Tesco Bank Travel Money Review: Is It Safe? How Does It Work? What Are the Rates?

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Is Tesco Travel Money the best option for sending money abroad? Compare your options to make sure you get the best exchange rate and lowest fees for your transfer.

What Monito Likes About Tesco Travel Money

- Wide availability across the U.K.

- A range of currency exchange services

- Tesco Bank Travel Money services are safe, secure and regulated

What Monito Dislikes About Tesco Travel Money

- Exchange rates can be considerably more expensive than the base exchange rate or exchange rates from other providers

- Local bureau de change rates can be more expensive still and you can only get these rates by visiting a Tesco bureau de change

Compare Tesco To Cheaper Travel Money Cards Now

Read our in-depth guide for the best travel cards in the UK, such as Revolut , that can reduce or eliminate foreign transaction fees, ATM fees, and expensive currency conversion fees.

Our Independent Review of Tesco Bank Travel Money

Tesco Bank Travel Money is a currency exchange provider that offers foreign currency services. As part of the largest supermarket chain in the U.K., Tesco Bank is very widely available with over 360 in-store money exchange locations and pre-order money collection from over 550 Tesco stores. They have minimum order amounts of £50 and maximum order amounts of £2,500. You can exchange money for more than 120 currencies.

Tesco travel money is provided through a partnership with Travelex .

Tesco Bank Click and Collect for Foreign Currency

You can choose to order foreign currency online through your Tesco bank account. You can then have the money delivered directly to your home address or to a Tesco store. If you order euros or U.S. dollars before 2 PM, you can pick them up the next day from most Tesco Travel Money locations. Other currencies can take up to five days. You can also order any currency for the next weekday delivery to most Tesco customer service desks.

You can choose a collection date for picking up your money and you’ll need to bring a valid photo ID—either a passport, or a full UK photographic driving license. You’ll also need to bring the card that you used to place the order.

Tesco Bank Currency Exchange at Local Bureaux de Change

Tesco Bank also provides immediate money exchange at 360 in-store locations across the U.K. Many of these locations are open seven days a week with same-day collections on many popular currencies.

Tesco Bank Home Delivery for Travel Money

If you order foreign currency before 2 PM from Monday to Thursday, you can get next day home delivery to most homes in the U.K. Orders of £500 or more and there’s a £3.95 delivery charge for orders under that amount. You will need to have someone available to sign for the delivery.

Tesco Bank Prepaid Currency Card

Tesco Bank offers a “Cash Passport” travel card. You can load up to seven currencies on the card including euros, U.S. dollars, U.K. pounds, South African rands, Australian dollars, Canadian dollars and New Zealand dollars. Tesco Bank does not charge a commission on foreign purchases, although there is a 2% fee if you use the card in the U.K. The travel money card is only available at a Tesco Bank location.

Tesco Bank International Money Transfer

Tesco Bank allows you to send money to an international account so you can make a payment or deposit money with family or friends. Tesco Bank has a partnership with MoneyGram . This means you can send money to over 200 countries around the world. MoneyGram can’t be used for business transactions.

You can send money through the MoneyGram app or by paying with a debit card or cash at a Tesco Bank location. Beneficiaries can get money deposited into their bank account, transferred to a mobile wallet or they can pick it up in cash at a MoneyGram agent location. Money transfers can take anything from a few minutes to a couple of working days.

You can also collect 50 Tesco Clubcard points every time you send £50 or more.

No Card Fees Charged by Tesco Bank

Whether you buy online or in-store, Tesco Bank does not charge any card processing fees, although you may be charged by your card provider.

Tesco Bank Price Guarantee

Tesco Bank provides a price match guarantee on local bureau de change orders. This does not apply to online orders. Here’s what Tesco Bank says about its price guarantee:

“If you find a better exchange rate advertised by another provider within three miles of your chosen Tesco Travel Money Bureau, on the same day, we'll match it.

Price Match only applies in store on a like-for-like basis on sell transactions and does not apply to any exchange rate advertised online or by phone. This is not available in conjunction with any other offer. We reserve the right to verify the rate you have found and the three-mile distance (using an appropriate route planning tool).”

Tesco Travel Money Fees & Exchange Rates

In most cases, Tesco Bank makes its money on the difference between the “base,” interbank* exchange rate and the exchange rate that they charge to you. However, some services such as international money transfers do incur additional fees.

*The interbank rate is also known as the mid-market or standard exchange rate, which is the midpoint between the buying and the selling prices of the two currencies.

Click and Collect Fees

There is no additional fee for Click and Collect orders, although if you cancel a Click and Collect order less than 24 hours before your collection date you will be charged a £10 late cancellation fee.

Tesco Bank Travel Money Money Card Fees

- Tesco Bank does not charge a commission on foreign purchases, although there is a 2% fee if you use the card in the U.K.

- There is a fee for ATM withdrawals as follows: GB £1.50, EU €1.75, US $2.30, AU $2.30, CA $2.40, NZ $3.00, ZA R20. Some cash machine operators charge an extra fee

- There may be other fees associated with the travel money card, you can get details of these fees from a Tesco Bank location

Tesco Bank Travel Money Money Card Limits

Tesco Bank locations will have details on any limits applicable to your travel money card.

Overseas Money Transfer Fees

Tesco Bank has a partnership with MoneyGram and they do charge a fee for sending money directly to some countries. Typically, the fee charged by MoneyGram is £3.99.

About Fees Levied by Banks

Certain fees may be levied by banks when you are transferring money to another account. These fees are outside the control of Tesco Bank Travel Money. Circumstances, where banks may charge additional fees, include:

- Wire transfers into or out of sender or beneficiary accounts

- Transfers that are sent via SWIFT or certain other banking protocols

- Beneficiary banks charge a fee to receive a transfer

- Intermediary banks charge fees to process money in transit

These fees could mean that the beneficiary receives less money than stated by Tesco Bank Travel Money due to circumstances beyond Tesco Bank Travel Money’s control. If you want to understand what these extra fees are likely to be, please contact your bank and the beneficiary's bank.

Tesco Bank Travel Money Exchange Rates for Online Travel Money

Tesco does offer better exchange rates the more you order. You can start to access these better exchange rates when you buy £800 or more of foreign currency.

Tesco Bank Travel Money makes most of its money on the difference between the exchange rate they offer to customers and the base exchange rate. For example, the base rate to convert U.K pounds into euros is 1.146 euros per pound. Tesco Bank Travel Money offers an exchange rate of 1.125 euros per pound, a difference of 2%. That means if you’re exchanging 1,000 pounds into euros, you’ll pay an exchange rate fee of around £20.

Here are some other examples:

Exchanging 1,000 U.K. Pounds Into Australian Dollars

- Base exchange rate, 1,000 GBP converts to 1,862 AUD

- Tesco Bank Travel Money online exchange rate, 1,000 GBP converts to 1,819 AUD

- The Tesco Bank Travel Money exchange rate is 2.3% more expensive, or around 23 GBP in exchange rate fees

Exchanging 1,000 U.K. Pounds Into Danish Krone

- Base exchange rate, 1,000 GBP converts to 8,560 DKK

- Tesco Bank Travel Money exchange rate, 1,000 GBP converts to 8,107 DKK

- The Tesco Bank Travel Money exchange rate is 5.2% more expensive, or around 52 GBP in exchange rate fees

Exchanging 1,000 U.K. Pounds Into U.S. Dollars

- Base exchange rate, 1,000 GBP converts to 1,265 USD

- Tesco Bank Travel Money exchange rate, 1,000 GBP converts to 1,244 USD

- The Tesco Bank Travel Money exchange rate is 1.7% more expensive, or around 17 GBP in exchange rate fees

If you’re purchasing currency online or you want to transfer money to an overseas account, you can get much better deals by comparing specialist currency exchange providers . Several money exchange services have overall fees of 1% or lower, even when taking into account differences in exchange rates.

All of the Tesco Bank Travel Money exchange rates quoted in this section are based on their online rates for converting money for home delivery or store pickup. Local bureau de change rates may vary and are likely to be more expensive than what we quote here. All rates correct as of early October 2019.

Tesco Bank Travel Money Exchange Rates for International Money Transfers

Here are the rates Tesco Bank charges for sending money to foreign bank accounts through MoneyGram.

Sending 500 U.K. Pounds to a Euro Account

- Base exchange rate, 500 GBP converts to 573 EUR

- Tesco Bank Travel Money exchange rate, 500 GBP converts to 550 EUR

- The Tesco Bank Travel Money exchange rate is 4% more expensive, or around 20 GBP in exchange rate fees

Sending 1,000 U.K. Pounds to a South African Rand Account

- Base exchange rate, 500 GBP converts to 9,343 ZAR

- Tesco Bank Travel Money exchange rate, 500 GBP converts to 8,551 ZAR

- The Tesco Bank Travel Money exchange rate is 8.5% more expensive, or around 43 GBP in exchange rate fees

Sending 1,000 U.K. Pounds to a New Zealand Dollar Account

- Base exchange rate, 500 GBP converts to 999 NZD

- Tesco Bank Travel Money exchange rate, 500 GBP converts to 937 NZD

- The Tesco Bank Travel Money exchange rate is 6.3% more expensive, or around 31 GBP in exchange rate fees

Note that you will need to pay a Tesco Bank Travel Money international money transfer fee, typically £3.99, to send money to a foreign account.

All of the Tesco Bank Travel Money / MoneyGram exchange rates quoted in this section are based on their online rates for sending money to an overseas bank account. All rates correct as of early October 2019.

Comparing Tesco Bank Travel Money Rates To Other Providers

You can easily compare many money transfer services directly using our comparison tool . There are several new services that it’s worth comparing directly to Tesco Bank Travel Money.

Specialist Currency Providers for Other Destinations

You may also be able to get a better deal for money transfers when you’re sending money to certain countries. For example, if you’re sending 500 GBP to India, the beneficiary would get around 44,846 INR with Skrill compared to 44,373 INR with Tesco Bank Travel Money, a difference of around 1% or £10.

How Easy Is It To Send Money With Tesco Travel Money

Tesco Bank Travel Money services provide convenient local and online currency exchange and money transfer services, combined with an international travel card.

Credibility Security

Tesco is a very well known, trusted brand. Here’s what they say on their website.

“Tesco Travel Money ordered in-store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: 4th floor, Kings Place, 90 York Way, London N1 9AG.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Issued by Wirecard Card Solutions Limited. Registered Office: 3rd Floor, Grainger Chambers, 3-5 Hood Street, Newcastle upon Tyne, NE1 6JQ. Registered in England No. 07875693. Authorised and regulated in the UK by the Financial Conduct Authority to issue e-money (Firm Reference Number: 900051).”

Customer Satisfaction

Tesco Bank Money scored very poorly for customer satisfaction on Trustpilot, achieving a score of just 1.4 out of 5 across more than 600 reviews. Around 11% of reviews said that they were “excellent” or “great” compared to 88% of reviews that said they were “poor” or “bad.” Note that these reviews were across Tesco Bank Money as a whole, not just for travel money or currency or online overseas transfers.

We could not find any positive reviews for Tesco Bank’s travel money service.

There were numerous negative reviews including problems with discrepancies in the amount of foreign currency received, complaints about customer service and issues of the late arrival of travel money. A typical review was, “Ordered travel money from Tesco. When counting the travel money, a significant amount was missing coming to the approximate value of £35. Tesco investigated and found no discrepancies. So I am £35 out of pocket due to their incompetence. Do not order travel money off Tesco.”

How Tesco Bank Travel Money works

If you want to pick up travel money in person, the individual who ordered the travel money must collect it. You will need to have an order reference number and the card you used to pay for your order. You will also need to know your card's PIN to verify your order. You should also have a valid photo ID like a passport, full photographic driving license or an EU ID card.

Here’s what you’ll need to make a money transfer with MoneyGram.

- If you have a MoneyGram account you can log in, otherwise, you will need to create a new account

- Decide how much you’d like to send and where you want to send it to

- Enter all the required information about the beneficiary, this might include their name, address, bank account details, and other personal data

- Tell MoneyGram how the beneficiary wants to get their money—through a bank transfer, cash pickup, or via some other means

- Agree to the MoneyGram exchange rate and any fees

- Pay for your transfer

- Enter your information to verify your identity

Tesco Bank Travel Money – How Does It Work?

Planning your dream vacation? Alongside your flight bookings and luggage preparations, it’s essential to ensure your travel money arrangements are in order.

If you prefer having cash in hand while abroad, one convenient option for acquiring foreign currency is through Tesco Bank Travel Money. But what exactly is it, and how does it work? Let’s delve into the details, covering the process of ordering, collection and delivery options, fees, exchange rates, and more.

Additionally, we’ll explore an alternative that not only streamlines your travel expenses but also potentially saves you money – the Wise card . It’s an international debit card designed for spending and cash withdrawals in over 150 countries, boasting favourable exchange rates and eliminating the need to carry cash around, leaving extra room in your luggage.

But first, let’s focus on understanding Tesco Bank Travel Money.

What is Tesco Bank Travel Money and How Does it Operate?

Tesco Travel Money is a service that allows you to purchase foreign currency, either online or at a physical Tesco store. This flexibility enables you to either pre-order your currency or buy it on the spot at your local Tesco supermarket, provided they have a travel money bureau in-store.

Tesco Bank boasts a wide range of readily available foreign currencies for purchase, including popular options like EUR and USD. However, if the currency you require isn’t in stock, they can place an order for you.

Here are the key features offered by this service:

- Price Match : If you come across a better exchange rate advertised within three miles of your local Tesco Travel Money Bureau on the same day, Tesco Bank will match it. This applies exclusively to in-store, like-for-like transactions and not to rates advertised online.

- Clubcard Prices : Tesco Clubcard holders can benefit from improved exchange rates by providing a valid Clubcard number. This perk is available only for online currency purchases.

- Buy Back Service : If you have any unused foreign currency remaining after your trip, you can exchange it back to Tesco Bank for pounds.

- 10% Discount on Tesco Bank Travel Insurance : When you purchase Tesco Travel Money, you can enjoy a 10% discount on Tesco Bank travel insurance.

It’s worth noting that Tesco Travel Money received the ‘Best Travel Money Provider’ award in the Personal Finance Awards 2022/23, a recognition bestowed by the public. This foreign currency exchange service is powered by Travelex.

Fees and Exchange Rates

Now, let’s explore the cost associated with using Tesco Bank Travel Money. The good news is that there’s no commission fee when ordering currency in a Tesco store or opting for Click and Collect services.

However, for certain orders requiring home delivery, there are delivery fees to consider. Here are the main charges you should be aware of:

- Online foreign currency orders between £75 and £149.99: £4.99 delivery fee.

- Online foreign currency orders between £150 and £499.99: £3.95 delivery fee.

- Online foreign currency orders over £500: Free.

- Late cancellation of Click & Collect order (less than 24 hours before the collection date): £10 late cancellation fee.

It’s essential to keep in mind that additional charges might apply if you use a credit card to pay for your Tesco Travel Money order. While Tesco Bank won’t charge you, your credit card provider is likely to impose fees for cash-related transactions, which often include foreign currency purchases.

Tesco Travel Money Exchange Rates

Tesco Bank Travel Money, like many other foreign currency providers, incorporates its margin into the mid-market exchange rate. Also known as the interbank rate, this is the rate used by banks for inter-currency transactions, considered one of the fairest exchange rates. However, it’s rarely available through most providers, except for a few like Wise.

By adding its margin to the rate, Tesco Bank generates revenue from the transaction. Unfortunately, this means you’ll receive slightly less foreign currency in exchange for your pounds. Nevertheless, Tesco Bank offers slightly improved rates for Tesco Clubcard holders when they order online.

The exchange rates provided by Tesco Bank are transparent and can be checked in real time on their website.

Do Tesco Clubcard Holders Get Better Exchange Rates?

If you’re a Tesco Clubcard holder considering using Tesco Bank Travel Money, you might be wondering if this loyalty program can help you secure more favourable exchange rates.

The Clubcard Price offered by Tesco Bank Travel Money is designed to provide you with better rates compared to the standard ones advertised online at the time of purchase . This exclusive perk is accessible when you make your currency purchases online. To benefit from the Clubcard Price, you’ll need to input a valid Clubcard number during the transaction.

It’s important to note that exchange rates can fluctuate depending on the method you choose for purchasing your foreign currency. Whether you opt to buy in-store, online, or by phone, these rates may vary.

How to Order Travel Money from Tesco – A 9-step Guide

If you’re interested in obtaining travel money from Tesco, here’s a step-by-step guide for placing an online order:

- Visit the Tesco Bank Travel Money website.

- Choose your desired currency from the dropdown menu on the right-hand side.

- Indicate whether you possess a Tesco Clubcard. If you do, you’ll benefit from enhanced exchange rates.

- Select the amount you wish to order, either by choosing from the predefined options or entering a specific amount.

- Review the exchange rate and the amount of currency you’ll receive in exchange for your pounds.

- Click on ‘Buy Currency Online’

- Follow the on-screen instructions to place your order, including entering your Clubcard number (if applicable) and payment details. Note that online orders are payable by card only.

- Select either Home Delivery or Click & Collect, making the required delivery fee payment if applicable.

- Await the arrival of your travel money through postal delivery or head to your local Tesco Bank bureau on your chosen collection date to pick up your order.

The Collection and Delivery Process

If you opt for Click & Collect, you can conveniently locate your nearest Tesco store with a foreign exchange bureau by entering your postcode. You’ll receive a specified collection date, and your money will be ready for collection after 3 PM on that date. Don’t forget to bring photo ID and the card used for placing the order to verify your identity.

For home delivery orders, here’s what you can expect in terms of delivery times:

- Orders placed before 1:30 PM from Monday to Thursday: Next day delivery.

- Orders placed before 1:30 PM on Friday: Delivery on Saturday or Monday.

- Orders placed after 1:30 PM from Monday to Friday, or anytime on Saturday or Sunday: Delivery within 2 working days.

Remember that someone must be present to sign for the delivery of travel money orders.

The Tesco Multi-currency Cash Passport

Tesco Bank offers an interesting alternative known as the Tesco Multi-currency Cash Passport. This prepaid travel money card allows you to load up to seven different currencies before your trip, enabling spending abroad just like you would with a regular debit card in the UK. The added benefit is the ability to lock in the exchange rate every time you load, reload, or switch between currencies.

However, there are a few considerations to keep in mind. The available currencies are limited to euros, US dollars, UK pounds, South African rands, Australian dollars, Canadian dollars, and New Zealand dollars. There are fees involved as well, including a £1.50 withdrawal fee at ATMs or a 2% commission on purchases made in UK Pounds.

The Wise Card – A Convenient Alternative to Currency Exchange

While Tesco Bank Travel Money provides a reliable option for obtaining foreign currency, it’s not the sole solution for managing your holiday expenses.

If you’re seeking more favourable exchange rates and a cashless approach, the Wise card is an attractive choice. This contactless international debit card can be used in over 150 countries, wherever Mastercard and Visa are accepted. This grants you the ability to make purchases in shops, restaurants, bars, and transport hubs worldwide.

When you use the Wise card, it automatically converts your pounds to the local currency at the mid-market exchange rate, with no additional margins or markups. There is only a modest currency conversion fee, or none at all if you already have the currency in your Wise account.

For cash needs, the Wise card allows you to withdraw up to £200 per month with no fees (up to two withdrawals). However, be mindful that overseas ATM operators may charge their own fees.

With the Wise card, you can enjoy the convenience of tapping and spending like a local, all while benefiting from a favourable exchange rate. Additionally, the Wise app allows you to manage your account, card, and expenses on the go.

By opening a Wise multi-currency account online, you can obtain a Wise card for a one-time cost of just £7, without any subscription fees. Be sure to review the Terms of Use for your region or check Wise fees and pricing for the most up-to-date information on costs and fees.

And there you have it – a comprehensive overview of Tesco Bank Travel Money and its operations, plus a cashless alternative for digital fans. If you prefer having foreign currency in hand before your trip, then Tesco Travel Money is certainly worth considering, particularly due to its lack of commission fees. Alternatively, you can conveniently visit your local Tesco store with a foreign exchange bureau to obtain your travel money instantly.

Remember, it’s advisable to conduct a quick comparison of exchange rates, as you may find more favourable options for obtaining foreign currency elsewhere but Tesco Travel Money solidifies its reputation with one of the more attractive offerings for travellers.

Similar Posts

Holiday Ideas For 2024

Choosing your next holiday destination can be a time-consuming and sometimes unenjoyable task, to say the least. There are…

The Best Student Bank Accounts For Managing Your Finances

Before You Open A Student Bank Account Suppose you’re planning to enter higher education at University or College or…

The Value of Peter Rabbit 50p Coins In 2024

Collecting 50p coins has become a captivating pastime, and enthusiasts are constantly on the lookout for unique and valuable…

Save Money As a Student With Amazon Prime Student

Are you a student looking for ways to save money on your online purchases? Look no further! In this…

Starling Bank – Personal & Business Current Accounts

Who is Starling Bank? Starling Bank was founded in 2014 by Anne Boden whose vision was to create the…

10 Of The Best Washing Up Liquids Tried & Tested

Doing the dishes is a household chore that many of us dread, but with the right washing-up liquid, it…

Cheap Holiday Money At Your Fingertips

Tesco Bank Exchange Rates

Tesco Bank’s Exchange Rates

It is safe to say that our review of Tesco Bank Travel Money, by carefully examining the exchange rates offered, is one of the cheapest bank providers. When compared to all holiday money providers in the UK , Tesco still seems to be offering good rates, particularly for the £750 and under inquiries and is commonly found as one of the top 3 cheapest providers for holiday money.

Tesco vs Wise

Does Wise have better exchange rates? Short answer = Yes.

Wise provides far better exchange rates for any currency pair needed. You can see the differences in the table below:

Additional Providers:

Check it for yourself – view how Tesco Bank fairs against other providers on our comprehensive comparison.

Tesco Travel Money Review:

Tesco PLC is a British-headquartered international supermarket chain with more than 6,500 stores worldwide, employing almost 500,000 people. It is consistently considered in the top 50 British companies in terms of market capitalisation. Tesco Bank is a relatively small part of the business, among other things the company does besides supermarket – convenience stores, tech support, telecom services, petrol stations.

The advantages of using Tesco are as follows:

- Clients have a total of 50 currencies to choose from, including US Dollars and Euros.

- Free click-and-collect service from more than 300 in-store bureaux transaction points, as well as select Customer Service Desks.

- Online exchange rate platform available to check live-rates for all currencies that are on offer.

- Zero percent commission charged on all foreign currency.

- It’s available with Travellers Cheques that can be obtained from their in-store Travel Money bureaux.

Disadvantages:

- There’s a currency conversion charge if you make purchases in a denomination different from that which is loaded on your card.

We use cookies to improve your experience on our website. Please let us know your preference. Want to know more? Check out our cookies policy Accept all cookies Manage cookies

Find a store

Travel Insurance

Compare our holiday cover for your next big adventure. Discount available for Clubcard members.

Tesco Bank Travel Insurance is arranged and administered by Rock Insurance Services Limited and underwritten by Inter Partner Assistance S.A.

Up to 4 kids under 18 go free on core Single and Annual Multi Trip Insurance cover

An additional premium may be required to cover any pre-existing medical conditions or add-ons.

Travel Insurance you can trust

- Choose from Economy or our 5 Star Defaqto rated Standard and Premier cover Single and Annual Multi Trip policies. Choose from Economy or our 5 Star Defaqto rated Standard and Premier cover Single and Annual Multi Trip policies.

- Cover for medical expenses and 24/7 Emergency Medical Assistance is provided with all our cover levels. Monetary limits, excesses and exclusions apply. Cover for medical expenses and 24/7 Emergency Medical Assistance is provided with all our cover levels. Monetary limits, excesses and exclusions apply.

Standard and Premier cover

Types of trip cover

Single trip.

Only plan on one holiday in the next 12 months? Buy cover for the length of your trip only and have protection from cancellation from the moment you buy.

Annual Multi Trip

If you plan on taking two or more trips in the next 12 months, Annual Multi Trip cover can offer greater convenience than Single Trip cover.

Designed for longer trips abroad up to 18 months, often to multiple countries. You may find this type of cover is right for you if you’re planning a gap year or career break.

The power to get holiday cover for less

Clubcard members get a 10% discount when you buy direct. Discount doesn’t apply to Later Life cover or add-ons. Just enter your Clubcard number when you get your quote.

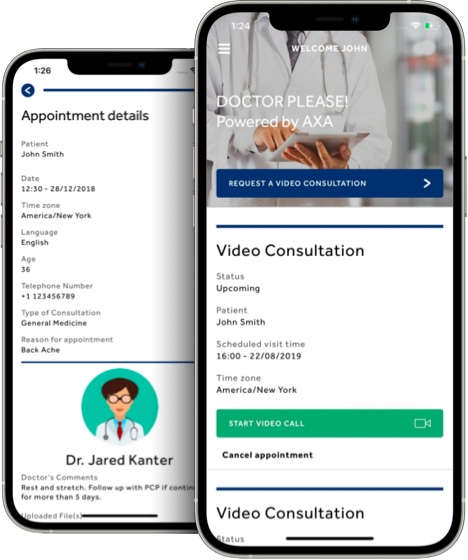

Get access to a doctor virtually

Available with our Single Trip and Annual Multi Trip policies, choose Premier cover and you'll have access to an English speaking GP on the phone or via an app. This comes as standard for our Backpacker and Later Life products.

COVID-19 cover includes

- If you have to cancel or cut short your trip as a result of contracting COVID-19. If you have to cancel or cut short your trip as a result of contracting COVID-19.

- Medical treatment if you contract COVID-19 abroad. Medical treatment if you contract COVID-19 abroad.

- If you’ve got to return home early because the region you’re in goes into lockdown. If you’ve got to return home early because the region you’re in goes into lockdown.

Remember to check the latest Foreign, Commonwealth & Development Office (FCDO) and local authorities travel advice before you go. We don't include cover for cancellation where the FCDO or local authorities advise against travel. For full details of the COVID-19 cover provided on our policies take a look at the policy booklets . Monetary limits, excesses and exclusions apply.

Quick answers to common questions

Getting set up

Just applied for Travel Insurance? Here's what you might need to get started.

Managing your policy

Some of our commonly asked questions about Travel Insurance.

Something's not right

Not sure about something on your policy? We're here to help.

Getting started with holiday cover

Travel insurance glossary and jargon buster

Do I need travel insurance?

What it covers and why it might be handy to have it

What type of travel insurance should I get?

Some key things you might need to know when picking a policy

Help for existing customers

If you’re an existing customer you can find information, ways to get in touch with us or start a claim here.

Important information

It’s important that you review the full policy document for your Travel Insurance policy. It contains details of cover, exclusions and limitations of your travel insurance. Monetary limits and excesses apply.

If you purchased or renewed your Travel Insurance policy on or after 13 December 2023, your policy documents are below.

If you purchased or renewed your Travel Insurance policy before 13 December 2023, your policy documents are below.

The Insurance Product Information Documents summarise the key features, benefits and exclusions of cover.

The Insurance Product Information Documents summarise the key features, benefits and exclusions of our additional cover.

Gadget Cover Documents

If you purchased or renewed your policy on or after 13 December 2023, your policy document is below.

If you purchased or renewed your policy before 13 December 2023, your policy document is below.

Car Hire Document

How we collect and use your personal data.

Tesco Personal Finance PLC (trading as Tesco Bank) acts as an intermediary for this policy. Tesco Bank Travel Insurance is arranged and administered by Rock Insurance Services Limited and underwritten by Inter Partner Assistance S.A. Gadget Cover is underwritten by AmTrust Europe Limited (AmTrust). You can find out more about how ROCK will process and share your data in their Privacy Notice.

ROCK will share some of your information with Tesco Bank as set out in their privacy notice and you can find out more about how Tesco Bank will then process that data in our Privacy Policy .

ROCK will also share data with IPA UK so that they can underwrite your policy and if you make a claim. You can find out more about how IPA UK will process your data in the ‘Data Protection Notice and Fraud’ section of the Policy Wording document and by visiting the AXA Assistance website and AmTrust Europe website.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market

- Home equity loan

- Personal loans

- Student loans

- Options pit

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Tesco recalls chocolate bars with urgent warning over peanut allergies

Tesco has urgently recalled two types of own-brand chocolate bars from its shelves due to the possibility that they could contain undeclared peanuts.

The company recalled Nutty Nougat Caramel Chocolate Bars Multipack and Dreamy Caramel Chocolate Bars Multipack, fearing they might contain peanuts even though their labels didn’t indicate so.

“This poses a possible health risk for anyone with an allergy to peanuts,” Tesco said.

The products , sold in packs of six for £1.15, pose a serious risk to anyone with peanut allergies, potentially causing reactions ranging from hives to anaphylactic shock, which can be fatal without immediate treatment.

The Food Standards Agency advised consumers to return the products for a full refund and not to consume them.

“If you have bought the above products do not eat them. Instead, return them to any Tesco store for a full refund,” the agency said in a statement.

“Tesco is recalling the above products from customers and has been advised to contact the relevant allergy support organisations, which will tell their members about the recall. The company has also issued a recall notice to its customers. These notices explain to customers why the product is being recalled and tell them what to do if they have bought the product.”

Tesco has informed allergy support organisations and issued recall notices to customers explaining the situation. The company said the lack of correct labelling on the chocolate covers was due to a “mispack”.

The recall relates to batches of the Nutty Nougat Caramel Chocolate Bars Multipack with a best before date of 28 February 2025, while the best before dates for the Dreamy Caramel Chocolate Bars Multipack are 31 January 2025 and 28 February 2025.

Tesco urgently recalls two chocolate bars and issues 'do not eat' warning over 'health risk' fears https://t.co/j6CWAGqRWR — 𝓒𝓸𝓷𝓼𝓮𝓻𝓿𝓪𝓽𝓲𝓿𝓮𝓓𝓲𝓿𝓪™ (@1776Diva) June 9, 2024

“Dreamy Caramel Chocolate Bars Multipack [are being recalled] because they contain peanuts which are not mentioned on the label,” a statement by the Food Standards Agency confirmed. “This means the products are a possible health risk for anyone with an allergy to peanuts.”

“If you have bought the above products do not eat them,” the agency cautioned. “Instead, return them to any Tesco store for a full refund. For more information contact Tesco Customer Services on 0800 505 555.”

Recommended Stories

The biden administration is planning to eliminate medical debt from credit reports of millions of americans. what could this mean for you.

The Biden administration proposed a new rule that would eliminate medical debt from credit reports. Here's what that means.

Musk withdraws his breach of contract lawsuit against OpenAI

Musk’s suit, which was filed in February, had accused OpenAI co-founders Sam Altman and Greg Brockman of violating the company’s non-profit status and instead prioritizing profits over using AI to help humanity.

What to know about stiff person syndrome as Celine Dion declares she is 'not going to die' of the neurological disease

Experts explain the symptoms and treatment options for stiff person syndrome, which is caused by an autoimmune disorder's attacks on the neurological system.

Hey Elon, go ahead and ban Apple devices

Following WWDC 2024, Elon Musk threatened to ban Apple devices at his companies if Apple's partnership with OpenAI goes through. So enough with the talk, let's see him actually do it.

Walmart is winning over investors, but its growth story relies on three key e-commerce initiatives

Walmart has been a reliable stock performer — but it needs to grow its e-commerce to maximize its future potential.

General Motors revives its robotaxi service Cruise in Houston, with human drivers

GM's Cruise robotaxi service is taking rides again in Houston.

Paramount stock plummets after Shari Redstone kills Skydance deal

Shari Redstone, who controls Paramount through her family's holding company National Amusements, has ended merger talks with Skydance Media, according to the Wall Street Journal.

How to invest in real estate with little money

You can invest in real estate with little money through house hacking, REITs, or crowdfunding. A HELOC is another option if you own your home.

64,000+ shoppers swear by these bestselling high-waisted leggings — now just $9

Devotees say these terrific tights flatter all body types, and you can even get them with pockets.

Joey Chestnut out of 2024 Nathan's Hot Dog Eating Contest over deal with rival brand

Chestnut has won the competition 16 times and every year since 2016.

Elektrostal, Russia

Essential elektrostal.

Elektrostal Is Great For

Eat & drink.

- Apelsin Hotel

- Elektrostal Hotel

- Apart Hotel Yantar

- Mini Hotel Banifatsiy

- Restaurant Globus

- Amsterdam Moments

- Cafe Antresole

- Viki Cinema

- Statue of Lenin

- Park of Culture and Leisure

Members can access discounts and special features

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Central Museum of the Air Forces at Monino

- Peter the Great Military Academy

- History of Russian Scarfs and Shawls Museum

- Ramenskii History and Art Museum

- Bykovo Manor

- Pekhorka Park

- Balashikha Arena

- Malenky Puppet Theater

- Military Technical Museum

- Church of Our Lady of Kazan

- Drama Theatre BOOM

- Balashikha Museum of History and Local Lore

- Pavlovsky Posad Museum of Art and History

- Saturn Stadium

- Borisoglebsky Sports Palace

- Church of Vladimir

- Fryazino Centre for Culture and Leisure

- Likino Dulevo Museum of Local Lore

- Orekhovo Zuevsky City Exhibition Hall

- Shirokov House

- Noginsk Museum and Exhibition Center

- Zheleznodorozhny Museum of Local Lore

- Stella Municipal Drama Theater

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Malakhovka Museum of History and Culture

- Art Gallery of The City District

Plan Your Lyubertsy Holiday: Best of Lyubertsy

Explore Lyubertsy

Essential lyubertsy.

Lyubertsy Is Great For

Eat & drink.

Expedia Rewards is now One Key™

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Central Museum of the Air Forces at Monino

- Peter the Great Military Academy

- History of Russian Scarfs and Shawls Museum

- Ramenskii History and Art Museum

- Bykovo Manor

- Pekhorka Park

- Balashikha Arena

- Malenky Puppet Theater

- Drama Theatre BOOM

- Balashikha Museum of History and Local Lore

- Pavlovsky Posad Museum of Art and History

- Saturn Stadium

- Church of Vladimir

- Likino Dulevo Museum of Local Lore

- Orekhovo Zuevsky City Exhibition Hall

- Noginsk Museum and Exhibition Center

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Malakhovka Museum of History and Culture

Money blog: Thailand wants you to move there for work on digital nomad visa

Thailand has joined the likes of Spain, Indonesia, Greece and Dubai in offering visas for travellers to stay and work. And we speak to the entrepreneur behind the UK's first net-zero whisky distillery for our Women in Business series. Leave your thoughts on anything we cover below.

Tuesday 11 June 2024 20:02, UK

- Thailand wants you to move there for work

- Another blow to hopes of interest rate cut next week

- These are the most and least affordable areas in the UK - where does yours rank?

- Asda workers stabbed, threatened with syringes and attacked with food

Essential reads

- 'Would you ask me that if I was a man?' Meet the woman behind the UK's first net-zero whisky distillery

- Basically... APR v AER - what's the difference?

- Money Problem: 'I bought a heat pump dryer that takes nine hours to dry a small load but Candy and AO say there's no fault - what can I do?'

- How long do trailers last at each cinema chain - and when to get there

- Best of the Money blog - an archive

Ask a question or make a comment

Since the pandemic, almost 800,000 people have fallen out of employment into "economic inactivity", a catch-all definition that covers the nine million people of working age not able or looking to work.

That includes students, early retirees and stay-at-home parents and carers, but the biggest and most pernicious reason is long-term sickness, which now accounts for more than 2.5 million people, an increase of more than 400,000 since COVID, driven largely by mental health conditions.

Business correspondent Paul Kelso travels to Middlesbrough to hear the stories behind the numbers.

Michael is fair haired and frail, with a face that tells a story.

Until seven years ago, his life was perhaps as he imagined it. He was married and working for a fancy food shop in his home town in North Yorkshire.

Then something happened. He is reluctant to share the full details but his marriage broke down, he lost the job, and was left with a choice: "It was to be homeless, or move to a bedsit in Middlesbrough."

Which is how we come to be speaking in the Employment Hub on Corporation Road, opposite Middlesbrough's Jobcentre.

A council-backed centre, it offers help and guidance to anyone looking to get back into work.

Young adults making the leap from education to employment; older people who want or need to earn again; and clients like Michael, who fall somewhere in between, derailed by illness or personal circumstances.

The prospect of an interest rate cut when Bank of England officials meet next week has been dealt a blow after data showed basic pay is still rising.

Wages continued to grow at 6% in the three months to April - more than double the rate of inflation, according to the Office for National Statistics (ONS).

The unemployment rate rose to 4.4% over the same period, up from 4.3% in the three months to March and the highest level since September 2021.

What does this mean for the Bank of England as it weighs cutting interest rates? Business reporter James Sillars has the latest...

The final set of employment figures before polling day will be monitored by the Bank before it decides on whether to cut rates - we'll get the announcement next Thursday.

The Bank has hinted an interest rate cut is likely in the coming months but it remains worried about sticky services inflation and the pace of wage growth fuelling more price rises in the economy.

There were 14 consecutive interest rate increases from December 2021 up until last summer, aimed at dampening demand to help bring price growth down.

The rate hikes drove up the cost of borrowing, with mortgage holders facing bills of hundreds of pounds more a month as low fixed-rate terms expired.

With the main consumer prices index measure of inflation running at 2.3% - above the Bank's 2% target - members of the rate-setting committee have acknowledged progress but are unlikely to follow the European Central Bank in cutting rates this month.

Even before the ONS data was released, financial markets projected just a 10% chance of a rate cut from 5.25% to 5% on 20 June.

Most of the money is on September. However, those predictions could yet shift.

The ONS is also set to publish this week the preliminary growth figures for the economy in April.

They are predicted by economists to show zero growth for the month, largely due to the impact of poor weather.

And next Wednesday, the day before the interest rate decision, the latest inflation figures will be published - another key factor for the Bank.

BP staff will have to disclose intimate relationships under a new policy.

The rules, which put employees at risk of being sacked if contravened, have come into force after the dismissal of former boss Bernard Looney.

Previously, employees only had to disclose relationships if there was a conflict of interest risk.

So-called "Super-ATMs" are going on trial in England to provide a cash lifeline to residents without a local bank branch.

Customers with multiple banks will be able to make deposits at one machine in a UK industry first.

The ATMs are already up and running in Athersone, Warwickshire, in Heathfield, East Sussex, and in Swanage, Dorset.

Fish and chicken bought from Sainsbury's will soon come in recyclable card trays.

The supermarket believes it can slash almost 700 tonnes of plastic packaging per year on its own-brand products.

Sainsbury's says it is a "UK retailer first" decision.

Jamie Oliver has backed a proposal to ban the sale of some energy drinks to under-16s.

The celebrity chef said the UK has some of the least healthy children in Europe and people would "be amazed" how many consumed an energy drink for breakfast.

Labour has pledged to stop giving younger teenagers access to highly caffeinated soft drinks as part of a strategy to improve child mental and physical health.

"This is really exciting for me. It means they're looking at the detail, it means they're looking at the science," said Oliver, who described himself as apolitical.

"Child health hasn't been put central to any manifesto in the last 20 years, ever, ever, ever. You've never seen it on a bus with a number."

Labour's plans would apply to drinks containing more than 150mg of caffeine per litre, meaning they would prohibit beverages like Monster Energy for under-16s but not Coca-Cola.

Oliver said children were "bouncing off the walls" in classrooms and teachers were struggling to control them.

"You would be amazed if you saw how many kids have breakfast in the form of an energy drink."

Speaking on X, Mr Oliver said: "When we've got some of the most unhealthy kids in Europe, we need to not have one thing, we need many, many things that are going to help make our kids fitter, healthier, have better outcomes and just flourish and be more productive as adults, and cost the NHS less."

Asda staff have been stabbed, punched and threatened with syringes by customers, according to new research.

One in three employees have been attacked at work, according to a GMB union survey of 1,000 members.

Delivery drivers said they have been chased by people in cars and confronted by customers in the nude.

Store workers have had watermelons and joints of gammon thrown at them.

Some three in five respondents said they had suffered injury or illness at work.

"These incidents are horrifying – no one should have [to] suffer this kind of abuse and violence at work," said Nadine Houghton, GMB national officer.

"This situation is only going to get worse as staff hours are slashed, leaving less people in store and those who are there more vulnerable."

An Asda spokesperson said all retailers had had an increase in violence and aggression towards staff in recent years.

"The safety of our colleagues is a primary concern," they said, adding the company had invested more than £30m over the past three years to upgrade store CCTV systems.

Employees have been provided with body-worn cameras, extra security guards have been hired and opening times amended in certain shops, they said.

"We work with all of our colleague representatives in the important area of colleague security and also back calls for violence or abuse against retail workers to be made a standalone criminal offence in all parts of the UK and hope this is a priority for any incoming government."

Do you work at Asda or another supermarket? Have you had similar experiences? Share your stories with us in the comment box above.

Like the idea of jetting off to live in Thailand?

Remote workers will now be able to stay in the country for up to five years on a digital nomad visa.

The destination Thailand visa, nicknamed the "digital nomad visa", allows foreigners to stay and work in Thailand for extended periods without worrying about immigration or tax.

Those with the multiple-entry visa are given the right to stay for 180 days a year, with an option to extend for another 180 days, for up to five years for the cost of 10,000 baht (£213.75).

While the initial fee is £213.75, workers need to leave and re-enter the country every 180 days and pay an additional £212.20 each time.

Full details on how to apply are still pending, but some information on the requirements have been released.

To apply for the visa, you must:

- Be at least 20;

- Have enough money to pay for the visa;

- Prove you have at least £10,687 in your bank account;

- Provide proof of employment with a registered company.

Until now, digital nomads could only stay in Thailand on tourist visas for up to 60 days but it is hoped the new visa will support the government's efforts to increase tourism.

The world's your oyster...

Thailand joins a growing list of countries offering digital nomad visas or similar. Here are some of the others:

- Spain - The remote work visa gives non-EU nationals the chance to live and work in Spain for up to five years;

- Portugal - Visa length is up to five years;

- Italy - Introduced in 2022, it gives workers the chance to stay in the country for one year with the possibility to extend;

- Croatia - Temporary stay is granted for up to a year;

- Greece - The digital nomad visa gives you legal residence as a remote worker for up to a year, after which you can apply for a residence permit which allows you to stay longer;

- Estonia - Right for remote workers to temporarily stay in Estonia for up to one year;

- Montenegro - The digital nomad visa is a temporal permit for non-EU remote workers employed in a foreign company outside Montenegro. Nomads can stay for up to two years in the country;

- Malaysia - The DE Rantau Nomad Pass allows foreigners to stay in Malaysia for up to 12 months in the first instance, with the option to renew for another 12 months, allowing 24 months of stay in total;

- Indonesia - The visa allows for up to 180 days of stay but this may be extended further;

- Costa Rica - The nomad scheme allows international residents to work remotely for up to a year, with the option to renew for an additional year;

- Dubai - The remote working visa scheme is valid for one year.

By James Sillars , business reporter

It's a positive start to the day for shares in London.

The FTSE 100 opened 0.4% higher at 8,265 after declines in the previous session that saw bank stocks under particular pressure.

Markets globally were reacting to renewed fears that interest rate cuts in the United States remained some way off and the results of the elections for the European Parliament.

They showed a big rise in far-right groups and even prompted France to call a snap parliamentary election.

Raspberry Pi made its London stock market debut this morning.

The personal computer maker saw its shares climb more than 30% at the open.

More widely, the cost of oil has been on the march again.

A barrel of Brent crude will set you back $81.

The price rose 3% yesterday on forecasts of strong demand during America's peak vacation (that's summer holiday) season.

Analysts, however, see that higher level being short-lived due to concerns about US interest rates being higher for longer.

The prospect of a pre-election interest rate cut by the Bank of England has been damaged by official figures showing no progress in bringing down the pace of wage growth.

Data from the Office for National Statistics (ONS) showed basic pay rising at an annual rate of 6% in the three months to April.

That was flat on the figure reported by the ONS a month ago.

The measure that includes bonuses actually rose to 5.9% from 5.7%.

While it leaves pay growth at way more than double the 2.3% inflation rate, it will not help persuade the Bank of England that the time is right for an interest rate cut when it reveals its latest decision on 20 June.

Just 18% of companies in the UK are led by women, and while data suggests female entrepreneurs are on the rise, men still receive more funding and are entrusted with higher average loans to get them started.

In a new series every Tuesday, Money blog reporter Jess Sharp speaks to women who are bossing it in their respective fields - hearing their stories, struggles and advice for those who want to follow in their footsteps.

This week, she has spoken to Annabel Thomas, the founder of Nc'nean whisky distillery...

Annabel left her job as a strategy consultant in London more than a decade ago to pursue her ambition to change the way the world thought about whisky.

With women and sustainability at the forefront of her mind, she has gone on to create the UK's first net-zero whiskey distillery - and has hired a female-led team to do it.

It took four years of hard graft, fundraising and actually building to create the Nc'nean distillery in the Highlands, and then another three years to produce its first bottle.

'Everyone thought I was mad'

She was first inspired by her parent's farm and dreamed of turning one of its old buildings into a distillery.

After touring lots of distilleries, she realised the industry was still very traditional and no one was talking about sustainability.

"No one seemed to be thinking very creatively about the spirit," Annabel, 41, says.

"I just thought that there was a need for that and consumers were going to increasingly demand sustainable products, which they now are. Though, at the time, everyone thought I was mad."

'I didn't have a time machine' - the long process to get started

After deciding to take the plunge, the mother-of-two says it was a "long, slow process" to get the business off the ground, especially juggling the financial needs of her family and childcare.

In fact, she initially took a sabbatical from her job to get started and then went back and started working on Nc'nean at the weekend to make sure she was drawing a wage from somewhere.

Eventually, her business became a full-time job and she managed to launch a seed funding round to really get things going.

"The thing about a distillery that is different to many other projects is that you have to raise an enormous amount of money upfront," she says.

"You can't make something in your kitchen and try to sell it. We spent £5m building a distillery before we produced a drop of liquid - so it's quite a different profile to many other startups," she added.

Getting the funding was "pretty tough", she says, explaining it's hard to raise money when you don't have a product to show for it.

"You can't even say this is what the whisky's going to taste like, because I didn't have a time machine."

'You would never ask me that if I was a man'

It took Annabel two years to raise the funds she needed, and she wonders if it would have taken as long if she were a man.

"Maybe it would have only taken me a year if I was a man, but you never know," she says.

Initially, she says, she didn't think about the challenges she might have to overcome in such a male-dominated field, but it quickly became obvious.

"It didn't really occur to me until people kept asking, me, basically every single day, if I actually liked whisky," she explains.

"I thought, 'You would never ask me about that if I was a man - just because I'm a woman, you assume I don't like it.'"

Making it sustainable

Sustainability was one of Annabel's key drivers when she embarked on her entrepreneurial journey and her distillery is powered solely by renewable energy.

She was the first to create a distillery that has been verified as having net-zero carbon emissions from its own operations, and also the first to use a 100% recycled clear glass bottle.

"It doesn't sound like a big deal," she says modestly. "But actually 100% recycled glass saves 40% of the carbon emissions versus what within the industry would be called fake glass, which is largely like new materials."

When you look at a Nc'nean bottle, it has a kind of green tinge and a few bubbles in it.

The "big guys" would consider them imperfect, Annabel says, but she has decided to "embrace the imperfections".

"If it saves 40% of the carbon emissions, then we think that's the right thing to do," she says.

Nc'nean also replants everything it harvests, only uses 100% organic Scottish barley (the main ingredient in whisky) and feeds the leftover grain to the cows that live on the farm.

The challenges

Away from the struggles with fundraising, Annabel says childcare is one of the biggest challenges she has had to overcome.

With her setting up the company and her husband a lawyer, she says full-time childcare was the only option, but it was far too expensive.

"I don't think as a country we have the right support system," she says. "It's not economic for me to work. If I was running the country, things would look very different."

The issue also means getting the work-life balance can be hard, and she always feels like she's "not spending enough time with the family, and too much time on work".

"I think at least I have some control over my own diary now, which is really helpful," she adds.

Annabel's advice

Use your differences to your advantage - that's Annabel's top tip.

She urges women not to be "put off" by jumping into a male-dominated field, saying the key is to create something different.

Being a woman in such an industry was actually an "advantage", she says.

"You will find that you think differently to everyone else and that can only be a good thing for creating something different, which is ultimately important because you need to find your niche."

Within the whisky world, work is already ongoing to encourage women to join and she hopes that's the same in other industries as well.

Practically, she says, seeking out support groups is "definitely worth it" and surrounding yourself with people who know more than you do is helpful.

"None of our distillers have ever worked in whisky before and I like that because it brings a different perspective," she says.

Read more from this series below...

British house hunters should look at buying Scotland if they want to get the most for their money, according to new research.

A study by Hopkins Homes, a real estate and zero energy bill expert, found Scotland prominently featured among the most affordable areas, while perhaps unsurprisingly, London dominated the least affordable category.

The research assessed the affordability of 325 areas in Britain by looking at average house prices, the rate of price increase, the ratio of the average couple's earnings to house prices and average council tax costs, to give a final "affordability" score.

The higher the score, the more affordable the area.

Angus in eastern Scotland has come out top for affordability in Britain, according to the research.

There, prospective buyers are looking at an average house price of £164,076, while the price-to-earnings ratio sits at 2.31. According to Hopkins Homes, it has an "affordability score" of 85.

It was followed by West Dunbartonshire, also in Scotland, with a score of 84.1, and Aberdeenshire with 83.2.

At the other end of the scale, the swanky London borough of Kensington and Chelsea came out as the least affordable area to buy a home in Britain.

With average house prices sitting at a whopping £1.2m, buying in this area is out of reach for many, with the house price-to-couple's earnings ratio sitting at 16.18.

The affordability score for Kensington and Chelsea is just 40 - the lowest in Britain - and is followed by London's City of Westminster at 53 and Elmbridge in Surrey with 57.3.

The Hopkins Homes report says Britain's housing affordability landscape in 2024 "presents a diverse picture, with significant variations across different regions".

"When making house buying decisions, the analysis highlights the importance of considering factors beyond just house prices, such as income levels, council taxes, and overall quality of life," it said.

"Overall, the data underscores the importance of careful consideration and planning when navigating the UK housing market."

Be the first to get Breaking News

Install the Sky News app for free

IMAGES

COMMENTS

Tesco Travel Money ordered in store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: Worldwide House, Thorpewood, Peterborough, PE3 6SB.

Tesco Travel Money. Tesco travel money is available to order online and in store at Tesco's travel bureaux. You can order up to £2500 in currencies used across every continent. Android customers can also order their currency from the mobile banking app. Euros and US dollars can be available the next day from your local travel money bureau if ...

Find Tesco Travel Money bureau info for Midsomer Norton Superstore. Check opening hours, stocked currencies and more.

Contact details. For queries on placing an order or existing orders. You can also order online. 0345 366 0103 *. If you have difficulties with your hearing or speech, contact us through the Relay UK app. You can find out how to use Relay UK on their website. *This number may be included as part of any inclusive call minutes provided by your ...

"Tesco Travel Money ordered in-store is provided by Travelex Agency Services Limited. Registered No. 04621879. Tesco Travel Money ordered online or by telephone is provided by Travelex Currency Services Limited. Registered No. 03797356. Registered Office for both companies: 4th floor, Kings Place, 90 York Way, London N1 9AG. ...

Tesco Travel Money. Coldfield Drive. B98 7RU. Closed - Opens at 9 AM. Store details. Find a different store. Find Tesco Travel Money bureau info for Worcester Superstore. Check opening hours, stocked currencies and more.

Free home delivery on orders worth £500 or more. As a little thank you, when you buy your travel money with them, Tesco Bank Travel Money will give you a voucher code for 10% off their Tesco Bank Travel Insurance. The code is for new policies only when you buy direct and must be redeemed by 31 January 2024. The voucher code should be entered ...

Tesco Travel Money is a service that allows you to purchase foreign currency, either online or at a physical Tesco store. This flexibility enables you to either pre-order your currency or buy it on the spot at your local Tesco supermarket, provided they have a travel money bureau in-store. Tesco Bank boasts a wide range of readily available ...

Tesco Travel Money Review: Tesco PLC is a British-headquartered international supermarket chain with more than 6,500 stores worldwide, employing almost 500,000 people. It is consistently considered in the top 50 British companies in terms of market capitalisation.

Popular filters F&F Clothing Petrol Filling Station Tesco Café Tesco Pharmacy Tesco Travel Money Facilities and services Click+Collect Electric vehicle charging point Fish GetGo Grab and go - fish Hand car wash Hot deli Meat MoneyGram Paperchase Scan as you Shop Sells gift cards Tesco Mobile The Entertainer Toy Shop Vision Express Whoosh Accessibility Accessible fitting room Accessible ...

Tesco Personal Finance PLC (trading as Tesco Bank) acts as an intermediary for this policy. Tesco Bank Travel Insurance is arranged and administered by Rock Insurance Services Limited and underwritten by Inter Partner Assistance S.A. Gadget Cover is underwritten by AmTrust Europe Limited (AmTrust). You can find out more about how ROCK will ...

The supermarket has issued an urgent health safety warning about its own-brand Tesco Nutty Nougat Caramel Chocolate Bars Multipack and Tesco Dreamy Caramel Chocolate Bars Multipack. Typically ...

Mon, June 10, 2024, 1:34 AM EDT · 2 min read. Tesco recalls chocolate bars with urgent warning over peanut allergies. Tesco has urgently recalled two types of own-brand chocolate bars from its ...

A mix of the charming, modern, and tried and true. See all. Apelsin Hotel. 43. from $48/night. Apart Hotel Yantar. 2. from $28/night. Elektrostal Hotel.

Travel guide resource for your visit to Elektrostal. Discover the best of Elektrostal so you can plan your trip right. Vacation Packages. Stays. Cars. Flights. Support. All travel. Vacation Packages Stays Cars Flights Cruises Support Things to do. My Account. Members can access discounts and special features.

Lyubertsy Tourism: Tripadvisor has 1,975 reviews of Lyubertsy Hotels, Attractions, and Restaurants making it your best Lyubertsy resource.

Travel Guide. Check-in. Check-out. Guests. Search. Explore map. Visit Elektrostal. Things to do. Check Elektrostal hotel availability. Check prices in Elektrostal for tonight, Apr 20 - Apr 21. Tonight. Apr 20 - Apr 21. Check prices in Elektrostal for tomorrow night, Apr 21 - Apr 22. Tomorrow night.

The Food Standards Agency has advised Tesco customers to return the chocolate bars for a full refund. Read this and the rest of today's personal finance and consumer news in the Money blog.

NEW YORK — Gas prices are once again on the decline across the U.S., bringing some relief to drivers now paying a little less to fill up their tanks. The...

In the UK, Tesco, Lidl and other grocers have issued body cameras to employees. Bakery chain Greggs gave employees body cameras after a rise in sausage roll thefts and threats from customers.