Download Now for Free

Get an immediate download of this template, then access any other templates you'd like in one click.

Travel Expense Report

Streamline your financial tracking with our credit card expense report template for 2024. Download your free copy now.

More Expense Reports Templates

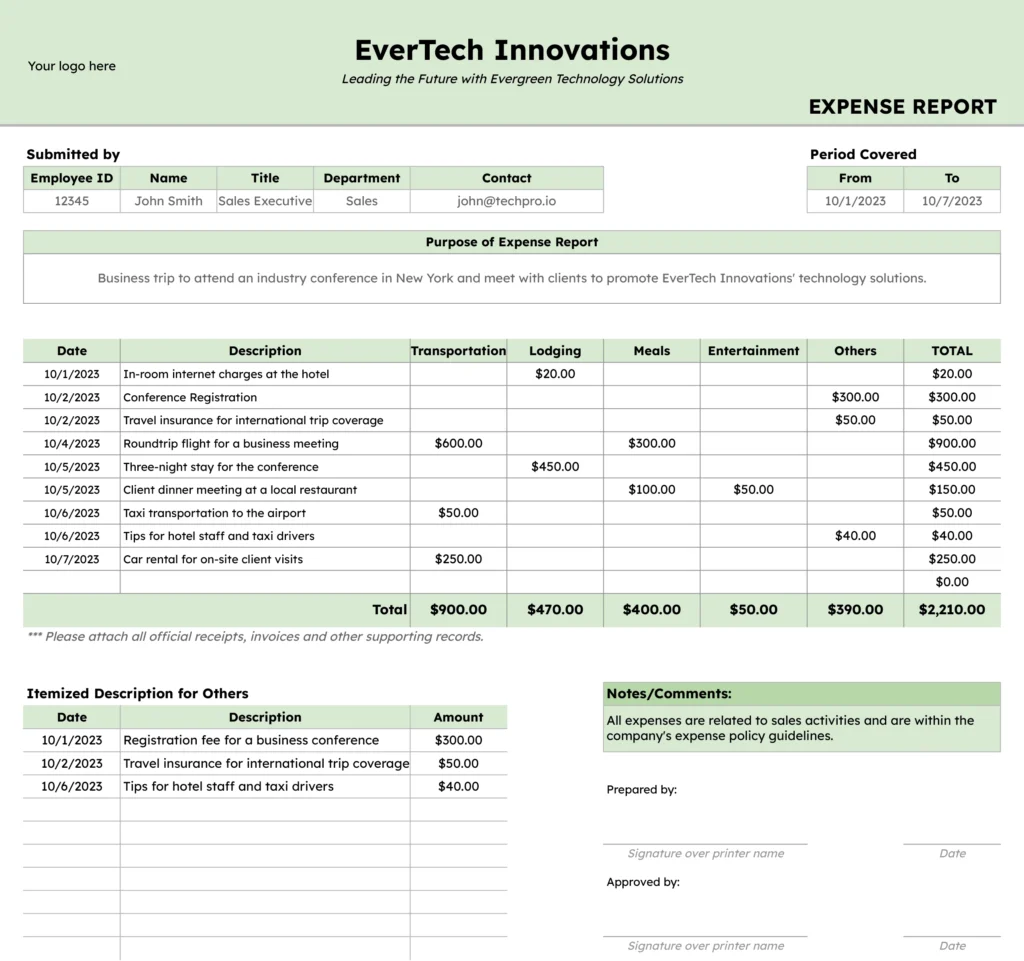

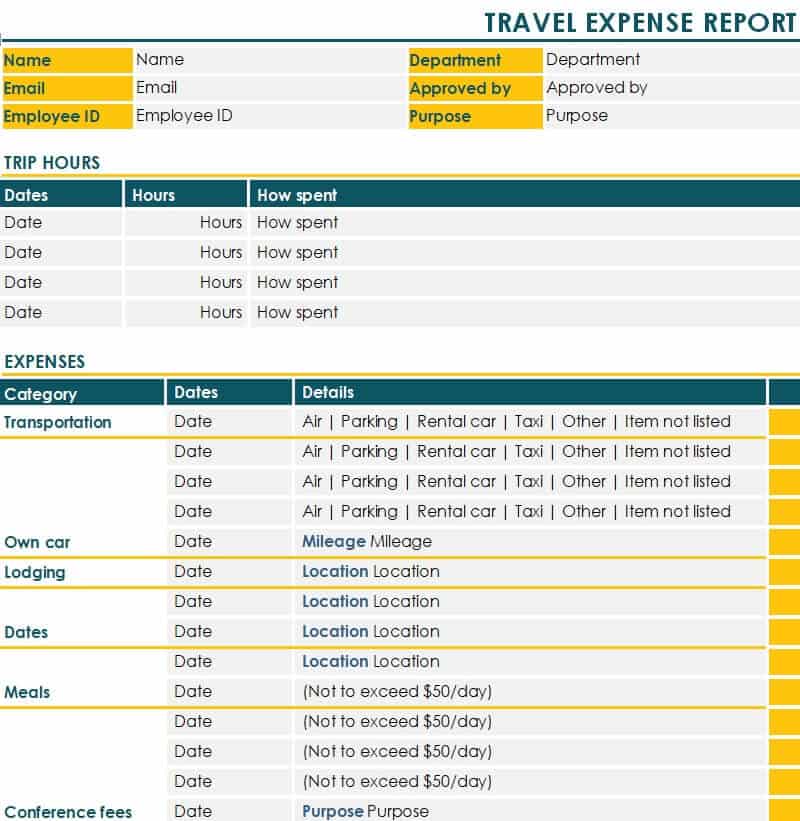

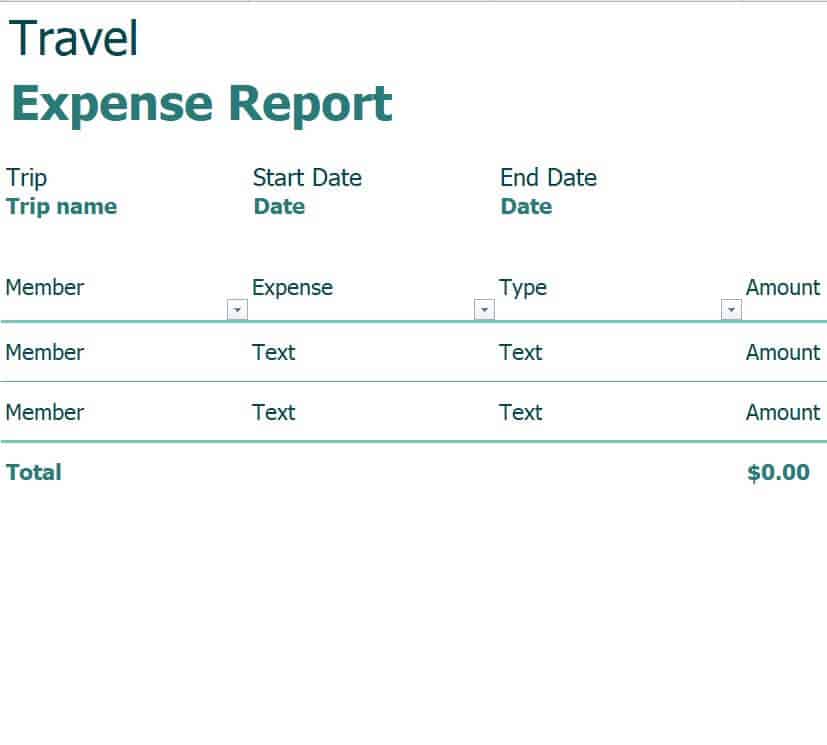

Simple Travel Expense Report Template

Download template in

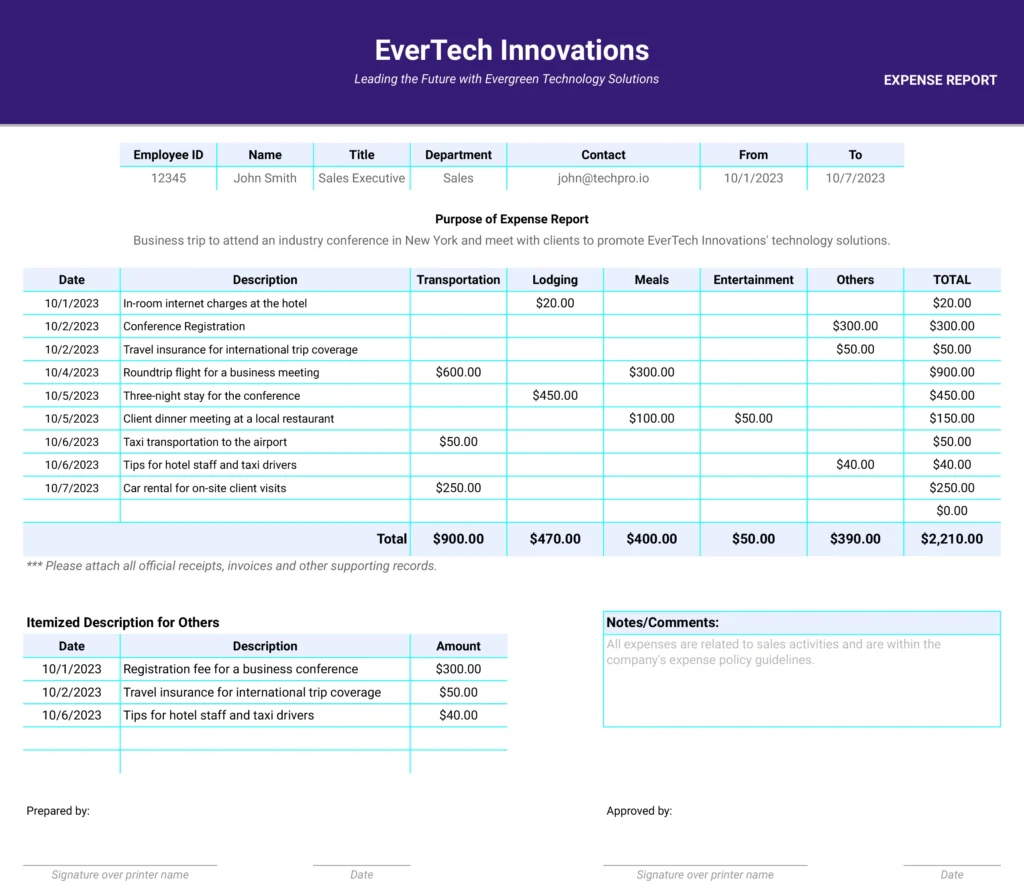

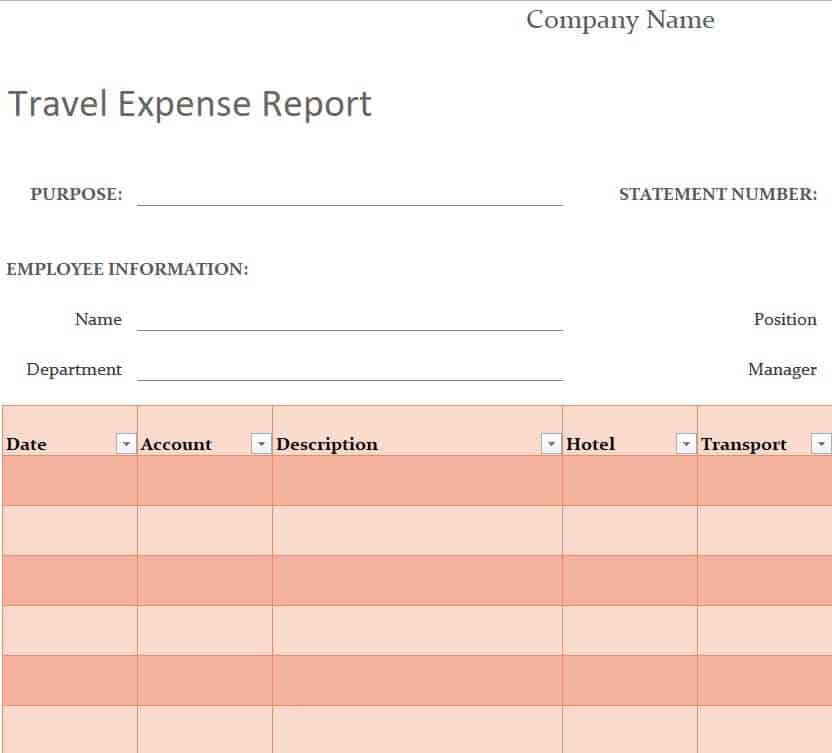

On-the-Go Travel Expense Template

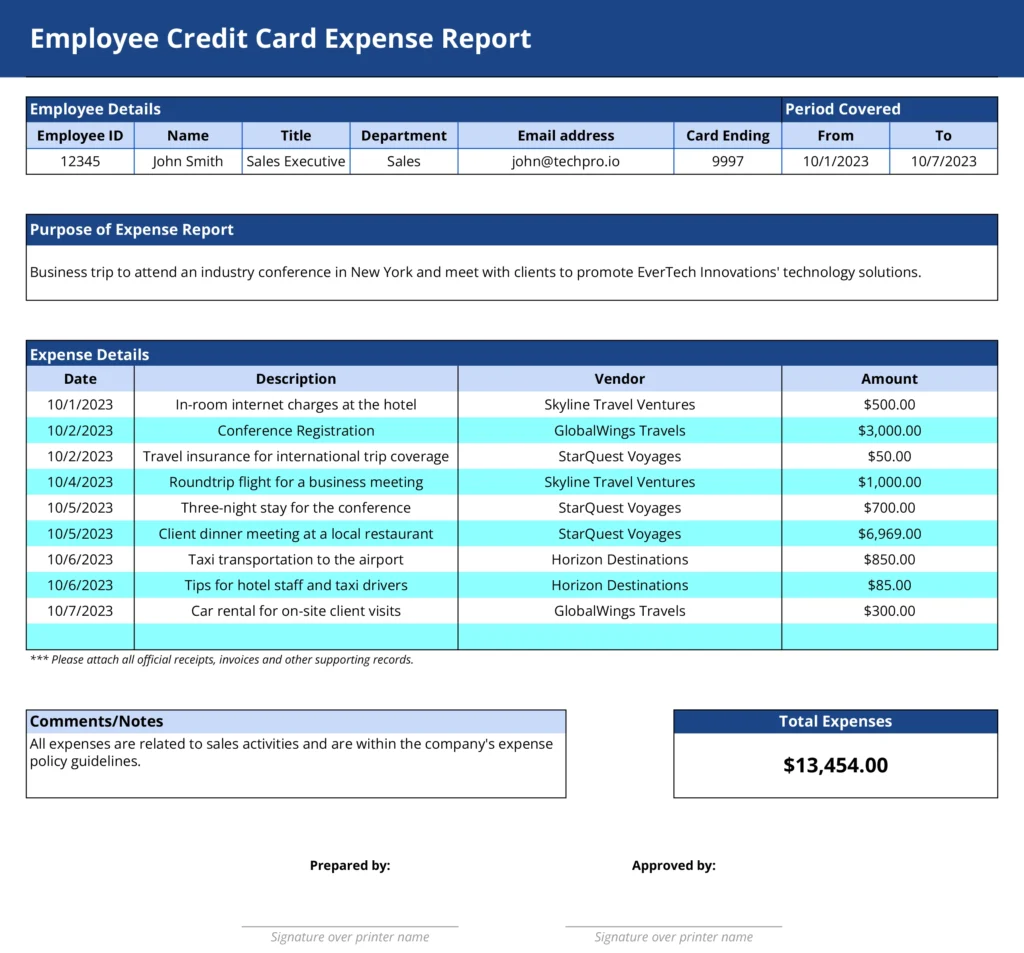

Credit Card Expense Template

Weekly Expense Report

Monthly Expense Report

Business Expense Reimbursement Template

Yearly Expense Report

On-to-Go Credit Card Expense Template

Employee Credit Card Expense Template

Branded Weekly Expense Report Template

Simple Weekly Expense Report Template

Branded Monthly Expense Report

Detailed Monthly Expense Report

On-the-Go Business Expense Template

Simple Business Expense Template

Browse Other Templates

Managing travel expenses can be a challenging task, especially when you’re dealing with multiple receipts and transactions. Our Travel Expense Report Template is designed to help you organize and analyze your travel expenses, providing you with a clear picture of your spending patterns and financial health.

Section 1: Why You Need a Travel Expense Report

A Travel Expense Report is an essential tool for anyone who travels frequently for business or personal reasons. It helps you:

- Organize Expenses: Categorize and record all your travel-related expenses in one place.

- Identify Spending Patterns: Analyze your spending patterns and identify areas where you can cut costs.

- Prepare for Reimbursements: Simplify the process of claiming reimbursements by having all your travel expenses organized in one place.

- Make Informed Decisions: Use the insights gained from the report to make informed decisions about budgeting and financial planning for future travels.

Section 2: How to Use Our Travel Expense Report Template

Our template is user-friendly and requires no advanced spreadsheet skills. Here’s how you can use it:

- Download the Template: Click the download button to get your free copy of the template.

- Input Your Data: Enter your travel-related expenses for the trip into the respective categories.

- Analyze Your Spending: The template will automatically calculate the total expenses for each category, providing you with valuable insights.

- Make Informed Decisions: Use the insights gained from the template to make informed decisions about your travel finances.

Don’t let the complexities of travel expense tracking overwhelm you. Download our Travel Expense Report Template now.

Free Expense Report Templates

By Andy Marker | November 28, 2016 (updated June 5, 2023)

- Share on Facebook

- Share on LinkedIn

Link copied

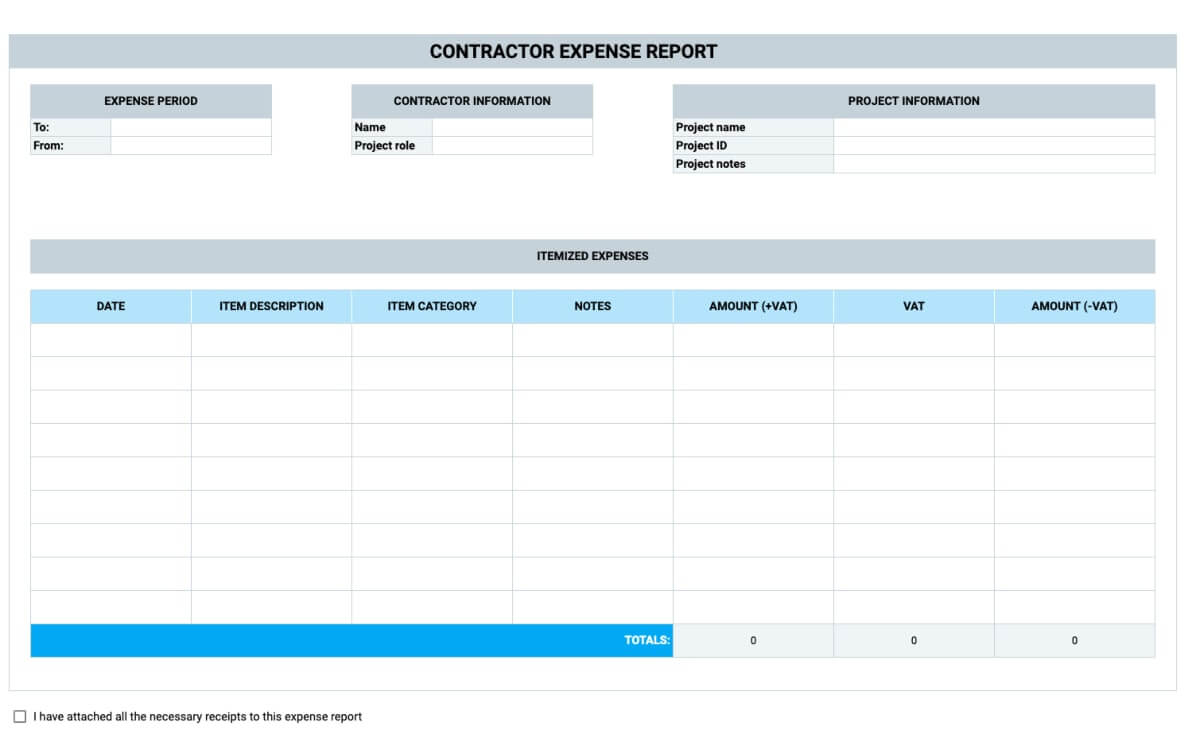

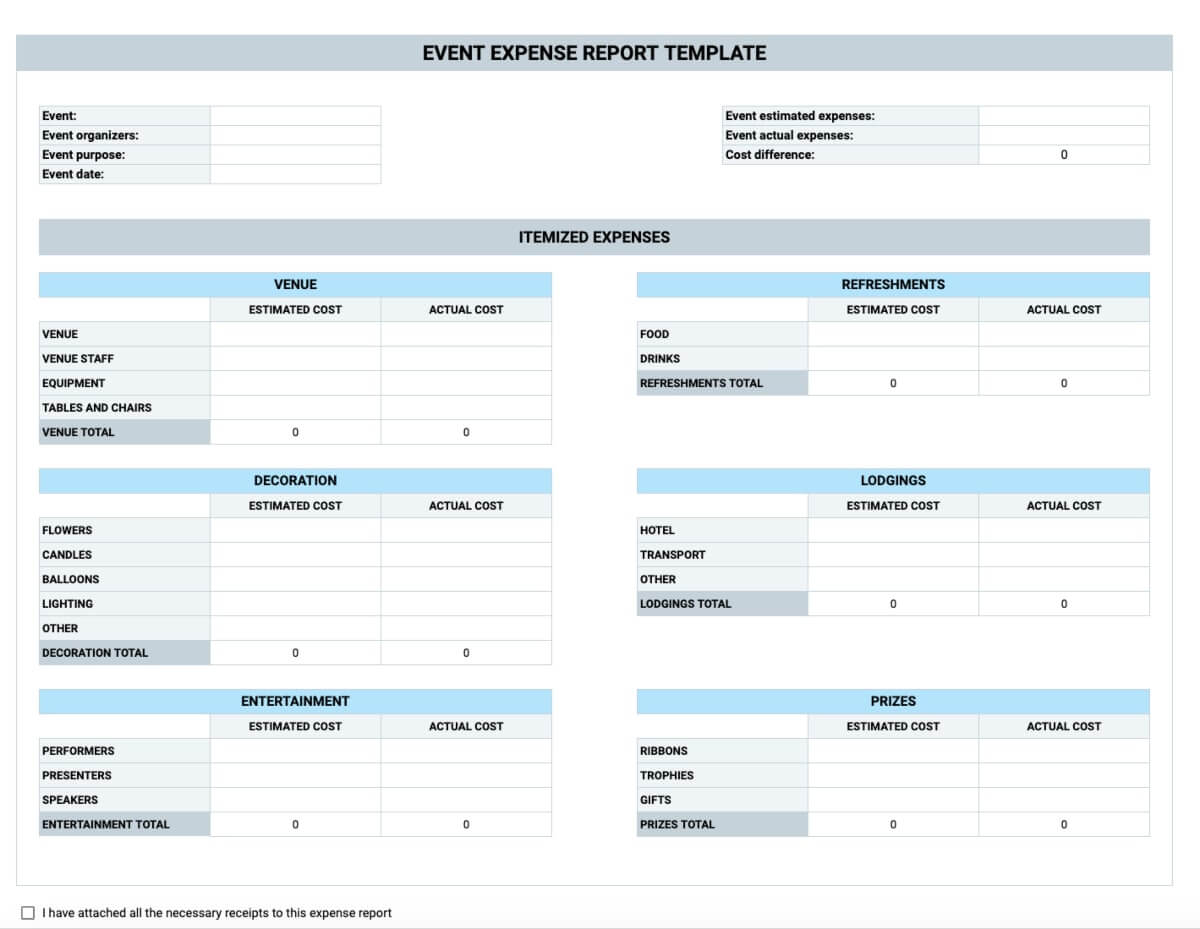

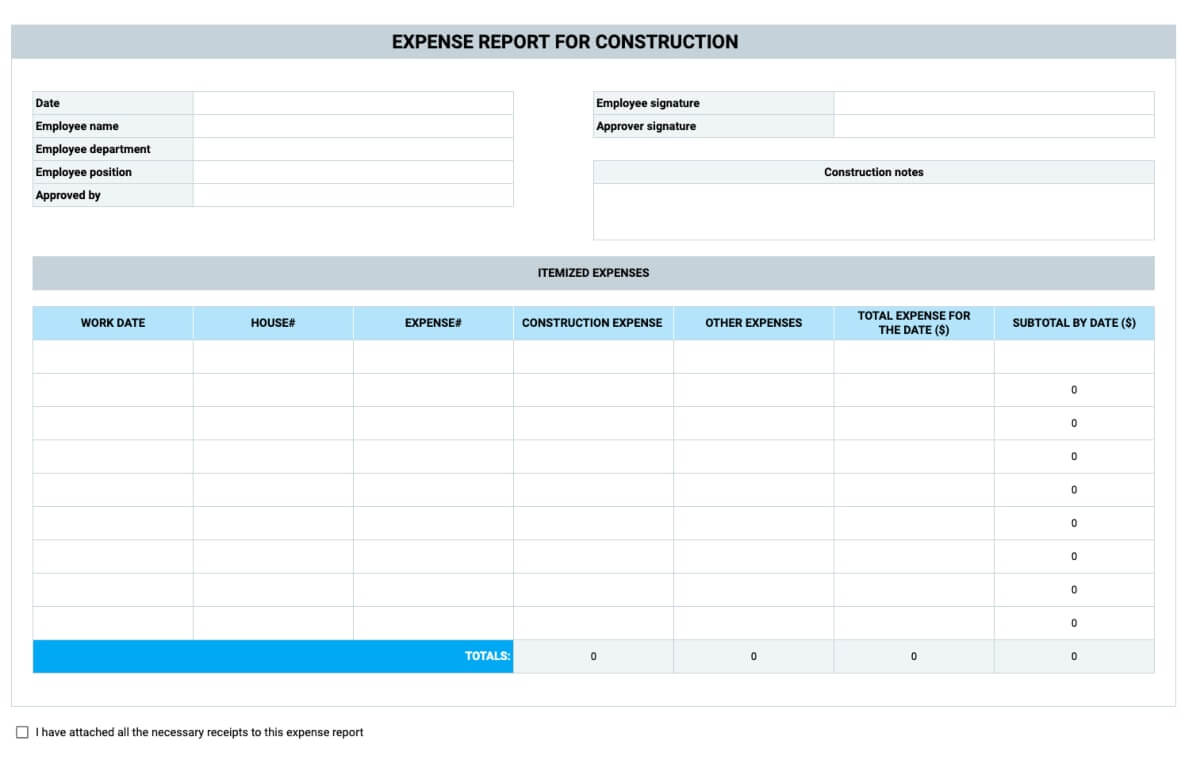

We’ve compiled the most useful collection of free expense report templates for businesses, individuals, nonprofits, contractors, consultants, construction employees, and fundraisers so they can better track and manage their expense reports.

Included on this page, you’ll find a monthly expense report template , a personal expense templat e, a printable business expense template , and more. We’ve also included a list of helpful tips for completing these expense report templates .

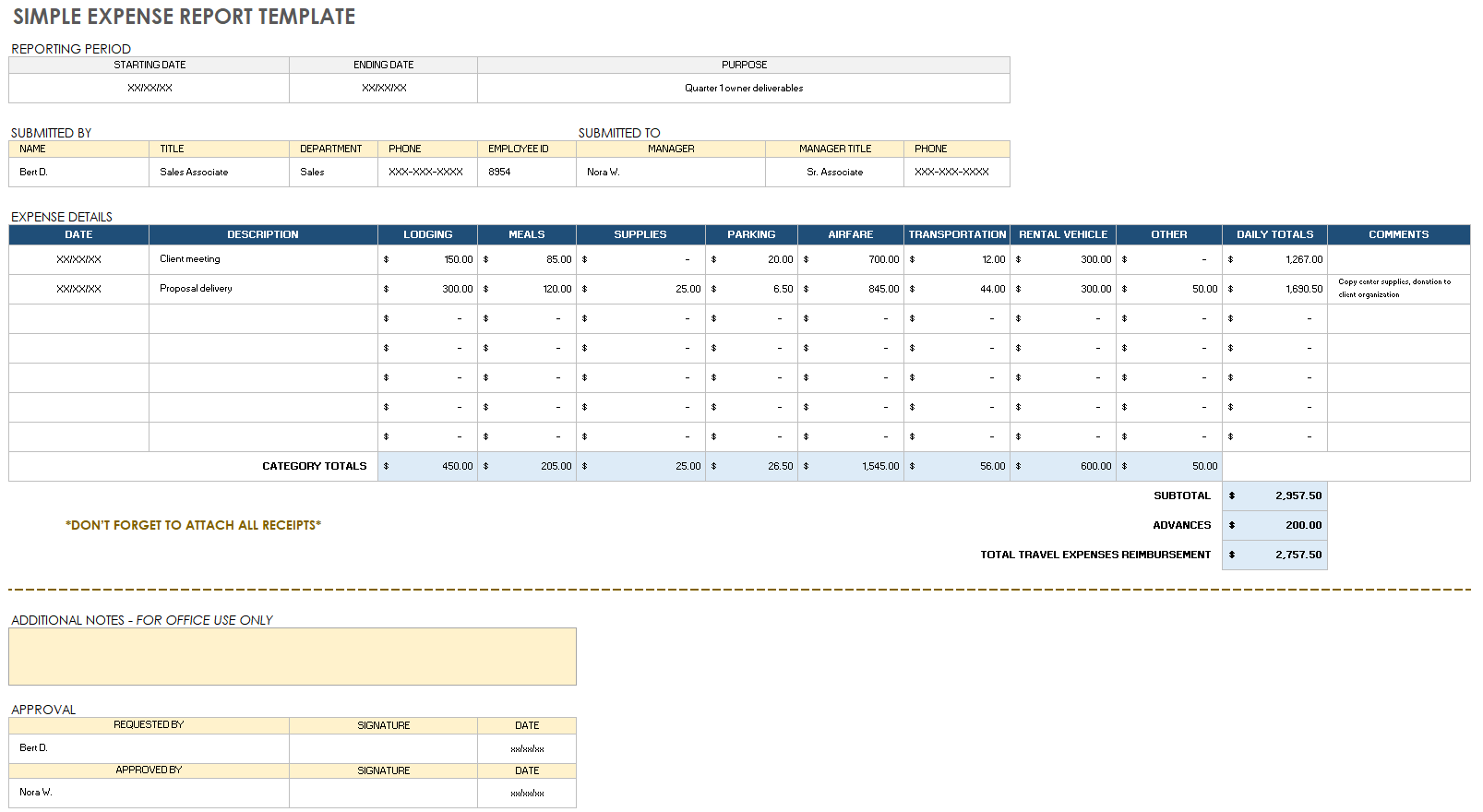

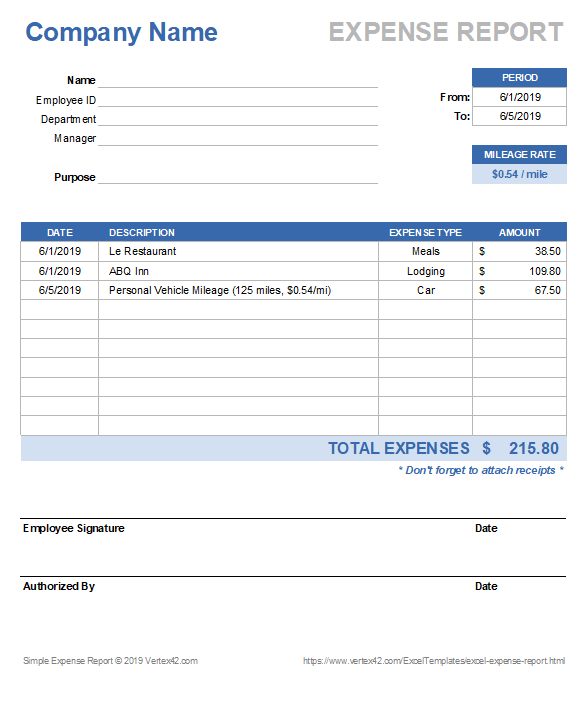

Simple Expense Report Template

Download a Simple Expense Report Template for

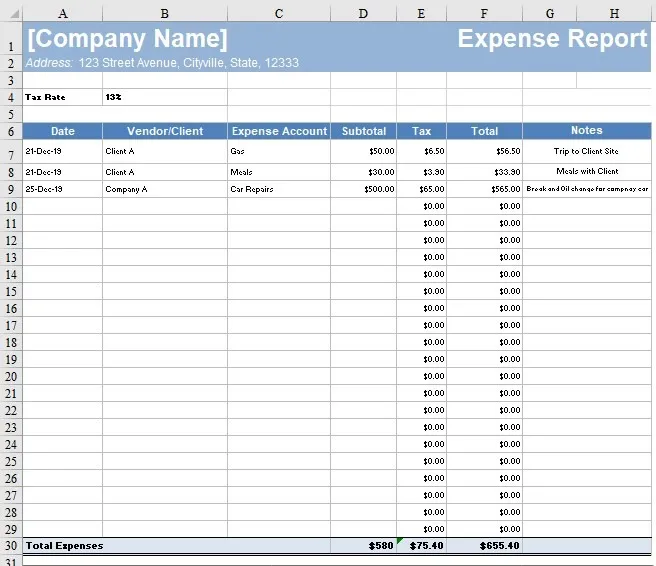

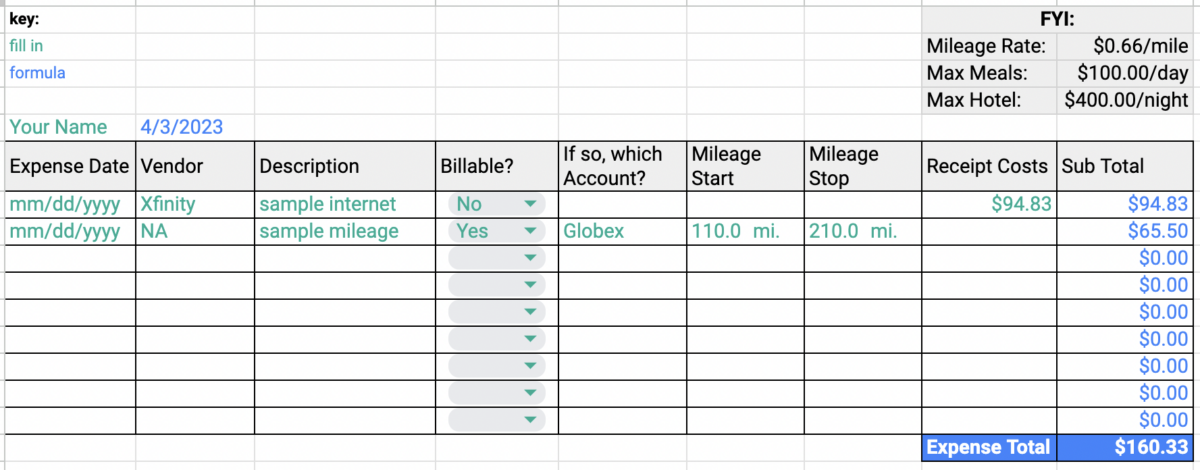

Excel | Google Sheets | Smartsheet

This expense report is a simple spreadsheet template for documenting the date, type, and total amount for each expense. You can customize the template by changing the column headings for categorizing expenses, or adding new columns if needed. Expenses are itemized, and the total reimbursement amount is calculated for you, minus any advance payments.

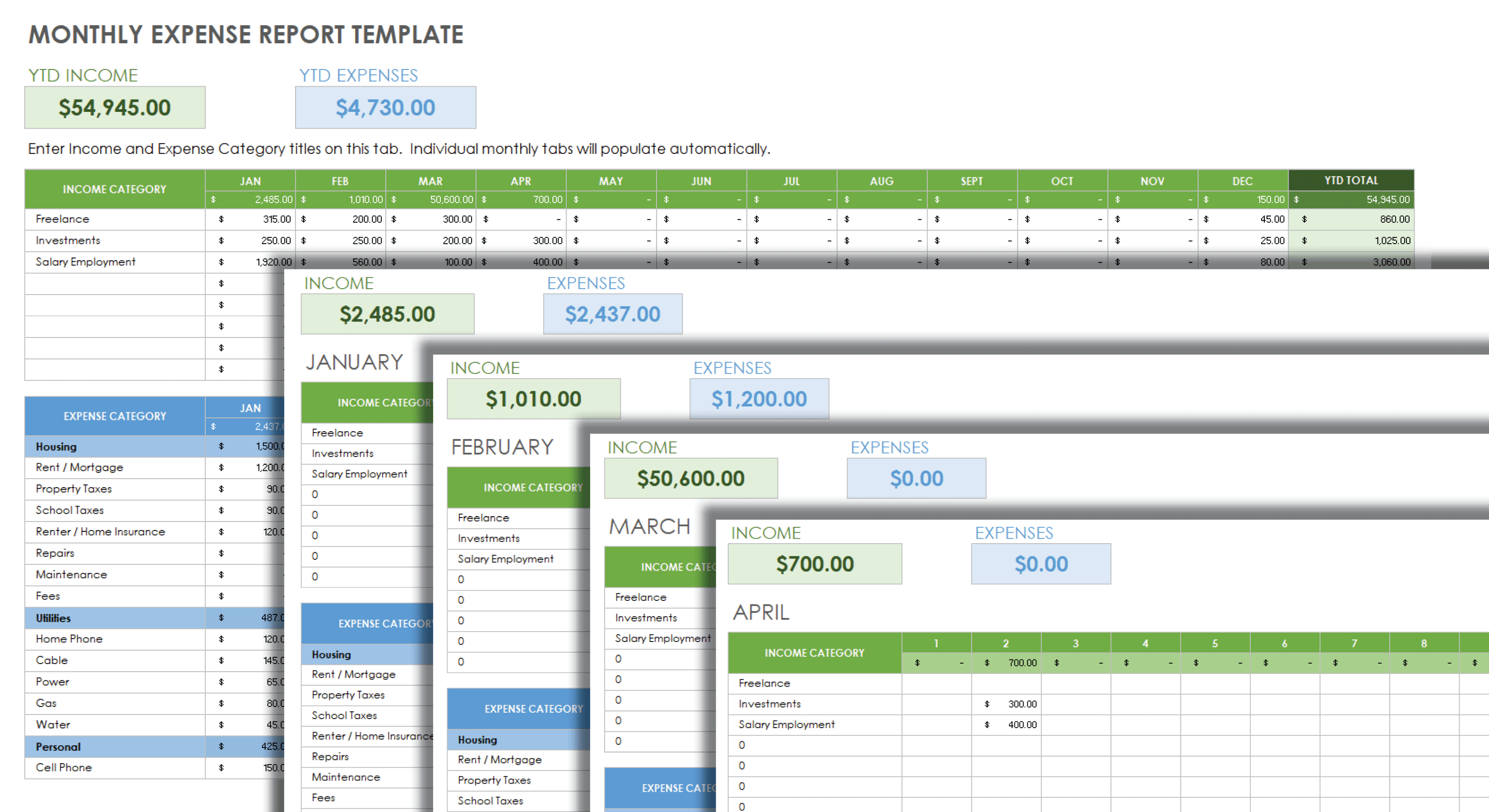

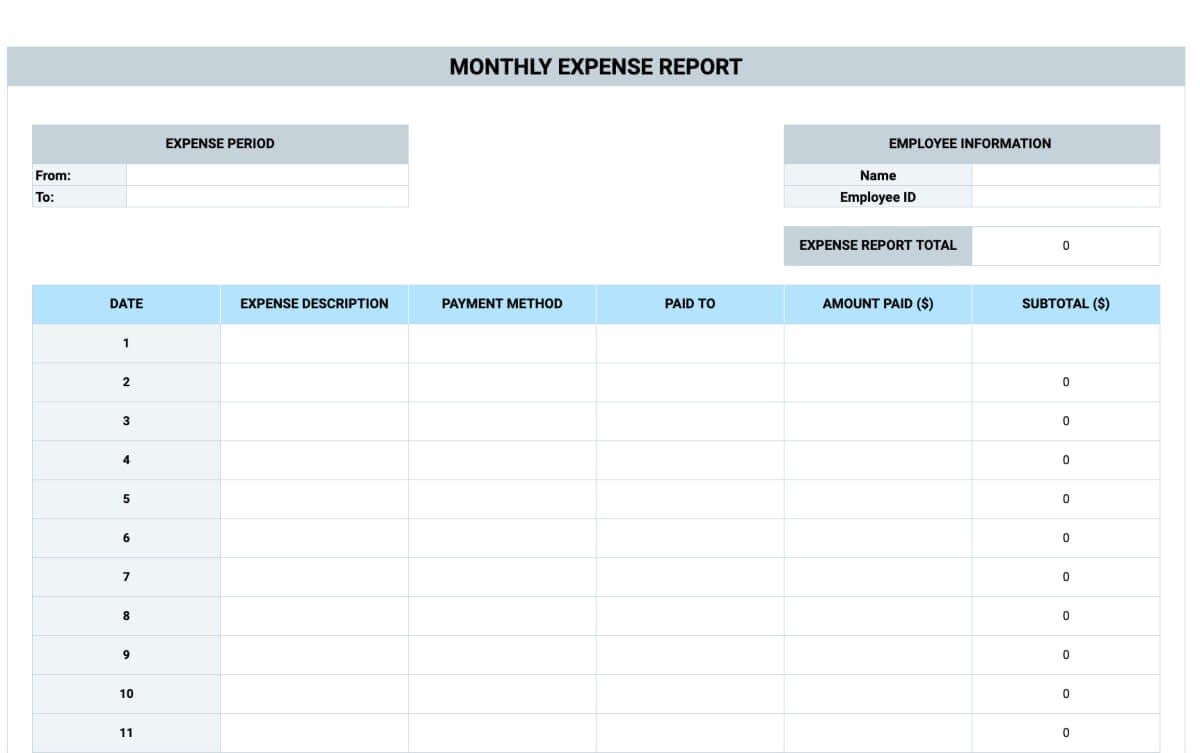

Monthly Expense Report Template

Download a Monthly Expense Report Template for Excel | Google Sheets

Keep your expenses organized and under control with this versatile monthly expense report template. The template features month-over-month records, with each month listed on a separate sheet, as well as a year-to-date total. This printable template is perfect for individuals, small businesses, fundraisers, project managers, contractors, construction workers, consultancies, and event managers who need to track expenses. Use it to stay on top of your finances and make better budgeting decisions.

Try one of these free business budget templates for your organization’s budgeting needs.

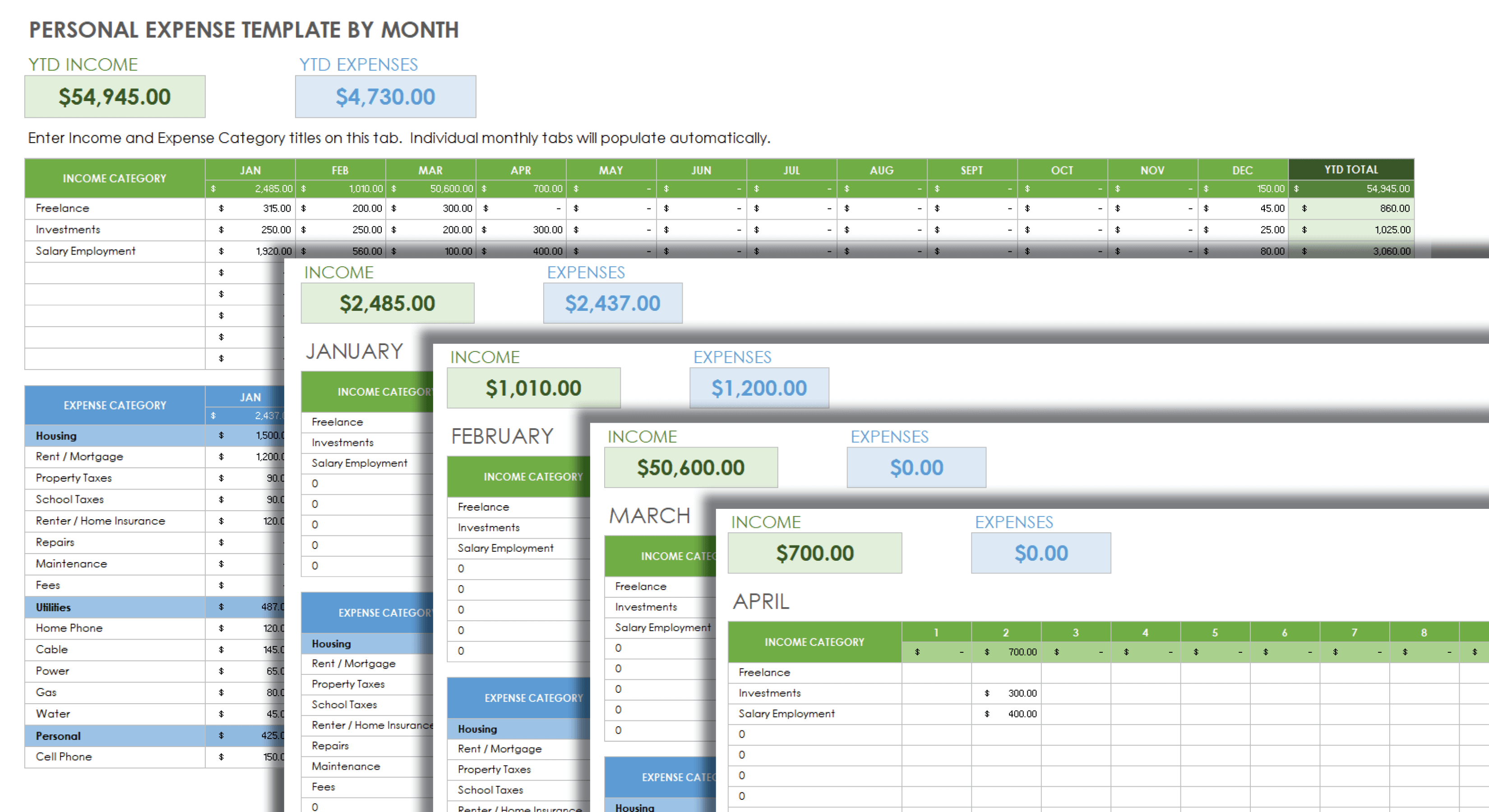

Personal Expense Template by Month

Download a Personal Expense Template by Month for Excel | Google Sheets

Consider using this personal expense template to effectively track your personal expenses on a monthly basis. With its user-friendly spreadsheet format, this printable expense template automatically calculates totals for you. You can customize the template to include only the expenses you want to monitor. Each month has its own dedicated sheet, making it convenient to track both monthly and annual expenses.

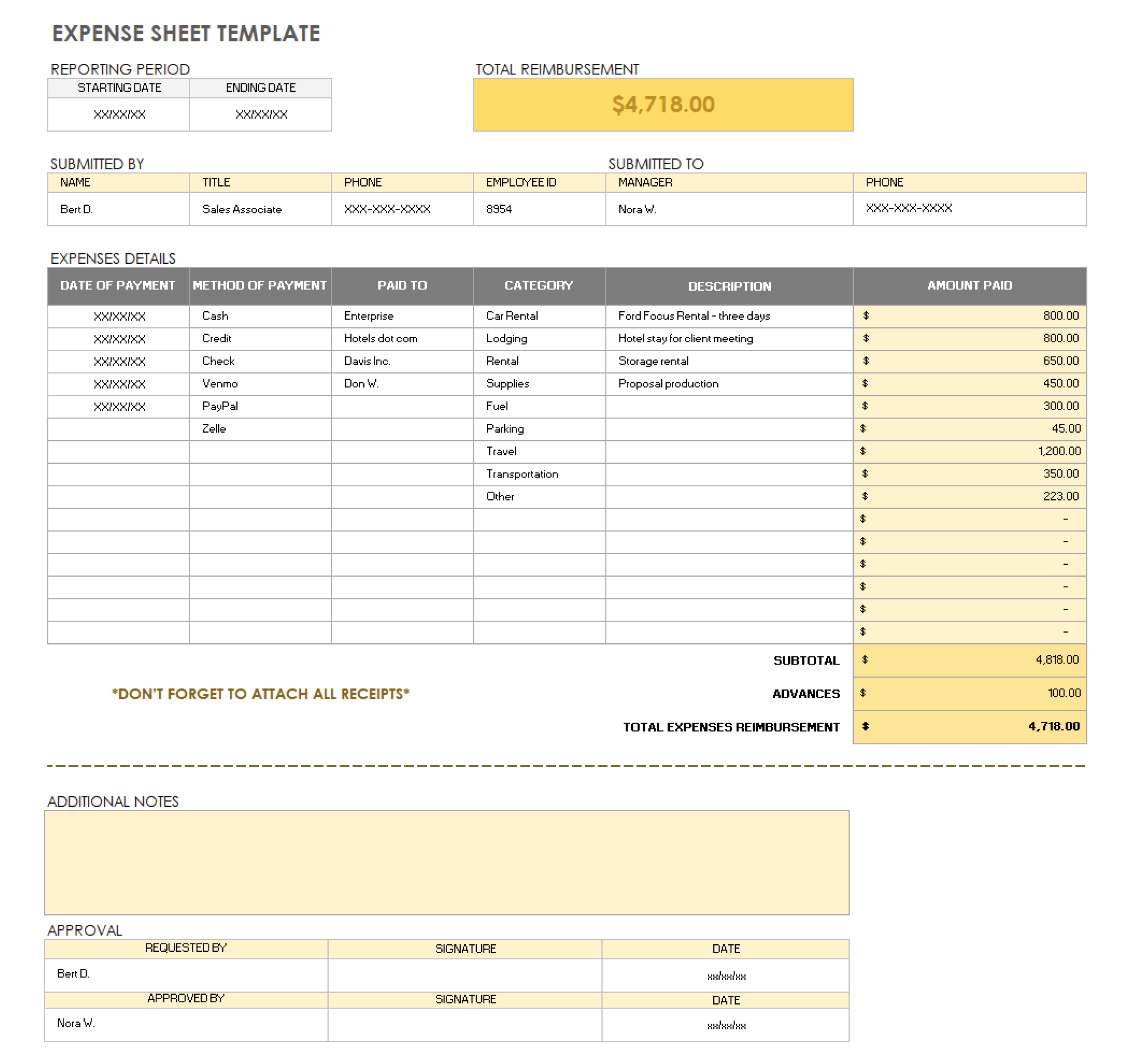

Expense Sheet Template

Download an Expense Sheet Template for Excel | Google Sheets | Smartsheet

This basic, printable expense spreadsheet template is designed for tracking expenses, whether personal or business related. Keep track of purchases and other expenses by recording the payment method, type of transaction, amount of payment, and other details. You can refer to this expense sheet as an easy reference tool, create a monthly expense report, and quickly add up expenses over any time period.

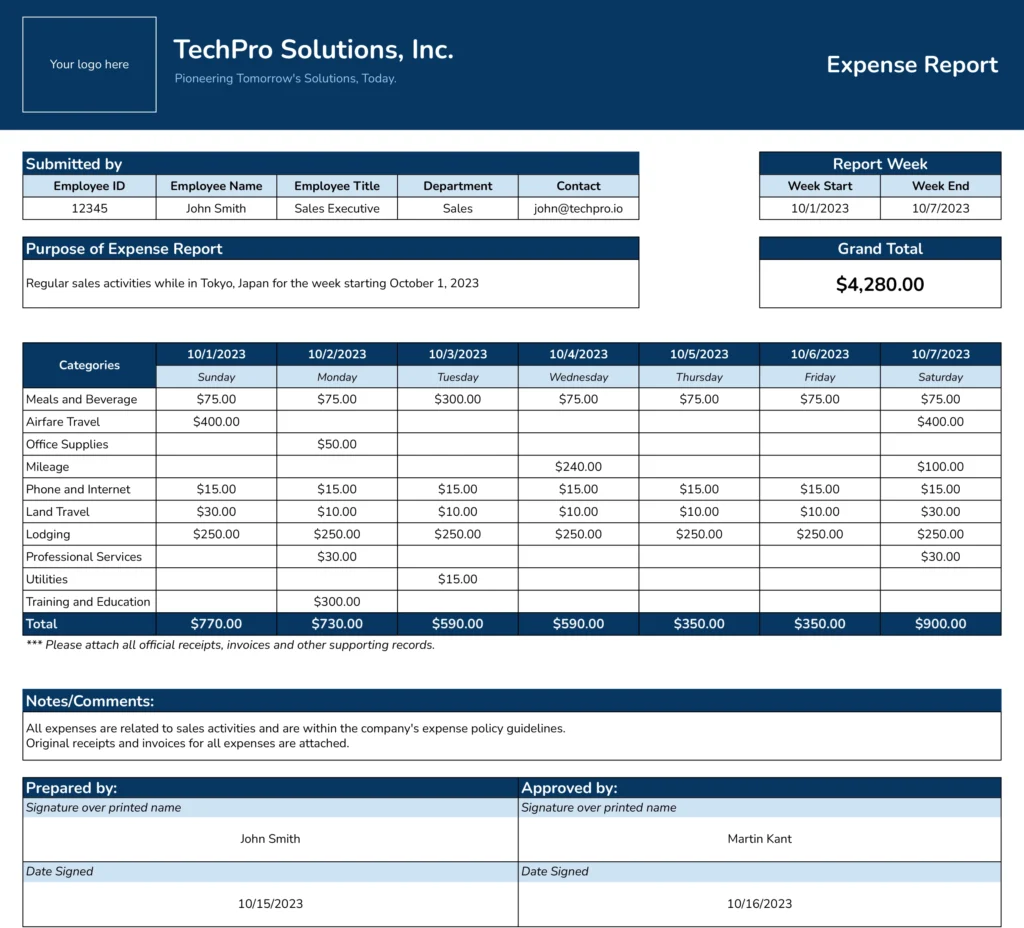

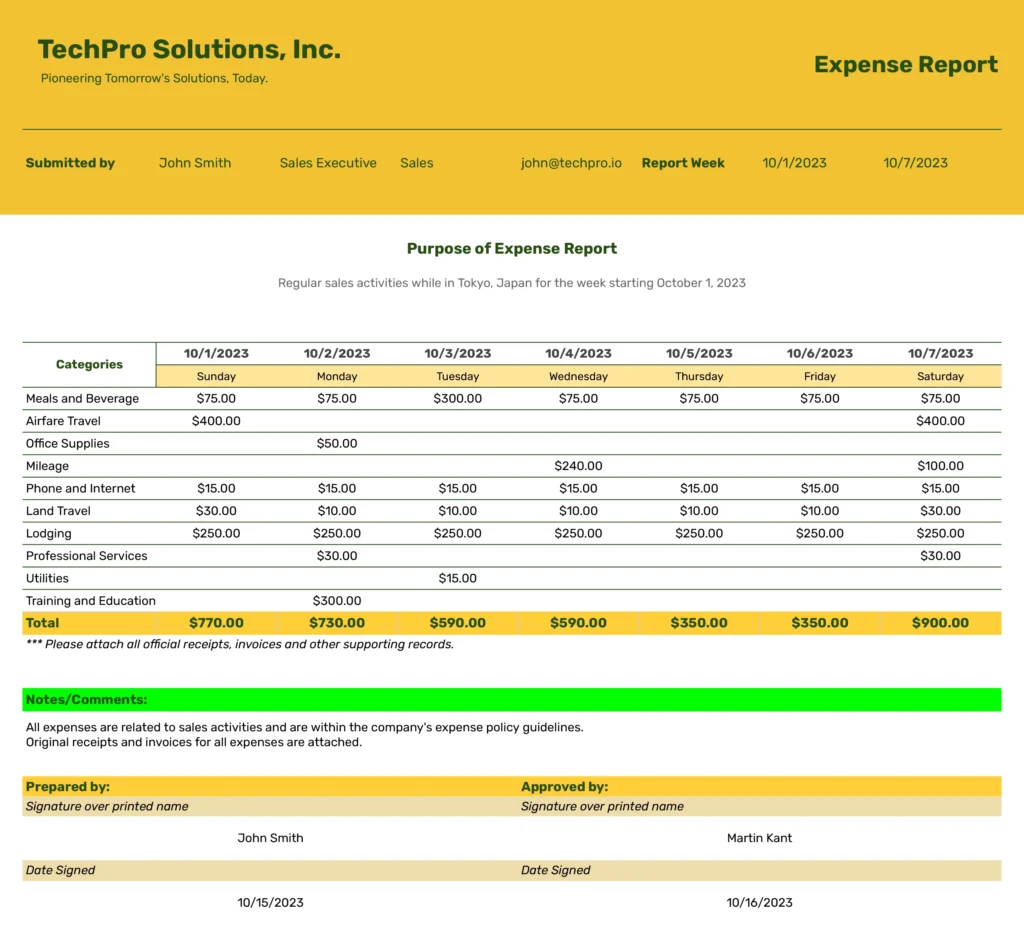

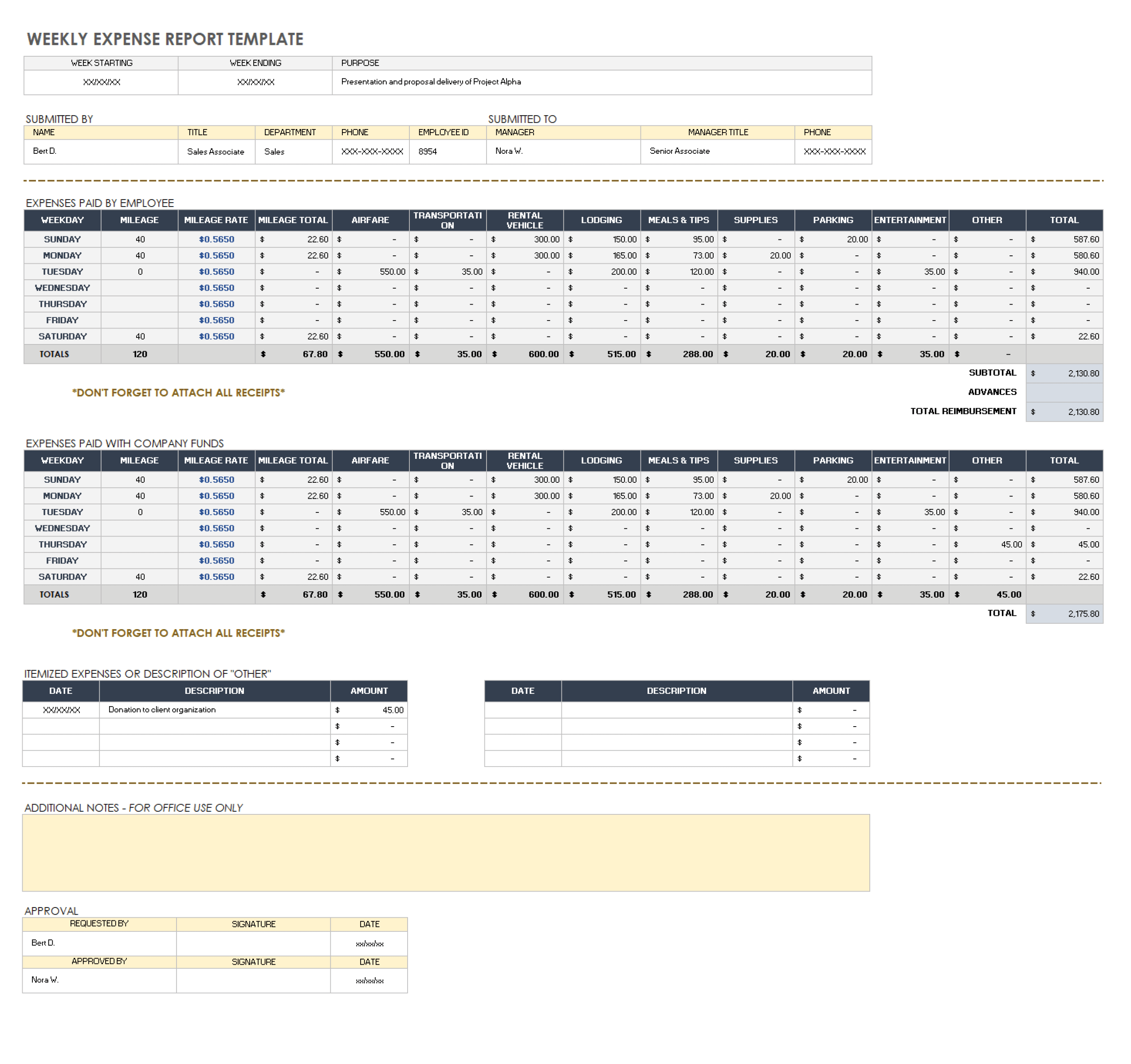

Weekly Expense Report Template

Download a Weekly Expense Report Template for Excel | Google Sheets | Smartsheet

Some businesses require employees to submit a weekly expense report so that expenses are tracked and reimbursed at consistent intervals. This printable template provides a detailed record of expenses for each day of the week. You can edit the expense categories to match your needs, whether it’s travel costs, shipping charges, business meals, or other expenses. There is room for describing the business purpose, the payment type, and subtotals.

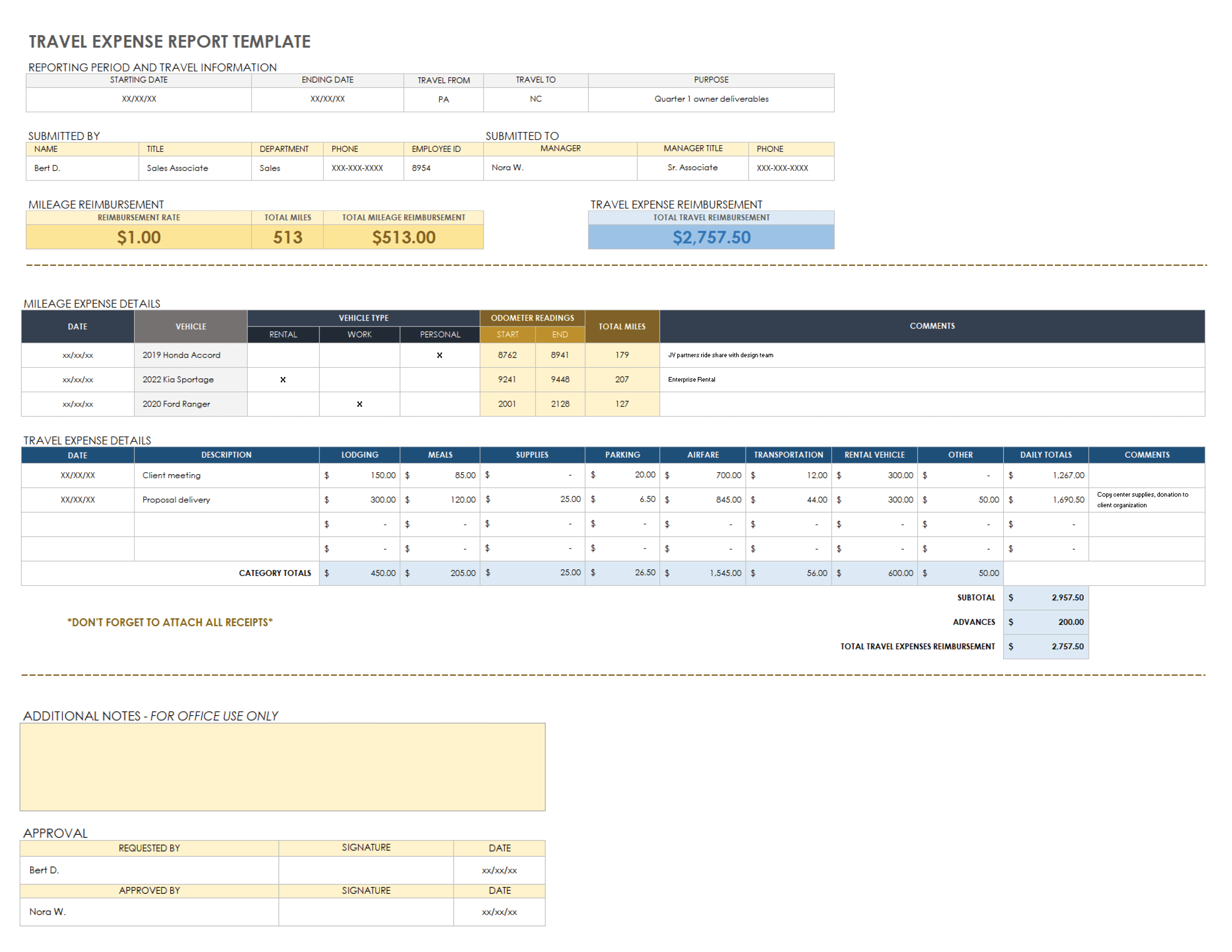

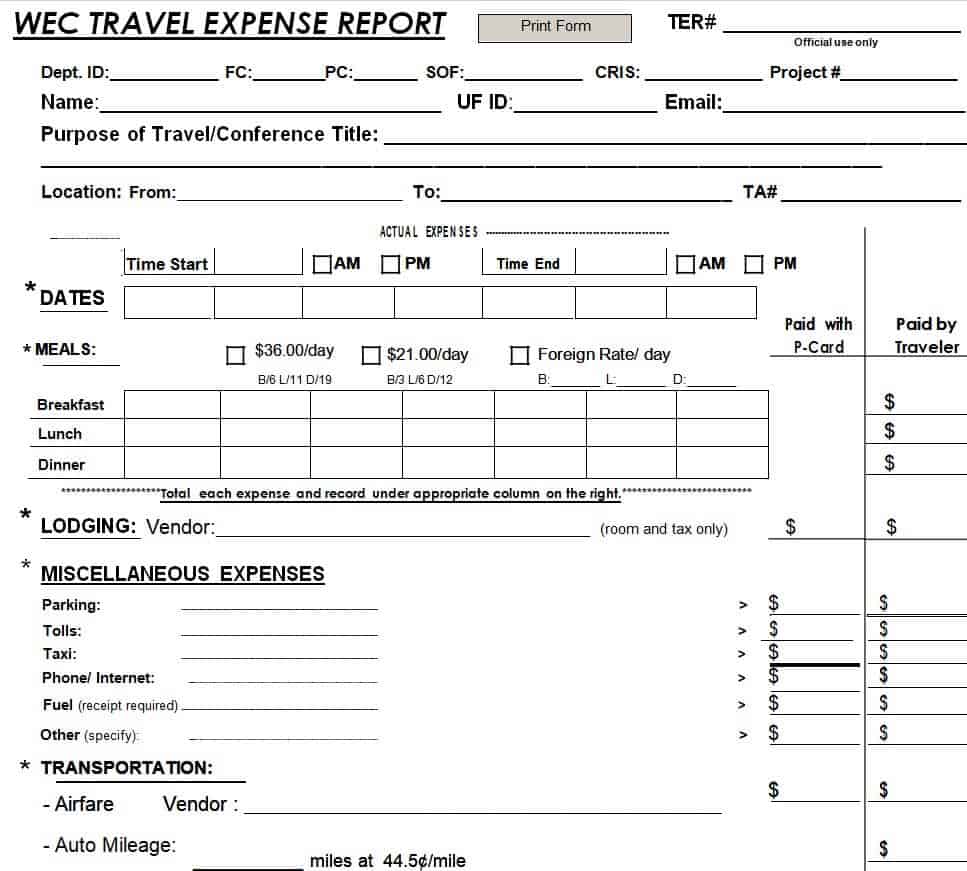

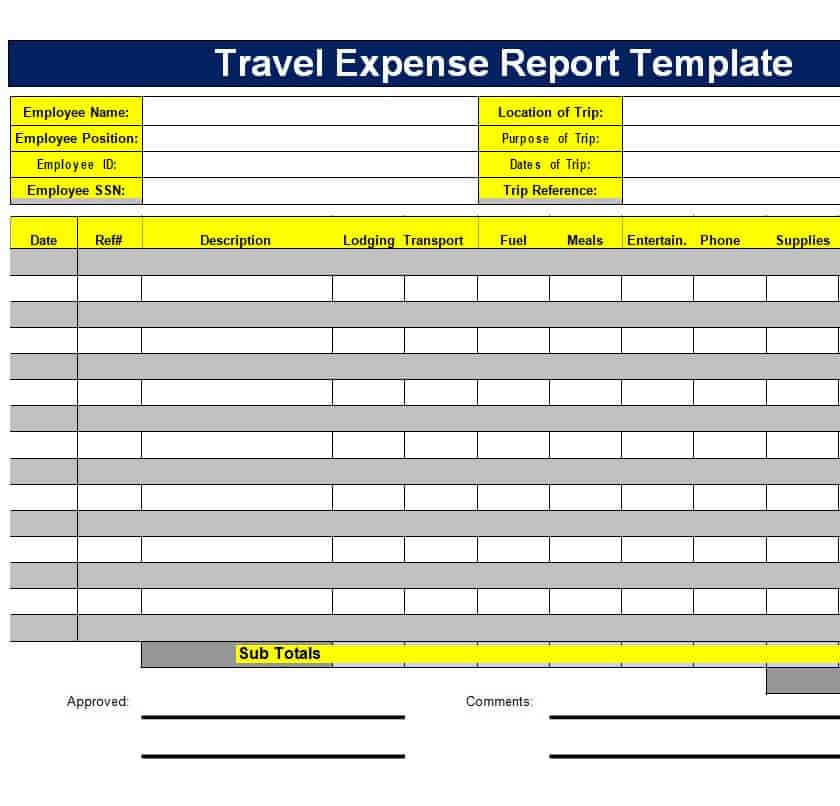

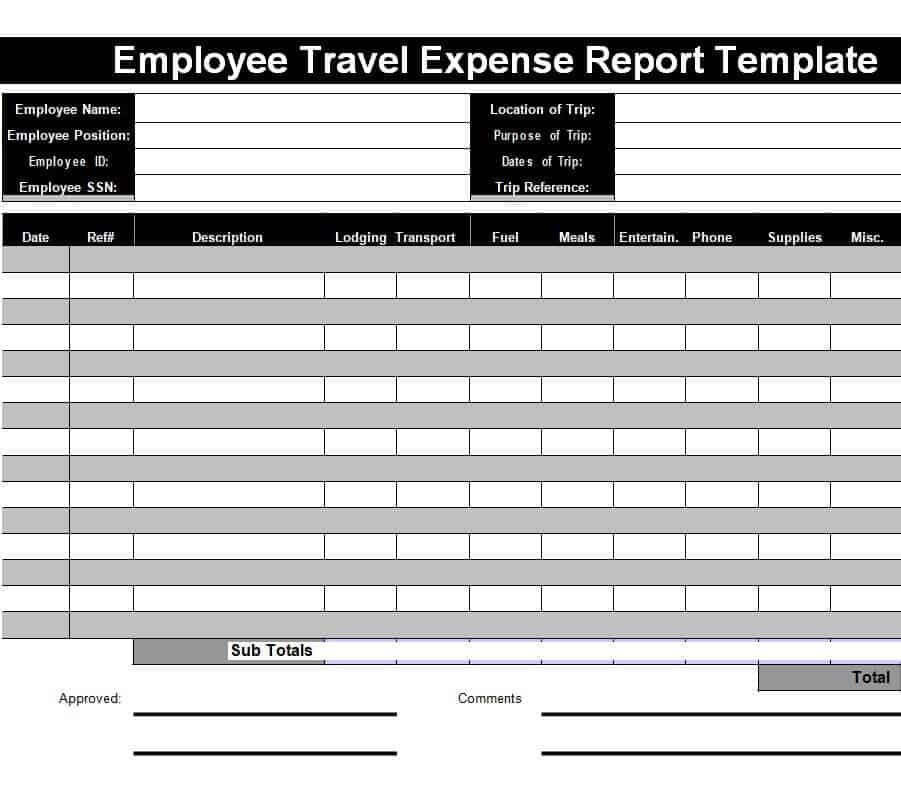

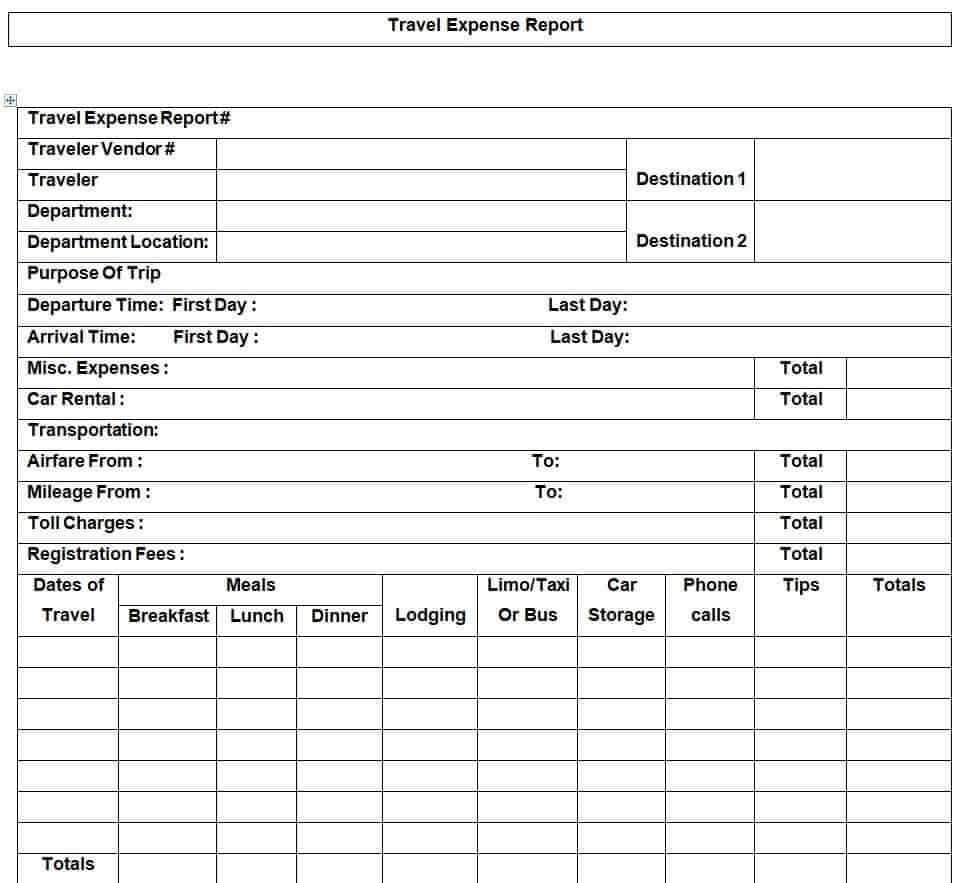

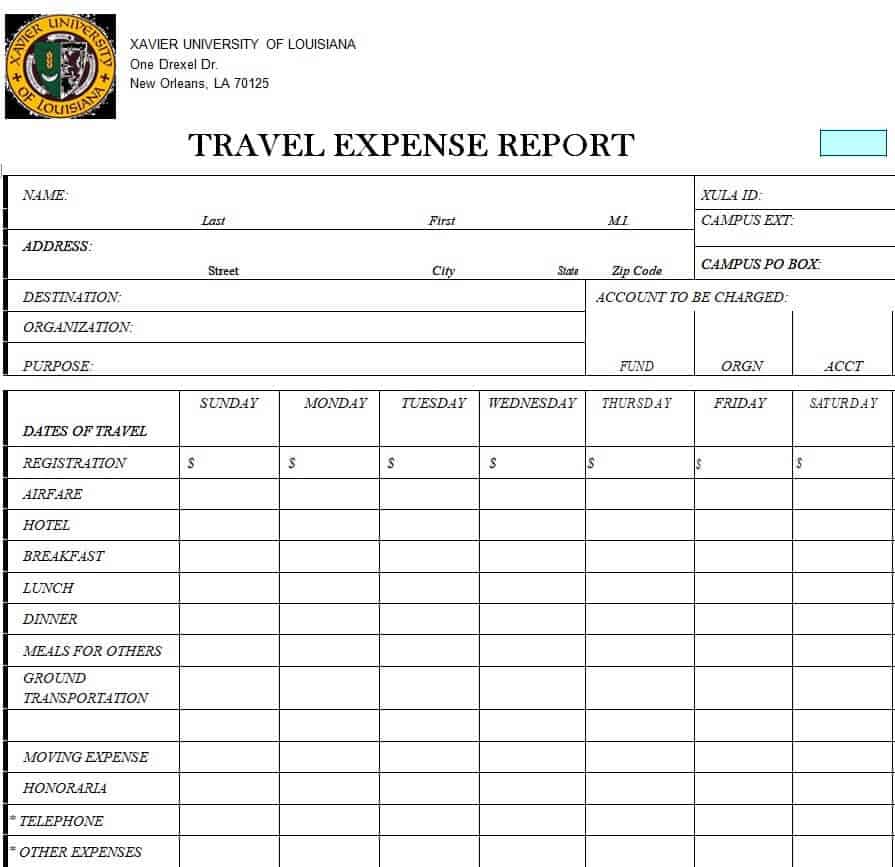

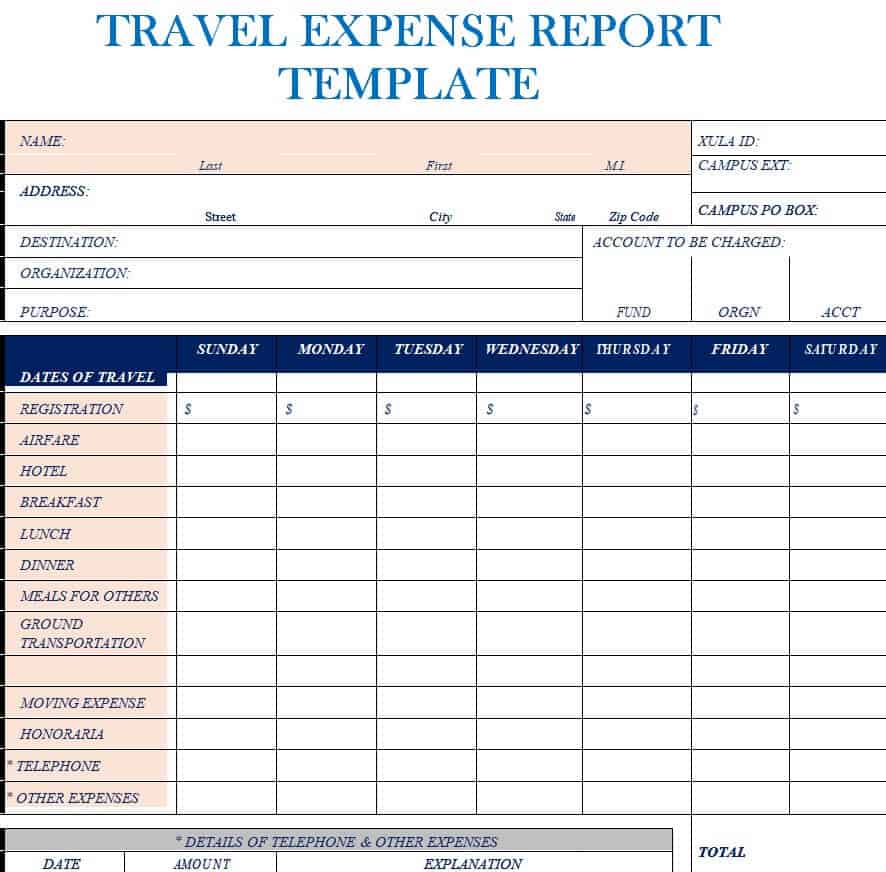

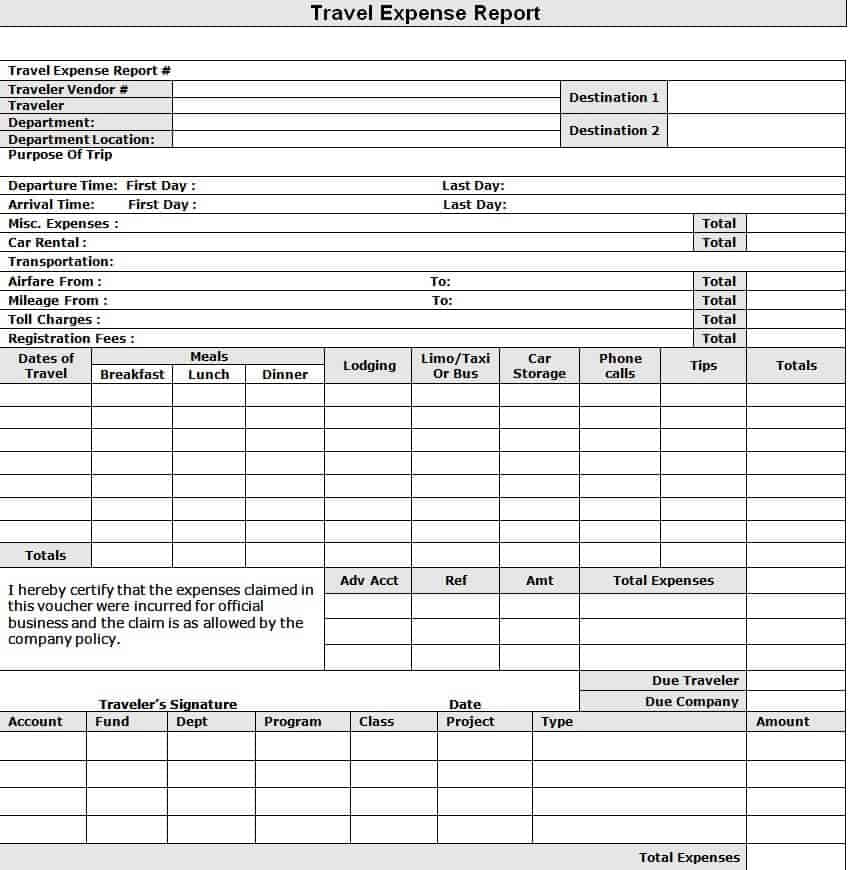

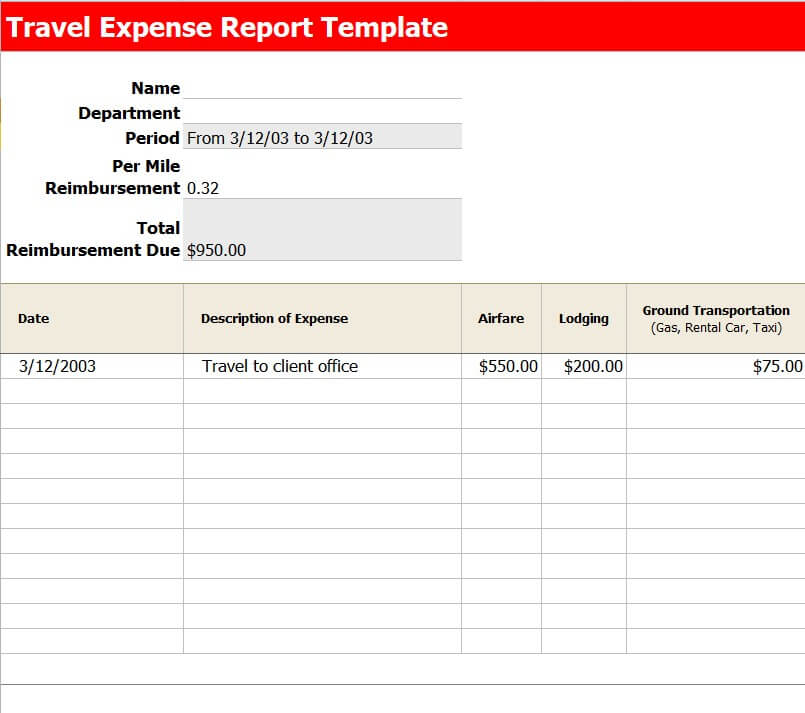

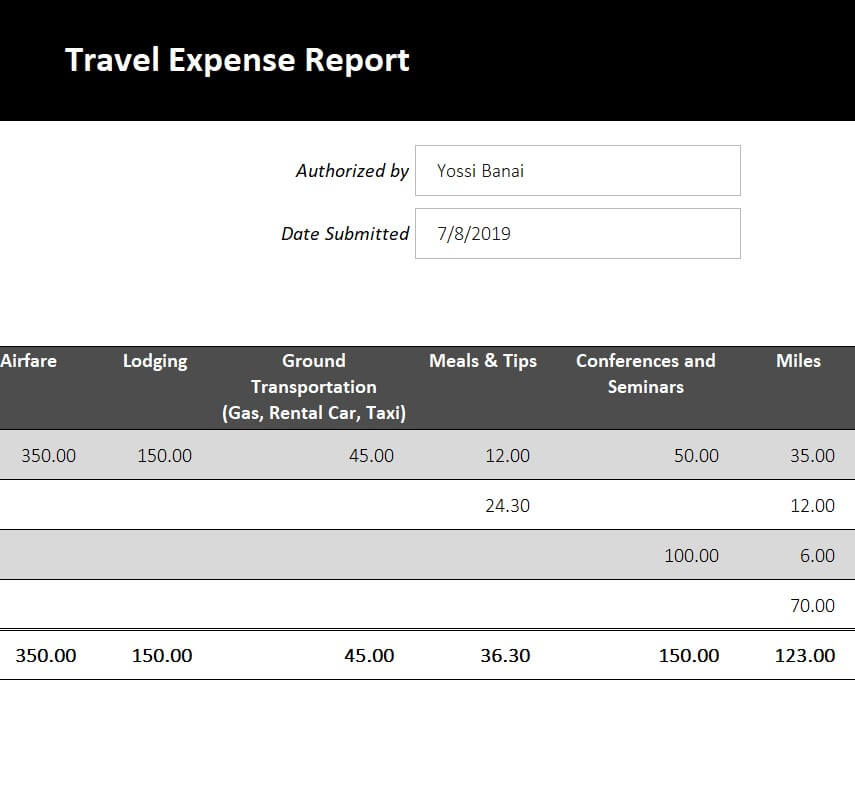

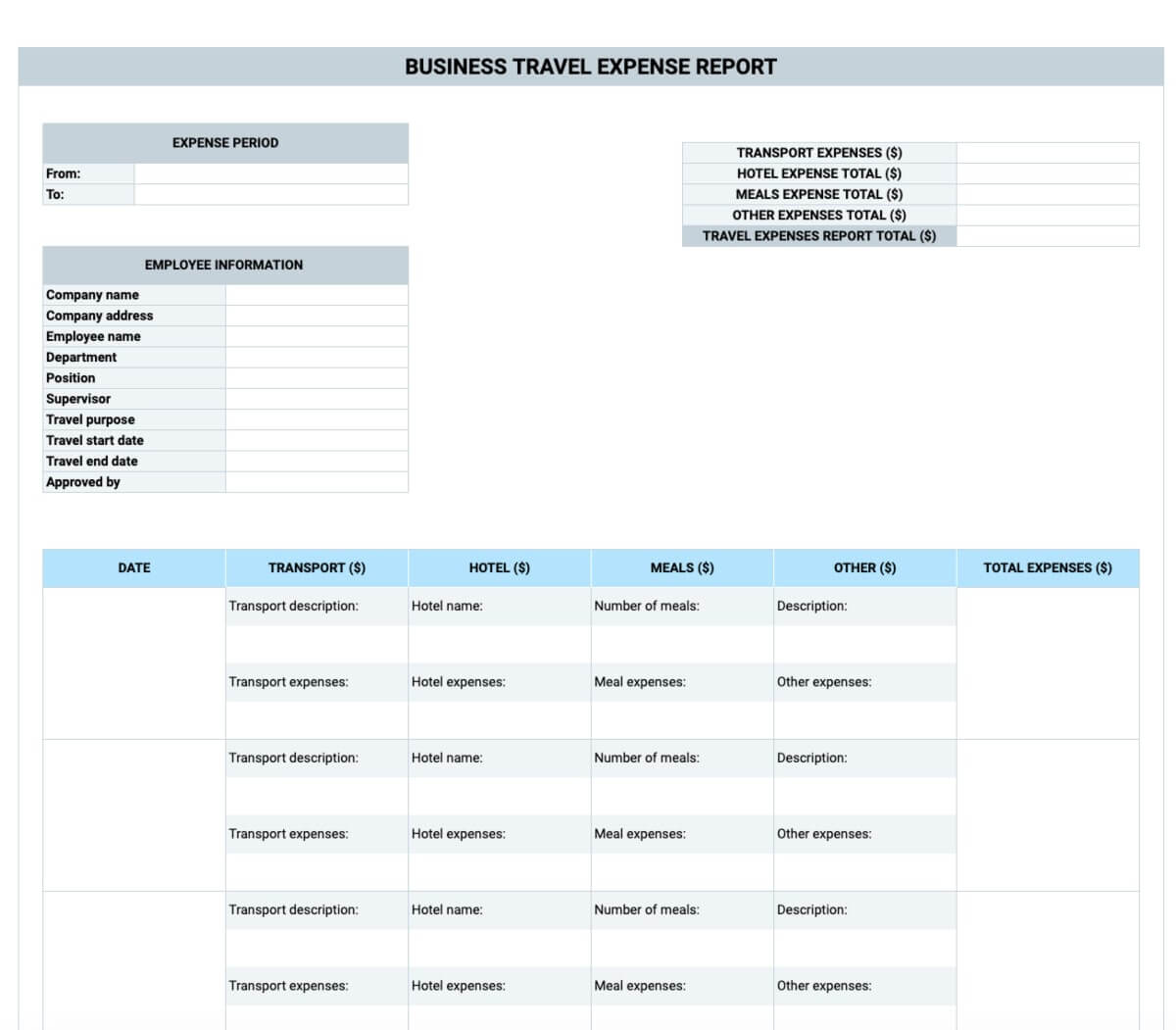

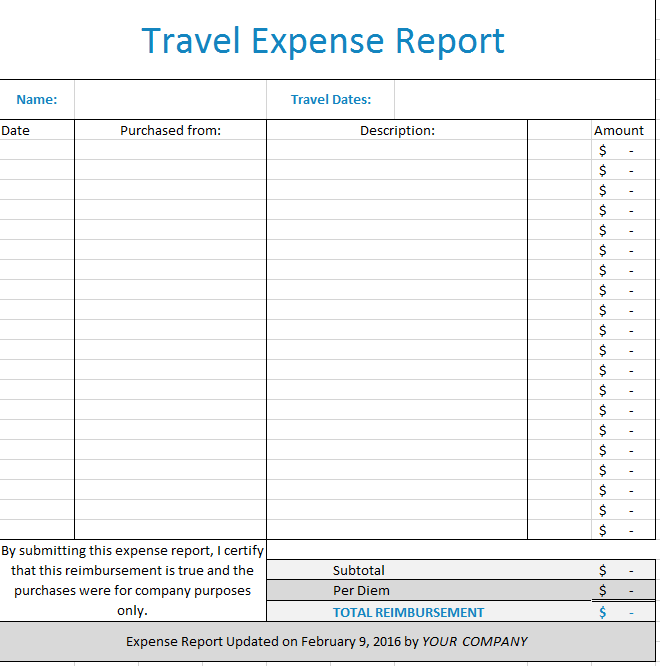

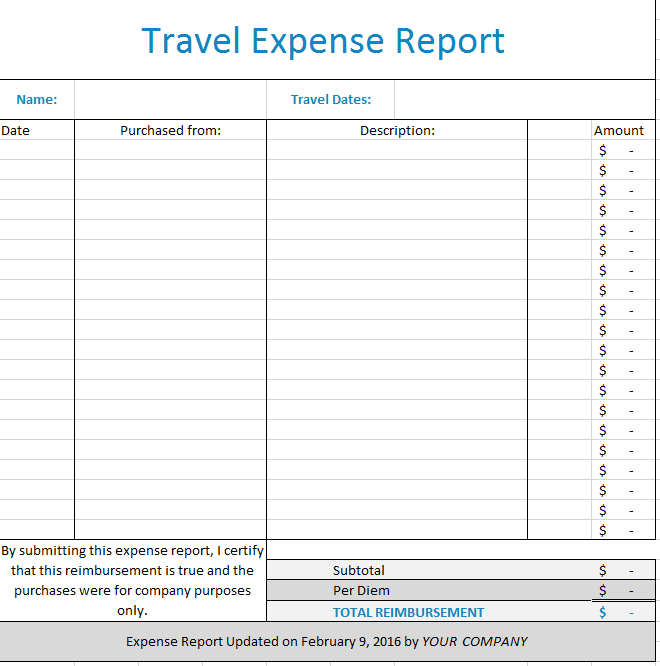

Travel Expense Report Template

Download a Travel Expense Report Template for Excel | Google Sheets

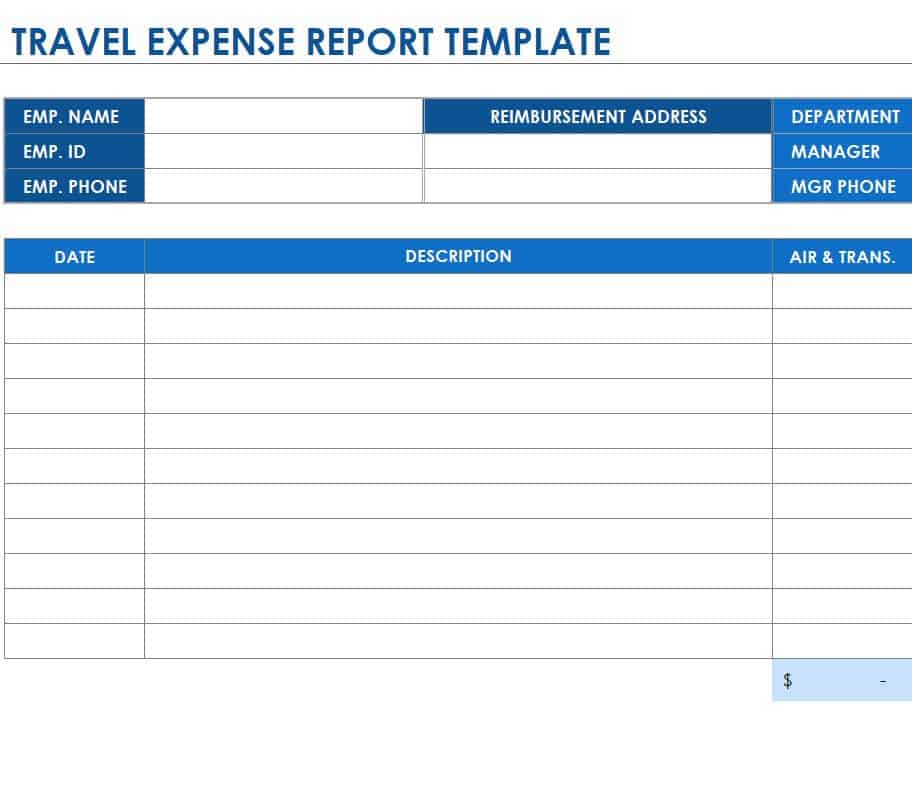

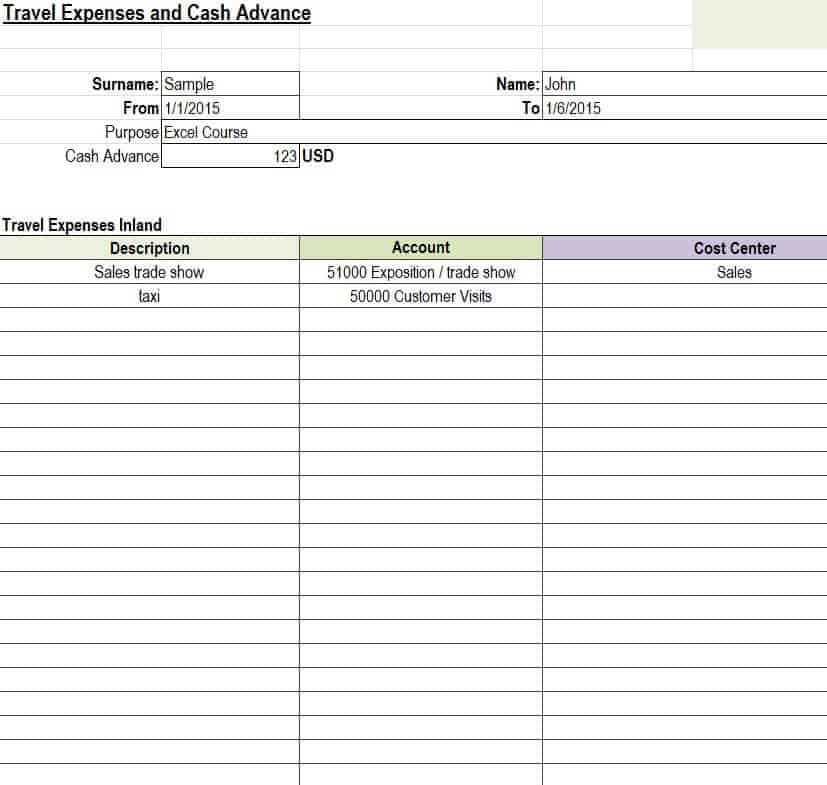

Use this detailed , printable travel expense report template to keep track of business trip expenditures. The template includes mileage tracking, other transportation costs, lodging, meals, and more. There is also space to list miscellaneous expenses that may not fit in the other categories. You can include contact information for employer and employee, as well as info on the travel destination and purpose for the trip.

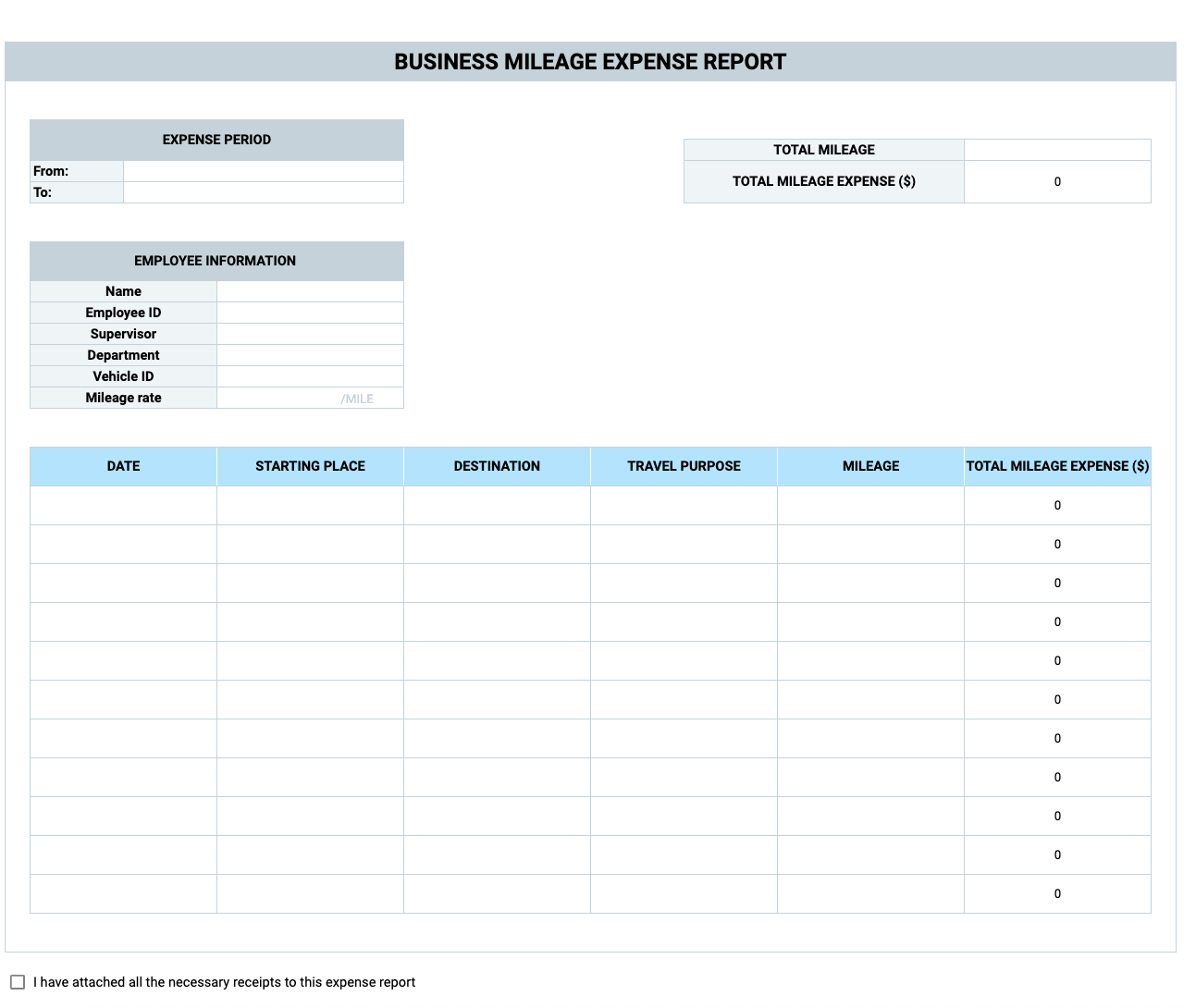

Expense Report With Mileage Tracking Template

Download an Expense Report With Mileage Tracking Template for Excel | Google Sheets

Many businesses and organizations reimburse employees for mileage costs. This printable mileage expense sheet can be used to record and calculate any miles accrued for business purposes. Enter the rate per mile and number of miles to calculate the total reimbursement amount. You can include odometer readings and any pertinent notes about the travel purpose or outcome.

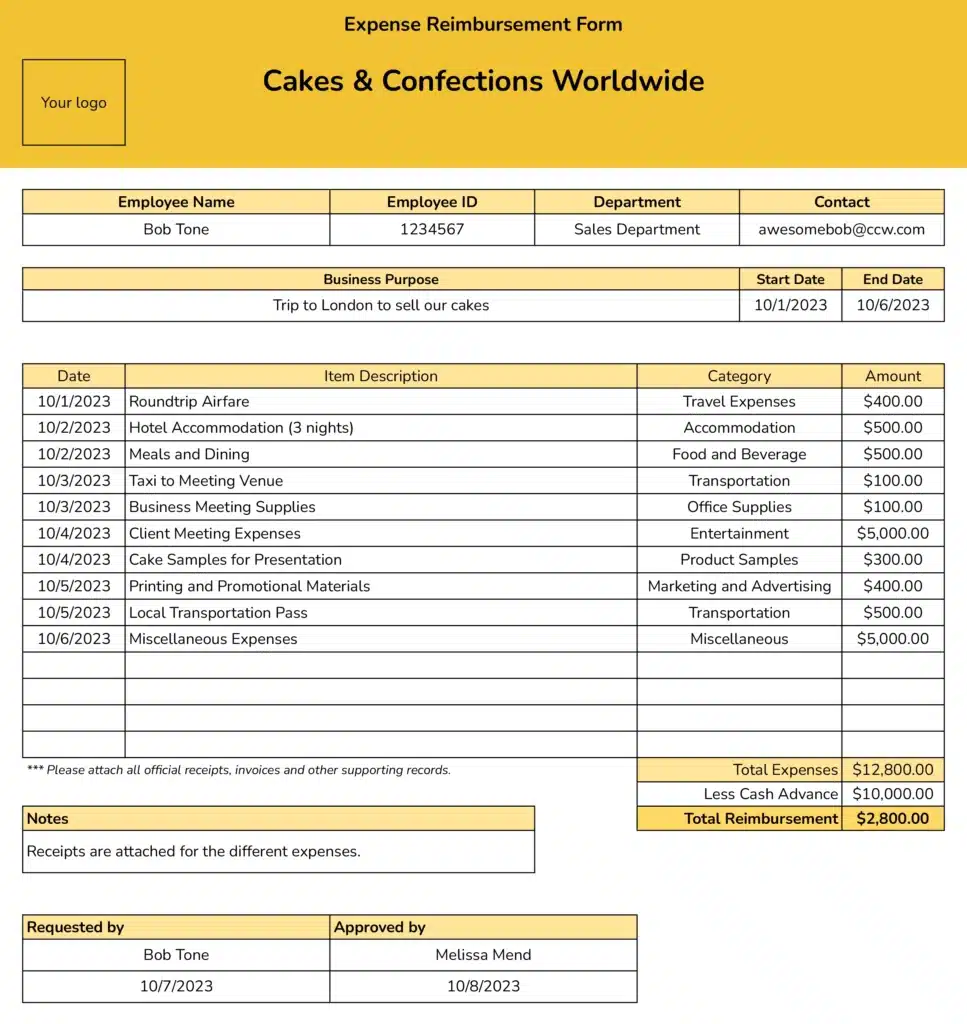

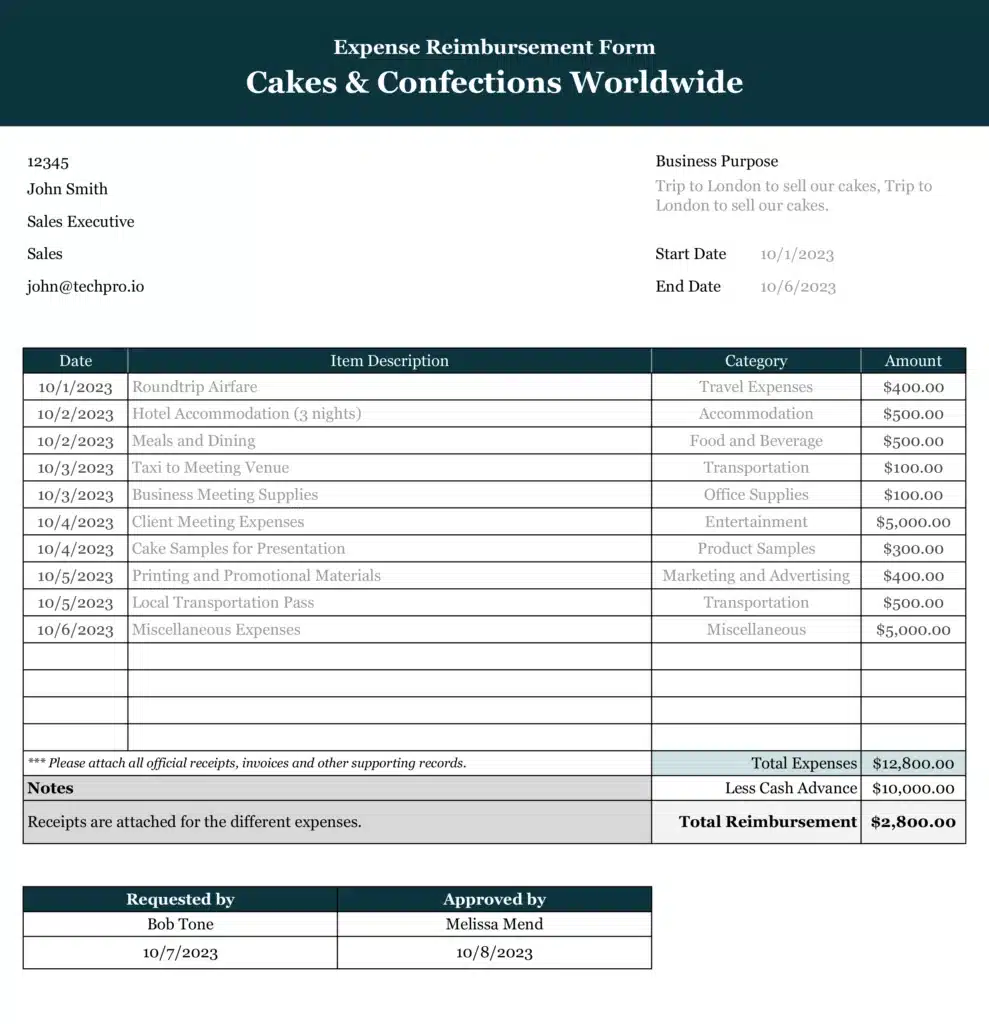

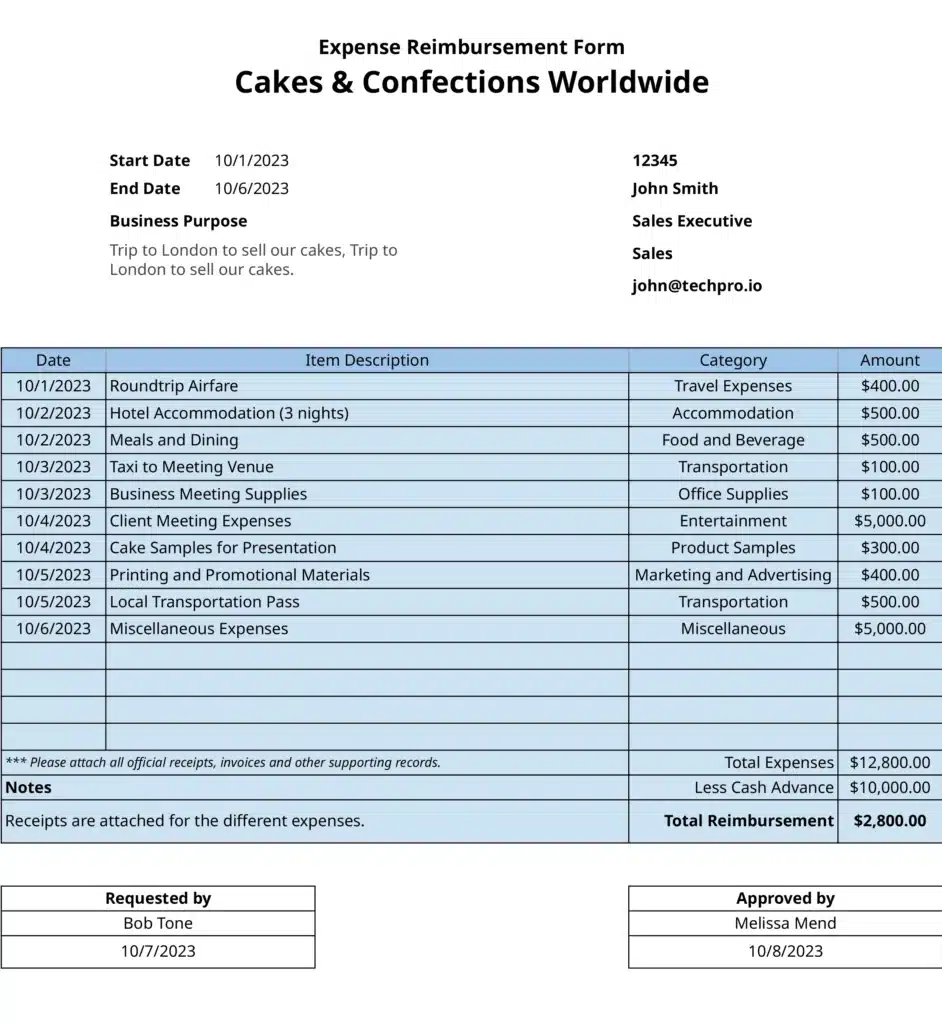

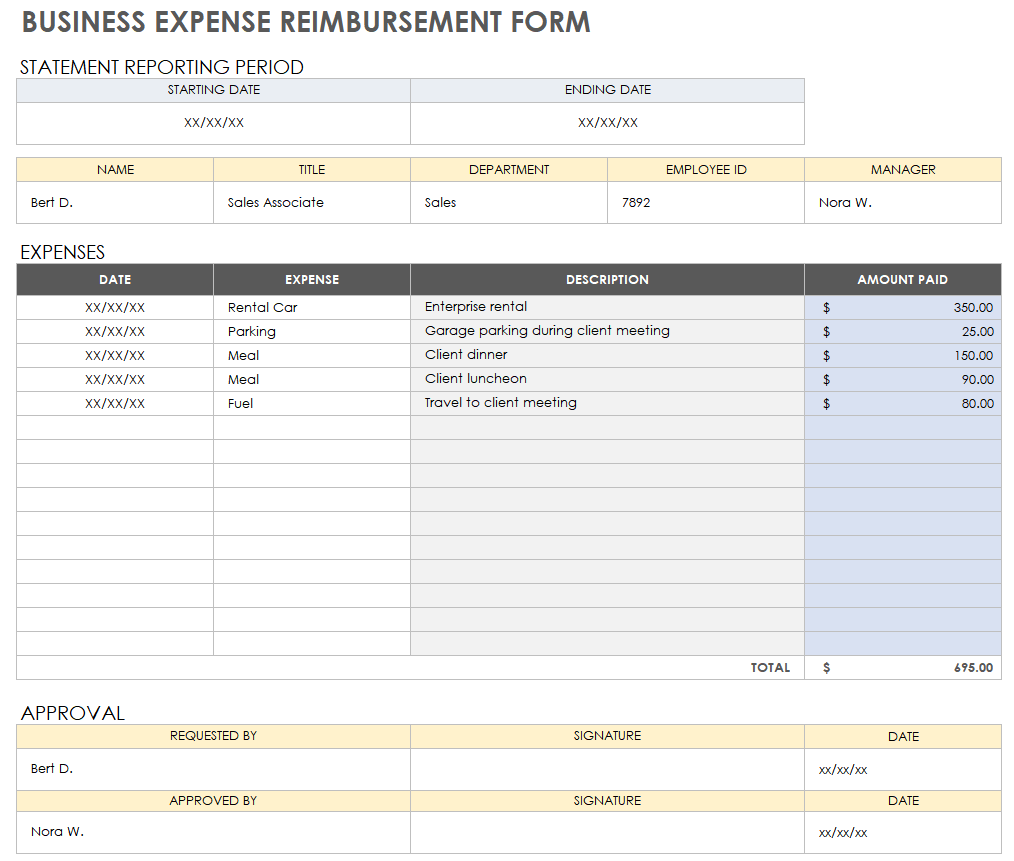

Business Expense Reimbursement Form

Download a Business Expense Reimbursement Form for

Excel | Google Sheets

Employees can use this expenses template to request reimbursement for business costs, and employers can use it to document that remuneration has been paid. This is a basic, printable expense report template for describing costs, listing amounts, and recording the dates of each transaction. It can also easily be modified to include more columns or additional information.

Explore these small business budget templates to find effective tools for managing the financial health of your company.

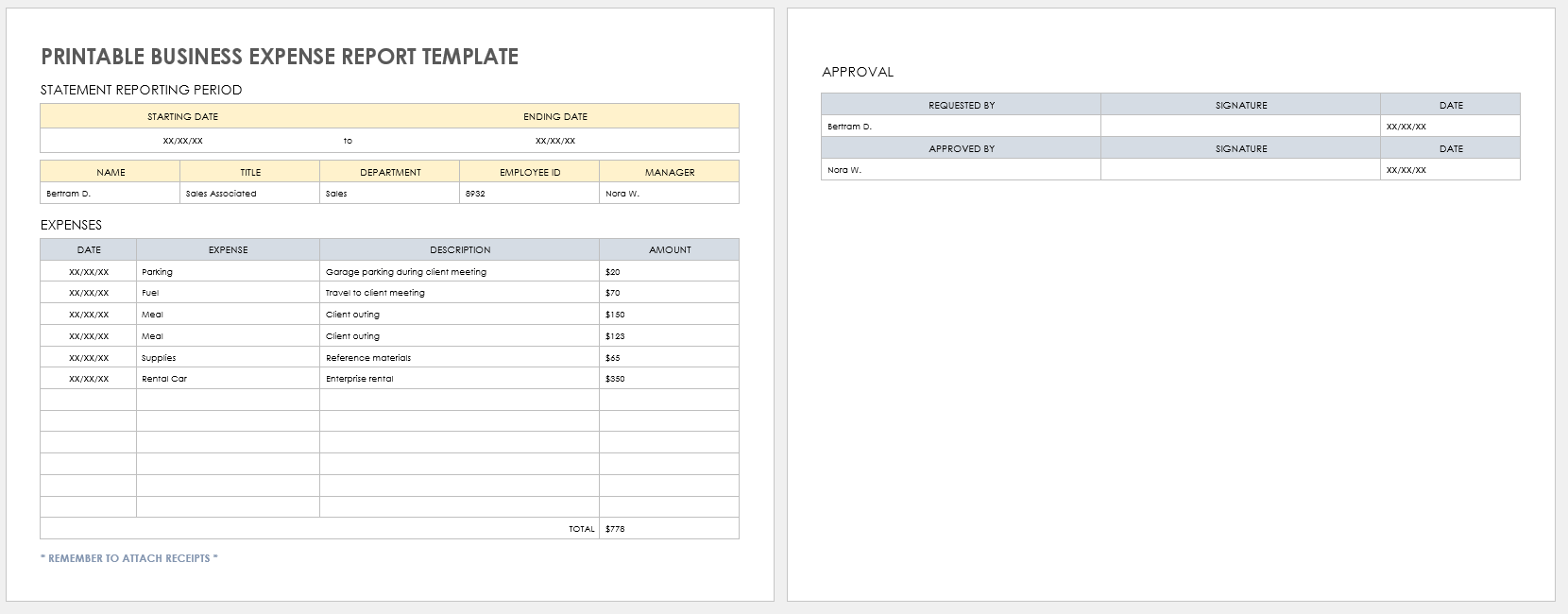

Printable Template to Fill Out Manually for Business Expenses

Download a Printable Template for Business Expenses Microsoft Word | Adobe PDF | Google Docs

If you need a printable business expenses template, this template provides an itemized outline in table format and is perfect for manually filling in your expenses. Use this easy-to-fill template to document various expenses, the dates they were accrued, total costs, and employee information. This is a simple form that can be modified to suit your business.

Download one of these free small business expense report templates to help ensure your small business’ expenditures and reimbursements are accurate.

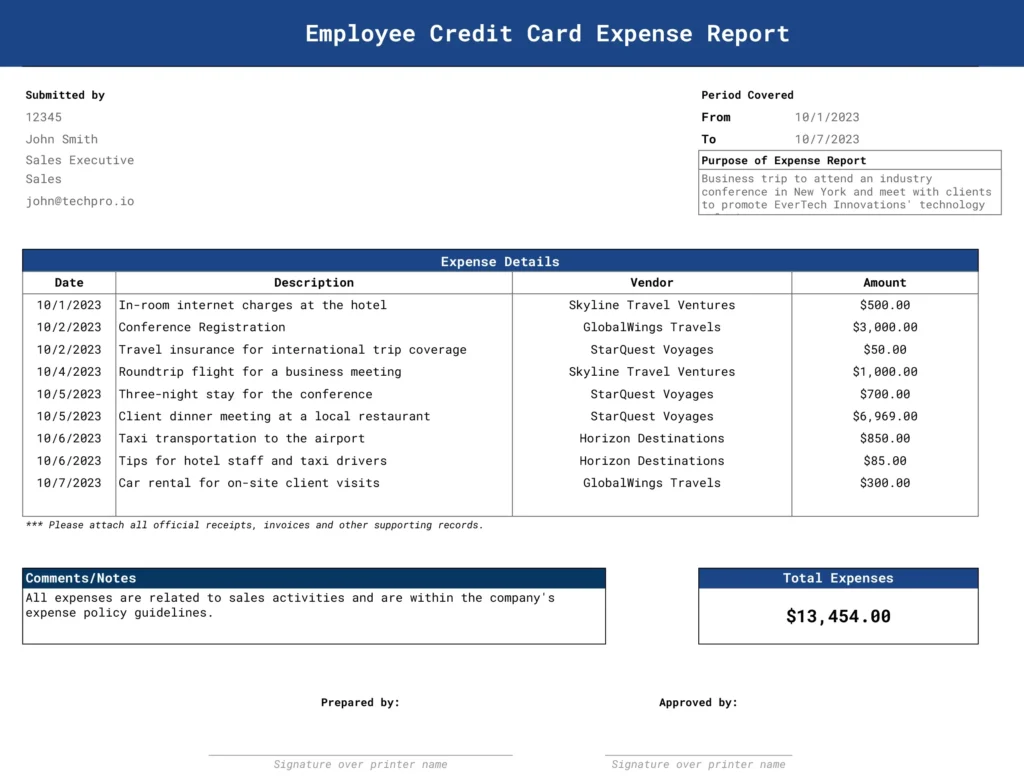

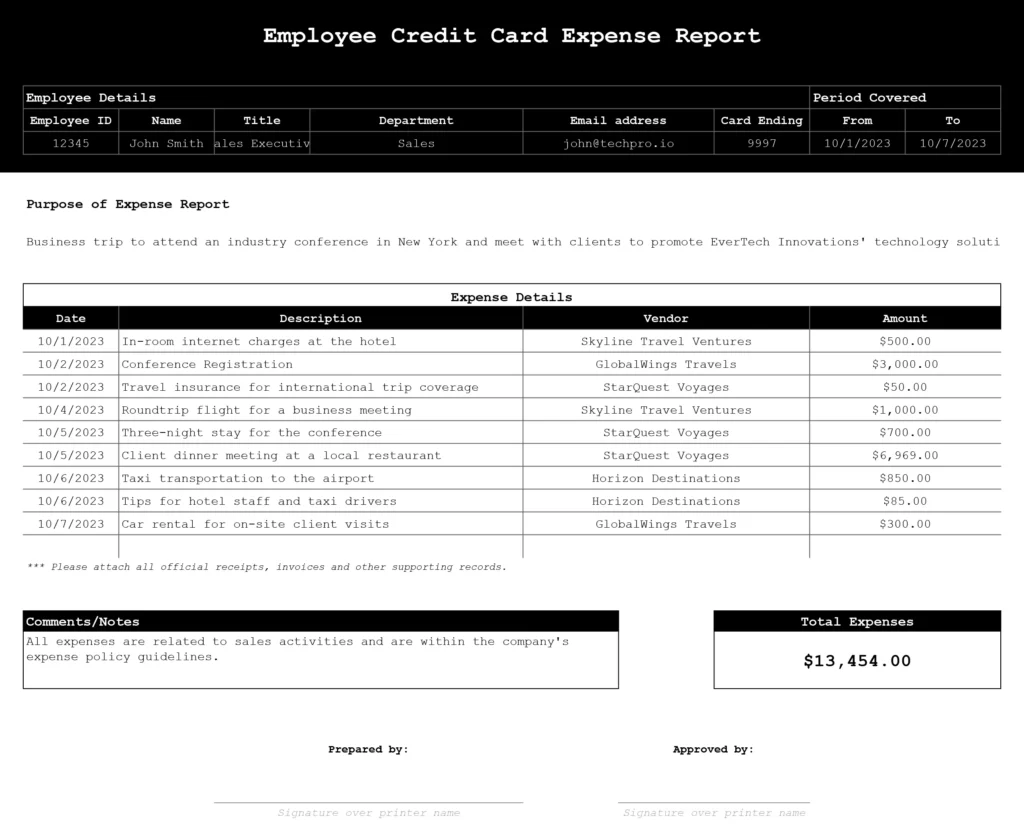

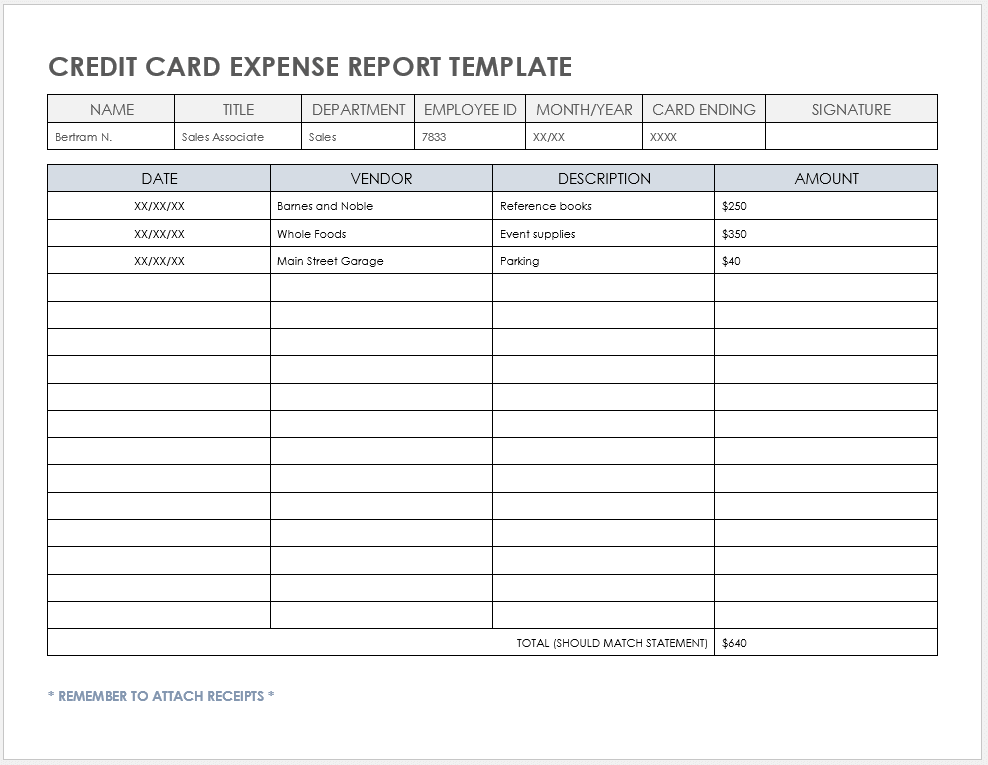

Credit Card Expense Report Template

Download a Credit Card Expense Report Template for Microsoft Word | Adobe PDF | Google Docs

This template summarizes credit card expenses to track business purpose and amount spent. This printable expense report should be accompanied by receipts for each transaction listed. This can be used for tracking monthly credit card expenses and to support accounting practices.

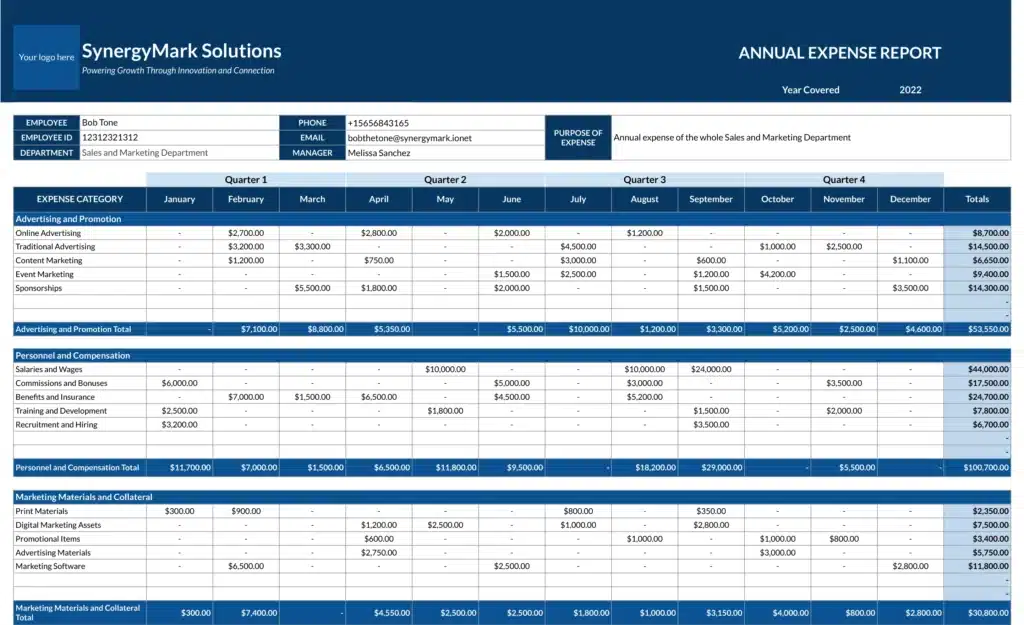

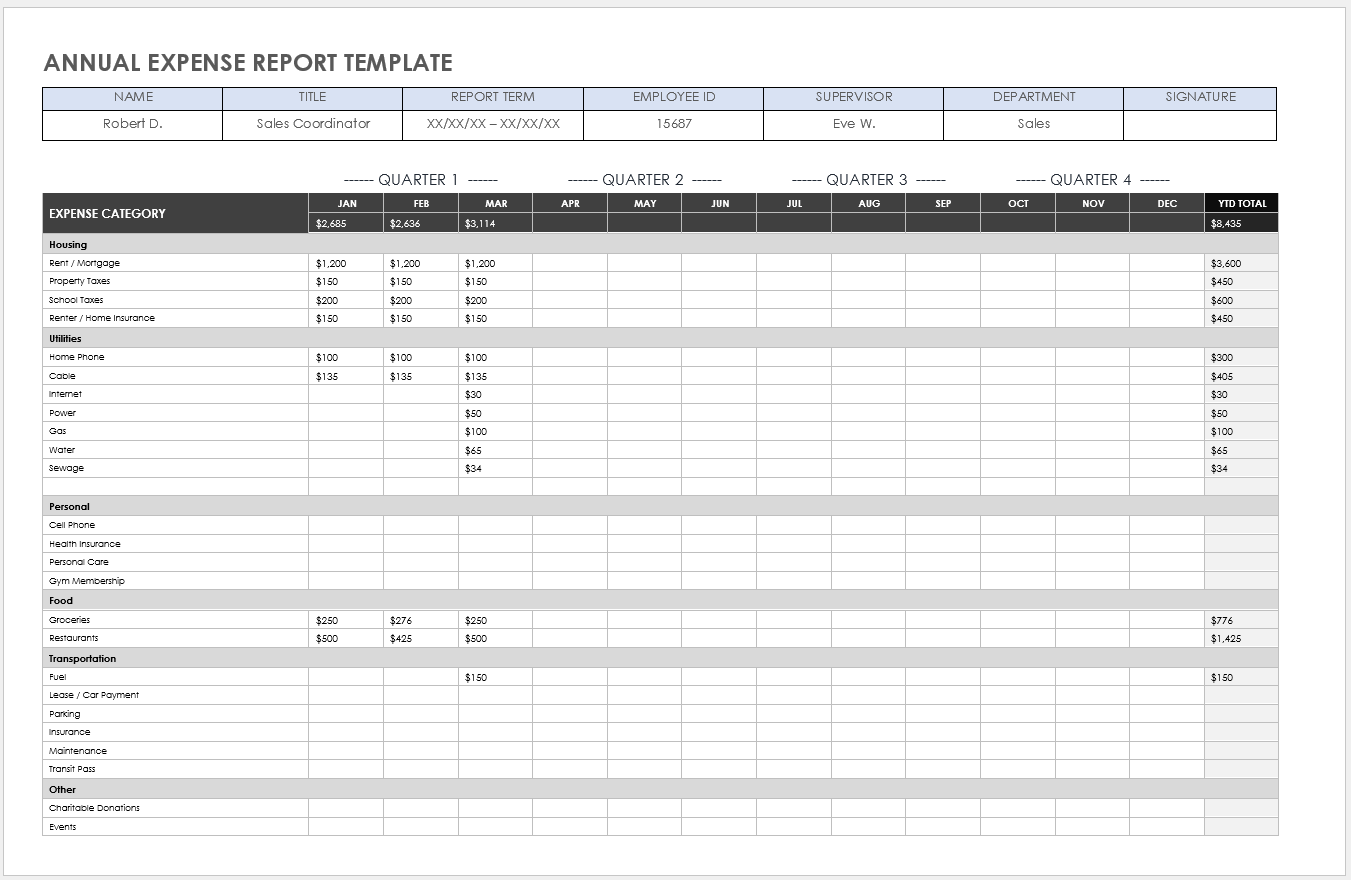

Annual Expense Report Template

Download an Annual Expense Report Template for Microsoft Word | Adobe PDF | Google Docs

Use this annual expense report to itemize monthly, quarterly, and yearly totals. This printable form provides a quick breakdown of costs for different business categories and creates a brief report. There is also room for notes if additional information needs to be included.

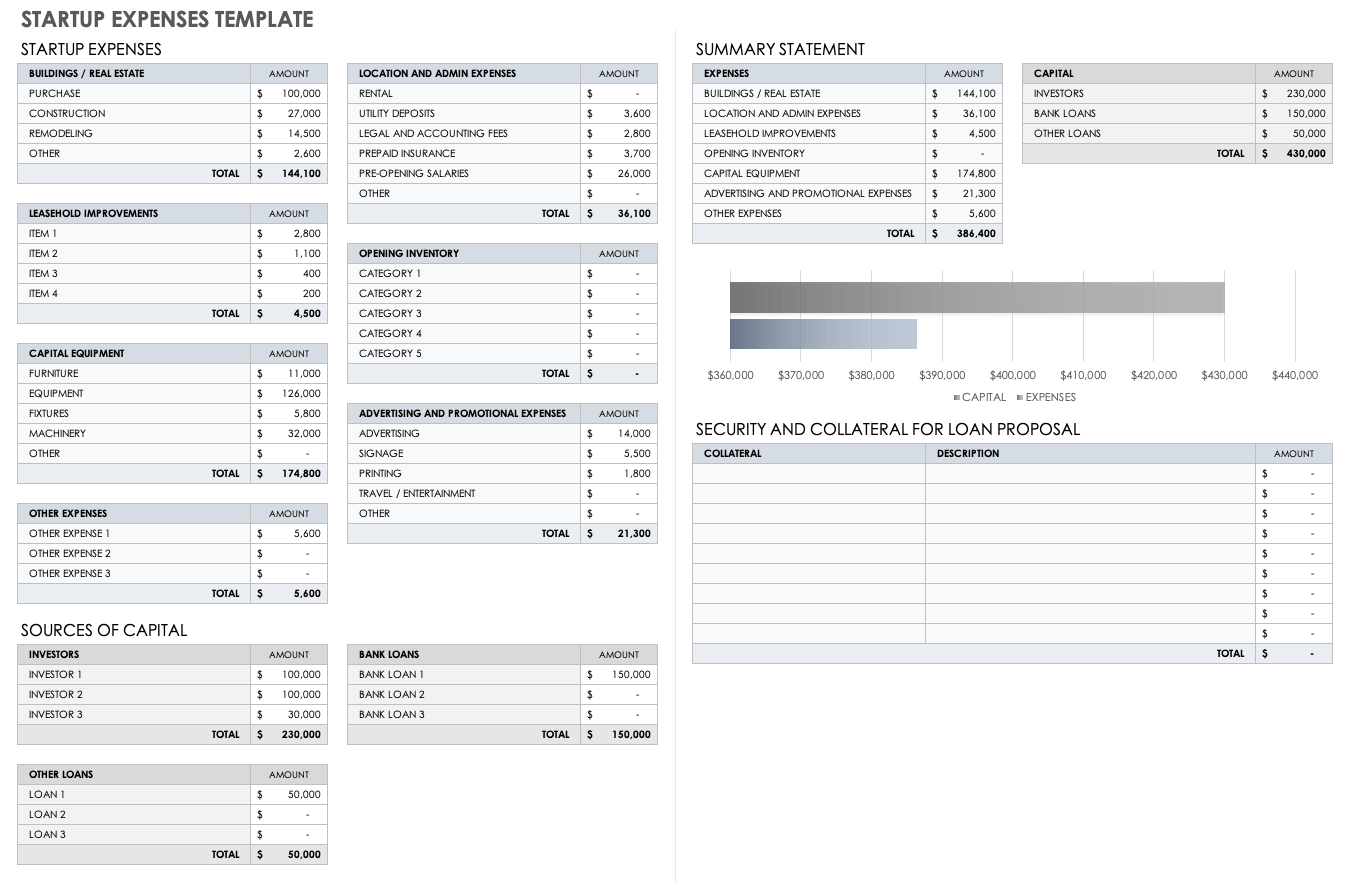

Startup Expenses Template

Download a Startup Expenses Template for Excel | Google Sheets

This comprehensive expenses-tracking template is designed for startups to monitor all the expenditures related to launching a new business. The printable template consists of pre-built sections for specific expense categories, such as building and real estate, leasehold improvements, location and administrative expenses, opening inventory, capital equipment, advertising and promotional expenses, and miscellaneous expenses. It offers a ready-made report that can be shared with key stakeholders and investors to review your startup's expenses.

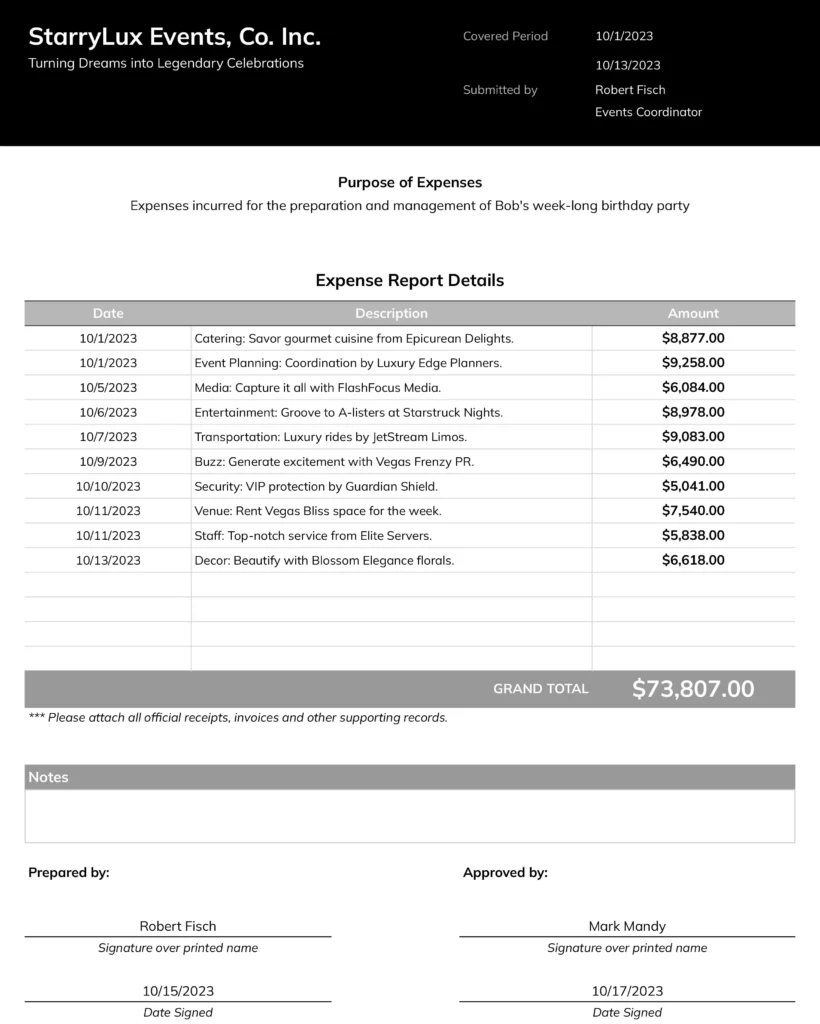

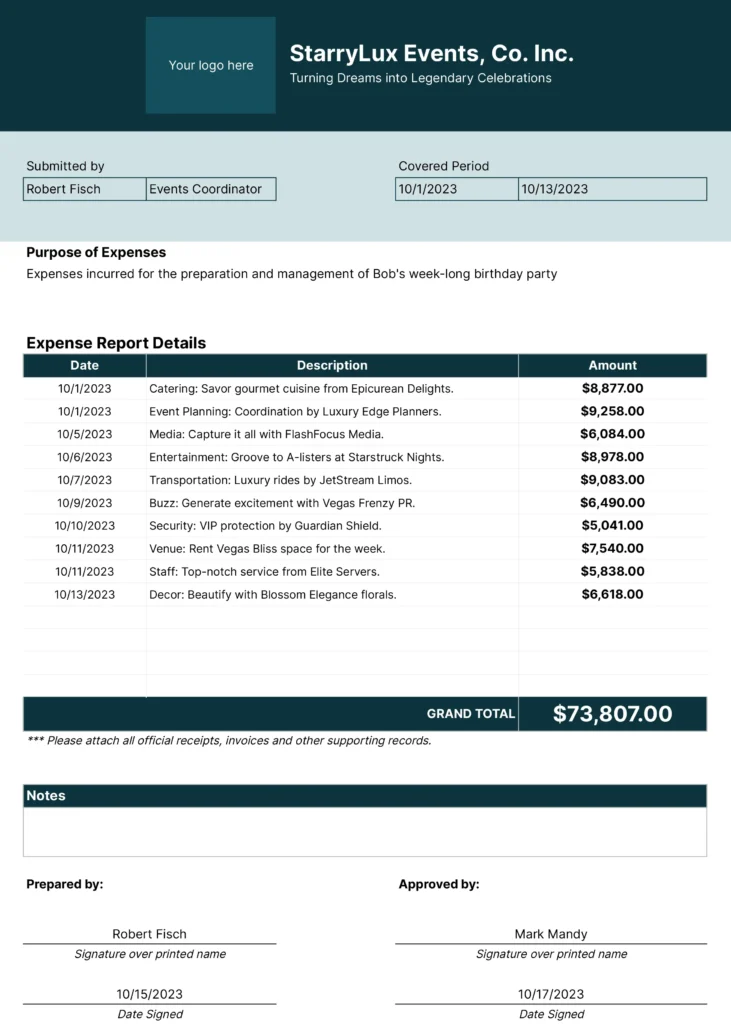

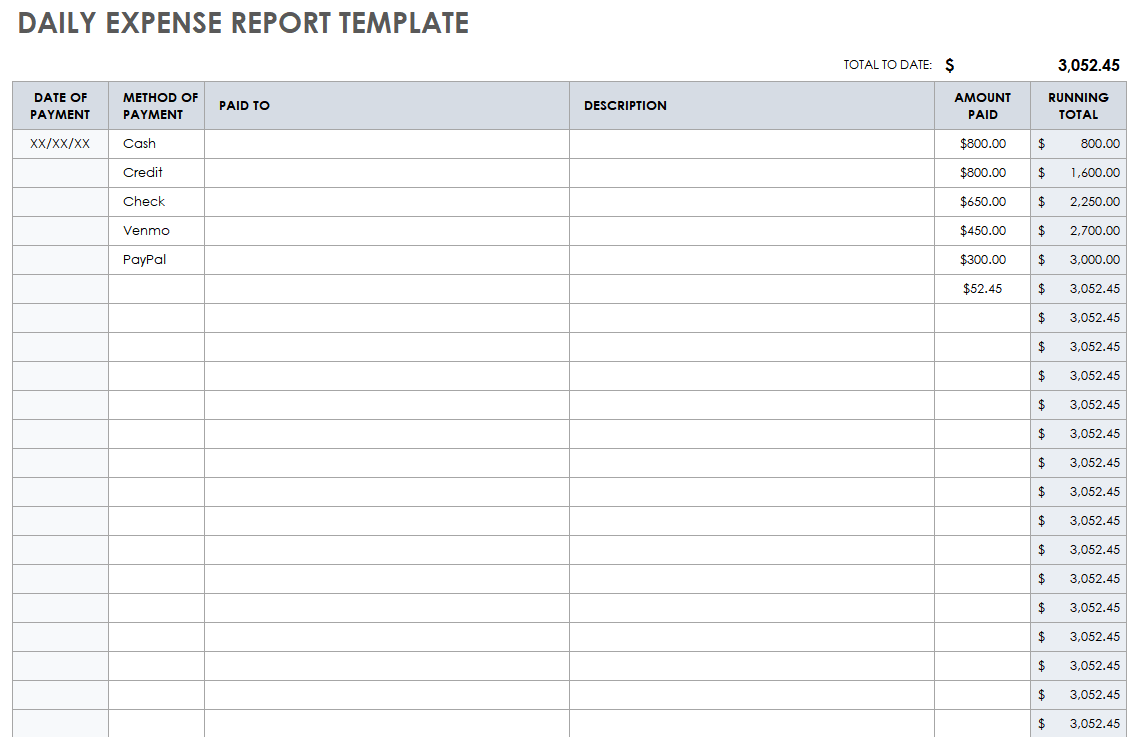

Daily Expense Report Template

Download a Daily Expense Report Template for Excel | Adobe PDF | Google Sheets

This printable daily expense report template is a versatile solution for various industries such as nonprofit, fundraising, construction, events, trucking, and more. It empowers you to track and monitor daily expenditures efficiently, ensuring timely and accurate reimbursements.

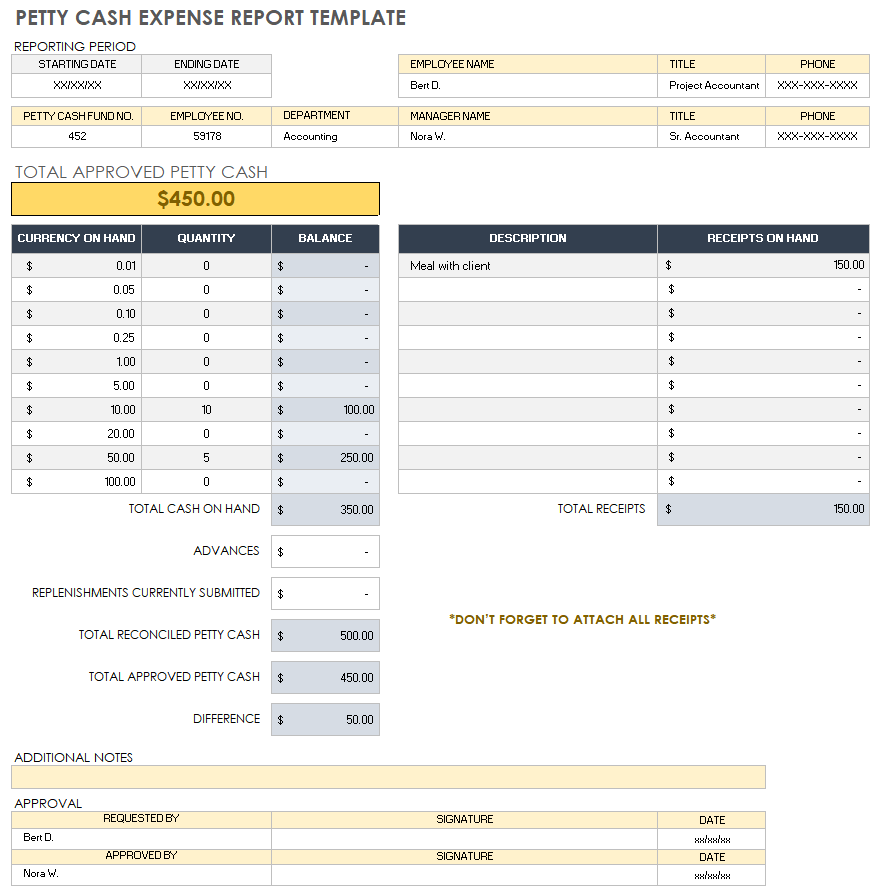

Petty Cash Expense Report Template

Download a Petty Cash Expense Report Template for Excel | Google Sheets

For organizations that keep petty cash on hand to pay for incidental expenses (e.g., paying for employees’ lunches, reimbursements, office supplies, etc.), this printable template is the perfect solution to track minor, one-off expenditures. The template provides Currency on Hand, Quantity, and Balance columns for each petty-cash expense. The template then allows you to reconcile these expenses with Total Reconciled Petty Cash and Total Approved Petty Cash cells, and the over-under difference between the two.

What Is an Expense Report?

An expense report is a document used to track business-related expenses, such as transportation, food, lodging, and conference fees. This report includes details about each expense and acts as an organized record for reimbursement or accounting purposes.

An expense report can be used in various scenarios, such as tracking mileage and gas expenses during work-related travel, documenting client meetings that involve meals or entertainment, or recording office supply purchases made by employees. Maintaining these reports is crucial for budgeting and tax purposes.

Requiring receipts for all listed expenses on a report is essential to minimize errors and facilitate tax filing and audits for businesses. Regularly collecting expense reports from employees, whether on a weekly or monthly basis, serves as a safeguard against budgeting inaccuracies and helps ensure responsible use of funds.

An expense report can vary in length and complexity depending on your business requirements. It can range from a simple form to a more detailed document. Typically, an expense report includes a comprehensive list of expenses, with each item accompanied by a corresponding description. Expenses are often categorized, such as mileage, meals, hotel costs, or employee training. In the case of a travel-specific report, additional details about the destination and purpose of travel may also be included.

When listing expenses for reimbursement, it is essential to include any advance payments, which should be deducted from the total reimbursement amount. Additionally, the expense report should feature a signature line for approval and provide contact information for the individual requesting reimbursement. To maintain accurate records, it is advisable to indicate the specific time period during which the expenses were incurred.

What Is an Expense Report Template?

An expense report template is a tool that allows businesses or individuals to track and manage their expenses. An expense report template helps you record and organize your expenses, making it easier to get reimbursed and keep accurate financial records.

Expense report templates are not only helpful for tracking business expenses but can also be useful in creating a personal budget. Whether you're managing your monthly income and household expenses, undertaking a remodeling project, or planning a special event like a wedding, a personal budget can help you keep track of your primary expenses. It enables you to identify areas where you can reduce costs and increase your savings.

While expense reports may vary, they typically include the following sections, which you can customize to suit your expense-tracking needs:

- Name: Enter the name of the individual to be reimbursed upon submission of the expense report.

- Department: Specify the department where the employee or individual works or the department responsible for reimbursement.

- Manager: Provide the name of the manager overseeing the individual who can authorize expense reimbursement.

- Date: Indicate the date(s) when the expenses were incurred.

- Description: Provide a brief description for each expense.

- Expense Category: Categorize expenses into specific categories such as transportation, lodging, food, or mileage.

- Subtotal: Calculate the total of all expenses.

- Advances: Record any advances given to the individual being reimbursed.

- Total Reimbursement: Calculate the final reimbursement amount by subtracting any advances from the subtotal.

- Authorized By: Enter the name of the person authorized to approve the expense reimbursement.

- Receipts: Attach all relevant receipts to the expense report for accurate and timely payment processing.

Discover a Better Way to Manage Expense Reporting and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Additional Resources

Budget & accounting

Free Excel Invoice Templates

Need to submit and track invoices? Here are 12 free invoice templates to get you started.

Aug 12, 2024 6 min read

Top Excel Financial Templates

Discover all the top financial templates that your business needs to succeed.

Sep 23, 2022 4 min read

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Excel Expense Report Template

An Expense Report is an organized way for businesses and their employees to track and report their expenses for business-related trips and events. The expense report is usually a printed form or a spreadsheet that is filled out and kept for accounting and tax purposes. Because of this, it is especially important to track any expenses that are tax deductible.

For a quick solution , instead of making your own expense report in Excel or Google Sheets, download and use one of our free Expense Report Templates below. Easily customize the spreadsheet by adding your company information and other details, then share the file with your employees.

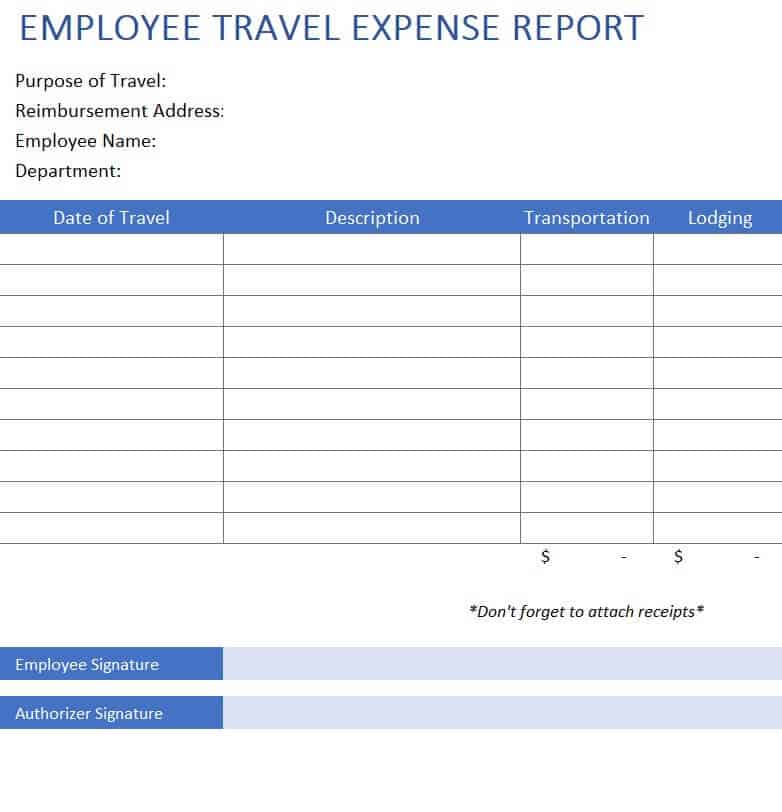

Important Note for Employers : When your employees use a travel expense report, they should also submit copies of receipts along with the report so you can keep adequate records for tax purposes. We've included the note "Don't forget to attach receipts" in these spreadsheets to help serve as a reminder.

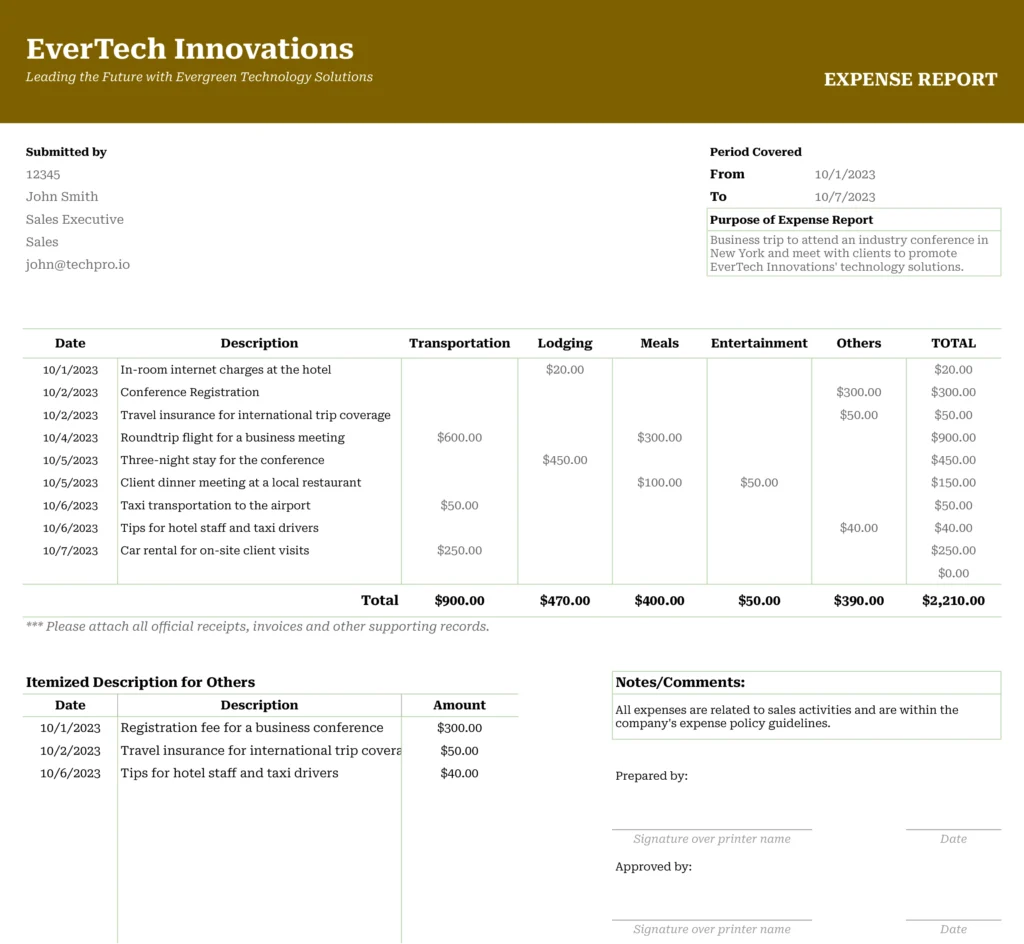

Travel Expense Report Template

License : Private Use (not for distribution or resale)

Description

Report your travel expenses , especially those that are tax deductible, with a simple and easy-to-use spreadsheet. This report template includes separate columns for common types of expenses. It also includes a table for recording detailed itemized expenses, such as a break-down of your meals or transportation expenses.

Simple Expense Report Template

The Simple Expense Report template uses one column for all expense types. The expense type can be selected from a drop-down that is easy to customize. There is also a designated place to specify the rate for mileage reimbursement.

For a blank, printable expense form that you can fill out by hand, simply remove the sample data and fill in the information you want printed.

Update 5/7/2020: I've added a new worksheet to this version of the expense report that lets you mark specific expenses "to be reimbursed" in case you use both a company card as well as personal money. Place an "x" in this column (or check the box in the Google Sheets version) if you want the amount to be added to the "Amount to Reimburse" total.

What business travel expenses are tax deductible?

Some of the most common tax deductible travel expenses include: flights, car rentals, mileage, uber rides, lodging, meals, tips, dry cleaning and laundry. We've based the expense types in our templates on these common expenses. For an official and detailed list that includes explanations and examples, we highly recommend visiting the Business Travel Expenses page on IRS.gov: https://www.irs.gov/taxtopics/tc511 )

Other Helpful Expense Report Templates

Our Reimbursement Form template is great for general employee expense reimbursements (for non-travel expenses). The Business Mileage Tracking Log lets you keep track of daily mileage for record keeping and reporting. The Weekly Expense Report template provides a way to include more details and more expense categories.

Disclaimer: The information on this page is for general education and not to be used as personal financial or tax advice. If you have questions about taxes or proper reporting procedures for travel expenses, please consult a certified professional.

Follow Us On ...

Related templates.

Timesheets & Payroll

For the office.

- 2024 Calendar

- 2025 Calendar

- Monthly Calendar

- Blank Calendar

- Julian Calendar

- Personal Letter

- Personal Reference Letter

- Collection Letter

- Landlord Reference Letter

- Letter of Introduction

- Notarized Letter

- Lease Renewal Letter

- Medication Schedule

- Bank Statement

- 100 Envelope Challenge

- Landscaping Invoice

- Credit Application Form

- Plane Ticket

- Child Support Agreement

- Payment Agreement

- Cohabitation Agreement

- Residential Lease Agreement

- Land Lease Agreement

- Real Estate Partnership Agreement

- Master Service Agreement

- Profit Sharing Agreement

- Subcontractor Agreement

- Military Time

- Blood Sugar Chart

- Reward Chart

- Foot Reflexology

- Hand Reflexology

- Price Comparison Chart

- Baseball Score Sheet

- Potluck Signup Sheet

- Commission Sheet

- Silent Auction Bid Sheet

- Time Tracking Spreadsheet

Free Printable Travel Expense Report Templates [Excel, PDF, Word]

Navigating the financial labyrinth of travel expenses can be a daunting task. In this article, we explore the ins and outs of creating a comprehensive Travel Expense Report . These reports, crucial for businesses and employees alike, ensure transparency, accuracy, and efficiency when handling travel-related expenditures.

As the compass to your financial journey, a well-prepared report not only streamlines the reimbursement process but also serves as a tool for cost management and budgetary control. Whether you’re a seasoned professional or a beginner in the world of expense reporting, this guide offers step-by-step instructions, best practices, and expert tips to help you manage your travel expenses with ease and precision.

Table of Contents

What is a Travel and Expense report?

A Travel and Expense (T&E) report is a detailed document that records all costs incurred by an employee during business travel. This could include expenses such as airfare, hotel accommodations, meals, transportation (like car rentals or taxi fares), and other incidental expenses necessary for conducting business.

The T&E report serves a dual purpose; it provides a record for the employee to seek reimbursement from their company, and it offers the company an audit trail for accounting and tax purposes. Well-documented and accurate T&E reports are essential for maintaining financial transparency, managing business costs, ensuring policy compliance, and identifying potential areas of savings.

Travel Expense Report Templates

Travel Expense Report Templates are organized formats for documenting and tracking expenses incurred during business travel. These templates provide a systematic method to record and categorize costs, facilitating efficient reimbursement and cost management.

Essential components of these templates include fields for the traveler’s name, travel dates, destinations, and purpose of travel. Detailed sections for different types of expenses such as accommodation, meals, transportation , and incidentals are also typically present. Space for attaching or referencing receipts is another common feature.

Travel Expense Report Templates play a significant role in corporate financial management. They provide a standardized way for employees to report travel costs, which aids in accurate reimbursement, financial accounting , and budget planning.

Importance of Travel Expense Report

Travel and Expense (T&E) reports hold significant importance in business operations for a multitude of reasons. These reports help to maintain financial transparency, comply with tax regulations, ensure fiscal responsibility, and manage budgets. Here’s a detailed explanation of why T&E reports are vital:

Financial Transparency

T&E reports provide a clear record of the money spent during business-related travel. By documenting every expenditure, companies can monitor their spending habits, identify irregularities, and keep track of all financial transactions related to travel. This level of transparency is essential for both internal auditing and maintaining trust between the company and its employees.

Regulatory Compliance

On a regulatory level, these reports are crucial for tax purposes. Tax authorities may require evidence of travel-related expenses, particularly when those costs are claimed as deductions. Detailed and accurate T&E reports can serve as proof of these expenses and help businesses comply with tax regulations.

Reimbursement

For employees, these reports are important to ensure they’re reimbursed promptly and accurately for any out-of-pocket expenses incurred during business travel. Without a systematic reporting process, employees could be left out of pocket, which could lead to dissatisfaction and potentially impact their work performance.

Budget Management

By analyzing T&E reports, businesses can manage their budgets more effectively. They provide valuable data on where and how travel funds are being spent, enabling organizations to spot trends, identify cost-saving opportunities, and make informed budgetary decisions for future planning.

Policy Compliance and Improvements

T&E reports help ensure that employees are complying with the company’s travel policies. If a report reveals spending that violates the company’s policy, this can be addressed directly with the employee. Alternatively, consistent issues may suggest that the policy itself needs to be reviewed and possibly revised.

Fraud Detection

Regular and thorough examination of T&E reports can help identify fraudulent activities. If certain expenses seem suspicious or out of line with typical spending, the reports provide a trail that can be further investigated.

Business Insights

Finally, T&E reports can offer valuable insights into business operations. For instance, they can reveal which clients or projects are requiring more resources in terms of travel and whether these costs align with the value being derived from those clients or projects.

When and how to submit a travel expense report

The timing of submitting a travel expense report can vary depending on a company’s policy, but it generally should be submitted as soon as possible after the completion of your business trip. Here is a detailed guide on when and how to submit your travel expense report :

During Your Trip: As you travel, make it a habit to keep all receipts for every business-related expense. These receipts serve as proof of your expenses and will be required when filling out your report. It’s also a good idea to note down the business reason for each expenditure to justify the costs.

Immediately After Your Trip: Once your trip has concluded, compile all your expense documentation and start creating your expense report. It is advisable to do this promptly to ensure that the details are still fresh in your mind, thereby minimizing the risk of forgetting or overlooking any expenses.

Compile Your Report: List all your expenses, categorized by type (such as meals, accommodation, transport), along with the corresponding receipts. Include the date, location, total amount, and the business purpose for each expense. Most companies have standard forms or software to simplify this process.

Review and Verification: Double-check all the expenses and their classifications. Ensure that all amounts listed are accurate, and that all receipts are attached. Mistakes can delay the approval process and reimbursement.

Submission: Submit your report promptly to your manager or the finance department, depending on your company’s policy. The faster you submit your report, the sooner you can get reimbursed.

Follow Up: After submission, monitor the status of your report to ensure it’s processed in a timely manner. If there’s any delay or questions regarding your report, be prepared to provide clarifications.

Typically, companies expect employees to submit their T&E reports within a specific timeframe, often within a week or two following the trip. However, it’s always best to check your organization’s specific policies regarding expense reporting and reimbursement. By promptly and accurately preparing and submitting your travel expense report, you ensure smooth processing and prompt reimbursement.

Components of a travel and expense report

A comprehensive Travel and Expense (T&E) report requires a range of key components to ensure it is complete, accurate, and compliant with company policies. Here’s a detailed guide on what to include in your T&E report:

Employee Information

This typically includes your name, employee ID , department, and the period or dates of the travel.

Trip Information

Include details about your travel such as the purpose of the trip, destination(s), and dates. This provides a context for the expenses and may be necessary for categorizing costs or determining tax deductions.

Transportation Costs

This includes all expenses related to travel from one location to another. This can involve airfare, train tickets, bus fare, car rentals, or mileage for using a personal vehicle (reimbursed at the standard rate per mile as defined by your organization or IRS guidelines).

Accommodation Costs

Record the costs for hotels or other accommodation, including taxes and fees. Some companies may require a detailed receipt showing a breakdown of the charges rather than a simplified credit card receipt.

This includes all costs for food and drinks consumed during the trip. Some companies have a per diem rate, where you’re given a fixed amount per day for meals, while others require itemized receipts for all meals.

Miscellaneous Expenses

These could include costs like taxi fares, car parking, tolls, tips, and other incidental costs incurred during the travel. Again, it’s crucial to keep all the receipts.

Itemized Receipts

Every expense claimed should have an accompanying receipt. These receipts should clearly show the vendor, date, cost, and what was purchased. For expenses without receipts, such as tips, provide a thorough explanation in the report.

Expense Totals

This is where you tally up all the expenses in their respective categories and provide a total cost for the trip.

Report Submission Date

This is the date you complete and submit your report for review or reimbursement.

This space is for signatures or approval dates from managers or supervisors who authorize the expenses. Depending on your company’s policies, this may also involve an area for a finance or HR representative’s approval.

Who is responsible to prepare a travel expense report?

Typically, the individual who incurs the travel-related expenses is responsible for preparing the Travel and Expense (T&E) report. This is usually an employee who has undertaken business travel. The employee is required to accurately record all expenses, attach necessary receipts, and provide relevant details about each expenditure.

Once compiled, they are responsible for submitting the report promptly to their manager, supervisor, or the finance department, as per the company’s policy. However, the ultimate responsibility for ensuring the accuracy and integrity of the T&E report doesn’t rest solely on the employee. Managers and supervisors play a key role in reviewing and approving these reports, ensuring they comply with company policy, and that all expenses are legitimate and correctly documented.

What are some lesser-known categories of expenses that can be claimed during travel?

Travel and Expense (T&E) reports often go beyond the usual categories of airfare, accommodation, and meals. Many additional costs incurred during business travel can be claimed, but they are often overlooked because they are less common or not as well-known. Here’s a detailed guide on some lesser-known expense categories that you can include in your T&E report:

Communications: This includes costs for phone calls, internet access, or data usage that is necessary for conducting business during your trip. If your mobile plan doesn’t cover travel or if you need to purchase a local SIM card or a WiFi package at your hotel, these costs can typically be claimed.

Tips and Gratuities: Many business travelers overlook the small amounts they give as tips to service personnel. This can include tips given to taxi drivers, hotel staff, waiters, and more. While these might seem minor, they can add up over a trip.

Baggage Fees: If your airline charges for checked baggage, or if you have extra charges due to heavy or oversized luggage (such as equipment necessary for your business meeting or trade show), these costs can be included in your T&E report.

Currency Exchange Fees: If you’re traveling internationally, you may incur charges when exchanging your money into the local currency or when using a credit card that has foreign transaction fees. These charges are often overlooked but can be claimed as well.

Laundry and Dry Cleaning: On extended business trips, the cost of laundry or dry cleaning services may be allowable expenses. Check your company’s policy, as some only allow this for trips exceeding a certain duration.

Visa and Passport Expenses: If your travel requires a visa or if you had to expedite a passport renewal specifically for the business trip, these costs could be included in your T&E report.

Travel Insurance: Some companies allow employees to claim for travel insurance, particularly for international travel. This can cover scenarios like trip cancellation, medical emergencies, lost luggage, etc.

Home Office Expenses: While not strictly a travel expense, if you’re working remotely from a location other than your office, you may be able to claim certain costs such as necessary office supplies or printing costs.

Fitness Fees: Some companies recognize the importance of their employees’ health even while traveling and will cover the cost of a gym pass or fitness center fee at the hotel.

Emergency Medical Expenses: If you become ill during your trip and need to seek medical attention, these costs can often be claimed. However, it’s essential to check your company’s policy as this can vary widely.

What can’t be claimed?

While there are many valid expenses that can be claimed during business travel, there are also several types of expenses that typically cannot be claimed, or are disallowed by company policy. These ineligible expenses can include:

Personal Expenses: Any costs incurred for personal activities or items unrelated to business cannot be claimed. This can include personal grooming items, clothing, personal reading material, or costs incurred by family members or friends traveling with you.

Entertainment: While some companies may allow for entertainment expenses under specific circumstances, expenses for personal entertainment like movies, sightseeing, sports events, or other leisure activities are typically not covered.

Alcohol: Depending on the company’s policy, alcohol may not be an allowable expense. Some companies might cover moderate alcohol consumption as part of a meal or business meeting, but others may disallow it completely.

Unapproved Upgrades: If you choose to upgrade your flight to business class or your hotel room to a suite without prior approval, this additional cost is generally not reimbursable.

Travel Fines: Any fines incurred during travel, such as parking tickets, traffic violations, or penalties for lost hotel items, are typically the responsibility of the employee and cannot be claimed.

Non-Emergency Medical Costs: While emergency medical costs might be covered, non-emergency expenses such as routine medications or elective procedures are typically not reimbursable.

Extravagant Expenses: Excessive or lavish expenses that exceed what is necessary and reasonable for the business purpose of the trip are usually not covered. This can include excessively expensive meals, luxury transport services, or unnecessary room services.

Travel Insurance for Personal Items: While travel insurance might be covered, insurance for personal items or equipment is typically not reimbursable.

No-show Fees or Cancellation Fees: Costs for missed flights, hotel no-show fees, or last-minute cancellations without a valid business reason are generally not covered.

How to complete your travel expense report template

Completing a Travel and Expense (T&E) report can seem daunting, but by following the right steps, you can ensure your report is accurate and compliant. Here is a detailed step-by-step guide on how to complete a T&E report template:

Step 1: Gather Your Receipts and Documentation

Collect all your receipts, invoices, and any other documents that verify your travel expenses. Make sure you have records for all transportation, accommodation, meals, and other costs related to the business travel.

Step 2: Review Your Company’s Expense Policy

Familiarize yourself with your company’s T&E policy before starting the report. This policy will outline what expenses are eligible for reimbursement, any spending limits, the documentation required, and how to fill out the report.

Step 3: Fill in Your Personal and Trip Information

In the provided sections of the report, enter your personal details such as name, employee ID, department, and contact information. Also include the purpose, dates, and destination(s) of your trip.

Step 4: List Your Expenses

Itemize your expenses in the appropriate categories such as airfare, hotel, meals, etc. Include the date, location, amount, and purpose for each expense. Some companies use software that can automate this process when you upload receipts.

Step 5: Attach Receipts

Attach the corresponding receipt to each expense. Digital platforms will usually allow you to upload scanned copies or photos of receipts. Make sure each receipt is clear, legible, and contains the necessary information: date, vendor, amount, and what was purchased.

Step 6: Calculate the Total

Once all expenses have been entered, calculate the total cost of the trip. Some templates or software will do this automatically.

Step 7: Review the Report

Go through the report carefully to ensure all the information is correct and that you’ve complied with the company’s expense policy. This includes checking all amounts, ensuring all receipts are attached, and verifying that each expense is legitimate and business-related.

Step 8: Submit the Report

Once you’re satisfied that the report is accurate and complete, submit it to the appropriate party in your company, which may be your manager, a supervisor, or the finance department. Ensure you submit it within the timeframe specified by your company’s policy to avoid delays in reimbursement.

Step 9: Keep a Copy

It’s always a good practice to keep a copy of your completed report and all related receipts until you’ve received reimbursement and for a period afterward in case there are any questions or audits.

Step 10: Monitor and Follow-Up

After submission, keep an eye on the status of your report. If there are any questions or issues, address them promptly to ensure you receive your reimbursement as quickly as possible.

What happens if I lose a receipt?

Company policies vary on this, but generally, you should contact your finance or HR department as soon as possible to ask how to proceed. Some companies allow for a written attestation or a credit card statement as a substitute, but it is best to always try to obtain a duplicate receipt if possible.

How long does it take to get reimbursed after submitting a T&E report?

The time frame for reimbursement can vary from one company to another. It typically depends on the company’s internal processes, the accuracy of your report, and how promptly it was submitted. Generally, companies aim to process reimbursements within a couple of weeks.

Can I include tips or gratuities in my T&E report?

Yes, most companies allow for reasonable tips and gratuities given to service personnel (like wait staff, hotel housekeeping, or taxi drivers) to be included in the T&E report. However, always check your company’s specific policy for any limitations.

What happens if my T&E report includes an expense that violates the company’s policy?

If an expense in your report violates the company’s policy, that particular expense may not be reimbursed. Repeated or serious violations could potentially lead to disciplinary actions, depending on the company’s policy.

Can I include my travel expenses if I extend my business trip for personal reasons?

Only the expenses incurred for the business portion of the trip are typically reimbursable. Any expenses related to personal activities or extensions of the trip for personal reasons are usually the responsibility of the employee.

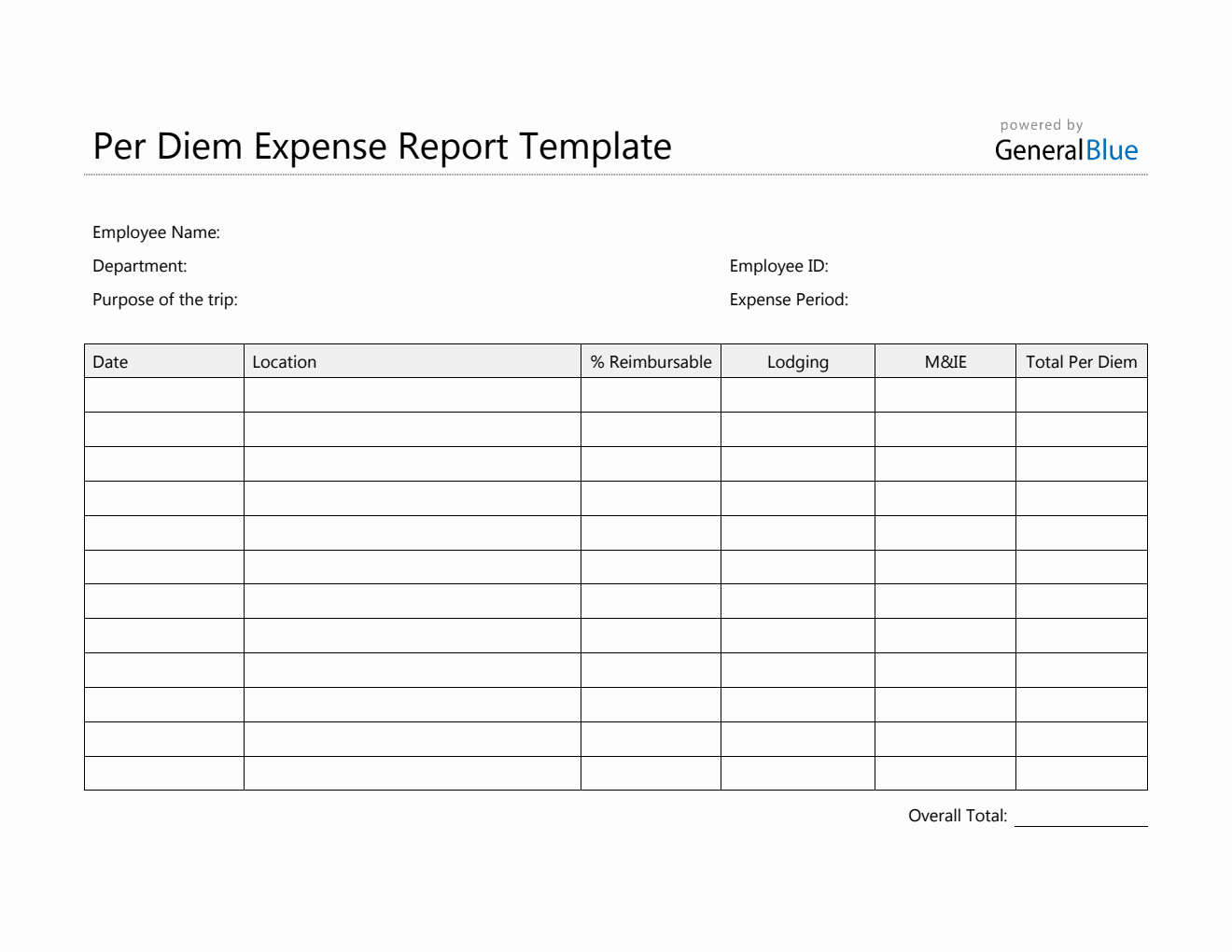

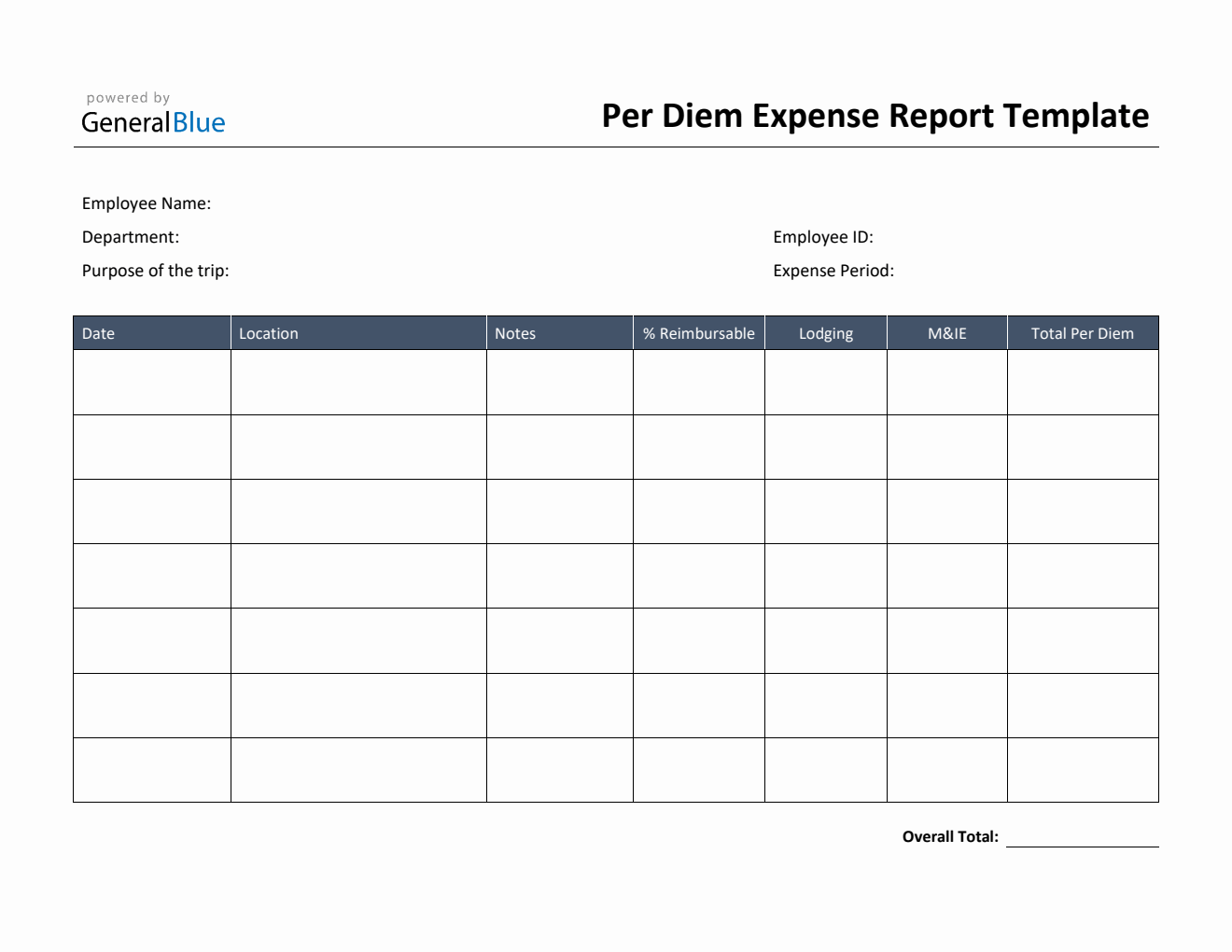

What is a per diem and how does it work in relation to T&E reports?

A per diem (Latin for “per day”) is a fixed amount of money an organization gives an employee per day to cover travel-related expenses like meals, lodging, and incidental expenses. If your company uses a per diem system, you might not need to provide detailed receipts for these expenses, but you still need to report the number of days for which you are claiming the per diem.

What if my actual expenses exceed the assigned per diem?

If your actual expenses exceed the per diem rate, you will typically be responsible for the extra costs unless you can provide a valid business reason for the overspending and it’s approved by your manager or finance department. Always check your company’s specific policy for details.

![Free Printable Status Report Templates [Word, Excel, PDF] 1 Status Report](https://www.typecalendar.com/wp-content/uploads/2023/04/Status-Report-150x150.jpg)

Effective communication is essential for the success of any business, whether it's a small team or a large organization spread across different departments. Project status reports play a crucial role…

![Free Printable Call Log Templates [Word, Excel, PDF] 2 Call Log](https://www.typecalendar.com/wp-content/uploads/2023/06/Call-Log-150x150.jpg)

Call logging is an essential practice for businesses that rely heavily on communication through mobile or telephone. By collecting, evaluating, and reporting on statistical and technical data, businesses can gain…

![Free Printable Consulting Report Templates [Word, PDF] Business 3 Consulting Report](https://www.typecalendar.com/wp-content/uploads/2023/05/Consulting-Report-1-150x150.jpg)

Whether you are a student or a practicing professional, there is no doubt that you will need to create a consulting report at some point in your life. While some…

![Free Printable Annual Report Design Templates [PDF, Excel] 4 Annual Report](https://www.typecalendar.com/wp-content/uploads/2022/11/Annual-Report-150x150.jpg)

For many companies, the annual report is their very first opportunity to view the progress they have made during the year. Any business can use annual reports as a promotional…

![Free Printable Audit Report Templates [PDF, Excel, Word] Example 5 Audit Report](https://www.typecalendar.com/wp-content/uploads/2023/04/Audit-Report-1-150x150.jpg)

All auditors require an audit report to deliver the audit report to their clients along with the financial statements. This audit report template aims to increase transparency within the business.…

![Free Printable Police Report Templates [PDF, Word, Excel] Students, Theft 6 Police Report](https://www.typecalendar.com/wp-content/uploads/2023/05/Police-Report-1-150x150.jpg)

A police report is a document prepared by law enforcement agencies to describe an incident that occurred and the actions taken in response. These reports are used to document the…

Betina Jessen

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

So what are you waiting for?

Enter your email or phone number to start simplifying your preaccounting with Expensify's expense management services.

Organize my own expenses

Manage my company’s expenses (1-9 employees), manage my company's expenses (10+ employees).

Or sign up with

Free expense report templates (and a better alternative)

If you’re not using expense reports to keep track of company spending, you’re missing out on crucial insights, potential savings, and peace of mind.

An expense report is a document that details a list of items an employee has purchased for work-related tasks. Each item on this list is called a business expense. At the very least, a business expense should include the merchant, date, amount, and currency of each purchase. Businesses use these reports to reimburse employees and monitor company spending.

Here we provide three free expense report templates to help you understand the ins and outs of expense reports. While these templates are great for businesses just starting out, you’ll eventually want to adopt software that streamlines the process to help you save time and reduce errors down the line.

Standard business expense report template

Our standard business expense report template is ideal for businesses that need to record and organize their daily operational costs. Within this template, you’ll be able to categorize your spending to get a clearer picture of where company money goes each month.

This basic type of template is best suited for businesses of any size that are seeking a straightforward way to document expenses for accounting, reimbursement, and tax purposes. Employees who need to get paid back for a business expense can fill out this form any time they incur an expense or if they have a set of project-related business expenses that need to be submitted all at once.

Monthly expense report template

Our monthly expense report template is designed to help you compile and review all expenses incurred within a given month. This template contains sections to compare your budget versus your actual spending for different expense types, allowing you to visualize where you’re keeping costs low and where you may need to scale back.

Ideal for individuals managing their personal finances and businesses tracking monthly operational costs, this template provides a clear snapshot of where your money is going, making it easier to plan, budget, and identify potential savings.

Travel expense report template

Our travel expense report template is designed to help individuals track and organize expenses incurred while traveling for business purposes . Within the template, you’ll find fields to record details like transportation costs, meals, accommodation, and other miscellaneous expenses, along with the details of each expenditure.

This template is ideal for professionals who frequently travel for work, such as sales representatives, consultants, and corporate executives, ensuring they can accurately capture and submit all travel-related costs for reimbursement or accounting purposes.

The importance of accurate expense reporting

Accurate expense reporting is crucial for understanding your company's true financial health, pinpointing areas for savings, and consolidating all expenses for easier audits. While manual expense report templates serve as a foundational tool, they often can lead to errors like duplicate entries or miscalculations — not to mention they take longer to do manually than an automated solution would.

Leveraging software like Expensify to streamline your expense reports will elevate the accuracy, efficiency, and ease of your reporting processes for everyone involved. If you’re interested in automating but still on the fence, check out our expense report calculator to determine if it’s worth it for your team.

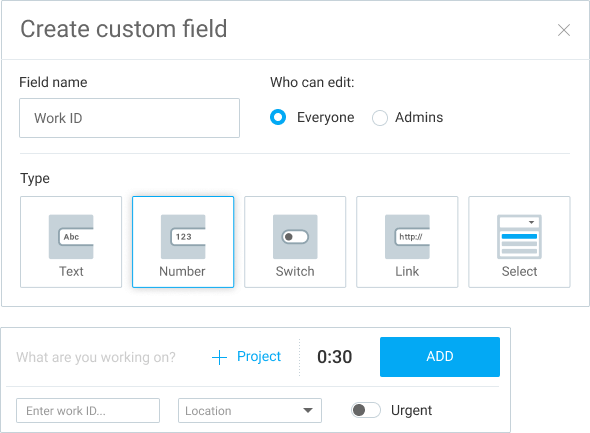

Expensify makes it easy to track expenses

From solo entrepreneurs to large corporations, Expensify makes spend management effortless for teams of all sizes. Expensify software tracks and categorizes every expense, including business trips, software subscriptions, daily operational costs, employee reimbursements, and more. With its intuitive design and automated features, Expensify centralizes and simplifies the entire expense reporting process from start to finish.

What to expect with Expensify expense reporting

Our expense report software is designed with the user in mind — lightening your load and reducing work across the board.

Explore what you get when you trust Expensify with your expense reports:

Automated receipt entry: Snap a photo of your receipt, and SmartScan will populate all the details for you — sans manual data entry.

Credit card integration: Link your credit card and watch as business expenses are synced automatically. Import your own cards or use the Expensify Card , which serves as a seamless extension of the Expensify app to ensure every transaction is captured and categorized in real time.

Structured submission: Employees can code and categorize expenses, making it easier for accountants and admins to review. Our automated systems also assist in creating and submitting expense reports on a regular cadence.

Simple spend controls: Set limits on certain types of expenses so you don’t have to worry about your team going over budget.

Swift approvals: Set custom approval workflows and rules, allowing admins to review and approve reports in just a few clicks.

Rapid reimbursement: With Expensify, you can kiss prolonged reimbursement periods goodbye. Once approved, employees can be reimbursed as soon as the next business day.

Expense reporting is a cinch with Expensify

While manual expense report templates can help you get a grasp on your finances, relying solely on spreadsheets for expense reporting can lead to overlooked errors and financial discrepancies that could cost your business big bucks.

Expensify, on the other hand, not only eliminates the chance of human errors but also automates and streamlines the entire expense management process, boosting your ROI while saving time. By choosing Expensify over manual spreadsheet methods, you're not just opting for convenience; you're investing in accuracy, cost-efficiency, and peace of mind for your whole team.

Spend half as much time as you used to on expense management

No, really! Expensify’s automation helps you save in more ways than one.

Expensify values your privacy. We’ll never sell your personal information to others.

- Expense Management

- Spend Management

- Expense Reports

- Company Card

- Receipt Scanning App

- ExpensifyApproved!

- ExpensifyHelp

- Expensify App

- About Expensify

- Expensify.org

- Investor Relations

Get Started

- Create a new account

©2008-2024 Expensify, Inc.

The Expensify Visa® Commercial Card is issued by The Bancorp Bank, N.A. pursuant to a license from Visa U.S.A. Inc. and may not be used at all merchants that accept Visa cards. Apple® and the Apple logo® are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

Money transmission is provided by Expensify Payments LLC (NMLS ID:2017010) pursuant to its licenses .

18+ Useful Travel Expense Report Templates [in WORD & EXCEL]

Nearly all business organizations and companies need an organized way of reporting travel expenses. Therefore, here we are presenting a collection of some useful travel expense report templates for this purpose. These templates are completely free to download and can be edited as per needs. A travel expense report is a document used to communicate details and information about travel expenses. The actual purpose of this report is to make the company or business known about overall travel expenses for reimbursement.

In the business field, sales personnel often travel within the country or internationally to boost up sales volume by creating new customers and clients. The company requires a travel expense report to be filed right after the traveling so they can get the money back that they had spent on traveling. Making a travel expense report is an excellent way to track travel expenses with the best. You should utilize a professional-looking format for writing a travel expense report.

More About Travel Expense Reports:

Travel expense reports may include details about travel expenses like accommodation, fuel, transport tickets, parking fees, food, phone calls, etc. Travel expense reports are essential for all kinds of businesses in which employees will be able to make reimbursement requests professionally. Not only in the business field but travel expense reports can also be prepared in personal life so one can enjoy traveling without going out of budget.

If you want to make a flawless travel expense report yourself, then you can download the free travel expense report templates given below. All these templates are easily customizable so as to suit your personal needs and requirements. Simply add your personal details and company information to any of the suitable templates and start preparing a spotless travel expense report within a few minutes. This travel expense report template is formatted by our team of professionals and is suitable for all types of businesses and companies as well as for personal use.

Download Travel Expense Report Templates MS WORD:

Business travel expense report template.

Fillable Travel Expense Report Form Template

Free Editable Travel Expense Report Template

Employee Travel Expense Report Template WORD

Simple Travel Expense Report Example

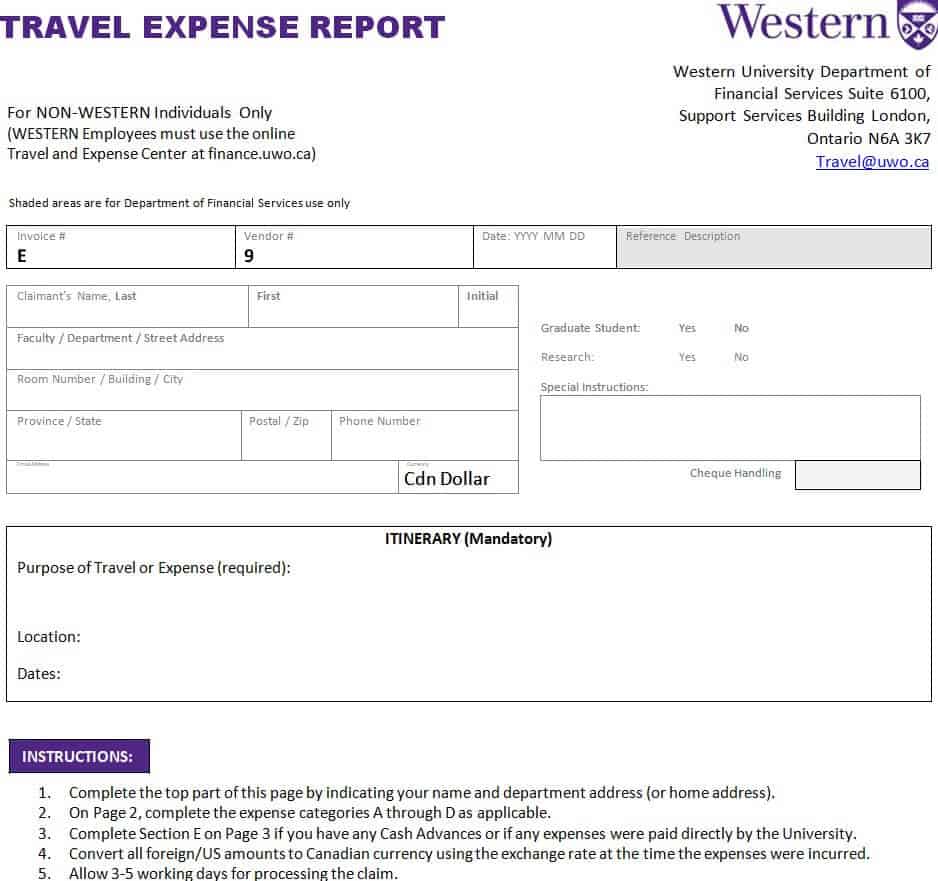

Travel Expense Report Template in DOC Format

Blank Travel Expense Report Layout

Official Travel Expense Report Template

Basic Travel Expense Report Sample

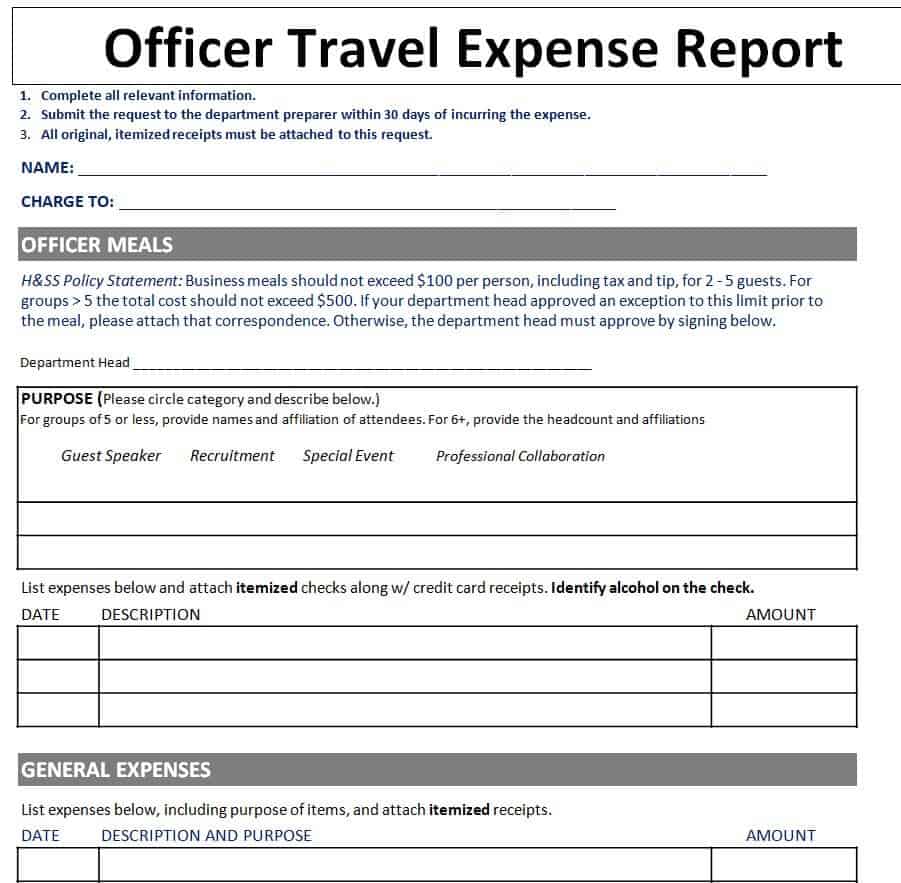

Officer Travel Expense Report Template MS WORD

Professional Travel Expense Report Word Template

Practical Travel Expense Report Template

Download Travel Expense Report Templates MS EXCEL:

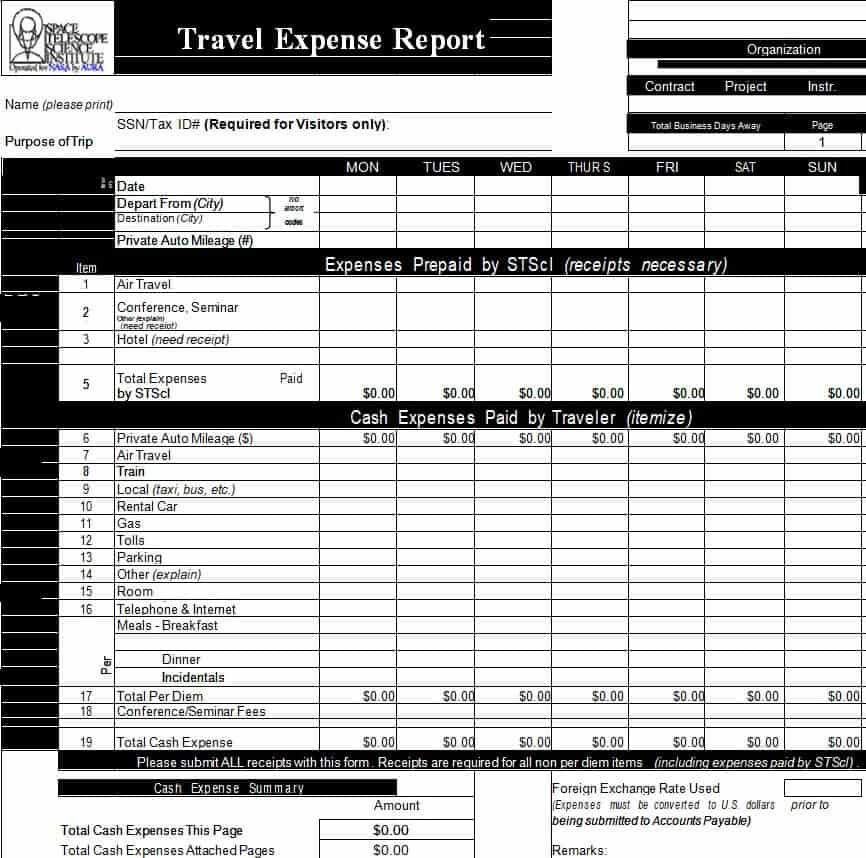

Travel expense report sheet template.

Latest Travel Expense Report Template

Company’s Travel Expense Report Excel Template

Sample Travel Expense Report Excel Format

Online Employee Travel Expense Report Template

Standard Travel Expense Report Template Excel

Printable Travel Expense Report Template

Travel Expense Report Template in XLSX Format

Related posts:

- 16+ Sample Expense Report Templates [in EXCEL & WORD] Jot down all your expenses at a place with help of these expense report templates. We are sure these templates will help you a lot in easy expense tracking either for personal or professional use. Expense tracking is not hard to do nor is it time-consuming if you really want...

- 18+ Monthly Report Templates – in Excel, Word & PDF Formats Below are monthly report templates which are available in Microsoft Word, Excel, and PDF formats and you can download them free of cost. These monthly report templates are very much useful for everyone. Report writing is the safest and most effective way to communicate business-related details and information with other...

- 15 FREE Service Report Templates [EXCEL, WORD, PDF] You can get free service report templates here without paying a single penny. After downloading any template available in Excel or Word formats, you can also make changes to compose an error-free service report for your business or company. A service report is an important business document that keeps your...

- 15+ Important Financial Report Templates [WORD, EXCEL, PDF] Here we have an endless collection of templates and the financial report templates are also added for your reference. You can simply download any of the given templates into the computer by hitting the below appeared download button. A vital business document that discloses an organization’s financial status to management,...

Free Word Travel Expense Templates

“Download free Microsoft Word Travel Expense templates and customize the document, forms and templates according to your needs. With these templates, you can save time and effort by starting with a pre-designed layout that you can customize to fit your specific needs.

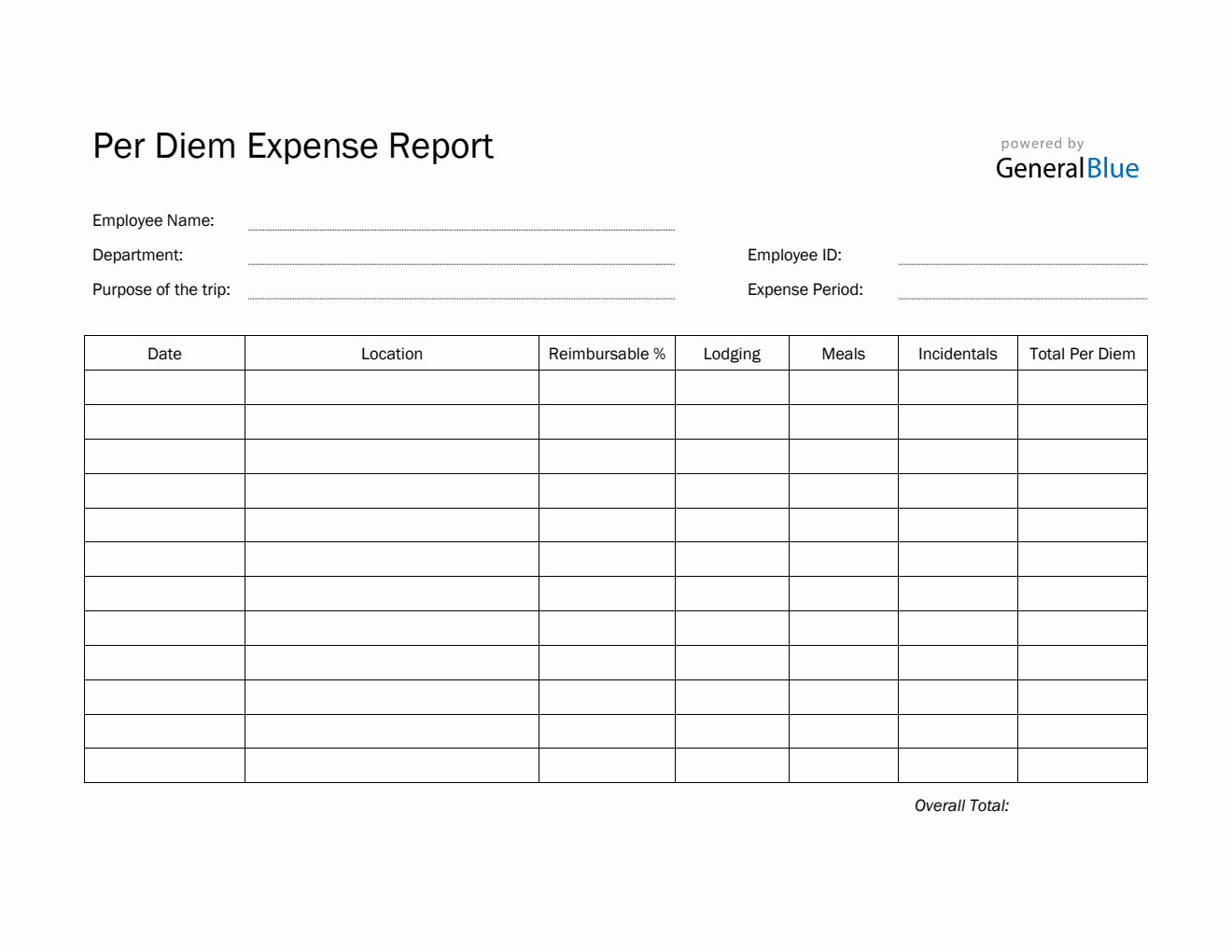

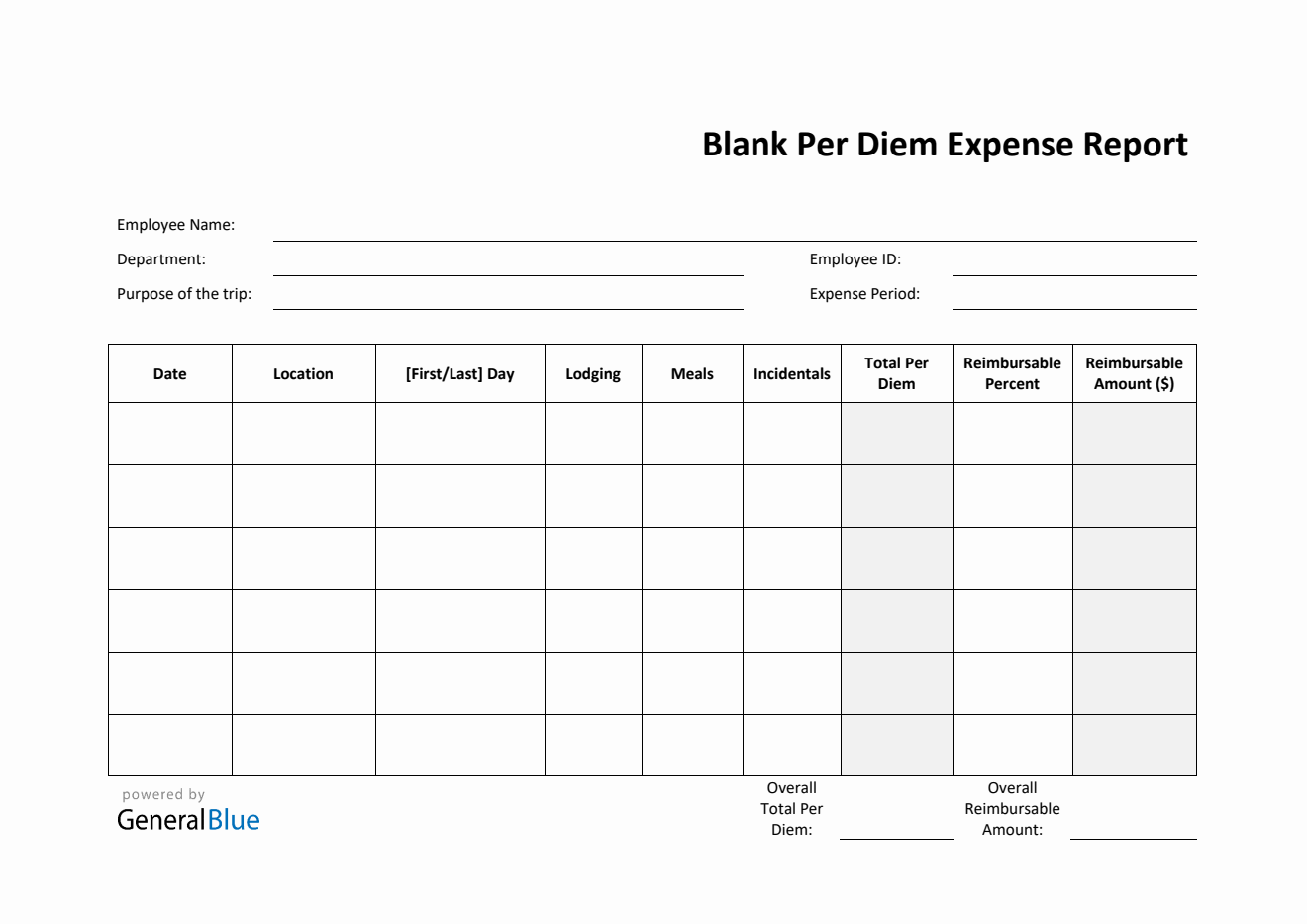

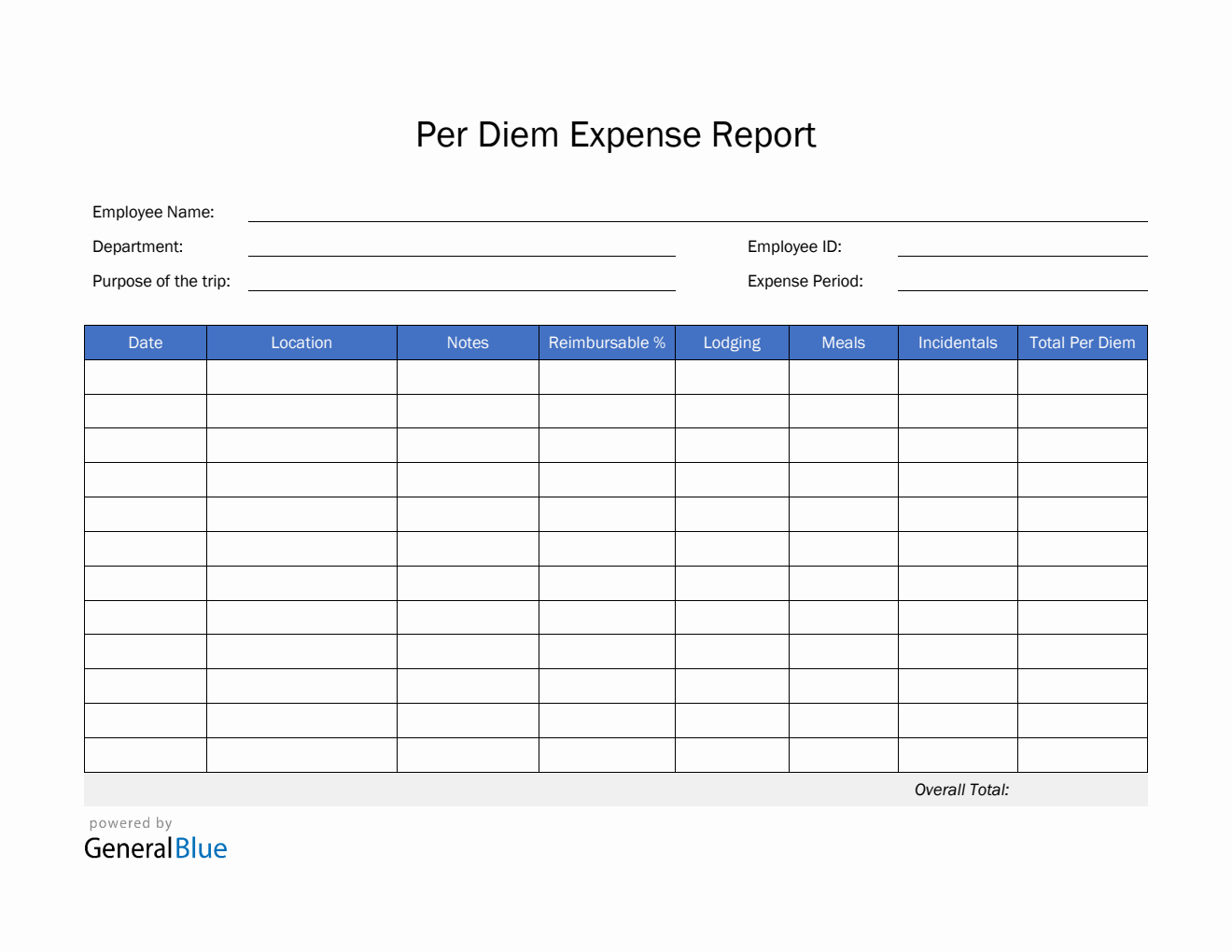

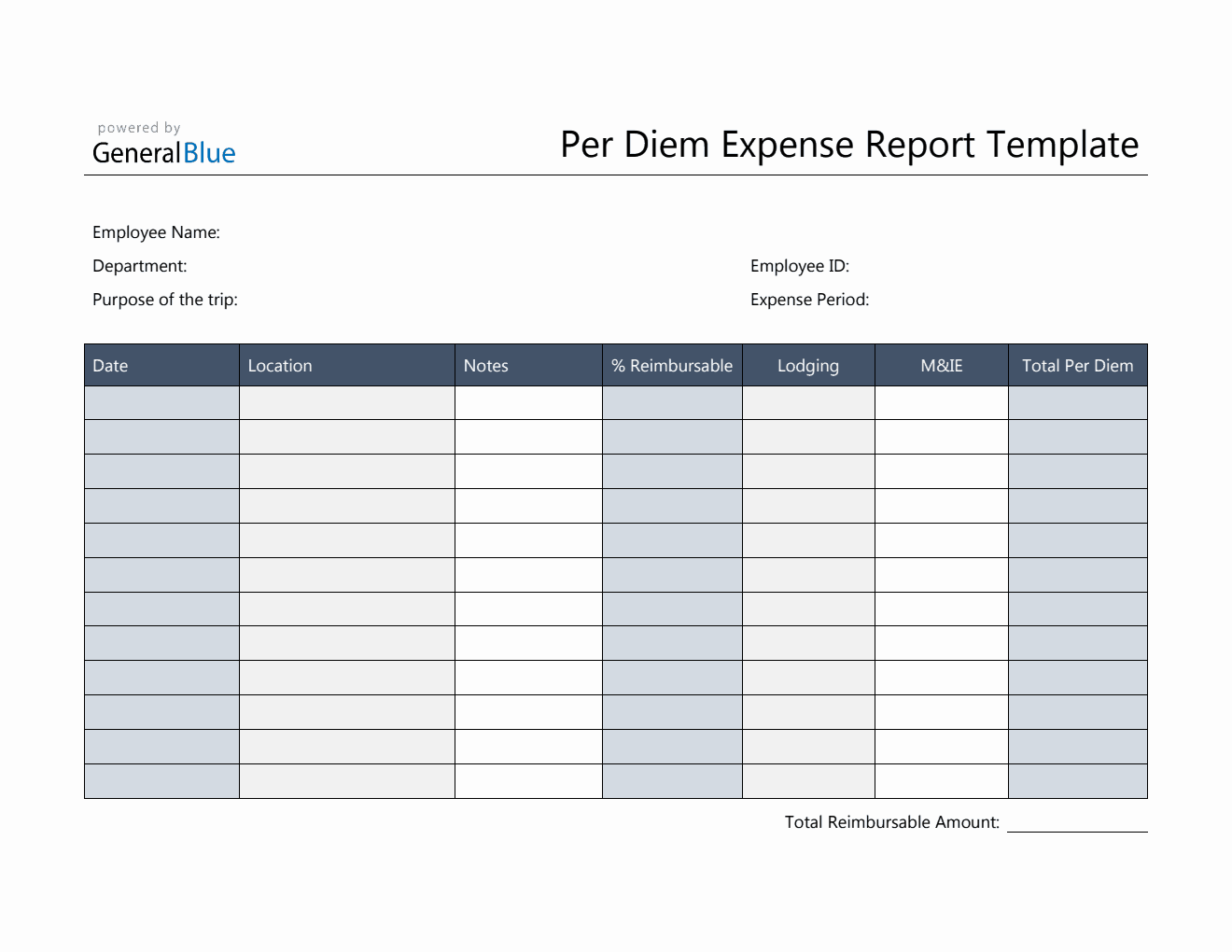

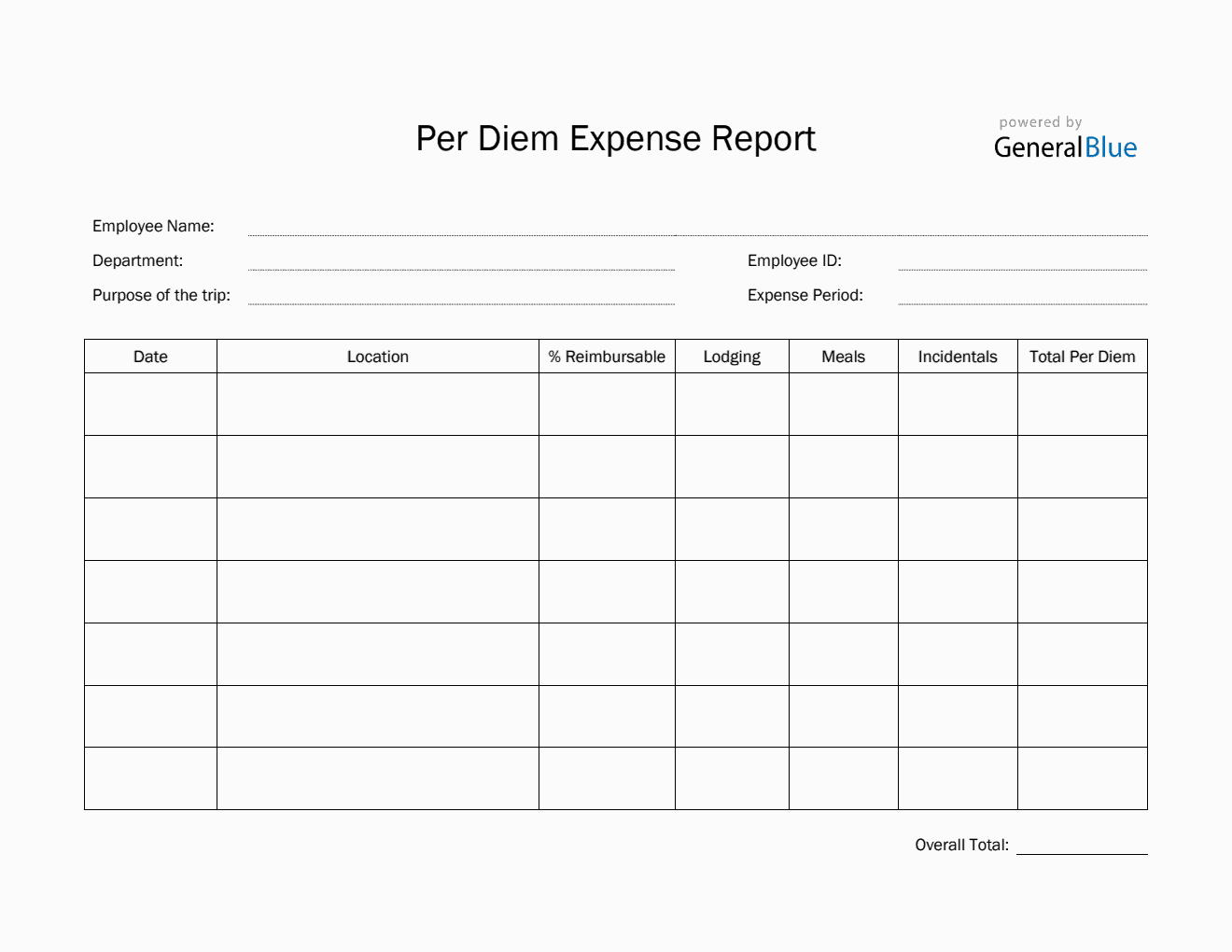

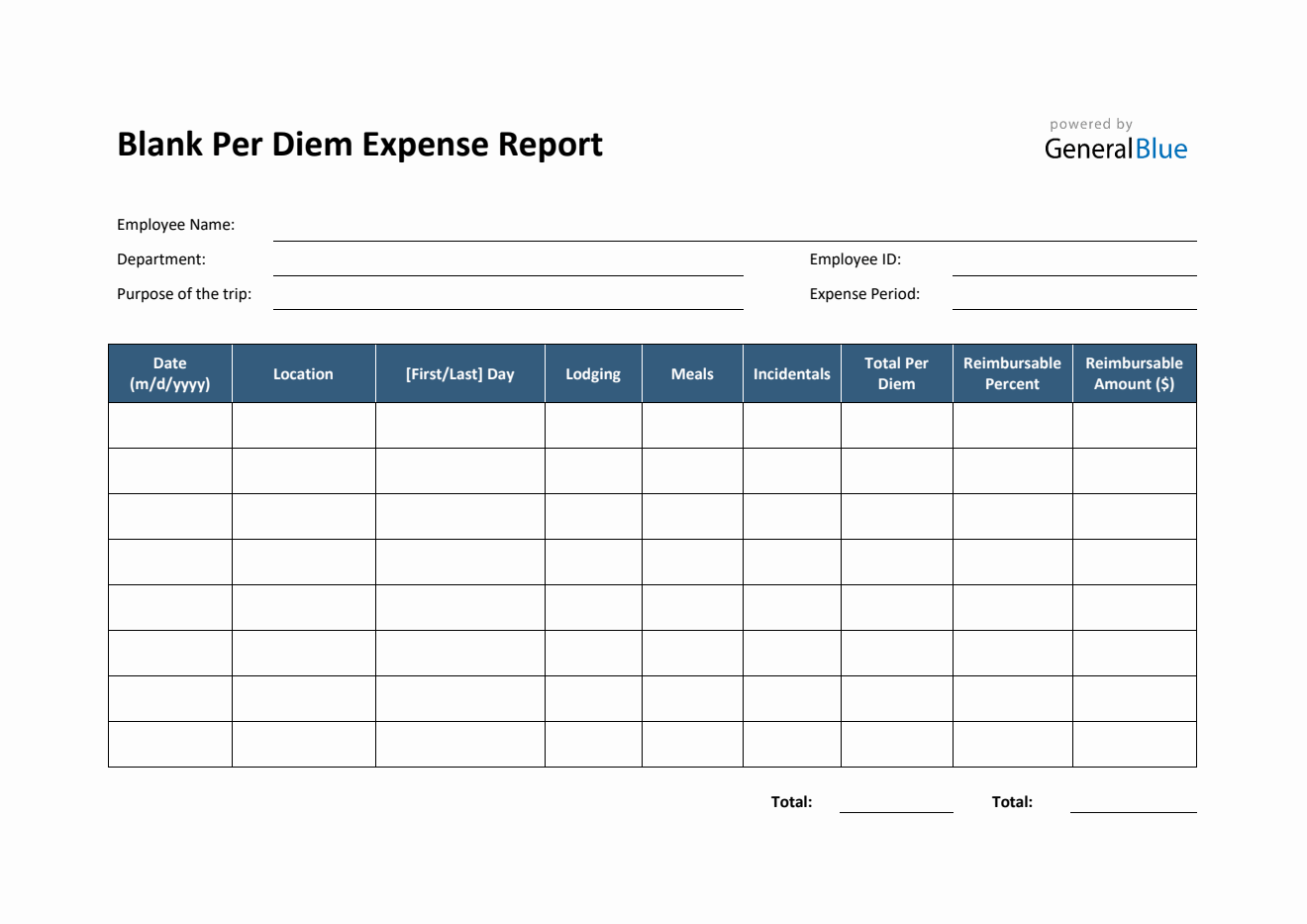

Printable Per Diem Expense Report in Word

Get this free Per Diem Expense Report Template available in Word to help track your employees’ business travel expenses on a daily basis.

Simple Per Diem Expense Report in Word

Per Diem Expense Report Template in Word (Printable)

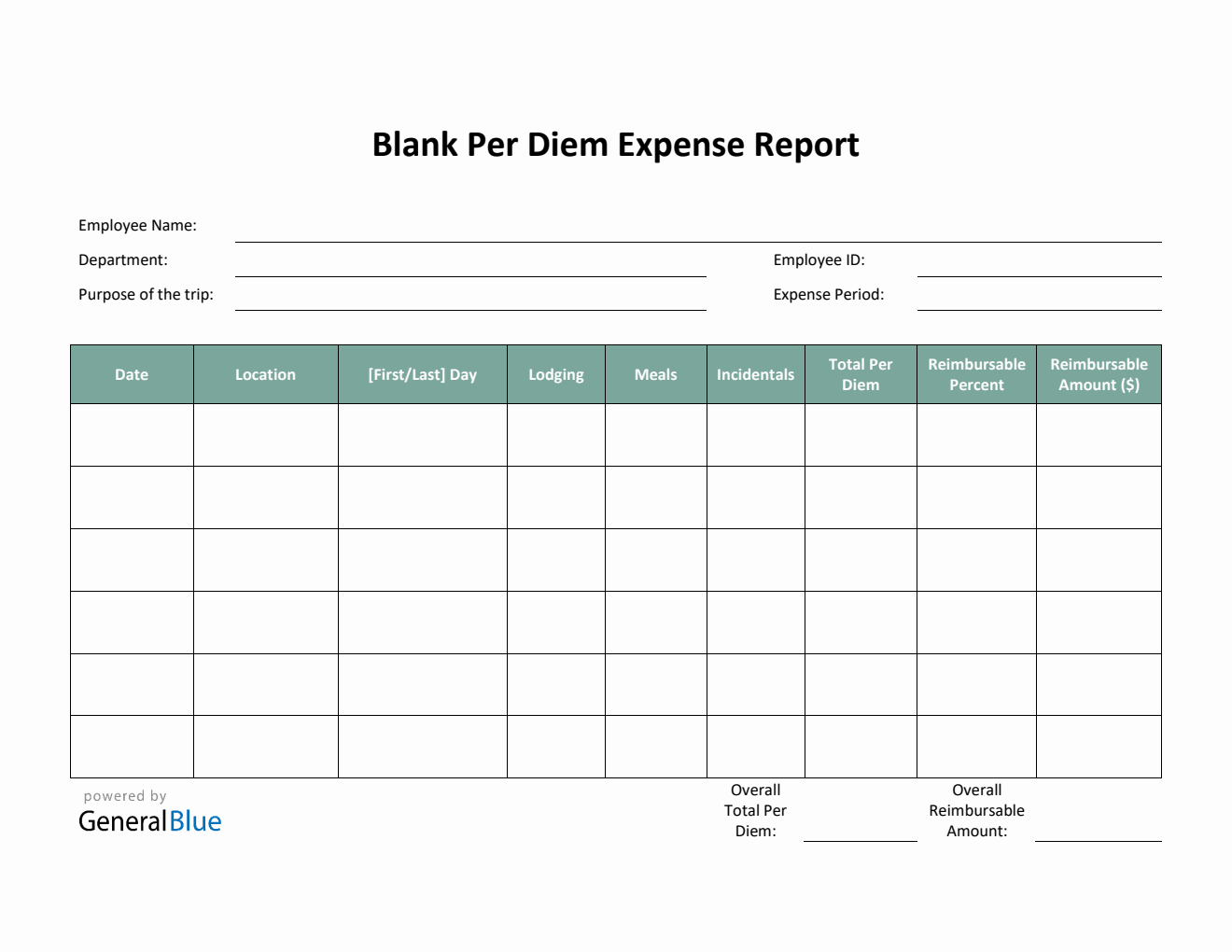

Blank Per Diem Expense Report Template in Word (Green)

Get this free Blank Per Diem Expense Report Template available in Word to help track your employees’ business travel expenses on a daily basis.

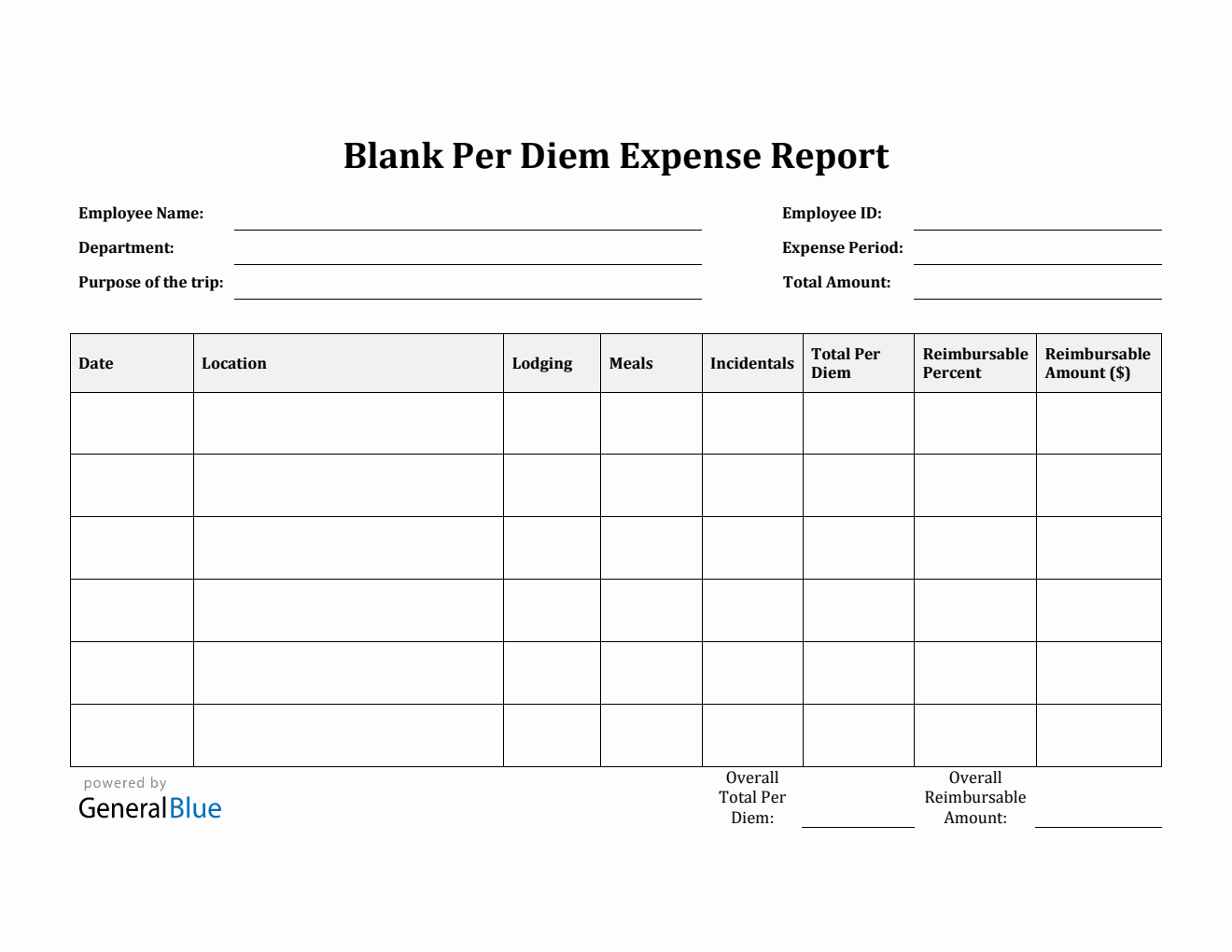

Blank Per Diem Expense Report Template in Word (Plain)

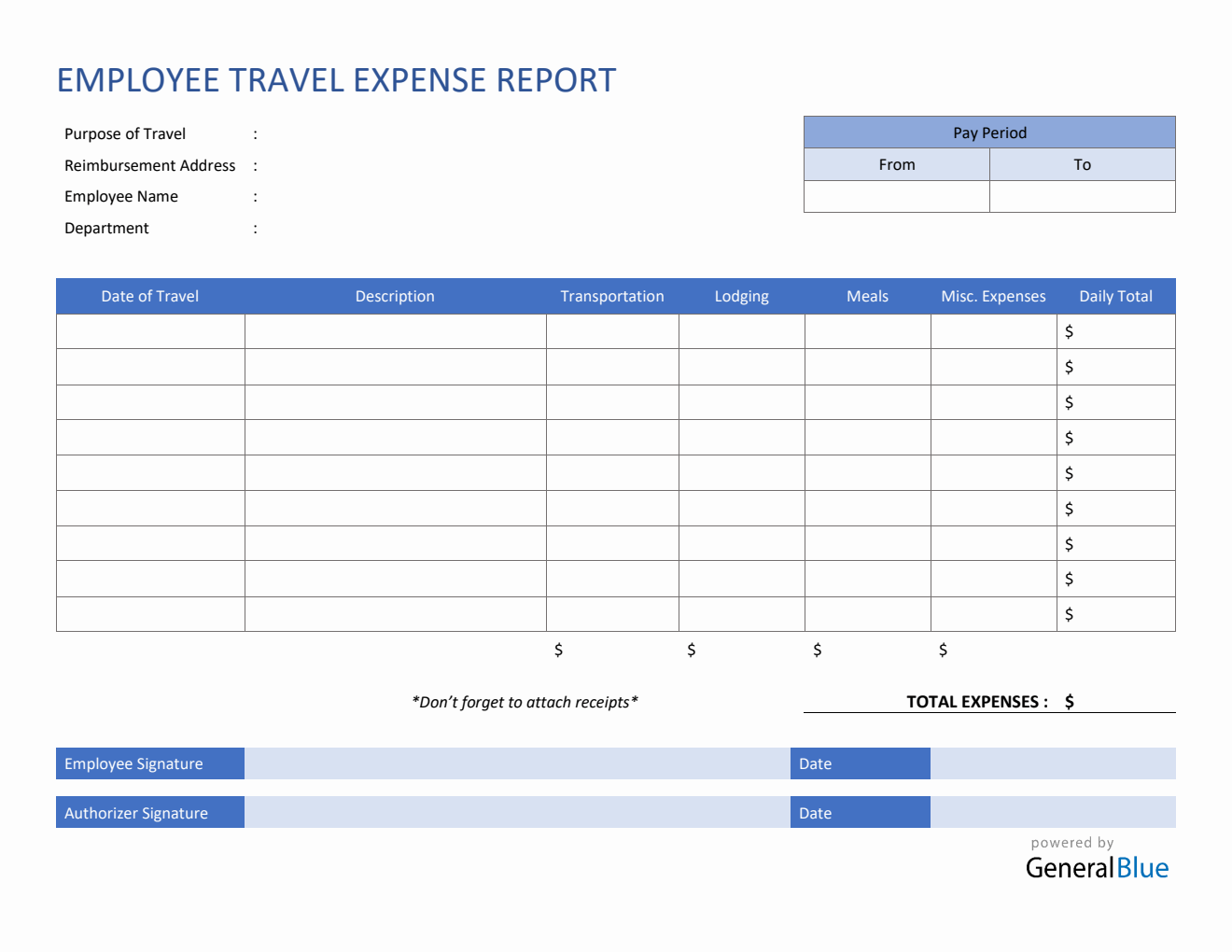

Employee Travel Expense Report Template in Word

Use this Travel Expense Report in Word to get reimbursements from all expenses spent during your trip. Receipts should be attached along with this form.

Blank Per Diem Expense Report Template in Word (Printable)

Per Diem Expense Report Template in Word (Blue)

Editable Per Diem Expense Report in Word

Per Diem Expense Report Template in Word (Striped)

Blank Per Diem Expense Report Template in Word (Simple)

The Best Expense Report Template for Excel [3 Options]

- Last updated October 11, 2023

In this guide, I’ll give you three examples of an expense report template for Excel under different categories:

Simple Expense Tracker

Business expense tracker, travel expense tracker.

Read on for a detailed guide on how to use each expense tracker.

Table of Contents

What Is an Expense Report Template for Excel?

An Excel expense report template is a pre-made spreadsheet that can be used by businesses and individuals to record and track their expenses.

Excel expense tracker templates are customizable, meaning you can change them based on your needs and requirements. You can add or remove rows and columns, adjust formatting, and include formulas to automate some of the calculations.

Using expense report forms can help you maintain an organized record of your business expenditures, which is crucial for tax purposes, budgeting, and financial planning.

Related: Get a Free Business Expenses Spreadsheet

Benefits of Using an Excel Expense Template

Using an expense tracking template in Excel has been a game-changer for managing my business finances. Here are some of the benefits I experienced:

Easy Expense Tracking

Using an expense tracking Excel template has simplified my expense tracking process. It lets me have an organized format to add all my financial transitions. This has eliminated the need for old-school manual records, making it a hassle-free experience.

Tailored Categories

When I create an expense Excel template, I can add a category section by using a dropdown button. This makes filtering data easier, as I can use a formula and search for rows containing “Rent” or “Groceries.” Removing or adding categories in a separate list also allows me to update the template in real-time, keeping the data accurate.

Automatic Calculation

Excel allows users to use functions and formulas to automate calculations. By using formulas, I don’t have to worry about manually updating the totals in my spreadsheet. Using simple formulas also allows me to perform calculations with changing values. For example, I can add the gas price in a cell and use it to calculate fuel prices based on the updated rates.

Effective Management

Budget management has become more accessible using a free expense report template, Excel. I can set a budget limit, monitor my spending, and see how much money I have left. Using conditional formatting, I can add rules to my budget to show a specific color based on how much funding I have used. For example, I can set it so my budget stays green when it’s less than 75%, becomes yellow between 76% and 90%, and goes to red above 90%.

Creating Charts

Excel’s graphs are one of the best features to use if you’re looking for visual insights. Making a chart allows me to visually represent my spending patterns. I tend to use bar graphs and pie charts to help me quickly identify my spending habits.

Simplified Tax Preparation

Using Excel expense report templates can be great for simplifying the process of consolidating deductible expenses into a single spreadsheet. This ensures that I always have an organized record of tax deductions, which helps save time and reduces the stress of the tax season.

Excel expense trackers are a valuable tool for businesses and individuals to manage their finances effectively. Using an expense template has become a daily part of my financial toolkit.

It streamlines the process of finance tracking, offers customization, real-time insights, automated calculations, budget management, charts, and graphs, and helps prepare you for tax season.

Related: Free Trucking Expenses Spreadsheet Template

What Should I Include in a Good Expense Report Template?

Although you can customize an expense report template according to your needs and preferences, let’s take a look at some essential elements I can add to an expense report template:

When creating templates for personal use, I don’t tend to add a lot of headers unless I need to add information for future reference. However, when creating templates for business use, I generally add cells for the company’s name, the expense report’s title, the date, or the reporting period.

Some of the details you should look to have in your expense template include the date of the expense, description or name, category, amount spent, and payment method.

Expense Categories

I like to divide my expenses into categories for easier sorting. You should look to create a separate column with a dropdown menu using Excel’s Data Validation feature. This way, you can have preset categories which you can add with a click.

Budget Tracking

Although this isn’t entirely needed in an expense tracker, having a budget tracker is certainly nice. I also like to create a cell for the money I have left, which uses a simple formula to check how much I have spent.

These are some of the things I like to add to the expense tracker template I make. However, feel free to add more elements to your expense tracker template based on your needs.

Related: How to Create a Budget Spreadsheet

Best Excel Expense Report Templates for 2024

Here are some expense report examples you can use in Microsoft Excel. To use the template, simply download it and open it using Excel. Feel free to make any changes and delete the previously added data to start from scratch.

If you like the following templates, you should also check out our premium templates library , where you can use the code “SSP” to save 50% off all SpreadsheetPoint templates.

Get Premium Templates

I created this expense tracker template to be as simple as possible for the user, as not everyone is looking for a template that allows them to micromanage their expenses.

This is a simple, hassle-free way to monitor your budget and expenses. The template was designed with both mobile and PC users in mind. This expense tracker features two distinct sections.

The first section records your expenses. Here, you can add a Name for the expense, choose its Category from a drop-down menu, and enter an Amount and the Date . You can also add optional Notes to describe the expense.

The second section allows you to add your Budget and Categories to the selected expenses in the first section. The top ribbon shows the Total Spent , your Budget , and the Money Left . The Total Spent is calculated automatically using a formula that sums the values in Amount . Add your Budget in the cell, which will then show the Money Left using a formula that subtracts the value in Total Spent from the Budget value.

Finally, you can add the Categories , shown in the Category section, by clicking on an arrow showing a drop-down menu.

I made this free Excel expense report template for people looking to track their business expenses. The template features a simple, intuitive design, which should make this template easy to use, even for the basic user.

The template consists of three sections. The first one allows you to add some basic information about the report. This includes the Company Name , ID , Employee Name , Department , Purpose , and the From and To dates.

The next section allows you to add information about the expenses. This includes the Date , Description , Transport Costs , Fuel , Meals , Lodging , and Other expenses. Finally, the third column adds the Total for the specific day. A row towards the bottom of the table also shows individual totals for Transport , Fuel , Meal s, Lodging , and Other expenses.

Additionally, two cells allow you to add the Date and the signature of the person by whom the payment was Authorised By .

Related: Google Sheets Expense Tracker

This is the perfect template for anyone looking for an expense tracker template for travel. The template has two sections. The first section allows you to add details like your Name , Position , Department , Manager , Purpose , Start Date , End Date , and Mileage Rate . The total costs of the expenses are color-coded for easier viewing.

The next section allows you to add the Expense name, Date , and Account . You can also add the expense amounts directly in the Hotel , Meals, and Other sections. To calculate the Mileage , write the starting and ending reading. It will be automatically calculated based on the Mileage Rate .

Finally, the grand total of the expenses can be found towards the top right part of the template under Expense Report Total .

Wrapping Up

Hopefully, you now have the perfect expense report template for Excel to cater to your needs. If not, remember you can edit templates to suit your specific purposes.

- The Best Excel Inventory Template (3 Options)

- The 12 Best Google Sheets Templates to Streamline Your Life

- Free Assignment Tracking Template for Google Sheets

Most Popular Posts

How To Highlight Duplicates in Google Sheets

How to Make Multiple Selection in Drop-down Lists in Google Sheets

Google Sheets Currency Conversion: The Easy Method

A 2024 guide to google sheets date picker, related posts.

How to Use The Excel CHOOSE Function

- August 27, 2024

Understanding the Excel NOT Function: A Comprehensive Guide

- August 21, 2024

How to Make Excel Macros

- August 12, 2024

Calculate Running Total with the SCAN Function in Excel

- August 5, 2024

Thanks for visiting! We’re happy to answer your spreadsheet questions. We specialize in formulas for Google Sheets, our own spreadsheet templates, and time-saving Excel tips.

Note that we’re supported by our audience. When you purchase through links on our site, we may earn commission at no extra cost to you.

Like what we do? Share this article!

Free Expense Report Templates

12 expense report templates you can use to keep a record of all your expenses, seek reimbursement, stay on top of your business travel costs, and more.

PDF • Excel • Google Docs

What is an Expense Report?

An expense report is a form that lets you track all business-related costs — from employee-incurred expenses to project-specific costs.

This record usually serves as a basis for a cash reimbursement request for the amounts employees spend while on a particular business duty.

However, expense reports can also be used to:

- Record project costs,

- Evaluate total expenses, and

- Come up with better budget estimates.

Notable examples of items that should be included in an expense report include:

- Money spent on gas during business travels or for running everyday business errands,

- Money spent on means of transportation during business travels,

- Money spent on business lunches and dinners with clients, or

- Money spent on lodgings during business travels.

How does an expense report work?

Here's how expense reporting works in more detail:

- Each time employees on business duty pay in cash, they use an expense report to itemize their expenditures.

- Employees attach the expense-related receipts to the expense report, to serve as proof that the amounts listed in the report match the actual amounts spent.

- Finally, employees submit the completed report to their employer or company bookkeeper, who writes them a check to reimburse the listed expenses.

What should be included in an expense report?

An expense report usually consists of:

- Employee information ,

- The date the expense was incurred,

- The type or category of the expense,

- A subtotal for each expense,

- The total expense amount , and

- Additional information .

Free Simple Expense Report Templates

So, you've understood what expense reports really are and found out more about their purpose.

Now, all you need is a set of reliable expense reports you can use on a regular basis.

Although creating your own expense reports in Excel is an adequate solution, there is a quicker alternative. Instead of creating your own expense report templates manually from scratch — it's always easier to use suitable, ready-made templates.

Here are 12 Expense Report templates you can try right now.

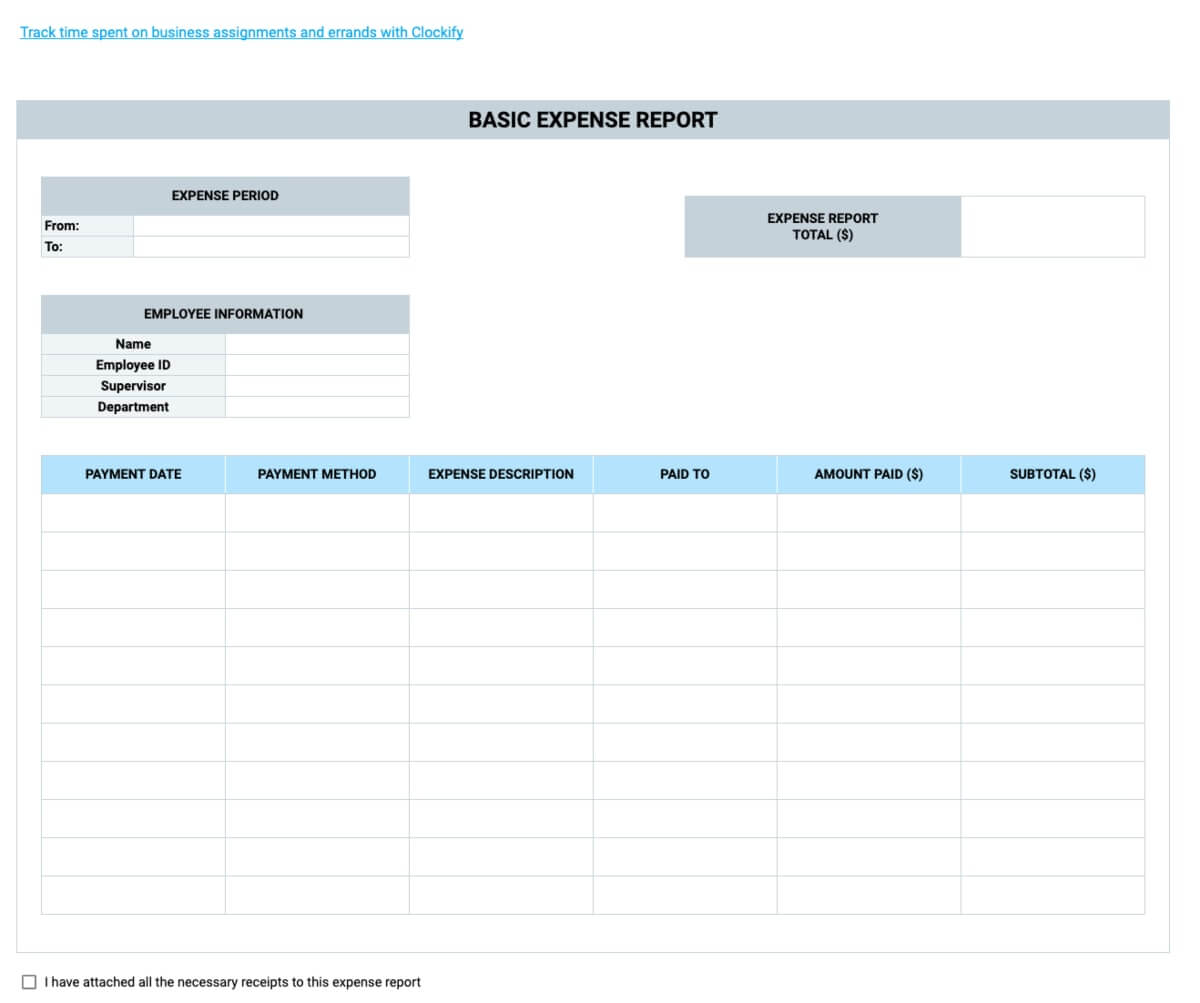

Basic Expense Report Template

Whenever you need a simple form to help you remain up-to-date with your recent expenses, you can go for a Basic Expense report template.

What is the Basic Expense Report Template?

The Basic Expense Report template lets you organize your basic payment expenses by the:

- Payment date,

- Payment method, and

How to use the Basic Expense Report Template?

Once you enter the amounts you paid for each item, you'll get your expenses calculated by subtotal for each date and total for the whole expense period covered.

The Basic Expense Report Template is best for:

- Businesses of any size (including small businesses),

- Individual transactions, and

- Nonprofit organizations.

Download: Google Docs • Google Sheets

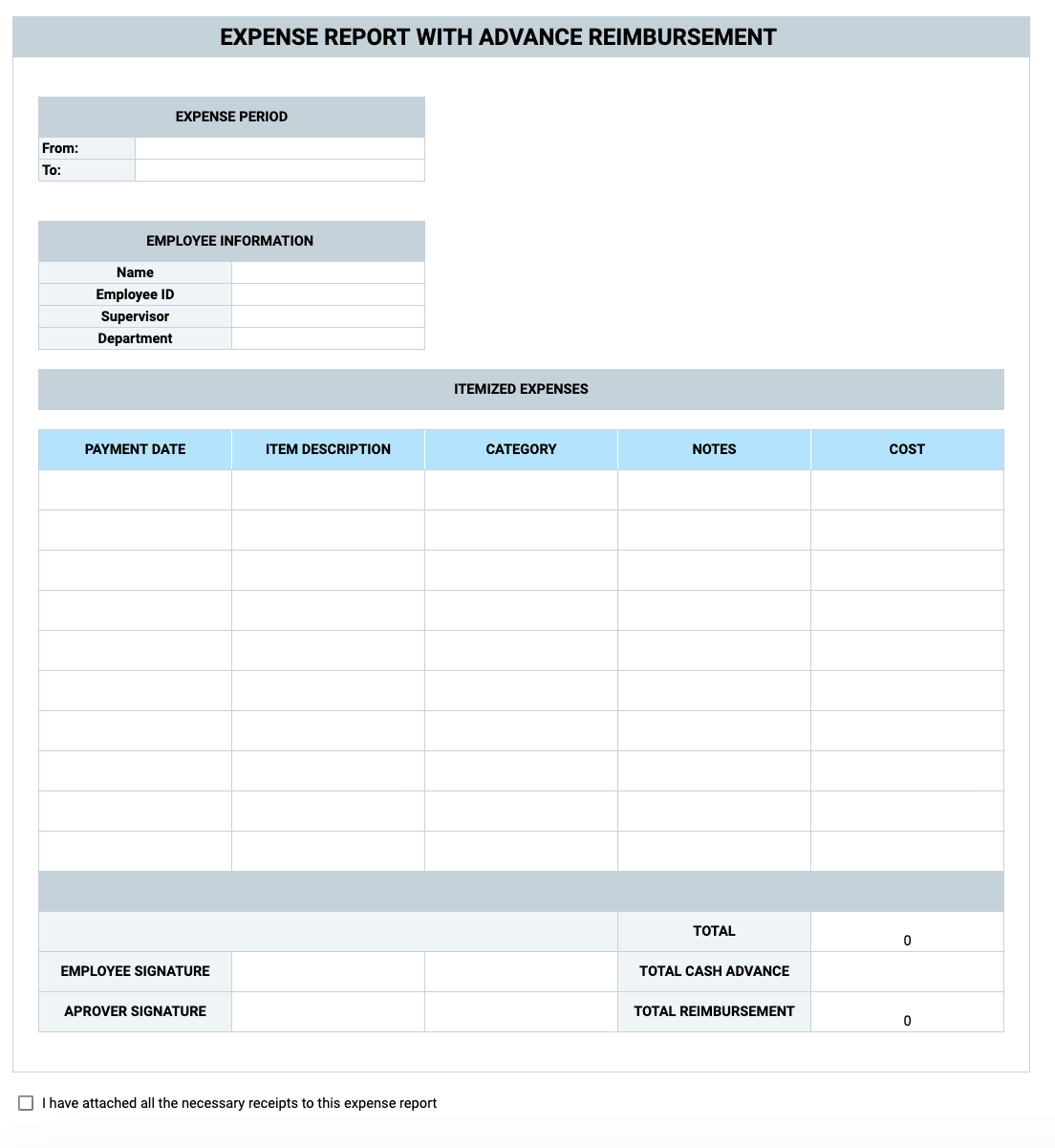

Expense Report with Advance Reimbursement Template

In case you need certain expenses to be covered ahead of their schedule, then the Expense Report with Advance Reimbursement could be just the solution to ensure everything goes as planned.

What is the Expense Report with Advance Reimbursement Template?

The Expense Report with Advance Reimbursement template assumes you got part of the sum you're expected to spend on the business activity in advance.

How to use the Expense Report with Advance Reimbursement Template?

In this report template, first, organize your expenses by:

- The payment date,

- Item category.

Once you enter the amounts you’ll pay for each item, you'll get your expenses calculated by the total.

As soon as you enter the amount you got in advance for the itemized expenses, you'll get the clean total reimbursement for the whole expense period covered.

The Expense Report with Advance Reimbursement is best for:

- Employees who get some of their future business expenses covered in advance.

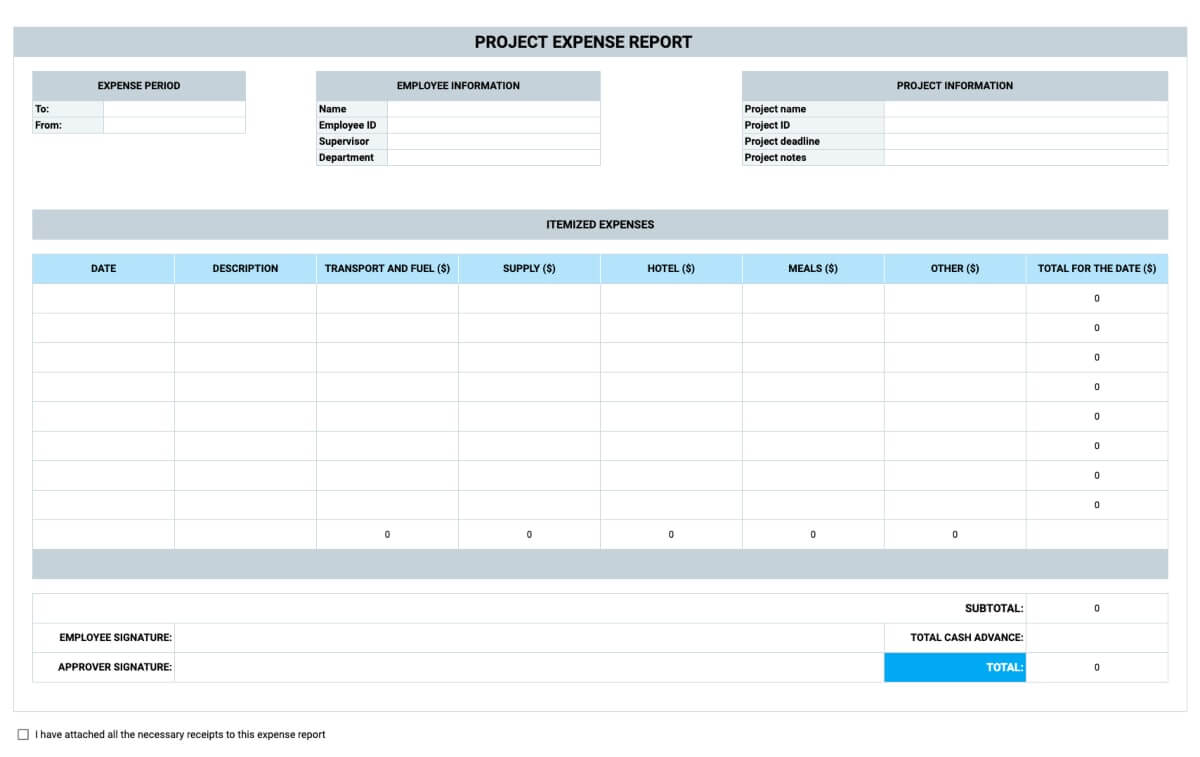

Project Expense Report Template

If you’re working on a project that requires you to take note of all the expenses incurred while completing your project tasks, then the Project Expense Report Template could come in handy.

What is the Project Expense Report Template?

The Project Expense Report Template lets you organize all your project-related expenses by date and description.

How to use the Project Expense Report Template?

You can start by specifying your task expenses.

Also, if your project requires travel, you can also add more detail regarding your transport, hotel, and meal-related expenses.

Once you've entered this data, you'll get your totals for each date calculated automatically, as well as the total for the entire expense period covered in this report. You'll also get the totals for each category (transport, hotel, meals) calculated automatically.

The Project Expense Report Template is best for:

- People who work on multiple projects, and

- People who have to travel for specific projects only, not as a part of their general business duties.

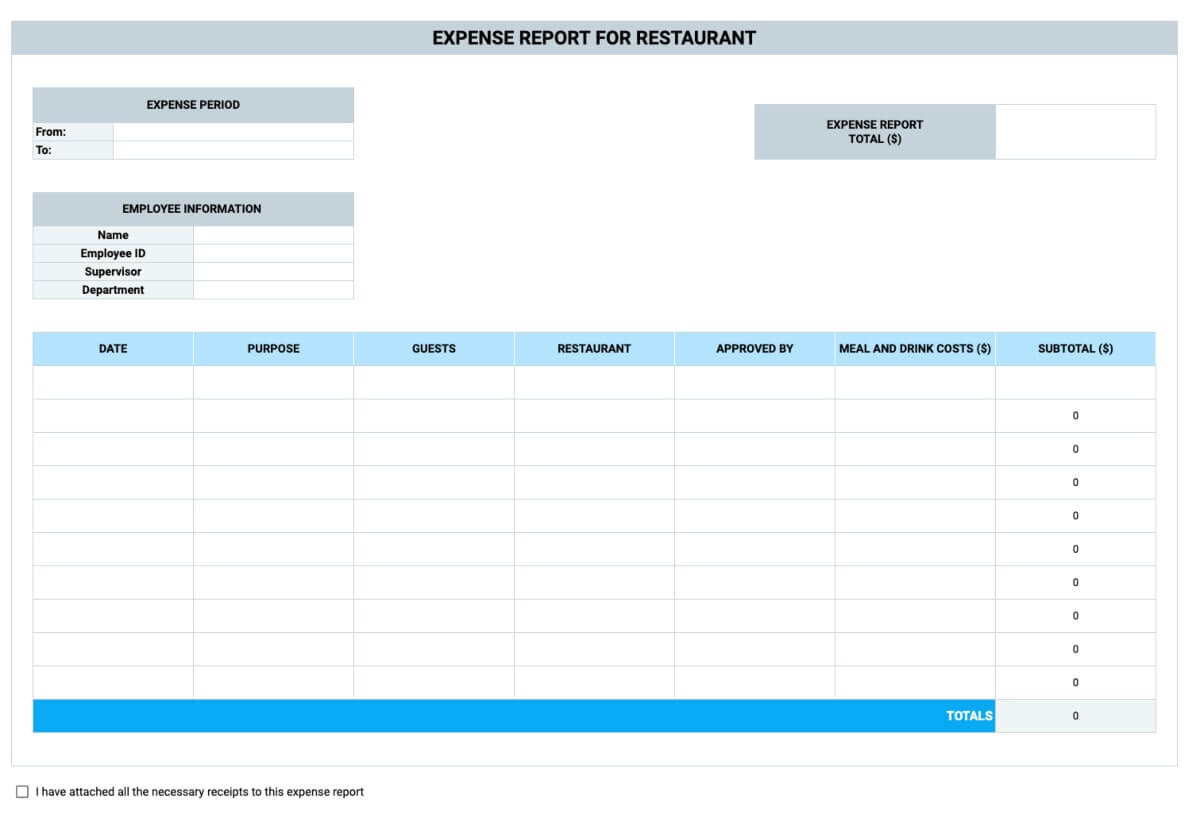

Expense Report for Restaurant Template

If your job requires you to frequently attend business lunches, then you need an expense report to keep track of all the costs, and that’s exactly what the Expense Report for Restaurant Template is for.

What is the Expense Report for Restaurant Template?

The Expense Report for Restaurant Template lets you track and record the expenses you make during business meals with business partners, clients, and potential employees you're looking to recruit to your company.

How to use the Expense Report for Restaurant Template?

Once you've added all the data regarding the purpose of your restaurant visit and the costs, you'll have your meal and drink costs calculated by date, subtotal, and total.

The Expense Report for Restaurant Template is best for:

- HR specialists,

- Account managers,

- Executives, and

- Other professionals who need to meet with business partners, clients, and potential employees on a regular basis.

Timed Expense Report Templates

In case you’re looking for ready-made, easy-to-edit Expense Report Templates that can help you keep an eye on your expenses on a weekly or monthly basis, then the Timed Expense Report Templates could be perfect for you.

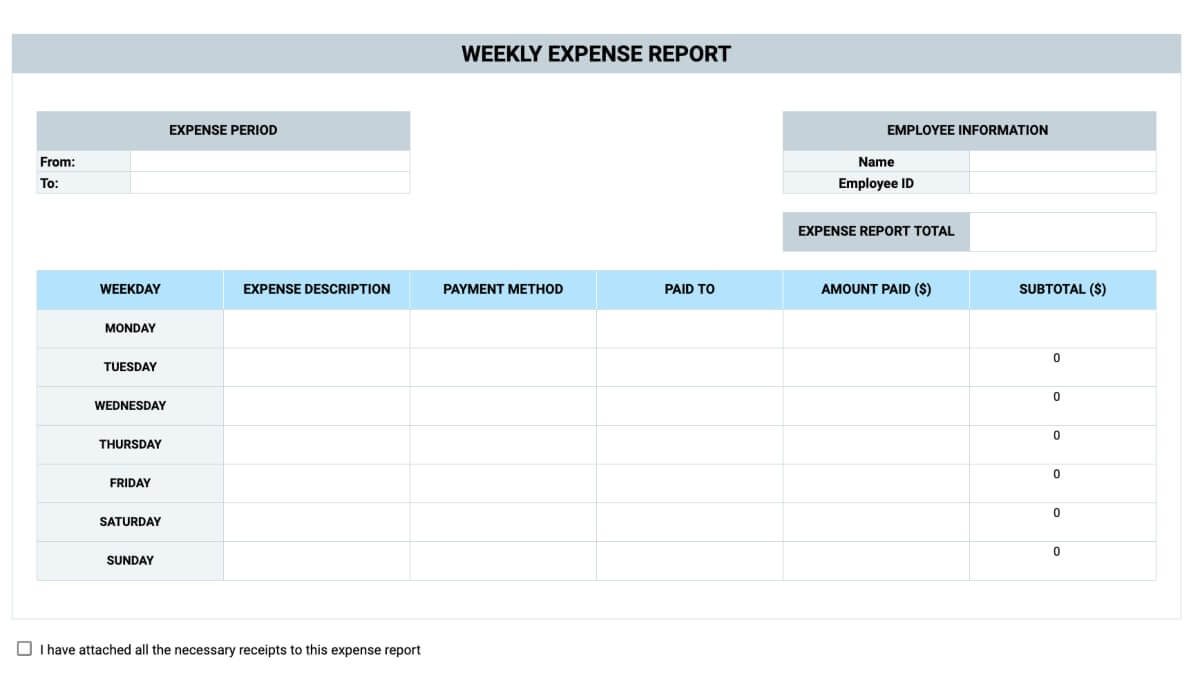

Weekly Expense Report Template

If you need to keep track of your expenses week in and week out, then the Weekly Expense Report Template could make your job quite easier.

What is the Weekly Expense Report Template?

The Weekly Expense Report Template lets you list your expenses, related payment methods, and the people the amounts were paid to on a weekly basis.

How to use the Weekly Expense Report Template?

Once you enter the expense description, payment method, the amount paid, and the person to whom the amount was paid, your subtotals for each day get calculated automatically.

You'll also get your total for the entire expense period calculated automatically.

The Weekly Expense Report Template is best for:

- People who need to file their reimbursement requests on a weekly basis.

Monthly Expense Report Template

Sometimes you’ll need to keep an eye on your expenses on a monthly basis, so to automate this process as much as possible, you can use the Monthly Expense Report Template. Such templates are specifically designed to monitor your monthly expenditures hassle-free.

What is the Monthly Expense Report Template?

The Monthly Expense Report Template lets you list your expenses, related payment methods, and the people the amounts were paid to on a monthly basis.

How to use the Monthly Expense Report Template?

Once you enter the data regarding your expense description, payment method, and the person to whom the amount was paid, your subtotals for each date get calculated automatically.

The Monthly Expense Report Template is best for:

- People who need to file their reimbursement requests on a monthly basis.

Travel Expense Report Templates

Whenever you need to travel for business purposes, you’ll need a way to keep a record of your expenses, and this is where Travel Expense Report Templates come into the picture.

Business Mileage Expense Report Template

If you frequently need to use your company’s vehicle, and you’re looking for a simple Expense template to keep up with all the costs — then the Business Mileage Expense Template can help you automate this process.

What is the Business Mileage Expense Report Template?

This Business Mileage Expense Report lets you:

- Specify your starting place,

- Destination,

- Travel purpose, and

- Mileage and mileage rate.

How to use the Business Mileage Expense Report Template?

After you've added all the data, including the date, purpose, and mileage, you'll get your total mileage expense for the said date calculated automatically.

You'll also get the total mileage expense for the expense period covered by this report calculated automatically.

The Business Mileage Expense Report Template is best for:

- Workers who often have to go on the field for the company's business, and who use their own vehicle for the purpose.

Business Travel Expense Report Template

In case you frequently need to travel for business purposes, then the Business Travel Expense Report Template could come in handy. Such templates can save you from calculating all your costs manually.

What is the Business Travel Expense Report Template?

The Business Travel Expense Report lets you track expenses for your business travels.

How to use the Business Travel Expense Report Template?

You can add your transport, hotel, meal and other travel-related expenses and have your total travel expenses for that date calculated automatically.

Once you've added this data, you'll also have your total transport, hotel, meal and other travel-related expenses calculated automatically for the entire business trip.

The Business Travel Expense Report Template is best for:

- Employees who have to travel for their business to longer distances that mandate they change several means of transportation and stay at hotels.

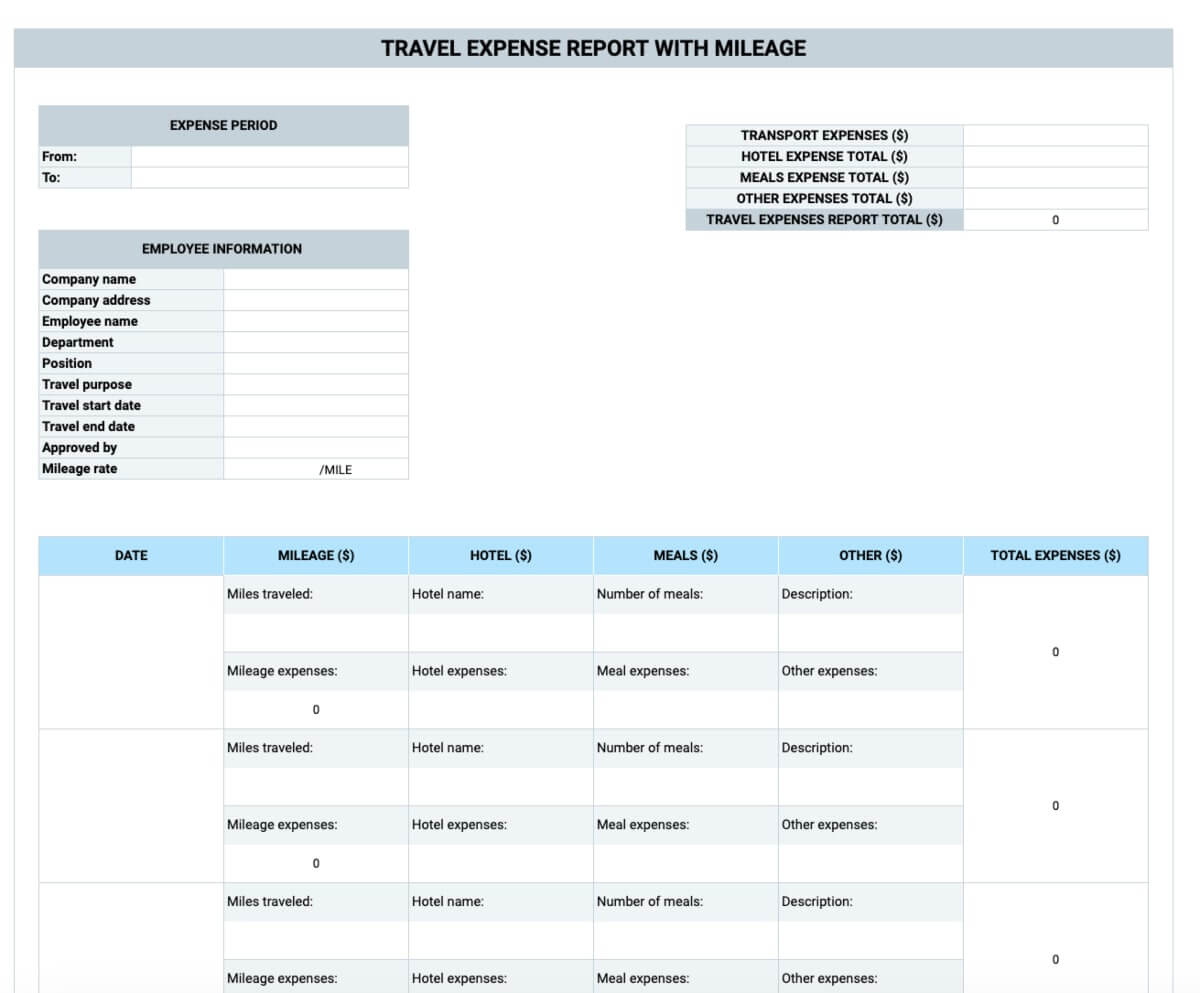

Travel Expense with Mileage Report Template

If your job requires you to travel frequently for business purposes, but you usually need to use your own vehicle — then the Travel Expense with Mileage Report Template can help you quickly calculate your travel expenses.

What is the Travel Expense with Mileage Report Template ?

Unlike a regular Business Travel Expense Report, the Expense Report for Travel with Mileage includes a section for mileage alongside the sections for the hotel, meals, and other travel-related expenses.

How to use the Travel Expense with Mileage Report Template?

After you've added all the data regarding your travel expenses, you'll get your total expenses for the specific date calculated automatically.

You'll also get your total mileage, hotel, meal and other travel-related expenses calculated automatically for the entire business trip.

The Travel Expense with Mileage Report Template is best for:

- Employees who go on long business trips that mandate that they stay at hotels — but who travel to these trips with their own car, so they also need reimbursement for mileage.

Freelancer Expense Report Templates