U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Travel Insurance for Europe: 4 Best Options for 2024

Allianz Travel Insurance »

Travelex Insurance Services »

Generali Global Assistance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance for Europe.

Table of Contents

- Allianz Travel Insurance

- Travelex Insurance Services

You almost certainly will want travel insurance for Europe, mostly because the high cost for international trips is worth protecting against travel delays and trip cancellations. Since your U.S. medical coverage will not apply overseas, you also need international health insurance that covers surprise medical expenses and medical evacuation.

If you're searching for the best Europe travel insurance that money can buy, consider the following plans and all they have to offer.

Frequently Asked Questions

Most people need travel health insurance at a bare minimum when traveling to European destinations like France, Italy or Switzerland, as well as additional countries inside and outside of the Schengen area. After all, U.S. health insurance plans do not provide coverage for medical emergencies overseas, and the same is true for government health plans like Medicare. Check out our article on whether your health insurance covers international travel .

Other benefits built into Europe travel insurance plans can also protect the money that's been spent on airfare, hotel stays, Europe cruises and tours. For example, travelers can benefit from having coverage for trip cancellation, trip delays, lost or delayed baggage, and more.

Every travel insurance policy is unique, so you'll want to read over individual travel insurance plans to see what they protect against. That said, the bulk of travel insurance plans for trips to Europe provide the following coverages:

- Trip cancellation

- Trip interruption

- Travel delays

- Lost luggage reimbursement

- Baggage delay coverage

- Medical expenses

- Emergency medical evacuation

- Rental car damage

Some travel insurance plans also offer additional or optional coverage for sports equipment or sports equipment delays, missed connections, accidental death and dismemberment (AD&D), adventure sports and more.

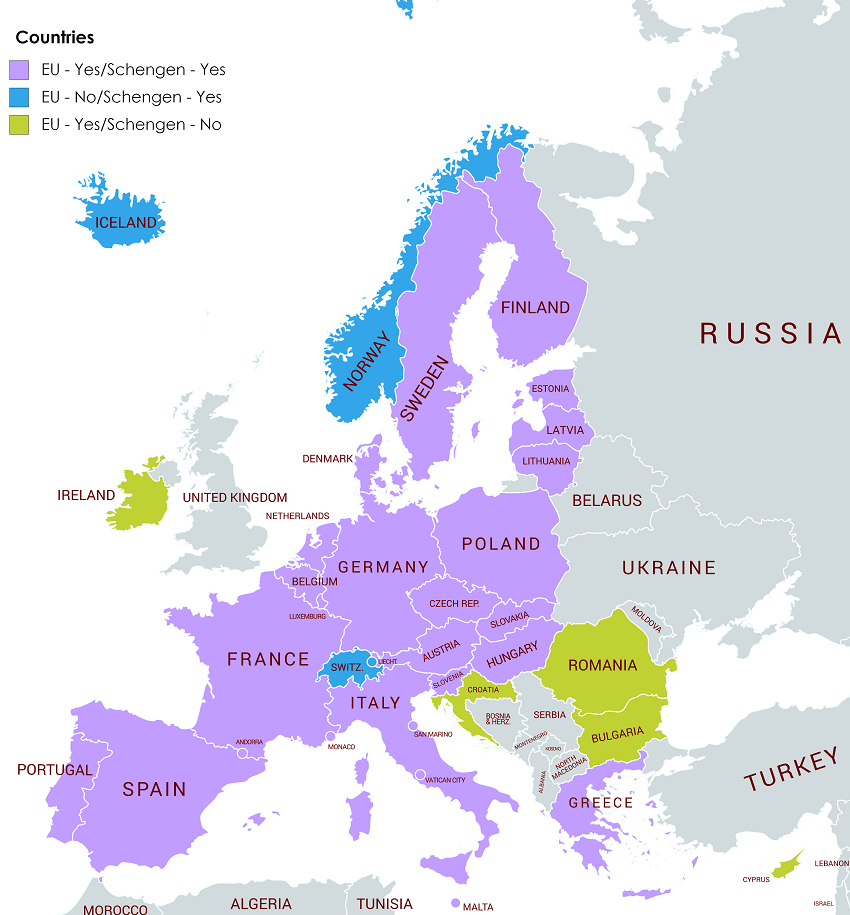

Some visitors to countries in the Schengen area are required to have a visa for short stays that can last for up to 90 days within a timeline of up to 180 days. However, this is not the case for American citizens, who can stay in Europe for up to 90 days at a time without meeting specific visa requirements.

The U.S. Department of State also notes that American citizens who want to stay in Europe for more than 90 days should reach out to the country they plan on visiting to inquire about their visa process.

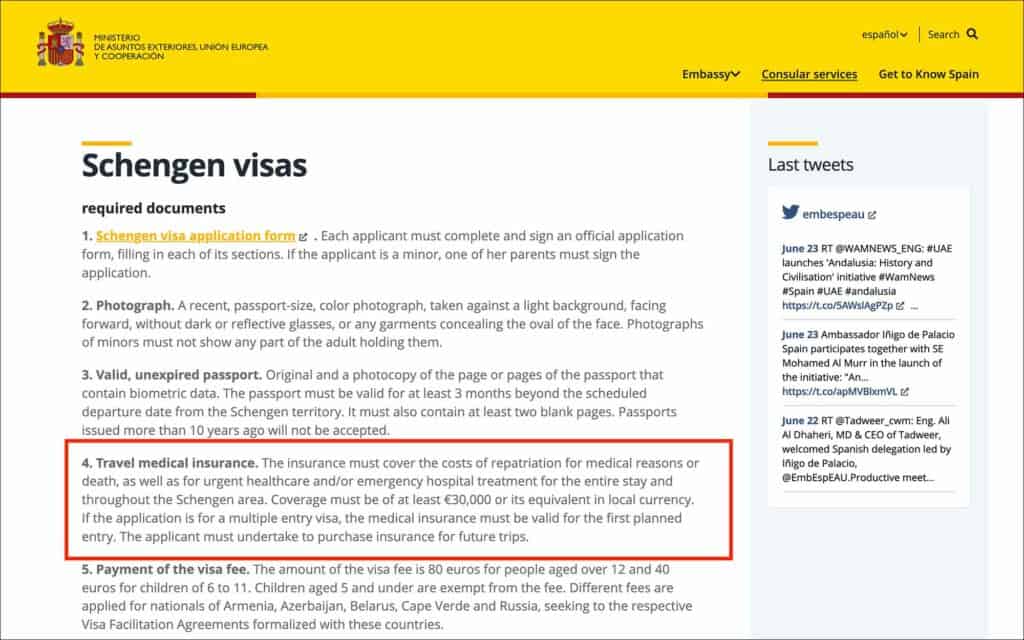

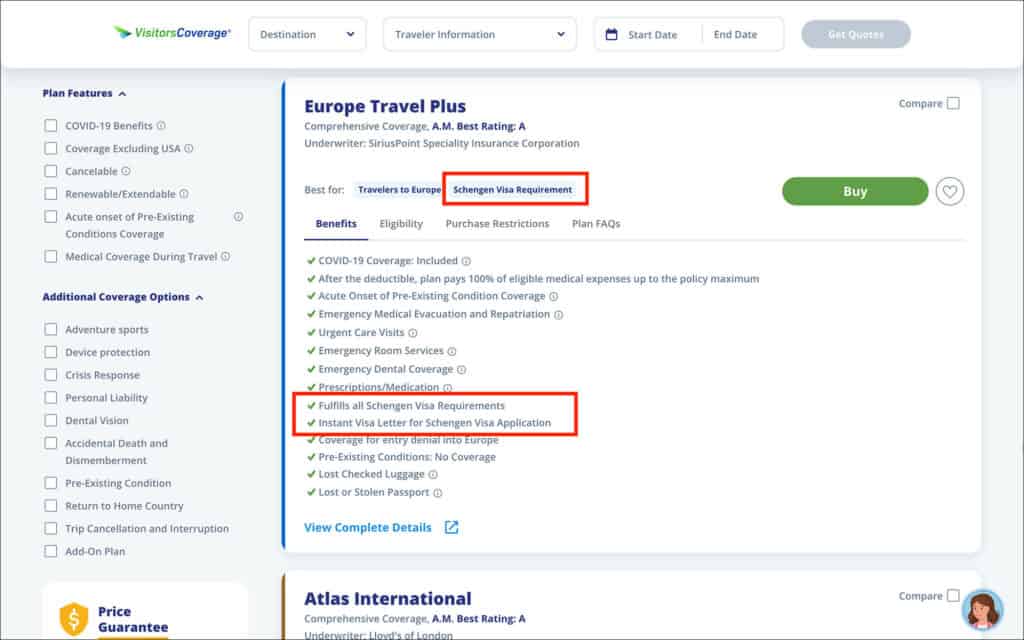

If you live in a country that requires a Schengen visa, you are required to purchase Schengen visa insurance that pays for overseas medical expenses. This coverage must provide at least 30,000 euros in protection against medical expenses that result from hospitalization, emergency treatment and repatriation of remains in the case of accident or death.

- Allianz Travel Insurance: Best Overall

- Travelex Insurance Services: Best Cost

- Generali Global Assistance: Best for Medical Emergencies

- WorldTrips: Best for Groups

Optional cancel for any reason (CFAR) and preexisting medical conditions coverage available

Kids 17 and younger covered for free

Lower coverage amount for medical expenses than some providers

- $100,000 per traveler in coverage for trip cancellation

- $150,000 per traveler in coverage for trip interruptions

- $500 in coverage for eligible trip changes

- $50,000 in emergency medical coverage

- $500,000 for emergency medical transportation

- $1,000 toward baggage loss or damage

- $300 in coverage for baggage delays of 12 hours or more

- $800 in protection for travel delays (daily limit of $200 applies)

- $100 per insured person per day in SmartBenefits coverage for eligible delays

- 24-hour hotline assistance

- Concierge services

SEE FULL REVIEW »

Optional CFAR and preexisting medical conditions coverages available

Kids 17 and younger are covered for free

Many coverages cost extra

- 100% of trip cost for trip cancellation (up to $50,000)

- 150% of trip cost for trip interruption (up to $75,000)

- $2,000 in coverage for trip delays of five hours or longer

- $750 in coverage for missed connections

- $50,000 in coverage for emergency medical expenses ($500 dental sublimit included)

- $500,000 in coverage for emergency medical evacuation and repatriation

- $1,000 in coverage for baggage and personal effects

- $200 for baggage delays of 12 hours or longer

- $200 for sporting equipment delays of 24 hours or longer

- $25,000 for accidental death and dismemberment coverage

- 24/7 travel assistance

- 100% of the insured trip cost for financial default of a travel provider (maximum of $50,000)

- Trip cancellation and interruption coverage for preexisting medical conditions (maximum of $50,000)

- Cancel for work reasons coverage

- CFAR insurance

- Car rental coverage worth up to $35,000

- $50,000 in additional emergency medical coverage

- $500,000 in additional coverage for emergency medical evacuation and repatriation

- Adventure sports exclusions waiver

- $200,000 in coverage for flight accidental death and dismemberment

CFAR and preexisting medical conditions coverages available

High coverage limits for medical expenses and evacuation

CFAR coverage only reimburses at 60%

- $1,000,000 coverage limit for emergency medical evacuation and transportation

- $250,000 coverage limit for medical expenses ($500 limit for dental emergencies)

- 100% of trip cost for trip cancellation

- 175% of trip cost for trip interruption

- $1,000 per person for travel delays ($300 per person daily limit applies)

- $2,000 per person in coverage for baggage and $500 for baggage delays

- $2,000 per person in coverage for sporting equipment and $500 for sporting equipment delays

- $1,000 per person in coverage for missed connections

- Air flight accident AD&D coverage worth $100,000 per person and $200,000 per plan

- Travel accident AD&D coverage worth $50,000 per person and $100,000 per plan

- $25,000 in coverage for rental cars

- 24-hour travel support

Discounts for groups of five or more

Potential for high coverage limits for medical expenses

No coverage for trip cancellation

Available coverage limits vary by age

- $5,000 for local burial or cremation

- Up to $25,000 in AD&D coverage

- $100,000 in coverage for emergency reunions

- $10,000 in coverage for trip interruption

- $1,000 for lost checked luggage

- $100 in coverage for lost or stolen passports or visas

- $100 in coverage per day for travel delays of at least 12 hours (two days of coverage maximum)

- Up to $25,000 in personal liability coverage

Why Trust U.S. News Travel

Holly Johnson is a travel writer who has created content about travel insurance, family travel, cruises, all-inclusive resorts and more for over a decade. She has visited more than 50 countries around the world and has an annual travel insurance plan of her own. Johnson also has experience navigating the claims process for travel insurance plans and has successfully filed several travel insurance claims for trip delays and trip cancellations over the years. Johnson works with her husband, Greg, who is licensed to sell travel insurance and owns the travel agency Travel Blue Book .

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The Best Travel Medical Insurance of 2024

Explore protection options for unexpected health issues abroad.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Find the coverage and benefits you need for your adventures abroad.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Travel insurance for Europe: Coverage and policies for 2024

Erica Lamberg

Heidi Gollub

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 9:30 a.m. UTC Nov. 27, 2023

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

- A trip to Europe often requires hefty prepaid and nonrefundable deposits to secure flights, hotels and tours. Travel insurance protects these outlays if you cancel your trip for a covered reason.

- Many U.S. health insurance plans don’t provide coverage in foreign countries, making a travel insurance plan with medical expense benefits important for trips to Europe.

- The best travel insurance for Europe will package together different types of coverage, including trip cancellation, trip delay, trip interruption, travel medical, emergency medical evacuation and baggage insurance.

Planning a trip to Europe is exciting, but can also be expensive. Your itinerary may include visits to several European countries, and you can quickly rack up prepaid and nonrefundable expenses for flights, hotels, excursions, tours and experiences.

Travel insurance can give you peace of mind that you’ll be financially protected if things go wrong before or during your trip. But plans differ, so it’s important to pay attention to included coverages, limits and exclusions when choosing your insurance for travel to Europe.

Do I need travel insurance for Europe?

Travel insurance is not required for entering Europe. “But it is a very important consideration for a number of reasons,” said Scott Adamski, spokesperson for AIG Travel.

In addition to protecting your trip deposits if you need to cancel, Adamski said an important reason to secure a travel insurance policy relates to health care coverage for U.S.-based travelers headed to Europe.

“In a surprise to many, their U.S.-based health insurance policy may not provide coverage, or may provide limited coverage, when they’re traveling out of the country,” said Adamski.

“Medicare also may not provide coverage outside the U.S. (for older Americans) and there may be restrictions/limitations on medical benefits when traveling abroad,” he said. “In short, it’s vital to review your existing health care coverage before traveling.”

To make sure you’re covered financially if things go awry before or during your European vacation, look for a travel insurance plan that includes travel medical benefits as well as coverage for trip cancellation, trip delay, trip interruption, emergency medical evacuation and baggage delay or loss.

Featured Travel Insurance Offers

Travel insured.

Via Squaremouth’s website

Top-scoring plan

Worldwide Trip Protector

Covers COVID?

Medical & evacuation limits per person

$100,000/$1 million

Atlas Journey Preferred

Seven Corners

Via Squaremouth’s Website

RoundTrip Basic

Average cost for plan with CFAR

CFAR coverage

75% of trip cost

Trip cancellation insurance for travel to Europe

If you’ve booked a trip to Europe, you’re probably thinking, why would I cancel my dream vacation?

“No one plans to cancel a trip, but sometimes there are circumstances beyond our control — you suffer an injury before your trip, circumstances at your job change or your flight is canceled due to severe weather at your destination,” said Shannon Lofdahl, spokesperson for Travelex Insurance Services. “Trip cancellation and interruption coverage reimburses you if your trip is canceled or interrupted for a covered reason,” she said.

In general, covered reasons for trip cancellation insurance benefits include:

- Death of an immediate family member or a travel companion.

- A serious illness or injury to you, a close relative or a travel companion.

- A sudden and serious family emergency.

- An unexpected job loss or layoff.

- Unplanned jury duty.

- Severe weather.

- Your travel supplier is going out of business.

- A national transportation strike.

So, if three days before your trip to Vienna, Austria, your husband has a heart attack, you can cancel your trip and receive 100% of any prepaid and nonrefundable trip outlays.

It’s important to note that not all reasons to cancel will be covered by your travel insurance policy. For example, if you see a rainy weather forecast in Barcelona or get nervous to travel to Paris because you learn about a rise in petty crimes there, these are not covered reasons.

If you want the highest level of flexibility to change your travel plans, consider adding “ cancel for any reason ” (CFAR) coverage.

CFAR is an upgrade to a basic travel insurance plan that may boost the price of your policy by about 50%, but will give you the latitude to cancel your trip for any reason as long as you cancel at least 48 hours before your scheduled departure. If you meet all the requirements of your plan, you can expect to be reimbursed for 75% — or 50%, depending on the plan — of your prepaid, nonrefundable trip costs.

Trip delay insurance

Delays are an expected part of traveling these days, especially while traveling abroad, and that fact has emphasized the importance of trip delay coverage, said Lofdahl. “A short delay probably won’t cause you too much stress, but longer delays can mean missing connecting flights.”

Trip delay coverage can reimburse you for costs you incur as a result of a travel delay, as long as the delay was caused by a reason in your policy documents. Severe weather, airline maintenance issues or a security breach at an airport, for instance, are typical reasons covered by trip delay insurance.

Most policies have a waiting period before your trip delay benefits begin, such as six or 12 hours. If you meet the criteria outlined in your travel insurance policy, you can expect to be reimbursed for a meal, hotel room, taxi fare and a few personal care items to tide you over for the delay, up to the limits in your plan.

Be sure to hold onto your receipts as you will be asked to submit this documentation when you file a trip delay claim.

DOT rules : What you’re owed when your flight is canceled or delayed may be less than you think

Trip interruption in Europe

No one wants to end their trip early, especially when it’s a long-awaited European vacation, but unexpected issues can arise, said James Clark, spokesperson for Squaremouth, a travel insurance comparison site.

If there is an emergency back home that is covered by your travel insurance plan, such as a critically ill parent, or if you suffer an injury while traveling in Europe and need to cut your trip short, your policy’s trip interruption insurance can provide financial assistance.

You can file a trip interruption claim to recover any prepaid, unused and nonrefundable trip costs you lose because of your unexpected early departure. Your benefits will also typically cover a last-minute one-way economy flight home, and transportation to the airport.

Keep in mind, however, not all reasons to end a trip early will be covered. For example, if you miss your new kitten or have a fight with your partner while in Budapest, and want to go home, these are not covered reasons. You will have to pay your own way home and can’t file a claim for losses.

Americans will have to get travel authorization to enter Europe

Currently, Americans don’t have to worry about getting a visa to travel around Europe. However, that will change in mid-2025. That’s when the European Travel Information and Authorisation System (ETIAS) goes into effect, requiring people traveling from visa-exempt countries like the United States to get authorization for travel to 30 European countries.

Once applications open up, you will be able to apply on the official ETIAS website or mobile app. You’ll need your passport information to apply, and it will cost 7 euros to process the application. For those who don’t get immediate approval, the decision process could take up to 30 days.

Once approved, your ETIAS travel authorization will be attached to your passport. It will be valid for three years or until your passport expires, whichever happens first.

A standard travel insurance policy won’t cover you if you don’t get your ETIAS travel authorization in time for your trip, or your ETIAS application is rejected. It will be important to apply for ETIAS early, in case there’s a delay or you need to appeal if you’re denied a visa.

If you have “cancel for any reason” (CFAR) coverage you could cancel your trip if your visa doesn’t get approved in time, but you’d need to cancel at least 48 hours before your trip to file a CFAR claim for reimbursement.

Travel medical insurance for Europe

Don’t assume your health insurance applies outside the United States. “Many [domestic health insurance] plans won’t cover you if you become ill or injured traveling in Europe or any other country outside the U.S., and, without travel protection, you would be responsible for all the medical expenses,” said Lofdahl with Travelex.

For instance, if you twist your ankle while touring in Rome, your travel insurance can cover the cost of seeing a doctor, getting X-rays, buying prescription medication and staying in the hospital if deemed necessary. Without this coverage, you are responsible for any medical expenses.

The average cost of travel insurance is between 5% and 10% of the total price of your trip. This can be worth it for the medical benefits alone when traveling in Europe.

Travel insurance plans also typically include travel assistance, which can help if you get sick or injured in Europe. “This benefit offers a range of 24/7 services while you’re traveling — from assistance finding a covered health care provider to helping with replacing lost or stolen passports,” said Lofdahl. These services can also assist with translation services.

Emergency medical evacuation

Depending on where in Europe you’ll be visiting, you might be far from a medical facility adequately equipped to treat severe illnesses and injuries.

“For this reason, travelers with underlying medical conditions might wish to consider additional medical evacuation coverage for certain costs associated with transportation, to either the nearest recommended medical facility or back home,” said Adamski with AIG Travel.

Also, he explains, many countries in Europe — particularly in the mountainous regions — offer adventure sports for visitors. “In the warmer months, the outdoorsy types who aren’t biking might pursue mountain climbing, available through a wide range of treks and climbs for beginners and advanced climbers alike. In the winter, of course, ski enthusiasts from around the world visit a number of European countries for their access to great snow, luxurious accommodations and challenging runs,” Adamski said.

Unfortunately, accidents can happen when mountaineering, regardless of the time of year. Having a travel insurance plan can provide financial protection in the event of medical or evacuation losses, he said.

As an example, said Adamski, a policyholder might need to return to the U.S. after a skiing injury and may need accommodations such as a lay-flat seat or a row of seats to stretch out a broken leg.

“A travel insurance provider, with on-staff doctors and medical coordinators, are invaluable in assisting with medical needs in foreign countries and coordinating with airlines to get injured travelers back home. Such arrangements are remarkably expensive, ranging from $20,000 easily into the six figures,” he explained.

Medical evacuation coverage could help cover these costs, and, in AIG Travel’s travel protection plans, said Adamski, this is complemented by access to an entire medical team dedicated to consulting with the local medical providers, working with you or your family to confirm what’s in your best interests as a patient and making the necessary arrangements to get you where you need to be.

When budgeting for a trip, even the most thorough planners rarely consider a contingency that includes a five- or six-figure emergency medical evacuation, said Adamski. “To be suddenly faced with a bill like that could be devastating. Also, the expertise of the medical staff that would be helping to coordinate such an evacuation could (literally) be a lifesaver,” he said.

Clark with Squaremouth notes that travelers heading to Europe should look for policies with at least $100,000 in medical evacuation coverage. However, if a traveler is doing more remote activities, such as backpacking through the Swiss Alps or exploring the Scandinavian wilderness, “We recommend at least $250,000 in medical evacuation coverage,” he said.

Travel insurance coverage for baggage and belongings

Lofdahl with Travelex said that the return to travel has been wonderful, but the labor shortage has brought some challenges to the industry. “Delayed and lost baggage is one that most people heard about last year and into this year,” she said. “Every airline experienced increases in lost and delayed baggage, and some even had triple the number of lost and delayed bags as they did in the same period in 2021. I can tell you from experience that this can impact your trip.”

European travel generally can include connecting flights which can increase the likelihood that your luggage can be misdirected or lost.

If your luggage decides to vacation in Madrid instead of Athens, you can file a claim with your travel insurance company. Just be sure to get a report from your airline carrier first.

You may also be able to file a claim for delayed luggage. Depending on your plan, you can purchase a few items to tide you over until your bags arrive at your destination, like a swimsuit, some toiletries and a change of clothes. Just be sure to keep any applicable receipts.

Your travel insurance plan may also reimburse you for other personal effect losses while on your vacation. For example, if your camera gets stolen while touring Copenhagen, or if your leather jacket is swiped while in Milan, you can file a claim. But first, you’ll need to file an incident report with your tour leader, hotel manager or local law enforcement. You will be asked for this documentation during the claim process.

It’s very important to read your travel insurance documents carefully so you understand the scope of your benefits. There are often per-item limits and caps for coverage, rules about how depreciation will affect your reimbursement levels and exclusions which won’t be covered. For instance, lost or stolen cash isn’t reimbursable, and many high-ticket items like heirloom jewelry and designer watches are often excluded from coverage.

Baggage loss insurance is also typically secondary coverage, meaning it comes into play only after you’ve filed for reimbursement from your airline or homeowners insurance (in the event of theft).

Frequently asked questions (FAQs)

Buying a travel insurance policy for Europe isn’t required, but it is a smart way to financially protect your trip investment and to ensure you have medical coverage while traveling abroad.

“Just because it’s not required doesn’t mean it’s not a good idea. Unexpected medical bills can be costly, and an unforeseen emergency evacuation or repatriation back home to the U.S. or Canada can climb to tens of thousands of dollars,” said Terra Baykal, spokesperson with World Nomads.

Travel insurance also provides trip cancellation benefits, which can help you recoup the cost of trip deposits. “Travel insurance may reimburse you for your missed nonrefundable, prepaid travel arrangements like hotels, flights and tours, if you need to cancel for a covered reason, like the death of an immediate family member, or your last-minute illness or injury,” said Baykal.

It’s also important to find an insurer who will cover you for all the activities you plan to pursue in Europe. So if skydiving in Switzerland, paragliding in Greece or ziplining in Croatia is in the cards, make sure your insurer covers your more adventurous pursuits, said Baykal.

World Nomads automatically covers more than 150 adventure activities and sports for U.S. residents without the need for an additional adventure activities rider.

While not required to enter Europe, a travel insurance policy with emergency medical coverage is a good idea when traveling to Europe, said Baykal of World Nomads.

Many U.S.-based health insurance providers offer no coverage abroad, or very limited global benefits. If your domestic health insurance doesn’t provide adequate coverage outside of the U.S., buying travel medical insurance for Europe is recommended.

Whether your health coverage travels with you outside the U.S. depends on your Blue Cross Blue Shield plan. Check with your carrier to determine the scope of your travel medical insurance .

According to Blue Cross Blue Shield, travelers should refer to their Certificate of Coverage and riders and also call customer service to find out about limitations to travel coverage.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Erica Lamberg is a regular contributor to Fox News, Fox Business, Real Simple, Forbes Advisor, AAA and USA TODAY. She writes about business, travel, personal finance, health, travel insurance and work/life balance. She is based in suburban Philadelphia.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations last week

Travel insurance Heidi Gollub

10 worst US airports for flight cancellations this week

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Travel insurance Jennifer Simonson

Cheapest travel insurance of June 2024

Travel insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel insurance Timothy Moore

John Hancock travel insurance review 2024

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of June 2024

Travel insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

The Best Travel Health Insurance Companies for Europe

If you’re traveling to Europe this summer, you will definitely want travel insurance to supplement your trip in case anything goes wrong. These are six of the best travel insurance companies for coverage in Europe.

Photo: Pexels.com

When you’re planning a trip to Europe, half of the fun is working out the details of your itinerary, creating a bucket list of attractions to visit, and mapping out the route you want to take.

It’s easy to forget about the finer details, like travel insurance.

That’s just human nature. Who wants to think about the bad stuff when there’s so much to look forward to?

Travel insurance gives you peace of mind while you’re exploring. It doesn’t matter if you’re planning a relaxing wine tour through Italy or a more adventurous jaunt through Switzerland – being insured means you’ll come home with only awesome memories and not outrageous medical bills.

But there are different types of travel insurance for Europe and the Schengen zone. Here’s how to pick the best one for your needs.

Why You Need Travel Insurance for Europe

So why do you even need travel insurance for Europe, anyway?

It all comes down to a very blunt truth: literally anything could happen while you’re on the road, and you need to protect yourself. It’s truly no different than having health insurance in your home country.

Travelers don’t like thinking about worst-case scenarios, but it’s the responsible thing to do. And a good travel insurance policy covers everything from the smallest stuff – like lost and stolen luggage – to all the big picture items, like natural disasters or broken bones. Yes, even death.

In countries where you’re not a resident, the cost of things like medical bills and emergency evacuation are drastically higher than in your home country (even compared to the US, where those bills are crazy high already). So while you might not like the idea of dishing out money for insurance, you definitely don’t want to return from your trip with hundreds of thousands of dollars in medical expenses.

Note: Depending on your home country, you might need to apply for a Schengen visa. Furthermore, countries outside the Europe Schengen zone may have different visa and travel insurance requirements than member states inside the Schengen zone, including the UK. When in doubt, talk to an agent!

BEST TRAVEL INSURANCE COMPANIES FOR EUROPE

If you take away just one important thing from this article, let it be this: Europe travel insurance is necessary. Just because these countries are developed and modern doesn’t mean you’re immune to accidents or illness on your travels.

Have a look at the different Europe travel insurance companies and their travel insurance plans.

1. Seven Corners: Best Travel Insurance Policy for Students

So you’ve got your visa application sent off and you’re planning on studying for a semester in Europe. Welcome to one of the best experiences of your life!

It’s likely that you’ll be required to have Europe travel insurance as part of your visa requirements to study abroad (and you may even need to present proof of insurance with your visa application and your visa letter). Regardless, travel health insurance is a must—and Seven Corners is the best.

Seven Corners has three different travel insurance plans specifically designed for international students. Each one is customizable so that you can even change the amount of medical coverage (up to $250,000) as well as the deductible. When you visit the student health center at your school, it’ll only cost you a $5 copay. Trip cancellation and interruption are also covered.

There are tons of options to add as well. For example, if you want to visit family back home while on your holidays, you can add coverage for when you return to the US (or wherever home may be). That means if you get into an accident while you’re at home, you’ll have health insurance coverage.

Get a quote

2. SafetyWing: Best Travel Insurance Policy for Expats & Long-Term Travelers

SafetyWing has incredibly unique travel insurance offerings for long-term travelers/expats.

SafetyWing is a rare gem of a travel insurance company because their plans allow you to have coverage for as long as you want. It works like a subscription, and your plan renews every four weeks automatically (until you cancel).

You’ll get coverage up to $100,000 for travel medical insurance and emergency medical evacuation coverage in 180+ countries. Trip interruption and trip delay coverage is also included (up to $100/day), but trip cancellations are not.

There’s one downside: SafetyWing’s insurance policies will not cover your gear. For digital nomads traveling with laptops, cameras, and other items of high value, this may be a dealbreaker. The good news is that you can add supplemental insurance like InsureMyEquipment to make sure you’ve got complete coverage.

More information

3. World Nomads: Best Travel Insurance Policy for Adventure Travelers

World Nomads is an all-around awesome insurance provider, but especially if you’re an adventurous type. They cover over 300 sports and activities, and their Explorer Plan is catered specifically to those interested in higher-risk activities.

Snowboarding in Switzerland? Diving in the Mediterranean? Competing in an air guitar competition (seriously) in Finland? This is the policy for you.

World Nomads’ plans include up to $100,000 in emergency medical coverage, medical evacuation and repatriation, and coverage for stolen or lost luggage. Bonus: their policies have always provided coverage for pandemics/epidemics, so you’re well covered up to $100,000 in emergency medical for COVID-19 too.

The user experience and customer service with World Nomads is also top-notch. If you’re not completely sure if your activity is covered, definitely speak with an insurance agent about your case.

4. Tin Leg: Best Travel Insurance Policy for Seniors

If you’re a senior ready to leave behind the US and make your dream of Europe travels come true, Tin Leg is the travel health insurance company for you.

Travel insurance requirements can be stringent for seniors, especially if you have pre-existing conditions (or if you’re over a certain age). Tin Leg is unique in that it offers travel insurance for people up to age 90!

Tin Leg has a few different plans, including the Tin Leg Economy policy with basic trip cancellations and medical coverage up to $20,000. That’s a bit low compared to other plans, but the Tin Leg Luxury policy covers people up to $100,000 for emergency medical and $250,000 for emergency medical evacuation and repatriation.

Pre-Existing Condition coverage is also included if your policy is purchased within 15 days of booking your Europe trip.

5. Travelex: Best Travel Insurance Policy for Families

Taking the whole fam on a country-hopping tour of Europe? Travel insurance coverage is a must for the whole gang.

One of the best things about Travelex is that they provide free coverage for all children age 17 and under, as long as they’re traveling with you under a single policy. It doesn’t matter if you have one kid or five…they’re all covered for travel health insurance!

Travelex is a heavy-duty insurer, and although they only have two main plans they also tons of add-on options. The Basic plan covers $15,000 in emergency medical expenses, $100,000 for emergency medical evacuation, and $500 for lost and damaged baggage.

But with their Travel Select plan, your coverage skyrockets: you’ll get $50,000 in emergency medical, $1,000 for lost or damaged luggage, and $500,000 in medical evacuation coverage. You’ll also get 150 percent of your insured trip cost reimbursed if your trip is interrupted.

6. AXA: Best Travel Insurance Policy for Multiple Trips

If you’re addicted to Europe travel, getting covered by Ama’s Multi-Trip Schengen visa travel insurance is a must.

Multi-Trip is an AXA Schengen visa insurance for frequent travelers who plan on making several trips to Europe over one year. That means if, for example, you’re traveling between the US and France all year on business, you don’t have to purchase travel insurance more than once.

AXA offers medical insurance for expenses up to €100,000 ($111,000) for both the Schengen zone as well as other countries outside of Schengen. If your Europe travel takes you to places like Monaco and Liechtenstein, the AXA Multi-Trip Schengen travel insurance is a great option for you.

But before you plan multiple trips all over Europe, make sure you’re aware of the Schengen visa requirements. Citizens of certain countries may need to apply for a visa depending on the country (if you’re a traveler from the US, you likely won’t have to). Visa refusal is never a fun experience, so make sure to include your AXA Schengen visa insurance certificate with your visa application.

If you’re unsure about anything, AXA has some great customer service. When in doubt, give them a call.

EUROPE TRAVEL INSURANCE FAQs

Now that you’re aware of the different Europe travel insurance options and their different travel insurance policies, let’s make sure you’re clear on everything else travel insurance related.

Is travel insurance necessary in Europe?

Yes, as soon as you leave the US (or your home country) to visit Europe and the Schengen area, travel insurance is necessary. Travel medical insurance is by far the most important asset for any traveler because those medical expenses will skyrocket if you get sick or injured abroad.

Plus your Schengen travel insurance should also cover things like trip cancellations and interruption. No matter what country you’re visiting, you need to be prepared.

Does travel insurance for Europe also cover the United Kingdom?

It’s important to understand that not all countries are part of the European Schengen area, including the United Kingdom. Your Schengen visa will not apply here, and your European travel insurance may not apply.

Some insurances, like World Nomads, will take into account that you’re traveling all over the European region and that you don’t just need Schengen travel insurance. When you’re requesting a quote online, you can select each destination you’ll be visiting.

You need to check with your travel insurance plan to make sure you’re covered for all your medical expenses and emergency evacuation (as well as anything else you want).

Talk to some travel insurance agents for greater clarity on your options. Europe travel awaits!

How much travel insurance do I need for Europe?

The amount of travel insurance coverage you need for Europe/the Schengen area really depends on what you’re planning to do. In any case, your insurance plan should at least cover you for up to $100,000 in medical expenses and emergency evacuation.

You’ll also want to consider what kind of expenses you’ll incur if you’re not covered for things like trip interruption, cancellations, and lost/damaged luggage. You can’t often make corrections to your travel health insurance plan after you’ve begun traveling, so make sure you get it right!

Do US citizens need travel insurance for Europe?

Yes, US citizens absolutely need travel medical insurance for Europe, including the Schengen area.

If you’re a US citizen and you get sick or if you’re seriously hurt while in Europe or the Schengen area, you could face crazy high medical expenses. That could mean hundreds of thousands of dollars in medical debt.

Europe travel insurance is a must for any traveler, and that means US citizens too.

What countries are included in Europe travel insurance?

Generally, Europe/Schengen travel insurance will cover all European countries. As mentioned above, insurers know that you’re likely to visit more than one country on your trip.

But do your homework. Some popular European countries aren’t part of the Schengen area, including the likes of Bulgaria, Croatia, and even the United Kingdom. When it comes to insurance coverage, make sure you read the fine print and make any corrections to your policy as needed.

Residents from certain countries other than the US may require a visa as well, and applicants will want to apply well in advance. Bottom line: your travel medical insurance (just like your Schengen visa requirements) may differ depending on where you’re going.

Does my health insurance cover me in Europe?

Depending on the health insurance coverage you have at home, you may have travel coverage for Europe travel too. Keep in mind this is still travel insurance though—you won’t be able to claim expenses for things like cosmetic surgery abroad.

But in general, residents of the US (and residents of other places, for that matter) shouldn’t assume they’re covered.

Pro-tip: review your policy in great detail before you leave, in case you need to make any corrections.

Do I need Schengen visa insurance for Europe?

Many citizens do not need a Schengen visa before traveling to Europe. You’ll need to figure out what the Schengen visa requirements are for your country first. If you’re a US citizen, for example, you do not need to apply for a Schengen visa.

Applying for a visa can be a daunting experience for some citizens, but the online process for applicants is pretty straightforward. Absolutely make sure you have proof of your Schengen visa travel insurance secured beforehand (like the AXA Schengen visa insurance certificate mentioned earlier), and include it with your visa letter and visa application.

Once you’ve received your Schengen visa, you’re good to go.

Now it’s time—are you ready to see Europe?

Latest Articles

- 5 Unique Glamping Experiences in Kent June 3, 2024

- 10 of the best Summer Festivals in and around Los Angeles June 3, 2024

- A Comparison of Luxury 5 Star Resorts in St Lucia June 3, 2024

- The Best Cinque Terre Tours from Florence June 3, 2024

- 5 of the best Liveaboards in the Philippines June 3, 2024

Do I Need Medical Insurance For Travel In Europe (+5 Best Providers)

Please note that some of the links may be affiliate links , and at no additional cost to you, I earn a small commission if you make a purchase. I recommend only products & companies I love and use, and the income goes back into making this little blog successful!

Let’s talk about medical insurance for traveling in Europe – Do I need it? And what’s the cheapest, best, and most inclusive?

Maybe it’s the over-thinker in me, but every couple of trips, I like to reflect on lessons learned – What will I remember most? What was the best meal? What sucked about the trip? This helps me decide what to pay attention to when booking my next adventure. And my biggest lesson learned is to be prepared in case I get sick while traveling in Europe.

Here are a few of my personal experiences when I was glad I paid the ~$40 a month for travel medical insurance and access to an English-speaking doctor :

- When I had a bad flu in Estonia , and I was flying out for a trekking trip in Norway the next day. I called my travel doctor, got a prescription for something stronger than Paracetamol, and was feeling better by the time the flight got around.

- Or when I needed to see a gyno in Norway for some medicine involving what turned out to be my first-ever UTI. I ended up paying nothing for the visit, which included a full gyno check and a comprehensive STD panel. Even with my full insurance in the States, I don’t get treated this well!

- And finally, when my girlfriend and I ate some delicious, albeit dubious, street food in Morocco ( as one does ), we couldn’t hold anything down. We ended up needing some heavy prescription medication to cure our stomachs so we could continue the trip.

All of these scenarios have one thing in common ( other than me ). You never know what can happen. It’s usually the small things – like a common cold, a stomach issue, or a terrible toothache that can ruin a trip unnecessarily if you’re not prepared . And by prepared, I mean having access to call an English-speaking doctor who can consult and write you a prescription if needed.

➡️ My personal recommendation for the overall best travel insurance is SafetyWing Nomad Insurance . ⬅️

Through my travels in Europe, I’ve learned to plan ahead, and I’ve learned to travel safely so I can continue doing the things I love. Travel medical insurance is on my checklist of things to have, along with my passport and a phone charger.

Table of Contents

Do You Need Medical Insurance For Travel In Europe?

YES, you will need travel medical insurance while traveling in Europe. Especially when it comes at a relatively small price for peace of mind. You don’t want to have the shits after a fantastic dinner in Greece and have to:

- Navigate a foreign hospital system

- Translate your medical condition into a foreign language

- Figure out how the hell to pay foreign medical expenses

- Get access to a Western-trained doctor

Let’s get into what to look for and my shortlist recommendations.

Is Travel Insurance Enough For My Trip To Europe?

Likely not. As you plan your trips, it’s important to understand the difference between travel insurance ( which I thought was more inclusive than it is ) and travel medical insurance ( which is what you actually need ).

✔️ Travel Medical Insurance (Travel Health Insurance) for Europe

- Typically, it will cover emergency medical care, evacuation, and repatriation (ie. getting you back to your home country).

- It gives you access to hospitals and doctors for unexpected medical problems, like stomach bugs, cases of flu, and other random accidents that just happen. (👈 this is what I’ve used it for mostly )

- Remember, it does not replace your normal healthcare, rather it’s there in case of emergencies. For example, you can’t get a regular checkup abroad using travel medical insurance outside your home country.

- Travel Medical insurance in Europe is a good idea if you’re worried about getting sick or hurt while traveling – just think about the foreign foods you’ll be eating, all the tours and walking you’ll be doing in the heat or cold, and the metros you’ll be riding full of people.

👉 PRO TIP: Don’t wait to get home to get medicine if you’re sick. Pharmacies, clinics, and even hospitals in Europe are top-notch and are used to working with Americans. Just make sure you keep the bills (if there are any) so you can get things reimbursed by your travel insurance.

✔️ Travel Insurance for Europe

- Travel insurance plans are designed to protect you from financial losses due to canceled plans or lost luggage, travel delays, or natural disasters.

- Some credit cards offer limited travel insurance to protect for these types of things but only if you’ve booked the trip through the card ( Chase Preferred is the one I use for this perk ).

- Travel insurance for Europe is a good idea if you’re worried about any potential disruptions to your trip.

Will My US Health Insurance Cover me In Europe?

The short answer is NO. Most health insurance programs limit their coverage to the home country due to so many things like politics, taxes, differences in global healthcare policies, cost, etc.

So when you travel or are abroad, you will need to cover your ass on your own. This is where buying travel medical/health insurance for Europe comes into play.

5 Best Medical Insurance Policies For Travel In Europe

Here is a list of the best travel health insurance in Europe. I use Safetywing, but each policy offers its own unique little things that might work better for your travel situation.

👉 PRO TIP: The 911 of Europe is 112. In most countries in Europe, if you have a medical emergency, call 112 and get connected to the ambulance, fire department, or police.

1. SafetyWing Nomad Insurance ( I Use This )

This is the one I use when I travel because it covers both travel and medical insurance and is overall the best for what I care about.

- Includes coverage for doctors, hospitals, emergency medical evacuation, travel delays, lost checked luggage, emergency response & natural disasters.

- It’s flexible and works like a subscription, with multiple services for different sorts of travelers, nomads, and remote workers.

- It’s pretty cheap, starting at $40 a month.

- COVID-19 coverage is included, and it covers quarantine abroad!

- 24/7 emergency assistance, you get to talk to a real human who is also a traveler.

- Can purchase while already traveling in about 180 countries.

How To Enroll: ➡️ Visit Website ⬅️

2. insuremytrip.

This would be my second “go-to” for sorting out travel medical insurance , because the InsureMyTrip compares tons of different insurances for you, giving you the pros and cons of each so you can pick what’s best for you.

This is what I thought was interesting and valuable about them:

- Compares plans from a bunch of different vendors and spits out what’s best for your specific trip requirements.

- “Anytime Advocates” help fight alongside you to get your claim reviewed and approved.

3. World Nomads

World Nomads offers a lot of the same protection as SafetyWing and is probably one of the more inclusive options out there regarding activities. Here are some of the benefits I see with them.

- Very comprehensive plans, including coverage for trip protection & cancellations, emergency medical or dental, loss/theft/damage of your bags and tech gear, and emergency evacuation.

- Can buy plans while abroad as well, so you can extend your trip if you want.

- Coverage for COVID-19, which is sadly still rare among insurance.

- Covers over 200+ adventure activities ( watch out for those exceptions )

How to Enroll: ➡️ Visit Website ⬅️

4. allianz travel insurance.

This is a huge insurance company, to say the least, so there are options galore. When doing my research, what stood out to me was the following:

- They cover all the usual, including trip cancellation, travel delays, medical assistance and evacuation, and even rental car insurance.

- Options are for single trips, multi-trips, or annual insurance (for those on sabbatical like me!)

- Children 17 and under are covered when traveling with parents/grandparents for some plans

- A little more pricey than the top two, but it depends on the policies.

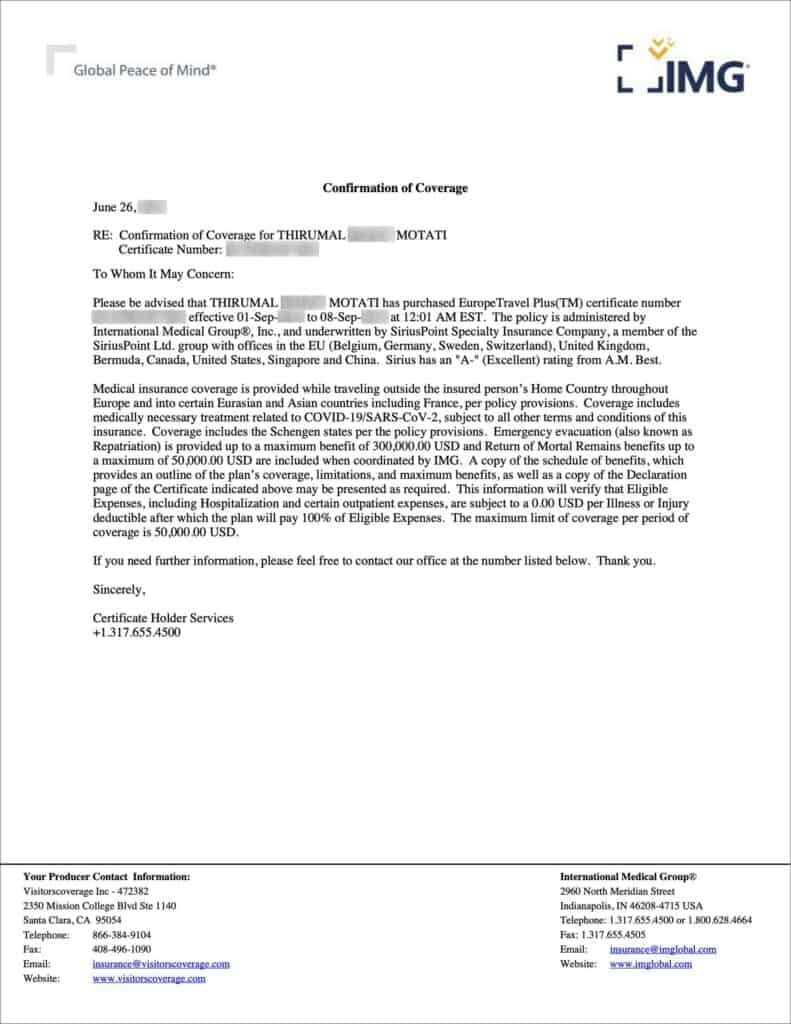

5. IMG Global Insurance

This option is the closest thing to normal health insurance and therefore has a few added perks.

- Includes coverage for doctors, hospitals, emergency medical evacuation, travel delays, lost checked luggage, and natural disasters.

- Some plans cover COVID-19 emergencies ( read the fine print )

- Tons of plans to choose from, including short and long-term options, but they tend to be more pricey.

- Best for people living overseas longer rather than short-term travelers, in my opinion.

FAQ: Travel vs. Medical Insurance in Europe

Let’s jump into a few more frequently asked questions.

What Is The Best Travel Insurance For Europe?

I use SafetyWing, but have done the research and informed myself on a few of the other best travel insurances for Europe. Each one offers a pretty similar and comprehensive package, with a few key differences that may appeal to you and your travel situation. I have the pros and cons of each policy reviewed below.

How much does Travel Medical Insurance Cost?

The cost can vary quite a bit depending on the policy. Some insurance companies offer basic coverage for around $40 per person per month (this is what I usually get), while others offer more comprehensive plans that cost several hundred dollars.

There are also a number of factors that can affect the cost of medical insurance, such as the length of the trip, the number of people traveling, and the medical history of the travelers. As a result, it’s important to compare rates from different companies before purchasing a policy.

Does Travel Medical Insurance cover COVID?

Unfortunately, I’ve learned that most travel medical insurance policies do NOT cover COVID-19 ( or pandemics/epidemics in general ). However, there are some policies, which I recommend below, that will provide coverage for medical expenses related to the virus, like per diem quarantine stipends and COVID testing.

Do EU citizens get free healthcare?

We all know that Europeans get universal healthcare, but the question remains: do its citizens get free healthcare? The answer is no.

Europeans get what is called a European Health Insurance Card (EHIC) which covers them like our travel medical insurance would in the EU.

Universal healthcare in Europe is supported by the massive taxes its citizens pay so that everyone can have access to healthcare when they cross EU borders, including the poor, and even foreigners. It’s not perfect, but it’s the safety net we all sometimes need when we’re sick and away from home.

Bottom Line? No matter where you are in Europe, if you get sick, go to a pharmacy or clinic and they will help you, no questions asked. Look for the green or red crosses everywhere.

What To Expect When You’re Sick In Europe

I wanted to share some practical options for when you get sick in Europe. The bottom line is, that you should call your travel medical insurance doctor and get their opinion on the next steps. They may send you a prescription via email or send you to a local clinic.

✅ Pharmacies in Europe

When people get sick in Europe, before visiting their doctor, they first go to their local pharmacy. Pharmacists can diagnose and prescribe medicine for small things like colds, flu, stomach aches, scratches, back pain, sinus things, etc. Every town or city will have at least one 24-hour pharmacy because it’s regulated by the EU.

So when you’re sick, travel insurance or not, head to a local pharmacy and use Google Translate if you must to tell them where it hurts. They will prescribe you what you need. If they can’t help you, they will send you to the nearest doctor or clinic.

✅ Medication in Europe

Here are a few things I learned from traveling and living in Europe.

- Medication that needs a prescription in the US is sometimes over the counter in Europe.

- Medication names are different – we call meds by their brand, like Tylenol. Europeans use the medicine term, acetaminophen. Same thing, different name.

- Doses can be stronger in Europe, so make sure you listen and read what the pharmacist tells you – don’t go rogue.

- When in doubt, paracetamol cures everything when taken as directed.

✅ Clinics in Europe

I’ve been to a few clinics in Europe, in Croatia, Estonia, Spain, and in Norway to name a few. They all work more or less the same. I googled a clinic online, saw which was closer, and took a taxi to the spot. You usually walk into a reception area, fill out some basic paperwork, and then wait to see a doctor.

In some countries, you pay some small fee, in others nothing – it just depends on the laws of the land you’re in. I paid $120 in Croatia for a clinic visit and nothing in Estonia or Norway for a similar emergency visit.

Clinics are great for getting tests done or seeing a doctor who can examine you more closely.

✅ Getting Medical Help in Europe

If you’re too sick to get out of bed, you can always call 112 and an ambulance will come get you. You can also ask your hotel to call a doctor for you. These are more expensive, but keep the bill, and work it out with your travel insurance later on.

Conclusion: Medical Insurance For Travel In Europe

I love wandering off on my own to explore places I’ve never been to before. I believe it’s the best way to meet the locals and truly experience the culture of a place.

And to cover my ass in case I get sick or injured, I use and recommend SafetyWing Insurance .

For anyone scared of traveling alone — don’t give up on it! Plan your trip and make sure you are traveling safely — be aware of your surroundings, always carry an external battery, tell your friends where you are staying, and purchase travel medical insurance for Europe so you don’t have to worry.

Here is me NOT worrying and going for it solo in Europe for a little inspiration!

If you dont live your own story, you will live someone else’s . – A very wise person

Mariana Barbuceanu is the owner and author of the Road Trip EuroGuide, a blog that inspires fellow travelers to explore Europe more authentically through slower travel and digging deeper into the culture of a place. When she isn't writing about her adventures, she is planning trips for her community and coaching people on how to take that next step towards a much-needed sabbatical.

Travel Insurance for holidays in Europe

Travel insurance for europe .

Europe is like a treasure chest brimming with wonders waiting to be discovered. Whether you're wandering through ancient ruins, savoring mouthwatering cuisine, or marveling at famous sights like the Eiffel Tower, there's something magical for everyone to experience.

But no matter where your adventures lead you, it's smart to be prepared. Here’s everything you need to know about travel insurance for Europe. We'll show you the ropes so you can expect a safe and worry-free journey.

Discover our Travel Insurance for Europe

- What should your Travel insurance cover for a trip to Brazil?

- How Does Travel Insurance for Brazil Work?

- Do I need Travel Insurance for Brazil?

- How Much Does Travel Insurance Cost for Brazil?

Our Suggested AXA Travel Protection Plan

What types of medical coverage does axa travel protection plans offer.

- Are There Any COVID-19 Restrictions for Travelers to Brazil?

- Traveling with pre-existing Medical Conditions?

Travel Insurance Germany | Travel Insurance Italy | Travel Insurance France | Travel Insurance Greece | Travel Insurance Iceland | Travel Insurance Norway | Travel Insurance Switzerland | Travel Insurance Spain | Travel Insurance UK | Travel Insurance Ireland

What should your travel insurance cover for a trip to europe.

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Brazil.

How Does Travel Insurance for Europe Work?

Picture yourself wandering through the streets of Rome. Suddenly, a mishap occurs – perhaps a twisted ankle while exploring the Colosseum. In this moment, AXA Travel Protection proves invaluable. With their support, you gain access to quality healthcare, addressing your injury without fretting over medical bills. This safety net allows you to focus on recovery, so your European journey isn't marred by unexpected health setbacks.

Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Additional Optional Travel Benefits

- Rental Car (Collision Damage Waiver) : Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days : Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days : Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for Europe?

Travelers from the United States and other visa-free countries do not need travel insurance to visit Europe. However, if you're from a country that requires a visa for the Schengen area, you must have travel insurance. Even if travel insurance isn’t required for your entry, securing one is still highly recommended.

Why? There are several reasons:

Medical Emergencies : Exploring Europe often involves extensive walking and adventurous activities. In the event of unexpected illness or injury, having coverage for medical expenses allows travelers to seek necessary medical treatment without worrying about exorbitant costs.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Trip Interruption: Unforeseen events such as natural disasters, political unrest, or personal emergencies can disrupt your European adventure. Trip interruption coverage may protect travelers if they need to cut their trip short due to unexpected circumstances.

How Much Does Travel Insurance Cost in Europe?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

Total Trip cost: The total amount of non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

Age: L ike any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to the United Kingdom will be offered three tiers of insurance: Silver, Gold and Platinum . Each provide varying levels of coverage to cater to individual's preferences and travel needs.

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Europe hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers to consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses.

The Platinum Plan is your go-to choice if you're looking for extra coverage for Europe’s experience. "Cancel for Any Reason" offers greater flexibility for those unexpected twists in your travel plans and the "Rental Car (Collision Damage Waiver)" offers assistance when you're out exploring Europe's stunning landscapes in a rental car.

Traveling to Europe for a ski or golf getaway? The Loss Skier Days and Loss Golf Days benefits, optionally available with the Platinum plan, have got you covered. If unexpected slope closures or golf course shutdowns disrupt your plans, these optional benefits may offer reimbursement for prepaid ski tickets or golf arrangements. This way, you can hit the slopes or the greens worry-free, knowing AXA has your back.

AXA covers three types of medical expenses:

Emergency medical

Emergency evacuation & repatriation

Non-medical emergency evacuation & repatriation

Emergency medical: Can cover unexpected incidents like broken bones, burns, sudden illnesses, and allergic reactions that require immediate medical attention.

Emergency evacuation and repatriation: Can cover your immediate transportation home in the event of an accidental injury or illness.

Non-medical emergency evacuation and repatriation: Can cover evacuation assistance when you must leave a place urgently due to non-medical reasons like natural disasters or civil unrest.

Are There Any COVID-19 Restrictions for Travelers to Europe?

No vaccination or COVID testing is required for entry into any European country.

Traveling with preexisting Medical Conditions to Europe?

Traveling with preexisting medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold Plan , and Platinum Plans offer coverage for preexisting medical conditions. The Platinum plan is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plan with a preexisting medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60 day look back period. We're here to make sure you travel with ease, no matter your health situation.

1.Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2.When should I buy Travel Insurance to Europe?

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14-days of making your initial trip deposit.

3.Do Americans need travel insurance in Europe?

Although not mandatory for entry into Europe, having a travel insurance policy that includes emergency medical coverage is highly advisable when visiting the continent.

4.What is needed to visit Europe from the USA?

US travelers entering Europe must have a valid US passport with at least six months left before expiration, any necessary visas, and ensure their passport remains valid for each country they visit. They must also have a clear reason for traveling and demonstrate adequate financial means for their stay.

5.What happens if a tourist gets sick in Europe?

If you become sick in Europe, travelers with AXA Travel Protection can contact the AXA Assistance hotline 855-327-1442. Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

4 Best Travel Insurance for Europe in 2024

Home | Travel | Europe | 4 Best Travel Insurance for Europe in 2024

Getting European travel insurance is one of the main requirements for obtaining a Schengen visa, whether for traveling, studying, or working overseas.

However, if you don’t need a Schengen Visa , you may ask yourself, Do I need travel insurance for Europe ? Well, it’s always a good idea. As I mentioned in my guide to the best international travel insurance companies , you should buy coverage if you want the peace of mind that comes with knowing you’re protected in any unforeseen circumstances.

4 Best travel insurance for Europe in 2024

Of course, not everyone needs the same kind of coverage, so in this article, I’m sharing the best travel insurance for Europe and Schengen travel insurance that meets all the visa requirements:

- Schengen visa travel insurance requirements

- Europe travel insurance cost & comparison