- Credit Cards

- View All Credit Cards

- See If You're Pre-Selected

- Balance Transfer Credit Cards

- 0% Intro APR Credit Cards

- Rewards Credit Cards

- Cash Back Credit Cards

- Travel Credit Cards

- Retail Store Cards

- Small Business Credit Cards

Quick Links

- Banking Overview

- Certificates of Deposit

- Banking IRAs

- class="ssr-key" Small Business Banking

- Personal Loans

- Overdraft Line of Credit

- Home Lending

- Refinance Your Home

- Use Your Home Equity

- Small Business Lending

- Investing Overview

- Self-Directed Investing

- Guided Investing

- Working with an Advisor

- Wealth Management

- Citigold ® Private Client

- Citi Priority

- Open an Account

Notificación importante

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta.

Please be advised that verbal and written communications from Citi may be in English as we may not be able to provide servicing related communications in all languages. These communications may include, but are not limited to, account agreements, statements and disclosures, change in terms or fees; or any servicing of your account. If you need assistance in a language other than English, please contact us as we have language services that may be of assistance to you.

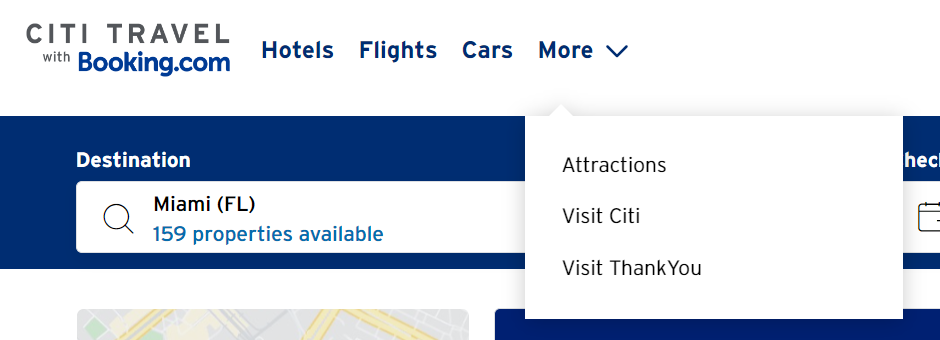

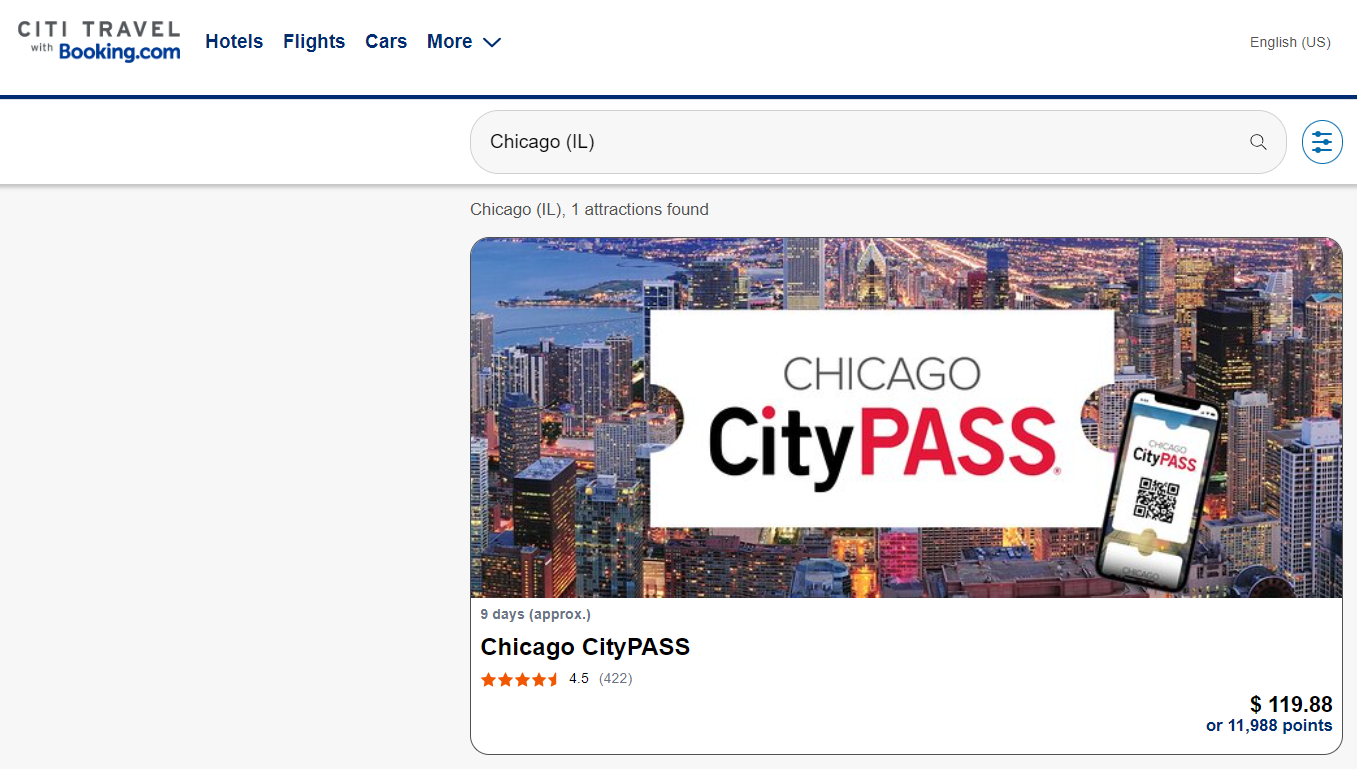

CITI TRAVEL with Booking.com

Introducing citi travel℠: your first stop to your next destination.

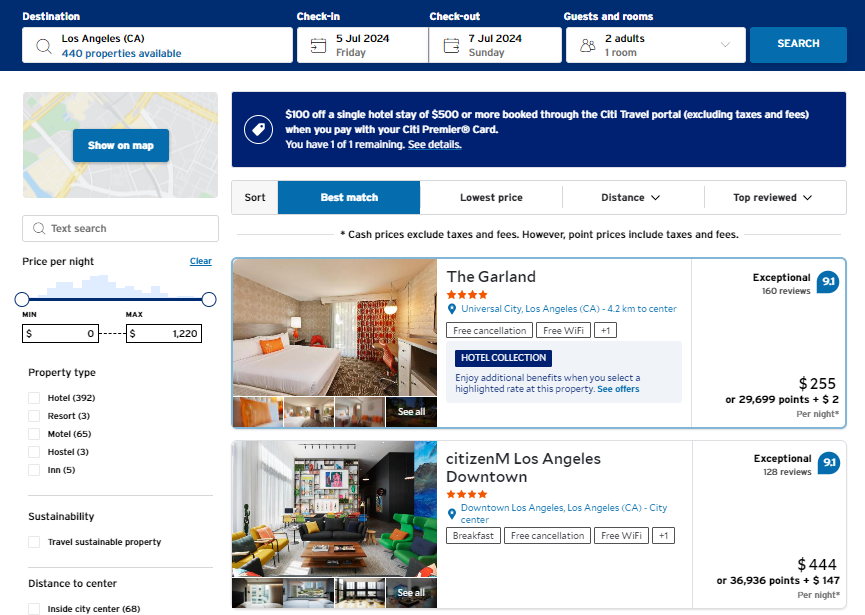

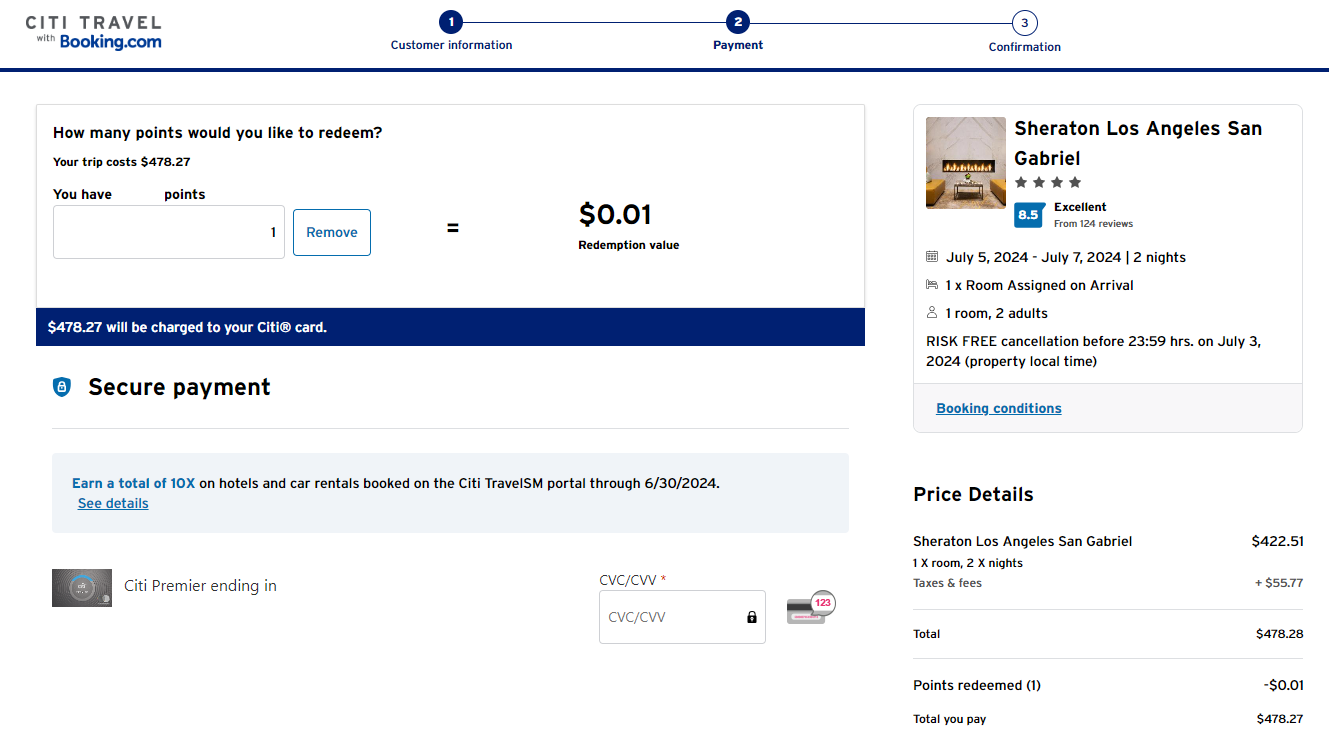

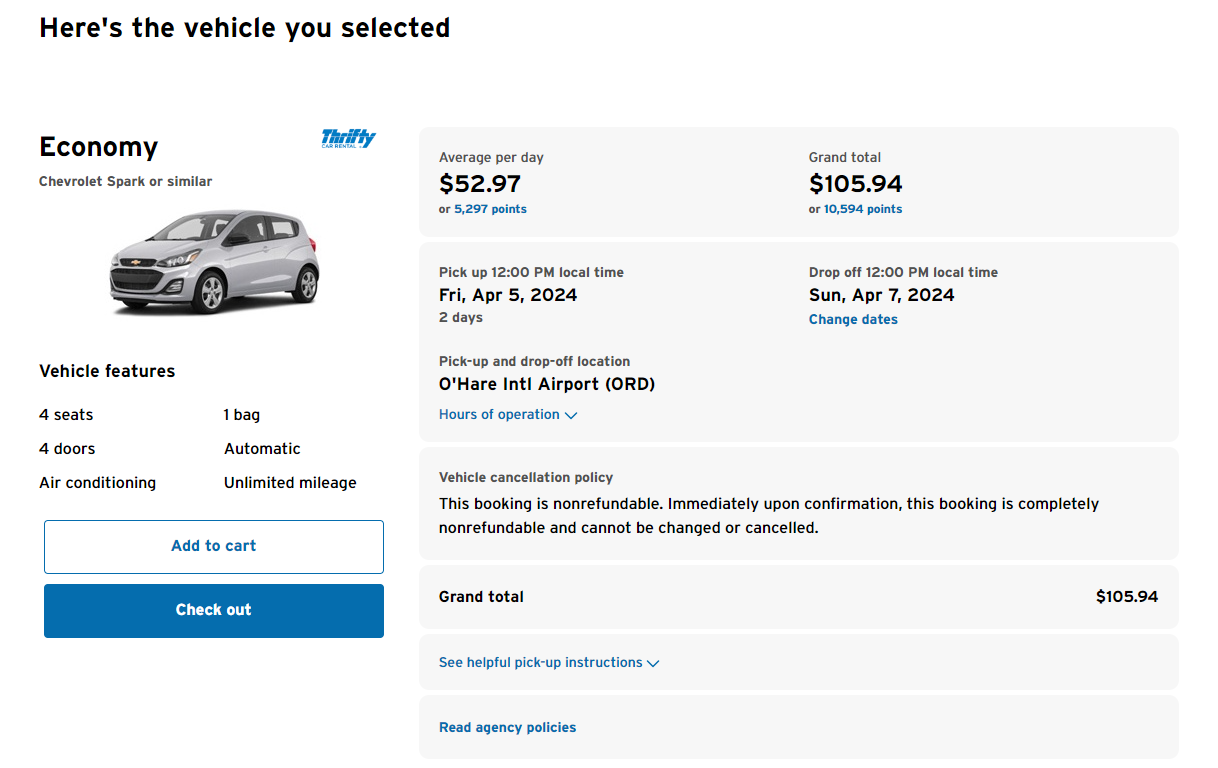

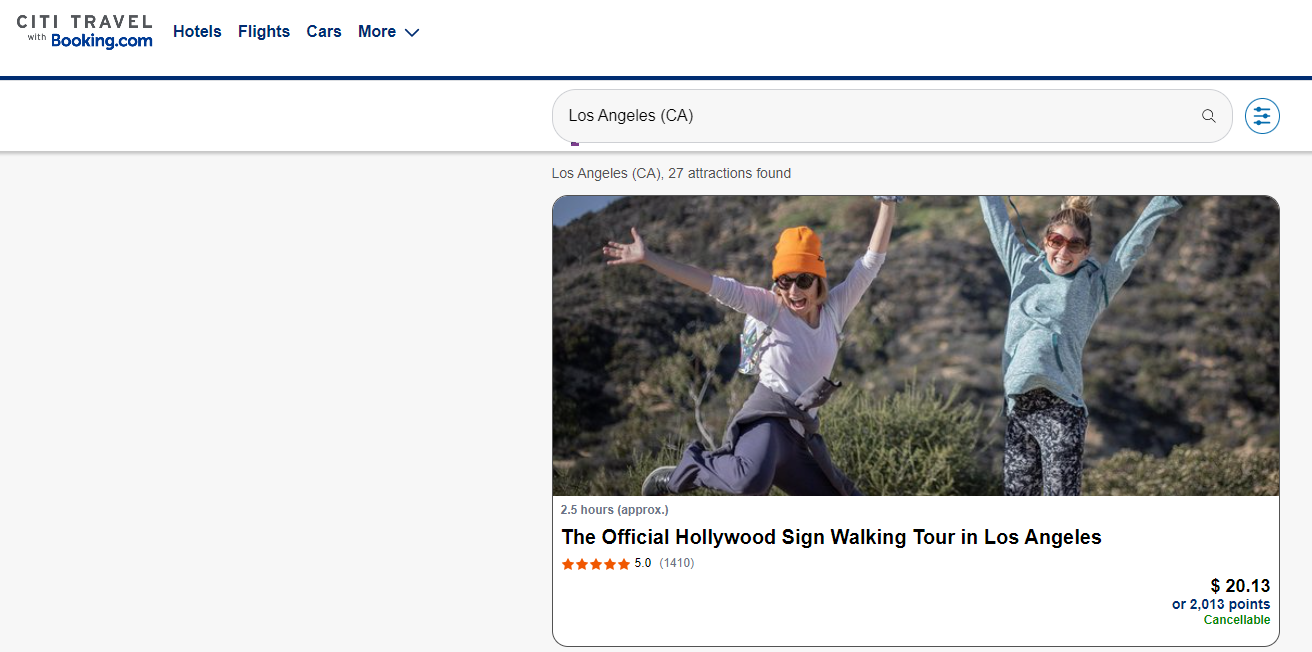

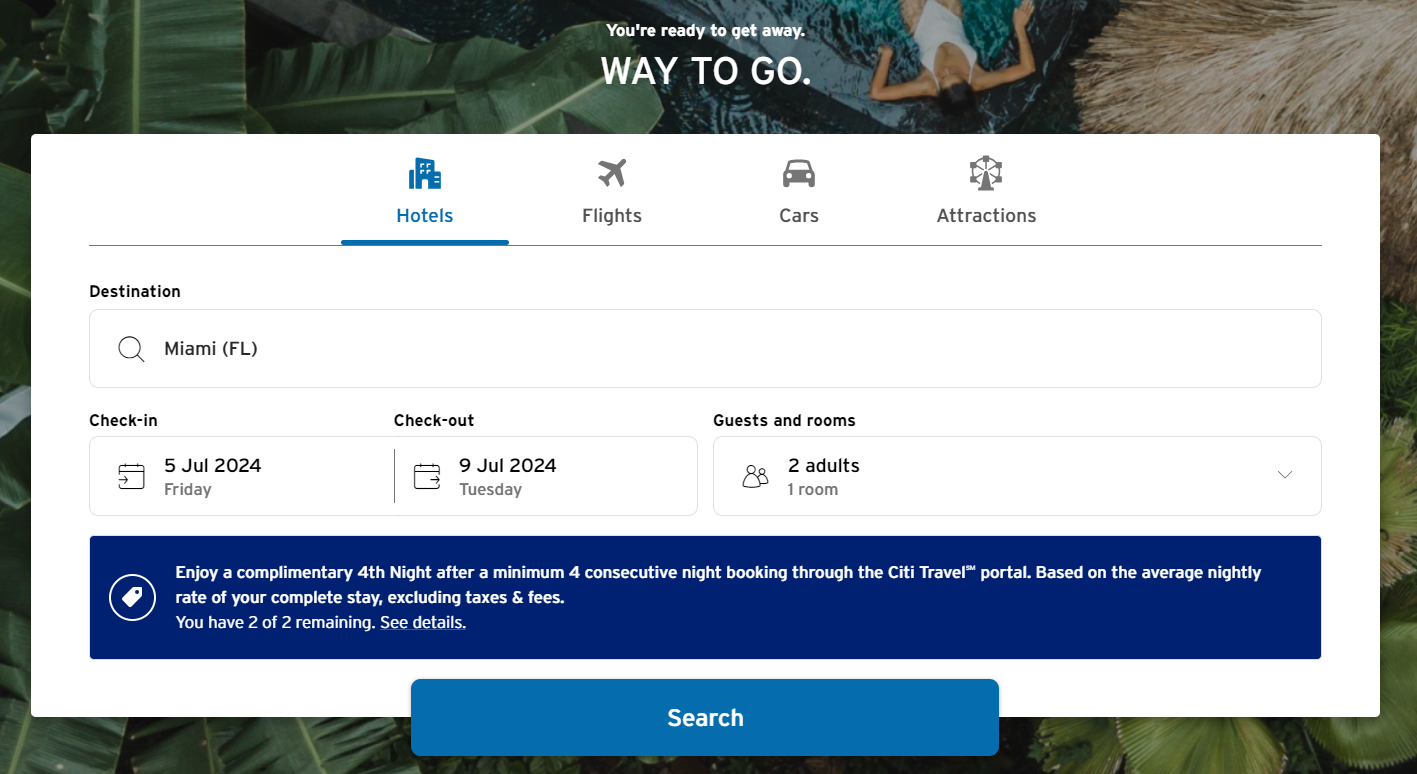

Earn ThankYou ® Points when you pay for part, or all, of your trip with your eligible Citi Card through the Citi Travel portal. Plus, you can redeem your points towards even more adventures through the Citi Travel portal. With customizable options and booking right from your Citi Mobile ® App for eligible cardholders, the way to go is now way easier.

Earn More ThankYou ® Points on Select Bookings Through the Citi Travel portal

10x the fun with citi strata premier℠.

Earn a total of 10x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. 1

5X the Fun with Rewards+ ®

Earn a total of 5x ThankYou ® Points on hotels and car rentals when you book on the Citi Travel portal. Offer expires December 31, 2025. 2

More Points, More Fun with Double Cash ®

Earn a total of 5 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires December 31, 2024. 3

Offer provides 3 additional points on top of the 1 point per dollar on purchases and 1 point per dollar for payments on purchases

Earn More Points with Custom Cash ®

Earn an unlimited additional 4 ThankYou ® Points per $1 spent on hotels and car rentals when you book on the Citi Travel portal. Offers expires June 30, 2025. 4

Additional Citi Travel Portal Benefits

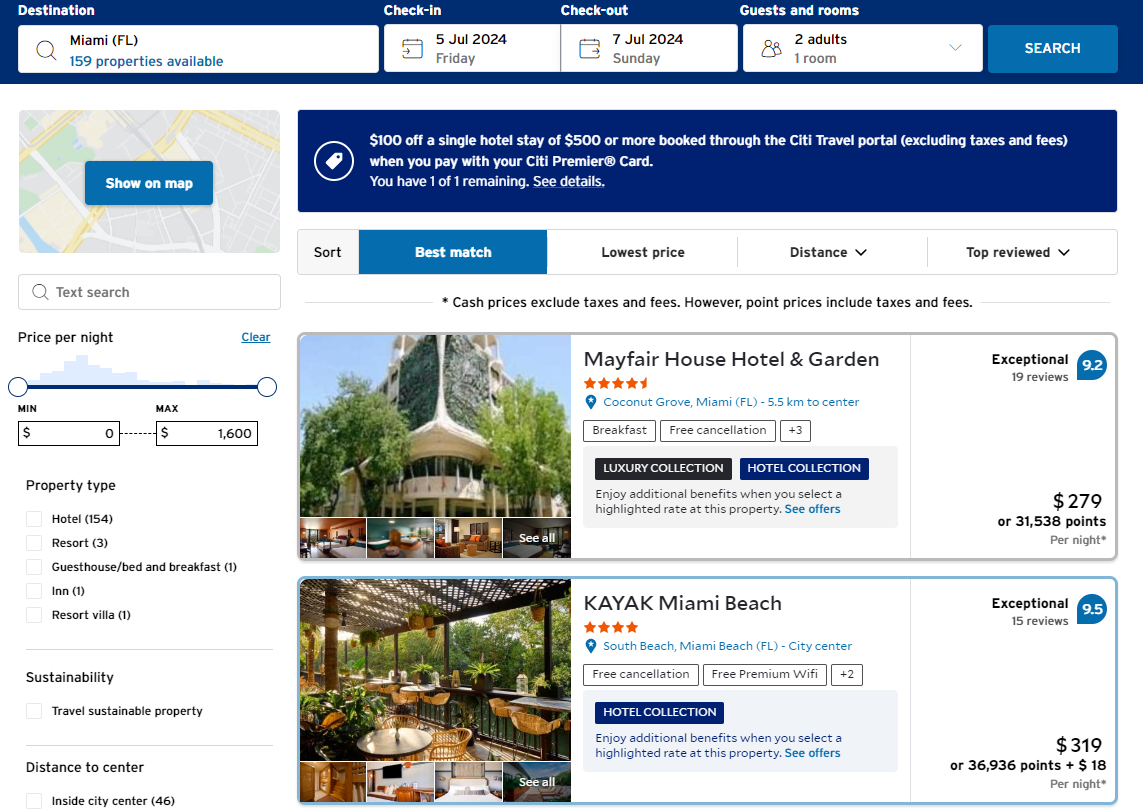

The citi travel portal offers perks to make your travel booking experience easier and more convenient., access to over 1.4 million hotel and resort options, competitive prices when booking flights, hotels, cars and attractions, 24/7 customer service support for your booking needs.

ThankYou ® Cards Make Every Day More Rewarding

It's easy to earn ThankYou ® Points with Citi credit cards. Find the one that helps you earn the most on your daily spending.

Citi Travel: Frequently Asked Questions

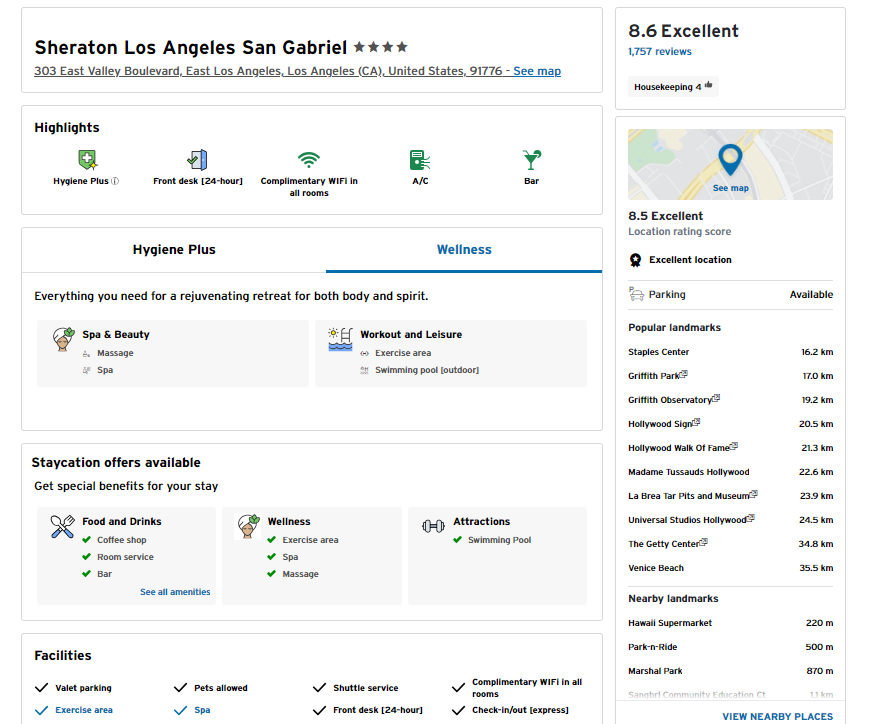

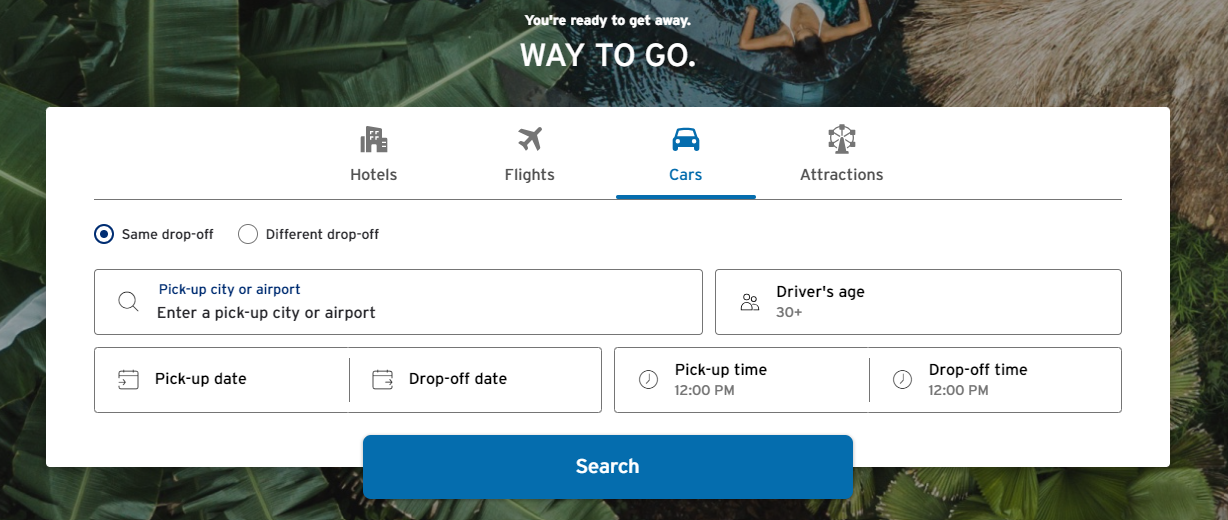

What is the citi travel portal.

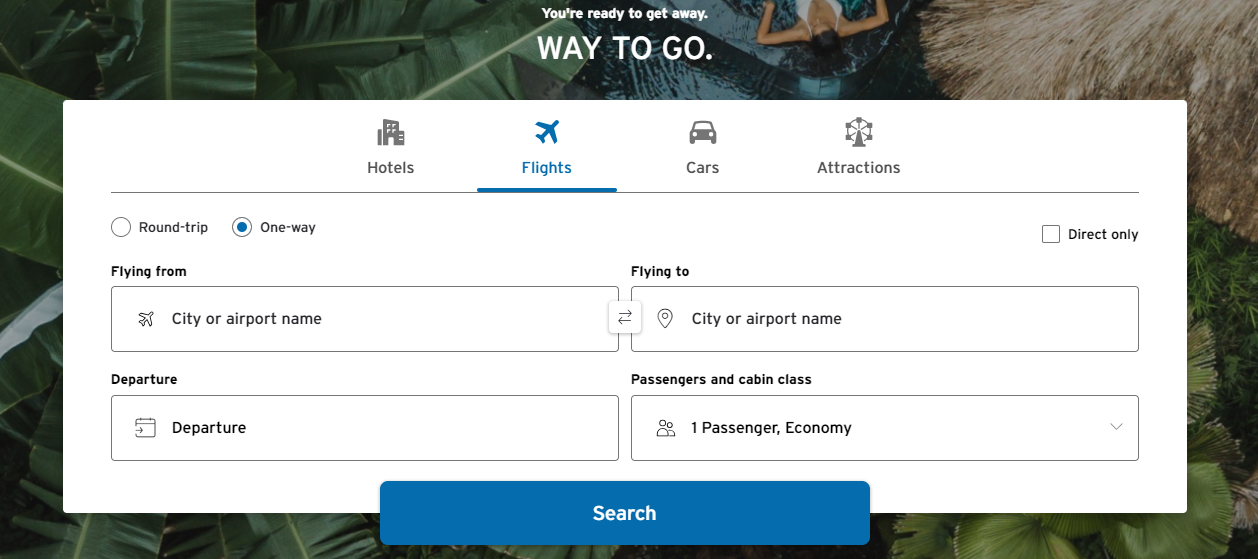

Citi Travel is a travel booking portal that gives eligible Citi card members access to book flights, hotels, rental cars, and attractions at competitive prices, along with 24/7 customer support. Additionally, when you book through the Citi Travel portal using ThankYou ® rewards cards, you can earn ThankYou ® points on your travel spending which can then be redeemed to be used on your next journey.

How do I book through the Citi Travel portal?

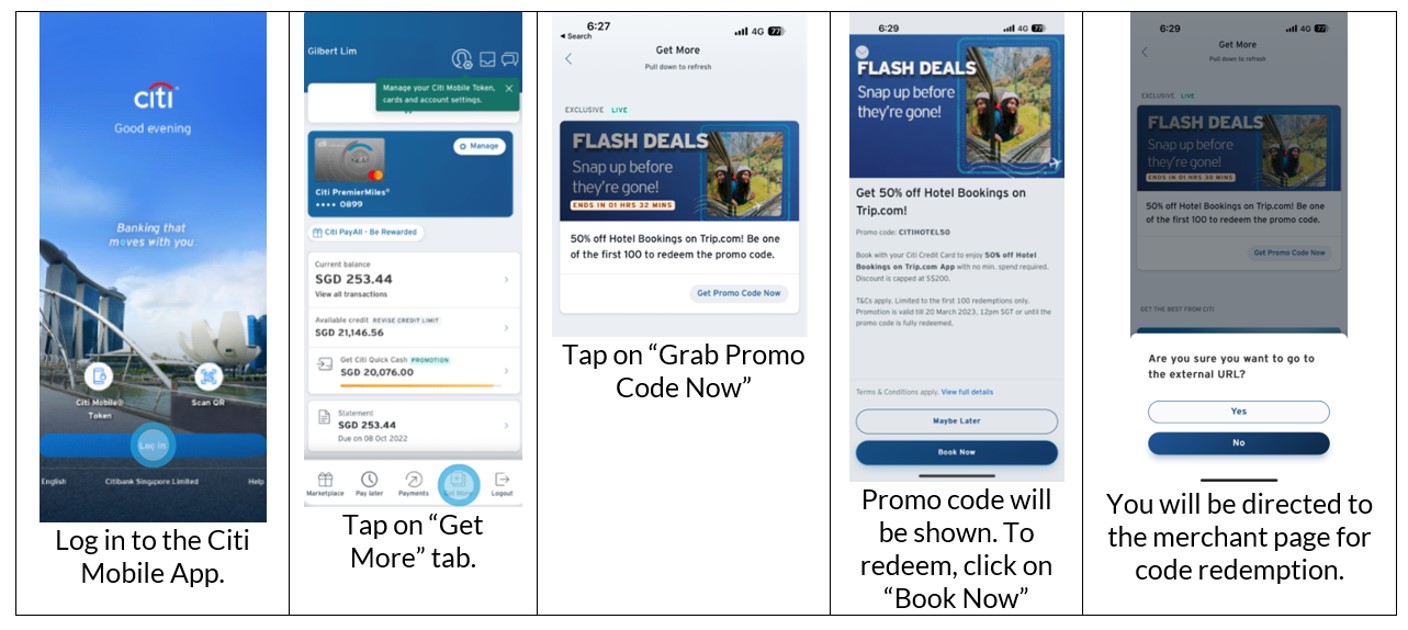

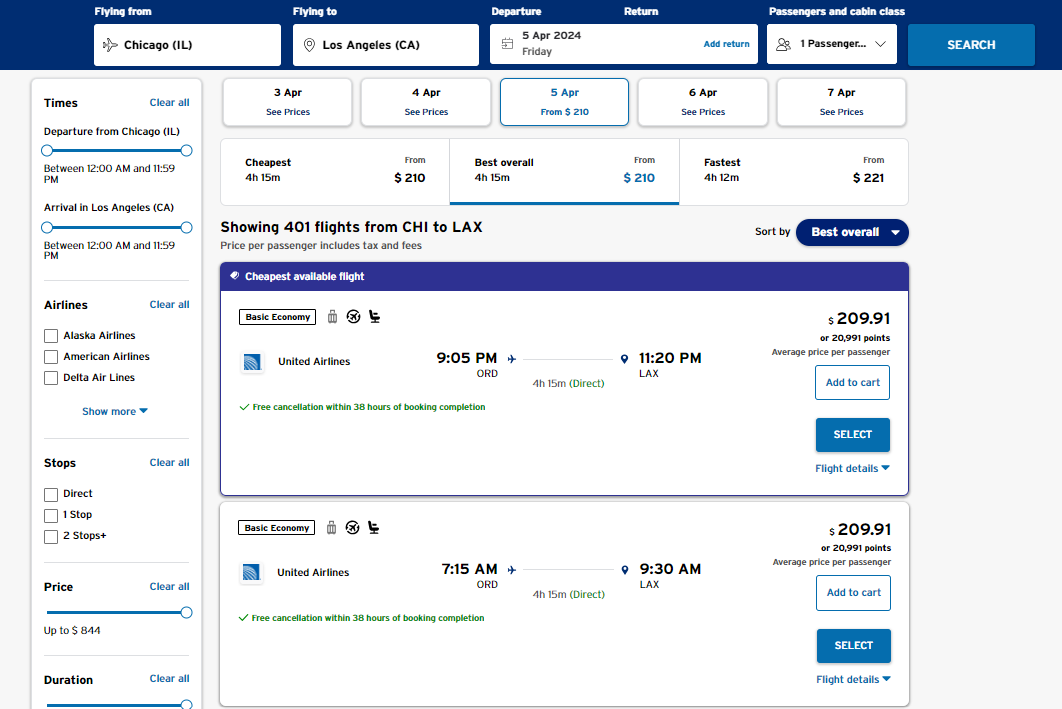

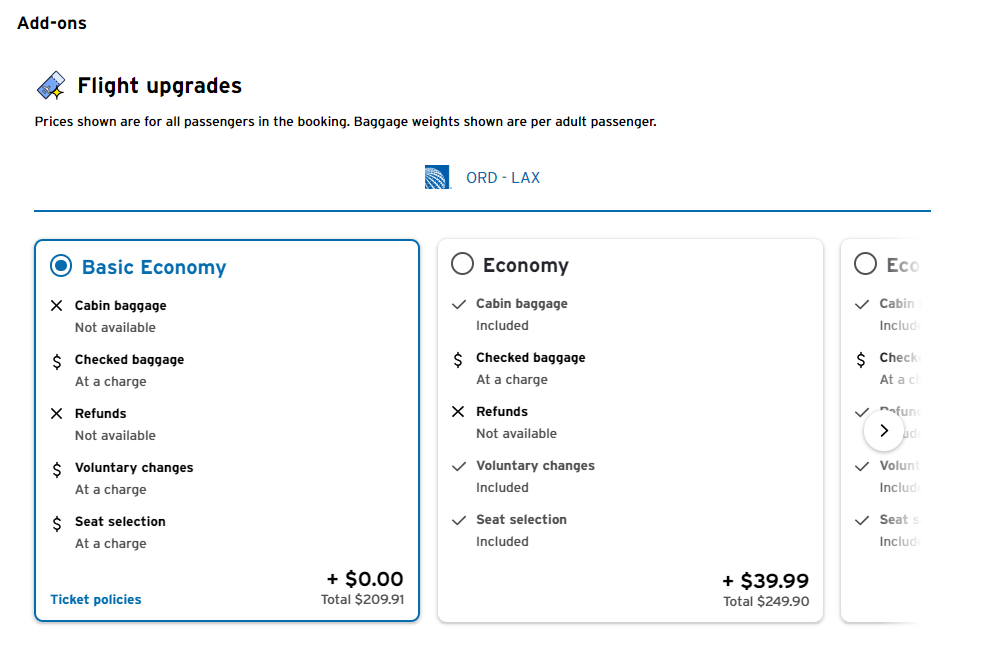

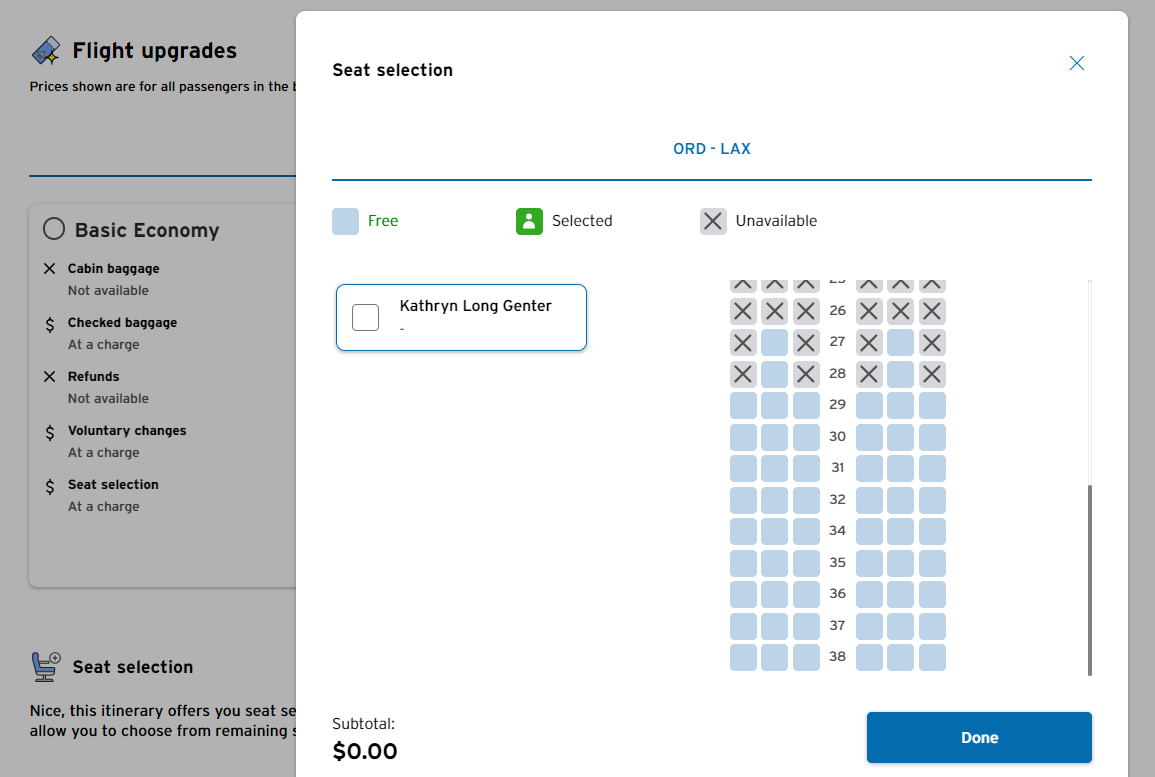

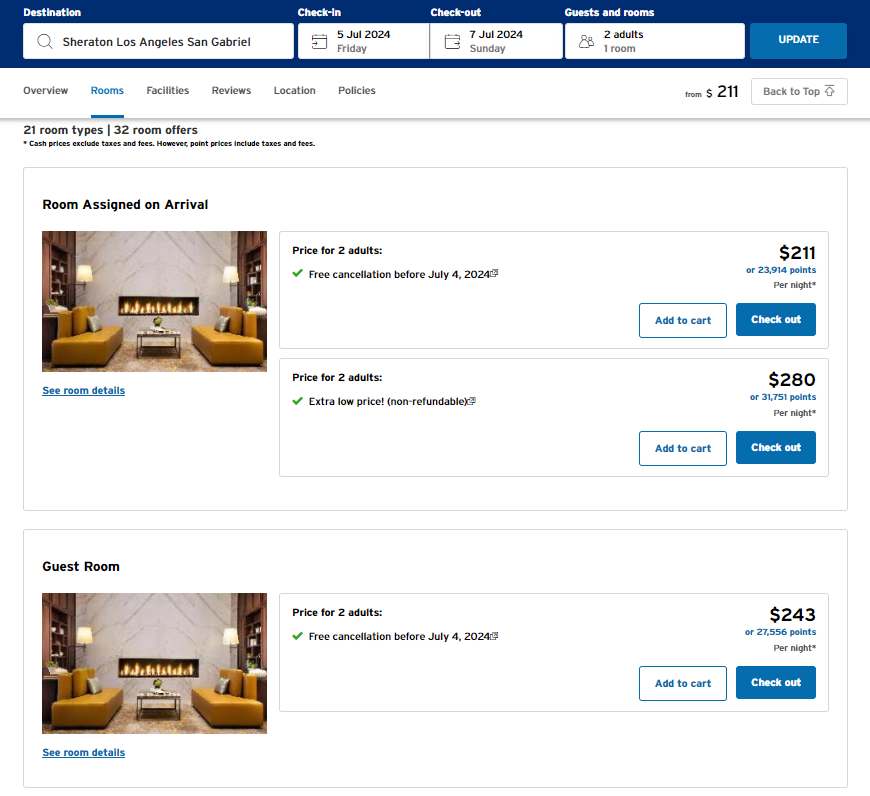

To book through the Citi Travel portal:

- Login into your Citi Mobile App or directly into the Citi Travel portal using your Citi Online User ID and password.

- After that, search for the flights, hotels, car rentals or attractions you want to book and enter the necessary information (such as number of guests or passengers, travel dates, etc.)

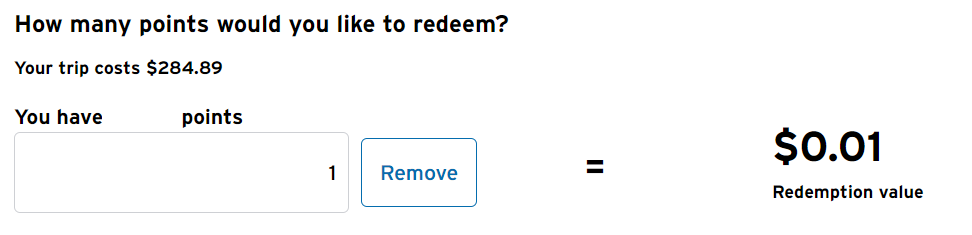

- Confirm your booking and choose whether you want to pay with card, points, or a combination of these purchase options.ns.

Can I use any Citi ® card to book through Citi Travel?

All Citi ThankYou ® Rewards Credit Cards

Citi Travel℠ is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

1 You will earn 10 ThankYou Points for each $1 spent on hotels, car rentals, and attractions when you use your Citi Strata Premier Card to book them through the Citi Travel site via CitiTravel.com or 1-833-737-1288 (TTY: 711). For bookings made with a combination of points and your Citi Strata Premier Card, only the portion paid with your card will earn points. Points are not earned on cancelled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with Booking.com.

2 Earn a total of 5 ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM 12/31/2025. You earn 1 ThankYou ® Point per $1 spent on the Citi Travel portal bookings. You will earn an additional 4 bonus ThankYou ® Points per $1 spent on hotel, car rental and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM 12/31/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Rewards+ ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your Citi Rewards+ ® Card, only the portion paid with your card will earn points. Bonus points will take up to 3 billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

3 Earn a total of 5 ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel℠ portal on cititravel.com or by calling 1-833-737-1288 and saying "Travel". Offer is valid through 11:59 PM Eastern Time (ET) 12/31/2024. You earn 1 ThankYou Point per $1 spent on the Citi Travel portal bookings and an additional 1 ThankYou Point per $1 paid on Eligible Payments (as defined in the Citi ThankYou ® Rewards Terms and Conditions for Citi Double Cash ® Card Accounts) made to your Citi Double Cash card account. You will earn an additional 3 bonus ThankYou Points per $1 spent on hotel, car rental, and attractions excluding air travel when booked through the Citi Travel portal or by calling 1-833-737-1288 through 11:59 PM Eastern Time (ET) 12/31/2024. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Double Cash Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi Double Cash card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

4 Earn an additional 4 Thank You Points per $1 spent on hotel, car rental, and attractions excluding air travel through the Citi Travel℠ portal or by calling 1-833-737-1288 (TTY: 711). Offer is valid through 11:59 PM Eastern Time (ET) 6/30/2025. The booking must post to your account during the promotional period to qualify. This offer may overlap with other special offers in which you are currently enrolled. You must use your Citi Custom Cash ® Card registered at the Citi Travel portal to earn the bonus points . For bookings made with a combination of points and your eligible Citi card, only the portion paid with your card will earn the additional points. Bonus points may take one or two billing cycles to post to your account. To qualify for this offer, this account must be open and current. Points will not be earned on canceled bookings. If your account is closed for any reason, including if you convert to another card product, you will no longer be eligible for this offer. Citi Travel is powered by Rocket Travel Inc., part of the Booking Holdings Inc. group of companies together with booking.com.

To provide you with extra security, we may need to ask for more information before you can use the feature you selected.

Just a moment, please...

Get Citibank information on the countries & jurisdictions we serve

You are leaving a Citi Website and going to a third party site. That site may have a privacy policy different from Citi and may provide less security than this Citi site. Citi and its affiliates are not responsible for the products, services, and content on the third party website. Do you want to go to the third party site?

Citi is not responsible for the products, services or facilities provided and/or owned by other companies.

Por favor, tenga en cuenta que las comunicaciones verbales y escritas de Citi podrían estar únicamente en inglés, ya que, tal vez, no podamos proporcionar comunicaciones relacionadas con los servicios en todos los idiomas. Estas comunicaciones podrían incluir, entre otras, contratos, divulgaciones y estados de cuenta, cambios en los términos o en los cargos, así como cualquier documento de mantenimiento de su cuenta. Si necesita ayuda en un idioma distinto al inglés, por favor, comuníquese con nosotros, ya que tenemos servicios de idiomas que podrían serle útiles.

Share Your Screen With A Phone Representative

During your call, you may be asked to share your screen for a faster, more efficient experience. If you agree, the phone representative you're speaking with will give you a Service Code to enter below.

If you need assistance from a Citi representative, contact us via chat or phone

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

Citi Prestige Card — Full Review [2024]

Alex Miller

Founder & CEO

297 Published Articles

Countries Visited: 34 U.S. States Visited: 29

Keri Stooksbury

Editor-in-Chief

36 Published Articles 3293 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1180 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Citi Prestige ® Card

17.99% - 25.99% Variable

Excellent (740-850)

Complimentary lounge access, fourth-night free hotel stay, an annual travel credit, and strong point-earning make the Citi Prestige card a great option.

The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer.

The Citi Prestige ® Card is an excellent all-around premium travel rewards card. With 4 different bonus categories to help you earn points, a $250 travel credit each year, complimentary lounge access, and more, there is tons to love about the Citi Prestige card.

Update: At this time, the Citi Prestige card is no longer available for new applicants.

Card Snapshot

Welcome bonus & info.

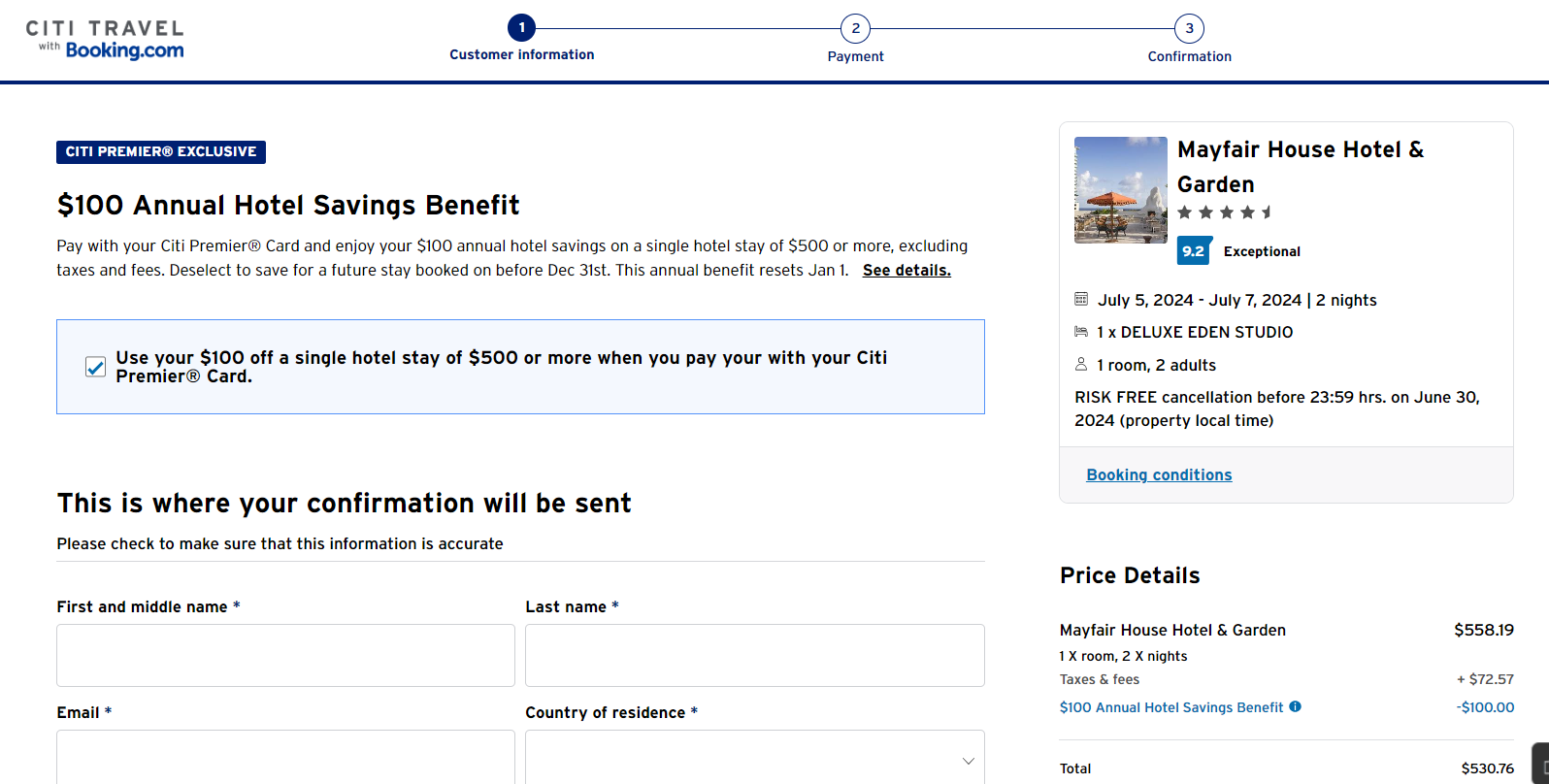

- $250 Air Travel Credit each year, and receive a statement credit, up to $100 every 5 years, as reimbursement for your application fee for Global Entry or TSA Pre √. Through December 2022 , supermarket and restaurant purchases will also count towards the $250 Travel Credit.

- Fourth-night hotel benefit for any hotel stay at hotels booked through the Citi Prestige Concierge; up to 2 times per calendar year

- Transfer points to a variety of travel loyalty programs from airlines to hotels

- Earn 5x points on air travel

- Earn 5x points at restaurants

- Earn 3x points on cruise lines and hotels

- 1 ThankYou Point per $1 spent on other purchases

Card Categories

Credit Card Reviews

- Travel Rewards Credit Cards

Rewards Center

Citi ThankYou Rewards

Customer Service Number

888-248-4226

- 5x points per $1 on purchases at airlines and travel agencies

- 5x points per $1 on dining

- 3x points per $1 on purchases at hotels and cruise lines

- 1x point per $1 on all other purchases

- $250 annual travel credit (can also be applied to supermarkets and dining purchases in 2022)

- Complimentary Priority Pass lounge access

- Annual fourth-night free hotel booking

- Access to Citi transfer partners

- Global Entry/TSA PreCheck credit

- Cell phone insurance

- $495 annual fee

- Doesn’t offer travel protections

Related Articles

Benefits of the Citi Prestige Card

Best Citi Credit Cards

Upgraded Points: Expertise You Can Trust

Our seasoned and experienced team brings years of expertise in the credit card and travel sectors. Committed to integrity, we offer data-driven guides to help you find the card(s) that best fit your requirements. See details on our intensive editorial policies and card rating methodologies .

- Content by Leading Industry Experts

- Routine Updates and Fact-Checks

- First-Hand Credit Card Experience

- Shared Across 200+ Top Outlets

The U.P. Rating System

- 1044+ Expert Credit Card Guides

Great Card If

- You fly often and want airport lounge access

- You want a card that earns transferable rewards

- You don’t mind paying a higher annual fee for more benefits

Don’t Get If

- You won’t use the perks

- You don’t travel much

Earning Categories

Earn 5x points at airlines, travel agencies, and dining, plus 3x at cruise lines and hotels. You’ll earn 1x points on all other purchases.

Your points are good for the ThankYou Rewards program and never expire. Earn as many points as you want to because there’s no cap!

Citi Prestige Card Travel Benefits

Travel abroad without the headache. There’s no foreign transaction fee when you use the card (a 3% savings by itself), and global transactions are seamless because it has an EMV chip.

The $495 annual fee is the biggest consideration, but it’s largely offset by a yearly airline travel credit of $250. This can apply to the cost of a ticket or any flight-related expenses charged to the card, including award taxes and fees, baggage fees, and more.

Update: Through December 31, 2022, the $250 travel credit can also be applied to supermarket and restaurant purchases.

Still, the annual fee is steep, separating the serious spenders from the crowd.

Travel is made a luxury since the card provides complimentary access to hundreds of VIP lounges through Priority Pass Select (complimentary Be Relax Spa treatment, anyone?).

You also get a $100 credit for the Global Entry application fee . Once the U.S. government approves your application, you can bypass long lines and enjoy expedited entry into the country.

Bottom Line: A $250 airline travel credit helps offset the steep $495 annual fee of the Citi Prestige card. Also enjoy zero foreign transaction fees, a Global Entry fee credit, and complimentary Priority Pass access!

Other Benefits of the Citi Prestige Card

Book a stay of 4 consecutive nights at any hotel (you choose!) and get the fourth night for free! The free night appears as a credit on your statement.

Enjoy 24/7 access to a global concierge team for help making trip arrangements, purchasing tickets, and booking exclusive events and dining experiences anywhere in the world.

Plus get access to exclusive events through Citi ThankYou Events and Citi Private Pass Beyond. You’ll have the opportunity to attend private concerts, sporting events, and red carpet experiences!

Bottom Line: A free fourth-night stay and other perks make the Citi Prestige card an attractive option.

Best Way To Redeem Citi ThankYou Points

With so many great ways to redeem Citi Prestige card points, it can be a little overwhelming.

We created a list of tips to ensure you get the most value out of your points when you redeem them. You can also check out this post for even more advice about maximizing Citi travel rewards .

Tips for Redeeming Citi ThankYou Points

Tip #1: Sometimes you will find a better deal transferring points directly through airline or hotel transfer partners . For this reason, it’s important to compare prices between the Citi ThankYou Travel Center and the airline partners.

Points must be transferred in 1,000 point increments, and there is a maximum of 500,000 ThankYou Points per transfer.

Also, watch for promotional periods that give you the best redemption for your Citi ThankYou Points. For example, Citi ThankYou has offered a 25% bonus for transferring points to Flying Blue.

Tip #2: Redeem ThankYou Points for gift cards and merchandise from a variety of online retailers.

Shop with Points allows you to link your Citi ThankYou loyalty account to sites like Live Nation, Amazon.com, and Expedia so you can pay with the points you’ve earned.

Pay with Points makes it easy to spend your points on purchases with Best Buy and Wonder online or directly through their apps.

You make the payment with your card and then receive statement credit within 24 to 48 hours.

Tip #3: Technically, it’s not about points redemption, but wait until you hear about this card feature that reduces your balance for free!

Select and Credit allows you to get statement credit for purchases you’ve already made!

With eligible categories including groceries, gas, utility bills, clothing, department stores, dining, and entertainment, your chances of qualifying are high.

Tip #4: Pay your bills online using points (or a combination of points and cash) in just a few clicks. All you need is an enrolled Citibank checking account.

Tip #5: Show your charitable side with PointWorthy. Once you enroll, you can browse non-profits approved by the IRS and make a donation with your ThankYou Points.

You can also make donations with your card and earn points for every dollar you donate.

Best Way To Maximize Citi ThankYou Points

As we mentioned above, you can earn points for things outside of what you may normally consider with some American Express Membership Rewards cards or Chase Ultimate Rewards cards.

If you want to get the most out of your Citi Prestige card, read on. We’ve created a list that spells out the best ways to use your card and earn lots of Citi ThankYou Points .

Tip #1: Clearly, the top strategy for banking points with this credit card is to use it for all of your purchases.

Tip #2: Book all your air travel and hotels with the card so you get 3x points. The rules state your tickets must be purchased from a merchant that provides air travel, so that includes sites like Kayak and Orbitz.

That means you can use your Google Flights results and get points for them, along with your ITA Matrix bookings if you’re using BookWithMatrix.com .

Tip #3: Make sure to also use the card for entertainment and restaurant purchases to get your 2x points.

Entertainment is a huge category that includes places like movie theaters, amusement parks, tourist attractions, sports promoters, theatrical promoters, and even record stores.

As far as restaurant spending, you can get a ton of points when you are dining with friends or colleagues. Just put all of the charges on your card, and the rest of the party can reimburse you with cash.

Tip #4: Even though other spending only gets 1x points, it can still add up. After all, the people who use the card are most likely higher spenders.

Putting all of your monthly expenses on the card will help you accumulate points steadily.

Tip #5: Add authorized users to the card. It will cost you $50 a pop, but the extra points from their purchases are likely to far outweigh the cost.

Tip #6: Enroll your Citibank banking account in ThankYou Rewards and earn extra points. If you don’t have a checking account with Citi, open one to participate.

After setting up the account, you need to make 2 consecutive monthly bill payments and keep the account open for 5 months to ensure you receive the points. Find out how many points you earn per account package here .

Tip #7: Another reason to consider being a Citigold banking member?

Citi Prestige cardholders who are also Citigold or Global Client Banking members receive an additional 15% bonus on ThankYou Points earned during the year. Private Bank clients get 25%!

Alternative Cards to the Citi Prestige Card

Besides the high annual fee, the card has a few other drawbacks.

For instance, there are a limited number of Citi ThankYou airline and hotel transfer partners when redeeming your points. Additionally, you don’t get additional bonus points for adding authorized users.

If you want an alternative, we recommend the Citi Strata Premier℠ Card . For a considerably lower $95 annual fee, you’ll get 10x points on hotels, car rentals, and attractions booked through CitiTravel.com . And 3x points on all air travel and hotels, plus supermarkets, gas stations, dining, and EV charging stations.

The Citi Strata Premier℠ Card is a great all-around travel rewards card that allows you to earn big rewards on a variety of purchases like air travel, at restaurants, supermarkets, gas stations, and more, along with flexible redemption options, all for a modest annual fee.

- 10x points on hotels, car rentals, and attractions booked through CitiTravel.com

- 3x points on air travel, other hotel purchases, restaurants, supermarkets, gas stations, and EV charging stations

- $100 annual hotel benefit

- $95 annual fee

- Earn 70,000 bonus ThankYou ® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com

- Earn 10 points per $1 spent on Hotels, Car Rentals, and Attractions booked on CitiTravel.com.

- Earn 3 points per $1 on Air Travel and Other Hotel Purchases, at Restaurants, Supermarkets, Gas and EV Charging Stations.

- Earn 1 Point per $1 spent on all other purchases

- $100 Annual Hotel Benefit: Once per calendar year, enjoy $100 off a single hotel stay of $500 or more (excluding taxes and fees) when booked through CitiTravel.com. Benefit applied instantly at time of booking.

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

- APR: 21.24%- 29.24% Variable APR

- Foreign Transaction Fees: None

The information for the Citi Prestige ® Card has been collected independently by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Citi Strata Premier℠ Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

What is the citi prestige card.

It is a credit card for active travelers who want access to luxury benefits. Cardmembers earn ThankYou Points that can be redeemed for travel, merchandise, and other rewards.

What are the Citi Prestige card benefits?

Benefits include a $250 airfare credit each year and a $100 credit for the Global Entry application.

Cardmembers also get a fourth-night free when booking a minimum 4-night stay through Citi Prestige Concierge and complimentary access to hundreds of VIP airport lounges through Priority Pass Select.

How do I redeem Citi Prestige card points?

Redeem Citi ThankYou Points through thankyou.com for travel, merchandise, gift cards, and more.

When do Citi Prestige card points expire?

Citi points have no expiration. You can also earn as many as you’d like because there is no limit.

What is the Citi Prestige card made out of?

The card is made of plastic but has an intricate design that places the magnetic strip on the front.

What is the annual fee for the Citi Prestige card?

The annual fee is $495. However, you also receive a $250 travel statement credit, which helps offset the cost.

About Alex Miller

Founder and CEO of Upgraded Points, Alex is a leader in the industry and has earned and redeemed millions of points and miles. He frequently discusses the award travel industry with CNBC, Fox Business, The New York Times, and more.

Top Credit Card Content

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![citi prestige travel card Citi Strata Premier Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2024/05/Citi-Strata-Premier-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- • Credit card strategy

- • Credit card comparisons

- • Rewards credit cards

- • Travel credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Citi Prestige® Credit Card

*The information about the Citi Prestige® Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

50,000 points

Intro offer

Earn 50,000 bonus points after spending $4,000 in purchases within the first 3 months of account opening

Offer valuation

Offer valuation is not available for this credit card.

Rewards rate

Earn 5 points per $1 on Air travel. Earn 5 points per $1 on Restaurants. Earn 3 points per $1 on Hotels. Earn 3 points per $1 on Cruise Lines. Earn 1 point per $1 on all other purchases.

16.99% - 23.99% variable APR based on your creditworthiness*

Regular APR

On This Page

- Pros and cons

- Current offer details

- Value of rewards

- Key cardholder perks

- Understanding the fees

- Expert experience

- Citi Prestige® Card vs. other premium travel cards

- Is this card worth getting?

Citi is an advertising partner.

Citi Prestige® Card Overview

The Citi Prestige® Card is a premium travel credit card offering select luxury travel perks for frequent flyers. While its $495 annual fee is not for the fainthearted, regular travelers can make their money back easily by taking advantage of Citi Prestige benefits like a complimentary fourth-night hotel stay and an annual $250 travel credit. The card has a generous rewards rate too, so you can accelerate your ThankYou points balance and get more for your spending.

What are the pros and cons?

5X points on air travel and restaurant purchases; 3x points on hotels and cruise line purchases; 1X point on all other purchases

Get the fourth night free when booking four consecutive nights or more at any hotel through Citi ThankYou.

$250 annual travel credit, which also includes supermarket and restaurant purchases through December 2021

up $100 application fee credit for Global Entry to TSA PreCheck every five years

Priority Pass Select VIP airport lounge access

Pairs well with other no annual fee Citi rewards cards

$495 annual fee

ThankYou points are only worth up to 1 cent each unless transferred to travel partner

Fewer travel benefits and protections compared to other similarly-priced travel cards

No intro purchase or balance transfer APR

A deeper look into the current card offer

Quick highlights.

- Rewards rate : 5X points on air travel and restaurant purchases; 3x points on hotels and cruise line purchases; 1X point on all other purchases

- Welcome offer : 50,000 bonus ThankYou points after spending $4,000 within three months of account opening

- Annual fee : $495

- Purchase intro APR : None

- Balance transfer intro APR : None

- Regular APR : 16.99 percent–23.99 percent variable

Current welcome offer

The Citi Prestige comes with a respectable 50,000 ThankYou points if you spend at least $4,000 in the first three months. This sign-up bonus is redeemable for $500 in travel if you book through the ThankYou Travel center—effectively offsetting your entire annual fee in the first year.

While this is a solid bonus, Chase Sapphire Reserve® has a great welcome offer for qualifying cardholders. But 60,000 Chase points (after you spend $4,000 on purchases in the first three months from account opening) is worth $900 in travel—if redeemed for travel through Chase Travel℠.

The Citi Prestige earns Citi ThankYou points , which provide a solid 1:1 value toward travel through Citi. Luckily, there is a good variety of redemption options, but it’s hard to squeeze extra value out of your points without utilizing Citi travel transfer partners. Waiting till the right moment is no problem, though, since your points won’t expire as long as your account stays open. However, points that are shared with another account expire in 90 days and purchased points must be used within a year.

Earning rewards

Unless you bank with Citi , the only way to earn substantial rewards is through spending with your credit card. Your biggest bonus category earns 5X points on air travel and at restaurants (including cafes, bars, lounges and fast-food restaurants—which isn’t always the case), but you’ll also rake in 3X points at hotels and on cruise lines. Naturally, you’ll also earn 1X points on all other purchases.

If you plan to maximize your rewards for travel, this 5X rewards rate makes the Citi Prestige one of the best cards for restaurants and airlines .

Redeeming rewards

Rewards redemption is where Citi Prestige comes into its own. You can use points to cover recent travel purchases (such as flights, hotels and car rentals) or eligible online bills, redeem them for a gift card, pay for purchases at participating retailers, receive them as cash back, donate them to charity or even share them with another person who has a ThankYou account. You may also be able to use points for payments up to $1,000 toward qualifying Citi credit lines, like a mortgage or student loan.

What’s particularly special about the Citi Prestige is that points earned on this card can be transferred to a partner airline loyalty program at a transfer ratio of 1:1. Points transfer at this ratio is not available with other no annual fee Citi credit cards .

How much are points worth?

Unlike other reward programs like Chase Ultimate Rewards, you can’t redeem your ThankYou points for a higher value toward travel. The best value you can get from your points through Citi is 1 cent apiece toward booking travel, redeeming for gift cards or contributing to your Citi home mortgage or student loan balance.

Other redemption options typically bring less than a 1:1 value, but your best opportunity to wring more value from your points is to transfer them to a partner Citi travel loyalty program. According to our latest points and mile valuations , ThankYou points can be worth up around 1.9 cents with the right transfer partner.

Outside the pack-in World Elite Mastercard benefits , the Citi Prestige carries the best additional features of any Citi card. If you travel regularly, these perks will elevate your travel experience and more than justify the hefty annual fee.

Complimentary hotel night

The Citi Prestige’s complimentary fourth-night hotel stay offer is by far the most popular benefit. Simply book a hotel of your choice through Citi’s online portal for four consecutive nights and you’ll only have to pay for three (excluding taxes and fees). What’s more, you can claim this benefit up to two times per calendar year.

Up to $250 annual travel credit

Every year, you’ll automatically receive up to $250 in statement credits toward eligible purchases that fall within the “travel purchases” category. Citi automatically identifies each of these purchases on your card and posts a credit one to two billing cycles later. Qualifying personal travel expenses include purchases from:

- Travel agencies, travel aggregators and tour operators

- Commuter transportation, including commuter railways, subways and bus lines

- Taxis, car services and limousines

- Bridge and road tolls

- Paid parking lots and garages

- Cruise lines

No worries if you’re hesitant to travel at the moment, your travel credit will also cover supermarket and restaurant purchases through December 2021.

Other travel perks

- Priority Pass Select airport lounge access. You and up to two guests can access hundreds of Priority Pass Select VIP lounges worldwide.

- Global Entry or TSA PreCheck credit. Get up to $100 back in fee credit for Global Entry or TSA PreCheck applications every five years.

- Concierge service. Cardholders are entitled to Citi’s Concierge service , which gives you access to a personal assistant who can help with travel planning, shopping, restaurant reservations and more.

Annual Citigold banking relationship bonus credits

This valuable perk is a bit under-the-radar but can make a difference in offsetting your annual fee each year. By being a Citi Prestige cardmember with a qualifying Citigold wealth management account, you can earn a $145 statement credit within three billing cycles of your assessed $495 annual fee being charged to your card. If you happen to have one or more authorized users, you’ll also receive a $25 statement credit for each $75 authorized user fee on your account.

Rates and Fees

The Citi Prestige has an annual fee of $495 and a further $75 for an additional authorized user, but there are no foreign transaction fees. Late payment triggers a fee of up to $40, and a penalty APR of 29.99 percent variable may apply.

In line with other travel rewards credit cards, there are no introductory APR periods with the Citi Prestige. However, if you need to transfer your balance with Citi , the balance transfer fee is either $5 or 3 percent of the transfer amount (whichever is greater). Both your purchases and balance transfers will be subject to the ongoing 16.99 percent to 23.99 percent variable APR, which is on par with other elite travel cards .

We tried it: Here’s what our experts say

Even through the benefits Citi Prestige Card have significantly decreased since she opened her account, Katie Genter , a travel rewards specialist at The Points Guy , is still keeping her card:

My Citi Prestige is perhaps my most frequently used card due to its five points per dollar earning rate at restaurants worldwide. Plus, it often has good Citi Merchant Offers. I’ll also occasionally find an independant hotel I want to book through the Citi Travel portal and use one of my two annual fourth night free benefits. I’m not getting nearly the value I used to get from my card, but I’m not ready to close it yet – especially since it’s no longer available. — Katie Genter, Senior Writer, The Points Guy

How the Citi Prestige Credit compares to other premium travel credit cards

The Citi Prestige’s main rivals are the Chase Sapphire Reserve and The Platinum Card® from American Express . Both of these cards are loaded with more travel benefits, especially travel and purchase protections but have a higher annual fees. Chase Sapphire Reserve offers a seemingly lower 3X rate on travel and dining (after earning your $300 travel credit), but you’ll get a stronger $300 annual travel credit and 50 percent more value when redeeming points for travel through Chase Travel℠.

The Platinum Card, on the other hand, offers 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel, plus a rich portfolio of extra benefits. The Platinum Card stands alongside the Sapphire Reserve as one of the best credit cards for travel insurance and delivers perks like complimentary Marriott Bonvoy and Hilton Honors elite gold status, annual credits for merchants like Uber (terms apply) and Saks Fifth Avenue and top-tier airport lounge access worldwide.

Citi’s Prestige Card may have a lower annual fee and wider category coverage, but it could be hard to stack up to these rivals’ perks and higher potential point value (Bankrate’s latest point valuation rates both Chase Ultimate Rewards points and Amex Membership Rewards points at around 2 cents apiece). However, the Citi Prestige may be the best choice hands down if you already bank with Citi or are considering other Citi rewards cards. The regular ThankYou points from eligible Citi banking activity and the partial annual fee credits from Citigold can pad out your rewards balance. Citi’s no annual fee rewards cards also compliment the Prestige card incredibly well, perhaps making the most cost-effective issuer card combinations to maximize rewards .

Recommended Credit Score

Chase Sapphire Reserve®

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Earn 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠. Earn 5x total points on flights through Chase Travel℠. Earn 3x points on other travel and dining. Earn 1 point per $1 spent on all other purchases.

The Platinum Card® from American Express

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. Earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

Best cards to pair with Citi Prestige

To fast track your ThankYou points, you could pair this card with the no annual fee Citi Double Cash® Card . While you’ll earn up to 2 percent unlimited cash back on purchases — 1 percent when you buy and 1 percent when you pay — you can convert cash back rewards into ThankYou points at a 1:1 ratio and pool them with your Citi Prestige. The Double Cash is already one of the best flat-rate cash back cards on the market, but it can seriously buff up your rewards income by doubling the points on purchases that fall outside your Prestige card’s bonus categories.

Citi’s rewards card is also amazing for earning extra ThankYou points on everyday purchases outside these categories. The Citi Custom Cash® Card has a novel approach to cash back: earn 5 percent cash back on your top spending category per billing cycle (up to $500, then 1 percent back). This bonus rate can apply to one of 10 categories that the Citi Prestige doesn’t cover, including common travel expenses like gas stations, select transit, live entertainment, grocery stores and more. The best part is that you actually earn ThankYou Points that can then be converted to cash back if you’d like. You can squeeze even more value from your purchases by pooling these points with your Citi Prestige and transferring them to a travel partner, or — if you’re not traveling soon — funnel your Prestige card’s points through the Custom Cash for a higher cash back redemption rate.

Bankrate’s Take — Is Citi Prestige worth it?

If your life or work involves regular travel, then you can no doubt get a lot of value from the Citi Prestige Card. Once you take benefits into account, like the $250 yearly travel credit and the biannual complimentary fourth night free for eligible hotel stays, the Citi Prestige’s annual fee is pretty easy to recoup—especially if you already have a Citigold bank account or plan on getting another Citi card.

While the Citi Prestige has fewer benefits compared to other issuers’ flagship travel cards, its issuer-centric focus elevates the Prestige card’s comparative ongoing value if you’re a loyal Citi customer.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

The information about the Citi Prestige® Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Delta SkyMiles® Reserve American Express Card Review

Bank of America® Travel Rewards credit card Review

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Citi Prestige Review: Applications Halted; Existing Customers Still Benefit

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations.

If you already have the card, its blend of rewards and perks may be well-suited to your travel needs. The fourth-night-free hotel benefit is sweet; the list of transfer partners, not so much.

Rewards rate

1 point per Dollar

Bonus offer

Earn 50,000 bonus points after spending $4,000 in purchases within the first 3 months of account opening*

Ongoing APR

APR: 16.74%-24.74% Variable APR

Penalty APR: Up to 29.99%, Variable

Cash Advance APR: 26.24%, Variable

Balance transfer fee

Foreign transaction fee

- 40,000 ThankYou® Points are redeemable for $500 in airfare on any airline, anytime with no blackout dates or $400 in gift cards

- $250 Air Travel Credit each year, and receive a statement credit, up to $100 every 5 years, as reimbursement for your application fee for Global Entry or TSA PreCheck

- 4th night hotel benefit for any hotel stay at hotels booked through the Citi Prestige® Concierge

- Transfer points to a variety of travel loyalty programs from airlines to hotels

- Earn 3X Points on Air Travel & Hotels

- Earn 2X Points on Dining Out & Entertainment

- Earn 1X Points on All Other Purchases

Bonus categories

Luxury perks

Has annual fee

Requires excellent credit

» This card is no longer available

The Citi Prestige® Card is no longer accepting applications. See our best travel credit cards and best premium credit cards for other options. Below is our review from when the card was still available.

As of summer 2021, the $495 -annual-fee Citi Prestige® Card was phasing out the acceptance of new applications .

But existing cardholders still get a lot in return for that pricey annual fee.

The card offers generous bonus rewards in major travel categories and several perks, including an annual $250 travel credit, a fourth-night-free benefit on hotel stays, a Global Entry or TSA Precheck credit of up to $100 every five years, airport lounge access via a Priority Pass Select membership, and multiple airline transfer partners, which could let you wring even more value out of your earnings.

If you're able to maximize that fourth-night-free benefit, and you do a lot of spending on airfare and via travel agencies, the Citi Prestige® Card will fit your travel needs like a glove.

But other players in the premium travel card field offer more extensive lounge access, fancier travel benefits and more domestic airline transfer partners. And you may find those perks are ultimately worth more to you. For current offers, check out NerdWallet's list of best credit cards to have .

Citi Prestige® Card : Basics

Card type: Travel .

Annual fee: $495 .

Interest rate: The ongoing APR is 16.74%-24.74% Variable APR .

Foreign transaction fees: None.

5 ThankYou points per dollar on purchases at airlines and travel agencies.

5 ThankYou points per dollar on purchase at restaurants, including cafes, bars, lounges and fast food.

3 ThankYou points per dollar on purchases at hotels and cruise lines.

1 ThankYou point for each dollar spent on all other purchases.

Earnings expire after three years to the day in which they were earned.

Redemption options:

Redeem for travel, cash back, gift card purchases, bill payments and more. All points are worth 1 cent each, regardless of which option you choose.

Transfer to one of Citi's partner airlines. Through strategic redemptions, you can potentially get more value out of your points this way. If you don't plan on traveling internationally, though, this option is somewhat limited. JetBlue is the only domestic carrier you can transfer points to.

Aeromexico (1:1 ratio).

Air France/KLM (1:1 ratio).

Asia Miles (1:1 ratio).

Avianca (1:1 ratio).

Emirates (1:1 ratio).

Etihad (1:1 ratio).

Eva Air (1:1 ratio).

JetBlue (1:1 or 1:0.8 ratio, depending on which card you have).

Qantas (1:1 ratio).

Qatar Airways (1:1 ratio).

Singapore Airlines (1:1 ratio).

Thai Airways (1:1 ratio).

Turkish Airlines (1:1 ratio).

Virgin Atlantic (1:1 ratio).

Accor Live Limitless (2:1 ratio).

Choice Hotels (1:2 or 1:1.5 ratio, depending on which card you have).

The Leading Hotels of the World (5:1 ratio).

Wyndham (1:1 ratio or 1:0.8 ratio, depending on which card you have).

Shop Your Way (1:10 ratio).

Other benefits:

Complimentary fourth-hotel-night-free benefit: Get the fourth night free when booking four consecutive nights or more at any hotel through Citi ThankYou.

$250 travel credit every calendar year: This can cover travel purchases including airfare, hotel stays and car rentals, to name a few.

Priority Pass Select m embership : Get complimentary access to Priority Pass lounges.

Global Entry or TSA Precheck credit: This covers your application fee for a Global Entry or TSA Precheck application if you pay with your card.

The Citi Prestige® Card is the top-tier option when it comes to Citi's rewards cards. With an annual fee of $95 , the Citi Premier® Card is the mid-tier option, and the Citi Rewards+® Card is more budget-minded with an annual fee of $0 and lower ongoing rewards than its sibling cards. (Editor's note: In 2024, Citi replaced the Citi Premier® Card with the Citi Strata Premier℠ Card .)

Rich ongoing rewards

Offering 5 points per dollar spent on airlines, travel agencies and restaurants, the Citi Prestige® Card soars past what most other cards can earn in these categories. If you're spending a bundle on travel and dining, this premium rewards rate could make the card worth getting. Spending on hotels and cruises will also earn you a respectable 3 points per dollar, which is on a par with what several other top-notch travel cards offer.

A $250 travel credit

The $250 annual travel credit on the Citi Prestige® Card can ease the sting of the card's high annual fee. Citi's definition of travel is broad and includes less-considered ways of getting around, including taxis, subways, parking lots and tolls. If you ever leave your house, you'll likely find a way to use up that credit and effectively bring the net cost of owning the card down to $245.

Through Dec. 31, 2022, the annual travel credit will cover more than just travel. Restaurant purchases (including takeout) and supermarket purchases will also trigger the travel credit.

Complimentary fourth night hotel stay

This is one of the more valuable perks of owning the Citi Prestige® Card . Anytime you book a hotel stay of four nights or more through the Citi travel portal through a paid booking, an award booking or a combination of the two, you'll get night four on the house — whether it's an inexpensive room or a presidential suite. It should be noted, however, that this once-unlimited feature was capped at two times a year as of Sept. 1, 2019. Even so, if you take advantage, that, combined with the annual $250 travel credit, you'll probably get more than your money's worth out of the card.

Lounge access and TSA Precheck or Global Entry credit

The Citi Prestige® Card comes with Priority Pass Select membership, which gets you complimentary access to lounges in the Priority Pass network around the world. Waiting for your flight in one of those lounges instead of by a busy boarding gate might make your next airport experience a little more pleasant.

Another useful benefit: Every five years, the card offers a credit to cover the cost of your application fee for TSA Precheck (worth $85) or Global Entry (worth $100). If you qualify for one of these programs, you could get through airport security a little faster.

» MORE: Citi credit cards mobile app review

If $495 is too much for your taste, consider this popular travel card. You earn 2 miles per dollar spent on most purchases. Miles can be redeemed for any travel purchase. There's a great sign-up bonus and a handful of nice perks. Annual fee: $95 .

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Robin Saks Frankel

/static-assets/statics-13437/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

Citi prestige ® card review [2024]: high-end benefits for frequent travelers.

/authors/robin_kavanagh_updated.png)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

EDITOR'S NOTE

Travel credit cards often deliver exceptional value to cardholders who want to be rewarded for their swipes. But there is a higher tier of travel card that caters specifically to customers who travel often and enjoy the finer things along the way.

The Citi Prestige ® Card is one of the best credit cards for high spenders who also have a healthy dose of the travel bug. This Citi Prestige review will take a closer look at this luxury card so you can decide whether or not it’s the right choice for you.

Note: The Citi Prestige is no longer available for applications. Find other card considerations at the bottom of this review.

- Who should get this card?

Card basics

Citi prestige benefits and perks, drawbacks to this card.

- Earning & Redeeming

Citi Prestige FAQs

Other cards to consider, who should get the citi prestige.

The Citi Prestige card is aimed at those who have excellent credit and are looking for more high-end experiences from their travel credit card. With travel perks like a free night twice per year, an annual travel credit, and Priority Pass lounge access plus this card's ability to quickly earn travel rewards, the Citi Prestige can be a good fit for an avid adventurer.

You would have to travel often during the year to earn enough Citi ThankYou points and travel credits to offset the card’s $495 annual fee. However, the benefits of being a Citi Prestige cardholder also go beyond what many of its competitors offer, which may well deliver enough value for some.

- $250 annual travel credit : Every year, you can get up to $250 in automatic statement credits for purchases categorized as travel.

- Free night at hotel : When you book 4 consecutive nights at a hotel using 1-800-THANKYOU or ThankYou.com, you get the fourth night free. You can take advantage of this complimentary fourth night benefit twice per calendar year.

- VIP lounge access: As a Citi Prestige cardholder, you are given complimentary access to VIP lounges through a Priority Pass Select membership. With hundreds of locations in the U.S. and over 1,300 lounges and restaurants in airports worldwide, you can have some downtime before flying in luxury.

- Earn major points : Citi Prestige rewards travel and dining purchases with huge point earnings per dollar spent.

- Global Entry or TSA PreCheck: You can get a statement credit for up to $100 every 5 years, as an application fee reimbursement for either Global Entry or TSA PreCheck . This can be a time saver for both domestic and international travelers.

- Lots of options for redeeming points : ThankYou points can be used for travel purchases, statement credits, exclusive events and experiences, gift cards, cash payments, and even charitable donations.

- High annual fee: The Citi Prestige does come with an annual fee of $495. But once you figure in the annual credit and other travel perks, this card can pay for itself if you take advantage of its benefits. This card will not be a good fit for someone who does not use these perks.

- Fewer travel partners: Citi does not have as robust of a transfer program as other credit card issuers like Chase or Amex, which have many hotel partners. While the list of Citi's hospitality partners has grown since they first introduced it, it will not provide you as much flexibility or value if you want access to a wider range of transfer opportunities.

Earning & redeeming ThankYou Points

Potential earnings in years one and two.

Here's a look how your ThankYou points can add up with the Citi Prestige. To calculate these values, we used a point valuation of 1.7 cents each, which is considered the average redemption value in the points-and-miles community.

Remember, this is an estimation. The actual value will be determined by how much you spend and in which categories you spend.

Year one earnings: $1,339.30

Year two earnings: $489.30

These values are based on the FinanceBuzz Credit Card Rewards Valuation Model which takes a look at points earned via spending, the sign-up bonus, and the annual fee. If you take advantage of the annual travel credit, free night, and other perks that come with the Citi Prestige, you will get even more value out of this card each year.

Best ways to earn

Taking advantage of bonus categories is the best way to use any rewards credit card. Whether you’re sleeping on the road or sailing the seas, every swipe of your Prestige card earns you points that can be turned into dollars to put toward your next trip.

In addition, the Citi rewards program allows you to pool your Citi ThankYou points from multiple Citi cards into one ThankYou account. This is important because only the Citi Strata Premier ℠ Card and Citi Prestige can transfer to all the airline partners.

But if you have a Citi Double Cash ® Card you can earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases; plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24. Then you can pool all those points together.

Maximizing your redemptions

You have a lot of flexibility when it comes to using your points. Citi offers a travel marketplace through which you can book your flights, hotels, cruises, and other arrangements for a trip and pay with points. If you make enough card purchases to qualify for the welcome offer, you’ll have $500 worth of points you can spend within months of opening an account.

You can apply your annual $250 in travel credits and possibly some of your points to the expense of booking four consecutive hotel nights through ThankYou.com so you can take advantage of your fourth night free benefit.

If these redemption options don’t appeal to you, you can always trade in points for statement credits, gift cards, or even cash.

Citi Prestige transfer partners

You can also take advantage of the Citi transfer partners . You can transfer to several airline loyalty programs and then redeem your rewards directly through those airlines. The Citi Prestige is one of the few cards in the ThankYou Rewards program that allows you to transfer your points to other programs, and in most cases, your points will transfer at a 1:1 rate.

Citi transfer partners include:

Is the Citi Prestige still worth it?

It can be for the right kind of customer. This card is for the frequent traveler who wants to take advantage of perks and opportunities to earn lots of points while they see the world. It is a high-end card that delivers high-end benefits that make the $495 annual fee pay for itself if used right.

If you don’t travel enough to use $250 in travel credits, a free fourth night at a hotel of your choice, free access to VIP lounges in airports around the globe, or a fee credit to pay for Global Entry or TSA Precheck, then this card may not be worth looking into.

Does the Citi Prestige have Priority Pass?

Yes. When you are approved for the Citi Prestige card, you become a Priority Pass Select member. This means you complimentary access to more than 1,300 VIP lounges and restaurants around the world. You can also bring up to two guests with you for free.

Is the Citi Prestige card metal?

Like many other high-end credit cards, the Citi Prestige card is metal.

Does the Citi Prestige waive the annual fee for the military?

Citi currently waives all fees for those who qualify for benefits under the Servicemembers Civil Relief Act, but you have to apply to Citi directly for this waiver.

If you’re thinking the Citi Prestige card might not be your cup of tea, but you’re still looking for a high-end rewards credit card, here are two other rewards card offers to investigate.

Both the Chase Sapphire Preferred and Reserve cards are popular and deliver good value for travelers. The Chase Sapphire Reserve ® earns you 3X points for other travel and dining, which is less than what you get with Citi Prestige. New cardholders can earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening — worth $900 in redemptions through Chase Travel, and the annual travel credit is $300 instead of $250.

The Platinum Card ® from American Express comes in with a higher annual fee of $ 695 , but some significant benefits for those dollars. Cardholders can earn 5X points per dollar spent on eligible airfare (on up to $500,000 per calendar year, after that 1X) and eligible hotel purchases, and 1X points per dollar on all other eligible purchases. Plus, this card comes with luxury perks like access to VIP properties in the American Express Global Lounge Collection and its partner networks, complimentary benefits with Fine Hotels & Resorts, and up to $200 in Uber Cash annually (terms apply). These benefits, coupled with complimentary rental car insurance and elite status with Marriott and Hilton make the annual fee worth it for many cardholders. Select benefits require enrollment.

You can compare the Chase Sapphire Reserve vs. Amex Platinum vs. Citi Prestige cards side by side to figure out which best fits your needs.

Premium Travel Benefits

Chase sapphire reserve ®.

/images/2024/02/13/chase_sapphire_reserve_02132024.png)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Current Offer

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

Rewards Rate

5X points on flights and 10X points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually; 3X points on other travel and dining & 1X points per dollar on all other purchases

- Up to $300 in annual travel credits

- Great rewards on travel purchases and dining

- Complimentary Priority Pass Select membership

- Comprehensive travel protections, including trip delay and cancellation insurance

- 50% point redemption bonus when booking through Chase Travel

- $550 annual fee

- High spending requirement for the welcome offer

- $75 annual fee for each authorized user

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

Author Details

/authors/robin_kavanagh_updated.png)

Citi Prestige Travel Credit Card 2024 Review

Update: This card is no longer available to new customers.

If you spend a lot of time traveling, a travel rewards credit card can be your best friend .

Depending on the card, you could earn miles or points towards free travel, plus cash in on things like priority boarding or free checked bags.

The Citi Prestige Card is one to consider if you’re looking for a card that’s packed with premium travel features .

In addition to earning rewards on travel, dining, and everyday purchases, you can take advantage of things like an annual air travel credit, concierge service, and complimentary nights at the hotel of your choice.

This card has no foreign transaction fee, but it does come with a $495 annual fee .

Our review of the Citi Prestige Card is a must-read if you need a little help deciding whether you should cough up the cash for this card.

Citi Prestige Travel Card Pros & Cons

- Good for people who want a card packed with premium travel features

- Annual $250 airline travel credit every year

- Get a free 4th night in a participating hotel

- Complimentary airport lounge access

- Points can be redeemed for travel, shopping, concert tickets, and more

- $450 annual fee

- If you don't travel frequently, card may not be worth annual fee

- Need excellent credit to get approved

Exceptional Travel Perks Come with a Price Tag

The Citi Prestige Card is a premium travel rewards card. We’ll get to how you can earn points in a moment.

First, we wanted to highlight all of the various travel benefits that make this card a true standout.

Annual Travel Credit

Right off the bat, you get a $250 travel credit per year . This credit will cover the cost of travel-related purchases, including airfare, baggage fees, seating class upgrades, in-flight purchases, hotels, car rentals, parking, ground transportation and more.

You use the card to pay for it as you normally would and the credit will be applied automatically to eligible travel purchases.

You will still earn rewards on this travel spending.

Tip: If you have trouble taking full advantage of this credit, you can buy gift cards through the airline . Save it and use it for later as you wish.

Complimentary 4th Night Stay

If hotel stays are a regular part of your travel routine, the Citi Prestige Card can make hotel bill less expensive.

When you book a stay of four nights or more through the Citi Prestige Concierge, your fourth night is instantly free.

The complimentary night is available at your choice of hotels so you can go low-key with a budget room or live it up in a luxury suite.

How it works is you'll receive a statement credit for the 4th night .

There is an annual limit on this perk. You can redeem this perk only twice per calendar year.

Global Entry Application Fee Credit

Global Entry membership can save you time at the airport if you’re traveling back to the U.S. from an international destination.

To apply, you’ll need to pay a $100 application fee but you can recoup that with your Citi Prestige Card.

If you use your card to pay the fee, Citi will issue you a $100 statement credit against the cost.

At airports, members just have to show their passports, scan their fingerprints, and turn in their customs declaration.

Complimentary Airport Lounge Access

When you’re stuck in the airport waiting to catch a flight, being able to relax in the lounge can make passing the time easier.

Priority Pass Select membership is included with your card , which means you can visit more than 900 VIP lounges around the world.

Lounge access is free for you and up to two guests. For each additional guest, there’s a $27 fee that’s charged on every lounge visit.

Citi Concierge Service

The Citi Prestige Concierge service can make your life a little easier if you need help making travel arrangements or you just need to find a great restaurant for dinner .

Concierge specialists are standing by 24/7 to answer your questions and guide you to where you want to go.

Discounts on Travel

When you’d rather cruise than fly or you’re looking to book an all-inclusive vacation, you don’t have to pay full price.

The Citi Prestige Card offers exclusive discounts on luxury tours, vacation packages, ocean cruises, and river cruises.

Earn Rewards On Every Purchase

As if the travel extras weren’t enough, the Citi Prestige Card comes with a generous rewards program.

You’ll earn:

- 5 ThankYou points per dollar on air travel and restaurants

- 3 ThankYou points per dollar on hotels and cruise lines

- 2 ThankYou points per dollar on entertainment (to be removed 8/31/19)

- 1 ThankYou point per dollar on all other purchases

Your points aren’t capped and they don’t expire as long as your account is open and in good standing.

To top if off, this card has a sizable points bonus that’s available to new card members who meet the minimum spending requirement.

Redeeming ThankYou points

When you’re ready to use all those ThankYou points you’ve earned, you’ve got plenty of choices, including:

- Gift cards to partner brands

- Electronics, jewelry, apparel, and other merchandise

- Statement credits

- Online bill pay

- Charitable donations

The number of points you’ll need and the value of those points will depend on what you’re redeeming them for. For instance, a $25 Barnes and Noble gift card requires 2,500 points. In that case, one point is worth $0.01.

A 50-inch TCL Roku TV retailing for $399.99, on the other hand, would take 49,990 points.

If you do the math, your points would then be worth one-eighth of a cent. It’s important to understand how the value compares so you can be sure you’re getting your money’s worth.

Shop or Pay with Points

If you’d rather buy merchandise directly from the merchant, you can shop or pay with points at selected Citi partners. Shop With Points is available at Amazon.com, Expedia, and Live Nation.

You can use Pay With Points at BestBuy.com or through the Wonder app. Again, the redemption value may vary.

Use Points for Travel

Frequent travelers will appreciate the ability to use their points towards flights, hotel stays, and other travel expenses. You’ve got several great ways to redeem points for travel .

First, you can use them to book your trip through the Citi ThankYou Travel Center. There are no blackout dates or restrictions and you can book flights, vacation packages, car rentals, or hotel rooms.

Best of all, when you book through the travel center, your points are worth 33% more. That means 40,000 points would be worth $532 in credit towards a flight.