Alle Vor- und Nachteile der Travel Prepaid Mastercard

Es gibt wenige Länder in denen die Schweizer Franken als Landeswährung verwendet werden. Diesen Umstand hat sich die Travel Prepaid Mastercard , die vormals als Travel Cash Kreditkarte bekannt war, zu Nutzen gemacht! Die Prepaid Mastercard von Swiss Bankers richtet sich an Reisende, die einen einfachen Weg suchen im Ausland in Euro oder US-Dollar ohne hohe Gebühren zu bezahlen und dabei eine Prepaid Kreditkarte nutzen möchten. Es klingt vielversprechend – doch kann die Karte wirklich überzeugen oder sind andere Prepaid Kreditkarten im Kreditkartenvergleich attraktiver? Wir habe sie uns für Euch im Detail angeschaut!

Travel Prepaid Mastercard

- keine Jahresgebühr

- Cashback bei 20+ Reisepartnern

- Zugang zu täglich neuen Travel Deals

- bis zu 10 Prozent sparen bei Booking.com

- keine Bearbeitungsgebühr im Ausland

- in EUR, USD oder CHF erhältlich

- weltweit kostenloser Ersatz

- über 70 Millionen Akzeptanzstellen

- maximale Sicherheit dank Prepaid

- schnelles Aufladen per App

- mobile Zahlungsoptionen

Die Leistungen mögen auf den ersten Blick nicht überragend erscheinen, sind aber für ein kostenloses Produkt durchaus interessant. Auf dieser Seite analysieren wir die Travel Prepaid Mastercard in allen Details und zeigen ihre Stärken und Schwächen auf. Da keine Kreditkarte immer für jeden die beste Option ist, mochten wir Euch zudem einige attraktive Alternativen präsentieren!

Inhaltsverzeichnis

Die Vorteile der Travel Prepaid Mastercard

Die nachteile der travel prepaid mastercard, für wen lohnt sich die travel prepaid mastercard, alternativen zur travel prepaid mastercard.

- Fazit zur Travel Prepaid Mastercard

Häufig gestellte Fragen zur Travel Prepaid Mastercard

Der grösste Vorteil der Travel Prepaid Mastercard ist, dass sie in drei Währungsversionen erhältlich ist – Euro, US-Dollar oder in Schweizer Franken. Wer also viel in der Eurozone oder im amerikanischen Raum unterwegs ist, sollte in Erwägung ziehen, die Prepaid Kreditkarte in der jeweiligen Währung zu beantragen. Zudem fällt bei der Swiss Bankers Travel Mastercard im Gegensatz zu den Konkurrenzprodukten keine Bearbeitungsgebühr für den Einsatz im Ausland an, was sie für Kartenzahlungen auf Reisen sehr attraktiv macht.

Darüber hinaus kommt die Travel Prepaid Mastercard ohne Jahresgebühr daher, was sie zu einer attraktiven kostenlosen Kreditkarte macht. An anderer Stelle fallen zwar Gebühren an, aber die Gebührenstruktur ist sehr transparent: Der Bargeldbezug erfolgt zu einem festen Preis und ist nicht an die Höhe der Auszahlung gebunden. Im Inland fallen bei Abhebungen am Bancomat 5 Franken/US-Dollar/Euro (je nach Version) an, im Ausland 7.50 Franken/US-Dollar/Euro. Damit können böse Überraschungen bei hohen Abhebungen vermieden werden.

Ein weiterer Vorteil ist auch hier die schnelle Aufladung der Travel Prepaid Mastercard über die App des Kartenanbieters: innerhalb von 15 Minuten soll das Guthaben auf der Karte verfügbar sein. Per Überweisung dauert es rund zwei Arbeitstage. Wer also kurzfristig Bargeld benötigt kann mit Hilfe der Travel Prepaid Mastercard schnell und unkompliziert an US-Dollar, Euro oder Franken kommen. Das Limit für die Kartenaufladung beträgt bei dieser Prepaid Kreditkarte 10’000 Franken/US-Dollar/Euro. Durch die Abrechnung in Landeswährung können Inhaber der Travel Prepaid Mastercard teure Umrechnungskurse der Hausbank oder schlechte Wechselkurse am Flughafen umgehen.

Ein weiterer Vorteil, der für eine kostenlose Kreditkarte wirklich unüblich ist und durch den man bei geschicktem Einsatz eine Menge Geld sparen kann, sind die bis zu 10 Prozent Cashback bei Booking.com. Die Unterkunft können dabei ganz leicht auf der Swiss Bankers Buchungsseite vorgenommen und später im Hotel per Travel Mastercard bezahlt werden. Nach dem Aufenthalt erhaltet Ihr das Cashback im Booking.com-Wallet.

Ausserdem bieten die Swiss Bankers einen kostenlosen Ersatz der Karte bei Verlust oder Diebstahl. Gerade, wenn man länger auf Reisen ist, gibt einem das ein grosses Plus an Sicherheit. Dieser kostenlose Service bietet die Travel Prepaid Mastercard weltweite per Kurier an.

Zu guter Letzt sollte nicht unerwähnt bleiben, dass die Travel Prepaid Kreditkarte für diverse Formen des Mobile Payments ausgestattet ist. Sie ist kompatibel mit Apple Pay, Samsung Pay, Google Pay, Garmin Pay, Fitbit Pay, und sogar SwatchPAY!.

Wie bei vielen kostenlosen Kreditkarten, gibt es aber auch bei der Travel Mastercard einige Nachteile, die nicht unerwähnt bleiben dürfen. Der grösste Nachteil der Travel Cash Prepaid Mastercard ist trotz ihrer Übersichtlichkeit sicher die Gebührenlage: mit einem Franken je Transaktion im Geschäft und 5 Franken/Euro/US-Dollar je Bargeldbezug im Inland und 7.50 Franken/Euro/US-Dollar erreicht man schnell die Grenze, an der es günstiger wäre eine teurere Kreditkarte komplett ohne Fremdwährungsgebühr zu bestellen. Gerade wer noch den alten Namen “Travel Cash” im Kopf hat, sollte bedenken, dass das Abheben von Bargeld zu einem erheblichen Kostenfaktor führen kann.

Dazu kommen noch die Aufladegebühren in Höhe von 1.5 Prozent des Aufladebetrags. Bei der Ladung per Banküberweisung fällt keine zusätzliche Gebühr an, bei Ladung per Kreditkarte jedoch eine zusätzliche Fremdgebühr von ebenfalls 1.5 Prozent. Wer seine Travel Prepaid Mastercard mit einer PostFinance Karte aufladen möchte, muss sogar mit 6 Schweizer Franken an zusätzlichen Gebühren rechnen.

Für kurze Trips in die USA kann sich die US-Dollar-Version lohnen, wer aber mehrfach Abhebungen tätigt oder im Ferienland regelmässig mit der Karte bezahlen möchte sieht die Gebühren sich anhäufen. Weiterhin bietet die Karte sich nur für Reisende in der Eurozone, sowie für die USA an. Sollte man in Japan Yen benötigen oder in Mexiko Pesos ist die Travel Prepaid Mastercard hierfür nicht gedacht und verliert einige Ihrer Vorteile.

Die Travel Cash Prepaid Mastercard lohnt sich primär für Reisende, die häufig in der Eurozone oder den USA unterwegs sind und die volle Kontrolle über ihre Ausgaben behalten wollen. Hierbei bieten sich dann aber eher Kartenzahlungen als Bargeldbezüge an, da die Abhebegebühr auf Dauer ganz schön ins Geld gehen kann.

Doch auch bei der Zahlung in Geschäften hängt es sehr stark vom Einkaufsverhalten ab: tätigt man viele kleine Transaktionen wird die Travel Cash Prepaid Mastercard sehr schnell enorm teuer, da pro Zahlung eine Gebühr von 1 US-Dollar/CHF/Euro anfällt – jedoch keine zusätzliche Bearbeitungsgebühr für den Auslandseinsatz.

Auch lohnenswert ist die Karte mitunter für Personen, die auf Reisen grosse Sorgen haben, dass sie ihre Karte verlieren oder durch Umrechnungskurse grosse finanzielle Einbussen erfahren. Die Ersatzkarte ist gratis und die Prepaid-Eigenschaft schützt vor einem Kontrollverlust der Ausgaben.

Wenn wir an die Vorteile der Travel Cash Prepaid Mastercard denken, müssen wir direkt an die N26 Kreditkarte denken. Die Karte ist ein Geheimtipp unter den Kreditkarten und bietet einige Vorteile, die sich auch auf Reisen sehr auszahlen können. Mit der Karte profitiert Ihr bis zu fünf kostenfreien Bargeldabhebungen pro Monat an allen Geldautomaten mit MasterCard Zeichen im Euroraum in Euro. Ein grosser Vorteil gegenüber der Travel Prepaid Mastercard sind bei der N26 Kreditkarte zudem die gebührenlose Abhebungen in der Schweiz in Euro. Hierbei ist aber wichtig, dass Ihr in Euro abhebt, da Ihr bei Abhebungen in der Schweiz in Schweizer Franken 1,7 Prozent Fremdwährungsgebühr zahlt.

N26 MasterCard Kreditkarte

- Kostenlose Kreditkarte – dauerhaft ohne Jahresgebühr

- Kostenfreie Zahlungen weltweit

- 3 kostenfreie Bargeldabhebungen in Euro im Monat

- Girokonto inklusive

- Abrechnung über modernes Online-Konto

Auch kann es sich lohnen, einen Blick auf ein anderes Produkt der Swiss Bankers Prepaid Kreditkarten zu werfen: Die Life Prepaid Mastercard. Diese bietet sich zwar mehr für den Alltag als für die Reise an, hat kommt aber gegenüber der Travel Prepaid Kreditkarte mit dem entscheidenden Vorteil daher, dass sie keine Ladegebühren und keine Gebühr pro Zahlung (im Inland) hat.

Life Prepaid Mastercard

- Nur für kurze Zeit: Jahresgebühr geschenkt dem Promo-Code “life4free”

- keine Ladegebühren

- keine Zahlungsgebühren

- Online-Beantragung ohne Bonitätsprüfung

- als digitale Version erhältlich

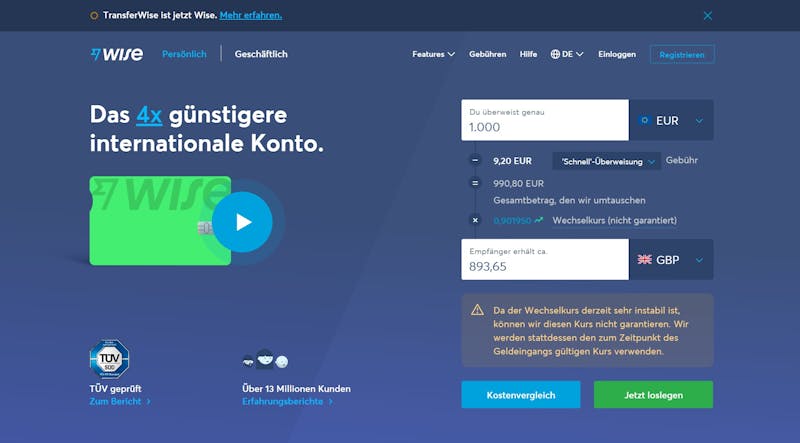

Eine andere Alternative wäre das Online-Konto von Revolut . Mit diesem Produkt zahlt Ihr keine Gebühren für den Auslandseinsatz, könnt dazu einfache Überweisungen tätigen und sogar noch Meilen dabei sammeln. Bei Revolut gibt es Grenzen bei der maximalen Bargeldverfügung je Monat, aber bei Zahlungen im Ausland behaltet Ihr dank dem Startup den Überblick und zahlt nie wieder zu viel für den Wechselkurs.

Wer oft auf Reisen ist, sollte einen Blick auf unsere Premium Reisekreditkarten wie etwa die American Express Platinum werfen. Diese sind zwar deutlich kostspieliger, dank zusätzlicher Versicherungen und der Möglichkeit Meilen oder Punkte zu sammeln gibt es dort aber sehr attraktive Optionen!

Fazit zur Travel Prepaid Mastercard

Im Bereich der Prepaid Reisekreditkarten ist die Travel Prepaid Mastercard sicherlich eines der bekanntesten Produkte und in ihrer Art einzigartig. Als Karte für grosse Transaktionen und das schnelle Aufladen im Ausland findet die Travel Prepaid Mastercard sicher ihre Abnehmer. Für die meisten Schweizer, die oft in Deutschland, Österreich, Frankreich oder Italien Transaktionen tätigen, sollte aber die N26 Kreditkarte oder das Produkt von Revolut zum festen Bestand gehören. Aus den Gründen, dass beide Karten vollkommen kostenlos sind und tiefere Gebühren bei den Abhebungen und dem Aufladen anfallen.

Prepaid Kreditkarten haben den grossen Vorteil, dass sie einem die volle Kostenkontrolle und finanzielle Übersicht ermöglichen. Gerade auf Reisen kann dies ein hohes Mass an zusätzlicher Sicherheit mit sich bringen. Man kann nur so viel ausgeben, wie eingezahlt wird. Ausserdem sind sie viel leichter zugänglich als herkömmliche Kreditkarten, da man in der Regel keiner Bonitätsprüfung standhalten muss. Auch Minderjährige können somit in den Genuss des international gängigsten Zahlungsmittels kommen.

Die Travel Prepaid Kreditkarte kommt ohne Jahresgebühr daher, allerdings können an anderer Stelle dennoch Kosten und Gebühren anfallen.

Ja, leider fallen beim Einsatz der Karte weitere Gebühren an. Insbesondere Transaktions- und Aufladegebühren sollten beachtet werden. Auch beim Bargeldbezug fallen feste Gebührensätze an. Genauere Infos dazu gibt es hier im Guide!

Antworten abbrechen

Sende mir eine E-Mail, wenn jemand auf meinen Kommentar antwortet

Bei der Travel Prepaid Mastercard steht nicht der vollständige Namen des Inhabers auf der Karte. Darum lässt sich oft im Ausland z.B. keinen Wagen oder eine Wohnung mieten, da die Vorschriften den vollständigen Namen verlangen. eher ärgerlich …

Neueste Beiträge

Condor baut durch Codeshare-Partnerschaft das Angebot in Nordamerika aus

Bis 31.12.2024: 20 Prozent Nachlass im Prince de Galles Paris

Lufthansa fliegt wieder nach Teheran

Qatar Airways Business Class Angebot von Italien nach Thailand

Bali: Steht eine Erhöhung der Touristensteuer bevor?

Bis zum 23. Juni: Die Schifffahrt-Tageskarte für 24 Franken

- Registrierung

Passwort vergessen?

Zurück zum Login

Bleibe informiert! Abonniere unsere Push-Benachrichtigungen.

- Online portal

- Organisation

- Shareholders and investors

- Publications

- Partnerships

- Open positions

By continuing to browse, you accept cookies from third parties offering you videos, share buttons, and social platform content feeds.

ERROR: No approved Web Content found with name: Alert Bar

We found matches for " "

- Individual Clients

- Private Banking

- Corporate Clients

- Institutional Clients

- SME & Self-Employed

- Day-to-day banking

- Swiss Bankers Travel Card

Swiss Bankers Travel card

Travel is a prepaid card that can be topped up, ideal for holidays or travel to withdraw cash in the local currency from ATMs worldwide and to pay in shops or on the internet. Lost or stolen? It will be replaced free of charge.

The essentials

The ideal card when travelling.

The Travel card is accepted worldwide to withdraw cash in local currency at ATMs, or to pay for your shop purchases. It is simple and safe to use. It is issued with a customisable PIN code. You can also pay using the contactless function on all PayPass terminals. It is simple and secure to use. It is delivered with a personalised PIN code. You order your card and ass credit as needed in your Netbanking or at your BCGE branch. There is no withdrawal limit on the card, but you cannot spend in excess of the amount credited. In the event of theft or loss, the card is immediately replaced with its balance, free of charge and anywhere in the world.

Travel cheaply

The Travel card is issued free of charge (no subscription). It is valid indefinitely. Top-up charges are very economical.

Greater transaction security

The Travel card is not tied to a bank account, which increases security should the card be lost or stolen.

Consult your card balance and your transactions

Further informations, a card that is practical, everywhere in the world.

You are about to change the origin location from where you are visiting Credit-suisse.com.

*The location of origin is defined in your browser settings and may not be identical with your citizenship and/or your domicile.

- Contact & Support

- Switzerland

Private Clients

- Online Banking for Private Clients

- Bonviva Rewards Shop

- my Solutions (Cross asset trading)

Corporates & Institutions and External Asset Managers

- Online Banking for Corporates

- Online Banking for Institutional Clients

- Direct Trade Finance

- Securities Expert

- AM Client Portal

- Portfolio Radar

- FactoringNet

Investment Banking

- Platforms & Applications

Recent searches

You are about to change your browser's location settings for credit-suisse.com. For the most relevant services and products, choose your regional site.

Travel Card

The Travel Card* is the electronic successor to the traveler’s check and works like a prepaid card with a PIN: Load the card with the desired amount in CHF, EUR, or USD and withdraw money worldwide in the local currency.

Withdraw cash and pay worldwide

Available in chf, eur, and usd, free replacement worldwide if lost or stolen, easily available, quickly loaded, your travel card.

We don't charge an annual fee for the Travel Card. You can withdraw cash at the current exchange rate worldwide at any time of day or night.

Travel safely with Travel Card: Spending is limited to the credit balance loaded on your card. If your card is lost or stolen, it will be replaced free of charge, including any credit balance, by courier service worldwide.

Load fee: 1.5% of the amount loaded

Secure Travel Money

Make purchases at more than 40 million businesses and withdraw money at roughly 2 million ATMs: The Travel Card 1 is a simple and secure form of travel funds for clients with a domicile in Switzerland or Liechtenstein. Before taking a trip, load the card like a prepaid card at a Credit Suisse counter.

3 Steps to Your Travel Card

Ordering a travel card from credit suisse is easy and convenient., visit branch.

Visit one of our branches in your area to order a Travel Card.

Our advisors will be pleased to tell you about our products and take your order for a Travel Card in the branch of your choice.

Use the card

For orders placed before 2:00 p.m. the card will be dispatched the same day by first-class mail. This means you can benefit from the many benefits the card offers without delay.

The Right Card for You

In Switzerland or abroad – Credit Suisse debit cards cover all your needs. Pay with the fast and simple contactless function or withdraw money conveniently at ATMs.

Prepaid Card

Use the Credit Suisse Prepaid Card* just like a traditional credit card to make purchases worldwide and online. You have full cost control over all payments.

* Card issued by Swiss Bankers Prepaid Services Ltd

Share article

Es wurde keine Einträge gefunden.

Swiss Bankers «Travel»

Reisen Sie unkompliziert und ohne Risiko: Mit der Swiss Bankers Travel Karte. Schnell aufgeladen, weltweit akzeptiert und ohne Jahresgebühr.

Ihre Vorteile auf einen Blick

Weltweit Bargeld beziehen und bargeldloses Bezahlen

Erhältlich in CHF, EUR und USD

Hohe Sicherheit und kontaktloses Bezahlen

Weltweit kostenloser Ersatz bei Verlust

Keine Jahresgebühr

Bis zu 10% Cashback auf Booking.com

Kartenfunktionen und Sicherheit

Für Entdecker und Pendler: Die Swiss Bankers Travel Karte ist Ihr treuer Begleiter auf Reisen.

Weltweit an über einer Million Bancomaten Bargeld in der entsprechenden Landeswährung beziehen

An 43 Millionen Mastercard-Akzeptanzstellen bequem und sicher bargeldlos bezahlen

Bei Verlust wird die Karte kostenlos weltweit ersetzt

Mit der kostenlosen Swiss Bankers App haben Sie die volle Kontrolle über Ihre Karte

Preise und Konditionen

Für die genauen Kosten und Konditionen wählen Sie Ihre Bank.

Häufige Fragen

Wie funktioniert die Swiss Bankers Travel Karte?

Die Swiss Bankers Travel Karte ist eine wiederaufladbare Prepaid-Karte mit PIN-Code. Die Karte wird von der Swiss Bankers Prepaid Services AG unter dem Namen, der Adresse, Nationalität und dem Geburtsdatum der wirtschaftlich berechtigten Person eingetragen. Der Name ist nicht auf der Karte ersichtlich. Laden Sie nach Bedarf Guthaben auf die Karte – der entsprechende Betrag steht Ihnen auf der ganzen Welt zur Verfügung.

Wo bestelle ich die Swiss Bankers Travel Karte?

Die Swiss Bankers Travel Karte bestellen Sie direkt bei Ihrer Raiffeisenbank. Sie benötigen lediglich ein Raiffeisen Spar- oder Transaktionskonto.

Wo kann ich die Swiss Bankers Travel Karte einsetzen?

Swiss Bankers Länderinformation

ATM-Locator weltweit: Mastercard

Haben Sie weitere Fragen?

Unter Hilfe & Kontakt finden Sie die häufigsten Fragen unserer Kunden.

Ihr nächster Schritt.

error Javascript ist deaktiviert

Diese Seite braucht Javascript. Bitte aktivieren Sie es in den Browser-Einstellungen.

- Online Kontoeröffnung

- calendar_today Beratungstermin

- question_mark Hilfe

- my_location Standorte

Swiss Bankers Travel-Karte

Für alle, die auf Reisen nicht ans Geld denken möchten: einfach Travel-Karte aufladen und sofort überall auf der Welt Geld in der Währung des Reiselands beziehen oder bargeldlos zahlen – auch online. Bei Verlust ersetzen wir Ihre Karte sofort – Restbetrag inklusive.

Aus «Travel Cash» wird neu die Swiss Bankers «Travel» Karte! Ihr treuer Begleiter auf Reisen in fremde Länder und in der Schweiz erhält ein neues Design und bietet zusätzliche Vorteile, wie 50% Ermässigung bei 600 Hotels in der Schweiz.

- Kostenlose Travel-Karte zum Aufladen

- Kontaktlos und bargeldlos bezahlen oder Geld abheben – einfach, schnell und sicher in der Schweiz und weltweit

- Unabhängig vom Bankkonto

- Wird bei Verlust sofort weltweit kostenlos ersetzt – inklusive Restbetrag

- Erhältlich in den Währungen CHF, EUR und USD

- Mit der kostenlosen Swiss Bankers App Länder sperren, Karte sperren, PIN neu setzen und mehr

- Rasche und flexible Aufladung dank Kartenzugriff im E-Banking

- Mobiles Bezahlen mit Apple, Google, Samsung etc.

- Bis zu 10% Cashback auf Booking.com erhalten

- Bargeldbezug in der Schweiz: CHF/EUR/USD 5.00

- Bargeldbezug im Ausland: CHF/EUR/USD 7.50

- Bargeldlos zahlen: CHF/EUR/USD 1.00

- Ladekommission: 1,5%

- Produktbeschrieb Travel-Karte (pdf 51 KB) file_download

- Kartenübersicht (pdf 307 KB) file_download

- Basisdokument (AGB) (pdf 194 KB) file_download

- Sicherheitshinweise Swiss Bankers Travel-Karte (pdf 2309 KB) file_download

* Der Cashback ist nur verfügbar, wenn dieser bei der Auswahl der Unterkunft angezeigt wird. Dieser wird erst nach einem Aufenthalt und der Bezahlung der Unterkunft ins Booking.com-Wallet gutgeschrieben. Der Cashback beträgt zwischen 5% und 10%. Das Angebot kann jederzeit innerhalb von 5 Tagen durch Booking.com geändert oder eingestellt werden. Barauszahlung und Rechtsweg sind ausgeschlossen.

Ihr Browser scheint nicht auf dem neusten Stand zu sein.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

6 Best Travel Cards for Switzerland

Getting an international travel card before you travel to Switzerland can make it cheaper and more convenient when you spend in Swiss Franc. You'll be able to easily top up your card in USD before you leave United States, to convert seamlessly to CHF for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from United States heading to Switzerland, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

6 best travel money cards for Switzerland:

Let's kick off our roundup of the best travel cards for Switzerland with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from United States:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to Switzerland.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in Switzerland. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to Switzerland or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in CHF, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in CHF when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in United States:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in Switzerland, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave United States and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in Switzerland with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to CHF instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in United States:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in United States and used for spending in Switzerland and globally. Monzo accounts are designed for holding USD only - but you can spend in CHF and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in United States:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in Switzerland. While these cards don’t usually let you hold a balance in CHF, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in United States:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

PayPal travel card

PayPal has a debit card you can link to your PayPal balance account, to spend in Switzerland as well as locally, in person and online. One advantage of PayPal is that there are lots of easy ways to add money in USD - but bear in mind that when you spend in CHF you’ll likely pay a foreign transaction fee of 2.5%. ATM fees apply when you make out of network withdrawals, too, which can push up the costs depending on how you use your card.

PayPal travel cards aren’t connected to your checking account which makes them a handy and secure way to spend, particularly if you already have a PayPal balance account.

PayPal features

Paypal travel card pros and cons.

- Globally accepted card

- Easy ways to top up your PayPal balance including cash and check

- Popular and reliable provider

- Use your card for spending online easily as well

- 2.5 USD fee for out of network ATM withdrawals

- 2.5% fee when you spend in a foreign currency

- Other charges may apply depending on how you fund and use your account

How to apply for a PayPal card

Here’s how to apply for a PayPal account and order a travel card in United States:

Visit the PayPal website or download the app

Click Get Sign up or log into your existing account

Add your personal details to create an account, or tap Request a card if you already have a PayPal account

Follow the prompts to order your card

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your US Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to Switzerland or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to Switzerland. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for Switzerland

We've picked out 6 great travel cards available in United States - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for Switzerland include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in CHF can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for Switzerland

The best travel debit card for Switzerland really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it's the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you're paying when you spend in CHF.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It's also important to look into the security features of any travel card you might pick for Switzerland. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For Switzerland in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in Switzerland - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in Switzerland

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In Switzerland, both card payments and cash payments are common. You'll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go, but it's still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use CHF?

You'll find that CHF can only be used in Switzerland. If you don't travel to Switzerland frequently it's worth thinking carefully about how much to exchange so you're not left with extra foreign currency after your trip.

What should you be aware of when travelling to Switzerland

You're sure to have a great time in Switzerland - but whenever you're travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you're been to Switzerland before it's worth looking up the most recent entry requirements so you don't have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to CHF before you travel to Switzerland if you'd like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to CHF in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach Switzerland to make an ATM withdrawal in CHF if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave United States so you have peace of mind. It's also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don't offer fair prices or adequate services.

Conclusion - Best travel cards for Switzerland

Ultimately the best travel card for your trip to Switzerland will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

FAQ - best travel cards for Switzerland

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in Switzerland.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / CHF rate to calculate how much Swiss Franc you would receive when exchanging / spending $4,000 USD. The card provider offering the most CHF is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Navigieren auf sbb.ch

- Zum Kontakt

Service-Links

- Suchen Öffnen Suchbegriff Suche

Deutsch ist die derzeit ausgewählte Sprache.

Travel – die Reisekarte.

Ihre Vorteile beim Kauf einer Travel-Karte bei der SBB.

- Kein Bankkonto nötig – Sie können Ihre Travel-Karte an über 130 SBB Verkaufsstellen aufladen.

- Sofort lieferbar – die Travel-Karte ist vor Ort verfügbar, es besteht keine Lieferfrist.

- Einfaches Wiederaufladen – auch Drittpersonen können eine Karte wiederaufladen.

- Die Travel Karte ist sicherer als Bargeld und wird bei Verlust weltweit kostenlos per Kurierservice ersetzt.

- Die Karte kann mit einem Betrag zwischen 100.− und 10 000.− in der entsprechenden Kartenwährung (CHF, EUR, USD) aufgeladen werden.

- Die Bezahlung der Aufladung erfolgt in Schweizer Franken. Den tagesaktuellen Wechselkurs für Euro und US Dollar Aufladungen erfahren Sie am SBB Schalter.

- An über 70 Millionen Mastercard-Akzeptanzstellen bezahlen Sie damit auch Ihre Einkäufe.

- Weltweit über 2 Mio. Bancomaten zum Beziehen von Bargeld.

- Keine Tages- und Monatslimiten der Karte. Bitte beachten Sie aber die Bezugslimiten der Bancomaten-Betreiber.

- Mit dem Handy bezahlen (Apple Pay, Samsung Pay, Google Pay, Fitbit Pay, Garmin Pay).

«Swiss Bankers» App.

Mit der «Swiss Bankers» App haben Sie Ihre Ausgaben jederzeit im Griff. Überprüfen Sie ihr Kartenguthaben oder schauen Sie sich Ihre Transaktionen an. Sie können die Karte nach Ihren Bedürfnissen einstellen und erhalten Benachrichtigungen nach jeder Transaktion.

Einfaches Aufladen.

Die Travel Karte ist an rund 130 SBB Verkaufsstellen ganz einfach erhältlich. Dort können Sie sie jederzeit mit einem Guthaben zwischen CHF 100.– und maximal CHF 10 000.– aufladen. Der Betrag wird innert kürzester Frist auf Ihrer Karte aktiviert. Ausserdem können Sie Ihre Karte via E-Banking sowie mit der «Swiss Bankers» App aufladen. Erfolgt die Ladung direkt am SBB Schalter, ist Ihr Guthaben innerhalb von 15 Minuten Ihrem Kartenkonto gutgeschrieben. Keine Wartezeit, sofortiger Einsatz! Eine Überweisung per E-Banking benötigt ca. 0-1 Werktag.

Volle Budgetkontrolle.

Mit der Travel Karte haben Sie alle Ausgaben im Griff: Sie können immer nur so viel ausgeben, wie Sie auf die Karte laden. Mit der «Swiss Bankers» App oder unter swissbankers.ch Link öffnet in neuem Fenster. haben Sie Ihre Ausgaben, Bargeldbezüge sowie den Stand Ihres Kartenguthabens jederzeit unter Kontrolle.

- Für die Ausstellung der Karte ist kein Bonitätsnachweis erforderlich.

- Damit eine Karte ausgestellt werden darf, muss der Wohnsitz in der Schweiz oder im Fürstentum Liechtenstein sein.

- Bei der Erstausstellung der Karte muss der Karteninhaber persönlich vor Ort sein. Danach kann das Guthaben sowohl vom Karteninhaber wie auch von Dritten aufgeladen werden.

- Pro Person dürfen maximal fünf Karten ausgestellt werden.

- Herausgeber der Karte ist die Swiss Bankers Prepaid Services AG.

- Es entstehen keine jährlichen Gebühren.

- Für der Ladung Ihrer Karte zahlen Sie bei den Kartenwährungen Euro und US Dollar lediglich eine Kommission in der Höhe von 1.5%, bei CHF-Karten 2.5% vom Ladebetrag.

- Ein Bezug am Bancomaten kostet je nach Kartenwährung im Inland EUR 5.–, USD 5.–, CHF 5.– und im Ausland CHF 7.50, EUR 7.50 oder USD 7.50.

- Bei Bezahlung in Geschäften und im Internet mit der Karte beträgt die Gebühr EUR 1.–, USD 1.–, CHF 1.–.

- Die Bezahlung der Kartenaufladung erfolgt unabhängig von der Kartenwährung in Schweizer Franken.

Preis- und Produktänderungen vorbehalten.

Reisetipps.

Travel ist die sichere Ergänzung zum Bargeld. Unsere Mitarbeiter/innen beraten Sie gerne, damit Sie ihr Reisegeld optimal zusammenstellen können.

Wenn die Karte in Ländern eingesetzt wird, in welchen die Lokalwährung Euro beziehungsweise US Dollar ist, ist es empfehlenswert die Karte bereits in dieser Kartenwährung zu beziehen. Beim Einsatz in Ländern mit einer anderen oder mehreren Lokalwährungen empfiehlt es sich die Travel Karte in Schweizer Franken.

Kartenverlust.

Melden Sie den Verlust Ihrer Karte sofort dem Kundenservice der Swiss Bankers Prepaid Services AG, Tel. +41 31 710 12 15. Es wird Ihnen umgehend Ihre Karte gesperrt und Ihnen eine neue Karte zugeschickt, welche mit dem Restwert der vermissten Karte geladen ist.

Die Zustellung einer Travel Ersatzkarte ist weltweit kostenlos und wird per Kurierdienst versendet. In Europa erhalten Sie die Ersatzkarte in der Regel schon am nächsten Arbeitstag. Auch Reisende in fernen Ländern müssen nicht lange warten – Kunden in den USA erhalten die Ersatzkare nach rund zwei Arbeitstagen und Kunden in weiter entfernten Ländern durchschnittlich nach drei Arbeitstagen nach der Verlustmeldung.

Weiterführender Inhalt

Weiterführende informationen..

- Verkaufsstellen Travel

swissbankers.ch Link öffnet in neuem Fenster.

Hilfe & Kontakt.

- Geldwechsel

- Themen-Übersicht

Mehr zum Thema.

- AGB Travel Link öffnet in neuem Fenster.

- «Swiss Bankers» App Link öffnet in neuem Fenster.

Verkaufsstellen Travel.

Ablösung Internet Explorer 11.

Microsoft stellt den Support für den Internet Explorer 11 nach und nach ein ( mehr dazu auf microsoft.com Link öffnet in neuem Fenster. ). Wenn Sie SBB.ch trotzdem weiter mit dem Internet Explorer verwenden, könnte es zukünftig zu Funktionseinschränkungen und Darstellungsproblemen kommen. Wir empfehlen Ihnen deshalb, einen moderneren Browser zu verwenden (z.B. Mozilla Firefox Link öffnet in neuem Fenster. , Google Chrome Link öffnet in neuem Fenster. , Microsoft Edge Link öffnet in neuem Fenster. ).

Uns ist bewusst, dass der Umstieg auf einen neuen Browser eine erhebliche Umgewöhnung bedeutet und mit Unsicherheiten verbunden sein kann. Dank modernerem Browser werden Sie künftig von einem schnelleren und sichereren Zugang zum Internet profitieren. Wir versprechen Ihnen, dass wir auch in Zukunft mit vollem Elan daran weiterarbeiten, Ihnen einen barrierenfreien und inklusiven Zugang zu SBB.ch zu gewährleisten.

Hilfe & Kontakt

Sie haben Fragen, benötigen Hilfe oder möchten mit uns Kontakt aufnehmen? Wir sind da, um Ihnen zu helfen.

Bahnverkehrsinformationen

Informationen über die aktuelle Betriebslage, Störungen sowie geplante Bauarbeiten auf dem Schweizer Schienennetz und über wichtige Behinderungen und Streiks im Ausland.

Newsletter & Social Media

Jeden Monat über Angebote und Neuigkeiten informiert sein.

- Die Facebook-Seite der SBB anzeigen. Link öffnet in neuem Fenster.

- Hier geht's zum X-Account der SBB. Link öffnet in neuem Fenster.

- Hier geht's zum Youtube-Kanal der SBB. Link öffnet in neuem Fenster.

- Hier geht's zum Instagram-Account der SBB. Link öffnet in neuem Fenster.

- SBB Social Media

- Jobs & Karriere Link öffnet in neuem Fenster.

- Geschäftskunden Link öffnet in neuem Fenster.

- Unternehmen Link öffnet in neuem Fenster.

- SBB News Link öffnet in neuem Fenster.

- SBB Community Link öffnet in neuem Fenster.

Zeitloses SBB Design.

Möchten auch Sie eine offizielle Schweizer Bahnhofsuhr von Mondaine? Ob als Armbanduhr, Wanduhr, Taschenuhr oder Wecker: Bestellen Sie Ihr gewünschtes Modell gleich online. Link öffnet in neuem Fenster. Anschauen und bestellen Link öffnet in neuem Fenster.

- Cookie-Einstellungen

- Rechtlicher Hinweis

- Datenschutz

- Barrierefreiheit

In Zusammenarbeit mit

- Health Insurance

- Supplemental Health Insurance

- Supplemental Hospital Insurance

- Life Insurance

- Legal Insurance

- Travel Insurance

- Rental Deposit Insurance

- Pet Insurance

- Insurance News

- Insurance Forum

- Insurance Magazine

- Insurance Calculators

- Savings Accounts

- Private Accounts

- Banking Bundles

- Business Accounts

- Credit Cards

- Business Credit Cards

- Prepaid Cards

- Banking News

- Banking Forum

- Banking Magazine

- Savings & Interest Calculators

- Mortgage Interest Rate Assistant

- Mortgage Calculators

- Personal Loans

- Business Loans

- Car Leasing

- Loan & Leasing Calculators

- Loans & Mortgages Forum

- Ratings of Swiss Banks

- Online Trading

- Forex Trading

- CFD Trading

- Asset Management

- Medium-Term Notes

- 3a Retirement Accounts

- Retirement Funds (3a & Vested Benefits)

- Vested Benefits Accounts

- Retirement Calculators

- Investing & Retirement Forum

- Investment & Retirement Magazine

- Trading Calculators

- Mobile Plans

- Internet Plans

- Landline Phone Plans

- Bundled Telecom Plans

- Video Streaming

- Music Streaming

- Telecom News

- Telecom Forum

- Telecom Magazine

- Telecom Calculators

- Accounts & Cards

- All Articles

- New in Switzerland

- About moneyland.ch

- Independence

- Advertising

- Moneyland Analytics

- Privacy Policy

- All Comparisons

- All Calculators

- Young Adults

Swiss Prepaid Card Guide

How are Swiss prepaid card different from standard Swiss credit cards? Does using prepaid cards make financial sense? Find answers to your questions in this guide to using prepaid cards in Switzerland.

1. Which Swiss card issuers offer prepaid cards?

Many Swiss card issuers issue prepaid cards. These include:

- Cornèrcard

- Postfinance

- Swiss Bankers

- Swissquote (SIX)

- Topcard (UBS)

2. How is a prepaid card different from a credit card?

The biggest difference between a prepaid card and a credit card is that a prepaid card cannot be used to make purchases on credit. Because a prepaid card account does not have a line of credit, you must add money to the account before you can use your card.

Creating or carrying a negative balance is not possible. You can only make purchases as long as there is money in your account which can be debited to pay for the purchases. Some prepaid cards come with the option of placing a direct debit order so that money is automatically drawn from your bank account and credited to your prepaid card account.

3. How is a prepaid card different from a debit card?

A debit card is directly linked to a private account at a bank. When you pay or make a cash withdrawal with a debit card, the amount spent is debited from your bank account balance. A prepaid card is not linked to a bank account, but to a prepaid card account from a card issuer. You do not necessarily need to have a bank account in order to use a prepaid card. You must load money to your prepaid card account in order to use a prepaid card.

4. Do I need a bank account to use a prepaid card?

As with credit cards, whether or not you need a bank account in order to obtain a prepaid card depends on the card issuer. For example, you do not need to have a bank account to use prepaid cards from Cornèrcard and Bonuscard. The prepaid cards which are sold at kiosks (like k kiosks from Valora) can also be used without a bank account.

5. How high are the annual fees of Swiss prepaid cards?

Like credit cards, prepaid cards typically have annual card fees. The highest annual fee charged for a Swiss prepaid card is 60 francs per year.

Some prepaid cards do not have annual fees. Swiss no-annual-fee prepaid cards include:

- Travel Card (Swiss Bankers)

- Silver Prepaid card (Swissquote)

- Coop Supercard Visa Prepaid (TopCard)

6. How much does it cost to load prepaid card accounts?

Unlike credit cards, Swiss prepaid cards generally have loading fees. You pay the loading fee every time you “load” your prepaid card by transferring or depositing money into your prepaid card account. With some prepaid cards this fee is waived for the first “loading” and then charged for each additional reloading.

Loading fees vary between prepaid cards:

- 2 francs per loading (some Cornèrcard prepaid cards, for example).

- 1% of the loaded amount, minimum 5 francs per loading (Viseca and Swissquote, for example).

- 4% of the loaded amount, minimum 2 francs per loading (Valora ok.- prepaid Visa or Mastercard).

- 6% of the loaded amount (Yuna To Go).

- No loading fees (Postfinance Mastercard Value, UBS Mastercard Prepaid).

Understanding prepaid card loading fees is very important because they can become very expensive. The interactive Swiss prepaid card comparison on moneyland.ch lets you select how many times you expect to load your prepaid card account each year. The loading fees are accounted for in the comparison based on your entry. You can also find the exact loading fee for each prepaid card in the detailed cost breakdowns.

7. How much do cash withdrawals cost?

Like the cash advance fees of credit cards, the cash withdrawal fees of prepaid cards are typically very high. Withdrawing money from your prepaid card account is generally not a good financial move. Debit cards are much more suitable for cash withdrawals. Many Swiss prepaid cards charge cash withdrawal fees equal to 4% of the amount withdrawn, with a minimum fee of up to 10 francs per withdrawal. When you make cash withdrawals outside of Switzerland, you pay a foreign transaction fee on top of the cash withdrawal fee.

8. What does using prepaid cards outside of the country cost?

When you use a Swiss prepaid card to make purchases from foreign merchants (online or while traveling, for example), you pay foreign transaction fees. Foreign transaction fees vary between prepaid cards, but can be as high as 2% of the amount you spend.

Additionally, you also pay a markup on the currency exchange rate. These markups can be just as important as the foreign transaction fee, and can add another cost equal to more than 2% of the amount you spend.

9. Are there any other costs?

Depending on the prepaid card, you may pay additional costs for certain services. For example, getting a replacement card if you lose your prepaid card typically costs 20 francs.

10. Where can I compare Swiss prepaid cards?

You can compare the costs and benefits of Swiss prepaid cards using the interactive prepaid card comparison on moneyland.ch .

11. Are prepaid cards cheaper than credit cards?

No. As the moneyland.ch comparison shows, the most favorable credit cards are often cheaper than the most favorable prepaid cards.

It is important to consider the total of all costs and not just annual card fees. The prepaid card comparison accounts for all fees, including loading fees and foreign transaction fees.

12. Do Swiss prepaid cards come with special cardholder benefits?

Most Swiss prepaid cards have very few benefits compared to Swiss credit cards. The majority of prepaid cards do not have rewards programs and do not come with complimentary insurance.

13. Who could benefit from using prepaid cards?

Prepaid cards are widely used by teenagers and students. One reason for this is that banks often market prepaid cards to teenagers as young as 12 or 14 years old. Credit cards, on the other hand, are only available to adults aged 18 or older.

Prepaid cards are also used as an alternative to credit cards by adults who are not eligible for credit cards (due to poor creditworthiness, for example).

Prepaid cards are also often promoted by teachers and educators because they do not allow you to make purchases on credit. Prepaid cards can also be practical for families because they enable parents to monitor their children’s’ spending and to freeze or reload a child’s prepaid card account remotely if necessary.

14. Can Swiss prepaid cards be used for mobile payments?

Yes. Many Swiss prepaid cards work with Apple Pay , Samsung Pay , Google Pay , Swatch Pay , Fitbit Pay or Garmin Pay . You can easily filter Swiss prepaid cards based on their compatibility with popular mobile wallets in the interactive prepaid card comparison.

15. Are there alternatives to Swiss prepaid cards?

In addition to conventional credit cards and debit cards, neobanks now offer cards which can be used much like prepaid cards. Examples include the cards from Swiss neobanks Neon, Yuh and Zak and UK neobanks Wise and Revolut .

The main advantage of neobank cards is that they typically have favorable currency exchange rates, which makes them an affordable option for international purchases. Another major advantage compared to most Swiss credit cards is that you do not pay loading fees to fund your card account. Basic neobank cards typically do not have annual card fees.

More on this topic: Swiss prepaid card comparison Swiss credit card comparison

Leading credit cards

Swisscard Cashback Cards Amex

No annual fees

Two cards Amex & Visa/Mastercard

With cash back

Migros Cumulus Visa

With Cumulus points

Without foreign currency fees

Cheap bank accounts with card

No account fees

Banking partner: Swissquote & Postfinance

CHF 20 trading credit with code «YUHMONEYLAND»

Multi-currency account with Visa card (CHF, EUR, USD, GBP)

Favorable foreign exchange rates

CHF 100 welcome bonus

50 KeyClub points as a welcome gift

Online private account with debit card

Find the cheapest credit card now

Information

About moneyland.ch Magazine

The moneyland.ch magazine provides accurate, unbiased information on topics related to finance and money. In addition to research and expert interviews, the magazine contains numerous financial guides. You can find more information about our editors and experts here.

Show categories

Compare Mandatory Health Insurance

Compare Credit Cards

Compare Private Accounts

Compare Personal Loans

Sign up for the free newsletter

Find all comparisons here

- Experts and Editorial Team

- Partnerships

- Calculators

- Bank Packages

- Fixed Deposits

- Home Telecom Packages

- Compulsory Health Insurance

- Security Deposit Insurance

- Pillar 3a Accounts

- Retirement Funds

moneyland.ch is Switzerland’s independent online comparison service covering banking, insurance and telecom. Contact us

Swiss Bankers Travel Cash Karte: Lohnt sie ich? Welche Alternativen gibt es?

Monito wird von Ihnen unterstützt. Wenn Sie sich über unsere Links bei einem empfohlenen oder beworbenen Service anmelden, verdienen wir unter Umständen eine kleine Provision.

Die Schweiz ist ein wunderschönes, aber auch ein relativ kleines und teures Land. Daher ist es nicht überraschend, dass im Durchschnitt jede in der Schweiz wohnhafte Person mindestens eine Reise in das Ausland pro Jahr durchführt.

Schweizer Banken sind allerdings für hohe Gebühren bei Zahlungen und Bargeldabhebungen im Ausland bekannt. Besonders ärgerlich: Da viele Gebühren über den Wechselkurs erhoben werden, stellen die meisten Reisenden erst nach dem Urlaub fest, wie hoch die Gesamtgebühren waren. Viele kennen den Marktmittelkurs auch gar nicht und bemerken nicht, dass sie Gebühren für Zahlungen im Ausland entrichten.

Die Swiss Bankers Travel Cash Karte soll Abhilfe schaffen und verspricht weltweite Zahlungen zu attraktiven Konditionen. Was die Karte bietet und ob sie sich lohnt, erfahren Sie im Monito-Ratgeber. Viel Spaß! 💸

Fakten zur Swiss Bankers Travel Cash Karte im Überblick:

- Die Travel Cash Karte von Swiss Bankers ermöglicht weltweite Zahlungen zum Fixpreis.

- Die Karte lässt sich in kürzester Zeit online oder an über 200 Stellen in der Schweiz beantragen.

- Wir empfehlen die Prepaid Kreditkarten von Swiss Bankers aufgrund ihrer hohen Gebühren nicht weiter.

Was bietet die Travel Cash Karte von Swiss Bankers?

Die Travel Cash Karte von Swiss Bankers ist ein beliebter Reisebegleiter. Reisende können sie in den drei Währungen CHF, EUR oder USD bestellen. Zahlungen sind aber grundsätzlich weltweit möglich.

Sie verspricht kostengünstige Zahlungen weltweit. Im Vergleich zu klassischen Schweizer Banken stimmt dies zwar, die Gebühren finden wir allerdings trotzdem relativ teuer.

Diese teilen sich in drei Bereiche auf:

Aufladegebühr.

Bei der Aufladung einer Travel Cash Karte von Swiss Bankers fallen direkt Gebühren an. Diese betragen 1,50 % des Ladebetrags. Möchten Sie bspw. 1000 CHF auf die Karte einzahlen, müssen Sie mit Gebühren in Höhe von 15 CHF rechnen.

Gebühr bei Zahlungen

Für jede Zahlung berechnet Swiss Bankers eine Grundgebühr von 1 CHF, 1 EUR oder 1 USD, abhängig von der Kontowährung der Karte. Das kann relativ niedrig sein, wenn man zum Beispiel nur große Zahlungen tätigt oder sich summieren, wenn man viele kleine Zahlungen tätigt.

Tätigt man auf der Auslandsreise 50 Kartenzahlungen, liegen die Gebühren bspw. bei 50 CHF, was in unseren Augen absolut überzogen ist.

Gebühren bei Bargeldabhebungen

Wer mit der Swiss Bankers Karte Bargeld abheben möchte, wird leicht enttäuscht sein. Die Gebühren dafür sind nämlich besonders hoch. Innerhalb der Schweiz werden 5 CHF, 5 EUR oder 5 USD fällig. Für Bargeldabhebungen im Ausland verlangt das Unternehmen sogar 7,50 CHF, 7,50 EUR oder 7,50 USD.

Insgesamt sind die Gebühren der Travel Karte von Swiss Bankers insbesondere bei regelmäßigen Auslandszahlungen sehr hoch. Diese sind zwar etwas günstiger als Zahlungen mit vielen klassischen Schweizer Banken, Schweizer Neobanken sind jedoch in der Regel um Längen günstiger.

Welche Vorteile bietet die Swiss Bankers Travel Cash Karte

An der Travel Karte von Swiss Bankers ist nicht alles negativ. Wir finden, dass es sich unter Umständen um einen praktischen Reisebegleiter handeln kann. Die Prepaid Kreditkarte ist vor allem praktisch.

Die Karte lässt sich in zahlreichen Verkaufsstellen in der Schweiz und in Liechtenstein oder auch direkt online erwerben. Anschließend gibt es die Möglichkeit, eine Aufladung per Überweisung innerhalb von einem Werktag oder eine Aufladung per Karte vorzunehmen.

Wer bis kurz vor Reiseantritt keine passende Reisekreditkarte organisiert hat, kann kurzfristig auf die Travel Karte von Swiss Bankers zurückgreifen. Die Verwaltung erfolgt komplett über die Swiss Bankers App und lässt sich damit auch im Ausland abwickeln. Besonders interessant: Wer die Travel Karte im Ausland verliert, erhält kostenfrei meist innerhalb von drei Werktagen einen Ersatz zugestellt. Digital hinterlegte Karten werden sogar sofort ersetzt.

Außerdem unterstützt die Karte nahezu alle gängigen mobilen Zahlungssysteme. Dazu zählen:

- Samsung Pay

Ansprechend finden wir auch, dass man bis zu 5 Travel Karten über Verkaufsstellen erwerben kann. So hat man direkt einen Ersatz, falls man eine verliert.

Lohnt sich die Travel Karte von Swiss Bankers?

Die Travel Cash Karte aus dem Hause Swiss Bankers ist eine praktische Prepaid Kreditkarte. Diese eignet sich insbesondere für kurzfristig geplante Reisen, bei denen es nicht möglich ist, eine günstigere Alternative zu beschaffen. Wer allerdings ausreichend Zeit hat, sollte eine echte Reisekreditkarte von einem Anbieter wie Wise oder Revolut bestellen. Diese sind im Auslandseinsatz deutlich günstiger.

Wir sind uns sicher, dass sich die Travel Karte von Swiss Bankers für die meisten Nutzer nicht lohnt. Das liegt nicht an den gebotenen Leistungen, sondern einfach an den enormen Gebühren, die für Zahlungen und Bargeldabhebungen anfallen.

Welche Alternativen zur Travel Karte von Swiss Bankers gibt es?

Glücklicherweise gibt es zahlreiche Alternativen zur Travel Karte. Viele Neobanken bieten Prepaid Kreditkarten an, die exzellente Konditionen im Auslandseinsatz versprechen. In der Schweiz sind sowohl Wise als auch Revolut verfügbar. Dabei handelt es sich um die wahrscheinlich günstigsten Reisekreditkarten für Schweizer.

Das Multi-Währungs-Konto von Wise ermöglicht es, über 55 verschiedene Währungen zu halten. Einzahlungen per Überweisung sind hier kostenfrei. Mit der zugehörigen Debitkarte lassen sich weltweit kostengünstigste Zahlungen zum Mittelkurs tätigen. Außerdem besteht die Möglichkeit, bis zu 200 € pro Monat kostenfrei weltweit abzuheben.

Wer regelmäßig Auslandsüberweisungen tätigt, kommt mit Wise ebenfalls auf seine Kosten. Wise ermöglicht kostengünstige Geldtransfers zum Mittelkurs in zahlreiche Länder. Das Beste dabei: Man kann Geld direkt vom Multi-Währungs-Konto überweisen.

Damit ist Wise deutlich günstiger und flexibler als die Travel Karte von Swiss Bankers.

Das Standard Konto von Revolut ist ebenfalls eine exzellente Reisekreditkarte. Zahlungen sind hiermit bis zu einem Limit von 1000 € pro Monat weltweit kostenfrei möglich. Außerdem können Nutzer bis zu 200 € pro Monat kostenfrei weltweit abheben. Normalerweise nutzt Revolut den Mittelkurs bei Auslandstransaktionen. An Wochenenden fallen jedoch 1,00 % an Gebühren an.

Bei Revolut handelt es sich um ein vollwertiges Bankkonto mit der gesetzlichen Einlagensicherung. Nutzer können außerdem Versicherungen, Kryptowährungen oder auch Aktien über die Revolut App erwerben. Damit handelt es sich um eine günstigere und deutlich vielseitigere Alternative zur Travel Karte von Swiss Bankers.

Wir würden die Travel Cash Karte von Swiss Bankers nicht weiterempfehlen. Die hohen Gebühren sind unserer Meinung nach nicht wettbewerbsfähig. Wise und Revolut sind eine deutlich bessere Alternative mit niedrigeren Gebühren und deutlich umfangreicheren Funktionen.

Der einzige enorme Vorteil der Travel Karte ist, dass man sie innerhalb kürzester Zeit abschließen kann. Personen, die es versäumt haben, sich auf ihren Urlaub vorzubereiten, finden in der Travel Karte jedoch eine gute Last Minute Option.

Warum Sie Monito vertrauen können

Sie kennen die oft unverschämten Kosten für Überweisungen ins Ausland wahrscheinlich nur zu gut. Nachdem sie 2013 selbst mit dieser Frustration konfrontiert waren, starteten die Monito-Gründer François, Laurent und Pascal eine Geldtransfer-Suchmaschine, um die besten Geldtransferdienste auf der ganzen Welt zu vergleichen.

Heute vertrauen rund 8 Millionen Menschen jedes Jahr auf die preisgekrönten Vergleiche, Bewertungen und Leitfäden von Monito. Unsere Empfehlungen werden durch Millionen von Preisdatenpunkten und Dutzende von Expertentests gestützt - so können Sie beruhigt die beste Entscheidung treffen .

Über 15 Millionen Nutzer auf der ganzen Welt vertrauen Monito.

Die Experten von Monito verbringen zahlreiche Stunden mit dem Testen und Vergleichen von Geldtransfer-Dienstleistern.

Partnerprovisionen beeinflussen niemals unsere Unabhängigkeit

Travel money guide: Switzerland

What every traveler needs to know about how to spend finding the right travel money product to use in switzerland..

In this guide

Travel card, debit card or credit card?

These are your options for spending money in switzerland, which credit card issuers are accepted in switzerland, potential credit card fees in switzerland, compare travel credit cards, swiss currency, buying swiss francs in the us, atms in switzerland, keep your travel money safe in switzerland, how many francs do i need to bring to switzerland, exchange rate history.

Travel money type

Compare more cards

Top picks of 2024

Whether you plan on skiing the Matterhorn or exploring the historical Basel Munster church, you’ll need to organize your travel money before you arrive in Switzerland. Switzerland accepts credit cards, debit cards and cash, with plenty of ATMs available throughout the country.

Credit cards are the best payment option thanks to their wide acceptance and safety measures. One that waives foreign transaction fees can also spare your wallet from extra expenses. However, debit cards and cash can serve you equally well during your Switzerland adventure.

Our picks for traveling to Switzerland

40+ currencies supported

- 4.85% APY on USD balances

- $0 monthly fees

- Up to $100 free ATMs withdrawals worldwide

- Hold and convert 40+ currencies

Up to $300 cash bonus

- 0.50% APY on checking balance

- Up to 4.60% APY on savings

- $0 account or overdraft fees

- Get a $300 bonus with direct deposits of $5,000 or more

Free ATM transactions

- $50 waivable monthly fee

- 0% foreign transaction fee

- Securely move money domestically and globally

- 5 monthly out-of-network ATM reimbursements

- Free international HSBC ATM transactions

There are numerous ways to access your money when you’re on vacation, and it’s best to use a combination of products. Credit cards give you money when you need it and can cover you in a financial emergency. Debit cards are good for access to your cash, without all the traveling fees.

Whether you’re heading to Switzerland for some skiing or simply to enjoy the culture, be sure to get your spending budget in order before you leave so you can hit the slopes with no worries.

Visa and Mastercard branded cards are accepted in more places than American Express and Diners cards throughout Switzerland. Look for logos at ATM point of sale terminals to be sure.

Switzerland has a modern banking economy — it’s their primary industry — so you won’t need lots of cash on your travels. If your card has a chip you’ll be able to make contactless payments.

Using a credit card

A travel credit card gives you access to a line of credit and you won’t pay for currency conversion when you transact in francs. Make sure the card doesn’t charge foreign transaction fees as well: the Capital One VentureOne Rewards Credit Card is a good example of such a card (Terms apply, see rates & fees ).

We don’t advise making a withdrawal on credit as cash advance charges apply and you’ll start paying an APR the day the transaction is made. Consider additional extras on your travel credit card such as insurance or an increased rewards for travel when you’re comparing credit cards to use overseas.

- Tip: Some providers waive cash advance charges when you keep a positive balance and make ATM withdrawals. Find out which providers let you do this and which won’t.

- No currency conversion fees

- Features such as insurance or reward points earning

- Some offer no foreign transaction fees

- You’ll pay a lot for a cash advance

- Rewards program may cost more than they are worth

Switzerland has “high merchant acceptance” for Visa, Mastercard and even Discover. Some merchants may accept American Express, but don’t rely on it.

For cash withdrawals, look for Six Multipay and Post Finance for all cards. Amex cardholders can make cash withdrawals from ATMs of Euronet, Credit Suisse and UBS.

Depending on your credit card and how you use it, you could incur:

- Foreign transaction fees. Pay up to a 3% fee for every transaction. That’s $150 for every $5,000 spent abroad.

- Currency conversion fees. Paying in US dollars at ATMs and vendors could set you up to pay a Dynamic Currency Conversion fee. Beware of using this option, though — the conversion fee is high and exchange rates are poor.

Explore top debit cards with no foreign transaction fees and travel credit cards by using the tabs to narrow down your options. Select Compare for up to four products to see their benefits side by side.

- Credit cards

Using a debit card

A debit card lets you spend and withdraw in Switzerland like you would at home. Find a debit card that waives the international ATM withdrawal fee, such as one from Betterment Checking , and you can make free ATM withdrawals when you use an ATM offered by a Swiss bank. European and Swiss banks don’t charge ATM fees.

- Tip: Make sure your debit card has a chip to avoid situations where you card won’t be accepted.

- Secured with a chip and PIN technology

- Block transactions with a phone call if you lose your card

- It’s easy to find ATMs in Switzerland

- Comes with a backup card

- Money-back guarantee for fraud

- No backup card if you lose it on your trip

- Some charge currency conversion and ATM fees

Using a prepaid travel card

There are no prepaid travel cards that hold Swiss francs. Usually, the advantage of these cards is you can hold multiple foreign currencies at a time and save on currency conversion fees. A travel card makes sense if you’re spending your time in the Eurozone (France, Germany, the Netherlands, Belgium, Spain, etc.) and the UK, but if you’re spending the majority of your time in Switzerland, you’ll pay for currency conversion when you spend in francs.

The currency conversion fee can be double the charge applied to most credit cards and debit cards. Travel money products can charge the Visa or Mastercard rate plus 4.5% for currency conversion and charges for international ATM withdrawals. So, regardless of which product you choose, you’re going to pay for currency conversion, international ATM withdrawals — or both when you use a travel card in Switzerland.

- Hold multiple foreign currencies at a time

- Save on currency conversion fees

- Not able to load Swiss francs

- Pay a currency conversion fee to use USD

- You’ll pay ATM fees

Paying with cash in Switzerland

It’s cheaper to get your cash exchanged in Switzerland than in the US, and even cheaper still with a no-fee ATM card. If you do have US dollars or euros you need to exchange in Switzerland, bureaux de change outlets can be found at airports and train stations. Or, change your money at a bank to get the most competitive rate for changing cash — and it shouldn’t charge a commission either.

- Tip: Some large retailers will accept euros — though a majority will not. If you use euros, you will get a worse rate than paying with the local currency.

- Greater payment flexibility

- Convenience

- More difficult to manage expenses

- Higher risk of theft

Using traveler’s checks

Traveler’s checks are an outdated way to travel with money — it’s far easier and cheaper to use an ATM. If you do have traveler’s checks, you can cash your them at exchange offices in train stations or a bank. Exchange offices offer the same rates as banks; however they may charge a commission for the transaction.

- Tip: Banks are open during regular business hours weekdays from 8:30 a.m.to 4:30 p.m.

- Accepted at most banks and hotels

- Can be costly with initial purchase charges

- Not all merchants accept traveler’s checks

The main banks in Switzerland are:

- Bank J. Safra Sarasin

- Banque Cantonale de Genève

- Credit SuisseEFG International

- Julius Baer

- Migros Bank

- Swiss Raiffeisen

- Zurich Cantonal Bank

It’s cheaper to exchange your US dollars once you arrive in Switzerland, either at a bank or an ATM. If you want francs before you arrive, get money changed at any of the providers listed here. There are ATMs at every international airport (Zurich, Geneva, Basel, etc.), which should eliminate the need to change currency in the US.

- American Express

Refreshing in: 60s | Sat, Jun 22, 06:04PM GMT

You’ll have little issue finding an ATM in Switzerland. To save on extra costs, try to bring a debit card that doesn’t charge international ATM fees, like the one from Betterment Checking.

The overall travel risk for tourists in Switzerland is low, and ranks at #11 for the safest country in the world. Still, exercise a reasonable level of caution and common sense in high tourist areas and on public transit.

Yes, the rumors are true, Switzerland is one of the most expensive countries in the world to visit, and — according to some estimates — the most expensive country in the world to live. Plan to spend anywhere from $75 to $400 a day, depending on what adventures you seek.

*Prices are approximate and based on summer seasonality and are subject to change

The Swiss Franc is one of the most stable currencies in the world and definitely one of the most valuable. Since the Global Financial Crisis, the value of the US dollar has dropped against the Swiss franc. The past few years, 1 USD is worth about 0.90 CHF.

Case study: Bart snowboarding in Verbier, Switzerland