- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase travel portal, you can use chase points to book flights, hotels, car rentals and more through its travel portal..

With the right amount of planning, it's possible to book your entire vacation, including flights , hotels , cruises , car rentals , tours and other activities, entirely on points through the Chase Travel SM portal.

But are you getting the best deal by doing this instead of transferring Chase Ultimate Rewards® points to travel partners and booking directly? It turns out there's a lot more to consider — everything from travel date flexibility and brand variety to the credit card you're using — if you want to get more value for your points by booking through Chase Travel SM .

Below, CNBC Select breaks down the best ways to book flights, hotels, cruises, tours and vacation activities through the Chase Travel SM portal with Ultimate Rewards® points.

How to use the Chase Travel SM Portal

- How to earn and redeem Chase Ultimate Rewards points

- How to get started with the Chase Travel portal

- How to book flights through the Chase Travel portal

How to book rental cars, cruises, and other travel activities

What to know about chase's airport lounges, bottom line, how to earn and redeem chase ultimate rewards® points.

To access Chase Travel SM , you'll need to have a credit card that earns Chase Ultimate Rewards® points, like the Chase Sapphire Preferred® Card , Chase Sapphire Reserve® , Ink Business Preferred® Credit Card , Ink Business Unlimited® Credit Card , Ink Business Cash® Credit Card , Chase Freedom Unlimited® or Chase Freedom Flex® .

The easiest way to earn Chase Ultimate Rewards points quickly is by taking advantage of the lucrative welcome bonuses offered by certain rewards cards:

- You'll earn 60,000 points by signing up for the Chase Sapphire Preferred and spending $4,000 within the first three months of opening your account. That's worth $750 when redeemed through Chase Travel SM

- With the Ink Business Preferred Credit Card 's welcome bonus, you'll earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel SM.

- The Chase Sapphire Reserve 's welcome bonus gives you 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

The card you're using to redeem Chase Ultimate Rewards points will also affect your point redemption value . For instance, if you're using the Chase Sapphire Preferred to book through the Chase Travel SM portal, points are worth 25% more (1.25 cents per point). But if you're booking through Chase Travel SM with the Chase Sapphire Reserve , points are worth 50% more (1.5 cents per point) — the other $0 annual fee Chase cards each carry a redemption rate of 1 cent per point.

That means the bonus points you'd earn from either the Chase Sapphire Preferred's welcome bonus is worth $750 towards travel and the Chase Sapphire Reserve's is worth $900 towards travel.

Chase Sapphire Preferred® Card

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

Ink Business Preferred® Credit Card

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5

Read our Chase Sapphire Reserve® review.

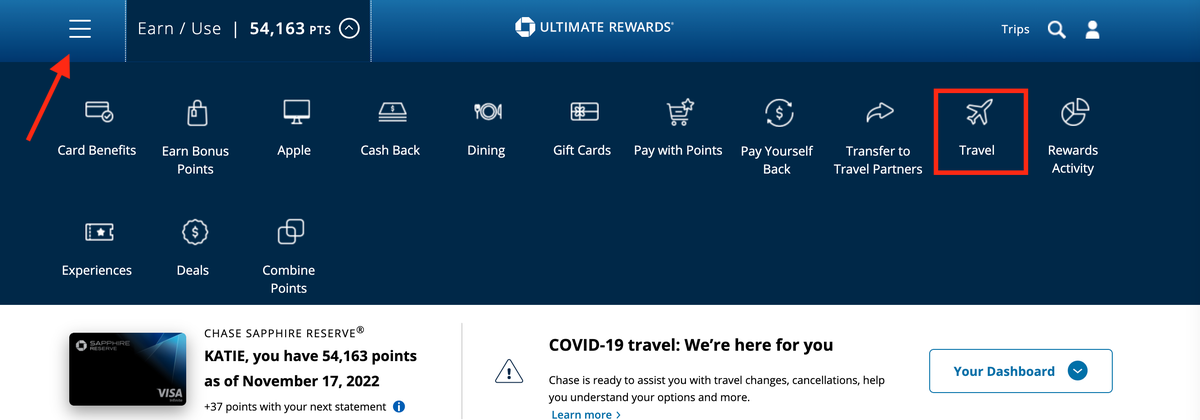

How to get started with the Chase TravelSM portal

To reach the Chase Travel SM portal, log into your Chase account, then click the area near the right side of the screen where it says the amount of your Chase Ultimate Rewards points. Depending on how many Chase credit cards you have, you may be asked to choose which one you want to proceed with.

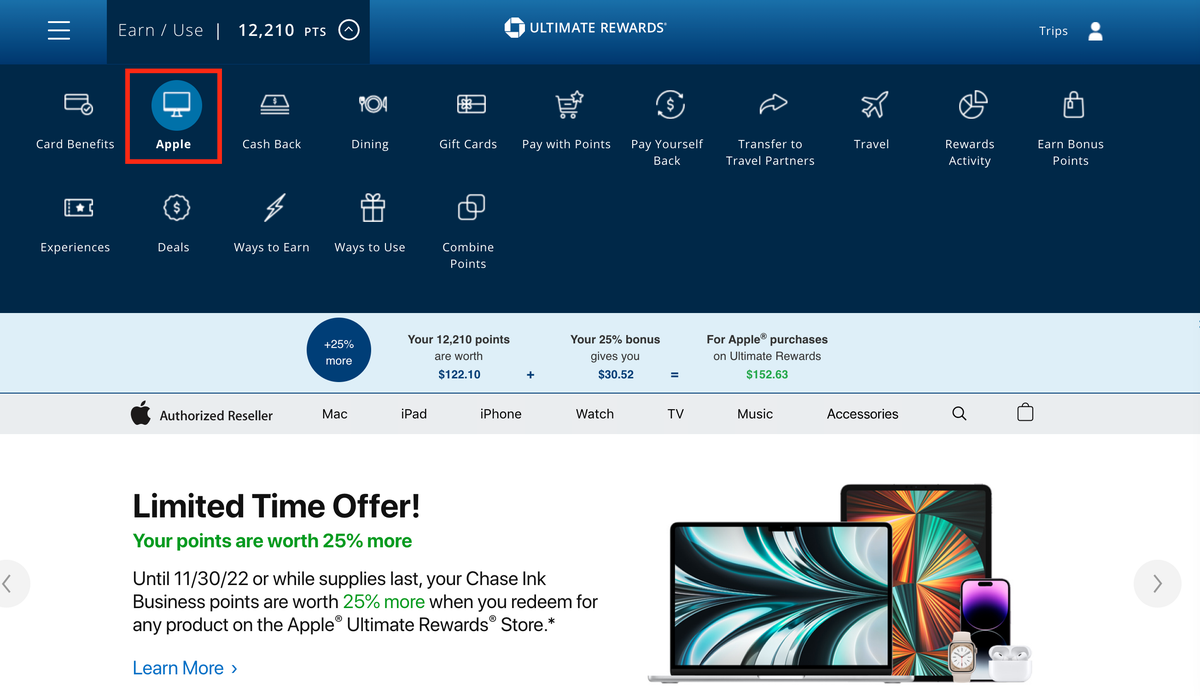

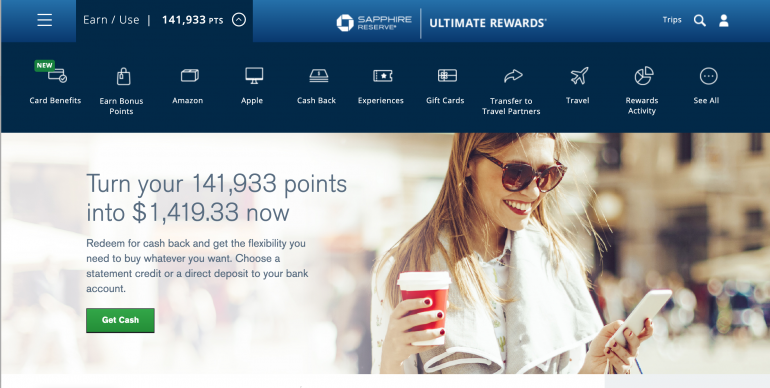

The next screen is your credit card's main dashboard, showing how many Ultimate Rewards points you currently have, as well as any deals or bonus opportunities. On the top of the page, you'll see several menus with redemption options.

While not the best redemption in terms of overall value, you could choose to use your Chase points for Apple and Amazon purchases, cash them in for gift cards and experiences. You can transfer points directly to one of Chase's 14 travel partners if you have a specific flight or hotel in mind. Otherwise, click "book travel" to enter the Chase Travel SM portal.

From here, you'll be able to search for flights, hotels, rental cars, activities and cruises. Simply choose your category, plug in your desired dates and details, and book with points, cash or some combination of the two.

Chase's travel partner programs

Currently, you can transfer your points to the following airline and hotel programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

How to book flights through the Chase TravelSM portal

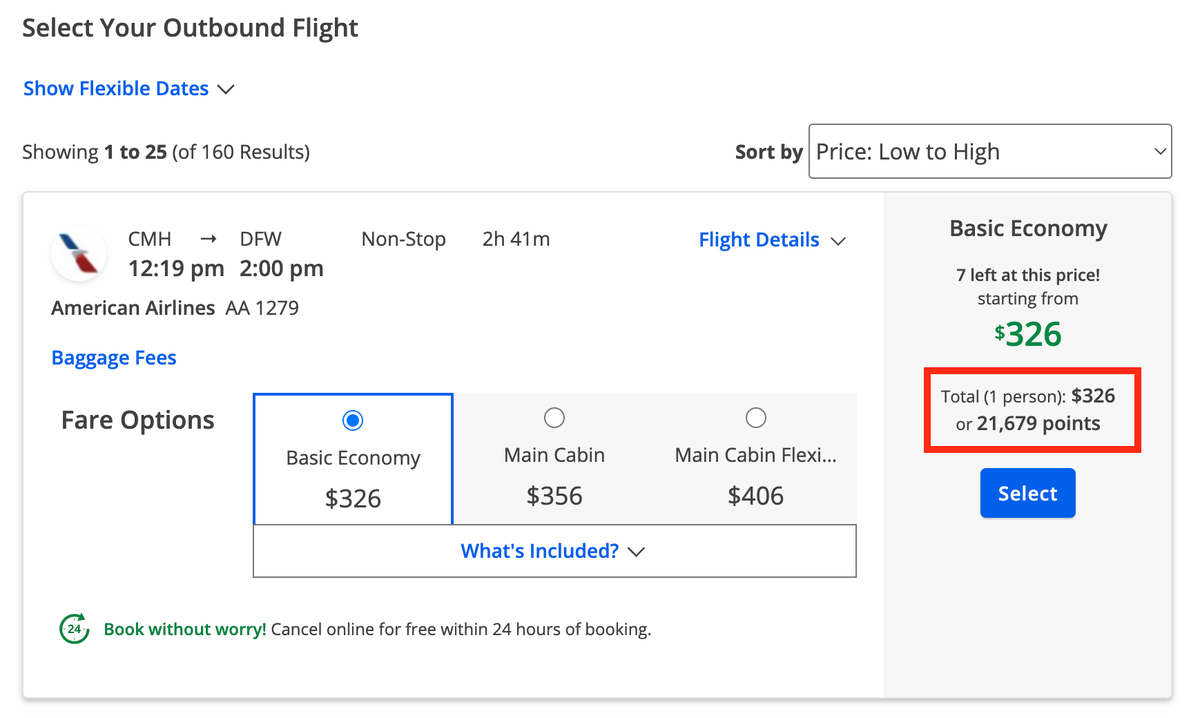

There are a few pros and cons to consider when booking flights through the Chase Travel SM portal. You won't have to worry about blackout dates or limited award availability, which makes it great if you're not flexible with dates and flight times. Just make sure you compare the number of points needed through the Chase Travel SM portal with how many points the airline would require if you were using its own miles, especially if you're hunting for a good deal on economy seats.

The catch with using the Chase Travel SM portal is you won't be able to shop for tickets on low-cost carriers like Spirit Airlines, Frontier Airlines, or Allegiant Air — you can search for flights on Alaska, Southwest, Delta, JetBlue, American, and United. You'll also be able to book flights on most international carriers.

Remember that you can still earn miles and elite credits on flights, as tickets booked through the Chase Travel SM portal are categorized as "paid" rather than as an award flight since you're "paying" for them with points instead of cash. Consider the taxes and fees you might have to pay if you were to transfer the points straight to one of Chase's travel partners versus booking directly through the portal, and to calculate and compare how many points and miles you'd earn by booking with either method.

You'll be able to search, filter, and sort by price, airline, booking class, departure time, arrival time, and departure airport. For this example, below, consider a round-trip flight from Seattle to Austin booked through the travel portal with a Chase Sapphire Preferred Card (redemptions are worth 1.25 cents per point):

Results included 107 results with an economy mix-and-match United and Delta fare for $370 or about 29,600 points being the most affordable option. For comparison's sake, the points price is about the same as what United and Delta are currently charging if you were to book the awards directly through the airlines, but Delta isn't a transfer partner of Chase. You also won't earn miles if you were to book these awards through the airlines, whereas you will earn miles when booking through Chase.

To finish booking your flight through the travel portal, select your route(s), review the details, choose how many points you'd like to use and complete your purchase.

Remember that if you're booking with money rather than points, you can earn extra rewards on your booking. In our example, if you paid $370 for a flight, you'd earn 1,850 Ultimate Rewards points with your Chase Sapphire Preferred or Reserve card. Either card earns 5X points on flight purchases through Chase Travel SM .

Booking travel with Southwest

In 2023, Chase also added the ability to use Ultimate Rewards points to book Southwest flights directly through the issuer's travel portal. To do so, simply search for the flight using the process described above. Your search results will only show Wanna Get Away and Wanna Get Away Plus fares. However, when you proceed with the booking, you'll also have the option to select an Anytime or Business Select fare.

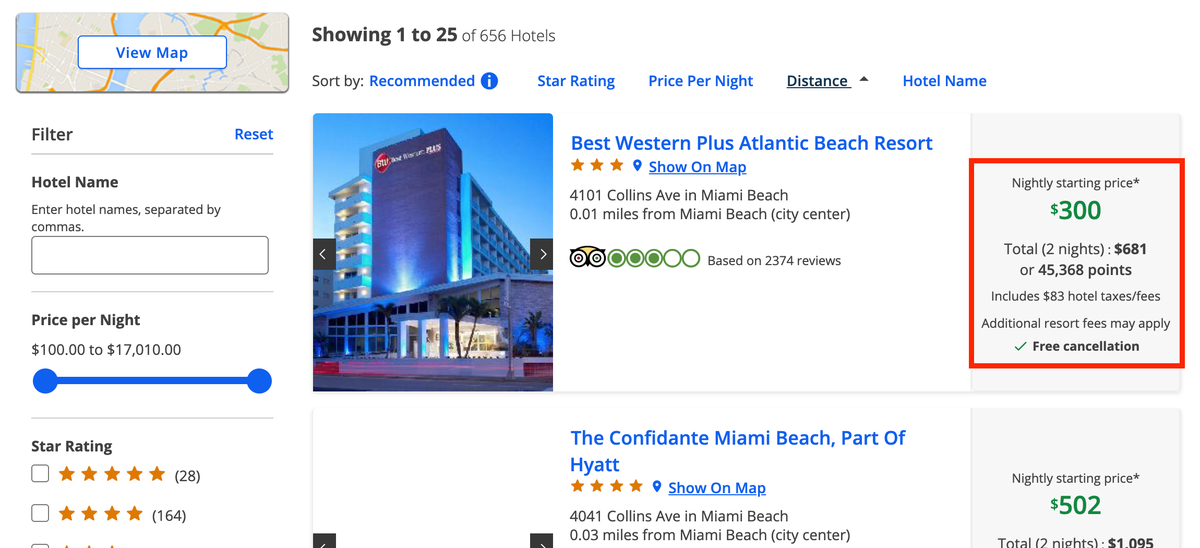

How to book hotels through the Chase TravelSM portal

While the best redemption rates are usually realized when you transfer Chase Ultimate Rewards points at a 1:1 ratio to hotel partner World of Hyatt, if you're not a huge fan of chain hotels or prefer boutiques or brands like Hilton, Choice Hotels, or Wyndham, it can be a good idea to book them through the travel portal.

As with flights, you won't have to worry about blackout dates or limited award night availability. However, keep in mind that hotels treat the Chase Travel SM portal as a third-party booking agency, so you won't be able to earn hotel points on stays as you might by booking your stay directly with the hotel.

Hyatt hotels usually offer better deals when you book directly, and since it's one of Chase's hotel partners, you can transfer UR points instantly at a 1:1 ratio. Marriott and IHG are usually more varied, so you may score a better deal by booking via the Chase Travel SM portal instead of transferring points over. For this reason, it's a good idea to ring up how much your hotel stay would cost in points through the portal as well as the hotel's website.

Start by searching by destination so you can see a list of all the available hotels. For this example, let's try looking for hotels in downtown Austin. Once the results appear, you'll be able to narrow down your search with filters based on price, star ratings, guest ratings, amenities and neighborhood.

Let's go over a couple of options within the Chase Travel SM portal, each booked with a Chase Sapphire Preferred credit card. One option is the Four Seasons Hotel Austin, which is listed for $556 or about 44,500 points per night through Chase. If you book through Four Seasons, directly, you'll pay $561 per night. The hotel chain also doesn't have a rewards program but going through Chase provides a way to pay with points.

Another example is the Hyatt Place Austin Downtown for $288 or about 23,000 points per night through Chase. If you were to book this directly through Hyatt, you'd pay $279 per night as a member of its loyalty program or just 15,000 World of Hyatt points per night if you booked with points. Since you can transfer your Ultimate Rewards points to Hyatt at a 1:1 ratio, in this case, transferring would make more sense.

As you can see, it's worth comparing points required by the travel portal and each hotel's website, as the time of year, location, and other factors may play a part in pricing. To book your stay through the travel portal, select your room type, review the details, choose how many points you'd like to use and complete your purchase.

If you have the Chase Sapphire Reserve card, you also get access to The Edit by Chase Travel SM — a premium travel booking platform offering complimentary benefits at featured properties. These perks include a room upgrade (if available), $100 property credit and daily breakfast for two, to name just a few.

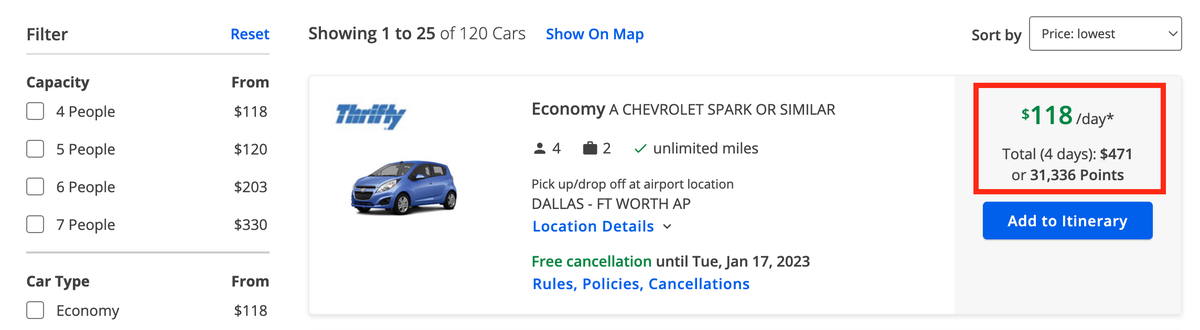

It's a pretty similar process if you want to book rental cars, tours and other travel activities through the Chase Travel SM portal. Cruises can also be booked as well, but you'll need to call.

As far as car rentals, make sure you're booking through the travel portal with points that are connected to Chase Sapphire Preferred or Chase Sapphire Reserve to take advantage of extra perks like primary rental car insurance — you'll also need to decline the rental car company's auto collision damage waiver when you book to activate this. You'll want to charge at least a few dollars to the card and not use points to cover the entire booking which ensures that you're still "paying" for the car rental with your Sapphire card, which means you'll be entitled to the card's rental car insurance.

Beyond that, simply plug in your itinerary and search. Here's an example for a rental in Austin booked with a Chase Sapphire Preferred credit card:

You'll be able to filter your search by capacity, car type, price per day, company, and car options (like air conditioning and automatic transmission). For a seven-day rental, it would cost around 24,800 points or $310 for the cheapest option. As with other travel portal purchases, you'll be able to enter how many Chase Ultimate Rewards points you wish to put toward the final price. It works the same way for booking tours and other travel activities, so you could potentially enjoy a free — or nearly free — vacation solely on Chase points if you were to plan it all out properly.

When it comes to Chase, your travel benefits don't end with booking. If you have the Chase Sapphire Reserve card, you also enroll and get access to two airport lounge networks: Priority Pass and Chase's Sapphire Lounge by The Club.

The Sapphire Lounge network officially consists of four lounges:

- Boston (BOS)

- Hong Kong (HKG)

- New York City (LGA)

- New York City (JFK)

Chase also manages and operates a lounge at Washington Dulles International Airport (IAD) on behalf of Etihad Airways. This lounge isn't branded as a full-fledged Sapphire Lounge, but it features a similar design and follows similar access rules.

Chase is planning to open four more Sapphire lounges in the future: in Las Vegas, Philadelphia, Phoenix and San Diego.

Separately, Chase Sapphire Reserve cardholders also receive access to Sapphire Terrace at the Austin-Bergstrom airport in Austin, Texas.

Priority Pass, on the other hand, is a vast network with over 1,500 airport lounges around the world.

Booking through the Chase Travel SM portal can be a great use of your Ultimate Rewards® points, but make sure to compare the rates against booking directly with an airline or hotel itself. Finally, consider transferring your points to one of Chase's travel partners, especially if you're looking to book a luxury hotel or flight in business class.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card guide is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Information about the Chase Freedom Flex ® has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

- SquareMouth travel insurance review 2024 Liz Knueven

- This checking account earns 8% APY — with a catch Andreina Rodriguez

- Are safe driving discounts worth it? Ryley Amond

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

The Complete Guide To Using the Chase Travel Portal — Maximize Your Options

Katie Seemann

Senior Content Contributor and News Editor

358 Published Articles 57 Edited Articles

Countries Visited: 28 U.S. States Visited: 29

Senior Editor & Content Contributor

118 Published Articles 721 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

Table of Contents

Why book travel through the chase travel portal, cards that earn chase ultimate rewards points, what are chase ultimate rewards points worth, earning chase points by booking travel, how to access the chase travel portal, how to book a flight through chase travel, how to book a hotel through chase travel, how to book a rental car through the chase travel portal, how to book activities through chase travel, how to book a cruise through the portal, how do the prices compare to other sites, other ways to use the chase travel portal, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Chase Ultimate Rewards is one of the major transferrable points programs and a favorite among many travelers. Points are easy to earn and can be transferred to many different hotel and airline partners. But you can also book travel directly through Chase’s travel portal using Ultimate Rewards points.

Booking travel through the Chase Travel portal is simple and can be a great way to use your points.

We’ll show you everything you need to know about how to redeem your points, including the benefits, how to know what your points are worth, and how to book airlines, hotels, and more through the Chase Travel portal.

Generally, you can get maximum value from your Chase Ultimate Rewards points by transferring them to the Chase airline and hotel partners , so why are we talking about using points through a travel portal? While it’s true that the only way to get the highest value redemptions is by transferring, there is still a lot of value to be had by booking directly through the Chase Travel portal.

Flexibility

Flexibility is not often available with points bookings. Unlike an award booking, booking through Chase Travel is like using any other online travel agency (OTA) . There are no blackout dates or limited inventory award seats. If a flight or hotel is available, you can book it with points through the Chase travel portal.

You Can Earn Frequent Flyer Miles

One of the major bummers of booking flights with frequent flyer miles is that you don’t earn miles on award bookings. You can end up doing a lot of travel without earning miles. However, any booking you make with your Chase Ultimate Rewards points through the Chase Travel portal will earn frequent flyer miles and accrue status points. Unfortunately, hotel and car rental bookings still won’t earn points.

We have talked to so many people over the years that love the idea of collecting points and miles but don’t want to deal with the hassle. While many don’t mind putting a little work into getting an awesome redemption, others are just looking for a simple way to book travel and hopefully save some money in the process.

That’s where the Chase Travel portal comes in. With this method of redeeming points, there is no transferring, comparing points values, blackout dates, limited award availability, or multiple travel accounts. You only have to deal with 1 type of point and 1 travel portal but can still retain many of the benefits of collecting points and miles in the first place.

Bottom Line: You can book flights, hotels, rental cars, activities, and cruises through the Chase Travel portal.

If you like the idea of using the Chase Travel portal, you’ll need a credit card that earns Chase Ultimate Rewards points:

A fantastic travel card with a great welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%-29.49% Variable

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

There are also some great cash-back cards from Chase that can be used to book travel through Chase Travel. The points earned on these cards can be converted into cash-back or alternatively, they can be used in the Chase travel portal.

- Chase Freedom Flex℠

- Chase Freedom Unlimited ®

- Chase Freedom ® card (no longer open to new applicants)

- Ink Business Cash ® Credit Card

- Ink Business Plus ® Credit Card (no longer open to new applicants)

- Ink Business Unlimited ® Credit Card

- Ink Business Premier ® Credit Card

It’s easy to earn lots of Chase Ultimate Rewards points , but do you know how much they are worth ? If you’re transferring your Chase Ultimate Rewards points to a travel partner, their value will go up or down depending on the type of redemption.

However, when you are booking your travel directly through Chase’s travel portal, each Chase Ultimate Rewards point has a set value that won’t change . The credit card you have will determine the value of your Chase Ultimate Rewards points.

Transfer Your Points Between Credit Cards for Maximum Value

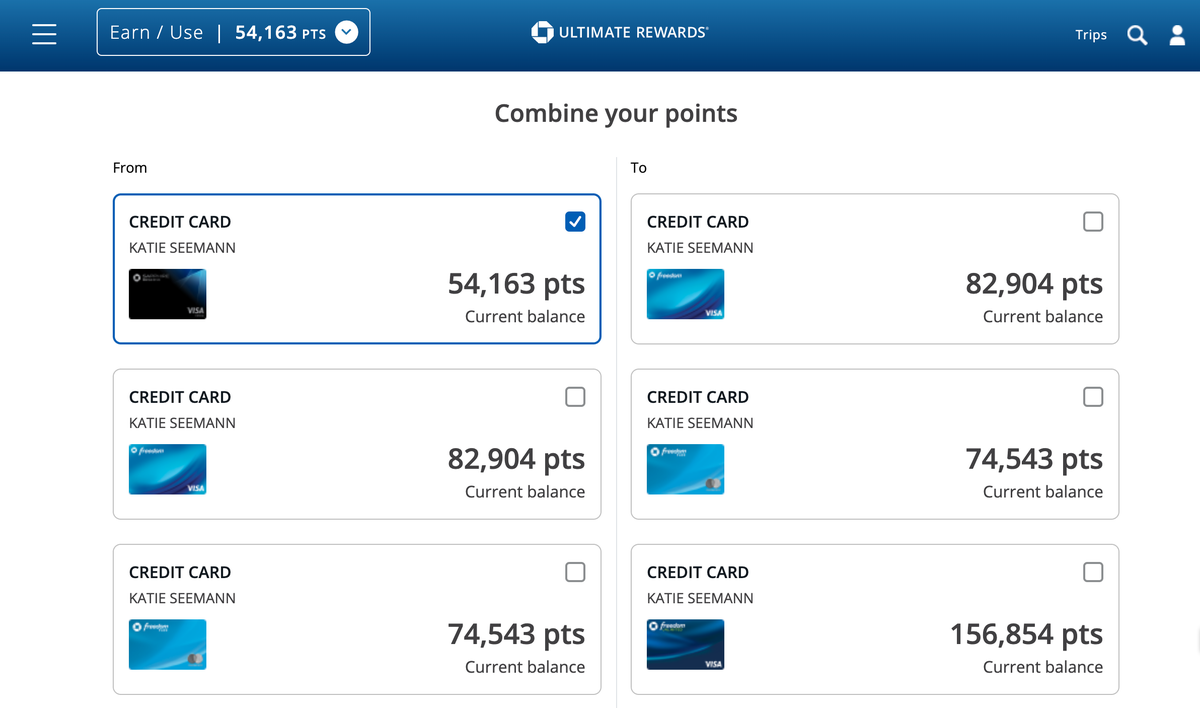

If you have multiple Chase credit cards, it makes sense to transfer your points to the card with the most valuable redemption rate. The only exception to this is the Ink Business Premier card because points earned on this card can’t be transferred to any other card.

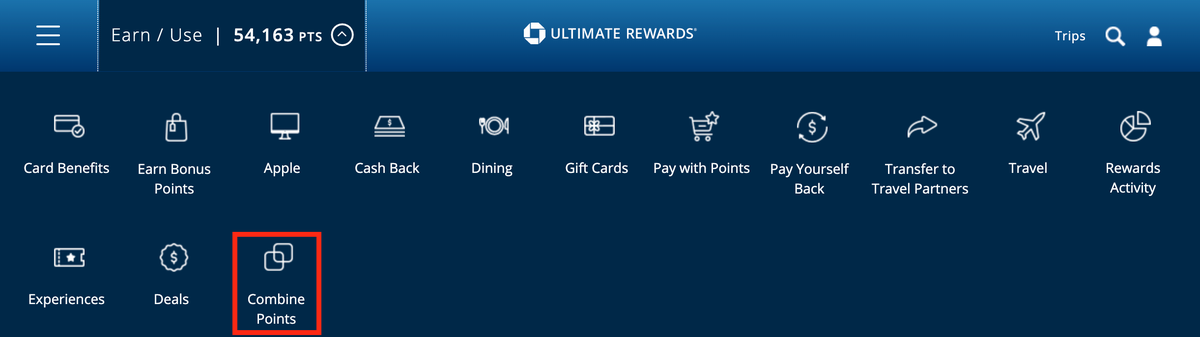

1. To transfer your points between 2 cards, log on to the Chase dashboard and select Combine Points .

2. Then you will be able to select the card you want to transfer points from and the card you want to receive the points. After you choose, click Next.

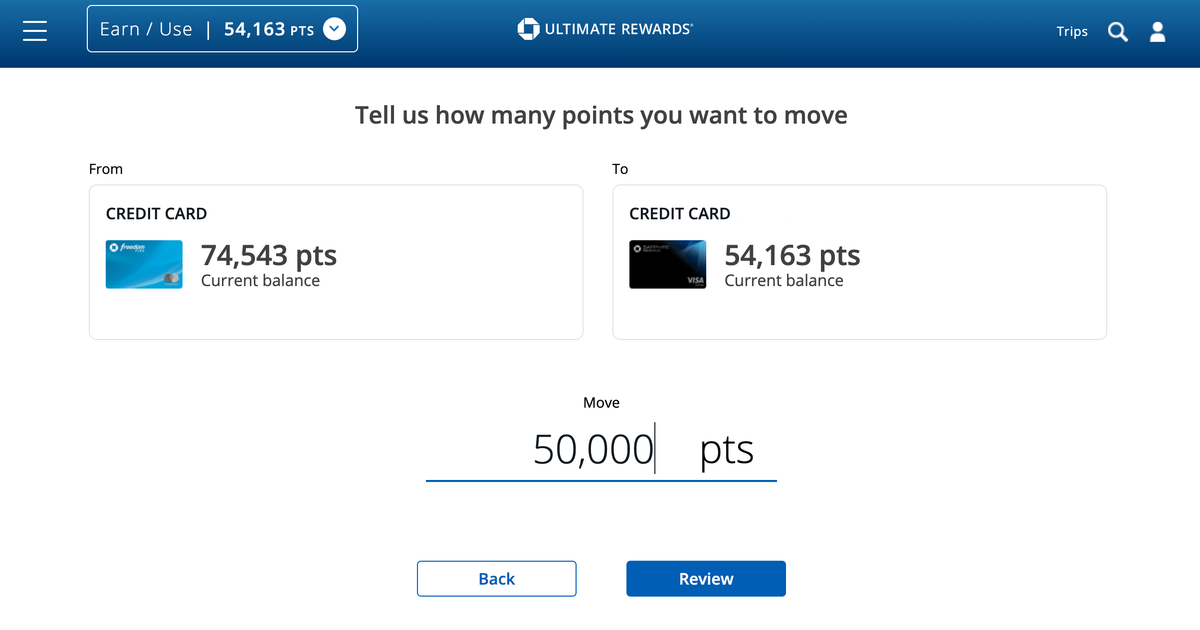

3. You can transfer all of your points or just what you need. Click Review to continue.

4. Double-check the details and click on the Submit button to complete the transfer.

Bottom Line: Your credit card will determine the value of your Chase Ultimate Rewards points. Your points are worth between 1 to 1.5 cents each depending on which credit card you’re redeeming points through.

What if you’d prefer to pay for your travel with a Chase credit card to earn Ultimate Rewards points? The number of points you’ll earn through the Chase travel portal is dependent on which credit card you have and what type of travel you’re purchasing.

You can log into your account in 2 ways.

First, you can go directly to the Ultimate Rewards website to log in or you can log in through your Chase account .

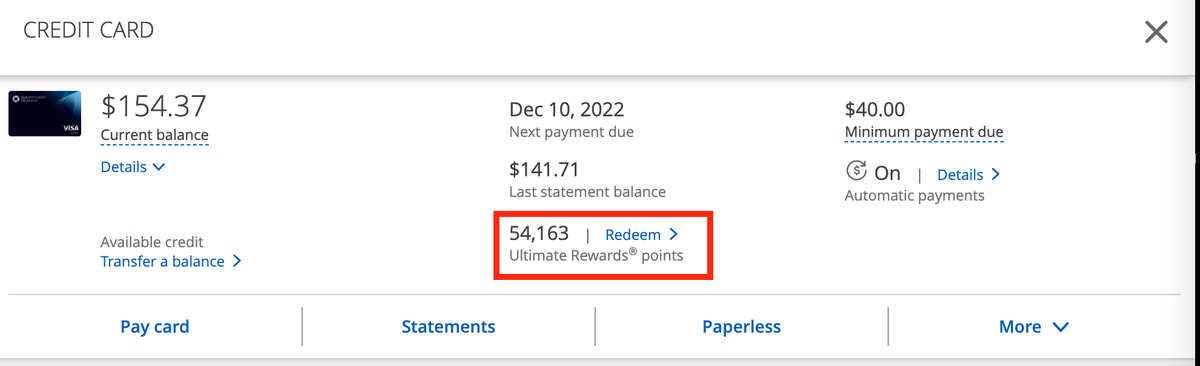

If you’re in your Chase account, click on one of your Ultimate Rewards credit cards and then click on Redeem next to the card’s Ultimate Rewards balance.

Then choose the card you want to use.

From here you can access Chase Travel by clicking on Travel in the top search box or you can switch to another card’s account by clicking on the 3-line icon in the upper left-hand corner.

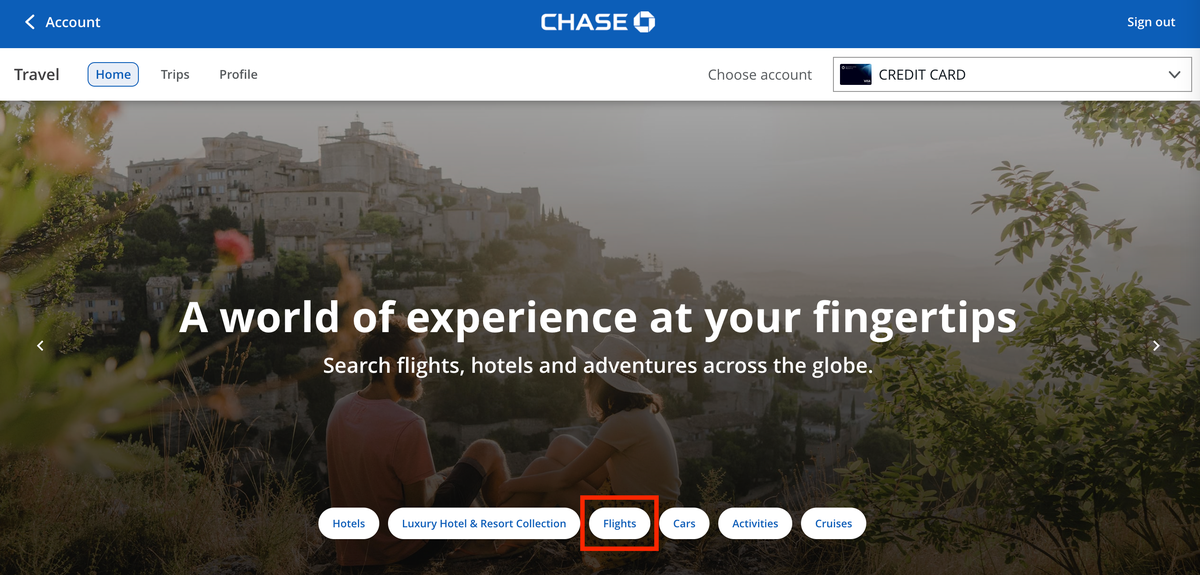

1. In the Travel section of your Ultimate Rewards account, click on Flights to start your search for a flight. As with any other OTA, you begin your search by inputting basic information such as departure and arrival city, travel dates, and the number of passengers.

2. Next, you will be able to narrow your search results . At the left-hand side of the page, you can filter your results by things like airline or flight times. Then you can sort your results by price, trip duration, or times using the drop-down box at the top of the search results.

3. For each flight option, you’ll be able to see the price in dollars and in points on the right-hand side of the results box.

4. Once you’ve found the flight you want, click the blue Select button. Next, you can choose your return flight using the same process as you did for selecting the outbound flight. Click the blue Select button once you have made your choice.

5. From here you can confirm your flight details and select a fare upgrade if you wish. Then, you’ll be able to choose how to pay for your flight . You can pay for the entire purchase with points or a Chase credit card, or you can split your payment between points and a Chase credit card.

6. Finally, input your passenger information next. Don’t forget to add a frequent flyer number, a Known Traveler Number, or a Redress number if you have them.

Hot Tip: When purchasing travel through the Chase travel portal, you can split your payment between Chase Ultimate Rewards points and a Chase credit card.

1. To book a hotel through the Chase Travel portal , you’ll need to start by clicking on the Hotels tab in the main search box. Then, input your destination, check-in and check-out dates, and the number of travelers. Next, click on the blue Search button.

2. Your search results will look like other sites that you may be familiar with. You’ll see filtering options to the left and sorting options above your search results.

3. Each search result will show the price in both dollars and Chase Ultimate Rewards points. These prices include taxes and fees with the exception of resort fees.

4. Once you select your hotel, click on Add to Itinerary . You can choose to pay for all or part of your hotel cost using Ultimate Rewards points. Click Begin Checkout to input your reservation details and finalize your booking.

Hot Tip: When booking a hotel through the Chase Travel portal, you won’t be eligible to earn points in the hotel’s loyalty program or take advantage of any elite status you may have.

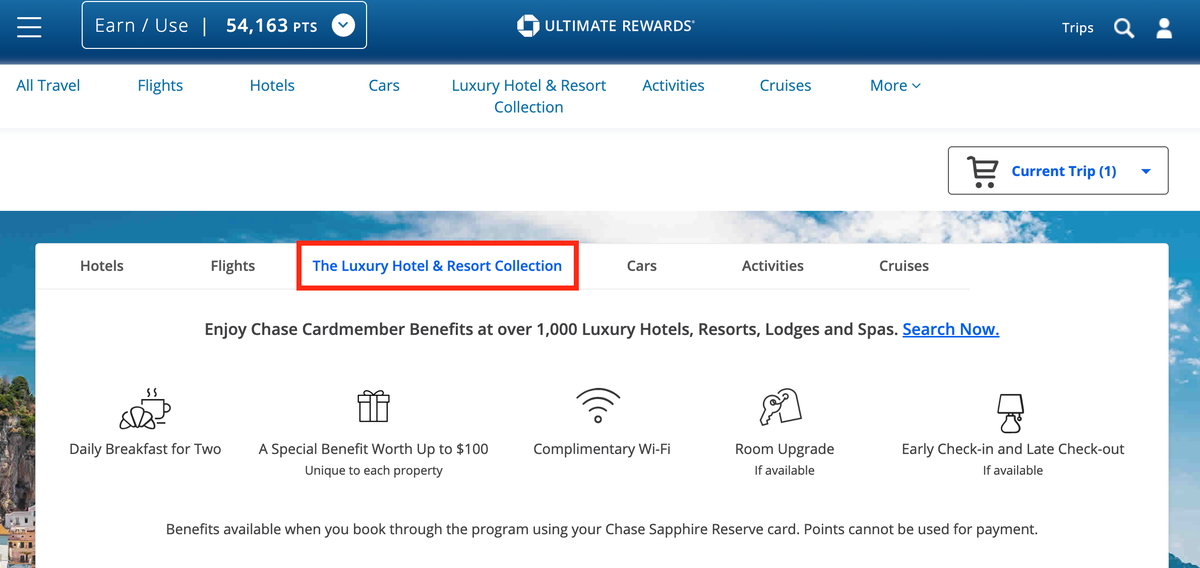

The Luxury Hotel and Resort Collection

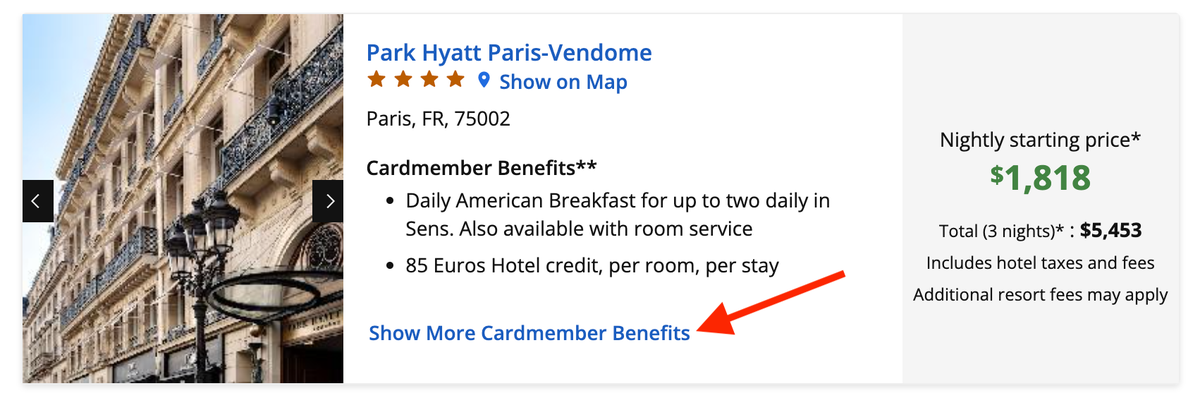

The Luxury Hotel and Resort Collection (LHRC) is exclusively for Chase Sapphire Reserve cardholders. From the Ultimate Rewards travel home page, just click on The Luxury Hotel & Resort Collection tab.

Once you are on the LHRC homepage, type in your destination and click Search to view available properties. Each listing will display the property’s unique cardmember benefits. Click on the listing for more information and to continue the booking process.

When booked through the Chase Travel portal, these properties offer the following benefits:

- Daily breakfast for 2

- Special amenity (varies by property)

- Room upgrades (based on availability)

- Early check-in and late checkout (based on availability)

The Luxury Hotel and Resort Collection properties are reservation-only bookings. You’ll make your reservations online and payment doesn’t happen until you check out from the hotel. These bookings will not take Chase Ultimate Rewards points as payment.

Bottom Line: Luxury Hotel and Resort Collection properties are only available to Chase Sapphire Reserve cardmembers. These properties can’t be booked with points.

1. To rent a car through the Chase Travel portal, start by clicking on the Cars tab in the main search box. Then, input your pick-up location, drop-off location, dates, times, and age of the driver. Click on the blue Search box to continue.

2. You can then narrow your search with the filtering options on the left-hand side of the page.

3. For each car option, you will be able to see the car details, rental company, and price in both dollars and Chase Ultimate Rewards points. Once you have selected the car you want to rent, click on Add to Itinerary .

4. You can pay for the entire purchase with points or a Chase credit card or split your payment in any amount. Double-check all of the details before completing your purchase.

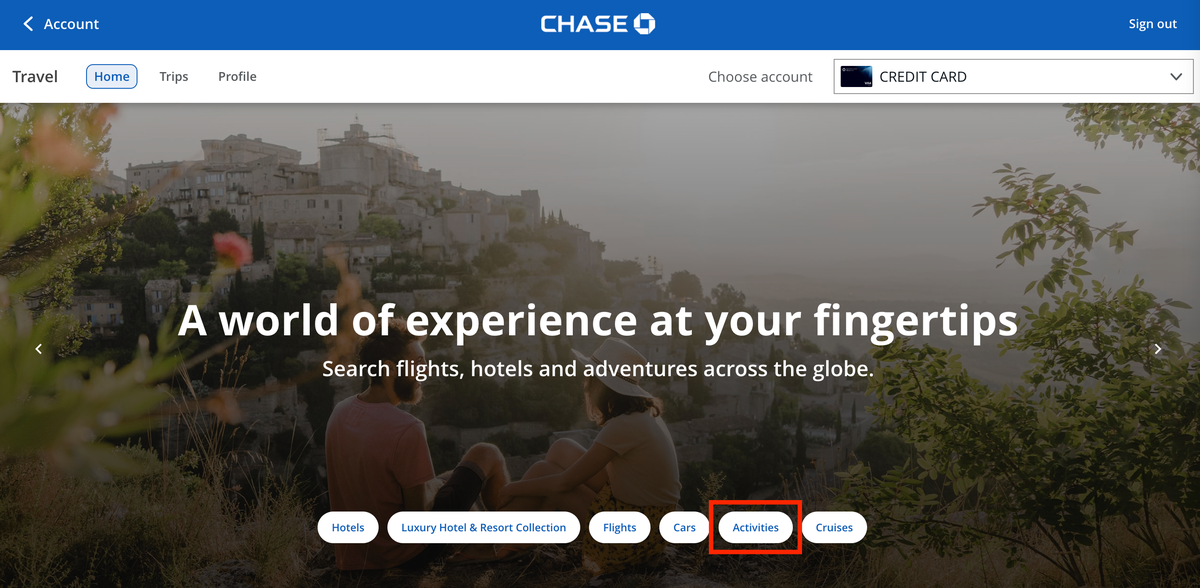

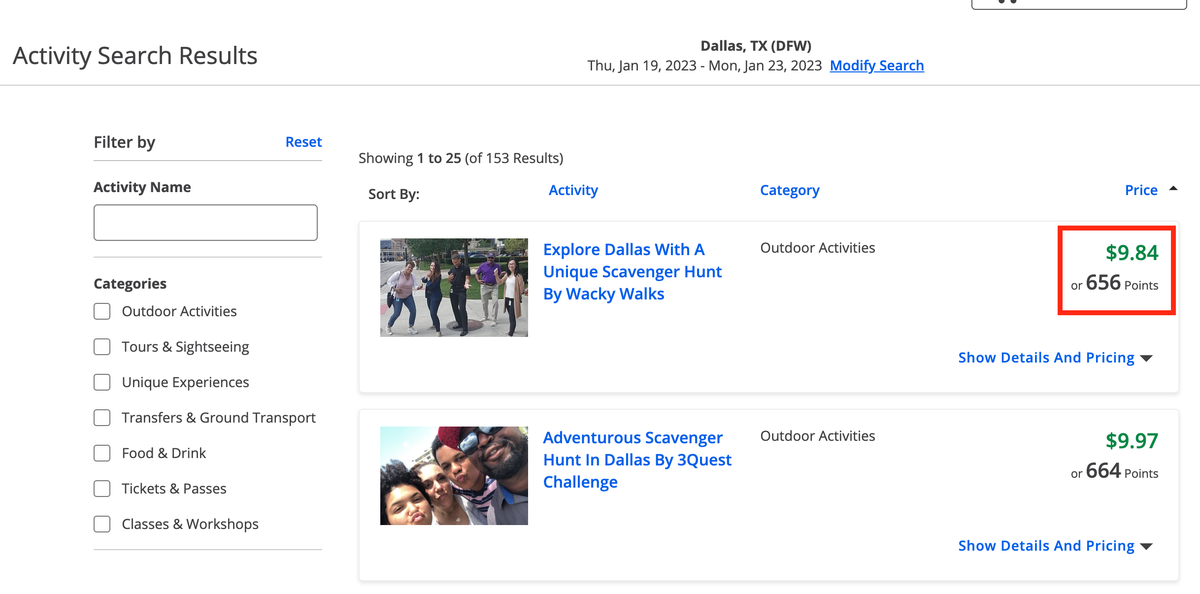

Did you know you can also book activities through Chase Travel?

1. Click the Activities tab on the Ultimate Rewards travel homepage to get started. Then, input your destination and travel dates and click the Search button to continue.

2. You can narrow your search by selecting 1 or more categories at the left-hand side of the page. Categories can include things like:

- Classes & workshops

- Cruises & sailing

- Food & drink

- Outdoor activities

- Seasonal & special occasions

- Tickets & passes

- Tours & sightseeing

- Transfers & ground transport

- Unique experiences

3. Each activity will show the price in both dollars and points to the right side of the screen. Click on Show Details and Pricing for more information and to book the activity.

6. Double-check all of the details on the final page before completing your purchase. Click the box confirming you understand the travel disclosures, then click Complete Checkout to finish your purchase.

Bottom Line: You can book lots of activities through the Chase Travel portal, including airport transfers!

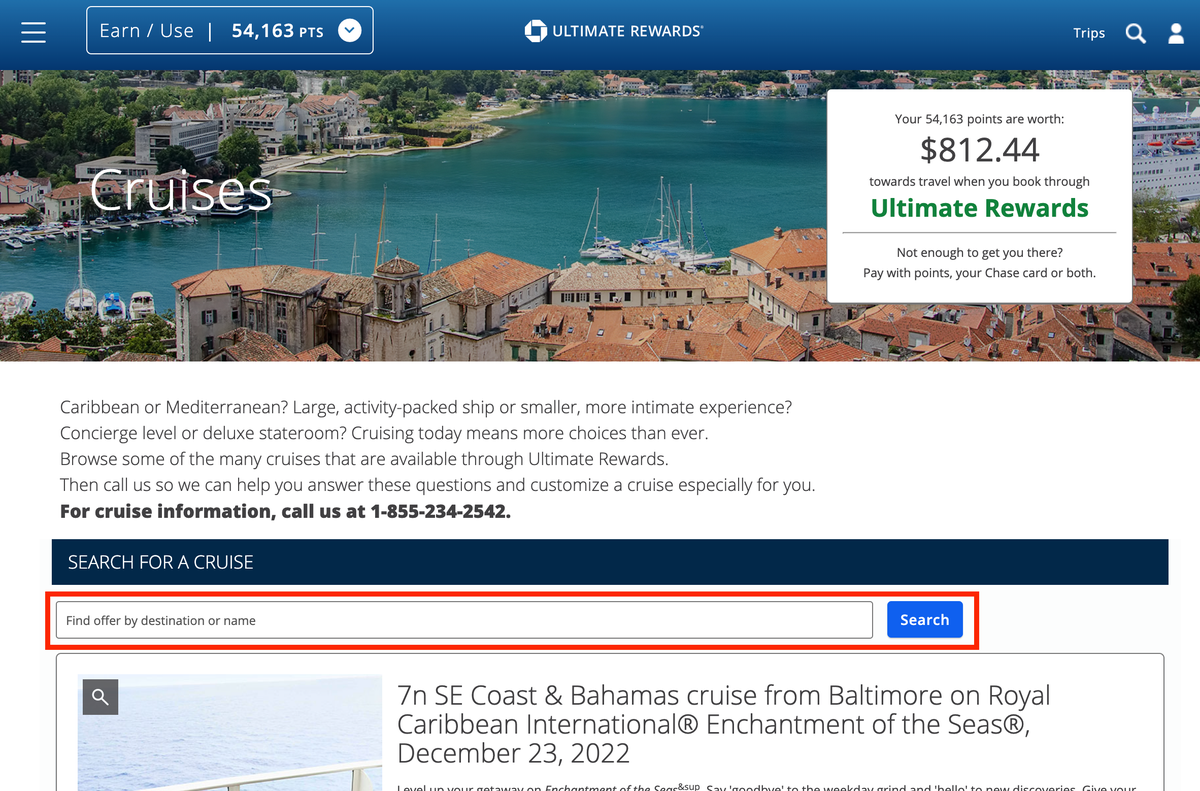

If you’re a fan of cruises, you’ll be pleased to know you can book them through your Chase Travel portal. To get started, click on the Cruises tab on the Ultimate Rewards travel homepage.

This will bring up a list of available cruises, but there’s also a search box at the top of the screen, so you can input a specific destination or cruise line.

Each listing will display the cruise line, ship, ports of call, sailing dates, and baseline pricing for an interior or oceanview cabin. Unfortunately, if you want any more specific information or if you want to book, you will need to call 855-234-2542 .

You’ll notice that only cash prices are listed for cruises, however, they can be booked using your Chase Ultimate Rewards points, too.

Hot Tip: You can book a cruise through Chase Travel but you’ll have to call to make your reservation as they can’t be booked online.

Are you getting a good deal by booking through Chase? Let’s look at how the prices available through the Chase Travel portal stack up to other OTAs and search engines including Hotwire , Kayak , and Expedia .

We did some flight searches and found there’s no clear-cut pattern on prices between the Chase portal to other websites.

Example #1: Round-trip flight between Philadelphia (PHL) and San Francisco (SFO) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between Alaska Airlines and Delta Air Lines for $526.20. This worked out to be the cheapest price we found, and Priceline had the same low price. Expedia and Hotwire both charge booking fees, making the price a little higher. Each airline’s own website couldn’t split the itinerary between different airlines, so those ended up being much more expensive.

If you are in doubt or would like to check prices yourself, Kayak is a great place to start. Kayak will show you prices for a flight on all of the OTAs as well as the airline’s website. It’s a great one-stop shop to compare flight prices.

Example #2: Round-trip flight between New York City (JFK) and Paris, France (CDG) for 1 person in economy.

We searched this route in the Chase travel portal and the cheapest option was a flight that was split between American Airlines and British Airways for $689.78. This wasn’t the overall best price we found, though. That award goes to Expedia and Priceline.

Hot Tip: You will earn frequent flyer miles when you book your flight through the Chase Travel portal.

Example #1: Here’s how prices looked for a week-long stay at the JW Marriott Cancun Resort & Spa in Mexico for 2 people including all taxes and fees. The $291.55 resort fee can’t be paid with points.

In this example, the best cash rate by far was through Marriott. However, if you wanted to pay with points, booking with Chase Ultimate Rewards points through the travel portal would be your best bet.

Keep in mind that Marriott doesn’t have an award chart, so different time periods can have different point costs. A 7-night stay at this hotel can dip down to 240,000 points for a 7-night stay. If you’re going to pay for your hotel stay in points, it’s always smart to calculate how many points it would cost to book through Chase versus transferring points . This information can help you make the best and least expensive choice.

Hot Tip: You won’t earn hotel loyalty points when booking a hotel through Chase and any elite status you have may not be recognized.

Example #2: Let’s look at an example of a hotel that doesn’t have a loyalty program. We priced out a 2-night stay at Almond Tree Inn Hotel in Key West, FL for 2 people. The highest prices were direct via the hotel with all other websites surveyed being cheaper.

Here’s how the prices stacked up:

Chase’s low price matched the other online travel websites and was actually lower than the hotel’s own website, so it would be a great option in this case. It also affords the opportunity to use points for a hotel that doesn’t have its own loyalty program.

Car Rentals

In many cases, car rental prices found through the Chase Travel portal were similar to prices found on the rental agency’s own website.

The main difference in booking through Chase vs. directly through a car rental agency is that the car rental agency often has the ability to book the car without paying up front. With the Chase portal, you will be paying at the time of booking and there may be change or cancellation fees if you need to modify your reservation.

In both of these examples, Chase Travel didn’t offer the lowest price, however, that won’t always necessarily be the case. Of course, the advantage of booking through Chase is the ability to use your Chase Ultimate Rewards points. It’s always a good idea to price out your car rental on a few different websites before booking to ensure you’re getting the best price.

Chase actually offered the lowest prices on activities for both examples:

Earn Bonus Ultimate Rewards Points

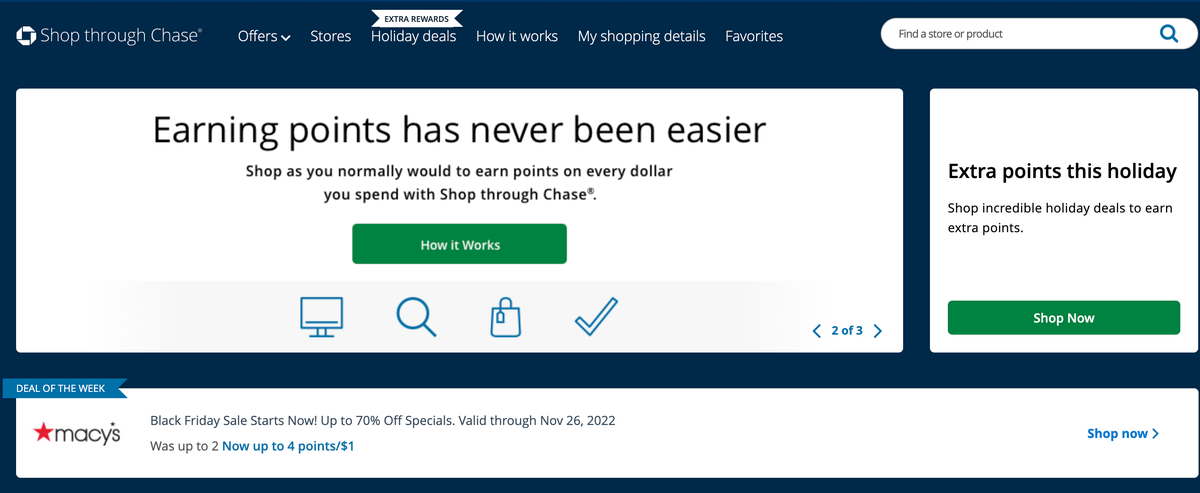

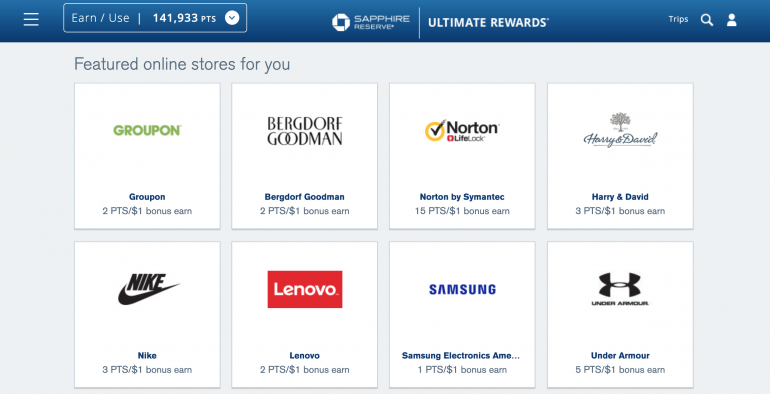

The Chase Travel portal also helps you earn bonus points. With the Shop through Chase feature, you can earn extra Ultimate Rewards points through your online shopping.

Just click Earn Bonus Points in the top search bar to access the shopping portal. Click on a featured store or search for a specific one. Then simply click through the portal to your website of choice to make your purchase. Your bonus points will be added to your Chase Ultimate Rewards points total within 3 to 5 days in most cases.

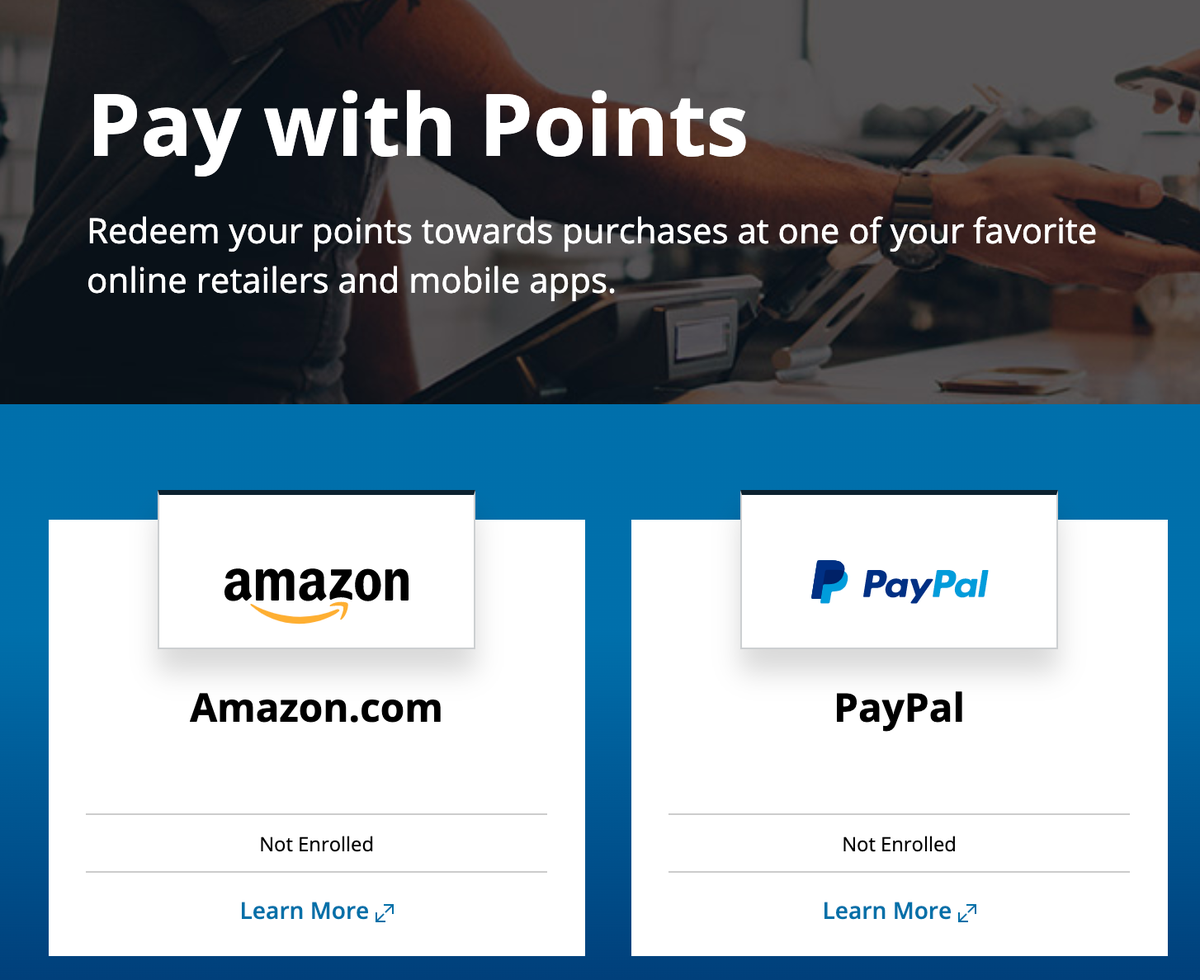

Pay With Points

Did you know you can use your Chase Ultimate Rewards points to make purchases at Amazon and PayPal? Click on Pay with Points in the top search bar, then select either Amazon or PayPal to enroll and shop.

Unfortunately, the redemption value you get when shopping through Amazon or PayPal is pretty bad — only 0.8 cents per point. While it’s great to have this as an option, we don’t recommend using points to shop at Amazon or PayPal as your main use of Chase Ultimate Rewards points.

Bottom Line: The value of using your Chase Ultimate Rewards points to shop through Amazon or PayPal isn’t great: you will only get 0.8 cents per point!

Apple Purchases

By clicking on Apple in the main search box in your Ultimate Rewards account, you can use your Chase points to make purchases. Normally, you’ll get 1 cent per point in value when using your points for Apple purchases, but there are occasional bonuses offered to get a better redemption rate.

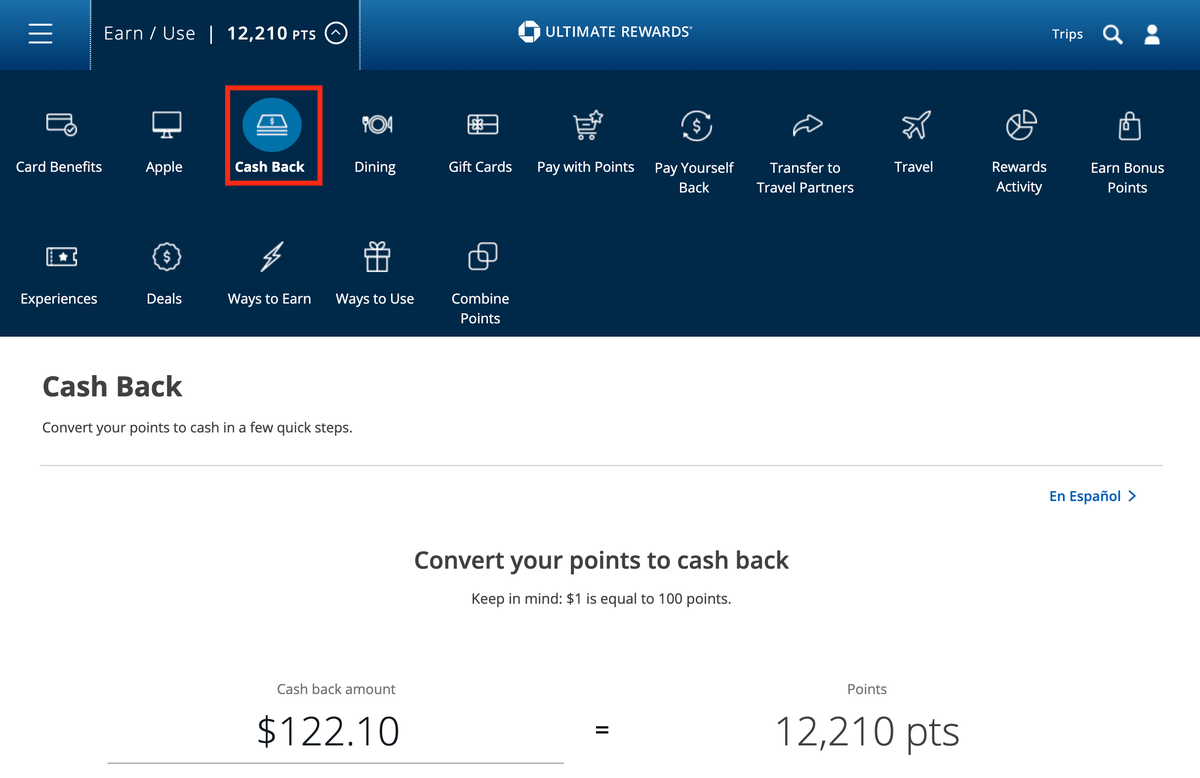

You can also redeem your Ultimate Rewards points for cash-back. To do this, simply select Cash-back from the main search bar at the top of the screen. You will then be able to see choose how many points you’d like to redeem for cash-back at a value of 1 cent per point .

You can choose to have your cash direct deposited into a checking or savings account or as a statement credit. The deposit or statement credit will be posted within 3 days.

Bottom Line: Your Chase Ultimate Rewards points are worth 1 cent each when redeemed as cash-back. We do not recommend this as a primary redemption option because you can get more value via the Chase Travel portal, and a lot more when transferring to airline and hotel partners.

Experiences

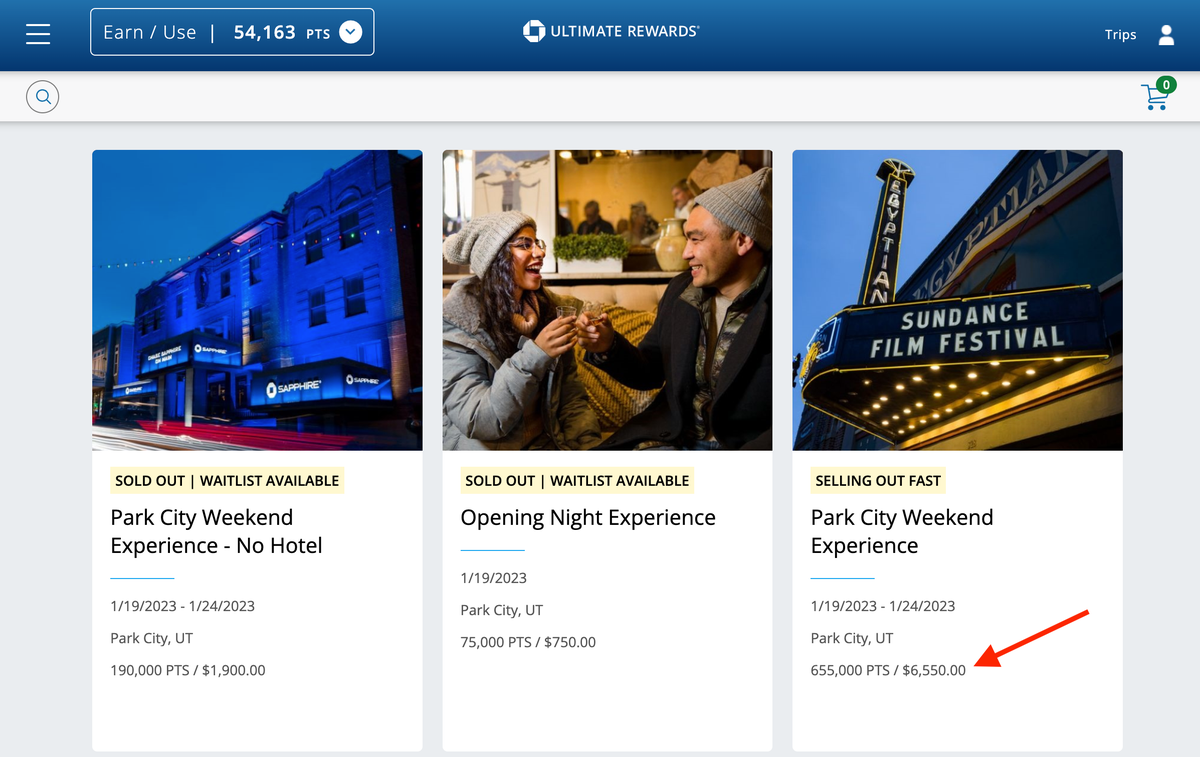

This is a really cool section of the Chase Travel portal. When you click on Experiences in the main search bar, you’ll see a list of exclusive events, preferred seating, and other offers for select Chase cardmembers.

Experiences can be purchased with a credit card or with points. You will get 1 cent per point in value when redeeming points for experiences. Some experiences are only available to cardholders of specific cards so be sure to check all of your cards if you have more than 1 to make sure you don’t miss anything.

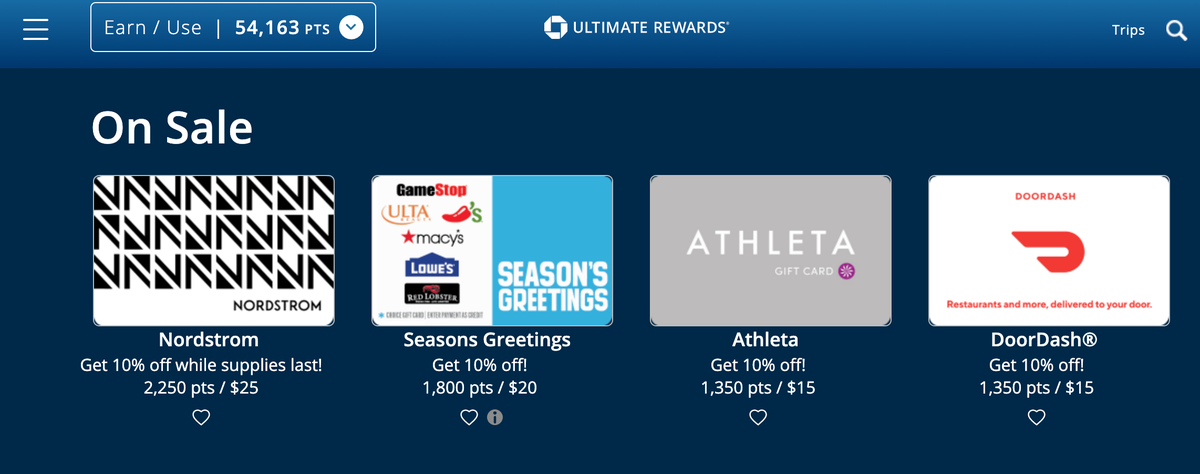

If you prefer gift cards, you can purchase them through the Chase Travel portal using points. Just click Gift Cards in the main search bar to get started. From here, you will be able to scroll through all of the available gift cards. You’ll get 1 cent per point in value, with occasional sales offering better redemption rates.

Hot Tip: Points redeemed for gift cards have a 1-cent per point value. However, you might notice some cards offer discounts, so there is the opportunity to get a bit more value!

Pay Yourself Back

Another way to use your Ultimate Rewards points is through the Pay Yourself Back feature. This allows you to redeem your points for a statement credit for purchases in select categories. The current categories include groceries, dining, select charities, credit card annual fee, internet, cable, phone, and shipping and the redemption value varies by card.

Transfer To Travel Partners

Transferring points to travel partners is the best way to get the most value out of your points . By transferring, you can potentially get 2, 3, or more cents per point value.

Chase Airline Transfer Partners

Chase Hotel Transfer Partners

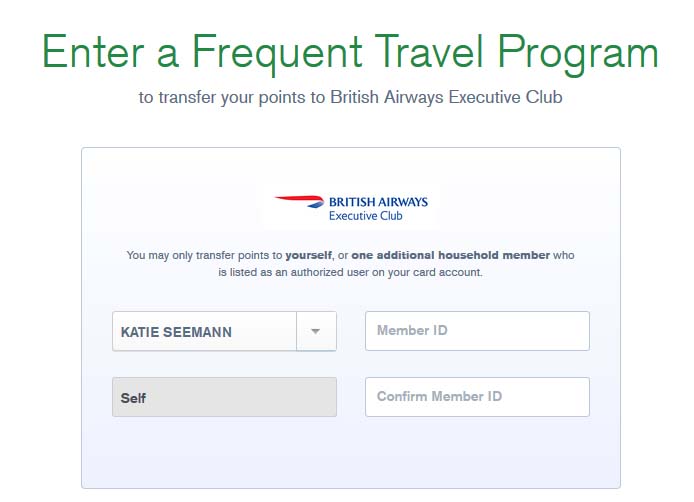

To transfer your Chase Ultimate Rewards points to any of the above airline and hotel partners, log on to your account and click on Transfer To Travel Partners in the top search box. Choose your airline or hotel and then select Transfer Points . You’ll need to fill out your frequent flyer information or hotel loyalty membership number to complete the transfer.

Bottom Line: You can currently transfer your Chase Ultimate Rewards points to 14 different hotel and airline partners.

There are many ways to use your Chase Ultimate Rewards points. While transferring points to one of Chase’s airline and hotel travel partners can get you maximum value, there are a lot of benefits for booking travel directly through the Chase Travel portal .

In addition to hotels and flights, you can book car rentals, activities, and cruises. Or, you can use your points for cash back, shopping, gift cards, or Chase exclusive experiences. With so many ways to use your Chase Ultimate Rewards points, your next trip is only a few clicks away!

The information regarding the Chase Freedom Flex℠ was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Chase Freedom ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Ink Business Plus ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

Do chase ultimate rewards points expire.

No. As long as you keep your Chase credit card open, your points will not expire.

Can I transfer my Chase points to someone else?

Yes. You can transfer your points to another member of your household who also has a Chase Ultimate Rewards account.

What are Chase Ultimate Rewards points worth?

When redeeming points through the Chase travel portal, the credit card you hold will determine your points’ value.

When redeeming for travel, your points have the following value:

- 1 cent : Freedom card, Freedom Flex card, Freedom Unlimited card, Ink Business Cash card, Ink Business Premier card, Ink Business Unlimited card

- 1.25 cents : Chase Sapphire Preferred card or Ink Business Preferred card

- 1.5 cents : Chase Sapphire Reserve card

When using your points to shop through Amazon or Chase Pay, they are worth 0.8 cents per point.

When redeeming your points for cash back, gift cards, or experiences they are worth 1 cent per point.

What airline partners can I transfer my Chase Ultimate Rewards points to?

Chase airline partners include Air Canada, Air France-KLM, British Airways, Iberia, Aer Lingus, Emirates, JetBlue, Singapore Airlines, Southwest Airlines, United Airlines, and Virgin Atlantic.

What hotel partners can I transfer my Chase Ultimate Rewards Points to?

You can transfer your Chase Ultimate Rewards points to the following hotels at a 1:1 ratio: IHG, Marriott, and Hyatt.

Was this page helpful?

About Katie Seemann

Katie has been in the points and miles game since 2015 and started her own blog in 2016. She’s been freelance writing since then and her work has been featured in publications like Travel + Leisure, Forbes Advisor, and Fortune Recommends.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!).

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![the chase ultimate rewards travel portal How To Earn 100k+ Chase Ultimate Rewards Points [In 90 Days]](https://upgradedpoints.com/wp-content/uploads/2023/01/Chase-bank-branch-new-york.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Dream, discover, book with Chase Travel

Go further when you book with Chase Travel

Competitive rates.

Take advantage of competitive rates at thousands of hotels and resorts, with no booking fees.

Seamless booking

Smoothly plan and book your whole trip, from coveted hotels and convenient flights to cars and must-do local experiences.

Premium benefits

Make the most of your card rewards. Access exclusive benefits and earn and redeem like never before.

Find inspiration

Don’t just dream it. Discover your next adventure with help from fresh trip recommendations and curated picks for unforgettable stays.

Get rewarded

Earn and redeem Ultimate Rewards points with your eligible Chase card, including Chase Sapphire, Freedom, Ink Business credit cards and more.

Chase Ultimate Rewards Travel Portal review

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Credit cards

- • Credit scores

- Connect with Ted Rossman on Twitter Twitter

- Connect with Ted Rossman on LinkedIn Linkedin

- Get in contact with Ted Rossman via Email Email

- • Travel loyalty programs

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

This article was originally published on March 23, 2023.

Booking travel through a credit card issuer’s portal — which is essentially their version of an online travel agency (OTA) such as Expedia or Orbitz — has its pros and cons.

The main advantage is extra rewards. That’s what convinced me to book a recent trip through the Chase Ultimate Rewards portal using my Chase Freedom Flex℠ *.

I earned 5 percent cash back on those flights, whereas I would have only earned 1 percent if I booked directly with the airline. I bought $1,137.26 worth of airfare, so there was a significant difference between 5 percent ($56.86) and 1 percent ($11.37).

Sometimes it can also make sense to use a card issuer’s travel portal if you’re redeeming rewards for the trip. That’s especially compelling if you have a card like the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® , which boosts the value of your points by 25 percent and 50 percent, respectively, if you redeem them through the Chase Travel portal.

The main drawback of any OTA — card issuer portals included — is that booking travel this way introduces an intermediary into the transaction. If anything goes wrong with your trip, you need to deal with the travel agency’s customer service instead of (or sometimes in addition to) the hotel or airline provider. This can make things more complicated.

Another important note is that hotel bookings made through OTAs typically do not earn loyalty points or count toward elite status. Airline reservations, on the other hand, are generally eligible for frequent flyer miles and elite status qualification.

In my case, I decided that an extra $45.49 in cash back was worth giving the Chase travel portal a shot. I also viewed it as a professional development opportunity to see how this works in the real world.

What happened with my trip

A 2023 Bankrate survey revealed that 77 percent of travelers who’ve traveled for leisure or business this year experienced at least one travel-related problem. These included higher prices than they were accustomed to (53 percent), long waits (25 percent), poor customer service (24 percent), hard-to-find availability (23 percent) and canceled or disrupted plans (23 percent). I experienced every single one of those things the night before my wife and daughter were scheduled to leave on the trip I booked through Chase.

Actually, I should back up. The problems started even earlier than that. Weeks before the trip, American Airlines made a schedule change that jeopardized my wife Chelsea and daughter Ashleigh’s chances of making their connecting flight. The new layover seemed impossibly short.

This was my first test of the customer service for the Chase travel portal. They passed with flying colors, efficiently rebooking Chelsea and Ashleigh at no extra cost and arranging the flights in such a way that it seemed much more likely they would be able to get from one plane to the other. It was fairly complicated because the connecting city needed to change, but the whole process was smooth. I was impressed.

Fast-forward to the night before the trip

We received an email from American Airlines that Chelsea and Ashleigh’s flight from Newark to Phoenix was canceled. There was no explanation, but we assume it had to do with either a staffing or equipment shortage since the weather was calm on both ends; the airline offered to rebook them on the same itinerary two days later. That was far from ideal, since the whole trip was only supposed to last five days (the ultimate destination was Monterey, California, where Chelsea’s parents live).

We simultaneously reached out to both Chase and American. Chelsea reported that the wait to speak with someone at the airline was listed at four hours. I got through to a Chase representative almost immediately.

I explained the situation, and the customer service agent and I started brainstorming alternatives. Was there a different way to get to Phoenix in time for the connecting flight to Monterey? We looked at Newark, JFK, LaGuardia — even as far away as Philadelphia and Hartford, but no dice. How about an entirely new routing? Could they fly from somewhere in the New York area to San Francisco, San Jose or Oakland, California? Those cities are all within a couple hours’ drive of Monterey.

After several attempts to find something that would work, we gave up. Nothing seemed to work. The Chase representative was great, and I feel like he did everything he could to try and solve our dilemma. American Airlines just didn’t have any availability.

We eventually got through to American Airlines and confirmed there were only two options: Travel two days later or cancel. We opted to cancel but — plot twist — we still found a way for Chelsea to visit her parents and for Ashleigh to see her grandparents. We rolled the dice and made an entirely new reservation with JetBlue. They had an early-morning flight from JFK to San Francisco with a few available seats.

The backup plan

The trip ended up costing $700 more due to higher-priced, last-minute plane tickets and a rental car to get them from San Francisco to Monterey, but the trip had a happy ending. It was ironic, too, because we had sworn off JetBlue after experiencing significant issues with them during family trips in the past. This time, they saved the day, and American Airlines dropped the ball.

I’ve heard that some people have taken to making backup flight reservations, especially on carriers such as Southwest, which have particularly generous cancellation policies. I’m not sure I would go that far, but there’s no doubt air travel has been a mess lately. In my view, airlines need to do a much better job of setting their schedules and sticking to them. Unfortunately, there’s little that passengers can do to protect themselves.

Travel insurance might help, and some travel credit cards provide travel insurance benefits at no added cost. But, at the end of the day, the airlines are the ones responsible for getting us from point A to point B.

The Chase portal wasn’t the problem; I would use it again. But given the current state of the airline industry, I’m going to be anxiously waiting to see if my next flight takes off as planned.

Have a question about credit cards? E-mail me at [email protected] and I’d be happy to help.

*The information about the Chase Freedom Flex℠ has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Related Articles

Chase Ultimate Rewards guide

Is the Chase Sapphire Reserve worth it?

Premium credit card comparison: Chase Sapphire Reserve vs. Capital One Venture X vs. Amex Platinum

Southwest Rapid Rewards Plus vs. Capital One Venture Rewards

Westend61/ Getty Images

Advertiser Disclosure

Guide to the Chase Ultimate Rewards portal

Chase Ultimate Rewards' perks are found in the redemption portal, but it is not always easy for cardholders to know where to begin

Published: June 16, 2023

Author: Dan Rafter

Editor: Kaitlyn Tang

How we Choose

The Chase Ultimate Rewards redemption portal offers plenty of perks for cardholders. But since it offers so much, it can be difficult for cardholders to know where to start when redeeming their points. Read on to learn how to navigate the Chase Ultimate Rewards portal.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

If you have a Chase Ultimate Rewards credit card in your wallet, odds are you’ve checked out the Ultimate Rewards redemption portal. This online portal allows users to redeem their points for travel purchases, gift cards, Apple products, Amazon.com purchases and more. And, Ultimate Rewards also offers plenty of other perks for users, from special gift-card discounts to bonus points for online shopping.

But because it has so much to offer, it can be tough to know where to start with Ultimate Rewards, especially when you are ready to redeem your points. To help you better understand the Chase Ultimate Rewards program, here’s what you need to know.

- What is Ultimate Rewards?

The Chase Ultimate Rewards program is the rewards program provided to cardholders on several Chase credit cards. It is one of the most robust travel rewards programs available, thanks to its generally high-rewards potential, flexible redemption choices and attractive partnerships with numerous travel brands.

Ultimate Rewards is also the name of the redemption portal that allows users to redeem their points for cash back, travel purchases, gift cards, online shopping and more. The portal includes a range of special promotions, from savings on hotels, car rentals and experiences to bonus points at certain retailers.

When accessing the portal, the rewards balances available for redemption are split between cards if you have more than one Ultimate Rewards card. You can also access the portal through each individual card account.

Chase allows you to transfer points between cards, so you can combine rewards earned from multiple accounts to boost your rewards budget. Some cards have a higher value when redeeming the points for travel, making transferring points between cards even more useful for certain cardholders.

When you redeem points for travel, you have the option to pay with your Chase credit card, Ultimate Rewards points or both. You can also use points to pay for part or all of a purchase you make on Amazon or Apple. No matter how you redeem your points, Ultimate Rewards is a flexible and user-friendly platform.

- Booking a trip through Chase Travel

One way to use your Ultimate Rewards points is to book travel purchases, including flights, hotels, car rentals, experiences and cruises. You can navigate to the homepage of the travel hub, now dubbed Chase Travel, through the Ultimate Rewards portal. On the homepage, you can toggle through the travel categories, search for destinations and read articles to inspire your next vacation. All bookings (other than cruises) are powered by Expedia, meaning there is a wide portfolio of options and competitive pricing across travel purchases.

Booking a trip through Chase Travel works like most other third-party booking sites but can vary a bit based on the type of purchase.

Booking flights

To book a flight, you’ll search available options by destination, travel date and number of travelers. To help you decide which trip is a good value, Chase rates each search result on a scale of 1 to 10.

The results are automatically ranked by lowest price, but you can filter the results to rank by shortest duration, earliest arrival time and other factors. You can also filter the options by the number of stops (nonstop, one stop or two or more stops), flight times, airline and more.

Booking hotels

Much like booking flights, you can book a hotel stay through the travel portal based on your travel destination and duration. You can further filter by hotel chain, star rating, Tripadvisor rating, neighborhood and other factors. Some hotel listings are even marked “sale,” which is a special hotel offer and the price could go back up.

You can also read Tripadvisor reviews directly on the portal rather than opening Tripadvisor in a separate tab to see how others like the property you’re eyeing.

Booking car rentals

Chase Travel allows users to book rental cars with several different companies through the platform. You can filter search results by car size, price level or your favorite rental company.

Booking experiences

One unique feature of Chase Travel is the ability to book activities at your vacation destination. To help users book their whole trip in one place with the flexibility of using rewards points, Chase offers experiences such as performances, city tours and spa services directly through its platform.

Booking cruises

Cruise bookings are the only Chase Travel travel category not powered by Expedia. Unfortunately, you cannot use the portal to search for cruises, like the other categories. Instead, the cruise page simply says to call the customer service line (1-866-331-0773) and speak to a representative directly.

Is booking a trip through Chase Travel worth it?

If you are an Ultimate Rewards cardholder, your points are flexible. They can even be redeemed for statement credits, allowing you to book travel on other sites and make up the cost with cash back. However, there are several benefits that come with booking directly through Chase’s platform. Before you decide how to book your next vacation, consider the following benefits.

No additional booking fees

Unlike some third-party booking sites, Chase Travel does not charge any extra booking fees on top of the fees charged by the hotel or airline. You also won’t be charged a cancellation fee for the first 24 hours after booking a flight.

Chase Travel rates compared to other booking sites

The rates on all travel purchases are competitive on Chase Travel, and in general, you won’t pay any more money by choosing to book through the portal. Take, for example, the following four-night stay at The Garland in Los Angeles.

When compared to rates listed on Hotels.com and Expedia, Chase Travel offered the same rooms at the same price.

Chase Travel also offers competitive rates on flights. For a nonstop, round-trip flight from JFK to LAX, the platform offered nearly the same cost listed directly on the Delta website and on Priceline.

Chase Travel points boost

Perhaps one of the greatest reasons why you should book through Chase Travel is the boosted point value when redeeming points. If you are a Chase Sapphire Reserve® , Chase Sapphire Preferred® Card or Ink Business Preferred® Credit Card holder, your Ultimate Rewards points have a higher value when redeemed for travel through Chase’s platform.

While cash back point redemptions only glean 1 cent per point across all Ultimate Rewards cards, certain cardholders have the potential to unlock better value by booking travel through the Chase Travel portal.

Earn more Ultimate Rewards points

Many Chase cards also let you earn more Ultimate Rewards points when you make travel purchases on the portal. If you don’t have quite enough points to spend on your trip, it can still be rewarding to make reservations with Chase, as you can rack up rewards to help cover your next one.

Note that though the Chase Freedom Unlimited* and Chase Freedom Flex* cards are technically cash back cards, their rewards are fulfilled as Ultimate Rewards points. Plus, if you do the math, 5 percent cash back is the same rate as 5X points.

No hotel elite benefits

Since Ultimate Rewards is a third-party booking site, you won’t be able to enjoy any hotel elite benefits when you book a stay through the platform. If perks like complimentary Wi-Fi, late checkout or room upgrades are an important part of your vacation, you might be better off redeeming points for a statement credit and booking directly with your favorite hotel.

Overall, booking a trip through Ultimate Rewards is usually worth it. You get competitive prices compared to other sites and can potentially eke more value out of your points. However, consider the value of your hotel elite benefits before deciding to book this way.

Other redemption options with Ultimate Rewards

Other than travel purchases, Ultimate Rewards cardholders have plenty of other ways to use their points. Here is a quick breakdown of other redemption options and how they work.

Pay with points

If you regularly shop on Amazon or use PayPal, you might be surprised to learn you can use your Chase Ultimate Rewards points to pay for your order. All you have to do is link your Chase card, through the Ultimate Rewards portal, to your account and shop as normal.

Apple Ultimate Rewards store

Another merchandise option for your Ultimate Rewards points is Apple products. By shopping through the Ultimate Rewards portal, you can use points to pay for your next phone or computer. And, the good news is that the products are the same price on the portal as they are on the Apple website.

If neither online shopping option appeals to you, you can still use your Ultimate Rewards points to fund purchases. Just apply your points toward a gift card, and you’ll generally get 1 cent per point of value by redeeming this way. However, there are a few special deals that pop up, such as 15 percent off a BJ’s Restaurant gift card. With the discount applied, it’ll only cost you 850 points for a $10 gift card.

Chase Ultimate Deals

Any time you are on the Ultimate Rewards portal, it is a good idea to check out Chase Ultimate Deals. This page includes current offers for bonus points at online retailers and discounts on gift card redemptions. If you are trying to rack up points or get more than 1-cent-per-point of value on a gift card, this is a great portal to check out.

Shop through Chase

While not strictly a redemption option, Shop through Chase is another unique feature on the Ultimate Rewards portal. It awards between 1 and 15 bonus points for shopping online at hundreds of different retailers. Just be sure you check out each site’s individual terms and conditions, as they might include specific purchase requirements or expiration dates.

To ensure you earn bonus points at these stores, make sure to check back on the “Rewards Activity” page on the portal. Any bonus points you earn should appear in your account in the next five business days.

Transfer to travel partners

If you have a premium Ultimate Rewards card (Chase Sapphire Preferred, Sapphire Reserve or Ink Business Preferred), you also have the option to transfer your points to one of Chase’s 14 transfer partners . Points transfer at a 1:1 ratio, meaning you generally get good value by choosing this option.

Tips for maximizing Chase Ultimate Rewards

- If you are a Chase Sapphire Preferred, Sapphire Reserve or Ink Business Preferred cardholder, use your points to book travel to get the best value.

- Check Chase Ultimate Deals regularly to see if you can earn bonus points or save money on gift cards.

- Check Shop through Chase before buying a product online to see if you can earn bonus points on your purchase.

- Purchase flights and hotels via Chase Travel because the prices are competitive and you can earn bonus points on those transactions, if you pay with your Chase card.

- If you need to make a purchase with Apple, Amazon or PayPal, consider going through Ultimate Rewards to use your available points.

Bottom line

Chase Ultimate Rewards is a user-friendly point redemption platform that offers plenty of flexibility for Chase cardholders. When it comes to booking travel, there are plenty of options and competitive rates. Plus, point boosts allow Sapphire and Ink Business Preferred cardholders to stretch their points further than they otherwise could. Ultimate Rewards cardholders also maximize the value of the platform by keeping an eye out for special deals on gift cards and online purchases.