U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

AXA Assistance USA

Generous coverage for medical expenses and medical evacuation

Cancel for any reason (CFAR) coverage available with Platinum plan

Gold and Platinum plans can cover preexisting medical conditions

Silver plan doesn't offer any optional coverages

Unimpressive reviews from past customers

What AXA Assistance USA Is Known For

AXA Assistance USA offers three main travel insurance options that help consumers protect against various mishaps that can occur during trips within the United States and abroad. For example, the company's Silver, Gold and Platinum plans offer coverage for trip cancellations and interruptions, lost and delayed baggage, travel delays, emergency medical expenses, and more. While the basic Silver plan offers essential coverage at a more affordable price point, the Gold and Platinum plans from this provider offer more benefits and higher coverage limits overall.

Standout benefits of AXA Assistance's premium travel insurance plans include a selection of optional coverages consumers can purchase for more protection. While the Silver plan doesn't have any optional benefits, consumers who choose the Gold plan can tailor their coverage with optional rental car coverage. With the Platinum plan, travelers can add on coverage for lost ski days, lost golf rounds, sports equipment rentals and car rentals.

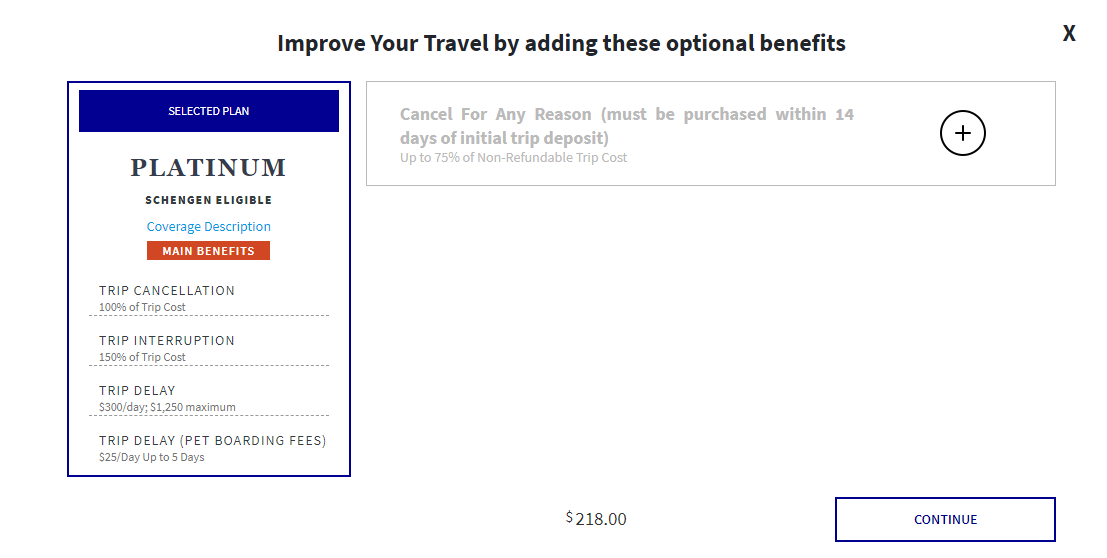

Platinum coverage is also the only plan from AXA Assistance that lets travelers purchase cancel for any reason (CFAR) coverage . This type of insurance reimburses travelers with 75% of their prepaid trip costs for airfare, hotels, tours and more, and it can apply when travelers cancel their trip for any reason at all.

Also note that both the Gold and Platinum plans from AXA Assistance USA provide coverage for preexisting medical conditions that existed at least 60 days before purchasing a policy. However, travelers do need to pay for their insurance coverage within 14 days of making an initial trip deposit for preexisting medical coverage to apply.

At the end of the day, there's plenty to like when it comes to the travel insurance options from this provider, whether you want essential benefits only or a premium plan with all the bells and whistles. Not only does AXA Assistance offer several plans that can suit different types of trips, but its optional coverage options make it even easier to tailor a travel insurance policy to your needs.

AXA Assistance USA for Individual Trips

Like other travel insurance providers, AXA Assistance offers several tiers of coverage to choose from. This makes it easier for travelers to select the exact amount of travel insurance protection they need with the policy limits that make sense for their trip.

The chart below provides an overview of available plans, what they include and policy limits that apply.

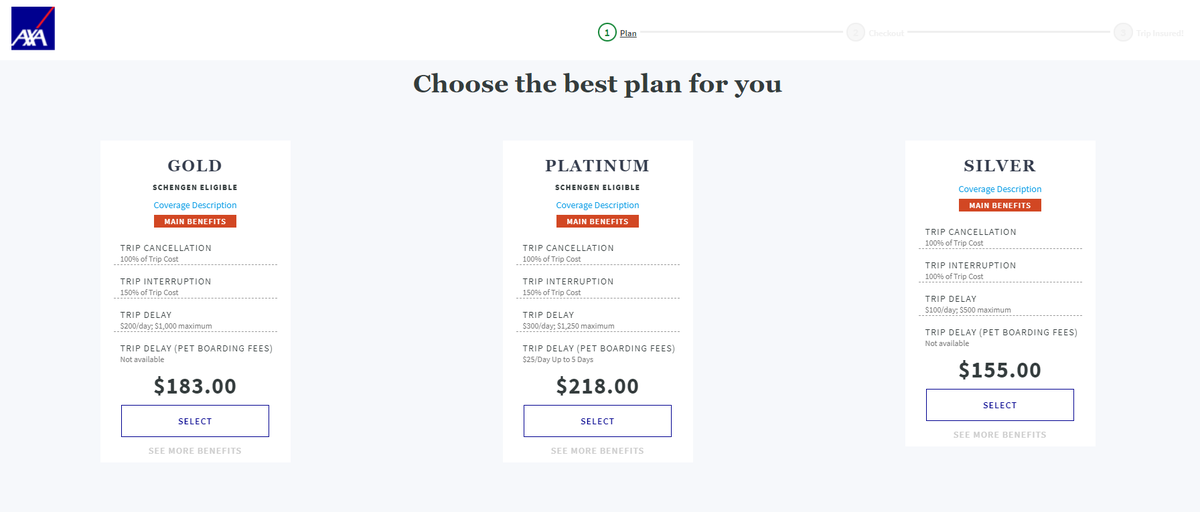

Available coverage from AXA Assistance USA is offered in three tiers. Where the Silver plan offers limited benefits and lower policy limits overall, the Platinum plan offers more included perks, more optional coverage options and higher policy limits overall. The Gold falls somewhere in between.

Here's an overview of the type of traveler each plan could work best for:

- Silver: While the Silver plan is the lowest tier of coverage available from AXA Assistance USA, it still offers generous benefits for medical expenses and emergency evacuation coverage. Other included perks can also protect your trip, including coverage for lost or delayed bags, missed connections, travel delays, and more. Overall, this plan is geared to travelers who want ample coverage for medical emergencies but want to pay lower premiums for their plan.

- Gold: The Gold plan from AXA Assistance USA offers higher limits than the Silver plan, especially when it comes to medical expenses and emergency medical evacuation. This makes it a solid option for people who are mostly worried about having coverage that can pay for emergency medical bills or emergency medical evacuation in the event of an injury or illness. Of course, additional benefits with this plan also come with higher policy limits as well.

- Platinum: The Platinum plan from this provider is for travelers who want the highest policy limits for medical emergencies, medical evacuation, travel delays, lost or delayed baggage, and more. This plan also has the most optional coverages that let you tailor your travel protection to your unique needs, and it's the only one from this provider that lets you purchase CFAR coverage. This additional benefit lets you cancel your trip for any reason you want and get 75% of your prepaid travel expenses back.

AXA Assistance USA Costs

The costs for a travel insurance plan can vary widely based on the company you purchase from, the ages of travelers in your group, your destination, the length of your trip and other factors. The tier of coverage you select can also impact your travel insurance premiums, especially if you opt for a premium plan with more benefits and higher levels of coverage.

We applied for travel insurance quotes for a range of example trips to help you find out approximately what you would pay with AXA Assistance USA. Note that premiums shared below do not include any optional coverages.

Reading travel insurance reviews can give you a glimpse into the experiences of past users when it comes to filing claims and receiving reimbursement. Unfortunately, this is one area where AXA Assistance USA appears to have some issues.

While the company has an A- rating with the Better Business Bureau (BBB), it is not accredited. AXA Assistance also has an average star rating of 1.47 out of 5 stars across user reviews on the BBB, and it has 35 closed customer complaints on the platform in the last three years. On other review platforms, it has a higher star rating.

The reviews below from various platforms provide a mix of positive experiences along with some of the most common customer complaints found with the company.

AXA Assistance USA Gold

Due to a personal tragedy at home my wife and I interrupted a cruise and returned home at the next port. The claim form and related documentation requested by AXA Assistance USA was emailed to their claims office on December 9th. On December 14th, I received an email from the claims adjuster confirming approval of the claim and that the payment check would be received in 10 to 15 business days. Based on my experience I would highly recommend this company. – John R. via InsureMyTrip

Policy: Gold

Absolutely terrible customer service experience. I filed my claim in January, after my flights were canceled and delayed. I did not even hear back until March! The message—delivered two months later—was garbled and incoherent. The amount of reimbursement was left blank, and the larger portion of the claim was denied, without a clear explanation of why. This is NOT what I expected when I paid over $2,000 for a policy! To date, no human spoke to me or emailed me. My calls haven't been returned, and no adequate explanation had been given. The denial "letter" simply quoted from the exclusions language of the policy but offered NO explanations as to why the exclusions purportedly applied. Extremely disappointed in the "services" offered. – Nicole via Squaremouth

Customer Review

They paid very slowly, but they eventually did pay. I took a trip to ***** in June 2022. While there, I got COVID just before I was to return. My return home was delayed by 9 days, and I had to buy a new return ticket home to *******. They do not respond to emails (other than the standard automatic "We received your correspondence, blah blah") but no personal communication until 8 to 10 weeks later. Don't bother calling because you will be put on hold for a very long time, then be disconnected. So, a grade of "F" for communication. Eventually I was contacted, however, and the claims agent asked for more information, including pdf copies of my receipts. I sent them the documentation and receipts, and to my shock, three weeks later, a check arrived in the mail with the full amount of reimbursement I had requested. I expected them to quibble over the receipts, but they didn't. Can I recommend them? No. Will I insure with them in the future? Certainly not. But to their credit they did reimburse me, and for the full amount I asked for. – William S. via Better Business Bureau

I had to cancel my trip. I ripped up my knee. I just got confirmation from AXA that I would receive a check for the full amount of the cost of the trip. I am looking forward to receiving my check. It was quite timely on their part. I would definitely recommend them and use them for my next trip. – Carl K. via InsureMyTrip

I am appalled by the poor service I have received thus far from AXA Assistance USA. The length of time to process a claim and respond to inquiries is absurd. – Sally via Squaremouth

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been writing about travel insurance for more than 10 years. Johnson has researched and purchased travel insurance plans for her own trips to destinations around the world, and she currently uses an annual travel insurance plan from Allianz for her own family. Johnson has two teenage girls and co-owns the travel agency Travel Blue Book . She works alongside her husband, Greg – who sells travel insurance for trips all over the world – in their family media business.

Read more about AXA Assistance USA in:

- The Cheapest Travel Insurance Companies

- The Best Cruise Insurance

- The Best Vacation Rental Travel Insurance

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

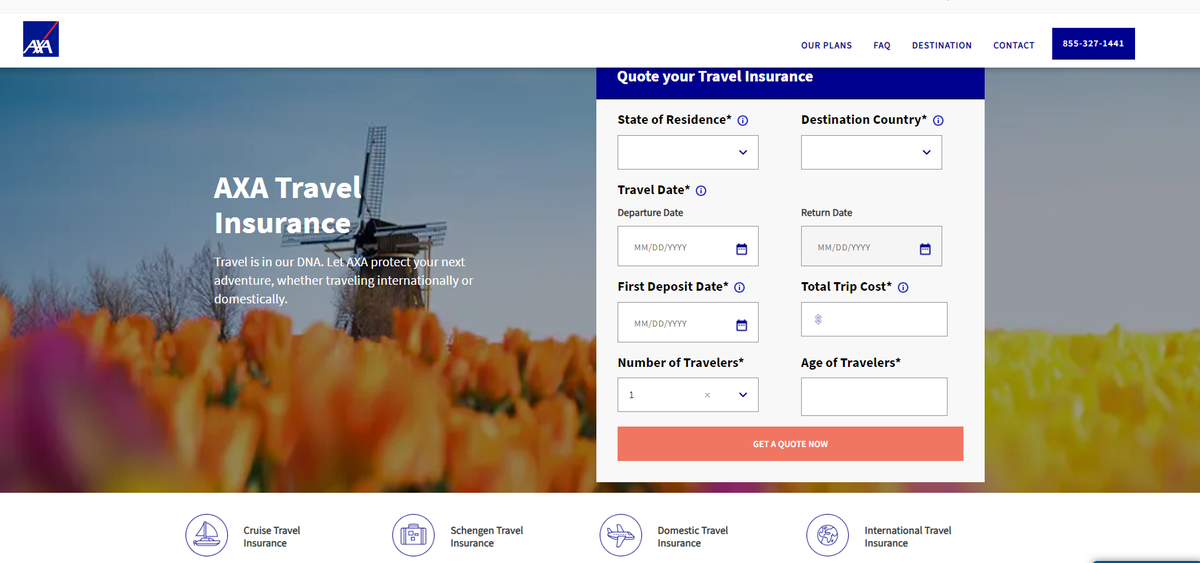

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550

Premiums for AXA plans are between 6.5% and 9.2%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to Purchase and Manage Your AXA Policy

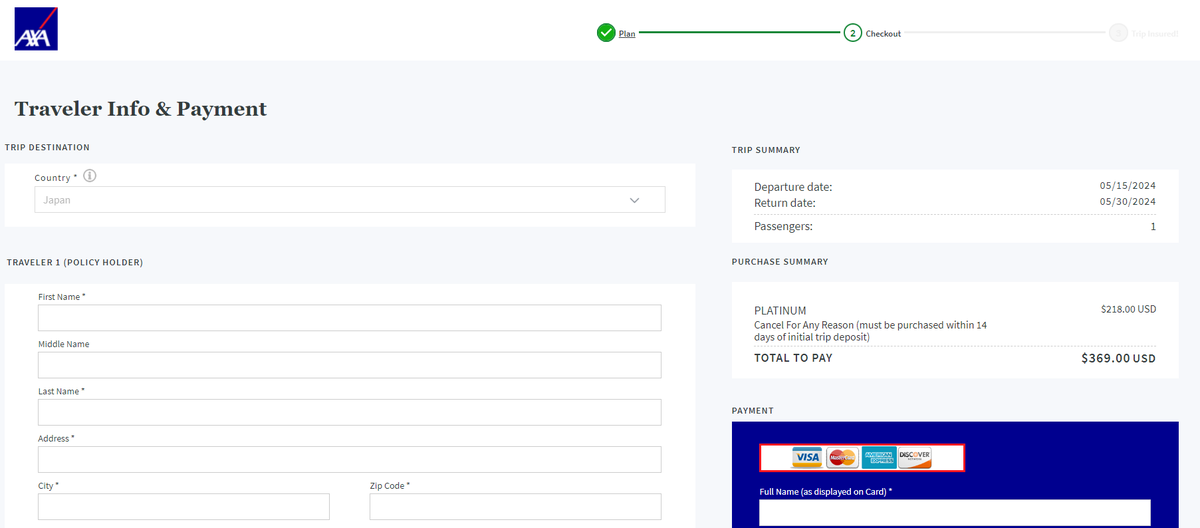

The process of purchasing an AXA policy is simple. After obtaining your quote, you'll need to decide which of AXA's three plans you want to buy. When you pay for your plan, be prepared to provide additional personal information, like your birthday, phone number, and address.

Once you finalize your purchase, you'll have a 10-day free look period, in which you can cancel your policy and get your money back.

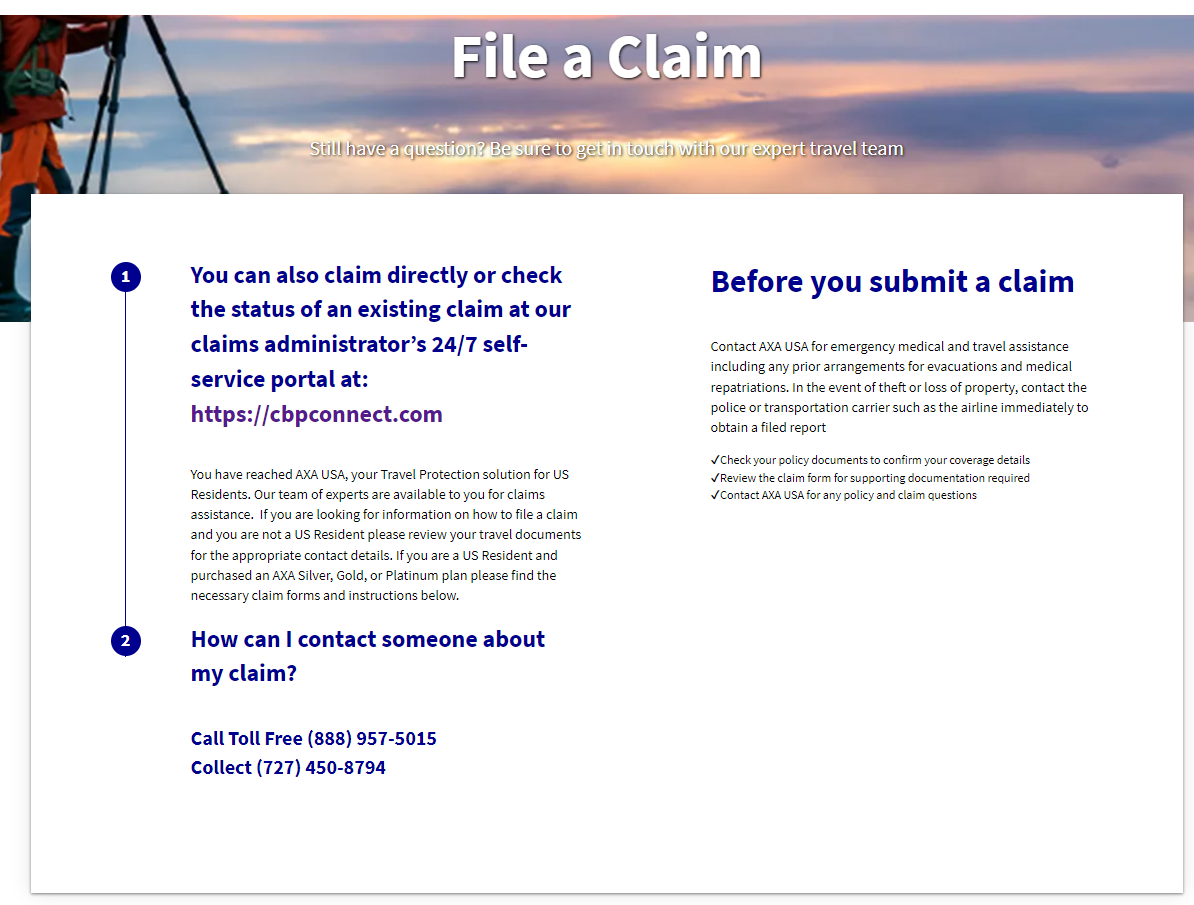

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can email them to [email protected] or send them by mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

If you need assistance when filing claims, AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the U.S.). Office hours are 9:30 a.m.-5 p.m. ET on Thursdays and 8:30 a.m.-5 p.m. ET on all other weekdays.

AXA's U.S. branch has few reviews on Trustpilot and the Better Business Bureau — just over 20 between the two sites. Its UK branch has over 1,100 reviews, most of which are overwhelmingly negative. However, the quality of AXA Travel Insurance UK isn't necessarily indicative of its U.S. coverage.

In fact, on SquareMouth, where the majority of AXA U.S.'s reviews, reviews are generally positive. It received an average of 4.22 stars out of five across over 900 reviews. Customers reported that adjusting an AXA policy was easy and the customer service team was responsive. However, reviews on the claims process was more mixed, with spotty communication and long wait times.

See how AXA travel insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA to Travel Guard , we'll look at the coverage levels from their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

Read our AIG Travel Insurance review here.

AXA Assistance USA vs. Allianz Travel Insurance

Allianz Travel Insurance provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz Travel Insurance. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Read our Allianz Travel Insurance review here.

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research the terms of your credit card's travel protection before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policy holders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

Read more about how Business Insider rates insurance products here.

AXA Assistance USA FAQs

If you're diagnosed with COVID-19 before a trip and need to cancel, AXA may cover your expenses. Additionally, a COVID-19 diagnosis during a trip may be covered under AXA's medical expense, trip interruption, and trip delay benefits. Be sure to review your policy to ensure coverage details.

While you may extend your coverage in certain circumstances, such as extended hospitalization, and update your travel dates prior to your departure, you can't extend AXA travel insurance plans while you're traveling.

AXA's Gold and Platinum plan cover pre-existing medical conditions as long as you purchase your policy within 14 days of your initial trip deposit. AXA's Silver plan does not cover pre-existing conditions and has a 60-day look-back period.

You can download AXA claims forms on its website and email them to [email protected].

AXA isn't the most flexible travel insurance company and isn't great at specializing, but it offers comprehensive general coverage. Its prices aren't significantly more expensive or cheaper than its competitors.

- Main content

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AXA Travel Insurance Review — Is it Worth It?

Jessica Merritt

Editor & Content Contributor

89 Published Articles 499 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3209 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

Why get travel insurance, travel insurance and covid-19, why purchase travel insurance from axa, types of policies available with axa, how to get a quote, how axa compares — summary, how to file a claim with axa travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Whether you’re traveling the world or crossing state lines, travel insurance such as the policies offered by AXA Travel Insurance can offer a safety net in case you have to cancel or interrupt your trip or need support along the way for medical emergencies, lost bags, or missed connections.

For more than 60 years, AXA Travel Insurance has provided peace of mind and financial stability to travelers. With solid ratings and underwriting by Nationwide Mutual Insurance, travel insurance plans sold by AXA are backed by an A.M. Best Excellent financial strength rating. AXA offers travel insurance with trip interruption and cancellation coverage, medical emergency and evacuation benefits, lost or delayed baggage, and more.

Let’s examine AXA’s travel insurance coverage options, benefits, and service and compare it to alternatives such as credit card travel coverage and other travel insurance providers.

Travel insurance can protect what you’ve invested in an upcoming trip. When the unexpected occurs, such as a trip cancellation or medical need , travel insurance can offer the benefits you need to cover it.

You might choose travel insurance for these reasons:

- Your trip has deposits or payments that you can’t get refunded if you need to cancel your trip.

- The health insurance you use at home doesn’t work at your destination.

- You’re planning activities that aren’t covered by your health insurance.

- Medical care is subpar at your destination and you may need to be evacuated to another location with adequate medical facilities.

- You’re concerned about the possibility of lost bags, delays, or missed connections, especially if you have multiple flights or transfers.

Travel insurance isn’t necessary for every trip, such as if you’re traveling domestically where your health insurance works and you don’t have major nonrefundable expenses. But travel insurance is worth it if you’ve got a lot of nonrefundable expenses invested in your trip or you’ll need medical coverage at your destination.

COVID-19 can interrupt your travel plans, whether you get sick and have to cancel a trip, need to quarantine or get medical treatment while traveling, or plan to visit a destination with high COVID-19 numbers. While some travel insurance companies exclude COVID-19 from insurance coverage , AXA offers COVID-19 coverage as part of its travel protection plans , including trip cancellation and trip interruption and emergency medical and evacuation coverage.

Any travel insurance company you purchase a policy from should be reputable, reliable, and stable. After all, you’re relying on the company to be there for you when you need it most. It pays to verify reviews and ratings — AXA offers good reassurance in this area.

With 64 years in business, AXA has an A- Better Business Bureau rating . On the travel insurance website Squaremouth , AXA has an overall 4.22/5 rating , with 0.1% negative reviews among more than 69,000 policies sold . AXA’s travel insurance plans are backed by Nationwide Mutual Insurance, which has an A (Excellent) financial strength rating from financial rating company A.M. Best. With 6 decades in business and solid ratings , AXA is a travel insurance company you can trust.

AXA offers travel insurance with medical and emergency evacuation benefits, trip cancellation and interruption, baggage loss, and Cancel for Any Reason (CFAR) options. Let’s look at the details of AXA travel insurance policies.

AXA offers 3 levels of travel insurance : Silver, Gold, and Platinum . Each level offers different limits, but all of AXA’s policies have 100% trip cancellation coverage, emergency medical coverage and medical evacuation, baggage delay and loss, and missed connection coverage.

Let’s compare what you get with each policy:

With plans as low as $16 and minimal coverage, AXA recommends the Silver plan for domestic travel. You can cover 100% of your trip cost for trip cancellation and interruption coverage. If your travel is delayed, you can get up to $100 per day for expenses, up to $500 total, and $200 for delayed baggage.

There’s also $500 in missed connection coverage. The $25,000 in emergency medical expense coverage isn’t much, but it might be adequate for domestic travel if you’re using your primary health insurance first.

Gold plans start at $36 but add more coverage and are appropriate for cruises or Schengen travel . Like the Silver plan, the Gold plan offers up to 100% trip cancellation coverage but bumps trip interruption to 150% of your trip cost. Limits for all coverages are higher, with $200 per day and $1,000 maximum in trip delay coverage and $1,000 for missed connections. Baggage delays offer up to $300, and you can get up to $1,500 for lost baggage and personal effects.

The health coverage is also much higher at $100,000, and it adds a $50,000 non-medical emergency evacuation option on top of the $500,000 medical emergency evacuation benefit. This plan also offers an optional $35,000 collision damage waiver.

The Platinum plan , starting at $52, steps up coverage and offers additional options. You’ll get 100% trip cost coverage for trip cancellation and 150% for trip interruption. Trip delay coverage offers up to $300 per day and a $1,250 maximum, plus $600 for baggage delays and $3,000 for lost baggage and personal effects.

Emergency medical treatment is also higher at $250,000, and you’re covered for $1 million in emergency medical evacuation — $100,000 for non-medical evacuation.

The Platinum plan also offers additional coverage for sports, with $25 per day for lost skier days, $500 for lost golf rounds, and $1,000 for sports equipment rental. It also offers optional coverage for up to 75% of trip cost with Cancel for Any Reason coverage and a $50,000 collision damage waiver.

You can get a quote directly from AXA by visiting the AXA Travel Insurance website . The quote form is the first thing you’ll see on the homepage.

To start your quote, you’ll fill out the quote form, including your state of residence, destination country, travel dates, first deposit date, total trip cost, number of travelers (up to 10), and the age of travelers.

Once you fill out the form, you’ll be presented with plan options. For a 60-year-old visiting Japan and spending $2,500, we were offered a Silver ($155), Gold ($183), or Platinum ($218) plan .

If you select a Platinum plan, you will be able to add CFAR optional coverage for up to 75% of your trip cost.

With your plan and options selected, the next and final step to secure coverage is entering your traveler information including your name and contact information, then making your payment for the policy.

AXA is a good option for travel insurance, but it’s not your only option. Let’s see how AXA compares to the coverage you can get from popular travel credit cards and travel insurance competitors .

AXA vs. Credit Card Travel Insurance

Many travel credit cards offer travel insurance as a complimentary benefit, whether it’s car rental collision waivers , trip cancellation coverage , or emergency medical and evacuation benefits. This coverage can be helpful if you’re using your card to pay for your travel expenses, but it’s often not as comprehensive as the coverage you can get from a travel insurance policy like what AXA offers .

Let’s compare AXA’s best travel insurance policy against The Platinum Card ® from American Express and the Chase Sapphire Reserve ® , which both offer some of the best travel protections available with credit card benefits.

Unless you’re taking a trip with expenses higher than $10,000, the trip cancellation coverage should be about the same whether you’re using an Amex Platinum card, Chase Sapphire Reserve card, or the AXA Platinum plan. However, the AXA Platinum plan comes out ahead with 150% of your trip cost for trip interruption.

We see a major difference in coverage for emergency medical treatment and evacuation. The Amex Platinum card doesn’t offer emergency medical coverage, but you can arrange an emergency medical evacuation using the Premium Global Assist Hotline. The Chase Sapphire Reserve card offers up to $2,500 in emergency medical coverage and $100,000 for emergency evacuation. Neither of these offerings compares to the $250,000 in emergency medical coverage and $1 million in emergency medical evacuation coverage you can get from AXA Platinum.

Credit card travel insurance coverage is complimentary if you already have the card, but it is lacking in some areas. It’s a good idea to use your card’s travel insurance as a backup for trip cancellation, interruption, travel delays, or lost baggage, but use the AXA Platinum plan for its superior emergency medical and evacuation coverage.

AXA vs. Other Travel Insurance Companies

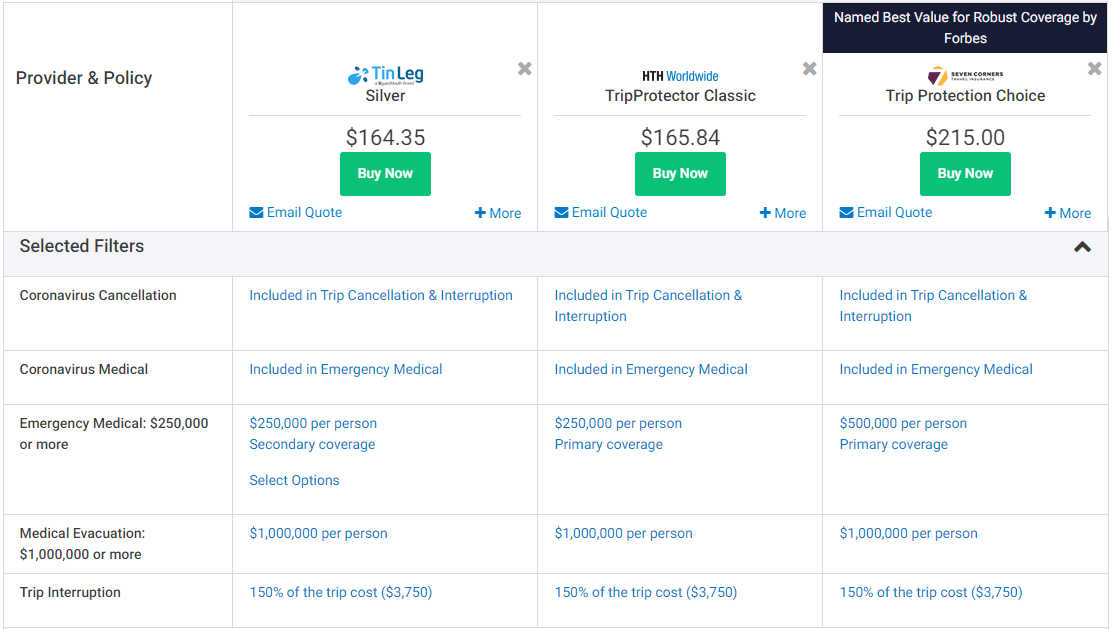

It’s always a good idea to compare travel insurance quotes across multiple providers so you can find the best price and coverage. We used Squaremouth , a travel insurance comparison website, to see how AXA’s policies compare to those of other companies.

As with the initial price quotes we pulled from AXA’s website, our sample trip on Squaremouth had:

- Traveling to Japan a month from now

- Trip cost: $2,500

- Initial trip deposit paid within the last 24 hours

- State of residence: Texas

We limited results to policies that offer at least as much coverage as the AXA Platinum policy does on major benefits:

- COVID-19 coverage

- Minimum $250,000 emergency medical benefit

- Minimum $1 million emergency medical benefit

- 100% trip cancellation

- 150% trip interruption

Each policy offered nearly identical coverage for these major benefits, and Tin Leg ‘s Silver plan had the lowest cost at $164.35, followed closely by $165.84 from HTH Worldwide ‘s TripProtector Classic plan.

If you’re mainly concerned with full coverage for trip cancellation and interruption along with $250,000 in emergency medical and $1 million for emergency medical evacuation, you can save if you go with Tin Leg .

However, the higher-priced policies offer additional coverage and options. For example, AXA Platinum offers the option to add Cancel for Any Reason coverage and includes sports equipment rentals and missed ski days or golf rounds. Tin Leg doesn’t have missed connection coverage, but Seven Corners Trip Protection Choice and AXA Platinum offer up to $1,500 for missed connections on cruises or tours.

All of the policies we quoted except for Tin Leg Silver offer employment layoff as a covered cancellation reason, and AXA Platinum allows you to cancel your trip for work reasons, though none of the other policies do. AXA Platinum also offers $100,000 in non-medical evacuation , which Tin Leg Silver and HTH Worldwide TripProtector Classic policies do not, and is much higher than the $20,000 benefit offered by the Seven Corners Trip Protection Choice policy.

AXA Platinum has a higher cost than competitors but offers more robust coverage. If you’re mainly concerned with major coverage for trip cancellation and interruption, emergency medical, and emergency evacuation, other travel insurance companies may offer a better quote. But if you want additional coverage and options such as non-medical evacuation and expanded cancellation reasons, check out the details on what AXA Platinum offers.

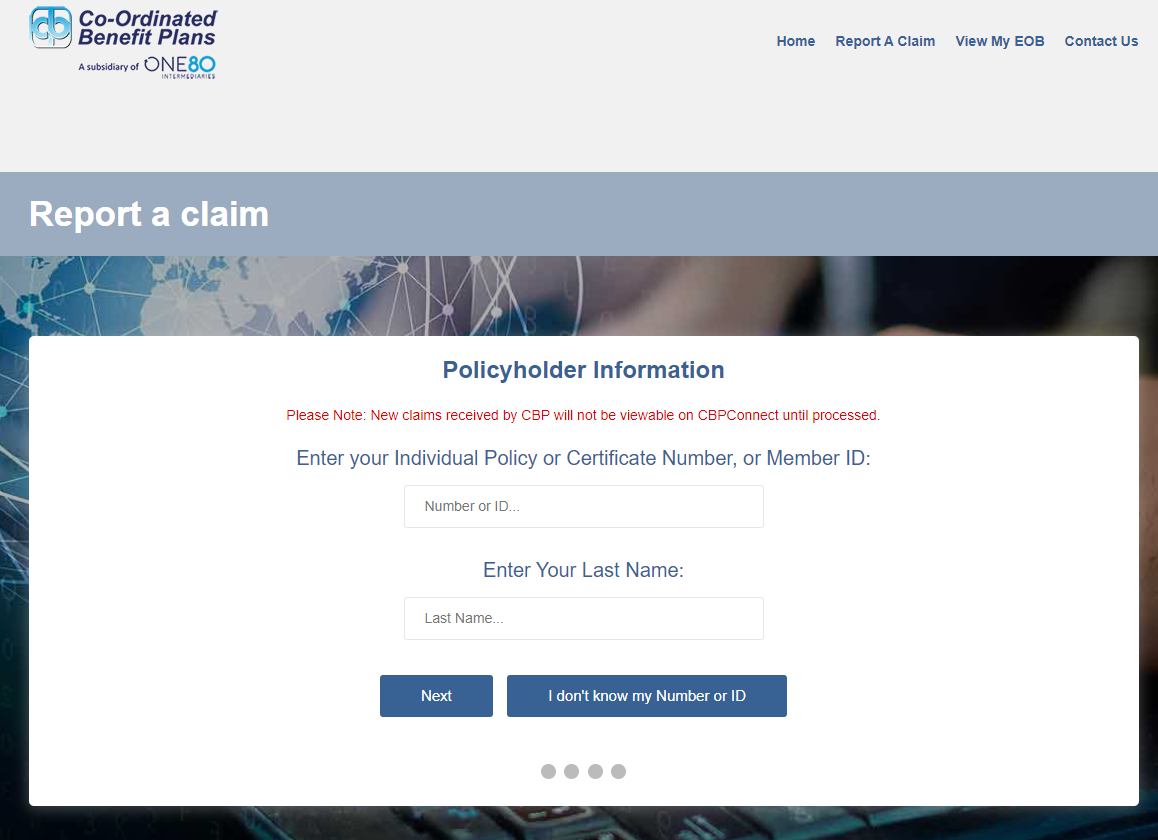

You can file a claim with AXA in a few ways:

- Using the claim administrator portal

If you’d like to file your claim online, you can visit the portal for Co-Ordinated Benefit Plans and enter your policy number and last name to get started.

Alternatively, you can call AXA toll-free at 888-957-5015 or collect at 727-450-8794 .

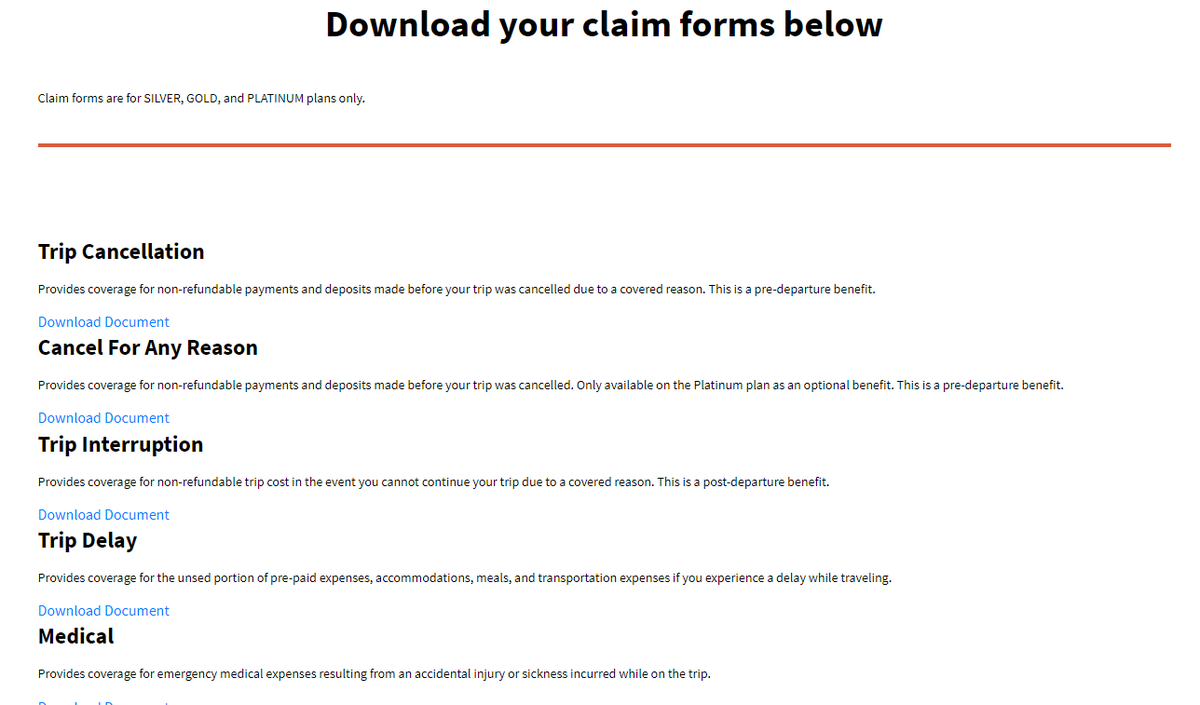

If you’d like to submit your claim via email or mail, you can download claim forms on the AXA website.

Once you download the claim form, you’ll get a list of documents required for submitting your travel insurance claim, along with mail or email info. For example, on a trip interruption claim form, AXA requires you to send in:

- Completed claim form

- Policy verification

- Booking confirmation, such as a ticket or proof of purchase

- Your original unused, nonrefundable tickets

- Your new ticket with confirmation of early return

- A cancellation statement from travel suppliers

- A medical report or physician statement if you interrupted the trip due to medical necessity

- Death certificate, if applicable

- Documentation of circumstances that led to trip interruption

- Documentation of reimbursement request expenses, such as receipts or credit card statements

You can email the form and other required documents to [email protected] or mail to:

AXA Assistance USA On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies P.O. Box 26222 Tampa, FL 33623

AXA Travel Insurance is a reliable option with more than 6 decades of experience and solid ratings. There are 3 levels of coverage to choose from — Silver, Gold, and Platinum — that offer varying levels of coverage and options. AXA Travel Insurance isn’t the cheapest option, but it offers robust coverage options and reputable service, so it can be a good choice if you’re looking for enhanced travel protection.

For the premium global assist hotline benefit of The Platinum Card ® from American Express, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the car rental loss and damage insurance benefit of The Platinum Card ® from American Express, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the baggage insurance plan benefit of The Platinum Card ® from American Express, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the trip delay insurance benefit of The Platinum Card ® from American Express, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of The Platinum Card ® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the axa silver travel insurance plan provide coverage for a safari.

Yes, AXA’s travel insurance policies offer coverage for safaris, including emergency medical expenses. Safaris are under the sports and activities covered for emergency medical and repatriation costs and personal accidents.

Is AXA travel insurance worth it?

AXA travel insurance can be worth it if you need coverage for significant nonrefundable expenses or your health coverage doesn’t extend to your destination. Competitors may offer lower cost policies for similar major coverage, but AXA may have greater policy options, so it’s a good idea to compare your options.

Is AXA travel insurance good for a Schengen visa?

AXA recommends its Gold plan or higher for Schengen travel.

Is AXA an international insurance?

Yes, you can use AXA for international travel , with coverage for countries in Europe, Asia and Pacific islands, the U.S. and Canada, Africa and the Middle East, Latin America, and the Caribbean.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

7 Best Cheap Travel Insurance Companies in May 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Finding the cheapest travel insurance is often a priority for travelers hoping to protect themselves and their finances while away from home.

But is it better to err on the side of affordable travel insurance or opt for a more comprehensive plan? That depends on your needs .

On average, a comprehensive plan that covers some combination of trip cancellation and interruption costs, medical coverage and baggage protection (and perhaps a number of other things) will cost you 5%-10% of what you paid for the trip, according to NerdWallet partner Squaremouth, a travel insurance marketplace.

That means a comprehensive policy for a trip that costs you $3,000 could run you anywhere between $150 and $300. Factors like the cost and length of your trip, the age of the travelers and how much protection you want can significantly influence what you pay for your plan.

Ultimately, Squaremouth recommends “the least expensive policy that offers the coverage [travelers] need.”

» Learn more: The best travel insurance companies right now

Factors we considered when picking cheap travel insurance plans

We considered a few factors as we looked for the most affordable travel insurance plans.

Price: If your goal is to find cheaper travel insurance, you want the price to be affordable.

Breadth of coverage: The best budget travel insurance is typically going to be a plan that offers a wide range of protections at an affordable cost, ensuring you’re protected with at least some coverage for a wide range of scenarios.

Uniqueness or customizability : While many travel insurance plans have similar protections, some stand out for particular coverage that can be helpful to certain travelers, like those needing to Cancel For Any Reason , those going on a cruise, or travelers with preexisting health conditions. We didn’t spring for the priciest plans with broad, deep coverage; instead, we picked those that meet a sort of budget "sweet spot" when it comes to cost efficiency.

» Learn more: Is travel insurance worth getting?

An overview of the best cheap travel insurance plans

We looked at travel insurance quotes for a hypothetical 10-day trip to Italy in October 2023. The traveler is a 40-year-old man living in North Carolina who spent $2,000 on the trip, including airfare.

Reliable but cheap travel insurance providers

1. axa assistance usa (silver plan: $70).

Why we picked it:

The $500 missed connection benefit is great for cruise and tour participants. It covers additional transportation, accommodations and meal costs when you miss a cruise or tour departure.

Full trip cancellation and interruption coverage, along with up to $25,000 for out-of-pocket medical costs and baggage coverage.

Among the lowest prices we found.

If you’re willing to spend a bit more than AXA's $70 Silver plan, a Gold plan only costs $19 more and gets you deeper coverage amounts and up to $35,000 in collision rental car insurance.

2. Berkshire Hathaway Travel Protection (ExactCare Value plan: $56)

Cheapest plan we found while still offering a wide array of protections.

Includes a preexisting medical condition waiver.

Add-on rental car collision coverage optional for $10 per day. You can pick how many days you want the additional coverage — it’s not all or nothing.

At $56, this plan comes in at less than 3% of the $2,000 trip cost.

3. IMG (iTravelInsured Lite plan: $77)

Treats COVID-19 like any other illness, which is to say, if your claim accepts flu, strep throat or appendicitis as an acceptable, covered condition, the coronavirus is, too.

Covers costs related to trip interruption up to 125%

Higher than normal limits on dental expenses, at $1,000. If your teeth are your Achilles heel (or your biggest fear), this plan might be for you.

The iTravelInsured Lite plan doesn’t offer some of the bells and whistles that other plans do, like rental car coverage , Cancel For Any Reason coverage or waivers for pre-existing conditions. But you’ll have relatively solid across-the-board trip protections.

4. John Hancock (Silver plan: $93 for a mid-tier plan)

Mid-level plan (as opposed to a basic plan) at an affordable price for travelers who want more coverage without paying too much.

Includes an optional Cancel For Any Reason add-on for travelers wanting flexibility. It is a bit pricey, at half the cost of the insurance ($46.50 extra for a $93 plan).

Reimburses up to $1,000 for lost baggage , far more than many basic plans.

Add-on rental car coverage for $9 per day.

At $88, John Hancock’s basic (Bronze) plan isn’t particularly affordable. But for just $4 extra, you can tap into the benefits of a mid-tier plan at still less than 5% of the total trip cost.

5. Nationwide (Essential plan: $76)

Includes a preexisting conditions waiver.

Add-on rental car coverage for $90.

Covers trip interruption at 125% of the trip cost while providing comprehensive emergency medical and baggage coverage.

6. Seven Corners (Basic plan: $75)

On top of standard trip protections, it includes a relatively affordable Cancel For Any Reason option for $31.50 extra.

If you plan to rent expensive sporting equipment, you might consider paying $10 extra to cover lost, damaged, stolen or destroyed gear.

COVID-19 coverage reimburses you for costs incurred if you have to quarantine .

Rental car coverage comes in at an affordable $7 per day.

Seven Corners’ Basic plan stands out because it offers a little bit of everything, appealing to athletic travelers, those who need affordable trip protections, those who want the flexibility to cancel for any reason and those still concerned about getting quarantined due to COVID-19.

7. Travelex Insurance Services (Basic plan: $71)

Straightforward: What you see is what you get. This plan’s coverage has fewer rules and caveats than many.

While not sporting the highest coverage amounts, it offers a solid range of protections to ensure you get at least something back when your travel is disrupted or you have a medical emergency.

Offers add-on rental car coverage for $10 per day.

At $71, the Travelex Basic plan’s cost is just over 3% of the $2,000 trip’s cost.

If you want to get travel insurance at the cheapest possible rate, here’s a trick. Put $0 as your trip cost, Stan Stanberg, co-founder of comparison site Travelinsurance.com said in an email.

“When excluding trip cancellation and trip interruption coverage the cost of a travel insurance plan goes down significantly,” Stanberg said.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical, trip delay , missed connection, baggage and other protections.

You’ll often find comprehensive travel insurance plans cost 5%-10% of your total trip cost, according to Squaremouth. This will often get you full trip cancellation and trip protection, baggage protection, emergency medical coverage and often other benefits.

Typically, the more you pay, the broader and deeper the coverage.

For many plans, you can purchase travel insurance up until you depart. However, to get access to the most protections possible, booking two days to two weeks after making your initial deposit is the best rule of thumb.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical,

, missed connection, baggage and other protections.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

AXA Travel Insurance Review | Money

T raveling can be an incredibly enriching experience, but it’s important to be prepared for the unexpected. From flight delays to medical emergencies, unforeseen events can quickly turn a dream vacation into a nightmare. Luckily, you can get travel insurance for peace of mind and financial protection during your journey.

There are many options out there, and choosing the best travel insurance company for your needs requires some research. In this article, we’ll take you through the pros and cons of choosing AXA Travel Insurance. We’ll also look at AXA’s plans, pricing, accessibility and customer satisfaction.

Best travel assistance services while abroad

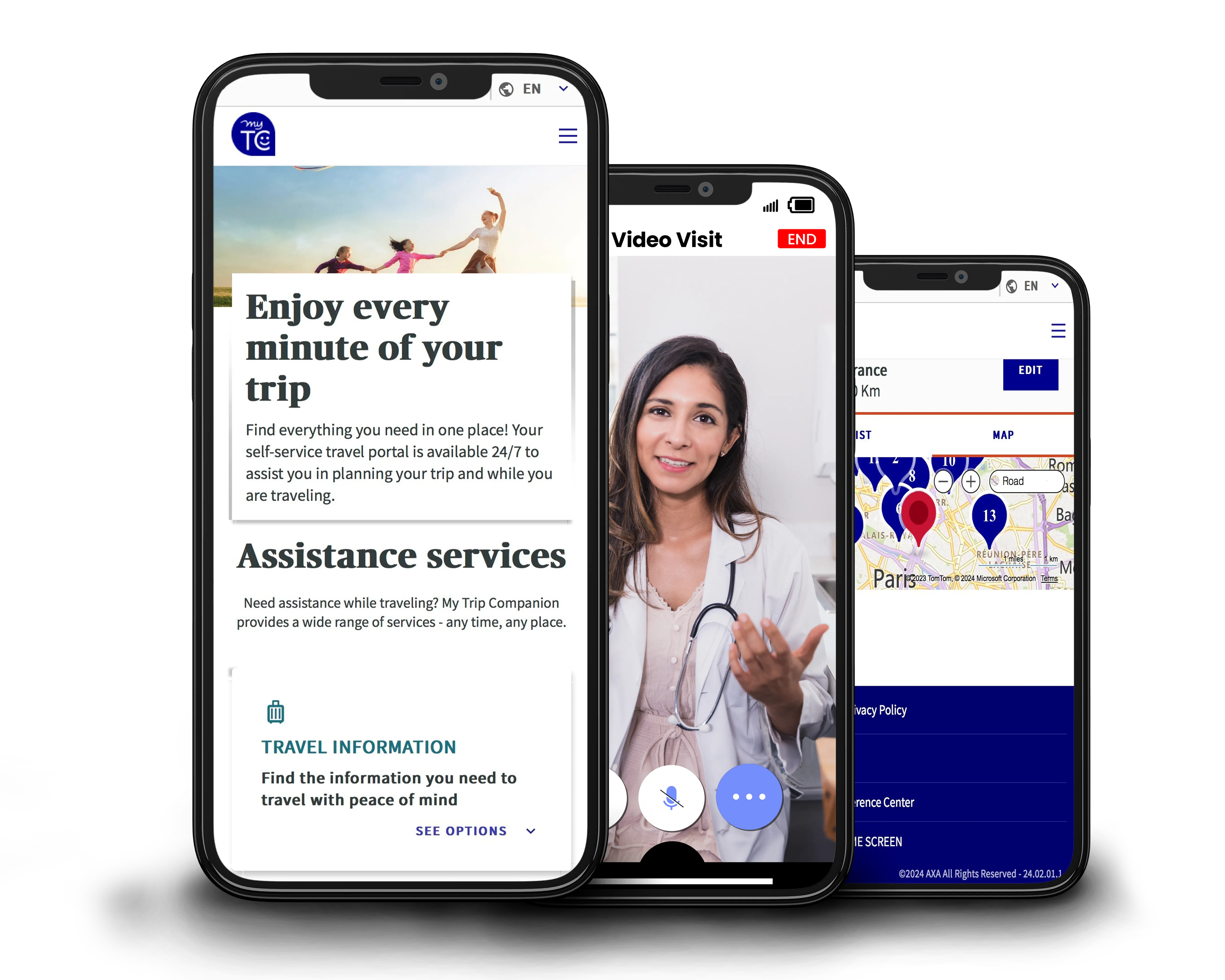

If you’re traveling internationally, having reliable assistance services can go a long way.

AXA Travel Insurance stands out in this department. It has a presence in 30 countries, and customer support services that include:

- 24/7 emergency assistance : AXA’s travel support team is available around the clock. Whether you’re facing a medical emergency or need help with lost documents, you can call for assistance.

- Multilingual support : Language barriers can be a significant challenge when dealing with emergencies in foreign countries. AXA’s multilingual customer support team bridges this gap by offering help in 20 different languages.

- Travel information services : AXA keeps travelers informed with up-to-date travel advisories and safety tips. AXA also offers referrals for lodging, transportation, restaurants and entertainment.

AXA Travel Insurance pros and cons

Concierge services included in all plans, high lost baggage coverage, coverage for lost sports days and equipment, negative customer reviews, cancel for any reason coverage only available with platinum plan, pros explained.

One of AXA’s strengths is the broad range of concierge services it offers with every plan tier. This includes support for booking hotel accommodations, rescheduling flights, arranging ground transportation, obtaining event tickets and making restaurant reservations.

AXA’s Platinum plan offers a maximum benefit of $3,000 for lost baggage. If you’re traveling with valuable property, this might be a worthwhile option.

If your travels include golfing or skiing, AXA Platinum covers up to $1,000 in rental costs should your checked sports equipment be delayed, lost or damaged by your carrier. The plan also covers lost golf rounds up to $500 and lost ski days at $25 per day for five days.

Cons explained

AXA has quite a few poor ratings on online review sites like TrustPilot. Some customers complained about delayed or unfulfilled insurance claims; others say it took months for their claim money to get reimbursed.

AXA’s Cancel for Any Reason (CFAR) benefit, which lets you cancel your trip without losing a dime, is only available on its most expensive plan.

AXA Travel Insurance plans

When evaluating whether AXA is the right provider for you, take some time to research what various travel insurance policies cover . Here’s a quick look at AXA’s plans.

Silver plan

AXA’s Silver plan provides basic coverage for travel-related risks. With this plan, you’ll be covered for 100% of your trip’s cost if it needs to be canceled or cut short due to illness, natural disaster or another specific reason outlined by the company.

The Silver plan also includes emergency medical coverage for emergencies like broken bones, strokes or allergic reactions. This coverage also includes compensation for accidental death and dismemberment, providing an added layer of security and support during your travels.

Moreover, the Silver plan provides baggage and personal belongings coverage, offering compensation if your baggage is lost, stolen or damaged during your trip.

Like the Silver plan, the Gold plan includes 100% trip cancellation coverage, but expands trip interruption coverage to 150%, which gives you an extra safety net if you have to cut your trip short — reimbursing you for a new flight home and any pre-paid expenses you weren’t able to use.

There’s also an option to add a Collision Damage Waiver to this plan, which covers damage or loss to a rental car due to collision, theft or vandalism.

Platinum plan

The Platinum plan is the most comprehensive offering from AXA Travel Insurance, encompassing all the benefits of the Gold Plan at higher maximums. In addition, the Platinum plan offers limited coverage for pre-existing medical conditions and for equipment and reservations related to golf and skiing. You’ll also have access to the Collision Damage Waiver.

At the Platinum plan tier, customers have the option to enhance their coverage with the Cancel for Any Reason benefit. This extends coverage (with a maximum benefit of up to 75% of the trip cost) for cancellations outside the scope of AXA’s standard coverage, like those related to work obligations.

AXA Travel Insurance pricing

The cost of travel insurance depends on several factors. The type of coverage you choose, as well as your destination, total trip cost and the age of travelers in your party all impact how much you pay. Older travelers will pay higher premiums, for example. AXA travel insurance offers competitive pricing, though premiums do vary. To get an accurate quote for your specific trip, use the quote tool on AXA’s website or contact the company at 855-327-1441.

AXA Travel Insurance financial stability

AXA Assistance USA operates as a subsidiary of AXA Group, a French firm, which has a strong financial standing. Major credit rating agencies give AXA Group solid ratings, including an A+ (Superior) from A.M. Best and an Aa3 from Moody’s. These ratings mean travelers can be confident in the company’s ability to pay out claims.

AXA Travel Insurance accessibility

Availability.

AXA Travel Insurance is available to U.S. travelers from all 50 states and Washington, D.C., providing coverage for trips to 200 destination countries around the globe.

Contact information

AXA Travel Insurance’s general customer support is available from Monday to Friday, 8 a.m. to 7 p.m. For policyholders, travel assistance is available by phone 24/7.

Here are the main points of contact for AXA:

- Sales phone number: 855-327-1441

- Customer support phone number: 855-341-9877

- AXA Travel Insurance claim support: 888-957-5015

- AXA Travel Assistance phone number: 855-327-1442

- AXA Travel Insurance email address: [email protected]

User experience

AXA’s website has a personalized quote tool, which can give you an estimate of how much your insurance premium will cost for all three of its plan levels. A downloadable PDF for each plan is available, which provides more details about coverage definitions, limitations and exclusions.

Filing a claim also happens online. To complete the process, policyholders need to download the applicable claim forms and upload them to AXA’s online portal.

AXA Travel Insurance customer satisfaction

AXA Assistance USA is rated A+ by the Better Business Bureau (BBB), though it’s not accredited by the organization. Customers give the company 1 out of 5 stars on the BBB site. Most of the negative feedback is focused on unpaid claims and poor communication with the company.

AXA Travel Insurance FAQ

Is axa travel insurance good, how much is axa travel insurance, does axa travel insurance cover cancellation, how we evaluated axa travel insurance.

To provide an accurate and objective review of AXA Travel Insurance, we analyzed:

- Coverage options

- Coverage limits and pricing

- Accessibility

- Financial stability

- Customer feedback

Summary of Money’s AXA Travel Insurance review

As a global company with employees on five continents, AXA is our pick for offering the best travel assistance services while traveling abroad. All plans include concierge services, which provide invaluable support and multilingual assistance during your travels. AXA’s Platinum plan is particularly good, providing high coverage amounts for lost baggage and sports equipment, among other expenses.

That said, some customers have faced issues with AXA’s claim process and customer service representatives, according to online reviews. Moreover, the company’s Cancel for Any Reason benefit is only available at the Platinum plan level.

Before you pay for a travel insurance policy, be sure to carefully research different providers and compare plans to find the best coverage for your situation. For more guidance, check out our explainers on whether travel insurance is worth it and the best time to buy travel insurance .

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

This article may contain affiliate links that Microsoft and/or the publisher may receive a commission from if you buy a product or service through those links.

More From Forbes

Is travel insurance refundable here’s everything you need to know.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Sometimes, travel insurance is refundable. Here's when you can get your money back.

Peter Hoagland always checks to see if his travel insurance is refundable. That's because anything can happen between the time you book your vacation and when you leave — and because travel insurance isn't always refundable.

During the pandemic, he discovered that the hard way. He had to cancel a trip and asked for his money back from the insurance company. It refused.

"Since then, I always read the fine print on the policy," he says.

The refundability of travel insurance has always been an open question. Some countries and U.S. states regulate refundability. Travel insurance companies put refundability details in the fine print of the policy. And, as Hoagland found out, there are always exceptions.

Like the pandemic, when refund policies were all over the map. Some insurance companies adhered to their published policies. Others offered a credit that could be reused within a year, which was minimally useful because the pandemic was still happening a year later. Others quietly gave their customers a refund.

Hoagland says he fought for his money. Eventually, he contacted a manager at his travel insurance company.

"That produced a quick result," he says. "I got my money back."

Google Chrome Gets Third Emergency Update In A Week As Attacks Continue

Japanese fans are puzzled that yasuke is in ‘assassin’s creed shadows’, forbes releases 2024 30 under 30 asia list.

But let's face it: Getting a refund for travel insurance can be difficult. There are times when insurance is always refundable because it's required by law. There are times when it's sometimes refundable. And there are times when it's almost never refundable. But even then, there may be a way to recover some — or all — of the value of your policy.

Getting a refund for travel insurance can be a challenge

If you have a travel insurance policy and would like to get a refund, it might be easier said than done, say experts.

"While travel insurance is regulated like auto and home insurance, it’s often less standardized," says Stuart Winchester, CEO of Marble, a digital wallet for your insurance. "So first off, it’s important to check the fine print of your specific policy. Don’t assume it’s like the last one you got."

Even when you have something in writing, a refund can require some serious negotiating skills.

"Getting a refund for travel insurance can be complicated and frustrating," says Peter Hamdy, the managing director of a tour operator in Auckland, New Zealand. He's asked for a refund on policies numerous times and says that despite what travel insurance companies may tell you, there are no hard-and-fast rules when it comes to getting a refund on your policy.

"Some situations can warrant a refund," he says. "It depends on your policy."

What does a typical refundability clause look like? For example, the World Explorer Guardian from Insured Nomads notes that it's refundable only during the 10-day review period from the date of delivery or 15 days from the date of delivery if mailed, provided you have not already departed on your trip and you have not incurred any claimable losses during that time. If you depart on your trip before the expiration of the review period, the review period ends and the policy can't be refunded.

"We go a bit further with our World Explorer Travel Medical plans," notes Andrew Jernigan, CEO of Insured Nomads. "If no claims have been filed then we can refund the unused portion of the policy if you cut your trip short.”

When can you get a refund for travel insurance?

Here are the most common cases where travel insurance can be refunded:

- If you cancel during the "free look" period required by the government. Most states require what's called a "free look" period of anywhere from 10 to 14 days. "During this period, travelers can review the purchase and make sure it fits their needs," explains James Nuttall, general manager of Insubuy . "If it does not, they can cancel it for any reason and get a full refund, no questions asked, so long as you haven’t departed yet.

- If you cancel during the travel insurance company grace period. Many insurance companies also have a grace period for refunds (usually, they are the same as the "free look" although some grace periods can be longer). "If you’re outside your grace period, which typically lasts one to two weeks after signing, you’re contractually obliged to pay your premiums," says David Ciccarelli, CEO of the vacation rental site Lake . "Still, it doesn’t hurt to ask your company for a refund or alternative options if you’re outside your grace window. You might not get a yes, but it could lead to some cost savings or better solutions."

- When someone else cancels your trip. "For instance, if your cruise is canceled due to low river tide, you are not at fault and would typically receive a full refund or credit for a future sailing, thus eliminating the need for the travel insurance policy," explains Rhonda Abedsalam vice president of travel insurance for AXA Assistance US.

- If you die. Typically, the policy would be refunded to your next of kin. Generally, you can also ask for a refund if your travel companion dies before your trip.

Remember, it depends on where you buy your insurance

The refundability of your insurance can depend on where you purchased it. Commercial policies bought from a cruise or tour company are generally canceled and refunded if you cancel the trip far enough in advance of your departure date.

"The travel insurance cancellation provisions are generally tied to the cancellation provisions for the cruise or tour," explains Dan Skilken, president of TripInsurance.com . "After you have paid the last deposits on the cruise and are close enough to departure that they will not provide a refund on the cruise, they generally will also not provide a refund on the travel insurance. But if you cancel early enough to get all or most of your deposit back, you will also get your travel insurance premium refunded."

If you’ve purchased retail travel insurance from a third-party provider or comparison website, you can often get a refund if you can show receipts proving that you received a full refund of all trip deposits and have not had any cancellation penalties or taken any travel credits when you canceled your trip.

That's because retail travel insurance is sold for a specific traveler and for a specific trip. If you have proof of a complete refund and have not received travel credits, then you no longer have what's called an "insurable interest" in the trip. The insurance company must cancel and refund your premium in full, says Skilken.

Insider tip: If the insurance company refuses, just tell them you have proof that you no longer have an insurable interest in the trip. You have to have an insurable interest in a trip to own a travel insurance policy.

Your agent may be able to help you get a refund

You may also be able to lean on the agent who sold you the policy. For example, all policies on Squaremouth come with a money-back guarantee.

"The purpose of this benefit is to give travelers extra time to review their policy documentation to be sure it’s the best policy for their coverage needs," says spokeswoman Jenna Hummer. At Squaremouth, the money-back period typically lasts between 10 and 14 days, which is in line with the mandated "free look" period.

However, I have also seen agents negotiate with travel insurance companies for a more generous refund period in case of extenuating circumstances. There's no guarantee that you'll get it, but it's worth asking — and one reason to work with a third party.

Agents can also help you avoid this problem. Susan Sherren, who runs Couture Trips , a travel agency, notes that American Airlines Vacation Packages offers a predeparture protection insurance plan, which allows cancellation for any reason before the outbound departing flight time. Other restrictions apply, she adds.

"More flexibility will often cost you more," she says. "But having the flexibility is a great way to sleep well at night."

Can't get a refund? Look for other kinds of flexibility from your travel insurance company

Even if your travel insurance company says no to a refund, it doesn't necessarily mean you've lost the value of your policy.

"If a travel supplier changes or cancels your trip, you should be able to change your travel insurance policy to match the new dates of your trip or even cover a new trip, sometimes up to two years into the future," says Daniel Durazo, director of external communications at Allianz Partners USA .

Pro tip: Be sure to change the dates of your travel insurance policy before the departure date of your current itinerary. You can do that online or by calling your agent. Once the policy's effective date has passed, making any changes or initiating a refund or credit becomes much more difficult.

Don't forget to do your due diligence

Bottom line: Travel insurance is refundable under certain circumstances. But knowing when can require research.

"It's important for consumers to carefully read their policy upon receipt to understand the specific terms offered by their insurance provider," says Robert Gallagher, president of the US Travel Insurance Association.

The more you know, the likelier you are to get the refund you want when your plans change.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

AXA Travel Benefits

For your holidays in the USA and abroad

Pre- Departure Travel Benefits

Post- departure travel benefits, medical benefits .

Emergency Medical Expenses Emergency Evacuation & Repatriation Non-Emergency Medical Evacuation & Repatriation

Baggage Benefits

Luggage Delay Lost or Stolen Luggage

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

File a Claim

Still have a question? Be sure to get in touch with our expert travel team

You can also claim directly or check the status of an existing claim at our claims administrator’s 24/7 self-service portal at: https://cbpconnect.com

You have reached AXA USA, your Travel Protection solution for US Residents. Our team of experts are available to you for claims assistance. If you are looking for information on how to file a claim and you are not a US Resident please review your travel documents for the appropriate contact details. If you are a US Resident and purchased an AXA Silver, Gold, or Platinum plan please find the necessary claim forms and instructions below.

How can I contact someone about my claim?

Before you submit a claim.

Contact AXA USA for emergency medical and travel assistance including any prior arrangements for evacuations and medical repatriations. In the event of theft or loss of property, contact the police or transportation carrier such as the airline immediately to obtain a filed report

- ✔Check your policy documents to confirm your coverage details