card features and fees carefully to make sure you're getting the best match for your needs.

The fees applied for travel cards can vary widely depending on the provider and the card type. With debit cards you may find ATM fees, and costs for converting currencies, although specialist providers like Wise and BigPay have linked accounts which can bring down the costs of currency conversion. Credit card fees include cash advance charges, foreign transaction fees and interest.

- Cost Guides

- Menu item 1

- Menu item 2

- Menu item 3

- Menu item 4

- Best Travel Insurance Plans

- Best Personal Loans 2024

- Best Debt Consolidation Plans 2024

A Quick Guide To The YouTrip Card – The Convenient Multi-Currency Travel Wallet With 0% Transaction Fees

Admit it, Singaporeans love to travel. Be it a quick getaway to Bali or a two-week vacation to Japan, we love it all. However, one of the main concerns most people have is whether they brought enough cash along or if they are able to use their credit cards at foreign countries.

On top of that, you might be scratching your head thinking of which card to use. Should you use the air miles credit card? The all-purpose card or the dining card? Decisions to be made.

And just to add on, credit cards and debit cards from banks usually carry an overseas transaction fee that falls between 2.5% to 3.5%.

Well, you’re not going to believe it, but making cashless payments overseas just got easier.

Introducing YouTrip, the card that helps you pay overseas with no fees. A fuss-free travel is what they want to give their consumers. Started by a team passionate about travel and technology who wanted to make overseas payment easier, YouTrip is Singapore’s first multi-currency travel wallet with a prepaid Mastercard so you can pay overseas with no fees.

Here’s How YouTrip Works

Here we go – all you need is the physical YouTrip card and the YouTrip app. YouTrip is not a credit card but a mobile wallet.

Simply top up your YouTrip wallet on your mobile with any Singapore debit or credit card. The card limit is $3,000. Next, you can observe and exchange currency rates of more than 150 currencies through the app. Finally, pay with your YouTrip Mastercard for cashless payments overseas at no fees.

YouTrip also allows you to monitor exchange rates from SGD to many other currencies including USD, GBP, JPY, HKD, EUR, AUD, NZD, CHF and more.

If you are travelling overseas, you will be able to withdraw money in cash from an ATM machine that takes Cirrus, Maestro, and Mastercard, and do so at an exchange rate that is considered wholesale. There is a withdrawal fee of only $5 for this, or an equivalent in the country’s local currency. Wholesale exchange rate is the rate given to large corporations, private and public institutions, and banks since they transact large amounts of money. This amount is in real time and is very close to the amount listed on financial sites, XE.com, and Google.

The wholesale exchange rate that YouTrip uses is actually managed by YouTrip working with MasterCard and its foreign currency partners. The marginal difference is generally 0.1% – 0.4% and the live rates can be viewed in app for the 10 stored currencies. Not only is this much cheaper for you, but it also eliminates the inconvenience of having to find a forex bureau in a foreign country in which to change your cash to local currency before you can spend.

In short, YouTrip card works like an EZ-Link card (and yes they do collaborate with EZ-Link, hence, increasing their credibility). Top up the card and spend conveniently overseas.

How Do I Get My YouTrip Card?

If you are travelling and need a convenient card to use, or if you’re unsure whether you have exchanged enough cash, this might be the card for you. The YouTrip card brings convenience, saves time which means you will have more time to travel and enjoy your vacation!

Step 1: Download the YouTrip app from Android Play Store or iOS App Store.

Step 2: The app will then prompt you for an e-mail address or a mobile number that you wish to use with YouTrip.

Step 3: First-time users who do not have a physical YouTrip card will be required to click on the button that says, “Get A YouTrip Card For FREE.”

Card delivery is said to be between 7 – 12 business days so do apply for your YouTrip card in advance of your travels!

Step 4: Singaporeans can also use their SingPass MyInfo, which makes it easy for them to sign up because no further documentation is needed. Sign-up and verification is relatively fast.

Log into your SingPass and grand access to YouTrip to gain specific information. The information needed will include your name, date of birth, NRIC, status of citizenship and gender. Your work will be simply be to confirm that the details are accurate.

If you are not a Singapore Citizen or a Singapore Permanent Resident (PR), fret not because YouTrip is available for you as well! Since you might not have SingPass, you will need to upload the necessary documents in soft copy. Alternatively, take pictures of the documents and upload them. All these can be done within the app and the documents acceptable include: Training Work Permit, Long-Term Visit Pass, Dependents Pass and EntrePass.

Step 5: Customization of your YouTrip Card. Now you are able to customize the physical card by having your name on it. The name you use on the card will need to be the same name that you have entered into the app registration to avoid having the card rejected.

Step 6: If you have a promo code, you will need to enter it at this point and then go on to confirm that you have indeed read, understood, and accepted the YouTrip terms and conditions.

The process is as simple as that. It only takes a few minutes to sign up and then you can get ready to receive your card in 7 to 12 days and enjoy the convenience and benefits it brings.

Apply for your card through Money Kinetics here to receive a credit of $7!

The Pros Of Using YouTrip

1. Signing up is free and there is no minimum balance required. There are no annual fees as well. Spend SGD overseas at 0% transaction fees.

2. Conversion rates are very competitive. The rates on the YouTrip app are usually better than the rates at physical money changers or at least the same. Typically, there are only marginal differences of 0.1% to 0.4%.

3. You can look at the exchange rates months before your trip to observe the values. This means that you can choose to exchange your money at the right time, at the best rates without having to visit a physical money changer. You get to save time.

4. The app is pretty user-friendly and straightforward.

5. YouTrip collaborates with EZ-Link, increasing the reliability of the card. You can also use the YouTrip card for public transport.

6. Good security features. If you were to lose your card overseas, you can simply deactivate the card with a single switch on the app. Should you find your card again, you can reactivate the YouTrip card in the same way as well. Of course, if you lost both your phone and your card, you can still make a call to deactivate the card.

7. You don’t have to link your card to your bank or savings account which reduces the amount you could possibly pay should your card goes missing.

8. The YouTrip card does not charge any dormancy fees so don’t worry if you are not travelling any time soon.

9. YouTrip regularly organizes events for its members. YouTrip users get to attend workshops that teach them travelling hacks as well as fun events to try new stuff.

For example, in March 2020, YouTrip is organizing an exclusive beer tasting workshop where attendees get to drink beers from all around the world in just two hours! How interesting is that! Sign up for the YouTrip card here to receive an instant credit of $7 and learn more about the event here.

The Cons Of Using YouTrip

1. Since the card is not linked to any bank or savings account, you will not be accumulate points, earn rebates or earn miles from your spendings. If you are really aiming to earn miles from your air miles credit card, then perhaps it would be better to charge on your credit card instead.

2. As YouTrip is a mobile wallet and not a savings account, users will not be able to earn interest by depositing money with them. As a rule of thumb, it might be better to only top up the amount you intend to spend.

3. There is a charge of $5 if there is inactivity after 12 months. Nonetheless, you can easily fix this by using the YouTrip card as an EZ-Link card for your usual public transport. (UPDATE: As of 22 July 2019, dormancy fees will no longer be applied for all users.)

4. If you are withdrawing cash overseas, there will be a $5 fee charged upfront by YouTrip.

5. Although having the card allows you to withdraw cash overseas conveniently, do check to make sure that the place you’re travelling to is under the coverage of Mastercard. There are still rural areas where they do not have enough facilities.

6. You won’t be able to top up your card if there is no internet. The YouTrip system is heavily powered by the internet and the app. Having no internet access might put you in a sticky situation if it’s your turn to pay.

7. Users will not be able to get their money back with the termination of the card. It’s a one-way mobile wallet. So, if you are planning to terminate the card, make sure to spend all the money in it first. Also, a daily spending limit of $6,000 applies.

4 Scenarios Where You Can Use Your YouTrip Card

1. Paying For Purchases In Singapore And Overseas

Used to going cashless when paying for your meals or items?

As YouTrip supports Mastercard transactions, you can make payment with the card for both local and overseas purchases. The difference in exchange rates is usually minimal.

2. Exchanging Currency Before Your Trip

Current exchange rate is good but not travelling until months later?

YouTrip is a mobile wallet that allows you to exchange currency beforehand and store them until you need to use it. This helps you get the best rates.

3. Withdrawing Cash Overseas

Ran out of cash overseas?

Not having enough cash in a foreign land can be quite troublesome. Worry less as YouTrip allows you to withdraw cash from ATMs overseas with a small charge.

4. Taking Public Transport In Singapore

Take the bus or MRT with your YouTrip card.

The YouTrip card also works like an EZ-Link card where it supports payment for public transport. You can also use this function to ensure at least one card usage per year.

Who Holds The Money?

One of the questions that people often ask is who holds the money once it is topped up on YouTrip.

Since it is not possible to get your money back even with the termination of the card, it might be wise to find out where exactly your money is at.

The funds are are actually kept with EZ-Link Pte Ltd in segregated bank accounts. EZ-Link is YouTrip’s card issuer in Singapore and also a licensed Mastercard prepaid card stored value facility. All transactions performed will follow the standards and rules of Mastercard.

Who Is Behind YouTrip?

Curious about who developed this multi-currency mobile wallet and app? You Technologies Group Limited is the company that developed YouTrip.

The company is currently based in Singapore and Hong Kong. The group is enthusiastic about payment, technology and travel and they have a background in top financial institutions and leading tech brands. With a focus on travelers, You Technologies Group Limited is dedicated to the creation of the very best in mobile financial services in the continent of Asia.

Working with EZ-Link Pte Ltd, they have partnered to create a top-notch travel experience for Singaporeans with this mobile wallet that deals in multiple currencies without charging conversion fees. This makes it one of their unique selling point as credit cards and debit cards offered by banks usually carry an overseas transaction fee of 2.5% to 3.5%. This also makes it an ideal card for public transport in Singapore and for making purchases online and across the world wherever Mastercard is accepted.

All in all, this is a card that is said to bring convenience to your travels and holidays. YouTrip’s website is pretty straightforward and user-friendly. Based on their features, the card might be most suitable for frequent travellers or people who prefer cashless payment methods. Though they charge a small fee for overseas cash withdrawal and that it’s a one-way ticket when depositing money into the card, their 0% transaction fee, competitive currency conversion rates (it’s the same or slightly better than physical money changers) and cashless payment methods make it a pretty convenient card to carry around.

One last thought is that if you’re planning to travel, it might be wise to deposit a part of your spending money into the YouTrip card and convert the other part to cash so that you still have some flexibility. Or, you can simply make use of the internet and transfer funds over from your debit account when you need it.

Lack of sleep searching for the best personal loan?

Receive multiple offers in 15 mins. FREE quotes. Apply for a personal loan with Money Kinetics here to enjoy the best interest rates in the market.

Latest news

- How Much Does It Cost To Own a Corgi in Singapore (2024 Price Guide)

- The Most Expensive (And Affordable) Schools In Singapore

- How Much Does It Cost To Own A Model 3 and Model Y Tesla in Singapore (2024 Update)

- How Much Does It Cost To Hold A Funeral in Singapore 2024 – Price Comparison Among Different Religions, Burial vs Cremation, Miscellaneous Fees

- Getting Therapy In Singapore: Factors That Influence Costs, Options, Subsidies (2024)

- Personal Finance

- Home Finance

- Student Finance

- Budgeting and Lifestyle

- Loans: The Definitive Guide

- Business Finance

- All About Loans

- Uncategorized

You may also like

What Services Does Credit Counselling Singapore Actually Offer? Who Should Consider Using Them?

Credit Score Singapore: How To Effectively Build and Maintain It, Improving Credit Score, Understanding Credit Bureau Reports

9 Best Maternity Wear That Is Comfortable Yet Affordable

Best Credit Cards For Travel & Overseas Spending 2024

Before you go on your vacations or business trips, there are some things you’ll probably have in mind to bring along, and your go-to travel credit cards are definitely one of the best things that you’ll need.

If you’re just starting to look around for better travel credit cards, you may find MoneySmart's credit card page helpful for you to compare different credit cards in terms of free flights, hotel stays, dining rewards, cashback, lowest fees, frequent flyer programme benefits, and more. This guide includes the best travel credit cards you can get in Singapore, plus some useful tips on how to maximise them so you can pick a suitable card for your travel needs.

Best Credit Cards For Overseas Spending

How To Maximise Your Travel Credit Cards

Tip #1: get cards that offer travel perks fast.

Depending on your spending habits, if you’re one who prefers air miles or rewards points for you to convert to air miles or other travel-related discount vouchers, picking an air miles card that offers you a generous amount of air miles for signing up is the fastest way to get the best benefits out of your card.

Travel credit cards which offer higher bonus air miles include Citi PremierMiles, DBS Altitude Card, and Amex KrisFlyer Ascend which gives you up to 45,000 miles, 38,000 miles and 21,000 miles respectively, each with a different minimum spend requirement.

Tip #2: Use a combination of credit cards for different travel benefits

Different cards offer different advantages, i.e. some will offer you bonus air miles upon your annual fee payment like Standard Chartered Visa Infinite X Card (30,000 miles upon annual fee payment), while others offer attractive cashback that is great for cruise vacations and family spending overseas or reward points to redeem shopping vouchers.

In order to maximise your credit card rewards, cashback or air miles, tap on multiple credit cards with each card specialising in a particular spending type or card feature that best suits your travel needs.

Tip #3: Picking cards with flexible rewards

Flexible rewards points programs give you a wider range of options such as redeeming points for a variety of gift cards, cash back and even airfares, hotels, cruises and car rentals.

Depending on the type of rewards points program and credit card you get, this can be a reasonable option to get more rewards from your credit cards. Usually these flexible rewards points programs are more beneficial for those who fly often for business trips and value the international business class cabins on flights or stay in budget and/or luxury hotel suites overseas.

3 Need-To-Knows About Cards For Overseas Spending:

Using your air miles credit card or cashback credit card or rewards points credit card to convert your points to air miles also means that you’ll have to pay for certain fees in exchange for all these benefits. Here are a few things to consider as you leverage on the rewards from your travel credit card for overseas spending .

- Choose flexible rewards whenever possible

Flexible rewards points like those offered by Standard Chartered Rewards+ Credit Card, OCBC 90°N Card and UOB PRVI Miles American Express Card are transferable to a variety of different airline and hotel loyalty programs while others which are more brand-specific like American Express Singapore Airlines KrisFlyer Ascend Credit Card and KrisFlyer UOB Credit Card only gives you the option to redeem them for a specific airline, which is Singapore Airlines in this case.

- Waiver of annual fees or foreign transaction fees or other conversion fees

It’s good to know which cards offer what types of fee waivers so that it’s more worthwhile to use it to gain cashback and other perks. Cards like UOB PRVI VISA Miles Card and DBS Altitude Visa Signature Card offer 1 year of fee waiver, while cards like Maybank World Mastercard will have your conversion fee waived for each conversion of points to frequent flyer miles. Others like American Express Singapore Airlines KrisFlyer Ascend Credit Card do not offer any annual fee waivers.

- Split spending over multiple cards

By using platforms like CardUp to split your overseas spending, it can actually help you to maximise your benefits so that you can gain reward points, cash rebates and air miles at the same time while using all of your cards.

Standard Chartered Rewards+ Card

CIMB VISA Signature Card

HSBC Visa Infinite Credit Card

Standard Chartered Journey Card

If you’re looking for a generous welcome bonus air miles, Standard Chartered’s Journey Card offers 45,000 miles upon sign-up as a new primary cardholder and meet the required minimum spending. To qualify for the 45,000 air miles, you’ll have to spend $5,000 within 30 days of card approval, transact $5,000 worth of spending on overseas transactions, and pay the annual fee.

This card lets you earn 3 miles for every S$1 spent on various categories including transportation, food delivery and online grocery merchants. Moreover, you can enjoy 2 complimentary visits to Priority Pass lounges around the world each year, complimentary travel insurance coverage of up to S$500,000, and more.

HSBC TravelOne Card

The welcome bonus of 20,000 air miles may not seem as attractive as what Standard Chartered Journey Card offers, but the HSBC TravelOne Card’s minimum spending requirement is definitely lesser than that of the SCB Journey Card, and you’re entitled to more lounge benefits including 4 complimentary airport lounge visits per year.

Besides that, the HSBC TravelOne Card’ offers you up to 2.4 miles (6X Reward points) for every $1 spent overseas, upon payment of an annual fee and a minimum spend of S$800. Annual fee waiver benefits are available with a minimum total annual spending of $25,000.

Purchase your travel insurance here

Get up to 40% off your travel insurance with our exclusive Moneysmart promotions!

3 Need-To-Knows About Cards For Air Miles:

With so many types of credit cards out there offering air miles, you may wonder which card suits you the most. To get started, you’ll need to know a few things about air miles credit cards before getting one.

- Avoid air miles cards with high fees

Paying off the balance of your account every month can get rather expensive for some air miles credit cards, because the high interest charges will cost more than the value of any miles you could earn.

- Go for cards with lower foreign transaction fees

For those who plan to pay in SGD instead of overseas currencies, it’ll be better to use credit cards offered by banks like CIMB and Standard Chartered that charge some of the lowest foreign transaction fees in Singapore.

- Compare miles earn rates & bonus air miles

Highest mile per dollar spend ratio, most bonus air miles and air miles with no expiry are some of the factors to look out for when choosing your air miles cards. Some cards offer higher miles per dollar spend ratio so you don’t have to spend as much to get more air miles, while some banks offer generous welcome bonus air miles upon signing up for certain air miles credit cards which gives you a lot of air miles in a short amount of time without having you to spend a minimum amount over time to get more air miles. Other cards offer earned miles that don’t expire, which comes in handy in uncertain situations like the COVID-19 pandemic that made travel plans a challenge at times.

Best Air Miles Credit Cards

DBS Altitude Visa Signature Card

UOB KrisFlyer Card

UOB PRVI Miles Card

American Express Singapore Airlines KrisFlyer Credit Card

Sign up for a free moneysmart account to continue reading.

With MoneySmart's free membership, you unlock unlimited access to blog, exclusive rewards on financial products, up to 70% cashback at the MoneySmart Store, and more! Registration only takes 30 secs.

Best Credit Cards For Hotel Stays

UOB PRVI Miles American Express Card

DBS Woman's World Card

DBS Altitude American Express Card

Related links.

Best Credit Cards for Movies Singapore (2024)

Best Credit Cards for Groceries

Best Credit Cards For Concert Tickets

Personal | Business

Best Multi-currency Card For Travel Spending 2022: YouTrip vs Instarem Amaze vs Revolut vs Wise

Planning to travel in 2022? Read on for a comprehensive guide to the best multi-currency cards around — we’re comparing exchange rates, fees, P2P transfer features and more that will benefit travellers and online shoppers alike!

Looking back on 2021, one of the best things that happened was the reopening of borders for travel hands down! If you’re one of the lucky few who managed to get some time away from work, you’re probably planning your dream VTL getaway for 2022 right now and considering all your financial options. There are a couple of things to consider when you’re travelling — changing money for overseas expenditure, security of your transactions, how to split money fairly amongst your buddies to minimise complications, hidden fees that come with bank cards and other rewards for spending. To make things easier, we’ve pulled together a table with the top players in the multi-currency card game right now so you can be fully prepared for your next travel expedition whenever that may be. Read on to find out!

Which Multi-currency Card is Good For Travel Spending?

*No charges on weekdays: between 18:00 New York time on Sunday and 17:00 New York time on Friday, except for transactions involving rare currency like THB or UAH which will incur a 1% fee. In addition, a 2% fee applies for exchanges involving THB or UAH on weekends. (Source: Revolut )

This multi-currency card is for the minimalist — fuss-free, no-frills travellers who just want a secure way to convert currency and go cashless on the road (of course there’s the option to withdraw cash but it’ll cost you S$5 per transaction), whilst also being able to shop on different websites in foreign currency with the same card. Savvy spenders would steer clear of topping up with Visa credit cards to avoid the extra 1.5% service fee, but keep tabs on their app for YouTrip Perks deals whenever they are shopping online.

If you’ve got loved ones overseas and find yourself constantly transferring cash in foreign currency, Wise is your best bet because they allow each user to store 56 currencies at one time! Just note that there is a 0.35-2.22% conversion fee for each transaction. Also, remember to top up with PayNow or bank transfer to avoid the fees that come with every debit or credit card top-up.

Tech-savvy individuals will love Revolut for its user interface which effectively makes it the perfect digital alternative to your usual traditional bank options. It works great with Apple Pay and Google Pay for added convenience. Plus, they offer a 1% cashback — if you’re willing to fork up S$199 per year or S$19.99 a month. Just be wary of the 0.5-2% rate markup* on weekends or when using rare currency (more info below the table).

If YouTrip is for the minimalist, Amaze is for the maximalist. You’re a maximalist if you believe more is more — and you’ve got a stack of credit or debit cards to prove it. Well, Amaze allows you to link up to five of them up and skip the top-up step, instead, using their card as an intermediary to earn 1% cashback on top of the various cards’ miles or points. Unfortunately, unlike the rest of the cards, the exact fees and markups were hard to identify based on their website so be sure to do a little more research before proceeding!

So How Much Would Spending With Each Multi-Currency Card Cost?

Let’s say you’re planning to buy a Medium Classic Chanel Flap Bag in Caviar Leather from the US even after the recent 12.8% increase that happened in late 2021. Based on our research , the bag currently costs about US$8,800. This is way cheaper than the S$13,190 price tag in Singapore. But let’s see how much it’ll cost when using all four of these multi-currency cards!

Time of exchange: 10 Jan 2022, 9.44 am

So Which Travel Card Is Best For Me?

🏆 For The Minimalistic Savvy Traveller & Online Shopper: YouTrip

🏆 For Comprehensive Remittance Function: Wise

🏆 For Digital Alternative To Traditional Bank Accounts: Revolut

🏆 For Credit Card Enthusiasts: Amaze

Even if you aren’t travelling soon, remember to use your YouTrip card when online shopping to skip out on all that additional fees and mark-ups on exchange rates to make sure you are getting the best value out of every dollar.

If you still haven’t gotten your free YouTrip card yet, sign up now! Be sure to check out our YouTrip Perks page for exclusive offers and promotions too! For more great tips and articles like this, join our Telegram(@YouTripSG) and subscribe to our free weekly newsletter here or down below!

And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad ? Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Related Articles:

Here’s Everything You Need to Know About YouTrip YouTrip Referral Programme: Get $5 Every Time You Refer A Friend! YouTrip New Feature: Send Money Instantly, In Any Currency, With YouTrip Send!

iChange Vs YouTrip Comparison 2024

iChange vs YouTrip — which is the better card? 🤔

PayPal Currency Conversion and Exchange Rates Guide 2024

Here’s to more savings 💰

Best Travel Agency in Singapore 2024: Your Guide To Stress-Free Travel Planning

For all you non-planners out there!

Download Youtrip

© 2023 You Technologies Group Limited. All Rights Reserved.

at Don Quijote Japan!

Up to 10% tax free + 5% additional discount

- Valid till 01 Oct 2024

- Flash the discount coupon at the payment counter & pay with YouTrip during checkout in store (Click discount coupon)

- Enjoy additional 5% discount with min 10,000 yen (JPY) spent excluding tax

- We want to help you get your discount! 1. Ensure that you t ap the " Discount C oupon" banner below to go to the barcode screen. 2. Present the coupon screen to the cashier staff at the time of payment. 3. Lastly, tap the "Use Coupon" button.

- Valid until 01 October 2024.

- [Japanese temporary returnees] who purchased tax-free goods are eligible for the coupon.

- Foreign diplomat(s) are not eligible for tax exemption.

- Eligible Stores: Don Quijote, APITA, and PIAGO Stores in Japan (Excluding some stores)

- Tap the coupon banner below to go to the barcode screen.