Travel Insurance Vietnam

Travel insurance for vietnam.

Ah, Vietnam – a vibrant chaos of scooters zipping around, ancient temples that have seen it all, and greenery that makes you feel like you're in a nature hug. This Southeast Asian gem isn't just about rich culture and history – it's also the kingdom of adventures and, of course, the land of the mighty pho. Before you kick off your shoes and wade into the wonders of Vietnam, let's talk about practical matters. While Vietnam's known for the stunning Ha Long Bay and its gregarious people, it's also a place where even the savviest traveler might hit a speed bump. Let's dive into the everything you need to know abouet travel insurance for Vietnam so you can face unexpected travel hiccups with confidence.

- What should your Travel insurance cover for a trip to Vietnam?

- How does Travel Insurance work for Vietnam?

- Do I need Travel Insurance for Vietnam?

- How much does Travel Insurance cost for Vietnam?

- Our Suggested AXA Travel Protection Plan

What Types of Medical Coverage Do AXA Travel Protection Plans Offer?

Are there any covid-19 restrictions for travelers to vietnam.

- Traveling with pre-existing Medical Conditions?

What should your travel insurance cover for a trip to Vietnam?

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Vietnam.

How does Travel Insurance for Vietnam work?

Imagine: you're on a motorbike adventure through the winding roads of Dalat. Suddenly, an unexpected slip or a minor mishap occurs, and you find yourself in need of medical attention. Here's where an AXA Travel Protection plan steps in with its "Emergency Medical Expenses" benefit. From hospital stays to doctor's fees, AXA can support and assist so you're not left navigating the complications of the Vietnamese healthcare system. Moreover, if the situation takes a serious turn and requires evacuation to the nearest medical facility or even repatriation, AXA Travel Protection's got your back. Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits:

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Additional Optional Travel Benefits:

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I need Travel Insurance for Vietnam?

Although it's not required to have travel insurance for Vietnam, we highly recommend that travelers think about getting an insurance plan to make sure they stay well-protected during their visit. Why? There are several reasons:

Medical Emergencies: Given the adventurous activities in Vietnam, the potential for minor mishaps or unexpected health issues is notable. Having coverage for emergency medical expenses ensures that you can seek necessary medical attention without worrying about the financial burden.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Emergency Evacuation & Repatriation: While Vietnam's healthcare has improved through the years, the quality of healthcare in more rural or remote areas may not be as advanced. In the event of a serious medical emergency, having coverage for emergency evacuation to the nearest suitable medical facility or repatriation becomes crucial.

How much does Travel Insurance cost for Vietnam?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Ecuador will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Vietnam hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. Travelers to Vietnam may want extra coverage. The Platinum Plan is a good choice for travelers who want a bit of extra coverage. Cancel for Any Reason is an option that offers coverage for canceling a trip for any reason. The Collision Damage Waiver coverage is also optional. It covers collisions, theft or damage to a rental car being used during your Vietnam trip.

AXA covers three types of medical expenses:

- Emergency medical expenses

- Emergency evacuation & repatriation

- Non-medical emergency evacuation & repatriation

Emergency Medical: Can cover medical expenses, hospital stays, and even emergency evacuations, covering the expenses of hefty bills and ensuring access to quality healthcare while away from home.

Emergency Evacuation and Repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: Offers assistance in unexpected situations such as political unrest or natural disasters, ensuring safe and timely relocation to a secure location or repatriation back home.

Starting in 2023, travelers heading to Vietnam no longer have to show a valid Covid-19 vaccine card or a negative PCR test. The travel restrictions in Vietnam have been lifted, making the entry process simpler for all travelers.

Traveling with pre-existing Medical Conditions?

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1. Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2. When should I buy Travel Insurance to Vietnam?

Purchasing travel insurance for your trip is advisable as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14 days of making your initial trip deposit.

3. Do Americans need travel insurance in Vietnam?

While travel insurance is not a mandatory requirement for Americans visiting Vietnam, it is highly recommended. Travel insurance can provide financial protection and assistance in case of unexpected events such as medical emergencies, trip cancellations, lost luggage, or other travel-related issues.

4. What is needed to visit Vietnam from the USA?

For a trip to Vietnam, US citizens need a visa for tourism or business, obtainable from the Vietnamese Embassy in the US or through a single-entry e-visa on the Vietnam Immigration website. Make sure your passport is valid for at least six months beyond your intended stay and has at least one blank visa page.

5. What happens if a tourist gets sick in Vietnam?

If you become sick in Vietnam, travelers with AXA Travel protection can contact the AXA Assistance hotline at 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

Vietnam Jack

Travel and discover the best things to do in Vietnam!

Vietnam Travel Insurance Guide: Top 5 Insurance Options for Your Trip

Embarking on a journey to Vietnam, with its captivating landscapes and rich cultural tapestry, is an adventure filled with excitement and discovery. Ensuring a safe and worry-free experience involves choosing the right travel insurance. From comprehensive coverage to specific needs for exploring Vietnam, this guide explores the best travel insurance options, providing peace of mind for every traveler’s unique journey.

1. World Nomads: Comprehensive Coverage

World Nomads stands out as a top choice for adventurous travelers exploring Vietnam’s diverse terrains. Offering extensive coverage for medical emergencies, trip cancellations, and adventure activities like trekking and motorcycling, it caters to the thrill-seekers. Their flexible policies and user-friendly online platform make it easy for travelers to customize plans based on their specific needs. With 24/7 customer support and a reputation for reliability, World Nomads ensures that adventurers can explore Vietnam with confidence.

2. Allianz Global Assistance: Versatile Coverage for Every Traveler

Allianz Global Assistance provides versatile coverage suitable for a range of travel styles, making it an excellent choice for Vietnam-bound tourists. Their comprehensive plans include coverage for medical emergencies, trip interruptions, and baggage loss. Allianz offers a user-friendly online interface for easy policy management and claims processing. With a global network of medical providers and assistance services, travelers can trust Allianz to provide reliable support throughout their journey in Vietnam.

3. AXA Assistance: Tailored Coverage with Global Support

AXA Assistance offers tailored travel insurance with a global support network, making it a reliable choice for Vietnam-bound travelers. Their plans cover a spectrum of needs, including medical emergencies, trip cancellations, and baggage protection. AXA Assistance’s emphasis on customer service ensures that travelers have access to assistance whenever needed. With a user-friendly online platform for policy management and claims, AXA Assistance provides a seamless experience for those prioritizing personalized coverage and global support.

4. Travel Guard: Customizable Plans for Personalized Protection

Travel Guard, powered by AIG, provides customizable travel insurance plans to suit individual preferences and needs. Their coverage includes medical expenses, trip disruptions, and comprehensive protection against unexpected events. With flexible options for coverage enhancements, travelers can tailor their policies for specific activities or preferences. Travel Guard’s commitment to customer satisfaction, coupled with its global presence, ensures that Vietnam-bound tourists have access to personalized protection for a worry-free exploration.

5. SafetyWing: Affordable and Flexible Coverage

For budget-conscious travelers seeking reliable coverage, SafetyWing emerges as an affordable and flexible option. With comprehensive medical insurance, SafetyWing is a practical choice for those exploring Vietnam on a budget. Their policies are available to travelers of all nationalities, and the coverage extends even during brief returns to the home country. SafetyWing’s affordability and flexibility make it an attractive option for those prioritizing financial considerations without compromising on essential coverage .

Choosing the Right Travel Insurance: Considerations and Tips

Selecting the best travel insurance for Vietnam involves considering factors like coverage for medical emergencies, trip cancellations, and specific activities such as adventure sports. Assess your individual needs, duration of stay, and the type of activities you plan to engage in. Read policy details carefully. Additionally, consider the ease of claims processing and customer support. Comparing quotes and reviews can guide you in making an informed decision tailored to your travel requirements.

Conclusion: Safeguarding Your Vietnam Adventure

Choosing the best travel insurance for your Vietnam adventure ensures a safety net for unforeseen circumstances. Whether you’re exploring off-the-beaten-path destinations or immersing yourself in cultural experiences, reliable coverage from providers like World Nomads, Allianz Global Assistance, SafetyWing, AXA Assistance, and Travel Guard ensures you can focus on creating lasting memories with peace of mind.

Featured Image: View of Hanoi at Night | Photo by Quang Nguyen Vinh

- Ho Chi Minh City

- Planning A Trip

All-in-one Guide to Travel Insurance For Your Vietnam Trip

- 1. Why Would I Need Insurance?

- 2. What Types Of Insurances Are There?

- 3. Insurance Plan

- 4. When To Get Your Insurance

- 5. Where To Start Looking For Travel Insurance

In many countries, purchasing and showing proof of a purchase for a travel insurance is a must as you apply for your travel documents. As you get a visa for Vietnam, you are not required to present one. But do you need one? The answer is YES, you will greatly benefit from a wisely picked travel insurance. And how to figure out which one is the best in the pool of insurance offered? We will tell you right now.

Why Would I Need Insurance?

You can just skip this section if you already know how important it is to get travel insurance. For those who are still skeptical, read on.

This is not to say Vietnam is an unsafe place to visit, but that anything can happen and it is better you get yourself prepared. Getting insurance sometimes will save you thousands of dollars, but in the least it gives you peace of mind. You know you are protected to a certain extent.

What Types Of Insurances Are There?

Thanks to Vietnam’s readily available tourism activities, you will find yourself anywhere from flying, taking cruise trips, staying at a high end resort, going kayaking on the bay or even simply crossing the streets. Fun as they may sound, some may be more prone to risk than others.

Currently in the insurance market, there is both individual and comprehensive plan for you to choose from: flight and trip cancellation insurance, travel health insurance, medical evacuation insurance, baggage coverage insurance, excess valuation, to name a few. Depending on your particular trip and preference, you may find one that best suits your interest.

How much your insurance will cost you will depend on the number of days you travel, the destination you will be travelling (Vietnam is generally listed as a safer place, and costing less money for insurance, some other countries), and the types that you choose.

Below is a closer look at the different types of insurance:

Trip cancellation.

If you book your flight with, Expedia or Orbitz or even directly from the airlines website such as Air Asia, chances are that you will be asked whether you want to purchase a flight or trip cancellation insurance. Unless you are 100% sure that you will make it for the trip, it may be wise to purchase one. This flight cancellation insurance starts from $13 and will be an excellent deal in case your flight or trip gets cancelled.

Flight Insurance

Baggage Insurance

You won’t be a happy traveler as you land and find out that you lost your baggage or your 2 trolleys were totally damaged. Most airlines will provide only hefty reimbursement in case of lost luggage. Baggage insurance will be necessary if you travel long distance.

Travel Health Insurance

Your national health care insurance will not cover your trip to Vietnam in particular. The Australian Reciprocal Medicare Agreement only entitle Australian nationals to get discounted treatment while in the UK, New Zealand, Sweden, Italy, among others, but Vietnam is not currently on the list. Canadians with OHIP coverage will too bear the full cost of medical expense while abroad. For US citizens, some private health insurance may cover basic needs for your travel but no company will assist you to evacuate or repatriate back to the homeland with your existing plan. With the evacuation or medication pack, you will be aided in case of injury or death and flown back to your home country. The annual premium starts from $250.

Other insurances available for your consideration are: Adventure travel, Credit card coverage, extreme sports insurance, to name a few.

Insurance Plan

Instead of going with individual coverage you may also purchase insurance plan:

Vacation plan

This is the most popular type of all travel insurance. Vacation plan includes trip cancellation or interruption, medical emergencies, loss or delays of luggage, and some over coverage depending on the insurance providers.

Specialty plan

This includes evacuation plans, accident plans, which cover the emergency evacuation and often-sold on annual basis. The insurance will cover transport and any emergency medial costs associated with the occurrence while you are abroad.

Travel medical plan

When To Get Your Insurance

It is best to get your travel insurance as you start your booking process: reserving a flight ticket, making deposit for a package tour to Vietnam or paying for your cruise trips.

Where To Start Looking For Travel Insurance

Below are some of the more prestigious travel insurance providers by countries:

Canada: Travel Guard, Kanetix (www.kanetix.ca), Manu Life (www.manulife.ca), RBC (http://www.rbcinsurance.com/travelinsurance/index.html)

US: Travel Guard, (http://www.travelguard.com)

UK: travel guard, Tesco Bank, Barclay (www.barclays.co.uk)

Australia: Travel guard, World Nomad, Travel Insurance Cover (www.travelinsurancecover.com.au)

Latest Travel Alerts & Updates for Vietnam

Can I travel to Vietnam right now? What are the requirement? When can I expect to be allowed to travel to Vietnam? Find answers to these questions with our frequently updated travel alerts.

Best Time to Visit Vietnam: When to Go & What to Expect

"When is the best time to visit Vietnam" is one of the most common questions that spring up to mind for all trip planners. Overall the golden time to visit the country is March-May and October-early December.

What $1 Can Buy in Vietnam

Although the cost of living has risen tremendously in Vietnam in recent years, you can still to live by with few dollars per day in your pocket. Below is a quick summary of what a dollar can be worth in various cities in Vietnam.

Featured Streets

Hang Thung - Street Of Buckets

Hang Bac - Street Of Silver

Hang Tre - Street Of Bamboos

Meet our experts.

Suggested Holiday Packages

Travel Insurance for Vietnam: Why It’s Essential

When exploring Vietnam’s stunning landscapes, bustling cities, and vibrant culture, it’s easy to overlook the importance of being prepared for the unexpected. From health emergencies to travel disruptions, unforeseen events can quickly turn an exciting adventure into a stressful situation .

Fortunately, travel insurance offers peace of mind, ensuring that help is just a phone call away when you need it most . Securing your insurance policy is your first, and most important step in planning a safe and worry-free journey.

Do I Need Travel Insurance in Vietnam?

While travel insurance isn’t a must, it’s definitely a smart choice. From handling unexpected medical needs to keeping your trip smooth despite the hiccups—why not stay covered? Click here to check out our suite of hassle-free travel insurance options.

Here are a few reasons why travel insurance in Vietnam is highly recommended:

Medical Emergencies

Vietnam’s healthcare system may not offer the same level of care that travelers are used to in their home countries. Having travel insurance ensures access to quality medical treatment and covers associated costs.

Emergency Evacuations

In severe cases where medical care exceeds local capabilities, travel insurance can cover the cost of emergency medical evacuations and repatriation.

Trip Interruptions

Unforeseen events like flight cancellations, delays, or interruptions can lead to financial losses. Travel insurance can provide protection against these types of disruptions.

Personal Safety

Theft or loss of belongings can occur while traveling. Insurance can offer coverage for personal belongings and liability protection.

What Should Your Travel Insurance Cover for a Trip to Vietnam?

To ensure you are fully protected, your Travel Insurance should include the following:

1. Medical Coverage

Illnesses or injuries can occur at any time. Insurance helps cover hospital stays, medication, and emergency medical expenses.

2. Coverage for Personal Belongings

Theft or accidental damage of your belongings is always possible. Insurance helps replace lost or stolen items.

3. Personal Liability Coverage

In the case of accidental damage to property or injury to others, personal liability insurance can help cover legal fees and compensation.

4. Trip Cancellation & Interruptions

Circumstances beyond your control might require you to cancel or delay your trip. Insurance covers non-refundable costs and rebooking expenses.

5. Emergency Evacuations & Repatriation

In critical medical situations, the insurance plan may provide for evacuation to the nearest medical facility and, if necessary, repatriation.

Protection Against the Unexpected

Imagine this: you’re exploring the lush rice fields and landscapes of Sapa when you unexpectedly slip and severely injure your leg. The pain is unbearable, and you know you need immediate medical attention.

Fortunately for you.. you have travel insurance!

You call your insurance provider, and they quickly arrange for a helicopter to take you to a reputable hospital in Hanoi. At the hospital, your insurance covers all the medical costs, from emergency care to surgery and rehabilitation, so that you can focus on your recovery.

Unfortunately, your injury means you can’t continue your journey. Thankfully, your travel insurance covers the cost of your interrupted trip, reimbursing you for any unused travel expenses. If the situation had been worse, your insurance would have arranged for emergency evacuation to your home country, ensuring you get the care you need.

“If you can’t afford travel insurance, you can’t afford to travel”

Shane Dillon – Tenzing Pacific Country Manager Vietnam

See what Shane says about travel insurance in Vietnam

How Much Is Travel Insurance in Vietnam?

The cost of travel insurance in Vietnam can vary based on:

- Duration of Trip: Longer trips generally have higher premiums.

- Coverage Limits: Plans with higher coverage limits are typically more expensive.

- Age of Traveler: Premiums tend to increase with the age of the traveler.

- Type of Coverage: Comprehensive plans that cover a broader range of scenarios cost more than basic policies.

Frequently Asked Questions

No, but it’s strongly advised due to potential risks.

Yes, you can purchase travel insurance after booking your flight. However, it’s best to secure insurance as soon as possible to cover unforeseen events that may occur before your departure.

Buy insurance as soon as your trip is confirmed to cover potential cancellations or disruptions.

If you fall ill, you should seek medical assistance. Your travel insurance can help cover the medical costs and arrange for evacuation if necessary.

Seek immediate medical attention, and contact your insurance provider for guidance on the next steps, including claims and medical coverage.

The process varies by provider. Your first step should be to contact your insurance provider’s emergency hotline. They will guide you through the claims process, and you’ll need to provide supporting documentation like medical reports and receipts.

Some policies include natural disaster coverage. Check your policy details to understand the extent of your coverage.

Yes, some insurance policies have age restrictions or limitations for pre-existing medical conditions. Check the specific policy details to understand the limitations and any potential exclusions.

Adventure activities may be covered, but they often come with specific limitations or exclusions. Review the policy carefully to understand which activities are covered and if additional coverage is required.

If your policy includes trip cancellation coverage, you may be reimbursed for non-refundable expenses in the event of unforeseen circumstances like illness, death in the family, or natural disasters. Review your policy for specific details.

Yes, many travel insurance policies include coverage for lost or delayed luggage, along with compensation for essential items you may need while your luggage is missing. Other inconveniences like missed flights and delays are also often covered.

Travel Insurance: Ideal for short-term trips, covering risks like trip cancellations, lost luggage, flight delays, and emergency medical expenses while traveling.

Health Insurance: Best for long-term stays or living abroad, covering regular medical treatments, preventive care, and long-term health needs.

Choose travel insurance for short trips and health insurance for extended stays or ongoing medical coverage.

- Single-Trip Policies: Cover a specific trip, lasting from a few days to several months.

- Multi-Trip or Annual Policies: Cover multiple trips within a year, usually 30 to 90 days per trip.

- Long-Term Travel Insurance: Covers extended travel up to 12 months or more.

Check policy terms to ensure they match your travel duration and needs.

55 Ta Hien, Thanh My Loi Ward, Thu Duc City, Ho Chi Minh City, Vietnam © 2024 Vietnam Is Awesome. All rights reserved. Terms of use | Privacy Policy Call Us: +84 98 1212 484

- No products in the cart.

Vietnam Travel Insurance: The best guide before you go

Should I need Vietnam travel insurance ? What are the benefits that I got? In this post, Prime Trave l will help you address all your concerns about travel insurance when visiting Vietnam, ensuring you have the safest and most enjoyable trip.

Why do you need travel insurance in Vietnam?

Do you really need to purchase travel insurance? If not, what are the disadvantages? Here are some several reasons:

- Vietnam has a different health care system than your home country. You may not be able to access the same quality of care or facilities that you are used to. And you also may have to pay upfront for medical services, which can be expensive and difficult to claim back from your regular health insurance.

- Vietnam has various natural and man-made hazards that could affect your travel plans. You could encounter typhoons, floods, landslides, fires, civil unrest, terrorism, or crime. These could cause injuries, damages, delays, or cancellations that could cost you a lot of money and stress.

- You need to meet strict entry requirements, such as visa, passport, vaccination.

- Vietnam has different laws and customs than your home country. You may not be aware of some of the rules or regulations that apply to you as a visitor. You could unknowingly break the law or offend the local culture and face legal consequences or social backlash.

Why do you need Vietnam travel insurance ? ( Source: Internet )

Read more>>> How to apply Vietnam E-visa 2023

What does travel health insurance in Vietnam cover?

Each Vietnam travel medical plan varies just as each trip and traveler varies. A travel medical insurance plan for Vietnam can be purchased as a standalone plan or as a part of a comprehensive travel insurance plan. A comprehensive travel insurance policy offers coverage for various travel-related expenses, such as cancellation, lost baggage, or delays.

Travel insurance provides a safe experience for travelers ( Source: Internet )

Some common coverages to consider for a trip to Vietnam include:

- Motorcycle/Motorbike travel insurance

- Coverage for pre-existing conditions (obtaining a waiver for the condition before traveling)

- Emergency Medical Evacuation

- Accidental Death & Dismemberment

Read more>>> Things to do in Hanoi

What do Vietnam travel insurance not include ? ( Source: Internet )

There are a few eventualities a standard travel insurance policy is unlikely to cover, including:

- Pre-existing conditions: Make sure you declare any pre-existing medical conditions to your provider when you buy your policy, otherwise you won’t be covered.

- Drugs or alcohol: But be aware that if your belongings are stolen or you’re injured while you’re under the influence, you might find your insurance provider won’t pay out.

- Natural disasters: Vietnam’s long coastline makes it prone to storms and flooding, particularly in the cyclone season from May to November. While it’s unlikely that extreme weather will affect your trip, it’s worth knowing that you may not be covered if it does.

- Terrorism: Vietnam doesn’t have a history of terrorist attacks, but it still pays to be vigilant. Although your travel insurance will cover the cost of any medical care you might need following an attack, it won’t cover much else.

How much is travel insurance to Vietnam?

The price of Vietnam travel protection can vary depending on the age, health status, and number of travelers being covered, as well as the duration of the trip and type of coverage.

Tourists experience boat rowing on Trang An ( Source: Internet )

As risk involved with the trip increases, prices may also increase. For example, a trip to Vietnam that lasts one week may cost less than a two-week trip, even if the type of coverage is the same, due to the extended length of the trip. Additionally, a traveler with pre-existing health conditions can usually expect to pay higher rates than a traveler who does not have any diagnosed pre-existing conditions.

In general, the cost of purchasing travel insurance in Vietnam for foreigners will range from $40 to $80 for a trip lasting from 7 to 10 days in Vietnam.

Read more>>> Vietnam trip cost for Australian

How to choose the best travel insurance in Vietnam?

There are many travel insurance providers and plans available for Vietnam, but not all of them are suitable for your needs. Here are some tips on how to choose the best travel insurance in Vietnam:

- Compare different plans and providers online. You can use websites like: Chubs, Luma, or Care to compare different features, benefits, prices, and reviews of various travel insurance plans and providers for Vietnam.

- Check the coverage limits and exclusions. Make sure that the plan you choose covers you adequately for the risks you face in Vietnam. For example, if you plan to ride a motorbike in Vietnam, make sure that your plan covers motorbike accidents.

- Check the customer service and claims process. Make sure that your provider has a reliable and accessible customer service team that can assist you 24/7 in case of an emergency. Also check how easy and fast it is to file and settle a claim with your provider.

How to choose the best travel insurance in Vietnam ? ( Source: Internet )

Read more>>> Top 5 best Vietnamese traditional food

How to use travel insurance in Vietnam?

Using travel insurance in Vietnam is simple and straightforward if you follow these steps:

- Keep your policy documents and certificate of insurance handy at all times. You may need to show them at the airport or immigration checkpoints when entering or leaving Vietnam.

- Contact your provider or their assistance company as soon as possible if you encounter any emergency or problem during your trip. They will guide you on what to do next and how to access their network of medical providers or other services.

- Keep all receipts and evidence related to your claim. You may need to submit them along with a completed claim form to your provider within a certain time frame after your trip.

- Enjoy your trip with peace of mind knowing that you are covered by travel insurance in Vietnam.

Tips for using travel insurance ( Source: Internet )

Read more>>> Hanoi street food – Top 10 delicious dishes

How to buy travel insurance in Vietnam?

Buying travel insurance in Vietnam is easy and convenient with online platforms. You can follow these steps to buy travel insurance in Vietnam online:

- Visit one of the websites mentioned above or search for other reputable online travel insurance providers for Vietnam.

- Enter your personal details and travel information, such as your name, age, nationality, destination, duration, and purpose of travel.

- Choose the plan that suits your needs and budget from the options available.

- Review the policy details and terms and conditions carefully before confirming your purchase.

- Pay securely online with your credit card or other payment methods.

- Receive your policy documents and certificate of insurance instantly by email.

Capturing best moment with safe journey in Vietnam ( Source: Internet )

You can also choose to purchase travel insurance directly in your home country through travel companies. Additionally, if you have already arrived in Vietnam, you can consider buying it from providers like Liberty , Chubb , etc….

Read more>>> Top 5 best tours in Hanoi

To conclude, travel insurance is not mandatory when traveling to Vietnam, but considering its various uses and benefits, it’s something you should contemplate purchasing. With the information shared by Prime Travel above, it is hoped that it will give you a detailed understanding of this type of travel insurance.

Check out Prime Travel’s tours here:

Dinner with Locals

Authentic Vietnamese coffee workshop

Best of Vietnam from North to South

primetravel

Political Situation in Vietnam: Safety Tips for Travelers

Vietnam weather in december: a traveler’s guide to the best trip.

Leave a Reply: Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Please Sign In

You don't have permission to register.

- Destinations

Vietnam Travel Insurance Requirements

Last updated: 03/07/2024

Effective May 15, 2022, Vietnam lifted all Covid-19 travel requirements, including mandatory travel insurance. With that said, these entry rules are subject to change at any time, and all travelers heading to Vietnam should confirm the latest entry requirements prior to departing for their trip.

Squaremouth’s Vietnam Travel Insurance Recommendations

In addition to a policy with Emergency Medical coverage with at least $50,000 in coverage, Squaremouth recommends a policy with at least $100,000 in Medical Evacuation coverage. Travelers who are visiting more remote areas of Vietnam should consider a policy with at least $100,000 of Emergency Medical and $250,000 in Medical Evacuation coverage, due to the potential for increased medical costs.

Emergency Medical coverage can offer reimbursement for treatment due to an unforeseen illness or injury, and typically includes treatment for contracting Covid-19. The Medical Evacuation benefit can provide reimbursement for costs associated with transportation costs associated with a traveler getting to the nearest adequate medical facility.

For travelers with prepaid and non-refundable trip costs, Squaremouth recommends the Trip Cancellation benefit, which can reimburse up to 100% of covered trip costs if a traveler has to cancel their trip before they’ve left. Typical reasons include an unforeseen illness or injury, death, inclement weather, or terrorism. Canceling from testing positive for Covid-19 is typically covered, as well.

Policies with Trip Cancellation coverage typically includes Trip Interruption. This benefit can cover a traveler’s unused, prepaid, non-refundable trip expenses if a person’s trip gets interrupted for a covered reason such as illness or injury, flight delays, or a natural disaster. If a traveler needs to cut their trip short, this benefit can also cover additional transportation expenses incurred to return home.

Vietnam Travel Insurance Trends and Data

Vietnam boasts delicious food, gorgeous hikes, and the world’s largest cave. Travelers also love to experience the limestone towers at Halong Bay.

Destination Rank: 19

Percentage of Squaremouth Sales: 1.23%

Average Premium: $269.97

Average Trip Cost: $3,665.63

Squaremouth Analytics compares thousands of travel insurance policies purchased pre- and post-pandemic to identify changes and trends in the travel insurance industry.

Helpful Resources

- Vietnam State Department Information

- Vietnam Travel Information

Available Topic Experts for Media:

Squaremouth's destination information is free and available for use within your reporting. Please credit Squaremouth.com for any information used.

Squaremouth's topic experts are on hand to answer your questions. Contact a member of our team for media inquiries about Squaremouth Analytics or to schedule an interview.

Steven Benna, Lead Data Analyst: [email protected]

We're here to help!

Have questions about travel insurance coverage? Call us! 1-800-240-0369 Our Customer Service Team is available everyday from 8AM to 10PM ET.

For your holidays in Vietnam and abroad

Who wouldn’t want to take in the beautiful green hills or wind down on the serene beaches? You get this and much more when visiting Vietnam. It is one of the most popular travel destinations with a rich history, breathtaking scenery, and vibrant culture. The country's beauty is among the significant reasons people from all over the world visit Vietnam. The friendly locals and the distinctive culture are also the reasons traveling to this country is exciting.

Staples of the Country

The stunning, unmatched nature of Vietnam is what attracts many travelers to this country. The astonishing Mekong Delta rover and the lush rice fields spread in the north are some must-see experiences. Another great thing about Vietnam is that it is filled with ancient traditions and history. You can't miss exploring the many world heritage sites in the country, including Cham Islands, Hoi An Ancient Street, Phon Nha Ke Bang Caves, and Halong Bay. The beautiful beaches are a wonderful place to relax and are surprisingly less crowded compared to the beaches in other countries. Trying authentic cuisine in this country is also something you won't want to miss. It is not just tasty but also healthy whether you eat at a fancy restaurant or from a food street stall.

Does Vietnam Require Travel Insurance?

All visitors entering Vietnam are required to have travel insurance with a minimum of $10,000. It is wise to purchase a complete travel insurance policy because of the unpredictable nature of traveling internationally. It is best to select the travel insurance plan that meets your unique requirements and concerns, including trip cancellation, illness, baggage and personal effects, flight disruptions, and delays.

Vietnam FAQ

What type of vaccinations are required to visit.

CDC recommends travelers visiting Vietnam must have the following vaccinations:

- Chickenpox (Varicella)

- Measles-Mumps-Rubella (MMR)

- Flu (influenza)

- Diphtheria-Tetanus-Pertussis

- Japanese Encephalitis

- Hepatitis A

- While COVID-19 vaccination isn’t required, it is highly recommended if you are traveling to different countries.

Does Vietnam require International Medical Coverage?

All travelers are required to have travel insurance that includes emergency medical coverage worth a minimum of $10,000.

Where is the U.S. Embassy in Vietnam?

The U.S. Embassy is in Hanoi, Vietnam. You can head to the embassy or contact them via phone or website.

What is the best time of year to visit Vietnam in terms of weather, crowds, and cost?

The best time to visit Vietnam to enjoy pleasant weather is between November and April. July to August is usually the peak season, and the cost is high for everything. You will also find larger crowds during the peak season.

What is the local currency of Vietnam and its exchange rate for USD?

The local currency of Vietnam is the Vietnamese Dong. You can get over 23,524 Dong for only 1 USD.

Are credit cards widely accepted in Vietnam? If yes, which ones?

Axa already looks after millions of people around the world.

With our travel insurance we can take great care of you too

Travel insurance for Vietnam – 5 Tips & Recommendations

- Travel tips

Traveling to Vietnam is an exciting adventure, but it’s essential to be prepared for unexpected events by having the right travel insurance. This comprehensive guide will provide you with tips and recommendations to ensure you have the best coverage for your trip. From understanding the legal requirements to navigating the complexities of motorbike travel, we’ve got you covered.

Travel insurance for Vietnam

Travel insurance is a crucial aspect of any trip, providing financial protection and peace of mind against unforeseen circumstances. Whether it’s a medical emergency, trip cancellation, or loss of belongings, having the right insurance can make a significant difference. In this article, we will explore the importance of travel insurance for Vietnam, discuss mandatory requirements, and provide valuable tips and recommendations to ensure you’re adequately covered.

Is travel insurance mandatory for Vietnam?

While Vietnam does not legally require travelers to have travel insurance, it is highly recommended. Although you can enter the country without proof of insurance, having coverage is essential for handling medical emergencies, accidents, and other unexpected events that could otherwise become costly. Some travel agencies and tour operators may require you to have travel insurance as part of their booking conditions, so it’s always best to check their policies.

Driving a a motorbike without a license

Many travelers explore Vietnam by motorbike, whether it’s a long journey from north to south or a short trip around regions like Ninh Binh or the Ha Giang Loop. However, the majority of these travelers do not have a valid motorbike license, including an International Driving Permit (IDP). This poses significant risks:

- Insurance coverage : Most travel insurance policies will not cover you if you’re involved in an accident while riding a motorbike without a valid license. This means you could be responsible for all medical expenses and damages.

- Legal liability : Riding without a license can make you liable for any accidents or damages, which could result in fines or other legal consequences.

It is crucial to either obtain the necessary licenses before your trip or reconsider riding a motorbike if you’re not fully compliant with local laws and your insurance policy requirements.

Tips for choosing travel insurance for Vietnam

1. comprehensive medical coverage.

Ensure your travel insurance includes comprehensive medical coverage. This should cover:

- Emergency medical treatment

- Hospitalization

- Medical evacuation and repatriation

- Coverage for COVID-19 related medical expenses

Vietnam has modern hospitals in major cities, but medical care in rural areas can be limited, making medical evacuation coverage particularly important.

2. Coverage for trip cancellations and interruptions

Trip cancellations and interruptions can occur due to various reasons such as illness, natural disasters, or unforeseen events. Make sure your policy covers:

- Trip cancellations due to illness or other covered reasons

- Trip interruptions and delays

- Lost deposits and pre-paid expenses

3. Personal Belongings and Luggage

Loss or theft of personal belongings can be a significant inconvenience while traveling. Ensure your policy covers:

- Loss or theft of luggage and personal items

- Delayed baggage

- Replacement costs for essential items

4. Adventure and sports coverage

Vietnam offers numerous adventure activities such as trekking, kayaking, and motorbiking. If you plan to participate in such activities, ensure your policy covers:

- Adventure sports and activities

- Equipment loss or damage

- Injury related to adventure activities

5. 24/7 Assistance Services

Choose a travel insurance provider that offers 24/7 assistance services. This can be invaluable in emergencies, providing support for:

- Medical emergencies and hospital referrals

- Lost passport or travel documents

- Emergency travel arrangements

Recommendations for Travel Insurance Providers

1. world nomads.

World Nomads is a popular choice for travelers due to its comprehensive coverage and flexibility. It covers a wide range of activities and provides 24/7 emergency assistance.

2. Allianz Global Assistance

Allianz offers extensive coverage options, including medical emergencies, trip cancellations, and personal belongings. Their plans are customizable to suit different travel needs.

3. AXA Travel Insurance

AXA provides a range of travel insurance plans with comprehensive medical coverage, trip cancellation, and adventure sports coverage. They also offer 24/7 assistance services.

4. SafetyWing

Safe tyWing is known for its affordable plans tailored to digital nomads and long-term travelers. It offers medical coverage, trip interruption, and personal belongings coverage.

5. IMG Global

IMG G l obal offers a variety of travel insurance plans with robust medical coverage, including evacuation and repatriation. Their policies can be customized to include adventure sports coverage.

Additional tips for safe travel in Vietnam

1. stay informed about local conditions.

Keep yourself informed about local conditions, weather forecasts, and any travel advisories. This can help you make informed decisions and avoid potential hazards.

2. Keep copies of important documents

Make copies of important documents such as your passport, visa, insurance policy, and emergency contacts. Keep digital copies on your phone and physical copies in a secure location.

4. Follow local laws and customs

Respect local laws and customs to avoid legal issues and ensure a respectful travel experience. Familiarize yourself with basic Vietnamese etiquette and regulations.

5. Stay connected

Ensure you have a reliable means of communication, such as a local SIM card or international roaming plan. Staying connected can be crucial in emergencies or when you need assistance.

Explore Vietnam with Local Experts

Got questions ask our vietnam experts.

- Ho Chi Minh City

- Mekong Delta

- Language & travel dictionary

- Electricity

- Internet & calling

- Best travel time & weather

- Hoe does it work?

- Visa on Arrival

- Visa at embassy

- Holidays & Events

- People & minorities

- Flights to Vietnam

- Domestic flights

- Motorbike buy/rent

- Train travel

- 15 most beautiful destinations

- 20 best things to do

- 10 best off the beaten track

- 10 most stunning beaches

- 10 best rice fields places

- 10 best adventures

- 10 cultural experience

- All travel inspiration

- Package trips

- Custom made trip

Local tip! You might like these experiences

Ha Giang Loop tour: the highlights in 3 days

- Driving the Ha Giang loop is the best experience you can do in Vietnam

- Choose either on the back of a motorbike (adventurous option) or by jeep (comfortable option) – both private tours

- Explore the most remote villages and markets and learn more about the unique minorities living in the mountains.

- Behold the most impressive views of mountains and passes in Southeast Asia; lots of stunning photo oppurtunities

- Local experience staying in a homestay and eating in local restaurants

- Local English speaking guides that can stop whenever you want

Sapa homestay trekking 2 days

- The Sapa homestay trekking is the #1 thing to do in Sapa and its region

- Take a trekking through the stunning terraced rice fields and authentic villages and go beyond the day trips.

- Enjoy a unique experience with an overnight stay in a homestay of a local hill tribe

- Learn about the local cultures

Ban Gioc waterfall tour & Ba Be lake 3 day experience

- Vtisit Ban Gioc waterfall; the most imrpessive waterfall in Vietnam

- Explore stunning Ba Be lake by boat, the biggest natural lake

- Stay overnight in a homestay for a true local experience

- Destination: Travel tips

- By: Marnick Schoonderwoerd

- July 29, 2024

- Destination Guide

- Essential Guide

- Getting Around

- Vietnam Month by Month

- Inspiration

- Vietnam blog

- Custom Made Trip

- Day- & Multiple Day tours

- Holiday Packages

- Local Meo Vac Homestay

- Local Dong Van Homestay

- Our Team & Company

- Our Customers & Reviews

Copyright © 2023 Local Vietnam

Start typing and press enter to search

Free ebook vietnam travel guide.

- +84 968667589

- [email protected]

Travel Insurance In Vietnam | All You Need To Know Before Visiting

Travel insurance to Vietnam has in common with the comprehensive protection of human and property risks for travelers throughout the journey. Depending on the most common risks that may be encountered during the journey, customers can participate with different denominations.

1. Do I Need Travel Insurance for Vietnam?

Many international visitors come to Vietnam and ask if it is Mandatory to Purchase Travel Insurance in Vietnam.

The answer depends; this was not mandatory by the law. However, it is to help you to enjoy your trip to the fullest.

Although Vietnam is a pretty safe country, traveling to a foreign country may involve many unexpected accidents. A good travel insurance will cover the unexpected and ease your worries.

This is a very common question for tourists.

The insured Foreigners entering Vietnam for tourism, sightseeing, vacation, visiting friends, attending conferences, seminars, congresses, sports competitions, performing arts, working individually or collectively go in an organized group and have a predetermined program.

2. Travel Insurance with Other Insurance

Travel insurance is different from other insurance in many ways. First, it is intended to offer medical coverage when you are in a foreign country. The medical coverage is often short-term within a specific destination and period. In this case, the destination is Vietnam. Second, it covers various risks that a traveler may encounter, including:

- Trip delays or cancellations

- Baggage loss, theft, or damage

- Thefts of personal belongings

- Personal liability

There are even more cases that travel insurance may cover. However, it often does not cover pre-existing medical conditions or post-travel.

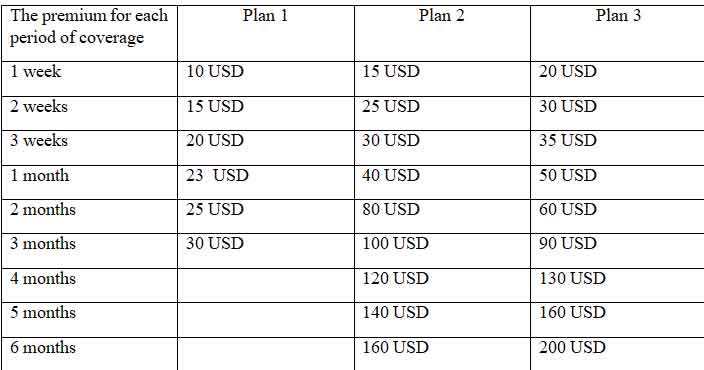

3. How Much Does Travel Insurance Cost In Vietnam?

4. Where To Buy Travel Insurance for Covid in Vietnam?

Many companies in the world and Vietnam provide this service, such as Bao Viet, Bao Minh, HSBC, Prudential, Chubb life, and Cathay Life. Each company has different services with different prices and different coverage. Here is some example.

4.1. Bao Viet

Bao Viet is a prestigious insurance company in Vietnam. It offers an international travel insurance plan with three tiers, including Silver, Gold, and Diamond. Each program has different coverage.

4.2. Chubb Life

Chubb provides extensive travel coverage in the ‘Worldwide Travel Protection Plan. The plan covers emergency medical assistance, personal accident, baggage, and personal effects, trip assistance, and personal liability. The travel insurance holders also have access to a global support network that can provide a referral service if you get sick overseas.

4.3. HSBC

HSBC Insurance (Vietnam) is owned by Hong Kong and Shanghai bank. Provide a lot of different travel insurance services for travelers from Bronze, Silver, Gold and Diamond with reasonable prices and benefits.

4.4. Travel Agencies

Many travel agencies collaborate with insurance companies to provide their tourists with travel insurance packages. It will be more convenient as you do not need to buy separate travel insurance. For example, Go Viet Trip works with many insurance companies to provide the best price and services for all tours in Vietnam.

There are many options for you

5. What’s Covered With Our Travel Insurance to Vietnam?

It will depend on the company, the price and the package you buy will cover different benefits. Here are some primary benefits

Bodily injury or accidental death

Sickness or non-accidental death

The baggage loss or damage causes fire, explosion, vehicle collision, collision, sinking, overturning.

Loss of checked baggage according to the baggage trip

Here is example Cathay Life has three tiers: Silver, Gold, and Platinum. The Silver plan only covers medical injuries, while Gold and Platinum also cover flight delays, cancellations, baggage lost or delays, emergency medical evacuation, repatriation of mortal remains, and terrorism. Hopefully, you find this article helpful, and your trip to Vietnam goes well, and you never need your coverage, but traveling without it and you could risk more than it costs of the policy. Make sure you have travel insurance for Vietnam. If you have any questions, please do not hesitate to contact us via Email: [email protected] or hotline +84968667589 . We are guarantee about quality and prices. Get a full refund if you do not feel happy with our services.

Author Hoan Nguyen

He has over 10 years of experience working in the tourism sector and operator. He has traveled to many places in Vietnam and around the world.

Photos: Go Viet Trip, Internet

How To Eat Banh Cuon: Full Guide From Vietnamese Locals

What Is Banh Cuon - Top Meal Around The World?

Top 5 Vietnamese Che For All Sweet Lovers

Top 10 unique places must visit in Vietnam in 2025

Lim Festival – A Not-To-Miss Cultural Experience In Vietnam

Cho Hom Market: Best place for Fabric in Hanoi? (Update)

- Hanoi Stay and Tips

- Halong Bay Travel guide

- Cat Ba Island

- Ho Chi Minh

WARNING RE COVID-19

Policies purchased after 8 Apr, 2020 will not provide any cover for claims directly or indirectly arising from, relating to or in any way connected with COVID-19 (or any mutation or variation thereof or any related strain). We will not therefore cover claims relating to any inability to travel, any decision not to travel or any changes to travel plans, nor any medical or health related loss or expense incurred, as a result of COVID-19.

Please note that the application service will be temporarily unavailable from 8:00PM on 1 March 2024 to 2:00AM on 2 March 2024 for maintenance works.

- What is covered?

- What is not covered?

- When am I covered?

- Where can I travel?

- Who is covered?

- Planning Your Travel

- Preparing to Travel

- At Your Destination

- When the Unexpected Happens

Chubb Assistance

- WORLDWIDE TRAVEL PROTECTION PLAN

- CHUBB FLIGHT INSURANCE – DOMESTIC PLAN

Travel Smarter with Chubb Travel Insurance

24 Hour Emergency Hotline +84 (28) 38228779

No matter where you are in the world. Ask for a reverse charge call in your visiting location and we’ll help you through with access to medical and dental treatment and emergency evacuation as the situation demands.

Claims Made Easy

Process your claim as quickly as possible.

Choose from 3 Levels of Quality Cover. Select from our Silver, Gold or Platinum cover to match your personal travel needs.

Quality travel cover at an affordable price

With more than 50 years of insurance experience and many millions of travellers served, Chubb Travel Insurance offers high-quality insurance to Vietnam travellers. We have plan options for all types of travellers, from frequent flyers and families to holidaymakers on a budget, adventure seekers and sports enthusiasts.

Access to a global team of travel experts

Purchasing travel insurance from Chubb means access to a truly global network. In addition to our wealth of local expertise, Chubb's operation in Australia is backed by our extensive global travel network and breadth of resources to serve your every need.

Fast, fair and efficient handling of claims

Experience has taught us the importance of being proactive when managing claims. Chubb understands that a fast, fair and efficient approach to claims handling will bring about an expedited outcome, and can help to deliver an improved result.

24 hour emergency assistance

When you purchase Chubb Travel Insurance, you are instantly covered by Chubb Assistance, our 24-hour emergency hotline that provides the support that you expect in your time of need, anywhere, anytime.

Travel Smarter with Chubb Travel Insurance. Get an instant quote now!

You may contact us via email or telephone..

Chubb Insurance Vietnam Company Limited

Head Office Saigon Finance Center, 9 Dinh Tien Hoang Str., 8/F, Da Kao Ward, District 1, Ho Chi Minh City, Vietnam

Chubb Customer Center

Tel: +84 (28) 3910 7300 (Mondays to Fridays, 8:30am to 5:30pm) Fax: +84 (28) 3910 7228

E-mail: [email protected]

For 24-hour emergency medical and travel assistance, call Chubb Assistance +84 28 3822 8779

Chubb Worldwide Offices

For the mailing address, telephone number and email address of any Chubb office in our global network, use our office locator.

Chubb. Insured.™

- About Chubb

- Terms of Use

- Chubb Insurance

© Chubb Insurance Vietnam Company Limited (Chubb). This policy is underwritten by Chubb. Full details of the terms, conditions and exclusions of this insurance are provided for in the Policy Wording documentation. Please read our Personal Data Protection Policy .

- Travel Insurance

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Travel Insurance For Vietnam: Everything You Need To Know

Updated: Jul 2, 2024, 11:04am

Editorial note: Forbes Advisor Australia may earn revenue from this story in the manner disclosed here . Read our advice disclaimer here .

Table of Contents

Do australians need travel insurance for vietnam, what does travel insurance for vietnam cover, frequently asked questions (faqs).

Vietnam is an increasingly popular travel destination for Australians, with the country even hoping to encourage more Aussies to visit by potentially waiving visa requirements in due time.

The Southeast Asian country is set to be high on the list for Aussies going overseas in 2024. The number of Australian tourists in Vietnam now exceeds pre-pandemic levels: more than 317,000 Australians visited Vietnam in 2019 , while there were 390,000 Aussie visitors in 2023.

Plus, as more and more flights become available, such as low-cost carrier Vietjet Air launching a direct service between Hanoi and Melbourne earlier this year, getting to Vietnam is becoming easier for Australians.

If the direct flights, fascinating history, vast scenery and delicious food aren’t enough to convince Australian travellers, the cost may be. Vietnam is considered one of the cheapest travel destinations in the world for Australian tourists due to our strong conversion rate against the Vietnamese Dong and the nation’s low cost of living in comparison to our own.

And while cheap thrills may be what you’re after on your vacation, it’s important not to skimp on the necessities that may cost that little bit extra—such as travel insurance. This guide outlines what you need to know regarding travel insurance in Vietnam.

Featured Partners

Fast Cover Travel Insurance

On Fast Cover’s Secure Website

Medical cover

Unlimited, 24/7 Emergency Assistance

Cancellations

Unlimited, (Trip Disruption $50,000)

Key Features

25-Day Cooling Off Period, Australian Based Call Centre, 4.6 Star Product Review Rating

Cover-More Travel Insurance

On Cover-more’s secure website

Unlimited, with a $2000 limit to dental

Yes, amount chosen by customer

Southern Cross Travel Insurance

Medical Cover

Including medical treatment, doctors’ visits, prescribed medication, specialist treatment & medical transport costs

$2,500 with option to increase to unlimited

Freely Travel Insurance

On Freely’s Secure Website

24/7 Emergency Assistance

Flexibility to adjust your coverage even when you’re away in real-time.

In-app travel safety alerts to keep you safe

Investing in travel insurance is a good idea for any overseas trip. Travel insurance policies can help protect you from having to dive deep into your pockets, with many offering unlimited medical treatment while abroad and cancellation cover for your trip should the unexpected occur.

Travel insurance is not just handy for medical purposes or travel changes, either. Your personal items can be covered, should any baggage go missing or an important item be stolen—which, unfortunately, often occurs in Vietnam.

Smarttraveller warns Australians to be alert at all times in Vietnam, considering petty theft–including bag slashing–is common in tourist areas and crowded places, especially during holiday times. Snatch-and-grab theft by thieves on motorcycles is also common, the website states.

Like most international travel insurance policies, you will be able to find basic coverage for your trip to Vietnam, or choose to opt for a more comprehensive, albeit more expensive, policy.

While a basic policy will often cover medical expenses and lost luggage,a comprehensive policy includes a lot more. Most basic policies also likely won’t offer compensation for travel delays, stolen cash, accidental death and more.

Additionally, if you are going on a trip to multiple countries within the year, it may be worth opting for an ‘annual multi trip’ insurance instead—making sure that there are no exclusions to the regions you are wishing to visit.

Visa Requirements For Australians Travelling to Vietnam

You’ll still be allowed to travel to Vietnam if you don’t invest in travel insurance, but you do so at your own risk—and, as stated, it is highly advised to have a travel insurance policy for any overseas trip.

However, what you cannot do is enter Vietnam as an Australian tourist without a tourist visa. While Vietnam will grant Australian citizens visas on arrival, applying for one online is much easier.

A tourist visa costs under $100 AUD; however the exact price depends on your length of stay.

The Vietnamese government may consider waiving visas for Australian citizens, especially since many other SEA countries have done so such as Indonesia and Thailand .

However, at the time of writing, Forbes Advisor Australia has confirmed that Australian citizens must still obtain a visa to visit Vietnam for tourism purposes.

The exact inclusions of your travel insurance will be dependent on your personal policy and the provider.

However, generally speaking, you can expect a travel insurance policy for Vietnam to offer some level of cover for:

- Medical expenses;

- Lost, damaged or stolen luggage;

- Travel cancellations or delays ;

- Personal liability;

- Credit card fraud;

- Covid-19 expenses;

If you are partaking in certain sports and activities, you will need to make sure that you choose a policy that covers them. You’ll also need to make sure that your policy covers any pre-existing medical conditions as well.

Plus, if you are travelling with valuables, you may wish to opt for a policy that lets you increase the protection cover on your items.

Ultimately, you need to consider what your trip consists of, what you will be taking with you, and your physical health to establish what policies would be appropriate for you.

From there, you can compare quotes of different policies and providers to ensure you have the optimal—yet affordable—cover for your trip to Vietnam.

Does Travel Insurance Cover The Ha-Giang Loop?

Considered one of the most scenic motorcycle routes in the world, the Ha-Giang Loop is a popular tourist activity in Vietnam for adventurous travellers. If the Ha-Giang Loop is one of your goals, you’ll need to make sure you have travel insurance that covers motorcycling.

Occasionally a policy may include this as one of their included ‘sports and activities’, but it is more often the case that you will need to purchase an additional ‘adventure pack’ that is either specific to, or includes, motorsports.

Even so, when purchasing an additional pack to cover motorbikes, you need to be cautious of the conditions. For example, some policies will only cover motorcycle riding if the bike you are riding has an engine under a certain size.

Often, coverage will cease and claims won’t be accepted if you haven’t been wearing the correct safety equipment such as boots and a helmet, or have been under the influence of drugs and alcohol.

What Does Travel Insurance Exclude?

Your travel insurance policy may exclude some activities that you wish to partake in, unless you can opt-in to purchase an additional adventure pack as explained above in regards to motorbike riding.

Just like with the inclusions of a policy, the exclusions depend on what type of policy you choose, and what provider you go with.

Commonly, however, you won’t be covered for instances where you:

- Break the law;

- Are under the influence of alcohol or drugs;

- Partake in an excluded activity;

- Receive medical treatment for a pre-existing condition that was not disclosed;

- Travel to a ‘Do Not Travel’ destination as outlined by Smarttraveller.

As always, it is essential to read the product disclosure statement (PDS) of your travel insurance policy carefully to understand what you will and won’t be covered for while overseas.

Do I need a visa to travel to Vietnam?

Yes, as of April 2024, Australian tourists still need a visa to travel to Vietnam. This visa can be obtained on arrival, or purchased online prior to travel. The visa takes approximately three days to process online, and the cost depends on how long you intend to stay in the country.

Does international travel insurance cover Covid-19?

Many comprehensive travel insurance policies now cover Covid-19, including medical conditions related to Covid-19 or trip cancellations due to a Covid-19 diagnosis. However, it is not guaranteed that all policies will. It’s important to check your policy’s PDS carefully to understand what it will and will not cover in regards to Covid-19 for both you and your travelling companions.

Related: Travel Insurance And Covid: Are You Covered?

How much does travel insurance cost for Vietnam?

The cost of your travel insurance for a trip to Vietnam will depend on your age, your health, the activities you wish to partake in, and the length of your stay.

For example, for a 34 year old with no pre-existing medical conditions travelling to Vietnam for two weeks, a policy from some of our top choices for comprehensive travel insurance would cost around $130 (based on quotes from Cover-More , 1Cover , and Fast Cover ).

The prices of these quotes would change depending on a chosen excess, cancellation cover, and any additional coverage options you may choose to purchase such as adventure packs or cruise cover.

Related: How Much Does Travel Insurance Cost?

- Best Comprehensive Travel Insurance

- Best Seniors Travel Insurance

- Best Domestic Travel Insurance

- Best Cruise Travel Insurance

- Best Family Travel Insurance

- Travel Insurance Cost

- Pregnancy Travel Insurance Guide

- Travel Insurance Cancellation Cover

- Travel Insurance For Bali

- Travel Insurance For Fiji

- Travel Insurance For The USA

- Travel Insurance For Thailand

- Travel Insurance For New Zealand

- Travel Insurance For Japan

- Travel Insurance For Europe

- Travel Insurance For Singapore

- Travel Insurance For Indonesia

- Travel Insurance For Canada

- Travel Insurance For South Africa

- Cover-More Travel Insurance Review

- Fast Cover Travel Insurance Review

- Travel Insurance Direct Review

- Travel Insurance Saver Review

- Allianz Comprehensive Travel Insurance Review

- 1Cover Comprehensive Travel Insurance Review

- Australia Post Comprehensive Travel Insurance Review

- Tick Travel Insurance Review

More from

What does travel insurance cover everything you need to know, our pick of the best comprehensive travel insurance providers in australia, best ski travel insurance for australians, travel insurance for the philippines: everything you need to know, travel insurance for new zealand: the complete guide, what is travel insurance the complete guide for australian travellers.