- Small Business

- Private Client Advice

- British Columbia

- New Brunswick

- Newfoundland Labrador

- Northwest Territories

- Nova Scotia

- Prince Edward Island

- Saskatchewan

- English Selected

- secure Login

Get a quote

Home/ Condo/ Tenant

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

Sorry, we do not offer this product in the selected province

Please visit our homepage to see products available in your province.

- Small Business

- English Selected

Understanding the Travel Benefits Your Credit Card Offers

Whether you’re travelling for work or play, there is a possibility of risk when venturing away from home. From losing luggage or scratching the rental vehicle, to injuring yourself or falling sick, the travel benefits included with your TD credit card can help you travel prepared.

How Credit Card Travel Benefits can help you

Travel prepared with the travel benefits on your TD credit card. Depending on the TD credit card, travel benefits could include:

- Travel Medical Insurance 1

- Trip Cancellation / Trip Interruption Insurance 2

- Delayed and Lost Baggage Insurance 3

- Flight/Trip Delay Insurance 3

- Common Carrier Travel Accident Insurance 4

- Auto Rental Collision / Lost Damage Insurance 5

- Emergency Travel Assistance Services 6

- Hotel / Motel Burglary Insurance 7

How do the travel benefits on my credit card work?

Credit card travel benefits can work in many ways. For example, they may:

Provide insurance for travel expenses Depending on the travel benefits included with your TD credit card, you may be insured for certain travel related expenses (i.e. car rentals) and you could also be insured in certain situations (i.e. medical emergencies).

Come with additional Travel Medical Insurance Timeframes vary depending on your age, the length of the trip and the type of credit card.

Make it easier to make a claim In the event of a claim, you’ll want to contact our claims administrator to initiate your claim. It helps to have all your receipts available during this process.

What coverage do I have with my credit card travel benefits?

Depending on the credit card you have, you could be eligible for a range of coverages, from trip cancellations, to lost baggage, to car rental accidents. Check your TD credit card travel insurance benefits here . It is important to read your certificate of insurance to understand which coverages you have with your credit card.

Benefits of having Credit card travel Insurance

There are a number of scenarios when having travel benefits on your credit card may be beneficial.

Your family vacation

It’s your first family trip, your flight’s been cancelled, and you’ve missed your connection. Fortunately, Trip Cancellation Insurance 2 may provide coverage for the cost of your required hotel room.

Lost luggage? No worries.

Imagine finally being able to travel only to then lose your luggage. Thankfully, Delayed and Lost Baggage insurance 3 can help cover a portion of the loss.

Your business trip

While driving to your annual sales meeting, you get into a minor collision and damage the rental vehicle. Thankfully, your Auto Rental Collision/Loss Damage Insurance 5 could help you get back on your way.

How to get started

If you love to travel the world and experience new places and cultures, a TD® Aeroplan® Visa* Credit Card might be for you.

- Travel Rewards

TD Travel Rewards Cards let you earn points on everyday purchases that can be redeemed for flights, hotels and much more.

Earn cash back on purchases, which can be redeemed whenever you want – for what is most essential to you.

Browse All Credit Cards

Explore our Canadian credit card accounts to see which one is right for you.

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan points

- No Annual Fee

- U.S. Dollar

- Personal Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Banking Advice for Seniors (60+)

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

- Employer Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- Supplier Information

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking

- TD Bank Small Business Banking

- TD Bank Commercial Banking

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

1 Underwritten by TD Life Insurance Company. Medical and claims assistance, claims payment and administrative services are provided by our Administrator. Benefits, features and coverages are subject to conditions, limitations and exclusions, including a pre-existing condition exclusion, that are fully described in the Certificates of Insurance included with your TD Credit Cardholder Agreement. Note that this insurance offers different benefits, with different terms and conditions, then the optional Travel Medical Insurance that may be medically underwritten and is available for purchase to all TD customers, which you may be eligible to top up with. The day of departure from and the day of return to your province or territory of residence each count as one full day.

2 Underwritten by TD Life Insurance Company (for medical covered causes) and TD Home and Auto Insurance Company (for non-medical covered causes). To be eligible for this insurance, at least 75% of your trip cost must be paid for using your TD Credit Card and/or Aeroplan points. Benefits, features and coverages are subject to conditions, limitations and exclusions, including a pre-existing condition exclusion, that are fully described in the Certificate of Insurance included with your TD Credit Cardholder Agreement. Note that this insurance offers different benefits, with different terms and conditions, than the optional Trip Cancellation and Trip Interruption Insurance that is available to all TD customers.

3 Underwritten by TD Home and Auto Insurance Company. To be eligible for this coverage, at least 75% of your trip cost must be paid for using your TD Credit Card and/or associated Aeroplan points. Benefits, features and coverages are subject to conditions, limitations and exclusions that are fully described in the Certificate of Insurance included with your TD Credit Cardholder Agreement.

4 Underwritten by TD Life Insurance Company. To be eligible for this coverage, your trip must be paid for in full using your TD Credit Card and/or Aeroplan points. Benefits, features and coverages are subject to conditions, limitations and exclusions that are fully described in the Certificate of Insurance included with your TD Credit Cardholder Agreement.

5 Underwritten by TD Home and Auto Insurance Company. Car rentals must be charged in full to the Card and/or associated Aeroplan points, cannot exceed 48 consecutive days and the rental agency’s Collision Damage Waiver(CDW) coverage must be declined by the Cardholder. Please note, in some jurisdictions, rental agencies may require you to purchase the CDW coverage from them — it is important to call before booking your car rental to confirm their insurance requirements. Refer to the Auto Rental Collision/Loss Damage Insurance section of your TD Credit Cardholder Agreement for rental exclusions and further details.

6 Provided by our Administrator under a service agreement with TD Life Insurance Company. This is not an insurance benefit but assistance services only.

7 Insurance coverages are underwritten by American Bankers Insurance Company of Florida (ABIC) under Group Policy TDA112020. Benefits, features and coverages are subject to conditions, limitations and exclusions that are fully described in the Certificates of Insurance included with your TD Credit Cardholder Agreement. ABIC, its subsidiaries, and affiliates carry on business in Canada under the name of Assurant ®. ®Assurant is a registered trademark of Assurant, Inc.

See Air Canada and Aeroplan trade-mark ownership details.

* Trademark of Visa Int., used under license.

® The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

TD Travel Insurance Review

- About TD Travel Insurance

TD travel insurance features

Td travel insurance product rating: 2.5 stars, the pros of td travel insurance, the cons of td travel insurance, td travel insurance alternatives.

TD travel insurance is a convenient option for Canadians who are already customers of the big bank, letting you get insurance coverage from a familiar name. You have 3 options when it comes to what type of plan you can get: single trip, an annual plan, or trip cancellation and interruption coverage. Each plan offers your basics to keep you covered on your next trip.

But as we continue to adjust to our pandemic lives, TD travel insurance still hasn't adapted to offer COVID-related insurance, though other banks and insurance companies have. You also may find you're charged a bit more from a big bank than you would be from a smaller company.

Below are the basic features of TD travel insurance.

- Includes pet return and return of dependent children

- Canadian resident

TD travel insurance offers all the basics you need in 3 simple plans. There may not be as many customization options as your other options, but things are streamlined and much simpler when you don't have to choose all the details. You'll also get some less common coverage included, like pet return and return of dependent children.

Being a big bank, TD may not have the cheapest prices on the planet. Usually, you pay a little more for the convenience of working with a big bank. Make sure to shop around before committing to any insurance cost.

Rating methodology

Wondering how we calculate our product rating? First we break down the product into its main features, then give each feature a score out of 5. These scores are based on how it performs relative to similar products on the market, and averaged together to get a final score.

So what are some reasons you'd go for TD travel insurance over your other Canadian options?

Backed by a big bank you trust

As one of the 5 biggest banks in Canada, chances are you already know TD as a reputable company – and this trust is even better if you also have products with them.

3 straightforward plans available

Big banks are all about convenience, and TD travel insurance definitely fits the bill. There may not be very many choices for you, but the quote process is very simple and streamlined – you either get single trip coverage (with or without travel cancellation and interruption) or an annual plan for unlimited trips. Click here to get your quote.

Some unusual coverage included

Though the TD travel insurance plans are pretty straightforward, they do advertise some interesting coverage that you won't see everywhere. The best examples of this are pet return and the return of dependent children. On top of that, they also hit most of the main boxes: medical emergency coverage, hospital accommodations, and bills.

Save 10% with the TD U.S. Dollar account

If you have a TD U.S. Dollar account , there's actually a special discount available for you. You'll get 10% off the premium for the Travel Medical Insurance, which isn't a significant savings, but still a nice touch.

24/7 emergency assistance

If you ever need to contact TD while travelling, they have 24/7 support from anywhere in the world. This is ideal, because it means you don't have to worry about time zones when calling to make a claim.

And of course, there will be a few reasons to encourage you to price-check other travel insurance providers as well.

Trip cancellation and interruption is at extra cost

If you want trip cancellation and interruption insurance, the cost is calculated separately from the standard premium, which is good to keep in mind. In our trial, this part of the insurance cost more than double the standard insurance ($79 for a $1,000 trip, on top of the $39 premium). And since the cost depends on the estimated price of the specific trip, you can't purchase this extra coverage for the annual plans.

No option to cover COVID-related claims

TD has an announcement front-and-center on their website that none of their plans will cover COVID-related claims. There have been other travel insurance companies that have stepped up to provide coronavirus coverage, so it would've been nice to see the same here.

Might not have the cheapest premiums

And since big banks are in favour of convenience, they can sometimes cost more than other online travel insurance companies. As an example, our test run was a 26 year old from New Brunswick going on a $1,000 trip for 8 days. TD didn't ask the destination country, but did give a mid-range price of $39 plus $79.60 for trip cancellation and interruption.

Here's how TD travel insurance compares to other options on the market.

What's covered by TD travel insurance?

TD travel insurance can cover you for all the basics: medical emergency coverage, hospital accommodations, physician's bills, transportation to bedside, pet return, and return of dependent children. If you're buying a simple trip plan, you can also add on trip cancellation and interruption insurance for an extra cost.

How do I get a TD travel insurance quote?

Getting a TD travel insurance quote is actually very easy. All you have to do is answer a few quick questions on the TD website, and you'll get your quote within minutes. Click here for more info .

How do I contact TD travel insurance to make a claim?

If you need to contact TD travel insurance, you can call 1-800-359-6704 if you're in North America, or (416) 977‑5040 if you're anywhere else in the world. They have 24/7 emergency assistance, so you can call them at any time.

Is TD travel insurance good?

Going with TD travel insurance is a safe choice because it's offered by a big Canadian bank that you're likely already familiar with. It offers standard protection with a very straightforward quote tool and plans. But if you're looking for the cheapest plan around, you may want to do some shopping around first.

Editorial Disclaimer: The content here reflects the author's opinion alone, and is not endorsed or sponsored by a bank, credit card issuer, rewards program or other entity. For complete and updated product information please visit the product issuer's website.

Hot Money Deals This Month

- Receive your GeniusCash when approved for a financial product through moneyGenius.

- Choose from credit cards, bank accounts, mortgages, and more.

- Offers end June 30, 2024. *

- Up to $600 in bonus cash when you complete a few actions.

- Get accounts for family members without paying an additional monthly fee

- Get up to a 5.50% promo interest rate when you add a Savings Amplifier Account

- $100 GeniusCash on approval – ends June 30. *

- Get up to $400 in cash when you open a new account and complete specified actions.

- Unlimited free transactions – including debit and Interac e-Transfers ® .

- Earn Scene+ points on every debit transaction.

- $125 GeniusCash on approval – ends June 30. *

- Best balance transfer offer in Canada – 0% for 12 months.

- Permanent low interest rates of 12.99% on purchases and balance transfers (24.99% for cash advances).

- No annual fee.

- Bonus: Get one of the lowest brokerage rates from an online broker from a Big 5 Bank →

Ratings & Reviews

Write a review, about moneygenius.

moneyGenius is a 100% free personal finance resource for Canadians looking to keep more money in their pockets. Designed and built by Canadians, moneyGenius is trusted by nearly 100K people every month, 45K newsletter subscribers, and 7.9M people since 2010.

Read more about moneyGenius .

Save money and find the best financial products

Discover the best deals from 393 financial products across 129 Canadian companies.

- Best of Money Awards

- Scholarship

- Featured In

- Privacy Policy

Get In Touch

Send us a note, or follow us on social.

200 Champlain St. Suite 210 Dieppe, NB E1A 1P1

Copyright © 2024 WeyMedia Inc. All rights reserved.

Join 45,000+ Canadians and be the first to know about the latest money news and exclusive offers.

Bonus : Get instant access to our 250+ page money-saving eBook for free.

We promise to keep your email safe. We hate spam too.

Disclosure: Some links on this page may be affiliate links. We're letting you know because it's the right thing to do. Here’s a more detailed disclosure on how moneyGenius makes money.

Your feedback matters

What do you think of moneygenius.

- Credit Cards

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Credit Card Travel Insurance Vs. Separate Travel Insurance

Updated: Jun 12, 2024, 6:10am

Fact Checked

Table of Contents

What travel policies have in common, credit card travel insurance, separately purchased travel insurance policies.

You’ve probably heard about the importance of travel insurance . If you get sick or injured while travelling outside of Canada, your provincial or territorial health insurance has limited coverage. Or if you’re halfway through your dream vacation and a family member back home is hospitalized, without travel insurance the costs to get to their bedside are yours alone. But where’s the best place to buy travel insurance?

Airlines and online booking platforms offer coverage as an add-on when you reserve your trip and it’s available through banks, travel agencies and insurance companies. Many credit cards also offer various forms of travel insurance as part of the benefits you pay for in your annual fee.

Featured Partner Offer

World Nomads Travel Insurance Review

On World Nomad’s Website

Emergency medical

$5 million, $10 million

Cancel For Any Reason (CFAR)

Baggage insurance (Maximum)

$1,000, $3,000

Each option protects you in different scenarios. With so much variation in coverage and price, it’s hard to compare. Fortunately, we did the heavy lifting for you, examining the included benefits offered by a few popular credit cards against separately purchased policies.

Before we look at the differences, let’s look at what the policies have in common.

First, travel insurance is meant to protect against sudden, unforeseen, or unexpected situations. This means that any personal pre-existing medical conditions aren’t covered unless your coverage includes a waiver or offers a pre-existing condition exclusion. Also, travelling for elective surgery or medical treatments of any kind is also not covered.

Secondly, all policies have time limits for when you can initiate a claim (plan on filing within 30 days of the incident, although in some cases you may have longer). You’ll then have additional time to compile and submit supporting documentation. Expect to share an elaborate paper trail detailing what happened and any related expenses you incurred. Receipts are non-negotiable.

Lastly, coverage is null and void anytime it’s a result of illegal activity. You may also be denied if the cause of the incident included alcohol or drugs. It’s important to read each insurer’s list of exclusions to be clear on what is and isn’t covered. As always, an ounce of prevention may be worth a pound of cure.

Credit cards tout travel benefits as a way to offer value in exchange for annual fees. Here, we’re comparing three popular cards that offer travel insurance: The TD®Aeroplan® Visa Infinite Privilege Card , the Scotiabank Gold American Express Card and the BMO Air Miles World Elite Mastercard .

With all of these cards, eligible non-refundable expenses, such as flights or hotel accommodations, must be charged to the credit card to be included in the coverage. You must also remain a card member at the time you file your claim and have an account in good standing. Immediate family members are covered, assuming you paid for their travel with your card. Keep an eye on age limits for children: This varies not only by card but by benefit. All benefits cover children up to 18, but some benefits will cover older adult children if they’re still students.

TD® Aeroplan® Visa Infinite Privilege

The TD® Aeroplan® Visa Infinite Privilege is a top-of-the-line travel credit card that offers comprehensive trip insurance, making it ideal for frequent flyers seeking extensive additional rewards. The downside? The steep $599 annual fee.

This card offers up to $5 million in emergency medical coverage for the first 31 days of your trip if you are 64 years of age or under. (If you’re 65 years of age or older, coverage is for the first four consecutive days of your trip.) Benefits under this coverage include fees for hospital accommodation, physician’s services, lab tests and other diagnostics, ambulance transportation and emergency return home. There’s also specific provisions for private duty nursing (up to $5,000) accidental dental ($2,000 maximum), costs to bring a bedside companion to you if you’re hospitalized (round-trip air fare and up to $1,500 for meals and accommodation), and return of your travelling companion, vehicle and/or dependent children.

Another valuable included benefit is Trip Cancellation and Trip Interruption Insurance . This coverage reimburses you for nonrefundable, prepaid expenses you incurred if you unexpectedly have to cancel the trip or have to cut the trip short. You can be reimbursed up to $2,500 per traveller with a maximum of $5,000 per trip for a trip cancellation, and up to $5,000 per traveller with a maximum of $25,000 for all insured travellers for trip interruption. Some examples of covered reasons include hospitalization or death of an immediate family member or a court subpoena.

The last major coverage this card includes is Accidental Death & Dismemberment insurance. This insurance pays out a lump sum if you lose your sight, speech, hearing, a limb, or life while travelling. The coverage maxes out at a generous $500,000.

All travellers have experienced trip delays at one point or another, for example when thunderstorms cancel your flight or your airplane has mechanical issues. With the TD® Aeroplan® Visa Infinite Privilege card, you can be reimbursed up to $1,000 if you’re delayed four hours or more for eligible causes (most commonly severe weather or mechanical issues). It will cover costs such as hotel rooms, taxis and meals.

The card also offers generous coverage of up to $2,500 per passenger for lost luggage or $1,000 for delayed luggage after four hours so you can buy what you need while waiting for your suitcase to arrive.

- Scotiabank Gold American Express Card

The Scotiabank Gold American Express Card is one of the top rewards cards in Canada with comprehensive travel insurance coverage and only a $120 annual fee.

Starting with the travel emergency medical coverage, this card offers up to $1 million in benefits for 25 days of consecutive travel for cardholders 64 and under, and for three days for cardholders aged 65 and above. While this maximum benefit is less than other cards, it has a long list of eligible expenses following treatment for a medical emergency including:

- Hospital accommodation, medical expenses and doctor charges

- Private duty nursing

- Diagnostic services, including laboratory testing and X-rays

- Ambulance services

- Emergency air transport to the nearest hospital or home

- Prescription drugs

- Emergency dental care due to a blow to the mouth, up to $2,000

- Medical appliances, including a sling, brace, splints or local rental of crutches, a walker or wheelchair

- A bedside companion if you’re hospitalized for more than three days, including round-trip airfare and a subsistence allowance of up to $100 per day (maximum $1,500)

- Vehicle return, maximum $1,000

- Car accident assistance, if your car is disabled due to an accident, with a maximum of $200 per day for three days for accommodation, food or commercial transportation/car rental

- Return of deceased, up to $5,000

If you need to cancel or interrupt your trip for a covered reason, such as the death of an immediate family member or a missed connection due to a mechanical delay, trip interruption coverage and trip cancellation coverage offers up to $1,500 per insured person and $10,000 per trip. And if your flight is delayed for more than four hours due to a covered reason, such as bad weather, mechanical breakdown or overbooking, this card pays up to $500 per person for expenses such a hotel, meals and sundry items, like magazines and snacks.

Lost, delayed or stolen baggage can put a damper on any trip. This card pays a maximum of $1,000 for checked bags lost by a common carrier, and up to $1,000 for the cost of buying essential items, such as clothes and toiletries, if your bags are delayed by more than four hours. This card also offers protection of up to $1,000 if your hotel or motel is burgled in the United States or Canada

While some cards have a provision for accidental death or dismemberment, the Scotiabank Gold American Express Card offers Common Carrier Travel Accident Insurance, which pays out in the event of catastrophic losses while travelling on an airplane or while in transit to or from the terminal. The maximum benefit for loss of life, total or permanent disability or multiple dismemberment is $500,000, while payout for partial dismemberment is $250,000.

BMO Air Miles World Elite Mastercard

The BMO Air Miles World Elite Mastercard is among the best Air Miles credit cards available, offering earn rates on rewards that outpace most other Air Miles cards on the market as well as decent travel insurance for a $120 annual fee.

Whether you’re travelling out of the province or out of the country, this card offers up to $5 million in coverage for eligible medical expenses for the first 15 days of travel if you are age 64 or younger. You are not eligible for coverage if you are 65 or above. Eligible medical expenses include:

- Emergency hospital, ambulance and medical

- Emergency air transportation or evacuation

- Professional services of a physiotherapist, chiropractor, osteopath, chiropodist or podiatrist

- Emergency dental

- Transportation to bedside

- Return of deceased

- Hotel and meals

- Return of vehicle

Under the Common Carrier Insurance provision (similar to Accidental Death and Dismemberment), this card pays out up to $500,000 in the event of accidental injury or death while you are entering or travelling on a common carrier.

If you need to cancel your trip before departure due to a covered reason, such as illness, complications of pregnancy (up to 31 weeks) or cancellation of a business meeting, this card offers up to $1,500 per person ($5,000 per account) in trip cancellation insurance. If you’ve already left on your trip and you need to interrupt or delay your travels, this card reimburses up to $2,000 per person (maximum $10,000 per account) under the trip interruption/trip delay coverage.

Flight Delay Insurance provides $500 in coverage if your flight is delayed more than four hours for expenses such as additional accommodation or meals.

If your bags are lost, stolen or damaged while travelling on a common carrier, Baggage Insurance pays out up to $500 per covered person ($1,000 per account per trip) and up to $500 per covered person ($1,000 per account per trip) if your bags are delayed by more than six hours, compared to four hours for the other two cards. And if your loss is due to a hotel burglary, this card pays up to $1,000 to replace or repair your personal property.

Given the included coverage available with these credit cards, how do paid policies differ? Premium prices vary based on traveller age, destination, coverage amounts and length of trip and add an extra expense to a potentially already big expenditure. Is it worth the extra cost?

Unlike credit cards, the main benefit of a standalone travel insurance plan is choice. Many offer a selection of plan options, such as an all-inclusive plan, emergency medical only or trip cancellation/interruption only. Standalone policies may feature higher coverage limits, or offer additional endorsements, such as a pre-existing condition rider, like the Stable for 3 Months add-on offered by Desjardins , that reduces your stability period (or the amount of time your health must be considered “stable” before you leave on your trip), coverage for adventurous activities that are usually excluded from travel insurance plans ( World Nomads covers more than 250) and Cancel For Any Reason (CFAR) coverage, such as that offered by CAA Travel Insurance .

While the travel insurance offered with your credit card is covered in the annual fee, you must pay for a standalone travel insurance policy, and premiums vary depending on your age, length of your trip, your answers to a health questionnaire (if required) and the amount of coverage you choose.

Here’s a deeper look at the corresponding standalone available from TD, Scotiabank and BMO to see how they compare to the credit card travel insurance.

TD Insurance Travel Insurance

TD Insurance Travel Insurance offers two single-trip insurance plans for trips outside of Canada: The Medical Plan and the Trip Cancellation and Interruption Plan. You can purchase one or both plans within a single policy. There’s also a multi-trip annual option if you travel several times within a year.

Like the TD® Aeroplan® Visa Infinite Privilege card, TD Insurance offers up to $5 million of emergency medical coverage, but there’s no stipulated days of coverage (unless you purchase a multi-trip plan). The maximum payouts are equal for benefits such as accidental dental and the costs to bring a bedside companion to you, but the standalone policy offers additional coverage including:

- Dental treatment due to pain, up to $500

- Paramedical services, such as a physiotherapist, up to $300 per specialist

- Subsistence allowance due to a medical delay, up to $1,500

- Incidental hospital expenses, such as a TV or parking, up to $500

The standalone insurance offers an update for trip cancellation insurance, up from $5,000 per trip with the card to a maximum of $25,000 with the separate policy.

It’s worth noting that the baggage insurance offered by the credit card is superior to that of the standalone policy. For example, the baggage delay benefit for the standalone policy is up to $400 after a 12-hour delay, while the credit card pays out up to $1,000 after four hours.

Scotia Travel Insurance

Scotia Travel Insurance offers comprehensive coverage in the event of a medical or travel emergency, including an all inclusive plan, emergency medical only and trip cancellation/interruption only plan. There’s also a COVID-19 Pandemic Travel Plan if you’re worried about testing positive for COVID-19 during your trip.

A big difference between the Scotiabank Gold American Express Card travel insurance and the standalone plan is the maximum emergency medical benefit: While the credit card offers a maximum of $1 million in coverage, the standalone policy offers up to $10 million in coverage, again without the trip duration restrictions of the credit card. While the credit card has a robust list of eligible medical expenses, the standalone policy is even more comprehensive, offering higher limits for emergency dental ($3,000), vehicle return ($3,000) as well additional expenses including:

- Dental treatment due to pain, up to $300

- Paramedical services, such as a physiotherapist, up to $700 per injury

- Subsistence allowance due to a medical delay, up to $2,000

- Incidental hospital expenses, such as a TV or parking, up to $300

- Childcare expenses during hospitalization, maximum $500

Like all insurance policies, the cost of a Scotia Travel Insurance plan depends on factors such as the cost of your trip, your age and the amount of coverage you choose. With a Scotia Travel Insurance plan you can reduce your premium cost by choosing a $500, $1,000, $5,000 or $10,000 deductible, or the amount you pay before your emergency medical coverage kicks in.

While all insurance policies have stipulations and exclusions about pre-existing conditions, essentially any health condition that existed before the start of your coverage, Scotia Travel Insurance offers an Individual Medical Underwriting Plan for travellers of any age who would like their pre-existing medical conditions covered with no stability requirements.

BMO Travel Insurance

BMO Travel Insurance offers three core plans for travelling outside of Canada: The Premium Travel Plan, Travel Medical Plan and Trip Protection Plan.

Similar to the BMO Air Miles World Elite Mastercard, the paid policy offers up to $5 million in emergency medical coverage. The medical coverage options are also similar. While the standalone policy does not offer flight or travel accident coverage, the credit card offers $500,000 in Common Carrier Insurance. However, the paid policies offers superior levels of trip cancellation and trip interruption coverage.

A big plus of this plan compared to the credit card is there is no maximum age.

Main Benefits of Paid Policies

There’s no question that a paid policy greatly increases the amount of medical reimbursement available to you in case of injury or illness. In most cases, there’s also more comprehensive coverage, such as reimbursement for childcare costs in the event you are hospitalized or evacuation from a remote area.

Paid policies may provide more opportunities to customize your coverage, and offer additional riders, discounts and even specialized coverage, such as a pandemic plan.

Paid policies offer non-tangible benefits as well. Most companies include extra resources for policyholders to help you plan or research safety issues for your destination before travelling. There are also assistance hotlines you can contact while traveling to get recommendations on doctors or medical facilities abroad.

The biggest downside is that you need to shell out additional money for a standalone policy while credit card travel insurance is included in your annual fee. However, insurance is there to protect your assets in case disaster strikes, so the question remains—how much does peace of mind cost you?

Bottom Line

Credit cards offer real, tangible travel insurance benefits that can protect you from unexpected bills. However, there’s no single credit card that covers every facet of travel coverage and many travellers will prefer a more comprehensive policy, especially if you are older or have pre-existing health issues.

In general, for simple trips, credit card insurance will often suffice. But travellers looking for extensive medical and/or evacuation insurance will need to purchase a separate policy or be prepared to pay for possible expenses out of pocket. A third option is that most standalone policies offer a top-up option where you can purchase insurance in addition to an existing policy, such as a credit card.

Ultimately, there is no one-size-fits all to travel insurance. But the good news is, with all the many options on the market there is certainly one to fit your needs and your budget.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Student Credit Cards

- Best Secured Credit Cards in Canada

- Best Business Credit Cards

- Best of Instant Approval Credit Cards

- Best Prepaid Credit Cards

- Best No-Annual-Fee Credit Cards

- Best Low-Interest Credit Cards

- Best Neo Financial Credit Cards

- Best Visa Cards

- Best Air Miles Credit Cards

- TD Aeroplan Visa Infinite Privilege Review

- EQ Bank Card Review

- TD Aeroplan Visa Platinum Card Review

- Scotiabank Platinum American Express Card

- TD® Aeroplan® Visa Infinite* Card

- KOHO Prepaid Mastercard Review

- MBNA Rewards World Elite Mastercard

- MBNA True Line Mastercard Review

- The American Express Business Edge Card Review

- TD First Class Travel Visa Infinite Card

- TD Rewards Visa Card Review

- RBC Avion Visa Infinite Review

- Neo Secured Credit Card Review

- Home Trust Secured Visa Review

- American Express Aeroplan Card Review

- Tangerine Money-Back Card Review

- TD Cash Back Visa Infinite

- TD Platinum Travel Visa Card Review

- Scotiabank Scene+ Visa Card

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

American Express Cobalt vs. Scotiabank Gold American Express Card

- TD First Class Travel Vs. TD Aeroplan

- Credit Card Expiration Dates: What You Need To Know

- What Is The Highest Limit Credit Card In Canada?

- What Is The Highest Credit Score Possible?

- Money transfer from Credit Card to the Bank

- How To Get Cash From A Credit Card At An ATM

- The Stack Mastercard Is No More

- How Is Your Credit Card Interest Calculated?

- How To Pay Your Mortgage With A Credit Card

- Does Applying For A Credit Card Hurt Your Credit?

- How To Check Your Credit Card Balance

- Cathay Pacific and Neo Financial Are Launching A Credit Card

- 4 Ways To Consolidate Credit Card Debt

- How To Get A Business Credit Card

- Canceling Credit Cards: Will I Get My Annual Fee Back?

- Can I Use A Personal Card For Business Expenses?

More from

How the pc optimum program works, expedia for td: is it worth it, how american express front of the line works in canada, 4 steps to take if your card is declined, credit card vs. debit card in canada: differences explained.

Becky Pokora is an avid traveler with a particular love for the outdoors. She's always looking for new ways to make travel easier, more memorable, and more affordable, particularly by using miles and points.

HelloSafe » Travel Insurance » TD

Is TD travel insurance the best in 2024?

verified information

Information verified by Alexandre Desoutter

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Visiting another country or province without travel insurance can be a costly mistake. Indeed, did you know that an overnight stay in a hospital in the United States can exceed $14,000 CAD? Some countries might even refuse to help you if you are unable to prepay for treatment.

It is not fun to think about, but travel insurance is a necessity when you are away from home . It guarantees your ability to get and pay for health care, if and when you need it. Beyond medical emergencies, travel insurance can also help with flight issues and lost luggage, amongst other things.

That being said, what to think about TD travel insurance in Canana? What coverage is TD providing? For what price? What are its pros and cons? Read our review on TD's medical travel insurance, get a quote, and see how the competitors fare.

Our 2024 review of TD travel insurance

TD Bank, or the Canada Trust Bank, is one of Canada's largest financial institutions.

Besides financial services, TD Bank is a trusted insurance provider offering travel insurance among other products.

See below TD's travel insurance pros and cons:

Why TD could be right for you:

TD Bank is a trusted insurance brand Offers both single trip and annual insurance plans High coverage amounts available

Why TD may not be right for you:

Only open to Canadian residents Required to have a provincial health plan

Before choosing TD travel insurance, compare options and quotes. A little shopping around can help you to save money and find a coverage that really fits your needs:

Compare the best travel insurance plans on the market!

What does TD travel insurance cover?

Td single trip plan.

- TD's medical travel insurance covers you for the following:

TD Annual Travel Plan

- This travel insurance covers you for the following:

TD Trip Cancellation/Trip Interruption Insurance

Td bank card travel coverage.

- TD Bank offers several bank card options with travel coverage, such as:

- TD Cash Back Visa Infinite Card

For more information on TD travel insurance, download the PDF below:

Good to know

Most credit cards offer some king of travel coverage . It rarely is as covering as a travel plan purchased with a private insurance company.

How much does a travel insurance with TD cost?

The cost of travel insurance coverage with TD depends on several variables:

- Your desired coverage and otpions.

- Your deductible.

- Your waiting period.

- Your destination(s).

- The lenght of your trip.

Therefore, we advise you to get a customized quote for an accurate rates for TD travel insurance.

Before settling on TD travel insurance, check out other travel insurance plans, coverages and prices using our free comparison tool below:

How to purchase a travel insurance plan with TD?

Purchase TD's health travel Insurance:

- Online through TD's dedicated travel insurance website. You could get a travel insurance quote on TD's website.

How to file a travel insurance claim with TD?

To make a travel insurance claim with TD, you have several options:

- If you prefer to send paper documents, please send them to the following address: Global Excel Management Inc. 73 Queen Street Sherbrooke, Quebec J1M 0C9

Does TD cover Covid-19-related travelling issues?

Within Canada, Covid-19 related medical claims are eligible for coverage if they are not already covered under your provincial health insurance.

Outside of Canada, claims originating in countries under an "Avoid non-essential travel" or "Avoid all travel" advisory before your travel date are not eligible.

Trip Cancellation and Trip Interruption insurance are eligible for reimbursement should you test positive for Covid-19 and are unable to travel.

How can I contact TD travel insurance?

For emergencies:

- For general inquiries: 1-800-293-4941**

Alexandre Desoutter has been working as editor-in-chief and head of press relations at HelloSafe since June 2020. A graduate of Sciences Po Grenoble, he worked as a journalist for several years in French media, and continues to collaborate as a as a contributor to several publications.

- Our Bloggers

Select Page

TD Travel Medical Insurance with your TD Credit Card

Posted by Maple Miles | Nov 3, 2023 | Travel Tips | 0

I have summarized a few important details as you evaluate whether you need additional emergency medical insurance during your travels.

The following credit cards have the Travel Medical Insurance coverage with TD:

- TD Aeroplan Visa Infinite ( Certificate of Insurance )

- TD First Class Travel Visa Infinite ( Certificate of Insurance )

- TD Cash Back Visa Infinite ( Certificate of Insurance )

- TD Aeroplan Visa Infinite Privilege ( Certificate of Insurance )

The information listed below is my interpretation of the insurance policy.

For other credit card issuers, information about their travel insurance policy is available here:

- American Express Out of Province and Country Emergency Medical Insurance

- BMO Out of Province Emergency Medical Protection Insurance

- CIBC Out of Province Emergency Medical Travel Insurance

- RBC Out of Province Emergency Medical Travel Insurance

- Scotiabank Travel Emergency Medical Insurance

- TD Travel Medical Insurance

Coverage Eligibility

The basic coverage provided for all the listed cards are:

- Coverage is provided to the cardholder, cardholder’s spouse, and cardholder’s dependent children.

- Coverage is limited to $2,000,000.

- The dependent children do not need to be traveling with the cardholder or the cardholder’s spouse.

- Additional cardholders are covered as well.

Exclusions of Basic Coverage

Important Exclusions:

- Pre-existing medical conditions need to be stable at least 90 days prior to your trip departure date, for those under 65, or 180 days, for those 65 or older.

- Scuba diving (unless you have a designation), motorized race, motorized speed contest, bungee jumping, parachuting, rock climbing, mountain climbing, hang-gliding or skydiving, amongst other sports and high risk activities.

Coverage Benefits

Differences between cards.

The major difference between the credit cards is what is the age group that is covered by the insurance and how long they are covered for.

One unique situation about the TD credit cards are that the benefits are extended to the dependent children and spouse, and even additional cardholders, even if they are not traveling with the cardholder.

Join our mailing list to receive the latest news and updates from our team.

You have successfully subscribed, maple miles.

Hello Hello, this is Moli! Welcome to Maple Miles. A tech professional on a weekday, and a global traveler outside of work. I manage my entire family's travel, connecting us across the globe, between Canada (Vancouver is home, for now), India and whatever country comes in between. I love water, so you might always find me either dreaming of a beach, or actually at a beach in my free time.

More Posts from Maple Miles

Oh, Hello from Maple Miles

March 8, 2023

Best Ways to Earn Free WestJet Flights

March 9, 2023

WestJet Companion Voucher: How to earn them?

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Most Popular Posts

Our Authors

The Unaccompanied Flyer

Travel Gadget Reviews

The Flight Detective

Takeoff To Travel

The Hotelion

Bucket List Traveler

MJ on Travel

The Points Pundit

Family Flys Free

Recent Reviews

- St Regis Cairo Review – A perfect stay Score: 100%

- Six Passengers in Two Business Class Seats in Gulf Air Score: 90%

- Review: Hyatt Place Waikiki Score: 83%

- Review: Hyatt Centric Waikiki Score: 81%

- Gulf Air Business Class from Mumbai to Bahrain Score: 65%

Key benefits of travel medical insurance

- Travel medical insurance coverage

- Who needs medical travel insurance?

Choosing the right travel medical insurance

How to use travel medical insurance, is travel medical insurance right for your next trip, travel medical insurance: essential coverage for health and safety abroad.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- Travel medical insurance covers unexpected emergency medical expenses while traveling.

- Travelers off to foreign countries or remote areas should strongly consider travel medical insurance.

- If you have to use your travel medical insurance, keep all documents related to your treatment.

Of all the delights associated with travel to far-flung locales, getting sick or injured while away from home is low on the savvy traveler's list. Beyond gut-wrenching anxiety, seeking medical treatment in a foreign country can be exceedingly inconvenient and expensive.

The peace of mind that comes with travel insurance for the many things that could ail you while abroad is priceless. As options for travel-related insurance abound, it's essential to research, read the fine print, and act according to the specifics of your itinerary, pocketbook, and other needs.

Travel insurance reimburses you for any unexpected medical expenses incurred while traveling. On domestic trips, travel medical insurance usually take a backseat to your health insurance. However, when traveling to a foreign country, where your primary health insurance can't cover you, travel medical insurance takes the wheel. This can be especially helpful in countries with high medical care costs, such as Scandinavian countries.

Emergency medical evacuation insurance

Another benefit that often comes with travel medical insurance, emergency medical evacuation insurance covers you for any costs to transport you to an adequately equipped medical center. Emergency medical evacuation insurance is often paired with repatriation insurance, which covers costs associated with returning your remains to your home country if the worst happens.

These benefits are for worst-case scenarios, but they might be more necessary depending on the type of trips you take. Emergency medical evacuation insurance is helpful if you're planning on traveling to a remote location or if you're traveling on a cruise as sea to land evacuations can be costly. Some of the best travel insurance companies also offer non-medical evacuations as part of an adventure sports insurance package.

It's also worth mentioning that emergency medical evacuation insurance is required for international students studying in the US on a J Visa.

Types of coverage offered by travel medical insurance

The exact terms of your coverage will vary depending on your insurer, but you can expect most travel medical insurance policies to offer the following coverages.

- Hospital room and board

- Inpatient/outpatient hospital services

- Prescription Drugs

- COVID-19 treatment

- Emergency room services

- Urgent care visits

- Local ambulance

- Acute onset of pre-existing conditions

- Dental coverage (accident/sudden relief of pain)

- Medical care due to terrorist attack

- Emergency medical evacuation

- Repatriation of mortal remains

- Accidental death and dismemberment

Travel medical insurance and pre-existing conditions

Many travel insurance providers will cover pre-existing conditions as long as certain conditions are met. For one, travelers need to purchase their travel insurance within a certain time frame from when they placed a deposit on their trip, usually two to three weeks.

Additionally, travel insurance companies usually only cover stable medical conditions, which are conditions that don't need additional medical treatment, diagnosis, or medications.

Who needs travel medical insurance?

Even the best-laid travel plans can go awry. As such, it pays to consider your potential healthcare needs before taking off, even if you are generally healthy. Even if well-managed, preexisting conditions like diabetes or asthma can make a medical backup plan even more vital.

Having what you need to refill prescriptions or get other care if you get stuck somewhere other than home could be essential to your health and well-being. That's without counting all the accidents and illnesses that can hit us when away from home.

Individuals traveling for extended periods (more than six months) or engaging in high-risk activities (think scuba diving or parasailing) should also consider a solid medical travel plan. Both scenarios increase the likelihood that medical attention, whether routine or emergency, could be needed.

In the case of travel via the friendly seas, it's also worth considering cruise trip travel insurance . Routine care will be available onboard. But anything beyond that will require transportation to the nearest land mass (and could quickly become extremely expensive, especially if you're in another country).

Like other types of insurance, medical travel insurance rates are calculated based on various factors. Failing to disclose a preexisting health condition could result in a lapse of coverage right when you need it, as insurers can cancel your policy if you withhold material information. So honesty is always the best policy.

Even the best-laid travel plans can go awry. As such, it pays to consider your potential healthcare needs before taking off, even if you are generally healthy. Making the right choice when shopping for travel medical insurance can mean the difference between a minor hiccup in your travels and a financial nightmare.

When a travel insurance company comes up with a quote for your policy, they take a few factors into consideration, such as your age, your destination, and the duration of your trip. You should do the same when assessing a travel insurance company.

For example, older travelers who are more susceptible to injury may benefit from travel medical insurance (though your premiums will be higher). If you're traveling for extended periods throughout one calendar year, you should look into an annual travel medical insurance plan . If you're engaging in high-risk activities (think scuba diving or parasailing), you should seek a plan that includes coverage for injuries sustained in adventure sports.

In the case of travel via the friendly seas, it's also worth considering cruise trip medical travel insurance. Routine care will be available onboard. But anything beyond that will require transportation to the nearest land mass (and could quickly become extremely expensive, especially if you're in another country).

Travel medical insurance isn't just for peace of mind. If you travel often enough, there's a good chance you'll eventually experience an incident where medical treatment is necessary.

Before you submit your claim, you should take some time to understand your policy. Your travel medical insurance is either primary (you can submit claims directly to your travel medical insurance provider) or secondary (you must first submit claims to your primary insurance provider). In the case of secondary travel medical insurance, a refusal notice from your primary insurance provider, even if it does not cover medical claims outside the US, is often required as evidence of protocol.

On that note, you should be sure to document every step of your medical treatment. You should keep any receipts for filled prescriptions, hospital bills, and anything else documenting your medical emergency.

As many people have found out the hard way, reading the fine print is vital. Most travel insurance policies will reimburse your prepaid, nonrefundable expenses if you fall ill with a severe condition, including illnesses like COVID-19.

Still on the fence about whether or not travel insurance is worth it ? It's worth noting that many travel insurance plans also include medical protections, so you can also protect against trip cancellations and other unexpected developments while obtaining travel medical insurance.

While short, domestic trips may not warrant travel medical insurance, it may be a good idea to insure longer, international trips. You should also consider travel medical insurance for trips to remote areas, where a medical evacuation may be expensive, and more physically tasking trips.

While shopping for travel medical insurance may not be fun, a little advance leg work can let you relax on your trip and give you peace of mind. After all, that is the point of a vacation.

Medical travel insurance frequently asked questions

Trip insurance covers any unexpected financial losses while traveling, such as the cost of replacing lost luggage, trip interruptions, and unexpected medical expenses. Travel medical insurance just covers those medical expenses without the trip interruption or cancellation insurance.

Travel insurance companies usually offer adventure sports as add-on coverage or a separate plan entirely. You'll likely pay more for a policy with adventure sports coverage.

Many travel medical insurance policies now include coverage for COVID-19 related medical expenses and treat it like any other illness. However, you should double-check your policy to ensure that is the case.

- Main content

Genymoney.ca: Make the Most of your Money

6 Best Travel Credit Cards for Seniors in Canada

My in law had some health issues last year and after she got better, we were thinking of doing a spontaneous small road trip down to the US and some traveling overseas (this was before all this COVID-19 hullaballoo, there are probably zero seniors traveling right now, haha). While she was looking at coverage for insurance through her credit card, we were shocked to find that coverage was actually very minimal especially for her pre-existing condition and age. Here are the best travel credit cards for seniors in Canada.

This post may contain affiliate links. Please see genymoney.ca’s disclaimer for more information.

In the end she decided not to do the small road trip down to the United States because she would not be covered for health issues related to her pre-existing condition should anything happen, and we all know how much medical costs can be in the US.

Last year, my husband was admitted for less than 24 hours and it cost around $10,000 . Thankfully we had travel insurance through my employer. Your travel insurance will ask you if you have eligible credit card travel insurance and they will go after them first to try and collect money.

This goes without saying that it reinforces my desire to travel as much as I can before I am too old to enjoy my travels and also too aged to qualify for decent travel insurance without paying an arm and a leg. I will still want to retire happy and travel though, but ideally I’d like to travel to my bucket list destinations before I turn 65 or even before I have to start reviewing my end of life financial checklist .

Also with the COVID-19 pandemic ongoing and vaccinations available, I think if I were a senior I would be itching to travel again. And they are. I met some friendly seniors on a bus in Hawaii who were having a great time on a 30 day cruise of the South Pacific!

Table of Contents

Emergency Travel Medical Benefits as a Senior

Many travel credit cards offer emergency travel medical benefits as part of their insurance benefits package. This is a great perk with many credit cards.

However, after age 65, the length of coverage is usually drastically shortened.

Most credit card companies only offer 3 to 4 days of travel medical insurance.

We all know that there are more health issues occur as you get older.

More strikingly, after age 75, the emergency travel insurance benefits on many credit cards do not exist.

There’s not a big window to travel worry-free (and for cheaper)– between age 65 and 75.

After age 65, as a retiree and senior you may have more pre-existing conditions such as diabetes, osteoarthritis, high blood pressure, and heart disease.

Emergency medical issues related to pre-existing conditions are not covered under the credit card travel insurance if you read the fine print.

Pre-existing Conditions and Travel for Retirees

The problem with many travel emergency medical insurance from credit cards is that there is limited coverage for pre-existing conditions.

What does a pre-existing condition mean? Pre-existing conditions usually mean that a doctor, had investigated, diagnosed, or treated, changed or prescribed medications.

For those under 75 years of age and older than 65, pre-existing conditions are typically not covered if anything was documented/ changed in the past 180 days (6 months).

If you are over age 75, then it is one year (365 days) prior to the date the trip was booked.

So if you have high blood pressure and your blood pressure medication was increased 2 months before your trip by your family doctor or cardiologist, any medical emergency that occurs during your trip related to high blood pressure is not covered .

I’m not an insurance underwriter or anything but to me when I read this, it seems like it can get to be a bit of a grey zone.

Though there are medical insurance packages that you can get that cover pre-existing conditions, and these come at an additional cost.

Anyway, here are the rare travel rewards credit cards that have extended medical insurance coverage (longer than the typical 3 or 4 days offered by other credit cards) if you are over the age of 65.

In this post about credit cards with travel insurance for seniors, I rank them from the highest number of days insured to the lowest.

It was interesting to see the differences in pre-existing coverage after reading the fine print in the Terms and Conditions. Read the Terms and Conditions yourself and do your own due diligence for these credit cards.

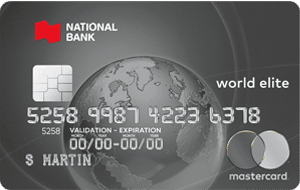

National Bank World Elite Mastercard

The National Bank World Elite Mastercard is $150 annually.

- You need $80,000 minimum personal income or $150,000 household (I suppose you’ll have to be a rich retiree) OR you have to have at least $400,000 in investable assets

- Coverage is up to $5 million emergency medical coverage

- If you are age 65 to 75: 15 days consecutive days are covered

- 76 and over: No coverage

- A part or total cost of the trip must be charged to the card for insurance coverage

- Pre-existing conditions for age 61 and over: No changes or adjustments to your pre-existing condition treatment plan for the last 6 months.

National Bank World Mastercard

The National Bank World Mastercard is $115 annually.

- You need $60,000 minimum personal income or $100,000 household OR at least $250,000 in investable assets

- More information here in the Certificate of Insurance

Meridian Visa Infinite Travel Rewards Card

The Meridian Visa Infinite Travel Rewards Card boasts travel insurance for up to 48 days (48 days if you are under age 59).

It is $99 annually but currently there is first year free !

- You have to be an Ontario resident

- You need $60,000 minimum income or $100,000 household income to be eligible.

- Coverage is provided by Desjardins

- I called Meridian and they say you don’t to book travel on the card to be eligible for the emergency medical coverage.

- If you are over age 75, you are not covered

- Pre-existing conditions for age 55 and over : No changes or adjustments to your pre-existing condition for the last 6 months otherwise illness related to your pre-existing is not covered. You have to have had your pre-existing condition for the last six months. If you are 55 and under it is 3 months.

- Also has mobile device insurance if you charge your plan to your card or you pay for your mobile device in full on the card

Desjardins Odyssey World Elite

The Desjardins Odyssey World Elite Mastercard is $130 annually.

You get 8 free passes to the Desjardins Odyssey lounge but this is in Montreal’s airport so unless you live in Montreal I don’t find this very useful. Cook perk though.

- You need $80,000 minimum personal income or $150,000 household income to be eligible.

- Coverage is up to $5 million in emergency medical coverage

- The unique thing is that your grandchildren also benefit from complimentary intergenerational insurance coverage when they travel with you!

- Coverage is provided by Desjardins Financial Security

- It doesn’t appear that you have to book your travel using this card

- If you are age 65 to 75, 15 consecutive days are covered.

- Your trip must begin and end in Canada in your province of residence though it doesn’t appear that you have to book travel using this card

- You have to call Assistance Service before you go to hospital or clinic otherwise you will have to pay 30% of service up to a maximum of $3000.

- Pre-existing conditions for age 55 and over : No changes or adjustments to your pre-existing condition for the last 6 months otherwise illness related to your pre-existing is not covered. It has to be stable. If you are 55 and under it is 3 months.

National Bank Platinum Mastercard

The National Bank Platinum Mastercard is $70 annually.

- There is no stated minimum personal income

- You and your spouse and dependents are covered for up to $5 million emergency medical coverage

- Up to 10 days if you are under age 76

- If you are 76 and over, there is no coverage

Scotiabank Passport Visa Infinite

The Scotiabank Passport Visa Infinite Card is $150 annually but it is free for the first year right now if you sign up before July 1, 2024.

It is also free for the first year if you have the Preferred Package.

It is free ongoing if you have the Ultimate Package chequing accounts.

You can even pair it with a Canadian bank promotion application and you’ve just made $350!

You get 6 free Visa Airport Companion Program visits (that’s a lot, typically it is 4) and 30,000 Scene Rewards points if you spend $1000 in the first 3 months (that’s about $300 worth in travel).

Here’s my recent airport lounge visit (free) thanks to the Passport Visa Infinite.

There’s also no foreign exchange mark up, you just pay the exchange rate.

Also, it’s $0 for supplementary card holders.

Usually the credit card’s foreign exchange fee is 2.5%.

- $60,000 minimum personal income, $100,000 minimum household income to qualify

- You, your spouse are covered up to $1 million emergency medical coverage

- If you are over 65 it covers for the first 10 consecutive days

- If you have pre-existing conditions these are not covered if anything changed with your treatment plan by the doctor or if you had an investigation done in the past 6 months (180 days) if you are under 75.

- If you are over 75, there’s no coverage for pre-existing conditions if anything changed with your treatment plan for 1 year (365 days)- that means no increase or decrease or addition of medications.

- You are not eligible for the travel emergency insurance if you participate in professional sports, speed contests, dangerous sports or events including recreational scuba diving 🙂

- You need to book 75% of your trip expenses on this credit card to be eligible for the medical insurance

Here’s my review of the Scotiabank Passport Visa Infinite . We recently got it.

Genymoney.ca’s Verdict

Personally I think many of these credit cards are similar and offer great benefits for travel medical for seniors. Most of them are first year free right now, and you get 15 days of coverage.

If you were to buy 15 days of coverage and have pre-existing conditions such as high blood pressure, or a previous stroke, this would probably cost you around $900.

Of course, you could get an annual medical insurance coverage through something like CAA as well, but the trip limit is still 15 days of coverage.

If you are a retiree with low income but high investable assets, the National Bank Mastercards are all pretty good.

Finally, The Scotia Passport Visa Infinite is a great option if you are over 75 and healthy and active- the no foreign exchange fee is a huge draw.

Related: Transunion vs Equifax, Why the 100 Point Difference Between the Scores?

Credit Card Travel Insurance for Seniors Summary

You don’t have to worry too much about the best credit card for travel insurance over 65, but after 75 it’s different.

To summarize, here are the credit cards that provide credit card travel insurance over 65 but under 76. They are over the typical three to four days travel insurance coverage.

Unfortunately, If you are over 75 your options are very limited.

Here are the credit cards that have long duration travel insurance for seniors, the best credit cards for seniors in Canada:

- National Bank World Elite Mastercard (15 days)

- National Bank World Mastercard (15 days)

- Meridian Visa Infinite Travel Rewards Card (15 days)

- Desjardins Odyssey World Elite (15 days)

- National Bank Platinum Mastercard (10 days)

- The Scotia Passport Visa Infinite (10 days) AND includes coverage for age over 75

If you are under 75 and older or are 65 but have pre-existing conditions (especially recent pre-existing conditions) you may want to consider purchasing separate travel insurance that covers pre-existing conditions to cover you on your trip.

Hope you found this list of best Canadian credit card for seniors travel insurance helpful!

- PC Travel Review

- 10% cash back credit cards for Canadians

- Roam Mobility Alternative

- How do Scene Points Work?

I would think this is especially relevant for Canadian snowbirds who travel to a warmer destination for 6 months of the year, no credit card covers that much travel insurance for that duration of time.

In the end, my Mother In Law decided to go for a multi trip travel insurance policy which gave her coverage for up to a 2 week trip anywhere in the world and for unlimited trips for one year. The quote for this was slightly higher than a quote for a two week trip, so this is more of a ‘deal’.

Alternatively, you could get one of these cards and limit yourself to a 2 week trip abroad.

I tend to apply for a number of credit cards at once (definitely do not have a minimalist wallet ) and when I do, I usually check my credit score to make sure it hasn’t taken too much of a beating. You can get a free credit score check with Borrowell . Here’s my review of Borrowell .

Do you use travel insurance through your credit card or do you usually buy separate travel insurance?

What are the best credit cards with travel insurance for seniors in Canada in your opinion?

Free Dividend Yield Spreadsheet Tracker Download and Blog Updates

GYM is a 40 something millennial writing about personal finance since 2009 and interested in achieving financial freedom through disciplined saving, dividend and ETF investing, and living a minimalist lifestyle. Before you go, check out my recommendations page of financial tools I use to save and invest money. Don’t forget to subscribe for a free dividend yield spreadsheet and the free Young Money Bootcamp PDF.

You might also be interested in:

5 thoughts on “6 best travel credit cards for seniors in canada”.

Hi Geny – I’m 58, newly retired and spent my first winter as a Canadian snowbird. Thanks for bringing my attention to the insurance options thru credit cards. Here’s a couple of comments. I brought my Mom to Florida in 2018 for a week. She was 80, diabetic and self-administered her own insulin, but otherwise in relatively good health. We did research and she bought travel insurance thru the TD Bank for a reasonable price!

For me, my retirement health package, included decent travel insurance for up to 90 days, whereupon I was to “come back to Canada for a day” and renew for another 90 days. Instead, I bought add-on insurance for $4.96 per day,30 extra days for $150. Cheaper than traveling home!

@Carly- Congratulations on the retirement! $10 million is excellent coverage. Yes, it can be quite reasonable to buy extra medical insurance, and some even cover pre-existing conditions that are ‘not stable’ for an added cost. Personally if I were over 65 I would still buy medical insurance because I would not feel 100% comfortable relying on credit card medical insurance, but that’s just me. I think I saw in the news recently a COVID patient who survived but has a $1.9 million bill because of a 6 week hospital stay (they had insurance).

PS: Coverage was for $10,000,000 CAD

We tried applying for the Meridian card, it stops you on the first page if you don’t have an Ontario residential address.

@Ken Mc- Thank you I will update.

Leave a Comment Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Book Travel

- Credit Cards

Which Credit Cards Have the Best Insurance for Seniors?

Insurance coverage offered by credit cards often doesn’t get the same attention as a card’s other benefits. However, it’s an important element to be aware of, particularly for travellers over the age of 65.

While some insurance coverage is fairly comparable among credit cards within the same tier, this isn’t the case when it comes to emergency medical coverage, which can differ dramatically between the cards.

In this guide, we’ll outline the best options for securing coverage for you or your loved ones.

Emergency Medical Care Outside of Your Province of Residence

Before delving into the cards themselves, it’s important to go over what this insurance covers, and to establish a baseline of the lower-end of what you can expect in terms of coverage.

Emergency medical care insurance coverage is designed to reimburse you for a certain dollar amount in the event that you’re injured or experience a medical emergency while travelling outside your home province.

This coverage becomes even more relevant if you’re travelling internationally, where it may be more difficult to navigate and understand the local medical system and its costs.

With coverage, not only do you have peace of mind when you travel, but you can also prioritize getting care without worry, should you run into some bad luck.

As we mentioned above, the emergency medical care coverage can vary considerably across different credit cards; therefore, to establish a baseline from which to compare, let’s first look at the coverage offered by two popular cards.

Our first example, the American Express Cobalt Card, offers emergency medical coverage for the first 15 consecutive days of your trip if you’re 64 years old or under; however, once the cardholder turns 65, there’s no coverage at all.

Looking at higher-end cards, the TD Aeroplan® Visa Infinite Privilege* Card offers emergency medical coverage for an incrementally better four days if you’re 65 or older.

As we can see, neither of these cards offers much in the way of emergency medical coverage for travellers over 65.

Therefore, you’ll want to consider a credit card that provides the best insurance for anyone travelling in their golden years.

As always, be sure to read the card’s insurance booklet to understand what’s covered in your specific situation. If you ever have any questions, reach out to the card issuer to confirm what’s included.

National Bank World Elite Mastercard