Travel Nursing Pay – Working as an Independent Contractor

Many travel nurses and travel allied health professionals express interest in working as independent contractors. Unfortunately, the vast majority of healthcare workers, registered nurses included, do not meet th e requirements set by the IRS to be considered independent contractors . In the end, it really depends on the particular work setting and the relationship between the payer and payee.

In the healthcare field, it’s most common for doctors, dentists and Advanced Practice Registered Nurses to meet the requirements for independent contractors. And even these professionals often do not meet the criteria depending on the facts of each individual case. Meanwhile, it is very rare for Registered Nurses and allied health professionals to meet the criteria.

Find your next travel healthcare job on BluePipes!

You might be asking why we’re spending any time on this then. Unfortunately, many travel nursing agencies staff healthcare professionals as independent contractors. Furthermore, many books about travel nursing, or travel healthcare in general, espouse it as a viable option. You may even know someone who has done it themselves. None of this means that it’s accepted by the IRS.

Do travel nurses qualify as independent contractors?

According to the IRS:

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.

The main focus here should be on the part of this statement that says, “payer has the right to control only the result of the work…” Note the emphasis added on “only.”

Free: Universal Job Application and Credential Management for travelers.

The IRS also states the following:

You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action. What matters is that the employer has the legal right to control the details of how the services are performed.

In the case of nurses and the vast majority of allied health workers much more than just the outcomes of work are controlled by the contracted facility. For example, in the case of travel nurses, the hospital will determine the hours worked as well as break times. The nurse will be using supplies and equipment belonging to the hospital. In addition, there are managers and doctors at the hospital who are supervising the nurse’s work. Moreover, nurses must seek the permission of a physician for decisions outside the nurse’s scope of practice which is a frequent occurrence. Unfortunately, these factors, taken a a whole, will disqualify someone as an independent contractor.

Do some employers treat nurses as independent contractors?

Despite this, some agencies still place nurses and allied professionals as independent contractors in settings that don’t meet the requirements. The funniest thing about them doing so is that it will undoubtedly break another one of the standard rules regarding independent contractors. You see, the vast majority of healthcare organizations that utilize agencies require the agencies to carry professional liability and workers compensation insurance for all agency staff. Covering such items is a violation of the rules regarding independent contractors and will disqualify the healthcare professional.

You may also find hospitals and other healthcare providers who are willing to bring people on as independent contractors directly without an agency in the middle. However, the same rules still apply. If the payer controls anything other than the results of the work, then the situation does not meet the requirements for consideration as an independent contractor.

Why do some employers treat nurses as independent contractors?

So why does the treatment of nurses and healthcare professionals as independent contractors persist? One reason is that it’s easier for the payer, i.e. the agency or the hospital. For example, when an agency treats the nurse as an independent contractor, they don’t have to deal with payroll taxes, worker compensation, disability, or unemployment . They also don’t have to deal with the complicated compensation package that travel nurses receive which splits money up over various categories and provides various services like travel nurse housing and travel arrangements .

Tired of filling out skills checklists? They’re free on BluePipes.

Instead, the agency simply pays an hourly rate to the nurse, and the nurse is responsible for everything else. And for the independent contractor, handling everything else presents a huge burden.

Why travel nurses should not want to be independent contractors

Independent contractors are really operating their own business in the truest sense. They pay the self-employment tax which accounts for the Social Security and Medicare payments typically made by the employer. They are required to file quarterly estimated tax payments on IRS form 1040-ES, as well as annual tax returns. They are required to carry their own liability insurance. They must keep a very detailed account of all income and expenses in order to write off as much as possible for tax purposes.

They might have to invoice the agency or hospital and run the risk of having to act as a bill collector from the agency or hospital who may pay on normal business terms (i.e. Net 60), or neglect to pay their bills at all. Let me be clear here; you may not get paid for 60 to 90 days, and maybe not at all without a fight. Oh, and let’s not forget the fact that you will definitely have to register your business at the federal and state level, and quite possibly the county or local level, in order to legitimately function as an independent contractor. Furthermore, agencies don’t typically act as advisers for independent contractors, so you’re on your own getting all of this set up.

Given the circumstances, I fail to see why any nurse or healthcare professional, other than a doctor, would even be interested working as an independent contractor. Many would argue that the independent contractor makes more money. I’d have to disagree. Any difference in gross figures is typically entirely soaked up by the additional costs of being a contractor. If there is any net revenue beyond that, it’s not worth the extra time and effort that contractors have to go through to keep on top of the business issues.

Discover why travel nurses are calling us their “secret weapon”.

There’s a reason that the Small Business Administration lists “Savings in labor costs” as one of its top advantages of using independent contractors . In the end, independent contractors tend to earn less than their permanent counterparts.

Money issues aside, we’re still left with the fact that the vast majority of nurses and healthcare professionals don’t qualify under the IRS definition of an independent contractor. Furthermore, there are fewer and fewer opportunities for them in the industry. Most hospitals will not consider them directly and also forbid agencies from treating agency employees as contractors. In addition, the Joint Commission on Accreditation of Healthcare Organizations (JCAHO) is now scrutinizing agency use of independent contractors and will not certify agencies paying W2 workers as independent contractors.

Create your free Travel Healthcare Resume on BluePipes!

With all of this in mind, it’s prudent for nurses and healthcare professionals to approach independent contracting with caution. If the setting is such that you will be working in an established healthcare facility such as a hospital, correctional health center, or psychiatric facility, then the relationship will almost certainly not meet the requirements for independent contractors. And in every case, it’s important to factor in all of the extra costs associated with independent contracting when evaluating compensation offers.

As always, we’d love to hear about your experience with this topic or answer any questions you may have. Please post your questions and comments in the comments section below!

Related posts:

- Travel Nursing Pay – Qualifying for Tax-Free Stipends and Tax Deductions: Part 2: Maintaining Temporary Status In our previous blog post we laid out the criteria under...

- Should You Know Your Travel Nursing Pay Before Submission? Many travel nurses wonder whether or not they should negotiate...

- Travel Nursing Pay: Flexible vs. Rigid If you’ve discussed travel nursing pay with multiple agencies, then...

I am an LVN and was offered what seems on the surface an amazing job. Doing visits 3 times a day for straight cathing the same patient. The schedule is wide open at the moment so i get first dibs on the days i want to work. They are offering me $80 per VISIT minus 15% ($12) per visit that the agency gets. Visits are typically 1 hour but we all know they can be much shorter. So $72 per visit 3xs a day. Say i work 5 days a week, so 15 visits times $72 equals $1,080 per week for what seems a simple visit. The agency does not provide w2 only 1099. I’ve never filed 1099 so I don’t know what I will be getting into. I know I will have to pay my own taxes but can deduct scrubs, stethoscope, milage, etc. I’m just not sure if it’s worth the headache of tracking my own finances and possibly being audited and whether it will be worth paying a lot in taxes. Any insight would be much appreciated. I am currently working in hospice continuous care for $21hr so $72 visit sounds AMAZING.

What if the hospital paid me as independent contractor for 8 years. Taking no taxes or anything from my checks and paid no overtime, holidays,sick, etc for that whole time. Do I have a case to file with an attorney to recoup all those back paid things that should have been paid to me as an employee? They are wanting me to start full time employee first of year because they said they can’t pay me as independent contractor. Which is and has been okay for me. I’m just upset due to the fact they didn’t pay OT. I literally work or am on call 24/7. Normal hours are at least 50 hours a week. If I get called back in it is just regular pay. I’m very concerned about what I’ve lost in pay. Do I have a case to pursue

It depends on what your role was at the hospital. The fact they are now wanting you to employ you as a W2 employee because “they can’t pay you as an independent contractor” indicates they may have discovered your role does not qualify to be classified as an independent contractor. You’ll need to speak with a labor lawyer or perhaps the state labor board to discuss whether or not you have a case. Given what you’ve described, it would be worth it to do so.

Late to this thread, but have a question. If I am a homecare RN wouldnt that be able to be a 1099 contractor? Since I would be going to an individuals house and not an employers?

It’s possible that you can qualify as a 1099 contractor in this scenario. However, if you follow the instructions of the employer, including the administration of medication, then you will most likely will not qualify. The key is that the payer can only control the outcomes and not how the work is performed. It doesn’t really matter where the work is performed. I hope this helps.

Kyle, What if I start my own agency and I and a friend work for that agency? Is that legal??

Thanks for the inquiry, Tera. Yes, to the best of my knowledge that would be legal. However, please note that I am not a registered legal adviser or tax adviser. You’d need to check with a registered adviser to discuss your particular circumstances to be certain. I hope this helps!

What if my wife registered a nursing agency business under her own name, and I (the RN) worked FOR the agency (my wifes).

that is a legal way of getting the full money the hospital is paying for the agency nurse, yes?

Yes, you could set up a staffing agency, have the staffing agency negotiate contracts with hospitals, and work through the staffing agency.

Why would a nurse not be able to set up an LLC and become a sub-contractor of the agency? That is exactly how the construction industry works; those sub-contractors use the builders materials and have no control of the final product or “end result” either.

According to the IRS, “The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.” In the example provided, the contractor, the payer in this case, maintains control over the “end result”, but the sub-contractor, the payee in this case, maintains control over what will be done and how it will be done to achieve the “end result”, which meets the general rule for an independent contractor.

Registered Nurses on the other hand are directed by the employer, or surrogates of the employer, on what will be done and how it will be done. Administering medications is one example. In the majority of cases, Registered Nurses administer medications based on a physician’s orders. In this case, the physician is controlling “what will be done”. This is one of the reasons Nurse Practitioners with furnishing licenses often qualify as independent contractors.

I have been following several discussions on this subject. Under the criteria stated physicians working locum tenens with a 1099 also would not qualify as an independent contractor. They also have hospital criteria for their services they have to meet related to shifts (my experience is ER), call, documentation. Physicians in a hospital situation do not have any more control over the “end result” than a registered nurse does.

In this scenario, the hospital is controlling the results of the work. Yes, they provide tools and resources, but that does not by itself negate the status as an independent contractor. At the end of the day, the physician controls and directs the provision of patient care. For example, physicians prescribe and administer medications. In the same setting, Registered Nurses administer medications, but do not have the authority to prescribe them. In this case, the administration of medications comes at the direction of the employer. This is one of the reasons it’s much more likely for Nurse Practitioners, who have furnishing licenses, to qualify as independent contractors.

Yes, I would agree that physicians working in a hospital ER setting would most likely not qualify as independent contractors. They must comply with charting requirements. They are scheduled by the hospital. They use the hospital’s supplies and equipment. And there are many other factors that may disqualify them.

Comments are closed.

Popular on bluepipes blog.

Discover Jobs

- Travel Nursing Jobs

- Travel Therapy and Tech Jobs

© Copyright 2012-2022 BluePipes, Inc

- Skip to main content

- Skip to footer

NurseRegistry

California's Leading Provider of Skilled Nurses

Nursing as an Independent Contractor

We’re here to dispel the myths.

No, you don’t have to be a travel nurse to regain control of where you work or when you work. Yes, nurses can be independent contractors. And yes, you can pick up extra shifts any time you want.

As you consider nursing as an independent contractor, lots of questions may come to mind. With over ten years supporting nurses in their journeys as they gain experience, advance in their careers, and find opportunities where they’re happy and making a difference, we have answers to many of your questions.

Here, we’ll answer the questions that nurses ask us most often about working as an independent contractor and specifically with NurseRegistry.

How much can I earn?

Independent contractors set their own pay rates.

We’ll only share with you shifts and patient visits that match your interests, experience, availability, and rates.

When will I be paid?

Nurses are paid weekly—the week following completed shifts—without waiting for client payment.

How will I be paid?

Is there overtime pay.

Independent Contractors are self-employed and do not get paid overtime.

What hours would I work?

Work when you want! You’re in charge of your schedule.

Shifts can be 2 hours long to 12 hours long, AM/PM, or NOC.

How does vacation time work?

When you want to take time off, simply notify us that you won’t be picking up shifts for a while.

Nursing Positions

What nursing positions does nurseregistry staff.

We have a wide variety of positions that include per diem work, contingent facility staffing, and private duty nursing care. Full-time positions are rare. Direct-to-hire roles are also few and far in between.

We provide staffing for facilities such as outpatient surgery centers, skilled nursing facilities, doctor’s offices, and mental health treatment facilities.

We work with specialty infusion pharmacies, home health agencies, and hospice organizations.

Individuals also contact us looking for one-on-one private duty nursing care.

Will I get the roles I want when I want them?

Not always, but you will never take a shift you don’t want. And that goes a long way.

NurseRegistry’s Care Coordination Team works one-on-one with nurses and clients to match types of roles, timing, and location. Nurses are encouraged to reach out to the coordinators to update their holiday schedules, new certifications, and changing interests.

As expected, the market need for nurses determines the positions that are available and can be seasonal.

November and December, for example, are known to be slow months for independent contractor nurses. Some roles—like the recent need for COVID-19 wellness checks or flu shots—went through a surge.

One of the primary factors that affects availability is also location dependent. Specialized care like recovery centers or eating disorder centers may be found more in certain locations, while elder private care may be more popular in other areas.

What if I agreed to an assignment, but I need to cancel?

We ask that you notify us 24 hours in advance, when possible, so we can find someone to substitute for you.

What if I agreed to an assignment, but it was cancelled?

We guarantee our nurses a 2 hour minimum pay if our client cancels within 12 hours of the shift start time.

What are the documentation or care notes requirements?

Documentation and care notes requirements are dictated by the client.

Facilities may have paper or computer charting.

Private clients may have a care binder for charting in-home, or you may need to complete a specific care note and send it to us.

We will let you know beforehand what kind of documentation is required for a particular client.

Requirements

What documentation does nurseregistry require.

NurseRegistry requires the following documents :

- Valid Nurse License

- Other Certifications (if applicable)

- Negative TB Test

- Hepatitis B Vaccination or Declination Form.

- Seasonal Flu Shot or Declination Form.

- Proof of Liability Insurance

Are any certifications required?

Nurses are responsible for maintaining their active licensure, as well as Basic Life Support (BLS) Card.

Some clients may require additional certifications, such as Pediatric Advanced Life Support (PALS), Advanced Cardiac Life Support (ACLS), Certified Hemodialysis Nurse (CHN), Wound Care Certification (WCC), etc.

Does NurseRegistry provide continuing education?

NurseRegistry does not provide continuing education credits at this time.

There are free CEU opportunities available online, should you need them.

How are taxes different for independent contractors?

At the end of the year, independent contractors receive a 1099, not a W-2.

Unlike an employee, independent contractors will not have taxes withheld from their paycheck. They may still owe taxes at the time of the income tax return.

The reporting threshold is $600.

Are independent contractors eligible for tax deductions?

Working as an independent contractor opens a wide range of tax deductions:

- Mileage & Gas

- Home office expenses

- Travel & hotel expenses

- Liability Insurance

- Professional & Legal Fees

- Self-Employment Health Insurance Deduction

We strongly recommend contacting your tax professional for further information on the tax deductions that are available to you. Please note that those consultations are tax-deductible.

Should I carry liability insurance?

Nurses must carry their own liability insurance and the policy has to be active.

At NurseRegistry, m ost nurses that come to us are insured through Nurses Services Organization (NSO.com) . Insurance rates vary, but usually range from $50 – $100/year.

Who provides independent contractor nurses with healthcare coverage?

Independent contractors are responsible for their own medical insurance.

Nursing Jobs On Your Terms

We like to think happy nurses do the best work. For the forth year in a row, NurseRegistry has earned the Best of Staffing Talent Award based on feedback from the nurses that work with us.

Connect with us. Call us toll-free 24/7

Call (866) 916-8773 ➝

In Home Nursing Care

- Private Duty Nursing

- VIP Concierge

- 24 Hour Nursing

- Hospice Care

- Palliative Care

- Post-Op Care

- Intravenous (IV) Therapy

- Pediatric Care

- Plastic Surgery Aftercare

- Post-Hospital Care

- Wellness Checks

- Medication Management

- Airway/Ventilation Care

- Respite Care

- In-Home Teaches

- Client Privacy

Nurse Staffing

- Eating Disorder Centers

- Psychiatric Facilities

- Infusion Pharmacies

- Drug and Alcohol Rehab Facilities

- Skilled Nursing and Long-Term Care Facilities

- Hospice Organizations

- Surgery Centers

- COVID-19 Screenings

- Home Health Agency Nurse Staffing Support

- Ambulance and Critical Care Transport

- Nursing Awards

- Resources for Active Nurses

- Skedulo Help Center

- Meet the Team

- Testimonials

I want to hire a nurse for:

If you are a nurse looking for work, apply here .

By continuing to use our website, you are consenting to Cookies being placed on your device. If you do not want Cookies placed on your device, we suggest you exit our website

Should Travel Nurses Sign with a Travel Nursing Agency or be an Independent Contractor?

Table of Contents

Do travel nurses have to sign with a travel nursing agency in order to travel nurse? No. The reality is that nurses who want to travel can sign up with a travel nursing agency, or in some cases (but very few) become an independent contractor or 1099 travel nurse. But why would travel nurses choose to be independent contractors, and which option is more advantageous?

Let’s not beat around the bush – recruiters are paid a rate by the hospital for your services. Some travel nurses may wonder why their agency is taking a cut of their bill rate. After all, it’s the nurses who are performing expert services and saving lives.

Take this comment in particular from a frustrated nurse exploring the subject at AllNurses.com:

“They (recruiters) sit behind the comfort of their desks and phones and get a percentage of the bill rate for what they charge for my expert services.”

Of course we don’t know which agency this nurse worked with, so we can’t speak to any specifics. But the gist of this complaint is that recruiters are simply raking in money from the efforts of travel nurses. And that’s not very accurate, because recruiters and their agencies are responsible for a lot of things.

Could nurses make more money on their own, sans agency? It’s possible. But there is a lot more involved in recruitment than sitting behind a desk and answering phones, and once you see everything independent contractors are responsible for – besides nursing – you may find more value in travel nursing agencies.

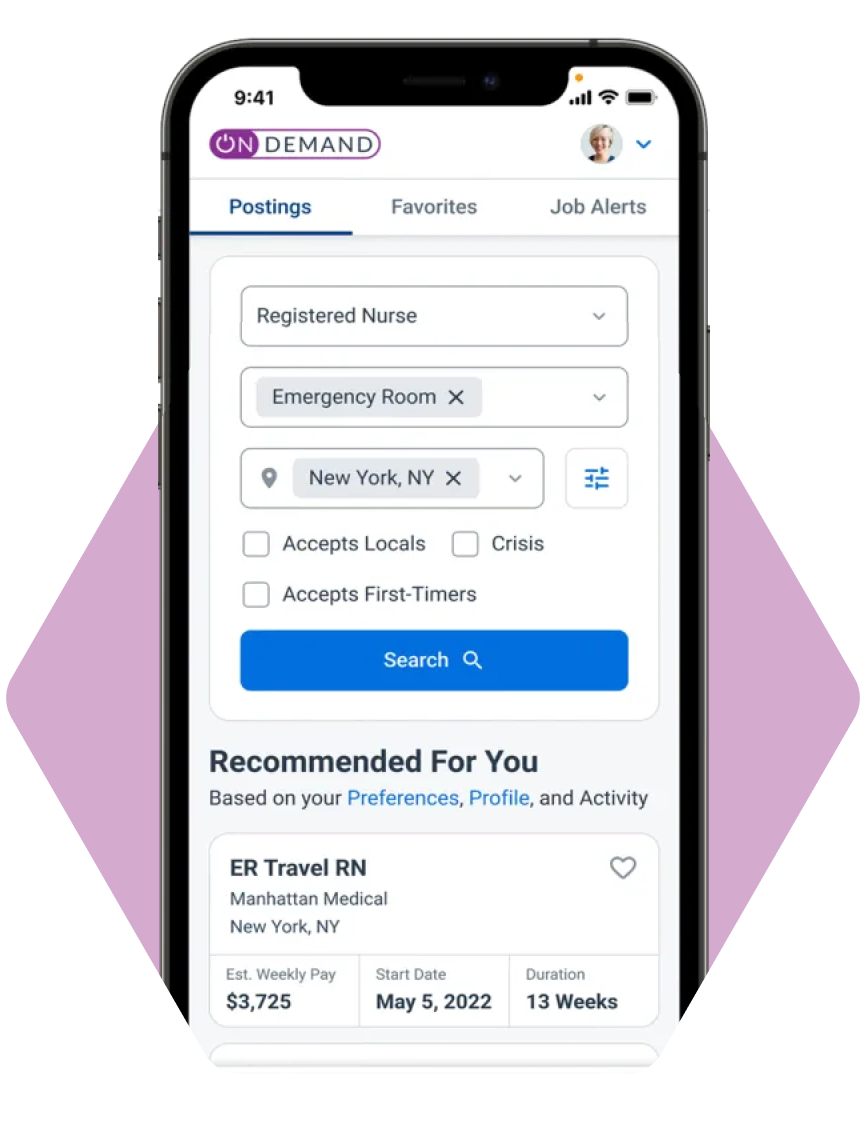

Did you know speed matters when submitting your application? Don't miss out on your dream job because you were 'too slow'. When you travel with us, you'll be submitted faster than your peers so you can be first in line for an interview. Get started today in On Demand .

INDEPENDENT CONTRACTOR TO-DO LIST

Is going rogue really a better option? That depends on how much extracurricular activity you’re interested in beyond nursing. The following is what independent contractors are responsible for in lieu of working with a travel nursing agency:

How do taxes work for an independent contractor? As an independent contractor, you will need to handle your own federal, state and local taxes. This gets even trickier when you’re constantly on the move every 13 weeks . And your tax situation would change based on whether you’re taking per diem or company housing. Depending on the costs, you may want to request higher travel nursing pay or an hourly rate.

Independent contractors also pay the self-employment tax, which accounts for the Social Security and Medicare taxes their agency would usually pay. They are required to file quarterly estimated tax payments on IRS form 1040-ES and annual tax returns.

If you’re too busy to account for all of these tasks and pay taxes quarterly, you may feel more comfortable letting your agency deal with this.

Speaking of housing, independent contractors are obviously on their own. Finding housing – especially housing that fits your budget – can be time-consuming and cumbersome. A good travel nursing agency is going to help you locate housing, whether you choose their housing services or per diem. But this is not universal. HCTN is proudly one of the few agencies who will still help you find housing if you choose per diem instead.

Then there are bills and utilities. Most good agencies can shave some of these expenses off and automate them for you, provided you take their company housing. There are different benefits to both company housing and per diem, and for more information on the two, click here . But the point is that without a travel nursing agency, you’re on your own to figure out which makes the most sense for your situation.

Independent contractors must also secure their own insurance, both health and liability. If you’ve ever browsed the healthcare marketplace, you’ll notice insurance rates are a lot higher without a group. Add that expense alongside your liability insurance, and you can expect a sizable chunk of your check devoted to insurance alone every month. Any good travel nursing agency will provide affordable first-day health insurance and liability insurance.

FINDING A JOB

Independent contractors are responsible for finding their next assignment as well. That means taking the extra time to both track down and contact the appropriate people at any hospital that interests you and doing so every 10-11 weeks.

As an independent contractor, you will also most likely need to cover compliance and credentialing costs on your own. This can include costs such as background checks, drug screening, occupational health physicals, and necessary blood work. Also consider licensing fees and cost of online competency testing. These costs can add up after a while, especially if you are changing healthcare facilities every few months. Some third party companies offer memberships, but this often comes at a higher cost than what travel nursing agencies pay.

On the other hand, if you work with a travel nursing agency, most (if not all) of these compliance costs will be covered. Recruiters have already established the relationships necessary for finding your next assignment. With a recruiter, your next assignment is just a phone call away.

BILLING, PAY

Getting paid is also a lot easier when you contract with an agency. Independent contractors are responsible for both billing and collections. That means you’ll spend time billing the hospital for hours worked, and waiting for your invoice to be paid. Are you confident hospitals are paying their invoices immediately? It’s not uncommon for hospitals to take 60-90 days to pay.

Why Travel with Health Carousel Travel Nursing?

We empower nurses to pick where they want to go, advance their careers, and get back to doing what they love. Partnering with the nation’s top facilities enables us to take the stress out of your search and get you placed in your dream location. Take control of your career faster when you travel with us. Get submitted quickly to top travel nurse jobs and be first in line for an interview. Plus, day in and day out, we support the whole you. So you can build the career you want and live your best life. We have the best benefits in the industry that support your health, wealth, career and life. On day 1 of working with us, every hour you work turns into Rewards. Our recruiters will help you land your dream job faster in On Demand . Live and work the way you want with us today!

FOR MOST TRAVEL NURSES, AGENCY JUST MAKES SENSE

After considering everything an agency is responsible for, an agency’s value-add is significant. For travel nurses, it’s hectic enough just getting to know a different hospital every 13 weeks. Having to juggle literally everything else involved with your employment, outside of nursing, is inconvenient and most nurses won’t mind deferring these tasks to an agency.

From the perspective of a travel agency, it’s very simple: we win when you win. The better an agency performs, the happier travel nurses are. And the happier travel nurses are, the better they perform. The relationship is reciprocal.

Furthermore, the vast majority of registered nurses and healthcare professionals simply don’t qualify under the IRS definition of an independent contractor. See the IRS’ definition for what it means to be an independent contractor:

You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action. What matters is that the employer has the legal right to control the details of how the services are performed.

But we don’t want to discourage anyone from being their own business owner. If you’re up to it, you should visit the National Nurses in Business (NNBA) website for some great resources on getting started as an independent contractor.

What Is a 1099 Travel Nurse?

Are travel nurses 1099 employees? Yes. A 1099 nurse is the same as an independent contractor nurse. As a 1099 nurse, you are responsible for calculating and paying taxes and self employment tax based on your taxable income. Healthcare systems or travel nursing agencies do not offer you benefits because you are a contract employee. Meaning you will need to search for medical and dental insurance, as well as open potential retirement accounts for savings. You will need to track work related expenses, such as the cost of malpractice insurance, or professional fees, for tax purposes. You will need to also account for any other job related expenses or additional costs, as they may be tax deductible depending on your tax home or state. Also, as mentioned before, you will need to account for compliance costs, such as background checks, drug screening, and required occupational health assessments.

What’s the Difference between W2 and 1099 Travel Nurses?

Let’s review a few key differences between W2 and 1099 travel nurses. If you are a W2 travel nurse, you are typically employed through a travel nurse staffing agency and will receive a modest base pay , you will receive your wages directly from the travel agency. This is where the company calculates and automatically deducts travel nurse taxes, which can include state and federal income tax, from your paycheck. Some agencies may also provide the ability to contribute to a retirement account.

As a 1099 nurse, you are not employed by a travel nursing agency. You will receive your entire gross income without any tax deductions directly from the hospital. Therefore, when it becomes tax time, you will need to calculate and pay your own taxes to the IRS. You can choose to pay yearly or quarterly taxes. As we mentioned before, you will also need to seek your own health insurance coverage.

FINDING YOUR OPTIMAL AGENCY

If you’re ready to let an agency handle all of the above, then you have options. Virtually every travel nursing agency offers different benefits. The truth is that of the some 340 travel nursing agencies in the US alone, it’s vital that travel nurses seek agencies that offer a complete package that best fits their unique needs. You'll be comparing the multiple job offers you receive, not job listings, when you travel with us. Get started today in On Demand .

GET STARTED IN

Land your dream job faster when you travel with us. Get started with top local and national travel nurse jobs in On Demand.

Similar Posts

How can dialysis staffing enhance your team, choosing the right travel agency for dialysis nurses, finding your perfect dialysis travel nurse agency, view top jobs in.

Search, apply and be the first in line for your dream job today.

Apply to Top Jobs in

Get Started in

Take Control of Your Career with

The Enlightened Mindset

Exploring the World of Knowledge and Understanding

Welcome to the world's first fully AI generated website!

What You Need to Know About Being a Travel Nurse as an Independent Contractor

By Happy Sharer

Introduction

Travel nursing is a popular career choice for healthcare professionals looking to explore new places while earning a good salary. As an independent contractor, travel nurses enjoy the freedom and flexibility of working as their own boss with the opportunity to work in different locations and settings.

In this article, we’ll discuss what you need to know before becoming a travel nurse as an independent contractor, how to maximize your earnings, compare travel nursing agencies, and navigate the legalities of being an independent contractor.

What You Need to Know Before Becoming a Travel Nurse as an Independent Contractor

Before you begin your journey as a travel nurse as an independent contractor, there are some important things you need to know.

Understanding Licensing Requirements

The first step to becoming a travel nurse as an independent contractor is to understand your state’s licensing requirements. Most states require that you have an active nursing license in order to practice as a travel nurse. Additionally, you may be required to obtain additional certifications or licenses depending on the type of work you plan to do.

Understanding the Types of Contracts

It’s important to understand the different types of contracts that can be offered when you’re working as a travel nurse as an independent contractor. There are three main types of contracts: short-term, long-term, and per diem. Short-term contracts are typically for assignments lasting up to 13 weeks, while long-term contracts can last anywhere from 13 weeks to several months. Per diem contracts are for shorter assignments that are usually less than a week in length.

Knowing Your Rights

As an independent contractor, you have certain rights that should be protected. You should always make sure you understand the terms of your contract before signing, and you should never sign any documents without fully understanding them. Additionally, you should be aware of your rights in regards to overtime, holidays, and other aspects of your employment.

Familiarizing Yourself with Tax Implications

As an independent contractor, you will be responsible for paying your own taxes. It’s important to understand the tax implications of working as a travel nurse so you can properly plan and budget accordingly. You may also be eligible for certain deductions, such as business expenses and travel costs.

How to Maximize Your Earnings as an Independent Contractor Travel Nurse

Once you have a clear understanding of the licensing requirements, types of contracts, and tax implications of working as a travel nurse as an independent contractor, you can start to maximize your earnings.

Negotiating Rates

One of the best ways to maximize your earnings as a travel nurse as an independent contractor is to negotiate your rates. While most agencies have standard rates, you may be able to negotiate for higher rates based on your experience and specialty. Additionally, you can negotiate for additional bonuses or incentives.

Taking Advantage of Reimbursement Opportunities

Many travel nursing agencies offer reimbursement opportunities for certain expenses related to your assignment, such as travel costs and housing. Be sure to take advantage of these opportunities if they are offered, as they can help you save money and maximize your earnings.

Exploring Supplemental Income Streams

Another way to maximize your earnings as a travel nurse as an independent contractor is to explore supplemental income streams. This could include taking on additional assignments, teaching classes, or writing articles. These supplemental income streams can help you supplement your travel nursing income and maximize your earnings.

Comparing Travel Nursing Agencies as an Independent Contractor

When choosing a travel nursing agency as an independent contractor, it’s important to compare the different options available. Here are some factors to consider when comparing travel nursing agencies.

Evaluating Agency Reputation

One of the most important factors to consider when choosing a travel nursing agency is the agency’s reputation. Research the agency to make sure they have a good track record and positive reviews from past travelers. Additionally, check the agency’s accreditation status to ensure they meet industry standards.

Comparing Compensation Packages

Another factor to consider when comparing travel nursing agencies is the compensation packages they offer. Look for agencies that offer competitive rates and generous benefits. Also, make sure to read the fine print to make sure you understand the terms of the contract.

Examining Insurance Options

When comparing travel nursing agencies, you should also examine their insurance options. Many agencies offer health, dental, and vision insurance, as well as disability and life insurance coverage. Make sure to compare the coverage and costs of the different plans to find the one that best fits your needs.

Assessing Benefits and Perks

Finally, assess the benefits and perks offered by the travel nursing agency. Some agencies offer additional benefits such as housing assistance, travel reimbursements, and educational stipends. Compare the different benefits and perks to find the agency that offers the best package.

Questions to Ask Before Signing Up as an Independent Contractor Travel Nurse

Before signing up with a travel nursing agency as an independent contractor, you should ask some important questions to make sure you fully understand the terms and conditions of the job.

What are the Terms of the Contract?

Make sure to ask about the terms of the contract, including the duration of the assignment, the compensation package, and any restrictions or requirements. Additionally, ask about the cancellation policy and any other details you should be aware of.

Are There any Restrictions on Where I Can Work?

Some travel nursing agencies may have restrictions on where you can work, especially if you’re working as an independent contractor. Ask the agency if there are any restrictions or requirements regarding where you can work and how often you can change locations.

Is Accommodation Provided?

If you’re working as a travel nurse as an independent contractor, you may be required to find your own accommodation. Ask the agency if they provide any assistance with finding housing or if you’ll need to arrange your own accommodations.

Are There Any Rewards or Incentives?

Finally, ask about any rewards or incentives offered by the travel nursing agency. Some agencies may offer bonuses or other incentives for completing assignments or referring other travel nurses to the agency.

How to Prepare for Working as an Independent Contractor Travel Nurse

Once you’ve chosen a travel nursing agency as an independent contractor, it’s time to start preparing for your assignment. Here are some steps to take to get ready for your new job.

Preparing Your Resume

Before beginning your assignment, it’s important to update your resume to reflect your recent experience and qualifications. Make sure to include any relevant certifications or licenses you’ve obtained, as well as any special skills or training you’ve received.

Researching Locations

Research the location where you’ll be working to get a better understanding of the area. Learn about the local culture, attractions, restaurants, and other points of interest. Additionally, research the hospitals and clinics where you’ll be working to get a better understanding of the environment.

Getting Necessary Documents in Order

Before starting your assignment, make sure to get all of your necessary documents in order. This includes obtaining the appropriate licensing and certification, as well as any paperwork needed for your assignment. Additionally, make sure to bring copies of your resume and references.

Navigating the Legalities of Being an Independent Contractor Travel Nurse

Finally, it’s important to understand the legalities of working as a travel nurse as an independent contractor. Here are some tips for navigating the legalities of being an independent contractor travel nurse.

Understanding Your Liability

As an independent contractor, you’re responsible for your own actions and liable for any mistakes or negligence. Be sure to review any contracts carefully before signing and make sure you understand your liabilities.

Obtaining Necessary Insurance Coverage

You may be required to obtain certain types of insurance as an independent contractor, such as professional liability insurance. Check with your travel nursing agency to determine what type of insurance coverage is necessary.

Complying with Labor Laws

Finally, make sure to comply with all applicable labor laws in the state you’re working in. Research the labor laws in the state you’ll be working in to make sure you’re in compliance.

Working as a travel nurse as an independent contractor can be a rewarding and exciting experience. By understanding the licensing requirements, familiarizing yourself with tax implications, negotiating rates, exploring supplemental income streams, comparing agencies, and navigating the legalities, you can maximize your earnings and become a successful travel nurse as an independent contractor.

(Note: Is this article not meeting your expectations? Do you have knowledge or insights to share? Unlock new opportunities and expand your reach by joining our authors team. Click Registration to join us and share your expertise with our readers.)

Hi, I'm Happy Sharer and I love sharing interesting and useful knowledge with others. I have a passion for learning and enjoy explaining complex concepts in a simple way.

Related Post

Exploring japan: a comprehensive guide for your memorable journey, your ultimate guide to packing for a perfect trip to hawaii, the ultimate packing checklist: essentials for a week-long work trip, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Expert Guide: Removing Gel Nail Polish at Home Safely

Trading crypto in bull and bear markets: a comprehensive examination of the differences, making croatia travel arrangements, make their day extra special: celebrate with a customized cake.

Welcome Back

Please sign-in using the links below. The job portal provides access to applications. The clinician portal is for clinicians currently on assignment.

- Benefits of Traveling

- Industry Insights

- Mental Health and Wellness

- Next Move News

- Testimonials

- Traveler Tips

Benefits of Traveling Traveler Tips // November 05, 2021

Independent nurse contractor: should you travel without an agency.

By Next Move

When exploring a career change to travel nursing many RNs may wonder if they should pursue becoming an independent nurse contractor. Can you travel nurse without a travel nurse agency and will you make more money by doing so? The bottom line is: Yes! But there are some catches.

The questions we’ll address here are:

- How much more money do independent nurse contractors make?

- What do you need to be aware of when travel nursing independently?

How can you find your own travel nursing contracts?

Let’s cut to the chase with the answer everyone is looking for:

Will you earn MORE money as an independent nurse contractor?

Can you earn more without a travel nurse agency?

The answer is yes, if you’re smart about it. Independent travel nurse have the potential to earn 10-15% more in annual income than travel nurses that work through a travel nurse agency.

That 10-15% is contingent on whether or not you can keep your personal costs down. There are a few things you’ll want to keep in mind when calculating your income potential:

- Taxes are not withheld from your paychecks as an independent contractor.

- You’re required to make quarterly tax payments to the IRS based on your estimated income.

- As an independent contractor you’ll be responsible for paying the entirety of your Medicare & Social Security taxes, whereas if you were an employee, your employer would pay half of those taxes.

- There are several deductions you can take as an independent contractor to offset your taxes owed, so you’ll want to factor in the cost of hiring a CPA who specializes in taxes for independent contractors.

- As an independent contractor you’ll need to cover the full cost of your health insurance.

- As an independent contractor you won’t have any additional benefits such as paid time off, or 401K options.

- As an independent travel nurse, you’ll be responsible for your own credentialing fees.

Why do travel nurses earn less by working with a travel nurse agency?

A question you might be asking is, why would I earn 10-15% less working with a travel nurse agency, than if I just travel nursed on my own?

Well, like any business, there are overhead costs associated with running a travel nurse agency. Some of those include matching employer taxes on each employed nurse, providing health insurance, paying legal fees and covering the costs of employee salaries and office expenses.

Smaller agencies will have less overhead costs and can often pay their nurses more than larger travel nurse agencies.

Benefits of working with a travel nurse agency

Travel Nurse Agencies Are Market Experts

A good agency understands local and regional markets and will know the limits of how high rates can go within each specialty and at each facility. Utilizing this knowledge, they’re able to effectively negotiate the highest pay rates for individual nurses.

Here are 3 examples:

- Two facilities in the same zip code can offer vastly different rates depending on their individual needs.

- Different specialties at the same facility will also often offer vastly different rates depending on their individual needs.

- A contract that was valued at $45,000 one week, could be valued at $55,000 the following week.

Travel nurse agencies are also “in the know” when it comes to hospital censuses. With close relationships within those hospitals, they’ll be the first to know when a need for more nurses goes up or goes down. The higher the need, the more room a travel nurse agency has to ask for a higher pay rate for their individual nurses.

Access to More Jobs

Good travel nurse agencies have strong relationships with hundreds (if not thousands) of healthcare institutions throughout the country. These relationships often result in hospitals making travel nursing contracts available exclusively to one agency or another. The hospital benefits because they have access to thousands of nurses at any given time, and nurses benefit because they have access to thousands of travel nursing jobs at any given time.

Less Administrative Work

As an independent contractor you would be responsible for several things that can be both timely & costly.

These include:

- Doing your own credentialing.

- Covering the cost for health insurance.

- Developing your own contract template to send to hospitals (hospitals do not provide the individual contracts for travel nurses).

- Hiring a CPA to consult for tax filings, especially if you plan to work in multiple states.

- Becoming a market expert and keeping up to date on hospital censuses and learning what the market rate is for your particular specialty.

- Effectively negotiating those rates with hospitals

Superior Negotiation Tactics

Good travel nurse agencies have a team of qualified and experienced recruiters that are skilled at negotiating the best rates and benefits for their nurses.

Good recruiters will always be on the look-out for:

- A higher rate

- A sign-on and/or completion bonus

- Block-scheduling

- Overtime pay

- Restrictions on a contract such as “no float,” or “no weekends”

You will need to have or develop a strong relationship with one individual hospital, or several hospitals. You can do this by:

- Becoming a staff nurse at your hospital of choice, or

- Travel nursing to different hospitals and developing those independent relationships

After you’ve developed a solid relationship, you would then want to speak to your Unit Manager, Unit Director or Chief Nurse Office about your interest in going independent. They will likely refer you to either the head of talent acquisition or the head of supply chain management.

You could also call a hospital and ask to speak to their staffing office who should be able to direct you to the person that handles agency staff contracting.

Do hospitals hire independent nurse contractors?

It is super rare for hospitals to hire an independent contractor, but possible if you have a personal relationship with them. In general, smaller, rural hospitals don’t use too many travel nurse agency staff and are more likely to hire independent contractors than some of the larger institutions like HCA Healthcare, Providence Health or Dignity Health. We spoke to our CEO, John Nolan on the subject as he’s been in the travel nursing world for over 10 years:

I’ve never personally met a nurse who has worked independently in the travel nursing field. I think in general, it’s super rare. It’s likely less than 1% of hospitals would hire an independent travel nurse. But I think it can be done, it would just take a lot of work and “know how” on the nurse’s part and a tight relationship with a particular hospital. I’d only recommend this path if the nurse was planning to work for a hospital for a long time, just given the amount of effort it would take to secure a good contract.

How much money do travel nurse agencies earn by placing you in a contract?

A travel nurse agency will earn anywhere from 10-25% per contract. The agency then needs to factor in costs like credentialing, insurance, legal fees and overhead costs. In the end most agencies will take-home between 3-5% per contract. So, if a travel nurse works a 13-week contract valued at $45,000, the agency will earn between $1,350 and $2,250 for that one contract.

It’s wise to consider working with an agency that has low overhead costs (such as some of the smaller agencies) because they’ll be able to get you a higher rate, since they don’t have as many costs to cover as some of the larger agencies.

Would you like to become an independent nurse contractor?

What do you think? Would you like to travel nurse without a travel nurse agency? Or do you think the benefits of working with a travel nurse agency outweigh the potential to earn more? Let us know in the comments below!

Did you know that nearly 25% of all nurses working in hospital settings are unhappy with their job? Not only are nurses laboring at the bedside overworked, but nurses are often underpaid for the invaluable job that they provide.

So what is a nurse to do when they can no longer stand working at the bedside?

Independent nurse consultants have got it figured out. Working for themselves based on their own terms outlined in independent nurse contractor agreements, independent nurse providers can get back to what they love, helping people, without laboring at the bedside where they are overworked and underpaid. Plus, learning how to become an independent nurse contractor may be easier than you think!

What is an Independent Nurse Consultant?

An independent nurse consultant is a skilled nursing professional who works on an independent nurse contractor agreement, rather than payroll. As contractors, or small business owners, independent nurse consultants have the flexibility to run their business how they see fit and create as-needed independent nurse contractor agreements with their clients that fulfill their specifications.

While one of the most popular independent nurse provider jobs is travel nursing, there are several other professions that fall under independent nurse consulting such as health coaching, legal nurse consulting, telehealth consulting, cannabis consulting, and more.

Skip ahead to “Independent Nurse Contractor Job Ideas” to learn more about the various types of businesses for independent LPN contractors, RN independent nurse consultants, and NP independent nurse contractor jobs.

Why Become an Independent Nurse Consultant?

If you are comfortable in your bedside nursing job and you are okay with working overtime and getting underpaid, then more power to you. But if you are a part of the 1/4 of nurses that are unsatisfied with their job, then learning how to become an independent nurse contractor is going to provide you with the freedom you need to take control of your life and finally find peace doing what you love.

Not convinced that becoming an independent nurse provider is the right choice for you? Check out these eight compelling reasons to become an independent nurse consultant:

- Exercising Your Passion

Perhaps the most compelling reason to explore independent nurse provider jobs is that you are free to exercise your passions and do what you love. Are you an LPN wanting to start your own cannabis consulting business? Why not become an independent LPN contractor and help people control chronic illness by safely using cannabis? Are you an RN with a passion for getting to the bottom of problems? Maybe it is time for you to look into legal nurse consulting?

The bottom line, it is never too late to do what you love, and by becoming an independent nurse consultant you can do what you were meant to do every single day–and make good money while you are doing it!

- Work-Life Balance

It is no secret that nurses are overworked and underpaid. If you are tired of sacrificing your personal life for your work then it is time for you to be your own boss and start your own independent nurse contractor business.

Having a better work-life balance is one of the main reasons why nurses start their own businesses. Not to mention, independent nurse contractor agreements can be made on your terms, freeing you from unfair contracts that negatively impact work-life balance.

- Building Your Skillset

Working in a competitive workspace, such as a hospital or ER, you do not always have opportunities to develop your skills, But as an independent nurse consultant you may find that you have more opportunities to work on projects that help you build your professional skill set, and the more skills you have as an independent nurse provider, the easier it will be to market yourself.

- Purpose-Driven Impact

When you are working on someone else’s dollar you do not have the opportunity to pick and choose the projects, clients, and causes that you truly believe in. But as an independent nurse consultant, you are free to pick and choose to apply your skills where they are most needed so you can do some real good in the world.

It may seem skill, but independent nurse consultants can make a purpose-driven impact that not benefits the medical community, but contributes to the overall good of mankind–who would not want to do that?

- Job Security

With the recent global pandemic we saw nurses lose their jobs left and right. We also saw nurses being overworked to the point of quitting, which is also not ideal. Whatever end you fall on the spectrum, you can find increased job stability by being your own boss and working on an independent nurse contractor agreement, rather than for an organization.

- Build an Empire

You may not realize it now, but when you start learning how to become an independent nurse contractor, you start learning how to build your own empire. Ditch the meetings, ditch the work politics, and ditch the long hours working to build someone else’s successful business. When you invest yourself you respect yourself!

Also, most independent nurse providers make more money than nurses working at the bedside, and eventually enjoy all the benefits of passive income.

- Greater Flexibility

One of the perks of being your own boss is that there is room for flexibility. Sure, you need to hold yourself accountable when you make errors, and ensure that you are upholding the highest standards in patient care. But when you are an independent nurse consultant you have the flexibility to work on your own terms and enjoy a happier and healthier balance between your life and work.

Having a family emergency? Needing to take some much needed time off for the good of your mental health? When you are your own boss you are free to do so, just as long as you are ensuring that your patients are being taken care of.

- Improved Patient Care

When you are working in traditional healthcare settings you do not always have the time to give patients your undivided attention and care. But as an independent nurse provider you can take as much time with patients as you need to provide them with the care that they deserve. Not only will your patients be happier with the care they receive, but they are more apt to tell their friends about the excellent care you gave them, which can lead to client loyalty and business growth.

Independent Nurse Contractor Job Ideas

There are many reasons why it is a good idea to start your own independent nurse consultant business, but it is not always obvious which independent nurse contractor jobs are profitable. Whether you are hoping to become an independent LPN contractor, or you are an NP searching to open up your own practice, here are some profitable independent nurse contractor job ideas to get the wheels turning:

- Travel Nursing – The most common type of independent nurse provider is a travel nurse. Travel nurses are independent nurse consultants that are hired on an as-needed basis to fill vacancies in hospital settings. Travel nurses often get paid more than nurses on payroll and have more flexibility.

- Wellness Coaching – Independent nurse consultants make excellent wellness coaches. By working with their clients to meet specific wellness goals, nurses can help their clients get their health under control to prevent illness and promote healthier living.

- Cannabis Consulting – Cannabis consulting is a unique independent LPN contractor job opportunity. Ideal for individuals with an extensive knowledge of cannabis and its health benefits, cannabis consultants help clients find the ideal cannabis regime to control health conditions.

- Legal Nurse Consulting – Amongst the most lucrative and interesting independent nurse contractor jobs includes legal nurse consulting. Legal nurse consultants (LNCs) provide invaluable guidance to lawyers seeking to understand the specific details of claims involving the healthcare industry and care standards.

- Telehealth Consultant – Do you love helping people? Is it easy for you to identify illnesses and ailments? If so, then this independent nurse provider job may be right for you. Telehealth consultants provide virtual consulting, so this job can be easily set up right from your home.

- Nutritional Coaching – If you have a passion for healthy eating and helping people, then nutritional coaching may be the right independent nurse contractor job for you. You do not need to be a nutritionist to help people make real lifestyle changes–which is why this job is a great choice for independent LPN contractors.

- Health Care Training – Not only do patients need a helping hand, but so do providers. Health care training services come in many forms, and there is no one right way to set up a health care training business. It may look like a nursing school tutoring business, online courses for RNs, patient care seminars, etc.

- Mindfulness Coaching – External physique is not only the part of your body that you should worry about. Mindfulness coaching seeks to bridge the gap between physical stress reduction and the art of mindfulness, which usually begins with self-care.

Get Started

Oftentimes the most difficult part of finding independent nurse contractor jobs, or setting up independent nurse provider businesses, is knowing how to get started. Where do independent nurse consultants find their first clients? Is there some sort of independent nurse contractor agreement that needs to be made between clients and independent LPN contractors?

If you are frantically searching online how to become an independent nurse contractor, your search is over! At NursePreneurs we help independent nurse providers set up their businesses and provide them with the tools needed to procure independent nurse contractor jobs.

From setting up the details of your independent nurse contractor agreement to marketing your business, we help independent nurse consultants create and sustain wildly successful businesses. Whether you are an independent LPN contractor, RN, or NP we are here to support you on your journey of entrepreneurship! Book a discovery call today to learn more about how to become an independent nurse consultant.

Whenever you’re ready, here are the ways we can help you…

Join our Business + Marketing Facebook group:

The NursePreneurs Community is exclusively for nurses who are looking to create and scale their business.

Request To Join

Visit our YouTube Channel which is about business + marketing for nurses:

Visit the channel here

Need inspiration from other NursePreneurs?

–> Check out our NursePreneurs Podcast on iTunes or Soundcloud .

Schedule a call with us:

General 15 Minute Discussion Courses/Coaching Programs Discussion Marketing Platform Demo Websites

Watch on Demand:

IV Hydration Concierge Nursing Content Writing Med Spa

More to Explore

Strategic website design for nurses.

Book Discovery Call Strategic Website Design for Nurses For nurses who want to launch their business and convert traffic into leads! You want a website that reflects your style and what you

Business Courses For Nurses

Business Courses for Nurse Entrepreneurs NursePreneurs has curated top experts to bring you proven programs that will teach you step by step how to start your business. We specialize in 90 day

The NursePreneurs Podcast With Catie Harris Listen Now Get Inspired By Listening To Professional Insights From Successful Nurse Entrepreneurs A little inspiration can go a long way. Join Catie Harris, a successful

What is an Independent Nurse Contractor?

An independent nurse contractor is a self-employed nurse who works with hospitals and healthcare facilities.

These specialists operate on a contractual basis rather than begin permanently employed by a hospital or institution.

Independent nurse contracts provide medical assistance to healthcare facilities with nursing or department shortages.

In short, they supply supplemental support to fill vacant nursing positions temporarily.

Independent nurse contractors may be confused with travel nurses due to their many similarities.

For instance, travel nurses also work on temporary assignments to support inadequately staffed hospitals.

Nevertheless, there are fundamental differences between independent nurse contractors and travel nurses.

What Do Independent Nurse Contractors Do?

In terms of responsibilities, independent nurse contractors perform the same duties as regularly employed nurses.

They provide patients with medical advice, monitor vital signs, keep medical records, and administer medications.

They also assist with rehabilitation, work with doctors and other specialists, and perform other work-related duties.

However, independent nurse contractors can enjoy the freedom to have more flexibility with their schedules and time.

These professionals can negotiate work based on their terms, especially if they’re highly skilled and trained.

Nevertheless, nurse contractors are responsible for finding work, negotiating their salary, and travel accommodations.

Without negotiating, marketing, and career experience, independent nurse contractors may have difficulty getting contracts.

Occupational Responsibilities:

- Assess the patient’s medical condition (observe and interpret symptoms)

- Administer medications and treatments

- Educate patients about their injuries, illness, and ailments

- Collaborate with nurses and doctors/physicians to develop patient care plans

- Update medical records and documentation

- Supervise LPNs, CNAs, and nursing assistants

- Assist patients in the ICU, ED, critical care, trauma unit, and other settings

- Assist with rehabilitation programs

- Feed, bathe, and clean patients unable to care for themselves

- Remove Stitches

Where do Independent Nurse Contractors Work?

Independent nurse contracts work in a broad variety of healthcare settings.

It includes hospitals, outpatient care facilities, nursing homes, community health centers, and private practices.

Some independent nurse contractors also work for medical sales, insurance companies, and marketing agencies.

Occupational Settings:

- Outpatient care facilities

- Nursing homes

- Community health centers

- Private practices

- Medical sales

- Marketing agencies

- Insurance companies

- Pharmaceutical companies

An independent nurse contractor’s duties vary depending on their education, specialization, and employer’s needs.

As a result, it’s beneficial to develop expertise to make themselves more marketable to different healthcare establishments.

How to Become an Independent Nurse Contractor

Becoming an independent nurse contractor requires having the proper training, skills, background, and work ethic.

As a result, this section focuses on the knowledge and skills registered nurses must acquire to operate in this profession.

1. Join a Nursing Program

The first step to becoming an independent nurse contractor is to join a nursing program.

The nursing programs provide the necessary training and education to operate competently as a registered nurse.

To join a nursing program students must have their GED or diploma.

It enables them to enter college and take the necessary prerequires courses to enter the nursing program.

Students must also maintain a good GPA while completing the prerequisite courses to compete successfully with other aspiring nursing students.

The prerequisite course takes roughly 1 – 2 years to complete depending on the student’s previous education.

After completing the necessary prerequisites students may apply for the nursing program.

2. Obtain an ADN or BSN Degree

Most nursing programs offer students two educational paths.

It includes the Associate Degree in Nursing (ADN) and the Bachelor of Science in Nursing (BSN) Degree.

The associate’s degree takes around 18 – 24 months to complete and provides a basic understanding of nursing.

As a result, successful nursing students can quickly enter the nursing field, gain experience, and earn money.

The ADN degree does have limitations regarding career advancement, job opportunities, and pay.

Those with this degree may join entry-level positions and see some career advancement options.

Nevertheless, many healthcare institutions prefer students with a BSN due to the additional education and training.

The BSN degree takes roughly 36 – 48 months to complete and provides a more compressive understanding of nursing.

Thus, nurses with a BSN can pursue numerous career opportunities, earn higher incomes, and land jobs more effectively.

Some registered nursing certifications also require a BSN and adequate work experience.

Therefore, obtaining this degree is highly beneficial for independent nurse contracts.

3. Pass the NLCEX-RN exam

After completing nursing school and obtaining a degree, students must pass the state-required NCLEX-RN exam.

This exam tests a student’s knowledge and competencies to ensure they have adequate training for the nursing field.

The National Council of State Boards of Nursing (NCSBN) produces the NCLEX exam.

Upon successful completion of the exam, students may obtain their licensure and begin working as registered nurses.

4. Acquire Work Experience

As with all healthcare professions, developing career experience is extremely important.

Independent nurse contractors must understand the ins and outs of nursing before working independently.

As a result, it’s beneficial to work at hospitals or healthcare facilities for several years to gain sufficient experience.

It enables nurses to better understand bedside care, hospital policies, and other vital aspects of nursing and patient care.

Registered nurses may also want to consider travel nursing and joining an entrepreneurship community for nurses.

Becoming a travel nurse provides lots of experience with working with various hospitals.

Travel nurses learn about salary and benefits negations, travel accommodations, and contract/assignment expectations.

Joining an entrepreneurship community for nurses is beneficial for connecting with successful healthcare professionals.

It enables aspiring independent nurse contractors to establish connections and learn vital business skills.

After obtaining adequate experience and developing a network of employers and hospitals, registered nurses may start the process of becoming independent nurse contracts.

Regardless, there is no official length of time needed to become an independent nurse contractor.

Operating in this profession primarily requires having the proper skillset, education, background, and mindset.

5. Develop Business / Entrepreneurship Skills

Developing business and entrepreneurial skills is essential to become a successful independent nurse contractor.

Independent nurse contractors must understand how to set up a corporation to protect themselves legally.

They must also learn how to perform marketing and sales, build relationships, manage finances and negotiate contracts.

Developing these skills takes a lot of time, research, and practice.

Nevertheless, it’s highly beneficial for those who want to obtain the best contacts and maintain steady employment.

Necessary Skills:

- Business set up

- Sales and marketing

- Relationship building

- Contract negotiation

- Time management

- Various professional nursing skills

Independent Nurse Contractors vs. Travel Nurses

There are numerous differences between independent nurse contractors and travel nurses.

For instance, independent nurse contractors work for themselves and must do their research and marketing to land jobs.

Travel nurses typically work with travel agencies who find them employment.

Travel agencies will also assist with hospital contracts, travel setup (i.e. room and board), and other expenses.

Secondly, independent nurse contractors are self-employed.

They don’t have the same agreements or employment with travel agencies or other staffing services.

As a result, they’re often responsible for negotiating their salaries, travel expenses, housing, and benefits.

They’ll also need to consider and negotiate other costs associated with reallocation and travel.

Less experienced independent nurse contractors may have difficulty negotiating for themselves or locating potential work.

Therefore, it’s beneficial for aspiring independent nurse contractors to first obtain experience as travel nurses.

It provides a foundation for how to acquire contracts, get housing and vehicles and negotiate expenses and benefits.

On a more positive note, experienced independent nurse contractors may find it easier to locate specific work.

They may find extra job opportunities since they don’t rely on particular agencies’ ability to find a specific assignment.

They can also earn more money through direct negations and receive various perks.

No one agency has all potential nursing job listings.

As a result, some travel nurses may only see the listings the agency makes available to them.

They may also be limited to the housing accommodations and benefits negotiated between the agency and the employer.

Accordingly, it’s highly beneficial for travel nurses to pick their travel agencies carefully.

Experienced agencies help nurses find the best jobs, receive the most money, and negotiate the most satisfying benefits.

On the other hand, experienced independent nurses can negotiate more satisfactory terms based on their training, education, experience, and negotiation skills.

These terms and perks can range from increased pay to better housing or medical coverage.

Which Career is Best for Nurses?

Whether to work for an agency as a travel nurse or operate unassisted as an independent contractor depends on the nurse’s experience, training, negotiating skills, and comfort level.

As previously mentioned, independent nurse contractors may benefit from negotiating their salary, and benefits.

They may also negotiate better travel accommodations to suit their relocation preferences.

It provides independent nurse contractors with more flexibility and negotiation power than inexperienced travel nurses.

On the other hand, independent nurse contractors must have a strong occupational background and good negotiation skills.

It requires months or years of training and relationship-building to become a successful independent nurse contractor.

Travel nurses do not need to understand all the ins and outs of finding a job, negotiating a contract, or managing finances.

It’s easier to obtain travel accommodations, benefits and salaries because a good travel agency manages these tasks.

Travel agencies may also have numerous employment opportunities if they have a large career network.

These agencies work closely with certain hospitals and healthcare facilities to quickly accommodate their staffing needs.

As a result, travel nurses can have numerous job offers and contracts sent to them more passively.

Independent nurse contractors need to establish their network/connection and understand marketing and negation.

Developing these skills takes time and can make or break the success of inexperienced independent nurse contractors.

Here are some things independent contractors or agencies negotiate with a healthcare facility during the hiring process.

- Negotiated salary

- Medical benefits

- Coverage for housing

- Transportations reimbursement

- Potential permanent job offerings

A good travel agency negotiates these terms, whereas an independent nurse contractor negotiates them.

Finally, independent nurse contractors must have excellent accounting, time management, and decision-making skills.

They’ll be responsible for keeping track of their hourly wages, contacting potential employers, and acting unassisted.

As a result, mastering the previously mentioned skills is essential to be successful in this career.

Additional Resources:

- National Nurses in Business Association

- National Association for Health Care Recruitment

- How to Become a Nurse Independent Contractor

Trusted Health Blog

1099 vs W-2s for Travel Nurses

If you’re here, chances are, you’re either already working as or are exploring the possibility of being a travel nurse. You've likely chosen this journey because you view travel nursing as an opportunity to build your dream career based on any combination of factors like new experiences, financial stability, and professional growth. However, travel nursing also comes with some of the same realities as with any job! One of those harder-to-navigate realities is taxes/tax preparation. In this article, we’ll share a bit about the main differences between being a W-2 employee and a 1099 (independent) contractor as well as distinguish the benefits and disadvantages of each.

Definitions of 1099 and W-2 forms

Generally speaking, a W-2 form and a 1099 form are designed for the same purpose - to report an individual’s income. We’re going to dive right into the broadly defined difference between these two classifications, as each one is used for different purposes and will differ in how taxes are filed at tax time. Most simply put, a W-2 form is a record of an employee’s income, taxes, and benefits throughout the year while 1099 forms are used to record income received by independent contractors throughout the year.

1099 Contracts: Independent Contractors

What does it mean to be an “independent contractor”.