Currency converter

Travel insurance

Australia Post Travel Platinum Mastercard® 1

Enjoy safe and easy access to your travel money with our prepaid Travel Mastercard.

Money transfers

Send money overseas easily and reliably with Western Union at Australia Post.

Australia Post acknowledges the Traditional Custodians of the land on which we operate, live and gather as a team. We recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Exchange Rates

Always great value and no minimum spend*

- Euro 1.1459

- US Dollar 1.2287

- Australian Dollar 1.8466

- Bulgarian Lev 2.1489

- Canadian Dollar 1.6591

- Czech Koruna 27.2471

- Danish Krone 8.3004

- Hungarian Forint 429.4129

- Icelandic Krona 160.8238

- Indonesia Rupiah 18502.1242

- Mexican Peso 19.5356

- New Zealand Dollar 2.0273

- Norwegian Krone 13.1561

- Polish Zloty 4.7015

- South African Rand 22.2695

- Sweden Krona 13.017

- Swiss Franc 1.1034

- Turkish Lira 37.0946

- Thai Baht 42.9607

- United Arab Emirates Dirham 4.288

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 15 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

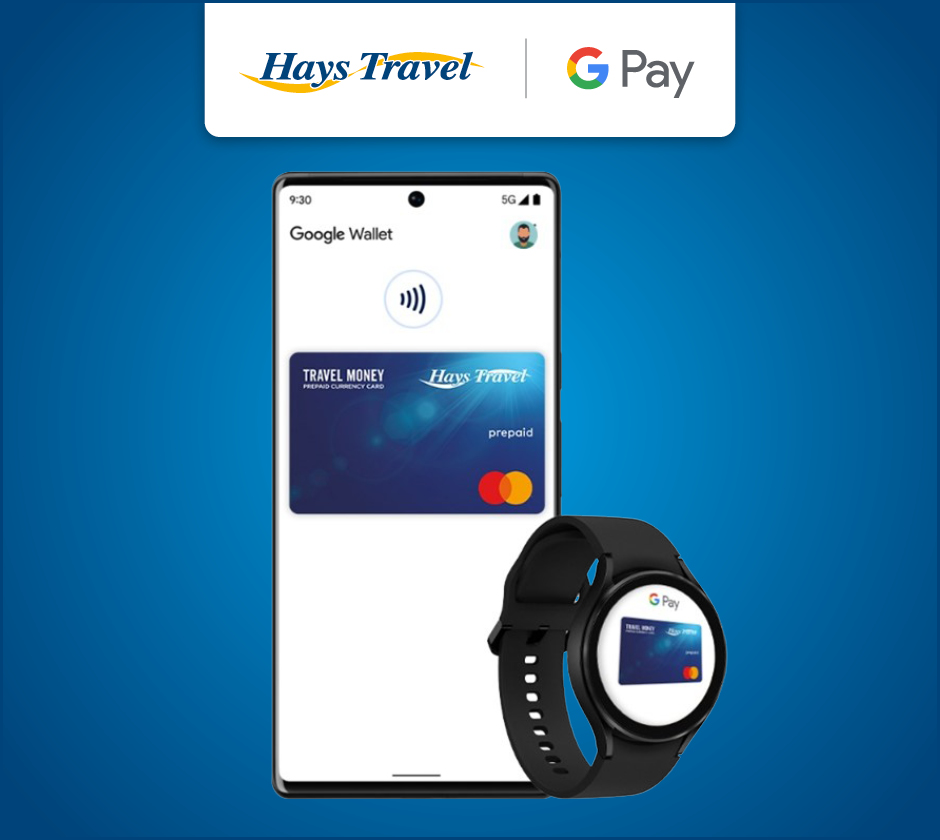

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

- Money Transfer

- Rate Alerts

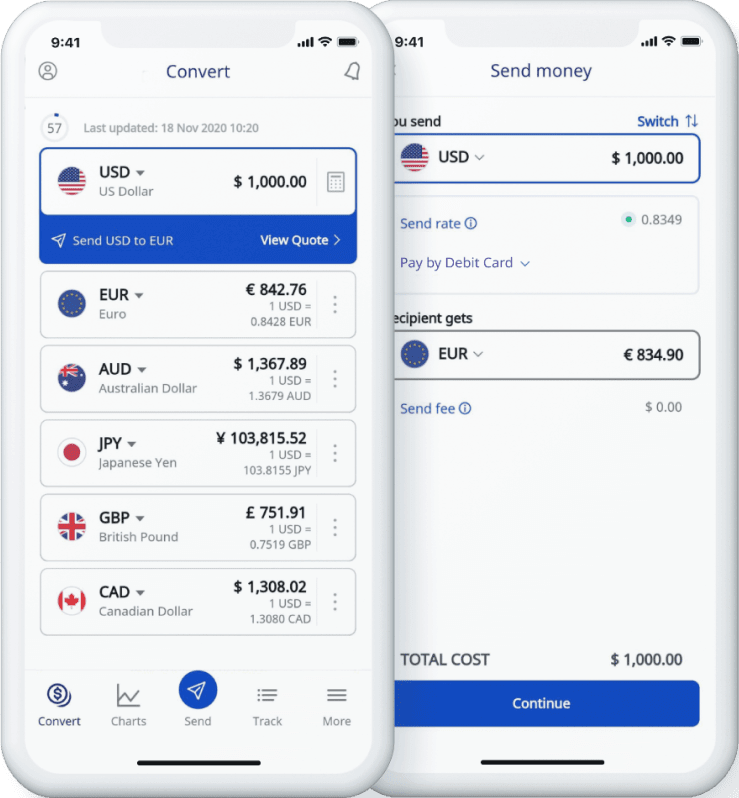

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

Tuesday, 22 Jan 2019 --> Last Updated : 2024-05-02 16:01:00

Group News Sites

Sunday Times

Tamil Mirror

Middleast Lankadeepa

Life Online

Home delivery

Advertise with us

Mobile Apps

Thu, 02 May 2024 Today's Paper

Today’s exchange rate - 02 May 2024

2 May 2024 01:34 pm - 0 - {{hitsCtrl.values.hits}}

Comments - 0

Add comment Comments will be edited (grammar, spelling and slang) and authorized at the discretion of Daily Mirror online. The website also has the right not to publish selected comments.

Name - Reply Comment

RECOMMENDED

‘Spike in blast fishing’ poses renewed threats to Sri Lanka’s marine ecosystems

UDA owned land in Thalawathugoda; UDA Minister Prasanna Ranatunga under the spotlight for forceful occupation of reserved land

Loss-making SMIB faces political pressure in recovering loans

Baltimore Bridge Collapse: MV Dali, SL authorities anchored in mystery?

US authorities are currently reviewing the manifest of every cargo aboard MV

Has Sri Lanka become a potential hub for the illegal wildlife trade?

On March 26, a couple arriving from Thailand was arrested with 88 live animal

Spotlight on Moragahakanda Development Project Moragolla villagers lose livelihoods and down to one meal a day

According to villagers from Naula-Moragolla out of 105 families 80 can afford

Ambitious Sri Lankan jobseekers ‘trafficked into Ukraine war zones’

Is the situation in Sri Lanka so grim that locals harbour hope that they coul

Most Viewed in News

Gota fires back at cardinal, rebuts allegations.

An Int’l summit avoids Sri Lanka due to beggar menace in Colombo

Sri Lanka weighs Open Skies amidst plans for national carrier privatization

How did Indian company take over visa issuance at BIA without cabinet approval?

Oil and gas exploration halted by prolonged legal dispute

Ranil’s evolving strategy to win 2024 presidential poll

MIRROR CRICKET

Nepal put forward strong squad on T20 World Cup return

01 May 2024 - 0 - 334

Sri Lanka continue unbeaten streak, Netherlands push for top spot in Group B

01 May 2024 - 4 - 1053

Wasim Akram to conduct training program for national players

01 May 2024 - 2 - 1744

Afghanistan announce T20 World Cup 2024 squad

01 May 2024 - 0 - 460

TODAY'S HEADLINES

Reduced diesel price not sufficient for bus fare revision: gemunu.

7 hours ago

BJP invites SLPP, UNP to study its election campaign

Indo-lanka passenger ferry service to resume on may 13, police looking for exhibitionist in ahangama.

8 hours ago

01 May 2024

Home > Company Hub > How much will IR35 cost you? Outside – Inside – Perm

How much will IR35 cost you? Outside – Inside – Perm

- March 9, 2020

This guide talks about the impact IR35 will have on your take-home pay. How much will IR35 cost you? Should you go Inside IR35/Umbrella or Perm?

In Part I of the IR35 mini-series we talked about the current state of contracting and the IR35 mess. We covered some pros and cons of being a contractor and how it compares with being a permie.

It’s now time to talk numbers. The math will hopefully help you decide whether IR35 has made contracting worth continuing. The answer, as usual, is: it depends! Before we dive in, first some definitions. What do we mean by Outside IR35, Inside and Perm:

Outside IR35: The pre-2020 contracting landscape. You operate as a limited company that pays corporation tax and personal income tax. You have the freedom to choose your taxes based on how much you want to withdraw as salary/dividends from your company. Also, business expenses can be claimed.

Inside IR35 / Umbrella : You still operate as a contractor through your limited company or through an umbrella . The take-home pay amounts between inside IR35 and umbrella are very similar. You are taxed more than a permanent employee. That’s because you have to pay both yours and the Employer’s National insurance.

You’re not paid while drinking Pina Coladas on the beach or when sick (except a small amount of Statutory pay).

Your gross pay is usually higher than a perm to compensate for these plus all other minuses that come with contracting, like void periods, short notice period, accounting, DIY pension etc. You don’t get to choose when to withdraw your profits, as everything is taxed at source and you must take all income home now.

Permanent employee (perm) : The majority of the workforce belongs here. The usual employee of a company, who belongs to the company payroll, has a salary that lands in your bank account each month no matter what. Entitled to holidays, sickness pay, and potentially other benefits such as pension, training and mandatory performance reviews.

How much will IR35 cost me Inside IR35 or Umbrella?

This is the most common question. People switching from Outside IR35 to Inside or Umbrella want to know how much income they will lose.

For starters, we assume that the Outside IR35 contractor takes all income home and leaves nothing in the company.

Taking all income out is not the most tax-efficient way to deal with your company money. But it’s a good baseline so let’s start with that. The following graph shows the take-home pay Outside IR35 compared to Inside IR35/Umbrella at the same rate.

The higher the rate the more it will cost you to transition from outside IR35 to inside IR35. But it’s not that bad. (hint: it gets worse).

So in most cases, a contractor will lose anywhere between 15% to 20% of their take-home income. Here’s a graph, showing the percentage difference for the given rates.

Punchline: For tax-inefficient contractors who take all money home, the difference between Outside IR35 -> Inside IR35 (or Umbrella) is between 15-20%.

What if you switch to perm, instead? Let’s see how an Outside IR35 compares to the same gross income taken as a perm employee.

Cost of moving from Outside IR35 (All Out) to Perm

But a few people I know have abandoned contracting altogether and want to switch to perm. What would the impact be if we take the same gross income as a perm?

Here’s the take-home pay when taken as an Outside IR35 contractor vs the equivalent gross pay as a perm employee. I’ve used the salary calculator ( link ) to calculate the take-home pay of all perm salaries.

As you can see, going perm doesn’t make much of a difference. On £600 per day, for which the equivalent annual gross is £132,000, the difference is just £6,000 per year.

However, here’s the catch:

It is really hard to achieve the same gross income as a perm. Here is a table outlining the equivalent gross amount of a daily rate when charged annually (44 working weeks. 5w hols, 8d bank hols, 7d sick/void):

Do you see the problem? In my experience, a contractor on £300/day will find it really hard to find a job at £66,000. Similarly, one who earns £600/day won’t easily find a £132,000 perm salary, even if you account for things like pension and bonus.

And it makes sense from a risk point of view. As we explained in Part I of this IR35 series , as a contractor your client doesn’t provide months of leave notice, job security or any perks. You provide a service at a cost. You are a Capital Expenditure (CapEx budget).

As a perm, the company makes commitments to you which is why the equivalent gross pay is unrealistic. I don’t know exactly what the equivalent “discount” we need to apply here when switching from Outside IR35 to Perm. But I do know there is one. So the percentage difference is higher than the table above suggests – to some extent.

The difference is BIG when the contractor is tax-efficient

The gap between Outside IR35 and all the other options widens further if you’re a tax-efficient contractor.

I’m sure you know a lot of people who don’t take all the money home.

Most contractors I know will at least take advantage of the minimum salary/dividends payout. So they all withdraw a minimum salary and dividends up to the point that doesn’t cross the higher taxpayer threshold (£50,000 as of 2020).

I think we can all agree this is a good tax strategy assuming you have no other (unsheltered) income outside your LTD affairs. Why take more £50,000 a year and pay higher taxes if you can just leave the money in the company and just pay corporation tax? Assuming, of course, you can live on this amount.

To the extreme end of this spectrum, there are people like myself who invest their company money . I consider my LTD money as “take-home” because it can provide income for years to come when invested. Others just leave it in there in cash and at some point, they claim “Entrepreneur’s Relief” (if this is not scrapped soon). This means they will only pay 10% tax to take it out of the company.

This all means the take-home pay for Outside IR35 contractors can be different from person to person despite having the same daily rate.

Putting it all together we have the following groups:

- All Out : Some other people say I want all my capital in my pocket, therefore I’m happy to pay the extra dividend tax to do that. This means I’ll have to apply a 32.5% dividend tax on the money before it becomes “take-home”. All-out approach

- Leave Surplus In strategy: Some, like me, consider the LTD surplus cash as “take-home” pay. Since you can invest the company money, the income/dividends will keep coming and I don’t need to (ever?) withdraw this surplus. So for the purposes of providing me income, the money is effectively take-home although it still belongs to the company. This is mathematically the most tax-efficient way.

- Entrepreneurs Relief approach : Some others take an accumulative approach but with ER in mind. They say, I will only withdraw a minimum salary and dividends as everybody else does and I will leave the rest of the money in the company. When the sum is big enough, I will close the company down and claim Entrepreneur’s Relief by paying only 10% tax to make the money mine . I will call this approach the ER approach.

So for an Outside IR35 contractor who takes a £50,000 take-home and leaves the surplus in the company (on 10% tax, Entrepreneurs Relief) here is the difference in take-home:

That’s a BIG difference. So if you leave some money in the company, moving from Outside IR35 to inside IR35 is going to cost you 30% loss of income on £650 per day. It’s “just” 15% on £200 per day but can go up to 33% loss on £1000 per day.

A bit depressing if you’re an Outside IR35 on a high rate. The data don’t lie!

Putting it all together: Outside IR35 vs Inside IR35 & Umbrella vs Perm

If we put all possible options in one single graph, it looks like this:

And that’s all on the same gross pay!!!

So when people ask me whether converting from contracting to perm has a difference, the answer is: It depends on how well you handle your taxes. If you’re wise with taxes, then it makes a massive difference . As you can see, an Outside IR35 contractor on £500 per day, who L eaves S urplus I n goes from £87,000 down to £70,000 (perm) or £62,400 (Umbrella). That’s a 30% drop in take-home income!

If you want to have a detailed look at the exact numbers, here’s the full table:

Even if you’re not working exactly 44 weeks and make the same assumptions as I do, the above table gives you a good indication. Here is a link to my spreadsheet which I used to calculate all the Outside IR35 take-home options. Use File -> Make a copy to edit the file, please do not request access to edit mine .

You may be wondering:

How can I improve my take-home pay if I cannot continue contracting Outside IR35?

There are a few things you can do to improve your take-home pay.

- Negotiate a rate increase

- Contribute to your pension

Negotiating a rate increase can work sometimes but it’s a bit futile. If everyone is running around like a headless chicken, why would companies offer more? It’s a question of supply and demand really because I’m sure companies still need some flexible workforce to scale up and down quickly.

So we shall wait and see who needs who more 🙂

Contributing to your pension is a sure win from a tax point of view and makes the transition much smoother. That’s because your pension contributions are income-tax-free, NI-free and corporation tax-free. In the next article we are going to answer the following questions:

- How can I increase my take-home pay inside IR35, Umbrella or Perm?

- How much do I need to increase my rate inside IR35 to match my Outside IR35 take-home?

Calculation Notes:

- A contractor works approximately the same weeks as a perm employee. Takes 5 weeks holidays, 8 days bank holidays, 7 days sickness/void periods between contracts. Total: 44 working weeks.

- All calculations were done for the Financial tax year 2019/20

- No pension was added to either perm or contract. It can save both perm and contractors a lot of tax. Pension deserves its own chapter, which is why we’re going to have another article just on how to use pensions to extract more out of your salary.

- Perm calculations include ALL benefits, bonus, overtime etc except pension.

- Used my Outside IR35 Contractor calculator ( Google Sheet ) to calculate all take home styles

- Inside IR35 calculations provided by Contractor Calculator – link

- Salary (perm) calculations by The Salary Calculator – link

Share this article:

Join the newsletter.

Every 2 weeks, I send a handwritten email with honest, valuable content. No spam, ever.

You may also like...

Flexible ISA: Business Owner’s Best Lifehack

Should Limited Companies Invest in a Dividend Fund over a Global Tracker?

Best Places to Hold Cash in the UK in 2024

17 thoughts on “how much will ir35 cost you outside – inside – perm”.

Great article Michael, this really clarifies what I’d always suspected but could never work out the maths for — and thanks for the spreadsheet.

You rock Michael! Great article!! I’m sure it will help lot of people at this time of chaos.

Hi Michael,

Thanks for this. Do you invest your company money through pension (so before corporation tax), or do you do it after you’ve paid corporation tax and invest it privately as profit?

I’m wondering because I’m quite loathe to leave it in government’s control (even private pension age is planned to go up), and that puts me off pensions.

Thank you, Michael. Great article.

I was using the minimum needed salary and dividends approach so it will be a big hit. One of my client has agreed to increase the rate so mitigate the impact and I’ll put the revised rate for future contracts. Increasing pension contribution is another option and I’d also suggest making the full use of ISA allowance while it lasts for any spare income you are forced to withdraw given that tax is already paid. Any dividends invested and re-invested in ISA, hopefully, coupled with some increase in rates, along with pension contribution will hopefully take the edge out of 33% or so hit on income.

@D I do both. As you rightly said, pension contributions suffer from lack of control but are 100% tax-efficient. So some of my investments go into a SIPP (saving corporation tax) and some I invest through my limited company after corporation tax is paid but still pre-income-tax. https://www.foxymonkey.com/how-to-invest-your-company-profits/

@Peterparker sounds like a good plan. I understand not everyone can increase their inside-IR35 rates but should definitely ask to share the pain with the employer.

@Satish, @Peter Jones – Glad you liked it 🙂 Hopefully, the chaos won’t last long!

Great article Michael – thanks for sharing the insightful graphs and calculator. You managed to make a difficult topic enjoyable to read!

Very well thought out and presented Michael. I have already gone permie as I saw the writing on the wall. The tax hike the past 9 months has been painful but at least some respite today in that Entrepreneurs relief has not been canned. I have a reasonable level of co. reserves over 100k; appreciate in your other posts you talk about opening a holding co. and investing via there but I think unless you have 200k plus or a growing warchest (on the expectation of being able to stay contracting outside IR35) the costs of running the two cos. would eat into potential returns too much.

Thanks, Andrew. I was glad to hear ER is not going away too! Starting an investment company for me has a much lower limit. £50k or so. If you can make a say 7-10% on £50,000 that’s between £3,500 to £5,000 versus £0 returns in the bank. But yeah, there’s hassle involved I hear you.

Thanks Michael. That makes sense if you’re planning on adding in fresh capital over time. But if you’re out of the contracting gig like me I think its harder to justify, and the fees for running the co. are going to eat into those returns. That’s why I was so relieved ER was retained as I can pull out the stagnant cash with only a minor hit. If I was staying contracting I would go down your second company route. But what with the world as it is and mine (and presumably most other’s) pensions and investments decimated knowing what to do with anything spare is all up in the air anyway! FIRE is perhaps less achievable but also not likely the top priority right now. Stay safe folks!

Indeed, Andrew, take care!

@Michael. A very in depth article, thanks!

Did you ever do the followup article covering the necessary increase in rate necessary to maintain the same take-home when moving from outside to inside IR35?

With the revised implementation date for IR35 changes now coming into force in a few months time, it’d be great to see your analysis on this.

Glad you found it useful, Martin. I haven’t written the article yet. You can probably estimate that by looking at the last take-home table based on your rate. So for a £500 per day outside IR35 contract (All money out) the equivalent would be ~£650 per day inside IR35.

The more tax-efficient you are with the company money the higher the rate increase to match it. Goes to show why IR35 can be a big showstopper and why it has really killed most of the freelancing job postings!

Hi @Michael, thanks for your response!

Just to check my understanding is correct: following your example, if I translated a £700 a day outside all out (£98k) that would be equivalent to around £900 a day Inside IR35?

Does the same logic apply to cross referencing between the Outside IR35 Entrepreneurs Relief and Inside IR35? ie a £650 a day at Outside ER (£107k) is equivalent to approximately £1,000 a day Inside IR35?

Hi Martin, both your examples are correct. Goes to show how big of an impact moving inside IR35 has. Plus how much room for tax optimisation company directors have!

Very good article. However, I am one of those contractors who are efficient with their tax. I am loosing 30% pay in real terms and its ruining my life. Sold my car (not a really nice one) and had to hand notice in to my sons private school. its heartbreaking. IR35 has ruined my life.

Hello Michael, I’m wondering what would be the best strategy for someone who has stopped contracting and taken on a perm role. Would you close the company, go with ER and take surplus funds out? Or continue down the strategy of investing surplus funds in stocks/shares or property?

I see the benefits if you continue to do contract work outside IR35. Investing surplus funds make total sense especially if you’re being tax efficient. However with Entrepreneurs Relief on the table I seem to think it flips to the other side.

Asking for a friend 😉

Hi Mannuel, short answer is it depends on your goals. If keeping Entrepreneur’s relief is important to you then investing a substantial amount might lose this benefit. You have to be more careful how you want to go about it.

See can I claim entrepreneur’s relief if my company invests?

ER also restricts you from operating in the same space for 24 months. That’s the “phoenixing” rule. So if you want to leave your perm job and go back to contracting, that’s another thing to consider.

Having said that, the Entrepreneur’s Relief rules change all the time so it might not be here for long. Just speculating though, but now we definitely know it’s on the table.

Overall, it depends on many different factors, and you have to run different scenarios. It’s a popular question and part of the tax pillar in the company investing course.

Leave a comment Cancel reply

Notify me via e-mail if anyone answers my comment.

Hi! I’m Michael and I love writing about different ways to earn, save and invest our money. Coffee addict :)

Recent Posts

Are Biotech stocks a good buy now?

- Matched Betting

- Career tips

- Extra Income Ideas

- LTD Companies

- Passive Income

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

[POST]Industrial Urals: Perm after the revolution

The Perm Gate art project was conceived by Nikolai Polissky (the ideologist behind the Archstoyanie project) in 2011. The work is situated in the square dedicated to Perm’s 250th anniversary, near the main railway station Perm 2.

Perm is located in the eastern part of European Russia (895 miles from Moscow). The city lies on the banks of the Kama river and is one of the hubs of industry, science, and logistics in the Urals.

The city traces its roots back to the construction of a copper smelting plant at the confluence of the Kama and Yegoshikh rivers in 1723. The construction project was the work of renowned historian, statesman, and engineer Vasily Tatischev, who also had a hand in the genesis of Yekaterinburg.

Perm’s cultural revolution began in 2008 under art gallery owner Marat Gelman. The initiative received the backing of the senator for the Perm region, Sergei Gordeev, and the former governor, Oleg Chirkunov.

The inscription “Power” is one of the "cultural objects" created during that revolution. It is inscribed in reinforced concrete outside the city’s Legislative Assembly. The project’s author says it gives the authorities an opportunity to view themselves with criticism and self-irony, while for the the public it illustrates that real power lies with the people.

It was the opening of the Russian Povera Exhibition inside Ruchnoy Station that gave impetus to the cultural changes. The station building later housed the Perm Museum of Contemporary Art (PERMM). Currently closed for renovation, the building's future is uncertain.

Today's Perm is one of the largest economic centers in Russia. In terms of industrial output the city ranks first in the Urals, ahead of the numerically superior Yekaterinburg and Chelyabinsk.

The city’s top industries are electric power, oil and gas refining, machine-building, chemicals, and petrochemicals.

Early 2013 saw the resignation of Oleg Chirkunov, after which rumor spread of the cultural project’s imminent demise. Given that all the initiatives have now ceased, it was obviously not idle chatter.

Talking to the locals, one hears a constant stream of unflattering opinions of the cultural events that took place. They all add up to the same thing: people do not understand why such sums were spent on the fine arts when the city is rife with other problems.

The former home of the “little red men” of the art group Professors is a symbol of Perm’s culture. Their presence received a hostile reception from the locals. As a result of protests against the new cultural policy, the little red men were removed.

Another notable feature of the new cultural policy was the appearance of new bus shelters, designed by Lebedev Studio. Now almost all of them are in a dilapidated condition.

Perm’s population is about 1 million. In the Soviet period from 1940 to 1957 the city was called Molotov.

The portrait of Russian poet Sergei Yesenin is one of the examples of public art on the streets of Perm.

The words “Money down the drain” inscribed near the Perm Gate installation encapsulate most residents’ attitude to the city’s so-called cultural revolution.

The best-known and still-standing (since the locals liked it) cultural object is a sign bearing the phrase “Happiness is on the horizon,” located behind the riverside station on the banks of the Kama.

to our newsletter!

Get the week's best stories straight to your inbox

This website uses cookies. Click here to find out more.

Japan's currency falls to its weakest since 1990 against the dollar as the yen keeps yelping

NEW YORK — Some of the world’s wildest action in financial markets is roiling around the Japanese yen.

The value of Japan’s currency has tumbled so much that for a moment on Monday it took 160 yen to equal $1. A few years ago, it took closer to 100 yen to make a U.S. dollar. The yen has been so weak that it’s back to where it was in 1990, shortly after Japan’s famous “bubble economy” burst.

After it briefly touched the 160 yen level in overnight hours for traders in New York, the value of a dollar quickly shifted back to 156 yen by midday Monday on the East Coast. Such sudden moves can happen in the foreign-exchange market, which can be notoriously volatile. Trading may also have been jumpy because of a holiday in Japan that kept its stock market closed. But the speed and degree of the yen’s swings raised speculation about whether Japanese officials were making moves to prop up the value of their currency.

The yen has long been under pressure as the Bank of Japan kept interest rates remarkably low to encourage more inflation in its economy. Only last month did it end its policy to keep its benchmark interest rate below zero.

The Bank of Japan’s latest decision on rates came on Friday, when it held interest rates steady. That helped spur this latest leg of weakness for the yen. The market may have been reacting to a lack of commitment by the Bank of Japan for more rate hikes in the near term, and the yen may remain under pressure into the third quarter of this year, strategists at Bank of America said in a BofA Global Research report.

That’s in part because of how solid the U.S. economy has remained. With inflation and the economy still higher than forecast, expectations are rising for the Federal Reserve to keep its main interest rate high for a while. That’s kept U.S. Treasury yields high and put upward pressure on the U.S. dollar’s value.

A weak yen is good for U.S. tourists heading to Japan, meaning each $1 of theirs buys more yen. It can also be a boon for Japan’s exporters because it boosts the value of their sales made in U.S. dollars when translated back into yen.

But keeping the yen weak carries risks. A central one is that it could cause inflation in Japan ultimately to overshoot targets and hurt the world’s third-largest economy. Japan imports almost all its energy, for example, and barrels of oil get traded in dollars, not yen.

Expedia Rewards is now One Key™

Find hotels in chusovoy.

Most hotels are fully refundable. Because flexibility matters.

Save 10% or more on over 100,000 hotels worldwide as a One Key member.

Search over 2.9 million properties and 550 airlines worldwide.

Pet friendly

Fully refundable

Reserve now, pay later

Bed & breakfast

Breakfast included

Lunch included

Dinner included

All inclusive

Golf course

Electric car charging station

WiFi included

Outdoor space

Air conditioned

Washer and dryer

Airport shuttle included

Wheelchair-accessible parking

Service animals allowed

Accessible bathroom

In-room accessibility

Sign language-capable staff

Roll-in shower

Stair-free path to entrance

LGBTQ welcoming

See properties that pledge to make all guests feel safe, welcome, and respected.

Business friendly

See properties with amenities to help you work comfortably, like WiFi and breakfast.

Family friendly

See properties that include family essentials like in-room conveniences and activities for the kids.

Compare hotels, room rates, hotel reviews and availability. Most hotels are fully refundable.

Chusovoy travel info, frequently asked questions.

Yes! You'll find that most room reservations are fully refundable provided that you cancel before the accommodation's cancellation deadline, which is often 24 or 48 hours before your scheduled arrival. If your reservation is non-refundable, it might still be possible to cancel it and be given a refund within 24 hours of booking. Filter your search by fully refundable to find flexible hotel deals in Chusovoy.

For additional details about updating your trip to Chusovoy or cancelling it, click here .

REGION 59 HOTEL is one of the top choices for your stay and is a popular 3-star hotel featuring a roundtrip airport shuttle and free extended parking. It's located 3.7 mi (6 km) from Bolshoye Savino Airport. Another top choice near the airport is Marmelade Hotel , located 0.1 mi (0.2 km) away.

The hottest months are usually July and August with an average temp of 59°F, while the coldest months are January and February with an average of 12°F. Average annual precipitation for Chusovoy is 29 inches.

- Explore a world of travel with Expedia

Hotels near Chusovoy Airports

- Bolshoye Savino Airport

Other Hotels near Chusovoy, Perm Krai

- Eastern Europe Hotels

- Nikiforovskoe Hotels

- Skal'Ninskoe Hotels

- Kalinskoe Hotels

- Lys'va Hotels

- Verhnekalinskoe Hotels

- Gremyachinskoe Hotels

- Sel'Skoe Hotels

- Gornozavodskoe Hotels

- Pashiyskoe Hotels

- Lysvenskiy Hotels

- Komarihinskoe Hotels

- Vil'Venskoe Hotels

- Mezhselennaya Hotels

- Volga Hotels

- Kus'E Aleksandrovskoe Hotels

Expedia's Latest Trends

- Skip to main content

- Keyboard shortcuts for audio player

Midwest tornadoes cause severe damage in Omaha suburbs

The Associated Press

Gopala Penmetsa walks past his house after it was leveled by a tornado near Omaha, Neb., on Friday. Chris Machian/Omaha World-Herald via AP hide caption

Gopala Penmetsa walks past his house after it was leveled by a tornado near Omaha, Neb., on Friday.

OMAHA, Neb. — A tornado plowed through suburban Omaha, Nebraska, on Friday afternoon, damaging hundreds of homes and other structures as the twister tore for miles along farmland and into subdivisions. Injuries were reported but it wasn't yet clear if anyone was killed in the storm.

Multiple tornadoes were reported in Nebraska but the most destructive storm moved from a largely rural area into suburbs northwest of Omaha, a city of 485,000 people.

Photos on social media showed heavily damaged homes and shredded trees. Video showed homes with roofs stripped of shingles, in a rural area near Omaha. Law enforcement were blocking off roads in the area.

Hundreds of houses sustained damage in Omaha, mostly in the Elkhorn area in the western part of the city, police Lt. Neal Bonacci said.

Police and firefighters are now going door-to-door helping people who are trapped.

Omaha Fire Chief Kathy Bossman said crews had gone to the "hardest hit area" and had a plan to search anywhere someone could be trapped.

"They're going to be putting together a strategic plan for a detailed search of the area, starting with the properties with most damage," Bossman said. "We'll be looking throughout properties in debris piles, we'll be looking in basements, trying to find any victims and make sure everybody is rescued who needs assistance."

Damaged houses are seen after a tornado passed through the area near Omaha, Neb., on Friday. Chris Machian/Omaha World-Herald via AP hide caption

Damaged houses are seen after a tornado passed through the area near Omaha, Neb., on Friday.

Omaha police Lt. Neal Bonacci said many homes were destroyed or severely damaged.

"You definitely see the path of the tornado," Bonacci said.

In one area of Elkhorn, dozens of newly built, large homes were damaged. At least six were destroyed, including one that was leveled, while others had the top half ripped off.

There were dozens of emergency vehicles in the area.

"We watched it touch down like 200 yards over there and then we took shelter," said Pat Woods, who lives in Elkhorn. "We could hear it coming through. When we came up our fence was gone and we looked to the northwest and the whole neighborhood's gone."

His wife, Kim Woods added, "The whole neighborhood just to the north of us is pretty flattened."

Dhaval Naik, who said he works with the man whose house was demolished, said three people, including a child, were in the basement when the tornado hit. They got out safely.

KETV-TV video showed one woman being removed from a demolished home on a stretcher in Blair, a city just north of Omaha.

Omaha Police Chief Todd Schmaderer said there appeared to be few serious injuries, in part because people had plenty of warning that storms were likely.

The exact link between tornadoes and climate change is hard to draw. Here's why

"We not upon by a sudden storm," Schmaderer said. "People had warnings of this and that saved lives."

The tornado warning was issued in the Omaha area on Friday afternoon just as children were due to be released from school. Many schools had students shelter in place until the storm passed. Hours later, buses were still transporting students home.

Another tornado hit an area on the eastern edge of Omaha, passing directly through parts of Eppley Airfield, the city's airport. Officials closed the airport to aircraft operations to access damage but then reopened the facility, Omaha Airport Authority Chief Strategy Officer Steve McCoy said.

Severe weather damage to Eppley Airfield in Omaha, Neb., can be seen from the Lewis and Clark Monument in Council Bluffs, Iowa on Friday Anna Reed/Omaha World-Herald via AP hide caption

Severe weather damage to Eppley Airfield in Omaha, Neb., can be seen from the Lewis and Clark Monument in Council Bluffs, Iowa on Friday

The passenger terminal wasn't hit by the tornado but people rushed to storm shelters until the twister passed, McCoy said.

Flight delays are expected Friday evening.

After passing through the airport, the tornado crossed the Missouri River and into Iowa, north of Council Bluffs.

Nebraska Emergency Management Agency spokesperson Katrina Sperl said damage is just now being reported. Taylor Wilson, a spokesperson for the University of Nebraska Medical Center, said they hadn't seen any injuries yet.

Before the tornado hit the Omaha area, three workers in an industrial plant were injured Friday afternoon when a tornado struck an industrial plant in Lancaster County, sheriff's officials said in an update on the damage.

The building just northeast of the state capital of Lincoln had collapsed with about 70 employees inside and several people trapped, sheriff's officials said. Everyone was evacuated, and three people had injuries that were considered not life-threatening, authorities said.

Sheriff's officials say they also had reports of a tipped-over train near Waverly, also in Lancaster County.

Two people who were injured when the tornado passed through Lancaster County were being treated at the trauma center at Bryan Medical Center West Campus in Lincoln, the facility said in a news release. It said the patients were in triage and no details were released on their condition.

The Omaha Public Power District reported that nearly 10,000 customers were without power in the Omaha area.

Daniel Fienhold, manager of the Pink Poodle Steakhouse in Crescent, Iowa, said he was outside watching the weather with his daughter and restaurant employees. He said "it looked like a pretty big tornado was forming" northeast of town.

"It started raining, and then it started hailing, and then all the clouds started to kind of swirl and come together, and as soon as the wind started to pick up, that's when I headed for the basement, but we never saw it," Fienhold said.

The Weather Service also issued tornado watches across parts of Iowa, Kansas, Missouri, Oklahoma and Texas. And forecasters warned that large hail and damaging wind gusts were possible.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Audio tour Ethnographic Park of the history of the Chusovaya river

Download the free izi.TRAVEL app

- Download on the App Store

- Android app on Google play

- Download from Windows phone store

Create your own audio tours!

Use of the system and the mobile guide app is free

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

A safe-to-use, prepaid, reloadable, multi-currency card that’s not linked to your bank account

No charges when you spend abroad*

Make contactless, Apple Pay and Google Pay™ payments

Manage your account and top up or freeze your card easily with our Travel app

*No charges when you spend abroad using an available balance of a local currency supported by the card.

Win £5000 with Post Office Travel Money Card

A chance to win £5000 when you top up a new or existing Travel Money Card*. Offer ends 12 May

*Exclusive to travel money cards. Promotion runs 4 March to 12 May 2024. 1 x £5,000 prize available to be won each week. Minimum equivalent spend of £50 applies.

Why get a Travel Money Card?

Carry up to 22 currencies safely.

Take one secure, prepaid Mastercard® away with you that holds multiple currencies (see ‘common questions’ for which).

Accepted in over 36 million locations worldwide

Use it wherever you see the Mastercard Acceptance Mark – millions of shops, restaurants and bars in more than 200 countries.

Manage your card with our travel app

Top up, manage or freeze your card, transfer funds between currencies, view your PIN and more all in our free Travel app .

It’s simple to get started

No need to carry lots of cash abroad. Order a Travel Money Card today for smart, secure holiday spending.

Order your card

Order online, via the app or pick one up in branch and load it with any of the 22 currencies it holds.

Activate it

Cards ordered online and in-app should arrive within 2-3 working days. Activate it by following the instructions in your welcome letter.

It’s ready to use

Spend in 36 million locations worldwide, and top up and manage your card in the app or online.

Stay in control

Manage your holiday essentials together in one place on the move, from your Travel Money Card and travel insurance to extras like airport parking.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Order a Travel Money Card

Order your card online – or through the Post Office travel app – and we'll deliver it within 2-3 days. Just activate it and go.

Need it quick? Visit a branch

Pick up a Travel Money Card instantly at your local Post Office. Bring a valid passport, UK driving licence or valid EEA card as ID.

Need some help?

We’re here to help you make the most of your Travel Money Card – or put your mind at ease if it’s been lost or stolen

Lost or stolen card?

Please immediately call: 020 7937 0280

Available 24/7

To read our FAQs, manage your card or contact us about using it:

Visit our Travel Money Card support page

Common questions

How can i order my card.

There are three ways that you able to obtain a Travel Money Card, each very simple.

Please note, you must be a UK resident over the age of 18 to obtain a Travel Monday Card.

- Via our travel app: you can order and store up to three Travel Money Cards in our free travel app . Delivery will take 2-3 working days.

- Online: follow our application process to order your card online. Your card will take 2-3 working days to be delivered. Once it arrives you can link it to our Travel app to manage on the go.

- In branch: simply find a nearby Post Office branch and pop in to get your Travel Money Card there. Please remember to take a valid passport, UK driving licence or a valid EEA card in order to obtain your card, and you can take it away the same day.

Whichever way you choose to order your card, don't forget to activate it once it arrives. Full details of how to activate your card will be provided in your welcome letter, to which your card will be attached if it’s been sent in the post.

How do I use my card?

Travel Money Card is enabled with both chip & PIN and contactless, so you can make larger and lower-value value payments with it respectively. For convenience, you can also add it to Apple Pay and Google Wallet.

You can load it with between £50 and £5,000 (see more on load limits below). You can use it to pay wherever the Mastercard Acceptance Mark is displayed. And you can withdraw cash with it at over 2 million ATMs worldwide (charges and fees apply, see 'Are there top-up limits?' below).

Your Travel Money Card is completely separate from your bank account so it’s a safe and secure way to pay while you’re abroad.

How can I manage my card?

After you've activated your card, you can manage it using our travel app or via a web browser. You can check your recent transactions, view your PIN, transfer funds between different currency ‘wallets’, top up your card, freeze your card and more.

Our travel app brings together travel essentials including holiday money, travel insurance and more together in one place. As well as managing your Travel Money Card you can buy cover for your trip, access your policy documents on the move, book extras such as airport parking and hotels, and find your nearest ATM while overseas or Post Office branches here in the UK.

Which currencies can I use?

The Post Office Travel Money Card can be loaded with up to 22 currencies at any one time. You can top up funds on the card and transfer currencies between different ‘wallets’ for these currencies easily in our travel app or online.

Currencies available:

- EUR – euro

- USD – US dollar

- AUD – Australian dollar

- AED - UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish krone

- GBP – pound sterling

- HKD – Hong Kong dollar

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish Krona

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

What are the charges and fees?

Full details of our charges and fees can be found in our Travel Money Card terms and conditions .

The Post Office Travel Money Card is intended for use in the countries where the national currency is the same as the currencies on your card. If the currency falls outside of any of the 22 we offer on your card, you’ll be charged a cross-border fee. For example, using your card in Brazil will incur a cross-border fee because we do not offer the Brazilian real as a currency.

Cross border fees are set at 3% and are only applicable when you use your currency in a country other than the ones we offer.

For more information on cross border fees, please visit our cross border payment page.

There are no charges when using your card in retailers in the country of the currency on the card. This means that a €20 purchase in Spain would cost you €20 and will be deducted from your euro balance.

To avoid unnecessary charges to your card, wherever asked, you should always choose to pay for goods or withdraw cash in the currencies of your card. For example, if you are using the card in Spain you should always choose to pay in euro if offered a choice; choosing to pay in sterling (GBP) in this example would allow the merchant to exchange your transaction from euro to sterling. This would mean your transaction has gone through two exchange rate conversions, which will increase the total cost of your transaction.

For loads in Great British pounds, a load commission fee of 1.5% will apply (min £3, max £50). A monthly maintenance fee of £2 will be deducted from your balance 12 months after your card expires. Expiration dates can be found on your TMC; all cards are valid for up to 3 years.

A cash withdrawal fee will be charged when withdrawing cash from a UK Post Office branch or from any ATM globally that accepts Mastercard.

We have listed all available currencies and their associated withdrawal limits and charges below:

EUR – euro Max daily cash withdrawal: 450 EUR Withdrawal charge: 2 EUR

USD – US dollar Max daily cash withdrawal: 500 USD Withdrawal charge: 2.5 USD

AED – UAE dirham Max daily cash withdrawal: 1,700 AED Withdrawal charge: 8.5 AED

AUD – Australian dollar Max daily cash withdrawal: 700 AUD Withdrawal charge: 3 AUD

CAD – Canadian dollar Max daily cash withdrawal: 600 CAD Withdrawal charge: 3 CAD

CHF – Swiss franc Max daily cash withdrawal: 500 CHF Withdrawal charge: 2.5 CHF

CNY – Chinese yuan Max daily cash withdrawal: 2,500 CNY Withdrawal charge: 15 CNY

CZK – Czech koruna Max daily cash withdrawal: 9,000 CZK Withdrawal charge: 50 CZK

DKK – Danish krone Max daily cash withdrawal: 2,500 DKK Withdrawal charge: 12.50 DKK

GBP – Great British pound Max daily cash withdrawal: 300 GBP Withdrawal charge: 1.5 GBP

HKD – Hong Kong dollar Max daily cash withdrawal: 3,000 HKD Withdrawal charge: 15 HKD

HUF – Hungarian forint Max daily cash withdrawal: 110,000 HUF Withdrawal charge: 600 HUF

JPY – Japanese yen Max daily cash withdrawal: 40,000 JPY Withdrawal charge: 200 JPY

NOK – Norwegian krone Max daily cash withdrawal: 3,250 NOK Withdrawal charge: 20 NOK

NZD – New Zealand dollar Max daily cash withdrawal: 750 NZD Withdrawal charge: 3.5 NZD

PLN – Polish zloty Max daily cash withdrawal: 1,700 PLN Withdrawal charge: 8.5 PLN

SAR – Saudi riyal Max daily cash withdrawal: 1,500 SAR Withdrawal charge: 7.50 SAR

SEK – Swedish Krona Max daily cash withdrawal: 3,500 SEK Withdrawal charge: 20 SEK

SGD – Singapore dollar Max daily cash withdrawal: 500 SGD Withdrawal charge: 3 SGD

THB – Thai baht Max daily cash withdrawal: 17,000 THB Withdrawal charge: 80 THB

TRY – Turkish lira Max daily cash withdrawal: 1,500 TRY Withdrawal charge: 7 TRY

ZAR – South African rand Max daily cash withdrawal: 6,500 ZAR Withdrawal charge: 30 ZAR

Are there top-up limits?

Yes, all currencies have top-up limits and balances. See full information below, which is applicable to all currencies available on the Travel Money Card.

- Top-up limit: minimum £50 – maximum £5,000

- Maximum balance: £10,000 at any time, with a maximum annual balance of £30,000

- Read more Travel Money Card FAQs

Other related services

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

For the first time in 16 years of our reports, Lisbon is not only the cheapest ...

The nation needs a holiday. And, with the summer season already underway, new ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Our annual survey of European ski resorts compares local prices for adults and ...

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

The nation needs a holiday, and Brits look set to flock abroad this year. The ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Find out more information by reading the Post Office Travel Money Card's terms and conditions .

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Post Office and the Post Office logo are registered trademarks of Post Office Limited.

Post Office Limited is registered in England and Wales. Registered number 2154540. Registered office: 100 Wood Street, London, EC2V 7ER.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

Money latest: Blow for hopes of June interest rate cut

The OECD anticipates inflation will be "elevated" at 3.3% in 2024 and 2.5% in 2025 - above the Bank of England's 2% target. No base rate cut will come until at least August, they say. Read this and all the latest consumer and personal finance news below, plus leave a comment in the box.

Thursday 2 May 2024 11:42, UK

- OECD warns UK shouldn't cut interest rates yet

- UK ranks bottom in G7 economic growth forecast

- New ISA rules were supposed to help savers - right now they've just made everything more complicated

Essential reads

- How to nab yourself a free upgrade on a flight

- Why you shouldn't buy a TV in May (or a mobile phone in October)

- You're probably washing and storing your clothes wrong. Here's what you should do instead

- Money Problem : 'Builders won't repair dodgy work - what are my rights?'

- '£2,000 landed in my account' - The people who say they're manifesting riches

Ask a question or make a comment

Following on from our previous post, and the OECD also says the UK will grow more slowly next year than any other major advanced economy.

It puts this down to stealth taxes and high interest rates squeezing the economy.

The organisation, which is based in Paris, downgraded its forecasts for GDP to 0.4% this year and 1% in 2025.

In February, the UK had been in the middle of the rankings with forecast growth of 0.7% this year and 1.2% next.

The OECD pointed to the fact "tax receipts keep rising towards historic highs" - with National Insurance cuts not offsetting the additional burden Britons are feeling due to tax thresholds not rising along with inflation due to a government freeze.

Some good news is expected for UK workers as the OECD said there will be "stronger" wage growth when inflation is factored in against pay.

One of the world's leading economic authorities has warned the UK that borrowing should remain expensive until the rate of price rises eases further and stays there.

Interest rates, which are at a post-2008-era high of 5.25% , should stay there, according to the Organisation for Economic Co-operation and Development (OECD).

"The fiscal and monetary policy mix is adequately restrictive and should remain so until inflation returns durably to target," the OECD's economic outlook for 2024 said.

It's an endorsement for the approach of the Bank of England whose statements on inflation have not indicated an imminent rate cut.

The OECD anticipates inflation will be "elevated" at 3.3% in 2024 and 2.5% in 2025 - above the Bank's 2% target.

No rate cut will come until at least August, the OECD added.

It may not come as a surprise, but the prices of a whole range of items fluctuate throughout the year.

It isn't always easy figuring out what is best to buy when - but a price comparison website has dug into the numbers.

PriceSpy has analysed its price history data to help direct shoppers to the best time of year to buy common, popular products.

This table should help:

Its analysis shows June is a great month to get yourself a lawn mower but if you're after a barbecue, you're best off waiting until December.

Organised parents can take advantage of LEGO price drops in September for Christmas presents.

PriceSpy estimates consumers can save more than £800 on the "peak pricing premium" by following its advice.

Following our feature on how assigning a lasting power of attorney may be more important than drawing up a will, a Money reader got in touch with a query...

As a married couple of 53 years, all our accounts are in joint names - so do we need lasting power of attorney? Thank you! David

We asked Joanna Grewer, partner at Roythornes Solicitors, to respond: "If you have accounts in joint names then the account can be accessed by the person who has capacity.

"However, this won't entitle the capacitous person to deal with any of the income which comes into that account for the non- capacitous person, such as pensions, or to manage any outgoings in that person's name.

"If both parties lost capacity, then there would be no access to funds at all."

This feature is not intended as financial advice - the aim is to give an overview of the things you should think about. Submit your dilemma or consumer dispute, leaving your name and where in the country you are, by emailing [email protected] with the subject line "Money blog". Alternatively, WhatsApp us here .

By James Sillars , business reporter

Another cent has come off oil costs over the past 24 hours - hopefully signalling better news for drivers ahead.

A barrel of Brent crude is currently costing just over $84 and had been trading at $83 in Asian trading.

It had stood above $90 a month ago as the crisis in the Middle East played out.

Evidence of a cooling in tensions between Israel and Iran have assisted the downwards trend.

The FTSE 100 began the day by erasing the losses seen on Wednesday.

A solid set of results for Shell helped the index climb by 0.3% in early deals...

Shell shares were more than 1% higher on the back of better than expected profits.

It revealed further shareholder awards in the form of a dividend and share buyback.

Online gamblers who lose £500 a month or more will face financial vulnerability checks.

Checks will come into force from 30 August.

The figure will reduce to £150 a month from 28 February next year.

The Gambling Commission said this would help identify acutely financially vulnerable online customers, such as those subject to bankruptcy orders or with a history of unpaid debts.

The checks will only use publicly available data and will not require gambling operators to consider an individual's personal details such as postcode or job title.

As well as light touch checks, the commission said a pilot of enhanced assessments would go ahead, aimed at preventing cases where customers are able to spend large amounts in a short time without any checks, resulting in significant gambling harm.

It's not uncommon to feel uncomfortable with flying - but we'd probably all feel a bit better if we were sitting in first class, wouldn't we?

The lucky few might be able to pay for themselves, but for the rest of us, frequent flyer experts Flight Hacks have shared their top tips to get a free upgrade (and you can let us know your tips for getting upgrades in the comments box above)...

Stay loyal to one airline

Many airlines have a rewards scheme that offers free upgrades, early check-in and even free flights to loyal customers.

One research survey found 80% of staff said a customer in the airline's frequent flier scheme would be more likely to receive a free upgrade.

Plus, getting early check-in could place you first in line to secure a seat in the plane's front section.

Travel alone or during quieter times

Let's face it, a single person on an empty flight is much more likely to get an upgrade than a family of six on a booked-out plane.

Try flying in the middle of the week or at off-peak times to get a quieter plane.

Dress to impress

If you're dressed smartly and look like a frequent flier, this can boost your chances of getting an upgrade.

Business travellers are an airline's favourite type of passenger as they fly regularly and are more likely to spend freely on their company cards - so it could be worth dressing in business attire.

Don't be afraid to ask

It doesn't hurt just to enquire, as long as you're polite.

Be flexible

Airlines will frequently overbook flights to compensate for no-shows and ensure the planes are full.

If there aren't enough seats after everyone checks in, they will often offer incentives to passengers willing to switch to a later flight.

This can mean seat upgrades or cash incentives.

Take advantage of special occasions

If it's your birthday, honeymoon or a special anniversary, it could be worth casually dropping this into conversation with the check-in staff.

Be polite when checking in

Perhaps all of these tips should be caveated with the need to remain polite.

As there is often no strict criteria on how airline staff may choose to give out free upgrades, the number one tip is to be nice.

Travel expert Immanuel Debeer, from Flight Hacks, says "being respectful and friendly is by far the best way to increase your chances of an upgrade".

"There are plenty of simple tricks to increase your chances of getting an upgrade, but the most important thing to remember is that airline staff are human."

Every Thursday Savings Champion founder Anna Bowes gives us an insight into the savings market and how to make the most of your money. Today she's focusing on ISAs after new rules came in last month. ...

New ISA rules were introduced from 6 April that should make opening and funding ISAs simpler. But what many people may not realise is that ISA providers do not need to implement most of the new rules – and many haven't yet, or may have no intention of doing so.

As a result, savers have been left scratching their heads, unsure if their ISA provider will allow them to make use of the rules or not.

What are the key new rules?

Harmonise ISAs to those over 18: This is not an optional change. The minimum opening age for adult cash ISAs is now 18, so not good news for those aged 16 and 17 who previously could have funded a junior ISA and an adult cash ISA.

Allowing multiple ISA subscriptions: People should now be allowed to open and pay into multiple ISAs of the same type in a single tax year. Previously people could only pay into one of each type of ISA every tax year, unless their ISA provider offered what we called "portfolio ISAs".

A portfolio ISA (other names for this have been used such as "ISA wallet" with Paragon Bank) allows savers to open more than one cash ISA with the same provider in the same tax year - but only a small number of providers offer it, such as Paragon, Aldermore and Charter Savings Bank, Nationwide and Ford Money.

With the new rules, savers assume they can open more than one ISA with either more than one provider or with the same provider. However, our research has shown that while many providers will allow you to open another cash ISA with them if you have already opened and funded an ISA with someone else in the current tax year, this doesn't mean they have adopted the portfolio ISA rule – so you may not be able to open two ISAs with them.

Partial transfers allowed: Partial transfers of ISA funds for the current tax year should be allowed, rather than being forced to transfer the whole amount of your current tax year ISA. Previously you could only make a partial transfer of old ISAs; you'd have to transfer the current tax year's ISA entirely.

Once again not many have adopted this rule yet.

The bottom line

So, while in theory these new changes should have made ISAs more flexible, in reality they have added an extra complication for savers and the bottom line is that you need to ask your existing and potential ISA providers about which of the rules they have adopted or are looking to adopt.

The pet supply retailer has opened two convenience stores in a move to branch out from its typical retail park sites.

The stores, which are in Sutton, south London, and Whetstone, north London, will sell a range of pet owner essentials and offer an advice counter.

They are much smaller than the usual Pets at Home stores and will not have the typical vet and grooming services.

Speaking to Retail Week, the chain did not confirm whether it would be opening more high street stores in the future.

Pets at Home Sutton store manager Rachel Etherington told the news outlet the location would "allows us to provide pet owners with convenient access to all their pet care essentials, as well as expert advice from our specially trained colleagues, right on their doorstep".

The Fed has issued its latest policy statement, announcing it will keep interest rates at the same level.

It did note inflation has eased over the past year, and it is still leaning towards eventual reductions in borrowing costs.

However, it pointed to recent disappointing inflation readings, suggesting moves towards more balance in the economy had stalled.

If you're wondering why we're telling you this, it's because there is a link between the Fed's interest rate and the Bank of England's base rate.

The interplay between the two can affect the value of the pound and currency alternatives such a gold.

Market expectations for the UK base rate are often heavily influenced by what's going on in the US.

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

VIDEO

COMMENTS

The Post Office Travel Money currency converter helps holidaymakers quickly check today's exchange rates for 60 currencies. Order your foreign currency today! ... First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF ...

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial ...

Learn how to exchange foreign currency at USPS locations. Find out the rates, fees, and restrictions for sending money abroad.

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

Compare travel money with MoneySavingExpert. Find a better exchange rate for spending overseas. Choose from a number of different currencies. Compare rates in minutes. Compare rates. Explore page: Pros and cons. Top tips.

Travel Money Online is the provision of foreign currency which is provided by First Rate Exchange Services Ltd. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW89DF, (Money Services Business licence No. MLR-64068). Post ...

Check our latest foreign currency exchange rates and order your travel money online. Check our latest foreign currency exchange rates and order your travel money online. ... AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, Heritage Bank Limited (ABN 32 087 652 024, AFSL 240984 ...

Travel Money Hays Travel Foreign Exchange, 4 great ways to buy your holiday money. ... Exchange Rates. Always great value and no minimum spend* Euro. 1.148 US Dollar. 1.2228 Australian Dollar. 1.8562 Bulgarian Lev. 2.1523 Canadian Dollar. 1.6591 ...

Whether you need to check the latest exchange rates, compare historical trends, or send money abroad, Xe Currency Converter is the ultimate tool for you. You can easily convert between any of the world's major currencies, including crypto and precious metals, and get the most accurate and up-to-date rates. Xe Currency Converter is free, fast, and simple to use.

DoS sets the per diem rates for foreign locations. Rates are updated at the beginning of each month. DTMO prescribes rates for non-foreign locations overseas (also referred to as OCONUS locations, which includes Alaska, Hawaii, Guam, Puerto Rico, etc.). Rates are updated monthly (or as necessary). View recent changes [PDF, 33 pages].

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial ...

DAILY POST recalls that on Tuesday, the Central Bank of Nigeria had raised the customs exchange rate by N162. According to CPPE, the latest customs rate change made it 38 times since this year's ...

Travel Travel Getaways Travel Tips Business Travel. ... Today's exchange rate - 02 May 2024. ... Post a new comment : Full Name: Email Address: Send.

As you can see, an Outside IR35 contractor on £500 per day, who L eaves S urplus I n goes from £87,000 down to £70,000 (perm) or £62,400 (Umbrella). That's a 30% drop in take-home income! If you want to have a detailed look at the exact numbers, here's the full table: Take-home for given gross.

FILE- A person looks at an electronic stock board showing Japan's stock prices at a securities firm in Tokyo, on April 30, 2024. Asian stocks fell Wednesday, May 1, 2024 with most of the markets ...

Perm is located in the eastern part of European Russia (895 miles from Moscow). The city lies on the banks of the Kama river and is one of the hubs of industry, science, and logistics in the Urals.

A monitor shows U.S. dollar/Japanese yen exchange rate in Tokyo Monday, April 29, 2024. (Kyodo News via AP) (Uncredited/Kyodo News)

Dinner included. All inclusive. Amenities. Pool. Pet friendly. Hot tub. Find of the best hotels in Chusovoy in 2024. Compare room rates, hotel reviews and availability. Most hotels are fully refundable.

The yen has tumbled well past levels touted as red lines for Japan and at a pace that has traders asking when authorities might start buying the currency to support it — and why they haven't ...

Post Office® Travel Money Sale - even better US dollar rates all summer long. Order dollars online by 2pm Mon-Fri & collect in branch or get next day delivery. ... First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF ...

Multiple tornadoes were reported in Nebraska but the most destructive storm moved from a largely rural area into suburbs northwest of Omaha. Hundreds of homes and other structures have been damaged.

Interest rates, which are at a post-2008-era high of 5.25%, should stay there, according to the Organisation for Economic Co-operation and Development ... Travel alone or during quieter times.

The central bank increased the BI-Rate by 25 basis points to 6.25% on Wednesday, a move predicted by only 11 of 41 economists surveyed by Bloomberg. The rest had expected no change.

The ethnographic complex 'The Museum of the History of the Chusovaya River' is located in the town of Chusovoy, 135 kilometers east of the city of Perm. You can easily reach Chusovoy by car, bus or train. The museum is located on the eastern outskirts of Chusovoy (you need to go along the mining route).

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial ...

Money latest: McDonald's to start selling bigger burgers - as it makes very rare changes to classic items. The fast food giant has revealed its chefs have created a "larger, satiating burger" in a ...