- Customer Care Number

Internet banking

- NRI Banking

- Money2World

- Money2India

Offers especially for you!

Open an Insta Save Account.

No Paperwork, No Branch Visits, No Hassle!

ICICI Bank Credit Cards

Save more on your everyday expenses.

ICICI Bank Personal Loans

For your safe, comfortable, and convenient travel needs

ICICI Bank Home Loans

The key to your Dream Home, within easy reach

Campus Power - from a dream to a degree, with you at every step.

Solutions for student, parents and institutes.

Just getting returns on your investment?

Save Tax too, while you build your corpus!

Manage all your utility bills, smartly.

Pay bills easily, using Internet Banking.

ICICI Bank Two-Wheeler Loan

Get your dream bike now!

ICICI Bank FD

Choose certainity during uncertain times.

ICICI Bank PPF Account

A blessing for wealth creation is here for you!

Your guide to Personal Finance

A refreshing way to learn all about Personal Finance.

All it takes is 5 minutes!

Instant payout on selling shares, with the ICICIdirect Prime Account.

ICICI Bank Car Loan

Experience a seamless Car Loan process!

- Credit Card

Apply for Travel Credit Card Online

Want us to help you with anything? Request a Call back

Thank you for your request..

Your reference number is CRM

Our executive will contact you shortly

THE ORANGE HUB

Travel Credit Cards

Travel Credit Cards just like any other financial tool have been specifically created to improve and enrich everyone’s journey. They not only offer redeemable reward points for expenses like flights, hotels and car rentals but also include perks such as travel insurance, airport lounge access and zero foreign transaction fees. This makes the Card an exciting and perfect companion while travelling around the world.

While selecting a Travel Credit Card, it is crucial to align it with your travel goals, lifestyle and factors like annual fees and interest rates. At ICICI Bank, we offer a diverse range of Travel Credit Cards including the MakeMyTrip ICICI Bank Signature Credit Card, InterMiles ICICI Bank Coral Credit Card and more. These cards cater to varied travel preferences, whether you are an adventure enthusiast, a frequent traveller or an avid explorer. Our aim is to match the right card to the right customer for unforgettable journeys enriched with attractive benefits that stay with you wherever you go.

Features and benefits:

At ICICI Bank, we believe in promoting the best travel options that everyone can rely on. Travel Credit Cards offer a variety of features and benefits usually meant for travel enthusiasts and adventure lovers who use such Credit Cards. Here are some of the key features and advantages one can expect from these cards:

Reward Points/Miles: Earn a MakeMyTrip holiday voucher up to Rs 3,000 as a joining benefit and enjoy Rs 500 MyCash to kick-start your journey. Collect benefits up to Rs 20,000 with Travel Credit Cards. Get up to 2.5 Skywards Miles per Rs 100 spent and earn 40,000 reward points when using the card for travel bookings.

Flight ticket benefit: This benefit provides 2,500 InterMiles and exclusive flight and hotel discount vouchers as a joining bonus. Enjoy an exclusive Etihad flight offer with up to 7.5 InterMiles and 5% discount on base fare for Economy Class bookings. Earn up to 3 MyCash per Rs 200 spent on various transactions including higher earnings on MakeMyTrip bookings.

Metro ticket benefit: You can get up to 20% discount while using these Travel Credit Cards for metro bookings.

Lounge access benefits: Gain access to domestic and international lounges for a seamless travel experience. Also, access the railway lounge facility to enhance your journey.

Fuel purchase benefits: Enjoy 2.5% cashback on every fuel purchase. Additionally, a fuel surcharge waiver of 1% is offered on transactions up to Rs 4,000 at HPCL pumps with ICICI Bank Travel Credit Cards.

Membership benefit: Get enrolled in the MakeMyTrip loyalty programme to enjoy extended benefits. You can also relish up to 10,000 Skywards miles and Emirates Skywards Silver Tier membership. Moreover, you will receive a complimentary DreamFolks membership for international lounge accesses. Avail Emirates Skywards Gold Tier membership with a total annual spend of Rs 15 lakh with a minimum of Rs 10,000 spent on Emirates.

Hotel booking benefits: Earn more MyCash on hotel/holiday bookings through MakeMyTrip.

Insurance benefits: Get an accidental air death cover worth Rs 1 crore, receive emergency overseas hospitalisation coverage of up to Rs 15 lakh and get credit liability coverage up to Rs 9 lakh.

Additional benefits: Gain exclusive access to Auto Expos and test drive experiences. Enjoy a complimentary car wash with Travel Credit Cards and get 24x7 roadside assistance in times of emergency.

Eligibility Criteria and Documentation for Travel Credit Card

Specific eligibility criteria for customers to qualify for a Travel Credit Card are mentioned below:

Age: The applicant’s age should be between 21 and 65 years. However, it may differ from bank to bank.

Income: Most Travel Credit Cards from ICICI Bank have a certain minimum annual income depending on the specific Card option. For instance, it may require a larger income to use a premier Travel Credit Card in comparison to a general one.

Credit score: To be eligible, one needs to have a good credit record and credit rating. Usually it should be in the ‘good’ or ‘excellent' score line.

Documentation:

The following documents are required to apply for a Travel Credit Card with ICICI Bank:

Identity proof: Valid documents that are commonly acceptable include a valid passport, Aadhaar Card, PAN Card and driving licence.

Address proof: Documents like utility bills, signed rental agreements or the latest bank account statement with the address.

Income Proof: Proofs of income may include salary slip, income tax return and even a business financial statement among others.

Duly filled application form: Fill in the application form provided by ICICI Bank and ensure that correct details are entered in each field.

Bank statements: You might need to submit recent bank statements while applying for the Card.

It is worth mentioning here that these criteria, in terms of document submissions, may vary depending on the particular Travel Credit Card being applied for.

Travel Credit Card fees & charges

Certain fees associated with the ICICI Bank Travel Credit Cards may differ according to the details of the specific Card. There are charges such as annual fee, joining fee and more. Some of the Card fees and charges for ICICI Bank Travel Credit Cards have been mentioned below:

How to apply for a Travel Credit Card?

Applying for a Travel Credit Card is a straightforward process and you can do it through the ICICI Bank official website or by visiting any ICICI Bank Branch. Below are the steps to apply for a Travel Credit Card:

Eligibility: Ensure you meet the eligibility criteria for the relevant Travel Credit Card variant. This typically includes factors like age, income, employment status and credit score.

Card selection: Review the available ICICI Bank Travel Credit Cards and choose the one that best matches your travel and financial needs. Different cards offer various benefits and features.

Online application: Firstly, visit the ICICI Bank website. Navigate to the Travel Credit Card section. Select the preferred Card. Click the ‘Apply Now’ or ‘Get Started’ button and then fill out the online application form with your personal and financial information.

Document submission: You will be required to submit documents such as identity proof, address proof, income proof and passport size photographs.

Application review: The Bank will review your application and if you meet the eligibility criteria, a Bank representative may contact you for further verification or clarification.

Approval: The Bank will approve your application upon successful review and verification.

Card delivery: Once approved, the Travel Credit Card will be delivered at your registered address.

ICICI Bank even provides Credit Cards for international travel. They are quite beneficial for people planning to go on international trips. It will make the journey smooth and easy giving you all the more reason to opt for ICICI Bank Travel Credit Card.

Your reference number is CRM 786578956

Sorry! Please check back in a few minutes as an error has occurred.

Share this blog, get social with us..

Credit Card Services

- Apply Credit card

- Credit Card Bill Payment

- Pre-Approved Credit Card

- Personal Loan on Credit Card

People who read this also read

Recommended.

Scroll to top

Your cookie settings

These cookies are essential for you to browse the website and use its features. These cookies are essential for website to function and make sure you are able to browse seamlessly. They are used for faster loading and effective representation of information on it, enabling our site to function as intended.

These cookies are used to recognise you when you return to the site. This enables us to remember your preferences and also let us monitor how our website is performing. These cookies collect information, such as, number of visitors on the website, how visitors were directed to the website and the pages they have visited. The cookies collect information in a way that does not directly identify anyone. If you do not allow performance cookies then some or all areas of website may not function properly.

These cookies help us track your online activity and allow us to display content relevant to you and your interests, based on the way you have used our website previously. Also, the cookies help us to measure the effectiveness of our advertising both on and off ICICI Bank websites, and helps us to present products that may be of interest to you.

We use cookies to improve and personalize your browsing experience. Click OK to continue else click Manage to change your preferences. By continuing to browse this website, you accept the use of cookies. read more

Safe, convenient and flexible.

The ICICI Bank Platinum Chip Credit Card offers you great value as a no-frills, easy to manage card with exciting benefits

Keep fuel costs under check with powerful cashback and zero fuel surcharge. What’s more, you earn accelerated rewards which can be redeemed for fuel at HPCL petrol pumps.

Get rewarded with ICICI Bank Coral Credit Cards.

The ICICI Bank Coral Credit Card offers you exciting rewards and benefits to your delight.

Amazing rewards and features with ICICI Bank Rubyx Credit Card.

The ICICI Bank Rubyx Credit Card brings to you a host of power packed features and rewards to your benefit.

Experience the joy of rewards with ICICI Bank Sapphiro Credit Card

The ICICI Bank Sapphiro Credit card offers you premium rewards and features like no other.

Your ticket to Old Trafford, Manchester.

Win a fully paid trip to Old Trafford, Manchester, UK with Manchester United Signature Credit Card by ICICI Bank . What’s more! You stand a chance to win Manchester United Jersey and Match Tickets.

Manchester awaits you!

Stand a chance to win a fully paid trip to Old Trafford, Manchester, UK with Manchester United Platinum credit card by ICICI Bank.

Escape the ordinary.

Avail amazing cashbacks and discounts on domestic and international flight and hotel bookings with MakeMyTrip ICICI Bank Platinum Credit Card.

Travel with excellence

Experience the finest in travel with MakeMyTrip ICICI Bank Signature Credit cards.

A cut above the rest

Enter a world of pure indulgence and convenience with ICICI Bank Emeralde Credit Cards.

Welcome Vouchers on Shopping and Travel worth 5000 on payment of joining fee.

2 complimentary domestic airport lounge visits per quarter, one each on Mastercard.

Enjoy your favorite movie with 25% discount on BookMyShow & Inox, twice a month.

Earn up to 15,000 PAYBACK Points every anniversary year.

Earn 2X Points on all international transactions on your card.

Salary Mode

Is Income Tax Return duly acknowledged by Income Tax department?

Amazon Super Value Days: 15% cashback as Amazon Pay Balance on ` 1500 and above upto a maximum of ` 600.

Lenskart - existing offer of ` 500 off on purchase of ` 3000 or more

GrabOn - existing offer

ICICI Platinum Chip Credit Card

ICICI Bank HPCL Coral Credit Card

ICICI Bank coral Credit Card

ICICI Bank Rubyx Credit Card

ICICI Bank Sapphiro Credit Card

ICICI Bank Manchester United Signature Credit Card

ICICI Bank Manchester United Platinum Credit Card

ICICI Bank MakeMyTrip Platinum Credit Card

ICICI Bank MakeMyTrip Signature Card

ICICI Bank Emeralde Credit Card

*Terms and Conditions of ICICI Bank apply. For details visit www.icicibank.com.

Corporate Office Address:- ICICI Bank Towers,Bandra-Kurla Complex, Mumbai 400 051.

ICICI Bank Credit Card

ICICI is one of the premier credit card issuers in India. They offer various credit cards suiting various individual needs like shopping, travel, dining, and entertainment.

Types of ICICI Bank Credit Cards

Amazon Pay ICICI Bank Credit Card

Joining Fee – NIL Annual Fee – NIL

Highlights : Flat Rs. 200 back on your 1 st shopping or bill payment at Amazon.

Fees – No Joining Fee and NO Annual Fee

- Gas Cyclinder Payment 10% back upto Rs. 250

- Prepaid Recharges 50% back upto Rs. 100

- Postpaid bill payment 25% back upto Rs. 350

- Electricity Bill Payment 20% back upto Rs. 250

- DTH Recharge 25% Back upto Rs. 200

- Broadband Bill 25% back upto Rs. 400

- 3 months of Amazon Prime at no cost

ICICI Bank RubyX Credit Card

- Travel friendly

Joining Fee – Rs. 3000+ GST Annual Fee – Rs. 3000+ GST

Highlights : Enjoy rewards across lifestyle, dining, golf, free movie tickets, and many other luxury privileges with Ruby X Credit cards

Fees – For the first year Rs. 3000 + GST fee will be charged. From the second year, Rs. 2000 will be charged as Annual fee which can be reversed if the annual purchases exceed Rs. 20000

- 25% discount upto Rs.150 on purchase of minimum 2 movie per transaction at Bookmyshow. This offer is applicable two times

- 25% discount upto Rs.150 on purchase of minimum 2 movie per transaction at Inox. This offer is applicable two times

- 2 Complimentary lounge visits to domestic airport and railway station

- complimentary Golf Round for every Rs. 50000 retail spends

- Exclusive dining offers through ICICI Culinary treats programme

- 24/7 Concierge services (hotel booking, restaurant booking)

- air accident insurance of ₹ 1 crore and lost card liability of Rs. 50000

ICICI HPCL Super Saver Credit Card

Joining Fee - Rs. 500 + GST Annual Fee - Rs. 500 + GST

Highlights – Joining benefit of 2000 Reward points on activation and upon fee payment and Rs. 100 cashback of HP Pay app

Fees – Annual Membership – Rs. 499 + Tax *(reversed on spends of Rs. 1.5 Lakhs per year)

- 5% back in reward points on utility, grocery, and departmental stores purchases

- 25% discount on movie ticket bookings upto Rs. 100 on min 2 tickets per transaction available on BookMyShow and INOX movies

- Additional 1.5% back in reward points for all fuel purchases through HP Pay app at HPCL Outlets

- 2 reward points for every Rs. 100 purchase on retail except fuel

- Complimentary domestic lounge access on spending Rs. 5,000 in a calendar quarter on your card

ICICI Bank Sapphiro Credit Card

Joining Fee – Rs. 6500 + GST Annual Fee – Rs. 3500 + GST

Highlights : Claim a generous welcome gift of Rs. 9000 for availing this credit card

Fees – Joining fee of Rs. 6500 + GST, Annual fee of Rs. 3500 + GST

- Buy one ticket and get upto Rs. 500 on the second ticket, twice every month through BookMy Show

- Fuel Benefits: Save on your fuel expenses with attractive fuel surcharge waivers at any petrol pumps.

- Avail concierge services such as Restaurant referral, reservation, flower and gift assistance, hotel reservation, car rentals, medical concierge privileges etc.

Credit Card Eligibility

- Age between 21-65

- Credit Score of 750+

- Salary of Minimum Rs. 25000

- Job stability, current job experience of 1 year atleast

Documents Required to Apply for ICICI Credit Card

- Recent Passport sized photo

- ID Proof (Voter ID/PAN Card/Aadhar)

- Address Proof

- Income Proof (Payslip, Salary Certificate)

- Bank Statements with salary credit

How to Apply for ICICI Credit Cards Online?

It is important that you ensure you fulfill the eligibility criteria before applying for ICICI Credit Cards,

- Click on the apply now link given at the top

- You need to enter some details as requested

- You would need to submit the documents required

- Once done, an application ID will be sent to you to track your application status.

Travel credit cards

Cashback credit cards

Rewards credit cards

Shopping credit cards

Fuel credit cards

Lifestyle credit cards

Students credit cards

Lifetime free cards

Business credit cards

Instant approval cards

Rupay cards upi

Balance transfer cards

- Share Market News

- e-ATM Order

- FindYourMojo

- Live Webinar

- Relax For Tax

- Budget 2024

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Credit Cards

- Credit Card

- Two Wheeler

- More Business Loan SME LOAN FOREX & REMITTANCE TRAVEL CARDS

Introduction

Add-on/supplementary card, choice of credit cards, terms and charges.

Explore a wide range of credit card options.

Check out our array of featured credit cards and pick the one that best suits your needs.

Get maximized benefits and premium rewards from credit card options offered by ICICI Direct through ICICI Bank.

Make your DREAM HOME come true with a dream loan

If you’re looking to buy that house of your choice or wish to build it from the ground up, it’s time to take action now. With a wide range of home loan solutions available to you at attractive interest rates, invest in building a future without restraints. Take advantage of our quick processing, flexible tenures and easy repayment options and select the right loan of your choice.

Flexible Purchases/ Transactions

Global and Local Partner Benefits

Cashback options, exciting rewards and points, balance transfer, special offers, premium service.

- With the choice of multiple lenders, customer would be able to get higher sanction and best rate in the industry.

- Interest rate as per Cibil Score and sole discretion of lending partner

- Easy, Hassle free and convenient

- Flexible Loan Tenure

- Doorstep Service

- Attractive Interest Rates

- Dedicated Home Loan Expert. Doorstep Service.

- Choice of multiple lenders

- Higher Sanction value

- Higher Approved rate

- Dedicated Home Loan Expert.

- With the choice of 9 lenders, the approval and sanction ratio is high

- Get in touch for your queries and service related complaints

ICICI Bank credit cardholders can also avail of an add-on card or supplementary card option in order to share the features of their card user experience with family. This facility is on offer with no additional fee.

The primary cardholders can share almost all benefits of their credit card with family, without a separate joining fee or annual fees. Your spouse, parents, children (above 18 years of age) and brothers/sisters (above 18 years of age) are eligible for a supplementary card.

This option simplifies day-to-day transactions for your loved ones, making household expenses and shopping easier for your family.

And what's more, you can apply for as many as three add-on cards against your primary ICICI Bank credit card.

TERMS & CONDITIONS

- The Primary cardholder is liable for the Supplementary Cards

- All communication for Supplementary Card will be sent to the Primary Card holder (except OTPs, which will be sent to the supplementary cardholder’s mobile number as mentioned in the application form)

- A maximum of 3 Supplementary Cards can be issued against the Primary Card

- The Supplementary Card can be used for international transactions, only if international usage is enabled on the Primary Card

FEES & CHARGES

- Supplementary Credit Cards are issued at no additional fee

- On Jet Airways ICICI Bank Coral Credit Card, Jet Airways ICICI Bank Rubyx Credit Card and on Jet Airways ICICI Bank Sapphiro Credit Card, an annual fee of Rs 250 is applicable

- On MakeMyTrip ICICI Bank Platinum Credit Card and MakeMyTrip ICICI Bank Signature Credit Card, a one-time fee of Rs 250 is applicable

- On ICICI Bank Expressions Credit Card, a one-time fee of Rs 199 is applicable

- On ICICI Bank Unifare Metro Credit Cards a one-time fee of Rs 299 is applicable

Watch our Video to know more

Adani Power settles a tad above

Adani Power settled at Rs 100.05 on BSE, at almost the same level as the initial public offer

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure ... Read more

Lorem ipsum dolor sit amet, consectetur

Lorem ipsum dolor sit amet

If you have received a SMS to avail the offer to increase your credit card limit, you may reply to the SMS and we will get in touch with you. Alternatively, if you want to know the eligibility, you may call our Customer Care by authenticating with your credit card and PIN.

You can view your credit card statement details through the following modes: Internet banking:

Log in to your Internet Banking Account > My Accounts > Credit Cards > Service request > Credit card statement request- E-mail > Choose the date required (You can download the statement as a PDF)

Login with your User ID and Password to view and download your Credit Card statement. iMobile app:

Login to iMobile > Click on > Select Credit Card Number> Click on Card Number > Click on More options > Select the Last/past Statement > Choose the Statement date and View/Send e-mail.

All the retail transactions of Rs. 3,000.00 and above made on credit card can be converted into EMI within 30 days from the purchase date for a tenure of 3, 6, 9 and 12 EMIs ( However, transactions of cash, jewellery and fuel purchases are excluded for EMI conversion).

In our endeavour to make your experience with ICICI Bank Credit Cards even more convenient, we bring you multiple payment options that you can avail of to pay your ICICI Bank Credit Card bill. Please click here to know the payment options.

There is no cap on the number of times the limit can be changed.

Yes, there is an option called View Last Credit received in Internet Banking Account, which will help you with this requirement of yours.

Please login to your Internet Banking Account > My Accounts> Credit Cards> View Last Credit Received.

It will show you the following details:

- Last payment received date

- Last payment amount

- Payment due date

- Next statement date

*Interest Rates and Processing Fees depend upon segment, category & Location. Prepayment charges - 5% on principal outstanding, Additional interest rate on late payment - 24%, EMI Bouncecharge - Rs 400 per bounce, Loan cancellation charges - Rs 3000 , Mode Swap charges - Rs 500 per transaction. GST applicable over and above the charges. Rates are subject to change as per ICICI Bank Terms and Conditions

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Fintech Cards

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

MakeMyTrip ICICI Bank Platinum Credit Card vs ICICI Bank Coral Credit Card

MakeMyTrip ICICI Bank Platinum Credit Card is a co-branded travel card for which MakeMyTrip and ICICI Bank have partnered with each other. With this credit card, the cardholders will get rewards in the form of My Cash which can be redeemed for booking hotels, flights, and holiday bookings on MakeMyTrip. Apart from this, the credit cardholders will get My Cash and holiday vouchers in the form of welcome benefits and also when they achieve spends in an anniversary year.

The cardholders will also get a discount while they book tickets on BookMyShow and INOX. As travel benefits, the cardholders will also get complimentary access to domestic airport lounges and railway lounges every quarter. With this credit card, the cardholders will only have to pay a joining fee of Rs. 500 and no renewal fee needs to be paid.

On the other hand, the ICICI Bank Coral Credit Card is a basic but popular credit card offering generous reward points across various categories such as travel, dining, and entertainment. This credit card is offered in 3 variants namely Visa, MasterCard, and AmEx, and the prospective cardholders have the freedom to choose from the options available.

The cardholders earn reward points with this credit card and will also get bonus reward points on achieving a particular spending amount in an annual year. This card also offers amazing discounts while booking movie tickets in BookMyShow and INOX and discounts on dining bills while dining at the partnered restaurants. You may also get complimentary access to the domestic lounges in a calendar quarter. The cardholder has to pay a joining and renewal fee of Rs. 500 on this credit card which can be waived on the basis of your spends.

Both the credit cards by ICICI Bank are quite decent credit cards but quite different credit cards as one is a normal credit card and the other one is a co-branded credit card. But they both provide quite unique rewards and benefits to their members. Now let us discuss both the credit cards in detail to have a better and clear understanding of the cards.

MakeMyTrip ICICI Bank Platinum Credit Card

A co-branded credit card by ICICI Bank, the MakeMyTrip ICICI Bank Platinum Credit Card is best suited for those who are quite frequent travelers. This credit card offers huge My Cash to the cardholders while they normally spend using their credit card and accelerated My Cash while they spend on travel-related bookings and that too on MakeMyTrip. Additionally, the cardholders can earn discounts while they book movie tickets on BookMyShow or INOX and exclusive discounts while dining at the partnered restaurants. The following are the details and features that come along with the MakeMyTrip ICICI Bank Platinum Credit Card –

- The cardholders will get a holiday voucher from MakeMyTrip worth Rs. 3,000 and Rs. 500 My Cash as a welcome benefit to this credit card. The cardholders will get these benefits once the cardholder has paid the joining fee on the credit card.

- With the MakeMyTrip ICICI Bank Credit Card, the cardholders will get My Cash as per the following table :

- The cardholders will get exclusive discounts on the dining bills while they enjoy delicate cuisines at the partnered restaurants under the ICICI Bank Culinary Treats Program.

- The cardholders will get a 25% discount (up to Rs. 100) on the booking of 2 movie tickets in a single transaction on BookMyShow and INOX. The cardholders can avail this benefit for a maximum of two times in a month.

- You get 1 complimentary railway lounge access every quarter.

- With MakeMyTrip ICICI Bank Platinum Credit Card, the cardholders will get 1 complimentary domestic lounge access only if the cardholders are able to spend a sum of Rs. 5,000 using their credit card in the previous quarter.

- As a milestone benefit, the cardholders will get Rs. 1,000 My Cash if the cardholder successfully spends Rs. 2.5 Lakhs using his credit card in an anniversary year.

- You are entitled to receive Rs. 1,000 My Cash Points each anniversary year if the cardholder spends Rs. 50,000 on flights/hotel/holiday bookings through MakeMyTrip Website, mobile application or mobile site.

- The cardholders will also get a fuel surcharge waiver of 1% on a maximum transaction of Rs. 4,000 at all HPCL fuel stations across India.

- The joining fee of this credit card is placed at Rs. 500. The cardholders do not have to pay any renewal fee on the credit card and can continue to enjoy the benefits that pertain to this credit card.

- The My Cash that the cardholders will earn with this credit card can be redeemed on the MakeMyTrip website or mobile application for booking flight/holiday/hotel bookings.

- For redemption purposes, 1 My Cash = Re. 1.

Read More: ICICI Bank Coral Credit Card vs ICICI Bank Rubyx Credit Card

ICICI Bank Coral Credit Card

ICICI Bank offers the ICICI Bank Coral Credit Card in 3 variants, i.e., Visa, MasterCard, and American Express. The applicants are free to choose from any of the variants as per their needs. This credit card provides reward points on all the spends made using this credit card, even on insurance-related spends. The cardholders can also earn huge reward points as a milestone benefit with this credit card. Furthermore, you can also enjoy discounts while booking movie tickets and enjoying meals at the partnered restaurants. Also, the cardholders will also get complimentary access to the domestic airport lounges and railway lounges. Following are the detailed benefits and features of this credit card –

- The cardholders will get 2 Reward Points for every Rs. 100 spent on all transactions using this credit card. This includes all transactions except for the amount spent on fuel transactions.

- You get 1 Reward Point for every Rs. 100 spent on utilities and insurance categories.

- The cardholders will get a discount of 25% or Rs. 100 (the lower of the two) on the purchase of a minimum of 2 movie tickets on INOX and BookMyShow. This offer can be availed 2 times in a month and is subject to the availability of seats.

- Under the ICICI Bank Culinary Treats Program, the cardholders can enjoy all the delicate cuisines by availing a 15% on the dining bills while eating at the 2500+ partnered restaurants.

- With ICICI Bank Coral Credit Card, you get 1 complimentary access to the domestic airport lounges on a minimum spend of Rs. 5,000 in the previous calendar quarter.

- Also, the cardholders will get 1 complimentary access per quarter to the railway lounges in India.

- As a milestone benefit with this credit card, you get additional 2,000 reward points on achieving spends of Rs. 2 Lakhs in an anniversary year and 1,000 Reward Points thereafter for every Rs. 1 Lakh spent using the ICICI Bank Coral Credit Card in an anniversary year.

- The maximum reward points that a cardholder can earn under milestone benefits is capped at 10,000 Reward Points in a year.

- The cardholders can also enjoy a fuel surcharge waiver of 1% on fuel transactions up to Rs. 4,000. This is applicable only to all HPCL fuel stations across India.

- The ICICI Bank Coral Credit Card comes with a renewal fee of Rs. 500 which can be waived if the cardholder spends any amount above Rs. 1.5 Lakhs in an anniversary year.

- The reward points earned with this credit card can be redeemed against a variety of products available on the website. These reward points can also be redeemed against cash.

- For redemption purposes, 1 Reward Point = Rs. 0.25.

Quick Comparison

Now that we have discussed the features of both the cards individually, let us now have a quick comparison between The MakeMyTrip ICICI Bank Platinum Credit Card and The ICICI Bank Coral Credit Card-

Bottom Line

MakeMyTrip ICICI Bank Platinum Credit Card is a travel credit card that provides various attractive travel benefits to its members. The cardholders can earn reward points on their regular spends and accelerated reward points while they spend on travel categories on MakeMyTrip Website, mobile site, and mobile application.

As a travel benefit, the cardholders will get complimentary access to the domestic airport lounges and railway lounges in India. As some additional benefits, the cardholders will get discounts on movie bookings through BookMyShow and INOX, discounts on dining bills, and also a fuel surcharge waiver on fuel transactions at HPCL fuel stations. Furthermore, the cardholders will also get additional My cash in the form of milestone benefits. The cardholders just have to pay Rs. 500 as a joining fee on this credit card.

On the other hand, the ICICI Bank Coral Credit Card, being a basic credit card is still popular among people because of the benefits and features that this credit card provides. This credit card comes with a decent reward structure providing the cardholders with reward points across almost every category. Also, the credit card provides with complimentary access to domestic airport lounges and railway lounges. Additionally, this credit card provides various other benefits such as milestone benefits, movie and dining benefits, etc.

This credit card comes with a joining and renewal fee of Rs. 500 which can be waived on the basis of the amount that you spend during an anniversary year. The MakeMyTrip ICICI Bank Platinum Credit Card will be best suited for those people who are quite frequent travelers. But the cardholders will have to analyze their own spending pattern and the benefits and advantages that the credit card provides and then choose the one he wants to opt for.

For any more queries related to these cards, please feel free to ask us in the comment section below!

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Find the perfect credit card in India by comparing the most rewarding options in one place!

Quick Links

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

TRAVEL Cards

- Personal Loan

- New Car Loan

- Two Wheeler Loan

- Business Loan

- Credit Cards

- Forex & Remittance

Travel Cards

ICICI Bank Travel Card is the perfect travel companion for all your international trips. Get the Travel Card of your choice by browsing through the ‘Travel Cards – Variants’ section. The power-packed ICICI Bank Travel Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas. Now avoid currency rate fluctuations and save cross currency charges by loading your card with 15 foreign currencies - USD, GBP, EUR, CAD, AUD, SGD, AED, CHF, JPY, SEK, ZAR, SAR, THB, NZD, HKD. Load and instantly activate your Travel Card to start using it immediately for booking your international flight and accommodation. You can make payments only on international websites and merchant outlets overseas

Online Account Management facility

No need to visit a branch or call Customer Care. It’s time to relax and manage all your Travel Card functions yourself at comfort of your home. ICICI Bank Travel Cards is providing digital interfaces that are simple to use where end users would be able to view, handle minor issues and information requests that would otherwise go to the service desk. Now log on to ‘Self Care Portal’ or ‘Internet Banking’ or ‘iMobile app’ and start managing Travel Card with just a click.

Self Care Portal

'Self Care Portal' is an exclusive real-time account management portal designed for ICICI Bank Travel Card customers. This facility provides 24*7 access to monitor spends, block/ unblock card, reset ATM PIN, instant wallet to wallet fund transfer and much more.

Travel Card functions available through Self Care Portal

- Change/ Regenerate your ATM/POS PIN: My Profile My Setup Repin

- E-Com Activation: My Profile My Setup e-com Activation

- Change/Regenerate your online Login/Transaction passwords: My Profile My Setup Change Password

- View/download your transaction history: My Accounts Statement View

- Temporarily block/ unblock Travel Card: My Accounts Support Functions Change Card Status

- Instant Wallet to Wallet transfer: My Profile Fund transfer Wallet to Wallet transfer

How to register Travel Card to Self Care Portal?

- Enter your Travel Card number à Enter your 4-digit ATM PIN

- Define your User ID, Login Password and Transaction Password

- Set your security questions and their respective answers and Submit to create User ID

Manage Travel Card through iMobile/ Internet Banking

You can now link yours and your close relatives’ Travel Cards to your Savings Account to view, manage and update basic Travel Card details on the go through Internet Banking and iMobile app*.

Travel Card functions available through Internet Banking and iMobile:

- View Travel Card balance and last 10 transactions

- Instant reload of Travel Card

- Update e-mail ID & mobile number (domestic & international)

- Block or unblock Travel Card

- Online refund of Travel Card

- PIN generation of Travel Card

How to link your Travel Card?

Travel cards faqs.

Forex Prepaid Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

Forex Card/Money Card/Travel Card/Currency Card are Prepaid Cards. Once an amount is loaded in a currency wallet, it can be used for transactions by swiping at merchant outlets or at e-commerce sites, as well as for cash withdrawal at ATMs

ICICI Bank Forex Prepaid Card is a Prepaid Card offering 15 currency wallets. It is a smart, convenient and secure alternative to carry foreign currency while travelling overseas

Forex Prepaid/Travel Cards provide a convenient and secure alternative to carry foreign currency while travelling overseas. Moreover, it allows the customer to store multiple currencies in a single card, in case they are travelling to different countries. Unlike Credit and Debit Cards, there is no extra charge associated with POS and e-commerce transactions. They are universally accepted. Exchange rate is fixed during loading of the card and there are no Dynamic Currency Conversion charges

A multi-currency card features multiple wallets of different currencies in a single card. ICICI Bank currently offers loading of up to 15 currencies in a single multicurrency card.

Yes. Once requirement of forex is over, the remaining amount in the Forex Prepaid Card can be refunded to the linked bank account

Request for Forex Prepaid Card can be submitted at the nearest ICICI Bank Forex Branch. ICICI Bank Savings Account holders can apply through iMobile too.

You can put/load money in an ICICI Bank Forex Prepaid/Travel Card online, through Internet Banking or iMobile app. If the account is not linked, the request can be submitted at the nearest ICICI Bank Forex Branch by the cardholder or any third party

With a fresh load, the Forex/Travel Card will be automatically activated. However, if your ICICI Bank Forex Prepaid Card is inactive/temporary blocked, please call ICICI Bank Customer Care to get it re-activated.

If you are unable to withdraw funds from the ATM using your Forex Prepaid/Travel Card, kindly check:

The balance in the card for confirmation on whether you can withdraw the amount.

If there is balance, check that you are not exceeding the daily withdrawal limit (includes ATM withdrawal charges).

If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

The daily limit of withdrawal is USD 2,000 or equivalent (including withdrawal charges and tax), unless otherwise specified.

- Get CIBIL Score

- Get Call Back

- Give a Missed Call

- Main Menu ×

- Search Flights

- Corporate Travel Programme

- Group Booking

- Special Offers

- Travel Insurance

- Flight Schedule

- Check In Online

- Manage Booking

- Seat Selection & Upgrades

- Self-Service Re-accommodation

- Request Refund

- Flight Status

- Nonstop International Flights

- Popular Flights

- Partner Airlines

- Baggage Guidelines

- Airport Information

- Visas, Documents and Travel Tips

- First-time Travellers, Children and Pets

- Health and Medical Assistance

- At the Airport

- The Air India Fleet

- About Flying Returns

- Sign In/Sign Up

- Our Partners

- Family Pool

- Earn Points

- Spend Points

- Upgrade Cabin Class

- Points Calculator

- Customer Support

What are you looking for?

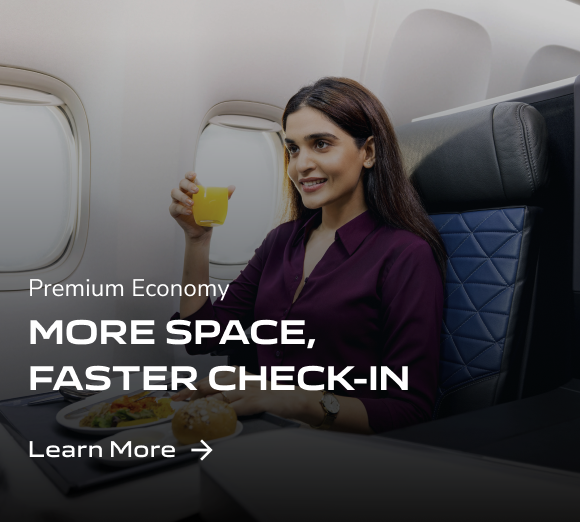

Book Your Flight using ICICI Bank Cards

Offer Terms & Conditions

As per this offer, eligible customers of ICICI Bank can avail an instant discount basis the grid mentioned in the table below. The offer will be applicable on bookings made on Air India website / mobile app only. The offer is valid on bookings made through eligible ICICI Bank Credit and Debit cards (including Amazon Pay credit cards) during the booking period i.e., from 8 th June 2024 to 30 th June 2024. Offer will be applicable every Saturday and Sunday only .

Offer Details:

Offer applicable only if there is One Passenger in the PNR.

Terms and Conditions:

- The Offer shall be applicable only to ICICI Bank Credit and Debit card holders(“Eligible Customers”). It shall not apply to (a) Business, commercial, and corporate card holders (b) Any other bank card holders. The offer will be applicable on only specific BINs.

- The offer will be applicable on every Saturday and Sunday, and a customer can avail of the offer only once a month.

- An eligible customer must transact only on Air India website / mobile app to qualify for the discount.

- The offer will be valid for any domestic or international ticket booked as per the table above. Only one of these offers can be avail in a month.

- The offer will be valid only if the payment is made in INR. For purposes of clarity, even if an eligible card is used to make a payment in any currency other than INR, such a transaction will not be eligible for discount.

- The instant discount is applicable on a single transaction and multiple transactions cannot be clubbed to avail the same.

- The offer will be applicable, where only one PAX in a PNR. For clarity, in case a PNR has more than one PAX, the offer will not be applicable. For Domestic bookings the offer will be applicable only of a return ticket is booked.

- All disputes, if any, arising out of or in connection with or because of above offer. Shall be subject to the exclusive jurisdiction of the competent courts/tribunals in New Delhi only.

- Air India, and ICICI Bank have the right to change or discontinue the Offer at any time during the Offer Period.

- The decision of Air India, and ICICI Bank will be final and binding and any correspondence in this regard will not be entertained.

- All Bookings made under this Offer shall be subject to Air India’s conditions of carriage available at www.airindia.com

It seems like you're in landscape mode. For the best view, switch to portrait mode where the magic happens!

Technology and policy in India

Adani One launches 2 credit cards in partnership with ICICI Bank

Adani Group has entered the retail finance sector with the launch of 2 credit cards in partnership with ICICI Bank and Visa. The two cards- Signature and Platinum will be offered by Adani One, the consumer app housed by Adani Digital Labs, the digital arm of Adani Enterprises Ltd. The cards provide a range of benefits including reward points on spends made through services offered on the Adani One app and complimentary benefits at Adani airports, revealed the ICICI bank website.

In a press release seen by ANI, Jeet Adani, Director Adani Group said the cards will be able to use the “Adani One platform which brings physical B2B businesses into the digital world”, while Rakesh Jha, Executive Director, ICICI Bank, said that this move would allow them to “strengthen the Bank’s credit card portfolio.”

What is Adani One?

Adani One, Adani Enterprises’ consumer app, was launched in November 2022, to expand Adani’s various consumer services like travel services, ticket booking, airport services, gas, electricity, etc. At its launch, Head of Adani One, Nitin Sethi shared in a LinkedIn post that the app aimed to “build a digital twin that will eventually parallel traditional businesses.”

In its Annual report for 2023-24, CEO Sudipta Bhattacharya explained Adani One’s strategy, saying that its goal was to “expand in two directions, welcoming new customers while broadening service offerings to existing customers. “

Recently, it was reported that the Adani Group also plans to offer online shopping through ONDC. It may also apply for a licence to operate on India’s public digital payments network, Unified Payments Interface (UPI). If finalised, the services will be available through Adani One and would initially target existing users of its businesses, which include gas and electricity customers and travellers at its airports.

- Adani Group Acquires Train Ticket Booking App ‘Trainman’

- Did Adani Group Use Paid Editors To Spin Wikipedia Articles In Its Favour?

- Adani Acquires 29% Stake In NDTV: Here’s All You Need To Know

- AdaniConneX’s First Data Centre Will Soon Be Operational In Mumbai

Adani Ventures Into Fin Sector, Launches Co-branded Credit Card With ICICI Bank

A dani Group on Monday announced a venture into the financial sector, launching with ICICI Bank a co-branded credit card with airport-lined benefits as it looks to leverage customer touchpoints across businesses.

Features and Benefits of the Co-Branded Credit Card

The group's Adani One, an app to help users book tickets, check flight status, access lounges, shop duty-free products, get cabs and avail parking, and ICICI Bank launched India's first co-branded credit cards with airport-linked benefits in collaboration with Visa.

"The cards come with a plethora of benefits designed to enhance the cardholders' lifestyle and elevate their airport and travel experience. They offer up to 7 per cent Adani Reward Points on spends across the Adani Group consumer ecosystem like the Adani One app, where one can book flights, hotels, trains, buses, and cabs; Adani-managed airports; Adani CNG pumps; Adani Electricity bills, and Trainman, an online train booking platform," a company statement said.

Adani One App: Integration and Functionality

In December 2022, Adani Group launched the Adani One app as 'a step forward' in the company's digital journey.

The co-branded card would also offer an array of benefits, including welcome benefits like free air tickets and airport privileges like premium lounge access, Pranaam Meet & Greet Service, porter, valet and premium car parking.

Card users also get privileges like discounts on shopping at duty-free outlets and on F&B spends at the airports, and benefits like free movie tickets and Adani Reward Points on groceries, utilities, and international spends.

"This strategic partnership marks the Adani Group's maiden venture into the financial sector, leveraging its unmatched reputation for excellence and innovation," the statement said. "With a vision to redefine the landscape of consumer finance, Adani One aims to set new standards by joining forces with ICICI Bank and Visa." The partnership with ICICI Bank aims to provide customers with an enhanced and seamless payment experience while unlocking a world of exclusive privileges, it said.

Jeet Adani, Director of Adani Group, said, "The Adani One ICICI Bank Credit Cards are a window to a seamless digital ecosystem. By leveraging the Adani One platform, which integrates physical B2C businesses into the digital world, users will experience unparalleled convenience and accessibility."

Rakesh Jha, Executive Director, ICICI Bank, said, "We believe that our focus on 'Customer 360', backed by our digital products, process improvement and service delivery, enables us to offer holistic solutions to customers in a seamless manner and grow market share across key segments. The launch of the co-branded credit cards, in association with Adani One and Visa, is in line with this philosophy. Through this launch, we intend to offer our customers rewards and benefits across the Adani Group's consumer ecosystem, and strengthen the Bank's credit card portfolio."

Sandeep Ghosh, Group Country Manager, Visa India and South Asia said, "These cards empower the globetrotting cardholders with an elite travel and shopping experience, both online and offline, elevating their convenience and travel experience." The Adani One ICICI Bank Signature Credit Card carries an annual fee of Rs 5,000 with joining benefits worth Rs 9,000, while the Adani One ICICI Bank Platinum Credit Card has an annual fee of Rs 750 with joining benefits worth Rs 5,000.

IMAGES

COMMENTS

Different cards offer various benefits and features. Online application: Firstly, visit the ICICI Bank website. Navigate to the Travel Credit Card section. Select the preferred Card. Click the 'Apply Now' or 'Get Started' button and then fill out the online application form with your personal and financial information.

ICICI Bank Travel Card is a smart, convenient and secure alternative to carry 15 foreign currency while travelling overseas. Apply the travel card from ICICIdirect now!

Know about 5 best ICICI Bank credit cards for air travel in 2024. Get benefits like complimentary airport lounge access, travel benefits, vouchers & more.

Get maximum benefits on ICICI Bank Travel Credit Card. Check out best ICICI Travel Credit Card along with limit, features, offers, eligibility & reviews online.

InterMiles ICICI Bank Sapphiro Credit Card - Premium Travel Credit Card By ICICI with best-in-class travel benefits. Check Review, Features and Apply Online!

Find the best travel credit cards in India for 2024. Enjoy travel offers, lounge access, vouchers etc. from top issuers like HDFC, ICICI, SBI & Axis Bank.

India's 1st dual Platinum Credit Card! Enjoy dual privileges across lifestyle, dining and golf; get travel benefits and free movie tickets. Get your ICICI Bank Rubyx Credit Card today!

ICICI credit cards come with a host of benefits for travel, dining, and entertainment. Apply now to get the Credit card that fits your requirement.

ICICIdirect offers credit cards through ICICI Bank with lots of benefits, offers & features to cater to your needs. Apply for Credit Card online & enjoy the unmatched privileges.

MakeMyTrip ICICI Bank Platinum Credit Card is a co-branded travel card for which MakeMyTrip and ICICI Bank have partnered with each other. With this credit card, the cardholders will get rewards in the form of My Cash which can be redeemed for booking hotels, flights, and holiday bookings on MakeMyTrip. Apart from this, the credit cardholders ...

ICICI Bank Travel Card is the perfect travel companion for all your international trips. Get the Travel Card of your choice by browsing through the 'Travel Cards - Variants' section. The power-packed ICICI Bank Travel Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

Know the list of top credit cards by ICICI Bank. Here's a detailed list of cards with the most useful and attractive offers at the most competitive prices.

ICICI Bank offers some of the popular credit cards for every individual, be it a beginner or a one with existing credit history. These credit cards are offered under multiple categories, including travel, shopping, entertainment, rewards and more.

The offer is valid on bookings made through eligible ICICI Bank Credit and Debit cards (including Amazon Pay credit cards) during the booking period i.e., from 8 th June 2024 to 30 th June 2024. Offer will be applicable every Saturday and Sunday only .

The Adani Group has launched credit cards in association with the ICICI bank and visa, which will be usable across the Adani One app.

Apply online for a Citi credit card that fits you: whether you want travel points or cash back, low-rate balance transfers, or to build your credit score.

Adani Group on Monday announced a venture into the financial sector, launching with ICICI Bank a co-branded credit card with airport-lined benefits as it looks to leverage customer touchpoints ...