Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

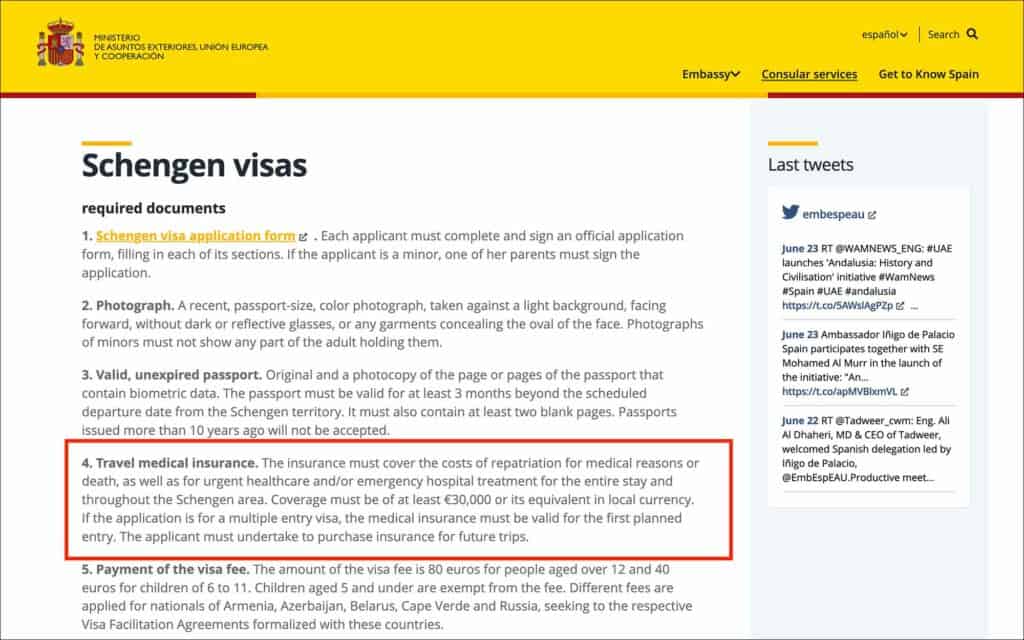

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

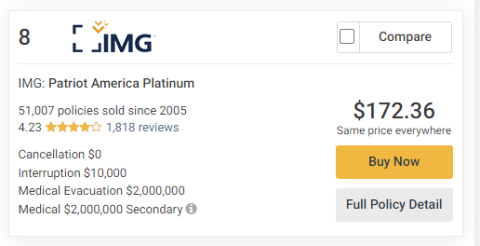

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

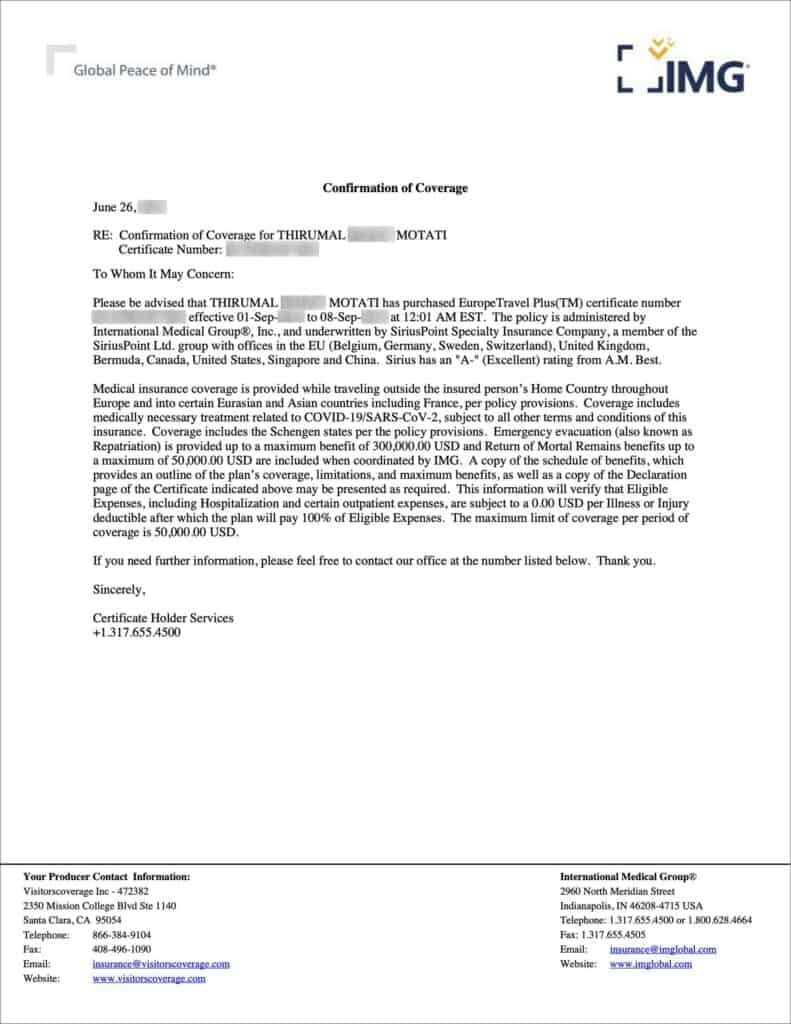

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

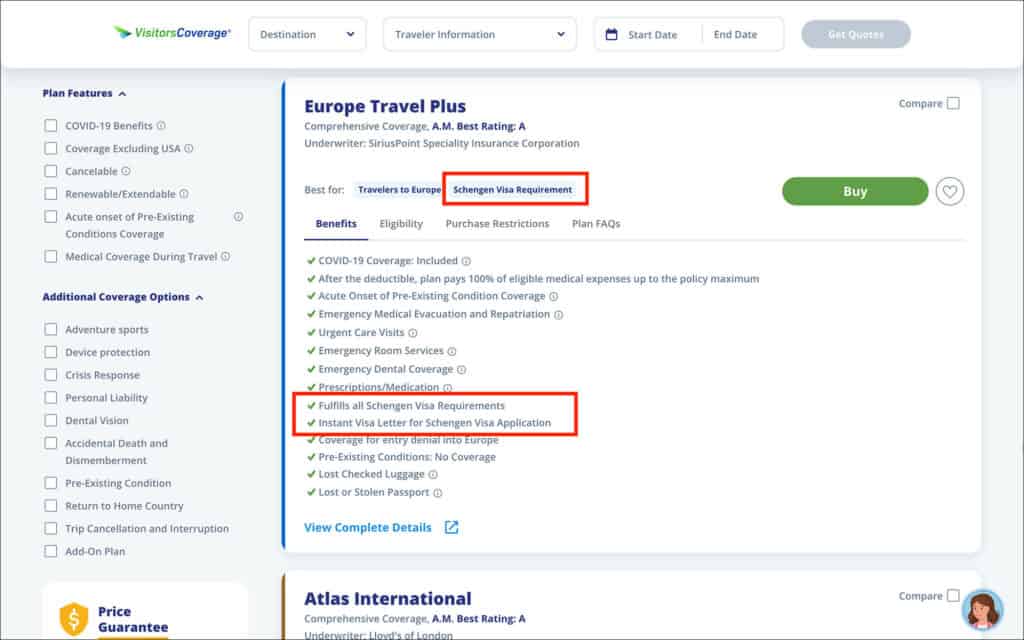

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

Schengen Travel Insurance

Traveling to a schengen area.

- Double-check the expiration date on your passport, paying particular attention to the validity of childrens passports, whic are only valid for five years.

- Make sure your passport is valid for at least six months beyond your intended return date

- Always carry your passport with you when traveling to other countries within the Schengen Area. While there may not be any border checks at the time of your travel, officials have the authority to reinstate border controls at any time, without prior notice.

Schengen Travel Insurance of which AXA is a leading provider, covers you in all 27 Countries within the Schengen Territory that have abolished internal border controls for their citizens. The countries are:

Do I need travel insurance while traveling to Schengen Countries?

What do I receive with my Schengen travel insurance?

What countries are covered under my axa travel plan, how can axa help with your trip to europe, how to get a travel protection quote.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Does AXA Travel Insurance provide coverage for Schengen Visa?

AXA Gold and Platinum plans offer the necessary medical and assistance coverage in all 27 countries in the Schengen Territory. However, the Gold and Platinum plans only provide coverage up to 60 – 90days.

What should I do if I have a medical issue while in the Schengen Area?

Please contact the local authority as soon as possible. Then contact us on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy. If you require assistance while traveling, call us at +1312-935-1719

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

Need help choosing a plan.

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

licensed agents available

Find the Best Travel Insurance & Avoid Costly Surprises

- 22 Top-Rated Providers

- Side-by-Side Comparison

- 3 Million+ Travelers Insured

Standard Single Trip Policies

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

Squaremouth has helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Great Experience!

"The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others."

Savannah from NC 03/26/2024

Great Coverage and Price

"Getting a travel insurance quote online was easy. We have used Squaremouth before and have been pleased each time. It's peace of mind for our travel needs."

Rhonda from IN 03/20/2024

Easy to Use!

"I always use Squaremouth simply because it is so easy to use and offers plans that are affordable to me."

Emily from AZ 03/08/2024

Very pleased!

"They give great service, and the website is so easy to navigate to find just the right insurance plan. I always appreciate working with them."

Don from UT 03/07/2024

The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others.

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

How to Buy Travel Insurance on Squaremouth

If you’re new to Squaremouth, this quick guide can help you identify your needs, start your first quote, and compare your results. If you need additional help, our customer service team is just a phone call away.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

While rare, some countries or organized tours may require proof of travel insurance that lasts for the duration of your trip. Our Destination Center is a good starting point to learn about entry requirements and travel insurance recommendations.

While it is typically not mandatory, travelers should consider buying insurance if they want to protect themselves financially from unforeseen events that may impact their travel plans. Many Americans and U.S. residents purchase travel insurance when planning international or high cost trips. View our list of the top international travel insurance providers .

What Does Travel Insurance Cover?

Comprehensive travel insurance is designed to cover common disruptions that may impact a trip. Most policies will provide coverage for trip cancellations , medical emergencies , travel delays , missed connections , accidental death and dismemberment , and lost luggage . Travelers that experience financial loss as a result of a covered disruption may be eligible for reimbursement through their insurance policy.

How Much Does Travel Insurance Cost?

In general, a comprehensive policy with Trip Cancellation typically costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without an insured trip cost will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: Travel insurance benefits outline what situations are covered under each plan. Make sure each plan you’re considering includes coverage for what’s important to you.

- Coverage Limits: Plans will set limits to how much reimbursement you’re eligible for, and can vary significantly. Higher coverage limits can result in less out of pocket expenses in the event of a claim.

- Exclusions: Travel insurance companies will list specific activities, equipment, and scenarios that are not covered by their plans in the event of a claim.

- Premium: Higher priced insurance products do not always equate to better coverage. We recommend choosing the most affordable plan that offers the travel protection you need.

- Provider Reputation: All providers on Squaremouth have been carefully vetted and offer 24-Hour Assistance services. Customers are also encouraged to share honest reviews about their experience before, during, and after their trips.

Does Travel Medical Insurance Cover International Trips?

In many cases, primary health care plans, such as Medicare or a policy you have through your employer, are not accepted overseas. If you’re not covered, you may be responsible for unforeseen medical expenses if you get sick or injured while traveling.

To avoid out-of-pocket expenses if you need medical care in the event of an emergency, many travelers opt for travel medical insurance. These plans can cover the cost of treating unexpected medical conditions incurred during your international trip.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance policies cover trip cancellations under specified circumstances, such as sudden illness, injury, or death of the insured or a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Travel insurance prices are regulated by law, meaning the price of one specific policy must be the same regardless of where it is sold, whether it’s purchased from Squaremouth or directly from the provider.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

8 Cheapest Travel Insurance Companies Worth the Cost

Trawick International »

World Nomads Travel Insurance »

AXA Assistance USA »

Generali Global Assistance »

Seven Corners »

Allianz Travel Insurance »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Cheapest Travel Insurance Companies.

Table of Contents

- Trawick International

- World Nomads Travel Insurance

- AXA Assistance USA

There are plenty of smart ways to save money on your travel plans, but refusing to buy travel insurance isn't necessarily one of them. Not having travel insurance can mean being on the hook for exorbitant medical bills or costs for emergency transportation if you become sick or injured during your trip. You could also face significant financial losses if your trip is delayed or your bags are lost or stolen, and without travel insurance you won't have a third party to rely on for assistance.

Buying affordable travel insurance makes more sense than skipping this coverage altogether, so read on to find out which companies offer the cheapest plans and all the protections you can get for a low cost.

How We Chose the Cheapest Travel Insurance Companies

To determine the cheapest travel insurance companies, U.S. News created sample traveler profiles for three separate eight-day trips to different destinations (the Cayman Islands, Spain and California) at a range of price points ($6,500, $10,500 and $8,500, respectively). We used that information to get quotes for the cheapest option for 100% trip cancellation coverage for each trip. We then calculated the average cost of the trips.

The travel insurance companies that made our ranking have a high credit rating and offer the lowest average cost, outlined below. (Note: The sample average costs are not price quotes from U.S. News. To find a travel insurance price quote, use the "View plans" link to enter your trip details and find more information.)

- Generali Global Assistance

- Seven Corners

- Allianz Travel Insurance

- IMG Travel Insurance

- Trip cancellation coverage (up to $30,000) for 100% of the insured vacation

- Trip interruption coverage (up to $30,000) for 100% of the insured vacation

- Trip delay coverage worth up to $1,000 ($150 per day for delays of 12 hours or more)

- $750 in coverage for lost and damaged luggage; $200 for baggage delays

- Up to $500 in coverage for missed connections of three hours or more

- Up to $50,000 in emergency medical coverage ($750 sublimit for emergency dental)

- Up to $200,000 in coverage for emergency medical evacuation

- Up to $2,500 of trip protection for cancellation or interruption

- Up to $1,000 in coverage of lost, stolen or damaged baggage; up to $750 for baggage delays on your outward journey

- Up to $100,000 in emergency medical insurance; $750 dental sublimit

- Up to $300,000 in coverage for emergency medical evacuation

- 24-hour travel assistance services

- Up to 100% coverage for trip cancellation and interruption

- Up to $500 in coverage for trip delays ($100 per day)

- Up to $500 in coverage for missed connections

- Up to $25,000 in coverage for emergency medical expenses

- Up to $100,000 in coverage for emergency medical evacuation

- Up to $750 in coverage for baggage and personal effects; $200 for baggage delays

- Up to $10,000 in coverage for accidental death and dismemberment (AD&D)

- Up to $25,000 in coverage for common carrier AD&D

- Coverage up to 100% of the insured vacation for trip cancellation

- Up to 125% of the insured vacation cost for trip interruption

- Travel delay coverage worth up to $1,000 per person ($150 per person daily limit)

- Up to $1,000 per person for lost, damaged or stolen bags; $200 per person for baggage delays

- Up to $500 per person for missed connections

- Up to $50,000 in emergency medical and dental coverage

- Up to $250,000 in coverage for emergency assistance and transportation

- AD&D coverage for air travel worth up to $50,000 per person ($100,000 per plan)

- Trip cancellation coverage up to $30,000

- Trip interruption coverage up to 100% of the cost of the trip

- Trip delay coverage worth up to $600 (for six-hour delays; $200 limit per person per day)

- Lost, stolen or damaged baggage coverage up to $500

- Baggage delay coverage worth up to $500 (for six-hour delays; $100 per day)

- Missed cruise or tour coverage worth up to $500 ($250 per day)

- Emergency accident and sickness medical coverage worth up to $100,000 (secondary coverage)

- Up to $750 in emergency dental coverage

- Up to $250,000 in protection for emergency medical evacuation and repatriation of remains

- Trip cancellation coverage worth up to $10,000 per traveler

- Trip interruption coverage worth up to $10,000 per traveler

- Travel delay coverage worth up to $300 ($150 per day)

- Luggage loss and damage protection up to $500 per traveler

- Baggage delay coverage worth up to $200 per day

- Emergency medical and dental coverage up to $10,000 ($500 for dental expenses)

- Emergency medical transportation coverage worth up to $50,000

- 24-hour hotline assistance

- Up to 100% in coverage for trip cancellation

- Trip interruption benefit worth up to 125% of the trip cost

- Up to $500 for travel delays per person ($125 daily maximum per person)

- Up to $750 for lost, damaged or stolen bags ($250 maximum per item)

- Up to $150 in luggage delay coverage

- Up to $100,000 in emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Trip cancellation coverage worth up to 100% of trip cost (up to $10,000)

- Trip interruption coverage up to 100% of trip cost

- Up to $500 in coverage for travel delays (five-hour delay required; $100 daily limit)

- Coverage worth up to $1,000 for lost, damaged or stolen baggage ($250 per item)

- Coverage worth up to $200 for baggage delays of 12 hours or more

- Up to $250 in coverage for airline reissue or cancellation fees

- Up to $250 in coverage for reinstatement of frequent traveler awards

- Emergency medical and illness coverage worth up to $10,000

- Up to $500 in coverage for emergency dental expenses

- Up to $250,000 in coverage for emergency medical evacuation and repatriation of remains

- AD&D coverage worth up to $10,000

- Travel assistance services

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has been writing about travel insurance and travel for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. In fact, she has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson also works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family media business.

You might also be interested in:

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

Holly Johnson

These are the scenarios when travel insurance makes most sense.

9 Best Travel Insurance Companies of 2024

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

The 5 Best International Travel Insurance Companies for 2024

International travel insurance is a must-have for every trip abroad, and for more reasons than one.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

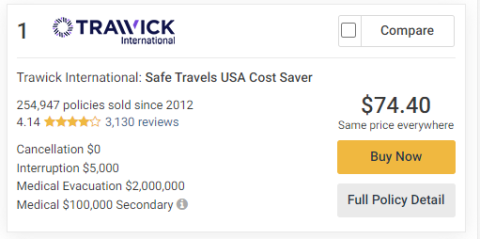

The search came up with nine results ranging in price from $74.40 to $179.18.

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

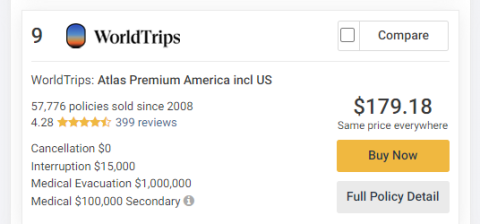

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

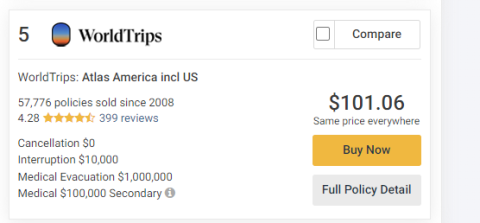

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Travel Insurance for Turkey – Requirements and Cost

Home | Travel | Travel Insurance for Turkey – Requirements and Cost

Purchasing travel insurance for Turkey is always a smart idea, no matter what type of trip you’ll be taking. Mishaps, delays, and accidents can occur at any time while you’re traveling abroad, and travel insurance is often the only means of getting health insurance coverage in a foreign country.

Turkey travel insurance is an absolute necessity for many travelers, however, since you must show proof of travel health insurance coverage to obtain a Turkish visa. Of course, not all travelers need a visa to enter to Turkey, but many do.

In any case, even if you don’t need a visa to enter Turkey, buying insurance for travel to Turkey will ensure that you’re covered for any injuries or illnesses you experience while traveling, as well as for any travel-related misadventures. You’ll often find that travel insurance is worth having in the end.

If you’re in a rush, I’ll tell you that we’ve been using Heymondo travel insurance for the past few years, and it’s been the best option for us. Whether it was dealing with an illness or getting an injury abroad, Heymondo’s coverage and customer assistance were there for us. You can even get a 5% discount for being our reader.

5% OFF your travel insurance

That said, there are other Turkey travel insurance options, so keep reading to find the best one for your needs.

Guide to Turkey travel insurance

As I’ve already mentioned, if you need a visa to enter Turkey, you must buy travel insurance for Turkey as part of your visa requirements. Passport-holders from the following countries must have a visa to enter Turkey:

Countries that need a visa to enter Turkey

Even if you don’t hold a passport from one of these countries, you should at minimum purchase health insurance for Turkey travel to cover any potential medical bills, especially since the EHIC (European Health Insurance Card) doesn’t work in Turkey. Of course, health insurance from other countries also doesn’t apply in Turkey, so purchasing Turkey travel medical insurance is the only way to guarantee medical coverage.

This guide to Turkey travel insurance will cover the following information:

Travel insurance for Turkey visa requirements

How much is travel insurance to Turkey?

Best travel insurance for turkey.

Is Turkey in Europe for travel insurance purposes?

What travel insurance do I need for Turkey?

Luckily, the travel insurance requirements for Turkey are simple. The main requirement for Turkey visa travel insurance is that the policy must cover travelers for the duration of their stay in Turkey.

Naturally, the most important type of coverage is for medical expenses, so your policy should at least be a Turkey travel medical insurance plan . You can always opt for a Turkish travel insurance plan with travel-related coverage as well if you’d prefer to be covered for issues like trip cancellation and baggage loss.

Just to be safe, you should ensure that your travel insurance for Turkey includes COVID-19 coverage . Nowadays, most travel insurance plans do have some kind of coronavirus coverage, but, as always, some plans offer more coverage than others.

For more information on Turkey’s travel insurance requirements , visit the Turkish government’s website .

Getting travel insurance for a Turkey visa doesn’t have to be expensive. Just keep in mind that your age and nationality, as well as the length and cost of your trip, will affect the cost of your travel insurance for Turkey .

To give you an idea of Turkish travel insurance prices, I’ve generated quotes by using the example of a 30-year-old American who is traveling to Turkey for two weeks and whose trip costs $2,500.

* price used for example

Heymondo , as you’ll see, easily stands out as the best travel insurance for Turkey , but all of the Turkey travel insurance companies in our comparison have their merits. To help you choose the best travel insurance for Turkey for your needs, you’ll find information below on all four companies’ advantages and disadvantages.

1. Heymondo , the best travel insurance to Turkey

Heymondo ’s Turkey travel insurance plans have it all: a high amount of coverage in all travel- and medical-related categories, incredible value for money, a $0 deductible for medical expenses, and coverage for COVID-19 testing and treatment.

Add in the fact that Heymondo pays your medical expenses directly and upfront for you, so you don’t even have to file a claim, and it becomes clear why Heymondo is considered the best travel insurance for Turkey .

As I said, we’ve been using Heymondo for over three years now, specifically the annual multi-trip insurance , and we have no complaints. One of my favorite things about Heymondo is their customer support app, which I’ve used to quickly file a claim when I lost my luggage. The service team takes care of the rest and I got reimbursed in no time.

If you’d like to learn more about the company, check out our Heymondo travel insurance review . You can even save 5% on Heymondo’s Turkish travel insurance plans with the discount code below.

2. World Nomads , a top-rated travel insurance for Turkey

If you’re planning on scuba diving, hot air ballooning, or kayaking while you’re in Turkey, World Nomads has got you covered. Their Standard and Explorer plans include coverage for hundreds of sports and activities, so you can adventure to your heart’s content without worrying about having to pay hundreds of dollars if you get injured.

Beyond sports coverage, World Nomads’ Turkey travel insurance plans include solid coverage in all medical- and travel-related categories, as well as coverage for COVID-19 treatment. There’s even a $0 deductible for medical expenses.

Still, although World Nomads offers excellent insurance for travel to Turkey , you can, in fact, get higher coverage in all categories for a lower price with Heymondo . As such, World Nomads is best suited for travelers who plan to do lots of exhilarating, potentially dangerous activities.

3. SafetyWing , the cheapest travel medical insurance for Turkey visa

Of course, you may just want to buy the cheapest plan that fulfills Turkey’s visa travel insurance requirements . Still, looking for an affordable price doesn’t mean you should skimp on quality coverage.

Luckily, SafetyWing is a Turkey travel medical insurance that offers the best of both worlds: excellent medical coverage and a reasonable price. Their Nomad Insurance plan also provides worldwide coverage, so you can head to other places besides Turkey, and coverage for COVID-19 testing and treatment. You can even choose to automatically renew your plan every 28 days until you pick an end date.

As with most travel medical insurance , SafetyWing doesn’t offer much travel-related coverage, which is not necessarily a problem, as you certainly don’t need this kind of coverage to meet Turkish visa requirements. SafetyWing’s major drawback, though, is its $250 deductible for medical expenses, which means you’ll have to put $250 towards any medical bills before SafetyWing pays any remaining balance.

4. IMG , a reliable travel health insurance for Turkey

IMG is consistently ranked as not only one of the best Turkey travel insurance companies but also one of the best travel insurance companies in general. As such, you can’t go wrong with their plans, which offer high, reliable coverage in all categories.

As with most top travel insurance for Turkey , IMG offers a $0 deductible for medical expenses and includes coverage for COVID-19 treatment. Moreover, their iTravelInsured Travel Lite plan is affordably priced, considering it offers both travel- and medical-related coverage.

If you feel that IMG’s already high coverage isn’t sufficient for you, though, depending on your age and nationality, you could get twice as much coverage for just $1 more with Heymondo .

You may be wondering, does Europe travel insurance cover Turkey ? After all, part of Turkey is located on the European continent, while the rest of it is located in Asia.

Ultimately, the answer to this question depends on the particular European travel insurance you’re looking at. Some insurance companies include Turkey in their European coverage, while others put the country under their worldwide coverage. Heymondo , for instance, includes Turkey as part of their European travel insurance coverage.

The best way to find an answer is to check with your individual insurance company when you’re purchasing insurance for travel to Turkey .

In summary, you must obtain Turkey travel insurance if you need a visa to enter Turkey. Even if you don’t need a visa, purchasing travel insurance for Turkey is an excellent idea because it will guarantee medical coverage if you fall ill or get injured.

As you’ll have seen from the comparison above, Heymondo stands out as the best travel insurance for Turkey for travelers who want both travel- and medical-related coverage. For travelers who are looking to save a little money, SafetyWing , the best Turkey travel medical insurance , is an equally viable option.

Whichever plan you choose, if you need a visa, just make sure that your policy covers you for the duration of your stay in Turkey. Hopefully, this guide has covered everything you need to know about insurance for travel to Turkey , but if you still have any questions, feel free to leave a comment down below.

Enjoy your trip to Turkey!

Ascen Aynat

2 replies on “ Travel Insurance for Turkey – Requirements and Cost ”

What are the Turkey medical insurance requirements? I’m traveling 9/1/22 to Turkey and need medical insurance. My insurance agent is asking me what the requirements are for turkey. THank you.

The only requirement for the turkey travel insurance is that it must cover travelers for the duration of their stay in Turkey.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Introduction to VisitorsCoverage Travel Insurance

- Types of Policies Offered

- VisitorsCoverage Cost

- Customer Service and Support

How to File a Claim with VisitorsCoverage Travel Insurance

- Why You Should Trust Us

VisitorsCoverage Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

The process of buying travel insurance can be tedious and stressful as you scour the internet for the best travel insurance companies . VisitorsCoverage exists to simplify the process by showing you all the options available for your particular travel details.

Since 2006, VisitorsCoverage has helped more than 1 million travelers check peace of mind off of their packing list, no matter the destination. It partners with popular travel insurance companies as a broker, so it can quote policies and manage payments on its website.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse travel insurance plans for solo and group travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers medical insurance for US visa holders for up to two years

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers plans designed for missionaries and international volunteers

- con icon Two crossed lines that form an 'X'. VisitorsCoverage does not underwrite or service travel insurance plans

- con icon Two crossed lines that form an 'X'. Claims experiences may vary widely based on which carrier you buy your plan from

VisitorsCoverage is a travel insurance marketplace that allows you to sort through the best travel insurance policies for your travel details and compare policies against one another. The information it provides on each policy is thorough and straightforward, so you don't have to wade through dense legalese to understand your policy. You can purchase travel insurance directly on VisitorsCoverage's website as well as manage your policy and adjust your coverage.

You'll have to file claims directly with your insurer, but VisitorsCoverage has a Claims Assistance Hub that will contact your insurer on your behalf to expedite the process and provide updates. The Assistance Hub is a great asset given that claims offices are infamously inaccessible and uncommunicative.

While VisitorsCoverage excels as a platform for travel insurance, VisitorsCoverage doesn't field customer reviews of insurance products, which you can find with some of its competitors like Squaremouth and InsureMyTrip. This isn't a major exclusion, but it means you have to conduct additional research for that information, which isn't ideal for a service that exists primarily to simplify the buying process.

Types of Policies Offered by VisitorsCoverage

VisitorsCoverage partners with many travel insurance providers to offer comprehensive coverage options. If you're looking for cancellation protection, baggage protection, and other standard coverages, it can provide many options based on your residence, destination, and costs.

It also works with carriers specific to Europe and Schengen visas. Europe-bound travelers also enjoy medical evacuation and repatriation protections. The descriptions are straightforward, and the site offers options to search for doctors, manage your plan, and more on its website,

If traveling with family, friends, or coworkers, its website may prompt you to consider group travel insurance. Coverage protects up to five travelers with health coverage in the event of an accident or illness at a reduced rate of up to 20% compared to identical coverage for five individual travelers. If you're traveling for business, you may also want to consider its business coverage, which covers lost luggage, trip interruption, and terrorism, along with emergency medical care (including emergency medical evacuation).

One thing this travel website brings to the table is variety. As an online broker, customers can get multiple quotes at once. However, its partnerships allow it to expand the most common understanding of what travel insurance covers , catering to less common travel scenarios such as non-US residents (including Americans working full-time abroad) traveling to the U.S., missionaries, and visa applicants.

Additional Coverage Options (Riders)

VisitorsCoverage has filters that can tailor your insurance search based on your needs. You'll find specific search functions for the following types of travel insurance :

- AD&D insurance coverage: This provides a lump sum benefit to the insured's beneficiary in the event of accidental death. The insured can also collect a benefit after an accidental dismemberment (losing a limb).

- Pre-existing condition insurance: This plan is designed for travelers with diagnosed conditions (existing before applying for travel medical insurance) who want to see the world without fear of what to do should a medical emergency arise. Coverage includes emergency services like hospitalization, surgery, and even medical evacuation.

- Cruise insurance: This short-term trip insurance protects cruisers from losses related to delays, cancellations, illnesses, injuries, etc., while at sea.

- Immigrant/Green Card insurance: This type of plan offers short-term coverage (up to two years) for individuals needing medical insurance coverage while visiting the United States. It's ideal for visa applicants who ideally obtain long-term healthcare through their employer once their work visa is approved.

- Student visa insurance: Students spending a semester away from their home country or attending university in a foreign country often require travel insurance that meets certain standards.

VisitorsCoverage Travel Insurance Cost

The average cost of travel insurance is around 4-8% of trip costs. Travel insurance premiums of $100-$200 per trip are standard, especially when traveling internationally. A cancel for any reason rider raises travel insurance premiums by about 50% with most travel insurance companies. However, many travelers enjoy the peace of mind of eliminating denials for excluded causes.

Individual policy premiums are based on benefits offered plus criteria unique to each traveler, including age, health status, and the length of the trip. Because VisitorsCoverage partners with many popular travel insurance providers, shoppers can compare the cheapest options with more substantial coverage and decide which plan works best for them.

VisitorsCoverage Customer Service and Support

VisitorsCoverage has very good online customer reviews, receiving an average of 4.8 out of five stars on its Trustpilot page and 4.6 stars from Google Maps reviews left on its company headquarters located in Santa Clara, California. Negative reviews often pertain to customer experiences with unresolved claims, which isn't necessarily a reflection on VisitorsCoverage, but the actual insurance provider.

It's worth noting that VisitorsCoverage's customer support team is extremely responsive to customer reviews, usually responding within one or two business days to Trustpilot and Google Maps reviews.

VisitorsCoverage is not your travel insurance company but a liaison between you and different travel insurance providers. As such, it's no surprise that it does not handle your claims. However, it can assist you in navigating your claims and will attempt to reach out to your insurance provider if the process is delayed.

If you input your policy number on its website, the company can identify which travel insurance company you purchased your plan from. Then it will direct you to the right website or offer the address and correct claims forms. If you don't have your policy number, its website lists the different insurers it partners with and basic claims information. If you need to file claims, the most its customer service agents can do is direct you to the right company and plan administrator.

Remember to file your claim as soon as possible, especially when seeking reimbursement for covered medical expenses. In addition to the claim form, be prepared to provide the plan administrator with copies of your passport plus any medical bills/receipts.

VisitorsCoverage Frequently Asked Questions

You can contact VisitorsCoverage by calling 1-866-384-9104 or email us at [email protected]. Business hours are from 7: a.m. - 5:00 p.m. PT, Monday to Friday. You can also chat with an agent through VisitorsCoverage's website chat function.

Yes, VisitorsCoverage has a specific search function for international trips as well as international travelers visiting the U.S.

VisitorsCoverage allows you to filter your search to only include policies that cover pre-existing medical conditions.

VisitorsCoverage doesn't have its own claims filing process, but has tools to make your filing process with your insurance provider more user-friendly. It will also contact unresponsive claims offices on your behalf.

You can filter your insurance search based on companies that offer adventure activities. You'll need to conduct your own independent research to see if your particular sport is covered under a particular policy.

Why You Should Trust Us: What Went into Our VisitorsCoverage Travel Insurance Review

When writing this review, we researched and compared popular travel insurance companies based on myriad factors, including policies offered, add-ons, cost, convenience, claims process, and customer satisfaction. Information on numerous travel insurance products is used in the process, and opinions expressed are based solely on facts gleaned.

Neither marketing tactics nor standalone online reviews were used in compiling these ratings. As most customer reviews come from individuals who have yet to file a claim, an emphasis is placed on plans offered instead of services rendered. VisitorsCoverage is unusual because it's not the travel insurance company, but we reviewed it based on the support provided, its partners' coverage, etc.

You can learn more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Best LastPass Alternatives

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Best LastPass Alternatives Of 2024

Updated: May 20, 2024, 12:44am

Reviewed By

In the wake of LastPass’ 2022 security mishap, many are rightfully on the hunt for safer shores. This significant event, coupled with an ongoing lawsuit, underscores the need to examine reliable LastPass alternatives. Below, we’ll explore top-tier password managers that expertly balance stringent security with user-friendly design. We looked at the best LastPass alternatives to help you find the ideal service for you.

- Featured Partner

The Best LastPass Alternatives of 2024

Norton password manager, keeper password, forbes advisor ratings, methodology, compare lastpass competitors, what to look for in a lastpass alternative, is lastpass the best password manager, frequently asked questions (faqs).

- Best Free Password Managers

- Best Password Managers

- Best iPhone Password Manager

- Best Password Manager For Mac

On LastPass’s Website

Personal and business

Free trials availability

14-day and 30-day

On NordPass’s Website

Starting price

Free; $1.49 per month (on a two-year plan)

30 days to test its Premium plan

Standout features

Stores credit cards and an unlimited number of passwords and generates unique passwords

On 1Password’s Website

starts at $2.99 per month

Travel Mode

lock vaults when traveling

Get alerts when passwords are weak, vulnerable, duplicated or breached

- NordPass: Best for usability

- Norton Password Manager: Best for integrated cybersecurity solutions

- Dashlane: Best for teams

- Bitwarden: Best open-source option

- 1Password: Best for cross-platform compatibility

- KeePass: Best for Windows users

- Keeper Password: Best for multifactor authentication (MFA)

BEST FOR USABILITY

Pricing starts at

Free (Personal & Family); $1.79 USD ($2.44 CAD) per user per month (Business)

Autofill web forms

Import data from browsers.

With its robust features and affordable pricing, NordPass is our top pick. Compared to LastPass, NordPass offers the convenience of autosaving and autofilling forms while providing extra security measures including multifactor authentication and a scan for data leaks. It even nudges you to rectify weak or reused passwords. Plus, there’s the ability to attach files to items—a feature LastPass doesn’t natively support. It also offers flexible plans, including a risk-free premium trial.

Who should use it:

Individuals or businesses wanting comprehensive password management with an easy-to-use interface.

- User-friendly interface with autosave and autofill features

- Advanced security features, including weak password detection and data breach scanning

- 30-day money-back guarantee