- Get a Passport

- Renew a Passport

- Get a Passport Fast

- Courier Services

- Passport Information

The Passport 3 Month Rule - Country Requirements & More

Home » Passports » How to Obtain a U.S. Passport

Are you ready to plan an international trip? Before booking your tickets and traveling abroad, make that the validity of your passport is up-to-date. One crucial part of this process usually overlooked by people is the 3-month rule enforced by certain countries.

Even if your passport has not expired yet, there are places you cannot travel to or through unless you have at least 90 days' worth of validity remaining before the expiration date. These passport requirements are not negotiable.

If you are looking to travel internationally, you need to be prepared with a passport that will allow you to travel to and through all the countries on your itinerary.

Short Summary

- The 3-month passport validity rule requires passports to be valid for at least 3 months beyond the intended date of arrival, with exceptions and special cases.

- It is important to research entry requirements, obtain necessary visas in advance, and verify a passport's expiration date before traveling.

- If your passport does not have enough validity remaining, you will need to apply in person at a regional passport agency. Alternatively, our expert advice is to enlist the help of a registered passport expediting service to get your passport renewed as fast as possible .

- Emergency situations may require contacting one's home nation embassy or consulate to apply for emergency passport renewal service .

Click for reliable expedited passport courier service .

Understanding the 3-Month Passport Validity Rule

The 3-month passport validity rule mandates that a passport is valid for up to three months after the anticipated date of arrival. This regulation is in place to prevent illegal residency and guarantee travelers possess legal passports throughout their stay. Simply put, if you don't have the right travel documents, countries will deny you entry across their borders.

It's important for people intending to travel abroad to be informed about their destination country's rules about expiring passports. These differ from one nation to another.

While some countries require just a 3 month validity period, others might have different passport validity requirements. Some simply require a valid passport at time of entry. Many countries require more.

For example, many countries impose 6 month passport validity rules where individuals must have at least six additional months left before their passport expires. In some cases, requirements include other validity periods based on the nature of the traveler's stay and the corresponding visa.

To learn more, be sure to check out our guide to the six month validity rule for passports . We also maintain a list of countries that require six months of validity for entry.

Europe, The Schengen Agreement, and the 3-Month Rule

Many European countries are a part of the Schengen Agreement. This decades-old agreement between 27 European countries was designed to make travel within member nations faster, more efficient, and less expensive.

The agreement requires travelers to have valid passports during their stay, and it is governed by a 3-month passport validity rule. This same rule is also imposed by most other non-member nations across Europe in order to ensure that visitors do not overstay beyond their visa period.

Because of this common policy, countries can more efficiently monitor movement at their borders while reducing any risks connected with extended visits.

If you are planning to travel to Europe, be sure to read more about the Schengen Agreement , its rules, and its history.

Countries with a 3-Month Passport Validity Requirement

Again, passport validity is a critical factor for anyone planning international travel. Many European countries that are part of the Schengen Agreement require passports to be valid at least three months after an intended date of departure, including France, Germany, Italy and Spain among others.

Aside from these nations within Europe's borders, other non-European states impose this same 3 month passport rule too. Albania, Guatemala, and Panama being some popular examples.

It is important to research the passport policies for each country you plan on visiting. This is the only way to make sure you don't have hiccups during your travels due to invalid passports or failure to meet requirements regarding particular validity periods (which may also include six month rules). Ensure your U.S. passport holds sufficient time before leaving home by double checking beforehand!

Schengen Area Countries

The following countries are part of the Schengen Agreement and require 3 months of validity remaining on your U.S. passport:

*Travel through the microstates of Monaco , San Marino, and Vatican City are also governed by the Schengen Agreement.

It's necessary that all people in transit through any of these 27 signatory nations are certain their passports maintain at least 90 days of validity throughout the duration of their travels.

Other Countries That Require 3 Months Passport Validity

Be advised that passport validity requirements can change with little notice, so please pay attention to these rules when traveling internationally so you don't stumble upon unexpected complications!

For instance, be sure to pay attention to whether the three month validity rule is calculated based on your date of entry or anticipated date of departure from your desitnation country.

As of 2023, the countries listed below have a 3-month validity rule for U.S. passport holders:

Traveling to Countries with a 3-Month Rule: Tips and Advice

When it comes to passport validity, researching the passport requirements and regulations of each destination country is key to a successful trip.

Check your passport expiration date

Check if you need a visa.

Certain countries might require a travel visa while others allow you to enter without one. Visas are issued based on why you are traveling (e.g. tourism, school , work , business , etc.). The types and lengths of each visa is determined by each country's bilateral agreements with the United States.

Like passports, visas can take time to acquire, so make sure any permits are obtained well in advance of your trip. Even though some countries offer visas on arrival , there can be issues if you are relying on this type of service.

Be prepared for emergency situations.

Even if you plan on a short trip to a destination with a low (or no) validity rules, you want to be sure you are covered in case you have to stay longer due to a medical or personal emergency. Should you need to travel internationally in a hurry, you want to be sure your passport allows you to take the most direct and efficient route without having to worry about whether your passport has enough months remaining before it expires.

As a rule, it is wise to prepare yourself before any trips by having contingency plans ready just in case anything unpredicted may occur during your trip abroad. There is a chance an unexpected emergency may require you to travel to or through a country with a three or six month validity rule. If your passport has plenty of validity left, this is something you won't have to worry about.

In case of an emergency abroad, such as a lost or stolen passport , you should contact the nearest U.S. consulate or embassy for help. You will not be able to continue your travels without a passport-no matter what the validity rules are for the countries you need to travel to or through.

Based on over 20 years of helping readers with their passport related questions, our best advice is to maintain a valid passport with at least 9 months of validity or more. When your passport gets within a year of its expiration date, don't delay; renew it!

How to Renew Your Passport and Reset Your Passport Validity

Again, if you plan to travel internationally and your passport will not be valid for three months or more, don't wait. Renew your passport as soon as possible. This will ensure you have access to any country that allows American travelers-even if it has a three or six month validity requirement.

To get yourself a new or renewed passport, you need to send an application form along with the required supporting documentation , current passport photos , and pay the passport application fees .

It should be taken into account that the time needed for this renewal process may vary, so making sure everything's in order beforehand can help avoid issues during travel plans. Currently, the time to process a passport application is 6 to 8 weeks . An expedited application will be processed in 2 to 3 weeks .

Be sure to take into account these current processing times for renewal applications before planning any international trips. Also be advised that you will need to submit your current passport as part of the passport renewal process. This means you will not be able to travel internationally until your renewed passport arrives.

Visit our complete guide to renewing a U.S. passport for step-by-step instructions for how to get your passport renewed and our best tips for speeding up the process.

Expedited Passport Services

For those who require a new passport or need to renew theirs in a hurry, expedited services are available. Choosing expedited passport renewal on your application can save you several weeks of waiting for your new travel document, but it may not be fast enough for your needs.

For a faster passport renewal, you can try to make an appointment at one of the 26 regional processing agencies across the U.S. Know that you will need to demonstrate a need to travel internationally within 14 days. This option also includes several additional costs that must be considered.

The fastest and most efficient way to get a passport renewed is through a passport expediting service . These professionals use their expertise and experience to get you a passport faster than you likely can on your own. While they charge a fee for their services, these fees are often much less than what it costs to travel to a regional passport agency on your own and potentially wait days for your new passport to be issued.

Should you opt to go this route, consult our directory of top passport expediters .

Frequently Asked Questions

Can i travel with less than 3 months on my passport.

When planning any international travel, it is important to ensure that your passport will be valid for the duration of your trip and beyond. You should have at least three months remaining on your passport before going abroad. Many countries may require a validity period of six months or more.

Most airlines refuse boarding if you don't meet this requirement, so make sure you check in advance! To avoid issues while traveling overseas. For maximum travel flexibility, make certain that there's still enough time left on your passport by checking that it is valid for at least six months after departure dates from each destination on your itinerary.

Can I travel with 2 months on my passport?

Most countries require that your passport remain valid for a minimum of either three or six months beyond the duration of your trip. If you are planning to travel to one of these locations, you can't travel with only two months left. You likely will not even be able to board your international flight as most airlines deny boarding if relevant passport requirements for the destination country are not met.

To make sure that you are able to have a secure and safe journey, be certain to check all details in advance like dates or other information about any passports used before taking off.

However, some countries require only that your passport is valid upon entry. For peace of mind, always be sure your passport has enough extra validity remaining to account for any potential emergencies or disruptions to your travel plans.

Can I travel to Mexico if my passport expires in 3 months?

As long as your passport is still valid for the duration of the trip, you may go to Mexico even if it's expiring in three months. Mexican travel regulations don't mandate any minimum validity period for passports.

Can I travel to Canada if my passport expires in 3 months?

You can go to Canada as long as you have a valid passport during your stay-even if it's expiring in three months. Canadian travel requirements do not have any minimum validity period for U.S. passport holders.

Top 5 Questions About Expedited Passport Couriers

1. How can you get a passport when you're in a hurry? 2. What exactly does a passport expediter do? 3. Are passport expediting services legitimate? 4. How can I identify a reliable passport expeditor? 5. Is expedited passport service worth it?

You can also visit our library of articles about passport expediting .

Get the Latest Updates

I'm Just A Girl

Affordable Luxury Travel

Ultimate 3 Month USA Road Trip Itinerary – New York To California

This post about the ultimate 3 month USA road trip itinerary contains affiliate links.

Our 3 month USA road trip from New York to California was nothing short of amazing and even now, I’m still processing all the incredible things we saw, did and ate during our time in the United States.

After spending an amazing month in New York City over Christmas and New Year , I couldn’t imagine how our trip could get any better, but it really did just seem to get more and more awesome as we made our way across the vast country.

We spent the full 90 days of our allotted time in the USA (British citizens are entitled to a 90-day visa-free stay in the US with a valid ESTA ) and every single moment is something I’ll cherish forever.

A cross-country American road trip is something I’d always dreamed of, but I assumed it would be something I’d do when I was more “grown-up”.

However, after the shambles of the last two years that the Covid pandemic caused, Matt and I were determined to get back out into the world again and start our dream life of full-time travelling and there was really no better place to begin again than the gargantuan United States of America.

Read more: 3 Months In The USA – How Much Does A USA Road Trip Cost?

✈️ COME TRAVEL WITH ME IN 2023/2024 ✈️

If you’ve been wanting to experience a bucket list trip, now is your chance to do it as I’m looking to host my very own group travel trips! 🤯

If you’re interested in joining, or just learning more about these trips, PLEASE fill this survey out to help me choose the destination, the dates, the activities and the cost! It only takes 2 minutes and it shows me where you might want to travel to! 👀

Top tours and attractions to experience on a 3 month USA road trip

- Top of the Rock Observation Deck Ticket In New York

- Magnolia Plantation Tour & Transport

- Orlando Universal Studios Park to Park Ticket

- Evening Jazz Cruise on the Steamboat Natchez In New Orleans

- From South Rim: Grand Canyon Helicopter Tour

- Lower Antelope Canyon: Admission Ticket and Guided Tour

- Bryce Canyon National Park Sightseeing Tour

- Grand Canyon, Hoover Dam, Lunch, Skywalk Option From Las Vegas

- Universal Studios Hollywood Entry Ticket Los Angeles

- Alcatraz Visit with Ferry and Bay Cruise From San Francisco

We spent 3 months travelling across 18 states (however, we only spent some proper time in 15 states) via plane, train, bus, car and bicycle all the way from New York City to San Francisco in California. We used various modes of transport during our trip which was such a cool experience and instead of just driving the entire way across the country, it meant that we experienced numerous different ways of travelling across America.

I’m still struggling to process the fact that we’ve ticked off this incredibly huge bucket list experience (although there are definitely still many states that I’d like to visit!), but I’ve attempted to document our remarkable trip below in the form of my ultimate 3 month USA road trip itinerary.

In my guide, I’ve covered the exact route we used for our 3-month road trip USA itinerary, all the different modes of transport we used, where we stayed and a brief list of the top things to see and do in each place.

It’s an absolutely mammoth post, so I hope you’re ready to start planning your epic 3-month road trip across the USA!

I want to preface this epic 3-month USA road trip guide by really enforcing the fact that this was our route, so it’s very tailored to our personal experiences and preferences. For example, I don’t expect you guys to spend a month in New York City or a week in Richmond, Virginia as those were very unique experiences as part of our USA road trip. I do, however, hope that you can take a lot of inspiration from our road trip across America and I really hope that it helps you to plan your own epic cross-country USA trip!

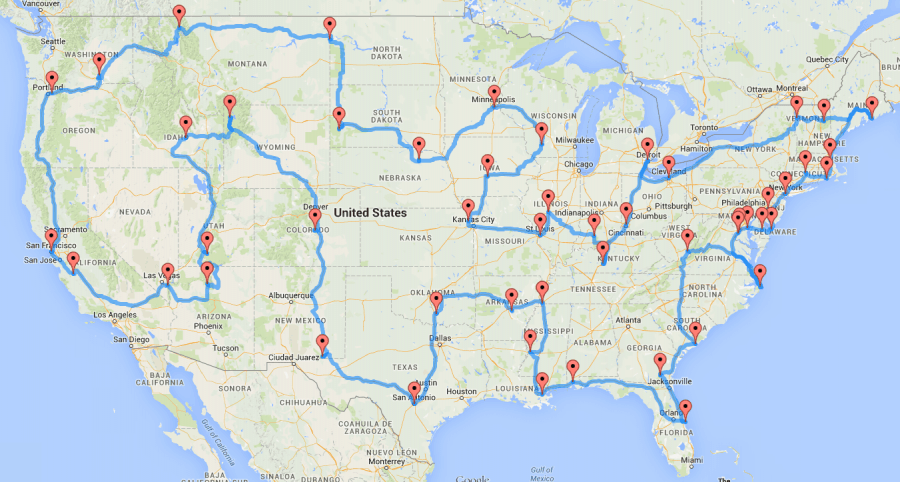

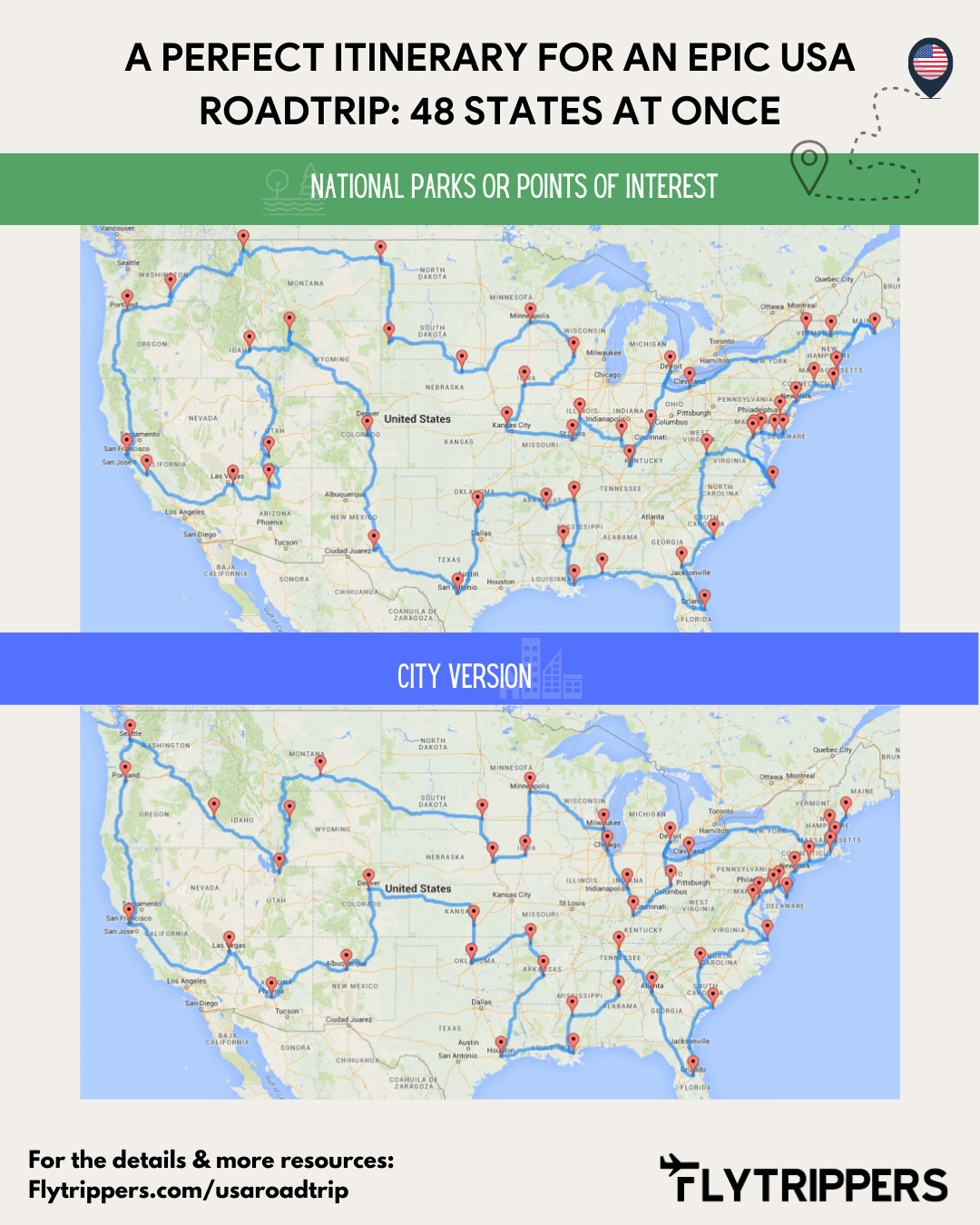

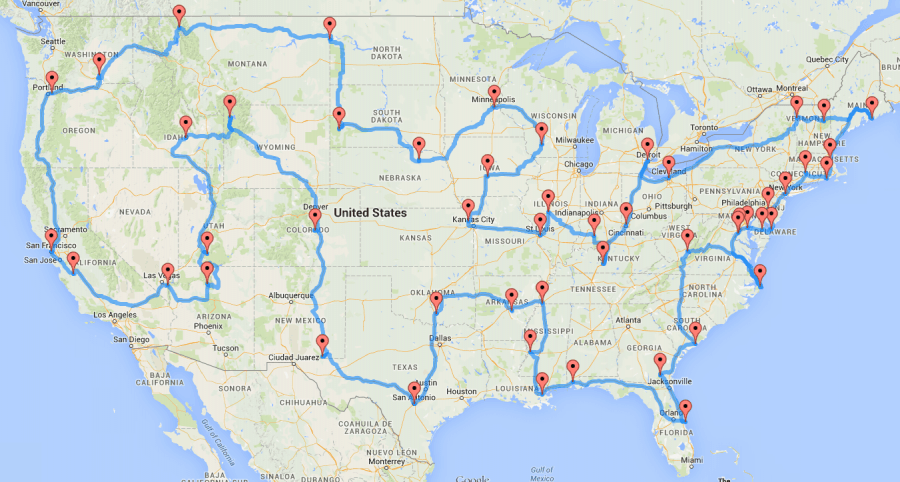

Map of our 3 Month USA Road Trip

As you can see from the map above, we didn’t drive the entire way across America; we took several buses, trains and planes before we eventually hired a car in Dallas, Texas. I’m going to be writing an entirely separate post all about the driving part of our USA road trip, so that will be helpful for you if you only want to drive across America or if you only want to take a route from Texas to California.

We didn’t hire a car straight away in America as we weren’t sure if we even wanted to at all. I was very worried about driving in America, plus the cost of a hire car and gas prices put me off at first. However, it turned out to be the very best decision for the rest of our American road trip and I’m so glad we hired one in Dallas.

The first part of our trip was 1 month in New York City , so we didn’t use any modes of transport there apart from the subway. After that, we took multiple trains and buses from NYC to Washington , Richmond, Charleston , Savannah, Orlando and Miami and then we flew to New Orleans where we took a few more buses until we finally got to Dallas where we hired our car.

Below, I’ve included all the details of our 3-month American road trip itinerary, so I hope it helps you to plan your own amazing journey across the USA!

Read more: 3 Months In The USA Budget – How Much To Travel America

3-month road trip USA itinerary summary

- Washington D.C.

- New Orleans

- Albuquerque

- Colorado Springs

- Glenwood Springs

- Arches National Park

- Dead Horse Point State Park

- Bryce Canyon National Park

- Zion National Park

- Grand Canyon National Park

- Joshua Tree

- Los Angeles

- Kings Canyon National Park

- Yosemite National Park

- San Francisco

Read more: The Ultimate 1 Month USA Road Trip Itinerary – California To Texas

Day 1-31 of our 3 Month USA Road Trip – New York City

We started our epic 3-month road trip across the USA with a one-month stay in New York City . It’s been my dream to live in New York ever since I can remember so making it a reality, even if it was just for one month, was quite literally one of my biggest dreams come true.

Naturally, I don’t imagine that many of you guys will start your American trip by spending a month in NYC, but if you do decide to, I’ve covered everything you need to know about living in New York for one month in this post .

Where to stay in NYC

We lived in an apartment for the one month that we stayed in NYC, but I have also stayed in numerous hotels on my previous visits to New York.

My favourite hotels in New York City include:

- Courtyard New York Manhattan/Times Square

- New York Marriott Marquis in Times Square

- The Plaza Hotel

Top things to do in NYC :

- Go to SUMMIT One Vanderbilt

- Enjoy drinks on the rooftop at 230 Fifth

- Visit the Top of the Rock at sunset

- Take a self-guided walking pizza tour

- Hang out in Central Park

Check out my New York content here.

Days 31-33 – Washington D.C.

After one month in New York, we got a bus to Washington D.C. for two nights. I’d been to D.C. twice before, so I’d already seen and done many things in the city, but it was Matt’s first time in the United States’ capital, so it was fun to explore the city with him.

Two or three days in Washington D.C. is more than enough time to see and do as many things as possible and while it’s not my favourite city in the US (it actually was before this trip, though!), I’d still recommend adding it to your USA road trip itinerary as there are some great cultural experiences to be enjoyed there.

Where to stay in D.C.

We stayed at the Motto by Hilton Washington DC City Center which was a great place to base ourselves while in D.C. It’s just a stone’s throw from the Capital One Arena and as it’s located in Chinatown, there are plenty of great places to eat around the hotel.

Top things to do in Washington D.C.

- See the Lincoln Memorial

- Walk the National Mall

- Visit the Smithsonian National Museum of Natural History

- See the National World War II Memorial

- Check out the Thomas Jefferson Memorial

Here’s more of my Washington D.C. content!

Days 33-41 – Richmond, Virginia

We spent eight days in Richmond, Virginia, which as I said above, I wouldn’t expect you to add it to your USA road trip itinerary as it’s not your typical tourist city. However, my aunty, uncle and two cousins live in Richmond so we decided to head there for just over a week to spend some quality time with them.

I don’t get to see them very often so it was so incredibly lovely to spend that time with them as part of our road trip across America. If you do decide to go to Richmond, I’ve included a few ideas of the best things to do below.

Top things to do in Richmond

- See the Virginia State Capitol

- Visit the American Civil War Museum

- Go to the Virginia Museum of Fine Arts

- Stroll through the Lewis Ginter Botanical Garden

- Take a day trip to Kings Dominion

Days 41-44 – Charleston, South Carolina

Charleston wasn’t originally on our road trip itinerary from New York to California, but after hearing so many incredible things about it and after seeing that it was voted as the best city in America by Travel+Leisure , we decided to visit and I’m so glad we did!

It’s such a beautifully charming city with plenty of stunning architecture and lots of fascinating history, which can’t actually be said about an awful lot of US cities. If Charleston isn’t on your USA road trip bucket list, add it now!

Where to stay in Charleston

Our hotel in Charleston, Wingate by Wyndham Charleston Airport Colesium , was actually one of my favourite places that we stayed during our entire trip across America and even though it wasn’t in the best location for exploring Downtown Charleston, the room was huge and the bed was so comfy and it was just a really lovely place to stay.

Top things to do in Charleston

- Take a tour of Magnolia Plantation

- Go on a tour of Boone Hall

- Admire St Matthew’s Lutheran Church

- Wander around The Battery

- Visit Charleston City Market

Read my ultimate guide to Charleston here.

Days 44-46 – Savannah, Georgia – 3 Month USA Road Trip

Savannah is another city that took me by surprise and it’s another great spot to visit on a trip across America. There aren’t tonnes of things to do in Savannah, so a day or two should be enough time to explore the city and check out some of the fun hotspots.

Where to stay in Savannah

We stayed at Days Inn by Savannah Airport for two nights and even though it wasn’t my favourite hotel, it gave us the chance to explore the awesome city of Savannah for a few days and it was one of the cheapest accommodation options in the city.

Top things to do in Savannah

- Stroll through Forsyth Park

- Spend an afternoon at Pour Larry’s Bar

- Admire the beautiful Cathedral Basilica of St. John the Baptist

- Eat a delicious breakfast at Clary’s Cafe

- Check out the River Street Market Place

Days 46-51 – Orlando, Florida

I never expected to visit any theme parks in Orlando, Florida on our road trip as I always assumed that you need to go on a huge two-week holiday there, but I was so happy that we carved out four days in our road trip schedule to visit Universal Studios and Islands of Adventure .

Where to stay in Orlando

The hotel we stayed at in Orlando, Quality Inn at International Drive , was another one of my favourite hotels from our trip. While it’s not exactly anything special, our room was huge, it had a pretty sizeable pool and it was just 10 minutes from Universal Studios!

Top things to do in Orlando

- Visit Universal Studios & Islands of Adventure Orlando

- Go to Disney World

- Ride the Orlando Starflyer

- Spend a day at SeaWorld Orlando

- Visit the Wizarding World of Harry Potter at Universal

Days 51-54 – Miami, Florida

Miami, Florida turned out to be one of my favourite cities in America and despite the fact that I’m not normally the biggest fan of the heat, especially when it comes to city life, I truly fell in love with Miami.

The beaches here are as good as everyone says they are, the food is awesome and the whole area of South Beach and the Downtown metropolis area are so much fun.

Where to stay in Miami

Our hotel in Miami, SoBeNY The Variety , was by far the most expensive place we stayed during our coast to coast American road trip, yet it was also one of my least favourite places that we stayed during our trip. It’s a hotel that clearly used to be a hostel and while the rooms were nice enough and the location was pretty great, it was just far too expensive for what it actually is in my opinion.

Top things to do in Miami

- Explore South Beach

- Ride bikes across to Downtown Miami from South Beach

- Get a Fat Tuesdays frozen cocktail

- Check out the Art Deco District

- Party on Ocean Drive

Check out my ultimate guide to Miami, Florida here.

Days 54-57 – New Orleans, Louisiana

From Miami, we decided to fly to New Orleans as there were very few places in between Miami and NOLA that we wanted to see, so it made the most sense for us to fly.

Unfortunately, if there’s one major place that we visited on our American road trip that I wouldn’t personally recommend, it would have to be New Orleans.

I was so disappointed to discover that I didn’t enjoy New Orleans very much, especially after hearing nothing but rave reviews from literally everyone I knew who had been, but it just didn’t do it for me.

However, I would never tell you not to go to a place as I’m a firm believer in encouraging people to visit new places and see what they think for themselves, but I wanted to give my honest opinion and say that I just didn’t love it as much as I expected to.

Where to stay in New Orleans

We stayed at Balcony Guest House in New Orleans which was a very adorable place to stay. It’s a guest house that very much feels like someone’s home and while we never actually met the hosts of the house, it felt very welcoming and it’s located in a nice neighbourhood of NOLA.

Top things to do in New Orleans

- Eat a scrumptious beignet from Café du Monde

- Go drinking down Bourbon Street

- Explore New Orleans City Park

- Admire the beautiful houses and buildings in the French Quarter

- Check out Jackson Square

Days 57-61 – Austin, Texas – 3 Month USA Road Trip

Austin, on the other hand, was a city in the US that I really loved. While I didn’t think that there were tonnes of things to do there, Austin has one of the best nightlife scenes I’ve experienced in any major city around the world and it just has a very nice feel to it.

Where to stay in Austin

We stayed at Days Inn by Wyndham Austin/University/Downtown which was a nice enough motel but it wasn’t in the best location if you haven’t got a car (we didn’t at this stage), so the walk into the main part of the city was around an hour or so. It was a nice enough walk though, and it takes you through the university campus which is brilliant, so I wouldn’t actually mind staying there again, it would just probably be more convenient if you have a car.

Top things to do in Austin

- Wander around the university campus

- Eat some barbecue (Black’s Barbecue)

- Check out the cool food trucks on Rainey Street

- Have a stroll through Waller Beach at Town Lake Metropolitan Park

- Spend an evening drinking and dancing on 6th Street

Dys 61-64 – Dallas, Texas

We mainly headed to Dallas to see one of my very good friends who’s originally from Doncaster (like me!) but has lived in the US for the last three years. It was so wonderful to see her and her beautiful one-year-old daughter and she made our time in the city very enjoyable.

We didn’t do loads of things while we were in Dallas and I definitely don’t think you need to spend four days there, but it’s a good place for a pit stop on a US road trip.

We also picked up a hire car in Dallas for the remainder of our road trip, so this is where the trip really gets interesting as we started to stay in a different town/city/state almost every night!

Where to stay in Dallas

We spent four nights in Dallas which you definitely don’t need to do, but we spent two of those with a friend of mine and two of them working. We stayed at the Comfort Inn & Suites Love Field – Dallas Market Center which was actually a pretty nice hotel. The location isn’t the best, but Dallas is so incredibly big that you really do need a car to get around the city (which is why we picked up a hire car here!).

Top things to do in Dallas

- Visit the Fort Worth Stockyards

- Watch the sunset over the city from the Ronald Kirk Bridge

- Go to The Dallas Arboretum and Botanical Garden

- Check out The Sixth Floor Museum

- Head to the top of the Reunion Tower

Days 64-65 – Roswell, New Mexico

On our first full day with our hire car, we made the 7+ hour drive from Dallas, Texas to Roswell, New Mexico. It felt so amazing to have our own vehicle to explore the country and even though I was incredibly nervous about hiring a car in America as I was scared that the roads would be too big and scary, I am beyond grateful that we did as it made the whole trip so much better and easier.

We really only wanted to visit Roswell because of all the alien connotations and the International UFO Museum was a great place to learn more about the history of the ‘Roswell Incident’, so if you’re into that kind of thing, definitely add Roswell to your American road trip bucket list.

Where to stay in Roswell

We only spent one night in Roswell and we stayed at the Days Inn by Wyndham Roswell (can you sense a theme of motels here?!) and it was a great place to stay for one night. The breakfast here was also one of the best we experienced out of all the free motel breakfasts on our trip which was a warm welcome as most of them were pretty terrible!

Top things to do in Roswell

- Go to the International UFO Museum

- Check out the alien-themed McDonald’s

- Visit the Roswell Museum

- Wander through the town and check out all the alien and space-themed memorabilia

- Explore the Roswell Historic District

Days 65-66 – Albuquerque, New Mexico

The following day we left Roswell and made our way toward Albuquerque with a stop at White Sands National Park first. This was the first official national park of our road trip and it was a great way to officially begin seeing incredibly cool stuff while driving through the many terrains in America.

Albuquerque itself was also a nice enough place to visit and while I wouldn’t necessarily be in a rush to visit again anytime soon, it was a logical place to spend the night between visiting different national parks.

Where to stay in Albuquerque

We stayed at the GreenTree Inn Albuquerque North I-25 and while the staff here weren’t the friendliest, there are on-site laundry facilities and free breakfast, so it was a good enough place to spend the night on our road trip.

Top things to do in Albuquerque

- Ride the Sandia Peak Tramway

- Wander around the adorable Old Town and Plaza

- Visit the Albuquerque Museum

- Check out the Indian Pueblo Cultural Center

- Admire the beautiful San Felipe de Neri Church

Days 66-67 – Santa Fe, New Mexico – 3 Month USA Road Trip

After Albuquerque, we drove to Santa Fe and even though there isn’t loads to do there, it made sense for us to spend the night there so that we were in a good location to head to the Great Sand Dunes the following morning.

Where to stay in Santa Fe

The place we stayed in Santa Fe, Motel 6 Santa Fe , was one of my least favourite places that we stayed during our entire road trip. It was also one of the cheapest places we stayed, but Motel 6 are probably one of the least desirable motel chains in America as they just feel super seedy and dodgy and there are always weird people hanging around. I’d recommend splashing out even just $10 more a night and staying somewhere slightly nicer.

Top things to do in Santa Fe

- Check out the Santa Fe Original Route 66 signs

- Wander around Santa Fe Plaza

- Visit the New Mexico Museum of Art

- Go to the IAIA Museum of Contemporary Native Arts (MoCNA)

- See the Palace of the Governors

Days 67-68 – Colorado Springs, Colorado

The next morning we ventured to the Great Sand Dunes National Park and Preserve which was such an incredibly cool place to visit. I also just want to note that the way I’m writing these brief snippets makes it sound like everywhere is really close together, when in fact, it’s the total opposite!

We did almost 100 hours of driving just on our self-drive itinerary from Texas to California, and that’s without all the places we visited before we got to Dallas, so be prepared for an awful lot of driving if that’s the mode of transport you choose to travel across America!

After the Sand Dunes, we drove to Colorado Springs, which was our first stop in Colorado and even though we only spent one night there, it was a lovely little place to spend time on our road trip.

The drive from Santa Fe to Colorado Springs was around 5 hours, so we didn’t really do very much in the evening when we arrived apart from eating at Olive Garden and hanging out in the common room/kitchen of our hostel!

Where to stay in Colorado Springs

We stayed at the ColoRADo Adventure Hostel while in Colorado Springs and it was such a cool and fun place to stay; I kind of wished we could have stayed there longer! We met some really cool and interesting people at the hostel and there’s the cutest little hostel dog which is so funny and adorable!

Top things to do in Colorado Springs

- Take a trip to the Garden of the Gods

- Check out Pikes Peak

- Head to the Cheyenne Mountain Zoo

- Visit the U.S. Olympic & Paralympic Museum

- Stroll around Prospect Lake

Days 68-69 – Denver, Colorado

Once we’d had breakfast at the hostel in Colorado Springs, we were on our way again, this time to the nearby Garden of the Gods Park, just outside of Colorado Springs.

This place is absolutely awesome and definitely somewhere to add to your USA road trip itinerary. It’s free to visit and the rock formations throughout the park are absolutely incredible.

We then headed to Denver for the afternoon/night where we explored the Downtown area before heading back to our hotel and having a McDonald’s for dinner as it was starting to get ridiculously cold and we couldn’t be bothered finding anywhere proper to eat!

This is where the weather really started to get freezing cold for the next few days of our road trip!

Where to stay in Denver

The hotel we stayed at in Denver, La Quinta Inn & Suites by Wyndham Denver Gateway Park , was another one of the nicer places we stayed during our road trip across America. Again, it wasn’t anything flashy or fancy, but it just felt much smarter and cleaner than many of the other places we stayed and it was in a nice enough part of the city.

Top things to do in Denver

- Take a trip to the Rocky Mountain Arsenal National Wildlife Refuge

- Explore Downtown Denver

- Spend an afternoon at Denver Zoo

- See the beautiful Denver Botanic Gardens

- Check out the Colorado State Capitol

Days 69-70 – Glenwood Springs, Colorado

Our morning started with a drive around the Rocky Mountain Arsenal National Wildlife Refuge in Denver before driving through Glenwood Springs to Aspen where we spent a few hours frolicking in the snow and checking out the awesome mountains (there was a lot of snow and it was unfathomably cold!), before driving back to Glenwood Springs again to spend the night.

It might seem silly to drive through Glenwood to Aspen and then come all the way back again and we did originally intend to spend the night in Aspen, but the hotels were a minimum of $600 a night because it was peak ski season and we couldn’t justify spending that much money just for one night!

Glenwood Springs was a great place to stay, however, and I’m still glad we made the little detour to go to Aspen as it’s such a cool little place and I’d definitely love to head back there again one day for ski season (if I ever actually learn to ski, that is!).

Where to stay in Glenwood Springs

The place where we stayed in Glenwood Springs was perhaps one of the most beautiful in terms of the surrounding views as we woke up to many inches of snow and gorgeous snowy mountains all around us at Silver Spruce Inn . This was a wonderful place to stay and Glenwood Springs was a surprisingly lovely little town.

Top things to do in Glenwood Springs

- Visit the Glenwood Hot Springs Pool

- Eat at Glenwood Canyon Brewpub

- Spend the day at Glenwood Caverns Adventure Park

- Relax at the Iron Mountain Hot Springs

- Explore Glenwood Canyon

Days 70-71 – Moab, Utah – 3 Month USA Road Trip

The next day we woke up and made our way over the border into Utah which marked our 12th state of the trip!

Utah welcomed us with crazy amounts of snow and some of the most glorious scenery I’ve ever seen. Spoiler alert; Utah is probably my favourite state in the USA!

The first place we visited in Utah was Arches National Park , just a short 10-minute drive from where we spent the night in Moab. Arches National Park is undoubtedly one of my favourite places of our entire three-month cross-USA road trip and I really must insist that you add it to your itinerary because it’s such a ridiculously beautiful and amazing place!

Where to stay in Moab

The Inca Inn in Moab was a fine place for us to base ourselves once we arrived in Utah. We spent the night there after visiting Arches National Park and while it wasn’t my favourite place we stayed as the room wasn’t the cleanest and the shower fluctuated so much in pressure and heat, it was still an OK place to spend the night for a very cheap price.

Top things to do in Moab

- Spend the day in Arches National Park

- Explore the Potash Road Dinosaur Tracks and Petroglyphs

- Check out the Sand Flats Recreation Area

- Take a trip to Dead Horse Point State Park

- Visit the Moab Museum

Days 71-72 – Panguitch, Utah

We started day 71 of our bucket list road trip across the USA by heading to Dead Horse Point State Park which is a place that easily rivals the Grand Canyon. This place was recommended to me by my very good friend and fellow travel blogger, Nele , and I am so glad we followed her advice because this place is absolutely freaking awesome!

Afterwards, we drove four hours across Utah to a tiny little town called Panguitch so that we were set up for the next day to head into Bryce Canyon National Park.

Where to stay in Panguitch

We stayed at the Color Country Motel in Panguitch and while the motel itself was a nice enough place to stay, there’s absolutely nothing in the town at all, so we actually struggled for something to eat when we arrived fairly late at night (we ended up eating at Subway at the gas station on the drive into the town!).

Days 72-73 – Big Water, Utah

The following day, we checked out of the motel in Panguitch and drove half an hour to Bryce Canyon National Park, which is another one of my trip highlights from our time in America.

This place is beyond beautiful and as I’d only ever seen pictures of it in the summer months, I was so shocked to see it completely covered in snow; it looked so otherworldly and magical. Please add Bryce Canyon NP to your USA road trip itinerary!

After Bryce, we drove approximately an hour and a half to our second national park of the day; Zion. This national park also needs to be on your USA bucket list and while I personally think that Bryce Canyon just trumps the top spot for me, Matt said he preferred Zion National Park, so you’ll have to visit both yourself and let us know which one you prefer ;). It’s a very tough call to make as they’re both so awesome and I’d highly recommend trying to add both to your road trip itinerary across America.

That evening, we drove to a little town called Big Water where we spent the night before heading into Arizona the following day.

Where to stay in Big Water

We stayed at Rodeway Inn & Suites Big Water – Antelope Canyon which is basically a motel on a ranch in the middle of nowhere and while there isn’t really anything to do in Big Water at all, it was an ideal spot for us to stay the night as we made our way into Arizona as it’s right next to the Utah/Arizona state border. This motel is also so lovely and homely, it has on-site laundry facilities and it was the cheapest place we stayed during our entire trip!

Days 73-74 – Flagstaff, Arizona

We were technically only in Arizona for 24 hours, but we managed to see and do quite a lot during that short window of time!

Firstly, once we’d driven over the border between Utah and Arizona, we went to Horseshoe Bend which wasn’t actually quite as cool as I thought it would be. It’s definitely an awesome feat of nature and I’d still recommend visiting, but the water didn’t look as nice as I’d seen in pictures online, but I think that’s because it hadn’t rained very much.

After Horseshoe Bend, we drove into the Grand Canyon National Park which was obviously another incredible highlight of our 3-month USA trip. I couldn’t get over just how big it is (did you know that it’s bigger than the state of Delaware?!) and I honestly think you could spend an entire week there and still not cover it all!

Unfortunately, we only spent a few hours at the Grand Canyon but this gave us time to embark on a few walks to various viewpoints so that we could see this remarkable natural landscape from a few different angles.

That evening, we drove to a place called Flagstaff which is actually a much bigger place than I first thought. We headed to the Lowell Observatory where we looked through several telescopes and learned plenty of awesome things about space. If you’re a bit of a space nerd, you’re sure to enjoy the Lowell Observatory, so if you pass through Flagstaff while you’re near the Grand Canyon, I think it’s worth making the stop to visit the observatory.

Where to stay in Flagstaff

The Travellers Inn in Flagstaff was definitely one of the worst places we stayed during our road trip across the USA. Even though it gets fairly respectable reviews on Booking.com, we really didn’t enjoy staying here; the staff took 15 minutes to come to the front door of the motel lobby when we rang the buzzer (even though there’s supposed to be a 24-hour front desk service), the room was really dirty and the shower was so filthy that we didn’t actually use it because it was so gross. I definitely wouldn’t recommend this place in Flagstaff, but there are numerous other hotels/motels in the city that would probably be much better; we only stayed here because it was by far the cheapest.

Top things to do in Flagstaff

- Spend an evening at Lowell Observatory

- Check out the North Pole Experience

- Look out for the Route 66 signs

Days 74-77 – Las Vegas, Nevada – 3 Month USA Road Trip

Once we’d woken up from a not-so-great night’s sleep due to the pretty shoddy motel in Flagstaff, we made the four-hour journey to Las Vegas !

We were in Las Vegas for Matt’s 24th birthday which was such a ridiculously cool place to enjoy his birthday celebrations. We had so much fun exploring all the crazy cool hotels, gambling (and inevitably losing!) money in the casinos and eating some truly remarkable food.

I totally get that Vegas isn’t for everyone, but I do think it’s a place you should try and experience while on an American road trip, even if it’s just for one day so that you can get a feel for what this crazy city is like!

Read more: 10 Best Party Cities In The US – Best Nightlife Cities

Where to stay in Las Vegas

We spent three nights at the SAHARA Hotel in Vegas and this was undoubtedly the nicest place we stayed on our 3-month road trip across America. Our room was absolutely beautiful, so clean and modern, and the only negative review I have to say about it is that the shower curtain didn’t go right down to the floor so the bathroom floor got soaking wet any time the shower was used.

Apart from that, the hotel is beautiful and it’s right at the top of the Strip so you get to enjoy walking all the way down to see every hotel and casino along the iconic Strip in Vegas.

Top things to do in Las Vegas

- Watch the Bellagio Fountain show

- Eat at Stripsteak in Mandalay Bay

- Explore the spectacular Venetian Hotel

- Go to the top of the Stratosphere observation deck

- Check out the New York New York hotel and rollercoaster

Days 77-78 – Yucca Valley/Joshua Tree, California

After our three days in Vegas were up, we made our way into the fifteenth and final state of our American road trip; California!

Our first stop was Joshua Tree National Park where we embarked on a few hikes on some relatively short trails in the park (such as Arch Rock and Heart Rock) and even though we didn’t spend a tonne of time there, it was still so great to see and it’s yet another spot that I’d highly recommend adding to your USA itinerary for a 3-month trip.

We actually spent the night in Yucca Valley which is just on the outskirts of Joshua Tree National Park.

Where to stay in Joshua Tree

We stayed at Super 8 by Wyndham Yucca Val/Joshua Tree Nat Pk Area for one night once we arrived in California and while it wasn’t exactly the fanciest hotel we stayed in, it was more than nice enough and did the job for the night.

Top things to do in Joshua Tree National Park

- Do the Arch Rock trail

- Walk to see Heart Rock

- Check out Keys View scenic point

- Hike to the Skull Rock viewpoint

- Go on a short walk on the Hidden Valley Nature Trail

Days 78-80 – San Diego, California

We’d heard mixed things about San Diego and while I personally really liked the city, I didn’t quite love it as much as New York , Miami or San Francisco , for example.

It is a really lovely city, however, with a lot of things to see and do and Balboa Park and the Gaslamp Quarter, in particular, are great places to hang out. While you’re in San Diego, be sure to get a burger from Hodad’s Downtown; it might not look like much, but Matt claims it’s the best burger he’s ever had (and he’s had a lot of burgers!).

Where to stay in San Diego

The Baymont by Wyndham San Diego Downtown where we stayed in the city was a great place to base ourselves as it’s in such a great location for exploring many of the city’s top sights and attractions. There was also free breakfast included and as we got a free room upgrade thanks to our Genius Level 3 status on Booking.com, we were given a room with two double beds. The only qualm I had about this hotel is that the people in the room next to us were ridiculously noisy all night until I called reception at around 4am and then they swiftly fixed the issue, so the staff were great. There’s also on-site parking, although it costs around $20 a day which is unusual for motels/hotels to charge for parking in the US.

Top things to do in San Diego

- Eat the best burgers (Matt’s words!) from Hodad’s Downtown

- Spend an afternoon in Balboa Park

- Take a trip to Mission Beach

- Eat and drink in the Gaslamp Quarter

- Watch a college baseball game

Days 80-84 – Los Angeles, California

After our two nights in San Diego, we made the three-hour drive to Los Angeles which is a city that had been sitting firmly at the top of my to-visit list for many years.

We spent four nights in LA which I think is about the right amount of time that you need to spend in the city. I honestly didn’t realise just how huge Los Angeles is until we got there and started planning an itinerary of things to see and do and while it is possible to get around without a car, I promise it’ll make your life 100 times easier if you have your own vehicle as everything is so vast and spread out and public transport is pretty poor in the city.

We had an awesome few days in LA, exploring the Downtown area and visiting some of the city’s top beaches such as Santa Monica and Venice Beach and we also had a wonderful experience watching a magical sunset from the Griffith Observatory.

Where to stay in LA

Los Angeles is such a huge city that it was difficult to decide where to stay. In the end, we settled for Park Cienega Motel which I was a bit apprehensive about when we first arrived as it looked a bit odd, but it was in fact a really lovely place to stay in LA. It’s not really within walking distance to anything, however, so you will have to be prepared to drive in this crazy city!

Top things to do in LA

- Spend the afternoon in Santa Monica

- Check out Venice Beach and the Venice Canals

- Visit the Griffith Observatory at sunset

- See the Hollywood Sign

- Go shopping on Rodeo Drive

Days 84-85 – Porterville, California – 3 Month USA Road Trip

After Los Angeles, we drove to Porterville, which is approximately a 3 hours drive north of LA. While we didn’t see or do anything in Porterville itself (largely because there aren’t many things to do there), we decided to stay here so that we would be close to the Sequoia National Park for a trip the following day.

The only thing we did when we arrived in Porterville was head out into the little town to a restaurant called The Vault Bar & Grill for something to eat. From checking various Google reviews, it seemed that Porterville has many highly-rated places to eat, so if you do happen to spend a night there, at least you know that you’ll be well-fed!

Where to stay in Porterville

America’s Best Value Inn Porterville was a very pleasant place to stay for the night in Porterville. Like many of the places we stayed on our cross-country American road trip, it wasn’t anything flash or fancy, but it did the job of letting us rest for the night without any complaints!

Days 85-86 – Mariposa, California

Once we’d left Porterville the following morning, we made our way to Sequoia/Kings Canyon National Park where we saw the giant Sequoia trees. This place wasn’t my number one favourite national park (although it is hard to pick an absolute favourite as we visited so many incredible places), but it was still remarkable to see the giant trees, particularly the General Grant Tree which is so cool to see!

When we left the national park, we drove two and a half hours to our next hotel in a tiny town called Mariposa. We decided it was worth driving that far on this day so that we would be as close as possible to go to Yosemite National Park the following day.

Where to stay in Mariposa

Mariposa was the most adorable little town that I really wished we’d have spent more time in. We stayed at 5th Street Inn which was such a beautiful guest house with the loveliest rooms and the comfiest bed!

Days 86-87 – Merced, California

Yosemite is undoubtedly one of the most iconic national parks in the United States and in my opinion, perhaps the number one best national park in the whole country!

It’s a place I’d wanted to visit for so many years and I’m so happy that it not only lived up to my expectations, but it also far exceeded them! Despite several of the trails and roads being closed due to winter weather conditions, we still managed to enjoy plenty of the awesome things that Yosemite has to offer, including the iconic Dawn Wall (El Capitan), Tunnel View, Half Dome, Bridalveil Falls, Upper Yosemite Falls and Lower Yosemite Falls.

Yosemite National Park simply has to be on your 3 month USA road trip itinerary!

Where to stay in Merced

After a busy day of exploring Yosemite National Park, we stayed at Days Inn Merced/Yosemite Area as it was a logical place for us to spend the night after a busy day in the national park before we headed to San Francisco. It was a nice hotel with a pretty decent free breakfast and even though the surrounding area isn’t the nicest, it was a perfectly acceptable place for a rest stop on our road trip.

Days 87-90 – San Francisco, California – 3 Month USA Road Trip

The following morning, we drove the two and a half hours to San Francisco where we spent the last three days of our American road trip.

I absolutely adored San Francisco and it’s probably my second favourite city in the US (after New York). There’s so much to see and do there with plenty of great restaurants and it just has such a great vibe to it. I was a bit worried that we wouldn’t enjoy it as we’d heard very mixed reviews about it, but San Francisco completely exceeded all my expectations and it was such a brilliant place to conclude our epic 3 month trip across America!

Where to stay in San Francisco

Alpha Inn & Suites was the last place we stayed as part of our 3-month trip across America and we spent three nights there. It’s located in a pretty good location to many of the city’s top sights such as the Golden Gate Bridge and Lombard Street and the bar and restaurant scene in the surrounding area is brilliant.

Top things to do in San Francisco

- Take a tour of Alcatraz Island

- Check out the viewpoints of the Golden Gate Bridge

- Eat at Super Duper Burger

- Explore Fisherman’s Wharf and the sea lions on Pier 39

- Play retro arcade games at Musée Mécanique

Writing this blog post has been such a good way for me to reminisce on our incredible time in America and I really hope it helps you to plan your own awesome USA road trip itinerary!

Related posts:

- 3 Months In The USA – How Much Does A USA Road Trip Cost?

- 111 Best Things To Do In New York City – Ultimate NYC Travel Guide

- Ultimate Miami Travel Guide – 25 Best Things To See, Do & Eat In Miami

- How To Spend Two Days In Washington D.C. – Best Things To Do & See

- 40 Best Things To Do In San Francisco – Ultimate San Fran Travel Guide

Pin for later – 3 month USA road trip

Do you have any of these places on your 3 month USA road trip itinerary? Would you like to add anywhere else to your trip? Let me know in the comments or on Instagram at @imjustagirl_16 .

The Ultimate 1 Month USA Road Trip Itinerary – California To Texas

The Best 4-Day Universal Studios Orlando Itinerary

Toronto vs New York City – Which Is Better To Visit In 2024?

The Best Casino Hotels In Las Vegas – Vegas Travel Guide

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

United States Travel Guide

Last Updated: April 14, 2024

The United States isn’t a popular destination for backpackers and budget travelers. Most overseas tourists come here for a short vacation, visit one or two cities, and then head home. They usually stick to the big coastal cities or places like Disney.

And it wasn’t until COVID that Americans en-masse bothered to hop in their cars and explore their backyard.

The U.S. is massive country that lacks a lot of tourist infrastructure or good cross-country transportation. Hostels haven’t quite caught on, trains don’t go to many places, and we don’t offer working holiday visas to attract young working backpackers. In short, it’s hard to get around.

However, the United States has a lot to offer: stunning national parks, gorgeous landscapes, incredible and diverse culture, world-class music, and a variety of delicious cuisine that varies from region to region.

I think the U.S. is one of the best destinations in the world to road trip . I’ve done several multi-month road trips across the United States . While the coastal cities are fun, the U.S. really reveals itself in the middle and countryside (it’s much more affordable there too). It’s in the nooks and crannies of America that you get a sense of its quirks.

But even if you aren’t spending months visiting the country in a car, there’s still a lot you can do via train, bus, or plane.

This travel guide to the United States can help you navigate the country, save money, and get off the beaten path.

Table of Contents

- Things to See and Do

- Typical Costs

- Suggested Budget

- Money-Saving Tips

- Where to Stay

- How to Get Around

- How to Stay Safe

- Best Places to Book Your Trip

- Related Blogs on the United States

Click Here for City Guides

Top 5 things to see and do in the united states.

1. Explore New York City

The city that never sleeps is one of the greatest cities in the world. There’s nothing you can’t do or see and you’ll find every language and food from around the world here. From world-class museums and art galleries to innovative theater performances to unique restaurants to the expansive Central Park, you can fill a lifetime of activities here. You can take the ferry to Ellis Island, see the Statue of Liberty, hang with the hipsters in Brooklyn, see a Yankees game, and so, so much more. Check out my detailed guide for everything you need to do .

2. Visit the Grand Canyon

Words can’t describe how epicly beautiful the Grand Canyon is. It’s simply breathtaking. Most people just look out at the canyon from the overlook at the top, but its vast size and beauty are best appreciated with a hike down to the Colorado River so try to do that if you have time (make the time). The canyon itself is 6,000 feet deep, and you can find plenty of hikes to take you further into the canyon that will give you a chance to experience it in more detail. For a shorter hike, Grandview Trail to the first overlook at Coconino Saddle and back is only a couple of miles. If you have a whole day to spend and want to challenge yourself, try the 12.5 miles from Bright Angel Trail to Plateau Point. Just be sure to bring plenty of water!

3. Discover Austin

The warm weather, lively honky-tonks, funky house bars on Rainey Street, amazing walking and biking trails, tons of outdoor activities — Austin is great (I lived there for many years). You can always find great live music on 6th Street. On a hot day, Barton Springs pool is the perfect place to cool off, there’s always something to do, the food scene gets better and better, and everyone is very welcoming. It’s one of the best cities in the U.S., boasting a combination of nature, city, and delicious food. Be sure to binge on BBQ while you’re here!

4. Visit Glacier National Park

This is my favorite national park in the country. It’s home to gorgeous snow-topped mountains, a beautiful lake from which to admire said mountains, large glaciers, and hiking trails galore. It is one of the most mind-blowing places I’ve seen on my adventures. There are more than 700 miles of hiking trails in the park that provide everyone an opportunity to explore the landscape. Park rangers offer various programs and guided tours are also available. There are spots for fishing and additional trails for biking and horseback riding. (If you plan to visit multiple national parks while traveling throughout the United States, it’s worth it to get the America the Beautiful Park Pass, which costs just $80 USD and provides entry to all the national parks for a year.)

5. Drive the Pacific Coast Highway

The Pacific Coast is considered one of the most scenic landscapes in the world, offering sheer cliffs, forests descending to the shoreline, miles of beaches, and giant redwoods. The Pacific Coast Highway (PCH) runs 1,650 miles from San Diego, California to Seattle, Washington taking you from the warm, sunny beaches to the lush temperate rainforests of the Pacific Northwest. Highway 1 thorough California is one of the longest historic state highways in the country. The California portion alone route takes 10 hours without stopping but I recommend dedicating at least several days to enjoy all the great stops along the way.

Other Things to See and Do in the United States

NOTE: There’s a lot to do in the United States and you can spend months traveling around the country . I could write an entire book on the places to visit! This is just a list to give you some ideas. Be sure to check out some of my other articles and city specific guides (scroll to the bottom of this guide for links) for more suggestions.

1. Have fun in Memphis

Gritty and industrial, Memphis appears like its best days are behind it. But don’t let the rough exterior fool you — the city is home to some killer food and a vibrant blues music scene. It is a cool city with boisterous and friendly locals. I love the vibe here. There’s Graceland (Elvis’s home) for fans of the King, a big waterfront for walking, and the phenomenal Museum of Civil Rights (it’s huge, so don’t rush it!). The city is going through a big revival right now. To use a cliché, it’s a hidden gem as most people, to their detriment, skip over it.

2. Discover Asheville

Asheville is full of tasty craft beer, great restaurants, and plenty of outdoor loving residents. The beautiful Smoky Mountains are a short drive away, Asheville Botanical Gardens are right near the university, and the gigantic Biltmore estate (the largest privately-owned home in the U.S. and once home to George Vanderbilt) is on the outskirts of the city. (If you’ve ever seen Downton Abbey, that’s what the house is like!) The town has a lot of parks and there are a lot of beautiful biking and hiking trails that you can get to from the center of town.

3. Explore Redwood National Park

Along the Pacific Coast is Redwood National Park, a huge expanse of towering redwood trees filled with picnic areas, places to camp, and miles upon miles of hiking trails. Trails range from easy to strenuous, and there are many loops that head out to nearby beaches. The trees range from 200-240 feet tall. It’s utterly beautiful, awe-inspiring, and humbling in every way. Admission is free, though the three adjoining state parks (Prairie Creek Redwoods State Park, Del Norte Coast Redwoods State Park, and Jedediah Smith Redwoods State Park) each charge $10 USD.

4. Explore Denver

Known as the Mile High City (the city is one mile above sea level), Denver offers a mix of outdoor ruggedness and big-city living. It has a huge craft beer scene, excellent restaurants (including, Sushi Sasa, one of my favorite sushi restaurants), a large international airport with lots of connections, and is close to the mountains. There are a lot of interesting museums, including the Denver Art Museum, Meow Wolf Denver, and the Clifford Still Museum. There’s plenty of art outside of the museums as well and there are walking tours available to show you around, if you prefer that to exploring on your own. It’s clean, lively, and the locals are incredibly friendly.

5. Get off-the-beaten-path in Natchez

I was surprised by Natchez . I didn’t know anything about it when it was recommended as a place to see historic 19th-century homes. These mansions were built by white plantation owners wanting to escape the summer heat and socialize with each other. As cotton became king, the houses became ever larger and more elaborate. Today, the homes are historic monuments you can tour while enjoying a view of the Mississippi River. It’s far off the beaten path and you’ll need a car to visit but it’s worth the trek.

6. Visit Savannah

Sitting on Georgia’s coast, Savannah escaped the wrath of the Civil War, allegedly because General Sherman thought it was too pretty to be destroyed. With streets lined with Spanish moss-covered oaks, large and inviting parks, and a bustling waterfront, Savannah is a wonderful place to experience the slow pace of the South. There are a number of interesting historical sites like the Bonaventure Cemetery and Factors Row. The city is full of small squares and sprawling parks where you can enjoy a stroll or a picnic. And nearby Tybee Island is a draw for many visitors due to its sandy beaches and slow pace of life.

7. Dive into Nashville’s music scene

Nashville is one of the fastest-growing cities in the U.S. It’s got a wonderful music scene (duh), a growing cocktail bar culture, and some world-class down-home Southern restaurants. There’s not a lot of “touristy stuff” to do here, but what makes this city one of my favorites are the music, the food, the wildly friendly people, and the positive energy the city seems to exude. When you’re here, plan to spend a few hours at the Tennessee State Museum. It goes into detail about the state’s history (and it’s more exciting than you might think!).

8. Catch some rays in sunny San Diego

I love San Diego. San Diego’s weather is almost always perfect, leading to a permanently happy population that’s friendly and outgoing and that loves the outdoors. From hiking, days at the beach, or running, people here love to get out and enjoy the sun. The downtown Gaslamp area — as well as the famous Pacific Beach — is full of trendy restaurants, bustling bars, and some seriously life-changing taco stalls.

9. Get tipsy in California’s Wine Country

California is home to some of the best wine in the world, and a visit to the Sonoma or Napa Valley shouldn’t be missed. While Sonoma is cheaper than Napa, both these destinations are meant for splashing out. Take a tour, book a cozy vineyard Airbnb, and enjoy a relaxing few days learning about the region’s wines. Tastings usually cost between $15-20 USD. If you go to Sonoma, check out Three Fat Guys winery. They have phenomenal reds.

10. Hike around Lake Tahoe

Lake Tahoe is impressive and beautiful. Ringed by tiny mountain communities, this is a terrific place for hiking and boating in the summer and skiing in the winter. For fun in the sun, be sure to spend some time lounging at Kings Beach. For hikes, check out the Rubicon Trail (16 miles/25.7 kilometers) or the Cascade Falls Trail (1.4 miles/2.2 kilometers). You can’t really go wrong here.

11. Anywhere in Montana

A lot has been written about how stunning Montana is, but words cannot do this state justice. To me, it’s the most beautiful state in the Union, filled with wondrous mountains and hills as far as the eye can see. It’s a nature-lover’s paradise and there is a huge craft beer scene here too, with tons of local breweries all around the state. If you want nature, good food, friendly locals, and just quiet, Montana is it!

12. Relax in Cape Cod

I spent a lot of summers on the Cape since I grew up in Boston. You’ll find plenty of small beach towns along the coast (Provincetown and Hyannis being the most famous but I also love Chatham, Falmouth, Wellfleet, and Brewster). There’s not a lot to “do” but if you’re looking for seafood, beaches, boardwalks, and that perfect family vacation, visit the Cape! Just avoid the weekends when it gets a little too crowded.

13. Explore Deadwood

Tucked away in western South Dakota, this town was famous during the Old West days (noteworthy enough to be the focus of the eponymous HBO series). Wyatt Earp, Calamity Jane, Wild Bill Hickok, and many other infamous gunslingers all spent time here. Sort of kitschy and re-created, it’s nonetheless a very cool place where you can experience a taste of the old frontier days. It’s also conveniently located near the Black Hills and Mount Rushmore so you can use it as a base for exploring the region.

14. Be surprised by Kansas City

I really loved this city, which features some of the world’s best BBQ and a lively downtown core. There’s a detailed and enlightening jazz museum here, as well as the eye-opening Negro Leagues Baseball Museum (that’s the actual name). This is yet another super underrated and under-visited destination.

15. Stay weird in Portland

Portland , Oregon is incredible. Here you’ll find an impressive food truck scene, cool bespoke bars and cocktail lounges, a craft beer scene that’s religion to residents, relaxing parks (including a peaceful Japanese garden), a vibrant art scene, and hiking in the nearby mountains. Portland is just an awesome city, especially in the summer when the weather is perfect and there are festivals and events galore.

16. Hike our national parks

America has 63 national parks as well as countless state and local parks. These parks highlight the best of the American wilderness. Yellowstone, Yosemite, Glacier, Zion, Byrce, the Smokey Mountains, Rocky Mountain Park, the Badlands — the list goes on. Make sure you visit as many national parks as you can to get a sense of the grand and diverse landscape that is the United States. You can use this government map to find a park near you! If you plan to visit multiple parks, get the America the Beautiful Park Pass, which costs just $80 USD and gets you free entry to all the national parks for a year.

17. Admire the architecture in Chicago

One of my favorite cities in the world, Chicago is full of amazing architecture, great parks, delicious and hearty food, and a fun nightlife. One of the best ways to see the city’s unique architecture is on a river cruise. There are multiple operators and prices start around $45. Don’t miss trying deep-dish pizza (it was invented here, along with stuffed-crust pizza) and seeing the iconic “Bean” sculpture in Millennium Park. Additionally, check out the city’s famous pier, aquarium, and waterfront park. The city also hosts one of the biggest St. Patrick’s Day celebrations in the country.

18. Enjoy Lively New Orleans

This French-influenced city has incredible seafood and Cajun cuisine and even better live music. A visit to New Orleans is a must for any jazz or blues fan. Live music is available seven nights a week. Frenchman Street is one of the best places to go (my favorite venue is the Spotted Cat). There are also tons of amazing walking tours that highlight the city’s unique culture and history (including ghost and voodoo tours). Nature lovers will enjoy wandering through the massive oak trees in City Park where you can also visit the city’s Botanical Gardens, which are open year-round. Admission is $12. Plus, there’s incredible independent bookstores, creole food, art museums, and the simply incredible and informative World War 2 museum. Don’t skip roaming the redone and revitalized Bywater district too. It’s a bit hipster. If you plan on celebrating Mardi Gras in NOLA , book early. Accommodations fill up fast.

19. Get some sun in Hawaii

Closer to Asia than the United States, Hawaii is America’s slice of South Pacific paradise. White sands beaches, clear blue water, tropical jungle, and great surf — Hawaii has it all! Don’t miss the otherworldly landscapes of Hawai’i Volcanoes National Park, the somber memorial at Pearl Harbor, and the hikes at Diamond Head and the Lanikai Pillbox Trail near Honolulu. There are a ton of opportunities for snorkeling and scuba diving where you get a chance to see manta rays, sea turtles, and plenty of colorful fish. Waimea Canyon and the Napali coast on the island of Kauai are places you can get up close and personal with the natural landscape. There are helicopter and boat tours or, if you’re up for a challenge, you can hike the iconic Kalalau Trail. Every island has its own vibe so, if you can, visit more than one.

20. Check out Boston

The birthplace of the revolution (and my hometown), no one leaves Boston disappointed. It’s a big city, but its lack of high-rises, as well as its cobblestone streets and brick buildings, give the city a small-town feel. The Freedom Trail, which covers all the main historic stops, is a must because it gives you a look at the city’s historic past. Be sure to lounge in the Boston Common and catch a Red Sox game at Fenway Park too (the city is big on sports).

21. Visit the nation’s capital

The country’s capital is home to many of the best museums in the country. And, given the large number of international embassy workers here, it’s unsurprising one of the most international cities in the country. You can find food from anywhere in the world thanks to all the embassies in the city. Plus, there’s a vibrant music and cocktail scene. Don’t miss the National Mall and all its monuments, the Holocaust Museum, and the various Smithsonian Museums (some of the best are the Air and Space Museum, the Museum of the American Indian, the African American Museum, the National Zoo, the Smithsonian Castle, and the American Art Museum). If you visit in the spring, you’ll get to see the cherry blossoms bloom along the Mall.

22. Learn about Mt. Rushmore

Completed in 1941, this historic monument in the Black Hills of South Dakota is a lot smaller than you expect, but it makes a good stop while driving. Originally, the indigenous Lakota Sioux inhabited this area, however, when gold was found in the hills, white settlers forcibly removed them from their homeland. At the Wounded Knee massacre, U.S. forces killed over 250 indigenous women and children. Decades later, Rushmore was built, much to the dismay of the local indigenous population, who consider the land to be sacred. Take a guided tour to learn more about this iconic monument’s complex and tragic history.

23. Be a kid at Disney World

Sure, it’s cheesy . Yes, it’s built for kids. True, it’s not authentic. But despite all that, Disney World is still a fun time and they have a lot of rides for adults too. I recently went back as an adult and there’s a lot to do there: they have some good restaurants, and Disney Springs has a fun nightlife. If you are in Florida, take a stop for a few days. Indulge your inner child. Tickets cost around $110 USD per day and go up from there.

24. Hike the Appalachian Mountains

Stretching the east coast of America, these mountains are almost 500 million years old and offer great hiking, camping, and trekking. For a multi-month adventure, hike the 2,190-mile (3,524-kilometer) Appalachian Trail which covers the entire mountain range and takes 5-7 months to complete. You can also do day hikes or weekend hikes of its various sections if you want a more manageable outdoor getaway.

25. Unwind in Put-In-Bay

One of the coolest, not-so-hidden places in the U.S. is this group of islands in Lake Erie. Widely known to Midwesterners (but unknown to most everyone else), South Bass Island is home to Put-in-Bay, where Midwest hospitality meets Caribbean vibes (you ride around in golf carts and bars have sand as floors). My favorite spot is Mojito Bay, an outdoor tiki bar with sand floors and swings for bar seats that offers up more than 25 different mojitos. These places get very wild on the weekends too.

26. Explore Maine

Tucked away up in the northeast, Maine evokes images of endless shorelines, wild forests, iconic lighthouses, and lots and lots of lobster dinners. It’s often overlooked yet it’s incredibly beautiful and perfect for a short road trip. Don’t miss trying lobster rolls (a regional favorite) and hiking in Acadia National Park. Portland has some great eateries (such as Duckfat and Eventide Oyster Co.) and picturesque historic lighthouses, including Maine’s oldest operating lighthouse, the Portland Head Light, which opened in 1791 when George Washington was president. Additionally, tiny Bangor is home to tons of breweries and Moosehead State Park is an incredible place to go hiking for a few days. And you can’t go wrong stopping in any of the quintessential New England fishing villages up and down the coast. Maine is one of the best states in the union!

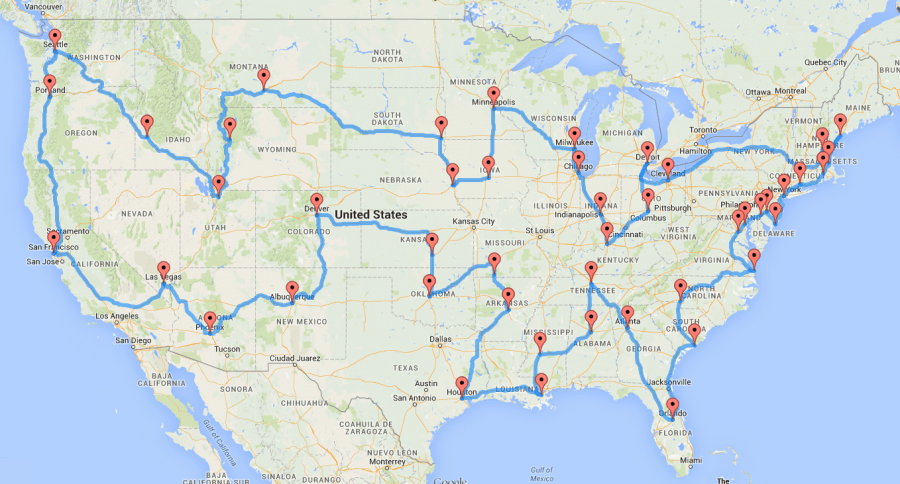

27. Take a road trip

The only good way to see this vast and diverse landscape and the small towns that populate it is with a road trip . I highly suggest renting a car and driving across the U.S. It’s an amazing experience. I’ve done several coast-to-coast trips as well as regional trips around New England , California , and the South . It’s the best way to see the country and you can do it for under $50 USD a day.

For the best rental car deals, use Discover Cars .

28. Take a tour

You can find all sorts of amazing walking tours, bike tours, and food tours all around the country. They’re a great way to get an in-depth look at the city you’re in with the help of an expert local guide. Take Walks is my go-to walking tour company when I’m looking for something thorough and insightful (and fun). They can get you behind the scenes and are much more comprehensive than your average free walking tour.

For information on specific cities in the United States, check out these city guides:

- Austin Travel Guide

- Boston Travel Guide

- Chicago Travel Guide

- Hawaii Travel Guide

- Las Vegas Travel Guide

- Los Angeles Travel Guide

- Miami Travel Guide

- New York Travel Guide

- Philadelphia Travel Guide

- San Francisco Travel Guide

- Seattle Travel Guide

- Washington D.C. Travel Guide

United States Travel Costs