The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

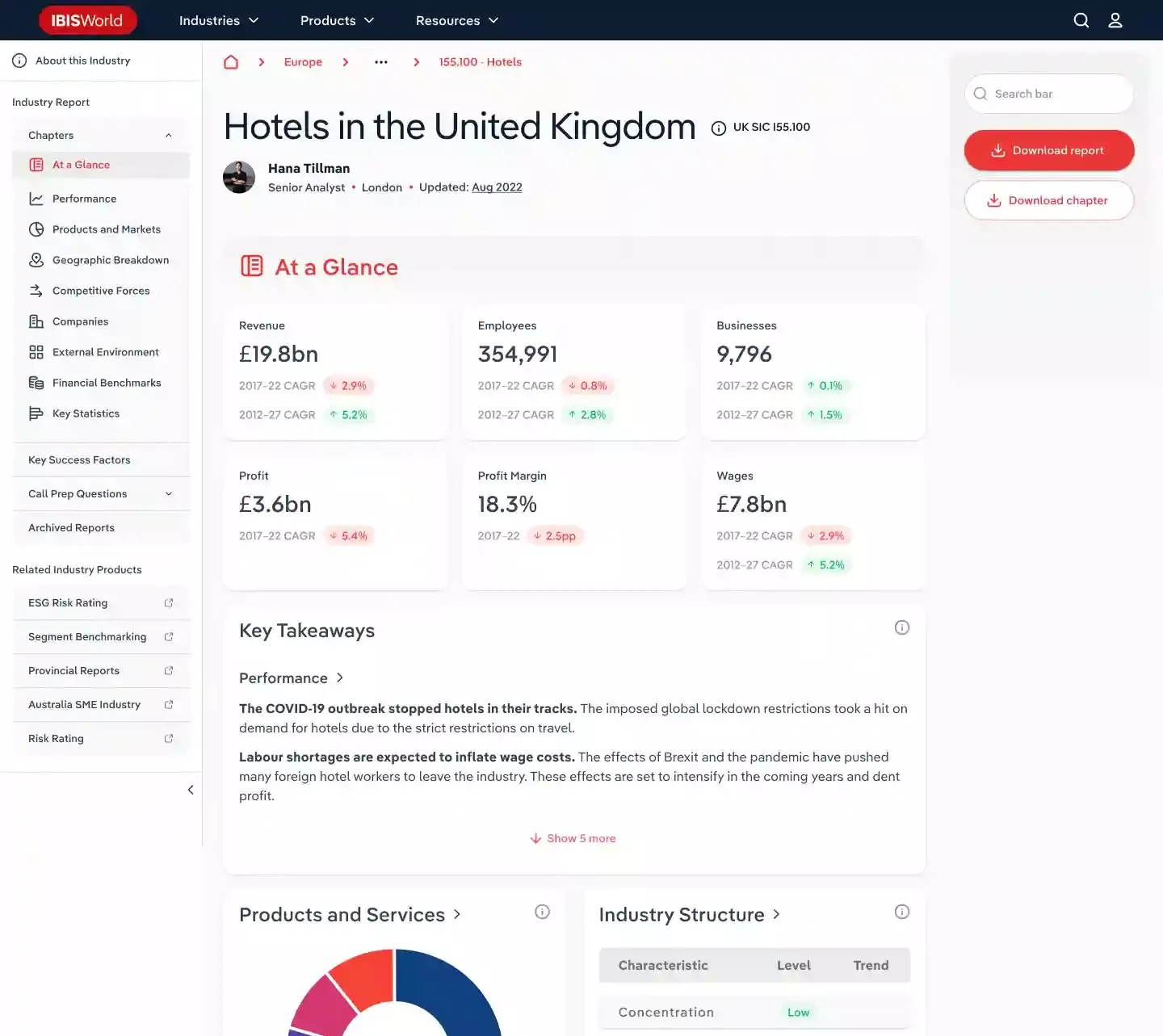

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage

While COVID-19 pushed organizations in a wide variety of sectors to embrace remote work, there are many hospitality roles that rely on direct physical services that cannot be performed remotely, such as laundry, cleaning, maintenance, and facility management. If faced with staff shortages, these roles could be outsourced to third-party professional service providers, and existing staff could be reskilled to take up new positions.

In McKinsey’s experience, the total service cost of this type of work in a typical hotel can make up 10 percent of total operating costs. Most often, these roles are not guest facing. A professional and digital-based solution might become an integrated part of a third-party service for hotels looking to outsource this type of work.

One of the lessons learned in the aftermath of COVID-19 is that many tourism employees moved to similar positions in other sectors because they were disillusioned by working conditions in the industry . Specialist multisector companies have been able to shuffle their staff away from tourism to other sectors that offer steady employment or more regular working hours compared with the long hours and seasonal nature of work in tourism.

The remaining travel and tourism staff may be looking for more flexibility or the option to work from home. This can be an effective solution for retaining employees. For example, a travel agent with specific destination expertise could work from home or be consulted on an needs basis.

In instances where remote work or outsourcing is not viable, there are other solutions that the hospitality industry can explore to improve operational effectiveness as well as employee satisfaction. A more agile staffing model can better match available labor with peaks and troughs in daily, or even hourly, demand. This could involve combining similar roles or cross-training staff so that they can switch roles. Redesigned roles could potentially improve employee satisfaction by empowering staff to explore new career paths within the hotel’s operations. Combined roles build skills across disciplines—for example, supporting a housekeeper to train and become proficient in other maintenance areas, or a front-desk associate to build managerial skills.

Where management or ownership is shared across properties, roles could be staffed to cover a network of sites, rather than individual hotels. By applying a combination of these approaches, hotels could reduce the number of staff hours needed to keep operations running at the same standard. 16 “ Three innovations to solve hotel staffing shortages ,” McKinsey, April 3, 2023.

Taken together, operational adjustments combined with greater use of technology could provide the tourism industry with a way of overcoming staffing challenges and giving customers the seamless digitally enhanced experiences they expect in other aspects of daily life.

In an industry facing a labor shortage, there are opportunities for tech innovations that can help travel and tourism businesses do more with less, while ensuring that remaining staff are engaged and motivated to stay in the industry. For travelers, this could mean fewer friendly faces, but more meaningful experiences and interactions.

Urs Binggeli is a senior expert in McKinsey’s Zurich office, Zi Chen is a capabilities and insights specialist in the Shanghai office, Steffen Köpke is a capabilities and insights expert in the Düsseldorf office, and Jackey Yu is a partner in the Hong Kong office.

Explore a career with us

Travel, Tourism & Hospitality

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Inbound and outbound visitor growth worldwide 2020-2025

According to a 2024 study, the number of both inbound arrivals and outbound visits globally is expected to grow that year. After the dramatic decline with the onset of the coronavirus (COVID-19) pandemic, and the rebound in 2022, inbound overnight arrivals and outbound trips worldwide are forecast to increase by 17.4 percent and 17 percent, respectively, in 2024 compared to the previous year.

Inbound and outbound visitor growth worldwide from 2020 to 2022, with a forecast until 2025

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

February 2024

2020 to 2022

Data for 2020 were previously published by the source. Figures for 2022 are estimates. Data from 2023 to 2025 are forecasts. Inbound refers to the sum of the overnight tourist arrivals and includes intra-regional flows. Outbound refers to the sum of visits to all destinations. Figures were calculated using the Global Travel Service (GTS) model as of December 12, 2023.

Other statistics on the topic

Number of inbound visitors to Japan 2005-2023

Number of overseas tourists in Tokyo 2013-2022

Number of inbound visitors in Japan 2023, by region

Monthly number of foreign visitors to Japan 2019-2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Other statistics that may interest you

- Inbound visitor growth in Africa 2021-2025

- Outbound visitor growth in the Americas 2020-2024, by region

- Outbound visitor growth in the Middle East 2011-2025

- Inbound visitor growth in the Middle East 2011-2025

- Number of tourist arrivals from the U.S. to Europe 2019-2022, by destination

- Inbound visitor growth in the Americas 2020-2025, by region

- Number of tourist arrivals from Mexico to Europe 2019-2022, by region of destination

- Number of tourist arrivals from Argentina to Europe 2019-2022, by destination

- Number of tourist arrivals from Brazil to Europe 2019-2022, by destination

- Number of tourist arrivals from India to Europe 2019-2022, by destination

- Outbound tourism visitor growth worldwide 2020-2025, by region

- Inbound tourism visitor growth worldwide 2020-2025, by region

- Monthly U.S. citizen travel to Africa 2015-2019

- Number of international tourist arrivals worldwide 1950-2023

- Countries with the highest number of inbound tourist arrivals worldwide 2019-2022

- Cities where international visitors spent the most worldwide 2018

- Most popular destination countries among outbound tourists from China 2018

- Most increasingly popular destination countries among tourists from China 2018

- Most increasingly popular destination cities among tourists from China 2018

- Number of international tourist arrivals in India 2010-2021

- Change in number of visitors from Mexico to the U.S. 2018-2024

- International tourist arrivals in Europe 2006-2023

- Foreign exchange earnings from tourism in India 2000-2022

- Annual revenue of China Tourism Group Duty Free 2013-2023

- Countries with the highest outbound tourism expenditure worldwide 2019-2022

- Leading countries in the MEA in the Travel & Tourism Competitiveness Index 2018

- International tourism receipts of India 2011-2022

- Number of tourist arrivals from Canada to Europe 2019-2022, by destination

- Outbound visitor growth in Africa 2020-2025

- COVID-19 impact on overnight stays of foreign and domestic tourists in Finland 2022

- Leading source countries for international tourists to Canada 2019-2021

- Number of Spanish tourist arrivals in Italy 2019, by region of destination

- Leading source countries for international tourists to Brazil 2014

- Italy: number of British tourist arrivals in 2015, by region of destination

- Italy: number of German tourist arrivals in 2015, by month

- Italy: number of overnight stays of French tourist in 2015, by region of destination

- Italy: number of Austrian tourist arrivals in 2015, by region of destination

- Number of tourist arrivals from China to Europe 2019-2022, by destination

- Outbound visitor growth in Europe 2020-2025, by region

- Inbound tourism visitor growth in Europe 2020-2025, by region

- Italy: number of overnight stays of British tourist in 2015, by region of destination

- Italy: number of German tourist arrivals in 2015, by region of destination

- Italy: number of German tourist overnight stays in 2015, by region of destination

- Italy: number of French tourist arrivals in 2015, by region of destination

- International tourist arrivals in Italy 2019-2022, by country

- Number of inbound tourist arrivals in Curaçao 2010-2022

- Leading inbound travel markets in the UK 2019-2022, by number of visits

Other statistics that may interest you Statistics on

About the industry

- Basic Statistic Inbound visitor growth in Africa 2021-2025

- Premium Statistic Outbound visitor growth in the Americas 2020-2024, by region

- Basic Statistic Outbound visitor growth in the Middle East 2011-2025

- Basic Statistic Inbound visitor growth in the Middle East 2011-2025

- Premium Statistic Number of tourist arrivals from the U.S. to Europe 2019-2022, by destination

- Premium Statistic Inbound visitor growth in the Americas 2020-2025, by region

- Premium Statistic Number of tourist arrivals from Mexico to Europe 2019-2022, by region of destination

- Basic Statistic Number of tourist arrivals from Argentina to Europe 2019-2022, by destination

- Premium Statistic Number of tourist arrivals from Brazil to Europe 2019-2022, by destination

- Basic Statistic Number of tourist arrivals from India to Europe 2019-2022, by destination

About the region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Basic Statistic Monthly U.S. citizen travel to Africa 2015-2019

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Premium Statistic Countries with the highest number of inbound tourist arrivals worldwide 2019-2022

- Basic Statistic Cities where international visitors spent the most worldwide 2018

- Premium Statistic Most popular destination countries among outbound tourists from China 2018

- Premium Statistic Most increasingly popular destination countries among tourists from China 2018

- Premium Statistic Most increasingly popular destination cities among tourists from China 2018

Selected statistics

- Basic Statistic Number of international tourist arrivals in India 2010-2021

- Premium Statistic Change in number of visitors from Mexico to the U.S. 2018-2024

- Premium Statistic International tourist arrivals in Europe 2006-2023

- Basic Statistic Foreign exchange earnings from tourism in India 2000-2022

- Premium Statistic Annual revenue of China Tourism Group Duty Free 2013-2023

- Premium Statistic Countries with the highest outbound tourism expenditure worldwide 2019-2022

- Premium Statistic Leading countries in the MEA in the Travel & Tourism Competitiveness Index 2018

- Basic Statistic International tourism receipts of India 2011-2022

Other regions

- Premium Statistic Number of tourist arrivals from Canada to Europe 2019-2022, by destination

- Basic Statistic Outbound visitor growth in Africa 2020-2025

- Basic Statistic COVID-19 impact on overnight stays of foreign and domestic tourists in Finland 2022

- Premium Statistic Leading source countries for international tourists to Canada 2019-2021

- Premium Statistic Number of Spanish tourist arrivals in Italy 2019, by region of destination

- Premium Statistic Leading source countries for international tourists to Brazil 2014

- Premium Statistic Italy: number of British tourist arrivals in 2015, by region of destination

- Premium Statistic Italy: number of German tourist arrivals in 2015, by month

- Premium Statistic Italy: number of overnight stays of French tourist in 2015, by region of destination

- Premium Statistic Italy: number of Austrian tourist arrivals in 2015, by region of destination

Related statistics

- Premium Statistic Number of tourist arrivals from China to Europe 2019-2022, by destination

- Premium Statistic Outbound visitor growth in Europe 2020-2025, by region

- Premium Statistic Inbound tourism visitor growth in Europe 2020-2025, by region

- Premium Statistic Italy: number of overnight stays of British tourist in 2015, by region of destination

- Premium Statistic Italy: number of German tourist arrivals in 2015, by region of destination

- Premium Statistic Italy: number of German tourist overnight stays in 2015, by region of destination

- Premium Statistic Italy: number of French tourist arrivals in 2015, by region of destination

- Premium Statistic International tourist arrivals in Italy 2019-2022, by country

- Basic Statistic Number of inbound tourist arrivals in Curaçao 2010-2022

- Basic Statistic Leading inbound travel markets in the UK 2019-2022, by number of visits

Further related statistics

- Basic Statistic Contribution of China's travel and tourism industry to GDP 2014-2023

- Premium Statistic Passenger traffic at Dubai Airports from 2010 to 2020*

- Basic Statistic Growth of inbound spending in the U.S. using foreign visa credit cards

- Premium Statistic Number of international tourist arrivals APAC 2019, by country or region

- Premium Statistic Middle Eastern countries with the largest international tourism receipts 2018

- Premium Statistic Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Premium Statistic Number of visitors to the U.S. from Russia 2011-2022

- Basic Statistic Importance of BRICS countries to UK tourism businesses 2011

- Basic Statistic Number of Marriott International hotels worldwide 2009-2023

- Premium Statistic Universal Orlando Islands of Adventure theme park attendance 2009-2022

Further Content: You might find this interesting as well

- Contribution of China's travel and tourism industry to GDP 2014-2023

- Passenger traffic at Dubai Airports from 2010 to 2020*

- Growth of inbound spending in the U.S. using foreign visa credit cards

- Number of international tourist arrivals APAC 2019, by country or region

- Middle Eastern countries with the largest international tourism receipts 2018

- Music tourist spending at concerts and festivals in the United Kingdom (UK) 2012-2016

- Number of visitors to the U.S. from Russia 2011-2022

- Importance of BRICS countries to UK tourism businesses 2011

- Number of Marriott International hotels worldwide 2009-2023

- Universal Orlando Islands of Adventure theme park attendance 2009-2022

Global tourism to recover from pandemic by 2023, post 10-year growth spurt

- Medium Text

Sign up here.

Reporting by Neil Jerome Morales

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

Australia says Palestinian UN membership bid builds peace momentum

Australian Foreign Minister Penny Wong said on Saturday the country's support for a Palestinian bid to become a full United Nations member was part of building momentum to secure peace in the Israel-Hamas war in Gaza.

Global Tourism - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Global Tourism

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Global Tourism industry is , which means the top four companies generate of industry revenue.

The average concentration in the sector in Global is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.

What's driving current industry performance in the Global Tourism industry?

What's driving the Global Tourism industry outlook?

What influences volatility in the Global Tourism industry?

- Industry Volatility vs. Revenue Growth Matrix

What determines the industry life cycle stage in the Global Tourism industry?

- Industry Life Cycle Matrix

Products and Markets

Products and services.

- Products and Services Segmentation

How are the Global Tourism industry's products and services performing?

What are innovations in the Global Tourism industry's products and services?

Major Markets

- Major Market Segmentation

What influences demand in the Global Tourism industry?

International Trade

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

- Industry Trade Balance by Country

What are the import trends in the Global Tourism industry?

What are the export trends in the Global Tourism industry?

Geographic Breakdown

Business locations.

- Share of Total Industry Establishments by Region ( )

Data Tables

- Number of Establishments by Region ( )

- Share of Establishments vs. Population of Each Region

What regions are businesses in the Global Tourism industry located?

Competitive Forces

Concentration.

- Combined Market Share of the Four Largest Companies in This Industry ( )

- Share of Total Enterprises by Employment Size

What impacts market share in the Global Tourism industry?

Barriers to Entry

What challenges do potential entrants in the Global Tourism industry?

Substitutes

What are substitutes in the Global Tourism industry?

Buyer and Supplier Power

- Upstream Buyers and Downstream Suppliers in the Global Tourism industry

What power do buyers and suppliers have over the Global Tourism industry?

Market Share

Top companies by market share:

- Market share

- Profit Margin

Company Snapshots

Company details, summary, charts and analysis available for

Company Details

- Total revenue

- Total operating income

- Total employees

- Industry market share

Company Summary

- Description

- Brands and trading names

- Other industries

What's influencing the company's performance?

External Environment

External drivers.

What demographic and macroeconomic factors impact the Global Tourism industry?

Regulation and Policy

What regulations impact the Global Tourism industry?

What assistance is available to the Global Tourism industry?

Financial Benchmarks

Cost structure.

- Share of Economy vs. Investment Matrix

- Depreciation

What trends impact cost in the Global Tourism industry?

Financial Ratios

- 3-4 Industry Multiples (2018-2023)

- 15-20 Income Statement Line Items (2018-2023)

- 20-30 Balance Sheet Line Items (2018-2023)

- 7-10 Liquidity Ratios (2018-2023)

- 1-5 Coverage Ratios (2018-2023)

- 3-4 Leverage Ratios (2018-2023)

- 3-5 Operating Ratios (2018-2023)

- 5 Cash Flow and Debt Service Ratios (2018-2023)

- 1 Tax Structure Ratio (2018-2023)

Data tables

- IVA/Revenue ( )

- Imports/Demand ( )

- Exports/Revenue ( )

- Revenue per Employee ( )

- Wages/Revenue ( )

- Employees per Establishment ( )

- Average Wage ( )

Key Statistics

Industry data.

Including values and annual change:

- Revenue ( )

- Establishments ( )

- Enterprises ( )

- Employment ( )

- Exports ( )

- Imports ( )

Frequently Asked Questions

What is the market size of the global tourism industry.

The market size of the Global Tourism industry is measured at in .

How fast is the Global Tourism market projected to grow in the future?

Over the next five years, the Global Tourism market is expected to . See purchase options to view the full report and get access to IBISWorld's forecast for the Global Tourism from up to .

What factors are influencing the Global Tourism industry market trends?

Key drivers of the Global Tourism market include .

What are the main product lines for the Global Tourism market?

The Global Tourism market offers products and services including .

Which companies are the largest players in the Global Tourism industry?

Top companies in the Global Tourism industry, based on the revenue generated within the industry, includes .

How many people are employed in the Global Tourism industry?

The Global Tourism industry has employees in Global in .

How concentrated is the Global Tourism market in Global?

Market share concentration is for the Global Tourism industry, with the top four companies generating of market revenue in Global in . The level of competition is overall, but is highest among smaller industry players.

Methodology

Where does ibisworld source its data.

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

Deeper industry insights drive better business outcomes. See for yourself with your report or membership purchase.

Discover how 30+ pages of industry data and analysis can give you the edge you need..

Industry Verticals »

- Chemicals And Materials

- Consumer Goods

- Electronics and Semiconductors

- Energy and Natural Resources

- Factory Automation

- Food and Beverages

- Heavy Engineering Equipment

- IT and Telecom

- Pharmaceutical

- Latest Reports

- Forthcoming Reports

- Top Industry Reports

Press Releases »

About tmr ».

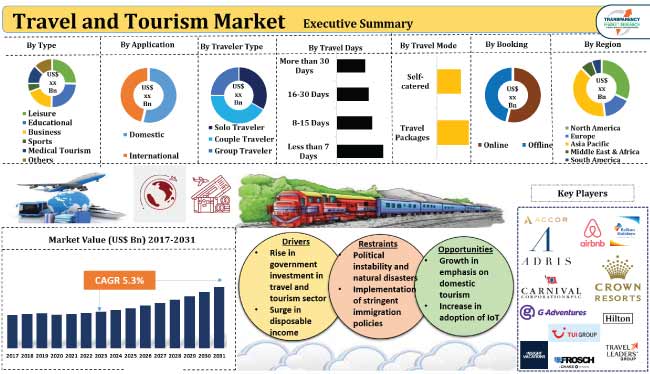

Travel and Tourism Market

Travel and Tourism Market (Type: Leisure, Educational, Business, Sports, Medical Tourism, and Others; and Application: Domestic and International) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast, 2023-2031

- Report Preview

- Table of Content

- Request Brochure

Global Travel and Tourism Market Outlook 2031

- The global industry was valued at US$ 615.2 Bn in 2022

- It is estimated to grow at a CAGR of 5.3% from 2023 to 2031 and reach US$ 972.5 Bn by the end of 2031

Analysts’ Viewpoint on Market Scenario Growth in disposable income, affordable commutes, easy accessibility of remote locations, and emerging travel trends are major factors boosting the travel and tourism market growth during the forecast period. Rise in government investment in the tourism sector is also projected to drive demand for travel and tourism in the next few years. Surge in adoption of IoT is likely to offer lucrative opportunities to players in the global travel and tourism industry. However, political instability, natural disasters, and implementation of stringent immigration policies are estimated to limit the travel and tourism market progress in the near future.

Market Introduction

Travel and tourism refers to the movement of people from one place to another due to various reasons such as leisure, education, business, and sports. It can be domestic, overseas, short distance, or long distance. The tourism sector is witnessing immense growth opportunities around the globe owing to rise in discretionary income, governmental support, infrastructural development, and technical integration to facilitate easy commutes.

Online booking platforms, mobile apps , and travel websites are gaining traction among travelers. Rapid globalization has led to a more interconnected world through trade, social media networks, business, and culture. Thus, people are traveling within and out of their borders with ease. These scenarios and travel trends are expected to augment the travel and tourism market value in the next few years.

Social media platforms and online websites are being used widely to promote various tourist destinations and hospitality and leisure facilities. They are attracting travelers through influencer marketing , travel blogs, articles, and user-generated content. This, in turn, is projected to spur growth of the travel and tourism industry. Moreover, increase in investment in infrastructural development and emergence of new travel trends among millennials are boosting the travel and tourism market size.

Tourism is becoming one of the major sectors driving a country’s revenue. Thus, governments across the globe are promoting and investing heavily in the sector, which is leading to improvements in public transportation, tourist destinations, and accommodation facilities. According to the latest travel and tourism market trends, travel and tourism is gaining traction among the middle-class population due to surge in disposable income.

In 2019, an average household in the U.S. spent around US$ 2,100 on travel. Security and health concerns play a major role in the tourism sector. This average dropped to US$ 926 post the emergence of the COVID-19 pandemic in 2020. Thus, travelers prefer safe and secure destinations.

Rise in Government Investment in Travel and Tourism Sector

The tourism sector across the globe is growing at a rapid pace, especially after COVID-19 lockdowns were lifted. Major governments are focusing on promoting and enhancing tourist traffic. In India, the Ministry of Tourism, under the CSSS Scheme of ‘Incentive to Tour Operators for Enhancing Tourist Arrivals to India’ is extending financial incentives to foreign tour operators, approved by the government. These promotional activities are contributing to the market size of travel and tourism.

Accessibility to remote yet beautiful tourist places and increase in popularity of travel destinations through online platforms has resulted in the tourist industry emerging as one of the key sectors in many countries. According to the U.S. Department of Commerce, International arrivals to the U.S. grew from 19.2 million in 2020 to 22.1 million in 2021. Moreover, the U.S. government is focusing on attracting around 90 million international visitors who are expected to spend approximately US$ 279 Bn annually by 2027. Hence, rise in number of international visitors is estimated to fuel the travel and tourism market.

Surge in Disposable Income

Rise in digital transformation and growth in penetration of the internet are offering emerging opportunities in the travel and tourism market. Online resources provide convenience in booking flight tickets and hotels and searching for places to plan trips.

Increase in disposable income provides a sense of economic stability, in which people tend to spend on leisure activities such as travel. Families are more likely to plan vacations, leading to surge in demand for trips and tourism. The gross national disposable income in India reached US$ 3,182.4 Bn in the financial year 2021-2022, recording a growth of 17.4% compared to the previous year. In the U.S., personal income increased US$ 45.0 billion (0.2% at a monthly rate) in July 2023, according to the Bureau of Economic Analysis. Hence, rise in disposable income is projected to boost the travel and tourism market revenue during the forecast period.

Regional Outlook

According to the latest travel and tourism market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Rise in disposable income and growth in government investment are fueling the market dynamics of the region. Geographical advantages, increase in number of international travelers, and presence of a well-established tourism sector are driving the travel and tourism market statistics in North America.

Analysis of Key Players

Most travel and tourism service providers are offering lucrative tour packages to attract more travelers. They are also investing heavily in promotional activities to increase their travel and tourism market share.

Accor, Adris Grupa d.d., Airbnb, Inc., Balkan Holidays Ltd., Carnival Corporation & plc, Crown Resorts Ltd., G Adventures, Hilton Worldwide Holdings Inc., TUI Group, Travel Leaders Group, LLC, Insight Vacations, and Frosch International Travel, Inc. are key players in the travel and tourism market.

Key Developments

- In August 2023 , G Adventures added two new National Geographic Family Journeys in Italy and Tanzania. The eight-day Tanzania Family Journey is expected to take families on game drives in the Serengeti throughout the tour and include a visit to a community tourism project.

- In July 2023 , TUI Group released a ChatGPT-powered chatbot on its U.K. app, the first of what is expected to be a wave of rollouts that incorporates generative AI into the company’s tech, to help consumers search through its own portfolio of products

- In February 2023 , Adris announced plans to invest US$ 511 Mn in its tourism arm Maistra until 2025 with an aim to boost its luxury segment

Travel and Tourism Market Snapshot

Frequently asked questions, how big was the travel and tourism market in 2022.

It was valued at US$ 615.2 Bn in 2022

What would be the CAGR of the travel and tourism industry during the forecast period?

It is estimated to be 5.3% from 2023 to 2031

How big will the travel and tourism business be in 2031?

It is projected to reach US$ 972.5 Bn by the end of 2031

What are the prominent factors driving demand for travel and tourism?

Rise in government investment in travel and tourism sector and surge in disposable income

Which region is likely to record the highest demand for travel and tourism?

Asia Pacific is anticipated to record the highest demand from 2023 to 2031

Who are the prominent travel and tourism service providers?

Accor, Adris Grupa d.d., Airbnb, Inc., Balkan Holidays Ltd., Carnival Corporation & plc, Crown Resorts Ltd., G Adventures, Hilton Worldwide Holdings Inc., TUI Group, Travel Leaders Group, LLC, Insight Vacations, and Frosch International Travel, Inc.

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Entertainment Market Overview

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Service Provider Analysis

5.8. Global Travel and Tourism Market Analysis and Forecast, 2017 - 2031

5.8.1. Market Value Projection (US$ Bn)

6. Global Travel and Tourism Market Analysis and Forecast, By Type

6.1. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

6.1.1. Leisure

6.1.2. Educational

6.1.3. Business

6.1.4. Sports

6.1.5. Medical Tourism

6.1.6. Others (Event Travel, Volunteer Travel, etc.)

6.2. Incremental Opportunity, By Type

7. Global Travel and Tourism Market Analysis and Forecast, By Application

7.1. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

7.1.1. Domestic

7.1.2. International

7.2. Incremental Opportunity, By Application

8. Global Travel and Tourism Market Analysis and Forecast, By Traveler Type

8.1. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

8.1.1. Solo Traveler

8.1.2. Couple Traveler

8.1.3. Group Traveler

8.2. Incremental Opportunity, By Traveler Type

9. Global Travel and Tourism Market Analysis and Forecast, By Travel Days

9.1. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

9.1.1. Less than 7 Days

9.1.2. 8-15 Days

9.1.3. 16-30 Days

9.1.4. More than 30 Days

9.2. Incremental Opportunity, By Travel Days

10. Global Travel and Tourism Market Analysis and Forecast, By Travel Mode

10.1. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

10.1.1. Travel Packages

10.1.2. Self-catered

10.2. Incremental Opportunity, By Travel Mode

11. Global Travel and Tourism Market Analysis and Forecast, By Booking

11.1. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

11.1.1. Online

11.1.2. Offline

11.2. Incremental Opportunity, By Booking

12. Global Travel and Tourism Market Analysis and Forecast, by Region

12.1. Travel and Tourism Market (US$ Bn), by Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, by Region

13. North America Travel and Tourism Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Demographic Overview

13.4. Key Brand Analysis

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Consumer Buying Behavior Analysis

13.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

13.7.1. Leisure

13.7.2. Educational

13.7.3. Business

13.7.4. Sports

13.7.5. Medical Tourism

13.7.6. Others (Event Travel, Volunteer Travel, etc.)

13.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

13.8.1. Domestic

13.8.2. International

13.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

13.9.1. Solo Traveler

13.9.2. Couple Traveler

13.9.3. Group Traveler

13.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

13.10.1. Less than 7 Days

13.10.2. 8-15 Days

13.10.3. 16-30 Days

13.10.4. More than 30 Days

13.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

13.11.1. Travel Packages

13.11.2. Self-catered

13.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

13.12.1. Online

13.12.2. Offline

13.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

13.13.1. U.S.

13.13.2. Canada

13.13.3. Rest of North America

13.14. Incremental Opportunity Analysis

14. Europe Travel and Tourism Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Demographic Overview

14.4. Key Brand Analysis

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Consumer Buying Behavior Analysis

14.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

14.7.1. Leisure

14.7.2. Educational

14.7.3. Business

14.7.4. Sports

14.7.5. Medical Tourism

14.7.6. Others (Event Travel, Volunteer Travel, etc.)

14.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

14.8.1. Domestic

14.8.2. International

14.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

14.9.1. Solo Traveler

14.9.2. Couple Traveler

14.9.3. Group Traveler

14.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

14.10.1. Less than 7 Days

14.10.2. 8-15 Days

14.10.3. 16-30 Days

14.10.4. More than 30 Days

14.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

14.11.1. Travel Packages

14.11.2. Self-catered

14.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

14.12.1. Online

14.12.2. Offline

14.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

14.13.1. U.K.

14.13.2. Germany

14.13.3. France

14.13.4. Rest of Europe

14.14. Incremental Opportunity Analysis

15. Asia Pacific Travel and Tourism Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Demographic Overview

15.4. Key Brand Analysis

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Consumer Buying Behavior Analysis

15.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

15.7.1. Leisure

15.7.2. Educational

15.7.3. Business

15.7.4. Sports

15.7.5. Medical Tourism

15.7.6. Others (Event Travel, Volunteer Travel, etc.)

15.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

15.8.1. Domestic

15.8.2. International

15.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

15.9.1. Solo Traveler

15.9.2. Couple Traveler

15.9.3. Group Traveler

15.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

15.10.1. Less than 7 Days

15.10.2. 8-15 Days

15.10.3. 16-30 Days

15.10.4. More than 30 Days

15.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

15.11.1. Travel Packages

15.11.2. Self-catered

15.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

15.12.1. Online

15.12.2. Offline

15.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

15.13.1. China

15.13.2. India

15.13.3. Japan

15.13.4. Rest of Asia Pacific

15.14. Incremental Opportunity Analysis

16. Middle East & Africa Travel and Tourism Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Demographic Overview

16.4. Key Brand Analysis

16.5. Key Trends Analysis

16.5.1. Demand Side Analysis

16.5.2. Supply Side Analysis

16.6. Consumer Buying Behavior Analysis

16.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

16.7.1. Leisure

16.7.2. Educational

16.7.3. Business

16.7.4. Sports

16.7.5. Medical Tourism

16.7.6. Others (Event Travel, Volunteer Travel, etc.)

16.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

16.8.1. Domestic

16.8.2. International

16.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

16.9.1. Solo Traveler

16.9.2. Couple Traveler

16.9.3. Group Traveler

16.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

16.10.1. Less than 7 Days

16.10.2. 8-15 Days

16.10.3. 16-30 Days

16.10.4. More than 30 Days

16.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

16.11.1. Travel Packages

16.11.2. Self-catered

16.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

16.12.1. Online

16.12.2. Offline

16.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

16.13.1. GCC

16.13.2. South Africa

16.13.3. Rest of Middle East & Africa

16.14. Incremental Opportunity Analysis

17. South America Travel and Tourism Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Price Trend Analysis

17.2.1. Weighted Average Selling Price (US$)

17.3. Demographic Overview

17.4. Key Brand Analysis

17.5. Key Trends Analysis

17.5.1. Demand Side Analysis

17.5.2. Supply Side Analysis

17.6. Consumer Buying Behavior Analysis

17.7. Travel and Tourism Market (US$ Bn), By Type, 2017 - 2031

17.7.1. Leisure

17.7.2. Educational

17.7.3. Business

17.7.4. Sports

17.7.5. Medical Tourism

17.7.6. Others (Event Travel, Volunteer Travel, etc.)

17.8. Travel and Tourism Market (US$ Bn), By Application, 2017 - 2031

17.8.1. Domestic

17.8.2. International

17.9. Travel and Tourism Market (US$ Bn), By Traveler Type, 2017 - 2031

17.9.1. Solo Traveler

17.9.2. Couple Traveler

17.9.3. Group Traveler

17.10. Travel and Tourism Market (US$ Bn), By Travel Days, 2017 - 2031

17.10.1. Less than 7 Days

17.10.2. 8-15 Days

17.10.3. 16-30 Days

17.10.4. More than 30 Days

17.11. Travel and Tourism Market (US$ Bn), By Travel Mode, 2017 - 2031

17.11.1. Travel Packages

17.11.2. Self-catered

17.12. Travel and Tourism Market (US$ Bn), By Booking, 2017 - 2031

17.12.1. Online

17.12.2. Offline

17.13. Travel and Tourism Market (US$ Bn) Forecast, By Country, 2017 - 2031

17.13.1. Brazil

17.13.2. Rest of South America

17.14. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Revenue Share Analysis (%), (2022)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Accor

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. Adris Grupa d.d.

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. Airbnb, Inc.

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. Balkan Holidays Ltd.

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. Carnival Corporation & plc

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. Crown Resorts Ltd.

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. G Adventures

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Hilton Worldwide Holdings Inc.

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. TUI Group

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. Travel Leaders Group, LLC

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

18.3.11. Insight Vacations

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Revenue

18.3.11.4. Strategy & Business Overview

18.3.12. Frosch International Travel, Inc.

18.3.12.1. Company Overview

18.3.12.2. Sales Area/Geographical Presence

18.3.12.3. Revenue

18.3.12.4. Strategy & Business Overview

18.3.13. Other Key Players

18.3.13.1. Company Overview

18.3.13.2. Sales Area/Geographical Presence

18.3.13.3. Revenue

18.3.13.4. Strategy & Business Overview

19. Go To Market Strategy

19.1. Identification of Potential Market Spaces

19.2. Understanding Procurement Process of Customers

19.3. Preferred Sales & Marketing Strategy

19.4. Prevailing Market Risks

List of Tables

Table 1: Global Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 2: Global Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 3: Global Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 4: Global Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 5: Global Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 6: Global Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 7: Global Travel and Tourism Market Value (US$ Bn) Projection By Region 2017-2031

Table 8: North America Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 9: North America Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 10: North America Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 11: North America Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 12: North America Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 13: North America Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 14: North America Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 15: Europe Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 16: Europe Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 17: Europe Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 18: Europe Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 19: Europe Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 20: Europe Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 21: Europe Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 22: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 23: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 24: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 25: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 26: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 27: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 28: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 29: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 30: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 31: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 32: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 33: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 34: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 35: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

Table 36: South America Travel and Tourism Market Value (US$ Bn) Projection By Type 2017-2031

Table 37: South America Travel and Tourism Market Value (US$ Bn) Projection By Application 2017-2031

Table 38: South America Travel and Tourism Market Value (US$ Bn) Projection By Traveler Type 2017-2031

Table 39: South America Travel and Tourism Market Value (US$ Bn) Projection By Travel Days 2017-2031

Table 40: South America Travel and Tourism Market Value (US$ Bn) Projection By Travel Mode 2017-2031

Table 41: South America Travel and Tourism Market Value (US$ Bn) Projection By Booking 2017-2031

Table 42: South America Travel and Tourism Market Value (US$ Bn) Projection By Country 2017-2031

List of Figures

Figure 1: Global Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 2: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 3: Global Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 4: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 5: Global Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 6: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 7: Global Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 8: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 9: Global Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 10: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 11: Global Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 12: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 13: Global Travel and Tourism Market Value (US$ Bn) Projection, By Region 2017-2031

Figure 14: Global Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Region 2023-2031

Figure 15: North America Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 16: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 17: North America Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 18: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 19: North America Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 20: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 21: North America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 22: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 23: North America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 24: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 25: North America Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 26: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 27: North America Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 28: North America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 29: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 30: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 31: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 32: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 33: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 34: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 35: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 36: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 37: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 38: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 39: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 40: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 41: Europe Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 42: Europe Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 43: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 44: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 45: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 46: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 47: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 48: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 49: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 50: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 51: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 52: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 53: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 54: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 55: Asia Pacific Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 56: Asia Pacific Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 57: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 58: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 59: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 60: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 61: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 62: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 63: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 64: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 65: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 66: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 67: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 68: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 69: Middle East & Africa Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 70: Middle East & Africa Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Figure 71: South America Travel and Tourism Market Value (US$ Bn) Projection, By Type 2017-2031

Figure 72: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Type 2023-2031

Figure 73: South America Travel and Tourism Market Value (US$ Bn) Projection, By Application 2017-2031

Figure 74: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Application 2023-2031

Figure 75: South America Travel and Tourism Market Value (US$ Bn) Projection, By Traveler Type 2017-2031

Figure 76: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Traveler Type 2023-2031

Figure 77: South America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Days 2017-2031

Figure 78: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Days 2023-2031

Figure 79: South America Travel and Tourism Market Value (US$ Bn) Projection, By Travel Mode 2017-2031

Figure 80: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Travel Mode 2023-2031

Figure 81: South America Travel and Tourism Market Value (US$ Bn) Projection, By Booking 2017-2031

Figure 82: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Booking 2023-2031

Figure 83: South America Travel and Tourism Market Value (US$ Bn) Projection, By Country 2017-2031

Figure 84: South America Travel and Tourism Market, Incremental Opportunities (US$ Bn), Forecast, By Country 2023-2031

Download FREE Sample!

Get a sample copy of this report

Your personal details are safe with us. Privacy Policy*

Get a copy of Brochure!

Copyright © Transparency Market Research, Inc. All Rights reserved

Trust Online

Report Description

Table of content, competitive landscape, methodology.

- Consumer Goods

- Travel & Luxury Travel

- Tourism Market Size, Share, Growth & Industry Trends [2032]

Tourism Market

Segments - by Travel Days (Within 7 Days, More Than 15 Days, and 7-15 Days), Travel Type (Business Spending and Leisure Spending), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Global Industry Analysis, Growth, Share, Size, Trends, and Forecast 2024–2032

Debadatta Patel

Fact-checked by:

Partha Paul

Tourism Market Outlook 2032

The global tourism market size was USD 12.4 Trillion in 2023 and is projected to reach USD 23.1 Trillion by 2032 , expanding at a CAGR of 5.4% during 2024–2032 . The market growth is attributed to the increasing standard of living and mobility. Increasing global mobility and disposable income are expected to boost the market. Tourism offers immense opportunities for economic growth and job creation as one of the world's largest economic sectors. It generates revenue, fosters cultural exchange, promotes peace, and helps preserve natural and cultural heritage.

Rising popularity of experiential tourism is projected to signify a shift in consumer preferences from traditional sightseeing to immersive experiences. Today's tourists seek authentic, personalized experiences that allow them to connect with local cultures, learn new skills, and gain a deeper understanding of their destinations. This trend is driving innovation in the tourism industry, with businesses developing unique offerings to cater to these evolving demands.

Impact of Artificial Intelligence (AI) in Tourism Market