*Certain terms, conditions and exclusions apply. For more information, please refer to your benefits guide or contact your issuing financial institution. ↩

**Offers may not always be available and may expire, be changed, or removed without notice. ↩

1. Mastercard cardholders will receive up to 7% off when booking accommodations marked with the Mastercard label and prepaying for such accommodations using an eligible Canada-issued consumer or small business Mastercard credit card, excluding any such cards that are used through a mobile wallet solution (e.g. Apple Pay, Google Pay, etc.), at booking.com/mastercardCanada .

Offer Period: April 1, 2024 – September 30, 2025, subject to early termination. Mastercard reserves the right to modify or cancel this offer at any time without notice. Neither Mastercard nor any participating financial institution card issuer has any involvement in or responsibility for Booking.com products or services and are not responsible for any claims or damages arising from the use of the Booking.com products or services.

Eligibility: This offer is available to Canadian residents who are holders of consumer credit and small business Mastercard credit cards issued in Canada.

Exclusions: Reservations booked but not prepaid are excluded from the promotion. Must select “Pay now” on the checkout page to receive the offer.

Additional Terms and Conditions: To receive the discount, bookings must be prepaid at the checkout and made exclusively through booking.com/mastercardCanada . The discount is applicable only to prepaid bookings when the option “Pay Now” is selected at the checkout. The discount will be applied automatically at the time of checkout and discount will vary depending on the property and dates selected. The discount applies to the accommodation cost only and does not include any additional fees or taxes. Booking.com reserves the right to modify or terminate this offer at any time without prior notice. All bookings are subject to availability and Booking.com’s terms and conditions. ↩

2. Offer expires 09/30/2024. New customers who pay for their first annual McAfee Total Protection for Mastercard subscription using an eligible Canada-issued Mastercard credit card will receive a special introductory price on a 13-month subscription term. Customers will also receive 13 months of McAfee TechMate at no additional cost. Limit one offer per cardholder. Unless you cancel your initial 13-month subscription at least 30 days before it expires, you will be charged the renewal subscription price in effect at the time of your renewal, and it will renew automatically for a 12-month term. You can cancel at any time or change your auto-renewal settings by accessing your My Account page . Pricing is subject to change. Mastercard reserves the right to modify or cancel this offer at any time without notice. You may request a refund by contacting McAfee customer support within 30 days of initial purchase or within 60 days of automatic renewal. Neither Mastercard nor any participating financial institution card issuer has any involvement in or responsibility for McAfee’s products or services and are not responsible for any claims or damages arising from the use of the McAfee products and services. Additional terms and conditions apply. Not all features may be available on all devices. For full terms and conditions, visit https://www.mcafee.com/mastercard-en-ca . ↩

3. Certain terms, conditions and exclusions apply. For full details, please visit: http://www.boingo.com/legal/end-user-license-agreement-boingo-customer-agreement/ ↩

4. Certain terms, conditions and exclusions apply. For full details, please visit: https://mastercardtravelpass.dragonpass.com/terms-and-conditions ↩

5. Get emergency assistance virtually anytime, anywhere and in any language. Mastercard Global Service helps you with reporting a lost or stolen card, obtaining an emergency card replacement or cash advance, finding an ATM location and answering questions on your account. For more information, please visit: https://sea.mastercard.com/en-region-sea/consumers/get-support/global-services.html ↩

6. Zero Liability does not apply to Mastercard cards issued: to an entity other than a natural person; primarily for business, commercial, or agricultural purposes; until such time as that person’s identity is registered by or on behalf of the Issuer in connection with the issuance and/or use of such card, which registration may include appropriate customer identification program requirements; outside of Canada. ↩

All third-party trademarks are the property of their respective owners.

Transitioning To Your New Mastercard ®

On June 15, your old CUETS Mastercard stopped working and was converted to your new Collabria Mastercard. If you haven’t activated your new Collabria Mastercard yet, please see the FAQs below that explain how to activate your new Collabria Mastercard, change your PIN if you need to, and other important information about this credit card conversion and your new Collabria credit card.

- The Transition

- How to Activate and Change the PIN on Your Collabria Mastercard

- Using Your New Collabria Mastercard

Will my existing card number and PIN be the same on my new card? No. Your new Collabria Mastercard will have a different card number and a different PIN. Once you have activated your new Collabria Mastercard you will be able to change your PIN if desired.

Will my credit limit remain the same? Yes. There will be no change to your credit limit.

Can I request a different credit limit? Yes. After your new Collabria Mastercard is activated, you can apply for a different credit limit by contacting Collabria Card Services at 1-855-341-4643 – the number that appears on the back of your new Collabria Mastercard.

Will any pre-authorized or recurring transactions automatically transfer to my new Collabria Mastercard? No, they will not automatically transition to your new Collabria Mastercard. To avoid any declines to your credit card account, please contact all the vendors you previously had pre-authorized payments set up with and provide them with your new Collabria credit card information.

How do I make changes to any pre-authorized or recurring transactions? You will need to contact each individual vendor that you have a pre-authorized or recurring transaction set up with and provide them with your new Collabria credit card details. Some common recurring payments include: • Netflix • Gaming subscriptions (Xbox, Playstation etc.) • Music subscriptions (Spotify, Sirius, Google Music etc.) • Mobility providers (Telus, Rogers, Bell, Shaw, Koodo etc.) • Amazon • Paypal • Apple • Gym memberships • Charitable donations • Annual subscriptions

Are items I’ve purchases on my old CUETS Mastercard still insured by the insurance coverage on my new Collabria Mastercard? To verify insurance coverage, please review the insurance certificate you will receive with your new Collabria Mastercard. If you have any questions or concerns, please contact the insurance provider outlined on that insurance certificate.

All of your credit card account information has transferred to your new Collabria Mastercard. However, you will need to activate your new Collabria Mastercard to make any further transactions.

How to activate your new Collabria Mastercard? There are three ways you can activate your new Collabria Mastercard. 1. Enroll in MyCardInfo and automatically activate your card a. Click on Enroll b. Fill out the required information, noting date of birth should be entered as mm/dd/yyyy c. After registering, a pop-up window will appear saying “A new card has been issued on your account. Do you have the card in your possession and wish to activate it?” You should say yes and go through the prompts to activate your card. You may need to log out of MyCardInfo and back in again to get the pop up notification.

2. Call the automated card activation service at the number that appears on the sticker on the front of your new Collabria card 1-866-498-3840 a. Follow the prompts including entering your card number, birth month, birth date and birth year, and the security code that appears on the back of your new Collabria Mastercard b. The system will confirm the card activation was successful or will transfer you to a live agent to complete the activation c. Do not select the option to change PIN online d. Discard the sticker from the front of your card after activation e. You can now immediately use your new Collabria Mastercard by using its tap functionality or by entering the PIN you received with the new Collabria Mastercard

3. Visit a branch or call the Member Service Centre (1-855-220-2580) and a staff member can activate your card for you. However, they cannot change your PIN.

If at any time you’d like to change your PIN, you can do so by calling PIN Now at 1-844-788-2725. When calling PIN Now, you will be prompted to enter your: a. New Collabria Mastercard card number b. Security code that appears on the back of your new Collabria Mastercard c. Your birthdate as month, month, year, year – this means enter the two digits corresponding to your birth month, and then the two digits corresponding to your birth year. For example, a birth date of November 1975 would be entered as 1175

If you encounter any issues trying to change your PIN, please call Collabria Card Services at 1-855-341-4643.

How to change the PIN on your new Collabria Mastercard To change your PIN, you have to first activate your Collabria Mastercard if you haven’t done this yet. Then you can change the PIN on your Collabria Mastercard by calling the PIN Now Service. Here’s how:

1. Call the PIN Now service anytime at 1-844-788-2725

2. When calling PIN Now, you will be prompted to enter your: a. New Collabria Mastercard card number b. Security code that appears on the back of your new Collabria Mastercard c. Your birthdate as month, month, year, year – this means enter the two digits corresponding to your birth month, and then the two digits corresponding to your birth year. For example, a birth date of November 1975 would be entered as 1175

3. The system will confirm the PIN change was successful or will transfer you to a live agent to complete the PIN change.

4. Your first purchase must be made at an in-store, point of sale terminal as follows: a. Insert your card into the vendor’s point of sale terminal (tap functionality will not work) b. While keeping your card in the point of sale terminal (don’t remove it), compete three PIN entries c. The first two entries will fail and the third will activate your new PIN and complete the purchase

Your future Mastercard purchases can be completed by using tap or entering your new PIN once only.

I no longer have the Collabria Mastercard you sent me. What do I do? Not to worry. You can have a new Collabria Mastercard sent to you by following these steps:

1. Call Collabria cardholder services at 1-855-341-4643

2. Follow the prompts, selecting “lost or stolen credit card”.

3. You will be transferred to a representative who will assist you

How do I get online access to my Collabria Mastercard? Visit MyCardInfo and register your new Collabria Mastercard. If you have multiple card types, you will need to register each card separately. Within MyCardInfo, you can view transactions, reward point balances and statements, make payments and set up fraud and travel alerts.

How can I pay my Collabria Mastercard bill? There are 3 ways to make a payment to your credit card account. The fastest and recommended approach is to register on MyCardInfo to make a payment from your account or call Collabria customer support with your account information. Any payments that are made this way before 5 p.m. on MyCardInfo or in the branch will post to your credit card account after 24 hours.

Alternatively, you can pay in-person at any Interior Savings branch or via online or mobile bill payment but both can take up to 5 business days for these payments to process.

On my old CUETS credit card, I had autopay. Is this available on the Collabria Mastercard? The autopay function (where you can automatically pay your minimum balance or full statement) will be available in the coming months. We will provide more information as it is released.

Where can I get a cash advance? Cash advances can be completed at any ATM that displays the Mastercard or Cirrus logo, including any Interior Savings branch. A maximum of 25% of the card limit can be taken as a cash advance. As well, the amount you can withdrawal at one time may differ depending on the ATM used.

Why did I get charged a foreign transaction fee? When cardholders make a purchase in a foreign currency, they get charged at 2.5% foreign transaction fee (also called an interchange fee). This is a fee charged by all credit card companies; however, some companies include this fee in the total foreign exchange calculation and some companies show the fee separately. Collabria shows the 2.5% foreign transaction fee separately so it will show as a separate line item on your statement and is labeled “foreign transaction fee”. Please be assured your total foreign transaction amount (the total of your purchase price, exchange amount and foreign transaction fee) is the same or slightly better than other credit card companies.

How do I redeem my points? To explore rewards or redeem your points, please visit MyCardInfo. When planning to redeem your points, please know it can take up to 45 business days for reward redemptions to show on your statement as a statement credit.

Where do I find my rewards balance? You can find your rewards points balance by registering on the rewards site or through MyCardInfo

Can I change my PIN anytime? How do I do this? Yes, you can change your PIN anytime. To change your PIN, please call the PIN Now Service. Here’s how:

4. Your first purchase must be made at an in-store, point of sale terminal as follows: a. Insert your card into the vendor’s point of sale terminal (tap functionality will not work) b. While keeping your card in the point of sale terminal (don’t remove it), compete three PIN entries c. The first two entries will fail and the third will activate your new PIN and complete the purchase.

What should I do if my card or PIN isn’t working? Please contact Collabria Support at 1-855-341-4643 – the number that appears on the back of your Collabria Mastercard.

My payment or transaction didn’t show up. What do I do? Please contact Collabria Support at 1-855-341-4643 – the number that appears on the back of your Collabria Mastercard.

If you have questions or concerns during this transition, please contact our new Mastercard provider, Collabria, at 1-855-341-4643 and a representative will be happy to assist you.

The Interior Savings Mastercard is issued by Collabria Financial Services Inc. pursuant to a license from Mastercard International Incorporated. Mastercard and the Mastercard Brand Mark are registered trademarks of Mastercard International Incorporated.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

10 Credit Cards That Provide Travel Insurance

Lissa is a freelance writer and editor. Her work has been featured by TripAdvisor, The Points Guy, Johnny Jet, Cruise Critic and Family Vacation Critic.

Mary Flory leads NerdWallet's growing team of assigning editors at large. Before joining NerdWallet's content team, she had spent more than 12 years developing content strategies, managing newsrooms and mentoring writers and editors. Her previous experience includes being an executive editor at the American Marketing Association and an editor at news and feature syndicate Content That Works.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance helps you get your money back when things go wrong with your trip. And it remains a debate: Do you really need it, and is it worth it?

Personally, I’ve often skipped travel insurance, preferring to put the extra money toward my trip. Yet as I pulled into the airport after a winter ski trip to Jackson Hole, Wyoming, in my SUV rental, a snowplow kicked up a rock and a crack extended across the windshield. And just like that, I got in the dreaded rental car accident .

Thankfully, I had rented my car with my Delta SkyMiles® Gold American Express Card , which covered rental car windshield reimbursement. Note that I had also specifically opted out of the car rental's insurance coverage offered at the counter, which is a requirement in order to allow my credit card coverage to kick in. Terms apply.

» Learn more: The best travel credit cards right now

A number of credit cards provide various types of travel insurance (including trip cancellation, trip interruption and car rental loss and damage insurance) when you use your card to pay for flights, rental cars and other travel expenses. So do you need additional travel insurance? Maybe not.

What does your travel insurance cover?

First, let’s look at the different types of coverage that your credit card may offer to help protect your trip, from your bags to your rental car to your health.

Baggage delay . If your luggage doesn’t arrive when you do, you may receive a reimbursement to offset the costs of having to purchase new attire and other items you may need. The length of delay required and the coverage offered varies by card.

Lost/damaged baggage . If your bags are lost or damaged by a carrier, or items have been stolen from your baggage, your provider may provide monetary compensation.

Trip delay . If your trip on a common carrier is delayed, you may receive monetary compensation to help cover meals, hotels, transportation and necessary purchases up to a certain amount per ticket.

Trip cancellation . If you need to cancel a prepaid, nonrefundable trip, you may receive compensation to offset the lost funds. This benefit generally applies to cancellations for covered reasons, which vary by card.

Trip interruption . If you miss a portion of your trip due to a covered reason, this benefit will reimburse you for any unused, prepaid, nonrefundable reservations (i.e., excursions, hotel nights).

Medical treatment . If you are hurt while traveling and require medical treatment, medical expenses may be covered up to a certain dollar amount.

Medical evacuation . If your illness or injury requires you to return home immediately for care, the insurance coverage through your card may cover the costs.

Travel accident insurance. In the case of accidental death or dismemberment, your credit card may provide coverage to you or to your beneficiary

Rental car insurance. This coverage provides protection to your rental car against theft and damage. Coverage may be primary or secondary to your personal auto insurance, depending on the card.

» Learn more: Should you insure your cruise?

Popular credit cards with travel insurance

Some of the best travel rewards cards include various forms of travel insurance. These are a few of our favorite cards that offer certain types of coverage. If you have a different travel rewards card, it’s a good idea to check the benefits of your card before assuming that it either does or doesn’t have any of the coverage listed here.

1. Chase Sapphire Reserve®

Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

Trip delay: Up to $500 per ticket for delays more than six hours.

Baggage delay: Up to $100 per day for five days.

Lost luggage: Up to $3,000 per passenger.

Travel accident: Up to $1,000,000.

Rental car insurance: Up to $75,000.

2. Chase Sapphire Preferred® Card

Trip delay: Up to $500 per ticket for delays more than 12 hours.

Travel accident: Up to $500,000.

Rental car insurance: Up to the actual cash value of the car.

3. Marriott Bonvoy Brilliant® American Express® Card

Lost luggage: Up to $2,000 for checked bag and up to $3,000 for checked and carry-on bag. New York state residents get $2,000 per bag, up to a maximum of $10,000 for all covered persons per trip.

Travel accident insurance. Up to $500,000.

Trip delay insurance: Up to $500 per trip. Maximum benefit of $1,000 per 12-month period.

Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

4. Marriott Bonvoy Boundless® Credit Card

Baggage delay: Up to $100 per day for five days for essential purchases like toiletries and clothing for delays of over six hours.

Lost luggage: Up to $3,000 per passenger for checked or carry on luggage.

Damaged luggage: Up to $3,000 per passenger for checked or carry on luggage.

5. Southwest Rapid Rewards® Plus Credit Card

Baggage delay: Up to $100 per day for three days.

Travel accident insurance: Up to $250,000 to $500,000 (Visa Platinum and Visa Signature, respectively).

Rental car insurance: Up to actual cash value of vehicle.

Travel and emergency assistance services: Assistance and referral via the Benefit Administrator, cardholder is responsible for all costs.

6. United℠ Explorer Card

Trip cancellation: Up to $1,500 per person and $6,000 per trip.

Trip interruption: Up to $1,500 per person and $6,000 per trip.

Rental car insurance: Covers damage or theft with restrictions.

7. Delta SkyMiles® Gold American Express Card

Lost carry on luggage: Up to $1,250 per person for carry on baggage while in direct transit to or from a common carrier terminal, while traveling on a common carrier or while at a common carrier terminal.

Lost checked luggage: Up to $500 per person while traveling on a common carrier.

Rental car insurance: Up to $50,000.

Terms apply.

8. The Platinum Card® from American Express

Trip delay: Up to $500 per trip for delays more than 6 hours.

9. Capital One Venture Rewards Credit Card

Lost luggage: Up to $3,000 per passenger. For New York state residents, coverage is limited to $2,000 per bag.

Travel accident insurance: Up to $250,000.

Rental car insurance: Covers damage or theft with restrictions. Eligible rental periods are limited to 15 consecutive days in the cardholders home country or 32 consecutive days outside it.

10. Hilton Honors American Express Aspire Card

Baggage delay: Up to $100 per carrier for three days.

Do I need additional travel insurance?

Even with the coverage listed above, some credit cards offering travel insurance benefits may not provide enough insurance for your needs. For example, if you have paid $10,000 for a vacation using your card and trip cancellation is not offered, you may want to purchase additional coverage. Likewise, if you book a very expensive trip but your card only covers $10,000 in trip cancellation coverage, you may want to consider additional coverage.

American Express offers full travel insurance options through AmEx Assurance . This specific benefit is available to all travelers and does not require an American Express card. You can pick and choose the coverage you want, and a quote will be processed based on your age, trip expense and days traveling.

For example, here's what we found when requesting insurance for a two-day trip that costs $1,000. You can decide what coverage you'd like and see the full cost of your options:

The quote we received covered 100% reimbursement for cancellation, then offered different levels for other types of coverage.

Medical protection was available for $25,000 to $100,000.

Travel accident protection was available for $250,000 to $1,500,000.

Baggage protection was available for up to $500 to $2,500.

Trip delay coverage was offered for $150 to $1,000 per day, depending on selecting basic, silver, gold or premium options.

When renting a car, be sure to check the specific requirements of your credit card, which may vary by location and type of vehicle.

So do you need travel insurance? A good rule of thumb is if the amount you could lose is more than you want to lose (or can afford to lose) if something goes wrong, get the insurance. For a list of travel insurance companies that provide online quotes, read more about how to find the best travel insurance .

» Learn more: Does trip insurance cover award flights?

Cards with travel insurance, recapped

If you are concerned about an upcoming trip and want to be fully protected, combine your travel credit card insurance with a build-your-own plan to cover what your credit card does not.

Insurance Benefit: Car Rental Loss & Damage Insurance

Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

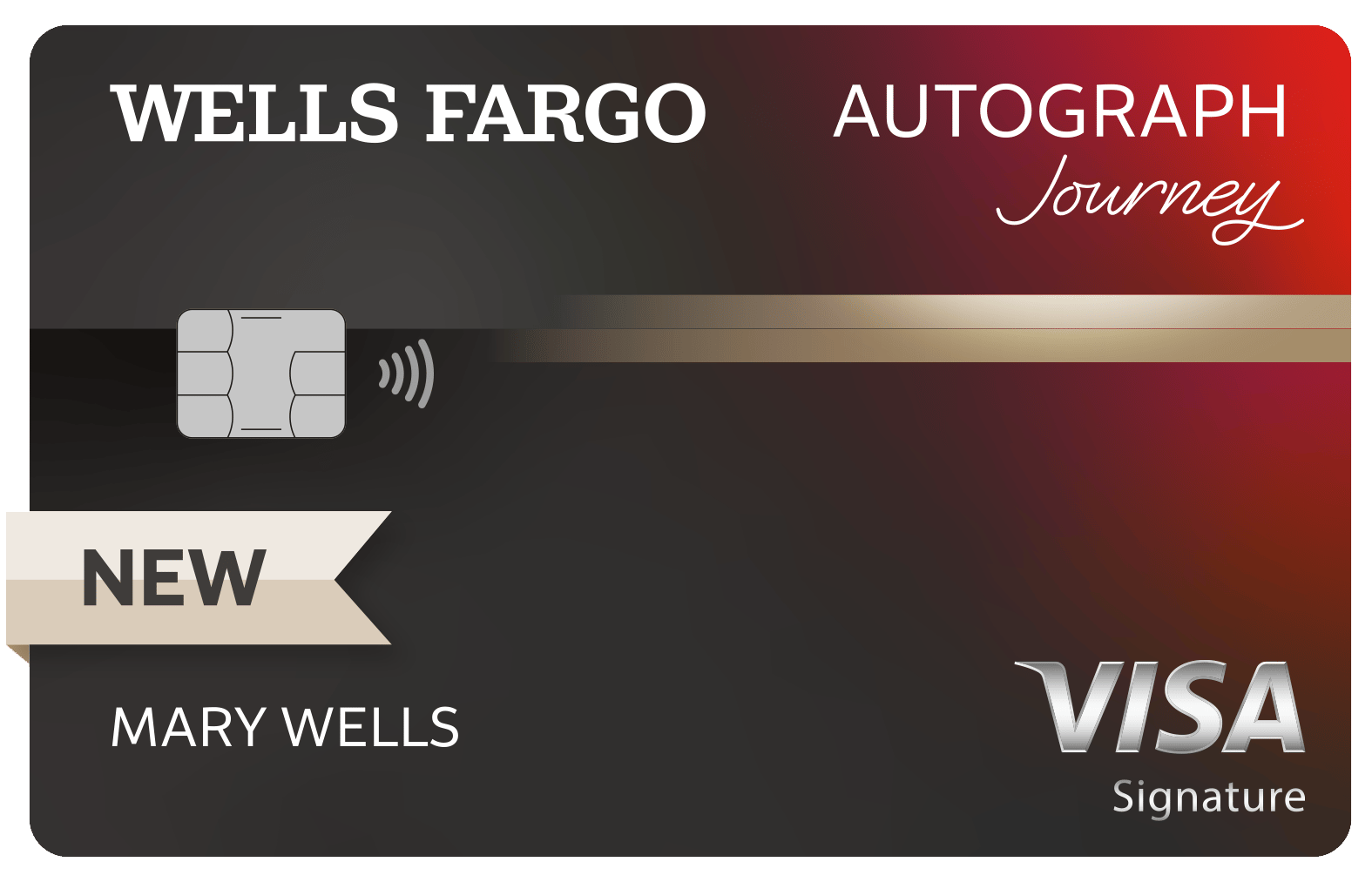

Wells Fargo Autograph Journey℠ Card

Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

8 best credit cards with travel insurance of June 2024

Many things can go wrong on a trip, so having one of the best credit cards with travel insurance in your wallet can provide peace of mind. Protection against unforeseen trip delays and mishandled baggage can save you money when your travels don’t go as expected.

Many credit cards include travel insurance coverage when you use them to purchase your trip. But our expert team has chosen the best credit cards with travel insurance to help ensure that your trips are as secure as they are captivating.

- Chase Sapphire Preferred® Card : Best for a lower annual fee

- United Club℠ Infinite Card : Best for United loyalists

- Ink Business Preferred® Credit Card : Best for bonus earning

- The Platinum Card® from American Express : Best for luxury benefits

- Delta SkyMiles® Reserve American Express Card : Best for Delta loyalists

- Chase Sapphire Reserve® : Best for premium travel value

- Capital One Venture X Rewards Credit Card : Best for premium perks while traveling

- Bank of America® Premium Rewards® credit card : Best for Bank of America Preferred Rewards members

Browse by card categories

Comparing the best credit cards, more details on the best credit cards, what is travel insurance, how we rate, maximizing credit cards with travel insurance, how to choose a credit card with travel insurance, ask our experts, pros + cons of travel insurance credit cards, frequently asked questions, chase sapphire preferred® card.

Year after year, the Chase Sapphire Preferred wins at the TPG Awards for Best Travel Rewards Card. In exchange for a $95 annual fee, you’ll gain access to the incredible Ultimate Rewards program — unleashing tons of potential value for award travel. Read our full review of the Chase Sapphire Preferred Card .

- Earn multiple points per dollar on things like travel and dining

- The current welcome bonus on this card is quite generous

- Premium travel protection benefits including trip cancellation insurance, primary car rental insurance and lost luggage insurance

- The card comes with a $95 annual fee

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

United Club℠ Infinite Card

The United Club Infinite Card comes with the most perks and highest earning rates of any of United’s personal credit cards. Read our full review of the United Club Infinite Card .

- Earn 4x miles on United purchases; 2x miles on travel and dining; 1x on everything else

- United Club℠ membership for you and your eligible travel companions at all United Club locations and participating Star Alliance lounges worldwide

- Up to $100 statement credit for Global Entry/TSA Precheck application every four years

- Free first and second checked bags for you and one travel companion on the same reservation

- 25% inflight statement credit on eligible purchases

- High $525 annual fee

- Limited-time offer: Earn 90,000 bonus miles after qualifying purchases

- Earn 4 miles per $1 spent on United® purchases

- Earn 2 miles per $1 spent on all other travel and dining

- Earn 1 mile per $1 spent on all other purchases

- Free first and second checked bags - a savings of up to $360 per roundtrip (terms apply) - and Premier Access® travel services

- 10% United Economy Saver Award discount within the continental U.S. and Canada

- Earn up to 10,000 Premier qualifying points per calendar year (25 PQP for every $500 you spend on purchases)

Ink Business Preferred® Credit Card

This card has a unique set of perks that make it attractive for business owners looking to maximize their earning potential and unlock valuable rewards through the Ultimate Rewards program. And it comes with one of the highest sign-up bonuses we’ve seen from Chase or any business credit card — 100,000 bonus points after $8,000 worth of spend in the first three months after card opening. Read our review of the Ink Business Preferred Credit Card .

- One of the highest sign-up bonuses we’ve seen for this card — 100,000 bonus points after $8,000 worth of spend in the first three months after card opening

- Bonus categories that are most relevant to business owners for a reasonable $95 annual fee

- Access to the Chase Ultimate Rewards portal for points redemption

- Trip cancellation/interruption insurance, trip delay reimbursement and primary car rental insurance when traveling on business

- Additional perks including extended warranty, cellphone protection and purchase protection

- High spending needed to get 100,000-point sign-up bonus

- Subject to Chase's 5/24 rule on card applications

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

The Platinum Card® from American Express

The Amex Platinum card is not just a symbol of luxury. It comes with an immense number of travel, entertainment, wellness and retail benefits making it a versatile card option that boasts more than $1,400 in potential value. Read our full review of The Platinum Card from American Express .

- The current welcome offer on this card is quite lucrative

- This card comes with a long list of benefits, including access to Centurion Lounges, complimentary elite status with Hilton and Marriott, at least $500 in assorted annual statement credits and so much more

- The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway

- The high annual fee is only worth it if you’re taking full advantage of the card’s benefits. Seldom travelers may not get enough value to warrant the cost

- Outside of the current welcome bonus, you’re only earning higher rewards on specific airfare and hotel purchases, so it’s not a great card for other spending categories

- The annual airline fee statement credit can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- See Rates & Fees

Delta SkyMiles® Reserve American Express Card

The Delta SkyMiles Reserve Amex is an excellent choice for flyers who want Sky Club access while traveling, or who can spend their way for a boost toward elite status. Read our full review of the Delta SkyMiles Reserve American Express Card .

- Delta SkyClub access when flying Delta

- Annual companion ticket for travel on Delta

- Ability to earn MQDs through spending

- High annual fee

- Other Delta cobranded cards offer superior earning categories

- Earn 95,000 Bonus Miles after you spend $6,000 in purchases on your new Card in your first 6 months of Card Membership.

- Enjoy complimentary access to the Delta Sky Club® and bring up to two guests or immediate family members at a rate of $50 per person per visit when flying Delta. Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

- Receive four Delta Sky Club® One-Time Guest Passes each year when you fly together on Delta. After that, you may bring up to two guests at a per-visit rate of $50 per person, per location.

- Enjoy complimentary access to The Centurion® Lounge when you book a Delta flight with your Reserve Card.

- Receive $2,500 Medallion® Qualification Dollars each Medallion Qualification Year and get closer to Status with MQD Headstart.

- Earn $1 Medallion® Qualification Dollar for each $10 of purchases made on your Delta SkyMiles® Reserve American Express Card in a calendar year and get a boost toward achieving elevated Medallion Status for next Medallion Year.

- Receive a Companion Certificate on First Class, Delta Comfort+®, or Main Cabin domestic, Caribbean, or Central American roundtrip flights each year after renewal of your Card. The Companion Ticket requires payment of government-imposed taxes and fees of no more than $80 for roundtrip domestic flights and no more than $250 for roundtrip international flights (both for itineraries with up to four flight segments). Baggage charges and other restrictions apply. See terms and conditions for details.

- $240 Resy Credit: With the Delta SkyMiles® Reserve American Express Card Resy Credit, earn up to $20 per month in statement credits on eligible Resy purchases using your enrolled Card.

- $120 Rideshare Credit: You can earn up to $10 back in statement credits each month on U.S. rideshare purchases with select providers after you pay with your Delta SkyMiles® Reserve American Express Card. Enrollment Required.

- Delta SkyMiles® Reserve American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees.

- With your Card receive upgrade priority over other Medallion Members within the same Medallion level and fare class.

- Delta SkyMiles® Reserve American Express Card Members with an eligible ticket will be added to the Complimentary Upgrade list, after Delta SkyMiles Medallion Members.

- Earn 3X Miles on Delta purchases and earn 1X Miles on all other eligible purchases.

- No Foreign Transaction Fees.

- $650 Annual Fee.

Chase Sapphire Reserve®

The Chase Sapphire Reserve is a no-brainer card for those who are looking to up their reward earnings to the highest level. Chase Ultimate Rewards are one of the most valuable points currencies. Read our full review of the Chase Sapphire Reserve .

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year

- Access to Chase Travel hotel and airline travel partners

- Unlimited 3x points on the broad category of travel and dining

- 50% more value when you redeem your points for travel through Chase Travel℠

- Broad definitions for travel and dining bonus categories

- Steep annual fee

- May not make sense for people that don't travel frequently

- You must spend the $300 travel credit before earning 3x points for travel and dining

- No automatic hotel elite status

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

Capital One Venture X Rewards Credit Card

The Venture X combines high-end benefits like travel credits, mileage bonuses and lounge access with a simple earning formula that’s easy to maximize. Read our full review of the Capital One Venture X Rewards Credit Card .

- Excellent welcome offer worth 75,000 miles after you spend $4,000 on purchases in the first three months

- $300 in annual credits toward bookings make through Capital One Travel

- 10,000 bonus miles (worth $100 toward travel) each account anniversary

- The $395 annual fee might be expensive for some, but this card’s benefits provide much more value than that

- If you don’t travel frequently, this might not be the best card for you

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

Bank of America® Premium Rewards® credit card

The Bank of America Premium Rewards card allows cardmembers to earn 2 points per dollar on travel and dining expenses, but Bank of America Preferred Rewards® members will earn at a higher rate of up to 3.5 points per dollar spent. Read our full review of the Bank of America Premium Rewards credit card .

- This card is more valuable for Bank of America Preferred Rewards® members, who can get between a 25% and 75% bonus on points earned

- Comes with up to $100 in airline incidental statement credits annually and up to $100 Global Entry/TSA PreCheck® statement credit and travel protections

- Can transfer points earned into a 529 college fund

- Other cards offer higher points for key bonus categories

- Must open a Bank of America account to get the best value for points

- Low $95 annual fee.

- Receive 60,000 online bonus points - a $600 value - after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don't expire as long as your account remains open.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87 - 2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

The Chase Sapphire Preferred Card is my favorite consumer credit card with travel insurance because you’ll earn at least 2 points per dollar on travel purchases. You’ll get access to trip delay reimbursement, baggage delay insurance and lost luggage reimbursement when you use your card to pay for flights and some other types of scheduled transport that require a ticket. You’ll also get primary rental car insurance when you pay for a rental car with your card.

The Chase Sapphire Preferred Card is a good choice for most travelers who don’t want to pay a massive annual fee. Between bonus earning on dining, travel, online grocery purchases and streaming, plus benefits like an Chase Travel hotel credit each account anniversary year, the Chase Sapphire Preferred can be useful for occasional and frequent travelers.

"The Chase Sapphire Preferred has been in my wallet for 5+ years and is the go-to mid-level rewards credit card that I recommend to people. It usually has a pretty solid sign-up bonus, with points that can be transferred to some of my favorite loyalty programs, like British Airways Executive Club and World of Hyatt. The strong earn rate on dining and travel as well as streaming services makes it a good choice for a millennial like me." - Matt Moffitt , managing editor

Consider the Chase Sapphire Reserve® , which offers more perks and slightly more comprehensive travel insurance in exchange for a higher annual fee.

The United Club Infinite Card offers perks with United, the ability to earn United miles on purchases and travel insurance comparable to the Chase Sapphire Preferred. This means you’ll get useful protections like trip delay reimbursement, baggage delay insurance and primary rental car insurance.

If you can benefit from travel perks with United, including a United Club membership and free first- and second-checked bags for you and a companion on United flights, the United Club Infinite Card is likely a good option. You’ll also get Avis President's Club status and IHG One Rewards Platinum Elite status with your card, making it a good choice for travelers who use these programs.

If you’re considering buying a United Club membership, you’ll likely come out ahead with the United Club Infinite Card. You’ll get some nice perks with United, as the card offers perks for United loyalists as well as those who don’t travel with United frequently enough to earn elite status with the airline.

If the United Club Infinite’s annual fee is too high for you, consider the lower-annual-fee United℠ Explorer Card .

The Ink Business Preferred is a go-to travel credit card due to its bonus earnings on travel and its built-in travel insurance. It earns valuable Chase Ultimate Rewards points and provides travel insurance that’s comparable to what is offered by the Chase Sapphire Preferred® Card.

You should get the Ink Business Preferred if you’re eligible for a small-business credit card and want to earn bonus points on shipping purchases, advertising purchases made with social media sites and search engines, internet, cable and phone services and travel each account anniversary year. Getting such a good earning rate with a card with a sub-$100 annual fee is amazing.

"I originally signed up for the Ink Business Preferred primarily for its sign-up bonus. But, over the last year, I've found myself making it my go-to card when booking travel. After all, the Ink Business Preferred earns 3 points per dollar spent on travel and provides excellent travel protections, including trip delay protection and rental car insurance." - Katie Genter , senior writer

If you are looking for a consumer card offering similar travel insurance and a slightly lower earning rate on most travel purchases, the Chase Sapphire Preferred® Card is a good option.

The Amex Platinum Card offers one of the highest bonus rates on flights booked directly with airlines or through American Express Travel , making it a compelling card to use when booking flights. Plus, you’ll get trip delay insurance and a baggage insurance plan when you use your card to book eligible round-trip travel.

You should consider the Amex Platinum If you’ll use the many benefits it offers, from Centurion Lounge access to a monthly digital entertainment credit . However, be sure to calculate the value you’ll obtain from the Amex Platinum’s perks and read the fine print on its travel insurance before deciding whether it is right for you.

“Whilst this card has a high annual fee, it more than justifies itself for frequent travelers like me. The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights — whether bought with cash or points — on this card to earn 5 points per dollar spent and trip protection insurance. I make sure to take full advantage of the Uber, Saks Fifth Avenue, Hulu/Disney+ and Clear credits. And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy.” - Matt Moffitt , managing editor

Consider the Capital One Venture X Rewards Credit Card if you prefer a card that earns at least 2 miles per dollar spent on all purchases, offers access to Capital One lounges and still provides competitive travel insurance.

The Delta Reserve Amex offers many of the same travel insurance perks as other premium Amex cards, like the Amex Platinum. But we love the Delta Reserve for its Delta Sky Club access , 15% off Delta-operated award flights and 20% back on inflight purchases on Delta-operated flights.

Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

If you are a Delta loyalist who wants to earn Delta miles on your credit card purchases and will benefit from Delta-related benefits, the Delta Reserve Amex may be a good fit. However, bonus earning is limited to Delta purchases, so you may want to use a different card for many of your travel expenses.

"As a Delta Diamond Medallion, I spend a lot of time on Delta jets. The card's annual companion ticket is valid on first class itineraries and has helped me offset the card's annual fee multiple years in a row." - Andrew Kunesh , former senior points and miles editor

If you want to earn more on flights, consider The Platinum Card® from American Express to earn bonus points per dollar on flights booked directly with airlines or through American Express Travel. After all, you can transfer Amex points to Delta.

The Chase Sapphire Reserve offers at least 3 points per dollar on travel purchases, an annual $300 travel credit and what is likely the most comprehensive credit card travel insurance available. On top of what is offered by many other cards in this guide, the Chase Sapphire Reserve offers travel accident insurance, emergency evacuation and transportation and an emergency medical and dental benefit.

The Chase Sapphire Reserve lets you redeem points for travel through the Chase Travel portal at a rate of 1.5 cents each, making it a good option if you prefer to redeem your Ultimate Rewards this way. It’s also a valuable option if you spend a lot of money on dining and general travel purchases, as both purchase categories earn 3 points per dollar spent.

"I've had the Sapphire Reserve for years, and it's going to stay in my wallet for the near future. I get $300 off travel every year along with great earning rates on travel and dining (3 points per dollar) and varied travel protections that can reimburse me when things go wrong. And by leveraging other cards in the Ultimate Rewards ecosystem, I'm able to maximize the earnings across all of my purchases." - Nick Ewen , senior editorial director

If the Chase Sapphire Reserve’s annual fee is too high, consider its sibling with a lower annual fee, the Chase Sapphire Preferred® Card .

The Capital One Venture X offers 10 miles per dollar on hotels and rental cars booked through Capital One Travel , 5 miles per dollar on flights booked through Capital One Travel and 2 miles per dollar on all other purchases. Plus, cardholders get access to car rental insurance, trip delay reimbursement, baggage delay reimbursement and more when using their Venture X card for eligible purchases.

If you can benefit from earning at least 2 miles per dollar on all purchases, the Capital One Venture X is a good option. The card offers two perks — a $300 annual credit for Capital One Travel bookings and 10,000 bonus miles each year (starting on your first anniversary) — that fully offset the annual fee before you even consider the card’s other benefits.

"With an annual fee that is $300 less than the Amex Platinum, the Capital One Venture X card is my favorite travel credit card. The card comes with an annual $300 Capital One Travel Portal credit, which I use to book flights. That effectively brings the annual fee down to $95 per year. Cardholders enjoy a Priority Pass Select membership and Hertz President's Circle status. I use my Venture X card to earn 2 miles per dollar in spend categories where most cards would only accrue 1 mile (e.g. auto maintenance, pharmacies, medical bills)." - Kyle Olsen , former points and miles reporter

Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

If you want to pay a lower annual fee in exchange for fewer benefits, you can still earn at least 2 miles per dollar spent on all purchases with the Capital One Venture Rewards Credit Card .

The Bank of America Premium Rewards credit card offers travel insurance protections to its cardholders if they experience trip delays, baggage delays, lost luggage and more. Plus, cardholders can claim up to $100 in airline incidental statement credits annually for qualifying purchases, which is more than enough to offset the card’s $95 annual fee.

This card offers 2 points per dollar on travel and dining purchases and 1.5 points per dollar on all other purchases. But, if you are a Bank of America Preferred Rewards® member, you’ll get 25% to 75% bonus rewards on every purchase. So, this card is a particularly good option for Preferred Rewards members.

If you are a Bank of America Preferred Rewards member, you should seriously consider adding this card to your wallet. Other travelers should also consider this card, as it offers competitive travel insurance protections and earning rates given its sub-$100 annual fee that can be fully offset by the card’s annual airline incidental statement credits.

The Chase Sapphire Preferred® Card is a good option since it carries a similar annual fee and offers 2 points per dollar spent on general travel purchases.

Travel insurance is a type of insurance that may cover unexpected losses you might incur while traveling. You can purchase many types of travel insurance policies , but some travel rewards cards include travel insurance when you purchase eligible travel with your card.

Types of credit card travel insurance

Here’s a look at some of the most common types of credit card travel insurance that might be available when you use your card to purchase travel. However, check your card’s guide to benefits to see what types of insurance are available and the specifics.

Trip cancellation protection may reimburse you for prepaid, nonrefundable expenses charged to your card if you must cancel your trip before departure due to a covered reason. Covered reasons often include illness, injury or death of you, your travel companion, or select family members. In some cases, trip cancellation may also help if your destination is affected by a natural disaster or other serious incidents.

Trip interruption protection is similar to trip cancellation, except that it may cover you during your trip. Sometimes, trip interruption protection may reimburse costs to rejoin your trip or return a rental car if you must abandon it.

Trip delay coverage may reimburse you if you are delayed by a passenger carrier (such as an airline or train company) for at least a set amount of time due to a covered reason. Usually, the delay must be outside your control. And in most cases, coverage is only provided for expenses incurred while you wait out the delay.

Travel accident insurance may offer you (or your survivors) payment in the case of accidental loss of life, limbs, sight, speech or hearing during travel. You’ll often need to be traveling on a passenger carrier during the accident for this type of insurance to go into effect.

Credit card rental car insurance usually covers damage to or theft of your car and, in some cases, may cover loss-of-use fees charged by the rental card company.

Many cards discussed in this guide offer primary rental car insurance, meaning you don’t need to file with your personal auto insurance first. But some cards offer secondary rental car insurance, in which case you must file with your personal auto insurance first.

Emergency evacuation insurance may help get you to the nearest medical facility if you are in a remote location and need to be medically evacuated. This perk is only offered by a few credit cards, and you usually must contact the credit card’s benefits administrator if evacuation is needed and have them arrange it for you.

Lost luggage protection may reimburse you if your carry-on or checked luggage is lost, stolen or damaged while you are a passenger. Meanwhile, delayed luggage protection usually kicks in six to 12 hours after an airline mishandles your luggage. It may reimburse your purchase of essential items you need while waiting for your luggage to arrive. For both types of protection, you’ll usually need to claim with the airline first.

Finally, some credit cards offer roadside assistance as a cardholder perk. If you need roadside assistance, you can call the number on the back of some cards, and they’ll send out someone to help.

Services often include jump starts, tire changing, fuel delivery, towing and locksmith services. Some cards will cover roadside assistance charges up to a certain amount, while others offer services at a pre-negotiated set rate.

How to claim travel insurance from a credit card

Claiming travel insurance, whether from a credit card or a private plan, usually requires filling out some forms. But before you start, double-check your guide to benefits and call the number listed in the benefits guide. By doing so, you can ensure your claim is valid and determine what documents the insurance company will need to process your claim.

Related: Readers say this credit card insurance provider isn't reliable: Here's what you need to know

Weigh the earning rate against the protections

When you look at the cards in your wallet, you may see a card that earns well on flights or car rentals. But, you may have another card that earns fewer rewards on these purchases but offers better travel insurance. So, you have to weigh the value of the travel insurance — which you likely won’t need — versus the incremental value of the rewards you could earn.

When paying the taxes and fees on award flights, I often use a lower-earning card with excellent trip and baggage delay protections. After all, taxes and fees are usually minimal, so missing out on a higher earning rate isn’t a concern. But if I’m booking an expensive flight, I’ll sometimes use a card with a higher earning rate and fewer protections to earn more rewards.

Know the coverage details

Before deciding that a specific travel insurance card is best for you, take some time to learn about the details of the card’s travel insurance benefits. For example, what travel companions, if any, are covered? Is round-trip travel required? What types of expenses can be reimbursed for a trip or baggage delay? What types of documents are needed for a claim?

Check out the application page and our review to learn about a card’s travel insurance protections. But you may also need to find a recent guide to benefits for the card online to get the full coverage details.

Consider the other benefits

Many cards discussed in this guide have benefits besides travel insurance. Multiple cards offer statement credits, airport lounge access and program-specific perks. So, especially if you aren’t interested in getting a card just for its travel insurance, you’ll want to consider what other perks you could use.

For example, United loyalists may benefit from the United Club℠ Infinite Card , while Delta flyers might enjoy the Delta SkyMiles® Reserve American Express Card . And Bank of America Preferred Rewards members might find the Bank of America® Premium Rewards® credit card most rewarding.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

- 1 Sign-up bonus Select a credit card with travel insurance that has a solid sign-up bonus with an achievable spend threshold. You can use this reward for future travel plans or to pay down a balance if you're earning cash back. Seek to earn the currency that's most valuable to you, be it points, miles or cash back.

- 2 Annual fee Credit cards with travel insurance come with varying annual fee prices. Some are higher for more premium benefits, while others are lower with less perks. We included a range of annual fee rates for every traveler to consider.

- 3 Bonus categories Many travel insurance credit cards feature bonus categories. We selected cards with a range of bonus category earnings to fit each consumer. Select a card that matches with your regular spending habits to maximize your expenses.

What's your favorite travel insurance card — and why?

- Travel insurance cards are good to have for protections while you're traveling

- Using a credit card with travel insurance responsibly can help you build your credit score

- Many cards with travel insurance come with other perks, such as elevated earning rates

- Credit cards can encourage overspending

- Carrying a balance on your card with travel insurance can damage your credit score

- The cost of borrowing on credit cards is higher than traditional loans

Many travel rewards cards offer travel insurance. We’ve discussed some of our favorites that offer the most comprehensive travel insurance in this guide. But many other cards also offer travel insurance — these cards may have lower benefit maximums, fewer types of coverage, and more exclusions.

The best way to determine if your credit card has travel insurance is to study the guide to benefits that came in the mail when you received your card. You can also usually find the guide to benefits or detailed information about your benefits in your online credit card account. However, you can also call the number on the back of your card and inquire about what travel insurance, if any, your card offers.

Many travelers wonder if more than credit card travel insurance is required. In particular, you may wonder whether you should get travel insurance if you have credit card protection . There’s no right answer, and it often depends on your health, the type of trip you are taking and whether you have an emergency fund that can cover unexpected costs if needed. In short, if you fear your credit card insurance isn’t enough, it may be smart to purchase a travel insurance plan.

World Elite® Mastercard®

Exclusive mastercard offers and vip experiences worldwide.

With the Servus World Elite Mastercard you’ll earn 2% back in Servus Circle Rewards® ️points on all eligible purchases† — points that never expire.

Invest your points towards a Circle Rewards GIC or redeem them for cash back on your credit card balance, merchandise and so much more!

Sign up bonus: Receive 25,000 Servus Circle Rewards points with a new Servus World Elite Mastercard — a value of $250.

Premium card features

- Annual fee of $150

- 25% of annual fee returned in Profit Share ® Rewards Cash paid* each year

- Purchase rate: 20.99%

- Servus Circle Rewards (2 points for every $1 spent on eligible purchases) that never expire

- Unlimited Circle Rewards earning potential

- Supplemental card fee of $40

- Mastercard ® Travel Pass provided by DragonPass §

- Mastercard Travel Rewards §

- Priceless.com §

- Boingo Wi-Fi for Mastercard ® Cardholders § **

- Mastercard Identity Check ™ verification for online transactions

- Zero-Liability Protection

- On-Demand and Subscription Services including: Ritual §

- Price Protection Service 2

- Concierge service 2

- Identity Theft Assistance Service 2

- Purchase Assurance and Extended Warranty 1

- Travel Emergency Medical Insurance 1

- Trip Cancellation Insurance 1

- Trip Interruption Insurance 1

- Baggage Delay Insurance 1

- Common Carrier Accidental Death and Dismemberment Insurance 1

- Accidental Death Insurance 1

- Car Rental Personal Effects Insurance 1

- Car Rental Collision Damage Waiver Insurance 1

- Car Rental Accidental Death and Dismemberment Insurance 1

- Travel Assistance Services – Lost travel documents, lost luggage, emergency cash transfer

Inquire online

You'll need government-issued ID, employment information and/or proof of enrolment for students. Inquire now Call 1.877.378.8728

® Mastercard and World Elite are registered trademarks and the circles design is a trademark of Mastercard International Incorporated.

®️ Circle Rewards is a trademark of Servus Credit Union Ltd.

1 Insurance coverage is underwritten by American Bankers Insurance Company of Florida (ABIC) and/or American Bankers Life Assurance Company of Florida (ABLAC). Servus Credit Union is not an insurer. All claims for insurance indemnities must be forwarded to the respective insurers. Details of the coverage, including definitions, benefits, limitations, and exclusions, including a pre-existing condition for certain benefits, are in the Certificate of Insurance provided with the card. Read the Certificate of Insurance then keep it in a safe place with your other valuable documents, and take it with you when you travel.

2 Price Protection Service is provided by American Bankers Insurance Company of Florida, and Concierge Services and Identity Theft Assistance Service are provided by Assurant Services Canada Inc. The services described herein are services only, not insurance.

§ For full terms and conditions, visit mastercard.ca/worldelite .

*Profit Share Rewards cash back is currently an annual payment that equals 25% of the annual fee paid for a Servus Mastercard. If your annual fee is waived or reduced at time of application or at any time while you maintain your Mastercard account, your annual Profit Share Rewards cash back payment may be likewise reduced at the full discretion of Servus Credit Union Ltd. The cash back annual payment may vary year to year.

**Terms and conditions apply. Boingo services provided by Boingo Wireless, Inc. See mastercard.boingo.com for full details.

Boingo, Boingo Wireless, Boingo Wi-Finder, and the Boingo wireless logo are registered trademarks of Boingo Wireless, Inc.

† Eligible purchases include all purchases except: cash advances, balance account transfer (BAT), fees, fraudulent charges or refunded purchases.

Cardholder documents

Servus Mastercard Account Agreement [pdf]

Certificate of Insurance and Statement of Services [pdf]

Mastercard Insurance Notice [pdf] ♦

Travel Medical Certificate [pdf] ♦

Servus Circle Rewards® Program Rules [pdf]

Enter your branch for account features

Search by address, city/town or postal code.

Please try another search term or view a <a href="/branches">list of branches.</a>

Not signed up yet?

Find out how to sign up

Branches near you:

Login Required

Mbna rewards.

Can there ever be too many rewards? We didn’t think so. That is why we’ve packed the MBNA Rewards program with more choices than ever before. Turn everyday eligible purchases into worldwide travel, brand name merchandise, charitable donations and more.

MBNA Rewards lets you redeem points for the things you really want. Be sure to visit the site often, to take advantage of exciting rewards offers and promotions.

Enjoy true flexibility and book to any destination with no restrictions or blackout periods.

Reward yourself with brand name merchandise and gift cards – shipped free to your door.

Have Questions?

Consult our list of Frequently Asked Questions or speak directly with one of our agents.

LOGIN REQUIRED

To redeem points, login to Internet Banking or the app, go to the ‘My cards’ section, select your NAB Rewards Card and follow the link. Or, login to NAB Connect and select NAB Rewards in the Accounts top menu. If you’re still not sure, see more instructions to login to NAB Rewards .

Don’t have a NAB Rewards Card? See our range of credit cards .

- Investing & super

- Institutional

- CommBank Yello

- NetBank log on

- CommBiz log on

- CommSec log on

Help & support

Popular searches

Travel insurance

Foreign exchange calculator

Discharge/ Refinance authority form

Activate a CommBank card

Cardless cash

Interest rates & fees

Travel / Travel insurance / Travel insurance included

International travel insurance included with your card

For eligible credit cards, you must spend at least $500 in a single transaction on your prepaid travel costs and activate to ensure you receive any cover, including Overseas Medical cover # . For World Debit Mastercards, you need to activate to receive comprehensive cover. Overseas Medical cover and personal liability insurance is automatically included.

International travel cover eligibility & activation

Effective 7 February 2024, the Credit Card Insurances Product Disclosure Statement and Information Booklet has changed.

Note: These changes are not applicable to World Debit Mastercards.

If you activated/departed on or before 6 February 2024, please refer to the Credit Card Insurances Product Disclosure Statement and Information Booklet – effective 2 June 2023 .

The changes include:

- You need to spend $500 in a single transaction on your prepaid travel costs (e.g. the cost of your return overseas travel ticket, prepaid accommodation, cruise, travel or tour) by charging the cost for that trip on your eligible credit card account before leaving Australia and activate to receive any cover. You will no longer automatically receive Overseas Medical cover.

- The excess for Benefit 2: Overseas Emergency Medical and Hospital Expenses; is no longer reduced to $250 upon activation. This will remain at $500 upon activation. No cover will be provided where you do not activate.

- We removed Benefit 6: Travel Service Provider Insolvency and Transit Accident cover. Business, Corporate Cardholders and Travel Management Account users will retain Transit Accident benefits, refer to the Certificate of Transit Accident .

- Platinum Awards * credit cards have the same benefits, maximum duration per journey, benefit limits and sub-limits as Gold credit cards.

- The maximum benefit limit for Cancellation Costs for Gold and Platinum credit cards is reduced to $5,000 – cardholder only and $10,000 – cardholder with family

- Refer to the Summary of Travel Insurance changes for a full list of the changes or contact Cover-More directly on 1300 467 951 , 8am-5pm Mon - Fri and 9am-4pm Sat (Sydney/Melbourne time).

Cards with comprehensive international insurance cover available

International travel insurance is available with Low Fee Gold, Low Rate Gold, Gold Awards ^ , Platinum Awards * , Diamond Awards * , Smart Awards and Ultimate Awards CommBank credit cards and World Debit Mastercard when you activate your insurance in NetBank, the CommBank app or by contacting Cover-More .

Then you, your spouse and up to 10 accompanied children, if they’re travelling with you for the entire journey, are protected.

If you don’t have an eligible CommBank credit card or World Debit Mastercard, take a look at our CBA International and Domestic Travel Insurance instead.

Check if you are eligible

For eligible credit cards

To receive cover, including Overseas Medical cover#, before you leave Australia you must: