- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

IMG Travel Insurance: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

IMG travel insurance plans and costs

Which img travel insurance plan is best for me, can you buy img travel insurance online, what isn’t covered by img travel insurance, covid-19 considerations, is img travel insurance worth it.

- Annual or single-trip policies are available.

- Coverage available for adventure travelers.

- Special medical insurance for ship captains and crew members, international students and missionaries.

- Claim approval can be lengthy.

Are you planning to travel soon? We don’t blame you — spending the last few years dealing with country shutdowns, testing requirements and travel restrictions has considerably impacted everyone.

If you’ve booked a vacation, you may wonder if you should purchase travel insurance. Among a variety of providers from which to choose, IMG insurance offers several different insurance plans. These include both short- and long-term policies, some of which include coverage for issues arising from COVID-19 illness.

Let’s look at IMG travel insurance, its different plans, and how to choose one that’s right for you.

» Learn more: Common myths about travel insurance and what it covers

The type of travel insurance you’ll want to purchase will depend on what kind of travel you’re doing. Are you looking specifically for medical coverage? How about trip insurance in case your plans go awry? You can be reimbursed in various circumstances if you have the proper insurance.

Single-trip plans

Single-trip plans are intended for those going on a trip for a predetermined period and returning home. This is compared to those who intend to take multiple trips within a year or those who will be abroad for a long time.

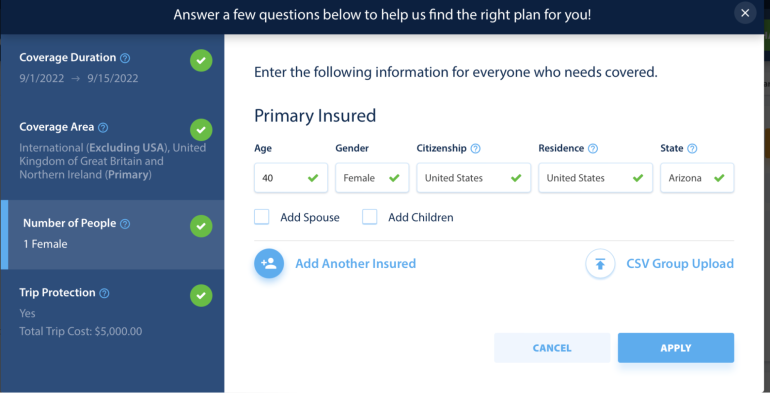

To get an idea of the options, we input a search for a 40-year-old female from Arizona traveling for two weeks to the U.K. on a $5,000 vacation.

IMG returned a total of 12 different plans. The cheapest plan, at $37.31, was limited strictly to health insurance. This includes coverage of up to $1,000,000 for unexpected illnesses and accidents.

The most expensive option, meanwhile, included medical insurance, trip cancellation insurance, and trip delay insurance. The total cost for this plan came out to $343.96.

Many travel credit cards offer complimentary trip insurance as long as you pay for the trip with your card, though coverage levels may vary.

Annual plans

Annual plans are built for those types of folks who travel often. This can be on many short trips or for longer-term absences from home.

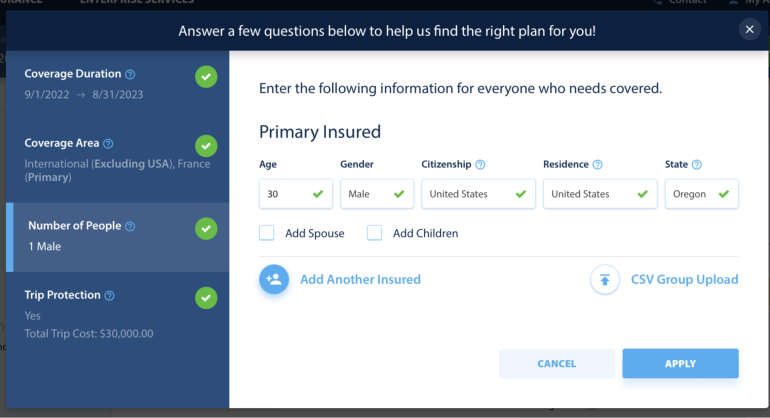

For an idea of the annual plan coverage IMG offers, we put in a search for a 32-year-old man from Oregon, traveling for a year with a budget of $30,000.

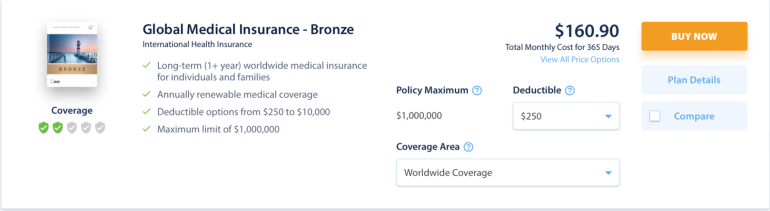

In this case, IMG returned a total of 19 different plans. The cheapest plan cost $160.90 for the year and included worldwide health insurance and a deductible of $250.

It’s worth noting that you can alter the deductible amount — upping the deductible to $10,000 dropped the annual cost of the insurance down to just $65.60.

The most expensive option, meanwhile, cost $816.69 and included 24/7 telehealth access for non-emergency medical questions. Maximum coverage limits for the policy range from $2,000,000 to $8,000,000.

» Learn more: How much is travel insurance?

The type of plan you’ll need will vary based on your travel habits. Here are some things you’ll want to think about when choosing your plan:

Look at coverage details

Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.

Think long-term

If you’re planning on traveling multiple times within the year, compare the cost of purchasing several different single-trip policies to buying a year-long plan, which may save you money.

Use existing coverage

If you hold a credit card with trip insurance, you may want to skip purchasing insurance entirely. Depending on your card, you may already have emergency medical insurance, trip interruption insurance, rental car insurance, trip delay insurance and more.

» Learn more: How to find the best travel insurance

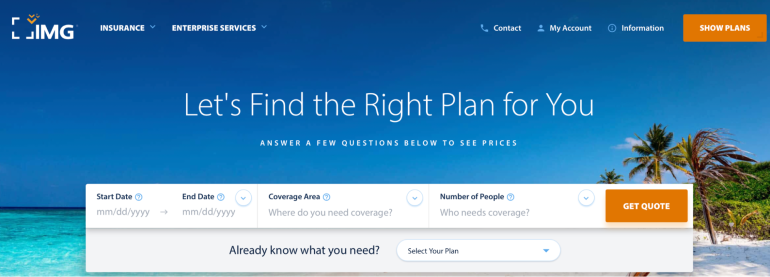

If you’re looking to purchase IMG travel insurance, you’ll first want to navigate its website: imglobal.com .

From there, you’ll be able to enter the details of your trip, including how many travelers you have, where you’re going and how long you’ll be gone. You’ll then be presented with various insurance plans to fit your needs.

We mentioned above that different plans have different levels of coverage. Still, in general, there are some things that you shouldn’t expect to be covered, including high-risk activities, intentional acts of harm and other designated events.

» Learn more: Does travel insurance cover medical expenses?

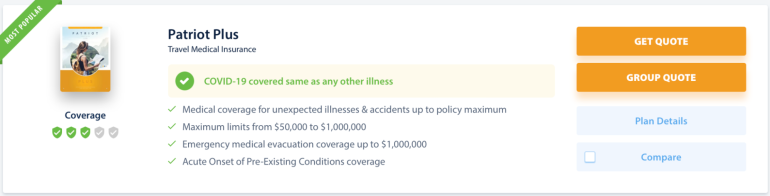

You’ll want to be aware that not all insurance plans cover instances of coronavirus. This is also true for IMG travel insurance; different plans have different levels of coverage and not all of these include COVID-19 protection.

If coronavirus is something you’d be covered for, you’ll want to double-check your plan before purchasing. Those that include coverage for COVID-19 will specify so like this:

» Learn more: Is there travel insurance that covers COVID quarantine?

The cost of your travel insurance will vary based on your coverage levels. Things that may bump up the price of your policy may include trip reimbursement insurance, cancel for any reason insurance and pre-existing condition coverage.

Yes, IMG offers international travel insurance. When getting a quote, you’ll be able to select the countries to which you’re traveling, though if you’re looking for a long-term plan, you can expect worldwide coverage.

Whether or not travel insurance is worthwhile will depend entirely upon your needs. If you have a credit card that provides complimentary insurance, that may suffice. Otherwise, purchasing a plan could help bring you peace of mind on your vacation and help you manage an unforeseen challenge if one occurs.

Some IMG travel insurance plans offer Cancel For Any Reason as an add-on. This benefit covers 75% of your nonrefundable trip cost and must be purchased within a specific time frame from your initial trip deposit. For example, for IMG’s iTravelInsured Travel LX plan you need to purchase CFAR within 20 days of trip deposit.

The cost of your travel insurance will vary based on your coverage levels. Things that may bump up the price of your policy may include trip reimbursement insurance,

cancel for any reason insurance

and pre-existing condition coverage.

Travel insurance can be a good option for those wanting coverage while away from home. The cost of your policy will vary based on the coverage you want — the better the plan, the more you can expect to pay.

Choosing whether or not to purchase travel insurance from IMG is a personal decision. However, if you’re heading out of town and want to be sure you’re covered, do your research and select a plan that suits your needs.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Vacation Rentals

- Restaurants

- Things to do

- Things to Do

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

Medical travel insurance advice - GeoBlue or IMG? - Air Travel Forum

- Tripadvisor Forums

- Air Travel Forums

Medical travel insurance advice - GeoBlue or IMG?

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Air Travel forum

Contemplating travel medical insurance for 2 upcoming trips from US to Europe and hopefully 2 more next year. We are both 64 and looking at travel insurance plans for the first time. Mostly focused on medical insurance (will use credit card coverage for trip cancellation complications). Appreciate any recommendations, specifically feedback on GeoBlue and IMG claim experiences. TIA.

8 replies to this topic

A lot will depend on any pre-existing conditions.

I have not bought from.either of those companies (though others on this forum have recommended GeoBlue) but suggest you also look for something that includes emergency assistance and evacuatjon, in case something really bad happens and you cannot return home by normal means.Alternatively, you might be able to get an emergency assistance and evacuation policy separately and at low cost.

Also note that pre-existing condition rules may work very differently in other countries than they do in US, so don't pay any attention to something someone in another country says. Read your policy carefully, know how such a provision might be applied and when it might be waived. But don't assume such policies work the same in all countries (or even in all US states)

When it comes to insurance (any kind of insurance) what is right for one person, isn’t for another.

You need to read both policy terms paying attention to what is included and excluded. If you have any pre existing conditions, you need to get quotes from both to see if they will cover them and if so, how much will they load the premiums.

Then look for reviews from people who had to claim.

Just a few more words about pre-existing exclusions as these rules are generally different in the US than in other countries.

First, when you say GeoBlue I assume you are talking about an annual policy covering medical only. I have never bought one of those, but know its provisions will be subject to the laws of the state where it is sold -- which is most likely the state of your principal residence. Hopefully another forum member who has bought one will jump in and share their experience.

Also, you say you are 64. Do you plan on going on Medicare when you are 65? If you do, consider getting a Medicare supplement that covers international travel. About four of the standard policies do, but cover only 80% of covered expenses up to lifetime max of $50,000. So you would still probably want more coverage than that, but at least shouldn't have to worry about pre-existing condition exclusions, esp if you buy when first eligible.

Last year I bought an AXA Platinum policy before a 6 week trip to Portugal. One reason why I chose the plan was that it would be my *primary* medical insurance while abroad. I ended up breaking my wrist while on my trip, and required two surgeries in Portugal. AXA reimbursed me 100% of the claimed medical costs that I submitted.

Terriks brings up an important point about the coverage of medical bills. Some insurers offer secondary benefits which means you have to file a claim first with your regular insurance company before they reimburse you for their part.

For my recent trip I had chosen IMG, also because of the primary coverage. I had to go to the emergency room in Siem Reap, Cambodia, and IMG reimbursed me for 100% of the cost in a timely manner.

It's advisable to always select "primary" medical coverage, unless your existing insurance includes coverage outside the US.

The sometimes huge collateral cost associated with illness or injury like having a family member stay with you for recovery and sometimes other things may not be 100% covered,

https://www.forbes.com/sites/christopherelliott/2019/09/07/need-know-medical-evacuation-coverage-before-you-travel/?sh=1355eba332c4

- Kiwi.com 7:55 pm

- 6 hour technical stop 7:51 pm

- British Airways Jet Kids Beds 7:08 pm

- Etihad cancel coach - options? 5:56 pm

- Indian with Green Card Flying USA to India through London 5:44 pm

- Kiwi.com safe & legit, but... 5:37 pm

- Which terminal does ryan air flights arrive at in Manchester 5:29 pm

- KLM flight - exceptional cirumstances 5:24 pm

- What does Staus:Ticketed on American Airlines Mean 4:52 pm

- Travelling with two passports - help! 4:47 pm

- Which Lounge Zurich 4:43 pm

- Heathrow T3 with sprained ankle! 3:59 pm

- Is Transit Visa Required at London(Heathrow) 3:44 pm

- Myflightsearch.com Is Continuing to Scam People 3:19 pm

- ++++ ESTA (USA) and eTA (Canada) requirements for visa-exempt foreign nationals ++++

- ++++ TIPS - PLANNING YOUR FLIGHTS +++++++

- Buy now or later? What's with these screwy ticket prices?

- Around-the-world (RTW) tickets

- All you need to know about OPEN JAW tickets

- Beware of cheap business class tickets (sold by 3rd parties)

- ++++ TIPS - PREPARING TO FLY +++++++++

- TIPS - How to prepare for Long Haul Flights

- TIPS - Being Prepared for Cancellations and Long Delays

- TIPS - How to survive being stuck at an airport

- Flights delays and cancellations resources

- How do I effectively communicate with an airline?

- Airline, Airport, and Travel Abbreviations

- Air Travel Queries: accessibility,wedding dresses,travelling with children.

- Connecting Flights at London Heathrow Airport

- TUI Airways (formerly Thomson) Dreamliner - Movies and Seating Information

- ++++ COVID-19 CORONAVIRUS INFORMATION ++++

- Covid-19 Coronavirus Information for Air Travel

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Buying the Best Travel Medical Insurance for You [2024]

Christy Rodriguez

Travel & Finance Content Contributor

87 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3109 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

![geoblue vs img travel insurance Buying the Best Travel Medical Insurance for You [2024]](https://upgradedpoints.com/wp-content/uploads/2020/12/Travel-Medical-Insurance.jpg?auto=webp&disable=upscale&width=1200)

What Is Travel Medical Insurance?

Plan limits.

- Deductibles

Length of Trip

Does travel medical insurance cover covid-19, what doesn’t travel medical insurance cover, comprehensive travel insurance, health insurance, how does travel medical insurance work, how much does travel medical insurance cost, credit card coverage, travel medical insurance policies, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The thought of getting sick or injured while traveling can be one of the most stressful aspects of planning a trip. Often, travelers assume that their primary health insurance will cover all costs of medical expenses on their trip, but not every health insurance plan covers every country and situation.

To ensure you have coverage if you need it, you may need to consider purchasing travel medical insurance. This can fill the gap between your regular insurance and any coverage you may have with your credit cards . We’ll break down all of the important details and tell you everything you should know about travel medical insurance.

If you are traveling domestically within your own country, you will likely be covered by your primary health insurance. If you are traveling abroad, your coverage may not extend to those other countries. This is primarily where travel medical insurance comes into play.

Travel medical insurance is a type of international insurance designed to cover emergency health care costs you might face when you are traveling or vacationing abroad.

A travel medical policy can be an important addition to your trip since your primary health plan may not cover you fully if you need assistance outside of your home country. An uninsured injury or illness abroad can result in a huge financial burden that can be significantly reduced by having travel medical insurance.

Bottom Line: Travel medical insurance is recommended by the U.S. Department of State, the Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO).

According to Allianz Travel, the most common overseas medical emergencies that are claimed include:

- Fractures from falls

- Cardiovascular problems such as a heart attack or stroke

- Trauma involving motor vehicles

- Respiratory problems such as a collapsed lung

So going with that first item, let’s say you’re exploring Europe and end up twisting your ankle on the beautiful, but uneven cobblestone streets in Rome. Depending on the plan you choose, you may be covered for:

- The cost of a local ambulance to transport you to the hospital

- Your emergency room co-payment

- The bill for your hospital room and board

- Any other eligible medical expenses, up to your plan limits

But there are limitations to travel medical insurance. Before you purchase a plan, it’s important to know exactly what you are buying — including which things are and aren’t included in your coverage.

What Does Travel Medical Insurance Cover?

Travel medical plans are designed to help in the event of an unforeseen illness or injury while traveling abroad. Travel medical insurance offers emergency medical expense coverage as well as emergency evacuation coverage. This means that the plan will reimburse you for reasonable and customary costs of emergency medical and dental care (up to the plan limits — discussed below).

It is important to look closely at all plans you are interested in since many important things are hidden in the details. You might also find it helpful to brush up on your insurance lingo before doing this.

Travel medical insurance covers emergency medical costs up to the plan limit. Plan limits vary greatly by plan but typically fall between $50,000 and $2,000,000. This is obviously a HUGE range, so you will have to determine the correct amount of coverage based on a few key items:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country? As we discussed above, Medicare doesn’t cover you at all outside of the U.S., so this would be an instance where you might want your plan’s coverage limit to be higher.

- How long is your trip? If you’re going to be away for more than 1 to 2 months, you might want a higher plan limit to account for the greater exposure to risk.

- Do you need extra coverage due to risky activities? For example, if you expect to ski, mountain climb, or do any other risky activities where you might get injured, you might want a higher plan limit.

- What do you feel comfortable with? If you feel safer having $100,000 as opposed to $50,000, then that may be the right decision for you. This insurance plan should provide you a sense of security so you can enjoy your trip.

Most medical single trip plans have some sort of deductible that you must pay before any benefits will be paid. After this, your travel medical insurance will cover any remaining costs, up to the plan’s limit.

However, you will be offered the option to increase, decrease, or remove the deductible altogether. Based on this choice, the price you pay (aka the premium) will be affected accordingly. For example, if you choose a higher deductible, your premium will decrease. If you choose a lower (or no) deductible, your premium will increase.

You are covered by travel medical insurance based on the type of plan you purchase. These come in 3 types:

Single-Trip Coverage

This is the most common type of travel medical insurance. When you leave your home, go on a trip, and then return home, this is considered to be a single trip. While on your trip, you can still visit multiple countries and destinations all under the umbrella of this single trip. You will be covered for the duration of this trip under a single trip travel medical insurance plan.

Multi-Trip Coverage

Multi-trip coverage is for multiple trips and often purchased in 3-, 6-, and 12-month segments.

Long-Term Coverage

This is continuous medical coverage for the long-term traveler (think expats or people working abroad) and is typically paid on a monthly basis.

Many travel insurance policies offer good medical coverage, but not all plans cover expenses related to COVID-19 . If that’s important to you, make sure to verify that the plan you’re buying specifically covers you in case you contract COVID-19.

In general, cancellations due to fear of travel are not covered. However, some plans cover you if you or your covered traveling companion were to become sick as a result of COVID-19. This means that you could still receive benefits for the losses that are covered by the plan.

Many countries around the world , such as Costa Rica and the United Arab Emirates, are even requiring travelers to hold a specific level of medical coverage to account for COVID-19-related medical care and evacuation.

In addition, “ Cancel for Any Reason ” has become a hot topic. This optional coverage is not available with all plans but lets you cancel a trip for a partial refund no matter what your reason — including unexpected travel bans, lengthy quarantine periods, or cancellations due to concerns over COVID-19.

Since travel medical insurance is meant to cover emergencies, certain types of expenses are excluded from most travel medical policies. In addition, for insurance purposes, a pre-existing condition is general defined as any condition:

- For which medical advice, diagnosis, care, or treatment was recommended or received within a defined period of time prior to your coverage date (varies from plan to plan, but is typically within 60 days to 2 years)

- That would cause a “reasonably prudent person” to seek medical advice, diagnosis, care, or treatment prior to your coverage date

- That existed prior to your effective date of coverage, whether or not it was known to you (commonly includes pregnancy)

Hot Tip: You do not need a medical examination in order to purchase travel insurance. If you have a claim, the insurance company will investigate to ensure that your claim occurred during the coverage period of your policy and wasn’t a result of any pre-existing conditions.

Here are some of the most frequent exclusions:

- Pre-existing conditions as defined above

- Routine medical examinations and care (i.e. wellness exams, ongoing prescriptions, etc.)

- Routine prenatal, pregnancy, childbirth, and post-natal care

- Medical expenses for injury or illness caused by extreme sports

- Mental health disorders

- Injury caused by the effects of intoxication or illegal drugs

- Payments exceeding the plan limit

Unless you’ve purchased a comprehensive travel insurance plan, other exclusions include claims related to:

- Trip cancellation

- Lost luggage

- Rental car damage

Be sure to read the description of coverage for any plan you’re considering before you make the purchase. While reading the entire document front to back can be tedious, it’s better to know what’s excluded before you attempt to make a claim.

What Travel Medical Insurance Isn’t

Now that we’ve let you know what is and isn’t covered by travel medical insurance, we’ll also breakdown the difference between travel medical insurance and other similar options.

Comprehensive travel insurance plans offer the most benefits of all plan types and will typically include medical coverage. It can offer you additional coverage for things like trip cancellation, trip delay and cancellation, lost luggage, and more. It’s the best way to cover a host of potential common travel-related problems.

Some comprehensive plans also offer additional coverage for things like rental car damage, Cancel for Any Reason, or a pre-existing condition waiver.

Bottom Line: Comprehensive travel insurance is a full-service plan and includes travel medical coverage as well as other coverages that will protect all aspects of your trip.

You might be thinking that already have medical insurance provided by your employer or through Medicare. However, when you travel to other countries, your primary health insurance might not go with you. Before your trip, check to see whether your domestic plan provides any coverage once you’ve left your home country since many offer limited or no coverage.

In case of a medical emergency, you will want to be able to lay your hands quickly on your travel insurance plan’s contact information for the 24-hour Emergency Assistance program as well as your policy number, so make sure to keep this information somewhere that is easily accessible. Also, be sure you know how to place a call to that number from outside the country.

This is important because you’ll be required to call your travel insurance provider and notify them that you need to be seen by a medical professional as soon as possible. Obviously, you may not be medically able to call before you seek emergency medical treatment, but you should do so as soon as you are able to.

The earlier you can call, the more likely it is that you can avoid any issues for payment of claims and you can also get help and advice from the company’s emergency assistance program.

Bottom Line: Specific details on when and how to contact your insurance provider in case of a medical emergency vary by plan and provider, so thoroughly review these details in your plan information.

For example, in the event of an emergency that requires emergency medical evacuation, your insurance provider will have to approve the evacuation and even make those arrangements for you. If you don’t call ahead to have them do this, the company may not approve the expense and you may be stuck paying for the evacuation in full.

Once you are actually at a medical facility to receive care, make sure to document the experience as thoroughly as possible. This means asking for copies of all of your records before you check out. You’ll need to provide these records to the insurance company when you eventually file your claim and having proof of treatment and costs will assist you in filing a successful claim and getting your money back as soon as possible.

Travel medical insurance plans can vary widely in price, but in general, plans cost anywhere between 4-10% of your total non-refundable trip cost. The pricing of any plan takes into consideration many things, including a few that we discussed above, to determine the cost. These include:

- Age of travelers

- Plan limits

- Supplemental plans such as “Cancel For Any Reason” coverage or coverage for pre-existing conditions

- Length of trip

In addition, if you decide that a comprehensive plan is a better choice for you, this will also increase the price.

Which Company Has the Best Travel Medical Insurance?

The best travel medical insurance company for you may be determined by what type and how much coverage you’d like to have. Let’s review a few options and companies to consider.

Many premium cards have some medical coverage, so be sure to look over all of the best credit cards for travel insurance coverage and protection.

For example, cardholders of The Platinum Card ® from American Express may already have $15,000 of secondary medical coverage . For many, this may be enough, but for others, you may not feel comfortable at this level of coverage and want to purchase a travel medical insurance policy.

If you are looking to purchase a plan from a reputable company, a few options include:

1. Patriot Travel Medical Insurance from IMG Global

For the out-of-country plans, Patriot offers:

- Short-term travel medical coverage

- Coverage for individuals, groups, and their dependents

- Daily or monthly rates

- Freedom to seek treatment with the hospital or doctor of your choice

The following plans are available based on the level of coverage that you desire and you can request a quote through their website linked above.

2. GeoBlue Single Trip Traveler Medical Insurance

GeoBlue offers both the “Voyager Choice” and “Voyager Essential” single trip plans. Both plans allow you to choose your level of medical coverage (from $50,000 up to $1 million) and offer $500,000 in emergency medical transportation and repatriation coverage.

The main difference between the 2 plans is that the Choice plan does not require you to be covered by a primary health plan, but doesn’t cover pre-existing conditions. The Voyager plan will cover all pre-existing conditions, but functions as a secondary coverage after your primary health plan.

3. Allianz Travel Medical Insurance

Allianz offers an Emergency Medical plan that offers additional benefits that extend beyond simply medical coverage. This plan is a comprehensive plan that covers lost baggage and trip cancellation and delay, in addition to emergency medical coverage. See just a few of these benefits below:

In addition, many companies, such as AAA, offer travel insurance through Allianz, so you may receive a further discount if you reference your AAA policy.

Travel medical insurance can be beneficial for most travelers when traveling internationally as most primary health insurance plans won’t cover you abroad. We hope we’ve given you the tools you need to select a plan that works best for you and your travel needs.

At the end of the day, a travel medical plan is a great option if you’re traveling abroad and are not worried about covering trip costs due to a cancellation or added expenses due to a travel delay. Anyone looking for robust coverage for baggage or interruption should consider an upgrade to a more comprehensive plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

How much travel medical insurance do i need.

When considering the amount of coverage you’d like for your travel medical insurance plan, consider the following:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country?

- How long is your trip?

- Do you need extra coverage due to risky activities?

- What amount of coverage do you feel comfortable with?

Refer to the section titled “Plan Limits” for more detailed considerations.

How long does it take to receive travel medical insurance?

Travel medical insurance coverage starts the day of your trip, so you want to make sure you sign up for it before you leave. Most plans allow you to buy insurance up until the day before your trip.

However, the best time to buy travel medical insurance is within 15 days of making the first payment on your trip, since buying early can often qualify you for bonus coverages.

Is travel medical insurance worth it?

Depending on your primary health insurance and any secondary coverage you might be eligible for, travel medical insurance can still be a great tool to protect you from financial hits caused by injury or illness.

In addition, travel medical insurance can help organize assistance in extreme circumstances (such as medical evacuation). You can also pick the appropriate level of coverage to make you feel comfortable.

Does AAA offer travel medical insurance?

Yes, AAA offers travel medical insurance, but it is usually serviced by another company such as IMG Global or Allianz. You will normally receive a greater discount if you mention your AAA insurance policy, so don’t forget to include this when you request a quote!

Can you get travel insurance when already abroad?

Most companies do not offer travel insurance policies once your trip has already begun. There are a few reputable companies, such as World Nomads and SafetyWing , that are set up for long-term travel.

These companies allow you to purchase plans once your trip has already begun, but the rates may be higher than a plan that was purchased prior to leaving for your trip.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Travel Insurance Plans

- GeoBlue Cost

Compare GeoBlue Travel Insurance

Why you should trust us, geoblue travel insurance review 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

GeoBlue travel insurance specializes in offering medical travel insurance plans . These specialized plans cover healthcare costs while traveling abroad but lack trip cancellation, lost luggage, and other standard travel insurance services. This GeoBlue travel insurance review looks at what GeoBlue offers and what it may lack.

This medical-only travel insurance option may only be suitable for some globetrotters. But travelers who are a fit will find GeoBlue provides extensive coverage options and access to a worldwide network of healthcare providers with cheap travel insurance .

Of course, travelers should always check with their regular health insurer first. Your standard health insurance may provide limited coverage abroad. Even if you still want supplemental coverage, you should know if it would be primary or secondary. Here's what you need to know before investing in GeoBlue plans.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. A subsidary of Blue Cross Blue Shield

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers strong medical plans as long as you have a regular health insurance plan, but it doesn't have to be through Blue Cross

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers long-term and multi-trip travel protection

- con icon Two crossed lines that form an 'X'. Multiple complaints about claims not being paid or being denied

- con icon Two crossed lines that form an 'X'. Does not provide some of the more comprehensive coverage like CFAR insurance

- con icon Two crossed lines that form an 'X'. Buyers who do get claims paid may need to file multiple claim forms

Travel Insurance Plans from GeoBlue

GeoBlue offers three distinct medical travel insurance plans for individual travelers with varying levels of coverage. It also has a few group travel insurance plans for larger parties. Regular health insurance plans, destination, budget, and other factors play into the shopping experience. GeoBlue recommends each program for specific groups, but all three can be used for extended periods or multiple trips.

Here's an overview of the types of coverage included in each GeoBlue individual plan:

Additional Coverage Options from GeoBlue

GeoBlue offers fewer riders or additional coverage options compared to other providers. Looking at the descriptions above, the three plans give a detailed list of included services, not all of which will be applicable during the average trip. The Voyager and Trekker plans have no additional coverage options.

However, the Xplorer plan is aimed at long-term travelers (including those who temporarily work internationally). So it provides two optional riders that come in handy if you're outside your home country for months at a time:

- Enhanced Prescription Drug Rider: Provides up to $25,000 of coverage for prescription drugs per calendar year.

- Basic US Benefits Rider: Provides healthcare benefits in the United States, emergency medical care, inpatient hospital coverage, and prescription drugs coverage.

GeoBlue Travel Insurance Cost

The price you pay for travel insurance can vary widely depending on several factors. Typically, your trip destination, duration, age, insurance plan, and any additional coverage options you add to the base plan will play a role. In GeoBlue 's case, you'll also have the opportunity to select your deductible and maximum coverage limits with some plans, which can impact your travel insurance premiums.

For instance, a 30-year-old who plans to go on a weeklong trip to France would have the following options with GeoBlue's Voyager Choice plan, which offers a choice of deductible and coverage limits.

- $11.68 premium with a $60,000 medical limit and $500 deductible

- $20.08 premium with a $1 million medical limit and $0 deductible

Meanwhile, two travelers in their sixties interested in purchasing GeoBlue's annual Trekker plan would have a choice between the following plans.

- $250 for the Trekker Essential plan with a $500,000 medical limit and a $200 deductible

- $390 for the upgraded Trekker Choice plan with a $1 million medical limit and a $100 deductible

Are you traveling long-term or looking for flexibility around your destination and end date? We recommend checking in with GeoBlue to make sure you understand the rules.

Unfortunately, many customers find themselves in a pinch without coverage because they went outside the stated terms of their insurance policy. GeoBlue agents can answer questions and clarify terms as needed.

How to File A Claim with GeoBlue

The easiest way to submit a claim with GeoBlue travel insurance is to file it through its online Member Services page or mobile app.

Policyholders can also file claims via mail, fax, or email. If you wish to submit physical paperwork, the company asks that you send it to one of the following addresses:

Mail: GeoBlue

Attn: Claims

933 First Avenue

King of Prussia, PA 19406

Fax: +1.610.482.9623

Email: [email protected]

See how GeoBlue travel insurance stacks up against the competition.

GeoBlue Travel Insurance vs. Allianz Travel Insurance

Both GeoBlue and Allianz offer single-trip, standalone medical insurance plans. In addition, both provide coverage for emergency medical transportation, emergency medical claims, and baggage loss. However, there are a few differences.

GeoBlue supplies coverage for non-emergent inpatient and outpatient visits and accidental death or dismemberment. It also explicitly includes preexisting conditions pending you travel with a regular health insurance plan. Meanwhile, Allianz issues coverage for epidemics and other travel services like cancel for any reason coverage.

In addition, the two plans are structured differently. Allianz offers payouts up to a set dollar amount. GeoBlue covers a certain percentage of qualifying medical costs after a met deductible.

Allianz Travel Insurance Review

GeoBlue Travel Insurance vs. AIG Travel Guard

AIG 's essential travel insurance plan provides medical evacuation coverage, security evacuation coverage, trip delay, and other coverages. In line with the low price, the essential plan's limits for each section are limited. For example, travelers would get a max of $15,000 medical travel insurance coverage. The company does not offer a standalone medical plan.

AIG Travel Guard customers may or may not be eligible for a preexisting conditions waiver, whereas GeoBlue's plans specify preexisting coverage as long as you have a permanent health insurance plan from your work or otherwise.

AIG focuses primarily on single-trip coverage options, though it does provide an annual travel insurance plan. GeoBlue's website recommends plans for different travelers, but all three programs allow for multiple trips or extended travel times.

Regardless, if you want broader protection for necessary medical treatments, you will likely be served with a plan from GeoBlue. On the other hand, if you're looking for more trip cancellation and other standard travel insurance coverages, you will steer towards AIG.

AIG Travel Insurance Review

GeoBlue Travel Insurance vs. World Nomads Travel Insurance

The travel insurance plans sold by World Nomads differ slightly from GeoBlue's. Rather than focusing exclusively on covering your medical costs and limited baggage loss, World Nomads offers a comprehensive insurance option. Its plan also includes trip cancellation, interruption, and more coverage.

In addition, World Nomads' plan covers a wide range of adventure sports, compared to the two (downhill skiing & scuba diving) covered by GeoBlue. Looking at the two companies side by side, you may see many of the same services. However, the two companies offer staggered benefits. World Nomads has a more extensive list to cover whatever comes your way.

However, GeoBlue is more thorough in covering preexisting conditions and other medical services if its terms are followed. If you look at the details, GeoBlue covers higher amounts for the services it includes.

World Nomads Travel Insurance Review

When reviewing GeoBlue travel insurance, we compared its products against those of other top travel insurance providers. In particular, we examined the available plan options, supplemental policies, claim limits, inclusions, exclusions, and sample policy premiums.

Selecting the best policy for you and your travel companions is about finding a policy with the correct type of coverage and adequate claim limits. That said, price is also an essential factor for many consumers. In addition, trip-specific riders for things like rental care coverage or adventure activities may be necessary for some travelers.

As such, we take all that into account when writing our reviews. Then individual readers can make decisions based on their travel plans and needs. You can learn more about how we rate travel insurance products here .

GeoBlue FAQs

The exact definition of legitimacy can often be subjective. However, GeoBlue currently holds an A+ rating with the Better Business Bureau. In addition, the company earns largely positive reviews from its customers.

GeoBlue travel insurance works in most places around the globe. Fortunately, the company provides a comprehensive service map to help potential customers determine if their destination is covered before applying.

Most GeoBlue travel insurance plans are meant to provide international coverage. However, the Xplorer plan offers the option to add a supplemental rider extending its coverage to include the United States.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Bad Credit

- Best Personal Loans for Fair Credit

- Home Equity

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Free Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Jumbo CD Rates of April 2024

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- American Home Shield Review

- First American Home Warranty Review

- Best Home Appliance Insurance

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Replacement Companies

- Best Gutter Guards

- Gutter Installation Costs

- Best Window Brands