At Morgan Stanley, we lead with exceptional ideas. Across all our businesses, we offer keen insight on today's most critical issues.

Personal Finance

Learn from our industry leaders about how to manage your wealth and help meet your personal financial goals.

Market Trends

From volatility and geopolitics to economic trends and investment outlooks, stay informed on the key developments shaping today's markets.

Technology & Disruption

Whether it’s hardware, software or age-old businesses, everything today is ripe for disruption. Stay abreast of the latest trends and developments.

Sustainability

Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics.

Diversity & Inclusion

Multicultural and women entrepreneurs are the cutting-edge leaders of businesses that power markets. Hear their stories and learn about how they are redefining the terms of success.

Wealth Management

Investment Banking & Capital Markets

Sales & Trading

Investment Management

Morgan Stanley at Work

Sustainable Investing

Inclusive Ventures Group

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals.

We have global expertise in market analysis and in advisory and capital-raising services for corporations, institutions and governments.

Global institutions, leading hedge funds and industry innovators turn to Morgan Stanley for sales, trading and market-making services.

We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions.

We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

We provide comprehensive workplace financial solutions for organizations and their employees, combining personalized advice with modern technology.

We offer scalable investment products, foster innovative solutions and provide actionable insights across sustainability issues.

From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success.

Core Values

Giving Back

Sponsorships

Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Underpinning all that we do are five core values.

Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back.

Morgan Stanley leadership is dedicated to conducting first-class business in a first-class way. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years.

The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

Morgan Stanley is differentiated by the caliber of our diverse team. Our culture of access and inclusion has built our legacy and shapes our future, helping to strengthen our business and bring value to clients.

Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research.

At Morgan Stanley, giving back is a core value—a central part of our culture globally. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best asset—Morgan Stanley employees.

As a global financial services firm, Morgan Stanley is committed to technological innovation. We rely on our technologists around the world to create leading-edge, secure platforms for all our businesses.

At Morgan Stanley, we believe creating a more equitable society begins with investing in access, knowledge and resources to foster potential for all. We are committed to supporting the next generation of leaders and ensuring that they reflect the diversity of the world they inherit.

Why Morgan Stanley

How We Can Help

Building a Future We Believe In

Get Started

Stay in the Know

For 88 years, we’ve had a passion for what’s possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

At Morgan Stanley, we focus the expertise of the entire firm—our advice, data, strategies and insights—on creating solutions for our clients, large and small.

We have the experience and agility to partner with clients from individual investors to global CEOs. See how we can help you work toward your goals—even as they evolve over years or generations.

At Morgan Stanley, we put our beliefs to work. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give back—all to contribute to a future that benefits our clients and communities.

Meet one of our Financial Advisors and see how we can help you.

Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

- Opportunities

- Technology Professionals

Experienced Financial Advisors

We believe our greatest asset is our people. We value our commitment to diverse perspectives and a culture of inclusion across the firm. Discover who we are and the right opportunity for you.

Students & Graduates

A career at Morgan Stanley means belonging to an ideas-driven culture that embraces new perspectives to solve complex problems. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

Experienced Professionals

At Morgan Stanley, you’ll find trusted colleagues, committed mentors and a culture that values diverse perspectives, individual intellect and cross-collaboration. See how you can continue your career journey at Morgan Stanley.

At Morgan Stanley, our premier brand, robust resources and market leadership can offer you a new opportunity to grow your practice and continue to fulfill on your commitment to deliver tailored wealth management advice that helps your clients reach their financial goals.

- Dec 21, 2022

2023 Outlook: Business Travel Bounces Back

Corporate travel budgets are recovering to pre-covid levels, our new survey finds. see where companies are spending in the year ahead..

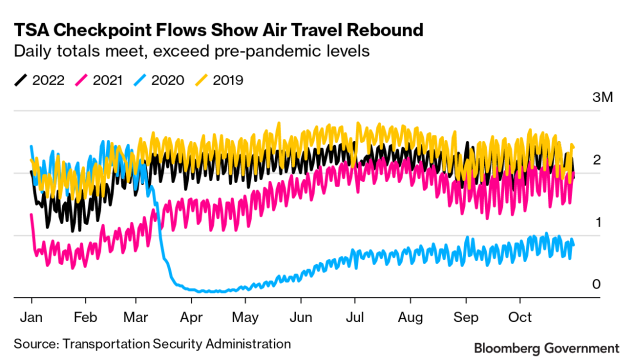

After grinding to a near halt during the COVID-19 pandemic, business trips—and profits for hotels and airlines catering to higher-paying corporate clients—are bouncing back even beyond pre-pandemic levels, per a recent survey from Morgan Stanley Research.

Despite higher airfares and room rates, the survey of 100 global corporate travel managers found that many respondents believe their company's travel expenditures are already back to pre-pandemic levels and will continue to grow. The biggest demand is coming from small companies, which means lower-cost airlines may benefit the more than their bigger peers.

“Travel budgets are expected to see a noticeable improvement in 2022, with 2023 nearly back to ‘normal,’” says Ravi Shanker, an equity analyst covering North American transportation. “Most interesting is that nearly half of the respondents expect 2023 budgets to increase versus 2019 overall. And of those that expect an increase in budgets, the majority believe 2023 budgets will be between 6% to 10% higher than 2019.”

Overall travel budgets show an improvement over previous surveys, with 2023 budgets expected to be 98% of 2019 levels on average.

Survey Highlights

- Smaller companies lead demand for corporate travel. More than two-thirds (68%) of companies with under $1 billion in annual revenue expect travel budgets to increase next year, versus just 41% of companies with annual revenues over $16 billion. Similarly, 32% of smaller companies said travel budgets had returned to pre-pandemic levels compared with 23% of big firms. “This trend could likely favor low-cost carriers, as smaller enterprises tend to be more localized and require less long-haul travel,” says Shanker. “However, the legacy carriers with strong corporate exposure should see gains as well.”

Nearly a quarter of both large and small companies say their firms are already back to pre-COVID travel levels, and 34% anticipate a full recovery by the end of 2023.

ESG Rate of Change

Holiday budgets hit by inflation, seeing a peak for food prices.

- Airfares are higher, but that’s not a drag on bookings. On average, corporate airfares are expected to be about 9% higher than pre-pandemic prices. “Clearly the expected increase in corporate airfares is not having a major impact on corporate travel as passenger volume is expected to be basically flat versus 2019,” says Shanker.

- Room rates will continue to rise, though not as fast as they have recently. As of this October, market room rates had spiked 20% to 25% over 2019. Next year they will rise even more, though by an average of just 8%, say respondents (9% in the U.S. and U.K.; 5% to 6% in Latin America, Asia and Africa).

- Hotels face economic and competitive headwinds. While overall travel budgets are growing, companies are cutting costs by trading down when it comes to accommodations. (Historically, budget hotels outperform upscale lodging in tough economic times.) Alternative sources of accommodation also threaten traditional hotels, with 31% of respondents saying they intend to use short-term rental services in the next year.

- Virtual meetings aren’t going away. Almost 18% of corporate travel will be replaced with virtual meetings, falling slightly to 17% in 2024, suggesting a degree of permanence in the shift with companies recognizing the benefits of virtual meetings ranging from cost savings to lower carbon footprints. Expect companies providing collaboration software to gain from this shift.

For more Morgan Stanley Research insights and analysis on global travel, ask your Morgan Stanley representative or Financial Advisor for the full reports, “Global Corporate Travel Survey: Snapping Back" (Nov. 8, 2022) and “Global Corporate Travel Survey: 2023 Travel Budgets Nearly Back to 2019 Levels, but ~20% of Meetings Could Still Shift to Virtual” (Nov. 8. 2022). Morgan Stanley Research clients can access the reports directly here and here . Plus more Ideas from Morgan Stanley’s thought leaders.

Sign up to get Morgan Stanley Ideas delivered to your inbox.

*Invalid email address

Thank You for Subscribing!

Would you like to help us improve our coverage of topics that might interest you? Tell us about yourself.

Dividends: A Volatility Shield

Dividend-paying stocks with steady distribution growth can offer outsized contributions to long-term portfolio returns.

Global Outlook: Tech & Beyond

Disruption in connected advertising, a digital-driven economic boom in India and more trends in tech, media and telecom.

Building Credit for Immigrants

Wemimo Abbey and Samir Goel present credit solutions for immigrants financially marginalized by America’s credit validation system.

Business Travel Trends in 2023

While doing business face-to-face is bouncing back after the pandemic, the corporate travel industry is still very much in recovery. Here’s what to expect from business travel trends in 2023.

>> Related: Corporate Travel Trends from Our Survey with Skift <<

Source: Bloomberg Law

While there is no longer a shortage of travelers, there are new challenges:

- 87% of hotels have persistent staff shortages ( source )

- The United States has a deficit of about 8,000 pilots, or 11% of the total workforce ( source )

- TSA is in a hiring crisis amid stagnant wages ( source )

- Airfares are rising 5x faster than the overall inflation rate ( source )

- Hotel rates are up 19%

The net impact on business travelers? One in four flights have been delayed in 2023, and travel is costing ~30% more per trip.

Higher travel costs and unreliable flights will strain businesses in 2023

Unfortunately inflation, staffing shortages, and uncertain flights will affect not just the traveling employee, but also their manager and the finance department.

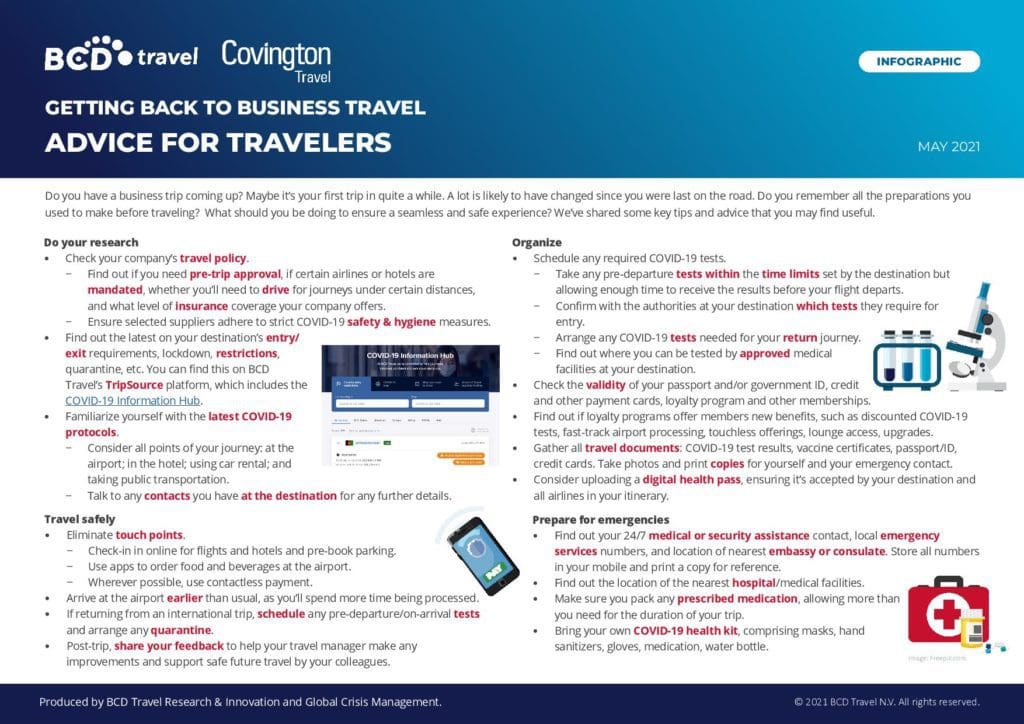

Business travelers should:

- Plan for long check-in and security lines at the airport, even with TSA pre check.

- Prepare for flights to sell out quickly. Book as soon as you can.

- Expect flights to be delayed – be conservative with your itinerary, and don’t schedule optimistic meetings or airport transfers.

- Prepare to rebook canceled flights. Save your company’s travel agency number in your phone so you don’t have to wait in line with hundreds of other stranded passengers.

>>Related: The New Era of Corporate T&E <<

Managers should:

- Prepare to manually field far more policy-exceptions for expensive flights.

- Triage travel or re-allocate budgets – with each trip costing ~30% more, you’ll exhaust travel and expense budgets faster.

Finance departments should:

- Urgently update travel policies, pricing limits, and per diems to reflect 2023 pricing.

- Create dynamic policy parameters that aren’t capped at arbitrary or outdated prices.

- Partner with travel agencies that have seasoned agents available 24/7 to rebook canceled flights.

- Explore incentives and reward employees who book under budget . On average, we see businesses trim 30% of their travel budget after implementing rewards.

Your California Privacy Choices

We use technologies, such as cookies, that gather information on our website. That information is used for a variety of purposes, such as to understand how visitors interact with our websites, or to serve advertisements on our websites or on other websites. The use of technologies, such as cookies, constitutes a ‘share’ or ‘sale’ of personal information under the California Privacy Rights Act. You can stop the use of certain third-party tracking technologies that are not considered our service providers by clicking on “Opt-Out” below or by broadcasting the global privacy control signal.

Note that due to technological limitations, if you visit our website from a different computer or device, or clear cookies on your browser that store your preferences, you will need to return to this screen to opt-out and/or rebroadcast the signal. You can find a description of the types of tracking technologies, and your options with respect to those technologies, by clicking “Learn more” below.

You have successfully opted-out.

Before you go, be sure you know:

This link takes you to an external website or app, which may have different privacy and security policies than TravelBank. We don't own or control the products, services or content found there.

- Apartment-style retreat Shorehouse Hotel opens in Colorado

- Ares and EQ acquires £400 million UK hotel portfolio

Does ADR have a ceiling? Identifying the right metrics for hotels

- KKR and Amante acquires Park Grand London Kensington Hotel

- June 17 May 14:00 BST – Leveraging new distribution channels

Boutique Hotel News

Home » Features » Six business travel trends in 2023

Six business travel trends in 2023

- January 16, 2023

[Credit: Rob Wilson on Unsplash]

[SPONSORED CONTENT] Cvent highlights some key findings from its latest Travel Manager Report and how venues can best capture demand in 2023.

Corporate travel is, apparently, back! According to the new Cvent Travel Manager Report: Europe Edition December 2022 , corporate travel managers seek value, sustainability, and cost-cutting opportunities in 2023.

The challenge for hotel teams is to show they have the facilities and technology to handle demand and put their venues at the front of the queue.

Cvent commissioned Censuswide, an independent research company, to survey 514 corporate travel decision-makers in the United Kingdom, France, Germany, Spain, Italy, and the Netherlands, between October 20th and November 2nd, 2022. Here’s what they found:

1. Business travel will be robust and international

In total, 72 per cent of travel managers expect their business travel volume to increase either somewhat (46 per cent) or significantly (26 per cent) in 2023, when compared to 2019. Just 13 per cent say they will likely see a decrease in the travel volume of their business in 2023 relative to 2019.

Supplier takeaway

With three in 10 travel managers expecting business travel to grow significantly in 2023 compared to 2019, and a further 46 per cent believing it will increase to some extent, the opportunity for hotels is clear. Venue teams must ensure they’re engaging now with travel managers – and be prepared to respond to an influx of RFPs.

Download the full report for country-specific data, charts, and additional commentary .

2. Rising costs spur budget increases

Eighty-one per cent in total say their budget will rise, including 26 per cent who predict it will increase significantly. Only around one in six travel managers (15 per cent) believe their budget will decrease.

Set against the expectation of budget rises is a predicted increase in travel costs. In fact, 83 per cent of travel managers believe costs will be higher in 2023 than they were in 2019, with around a third of them (33 per cent) believing prices will increase significantly.

Hotels must now focus on available opportunities to increase revenue per visitor. With fewer people travelling but more events planned, providing incentives for people to spend on expenses or from their own pockets is vital. Use of technology can help venues understand what experiences and additional services visitors would like them to provide.

3. Travel managers have new needs when sourcing hotels

With budgets under pressure due to rising costs, travel managers are increasingly asking whether trips are truly necessary, and how each one fits into a new formula of cost and value.

Almost half (46 per cent) of travel managers say they are more closely assessing whether a business trip is needed. Once they’re certain it is – with the option of virtual events also available as an alternative – they rigorously compare hotels on a shifting set of priorities: cost, flexibility and sustainability.

Once the decision is made, new factors come into play during the sourcing process. Hotels should pay heed to these changing priorities. With choice revolving around price, flexibility and sustainability, venues must demonstrate their value for every element to keep ahead of their competition.

4. Demand for sustainable travel takes off

An environmentally aware approach to business travel programmes is front-of-mind for many travel buyers. Ensuring a level of sustainability in decision-making is a key part of sourcing strategies – third only in the list of planning priorities (37 per cent) that are now more important than they were pre-pandemic.

Sustainability is also having a direct impact on choice of venue. In total, 89 per cent of travel managers say this factor influences which hotels they book as part of programmes, with almost a third of them (32 per cent) claiming sustainability concerns play a significant part in selection.

Organisations in many sectors are keen to demonstrate a commitment to sustainability – corporate travel is no different. With a large majority of travel managers prioritising environmentally-friendly options when sourcing for programmes, hotels that can showcase their sustainable practices, awards, or facilities on platforms like Cvent Transient , will have the edge in 2023.

5. Interest in dual or dynamic rates increasing

Cvent’s Travel Managers Report – Europe Edition , published in June 2022, revealed almost two-thirds of travel managers (62 per cent) were open to discussing dual or dynamic rates.

In our latest study, even more (69 per cent) say their interest in such an approach has increased for the 2023 RFP season, with 20 per cent of that total stating their openness to dual or dynamic rates has risen significantly. Travel buyers in Spain are the most interested (80 per cent), although a large minority of those in the UK (38 per cent) remain to be convinced.

Interest in dual and dynamic rates as a way to make corporate travel and venue hire more cost-effective is clear. To win business in what will certainly be a competitive market in 2023, hotels must understand their potential customers’ rate strategy and expectations.

6. Travel buyers also plan events

It might not come as a shock to discover that 90 per cent of travel buyers are also the people responsible for planning. Travel managers in Italy are the most likely to also have oversight of event planning as part of their remit (98 per cent).

It’s vital to take note of the full list of duties that travel buyers oversee. Post-pandemic, many have several hats to wear: 46 per cent have assumed dual remits since 2020. Venue teams should enter negotiations fully on top of the detail of business travel sourcing and event sourcing information, to present a compelling and competitive case to win hearts and minds – and the business.

Want the country specific data, graphs, and even more commentary? Download the Cvent Travel Manager Report: Europe Edition December 2022 !

You might also like

Tipping legislation: What hoteliers need to know

Green incentives: Boutique hotel investment, development and sale

Embarking on the pathway to net zero: A guide for hotels

Why AI is the puzzle piece hotels don’t know is missing

How guest experience technology meets ESG goals

Be in the know., subscribe to our newsletter ».

- First name: *

- Last name: *

- Organisation *

- Job Title *

- Country * Please select Afghanistan Albania Algeria Andorra Angola Antigua & Deps Argentina Armenia Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bhutan Bolivia Bosnia Herzegovina Botswana Brazil Brunei Bulgaria Burkina Burundi Cambodia Cameroon Canada Cape Verde Central African Rep Chad Chile China Colombia Comoros Congo Congo {Democratic Rep} Costa Rica Croatia Cuba Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Fiji Finland France Gabon Gambia Georgia Germany Ghana Greece Grenada Guatemala Guinea Guinea-Bissau Guyana Haiti Honduras Hungary Iceland India Indonesia Iran Iraq Ireland {Republic} Israel Italy Ivory Coast Jamaica Japan Jordan Kazakhstan Kenya Kiribati Korea North Korea South Kosovo Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho Liberia Libya Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Mauritania Mauritius Mexico Micronesia Moldova Monaco Mongolia Montenegro Morocco Mozambique Myanmar,{Burma} Namibia Nauru Nepal Netherlands New Zealand Nicaragua Niger Nigeria Norway Oman Pakistan Palau Panama Papua New Guinea Paraguay Peru Philippines Poland Portugal Qatar Romania Russian Federation Rwanda St Kitts & Nevis St Lucia Saint Vincent & the Grenadines Samoa San Marino Sao Tome & Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Singapore Slovakia Slovenia Solomon Islands Somalia South Africa South Sudan Spain Sri Lanka Sudan Suriname Swaziland Sweden Switzerland Syria Taiwan Tajikistan Tanzania Thailand Togo Tonga Trinidad & Tobago Tunisia Turkey Turkmenistan Tuvalu Uganda Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vanuatu Vatican City Venezuela Vietnam Yemen Zambia Zimbabwe

- Sector * Please select Hotel Assisted/Senior Living Advisory/consultancy Build to Rent CoLiving CoWork Corporate Travel Developer Finance Hostel Investor Legal Media & PR Other Operator Owner PropTech Serviced Apartment Student Accommodation Short Term Rentals Supplier

- Boutique Hotel News is part of International Hospitality Media. By subscribing, periodically we may send you other relevant content from our group of brands/partners.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

Covington Travel

804-747-7077

Travel Maestro

5 emerging business travel trends to expect in 2023.

December 5, 2022 by Travel Maestro Leave a Comment

No one can definitively say what 2023 will bring to business travel but as post-pandemic travel resumed throughout 2022, we saw trends developing. Here are five business travel trends that are expected to strengthen in 2023.

Biometrics will make travel more efficient.

Biometrics, or unique physical characteristics such as fingerprints, are now common in payment apps such as Apple Pay and Google Pay. Travelers can expect increased opportunities to use these and other touchless payment systems for travel options like in-flight purchases, hotel upgrades, and train tickets.

COVID-19 forced airlines and airports to reduce touchpoints so biometric technology was readily adopted. A bonus effect is an operational efficiency and time savings for the traveler.

- Biometric check-in and baggage drop systems were piloted in Chicago’s O’Hare and New York’s LaGuardia airports, cutting travelers’ time spent by 30%.

- Los Angeles International Airport’s $1.7 billion terminal expansion uses contactless boarding gates. It can board 400 people in 20 minutes, half of the normal boarding time.

- International business travelers will see immigration and border control speed up at 27 U.S. airports with the use of facial recognition technology.

- Airports will increasingly use fingerprint and retinal scanning technologies for security.

With the growing use and acceptance of biometric-based screening, one day your face may be the only ID you need to carry.

Blended travel continues to increase.

Bleisure travel , the combining of business and leisure travel, has been a business travel trend for several years and there is no indication that it’s going away. Most employees now see business travel as a perk and an enriching experience and enjoy extending for personal motives.

- Younger members of the workforce often want to advantage of a business trip by adding on some vacation time and exploring the new destination’s sights, activities, and food.

- More than half of international business travelers indicated they are willing to extend their trips for leisure activities.

- Many business travelers bring family along, contributing to their work/life balance and well-being.

Work-from-anywhere policies become normalized.

Office shutdowns during the pandemic showed many businesses that it is possible to keep the company functioning while people work remotely. As a result, many of those adjusted their policies and now allow business travelers to become digital nomads. Not all job positions are suited to remote work, but for those that are, countries such as Costa Rica, Georgia, Croatia, Iceland, and Germany created programs and incentives to attract digital workers to make a temporary base there for a month or more.

Another development stemming from remote workforces is the trend for team business travel. Since employees don’t have the proverbial “water cooler” office experience, team meetings and retreats allow colleagues to bond and strengthen relationships. Experts expect a significant increase in team travel programs because they effectively motivate teams, improve employee satisfaction, strengthen company loyalty, and unlock creativity.

A demographic shift is afoot in business travel.

The Millennial generation (born 1981-1996) is firmly entrenched in the corporate workforce now. Generation Z (born 1997-2012) is currently the smallest generation in the workforce, but they are undoubtedly its future. These age groups have different ideals than the traditional business traveler of the past. They want more flexible work models, value work/life balance, and require better mental health on the job.

One business travel trend that exemplifies this shift is the preference for non-traditional accommodations. Studies show that in 2019, over 70% of millennial corporate travelers stayed in boutique hotels or home-like rental accommodations. More travelers stay further away from the city center prioritizing comfort and proximity to leisure activities.

Younger employees prefer remote work and Millennials are particularly inclined to take advantage of leisure travel because of the high value they place on “travel and seeing the world.” Gen Z is the first generation to have internet access, social media, and connected devices since birth. They have an intuitive aptitude for technology and are likely to incorporate it into their business travel in multiple ways. Millennials and Gen Z also have an amplified concern for global sustainability.

Sustainability influences business travel trends.

It’s no secret that travel, air travel emissions, in particular, have a large impact on the environment. It’s also a fact that travel generates growth and is key to building and maintaining business relationships. Therefore, sustainability is one of the hottest topics trending in business travel.

Global Business Travel Association (GBTA) found that 89% of companies are making sustainability a priority. While there are many ways to effect change , it begins with assessing the true carbon costs of travel, creating a strategy, and educating travelers on the environmental effects of travel.

Some sustainability trends in business travel include:

- Updating corporate travel policies by increasing traveler options to balance business costs with employee well-being and sustainability. For example, offering more flexibility in property and rate options, allows employees to align their own needs with company policies.

- Companies prioritizing green hotels in corporate online booking tools and making sustainability-related information a prerequisite for preferred supplier status.

- Providing education for travelers on best practices and technologies that help reduce their carbon footprint.

- Travelers choosing direct flights, using trains when possible, and choosing the most sustainable hotels.

- Travelers packing lighter or even suitcase-free to reduce the airline’s load factor. For example, consider renting golf clubs instead of taking your own with you.

- Organizations and individuals purchasing carbon offsets to compensate for the emissions their travel causes.

Will you adopt any of these emerging business travel trends in the coming year? If you have already, you are one of the trend setters!

Reader Interactions

Inspired to travel, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

By using this form you agree with the storage and handling of your data by this website. *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Connect with Amy

- Name * First Last

- Email * Enter Email Confirm Email

- Tell Me More About Your Vacation Plans? (Destination/Travel Dates/Budget) *

- How Did You Hear About Us? (Optional)

- Consent * I agree to the privacy policy.

- Name This field is for validation purposes and should be left unchanged.

Connect with Doug

- Comments This field is for validation purposes and should be left unchanged.

Connect with Stacie

- Email This field is for validation purposes and should be left unchanged.

AER LINGUS AIR CANADA AIR FRANCE AIR MEXICO AIR NEW ZEALAND ALASKA AIRLINES ALL NIPON ASIANA AIRLINES AUSTRIAN AIR AVIANCA BRITISH AIRWAYS CATHAY PACIFIC EMIRATES ETIHAD HAWAIIAN AIRLINES IBERIA ICELANDAIR ITA AIRWAYS JAPAN AIRLINES JET BLUE KENYA AIRWAYS KLM KOREAN AIR LATAM AIRLINES LUFTHANSA MALAYSIA AIRLINES PHILIPPINE AIRLINES QANTAS QATAR ROYAL JORDANIAN SAS AIRLINES SAUDIA SINGAPORE AIR THAI AIRLINES TURKISH AIR VIRGIN ATLANTIC WEST JET

Accor Hotels

Address Hotels

Best Western Hotels and Resorts

CaminoReal Hotels

Choice Hotels

Four Seasons Hotels

Hilton Hotels

Holiday Inn

Hyatt Hotels

IHG Hotels and Resorts

Intercontinental Hotels

Leonardo Hotels

Loews Hotels

Louvre Hotels

Marriott International

Mandarin Oriental

Melia Hotels and Resorts

Millennium Hotels

Mövenpick Hotels & Resorts

NH Hotel Group

Omni Hotels & Resorts

Radisson Hotels

Scandic Hotels

Shangri-La Group

Sonesta Hotels

Warwick Hotels

How May We Help You?

- Active/Adventure Travel

- All-Inclusive Resorts

- Family/Multi-Generational Travel

- Food/Wine Travel Experiences

- Honeymoons/Anniversaries

- River/Ocean Cruising

- Sun/Sand Vacations

- Tell Us More About Your Vacation Plans (Destination/Travel Dates/Budget) *

- Company/Organization

- Tell Us More About Your Group (Optional)

- Email Address *

- Company Name (Optional)

- Tell us More About Your Trip! *

- We'd love to see photos from your recent trip. Please upload them here. Max. file size: 50 MB. Acceptable file types are .jpg, .gif, or .png. File size must be less than 1 MB. For assistance, email [email protected].

- First and Last Name

- First Name Only

- Company Name

- My story/testimonial

- Company/Organization *

- Business Travel Reservations

- Corporate Account Management

- Online Booking Solutions

- Other: Please Describe

- Tell Us More About Your Travel Needs (Optional)

- How Did you Hear About Us? (Optional)

- First Choice

- Second Choice

- Third Choice

Connect with Valerie

- Phone This field is for validation purposes and should be left unchanged.

Connect with Tracy

Connect with sharon, connect with rosemary, connect with pat, connect with lydia, connect with liz, connect with kim, connect with karen, connect with jean, connect with debie, connect with debi, connect with cindi.

Advertisement

Supported by

Business Travel’s Rebound Is Being Hit by a Slowing Economy

By the early fall, domestic business travel was back up to nearly two-thirds of its prepandemic level. But companies have now begun to cut back.

- Share full article

By Jane L. Levere

Business travel came back this year more strongly than most industry analysts had predicted in the depths of the pandemic, with domestic travel rebounding by this fall to about two-thirds of the 2019 level.

But in recent weeks, it appears to have hit a new hurdle — companies tightening their spending in a slowing economy.

Henry Harteveldt, a travel industry analyst for Atmosphere Research, said that corporate travel managers have told him in the last few weeks that companies have started to ban nonessential business travel and increase the number of executives needed to approve employee trips. He said he was now predicting that corporate travel would soften slightly for the rest of the year and probably remain tepid into the first quarter of 2023.

Mr. Harteveldt also said his conversations led him to believe that business travel would “come in below the levels airline executives discussed in their third-quarter earnings calls.”

Airlines were bullish on those earnings calls, a little over a month ago. Delta Air Lines, for one, said 90 percent of its corporate accounts “expect their travel to stay the same or increase” in the fourth quarter. United Airlines, too, said its strong third-quarter results suggested “durable trends for air travel demand that are more than fully offsetting any economic headwinds.”

Hotels, too, were optimistic. Christopher J. Nassetta, president and chief executive of Hilton, said on his earnings call that overall occupancy rates had reached more than 73 percent in the third quarter, with business travel showing growing strength.

The change in mood has come as the economy has more visibly slowed. Technology companies, in particular, have been announcing significant layoffs. Housing lenders have also been reducing staff, as rising mortgage rates cut into their business.

The travel industry has long relied on business travel for both its consistency and profitability, with companies often willing to spend more than leisure travelers. When the pandemic almost completely halted business travel in 2020, people were forced to meet via teleconference, and many analysts predicted that the industry would never fully recover.

But business travel did come back. As the economy reopened, companies realized that in-person meetings serve a purpose. In a survey taken in late September by the Global Business Travel Association, a trade group, corporate travel managers estimated that their employers’ business travel volume in their home countries was back up to 63 percent of prepandemic levels, and international business travel was at 50 percent of those levels.

One reason international business travel has not come back as strongly, Mr. Harteveldt said, is that some employers have imposed restrictions on high-priced business-class airline tickets for long-haul flights. He said employers are instead requiring travelers to take a cheaper connecting flight or to fly nonstop in premium economy or regular economy class.

“Travelers are telling managers they won’t fly long-haul in economy if they have to go directly to a meeting when they arrive,” Mr. Harteveldt said.

What will business travel look like in the next year?

Pandemic travel restrictions will probably play less of a role. A survey by Tourism Economics, U.S. Travel Association and J.D. Power released in October found that 42 percent of corporate executives had policies in place restricting business travel because of the pandemic, down from 50 percent in the second quarter. Over half expected pandemic-related business travel policies to be re-evaluated in the first half of 2023.

With Americans able to work remotely, many are combining professional and leisure travel, airline and hotel executives said on recent earnings calls. That was a big reason travel did not drop off in September, when the peak vacation period ended, as it used to in years past.

Jan Freitag, national director for hospitality market analytics at CoStar Group, said hotel occupancy by business travelers currently varies by market, with occupancies high in markets like Nashville, Miami and Tampa, Fla. — places where business travelers may well be taking “bleisure” trips. But hotel occupancies by business travelers are low in markets like Minneapolis, San Francisco and Houston.

Mr. Freitag said the lower hotel occupancies in some cities may reflect a lower return-to-office rate in those places, which reduces the ability to have in-person business meetings.

Mr. Freitag said he was “very bullish on group travel, trips for meetings, association events, to build internal culture.” Those trips will recover more quickly, he predicted, than individual business travel.

“It’s all about building relationships,” he said. “It’s very hard to do that online.”

On the other hand, short business meetings and employee training sessions may continue to be conducted online, which is less expensive than in person, said Grant Caplan, president of Procurigence, a consulting firm in Houston that advises companies on their spending for business travel, meetings and events.

Even as business travel has resumed, hotels, airlines and airports still have inadequate staffing. A survey of hoteliers by the American Hotel and Lodging Association, a trade group, released in October found that 87 percent of respondents were experiencing staffing shortages. Although that was an improvement over May , when 97 percent of respondents said they were short-staffed, the current findings do not bode well for smooth hotel stays.

Disruptions in flying, particularly in the United States and Europe — because of weather delays, inadequate flight crews or air traffic control and security issues at airports — have been notoriously high, particularly earlier this year.

Although “we can’t say that these disruptions have discouraged business travel, they have clearly complicated” the experience for travelers, said Kathy Bedell, senior vice president of the Americas and affiliate program for BCD Travel, a travel management company.

Kellie Kessler, a pharmaceutical clinical researcher in Raleigh, N.C., said the travel disruptions she faced this year were too much. She changed jobs recently to take one that requires her to travel on business 10 percent of the time, compared with 80 percent in her previous position.

“The reason I took a nontravel position is that I can count on one hand the number of on-time flights I had this year,” she said.

And flight disruptions have led to a decline in some road warriors’ loyalty to airlines, even those who have accrued elite status in the carriers’ frequent-flier programs.

“The disruptions overall have caused me to be less loyal to any one airline,” said Trey Thriffiley, chief executive of QIS Aviation Group a consulting company in Savannah, Ga., that advises individuals and companies about their use of private jets. He is also an elite member of the loyalty programs at Delta, United and American Airlines. “Instead of searching by preferred airline or even cheapest price,” he said, “I search for direct flights or connecting flights to cities closest to where I live that I can drive home from if I need to.”

Airlines’ bullish forecasts notwithstanding, some experts find prospects for business travel this fall and next year extremely murky.

They say they cannot accurately predict how strong business travel will be and what airfares and hotel room rates will look like because of many unknowns, including the duration of the war in Ukraine and its impact on the European and global economies; increasing gasoline and jet fuel prices; and rising inflation, recession fears and political uncertainty.

Mr. Harteveldt, the travel industry analyst, said the recovery of business travel varies by geographic region, with the United States rebounding faster than Europe.

He said the Chinese government could be using its reopening strategy “in a geopolitical way,” adding, “If a country is more friendly, China will grant access to that country’s business and leisure travelers rather than to travelers from countries with which China has greater political differences.”

He predicted that 2023 would be a “difficult year” for business travel unless the war in Ukraine “comes to an abrupt end and there is more certainty about oil and the price of jet fuel.” Also a factor, he said, could be decisions by companies that may have added too much staff during the pandemic to save money by reducing business travel rather than by laying people off.

“If there’s a symbol that can be used to describe the outlook for business travel in 2023, it’s a question mark,” he said. “No airline, travel management company or travel manager can be 100 percent certain what 2023 will bring right now. It’s one of the most confounding, confusing times to be in business travel, perhaps in decades.”

In a report issued in August, Mike Eggleton, director of research and intelligence at BCD Travel, had a similar take on the immediate future for business travel. “Producing a credible travel pricing forecast in the current environment is incredibly difficult,” he wrote. “The near-term travel outlook is more uncertain than ever. Volatility has never been so high and seems likely to persist. There’s vast variation in market performance and outlook.”

Going forward, Ms. Bedell said, perhaps the overriding question about business travel will be whether the trip is necessary.

“Client-facing and revenue-generating travel is taking a priority over internal meetings,” she said.

- Travel Agents

- Inbound Tour Operators

- Outbound Tour Operators

- Airline Vacation Companies

- Success Stories

Business Travel Trends for 2023: Expectations and Projections

Both the business and leisure travel industries faced serious changes during the pandemic. But while leisure travel is back and stronger than ever, the face of business travel seems to be forever changed.

The shift to remote work and virtual meetings made it clear that the 9-to-5 office model was becoming one of the past. Stemming from concerns about employee safety, this idea has grown into an understanding that technology can be used to allow more flexibility to employees when it comes to working hours both in and out of the office.

As a result, the corporate travel industry in a traditional sense has changed and is expected to continue on this new trajectory. While fewer people may be taking trips for strictly work purposes, the ability to work from anywhere is undoubtedly shaping the future of business travel.

1. Everyone, everywhere, all at once

If there is one thing the pandemic taught us, it is that if there is a will, there is a way – companies of all shapes and sizes powered through, despite the inability to meet face-to-face for almost two years.

And much of this is thanks to technology allowing for connectivity regardless of physical location.

Meetings were held on Zoom instead of in person, and emails and other modes of digital communication kept people connected.

The ability to work from anywhere allowed employees to discover a new meaning of work-life balance, which has extended long past the initial days of the pandemic. As a result, many companies have chosen to continue to allow their employees to work from anywhere.

The notion that anyone can be anywhere regardless of physical distance, combined with the need to make up for lost time (otherwise known as “revenge travel”) has created a new kind of trip that combines business and pleasure.

This new era of travel is marked by people who are traveling for fun and working remotely along the way. In fact, 82% of airline executives reported that they expect the combination of business and leisure travel to be more prominent than ever in a post-pandemic world.

While what we once considered a “business trip” may not be as common anymore, people are taking more trips for longer periods of time because they now have the ability to work from anywhere.

2. Workcation expectations

The shift to “bleisure” travel presents a new set of expectations and needs from the travel industry. For one, these business travelers are looking for efficiency and personalization when it comes to booking their trips. They want the ability to plan trips quickly and ensure that they will have everything they need during their travels to enable both work and relaxation.

Bleisure travelers need to know in advance that they will have access to things that make remote work possible, like access to WiFi throughout their trip. Automated travel systems allow travelers to find the best located and highest reviewed places that can accommodate their needs with just a few clicks. Booking trips via this technology makes the process more seamless than ever before, so travelers can focus on more pressing matters.

The industry is paying attention to these needs. One survey reported that 92% of travel agencies want the support of new technologies to help enhance the customer experience. With the help of this new technology, the corporate travel industry is evolving into a system that can adapt to these changes in business travel.

3. Slow return to corporate travel

While the gap between business and leisure travel is much more narrow than it once was, strictly corporate travel has still fallen short of overall expectations, with only 17% of travel managers expecting a full recovery by the end of 2022. There are a number of factors pointing to reasons why.

For one, travel costs are higher than ever and many companies are not able to foot the bill. That being said, there is no replacement for face-to-face contact, so corporate events and retreats are likely to continue to take place, at least for larger companies.

Conferences and events are still sparse in 2022, with 57% of live events still taking place online, with low attendance and high costs to blame. They are likely to return in the future, however, due to the invaluable networking and partnership components.

Another factor is a higher awareness of sustainability priorities. More than 400 companies signed the 2021 Davos World Economic Forum pledge to decarbonize by 2050. As a result, a projected 10% less is likely to be spent on corporate travel by these companies by 2025.

The current climate certainly presents a new set of challenges to the corporate travel industry. Some of these changes may affect long-term trends, while others will be more short-lived. That being said, there are also many new opportunities for travel providers to grow.

It is possible to adapt to this new world of corporate travel through the implementation of new technologies and understanding the changes in the industry. This new technology makes it possible for travelers of all kinds to personalize travel more easily than ever before. The new era of travel is marked by complicated travelers looking for simple solutions.

If you’re looking to stay ahead of the curve and on top of the trends, having the right travel software is vital. Travel Booster provides you the agility you need to do just that, wrapped inside innovative travel technology that will also boost your efficiency and profitability.

Want to find out more? Book a demo .

Subscribe to our newsletter

Let's go for a journey

Schedule a meeting

More Resources

Reshaping travel as we know it: ai’s evolutionary impact on the industry, unveiling the future: 6 fintech trends revolutionizing the travel industry, enhancing travel industry success through advanced reporting and bi solution.

Expected Business Travel Trends in 2023

Business travel has always been an industry subject to constant change.

The travel and tourism industry has rightly prided itself on its ability to adapt to new circumstances and requirements, adopt innovative technology and working methods and pioneer new approaches to making the life of the business traveller more efficient, safe and productive.

However, in recognising that ability to be fleet of foot and welcoming to business travel trends, it’s also important to highlight the many significant challenges which travel managers have had to face and will continue to confront in maintaining high standards of global business travel .

How has business travel changed over the past few years?

It would be difficult to identify many – if any – sectors of the business world which have been unaffected by the pandemic.

But for the business travel industry and, particularly for international business travelers, the impact of the global health crisis has been genuinely unprecedented.

By its nature, the corporate travel market and the business trips which it enables, depend on the ability to move freely across cities, countries and continents.

That ability was, of course, severely limited at the height of the pandemic and, even now, restrictions remain due to the continued threat which the COVID-19 virus poses to global health.

That was highlighted again at the beginning of 2023 with the introduction by a number of European countries, including the UK, of COVID testing for passengers arriving from China.

It was a move which signaled how swiftly the corporate travel industry can be affected by events beyond its control and emphasised how important it is for travel management companies to be aware of the threat of similar health crises in future.

Besides the complexities with these health risks, we have seen various other changes off the back of the pandemic, some of which are listed below:

Depleted capacity of resource in airports, airlines & hotels causing problems with travel delays.

Frequent cancellations & adjustments to travel schedules due to the capacity issue.

Disruption is no longer limited to peak times, making it harder for business travellers to plan their business trips.

A need to overhaul travel policies.

Increased focus on sustainability.

On the plus side, the travel industry’s response once the worst of the pandemic had passed demonstrates how resilient the business travel sector is despite the challenges it faces.

At the same time, the pandemic is just one of many external events which has had – and will continue to have - a significant impact on travel companies and corporate travelers and on the way in which business trips are organised.

In the last year alone, further upheaval has been created as a result of unanticipated events such as the Russian attack on Ukraine, the cost of living crisis and the huge rise in energy prices. Not to mention various cyber attacks on SAS airlines and multiple rail & airline strikes which has led to capacity caps at numerous airports.

Added to that, the UK’s departure from the EU continues to create issues for business travellers and for the industry’s ability to retain and attract the people it requires to match the growing demand.

All these factors have, to some extent, led to a scenario in which many corporate travelers are now seeing airports, airlines, hotels and car fleets on their business trip all affected by reduced capacity and resources as well as more frequent cancellations and schedule changes.

And, like many other sectors, the corporate travel industry continues to work diligently to become more sustainable and to find ways to service business professionals while also reducing its carbon footprint.

In summary, the world of corporate travel management has changed immeasurably in the past two years alone and there is nothing to suggest that the pace of change will slacken in the years ahead.

Is corporate travel still important for business success?

All the indications are that, despite challenging economic and geopolitical circumstances over the past few years, demand for corporate travel is showing signs of strong recovery for 2023.

While earlier predictions of a $1.4 trillion annual spend have now been revised, the Global Business Travel Association (GBTA) has forecast a $1.2 trillion spend for business travel in 2023.

The simple reason for that is that business travel remains absolutely essential because of its key role in reconnecting organisations both internally but, equally importantly, with external stakeholders in the commercial marketplace.

The enormous increase in remote working since the pandemic has been well documented and while many companies have now adopted a hybrid model which combines office and home working, it’s clear that, for an increasing number of organisations, working remotely is an option which many people want or expect and one which is here to stay.

However, making personal connections is invaluable in the commercial world and there is no replacement for a face-to-face meeting, whether the purpose of that is employee motivation and bonding, securing new business, closing a deals or assessing a potential new suppliers or customers.

In short, the business travel market and effective corporate travel management remains integral to economic growth.

Can we expect further growth for business travel over the next 12-months?

A recent poll conducted by the GBTA states three in four travel managers expect their company will make more business trips in 2023 and is expected to increase significantly compared 2022.

However, as we’ve already seen, forecasting likely trends in the corporate travel market for the year ahead, while always an inexact science, is even more challenging at present due to global economic and political circumstances.

That said, there are a number of areas in which clear trends are emerging.

Sustainability

The demand for more sustainable ways to travel is expected to accelerate in 2023, meaning businesses will be even more keen to demonstrate their commitment to sustainability . Travel managers will need to prioritise environmentally-friendly options when arranging flights & accommodation.

Businesses will need to be more conscious about investing in better & greener choices when travelling for business. This could involve choosing a more sustainable mode of transport, selecting accommodation that has a sustainability policy in place or it could even be as simple as having digitalised travel documents to cut down on the amount of paper being used.

In addition, many companies will have the option to participate in a carbon offsetting scheme, in order to compensate for their own carbon emissions produced via business travel activity. This can be done through either existing suppliers or separate green projects.

All in all, the world of business travel will have an increasing focus on sustainability as the year progresses.

Are Travel budgets Making their way back to 2019 levels?

Despite the challenges of recent times, business travel bookings and spending continue to make their way back to pre-covid levels. According to the GBTA, travel buyers have estimated that their companies' domestic business travel bookings have returned to 68% of their 2019 spend levels, which is up from 63% in Q4 2022.

However, companies that do not have an extensive travel budget, will have to come up with solutions to cut down on spend when employee travel is absolutely necessary for the business. Many businesses may look to send their employees on longer haul trips, with multiple layovers to make their trip more efficient, while reducing the number of travel bookings needed.

Ideally, your travel manager should be looking to assist you in formulating a clear, effective travel policy which provides your people with all the information and guidelines they need on expected costs.

Changes to business travel policies

Many businesses have adopted a hybrid-working approach since the pandemic, which has forced them to think about what their employees can, and can't claim back as expenses.

Savings made by businesses from employees working at home will require policies to be updated or renewed to include a new employee allowance.

Travel policies which may have been appropriate pre-pandemic may no longer be fit for purpose and, as corporate travel remains a key economic driver, it will be important for the business community and their corporate travel management partners to ensure that policies are updated accordingly.

Technology will become even more important for business travel

With online booking such an essential element of so much corporate travel, there are also signs that self-booking is increasing in popularity, particularly for younger business travelers who may be more comfortable with its use during the booking process.

In addition, your people don't want to be thinking about collating multiple receipts needed for an expense report while travelling on business. They want to be focusing on the reason for the business trip.

Technology can play a huge part in streamlining the business travel process; whether it's a more efficient booking process, digital payment methods or managing your travel documents.

'Bleisure' travel: can employees mix business with leisure activities?

Along with a 44% increase in business travel airfares, which is expected to rise further in 2023, we can also expect to see a rise in bleisure travel with increasing numbers of business travellers using their time away from the office to accommodate leisure activities within their itineraries.

Remote working has been the driver of this. With employees able to work from virtually anywhere that has a good WiFi connection and charging points, travel can be extended by a few days or even weeks, depending on how far they have to travel.

Traveller safety

For the best travel managers, safety will remain one of the top priorities in corporate travel.

The pandemic has emphasised the importance of employee security when travelling for business and other recent external world events have only underlined this further.

Marine & Offshore Travel are the core of Clyde's business

Alongside Clyde’s wider corporate travel management activities, our core business is our specialist support for the marine and offshore industries.

We have a 30-year track record of helping to move crews safely around the globe for some of the world's largest ship owners. As part of the Northern Marine and the wider Stena Group, Clyde live and breathe the Marine sector.

Our performance over the pandemic is testament to our expertise in this area, with one of our customers quoting that the industry average was 25% behind in crew changes in 2020; however, they were only 8% behind because they had Clyde as the trusted travel management company.

We have an unrivalled understanding of the marine sector’s complexities and challenges. Our proprietary Consort technology, which helps businesses improve communication to speed up the booking process, makes us the ideal partner to get your people where they need to be safely, efficiently and cost-effectively.

With over 100 global marine airline contracts and wholly owned operations in the UK, US, Sweden, Norway, Denmark, Netherlands and an offshore service centre in India, we have the content, knowledge and infrastructure to support some of the largest ship owners and managers in the world.

We also work closely partner agencies across the globe to ensure we deliver the best marine and offshore fares, with the flexibility required for your company and crew.

Our specialist expertise enables us to safely mobilise thousands of seafarers across the globe each year from across Europe and other key territories including the Philippines, Russia, India and Ukraine.

Our expert teams have an average length of service of nine years, can deploy unique products and technology specifically tailored to mobilising crew and access airfare savings through our farewatch and unused tickets tracking, providing our customers with tangible cost and efficiency savings.

Want to know more about what to expect for business travel in 2023? Get in touch with our corporate travel experts today.

Recent News

Get in touch with us

New enquiries can be made using the contact form opposite.

Existing customers are reminded to contact their designated travel team using the email or telephone numbers provided to their organisation, to ensure their enquiry is dealt with by the correct team.

- SOFTWARE CATEGORIES

- FOR REMOTE WORK

- Research Center

10 Future Business Travel Trends & Predictions for 2024 and Beyond

Corporate travel remains a crucial aspect of a business. Despite advancements in technology, business travel trends indicate that there’s no substitute for face-to-face interactions. Travel can also support business initiatives for networking, skills development, and recruitment. However, the presence of COVID-19 has thrown a wedge at some of those travel plans, which prompts the importance of risk assessments and possible changes in future travels.

In this business travel forecast, you can read all about the direction the industry is moving in. We’ve also included some business travel statistics so you can make data-driven decisions in your company’s business practices.

Business Travel Trends Table of Contents

- Business is almost always mixed with pleasure

- Unconventional accommodations are in

- Self-booking is becoming the norm

- More flexible corporate travel policies

- Technology continues to revolutionize corporate travel

- The rise of AI, virtual reality, and intelligent assistants

- Blockchain: the future of business travel

- Business travel as a perk

- Slower years for corporate travel and business tourism

- New travel markets are emerging

The business travel industry experienced a decline of 52% during the early months of the COVID-19 pandemic, but with the recent rollout of vaccines, business travel spending is expected to rise to $842 billion in 2021, which accounts for a 21% increase (Reuters, 2021). The majority of businesses have even reported that they are considering resuming their corporate travel plans for 2021, although there are no definite plans yet (GBTA, 2021).

Source: GBTA

One of the major changes to anticipate is the rise of a new type of corporate traveler. Members of Generation Z are taking over the workplace, and predictions point to this age bracket making up around 40% of the workforce by 2021 (Connecteam, 2020). At the end of 2024, business travel spending is expected to reach $1.4 trillion and make a full recovery from the pandemic in the succeeding year (Reuters, 2021). By this time, millennials and Gen Z-ers will be doing much of the traveling given their respective shares in the labor force.

This shift in the demographics of corporate travelers has influenced the global business travel forecast in the coming years. Many business travel trends center around technology and its abilities to enable self-service and make travel seamless.

1. Business is almost always mixed with pleasure

The rise of bleisure travel proves to be one of the most significant outcomes of the demographic shift in corporate travel, and this trend is expected to continue in the midst of COVID-19 vaccinations. With the workforce becoming younger, more employees are looking to do more than work during their trips away from the office.

Although 92% of organizations suspended business travel during the early months of the pandemic, pre-pandemic figures suggest that 90% of millennial business travelers added components of leisure to their affairs (National Geographic, 2020). This could very well occur within 2021 as COVID-19 vaccines are now available.

Bleisure travelers go on these trips once every two to three months. More than half of international business travelers plan to extend business trips to accommodate leisure activities at their destination.

Companies in the tourism industry can capitalize on this trend by focusing their marketing campaigns on local tourist attractions and events. If you’re more concerned of your employees not doing enough business, though, time tracking software can help ensure sufficient productivity.

Key takeaways:

- More employees are taking bleisure trips.

- Bleisure travelers go on trips at least every quarter.

- Business travelers are also willing to extend business trips for leisure activities.

2. Unconventional accommodations are in

Another business travel trend influenced by the new generation of corporate travelers is the growing popularity of unconventional accommodations. Business travelers have become more open to considering staying somewhere other than traditional chain hotels. More are opting to stay in apartments and other accommodations that have a more homey feel.

Smaller boutique hotels and home-like accommodations, like those offered by Airbnb, enjoy increased popularity among business travelers today. For instance, over 70% of millennial corporate travelers had stayed in a vacation rental during business trips (American Express, 2019).

These non-traditional accommodations provide opportunities for exploring the destination in new ways. More travelers also stay further away from the city center, as comfort and proximity to leisure activities are prioritized.

- More business travelers opt to stay in home-like accommodations.

- Small boutique hotels and home rentals have the edge over traditional chain hotels.

- Additionally, more corporate travelers prioritize comfort and proximity to leisure activities.

3. Self-booking is becoming the norm

More corporate travelers opt to book travel options and accommodations on their own. According to recent surveys, 68% of employees book business travel through tools not approved by the company instead of seeking the services of a travel agent (Expedia Group, 2021). After all, there are numerous self-booking options that business professionals can leverage. This trend towards self-booking may also be another offshoot of the generational shift in corporate travelers. After all, millennials prefer self-booking when they travel so that they can find flights and accommodations that meet their preferences.

In some cases, corporations push for self-enablement and provide tools that help employees resolve issues. When these self-service tools fail, though, corporate travelers will continue to rely on customer service from an agent. This is particularly true when emergencies arise, like in cases of canceled flights. Corporate travelers also tend to want to rely on a human for support in more complex issues like visas.

- Business travelers, especially millennials, prefer the self-booking process.

- However, business travelers will continue to rely on human support for complex issues and travel emergencies.

Most Popular Online Booking Software

Here are some of the best online booking software that you can choose from:

- YouCanBook.me is an online booking software that connects customer bookings right into your Google or Microsoft calendars. It also allows you to personalize your booking page and display your availability for multiple locations.

- Acuity Scheduling provides a user-friendly online booking platform to help your clients self-book their appointments. It lets you create branded and customized confirmations, reminders, and follow-ups to drive more client bookings.

- Bookeo is an industry-leading online booking software perfect for service providers, schools, and tour companies. It provides you with advanced marketing tools to help you maximize profit.

- SimplyBook.me lets you build your own personalized and mobile-optimized booking website. It allows you to integrate the system with your existing site or with your Facebook and Instagram pages.

- Checkfront easily handles customer bookings in a unified toolset. With its advanced rule system, it lets you enforce and set your own booking rules.

4. More flexible corporate travel policies

When was the last time you looked at your company’s corporate travel policy? There’s a good chance that some of these policies need tweaking. Recent business travel trends indicate that more corporate travelers are “going rogue (RateGain, 2019).” This means travelers are now more likely to go outside employer-approved channels when booking properties and transportation for their trips.

Corporate travelers need a booking process that provides better availability and allows them to choose from more property and rate options. Combined with emerging preferences for unconventional accommodations, the need for more varied booking options pushes corporate travel policies to become more flexible.

The good news is that companies that offer a plethora of travel options enjoy higher adoption rates for their corporate travel programs (TripActions, 2019). Allowing employees to make choices that align with their needs and preferences encourages a culture of transparency and reinforces trust between employers and employees.

Worried about reining in travel spending while empowering business travelers to make their own choices? Technology now allows companies to adopt a dynamic travel policy. A dynamic business travel policy adjusts according to available options at the time of booking. This way, business travelers will still be able to make their own choices while complying with company policies.

As far as flexibility is concerned, video meetings and teleconferencing have also become alternatives during the pandemic, with 31% of employees stating that remote setups are just as effective as business travel (Forbes, 2020).

Why did you book accommodations outside of approved channels?

Source: Expedia, 2018

- More corporate travelers are going rogue, i.e., not using employer-approved channels, during the booking process.

- Corporate travel policies are becoming more flexible.

- Dynamic travel policies also have a higher adoption rate.

5. Technology continues to revolutionize corporate travel

Technology plays a central role in the global business travel forecast. Mobile technology currently accounts for 39% of hotel bookings and 22% of airfare bookings (FCM Travel Solutions, 2019). These numbers will probably grow with the upcoming upgrade to 5G wireless internet. Also, once the COVID-19 travel restrictions ease up, this technological trend will likely continue.

International business travelers can expect to spend less time waiting in airport lines, thanks to facial recognition technology that speeds up immigration protocols and border control procedures. Other biometric technologies seeing increasing use at airports include fingerprint and retinal scanning.

Trip disruption technology (CWT, 2019) is also evolving to minimize the hassle caused by delayed flights and trains. Travel technology providers can now deliver real-time trip updates to travelers’ mobile devices. This way, business travelers can adjust their plans accordingly and minimize downtime.

Faster in-flight internet access is also in the works. Travel suppliers and mobile network operators are working together to bring high-speed internet into the cabin. With this technology, employees can stay productive even during long-haul flights .

Technology has also moved beyond airports and train stations to make business travel easier. Business travelers can now enjoy automated check-in and check-out processes. These technologies allow travelers to pick up their room key upon arriving at the hotel and head straight to their room. Centralized billing can save travelers from the hassle of having to compute expense costs separately.

- Upcoming upgrades to 5G wireless internet may result in more mobile bookings in the future.

- Facial recognition and biometric technologies will also reduce waiting time for international travelers.

- Trip disruption technology helps corporate travelers adjust to delays in the journey.

6. The rise of AI, virtual reality, and intelligent assistants

More advanced technologies like artificial intelligence (AI) and virtual reality are poised to bring more changes to the business travel industry. Travel suppliers can use these technologies to discover business travelers’ preferences and take advantage of upselling opportunities. Virtual reality is also predicted to enable personalization, allowing guests to adjust rooms based on their taste (FCM Travel Solutions, 2019).

The coming years also pose many possibilities for intelligent assistants like Siri, Cortana, and Google Now. These assistants are able to handle more complex tasks (Wishup, 2019), like provide updates to itineraries during disruptions and recommend services. All these technologies will greatly benefit business travelers looking to maximize their time during the journey.

Want to learn more about artificial intelligence? Here are some artificial intelligence statistics you may find interesting.

- Artificial intelligence and virtual reality can be used to discover travelers’ preferences.

- Siri and Cortana will soon be able to provide itinerary updates.

7. Blockchain: the future of business travel

Blockchain is also expected to improve security for corporate travelers by 2021. Blockchain’s built-in security protocols make it the perfect technology for making travel as convenient and seamless as possible (Revfine, 2020).

The technology makes data storage and access easier. The constant availability of information is crucial since the travel industry relies on the information exchange between companies. For instance, travel agents pass customer information to hotels and airlines.

Blockchain makes it possible to collect every bit of information involved in the travel process (Amadeus, 2019) – from traveler preferences to flight prices and hotel rates – into a file that’s duplicated across multiple computers. And since the technology decentralizes data and arranges it into permanent blocks, blockchain offers more security. Travel information is always available and safe from user errors or cybersecurity attacks.

Businesses in the tourism and hospitality industry can also take advantage of blockchain technology for luggage tracking, identification services, and customer loyalty schemes.

Outside the realm of travel, blockchain can even be leveraged for other complex tasks like COVID-19 vaccine distribution (Mobi Health News, 2020). Technology this flexible will probably have niftier applications for business travel in the near future.

Cryptocurrencies such as Bitcoin may also soon be accepted as payments by travel companies. If you’d like to learn more about cryptocurrencies, you can check out our guide and FAQs on Bitcoin .

- Blockchain can greatly improve the security of travel information

- Blockchain can also ensure that every bit of travel information is always accessible.

- Likewise, this technology can ease luggage tracking and support customer loyalty plans.

8. Business travel is a perk

Another important aspect of the business travel forecast is the fact that most employees now see corporate travel as a perk (TripActions, 2019). According to surveys, international business travelers consider travel as valuable to professional and personal growth.

Making up the largest segment of the workforce, millennials are also more willing to travel, as they consider it an enriching experience. Similarly, employees who travel often feel more empowered and engaged. Travel can even help improve confidence and interpersonal relationship skills.