Vorgeschlagene Unternehmen

Allianz travel, ergo reiseversicherung ag, allianz partners usa.

AllianzTravelDE Bewertungen

Zu dieser Website

Aktivitäten des Unternehmens Alle ansehen

Bewertung abgeben

Bewertungen 2,4.

Insgesamt 21

Sortieren :

Relevanteste zuerst

Schnelle Abwicklung und Bezahlung

Ich konnte aufgrund eines Unfalls eine Reise nicht antreten. Schaden gemeldet und 14 Tage später war das Geld auf meinem Konto. Top

Datum der Erfahrung : 26. März 2024

Versicherung bei AWP P&C S.A. (Allianz Tochter)

Versicherung bei AWP P&C S.A. Zweigniederlassung CH: Annullation infolge Krankheit: Die Versicherung meiner Partnerin hat den gleichen Schaden (Sachverhalt) innert drei Wochen reguliert (Hanse Merkur). Die Allianz Tochter macht auf Hinhaltetaktik, obwohl die Unterlagen vor 42 Tagen eingereicht wurden. Gemäss Gesetz VVG 41 hätte der Versicherer max. 4 Wochen Zeit den Schaden zu regulieren. Diese Versicherung steht über dem Gesetz. Werde Vertrag kündigen. A. Lautenschlager

Datum der Erfahrung : 20. November 2023

Obwohl in der Versicherungspolice…

Obwohl in der Versicherungspolice angeben ist das man eine Entschädigung bei Verspätung ohne Belege des Reiseantritts in der Höhe von Max. 200 Euro bekommt. Nein man muss es dann doch genau mit Belegen für Essen, Unterkuft und Taxi belegen. Da ist die Policebeschreibung mehr als bescheiden. Raus geschmissenes Geld für diese Versicherung.

Datum der Erfahrung : 24. Mai 2023

Unkomplizierte Erstattung

Musste letzte Woche 1 Tag vor Abreise aufgrund von Krankheit Reise stornieren. 2 Tage später lag ich im Krankenhaus und war 3 Tage dort. Per App konnte ich alle Unterlagen (von Airline, Krankenhaus, AU, Eintrittskarten) einreichen, nach 3 Tagen wurde Auszahlung bestätigt. Top! Jederzeit wieder.

Datum der Erfahrung : 25. November 2022

Jahrespolice ziemlich nutzlos

Wenn man eine Jahrespolice mit einer Versicherungssumme abschließt und davon ausgeht, dass man dann Schäden bis zu dieser Summer erstattet bekommt, hat man sich gewaltig geirrt. (Wenn man zu den Leuten zählt, die sich jeden kleingedruckten Satz der Versicherungsbedingungen durchlesen, kann man das natürlich vermeiden) Ist der Reisepreis höher als die Versicherungssumme, gilt dann Paragraf 75 VVG. Konkret bedeutet das: Man hat jahrelang Beiträge bezahlt bis man man einen Schaden hat und stellt dann fest, dass das Geld praktisch zum Fenster rausgeworfen ist. Mit anderen Worten: Die Versicherung ist ein gutes Geschäft für die Allianz aber quasi wertlos für die Kunden.

Datum der Erfahrung : 21. März 2023

Wie immer, viele Worte , nichts passiert!

Sehr geehrte Frau Antje. Wie von mir in unserer Korrespondenz zu meinem Problem vorausgesagt hat sich nichts getan. Weder wurde mit mir in irgendeiner Form Kontakt aufgenommen noch hat sich am Zustand der seit Monaten anhält und den ich seit Monaten mit unzähligen Mitarbeitern ihrer Versicherung diskutiere etwas geändert . Würde ich es können, würde ich mich Fremdschämen. MfG. K. Zobel

Datum der Erfahrung : 11. September 2022

Nicht empfehlenswert!

Ich war im August im Urlaub, war dort Covid positiv und warte seitdem auf die Rückerstattung der Flugkosten, Hotelquarantänekosten, etc. Am Telefon wird einem versichert, dass alle Formulare richtig ausgefüllt sind und das Geld in einer Woche da ist - es ist jedoch nicht da; sondern ein Brief mit neuen Fragen, die in den letzten Formularen allerdings schon geklärt worden sind! Nie wieder!

Datum der Erfahrung : 11. April 2022

In der Hotline 30 Minuten hängen, denn die Versicherung wird nicht automatisch auf neue Plattform migriert - 100€ im Jahr für kein Nutzerkonto, top. Ich höre förmlich wie sehr es die Mitarbeiterin hasst, dass ich sie jetzt gerade störe… Kiloweise Dokumente hochladen, aber auch das funktioniert nur so halb - selbst wenn man vorher alles in kleine pdfs gepackt hat. All das hab ich noch hingenommen, aber der BRIEF! dass die Bearbeitung ZEHN! Wochen dauert ist das Höchste. Der gleiche Schaden wurde bei meinem Partner übrigens innerhalb von 5 Tagen mit Hilfe von 4 Screenshots beglichen.

Datum der Erfahrung : 15. Juli 2022

Habe Allianz Travel über die Website…

Habe Allianz Travel über die Website für 1 Jahr gebucht. In den AGB's wurde versteckt geschrieben dass die Versicherung ohne zu fragen um 1 Jahr verlängert wird. Bei der Hotline wurde auf mein Kündigungswunsch gar nicht eingegangen. Einfach ein No-Go. Werde niemehr mit Allianz geschäfte machen. Die behandeln Kunden wie Dreck.

Datum der Erfahrung : 28. Juli 2022

Wenn Sie Hilfe brauchen - versichern Sie sich woanders!

Seit 10 Wochen warte ich auf eine Bearbeitung meines Versicherungsfalles. Gut, andere warten viel länger.... Hilfe oder gar Geld? niemals. Nur die üblichen Ausreden: Corona - völlig überraschend nach über 2 Jahren... Den Hinweis auf die Beschwerdestelle habe ich tatsächlich ernst genommen. Die Kollegen werden sich spätestens nach 3 Tagen melden. Eine Lachnummer, die einem im Halse stecken bleibt. Über 3 Wochen keine Reaktion. Also, vergessen Sie die Allianz Travel Versicherung. Suchen Sie sich eine andere Versicherung. Mit viel Glück: Da werden Sie geholfen...Ich wünsche es Ihnen. Update 05.09.2022. Keine Reaktion von Allianz. Auch nicht von der Beschwerdestelle. Vergessen Sie Allianz Versicherungen - am besten für immer! 16.09.2022: Keine Reaktion! Am 21.09.2022 alles überwiesen. 13 Wochen. Mein Geburtstagsgeschenk. Danke. Allen anderen viel Geduld.

Datum der Erfahrung : 27. August 2022

Bei dieser Versicherung Wartet man…

Bei dieser Versicherung Wartet man länger auf eine Antwort als auf die Erstattung der Flugesellschaften. Telfonisch hängt man min 20min. in der Warteschleife. Keine Angabe zu Bearbeitungsterminen. Und das bei sehr hohen Preisen für die Versicherung. Danke Allianz für gar nichts... Nächstes Mal versuche ich es vielleicht woanders!

Datum der Erfahrung : 13. Oktober 2022

Allianz Travel … NIE WIEDER!

Auch ich kann nur abraten von dieser Reiserücktrittsversicherung! NIE WIEDER! Mein Bruder und ich mussten wegen eines schlimmen Sturzes unserer Mutter, 4 Stunden vor Abflug unseren Urlaub stornieren. Mein Bruder (hatte Versicherung bei einer anderen Firma) bekam nach 3 Wochen sein Geld zurück. Ich warte jetzt seit Mai auf die Bearbeitung meines Anspruchs! Bekam 3 Wochen nach Einsendung aller Papiere, eine automatisch erstellten Brief mit der Ansage, dass man Geduld haben müsste, denn aufgrund vieler Stornierungen, würde die Bearbeitung leider 8 - 10 Wochen dauern. In der 12. Woche nach gefühlt stundenlangem Hängen in der Warteschleife, bekam ich die Info, dass ich noch warten müsste. Inzwischen sind es 17 Wochen ohne jegliche Bearbeitung! Heute war ich bei einem Allianz Vertreter und hab ihm mein “Leid geklagt”, aber auch er kam leider nicht weiter, was ihm wohl auch recht peinlich war.

Datum der Erfahrung : 02. September 2022

Nie wieder Allianz Travel

Ich kann mit meiner Familie nur abraten von einer Reiseversicherung bei der Allianz Travel. Solange kein Schadensfall zustande kommt, ist alles in bester Ordnung. Eines unserer Kinder bekam unerwartet ein Virusinfekt, woraufhin wir eine ärztliche Untersuchung in Anspruch nehmen mussten. Da diese im europäischen Ausland erfolgte, war diese auch mit Kosten verbunden. Nachdem ich nun zweimal die Allianz Travel inkl. zugesendeter originaler Belege per Einschreiben um Rückerstattung bat, warte ich noch heute auf jegliche Rückmeldung oder Rückerstattung. Kein zweites Mal werden wir irgendeine Versicherung mit der Allianz Travel abschließen.

Datum der Erfahrung : 06. Mai 2022

Ewig lange Bearbeitung einer einfachen…

Ewig lange Bearbeitung einer einfachen Ticketversicherungs-Erstattung. Nach finaler positiver Bestätigung einer Auszahlung in den nächsten Tagen!! ist nach Wochen immer noch kein Geldeingang verbucht! Werde nie wieder eine solche Versicherung abschließen! Und ein telefonischer Kontakt ist unmöglich. Man hängt nur stundenlang in der Warteschleife und es wird auf ein Online-Kontaktformular verwiesen. Verwendet man dieses, erhält man frühestens eine Woche später eine Antwort, dass man sich gedulden möchte und die Bearbeitung aufgrund eines hohen Arbeitsaufkommens sich verzögert! Es ist unglaublich, dass man keinen direkten Kontakt aufnehmen kann 🤬

Datum der Erfahrung : 08. August 2022

Mein Mann erlitt auf einer Kreuzfahrt…

Mein Mann erlitt auf einer Kreuzfahrt einen Schlaganfall, kam in Antigua ins Krankenhaus. Meine Tochter und ich mussten mit von Bord. Erste Kontaktaufnahme mit der Versicherung war super. Nach 3 Tagen kam der Vorschlag ihn auf einen normalen Flug mit 2mal starten und Landung ausfliegen zu lassen und dann von Paris mit den Krankenwagen 10 Stunden ins Krankenhaus zu bringen. Die Ärzte in Antigua lehnten dies absolut ab. Nur ein Airambulanceflug wäre das Richtige. Dies lehnte die Allianz jedoch ab. Der Gesundheitszustand meines Mannes verschlechterte sich jeden Tag, neben einen Lungentzündung kollabierte noch der rechte Lungenflügel. Mittlerweile brauchte er auch schon sehr viel Sauerstoff. Auch jetzt lenkte die Allianz nicht ein. Mein Mann ist nicht transportfähig meinten sie. Nach 16 Tagen habe ich uns auf eigene Kosten mit einer Airambulance ausfliegen lassen, sonst wäre mein Mann gestorben.Für die Übernahme der Krankenhauskosten musste ich einen Anwalt einschalten. Die Kostenübernahmebestätigung kam nach 15 Tagen. Da braucht man auch keine Versicherung.

Datum der Erfahrung : 01. November 2022

Der mieseste Kundenservice

Einen mieseren Kundenservice habe ich noch nicht erlebt !!! Wochenlang keinerlei Reaktion auf Emails etc. Geld abbuchen sind se so schnell und zuverlässig, aber dann hört es schon auf, mit schnell und gut. Seit Wochen keine Chance die Versicherung unserer Reise zu ändern etc. War vorher immer bei der Ergo, bin nun nach Allianz weil billiger und wollte mal was sparen. Nie nie wieder und werde wieder zur Ergo gehen, lieber etwas mehr bezahlen als so einen billigen Mist. Pfui

Datum der Erfahrung : 20. Juni 2022

Ich liege seit drei Tagen im Krankenhaus im Ausland und habe nur Enttäuschungen mit der Allianz Travel. Bin seit Jahren mit der ganzen Familie versichert und glücklicherweise ist nie etwas passiert. Aber jetzt wo ich ein Problem habe, machen sie nur Probleme. Es fing schon damit an, dass ich drei Mal über 20 min warten musste und am Ende NIEMANDEN über sie Hotline, die auf der Karte steht, erreicht habe. Erst am nächsten Tag über Umwege. Die Romingskosten werden sicherlich auf mir sitzen bleiben. Dann ist der Support richtig mies. Man wird mit Formularen und Bürokratie nur gestresst während das Krankenhaus auf die Deckungszusage wartet und ebenfalls stresst. Keine Ahnung was hier dabei rum kommt, aber ich ahne nichts Gutes! Eine Gesellschaft wie die Allianz, die keine 24/7 Hotline inkl. WhatsApp, Chatbot usw hat, die will auch nicht helfen!

Datum der Erfahrung : 31. Dezember 2021

Reiseversicherung Allianz Travel

Ich habe für meine Familie eine Reiseversicherung als Gesamtpaket abgeschlossen. Die Allianz ist zwar einer der hochpreisigeren Anbieter, aber ich wollte bei Problemen keinen mir unbekannten Versicherer haben. Dachte das es alles einfacherer macht. Leider Nein! Eine Woche vor Reisebeginn erkrankte einer nach dem anderen von uns an Covid. Drei Tage vor Reisebeginn waren wir immer noch nicht Reisefähig. Das Telefonat mit der Storno Hotline war komisch. Aussage, wenn Sie wollen können sie auch positiv Reisen. Aha, was für ein toller Tip! Klar, wenn man die Absonderung in Deutschland beenden kann ist es gut, aber welches Land lässt einen rein wenn man noch positiv ist und dem man es einem ansieht das er krank ist. Dann habe ich storniert und alle Unterlagen eingereicht. Und nun warte ich seit 11 Wochen, dass was passiert. Nichts passiert. Telefonisch kommt man nicht durch. Unglaublich! Da hätte ich einen Anbieter wählen können der günstiger ist! Es reagiert ja nicht einmal jemand von der Allianz auf die vielen Negativen Bewertungen. Das ist dem Kunden gegenüber einfach nur peinlich!

Datum der Erfahrung : 04. Dezember 2022

Nicht erreichbar

Es ging um eine Verlängerung der Reiseversicherung. Keine Antwort auf meine Anfrage per Mail. Telefonisch nicht erreichbar. Ich habe nach 22 Minuten Wartezeit aufgelegt und eine andere Versicherung gewählt.

Datum der Erfahrung : 16. August 2022

Allianz lehnt Schadensregulierung wegen fehlender Diebstahlserklärung des Hotels ab

Bei der Reisebuchung über Check24 wurde eine Ganzjahresreiseversicherung bei der Allianz abgeschlossen. Schadeneintritt im außereuropäischen Ausland. Vorfall ist das Abhandenkommen einer Jacke und Sportschuhen. Die erste Ablehnung der Allianz erfolgte dahingehend, dass die Versicherung nicht greife. Dabei konnte die Allianz jedoch trotz Bitte dies zu tun, keine ausreichende Grundlage anführen. Dann zog sich die Allianz darauf zurück, dass keine Strafanzeige erstattet wurde und das Hotel mir den Diebstahl nicht bestätigt habe. Wohlbemerkt, ein Schaden von 80 - 150 € . Für eine Anzeige eine vollständigen Tag auf einer außereuropäischen Polizeiwache verbringen, dafür einen Dolmetscher bezahlen müssen oder von einem Hotel eine schriftliche Bestätigung zu einem Diebstahl in ihrem Hause zu bekommen, einfach realitätsfremd. Meine Frage, ob die Allianz mir einen Betrug vorwirft, wurde nicht beantwortet. Ich sage, diese Reiseversicherung der Allianz bracht mach nicht! Liebe bei der eigenen Hausratversicherung/Krankenversicherung mögliche Schäden bei Auslandsreisen zusätzlich versichern.

Datum der Erfahrung : 15. Februar 2023

Ist dies Ihr Unternehmen?

Beanspruchen Sie Ihr Profil, um Zugang zu den kostenfreien Business-Tools von Trustpilot zu erhalten und die Beziehung zu Ihren Kunden zu stärken.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

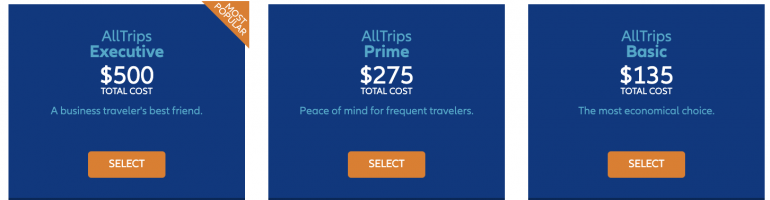

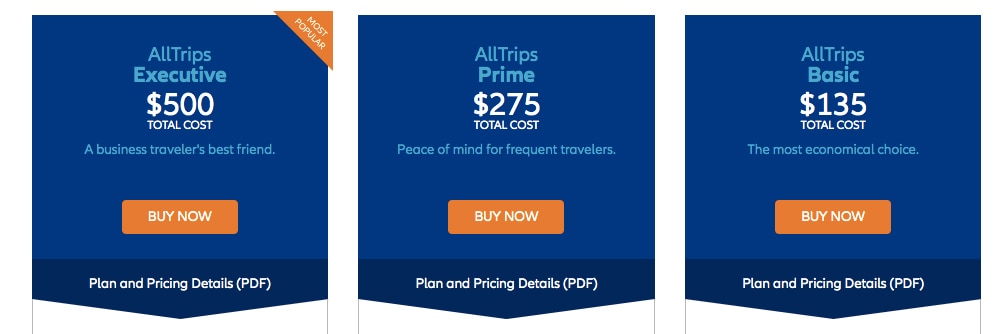

Allianz offers four different annual/multi-trip plans.

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

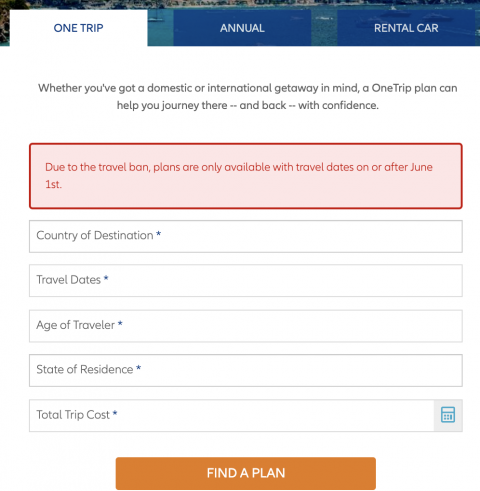

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » HONEST Allianz Travel Insurance Review – [Updated 2024]

HONEST Allianz Travel Insurance Review – [Updated 2024]

Planning and preparing for a trip can be fun and exciting. Personally I love flicking through Lonely Planets seeking out those “Must See” places and I even enjoy scouring through forums for insider advice. I relish the challenge of arranging sophisticated logistics and revel in finding bargain flights from London to the ends of the earth.

Indeed, the feeling I get during the days before I start a trip is both exciting and invigorating. In fact, sometimes I wonder whether I’m equally as addicted to this “state of leaving” as I am to travel itself – they do say that often anticipation is even better than the event itself.

What is far less exciting though, is comparing Travel Insurance policies. There are far too many policies and providers out there with far too many fine print details to scrutinise. Yep finding the best travel insurance is confusing, and finding cheap backpacker insurance can seem impossible. But, to make finding and buying Travel Insurance that bit easier for you, we have tried, tested and reviewed all of the major providers out there.

Allianz Travel Insurance Review

Do you need travel insurance, what does travel insurance cover, should i get insurance, who are allianz, allianz travel insurance policies, what’s covered by allianz travel insurance, what’s not covered by allianz travel insurance, who is allianz travel insurance suitable for, who isn’t allianz travel insurance suitable for, how much does allianz travel insurance cost, other travel insurance providers, when should you buy travel insurance, how to make an allianz travel insurance claim, final thoughts on allianz travel insurance.

Today we are going to review Allianz Travel Insurance. I have spent hours going through their policies and breaking them down for you. By the end of this post, you should know whether Allianz is the right travel insurance for you.

It’s important that you take time to look at other good travel insurance providers too. Different providers suit different kinds of travellers. So you may be better suited elsewhere.

Before we begin the Allianz Travel Insurance review, do note that the terms and conditions of insurance policies are subject to changes and are always ultimately based on your individual circumstances. Therefore, it is very important that you read any policy terms and conditions yourself.

Hey you there! Before you delve any further or waste any more valuable time on this Allianz Travel Insurance Review, let me just tell you straight up front that we at The Broke Backpacker no longer use Allianz for our travel insurance needs.

We have nothing against them, we just found other providers more suited to the needs of travellers and backpackers whilst offering VERY competitive quotes.

If you are taking a single trip or going backpacking, we recommend World Nomads Insurance .

Alternatively, if you are a digital nomad working and travelling remotely from all over the world, then SafetyWing Insurance offer some very interesting travel insurance plans.

Ahem – Please note that insurance companies change their policies and product terms fairly regularly. We do our best to keep this review up to date but cannot guarantee that all of the information is 100% correct. Therefore, only use this review as a guide and check all policies yourself. Also note that some of the links in this post are affiliate links.

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Do you need travel insurance? Does anybody really need travel insurance ?

After shelling out for flights, visas, and a new backpack, having to find a few more bucks for travel insurance may feel a bit depressing. I mean, all you get is a “policy certificate” AKA a boring 100-page booklet to read. Aren’t there more sexy and fun things to be spending that money on?

After all, most trips, vacations, and odysseys end happily and safely without any ill occurrence. There is no definitive answer to this.

Our team at the Broke Backpacker , we have (collectively) spent more than a century backpacking the globe and we have visited over 100 countries. Most of those trips ended without incident. However, we have also clocked up a fair few mishaps along the way: inflected legs, tropical diseases, broken backs, and even gunpoint robberies.

These incidents were all bad enough in themselves, leaving physical and mental scars. Thankfully though, we were all insured at the time. This meant that we were spared the further trauma of paying out thousands in medical bills or replacing technologies.

Basically, insurance is one of those things that most people never actually need. But the ones who do are very lucky to have it.

So now, you get the picture: travel insurance is essential when it comes to staying safe on the road . But is Allianz travel insurance right for you? Or do other travel insurance options suit you?

So let’s take a look. Here are some things good travel insurance plans help with, and where you would be without them.

Lost Luggage

Luggage gets lost both on planes and in airports. It shouldn’t happen, but it sure as hell does.

That in itself is bad enough but replacing all your essential travel gear will cost. Any decent travel insurance policy usually covers lost luggage, usually up to at least $1000.

In fact, the aviation watchdog states that 5.73 items of luggage are lost for every 1000 passengers. That means that if you take 10 flights, then there is a 5% chance of your luggage getting lost forever. Some airports and airlines lose more baggage than others but all of them are equally as obtuse and obstructive when it comes to trying to make a claim.

Lost luggage can ruin your whole trip. I mean, imagine you head to Iceland and they lose all your cold weather gear?!

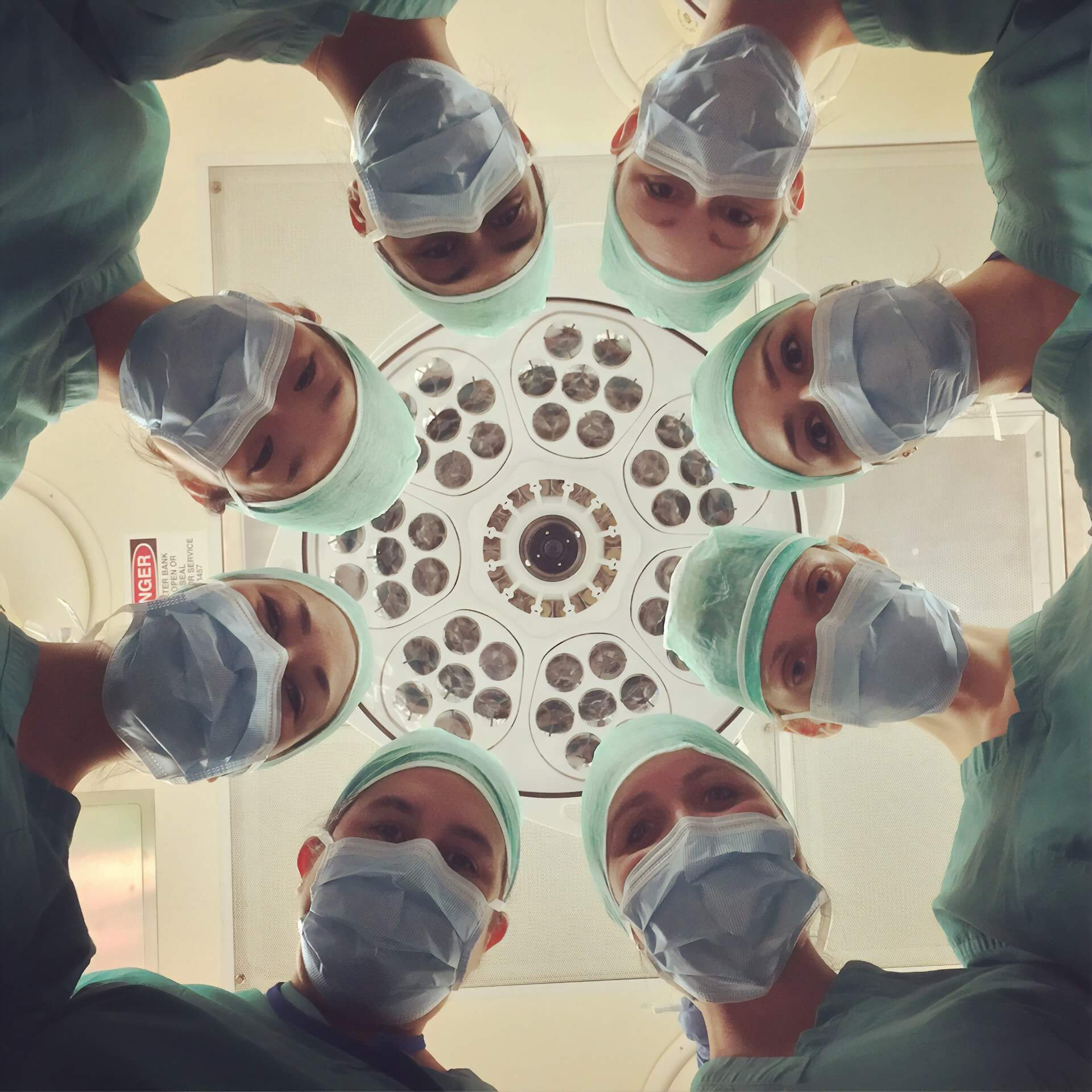

Medical Bills

Foreign medical care costs can be very high. A friend of mine was once hospitalised while backpacking in Costa Rica and ran up bills in excess of $10,000.

More recently he spent 1 night in a Thai hospital, was billed $1,000 and his passport was used as a ransom (that boy has no luck. Maybe he should stay at home?) . Personally, I don’t have $10,000 to pay to Costa Rican Doctors, but I do have maybe $50 to buy myself a travel insurance policy.

If you come from Europe, the cost of medical care in some parts of the world is quite a revelation. If you’re in the US, then you already know all about health extortion. But do remember, your domestic health insurance will most probably not cover you outside of the US.

Accidents happen (and without warning…) and ill health can strike any of us down at any time, anywhere. In fact, if you have experienced the driving or the hygiene standards in India, you’ll already know that you are at high risk of coming to some harm out on the road.

Trip Interruption Coverage

Trip interruption comes in all shapes and sizes. Claiming for flight delays or cancellations is annoying – and in the end, nothing’s guaranteed.

Every year a few airlines or travel agents go out of business leaving passengers stranded. Booking flights home at short notice is costly.

Not getting home on time on the other hand, can mean getting sacked from your job – ouch. If you have to stay a few more nights at your destination waiting for a flight home, then that can also stretch a maxed-out travel budget.

Having trip cancellation and interruption coverage can mean the difference between desperately raiding your overdraft or getting a few extra days of vacation, free of charge.

Theft Coverage

Sadly, tourists are a target for thieves in many parts of the world. Our team have been robbed with guns while backpacking South America . And I know people whose diamond jewellery and MacBooks were burgled from hotels.

Being robbed is scary. But theft coverage makes it suck a little less when you don’t have to fork out for your stolen iPhone.

Repatriation

In the unlikely event of your demise, your travel insurance can cover the cost of repatriation or sending your body home. The costs of this can otherwise run into several thousands of dollars.

Nobody ever thinks it will happen to them. And yet, it does happen.

Furthermore, the law of averages dictates that if you travel enough, something, somewhere will eventually go wrong. Just like you should always look twice before crossing the road, and always wear your helmet before riding a bike, you really should get comprehensive travel insurance.

By the way, some countries require you to obtain insurance before even letting you enter. Imagine being turned back at the airport for the sake of a few quid?! I personally never leave home without first obtaining travel insurance plans from either World Nomads or SafetyWing.

If you’re reading this, then I guess you decided that you do need travel insurance. Yay! Welcome to the world of sensible adults (AKA accepting your own mortality and the fact that you have no control whatsoever over the universe, despite whatever bullshit “The Secret” may have told you).

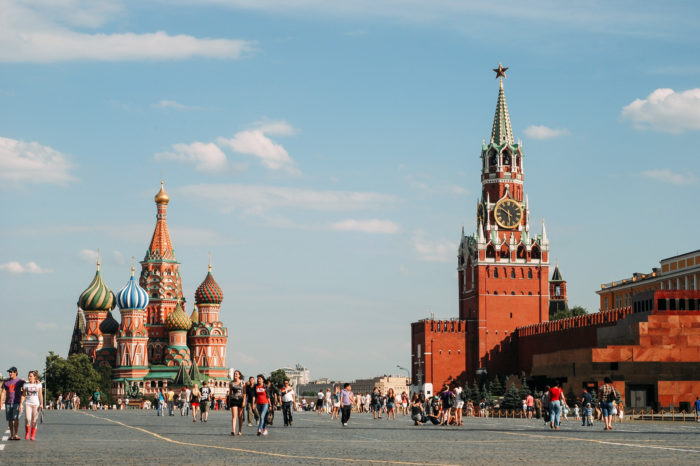

Allianz travel insurance is perhaps one of the biggest insurance companies in the world. They have been trading for over 120 years and they have offices across the globe.

Though travel Insurance is by no means Allianz’s primary focus or modus operandi. But this is not a bad thing. Note that even “specialist travel insurers” are often, in fact, brands or shop fronts backed by big insurance companies like Allianz.

They are governed by the Financial Services regulators in pretty much every national market they trade in. This means that if you have a problem with them, you can squeal on them and have your case reviewed independently and fairly by an adjudicator free of charge.

Now that the introductions are out of the way, let’s take a look at the individual travel insurance policies they offer.

Allianz are a major financial service provider and as such, they offer different coverage options, policies and plans aimed at different travellers. Let’s quickly run through them.

Firstly, Allianz travel insurance offer travellers 2 main types of policy. Within these coverage types are little variations. The main policy types are OneTrip and AllTrips .

Within both the OneTrip and AllTrips umbrellas are 3 variations : Basic, Prime, Premier . These vary depending on how much cover you want and how much you want to pay.

As the name kind of suggests, OneTrip covers one single, specific trip generally with a fixed start and end date.

AllTrips covers any and all trips that you make in a one-year period. This annual plan runs from the date you take out the policy, or a date of your choosing, and lasts for 365 days (or 366 in a leap year) .

You can take an unlimited number of trips in the year and an unlimited number of days travelling. Do be sure that all your chosen destinations are covered by the annual travel insurance policy though, otherwise, you may need to obtain additional cover.

OneTrip Basic Plan

This travel insurance policy covers all travel insurance basics such as medical coverage, trip cancellation and lost luggage. Look at it as the entry-level “classic cover” if you like.

The plan may be able to offer;

- Emergency Medical and Emergency Dental Coverage up to $10,000 and $50,000 for Medical Evacuation. These amounts may seem high but are not enough if you need to be airlifted home from an accident, for example.

- Lost or Stolen Baggage Coverage up to $500 and $200 for Delayed Baggage. Now, $500 may be enough for your baggage depending on how expensive your clothes are, and whether you pack any specialist equipment. However, a solid travel backpack is usually worth around $200.

- Trip Cancellation Cover up to $100,00. One of the best features of the OneTrip Basic plan is that Allianz may be able to reimburse the full cost of your trip if you need to cancel early. However, the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons – not because you got bored or changed your mind.

This policy is a good all-rounder and ideal for travellers on a budget . However, it does have some limitations.

Some of the Allianz travel insurance OneTrip basic coverage is a bit on the tight side. Furthermore, OneTrip Basic plan does not include coverage for missed connections or airline change fees. There are also relatively fewer accepted reasons for claiming on the trip cancellation clause.

OneTrip Prime Plan

Broadly speaking, Allianz OneTrip prime plan is more or less the same as the basic – with increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage and Dental Coverage up to $25,000 worth of and $500,000 worth of emergency evacuation coverage.

- Lost and Stolen Baggage Cover up to $1,000 which should cover most people’s hold luggage. However, the per-item max is $500. So if you pack your $8000 top-quality travel camera , you will only get $500 back for it. It also includes Baggage Delay Costs of up to $300.

- Missed Connection Coverage up to $800.

- Airline Change Fees up to $250.

OneTrip Premier Plan

In case you need a bit more on top of that, then we have the OneTrip Premier Plan. The Allianz OneTrip Premier policy is essentially the Prime with even higher coverage amounts. OneTrip Premier may be able to offer cover to;

- Emergency Medical and Dental Coverage of up to $25,000 to $50,000.

- Emergency Evacuation Coverage also increases to $1,000,000. With international evacuation averaging around $100,000, this amount is more than adequate to cover your transportation back home.

- Lost or Stolen Baggage up $2,000. However, like with the OneTrip Prime plan, you can only claim a maximum of $500 per item (up to $2,000 in total). $600 in Baggage Delay.

- Travel Delay coverage up to $1,600.

- Missed Connection Coverage up to $1,600.

Other Allianz OneTrip Options & Offshoots

In case that wasn’t choice enough for you, Allianz also offers 2 offshoots of their OneTrip policy. If you like, look at them as the highly specialised cousins of the OneTrip family.

OneTrip Cancellation Plus Plan

OneTrip Cancellation Plus Plan is definitely Allianz’s budget policy. With this plan, you are only covered against trip cancellation, interruptions, and delays. Medical coverage, medical transportation, and baggage loss are not included.

Personally, I would only consider this policy if (1) you are not checking luggage (2) you have medical coverage elsewhere. For example, this may be OK if you are an EU citizen taking a short break to another EU country where you only have your trusty carry-on luggage and an EU emergency healthcare card.

OneTrip Emergency Medical Plan

This policy is great for travellers who only want medical coverage on one single trip. It provides up to £50,00 in emergency medical coverage and $250,000 in emergency medical transportation coverage.

Remember that this plan only offers protection for medical expenses. If you are robbed, your cuts and bruises are covered but your stolen phone is not. If the airline loses your luggage it is not covered and neither is heartbreak. Trip cancellation coverage is also not included.

This plan is, therefore, for anybody whose sole and only concern is medical coverage.

Remember, the OneTrip policies cover one specific trip. The AllTrips policies we are going to detail below cover long, or multiple trips within a one-year period.

Note that AllTrips policies may also be able to offer rental car coverage for damage as well as dismemberment cover. On the flip side, trip cancellation coverage is either non-existent or limited.

AllTrips Basic Plan

The AllTrips basic may be able to offer coverage for the “classic” issues on multiple trips within a one-year period. Let’s see those numbers.

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Evacuation Coverage. Note that $20,00 on medical emergencies may still be a little on the low side in the event you get very sick in an expensive part of the world such as the US.

- Lost/Stolen or Damaged Baggage up to $1,000. Yes, this may be able to cover most checked bags but remember the $500 max item clause. Baggage Delay is offered up to $200 and then $300 for trip delay.

- Rental Car Damage Coverage up to $45,000. Note that additional premiums may apply.

Note that the AllTrips Basic plan does not come with Trip Cancellation or Interruption Coverage. Remember that means you will not be reimbursed in case you are unable to go on your trip!

AllTrips Prime

As you probably guessed, AllTrips Prime is more or less the same as the basic package with some increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00. Remember that the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons.

- Lost/Stolen or Damaged Baggage up to $1,000 and $200 for Baggage Delay.

- Trip Delays up to $300.

AllTrips Premier

If you want even more coverage, then we have AllTrips Premier. The Allianz AllTrips Premier policy is basically the Prime one with even higher coverage amounts. AllTrips Primer may be able to cover;

- Emergency Medical Coverage of $50,000,00 and $500,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00.

- Trip Delays Coverage of up to $1,500.00.

- Dismemberment and travel accident up to $50,000 if you lose a limb or your eyesight when travelling.

Wanna know how to pack like a pro? Well for a start you need the right gear….

These are packing cubes for the globetrotters and compression sacks for the real adventurers – these babies are a traveller’s best kept secret. They organise yo’ packing and minimise volume too so you can pack MORE.

Or, y’know… you can stick to just chucking it all in your backpack…

We’re now going to drill down and look at the various things that may be covered by Allianz travel insurance. Remember that some of these are covered by some policy types but not others, and note that coverage amounts and excess’ also vary depending on the exact Allianz policy type.

Emergency Medical Coverage

Got food poisoning in Delhi? Got hit by a moped in Bangkok? Or maybe you just slipped in the shower and broke your wrist in Madrid?

These things can, and do, happen and will all require emergency medical care. Being sick, infirm, and unable to make TikToks is bad enough as it is, so the last thing you want is a hefty medical bill which you have to pay out of your own pocket.

Emergency accident and sickness coverage is quite likely the most important aspect of travel insurance plans.

Emergency Transportation

Emergency Medical Evacuation is when you need to be sent to your home country, or another country, for further or continued medical treatment, and are too sick to travel home normally as a regular passenger. For example – if you are stuck in a hospital bed on a drip in a leg cast.

Trip Cancellation

Reimburses for prepaid, non-refundable cancellation charges if you must cancel your trip (after the effective date of your insurance plan) due to covered sickness, accidental injury, or death of you, a family member or travelling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike, or other covered reasons.

Trip Interruption

Trip Interruption Coverage includes the same stipulations as listed above in “Trip Cancellation”. It includes the caveat of covering the cost of accommodation to you if you are delayed.

Baggage Coverage for Loss/Damage

Being compensated for baggage loss of lost personal gear is likely the second most important aspect of your insurance. This is one of the most common reasons file a claim on your travel insurance.

This covers reimbursement for loss, theft, or damage incurred during the trip. It can be applied to all personal items that were lost, stolen, or else accidentally blown off the roof of a chicken bus travelling at top speed.

Baggage Delay

In the event your checked baggage is delayed or misplaced by the air carrier (for more than 12 hours) , you can claim reimbursement for any necessary items you need to purchase until your bag arrives. This will typically mean toiletries but may even mean some travel clothes if you can demonstrate the purchase is essential.

Trip Delay cover protects you when you’re unable to reach your destination on time due to circumstances beyond your control. If your airline cancels your flight due to a technical fault, Allianz travel insurance will reimburse you for any meals, transportation, or accommodation costs you incurred as a result. Note that delays of less than 6 hours are not covered.

Change Fee Coverage

Have you ever tried to change or vary a flight date or add or remove a passenger?! The fees can be insanely high. This is where Change Fee coverage comes in. If you have the AllTrips Executive, OneTrip Prime plan or OneTrip Premier plan, you can claim up to $500 to cover the cost of the airline change fee.

Travel Accident Coverage

If you are in an accident, you may be entitled to claim a compensation payment in addition to your medical/repatriation costs. This is usually reserved for loss of limb/eyesight type scenarios and you can’t claim for whiplash or emotional trauma from falling from a donkey!

The Travel Accident Coverage is also payable to your family in the event of your death.

Rental Car Damage and Theft Coverage

The AllTrips travel insurance polices also include rental car coverage. This can often prove considerably cheaper than obtaining insurance direct from the rental car provider.

If you are resident in the US, this feature may not be available to you. For clarity, we suggest you speak with Allianz travel insurance directly.

There are some notable omissions from Allianz’s cover. Let’s take a look at them.

Pre-Existing Medical Conditions

If you have a pre-existing medical condition which causes you problems on your trip, it is not covered under the Allianz policies. This is fairly common amongst insurers. It is important that you do declare any pre-existing conditions when taking the policy out.

If you do have a pre-existing medical condition, then you may be very interested to hear that SafetyWing can offer full coverage for PEMCs in their policies.

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Extreme Sports

Allianz Travel Insurance does not any kind of adrenaline sport such as Quad Biking and Parachuting. The lack of coverage for extreme or adventure actives is one of the many reasons why we now prefer World Nomads. To get full details of the kind of activities World Nomads can offer coverage for, head over to their site and get a tailer made quote.

So as you can see, Allianz Global Assistance offers a lot of different policy types for a lot of different people. Allianz Travel Insurance maybe suitable for the following kinds of travellers;

- Annual Travellers – With the Allianz annual plan, you may be covered for a whole rotative journey around the sun, no matter how many times you travel! Annual plans are great for frequent and long-term travellers to save you money in the long run. On the other hand, though, SafetyWing offers a month-by-month policy which you can stop and start depending on how much you travel; this may prove to be more cost-effective.

- Senior/Ageing Travellers – Allianz travel insurance policyholders are among the best senior travel insurances . They have no age limit. Believe us, not all insurers offer this and we have a LOT of queries from over 65’s & over 70’s who have struggled to find insurance elsewhere.

- Travelling Families – Allianz travel insurance policies may allow children under the age of 17 to travel with their parents for free, on selected plans. This is great for families with kids. My earliest travel memory is of a Spanish ER department, my parents were glad they had me on their policy. Otherwise my foot would still be bleeding 33 years later!

Whilst they do offer a myriad of different plans to cover most travellers types, Allianz is perhaps not the ideal travel insurance company for absolutely everybody out there.

- Adventure Travellers – Allianz Travel Insurance does not offer protection for extreme activity or sport of any kind! If you plan on doing any dangerous, adrenaline-type activities, then perhaps consider World Nomads who can offer coverage for over 201 different extreme sports. SafetyWing are also rapidly extending their extreme coverage.

- Travellers Wanting High Medical Coverage – We usually recommend travelling with at least $100,000 of emergency medical coverage. If you come down with a severe illness or are mangled by a badger, you might be stuck with thousands of dollars in medical bills so need to be prepared. World Nomads do offer $100,000 in medical emergency cover.

- Corporation Haters – Allianz are a major international finance company and we know some of you prefer not to deal with such organisations. That’s a perfectly legitimate point of view. However, remember that even a lot of “boutique” insurers are in fact ultimately shop fronts for big insurers such as Zurich, Lloyds, or even Allianz. In fact, all some boutique firms do is sell you the illusion of dealing with a small firm and charge you a hefty commission for the privilege.

So now we know the details, the next burning question is how much does Allianz Travel Insurance cost?

Well actually, it’s very difficult to say. The pricing details vary depending on a wide range of factors such as your age, location, your trip plans, if you have a pre-existing medical condition, and numerous other factors that only the gods of insurance can compute. It’s worth it to get in there and check yourself.

So, now, let’s talk about our trusty travel insurance plans for backpackers.

World Nomads

World Nomads offers coverage for backpackers and adventure trailers. They are one of our favourite travel insurance providers and we have used them for years.

Unlike Allianz travel insurance, World Nomads are a travel insurer with a focus on backpackers.

World Nomads offer 2 separate plans depending on how much cover you want and what exactly you intend to do. World Nomads can also offer trip cancellation coverage, electronic gadget, and theft coverage in the policies.

Word Nomads can cover over 140 countries (but not Pakistan which is a shame for us) . They can also cover a wide range of adventure stuff and extreme sports like mountaineering which Allianz travel insurance do not.

However, they do not offer home country cover and do not offer open-ended cover. If you are not planning on doing any adventure stuff though, then you may find World Nomads to be a bit expensive.

SafetyWing are a relatively new player on the scene. They are founded by travellers, for travellers, and their primary target is for those travelling as a digital nomad : people like me who move around the world working from our laptops. We can go many years without ever going “home” and SafetyWing recognises this and can offer open-ended cover.

What we LOVE about SafetyWing is that their insurance operates like a monthly subscription that you can stop and start as and when you need it. They are also one of the few providers who may be able to cover some pre-existing conditions and provide assistance with “routine” health stuff.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

By this point, you may well know which travel insurance is best for you. Maybe it’s Allianz travel insurance, or maybe it’s one of the others.

The question now then is, when should you buy travel insurance?

You can buy travel insurance up until the start date of your trip for most insurers. Many will not cover a trip that has already begun – with the exception of World Nomads and SafetyWing.

Note : if you ever do make a claim, you may well be asked to provide evidence of the start date. So I do not recommend trying to hoodwink insurers. Be totally honest or it will come back on you.

However, in our experience, the earlier you book your travel insurance, the better. This is for a number of reasons:

- Things sometimes go wrong before the trip even starts. For example, if the airline goes bust. This happens to 1000s of people every year. Or what if you get very sick a week before flying and have to cancel?! If you have the right travel insurance in place, your insurer may cover you in these scenarios.

- The vast majority of policies include a cooling off period . This is a period of time (usually 28 days) when you can cancel the policy and get all of your money back. We suggest using the cooling period to read through the policy documents and ensure that the cover fully meets your needs. Upon a closer look, if it does not suit you, you have time to contact the insurer and amend the policy, or cancel it and obtain more suitable travel insurance.

Personally, I usually book my travel insurance the very same day I book my flight. The only exception is if I already have long term or an annual plan. In these scenarios, instead, be sure to check the last date on your annual/long-term cover and make sure it covers your whole trip.

First up, it is unlikely you will ever need to make a travel insurance claim. Yipee!

In case you do though, you will be very pleased to hear that the process is pretty straightforward as long as you are dealing with a reputable company. If you are not then it may be a lot harder.

To initiate a travel insurance claim, all you need to do is contact (call) Allianz Global Assistance and chat with their 24-hour multilingual staff. You should do this as soon as possible or as soon as you know you will need to make a claim .

You will need to tell them about your claim including details of what has gone wrong, and what the damage seems to be. You can also initiate the process online by signing into your account.

If you are claiming lost or stolen items, you will need to write up a formal sworn statement of events, detailing what happened and what was lost. You will also need to have an official police report made up – it is highly important that you obtain this even if it means paying a fee/bribe or hassling the police to do it. Try to get it in both the native language and in English if possible.

The Insurance company may contact you to discuss your claim further. You may even be subjected to a an anti-fraud interview and your call may even be run through voice detection software designed to spot deceit! However, you have nothing to worry about if your claim is legitimate and in order.

It is very helpful to get all of your receipts and invoices together first and submit all expenses at once. Do keep copies of every expense, bill, invoice, and report as you will need to provide these to the claims team. They may pay out small amounts without a bill, but in the case of extra hotels, flights, or electronics, the rule is usually “no proof = no payment”.

After that is sorted, you upload all of your information and documents, review the claim and submit. The Allianz team will get cracking and stay in contact with you throughout this process. Note that resolution time does vary from case to case. It may be days, weeks, or sometimes months depending on the details of your claim.

I hope you found this Allianz Travel Insurance Review to be informative – it certainly took a lot of work on our part to put it together! Comprehensive travel insurance is important to safe travel and you need to carefully choose the best provider for your needs.

We really care about the safety of our readers. That’s why we do recommend travel insurance so strongly. We’ve seen ourselves what can go wrong – and we wouldn’t wish it on anyone.

So check for trip interruption coverage, get your gadgets covered, but most importantly, make sure any potential medical expenses are covered, especially emergency medical expenses. Shop around different providers to find the right one for you. Once again, we wish you an awesome and safe trip!

And for transparency’s sake, please know that some of the links in our content are affiliate links . That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!

Aiden Freeborn

![allianz travel rezensionen Brutally HONEST Allianz Travel Insurance Review – [Updated 2023] Pinterest Image](https://www.thebrokebackpacker.com/wp-content/uploads/fly-images/716330/Allianz-travel-insurance-review-pin-260x337.jpg)

Share or save this post

The author did a very nice job explaining the different types of insurance Allianz offers. But, until you have experienced their VERY POOR customer service and actual reimbursement procedures, you will not have the complete Allianz story.

I would never use Allianz Global Assistance for your trip insurance needs During a Viking River Cruise June, 2023, my husband came down with COVID. VIKING handled their end of any claims and taking care of us beautifully, BUT Allianz Global Assistance was a completely different story. We had Trip Interruption insurance (which included coming down with COVID) and trying to get reimbursement for all our medical expenses and a post trip to Amsterdam we had planned (not with Viking, but through our travel agent) has been one of the most frustrating ordeals I have ever dealt with. We are asking for approximately a $2,000 reimbursement and we have received $300.

If you need to file a claim, here is what you can expect after you complete the on-line claim form on Allianz’s website : 1. They will tell you they can’t read your receipts (even though you can read them on the email you send or they are PDFs from Viking or your TA). One Allianz customer service rep (probably the 7th person I talked to), told me to download a $50 app that makes receipts readable, which I did, and they still couldn’t read them. I finally snail-mailed copies of the receipts and they still declined 75% of them. 2. Phone calls with wait times of over an hour. This has happened to me 10+ times (not just a random occurrence), and I have tried all times of the day – same thing. 3. When you do talk to a rep, the call will always, and I mean always, disconnect before the issue is handled.

I could go on and on, but bottom line, I will NEVER use Allianz again or recommend them to anyone. We are out $2,000 + $1,000 we paid for the Trip Insurance. It is a big deal, but I can’t imagine if we had to rely on Allianz for the total trip reimbursement. Thank goodness Viking stepped up and provided the level of customer service they did.

Of course, we are aware that some customers sometimes have insurance claims denied. We also appreciate that others have bad customer service experiences with all kinds of different companies.

However are not privy to the finer details of your situation, and Allianz are not here to put across their side of the story either – furthermore this is not really the legitimate forum to air complaints about them. Still in the interest of openness and transparency we will let your comment stand.

Best of luck with your next trip.

Yes agreed – your statement about Allianz not offering unlimited medical cover is complete BS and misleading to readers. Are you paid to promote World Nomads Insurance? Please provide full disclosure to your readers.

I have just rechecked the Allianz policy information available on their website and what we have said appears to remain correct. If you feel we have missed something then please elaborate.

As for World Nomads, we have made it clear that some of the links in this post are affiliated.

Hi there, I found your article very informative, but I just wanted to make a couple of corrections. Im not affiliated with Allianz, but Ive been researching which insurance to buy and they have provided me with a quote and their PDS, which Ive read in full. The amounts that Allianz offers for overseas emergency assistance and overseas medical and hospital expenses under their comprehensive plan are both unlimited, and they do offer insurance for pre-existing medical conditions, you just have to pay an additional premium.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Allianz Travel Insurance Coverage Review — Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

306 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3136 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Why Purchase Travel Insurance

Allianz epidemic coverage endorsement, onetrip plans — for affordability and select coverages, alltrips annual plans — cover all of your trips for a 12-month period, how to obtain a quote with allianz, onetrip emergency medical plan, onetrip cancellation plus plan, rental car damage protector, allianz vs. credit card travel insurance, allianz vs. other travel insurance companies, allianz vs. point-of-sale travel insurance and protection, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

There are a lot of choices when it comes to travel insurance companies , so narrowing your selection to those that have a solid financial rating, offer products that provide good value, and receive high customer ratings should be baseline criteria.

Allianz Global Assistance company ( Allianz Travel) checks all of those boxes. Its parent company, Allianz SE, receives an A+ rating from A.M. Best (a leading insurance financial rating firm), and the company offers competitive individual trip and annual travel insurance products. It also serves over 45 million customers in the U.S. each year with 84% of those customers giving the company a 5-star rating.

Allianz has also been around a long time. In fact, the company was there to insure the Wright Brothers’ first flight and the construction of the Golden Gate Bridge — so you know you’re working with an established organization. You’ll also find that Allianz does business in more than 35 countries.

Let’s take a look specifically at Allianz Travel’s insurance products, show you how to obtain a quote, and give you some tips on purchasing and comparing travel insurance policies.

And while our focus is on Allianz Travel coverage, much of our information can apply to purchasing travel insurance in general.

Travel insurance can protect your trip investment with coverage for disruption due to unforeseen events such as severe weather, should you become ill, for illness in your family, missed connections, medical emergencies, and more.

Deciding whether to purchase travel insurance for your trip is an option each time you make a travel booking. The coverage is commonly offered by airlines, cruise companies, tour operators and other travel providers at the point of sale. If you travel infrequently and the cost is relatively low, you may just opt for the coverage during the booking process.

However, if you’re going to be taking several trips, you may be able to save money and receive better coverage if you compare with other travel insurance policies in the marketplace. Additionally, you’ll want to determine if it makes sense to purchase single insurance coverage for each trip or an annual all-trips-included policy.

Situations where it makes sense to purchase travel insurance include the following:

- You’re booking an expensive trip that includes a lot of non-refundable upfront expenses

- Your trip includes several travel providers (i.e. airlines, hotels, and tour operators)

While travel insurance is meant to cover unforeseen events, purchasing Cancel for Any Reason coverage may allow you to cancel your trip for any reason.

Bottom Line: If you’re uncomfortable with the amount of money you have at risk when you travel, securing travel insurance can provide immediate peace of mind . You’ll have solace in knowing that if you needed to cancel your travel plans due to a covered event or if your travel is disrupted, you’ll be able to recoup most, or all, of your investment.

Travel Insurance and the COVID-19 Virus

Most travel insurance policies do not provide coverage for trip cancellation due to fear of the coronavirus pandemic . However, COVID-19 is an included illness on many travel insurance policies as it relates to certain coverages such as emergency medical care while traveling and canceling a trip if you become ill with the virus. You may also have coverage if a family member or travel companion contracts the virus and you must cancel your trip as a result.

The only way to cover trip cancellations due to fear of contracting COVID-19 is to purchase Cancel for Any Reason insurance. This coverage can be added to a comprehensive travel insurance policy (with limitations) and subsequently allows you to cancel your trip for any reason.

While Allianz does not offer Cancel for Any Reason insurance , it may cover COVID-19 related illness in the following circumstances:

- Emergency medical care while traveling

- Trip cancellation due to becoming ill with the virus

Allianz recently announced that it is adding a new endorsement to select policies that will offer limited coverage for COVID-19 . Circumstances such as becoming ill with COVID-19 and having to cancel your trip, hospitalization, and trip delays due to such illness while traveling will have coverage.

Emergency transportation coverage has also been expanded to include COVID-19-related illness. Terms and conditions apply and the endorsement is not available on all policies Allianz offers.

You can find policies that offer Cancel for Any Reason insurance at TravelInsurance.com and Aardy.com .

Bottom Line: Travel insurance policies normally do not cover canceling your trip because of fear you might get ill. However, Cancel for Any Reason insurance allows you to cancel a trip for any reason you determine is necessary.

Types of Travel Insurance Policies Available With Allianz

Allianz Travel offers 2 core types of travel insurance plans: single trip plans and multi-trip plans . Each plan allows you to select the level of coverage you want and subsequently, the level of premium you prefer to pay.

We’ve used criteria to obtain a quote for a traveler age 35, traveling for 1 week to Mexico on a trip costing $3,000 . All benefits are per person, per trip, unless otherwise noted.

The single trip option allows you to select from a Basic, Prime, or Premier plan. Premiums vary by plan and coverage levels. For the example we selected, the premiums ranged from $116 for the Basic to $192 for the Premier pla n .

OneTrip Basic Plan — the Most Affordable Plan

The OneTrip Basic plan offers basic trip protection at an affordable price.

OneTrip Prime Plan — the Most Popular Plan

Need more coverage but still want your travel insurance protection to be affordable? The OneTrip Prime plan offers higher coverage limits at a reasonable cost.

The following are the maximum coverage limits for OneTrip plans. These coverages can be found under the OneTrip Premier Plan:

- Trip Cancellation — up to $100,000 reimbursement for prepaid non-refundable expenses; pre-existing medical conditions included

- Trip Interruption — up to $150,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event; pre-existing medical conditions included

- Emergency Medical — up to $25,000

- Emergency Medical Transportation — up to $500,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $300 for delays 12 hours or more

- Trip Delay — up to $800 ($200/day for 4 days) for delays of 6 hours or more, for eligible expenses; an option to receive $100/day with no receipts required is also available

- Change Fee Coverage — $500

- Loyalty Program Re-deposit Fee Coverage — $500, covers re-deposit of points/miles due to covered trip cancellation

- 24 Hour Hotline Assistance

- Optional coverages include pre-existing medical coverage, rental car coverage, and required to work coverage — restrictions apply

Also worth noting is that kids age 17 and under are covered at no additional charge when traveling with a parent or grandparent.

Bottom Line: Allianz offers several levels of single-trip travel insurance plans that can fit every budget and level of coverage needed.

If you’re a frequent traveler and want to ensure all of your trips are covered without having to purchase individual travel insurance policies, one of the AllTrips plans might be an appropriate choice. All of the trips you book within the 12-month policy period are covered automatically.

Coverage limits are per person, per trip, but more than 1 person can be included in the policy. Children 17 and under are covered at no additional charge when traveling with a parent or grandparent.

The AllTrips Executive plan is the most comprehensive policy and includes the maximum coverage limits listed below . AllTrips Prime and AllTrips Basic have less coverage than the Executive plan but may still be appropriate for your situation.

For example, the AllTips Basic plan does not include trip cancellation/interruption insurance but has emergency medical, evacuation, trip delay, baggage insurance, and car rental insurance.

- Trip Cancellation — up to $10,000 reimbursement for prepaid non-refundable expenses

- Trip Interruption — up to $10,000 reimburses for remaining non-recoverable expenses and increased cost of return transport due to trip interruption as the result of a covered event

- Emergency Medical — up to$50,000

- Emergency Medical Transportation — up to $250,000 for transportation to the nearest medical facility

- Baggage Loss/Damage — up to $1,000 for theft, loss, or damage

- Baggage Delay — up to $1,000 for delays 12 hours or more

- Trip Delay — up to $200 per day for eligible expenses, up to $1,600 in coverage , for delays of 6 hours or more

- Rental Car Damage and Theft — up to $45,000

- Business Equipment Coverage — up to $1,000

- Change Fee Coverage — up to $500

- Loyalty Program Redeposit Fee — up to $500

- Travel Accident Insurance — up to $50,000

- Concierge Services

- Optional Pre-Existing Medical Coverage — restrictions apply

Bottom Line: Allianz’s AllTrips 12-month plans offer affordable options to cover every trip you have booked or have yet to book within a 12-month period.

Travel insurance is one of the easiest policies for which to obtain a quote and subsequently purchase a policy. Unlike auto or home insurance, you simply input some basic information about your trip, your age, where you reside, and your quote is instant.

You can then read through the coverages, select a policy that fits, and hit the purchase button. There is also no risk as you’ll have a free-look period where you can review the policy and decide whether to keep it or not.

If not, you can get a full refund. This period can be 10-14 days after purchase , depending on your plan and state regulations.

Additional Travel Insurance Offered by Allianz

In addition to the travel insurance packages offered by Allianz, you can purchase these additional plans and coverages available for single trips:

If trip interruption/cancellation is not important to you, you’ll find this plan with emergency medical, baggage insurance , emergency transport, travel accident coverage , and trip delay an affordable alternative.

If you need to cancel your trip for a covered reason or your trip is interrupted for a covered event, you’ll have coverage. Trip delay and 24-hour assistance are included.

For $9 per day, receive rental car damage/theft coverage, rental car trip interruption protection, and baggage loss coverage.

Hot Tip: If trip cancellation/interruption or trip delay coverage comes with your credit card is adequate for your trip but you want additional medical coverage, the Allianz’s OneTrip Emergency Medical plan may be a viable and affordable supplement.

How Allianz Compares

When it comes to comparing travel insurance policies, it’s difficult to match apples to apples. Coverages vary widely, as well as terms and conditions. The lowest-priced policy is not always the best value for your needs. The flip side is possible, too. You may find a policy with plenty of coverage at a price that is more than you want to spend.

The best solution is when you find a balance between coverage and cost.

Here’s how Allianz’s travel insurance offerings compare with other travel insurance options.

The coverage that comes with your credit card does not compare with a comprehensive travel insurance policy . In addition to the limited travel insurance coverage credit cards offer, if you do have a claim, you’ll have the potential hassle of dealing with a third-party claims administrator.

With that being said, the trip cancellation, trip interruption, trip delay insurance, and primary rental car insurance coverages found on several credit cards may be more than adequate for your trip.

Here are some of the best credit cards for travel insurance:

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.