- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Best Adventure Sports Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Heading out on a vacation can be an exhilarating experience, especially if you’re into adventure activities. However, with increased adrenaline comes increased danger — and decreased coverage from insurance companies.

Being protected in an emergency is valuable when you’re doing something risky, so we’ve gathered some of the best adventure travel insurance policies.

Factors we considered when picking adventure sports travel insurance companies

You’ll want to consider the following facets of travel insurance during a comparison:

Cost . We looked for a mix of affordability and comprehensive coverage.

Types of coverage . Extreme sports insurance isn’t usually included with standard travel insurance, which is why we’ve made sure it’s included.

Coverage amounts . Being underinsured is almost as bad as having no insurance at all.

Customizability . Plans that can be customized offer more flexibility for travelers.

» Learn more: What does travel insurance cover?

An overview of the best adventure travel insurance

To determine the best extreme sports insurance, we gathered quotes from various companies using insurance aggregator SquareMouth. To do so, we input a sample trip of a 33-year-old from Colorado traveling to New Zealand for two weeks. The total trip cost was $3,400, and activities included hiking and camping.

SquareMouth came back with 16 policies offering varying levels of coverage. Among the six we chose as the best, the average cost totaled $147.18 — though you’ll find significantly lower and higher on this list. Here are our picks.

» Learn more: The best travel credit cards right now

Top adventure travel insurance options

Let’s take a closer look at our top six recommendations for adventure travel insurance.

What makes Battleface adventure insurance great:

Much lower cost than other options.

Provides primary health insurance.

Includes six customizing options.

Battleface is known for its adventure sports travel insurance, which makes it much more compelling than other products. Even at less than half the cost for other options, Battleface is providing you $100,000 in primary health insurance, $500,000 for medical evacuation and even coverage for pre-existing conditions .

Although its basic plan lacks features like lost luggage reimbursement, you’ll still get standard trip protections such as trip cancellation and employment layoff coverage. The extremely low cost may make this an enticing option for backpacker travel insurance or anyone wishing to save money on their travels.

What makes Travelex great:

Strong travel protections.

$50,000 in primary medical insurance.

Coverage for medical quarantine included.

Here’s a snippet from our Travelex review :

“Travelex’s primary goal is to provide travel insurance protection personalized to the type of trip you’re taking and the style of traveler you are. And regardless of which plan you choose, you’ll always have 24/7 access to travel assistance.”

What makes Tin Leg great:

Coverage for activities such as bungee jumping and skydiving.

No medical deductible.

Strong trip protections.

Here’s a snippet from our Tin Leg review :

“The Adventure Plan … features primary medical coverage and work-related cancellations, plus more lost luggage insurance than the Luxury plan, coverage for accidental death and dismemberment during the trip (excluding flights) and extra coverage for delayed sports equipment. It’s also the only plan that offers medical coverage for adventure activities like mountain biking.”

What makes IMG great:

Up to $300 in reimbursed kennel fees for delays in returning home.

Comprehensive trip protections, including trip delay and trip interruption reimbursement.

Lower-than-average cost.

Here’s a snippet from our IMG review:

“Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important if you travel to a remote location or engage in physical activity such as trekking.

“More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.”

John Hancock

What makes John Hancock great:

Trip delay reimbursement after three hours.

No medical deductible.

$750 reimbursement for missed connections.

Here’s a snippet from our John Hancock review :

“The Gold plan provides the greatest benefits, including a much higher limit for emergency medical and lost baggage reimbursement. Other than that, however, the Silver level is fairly similar, enjoying the same 150% reimbursement rate for trip interruption and a three-hour window for trip delay to kick in.

“The Bronze level is the least expensive, but it’s not all that far off from the cost of the Silver level. At this rate, you’ll be looking at far less coverage for emergency medical and trip delay, though you’ll still have $200 in coverage for change fees and 100% of costs incurred for trip cancellation.”

HTH Travel Insurance

What makes HTH Travel Insurance great:

$500,000 in primary medical coverage.

$1 million in medical evacuation.

High-limit travel protections.

Here’s a snippet from our HTH Travel Insurance review :

“HTH offers several types of travel medical insurance, as well as trip protection plans that include coverage for trip cancellation or interruption, baggage delays, and accident or sickness. … The cheapest plan … included 100% of the trip cost in case of cancellation, up to 150% of the trip cost in case of trip interruption and a variety of other benefits, including medical insurance coverage.”

What does travel insurance cover?

You’ll find a wide variety of coverage types offered by travel insurance policies. This is true whether you’re purchasing a single-trip or annual travel insurance plan.

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip interruption insurance .

How to choose the best adventure travel insurance policy

Travel insurance can be good to have while you’re away from home and can provide coverage when your plans go awry. Standard plans will generally include coverage for trip interruption, lost luggage and emergency medical situations.

However, they also usually include a provision excluding adventure sports from their policies, so it’s important to read over your plan documents thoroughly. Companies like SquareMouth also allow you to filter travel insurance plans by the types of activities you’re doing, which may make it simpler to find one that fits your needs.

» Learn more: How to find the best travel insurance

If you want to buy adventure sports travel insurance

Participating in adventure sports or extreme activities can be thrilling but also riskier than the average traveler’s trip. Because of this, if you’re interested in purchasing travel insurance, you’ll want to be sure it provides coverage for your planned activities — whether you’re camping or cliff diving.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Best Travel Insurance for Winter, Adventure, and Extreme Sports

Jessica Merritt

Editor & Content Contributor

84 Published Articles 482 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

151 Published Articles 740 Edited Articles

Countries Visited: 35 U.S. States Visited: 25

Stella Shon

News Managing Editor

87 Published Articles 626 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Why Get Adventure Sports Travel Insurance?

Travel insurance often excludes high-risk sports, credit card travel insurance often excludes high-risk activities, travel insurance for high-risk sports, how to get travel insurance for high-risk sports, what sports travel insurance costs, how to choose travel insurance for high-risk sports, the best sports travel insurance plans, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Planning an adventurous trip? Your travel insurance might not cover everything you want to do — particularly if you plan on adventure activities or winter or extreme sports.

Whether diving the ocean’s depths or ziplining through a forest, sports travel insurance can help you go confidently on adventures knowing you’re covered if anything goes wrong. Whether you need emergency assistance and evacuation or a reimbursement for a trip cut short by injury, travel insurance with sports coverage can help.

While standard travel insurance typically offers medical coverage, most policies exclude certain activities, particularly risky sports. But you can purchase a travel insurance policy that provides coverage for all your adventures , either as a stand-alone policy or an add-on to a comprehensive travel insurance package.

Let’s explore everything you need to know about travel insurance for sports and adventure activities and how to get that coverage for any high-risk activities you may plan for your travels.

Adventure sports travel insurance covers activities such as mountain climbing or deep-sea scuba diving (i.e. any activity that has a higher risk level than a “regular” travel activity).

While accidents can happen anywhere, you’re particularly vulnerable when away from home. Medical expenses and evacuation can be costly , especially if traveling to remote areas or a foreign country where you’re unsure about quality medical care. Sports travel insurance covers emergency medical expenses, ambulance services, and evacuation.

Some travel insurance companies offer emergency assistance services , which can help you get the medical care you need in a remote location or challenging environment. The travel insurance company can provide access to medical professionals, coordinate your care, and arrange an emergency evacuation if needed.

For example, if you’re climbing a mountain and break a leg, adventure sports travel insurance can help get you off the mountain and connected with medical care.

Adventure sports travel insurance can also help if a sports-related injury requires you to cancel or interrupt your trip or if you experience equipment loss or damage. That can save you money on non-refundable expenses and help you replace sports equipment.

While getting travel insurance is wise, you should understand that standard travel insurance policies may not include coverage for certain sports activities . Some travel insurance plans offer coverage for sports-related injuries and accidents, but others may have exclusions or limitations for high-risk or extreme sports.

When you purchase a travel insurance policy, review the terms and conditions to know which sports and activities are covered and any exclusions or limitations you may need to work with. Usually, travel insurance medical coverage encompasses unexpected accidents or injuries, which can include some sports like hiking or snorkeling, for example. But extreme or high-risk sports such as white water rafting or skydiving may not be included.

Exclusions depend on the insurance policy, but here are some examples of sports and activities that your standard travel insurance policy may not cover:

- Base jumping

- Bungee jumping

- Martial arts and combat sports

- Motor racing and motorsports

- Mountaineering and rock climbing

- Off-piste skiing and snowboarding

- Paragliding and hang gliding

- Scuba diving and deep-sea diving

If you find your travel policy lacking in coverage for the activities you’ve planned, you should consider getting additional coverage, such as a specialized sports travel insurance policy or add-on coverage.

Don’t expect your credit card travel insurance to cover extreme sports.

While you should read the terms and conditions of the policy, most credit card travel insurance policies exclude risky activities , which extends to sports considered extreme.

Credit card travel insurance often covers basic medical expenses, trip cancellation or interruption, lost baggage, and travel accidents. For example, the Chase Sapphire Reserve ® has premium travel insurance, offering up to $1 million in travel accident insurance, along with emergency evacuation and transportation insurance, emergency medical and dental benefits, and other travel insurance benefits.

If you plan to do high-risk activities and use credit card travel insurance, check your coverage and consider upgrading your travel insurance to include your desired activities.

Credit card travel insurance is helpful but sometimes limited, especially compared to adventure sports travel insurance policies. You may need to pay for travel insurance if you’re planning extreme sports or activities.

As you plan an adventurous trip, consider which travel insurance coverage may be most appropriate for your plans. Some travel insurance policies are comprehensive and cover multiple types of high-risk sports, while others are more specialized.

Because there’s a wide variety of what’s covered (or not) on each policy, using a travel insurance comparison service such as Squaremouth can be helpful. You can search for travel insurance policies that cover the activities you’re looking for and compare costs and coverage.

Consider these types of adventure travel insurance policies or add-ons:

- Adventure Sports: On an adventure sports travel insurance policy, look for covered activities such as hiking, mountaineering, or rafting. The policy may encompass injuries, medical expenses, trip cancellations or interruptions, and equipment loss or damage.

- Extreme Sports: Travel insurance for extreme sports typically covers skydiving, bungee jumping, or rock climbing, providing coverage for accidents, injuries, medical expenses, and emergency evacuation.

- Sports Equipment: Some travel insurance offers coverage for sports equipment, which can reimburse you for loss, theft, or damage to your gear.

- Team Sports: A travel insurance policy may cover team-related expenses, such as tournament cancellations or travel delays if you travel for competitive events.

- Water Sports: Water sports travel insurance policies may cover surfing, diving, snorkeling, or water skiing. For diving coverage, you should verify that the policy covers the depths you’re planning and whether you need certifications for coverage.

- Winter Sports: Winter sports travel insurance policies are designed for winter sports enthusiasts, offering coverage for skiing or snowboarding-related injuries and emergency medical expenses or equipment loss or damage. Some also cover ski resort closures.

While you can get travel insurance for sports, including high-risk sports, most travel insurance companies have personal liability requirements . Generally, you’re required to act responsibly to use your coverage. That includes not going against local authority warnings, like entering restricted spaces, working close to dangerous animals, or not using proper safety equipment.

Do some pre-trip planning on your chosen activities to learn about the risks and requirements for everything you want to do. You may need to complete certifications or training to participate safely.

Generally, if you want travel insurance for adventurous activities, you should get quotes for a comprehensive travel insurance plan and add a hazardous sports rider. Or specialized insurance providers may offer comprehensive plans for high-risk sports and activities.

Looking for insurance companies specializing in adventure sports is often a good idea to get comprehensive coverage for all your planned activities.

With any travel insurance policy, you should review the terms and conditions to verify your planned activities are covered. Read your policy documents for exclusions, limitations, or requirements for your chosen activities. You should also verify your coverage limits.

If you have a health or life insurance policy, check with your insurance carrier about coverage for high-risk sports during travel. While these are likely not covered, you may be able to add a special endorsement to your policy.

Travel insurance that can evacuate you off a mountain sounds like it would be costly, but it might be more affordable than you’d think. It’s certainly less expensive than calling for your own rescue helicopter.

You should expect to pay around 5% to 10% of your total trip cost for sports travel insurance. Your actual adventure sports travel insurance costs will vary depending on your age, trip cost and duration, location, planned activities, and other factors.

To give you an idea of what you should expect, we got a quote from IMG for an iTravelInsured Travel Sport policy. For a 29-year-old traveler on a $1,500 5-day skiing trip in the U.S., coverage costs $119.65 .

This policy includes $1 million in medical evacuation coverage and $50,000 in search and rescue coverage. You’re covered for up to $50,000 for medical expenses due to adventure or organized sports, though hazardous and extreme sports are limited to $5,000.

Consider these factors as you compare high-risk sports travel insurance coverage:

- Claims Process and Customer Support: Get the details on what happens if you need emergency assistance or want to file a claim. For example, find out how to get medical attention if injured in a remote area and whether you’re expected to pay upfront and file for reimbursement.

- Cost: Expect adventure travel insurance to cost more than standard travel insurance. Cheaper policies tend to offer less comprehensive coverage, so consider your needs as you balance cost and coverage.

- Duration: Some sports travel insurance policies limit the length of coverage for certain activities, so make sure you have coverage for your whole trip.

- Emergency Assistance and Evacuation: You may engage in high-risk activities in remote locations or challenging environments where medical attention is unavailable immediately. A travel insurance policy can offer emergency assistance or evacuation for medical care.

- Exclusions, Limitations, and Deductibles: Every policy has limits — even extreme policies. Find out what’s excluded, the limits of what you can claim, and if you’re expected to pay a deductible before getting reimbursed. Also, understand the terms and conditions, such as duration and geographical coverage.

- Medical Coverage: With a greater risk of injuries from extreme sports, you should ensure that the insurance policy has adequate coverage for medical emergencies, including hospitalization, ambulance services, and, if needed, medical evacuation.

- Requirements: You may need to meet age limits and disclose any preexisting medical conditions to get appropriate sports travel insurance coverage.

- Reviews: Consider customer reviews and ratings, which can give insight into a travel insurance provider’s coverage quality, customer service, and claims handling.

- Sports Coverage: Find out which sports and activities are covered so you can verify yours are covered.

- Sports Equipment Coverage: If you’re traveling with costly sports equipment such as scuba gear or snowboarding equipment, compare coverage for loss, theft, or damage to your equipment.

- Trip Cancellation and Interruption: A travel insurance policy should cover trip cancellation or interruption due to sports-related injuries.

Your high-risk sports travel insurance may require you to participate responsibly. For example, terms of coverage may require you to choose reputable operators, obtain proper training or certifications, follow local regulations, and use appropriate safety gear.

Not all travel insurance providers offer sports travel insurance, but you have options. Compare these leading travel insurance policies for sports:

- battleface : battleface’s adventure sports coverage includes cycling, mountain climbing, scuba diving, canoeing, snowboarding, and more, but it has limitations, including how deep you can dive or how high you can climb.

- Cat 70 : Cat 70’s Travel Plan covers some adventure sports, including snowboarding, but excludes bodily contact sports, skydiving, scuba diving, and more.

- HTH Worldwide : The HTH Worldwide Trip Protector Preferred plan offers coverage for adventure sports, including certified divers up to 60 feet and water rafting grades 1 to 3.

- IMG : IMG’s iTravelInsured Travel Sport plan has a wide range of covered activities, including adventure, extreme, hazardous, and organized sports. However, there are exclusions for races, endurance competitions, and piloting or learning to pilot.

- John Hancock : You’re covered for some — but not all — adventure sports with a John Hancock Gold travel insurance plan. Some exclusions include diving deeper than 100 feet, participating in sports competitions, or contact sports.

- Nationwide : With a Prime plan, you can get covered for adventure sports such as cycling, fishing, rafting, and zip lining, but exclusions apply, such as extreme sports, mountaineering, and organized sports.

- Travelex : The Travelex Adventure Sports upgrade covers professional athletic events, mountain climbing, skydiving, and more. Travelex’s Travel Basic and Travel Select plans provide basic coverage for some activities, including skiing, snorkeling, and scuba diving up to 60 feet.

- World Nomads : With the World Nomads Explorer plan, you can get covered for more than 200 activities, including scuba diving, bungee jumping, and mountain biking.

The right travel insurance coverage is essential when embarking on an adventurous trip with high-risk sports or activities. Adventure sports travel insurance can coordinate medical care, offer evacuation, and save you thousands if you’re injured on a trip. Whether bungee jumping or scuba diving, sports travel insurance can provide peace of mind while you’re chasing thrills.

Frequently Asked Questions

Are adventure sports covered by travel insurance.

Adventure sports can be covered by travel insurance, but extreme sports are usually excluded from standard travel insurance coverage. Review your policy’s terms and conditions to determine whether your desired activities are covered. If not, you may want to purchase additional coverage appropriate for the activities you’re planning for your travel.

Does travel insurance cover water sports?

Travel insurance coverage for water sports varies depending on the policy and provider. For example, your standard policy may cover snorkeling, shallow diving, and surfing but could exclude deep-sea diving or white water rafting.

Does travel insurance cover sports injuries?

Travel insurance often covers sports injuries, but it depends on the sport. If you’re injured doing a sport not covered by your policy — such as ziplining or skydiving — medical care for your sports injury will not be covered.

What travel insurance includes cover for sports equipment?

Sports travel insurance typically offers coverage for sports equipment, which can reimburse you for loss, theft, or damage of your sports equipment while traveling.

What travel insurance company covers me for extreme sports?

Several travel insurance companies cover extreme sports, including battleface, Cat 70, HTH Worldwide, IMG, John Hancock, Nationwide , Travelex, and World Nomads.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Out of Your Comfort Zone

The art of backpacking & adventures to get out of your comfort zone – tips and advice, 7 best travel insurance for extreme sports and adventure activities.

Ahhh, nothing better than traveling to practice a sport or take on an adventure activity . Seeing a new country and getting that adrenaline rush from at the same time is just the best!

But with sports and activities, there come risks. Which means this type of trip is one you need to be prepared for. So, an international travel insurance that covers adventure is essential .

It’s worth mentioning that travel insurance is also very important for normal trips. Which means that it’s practically obligatory on a trip where you’ll do adventurous activities or sports since they only make the trip riskier. So, having travel insurance is more than just important.

If you are just looking for a normal travel insurance, I recommend my article with the 3 Best and Cheapest International Travel Insurance in 2020 !

Why do I need special travel insurance for extreme sports and adventurous activities?

Not all insurance companies cover all types of activities.

In other words, if you buy a type of travel insurance that doesn’t cover snowboarding and you get hurt snowboarding, your insurance won’t help you.

Basic travel insurance plans cover basic activities (like “safe” sports, fishing , hiking, snorkeling, etc.). But if you plan to do more extreme sports or adventurous activities such as surfing, diving, skiing, snowboarding, etc…, there’s a good chance you’ll have to add on a supplement to your plan to make sure your specific activity is covered.

What do I mean by adventurous activities and extreme sports?

These are the types of sports and activities that normal types of travel insurance (or at least the basic plans) often don’t cover. This will vary from insurance company to insurance company.

For example, skydiving is an activity that will never be covered by a basic travel insurance plan. However, canyoning may be covered by some plans, but not by others.

When I talk about the 7 best companies below, you’ll see screenshots with what activities are considered adventurous activities or sports (and thus will know what type of plan will cover you).

By the way, if you like to play sports and stay in shape during your travels, check out my article with 9 Tips to Stay Fit During Your Travels .

How to choose the best international travel insurance for extreme sports and adventure activities?

To choose the right plan for you, you’ll need to consider a few factors. From the coverage amount to the activities and sports covered.

First, it’s important that you pay attention to the requirements for your destination (in Europe, for example, you need to have coverage of 30,000 US dollars at the minimum in the Schengen area ).

And remember that the cost-benefit may be more important than the simple price of travel insurance coverage . This is because a difference in value can reflect greater coverage (for more sports/activities) and benefits which make it worth more than a cheaper plan.

Besides this, make sure to read the insurance policies and pay attention to the conditions , exclusions, and service instructions. So you can avoid unpleasant surprises when an emergency strikes, and make sure that your sport/activity will be covered.

The 4 Best Travel Insurances for Extreme Sports and Adventure Activities

A sport/adventure travel insurance is much more specific than one for a leisurely trip and it can be very stressful to spend hours searching the ‘net to find the right insurance.

Plus, it’s much better to know that the insurance you buy won’t let you down.

With that in mind and to help you choose the best insurance for adventures and extreme activities, I made a list below comparing the 4 best travel insurances available.

At the end of the post, you’ll find a table comparing the activities and sports covered, as well as the coverage amounts from each insurance company.

TIP: As always I recommend you get a quick quote online on all the companies I list below. You will only lose a few minutes and you could end up saving a lot just with good research.

(5% discount coupon comfort5 )

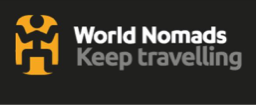

World Nomads is a respected and well-known company focused on adventure travel insurance and lots of sports! It’s even the insurance recommended by the largest travel guide in the world, Lonely Planet.

Their coverage is guaranteed and provided together with Bupa, AIG, and Nationwide insurers, depending on which country you are from. It includes emergency service in many languages 24/7.

There are two possible plans offered by World Nomads: Standard and Explorer.

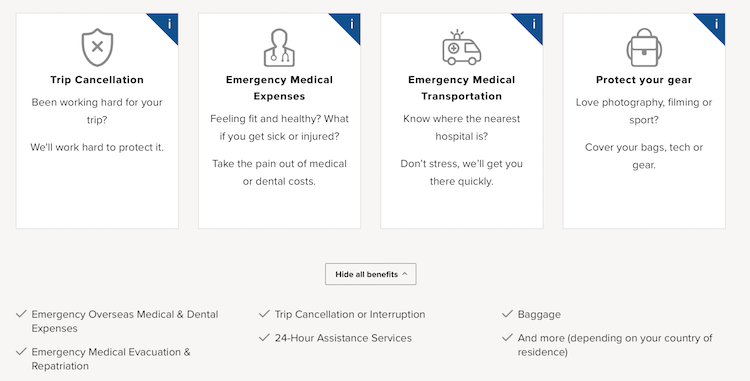

As you can see from the table, the coverage amounts vary greatly. But the same is not true of the price you pay. And both plans cover more than 150 activities!

There are, however, a few activities that are only covered by the Explorer plan (make sure you check for your specific sport/activity before you buy).

Since there are so many activities (even with just the Standard plan), it’s a great option for adventurous travelers who practice lots of types of sports and might need emergency medical coverage.

The price, when you consider all it covers, is really worth it. Just to help you have an idea, I got a hypothetical quote for two weeks in Switzerland, a destination known worldwide for its skiing :

You can get a quote and purchase directly from the World Nomads website.

One of its biggest attractions is the amount of coverage which can be greater than many other insurance providers depending on your country of residency. It usually goes from US$ 100,000.00 to unlimited!!

And considering the pricey costs of sports accidents, if you practice sports (that are included on the list above), World Nomads is a safe choice.

By clicking on this link here and using the coupon code comfort5 , you will get a 5% discount on your World Nomads travel insurance plan.

2) SafetyWing

SafetyWing is a new travel insurance that is really similar to WorldNomads and focuses on covering travelers who practice all kinds of sports.

They are partners of HCC (that I mentioned above) and they are underwritten at LLOYD’s. In other words, it’s a pretty trustworthy company.

Plus, like the other insurances mentioned above, SafetyWing covers people from all over the world!!

One great thing about them is that they have a precise list of all the sports and extreme activities they cover on their website.

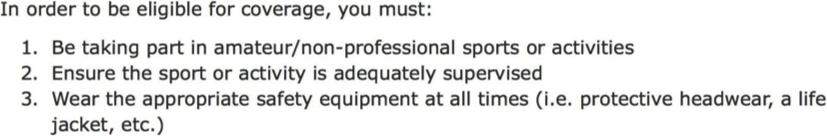

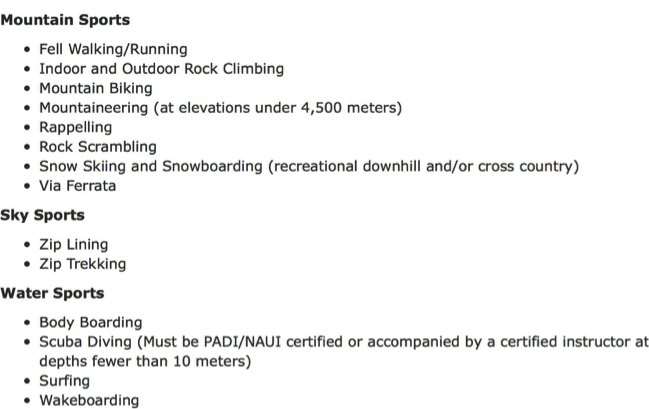

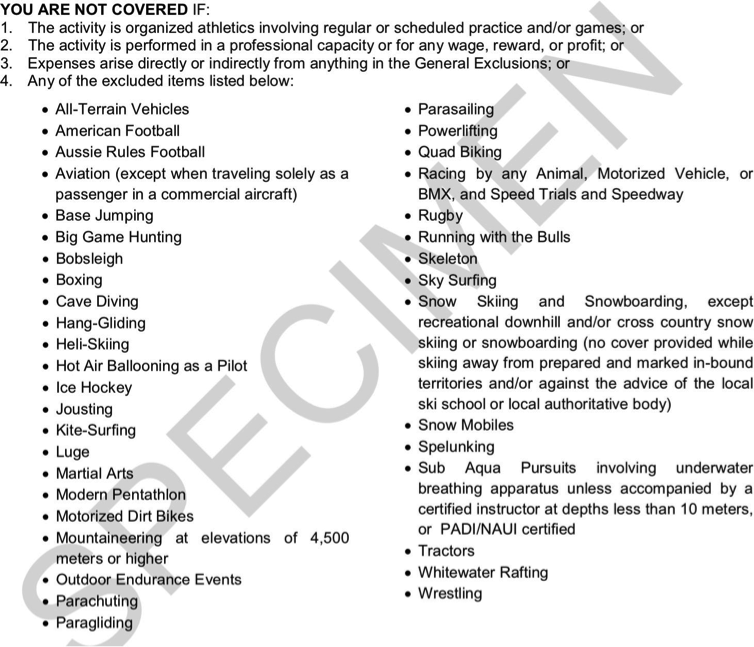

I will post this list here plus the sport activities they DON’T cover. It is important to highlight that this is a non-exhaustive list. And keep in mind that these activities are only covered if they are practiced recreationally. They are not covered for organized athletics* or professional sports:

List of Included sports covered by SafetyWing travel insurance

*You are not covered if the activity is organized athletics involving regular or scheduled practice and/or games, or the activity is performed in a professional capacity or for any wage, reward, or profit.

You must ensure the activity is adequately supervised and that appropriate safety equipment (such as protective headwear, life jackets etc.) are worn at all times.

Sports that are excluded from coverage by SafetyWing travel insurance

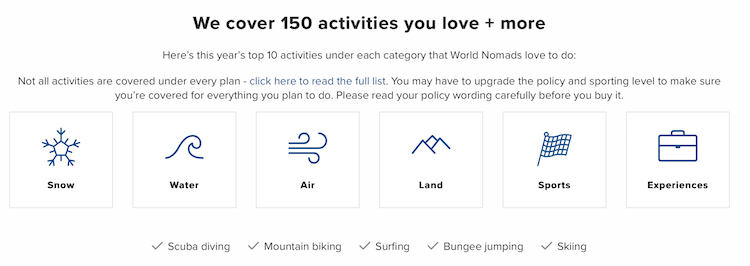

IMG Global is another well-known company that’s been around since 1990.

They offer several different plans, including insurance options for exchange students and insurance for expats (foreigners who live in other countries) .

The best international insurance for adventure travel from IMG Global is their Patriot Travel Medical Insurance, which you can get for trips as short as 5 days and as long as 12 months.

With this plan, the coverage limit can be up to 2 million USD. But for the specific coverage for adventure sports accidents, the limit decreases considerably.

Plus, the company still uses age to define coverage maximums:

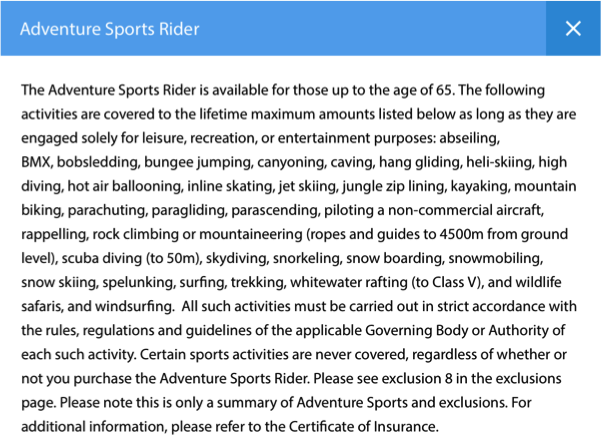

The coverage for sports is extra. So, you’ll need to choose the “Aventure Sports Rider” when getting a quote.

IMG Global’s “Adventure Sports Rider” includes 33 adventure sports and is only available for those under 65:

Still, the plan has potential since it covers activities that aren’t covered by World Nomads’ Standard Plan, like bungee jumping and skydiving (although these are covered in World Nomads’ Explorer Plan). So IMG can be a good alternative if you plan to do these activities during your trip.

Not to mention that the prices are a bit more attractive. Getting that same hypothetical quote, two weeks in Switzerland, with the coverage of adventure sports adds up to the following:

So, although it doesn’t cover as many activities overall and the coverage is less than World Nomads, it’s worth seeing if your sport/activity is on the list I gave above.

You can get a quote directly on their website. They also have multilingual customer service either by phone or live chat on their website.

HCC Medical Insurance is an American insurance company that was purchased in 2015 by Tokyo Marine, another well-known insurance company.

One of the most interesting differences in HCC is that it offers specialized travel insurance options with coverage ranging from leisure trips to missionary trips to exchange students.

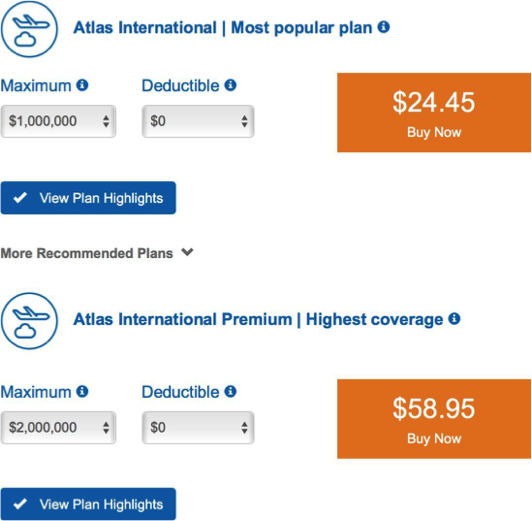

The insurance is offered in partnership with Atlas Travel, with a maximum coverage of up to 2 million USD.

The two plans HCC offers for travel insurance are Atlas International and Atlas International Premium .

The first plan has a maximum coverage of up to $1 million USD (and thus is cheaper), while the second has up to $2 million USD .

Between these two plans, there is no difference in the sports/activities covered.

The values are pretty good in that, if you consider the maximum coverage, this is the travel insurance option with the best cost-benefit among the 4 listed.

With the same hypothetical, here’s the cost of my two weeks in Switzerland with HCC:

Both plans include adventure activities without additional cost. The list of covered sports and activities are given by exclusion. In other words, all the adventure sports that are not expressly excluded in the insurance policy are covered .

For your activities to be covered by HCCMI, you must meet these standards.

And with the above precautions, the following activities are included:

These are the sport/activities which are NOT covered by the Atlas Travel plans:

All of the activities that are not on the list of excluded items are covered by the insurance.

One other useful difference is that, before you buy a plan, you can find a list of local HCCMI partners where you can be treated simply by presenting your insurance ID card. Meaning you can avoid the big headache of trying to get reimbursed by your insurance plan.

Table comparing the 4 best travel insurances for extreme sports and adventure activities

Now that you’ve seen the pros and cons for these 4 insurance companies, take a look at the comparative table to help you choose the right insurance for you:

It’s worth mentioning that all 4 insurance companies here are excellent and have a good reputation in their market. So you’re sure to be well-protected if you take out a plan with any of them.

Other options for searching travel insurance for extreme sports and adventures

If you’re still unsure which travel insurance is right for you, take a look at this list of online travel insurance search aggregators. All on this list are great-to-plan and insurance comparison tools.

When searching for the best insurance for you, do not forget to mention that you intend to carry out and physical activities during the trip, in this way, they will present them as the most suitable options for these cases.

- Travel Insurance

Travel Insurance is a travel insurance research aggregator website, that is, it works as an online comparison of different plans and companies.

This is one of the most practical ways to find the ideal travel insurance for you, as instead of going through countless websites and comparing them, you can simply add what you are looking for in an insurance policy. After that, the site will compare services, taking into account customer ratings and price range.

One of the main advantages of using Travel Insurance is that it is possible to find insurance for the most varied profiles. If you are looking to carry out radical and extreme activities during your trip, you are a digital nomad and travel the world working, you are an expatriate starting a new life in another country … There are countless possibilities.

VisitorsCoverage

VisitorsCoverage provides an extensive range of insurance policies, catering to various needs, including specialized coverage for students and business travelers.

A notable advantage of VisitorsCoverage is their exceptional customer service, which operates seven days a week. Additionally, they offer coverage to citizens from over 175 countries.

Their website allows users to apply filters to explore policy options specifically related to Covid-19. This feature proves particularly beneficial as insurance coverage for this condition can vary among different providers.

Here are the pros and cons of comparing travel insurance with VisitorsCoverage:

- Wide selection of plans available.

- Ability to apply specific filters, such as Covid-19 coverage, to streamline your search.

- Excellent customer service.

Currently, there are no identified cons associated with comparing travel insurance with VisitorsCoverage.

AARDY works similarly to Travel Insurance, it is a travel insurance aggregator and aims to help its customers choose the ideal insurance for their profile.

One of AARDY’s areas of focus is customer service, so they boast an exemplary TrustPilot score above any other travel insurer in the US.

Unlike most online insurance companies, this company bets on online self-service and on phone and email service with brokers, thus forming a hybrid system for customers to choose the way they like best.

Another feature of AARDY is the way your quotes are made, in addition to being fast, they also show the information that may interest you the most and compare in a very effective way the plans and companies most suitable for your profile.

Interesting information is that this institution converts 10% of its annual earnings into donations to institutions that help children of soldiers killed in action who need financial help.

- InsureMyTrip

Another great insurance aggregator option that can facilitate your choice and taking out insurance is InsureMyTrip.

By entering this company’s portal, it is super easy to make budgets and comparisons between the best companies and plans for your trip.

One of the biggest advantages of using InsureMyTrip is that this portal has a super strict classification rule. If an insurer receives a bad rating, it will be automatically excluded from the site to avoid complications with future customers.

One of the disadvantages of InsureMyTrip is that they do not provide insurance for expatriates and international students. If that’s the case for you, check out my article 5 Best & Cheapest Health Insurances for International Students & Studying Abroad or 7 Cheapest International Health Insurance Plans for Immigrants & Expats . I’m sure it will be useful!

Conclusion…

Even after this very complete list comparing the four adventure insurances, it’s still important to take some time to read the policies for each of them.

This is because choosing the right travel insurance is highly subjective. Especially if you’re practicing a specific sport or activity (and need to make sure it’s covered by your policy).

The important thing is that you make sure to get travel insurance. Like I said, if travel insurance is important for normal travel, it’s essential for adventure travel.

Your trip will definitely be better if you can travel with peace of mind, knowing that if something happens, you’ll have the help of a reliable insurance company.

And remember, after purchasing your policy, don’t forget to print it out or save it to your phone, as well as the 24-hour “help” phone number.

Planning your next trip?

Already reserved your hotel or hostel? If not, our article with The 6 Best and Cheapest Websites to Find & Reserve Accommodation can help you out. You’ll also find some promotions and discount codes .

Still haven’t booked your plane ticket and want to save big? Take a look at our page with 16 Tips to Save on Flights where you’ll also find the 4 best websites to buy your plane tickets.

And finally, will you need to rent a car during your trip? Then surely our page with The 5 Best and Cheapest Websites to Compare and Rent Cars Around the World will help you choose the best rental car and find a good deal.

Next stop….The DMZ, South Korea

- Help and Support

- Travel Insurance

Adventurous Sports Insurance

Throwing yourself onto a bike or into the sea be sure you're covered., do i need adventurous sports insurance.

There's a degree of risk to most sports, but particularly the adventurous ones.

Having the right cover in place before you go on holiday means you can try exciting and adventurous sports without worrying about what might happen if something goes wrong.

Admiral Travel Insurance covers a wide range of sports, but let’s take a look at which ones you’re covered for as standard and which you’ll need to pay a bit extra for.

Covid-19 - what our travel insurance covers

Our travel insurance now covers you for certain events related to Coronavirus (COVID-19), provided you have proof of a positive Covid-19 test and your cover is active at the time of the event.

What we cover

We provide cover for some costs related to Covid-19: please see Section 1 'emergency medical costs and repatriation' and Section 2 'cancelling or cutting short your trip' in your policy book for full details on what's covered.

We'll cover you if:

- you were diagnosed with Covid-19 before your trip was due to start

- a close relative died or became seriously ill as a result of Covid-19 before your trip was due to start

- you weren't allowed to board your pre-booked outbound travel due to symptoms of Covid-19

- an insured person or a close relative died during the trip because of Covid-19

- you couldn't take part in an excursion due to you self-isolating after getting Covid-19

What we don’t cover

You won't be covered if:

- you had reason to believe your trip may be cancelled, postponed or cut short when you booked it, purchased your policy or started your trip

- any government or public authority imposes travel restrictions or quarantine on a community, location, or vessel because of Covid-19 (this includes, but is not limited to, local lockdowns, entry requirements, being denied entry and airspace closures)

- you have to quarantine after arriving in the UK or abroad

- the Foreign Commonwealth & Development Office (FCDO) change their advice to avoid ‘all travel’ or ‘all but essential travel’ to your destination because of Covid-19

For more information about how Coronavirus (COVID-19) affects your travel cover, see our FAQ page . And remember to check the policy booklet carefully before you buy to make sure our cover meets your needs.

What's covered under standard travel insurance?

Many of the sports you might want to do on holiday are covered by our standard holiday insurance.

These activities don’t require an extra payment on top of your standard travel insurance – and you’ll be covered for personal accident and legal liability too:

Banana boating

Body/boogie boarding

Canoeing (up to grade two rivers)

Fishing Kayaking (up to grade two rivers)

Parasailing (over water)

River tubing

Sailboarding

Scuba diving up to 30m*

Sea kayaking

Snorkelling

Wake boarding

Windsurfing

Yachting (inside territorial waters)

Water skiing

White/black water rafting (up to grade four rivers)

*For unqualified scuba divers, the diving depth is limited to 30m. (See policy wording for more conditions around scuba diving cover).

Raquet ball

Table tennis

Tennis Volleyball

Beach games

Cycling (except for racing, BMX, mountain biking, and cycling on extreme terrain)

Fell walking

Hiking (up to 4,000m altitude)

Hot air ballooning

Ice skating

Orienteering

Paintballing

Pony trekking

Safari (guided)

Rollerblading/inline skating

Sand boarding

Skateboarding

Trekking (up to 4,000m altitude)

Paddle boarding

Jogging/Running (excluding marathons)

Pony trekking (any equine 58 inches or less at the wither)

Extreme sports travel insurance: how to get covered for hazardous activities

If you couldn’t see your chosen activity on the list above, don't panic. Adrenaline junkies out there can still try that once-in-a-lifetime bucket list activity – you’ll just need to pay a little extra to be covered.

When buying travel insurance through Admiral, you’ll get the option to add extra cover for a specific hazardous activity. Just select the sport or activity you’ll be taking part in and pay the extra cost to get cover.

Bear in mind all hazardous sports and activities on our list exclude cover for personal accident and legal liability:

Assault course

Bungee jumping (maximum three jumps)

Canoeing (rivers over grade 2)

Canyon swinging

Coasteering

Gorge walking

Horse riding

Kayaking (rivers over grade two)

Kite surfing (over land)

Sand yachting

Scuba diving to depths between 30m and 50m (requires qualification)

Sea canoeing

Shark diving

White/black water rafting (rivers over grade four)

Yachting (outside territorial waters)

Trekking (up to 4500m altitude)

Hiking (up to 4500m altitude)

Motorcycling over 125cc (Europe only)

Sky diving (max 3 jumps)

Paragliding

If you'd like to be insured for a sport that’s not listed, contact our team to find out if we can arrange cover for you.

What level of cover do I need?

Now you know what activities are covered as standard and which require an extra payment, you need to choose the right cover for your trip. We break travel down into three zones:

- Worldwide excluding USA, Canada, Caribbean and Mexico

See the full list of benefits in the policy summary booklet .

Winter sports insurance: make sure you're covered

If you're taking to the slopes to go skiing or snowboarding, you'll need to add our winter sports insurance to your standard cover.

As well as covering you in case of accidents or injury on the slopes, winter sports insurance means you'll get compensation if your equipment is lost, stolen or damaged. It also covers you if your trip is affected by severe weather, like avalanches.

Without the upgrade, your trip won't be covered at all but adding it means you'll get all the standard protection included in our single trip and annual policies as well as cover for the sport you'll be taking part in.

Limitations and exclusions

As is always the case with insurance, there are certain limitations and exceptions that could invalidate your cover.

For Admiral's winter sports insurance, we don’t cover travellers over 75 years old for trips within Europe and over 70 years old for trips outside of Europe.

Reckless behaviour

You won't be covered if you're injured as a result of your own reckless behaviour. This includes:

- Deliberately injuring yourself

- Being under the influence of drugs, solvents or excessive amounts of alcohol

- Not following the safety precautions while taking part in an activity

For a full list of exceptions, see the General Exclusions section in our policy documents .

What if I have a pre-existing condition?

A pre-existing condition is a short or long term illness or injury you have or have had before you buy travel insurance. This includes having symptoms, tests, diagnosis or medical treatment for a condition.

You can declare your pre-existing conditions during the quote process to see if we can offer cover. If you’re unsure what needs to be declared or if you're unable to find your condition on the medical conditions list, please contact us on 0333 234 9913 .

Your pre-existing conditions won’t be covered unless you’ve:

- Declared them all on your policy

- Received written confirmation that we’ll cover your medical condition

- Paid any additional premium in full

Policy terms and conditions apply. Please note, if you’ve had a positive diagnosis of Covid-19 and been prescribed medication, received treatment, or had a consultation with a doctor or hospital specialist for any medical condition in the past two years, this needs to be declared on your policy.

If you don’t tell us about your pre-existing conditions or give us incorrect information, your policy may be invalid, and we may refuse all or part of any claim you submit.

For a quote with us, click the green button above.

The MoneyHelper directory

If you require cover for more serious medical conditions, MoneyHelper may be able to help you find specialist travel insurance through their medical directory.

If you wish to get in touch with them you can call them on 0800 138 7777 or find them online . (Monday to Friday 8:00-18:00, closed on Saturday, Sunday and bank holidays.)

Getting the most out of your trip

Going anywhere nice.

Off to one of the destinations below? Take a look at our guides for some hints and tips on what you need to remember.

Travel insurance that suits you

Whether you're travelling solo, with your family, or with a little one on the way, read our guides to make sure our cover is right for you.

Family Travel Insurance

Student travel insurance, travelling while pregnant, travel insurance over 65, travelling with medical conditions, travel insurance upgrades.

Whether you want the adrenaline rush of a skiing holiday, or fancy taking to the seas on a cruise, you'll need to add extra cover to your policy.

Cruise Travel Insurance

Ski travel insurance, gadget travel insurance, single trip insurance, annual trip insurance.

2024’s Best Travel Insurance for Adventure and Extreme Sports

- Updated on: March 12, 2021

This article may contain affiliate. For more information, please see our disclaimer here.

Table of Contents

Adventure travel insurance is one of the most important things, if not the single most important thing, you can take with you on your trip. Accidents happen when you least expect them, and the last thing you want to do is be stranded in a foreign country with thousands of dollars in medical bills and expenses.

Travel insurance becomes even more important if you plan on doing any extreme sports or activities, like skiing, boating, or even bungee jumping. We love thrilling sports and adventures but we also know that doing those fun things don’t come without risk.

That’s why we never travel without adventure sports travel insurance. It doesn’t just protect us against travel mishaps and medical emergencies, but it also gives us peace of mind so we can enjoy our trip (and all the fun, exciting activities we do) without worry!

Our experience with travel insurance

Only on the third day of our trip around the world, Kelly got really sick. We were in Romania when she suddenly had a lot of pain in her belly. Not only did we have to visit the hospital, but she also had to have emergency surgery to remove a cyst the size of a tennis ball that started to leak. Without adventure travel insurance, we would have to pay all those bills out of our own pocket and our world trip would be over within a shorter timeframe than our average holiday. But luckily, we were insured well, so we didn’t even see a single bill. And as soon as she was recovered, we could continue our travels without spending a dime on hospital or medical costs.

Sure, the chances that something major like this happens on your trip are pretty slim. But we can tell you from experience that these things are always a possibility. No matter how cautious, experienced, or well-traveled you might be – you simply can’t predict the future! Accidents can happen anytime and to anyone.

Adventure Travel Insurance vs. Regular Travel Insurance

Not all travel insurance is made equal! While most travel insurance providers have coverage for medical emergencies and trip protection, very few of them offer protection for adventurous activities. That’s why it’s important to know the difference between regular travel insurance, and adventure travel insurance.

Regular travel insurance should usually cover the following:

- Emergency medical and dental

- Emergency evacuation to the nearest hospital

- Trip delay, interruption, or cancellation due to an unforeseen circumstance

- Lost, stolen, or damaged luggage and personal property

However, adventure travel insurance is a little different. While it also should cover the situations described above, it should also provide coverage for extreme sports and activities . So in the rare instance that you get injured, let’s say while hiking, then you’ll be reimbursed for any medical bills related to your incident.

On the other hand, regular travel insurance will only cover low-risk activities, like sightseeing. While this is generally fine for most people, more adventurous travelers will need more robust coverage to protect them in a variety of outdoor situations.

World Nomads Insurance

World Nomads is one of the biggest names in the adventure travel insurance industry. A lot of avid travelers, sports enthusiasts, and digital nomads use them for their international trips since they cover medical emergencies, trip cancellations and interruptions, and of course, extreme sports.

In fact, there are over 200 activities that are covered with a World Nomads travel insurance policy.

Their most affordable plan (the Standard Plan) includes protection for numerous activities like skiing, kayaking, surfing, quad biking, and ziplining. However, more extreme activities, like shark cage diving, cliff jumping, or sky diving are not included with this plan. If you are spending your trip doing more adventurous sports, then we recommend upgrading to the Explorer Plan.

Check here our in depth review of World Nomads

The Explorer Plan includes coverage for all the sports listed for the Standard Plan plus way more. You can see a full list of what is covered under each plan on their website .

SafetyWing Nomad Insurance

SafetyWing may be one of the newest insurance providers for travelers, but they’re quickly becoming one of the most popular. Their Nomad Insurance plan is targeted specifically at digital nomads, arming them with protection against medical emergencies and a variety of outdoor activities.

And don’t worry if you’re not a “digital nomad” per se. All travelers spending time abroad are able to apply for a SafteyWing travel insurance policy!

While SafetyWing provides decent coverage for medical emergencies and evacuation, they also protect you when participating in extreme sports and activities. Practically all recreational sports and activities are backed by your SafetyWing policy, from bungee jumping and hiking to kayaking and surfing.

Check here our in depth review of SafetyWing

Keep in mind there are about 40 activities that aren’t covered (like running with the bulls, whitewater rafting, and boxing). You can see the full list here .

Safety Wing vs. World Nomads

Which is better safetywing or world nomads.

It’s hard to say point-blank which adventure sports travel insurance provider is better. Choosing between SafetyWing and World Nomads will depend on numerous factors, like where you’re going, what type of sports you plan on doing, and how much coverage you want to have.

World Nomads may be the pricier option, although they do provide more coverage for things like trip cancellation and lost or damaged property. While SafetyWing includes coverage for trip interruption and lost airline checked luggage, they don’t offer any reimbursement if you have to cancel your trip before you leave or if you lose valuables once you’re at your destination.

On the other hand, SafetyWing does offer a higher maximum amount of coverage for medical emergencies ($250,000 vs. World Nomad’s $100,000). This can be a huge deal if you end up spending a lot of time in the hospital or require major surgery.

When it comes to sports coverage, you’ll need to look specifically at each provider to see if your exact activity is covered. Some activities may be covered with SafetyWing and not World Nomads and vice versa.

But at the end of the day, both SafetyWing and World Nomads are excellent options for digital nomads, world travelers, and adventure enthusiasts.

Pin for later

Save this post in your Pinterest ‘ Travel Tips Board ” to find back this article easily when you need an insurance for your next trip.

We love to hear from you

Thanks a lot for checking out this comparison guide between the two most popular adventure travel insurances: SafetyWing and World Nomads. If you have any questions, concerns or if you think this guide was just really helpful, please leave us a comment below!

Don’t forget out to check out more of our travel tips and the reviews of SafetyWing and World Nomads for more information on any of these adventure travel insurances.

All travel tips posts

2 thoughts on “2024’s Best Travel Insurance for Adventure and Extreme Sports”

Which travel insurance did u have that covered you while in Romania…Safteywing or World Nomads?

Hi John, good question! This was the SafetyWing insurance. They helped us out very well and checked in every day to see how I was doing.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Related Posts

Iceland Packing List: What to Pack in Winter and Summer?

How To Install An Off-Grid Solar System In Your Car Successfully?

30 Best Single & Multi-Day Hikes in Europe

2024’s Ultimate Backpacking Checklist for Multi-Day Hikes

Also interesting, best daypacks for women, best travel insurance, destinations, travel tips.

Adventure Travel Hub

Travel Resources for Adventurers

Home » Travel Insurance » Buying Tips » Adventure Travel Insurance for Extreme Sports

Adventure Travel Insurance for Extreme Sports: Staying Protected

Written by Antonio Cala.

Adventure travel is an exciting way to explore the world and push your limits. But with adventure comes risk, and it’s important to make sure you’re protected in case of an accident or emergency. That’s where adventure travel insurance comes in. This type of insurance is specifically designed to cover the unique risks associated with extreme sports and adventure activities.

Understanding adventure travel insurance can be overwhelming, but it’s important to take the time to research and choose the right policy for your needs. There are a variety of factors to consider, such as the type of activities you’ll be participating in, the level of coverage you need, and the cost of the policy. By taking the time to understand your options and choose the right policy, you can have peace of mind knowing that you’re protected in case of an accident or emergency.

Key Takeaways

- Adventure travel insurance is designed to cover the unique risks associated with extreme sports and adventure activities.

- It’s important to take the time to research and choose the right policy for your needs, considering factors such as the type of activities you’ll be participating in, the level of coverage you need, and the cost of the policy.

- By choosing the right adventure travel insurance policy, you can have peace of mind knowing that you’re protected in case of an accident or emergency.

Looking for Adventure Travel Insurance?

Check out our master guide specifically designed for adventure travelers

Table of Contents

Understanding adventure travel insurance.

When it comes to extreme sports, it is important to have the right insurance coverage to protect yourself in case of an accident or injury. This is where adventure travel insurance comes in. It is specifically designed to cover the risks associated with extreme sports and other adventurous activities.

Defining Extreme Sports Coverage

Adventure travel insurance provides coverage for a wide range of extreme sports, including but not limited to:

- Bungee jumping

- Snowboarding

- Scuba diving

- Mountain climbing

It is important to note that not all travel insurance policies provide coverage for extreme sports. Therefore, it is crucial to check the policy details carefully before purchasing.

Key Benefits and Features

Adventure travel insurance provides a range of benefits and features that are specifically designed to protect extreme sports enthusiasts. Some of the key benefits and features include:

- Emergency medical coverage: This covers the cost of medical treatment in case of an accident or injury while participating in an extreme sport.

- Trip cancellation coverage: This covers the cost of canceling a trip due to an unforeseen event, such as an injury or illness.

- Equipment coverage: This covers the cost of replacing or repairing equipment that is lost, stolen, or damaged while participating in an extreme sport.

- Emergency evacuation coverage: This covers the cost of emergency evacuation in case of an accident or injury while participating in an extreme sport.

In conclusion, adventure travel insurance is an essential part of staying protected while participating in extreme sports. It provides coverage for a wide range of activities and offers a range of benefits and features that are specifically designed to protect extreme sports enthusiasts.

Choosing the Right Policy

When it comes to choosing the right adventure travel insurance policy for extreme sports, there are several factors to consider. Here are some important things to keep in mind:

Comparing Providers

Before purchasing a policy, it’s important to compare providers to ensure that you’re getting the best coverage for your needs. Look for providers that specialize in adventure travel insurance and have experience covering extreme sports. Additionally, check the provider’s financial stability and ratings from independent rating agencies to ensure that they will be able to pay out claims if necessary.

Policy Exclusions to Watch Out For

When reviewing adventure travel insurance policies, be sure to carefully read the policy exclusions . Some policies may exclude coverage for certain activities or sports, such as skydiving or rock climbing. Additionally, some policies may have exclusions for pre-existing medical conditions or injuries sustained while under the influence of drugs or alcohol. Make sure you understand what is and isn’t covered before purchasing a policy.

Evaluating Premiums and Deductibles

When evaluating adventure travel insurance policies, it’s important to consider the premiums and deductibles. Premiums will vary based on factors such as the type of activity you’ll be participating in, the length of your trip, and your age and health. Deductibles will also vary, and you’ll want to choose a deductible that you can afford in the event of a claim. Be sure to compare premiums and deductibles across different policies to find the best balance of coverage and affordability.

By keeping these factors in mind, you can choose an adventure travel insurance policy that will provide the coverage you need to stay protected while participating in extreme sports.

Claims and Assistance

Filing a claim.

In the event of an accident or injury, the policyholder must file a claim with their adventure travel insurance provider. This process typically involves submitting a claim form, along with any necessary documentation such as medical bills or police reports. It is important to carefully review the policy’s terms and conditions to ensure that all necessary information is included in the claim.

Some adventure travel insurance policies may require the policyholder to notify the insurance provider within a certain timeframe after the incident occurs. Failure to do so may result in the claim being denied. It is also important to keep all receipts and documentation related to the incident, as these may be required when filing the claim.

Emergency Assistance Services

Many adventure travel insurance policies include emergency assistance services, which can provide invaluable support in the event of an emergency. These services may include 24-hour access to medical professionals, emergency medical evacuation , and assistance with travel arrangements.

When purchasing an adventure travel insurance policy , it is important to carefully review the emergency assistance services provided. Some policies may only offer limited coverage, while others may provide comprehensive support in the event of an emergency.

In the event of an emergency, it is important to contact the insurance provider’s emergency assistance services as soon as possible. These services can provide guidance and support, and may be able to help arrange medical treatment or emergency transportation. It is important to keep the emergency assistance services contact information readily available, in case of an emergency.

Frequently Asked Questions

What’s the best travel insurance for adventure seekers from the u.s..

The best travel insurance for adventure seekers from the U.S. depends on the specific type of adventure activity they plan to engage in. Some insurance companies like World Nomads, IMG Global, and Allianz offer comprehensive coverage for a wide range of adventure sports. It’s essential to read the fine print and ensure that the policy covers the specific activity.

How much does insurance typically cost for high-risk adventure sports?

The cost of insurance for high-risk adventure sports varies depending on the type of activity, the level of risk involved, and the duration of the trip. Generally, adventure sports travel insurance is more expensive than standard travel insurance. It’s recommended to get quotes from multiple insurance providers to compare prices and coverage.

Which extreme sports are usually covered by travel insurance policies?

Most travel insurance policies cover a range of adventure sports, including but not limited to rock climbing, bungee jumping, skiing , snowboarding, surfing, mountain biking , and more. However, it’s essential to read the policy’s fine print and ensure that the specific activity is covered.

Can you get adventure sports coverage with Travel Guard’s packages?

Yes, Travel Guard offers adventure sports coverage as an add-on to their standard travel insurance packages. The coverage includes a range of adventure sports, including but not limited to skiing, snowboarding, bungee jumping, and more.

Are there any adventure activities that travel insurance won’t cover?

Yes, some adventure activities may not be covered by travel insurance policies due to their high-risk nature. Examples include base jumping, wingsuit flying, and other extreme activities that pose a significant risk of injury or death. It’s essential to read the policy’s fine print and ensure that the specific activity is covered.

Does a typical life insurance policy include extreme sports accidents?

No, a typical life insurance policy does not include coverage for extreme sports accidents. However, some insurance companies offer accidental death and dismemberment (AD&D) policies that cover accidents resulting in death or serious injury. It’s essential to read the policy’s fine print and ensure that the specific activity is covered.

About the Author

Antonio was born and raised in Southern Spain, and quit his job in 2013 to travel the world full-time with his wife Amanda for 10 years straight. Their passion for adventure took them to visit 150+ countries.

They cycled 25,000km + from California to Patagonia, sailed over 10,000NM around the Caribbean & Sea of Cortez, rode their motorbikes 30,000 kms+ across West Africa (Spain to South Africa) and visited Antarctica, among many other adventure expeditions. Today, they’re still traveling, currently around the USA with an RV.

Traveling to so many places, remote destinations and by different means taught them a lot about travel insurance, which policies to hold depending on the area and the type of adventure they were doing. Antonio now publishes regular content to help other travelers choose the best travel insurance for adventure trips.

Together, they also run the travel community Summit , the RV site Hitched Up , the boutique accommodation blog Unique Places and the popular newsletter Adventure Fix , where they share their knowledge about the places they’ve visited and the ones still remaining on their list.

Antonio Cala

Co-Founder of Adventure Fix

Privacy Overview

Adventure Travel Insurance Plans

- Trip Cancellation and Interruption for adventure travel

- Coverage for 450+ sports and activities.

- For high-altitude climbing (4,000' and above), guide services must be vetted and approved by Trawick International.

- Includes sports equipment rental, search and rescue, and non-medical evacuation

- Emergency Medical

- 10 Day Free Look Period

- Valid for US Residents traveling within the U.S and/or internationally

- Plan is available for purchase 15 months in advance of departure

- Available for travelers up to age 65 at the time of purchase

- Plan rates are per person, based on trip costs, number of days and age of traveler at the time of purchase

- Coverage for a maximum of 90 days

Privacy Policy

Trawick International’s Privacy Policy

Welcome to our website. We appreciate your interest in us. We take the privacy of our customers very seriously and are committed to protecting your privacy. This policy explains how we collect, use, and transfer your personal data, and your rights in relation to the personal data stored by us when you use our website or otherwise engage with our services.

Effective October 3, 2023

This policy sets out the following:

- What personal data we collect about you and how;

- How the data is used;

- Our legal basis for collecting your information;

- Who we share your data with;

- Where we transfer your information;

- How long we retain your information for;

- Your rights and choices in relation to the data held by us;

- How to make a complaint in relation to the data held by us;

- How to contact us with any queries in relation to this notice, or the personal data held by us.

Who is Trawick International?

Trawick International (“we,” “us,” or “our”) provides worldwide travel medical insurance, travel insurance, trip insurance for trip cancellation or trip interruption, international student insurance, group travel insurance, and many other products designed specifically for those traveling. Our travel insurance programs are designed for those traveling to the USA, individuals traveling abroad, US Citizens who are traveling in the USA and non US citizens traveling from their home country but not visiting the USA. We offer an extensive worldwide network of quality physicians, hospitals, and pharmacies. We cover employees, corporations, schools, frequent world travelers, international students, study abroad programs, missionary trips, and just the casual vacation traveler. Our individually customized plans can cover hospital stays, doctor visits, x-rays, prescriptions, ambulance, emergency evacuation, repatriation, flight insurance, trip interruption, trip cancellation, trip delay, and lost baggage.

For the purposes of European data protection laws, if you are visiting our website www.trawickinternational.com (or otherwise engaging with our services from the European Economic Area (or "EEA"), the data controller of your information is Trawick International.

What is personal data?

In this privacy policy, references to "personal information" or "personal data" are references to information that relates to an identified or identifiable individual. Some examples of personal data are your name, address, email, and telephone number, but it may also include information such as your IP address and location in certain jurisdictions.

What personal data do we collect?

We collect personal data that you provide to us when you sign up for our services, such as your contact information and financial information. We may also collect commercial information based on how you interact with our services, such as the products or services you’ve purchased or other Internet or network activity, such as your website browsing history or mobile device information.

Below are some more details on the type of personal data we collect.

Information that is provided by you:

In order to provide services to you we may ask you to provide personal information. This may include, amongst other things, your name, email address, postal address, telephone number, gender, date of birth, passport number, bank account details, credit history and claims history, citizenship status, marital status depending on the service you are seeking. The personal information that you are asked to provide, and the reasons why you are asked to provide it, will be made clear to you at the point at which we ask you for it or upon request.