- Asset Managers

- Fund Finder

- Asia Outlook 2024

- Asia Bonds – the time is now

- Asian stock exchanges

- China A-Shares: All investors need to know

- China bond fund: China’s bond market becomes investable

Select your geography

by clicking a geography button, you agree to abide by terms and conditions listed herein .

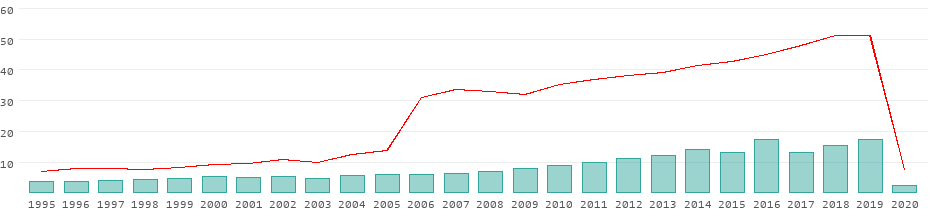

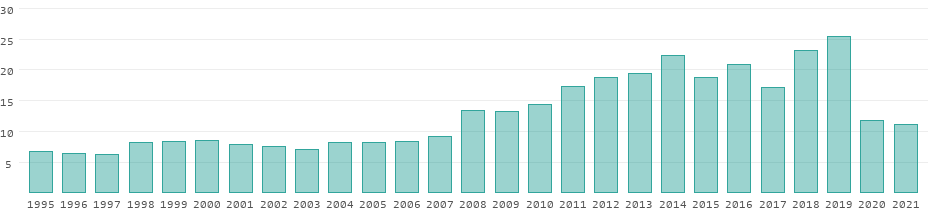

Charting the growth of South Korea’s tourism industry

As the world emerges from the shadows of the Covid-19, South Korea’s tourism sector is witnessing a remarkable rebound. Renowned for its breathtaking landscapes, the nation is strategically leveraging a diverse array of events to attract tourists in 2023.

Notable among these are the Seoul Lantern Festival and the 2023 K-Link Festival featuring popular K-Pop stars. Also, the country will host the 2024 Winter Youth Olympics next year.

Besides, the country’s distinctive culture, blending the contemporary appeal of K-pop with the timeless charm of traditional arts, has captured the attention of a global audience. This cultural magnetism forms a sturdy foundation for enterprises within the country’s flourishing tourism sector.

Before the onset of Covid-19, South Korea recorded 17.5 million visitors in 2019 . Notably, a record-breaking $21.5 bn was reported in 2019 for tourist expenditures in South Korea, with an average spending of $1,230 per visitor.

However, the pandemic negatively impacted South Korea’s tourism for nearly two years. In 2021, only about 967,000 foreign tourists ventured into South Korea. However, the numbers nearly tripled to approximately 3.198 million in 2022. The positive trajectory continues into 2023, with an estimated 6.5 million foreign tourists visiting the country from January to August, as per government data.

Additionally, the country’s tourism market, currently valued at $35.8 mn, saw international tourist arrivals rise above 1 million in July. This happened for the first time since the start of the Covid-19 pandemic. Subsequently, in September, the growth rate for tourist arrivals was 227.3%, amounting to 1.094 million foreign tourists.

Asian Market Insights

Exclusive news, analyses and opinion on Asian economies and financial markets

Email Address*

Exklusive News, Analysen und Meinungen zu den asiatischen Finanzmärkten

“South Korea’s tourism sector has been strengthening during 2023 and is expected to show further improvement during 2024, as international tourist travel in the Asia-Pacific region continues to recover,” says S&P Global .

Government measures driving South Korea’s tourism sector

Experts believe that a rebound in South Korea’s tourism industry has been facilitated by a series of government measures aimed at boosting the sector. This year, South Korea has allocated significant financial resources to support tourism-related initiatives.

To promote domestic travel, the government plans to subsidise local trips for employees of small and mid-sized firms. Lowered railroad fares and discount coupons for popular tourist attractions are also set to further incentivise travel.

Moreover, the 6th Master Plan for Tourism Development (2023-2027) by the government delineates a strategic framework aimed at the expansion of the tourism sector. To enhance tourism exports, the plan recommends diversifying the inbound market and integrating promotional activities with K-culture. The government’s 2024 tourism budget of 1.36 tn won ($1 bn) will focus on drawing foreign tourists to the land and plugging in the tourism deficit.

“Seoul’s government has announced measures that will ease travel restrictions and is targeting 30 million tourists by 2027…. (it) intends to achieve this number through digital tourism platform services and Korean-content storytelling tour programs, featuring cities such as Gyeongju, Jeju City, Suwon, Busan, Chuncheon, and, of course, the capital Seoul,” says GlobalData .

Looking ahead, South Korea’s tourism market is expected to expand at a CAGR of 8.10% between 2023 and 2028, amounting to $77.7 mn, as per Future Market Insights . The market research firm also informs about a few challenges facing South Korea’s tourism.

“Due to a few factors, it can be difficult to promote South Korea’s tourism market…Political tensions spurred on by unsolved problems with neighbors like North Korea, China, and Japan have made this region a potential hotspot that could suddenly erupt,” it adds. Along these lines, South Korea’s reliance on Chinese and Japanese tourists for a significant portion of its international arrivals can pose significant challenges in the future.

Related Articles

K-pop is making billions for South Korea

After elections in South Korea: major policy shifts unlikely

South Korean Economy

Foxconn Technology Group: future is in EVs

Report: China, Indonesia, Vietnam need to increase their climate am...

How China is losing the chip war

India’s bond index inclusion is “on track”

- Investments

- Terms and Conditions

- Legal Notice

- Privacy Policy

- Cookie Policy

Find us on social

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

The Straits Times

- International

- Print Edition

- news with benefits

- SPH Rewards

- STClassifieds

- Berita Harian

- Hardwarezone

- Shin Min Daily News

- Tamil Murasu

- The Business Times

- The New Paper

- Lianhe Zaobao

- Advertise with us

South Korea determined to become tourism powerhouse

SEOUL – South Korea’s Ministry of Culture, Sports and Tourism is going all out to make the country another Asian tourism powerhouse and create a more enjoyable tourism environment for domestic holidaymakers.

In a press briefing in Seoul on Dec 8, Second Vice-Minister of Culture, Sports and Tourism Jang Mi-ran expressed high hopes to turn South Korea into an appealing destination for both foreigners and locals, and exceed pre-pandemic visitor levels in 2024.

“I engaged in various tourism-related meetings with local governments, agencies and firms to gather perspectives from industry professionals, but there were not a lot of unique or special tourism products or festivals,” Ms Jang said in a briefing at the Seoul Government Complex in Jongno-gu, central Seoul.

“It is important to create tourism products that are appealing to locals and approved by them. We are recommending or introducing things if we like them first. I personally feel this applies to tourism as well,” the Vice-Minister told The Korea Herald.

Ms Jang said tourism major students who share their individual travel experiences on various social media platforms can offer realistic suggestions and showcase the charms of their home towns, as well as areas of improvement. She added that she wanted to spend more time with such students to understand the local tourism landscape.

She also emphasised the importance of creating a safer tourism environment for global and domestic visitors.

The Ministry of Culture, Sports and Tourism is set to organise a public participatory inspection team to root out rip-offs and discriminatory pricing. A separate team will be launched to deal with such cases and assist visitors who file complaints.

The ministry has decided to increase the number of K-tourism roadshows – which are promotional events held overseas to showcase South Korea’s traditional and contemporary cultures – from 15 to 25 in 2024.

Chinese tourists will continue to be exempt from visa fees. This was temporarily applied to Chinese travellers from September to December, and will be extended to 2024. Vietnam, the Philippines and Indonesia will be included in the list of exempt countries.

According to Ms Jang, travel-friendly services – such as a foreigner-exclusive mobile app for train, bus and taxi services, and an English-language navigation app – will be made available in 2024.

To quench tourists’ thirst for Korean content-related events, beauty festivals, K-pop shows, food fairs, e-sports experiences and medical tourism packages, as well as meetings, incentives, conferences and exhibitions tourism packages, will be expanded as well.

“We hope to attract 20 million global visitors to Korea in 2024, and exceed the pre-pandemic number of foreign travellers from 2019. We will also make the utmost effort to collaborate with local governments and tourism-related firms to support mass tourism,” she said.

In 2022, South Korea welcomed approximately 3.2 million inbound visitors, according to the Korea Tourism Organisation. Just before the Covid-19 pandemic, the country had a record 17.5 million inbound tourists in 2019. THE KOREA HERALD/ASIAN NEWS NETWORK

Join ST's Telegram channel and get the latest breaking news delivered to you.

- South Korea

- Travel and leisure

Read 3 articles and stand to win rewards

Spin the wheel now

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

South Korea Tourism Market

In 2019, 28.7 million Koreans, more than half of South Korea’s population, traveled abroad with 2.3 million Koreans traveling to the U.S. (the number of Koreans traveling to the U.S. is an increase of 4% over the previous year). International travel is rapidly growing for Koreans and offers significant opportunities for U.S. tourism exports. The U.S. remains one of the top five destinations for Korean outbound travelers and is the top non-Asian and long haul destination. On average, a Korean visitor to the U.S. spends approximately USD 4,900 per trip.This number translates to over USD 11 billion in tourism revenue in 2019 from Korean outbound travelers to the U.S. Korea is currently the sixth largest source of inbound travel to the U.S.

Korean consumer confidence has increased gradually across generations. Rising discretionary spending on activities, gradual increases in vacation time, heightened globalization, and greater awareness of international developments are motivating more Koreans to travel overseas. Korea’s GDP per capita (PPP) rose to USD 44,740 in 2019 (according to the World Bank), placing it securely in the ranks of middle-income countries. Positive perception of overseas travel and the abundance of information-sharing through mass media and social media are expected to continue to boost the growth of outbound tourism in the coming years. The recent boom of social commerce (social networks and websites that give product/service sellers access to a large pool of Korean travel consumers) is attributing to this growing trend, as they offer all types of travel products and unique experiences. Moreover, travel booking on mobile devices continues to expand for Korean consumers and is becoming a widely-used method of travel planning. Nine out of ten Korean travelers own a smartphone and roughly half of those users booked a flight/hotel via smartphone in the past twelve months. The number of users of the Internet and smartphones has reached 90 percent in the Korean population.

The U.S. is the leading non-Asian destination for Koreans as it offers a variety of activities, culinary tours, and cultural experiences. U.S.-bound Koreans account for 8% of Korea’s outbound market and there is a room for further growth. Koreans use group tours, or travel individually to visit friends and relatives. Group tours can focus on price-competitive products that entice travel agencies in Korea to sell these products. Korean travelers are generally interested in the following activities: visiting museums, national parks, amusement parks, fashion outlets, golf courses, and unique local restaurants and wineries. To tap into this market, American travel and tourism entities should provide marketing collaterals on their destinations in the Korean language and cultivate long-term relationships with the travel trade industry in Korea. There are approximately 11,000 tour agents in Korea. Having effective training programs and promotional information on the U.S. destinations are key factors in accessing the Korean market.

For questions, contact the U.S. Commercial Service Korea at the U.S. Embassy in Seoul: Daniel Lew , Commercial Officer or Jessica Son , Senior Commercial Specialist

South Korea targets to shape its tourism industry

Wednesday, December 13, 2023 Favorite

Prime Minister HAN Duck Soo presided over the 8 th National Tourism Strategy Meeting.

He was focusing on regional tourism, tourist convenience and industry innovation to shape “South Korea’s Tourism Export Innovation Strategy”

Strategy 1: K-Culture Linked Tourism Export Enhancement

As part of the Visit Korea Year 2023–2024 initiative, the plan involves expanding group electronic visa fee waivers, increasing limits for immediate tax refunds on duty-free purchases, and improving transportation reservation services and payment methods

Intensive promotion of Korean tourism in 25 international cities through the “K-Tourism Roadshow,” large events such as the Korea Beauty Festival and K-Pop concerts, and the development of related tourism products

Strategy 2: Boosting Regional Tourism with Local Content

From 2024 to 2033, approximately KRW 3 trillion will be invested in Busan, Gwangju, Ulsan, Gyeongnam, and Jeonnam to enhance cultural, maritime, and recreational tourism infrastructure as part of the “Southern Region Mega-Tourism Development” project

Development of K-Food belts, representative regional festivals, and stay-over tourism

Establishment of “Regional Tourism Strategy Meetings” and “Regional Tourism Collaborative Bodies” to strengthen governance and cooperation between central and local governments

Strategy 3: Industry Innovation through Convergence and Value Addition

Easing medical tourist visas, selecting Korea’s representative healing tourism destination, opening a new Yeongjongdo resort complex equipped with shopping malls, performance halls, and water parks, and developing package products

Applying the E-9 employment permit system to the hotel and condo industry, expanding “Youth Job Leap Encouragement Fund” support in the travel industry to address workforce shortages

Operating joint inspection teams with public participation to eradicate low-price dumping and overcharging and establishing a “Fair Coexistence Center” for receiving and supporting unfair trade complaints to improve tourism quality

The government announced “South Korea’s Tourism Export Innovation Strategy” during the eighth National Tourism Strategy Meeting, chaired by Prime Minister HAN Duck Soo on December 8 at the Asia Culture Center in Gwangju Metropolitan City

The National Tourism Strategy Meeting, established under the Framework Act on Tourism, is a government-wide body for establishing and coordinating tourism policies. Chaired by the Prime Minister and involving ministers from 13 departments, this body previously announced the “6th Tourism Promotion Basic Plan” during the Visit Korea Year 2023–2024, targeting 30 million foreign tourists by 2027.

“ South Korea ’s Tourism Export Innovation Strategy” was discussed in the eighth meeting of the National Tourism Strategy Meeting, which was attended by various government departments, private experts, and stakeholders. The strategy focuses on attracting 20 million foreign tourists and achieving USD 24.5 billion (KRW 32.3 billion) in tourism revenue by 2024, emphasizing enhancing tourist convenience, boosting regional tourism, and driving industry innovation.

Chairman YOON Young Ho of the Korea Tourism Association, Chairman OH Chang Hee of the Korea Association of Travel Agents, Vice-chairman KIM Young Moon of the Korea Hotel Association, Chairman SHIN Hyun Dae of the Korea MICE Association.

At the meeting, Prime Minister HAN stated, “Because of COVID-19, the number of foreign tourists, which had exceeded 17 million, drastically dropped to 970,000 in 2021, leading to difficult times for the industry, national, and local economies.” He added, “Fortunately, this year, we expect to surpass 10 million visitors for the first time in four years, indicating a recovery in the tourism market. As such, the government must exert every effort to ensure that our tourism industry achieves its best performance ever by 2024.”

He further instructed, “The government, local authorities, and the tourism industry must collaborate closely to promptly implement the innovative strategies discussed today. The Ministry of Culture, Sports and Tourism should regularly review and adjust these strategies.”

The details of the “South Korea’s Tourism Export Innovation Strategy” discussed today are as follows:

Enhancing tourist convenience is a crucial factor in securing international competitiveness for attracting tourists post–COVID-19.

The government will focus on significantly improving the convenience of K Tourism, including immigration, shopping, and transportation.

To lower the barrier to visiting Korea, we will alleviate the visa fee burden.

The group electronic visa fee waiver, temporarily applied only to Chinese tourists from September to December 2023, will be extended through 2024 and expanded to include Vietnam, the Philippines, and Indonesia.

To boost shopping tourism, which contributes to foreign currency earnings and stimulates local economies and related industries, the government will double the limit for immediate tax refunds on duty-free purchases starting January 1 next year.

Additionally, we aim to connect 1.8 million ZeroPay merchants with foreign apps for seamless payments and provide immediate tax refund services at duty-free shops, planning to increase the number of these shops to 40% of all duty-free outlets by 2024.

A new duty-free shop will also be reopened at Incheon Port with a newly selected operator.

In line with the increasing trend of individual tourism, we will enhance domestic travel convenience after entry into Korea. The government, in collaboration with the private sector, will develop a mobility app exclusive for foreign tourists to assist with public transport reservations for trains, buses, and taxis and improve English services on navigation apps. We will also expand tourist interpretation guides using artificial intelligence to assist foreign tourists in navigating the country with ease. Intensively promote Korean tourism during the “Visit Korea Year 2023–2024” In collaboration with the private sector, the government will host large events throughout the year where potential tourists can experience Hallyu, shopping, beauty, and medical services. Starting with the “Korea Grand Sale,” set to take place early next year (January–February), the first “Korea Beauty Festival,” which combines beauty, fashion, and medical wellness, will be held in Gwanghwamun Square in June. In September, for the first time domestically, we will host a large-scale Hallyu festival that was previously held overseas, aiming to attract global Hallyu fans. The “K-Tourism Roadshow” for comprehensive marketing in foreign countries will be expanded from 15 cities this year to 25 cities next year, and new (Provisional) Korean tourism promotion offices will be established in 10 countries, including Saudi Arabia, Sweden, and New Zealand for market expansion. At Incheon Airport, the starting and ending point of Korean tourism, a K-Touris and Culture Zone will be established to promote various attractions and major events using immersive content. In collaboration with overseas K-brand franchises such as convenience stores and chicken shops, we plan to release limited edition private label products and conduct Korean tourism promotion campaigns, expanding the marketing frontiers for Korean tourism through public-private collaboration. Enrich various Korean tourism contents by converging with K-Culture We will develop tours linked with major international art fairs such as KIAF and Frieze (September 4–8, 2024) and expand the representative performing arts festival “Welcome to Daehangno.” Additionally, we plan to introduce custom-themed tours for Hallyu fans, such as “BTS Road,” and launch a “K-Culture Training Visa” for foreign youths participating in K-Culture training programs within this year. The ongoing transformation of the Cheongwadae into a landmark for Korean tourism will continue. We will expand themed tourism courses linked with nearby historical, cultural, and tourist resources (10 courses in 2023 to 20 in 2024), enhance exhibition and performance programs, and improve rest and convenience facilities to increase visitor satisfaction. Leveraging the “2024 Gangwon Winter Youth Olympics” held from January 19 to February 2 in Gangwon Province, we will actively promote winter tourism products to the travel industry in China and Southeast Asia. We will support transportation to nearby festivals, such as the Daegwallyeong Snow Flower Festival. Additionally, plans are in place to further develop tourism products and training programs linked with major e-sports events, building on the global popularity of the “2022 Hangzhou Asian Games” gold medal and the “2023 League of Legends Championship” victory.

Advance the era of regional tourism by expanding large-scale regional tourism infrastructure and strengthening central-local governance. The “Southern Region Mega-Tourism Development” project, a 10-year initiative (2024–2033), will be fully implemented. The government, local authorities, and private sectors will invest a total of KRW 3 trillion in Busan, Gwangju, Ulsan, Jeonnam, and Gyeongnam. This investment aims to develop stay- and experience-based tourist attractions in each region by integrating tourism resources such as coastal and inland areas, and the Dadohae islands with culture and technology, creating a “KTourism Resort Belt.” Additionally, approximately KRW 10 billion (USD 7.6 million) will be invested over four years (2023–2026) in Geomundo, Maldo, Myeongdo, Bangchukdo, Baengnyeongdo, Ulleungdo, and Heuksando to develop them as “K-Tourism Islands.” The regional tourism promotion system will be strengthened. A new “Regional Tourism Strategy Meeting” will be established where 17 cities and provinces will discuss regional tourism promotion plans. Regional tourism councils in Gangwon, Chungcheong, Gyeongbuk, Gyeongnam, Honam, and other regions, involving airports, local governments, and industry stakeholders, will also operate to enhance the development and marketing of competitive regional products. We will support the discovery of tourism content that reflects regional characteristics to transform thewhole of Korea into a vast tourist destination. For each of the five major regions nationwide, representative food content will be identified toestablish the “K-Food Belt 30” and promote Korean gastronomic tourism internationally. Furthermore, potential cultural tourism festivals will be selected through a contest to be developed as “Global Festivals,” with support for an extended duration, securing one-stop transportation from airports to festival venues, and enhanced foreign language guidance. To address regional population decline, support for stay-over tourism will be strengthened. By the end of the year, a provisional “Digital Nomad Visa” will be introduced to facilitate workations, allowing domestic stays of 1–2 years. Additionally, the number of cities specializing in night tourism will increase from 7 to 10, including Tongyeong, Daejeon, and Busan. Reflecting the growing demand for outdoor activities, bicycle tourism and walking trips will be promoted through course development, improved guidance systems, and stamp tours. In particular, the “Korea Trail,” which opens in full this March, will be developed into a world-class walking trail resource, with plans for inviting famous trail completers from abroad for exchanges and launching national participation campaigns.

We will focus on developing high-end tourism by leveraging South Korea ’s competitive strengths, such as natural landscapes, traditional heritage, K-Culture, advanced industries, and safe living environments, to generate high added value. Healing, meditation, beauty, and spa are among the themes for designating Korea’s representative healing tourism destinations, supported by integrated branding and marketing. Additionally, to make full use of Korea’s renowned medical technology for medical tourism, we will ease the issuance of medical tourism visas and expand tailor-made medical tourism products for patients undergoing treatments like dermatology and cosmetic surgery, often followed by tourism activities. Strategic marketing will also be implemented in a total of 12 countries, including new additions such as

Vietnam, Thailand, the Philippines, and Canada. With the opening of a new complex resort in Incheon’s Yeongjongdo Island, equipped with a foreigner-exclusive casino, 5-star hotels, and a 15,000-seat performance hall, we will develop stay and transit tourism programs and package products utilizing the large performance hall to establish a hub for K-Pop concert tourism. Furthermore, we plan to establish the “5th International Meeting Industry Promotion Basic Plan (2024–2028)” in February to leap toward being “Asia’s No.1 International Meeting (MICE) Tourism Destination,” offering a blueprint for hosting and promoting international conferences. To restore the tourism industry heavily affected by COVID-19, we will expand the supply of the workforce and continue to pursue the improvement of the quality of Korean tourism.After piloting, we will develop and implement a plan to introduce the Employment Permit System (E-9) to the hotel and condo industry, and relax the criteria for the specific activity visa (E-7) for semi-professional staff (hotel reception clerks). We will also expand the “Youth Job Leap Encouragement Fund” support for the travel industry, allowing any employer with more than one insured person under employment insurance (previously five or more) to receive incentives foremploying youth, actively addressing the industry’s workforce shortage. To eradicate the recent social issue of overcharging, we will newly operate a “Public Participation Joint Inspection Team” and host a “Festival Food Fair Pricing Campaign” to improve the quality of services like accommodation, transportation, and food in major tourist areas. Additionally, a new“Fair Coexistence Center” will be established to support the travel industry with unfair trade complaints and legal consulting, and a continuous effort of self-regulation will be made through public-private cooperation and regular inspections.

Tags: south korea , Tourism , Tourist

Subscribe to our Newsletters

Related Posts

- The Marianas is a stand out at the 39th Seoul International Travel Fair

- Time to diversify Hawaii’s inbound tourism market

- Vietnam welcomes nearly 847,000 South Korean visitors in April

- Visa-free countries for Turkish citizens

- Do you know why South Korea and Taiwan is implementing this new tourist exchange?

Select Your Language

I want to receive travel news and trade event update from Travel And Tour World. I have read Travel And Tour World's Privacy Notice .

REGIONAL NEWS

Iberia Takes Flight with Culinary Excellence: Wins ‘Outstanding Food Servi

Thursday, May 30, 2024

Here are the spectacular Northern Europe’s destinations that offer a cool

Small plane makes emergency landing on Highway 501 in South Carolina

Alaska Airlines Launches ‘Upgrade Unlocked’ – Surprise Premium Cla

Middle east.

Diriyah Offers Multilingual Historical Tours Showcasing Heritage and Cultural Si

From Al Ula to Seychelles: Here are the visa-free Eid escapes and summer flight

Incubase Studio Extends Fullmetal Alchemist Exhibition at INCUBASE Arena in Hong

India’s Golden Triangle Tourism Circuit Faces Massive Heatwave: Check if You A

Upcoming shows.

May 29 ASTA:The Travel Advisor Conference May 29 - May 31 Jun 02 Global Travel Marketplace West 2024 June 2 - June 4 Jun 02 The Leisure Show 2024 June 2 - June 6 Jun 03 ProcureCon June 3 - June 4

Privacy Overview

Tourism in South Korea

Development of the tourism sector in south korea from 1995 to 2020.

Major travel destinations in South Korea

Revenues from tourism.

All data for South Korea in detail

How Has The Korean Wave Influenced Tourism In South Korea?

The Korean entertainment industry, with its dramas and chartbusting K-pop, has increased the cultural exportation of the brand ‘Korea’.

Before we dive into the effect of the Korean Wave on tourism, it’s important to understand what the wave is. The Korea Tourism Organization (2012) defines the Korean Wave as “a favorite phenomenon of Korean popular culture abroad”. The term was originally coined by the Chinese press in the 1990s when Korean dramas like ‘Jealousy’ (1993) and ‘What is Love All About?’ (1997) were first shown on China State Television. They gained an extensive audience and recognition and kickstarted the Korean Wave. Later, it spread to Japan through music. Thanks to the many bands such as BoA, Girls Generation, Super Junior, Big Bang, BTS, GOT7, and BlackPink, the Korean Wave exploded across not just Asia, but the world. Today, the term Korean Wave (Hallyu in Chinese) is synonymous with Korean culture, and its increased popularity and cultural impact, and includes everything from television, movies, music, and food, to sports.

The Korean Wave spread like wildfire through different stages: In the 1990s, it swept across Japan, China, and Taiwan; in the early 2000s, Hallyu went global with dramas being broadcast in the Middle East, Australia, and the American continent; and in 2020, K-pop bands like BTS sold out stadiums and topped international music charts.

Impact On Tourism

The influence of the Korean Wave on international fans is something that cannot be ignored. But has this influence impacted the country’s outbound or inbound tourism? Some scholars argue that in 1962, South Korea was viewed as an unfavourable tourist destination. This was due to student riots and perceptions of political instability, further enhanced by overseas news media reports that showcased only the ongoing tensions between North and South Korea. However, this changed after the 1988 Seoul Olympics which allowed a larger audience to witness Korea differently. Tourism increased but the government did not fully recognise its potential until after further economic growth following co-hosting the 2002 soccer World Cup with Japan.

Since the late 1990s, Hallyu tourism has trended across the globe and attracted more and more foreign fans to visit Korea. ‘Hallyu tourism’ refers to those foreigners who visit Hallyu tourist attractions due to the influence of this Korean wave. The cultural influences brought by the Korean Wave have proven to be an essential component of South Korean tourism. The wave brought Hallyu stars, which include Korean actors, pop stars, and athletes, to a world platform, and their popularity became an effective and profitable method to attract tourists. According to Martin Roll, the Hallyu effect has been tremendous, contributing to 0.2 percent of Korea’s GDP in 2004, amounting to approximately USD 1.87 billion. In 2019, Hallyu had an estimated USD 12.3 billion boost to the Korean economy.

How Has The Korean Wave Managed To Impact The Tourism Industry?

The government’s involvement:.

The Republic of Korea became a sought-after tourist destination both regionally and internationally since the Korean Wave or Hallyu started being used by the Korean government to increase its tourism efforts. The promotion of Hallyu stars by the government through various campaigns led to an increased desire to travel to Korea and increased attention to Korean culture. Whether it is SouthEast Asia or the world, the concept of the Korean Wave has increased the cultural exportation of the brand ‘Korea’ and increased the influx of tourists to Korea.

Hallyu’s power to attract can be seen not only in Southeast Asia but across the world as well. It has led to K-pop/K-drama-based tours that take die-hard fans to the best K-pop/K-drama locations around the country. The Korean government, through its Ministry of Culture, Sports, and Tourism (MCST) has used the Korean Wave to not just increase tourism to South Korea but also to encourage the purchase of Korean cultural products, as well as national goods like Samsung and LG electronics. All of it leads to increased GDP.

The worldwide interest started with K-pop performers such as Girls’ Generation, Super Junior, Big Bang, and Psy’s popularity. Their image transformed the social and cultural image of Korea. When once Korea was seen as politically unstable, it was now viewed as a place of wealth and opportunity due to the high fashion of these stars, their music, and their message. This interest in Korean culture also led to an avid interest in the Korean language, electronic items, fashion, beauty products, and cuisine. While Western culture has a certain amount of hegemony over the planet, it seemed South Korea wasn’t far behind.

Kpop Or Kdrama Locations

Various universities in South Korea were assigned to produce the next generation of directors, producers, and actors. Film studios were actively promoted by the government and additionally, budgets were allocated to creating agencies ( Hallyu agencies under the umbrella of South Korea’s Ministry of Culture, Sports and Tourism) that primarily focused on promoting tourism based on Korean culture and K-Drama locations such as movie sets and television sets as tourist destinations. Today while the government owns many of the media outlets, there are numerous private organisations, and the philosophy is no longer domestic-orientated but rather internationally focused and promoted. These departments focus on promoting the Korean Wave through avenues such as food, sports, or celebrity events. The government has also promoted and encouraged the Korean Broadcasting Commission (KBC) to visit international film festivals.

In 2019, Maria Teresa Ogando Barros in ‘The Hallyu Wave and Tourism in South Korea’ notes that South Korea accounted for a total of 17,502,623 international visitors due to the Hallyu Wave, a 14 percent increase as compared to 2018, and a tourism expenditure of US$28,855,400,000 was made during this year – an impact of Hallyu Wave. East Asia and the Pacific countries still make up for 83.1 percent of tourists visiting South Korea, with 34.4 percent of those being Chinese visitors (Korea Tourism Organisation).

Fashion Tourism And Medical Tourism

Due to the Korean Wave, Seoul, the capital city of South Korea, became a global icon of fashion, beauty and culture. Fashion that was closely related to Hallyu idols, served as a promotional image of South Korea. So much so that many Hallyu fans began visiting Korea to look like their favourite pop stars or Hallyu stars. And because of that aspiration, medical tourism, particularly cosmetic surgery and the cosmetics industry were also directly affected by the Korean Wave. Dobo Shim in his paper ‘ Waxing the Korean Wave’, 2011 notes that Hallyu fans visit Korea to get plastic surgery to look like their idols.

A Hybrid Of Different Cultures

The Korean Wave includes Korean music and drama. Korean music or the K-pop industry created a hybrid genre where they would mix American music styles and choreography with Hangul. An idol’s image was tailored to Western standards. The Korean Wave was therefore a mix of Asian and Western tastes. According to Howard K’s ‘Exploding Ballads: Due to the Transformation of Korean Pop Music’, “…more and more musicians appropriated foreign music styles”.

The success of Kdrama culture is believed to be due to its apolitical nature and its adaptability to a majority of cultures. South Korean dramas have something for everyone. The dramas evolve with the audience, showing shifts in generational mindsets, and appealing more and more to an audience beyond South East Asia. Even ‘ Forbes’ notes that JTBC’s ‘Itaewon Class’ (2020), might not be the first drama to feature a transgender character in a positive light, but it might be the first one to celebrate a character’s transition.

This adaptation has led to Kdrama’s increased popularity. According to Ulara Nakagawa’s article “Korea’s Hallyu Boom?” , a plethora of ‘fan clubs’ have sprung up around the world, not only to support their K-pop groups but also to work towards various causes. One of the more recent examples is how in June 2020 the BTS ‘Army’ raised over $1 million for the Black Lives Matter movement in just 25 hours .

Globalisation And New Technologies Helped

Of course, South Korea has used globalisation and digitalisation to promote its cultural media. The Korea Creative Content Agency USA highlights that while globalisation was initially created through traditional media, it was new media that brought different means of mass communication using digital technology that globalised the Korean Wave. Having played this significant role in the continued growth of Hallyu, the internet and social networking services (SNS) further led to significant growth in tourism.

Government agencies such as the Ministry of Culture, Sports and Tourism (MCST) and the Korean National Tourism Organisation (KNTO) have regularly published news articles about Hallyu on their digital media websites and even produced in-depth reports on the popularity of Kdramas and Kpop. The ease of access of Kdrama or Kpop through various platforms enhanced the spread of Korean culture. What began with the airing of a television drama in China in the early 1990s, transformed into a global phenomenon within just two decades.

Cancelling Out The Language Barrier

The digitalisation of the Korean Wave enabled access to Korean drama with subtitles, cutting language barriers. It encouraged people to take an interest in Korean culture and language, leading to the opening of Korean cultural centres in other countries. Korea Economic Institute Of America notes that the only language to experience significant growth in the United States over the last few years was Korean. The number of students studying Korean increased by 44.7 percent even as overall language enrollment decreased by 6.7 percent.

Tourism Promotions

Prominent actors, actresses, and K-pop stars are used by government agencies to promote Korea as a tourist destination and have allowed Korean businesses to break into regional markets. According to the Korean Culture and Content Agency’s ‘The Korean Wave. Entertaining more than half the world, the Korean Wave has improved Korean business access and profits both regionally and internationally. Tourism campaigns regularly feature K-pop idols. For example in 2018, eight members of EXO were made honorary ambassadors of Korean tourism. They were not just extremely popular, they also became a practical way to connect K-pop and tourism.

After Korean singer Psy’s ‘Gangnam Style’ became YouTube’s most-viewed video of all time in 2012, tourism officials posted a guide to the real Gangnam (one of Seoul’s most affluent areas). BTS under Big Hit Entertainment, has been strongly positioned as the main player for Hallyu. In 2018, Seoul launched seven advertisements with BTS, to amp up the appeal and tourist-friendly nature of Seoul.

Also Read: 9 K-pop/K-drama Locations You Must Visit If You’re A True Fan

Success And Failure?

While we can all agree that the Korean Wave has led to South Korea becoming the world’s leading exporter of popular culture, the wave’s influence has also drawn attention to the weaknesses within Korean society or the entertainment industry as a whole.

Wage Gap Due To Gender

Like many androcentric societies, even in South Korean society, gender inequality has been perpetuated and deepened by historical practices and traditions. In Korean society, hierarchical and patriarchal values go hand in hand, thus reinforcing gender norms. Even the K-pop idol industry contains elements that reinforce a sexist culture, all of which continue to be a big obstacle for women to pursue an equal opportunities in any industry. Many girl groups in K-pop or female stars are criticised more harshly than their male counterparts for the same behaviour.

It is no surprise that Korea has the biggest gender wage gap among OECD nations. According to a report by ‘Koreaboo’, Korea’s National Tax Service released shocking findings on the difference in income between male and female actors and singers: “In the entertainment industry, men made 9 million won ($ 7,605) more on average than their women counterparts. However, this disparity was not observed within the top 1 percent. As far as the music industry is concerned, male stars made an average of 53 million ($44,789) more than female stars. This disparity was true within the top 1 percent where male singers earned more than double their female counterparts.

Unnatural Standards Of Beauty

Korea’s unnatural standards of beauty can easily be seen in the kind of K-pop or Hallyu stars produced by the industry. While both male and female stars are subjected to the pressure of looking ‘young and physically attractive’, the female stars have specifically stricter standards and more limitations. They are expected to live up to all but impossible standards. There are many who say that Korea is a society obsessed with appearance when cosmetic-surgery clinics are ‘as many as convenient stores’. Hallyu culture cuts into the fabric of beauty perception and its influence on beauty standards.

LGBTQ Representation

Another threat that concerns both the entertainment industry and South Korea as a tourism destination is the lack of LGBTQ+ rights and their representation in the industry. The Kdrama and Kpop industry hasn’t been very open about LGTQ+ rights because they are still not accepted in mainstream society in the country. In Korea, where same-sex marriage is still illegal, and most still hold onto conservative mindsets, those who struggle to find their sexual identity also feel the need to repress it. It could also appear as a drawback for attracting LGBTQ+ tourists.

Lawsuits Against The Entertainment Companies

The K-pop industry has an extremely demanding nature. The recruitment practices, rigorous training system, and the continual pressure to be ‘perfect’—have led to many artists filing lawsuits against their own companies. At different training academies, many well-known entertainment agencies usually first recruit dozens of students, bind them in contracts that last up to 15 years or more, and train them so that they can become ‘global stars’. Decisions about their costumes, choreography, lines, and monthly evaluations are usually not up to the idols to make. The demanding nature of the industry has led to many issues with how trainees, idols, and actors are treated by their companies.

One of the biggest examples of these lawsuits is when the group B.A.P, which debuted in 2012, filed a lawsuit two years later against their company TS Entertainment. They reported many unfair terms in their contract. This lawsuit led to the South Korean government revising several contracts. The case became a massive reference in the industry. The lawsuits following this highlighted how the trainees or popstars were treated by the entertainment industry, and have in one way or another created a grim image of South Korea as a tourism destination.

Abuse And Mental Health

According to OECD Data , South Korea has the second-highest suicide rate among OECD countries. Indisputably, lack of attention to mental health is a growing problem in the country and the Hallyu industry. It’s unfortunately apparent in the spate of suicides involving K-pop stars in recent times. It is not uncommon for artists to go on a hiatus due to anxiety or depression, or even die by suicide. In 2017, Kim Jong-hyun, 27, a member of SHINee, died by suicide. In 2019, Jeon Mi Seon (actress), Sulli (actress and former member of f(x)), Goo Hara (actress and former member of KARA), and Cha In Ha (actor and member of Surprise U) also died by suicide.

Mental health issues are still taboo in South Korean society, therefore people either hide their issues or prefer not to get treated. Further, the mental health problems caused by various reasons, be it online abuse or unnecessary high standards of beauty, have created a negative image of the South Korean entertainment industry, and also led to a high percentage of people seeing South Korea as an undesirable country to visit.

Sex Scandals

Reports of sexual and other forms of abuse have plagued the South Korean entertainment industry for years. In March 2019, several male Kpop stars, including Seungri, a member of the boy group Big Bang, Choi Jong-hoon, a former member of FT Island, and singer-songwriter Jung Joon-young were implicated in a spycam sexual abuse scandal, also called the Burning Sun scandal. The successive accusations in the case not only highlighted sexual assault but also involved sex trafficking, secret and non-consensual filming, and video distribution of sexual acts, drug trade, rape, police corruption, and tax evasion in the industry. The case resulted in a huge investigation and re-opening of sex crime cases related to the entertainment industry.

Also, the suicide of soap star Jang Ja-Yeon highlighted South Korea’s deep-rooted misogyny. These scandals, once again, lent to South Korea’s image of being an unsafe country for female residents and travellers.

BTS And Tourism

The best example that showcases the worldwide spread and rising relevance of South Korean media is the K-pop group Bangtan Sonyeondan or BTS. Their success appears to have improved Kpop’s image, raised the global recognition of Korean artists, and furthered interest in Korean culture. According to ‘ Business Insider ’, BTS increased South Korea’s popularity, contributing to a surge in tourism. Seemingly breaking all kinds of cultural barriers, their 2020 album Map of the Soul: 7 continues to dominate the world.

Just last year, BTS’ World Tour ‘LOVE YOURSELF: SPEAK YOURSELF’ concluded in Seoul in October at the Seoul Olympic Stadium. According to a research study conducted by the Korean University professor Pyun Ju Hyun, the event drew around 187,000 tourists, of whom approximately 23,000 attended the concerts, and an average of 3 in 10 visitors went to Seoul. Soompi reports that this resulted in an increase in the average number of visitors in South Korea in 2019—approximately 87,000 more people than average.

In fact, according to a study by South Korea’s Ministry of Culture, Sports and Tourism and a government tourism institute BTS’s US-chart-topping single ‘Dynamite’ of 2020 was predicted to generate more than $1.4 billion for the South Korean economy and thousands of new jobs in the country. The study excluded foreign tourism due to the tight travel restrictions imposed by Seoul over the coronavirus pandemic. However, the ministry added, “If we include the projected tourism revenue down the road… we expect the economic impact to be stronger.”

How Can Hallyu And Tourism Work Together?

The Hallyu industry is a solid export product for the country and owns a stable foundation to develop a high-quality tourism industry. Strong government support and recognition of Hallyu could be a key element that can prove its power and relevance, and the likelihood of Hallyu tourism can be further developed annually. However, South Korean society and the Korean government have to work together, on the weaknesses mentioned above, especially the ingrained misogyny and gender inequality. These drawbacks paint a negative picture of the country and prevent female tourists from visiting. Also, legal actions must be introduced into the entertainment industry, to deter the recurrent issues arising from artists’ mistreatment, which not only goes against basic human rights but also feeds the controversial image of the entertainment industry. The idea that Hallyu creates and affects South Korea’s image as a destination might be bound to subjective interpretation and personal preferences, but it is clear that Hallyu tourism is strongly related to globalisation. Therefore, the country should benefit from the fact that newer generations seem to be more open-minded and accepting of different cultures. Moreover, these newer generations seem to be more interested in themed travels and cultural experiences which are likely to increase the influx of tourists interested in film or music.

- Millennial Trends

- Tourism Industry

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Buy USA travel guides

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

WTTC research reveals Travel & Tourism sector’s contribution to South Korea’s GDP dropped by $33.3 billion in 2020

COVID-19 sparks a dramatic 45.5% collapse in the sector’s contribution to GDP 84,000 jobs lost, while many more remain protected by the job retention scheme However, the return of international travel this year could see GDP contribution rise sharply and jobs return WTTC recognises the government for its effectiveness in managing the crisis through the implementation of processes, policies, and protocols

London, UK: The World Travel & Tourism Council’s annual Economic Impact Report (EIR) today reveals the dramatic impact COVID-19 had on South Korea’s Travel & Tourism sector, wiping out $33.3 billion from the nation’s economy.

The annual EIR from the World Travel & Tourism Council (WTTC), which represents the global Travel & Tourism private sector, shows the sector’s contribution to GDP dropped a staggering 45.5%.

Travel & Tourism’s impact on the nation’s GDP fell from USD$73.2 billion (4.4%) in 2019, to USD$39.9 billion (2.4%), just 12 months later, in 2020.

The year of damaging travel restrictions which brought much of international travel to a grinding halt, resulted in the loss of 84,000 Travel & Tourism jobs across the country.

However, this number, while devastating to those affected, is much lower than many other countries globally and within the region.

WTTC believes the true picture could have been significantly worse, if not for the government’s job retention scheme, the Universal Employment Insurance Roadmap, and the emergency relief stimulus payments, all of which offered a lifeline to thousands of businesses and workers.

These job losses were felt across the entire Travel & Tourism ecosystem in the country, with SMEs, which make up eight out of 10 of all global businesses in the sector, particularly affected.

Furthermore, as one of the world’s most diverse sectors, the impact on women, youth and minorities was significant.

The number of those employed in the South Korean Travel & Tourism sector fell from nearly 1.4 million in 2019, to 1.3 million in 2020, a drop of 6.2%. However, again due to the government’s job retention scheme, this figure was significantly lower than the global average fall of 18.5%.

The report also revealed domestic visitor spending declined by 34%, and while international spending fared even worse due to more stringent travel restrictions, falling by 68%, only slightly better than the global average decline of almost 70%.

Virginia Messina, Senior Vice President WTTC said: “The loss of 84,000 Travel & Tourism jobs in South Korea has had a terrible socio-economic impact, leaving huge numbers of people fearing for their future.

“However, we must applaud President Moon Jae-in for his incredible efforts. WTTC and its members would also like to thank Minister of Culture, Sports and Tourism Hwang Hee for his commitment to the private sector in its efforts to save Travel & Tourism.

“The government’s response to COVID-19 has been extremely good, managing the crisis through the implementation of robust processes, strong policies, and protocols.

”Building on its experience handling Middle East Respiratory Syndrome (MERS), South Korea was able to flatten the epidemic curve very quickly, without closing businesses, issuing stay at home orders, or implementing many of the stricter measures adopted by other countries until late 2020.

“Furthermore, it developed clear guidelines for the public, conducting comprehensive testing and contact tracing, and supported people in quarantine to make compliance easier. The easing of quarantine rules for vaccinated travellers is certainly a step in the right direction.

“WTTC believes that if restrictions on travel are relaxed before the busy holiday season, alongside a clear roadmap for increased mobility and a comprehensive testing on departure scheme in place, the 84,000 jobs lost in South Korea could return later this year."

WTTC research shows that if mobility and international travel resume by June, the sector’s contribution to global GDP could rise sharply in 2021, by 48.5%, year-on-year.

The global tourism body believes the key to unlocking safe international travel can be achieved through a clear and science-based framework to include rapid testing before departure, as well as enhanced health and hygiene protocols, including mandatory mask wearing, alongside the vaccine rollout. These measures will be the foundation to build the recovery of the many millions of jobs lost due to the pandemic.

It would also reduce the terrible social implications these losses have had on communities reliant on Travel & Tourism and upon ordinary people who have been isolated by COVID-19 restrictions.

Download the press release.

.jpg)

El sector de viajes y turismo generará más de 11% de los empleos totales en Argentina durante el 2024

.jpg)

El sector de viajes y turismo contribuirá con 19.2 mil millones de dólares al PIB de Colombia durante 202: WTTC

.jpg)

Travel & Tourism in Germany is Still Trailing European Neighbours, WTTC Research Reveals

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

South Korea Tourism Market

A Detailed Analysis of the South Korea Tourism Market by Sustainable, Medical, Sports, Cultural, Culinary, Faith, Wellness, and Others

Travel Agencies and Operators Capitalizing on the Growing Demand for South Korea as a Requested Travel Destination- Make Better Business Decisions with the Help of FMI's Insights

- Report Preview

- Request Methodology

South Korea Tourism Market Outlook (2023 to 2033)

As per newly released data by Future Market Insights (FMI), the South Korea tourism market is estimated at US$ 35.8 million in 2023 and is projected to reach US$ 77.9 million by 2033, at a CAGR of 8.10% from 2023 to 2033.

In Korea, tourism is a key factor in economic expansion. Opportunities in the Korea tourism market are still plentiful. More diverse travel experiences and social media optimization are on the rise as growth trends.

With Hong Kong, Taiwan, and Singapore, South Korea was one of the ‘Four Dragons of Asia’ and had tremendous growth starting in the 1970s. An increase in tourism has accompanied this economic boom.

It constantly ranks among the most popular and in-demand travel destinations on the planet. A cultural phenomenon known as 'Hallyu,' or the 'Korean wave,' is what drives the demand for South Korea tourism.

The fashion was originally seen in TV dramas and stage performances by K-Pop performers, and it afterward made an appearance in the technology, food, and cosmetics industries.

The resurgence of the tourism industry is primarily being supported by the entertainment industry. The Korean Hallyu, as was already said, is a significant contributor to the South Korea tourism industry.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

What are the Drivers of the South Korea Tourism Industry?

The younger generation in South Korea is likely to research vacation possibilities using online social media platforms and sources. Due to more lenient international travel laws and visa restrictions, the South Korea tourism industry size is expected to expand during the forecast period.

Moreover, with rising interest in seeing new places, enhanced air connectivity, rising earnings, and government programs that have given South Koreans more free time, travelers from South Korea increasingly prefer to travel overseas.

Several South Korea's tourists come from neighboring countries, including Hong Kong, Japan, China, and Taiwan. The primary source of tourism in South Korea is the so-called ‘Korean Wave.’

Furthermore, in the late 1990s, Korean pop culture experienced a dramatic rise in popularity worldwide. Korea's dramas, TV shows, and pop music evolved from being a regional fad to a global phenomenon.

This was especially noticeable in the neighboring nations, and it even prompted the Korean government to promote the demand for South Korea tourism by providing subsidies or startup capital.

The declared goal is to displace the United States from the top spot it has held for nearly a century by making the nation a leading exporter of culture alongside British and Japanese culture.

What are the Key Trends in the South Korea Tourism Market?

Expanding Entertainment Industry

Korea's culture, music, and films have been known as Hallyu, to which K-pop and K-drama have been added. Travelers' increasing preference for working abroad due to more flexible international travel requirements and visas, travelers' growing interest in discovering new places, improved air connectivity, and rising incomes.

Government Initiatives

Government initiatives that have given South Koreans more free time all contributed to South Korea's rapid growth in outbound tourism. Famous spots for food and drink influence South Korean respondents' decision-making when selecting a holiday spot.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

What Factors Restrain the South Korea Tourism Industry?

Due to a few factors, it can be difficult to promote South Korea's tourism market, which has tremendous potential, to the rest of the world. Political tensions spurred on by unsolved problems with neighbors like North Korea, China, and Japan have made this region a potential hot spot that could suddenly erupt.

It is expected to be highly rare for tourists from outside of East Asia to travel to South Korea amid unrest, as safety and security are of the utmost priority. Even countries that the government disagrees with politically may face restrictions on travel to and from their territory. This can be especially challenging, as several tourists are locals.

A Cultural Boost is Helping the South Korea Tourism Industry Grow

South Korea is one of the most attractive countries, and it is likely to continue to draw more tourists over the projection period owing to its picturesque beaches, islands, lovely seasons, culture, food, and many other features.

South Korea is renowned throughout the world for its dynamic music scene. K-pop is not just a style of music. It is also an element of Korean culture that has captivated audiences throughout Asia and the rest of the world. Numerous skincare and cosmetics companies with the most cutting-edge and futuristic items on the market can be found in South Korea.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Comparative View of the South Korea Tourism Market

South Korea Tourism Market:

Virtual Tourism Market:

Mexico Sustainable Tourism Market:

Category-wise Insights

Which type of tourist is more prominent in the south korea tourism market.

Domestic Tourism is the Most Prominent Tourist Type in South Korea tourism

A lot of the profit made by the South Korea tourism business comes from domestic travel. Due to the nation's extensive train and bus network, a large part of the country can be reached in one day or less from any leading city.

In Korea, domestic tourists are increasing. The amount of people that travel within the country, including on day excursions, is encouraging the demand for South Korea Tourism.

Which Age Group Is Contributing More to The South Korea Tourism Industry?

South Korea tourism is continuing to be quite popular among people aged 35 to 49

Due to their propensity for attraction, readiness for travel, and desire to explore, people in the 35 to 49 age range make up the majority of South Koreans who go on vacation.

What Type is More Preferred in the South Korea Tourism Industry?

People in the South Korea Tourism Market Usually prefer package travel.

The main reason tourists opt for packaged travel is the cost savings compared to booking individual flights. The lodging, transportation, and site entrance fees are all included in package travel, with significant savings and promotions.

What Type of Booking Channel is the Most Prominent in the South Korea Tourism Market?

Online Booking is More Preferred by Tourists

Tourists prefer to book online or use a mobile application platform. This is to offer hassle-free digital payment transfer, enhanced security, and live tracking. Furthermore, the number of Korean customers purchasing trips on their mobile devices keeps growing and is increasingly common.

Online booking is becoming an increasingly widespread approach worldwide. Travelers use the internet to search, compare, and analyze information regarding vacation spots, accommodations, restaurants, and more.

How Are Start-ups Performing in The South Korea Tourism Market?

Start-ups are encroaching on the South Korea tourism market due to the abundance of lucrative opportunities there. Digitalization and technological development support the South Korea tourism market.

Some Recent Start-ups Contributing to the South Korea Tourism Industry Share Are

The South Korea internet travel agency Waug.com offers a variety of trips and activities. The platform allows users to search, look up availability, compare costs, and book trips and activities. Extreme sports, trips to theme parks and museums, and other activities are all covered online with platform payments available.

A platform for booking vacation packages is offered by Extriber. Provides ‘TripStore,’ an app-based marketplace that enables customers to browse, assess, and reserve travel arrangements from a variety of affiliated travel agents and tour operators. The trip packages can be picked out based on their budget, places, and length of stay and grouped based on themes and preferences.

Users may find, evaluate, and reserve vacation packages from a variety of partner travel agencies and tour operators using the app-based Tripstore platform.

How Competition Influences the South Korea Tourism Industry?

South Korea tourism market players seek strategic alliances and partnerships with other tour operators or travel agencies to broaden their service offerings and draw more tourists.

Recent Developments

- South Korea travel tech start-up Yanolja has acquired a 70% stake in a listed South Korea e-commerce pioneer, Interpark for about US$ 250 million. The firm aims to use the acquisition to advance further in the overseas tourism industry.

- ‘Feel the Rhythm of Korea,’ a collection of eight videos that highlight the traditional and contemporary aspects of ten different Korean tourist destinations, has amassed 161 million views on YouTube and is still growing. This may make it the most successful single global tourism recovery campaign to be launched since the pandemic.

- In June 2023, Korea Tourism Organization (KTO) introduced a special K-incentive Scheme to ramp up the sales of Korea tour & travel packages in the market. The new initiative is aimed at travel agencies throughout India. The main benefit of this scheme includes offering travel agents prizes worth US$ 30 for every passenger. Along with this, simple, quick, and hassle-free tour visas are also expected to be arranged for visitors to Korea from June to December 2023.

Key players

- G Adventures

- The Dragon Trip

- Intrepid Travel

- On-the-go Tours

- Exodus Travels

- Travel Marvel

- TNT Korea Travel

- Korea Private Tours

- Thomas Cook

- Koryo Tours

Scope of Report

South korea tourism market by category, by tourism type:.

- Sustainable

By Booking Channel:

- Phone Booking

- Online Booking

- In-Person Booking

By Tourist Type:

- International

By Tour Type:

- Independent Traveler

- Package Traveler

Consumer Orientation:

By age group:.

- 15 to 25 Years

- 26 to 35 Years

- 36 to 45 Years

- 46 to 55 Years

- 66 to 75 Years

- EA (East Asia)

Frequently Asked Questions

What is the growth potential of this market.

The growth potential of this market is 8.10% through 2033

Which Age Group Is contributing more to the South Korea Tourism Industry?

South Korea tourism remains favored by ages 35-49.

What Limits the Growth Potential of the Market?

Unresolved issues with North Korea, China, and Japan makes potential volatile hotspot and limits growth.

Which Product Type is preferred in the South Korea Tourism Industry?

Packaged travel is preferred in the South Korea tourism industry.

What drives sales of this market?

South Korea's tourism industry is set to grow with relaxed travel laws and visa rules.

Table of Content

Recommendations

Travel and Tourism

Asia-Pacific Tourism Market

Published : February 2023

South Korea Sports Tourism Market

Published : August 2022

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Travel & Tourism in South Korea (2023)

Unlock hidden opportunities in the Travel and Tourism industry

Published: May 23, 2024 Report Code: GDTTCS-22-48-MP-L5

- Share on Twitter

- Share on LinkedIn

- Share on Facebook

- Share on Threads

- Share via Email

- Report Overview

Table of Contents

Methodology.

Discover untapped potential in the Travel & Tourism industry with our Travel & Tourism in South Korea (2023) report and make more profitable business decisions.

GlobalData’s country series report titled ‘Travel & Tourism in South Korea (2023)’ provides a wealth of key data for the travel & tourism sector in South Korea. The data in this report includes demands & flows data on domestic travel, international arrivals and departures. Additionally, data is provided on traveler spending patterns, the airlines, hotels, car rental, and travel intermediaries sectors. The report also identifies the key themes impacting the tourism industry.

In 2022, South Korea welcomed 2.72 million international arrivals. The country also saw 4.86 million international departures over the same period. This report is based on data from databases compiled by GlobalData’s team of industry experts.

- Assess and seize new business opportunities in the current landscape of South Korea’s travel and tourism sector.

- Future-proof your strategies by utilising historical and projected performance data from specific market segments that shape the industry.

- Effectively plan and allocate resources in response to evolving tourism behaviours, fostering sustainable growth.

Reasons to Buy

Uncover comprehensive data on the patterns and trends of travel within South Korea. Dive into information related to travel destinations, purposes, and preferences of domestic tourists.

Capitalise on business opportunities by understanding how travellers allocate their expenditures based on their spending habits on accommodation, transportation, food, and other expenses.

Access data on inbound tourists arriving in South Korea and outbound trips made by residents. This section includes popular destinations, factors driving these travel trends, and visitor demographics.

Understand occupancy rates for hotels, load factors for airlines, car rental trends, and the role of travel intermediaries in facilitating bookings and reservations.

Identify opportunities within the market and tailor your strategies to target specific customer groups in the travel and tourism industry of South Korea.

Leverage historical and projected performance data to gauge the trajectory of the industry. Study how it has evolved over time and determine what can be expected in the future to enhance your strategies.

Key Players

Definitions & Research Methodology

Frequently asked questions

All the above details are then collated to build the end deliverable in an easy to consume format.

- Currency Conversion is for Indicative purpose only. All orders are processed in US Dollars only.

- USD - US Dollar

- AUD — Australian Dollar

- BRL — Brazilian Real

- CNY — Yuan Renminbi

- GBP — Pound Sterling

- INR — Indian Rupee

- JPY — Japanese Yen

- ZAR — South African Rand

- USD — US Dollar

- RUB — Russian Ruble

Can be used by individual purchaser only

Can be shared by unlimited users within one corporate location e.g. a regional office

Can be shared globally by unlimited users within the purchasing corporation e.g. all employees of a single company

Undecided about purchasing this report?

Get in touch to find out about multi-purchase discounts.

[email protected] Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Sample Report

Travel & Tourism in South Korea (2023) was curated by the best experts in the industry and we are confident about its unique quality. However, we want you to make the most beneficial decision for your business, so we offer free sample report to help you:

- Assess the relevance of the report

- Evaluate the quality of the report

- Justify the cost

Download your copy of the sample report and make an informed decision about whether the full report will provide you with the insights and information you need.

Below is a sample report to help you understand the structure of the report you are buying

“The GlobalData platform is our go-to tool for intelligence services. GlobalData provides an easy way to access comprehensive intelligence data around multiple sectors, which essentially makes it a one-for-all intelligence platform, for tendering and approaching customers.

GlobalData is very customer orientated, with a high degree of personalised services, which benefits everyday use. The highly detailed project intelligence and forecast reports can be utilised across multiple departments and workflow scopes, from operational to strategic level, and often support strategic decisions. GlobalData Analytics and visualisation solutions has contributed positively when preparing management presentations and strategic papers.”

“COVID-19 has caused significant interference to our business and the COVID-19 intelligence from GlobalData has helped us reach better decisions around strategy. These two highlights have helped enormously to understand the projections into the future concerning our business units, we also utilise the project database to source new projects for Liebherr-Werk to use as an additional source to pitch for new business.”

Your daily news has saved me a lot of time and keeps me up-to-date with what is happening in the market, I like that you almost always have a link to the source origin. We also use your market data in our Strategic Business Process to support our business decisions. By having everything in one place on the Intelligence Center it has saved me a lot of time versus looking on different sources, the alert function also helps with this.

Having used several other market research companies, I find that GlobalData manages to provide that ‘difficult-to-get’ market data that others can’t, as well as very diverse and complete consumer surveys.

Our experience with GlobalData has been very good, from the platform itself to the people. I find that the analysts and the account team have a high level of customer focus and responsiveness and therefore I can always rely on. The platform is more holistic than other providers. It is convenient and almost like a one stop shop. The pricing suite is highly competitive and value for our organisation.

I like reports that inform new segments such as the analysis on generation Z, millennials, the impact of COVID 19 to our banking customers and their new channel habits. Secondly the specialist insight on affluent sector significantly increases our understanding about this group of customers. The combination of those give us depth and breadth of the evolving market.

I’m in the business of answering and helping people make decisions so with the intelligence center I can do that, effectively and efficiently. I can share quickly key insights that answer and satisfy our country stakeholders by giving them many quality studies and primary research about competitive landscape beyond the outlook of our bank. It helps me be seen as an advisory partner and that makes a big difference. A big benefit of our subscription is that no one holds the whole data and because it allows so many people, so many different parts of our organisation have access, it enables all teams to have the same level of knowledge and decision support.

“I know that I can always rely on Globaldata’s work when I’m searching for the right consumer and market insights. I use Globaldata insights to understand the changing market & consumer landscape and help create better taste & wellbeing solutions for our customers in food, beverage and healthcare industries.

Globaldata has the right data and the reports are of very high quality compared to your competitors. Globaldata not only has overall market sizes & consumer insights on food & beverages but also provides insights at the ingredient & flavour level. That is key for B2B companies like Givaudan. This way we understand our customers’ business and also gain insight to our unique industry”

GlobalData provides a great range of information and reports on various sectors that is highly relevant, timely, easy to access and utilise. The reports and data dashboards help engagement with clients; they provide valuable industry and market insights that can enrich client conversations and can help in the shaping of value propositions. Moreover, using GlobalData products has helped increase my knowledge of the finance sector, the players within it, and the general threats and opportunities.