ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

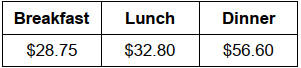

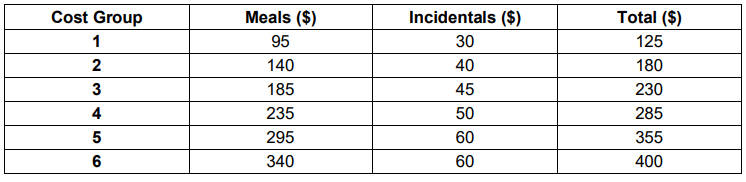

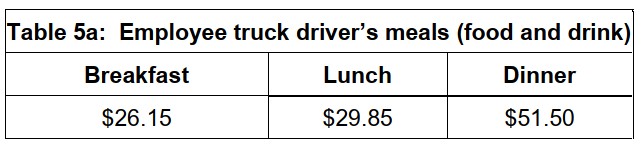

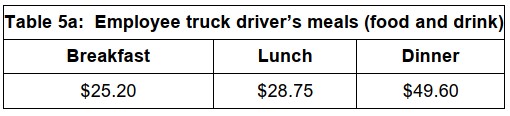

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

2023-24 Domestic Travel

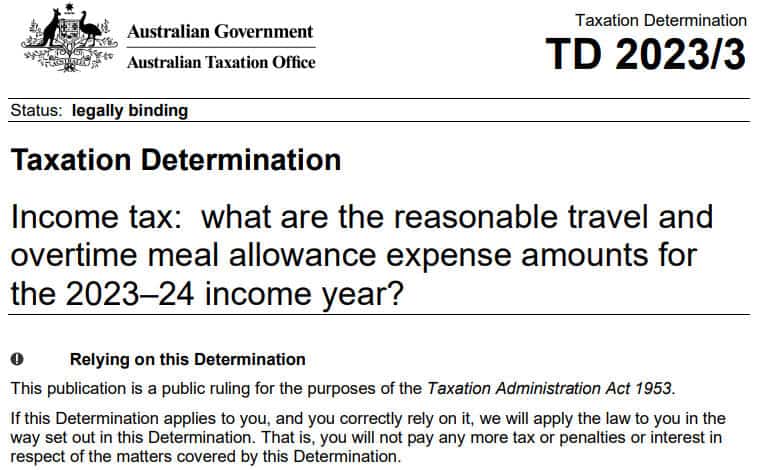

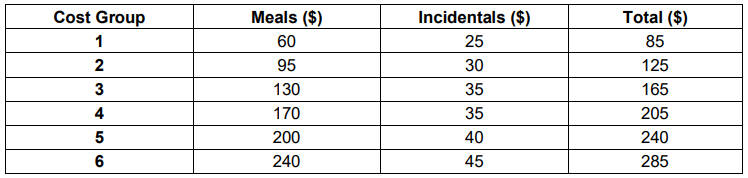

Table 1:Salary $138,790 or less

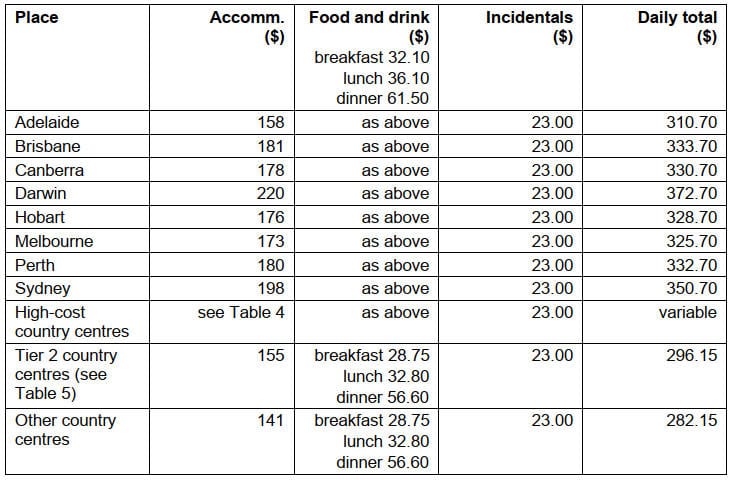

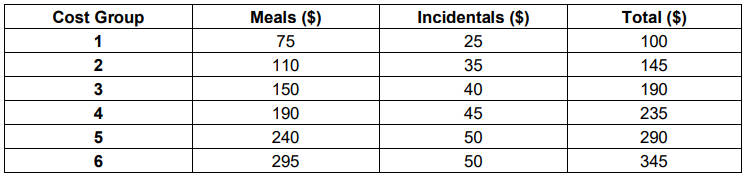

Table 2: Salary $138,791 to $247,020

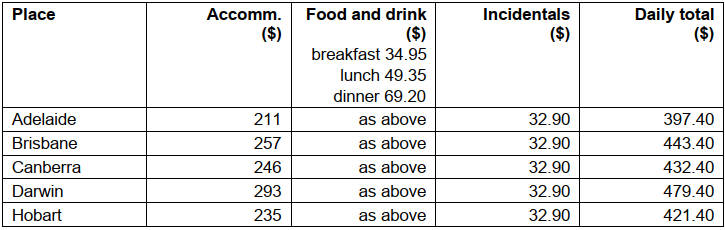

Table 3: Salary $247,021 or more

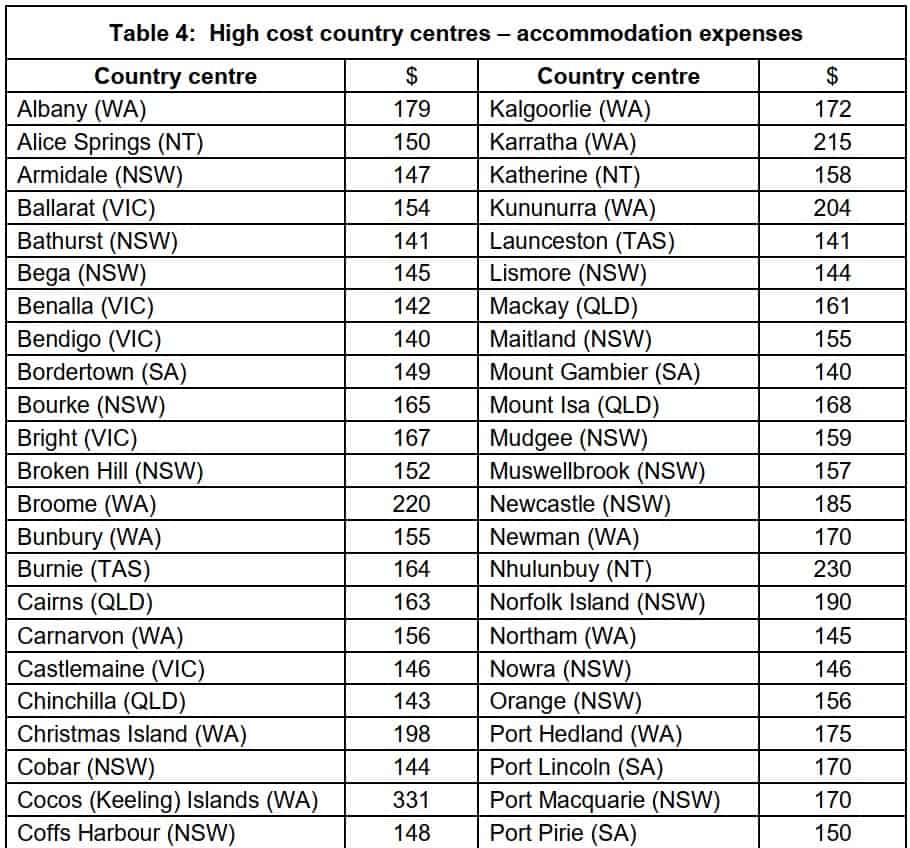

Table 4: High cost country centres accommodation expenses

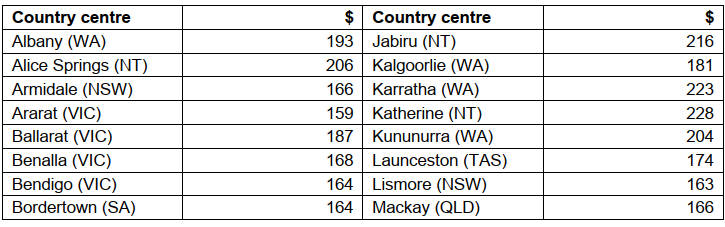

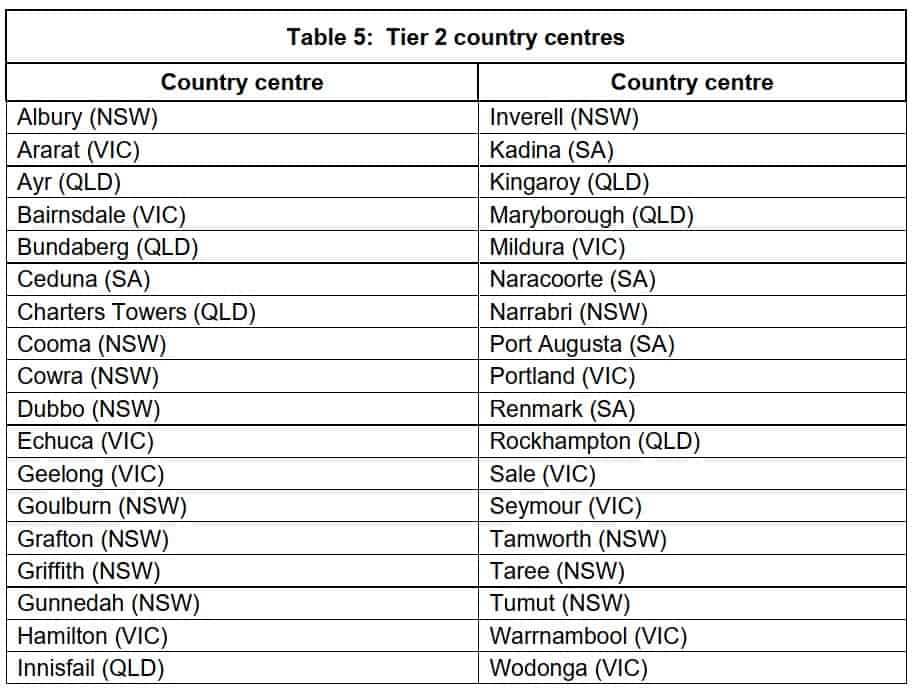

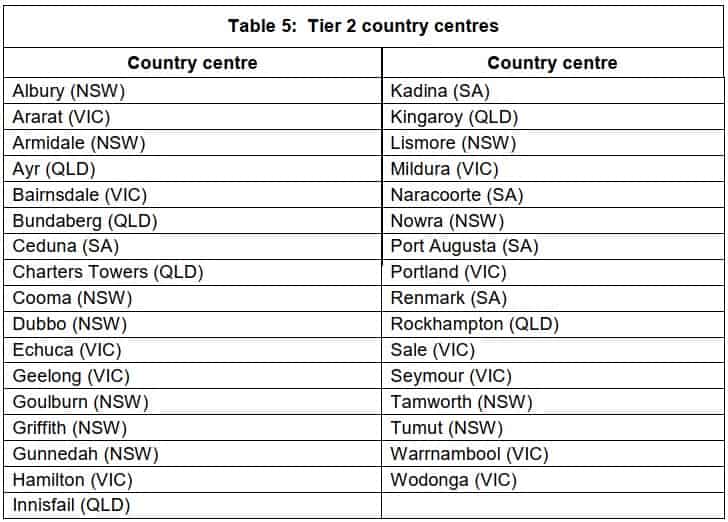

Table 5: Tier 2 country centres

Table 5a: Employee truck driver’s meals (food and drink)

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

Table 7: Salary $138,791 to $247,020

Table 8: Salary $247,021 or more

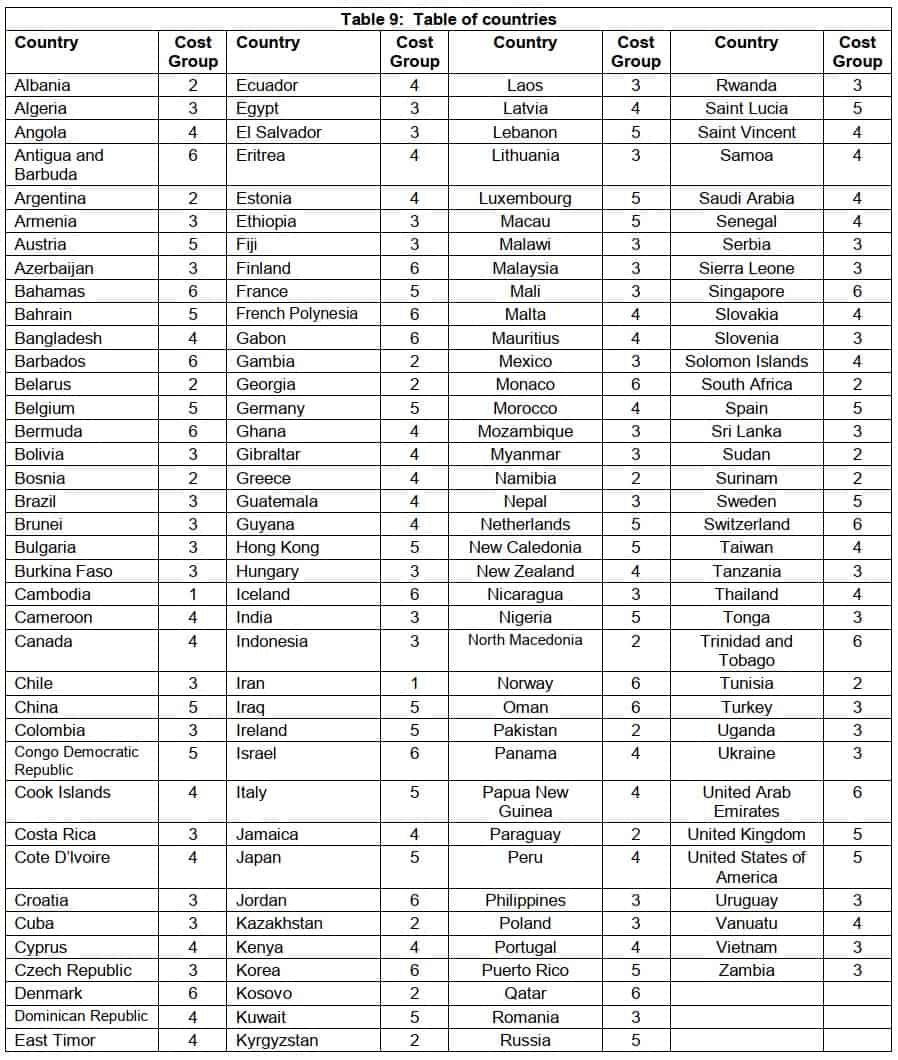

Table 9: Table of countries

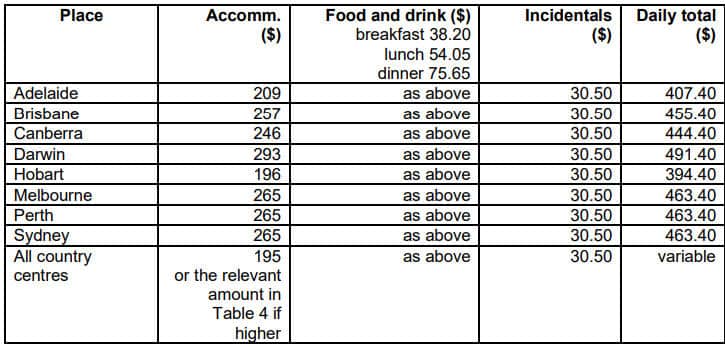

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

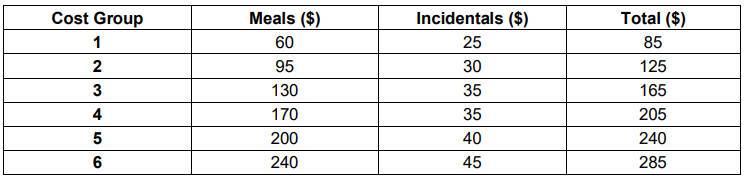

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

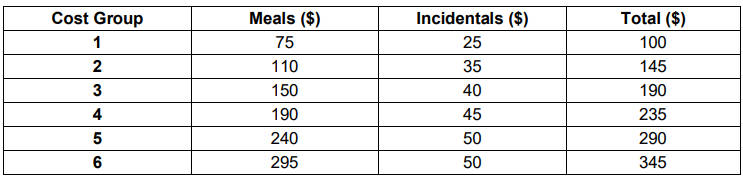

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

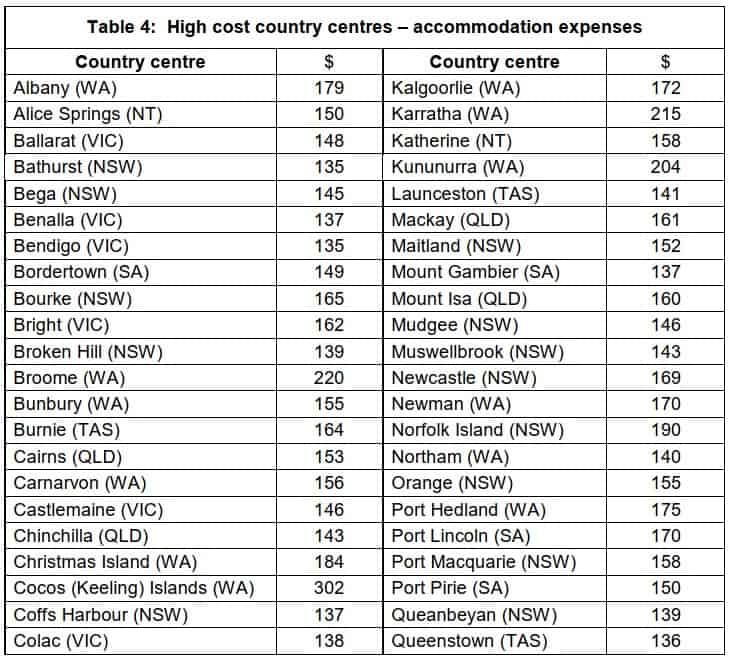

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

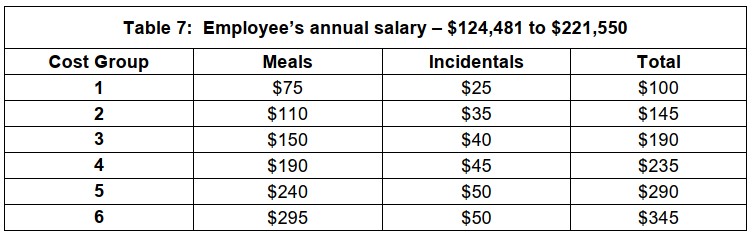

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

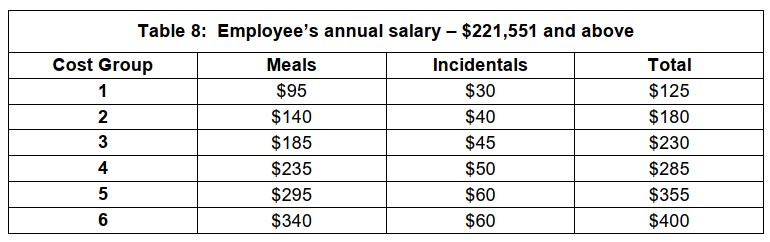

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

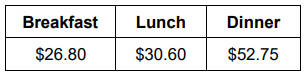

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

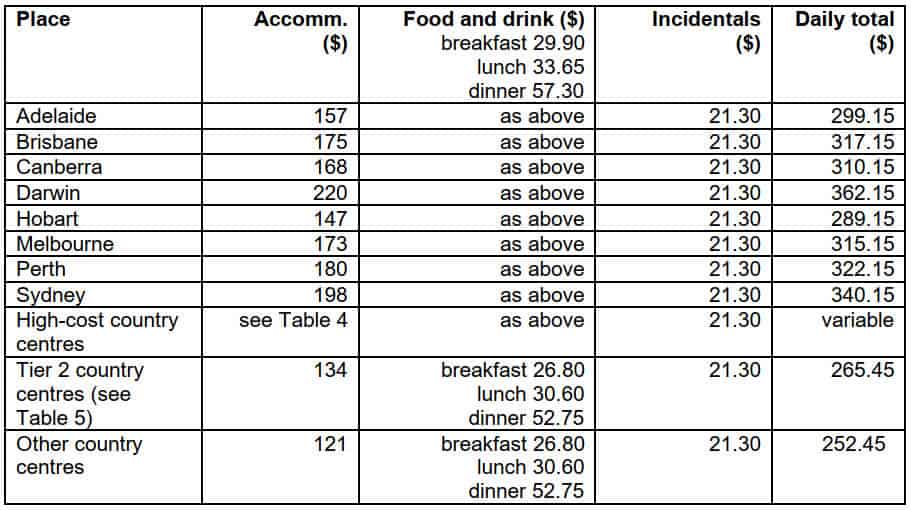

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

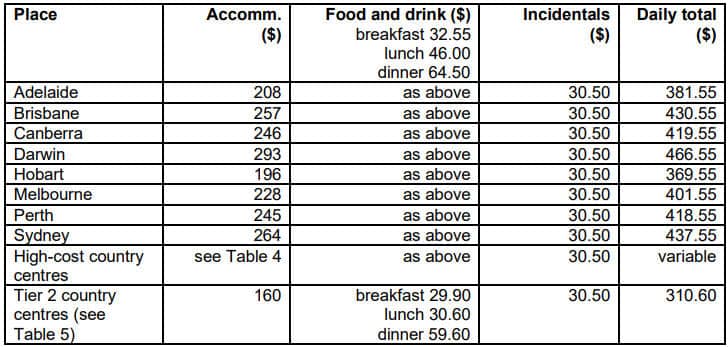

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

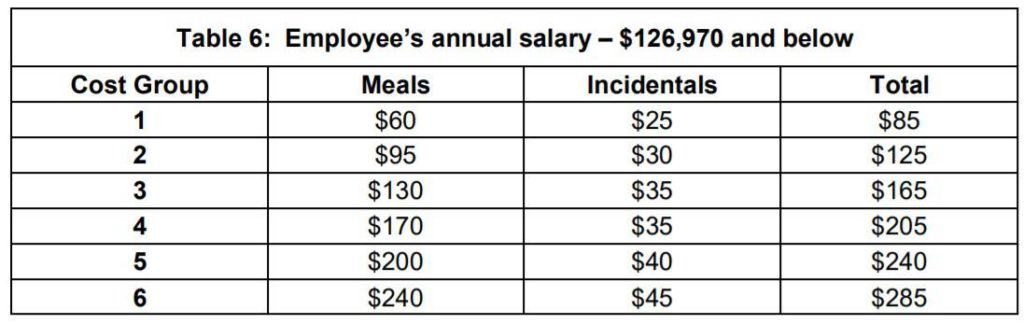

Table 6: Salary $133,450 and below

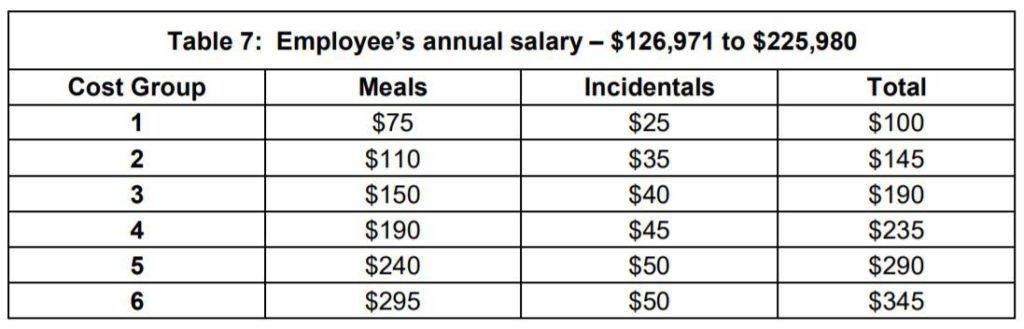

Table 7: Salary – $133,451 to $237,520

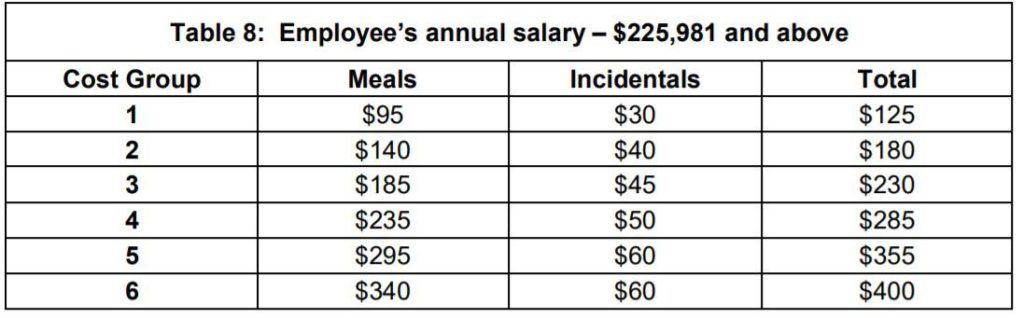

Table 8: Salary – $237,521 and above

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

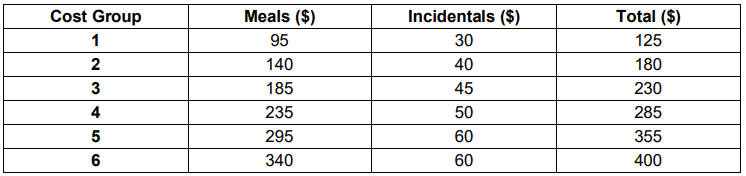

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

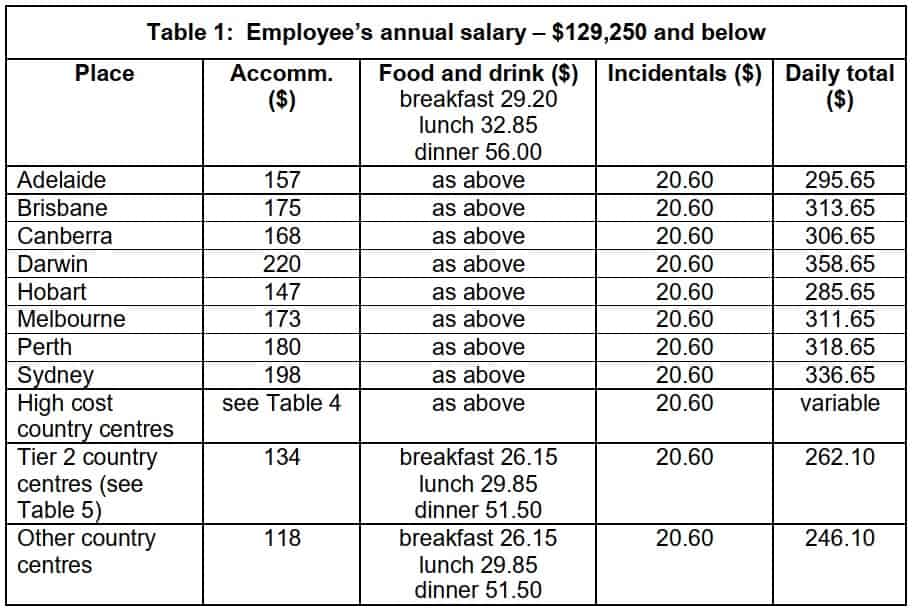

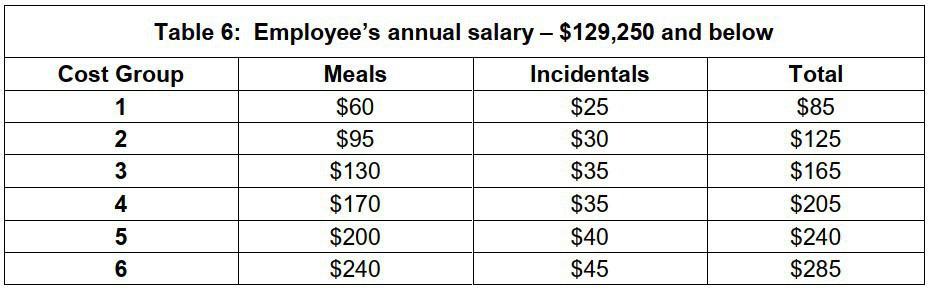

Table 1: Salary $129,250 and below

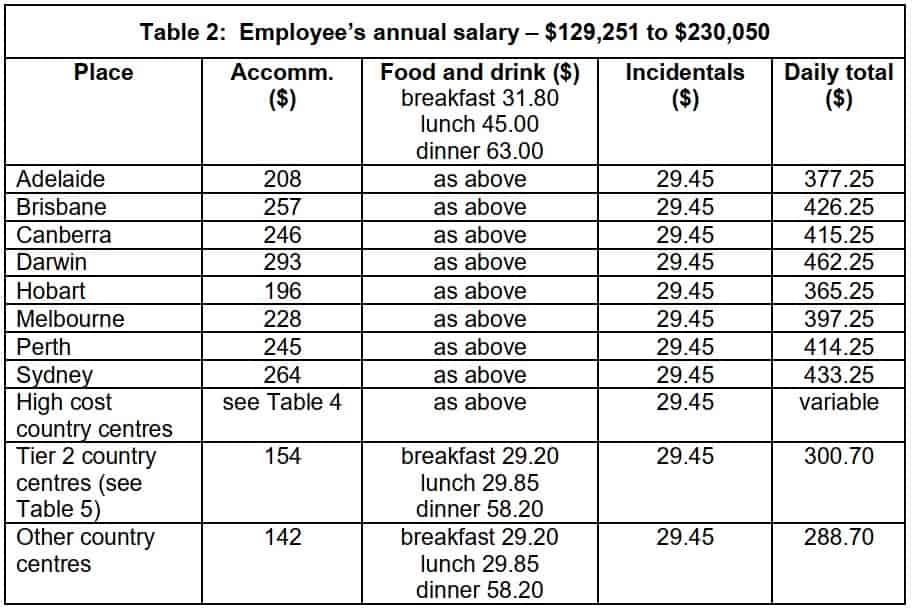

Table 2: Salary $129,251 to $230,050

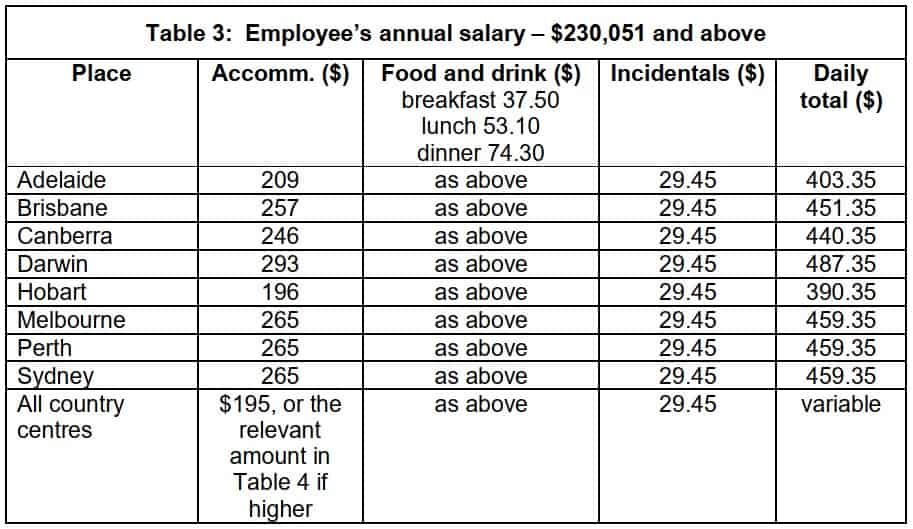

Table 3: Salary $230,051 and above

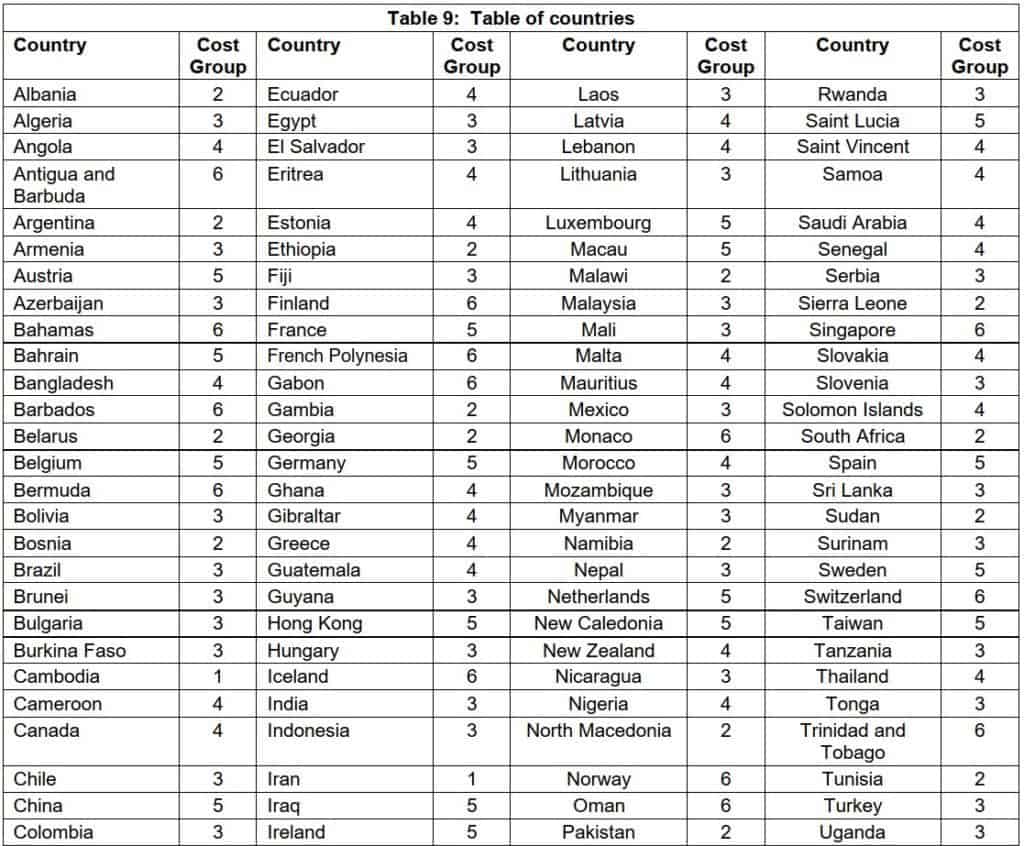

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

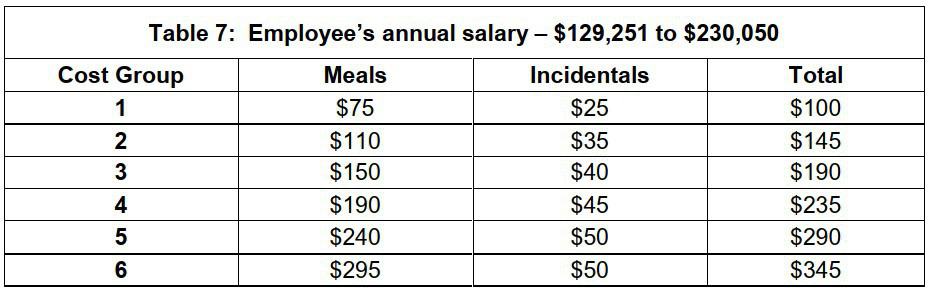

Table 7: Salary – $129,251 to $230,050

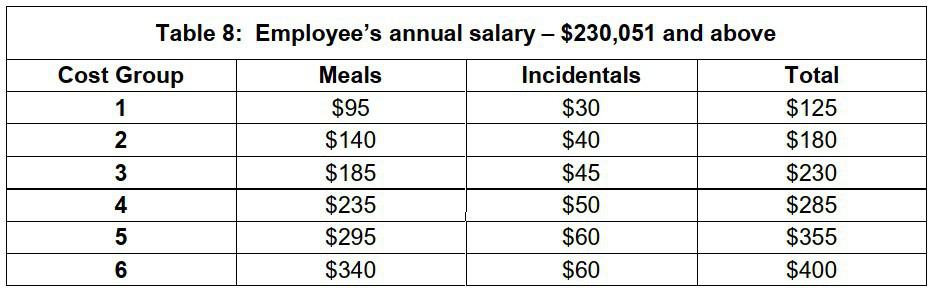

Table 8: Salary – $230,051 and above

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

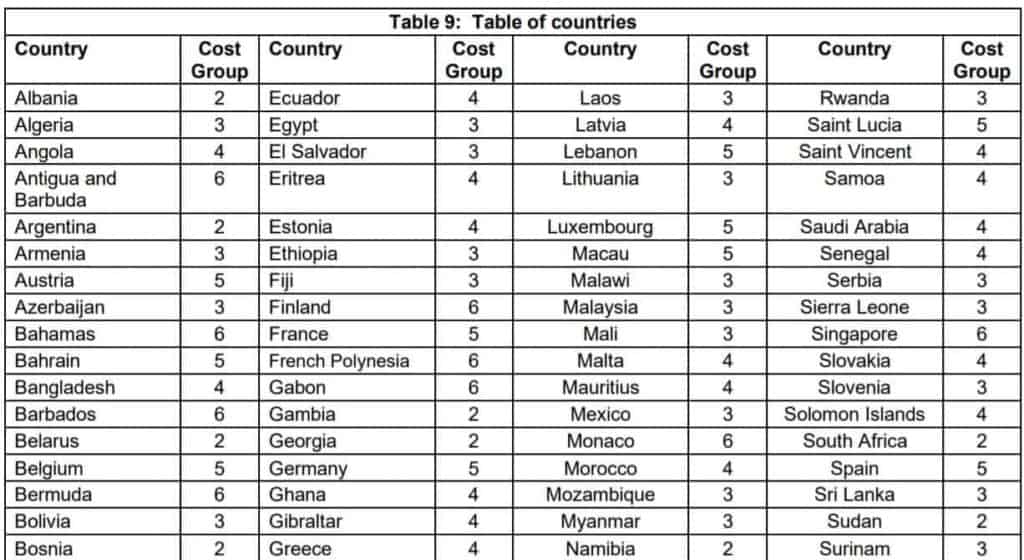

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

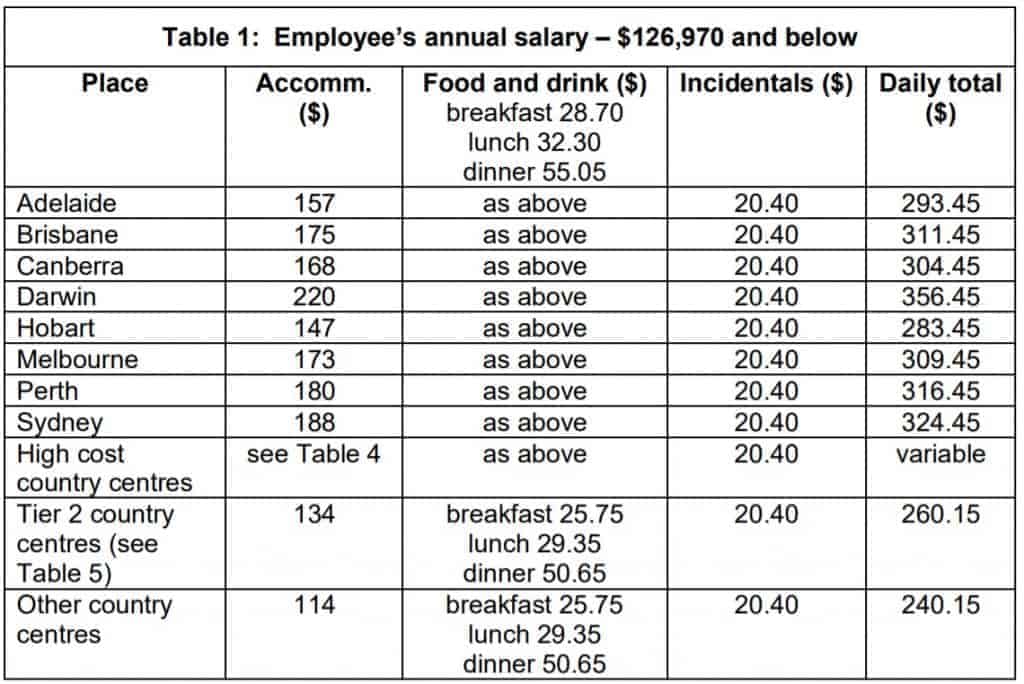

Table 1: Salary $126,970 and below

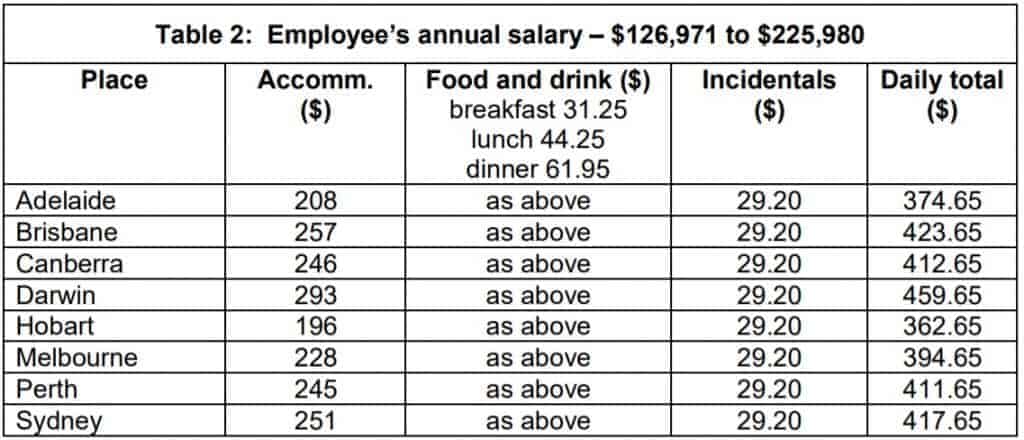

Table 2: Salary $126,971 to $225,980

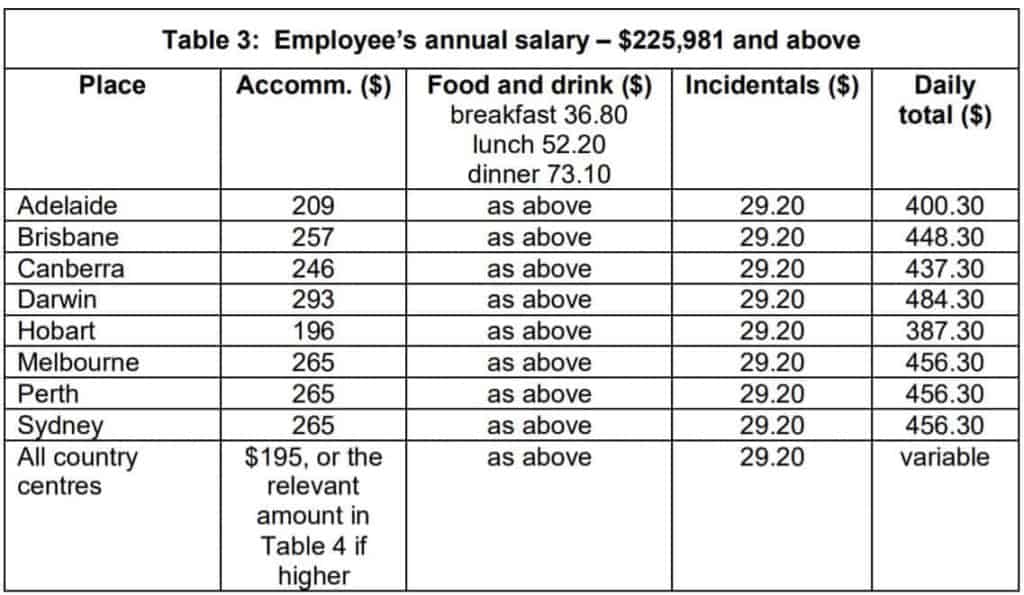

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

Table 6: Salary $126,970 and below

Table 7: Salary – $126,971 to $225,980

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

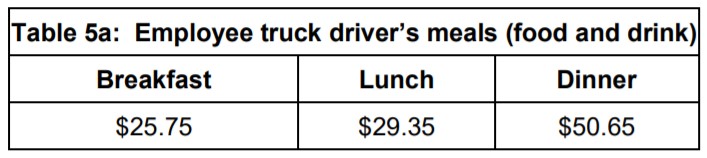

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

2020-21 Overseas Table 9: Table of countries

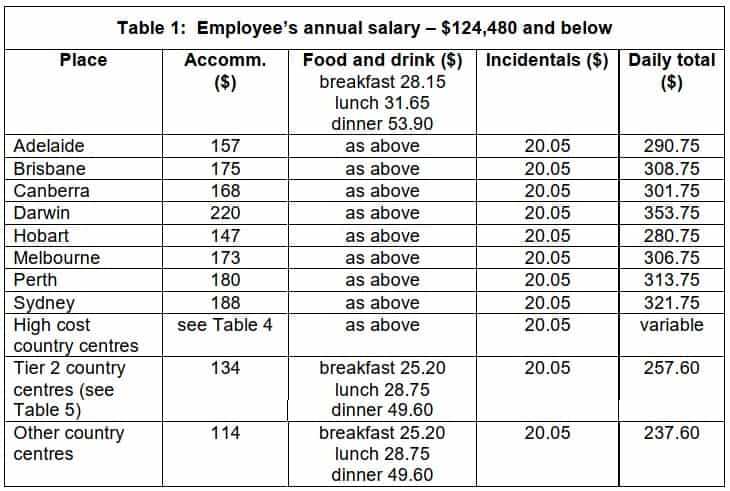

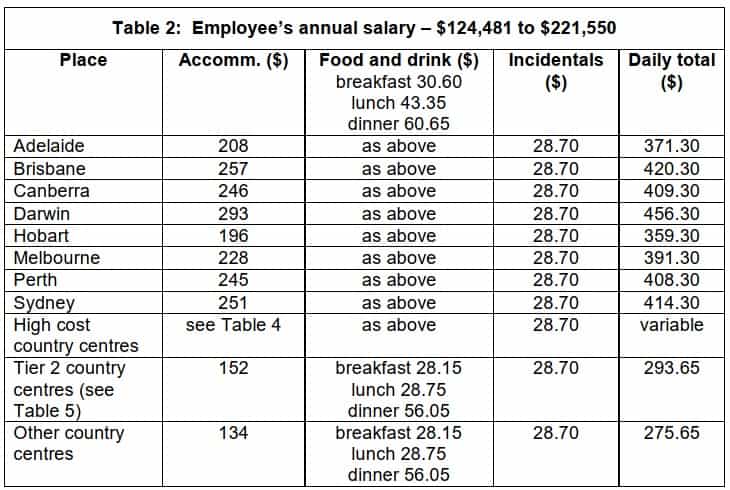

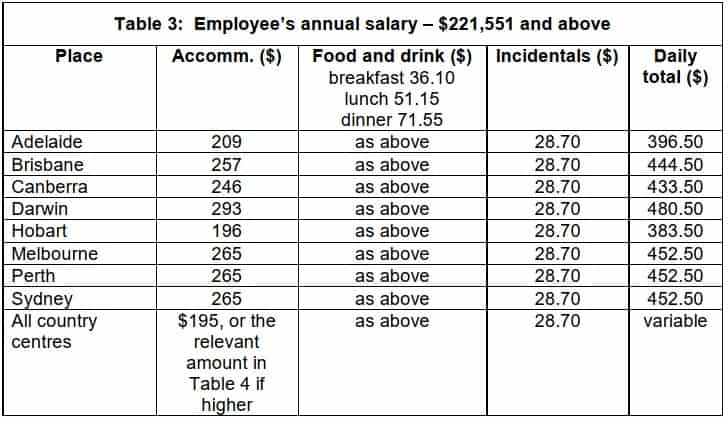

Allowances for 2019-20

The determination in sections:

Domestic Travel

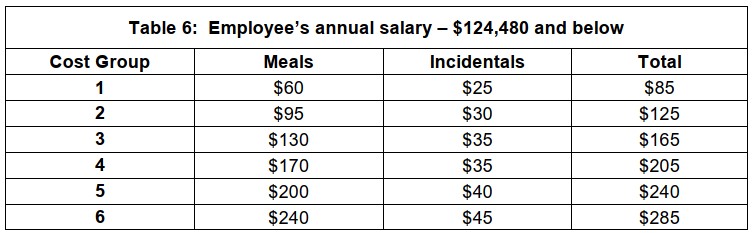

Table 1: Employee’s annual salary – $124,480 and below

Table 2: Employee’s annual salary – $124,481 to $221,550

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

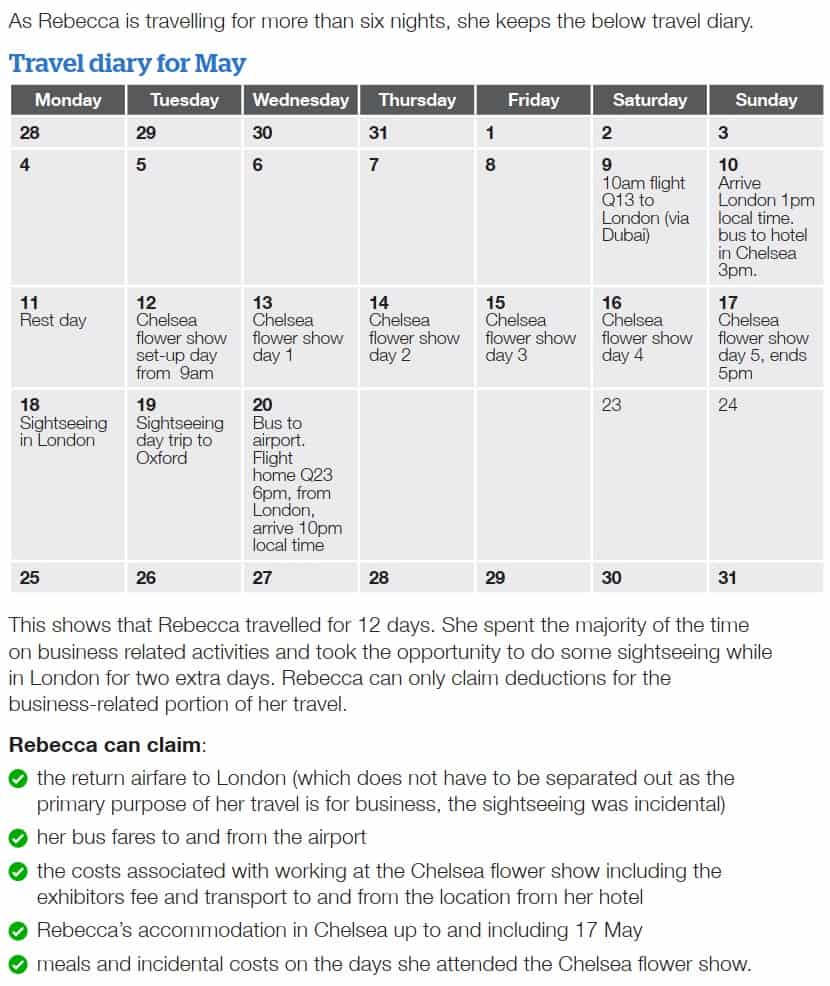

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here .

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28

- Help and resources

- Register for My Account

- Sign in to My Account

Federal Register of Legislation

Page not found.

The page you requested could not be found.

If you can't find what you are looking for the page or file that you are trying to access may have moved, or the web address you have entered is now incorrect.

To help find what you’re looking for, you could:

- check that you entered the address correctly

- search the website using keywords

- navigate from the homepage or use the browse menu

- access previous versions of this website on the National Library of Australia’s Australian Government Web Archive

If you still can’t find what you need, contact us for assistance.

Reasonable travel and overtime meal allowance amounts for 2019-20

Taxation Determination TD 2019/11, issued on 3 July 2019, sets out the amounts the Commissioner treats as reasonable for the 2019-20 income year in relation to employee claims for overtime meal expenses; domestic travel expenses; and overseas travel expenses.

For employee truck drivers who receive a travel allowance and are required to sleep (take their major rest break) away from home, TD 2019/11 provides separate meal expense amounts for breakfast, lunch and dinner.

Post navigation

- What's new

- ATO Community

- Legal Database

Login to ATO online services

Access secure services, view your details and lodge online.

Travel allowances for overnight travel

How to declare your travel allowance and claim expenses. Check the reasonable amounts and record keeping exceptions.

What is a travel allowance?

Check if the payment you receive from your employer is a proper travel allowance.

Declaring your travel allowance and claiming expenses

What to do if you receive a travel allowance to cover your travel expenses when travelling for work.

Record keeping exceptions for travel allowance expenses

You may not need to keep receipts or a travel diary for travel allowance expense claims within the reasonable amounts.

- Our History

- Our Mission

- Opportunities

- Testimonials

- Michael Quinn

- Peter Quinn

- Neutral Bay

- Virtual Meetings

What you need to know about travel allowances and your tax return

by Quinns_News | May 18, 2011 | Accounting News | 2 comments

In certain roles and industries, as defined by your employer, you may be required to travel in order to carry out particular tasks. In such circumstances, it is likely that you will be provided a travel allowance in addition to your regular wage or salary package.

A travel allowance is paid to you as an employee to cover losses or outgoings that are incurred when you travel away from your ordinary residence in the course of your duties.

Each year, the ATO publishes a determination setting out the amounts considered ‘reasonable’ for claims for domestic and overseas travel allowance expenses. For example, the reasonable overtime meal allowance for the 2009-10 year is $24.95 per meal.

Travel allowance expenses include:

• accommodation • meals • expenses incidental to travel. For example, car, travel and transport allowances, including reimbursements of car expenses calculated by reference to the distance travelled by the car, such as ‘cents-per-kilometre’ allowances

They are set out for various travel destinations and employee categories and the rates shown for domestic travel apply only for stays in commercial establishments such as hotels, motels and serviced apartments. If a different type of accommodation is used, the rates do not apply.

If you receive an allowance you may be able to claim a deduction for your expenses covered by the allowance but only to the extent that you actually incurred those expenses in producing your employment income.

Your employer is required to withhold part of your pay for PAYG reasons if you are expected to incur expenses that may be able to be claimed as a tax deduction at least equal to the amount of the allowance; or if the amount and nature of the allowance is shown separately in your employer’s accounting records.

If the allowance is paid at the rate equal to or below the ‘reasonable travel allowance’ rate, and the allowance is separately accounted for, no PAYG withholding is necessary. In addition, the travel allowance does not need to be shown on your payment summary.

Alternatively, if the allowance is paid above the ‘reasonable travel allowance’ rate (in total), your employer is required to withhold PAYG from the amount over the reasonable allowances amount. The total amount of the allowance should be included on your payment summary in the allowance section/box.

Where the deductible expense is less than the allowance received, you must show the allowance as assessable income in your tax return, and claim only the amount of the deductible expense incurred. For example, if you received a $500 allowance for accommodation on a work trip, yet you only spent $300, you should include the whole amount of the allowance ($500) in your assessable income when preparing your tax return, but then claim a deduction of $300.

If the cost of accommodation, meals and incidentals exceed the amount of travel allowance received, you will need to keep documentary evidence for those particular trips during the financial year. With these costs, you can either:

• claim the actual expenses incurred by including the amounts of travel allowance for which excessive expenditure is being claimed and claim a deduction for the corresponding expenses incurred in your income tax return • claim nothing, if the travel allowance is not recorded on your payment summary. There is no need to include the total amount as assessable income in your income tax return and, therefore, no need to claim a reciprocal deduction.

If the travel allowance is recorded on the payment summary, you will need to include the amount in your assessable income and claim either:

• the expenses you incurred (that can be substantiated with receipts or other documentation) or • the ATO’s reasonable travel amounts.

If you received a travel allowance or an overtime meal allowance paid under an industrial law, award or agreement you do not have to include it on your tax return if:

• it was not shown on your payment summary • it does not exceed the Commissioner’s reasonable allowance amount, and • you spent the whole amount on deductible expenses.

It is important to be aware that the mere receipt of an allowance does not entitle you to a deduction. Also, expenses incurred by travelling between work and home everyday are not an allowable deduction unless exceptional circumstances exist.

Since you are not always guaranteed to be able to claim a deduction for your allowances it is important you seek the advice of a professional before lodging your tax return. Here at The Quinn Group our experienced team of tax agents and accountants can assist you in legally minimising your tax. For more information submit an online enquiry or call us on 1300 QUINNS (7854 667) or on +61 2 9223 9166 to book an appointment.

during the past year I was sent to Canberra from Wollongong for work, the company paid the accomodation costs and paid me $75 a day for my meals and no incidental allowance, the cost of meals and incidentals was slightly more than the allowance paid but below the reasonable amount set out inT/D 2011/17, can I claim the difference?

Please can somebody advise me as to whether my employer should pay me for petrol costs when I use my car for work purposes. They do not pay me anything extra at present and although I am only travelling 10-15km a day for them I feel that they should be reimbursing my costs. Hope somebody can help. Gill

Latest Post

categories.

- Accounting News

- Consumer News

- Employment and Human Resources News

- Financial Planning News

- Mergers & Acquisitions News

- Newsletter Features

- Small Business News

- Tax Advice and Updates

- Uncategorized

- Accounting Services

- Business Lawyers

- Corporate Lawyers

- Family Lawyers

- Tax Accountants

- Tax Lawyers

Free Resources

Latest News

quinntessential tv.

Our Clients

We value feedback. Here is what our clients say…

Glenn Burns Overseas Legal & Accounting Client as a time-poor business owner operating a subsidiary in Australia, it was necessary for me to find an

Reasonable travel and overtime meal allowance amounts for 2019-20

12 aug reasonable travel and overtime meal allowance amounts for 2019-20.

Taxation Determination TD 2019/11, issued on 3 July 2019, sets out the amounts the Commissioner treats as reasonable for the 2019-20 income year in relation to employee claims for overtime meal expenses; domestic travel expenses; and overseas travel expenses.

For employee truck drivers who receive a travel allowance and are required to sleep (take their major rest break) away from home, TD 2019/11 provides separate meal expense amounts for breakfast, lunch and dinner.

IMAGES

VIDEO

COMMENTS

TD 2019/11 Page status: legally binding Page 1 of 13 . Taxation Determination Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2019-20 income year? Relying on this Ruling This publication (excluding appendixes) is a public ruling for the purposes of the Taxation Administration Act 1953.

Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2022-23 income year? Relying on this Determination This publication is a public ruling for the purposes of the Taxation Administration Act 1953. If this Determination applies to you, and you correctly rely on it, we will apply the law to you in the

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25. The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019). Download the PDF or view online here.

The ATO has also included an example in this regard. PCG 2021/3 has clarified the potential to reset the 21-day count for travel to other work locations, or travel back home. Additionally, PCG 2021/3 now also applies the 90-day threshold on a fringe benefit tax (FBT) year basis, effectively allowing for the reset each FBT year.

In brief. On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax ...

a tool allowance of $20.02 per week. ... use this allowance type to report only travel allowances that exceed the ATO reasonable amount. As travel allowances for overseas accommodation don't have a varied rate for PAYG withholding, don't report them using this allowance type. ... allowance that is paid for overseas accommodation for business ...

The Legislative Instrument, or determination, applies the Tribunal's 2019 travel and motor vehicle allowances review decisions effective from 25 August 2019. The determination supersedes the previous principal determination, Remuneration Tribunal (Official Travel) Determination 2018. The major purpose of the determination is to adjust the ...

Draft Practical Compliance Guideline (PCG) 2021/D1 - Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location - ATO compliance approach. These newly published products replace previous ATO draft guidance TR 2017/D6 which has been withdrawn. The subject matter of TR 2021/1 is ...

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 2021/22) financial year. Tax Determination TD2021/6 sets out the rates for employee taxpayers who travel within Australia or overseas for work-related purposes and receive travel allowances. Substantiation requirements do not apply if accommodation, food ...

Quarantine and testing expenses when travelling for work. Deductions for expenses you incur if you're travelling for work during COVID-19 and must quarantine. QC 72129. Work-related travel expenses, records you need to keep, travel allowances and record keeping exceptions.

The reasonable amount for incidentals applies in full to each day of travel covered by the allowance, without the need to apportion for any part-day travel on the first and last day. 39. The reasonable amounts for overseas travel expenses per day according to salary levels and cost groups for the 2022-23 income year are shown in Tables 6 to 9 ...

Reasonable travel and overtime meal allowance amounts for 2019-20. Taxation Determination TD 2019/11, issued on 3 July 2019, sets out the amounts the Commissioner treats as reasonable for the 2019-20 income year in relation to employee claims for overtime meal expenses; domestic travel expenses; and overseas travel expenses.

Reasonable amounts for overseas travel expenses 31 . Example 4 39 Date of effect 43 . ... $20 on her meal. 6. Because Samantha has spent less than the reasonable amount for overtime meal expenses, she can claim a deduction for the $20 she spends and she is not required to ... Canberra travel allowance rates for domestic travel, having regard to ...

Reasonable allowance amounts. If your travel allowance was not shown on your income statement or payment summary and was equal to or less than the reasonable allowance amount for your circumstances, you do not have to include the allowance at item 2 provided that you have fully spent it on deductible work-related travel expenses and you do not ...

Record keeping exceptions for travel allowance expenses. You may not need to keep receipts or a travel diary for travel allowance expense claims within the reasonable amounts. QC 72132. How to declare your travel allowance and claim expenses. Check the reasonable amounts and record keeping exceptions.

reasonable (reasonable amounts) for the substantiation exception 1 in Subdivision 900-B of 1 This Determination should be read together with Taxation Ruling TR 2004/6 Income tax: substantiation exception for reasonable travel and overtime meal allowance expenses which explains the substantiation exception and the way in which these expenses are ...

If you want to apply for a private ruling about the deductions you can claim for overseas travel, you need to: complete and submit the relevant private ruling application form (for tax professionals or not for tax professionals) provide the supporting information listed below. If you want to lodge an objection about the rental property ...

Each year, the ATO publishes a determination setting out the amounts considered 'reasonable' for claims for domestic and overseas travel allowance expenses. For example, the reasonable overtime meal allowance for the 2009-10 year is $24.95 per meal. Travel allowance expenses include: • accommodation • meals

Taxation Determination TD 2019/11, issued on 3 July 2019, sets out the amounts the Commissioner treats as reasonable for the 2019-20 income year in relation to employee claims for overtime meal expenses; domestic travel expenses; and overseas travel expenses. For employee truck drivers who receive...

Hello, I have a question about claiming a deduction for meals and incidentals for working away from home. My employer is an Australian company and I have a payment summary showing a taxable travel allowance of $2,900. ="Matt">They send me to China to teach, and during the 2019/20 financial year I worked for 147 days in China.

My accommodation was paid by my employer and a flat rate of $90 a day to cover my meals & incidentals. I have spent more than $90 per day and ATO's reasonable amounts for overseas travel expenses per day is more than $90. According to ATO website I can claim the travel allowance if its within the ATO guide. However, the allowance is not shown ...