June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Why is Annual Travel Insurance a Great Gift for Travelers?

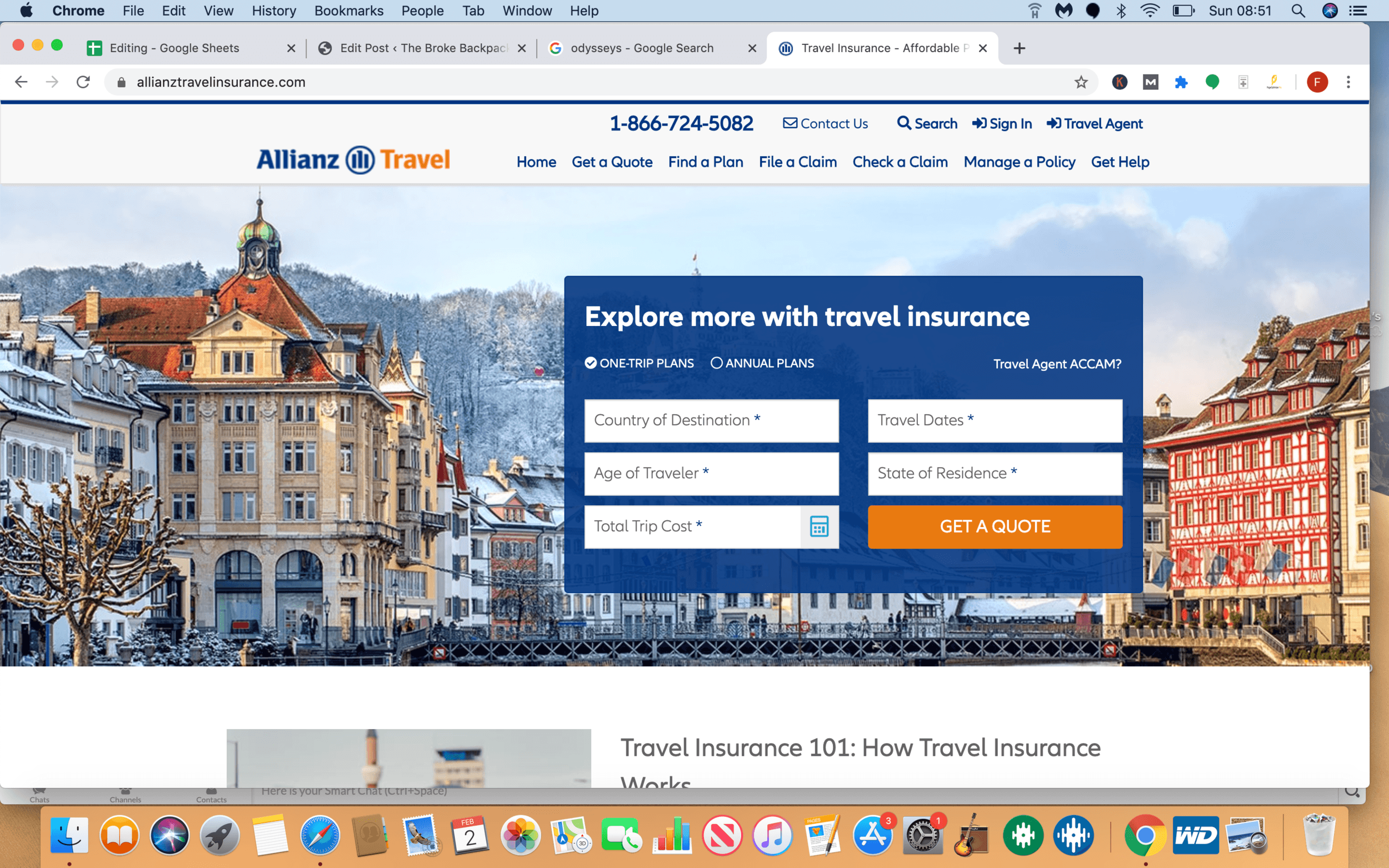

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Single Trip

- Annual Multi-Trip

- Winter Sports & Ski

- Travel Advice & News

- Policy Information

- File a Claim

- Insurance Glossary

Annual Travel Insurance

What is Multi-Trip Travel Insurance?

Enjoy peace of mind with our Annual travel insurance. We cover big family holidays, city breaks, long weekends and even last-minute trips.

If you travel regularly, our Annual Multi-Trip insurance may be more cost-effective than buying several Single Trip policies. That’s because Annual travel insurance from Allianz is designed specifically with frequent travellers in mind. With our multi-trip travel insurance, there’s no need to buy separate insurance each time you travel, and you’ll be covered for every trip you take during the year. We can provide you with cover if you’re staying in Europe, or if you’re travelling further afield.

Below is some more information about our products, for which Terms and Conditions apply. Please visit the policy information hub for full details.

What's covered with an Annual Multi-Trip policy from Allianz?

With Annual travel insurance from Allianz, you can choose the level of cover that’s right for you. Our multi-trip insurance is designed for frequent travellers, so you’ll be covered for unlimited trips, up to 35 days in duration over a 12-month period.

You can buy cover for European or worldwide travel (including or excluding the USA and Canada), depending on your plans.

Our Bronze, Silver and Gold levels of cover allow you to choose an option that suits your cover requirements best. All of our policies protect you if you need to cancel your trip before you travel, or if you need to curtail your journey. We can also compensate you if your departure is delayed, if you miss your departure or if you need to buy personal possessions because yours have been delayed.

We also understand that medical cover is important, in case you become poorly or injured while you’re away. That’s why all of our yearly holiday insurance policies cover emergency medical and associated expenses, personal accident cover and personal liability cover.

Our Silver and Gold multi-trip travel insurance policies can provide cover if you lose your passport, personal money or personal possessions too.

To find out exactly what you’re covered for, consult your policy documents . Or, take a look at our to see the different excess amounts and payment limits.

Swipe to view more

Frequently Asked Questions

Do i need annual multi-trip travel insurance.

If you’re planning more than one holiday this year, you can save money by taking out one Annual travel insurance policy, rather than buying multiple Single Trip policies. Our yearly travel insurance will save you time too, because you’ll be covered all year – no matter how many holidays you take.

Our Bronze, Silver and Gold levels of cover allow you to choose a policy that best suits your needs. Once you’ve found the right policy, you can either be covered straightaway or – if you don’t need your cancellation cover to start immediately – you can defer your start date by up to 31 days. Get a quote today to see exactly how much your policy will cost.

How does Annual Multi-Trip travel insurance work?

Jet-off whenever you like with our Annual travel insurance, because you’ll have cover for all of your trips that last up to 35 days, over a 12-month period. There’s no obligation to tell us when you’re going away either, so you can pack your bags knowing you’re already covered.

You can choose the area of cover that’s most appropriate for your travel plans, from Europe-only to worldwide. You can also choose a level of cover that suits you: Bronze, Silver or Gold.

Can I get Annual Multi-Trip cover for longer holidays?

When you purchase one of our multi-trip holiday insurance policies, while you can be covered for multiple holidays throughout the year, it does not cover trips that last over 35 days. Our Single Trip policy can provide cover for trips of up to 180 days.

Alternatively, if you need to cover an even longer holiday and are aged 50 or under, you can purchase Backpacker insurance. This will provide cover for one holiday across multiple destinations, lasting up to 365days.

How much does Annual Multi-Trip insurance cost?

One of the key benefits of purchasing a multi-trip insurance policy is that it’s more cost-effective than buying several Single Trip policies.

The cost of taking out an Annual travel insurance policy will vary, depending on a number of factors including:

- The area of cover you require

- The number of people travelling

- The level of cover you choose

If you have any pre-existing medical conditions, this will affect your eligibilty for cover.

The amount your policy costs will also depend on the level of cover you choose: Bronze, Silver or Gold. To find out exactly how much your Annual travel insurance will cost you, and to compare different policies and cover limits, get a quote online today.

What should I do if I experience changes to my health after taking out an Annual Multi-Trip policy?

If your health changes after you’ve taken out yearly travel insurance, you’ll need to call us on 1890 882822 as soon as possible.

For the purposes of our policies, a change in health means:

- You have seen a doctor and have been referred to a consultant or specialist.

- You have been admitted to hospital for treatment, including surgery, tests or investigations.

- You’re awaiting treatment or the results of tests and investigations.

We will then tell you whether or not your condition (or conditions) can be covered for future travel plans you make. If we cannot cover your medical condition(s), you can choose to:

- Make a cancellation claim for any journeys you have already booked.

- Continue with your policy, without receiving cover for your conditions.

- Cancel your policy and request a proportionate/partial refund (as long as you have not made a claim or intend to make a claim).

Additional cover options from Allianz

Single Trip Travel Insurance

Business Travel Insurance

Winter Sports & Ski Insurance

Our other types of insurance you may be interested in.

Family Travel Insurance

Backpacker Travel Insurance

Need help? Call us on: 01 619 3681

Make a claim, policy documents.

Terms and conditions apply.

Enable JavaScript

Please enable JavaScript to fully experience this site. How to enable JavaScript

Allianz Trip Insurance

Protect your travel experience

Read about Allianz Trip Insurance’s COVID-19 insurance coverage limitations and accommodations.

U.S. coverage alert Opens another site in a new window that may not meet accessibility guidelines.

Top reasons to buy trip insurance

- Financial reimbursement if you have to cancel or interrupt your trip due to a covered illness, injury, jury duty, and more

- Emergency medical benefits in and outside the U.S. – where many personal health insurance policies (like Medicare) won’t cover you

- 24-hour emergency assistance to help you solve medical and other travel-related problems on the go

Types of trip insurance plans

Allianz Trip Insurance comes in a variety of plans to fit your specific needs. Single-trip plans can protect one trip, annual plans can protect all your trips for an entire year, and rental car protection plans can keep your budget safe from accidental collision and damage to a rental vehicle.

All insurance is recommended / offered / sold by 3rd party, Allianz Global Assistance, not American Airlines. Underwriter: Jefferson Insurance Company or BCS Insurance Company. AGA Service Company is the licensed producer and administrator of these plans. AGA Service Company is a licensed producer in all 50 states plus the District of Columbia.

Get a quote Opens another site in a new window that may not meet accessibility guidelines.

Trip insurance benefits

Reimburses your prepaid, non-refundable travel expenses if you need to cancel your trip due to a covered illness, injury, and more.

Reimburses the unused, non-refundable portion of your trip and increased transportation costs it takes for you to return home early or to continue your trip due to a covered illness, injury, and more.

Reimburses expenses related to covered emergency medical or dental care incurred on your trip.

Provides benefits for medically necessary transportation to the nearest appropriate medical facility following a covered injury or illness.

Reimburses extra meals and accommodations you may need if your flight is delayed for 6 or more hours for a covered reason.

Reimburses you if your luggage is lost, damaged or stolen during your trip—keeping your travel plans on track.

Reimburses the purchase of essential items if your luggage is delayed for more than 24 hours.

Turn your trip into a VIP experience. Our travel experts can give you destination information, make restaurant reservations, find tickets to shows, and more.

Help is just a phone call away. Our team of multilingual problem solvers is available to help you with medical and other travel-related emergencies.

Provides primary coverage with no deductible.

Review period

If you’re not completely satisfied, you have 15 days (or more, depending on your state of residence) to request a refund, provided you haven’t started your trip or initiated a claim. Plans are non-refundable after this period.

Additional assistance

Coverage by country of residence.

- Frequently asked questions

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best’s 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive,Richmond, VA 23233 or [email protected]

Email [email protected]

PLEASE BE ADVISED: This plan contains insurance benefits (which may include disability and/or health insurance benefits) that only apply during the covered trip. This optional coverage may duplicate coverage already provided by your personal auto, home, renter’s, health, life, personal liability, or other insurance policy or source of coverage but may be subject to different restrictions. You should review the terms of this policy with your existing coverage. If you have any questions about your current coverage, call your insurer/health plan or insurance agent/broker. This insurance is not required to purchase any other products/services. Unless licensed, travel retailers and their employees may provide general information about the insurance, including a description of coverage and price, but are not qualified/authorized to answer technical questions about terms, benefits, exclusions, and conditions of the insurance or evaluate the adequacy of existing coverage. Plans are intended for U.S. residents only and may not be available in all jurisdictions. Rental Car Protector is not available to KS and TX residents, except when purchased as a separate policy and is not available in all countries or for all cars. This coverage does not provide liability insurance or comply with any financial responsibility law, or any other law mandating motor vehicle coverage and does not cover you for any injury to another party. Additionally:

California Residents: We are doing business in California as Allianz Global Assistance Insurance Agency, License # 0B01400. California offers a toll-free consumer hotline at 1-800-927-4357.

New York Residents: The licensed producer represents the insurer for purposes of the sale. Compensation paid to the producer may depend on the policy selected, or the producer’s expenses, volume of business, or profitability. The purchaser may request and obtain information about the producer’s compensation, except as otherwise provided by law.

Maryland Residents: The purchase of travel insurance would make the travel insurance coverage primary to any other duplicate or similar coverage. The Commissioner may be contacted to file a complaint at: Maryland Insurance Administration, ATTN: Consumer Complaint Investigation Property/Casualty, 200 St. Paul Place, Suite 2700, Baltimore, MD 21202.

Texas Residents: Before deciding whether to purchase this insurance plan, you may wish to determine whether your own automobile insurance or credit card agreement provides you coverage for rental vehicle damage or loss and determine the amount of deductible under your own insurance coverage. The purchase of this insurance plan is not mandatory. This coverage is not all inclusive, which means it does not cover such things as personal injury, personal liability, or personal property. It does not cover you for damages to other vehicles or property. It does not cover you for any injury to any other party.

Plan charge includes the cost of insurance benefits and assistance services. See your Plan Details for more information, or call Allianz Global Assistance at 800-284-8300.

AGA Service Company dba Allianz Global Assistance (AGA) compensates their suppliers or agencies for allowing AGA to market or offer products to customers of the supplier or agency.

*Terms, conditions, and exclusions apply, including for pre-existing conditions. Plans may not be available to residents of all states. Insurance benefits are underwritten by either BCS Insurance Company or Jefferson Insurance Company, depending on insured’s state of residence. AGA Service Company is the licensed producer and administrator of these plans.

Travelling is ultimately a tool for growth. If you want to venture further, click this banner and take the leap 😉

- Meet the Team

- Work with Us

- Czech Republic

- Netherlands

- Switzerland

- Scandinavia

- Philippines

- South Korea

- New Zealand

- South Africa

- Budget Travel

- Work & Travel

- The Broke Backpacker Manifesto

- Travel Resources

- How to Travel on $10/day

Home » Budget Travel » HONEST Allianz Travel Insurance Review – [Updated 2024]

HONEST Allianz Travel Insurance Review – [Updated 2024]

Planning and preparing for a trip can be fun and exciting. Personally I love flicking through Lonely Planets seeking out those “Must See” places and I even enjoy scouring through forums for insider advice. I relish the challenge of arranging sophisticated logistics and revel in finding bargain flights from London to the ends of the earth.

Indeed, the feeling I get during the days before I start a trip is both exciting and invigorating. In fact, sometimes I wonder whether I’m equally as addicted to this “state of leaving” as I am to travel itself – they do say that often anticipation is even better than the event itself.

What is far less exciting though, is comparing Travel Insurance policies. There are far too many policies and providers out there with far too many fine print details to scrutinise. Yep finding the best travel insurance is confusing, and finding cheap backpacker insurance can seem impossible. But, to make finding and buying Travel Insurance that bit easier for you, we have tried, tested and reviewed all of the major providers out there.

Allianz Travel Insurance Review

Do you need travel insurance, what does travel insurance cover, should i get insurance, who are allianz, allianz travel insurance policies, what’s covered by allianz travel insurance, what’s not covered by allianz travel insurance, who is allianz travel insurance suitable for, who isn’t allianz travel insurance suitable for, how much does allianz travel insurance cost, other travel insurance providers, when should you buy travel insurance, how to make an allianz travel insurance claim, final thoughts on allianz travel insurance.

Today we are going to review Allianz Travel Insurance. I have spent hours going through their policies and breaking them down for you. By the end of this post, you should know whether Allianz is the right travel insurance for you.

It’s important that you take time to look at other good travel insurance providers too. Different providers suit different kinds of travellers. So you may be better suited elsewhere.

The Broke Backpacker is supported by you . Clicking through our links may earn us a small affiliate commission, and that's what allows us to keep producing free content 🙂 Learn more .

Before we begin the Allianz Travel Insurance review, do note that the terms and conditions of insurance policies are subject to changes and are always ultimately based on your individual circumstances. Therefore, it is very important that you read any policy terms and conditions yourself.

Hey you there! Before you delve any further or waste any more valuable time on this Allianz Travel Insurance Review, let me just tell you straight up front that we at The Broke Backpacker no longer use Allianz for our travel insurance needs.

We have nothing against them, we just found other providers more suited to the needs of travellers and backpackers whilst offering VERY competitive quotes.

If you are taking a single trip or going backpacking, we recommend World Nomads Insurance .

Alternatively, if you are a digital nomad working and travelling remotely from all over the world, then SafetyWing Insurance offer some very interesting travel insurance plans.

Ahem – Please note that insurance companies change their policies and product terms fairly regularly. We do our best to keep this review up to date but cannot guarantee that all of the information is 100% correct. Therefore, only use this review as a guide and check all policies yourself. Also note that some of the links in this post are affiliate links.

Unlock Our GREATEST Travel Secrets!

Sign up for our newsletter and get the best travel tips delivered right to your inbox.

Do you need travel insurance? Does anybody really need travel insurance ?

After shelling out for flights, visas, and a new backpack, having to find a few more bucks for travel insurance may feel a bit depressing. I mean, all you get is a “policy certificate” AKA a boring 100-page booklet to read. Aren’t there more sexy and fun things to be spending that money on?

After all, most trips, vacations, and odysseys end happily and safely without any ill occurrence. There is no definitive answer to this.

Our team at the Broke Backpacker , we have (collectively) spent more than a century backpacking the globe and we have visited over 100 countries. Most of those trips ended without incident. However, we have also clocked up a fair few mishaps along the way: inflected legs, tropical diseases, broken backs, and even gunpoint robberies.

These incidents were all bad enough in themselves, leaving physical and mental scars. Thankfully though, we were all insured at the time. This meant that we were spared the further trauma of paying out thousands in medical bills or replacing technologies.

Basically, insurance is one of those things that most people never actually need. But the ones who do are very lucky to have it.

So now, you get the picture: travel insurance is essential when it comes to staying safe on the road . But is Allianz travel insurance right for you? Or do other travel insurance options suit you?

So let’s take a look. Here are some things good travel insurance plans help with, and where you would be without them.

Lost Luggage

Luggage gets lost both on planes and in airports. It shouldn’t happen, but it sure as hell does.

That in itself is bad enough but replacing all your essential travel gear will cost. Any decent travel insurance policy usually covers lost luggage, usually up to at least $1000.

In fact, the aviation watchdog states that 5.73 items of luggage are lost for every 1000 passengers. That means that if you take 10 flights, then there is a 5% chance of your luggage getting lost forever. Some airports and airlines lose more baggage than others but all of them are equally as obtuse and obstructive when it comes to trying to make a claim.

Lost luggage can ruin your whole trip. I mean, imagine you head to Iceland and they lose all your cold weather gear?!

Medical Bills

Foreign medical care costs can be very high. A friend of mine was once hospitalised while backpacking in Costa Rica and ran up bills in excess of $10,000.

More recently he spent 1 night in a Thai hospital, was billed $1,000 and his passport was used as a ransom (that boy has no luck. Maybe he should stay at home?) . Personally, I don’t have $10,000 to pay to Costa Rican Doctors, but I do have maybe $50 to buy myself a travel insurance policy.

If you come from Europe, the cost of medical care in some parts of the world is quite a revelation. If you’re in the US, then you already know all about health extortion. But do remember, your domestic health insurance will most probably not cover you outside of the US.

Accidents happen (and without warning…) and ill health can strike any of us down at any time, anywhere. In fact, if you have experienced the driving or the hygiene standards in India, you’ll already know that you are at high risk of coming to some harm out on the road.

Trip Interruption Coverage

Trip interruption comes in all shapes and sizes. Claiming for flight delays or cancellations is annoying – and in the end, nothing’s guaranteed.

Every year a few airlines or travel agents go out of business leaving passengers stranded. Booking flights home at short notice is costly.

Not getting home on time on the other hand, can mean getting sacked from your job – ouch. If you have to stay a few more nights at your destination waiting for a flight home, then that can also stretch a maxed-out travel budget.

Having trip cancellation and interruption coverage can mean the difference between desperately raiding your overdraft or getting a few extra days of vacation, free of charge.

Theft Coverage

Sadly, tourists are a target for thieves in many parts of the world. Our team have been robbed with guns while backpacking South America . And I know people whose diamond jewellery and MacBooks were burgled from hotels.

Being robbed is scary. But theft coverage makes it suck a little less when you don’t have to fork out for your stolen iPhone.

Repatriation

In the unlikely event of your demise, your travel insurance can cover the cost of repatriation or sending your body home. The costs of this can otherwise run into several thousands of dollars.

Nobody ever thinks it will happen to them. And yet, it does happen.

Furthermore, the law of averages dictates that if you travel enough, something, somewhere will eventually go wrong. Just like you should always look twice before crossing the road, and always wear your helmet before riding a bike, you really should get comprehensive travel insurance.

By the way, some countries require you to obtain insurance before even letting you enter. Imagine being turned back at the airport for the sake of a few quid?! I personally never leave home without first obtaining travel insurance plans from either World Nomads or SafetyWing.

If you’re reading this, then I guess you decided that you do need travel insurance. Yay! Welcome to the world of sensible adults (AKA accepting your own mortality and the fact that you have no control whatsoever over the universe, despite whatever bullshit “The Secret” may have told you).

Allianz travel insurance is perhaps one of the biggest insurance companies in the world. They have been trading for over 120 years and they have offices across the globe.

Though travel Insurance is by no means Allianz’s primary focus or modus operandi. But this is not a bad thing. Note that even “specialist travel insurers” are often, in fact, brands or shop fronts backed by big insurance companies like Allianz.

They are governed by the Financial Services regulators in pretty much every national market they trade in. This means that if you have a problem with them, you can squeal on them and have your case reviewed independently and fairly by an adjudicator free of charge.

Now that the introductions are out of the way, let’s take a look at the individual travel insurance policies they offer.

Allianz are a major financial service provider and as such, they offer different coverage options, policies and plans aimed at different travellers. Let’s quickly run through them.

Firstly, Allianz travel insurance offer travellers 2 main types of policy. Within these coverage types are little variations. The main policy types are OneTrip and AllTrips .

Within both the OneTrip and AllTrips umbrellas are 3 variations : Basic, Prime, Premier . These vary depending on how much cover you want and how much you want to pay.

As the name kind of suggests, OneTrip covers one single, specific trip generally with a fixed start and end date.

AllTrips covers any and all trips that you make in a one-year period. This annual plan runs from the date you take out the policy, or a date of your choosing, and lasts for 365 days (or 366 in a leap year) .

You can take an unlimited number of trips in the year and an unlimited number of days travelling. Do be sure that all your chosen destinations are covered by the annual travel insurance policy though, otherwise, you may need to obtain additional cover.

OneTrip Basic Plan

This travel insurance policy covers all travel insurance basics such as medical coverage, trip cancellation and lost luggage. Look at it as the entry-level “classic cover” if you like.

The plan may be able to offer;

- Emergency Medical and Emergency Dental Coverage up to $10,000 and $50,000 for Medical Evacuation. These amounts may seem high but are not enough if you need to be airlifted home from an accident, for example.

- Lost or Stolen Baggage Coverage up to $500 and $200 for Delayed Baggage. Now, $500 may be enough for your baggage depending on how expensive your clothes are, and whether you pack any specialist equipment. However, a solid travel backpack is usually worth around $200.

- Trip Cancellation Cover up to $100,00. One of the best features of the OneTrip Basic plan is that Allianz may be able to reimburse the full cost of your trip if you need to cancel early. However, the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons – not because you got bored or changed your mind.

This policy is a good all-rounder and ideal for travellers on a budget . However, it does have some limitations.

Some of the Allianz travel insurance OneTrip basic coverage is a bit on the tight side. Furthermore, OneTrip Basic plan does not include coverage for missed connections or airline change fees. There are also relatively fewer accepted reasons for claiming on the trip cancellation clause.

OneTrip Prime Plan

Broadly speaking, Allianz OneTrip prime plan is more or less the same as the basic – with increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage and Dental Coverage up to $25,000 worth of and $500,000 worth of emergency evacuation coverage.

- Lost and Stolen Baggage Cover up to $1,000 which should cover most people’s hold luggage. However, the per-item max is $500. So if you pack your $8000 top-quality travel camera , you will only get $500 back for it. It also includes Baggage Delay Costs of up to $300.

- Missed Connection Coverage up to $800.

- Airline Change Fees up to $250.

OneTrip Premier Plan

In case you need a bit more on top of that, then we have the OneTrip Premier Plan. The Allianz OneTrip Premier policy is essentially the Prime with even higher coverage amounts. OneTrip Premier may be able to offer cover to;

- Emergency Medical and Dental Coverage of up to $25,000 to $50,000.

- Emergency Evacuation Coverage also increases to $1,000,000. With international evacuation averaging around $100,000, this amount is more than adequate to cover your transportation back home.

- Lost or Stolen Baggage up $2,000. However, like with the OneTrip Prime plan, you can only claim a maximum of $500 per item (up to $2,000 in total). $600 in Baggage Delay.

- Travel Delay coverage up to $1,600.

- Missed Connection Coverage up to $1,600.

Other Allianz OneTrip Options & Offshoots

In case that wasn’t choice enough for you, Allianz also offers 2 offshoots of their OneTrip policy. If you like, look at them as the highly specialised cousins of the OneTrip family.

OneTrip Cancellation Plus Plan

OneTrip Cancellation Plus Plan is definitely Allianz’s budget policy. With this plan, you are only covered against trip cancellation, interruptions, and delays. Medical coverage, medical transportation, and baggage loss are not included.

Personally, I would only consider this policy if (1) you are not checking luggage (2) you have medical coverage elsewhere. For example, this may be OK if you are an EU citizen taking a short break to another EU country where you only have your trusty carry-on luggage and an EU emergency healthcare card.

OneTrip Emergency Medical Plan

This policy is great for travellers who only want medical coverage on one single trip. It provides up to £50,00 in emergency medical coverage and $250,000 in emergency medical transportation coverage.

Remember that this plan only offers protection for medical expenses. If you are robbed, your cuts and bruises are covered but your stolen phone is not. If the airline loses your luggage it is not covered and neither is heartbreak. Trip cancellation coverage is also not included.

This plan is, therefore, for anybody whose sole and only concern is medical coverage.

Remember, the OneTrip policies cover one specific trip. The AllTrips policies we are going to detail below cover long, or multiple trips within a one-year period.

Note that AllTrips policies may also be able to offer rental car coverage for damage as well as dismemberment cover. On the flip side, trip cancellation coverage is either non-existent or limited.

AllTrips Basic Plan

The AllTrips basic may be able to offer coverage for the “classic” issues on multiple trips within a one-year period. Let’s see those numbers.

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Evacuation Coverage. Note that $20,00 on medical emergencies may still be a little on the low side in the event you get very sick in an expensive part of the world such as the US.

- Lost/Stolen or Damaged Baggage up to $1,000. Yes, this may be able to cover most checked bags but remember the $500 max item clause. Baggage Delay is offered up to $200 and then $300 for trip delay.

- Rental Car Damage Coverage up to $45,000. Note that additional premiums may apply.

Note that the AllTrips Basic plan does not come with Trip Cancellation or Interruption Coverage. Remember that means you will not be reimbursed in case you are unable to go on your trip!

AllTrips Prime

As you probably guessed, AllTrips Prime is more or less the same as the basic package with some increased coverage amounts. The policy may be able to offer;

- Emergency Medical Coverage of $20,000,00 and $100,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00. Remember that the reason for cancellation needs to be one of Allianz Global Assistance’s list of acceptable cancellation reasons.

- Lost/Stolen or Damaged Baggage up to $1,000 and $200 for Baggage Delay.

- Trip Delays up to $300.

AllTrips Premier

If you want even more coverage, then we have AllTrips Premier. The Allianz AllTrips Premier policy is basically the Prime one with even higher coverage amounts. AllTrips Primer may be able to cover;

- Emergency Medical Coverage of $50,000,00 and $500,000 in Emergency Transportation Coverage.

- Trip Cancellation or Interruption Coverage up to $2,000.00.

- Trip Delays Coverage of up to $1,500.00.

- Dismemberment and travel accident up to $50,000 if you lose a limb or your eyesight when travelling.

Wanna know how to pack like a pro? Well for a start you need the right gear….

These are packing cubes for the globetrotters and compression sacks for the real adventurers – these babies are a traveller’s best kept secret. They organise yo’ packing and minimise volume too so you can pack MORE.

Or, y’know… you can stick to just chucking it all in your backpack…

We’re now going to drill down and look at the various things that may be covered by Allianz travel insurance. Remember that some of these are covered by some policy types but not others, and note that coverage amounts and excess’ also vary depending on the exact Allianz policy type.

Emergency Medical Coverage

Got food poisoning in Delhi? Got hit by a moped in Bangkok? Or maybe you just slipped in the shower and broke your wrist in Madrid?

These things can, and do, happen and will all require emergency medical care. Being sick, infirm, and unable to make TikToks is bad enough as it is, so the last thing you want is a hefty medical bill which you have to pay out of your own pocket.

Emergency accident and sickness coverage is quite likely the most important aspect of travel insurance plans.

Emergency Transportation

Emergency Medical Evacuation is when you need to be sent to your home country, or another country, for further or continued medical treatment, and are too sick to travel home normally as a regular passenger. For example – if you are stuck in a hospital bed on a drip in a leg cast.

Trip Cancellation

Reimburses for prepaid, non-refundable cancellation charges if you must cancel your trip (after the effective date of your insurance plan) due to covered sickness, accidental injury, or death of you, a family member or travelling companion; inclement weather, unforeseen natural disaster at home or at your destination, strike, or other covered reasons.

Trip Interruption

Trip Interruption Coverage includes the same stipulations as listed above in “Trip Cancellation”. It includes the caveat of covering the cost of accommodation to you if you are delayed.

Baggage Coverage for Loss/Damage

Being compensated for baggage loss of lost personal gear is likely the second most important aspect of your insurance. This is one of the most common reasons file a claim on your travel insurance.

This covers reimbursement for loss, theft, or damage incurred during the trip. It can be applied to all personal items that were lost, stolen, or else accidentally blown off the roof of a chicken bus travelling at top speed.

Baggage Delay

In the event your checked baggage is delayed or misplaced by the air carrier (for more than 12 hours) , you can claim reimbursement for any necessary items you need to purchase until your bag arrives. This will typically mean toiletries but may even mean some travel clothes if you can demonstrate the purchase is essential.

Trip Delay cover protects you when you’re unable to reach your destination on time due to circumstances beyond your control. If your airline cancels your flight due to a technical fault, Allianz travel insurance will reimburse you for any meals, transportation, or accommodation costs you incurred as a result. Note that delays of less than 6 hours are not covered.

Change Fee Coverage

Have you ever tried to change or vary a flight date or add or remove a passenger?! The fees can be insanely high. This is where Change Fee coverage comes in. If you have the AllTrips Executive, OneTrip Prime plan or OneTrip Premier plan, you can claim up to $500 to cover the cost of the airline change fee.

Travel Accident Coverage

If you are in an accident, you may be entitled to claim a compensation payment in addition to your medical/repatriation costs. This is usually reserved for loss of limb/eyesight type scenarios and you can’t claim for whiplash or emotional trauma from falling from a donkey!

The Travel Accident Coverage is also payable to your family in the event of your death.

Rental Car Damage and Theft Coverage

The AllTrips travel insurance polices also include rental car coverage. This can often prove considerably cheaper than obtaining insurance direct from the rental car provider.

If you are resident in the US, this feature may not be available to you. For clarity, we suggest you speak with Allianz travel insurance directly.

There are some notable omissions from Allianz’s cover. Let’s take a look at them.

Pre-Existing Medical Conditions

If you have a pre-existing medical condition which causes you problems on your trip, it is not covered under the Allianz policies. This is fairly common amongst insurers. It is important that you do declare any pre-existing conditions when taking the policy out.

If you do have a pre-existing medical condition, then you may be very interested to hear that SafetyWing can offer full coverage for PEMCs in their policies.

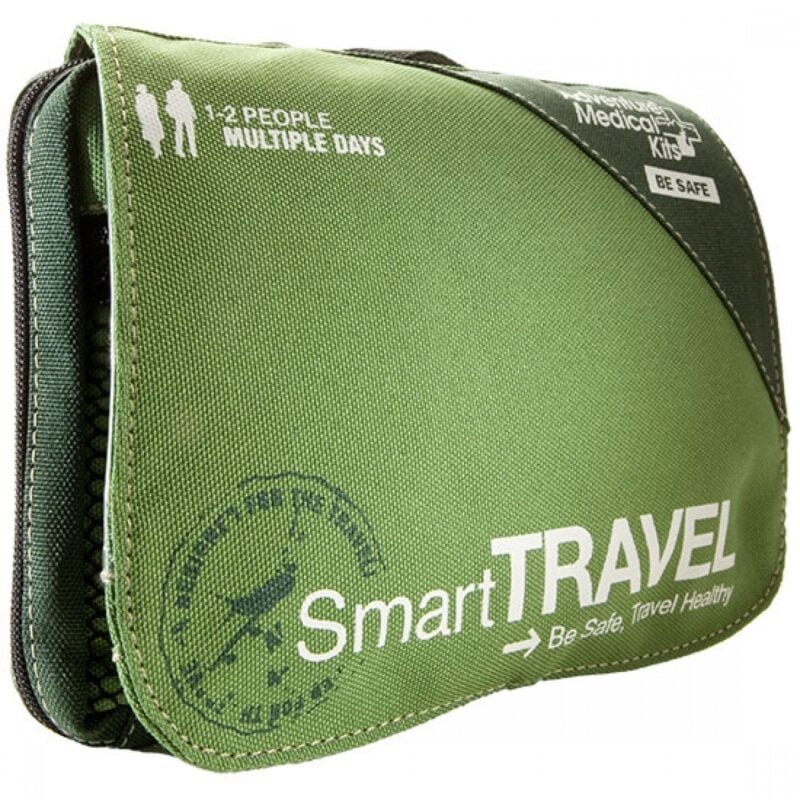

Things go wrong on the road ALL THE TIME. Be prepared for what life throws at you.

Buy an AMK Travel Medical Kit before you head out on your next adventure – don’t be daft!

Extreme Sports

Allianz Travel Insurance does not any kind of adrenaline sport such as Quad Biking and Parachuting. The lack of coverage for extreme or adventure actives is one of the many reasons why we now prefer World Nomads. To get full details of the kind of activities World Nomads can offer coverage for, head over to their site and get a tailer made quote.

So as you can see, Allianz Global Assistance offers a lot of different policy types for a lot of different people. Allianz Travel Insurance maybe suitable for the following kinds of travellers;

- Annual Travellers – With the Allianz annual plan, you may be covered for a whole rotative journey around the sun, no matter how many times you travel! Annual plans are great for frequent and long-term travellers to save you money in the long run. On the other hand, though, SafetyWing offers a month-by-month policy which you can stop and start depending on how much you travel; this may prove to be more cost-effective.

- Senior/Ageing Travellers – Allianz travel insurance policyholders are among the best senior travel insurances . They have no age limit. Believe us, not all insurers offer this and we have a LOT of queries from over 65’s & over 70’s who have struggled to find insurance elsewhere.

- Travelling Families – Allianz travel insurance policies may allow children under the age of 17 to travel with their parents for free, on selected plans. This is great for families with kids. My earliest travel memory is of a Spanish ER department, my parents were glad they had me on their policy. Otherwise my foot would still be bleeding 33 years later!

Whilst they do offer a myriad of different plans to cover most travellers types, Allianz is perhaps not the ideal travel insurance company for absolutely everybody out there.

- Adventure Travellers – Allianz Travel Insurance does not offer protection for extreme activity or sport of any kind! If you plan on doing any dangerous, adrenaline-type activities, then perhaps consider World Nomads who can offer coverage for over 201 different extreme sports. SafetyWing are also rapidly extending their extreme coverage.

- Travellers Wanting High Medical Coverage – We usually recommend travelling with at least $100,000 of emergency medical coverage. If you come down with a severe illness or are mangled by a badger, you might be stuck with thousands of dollars in medical bills so need to be prepared. World Nomads do offer $100,000 in medical emergency cover.

- Corporation Haters – Allianz are a major international finance company and we know some of you prefer not to deal with such organisations. That’s a perfectly legitimate point of view. However, remember that even a lot of “boutique” insurers are in fact ultimately shop fronts for big insurers such as Zurich, Lloyds, or even Allianz. In fact, all some boutique firms do is sell you the illusion of dealing with a small firm and charge you a hefty commission for the privilege.

So now we know the details, the next burning question is how much does Allianz Travel Insurance cost?

Well actually, it’s very difficult to say. The pricing details vary depending on a wide range of factors such as your age, location, your trip plans, if you have a pre-existing medical condition, and numerous other factors that only the gods of insurance can compute. It’s worth it to get in there and check yourself.

So, now, let’s talk about our trusty travel insurance plans for backpackers.

World Nomads

World Nomads offers coverage for backpackers and adventure trailers. They are one of our favourite travel insurance providers and we have used them for years.

Unlike Allianz travel insurance, World Nomads are a travel insurer with a focus on backpackers.

World Nomads offer 2 separate plans depending on how much cover you want and what exactly you intend to do. World Nomads can also offer trip cancellation coverage, electronic gadget, and theft coverage in the policies.

Word Nomads can cover over 140 countries (but not Pakistan which is a shame for us) . They can also cover a wide range of adventure stuff and extreme sports like mountaineering which Allianz travel insurance do not.

However, they do not offer home country cover and do not offer open-ended cover. If you are not planning on doing any adventure stuff though, then you may find World Nomads to be a bit expensive.

SafetyWing are a relatively new player on the scene. They are founded by travellers, for travellers, and their primary target is for those travelling as a digital nomad : people like me who move around the world working from our laptops. We can go many years without ever going “home” and SafetyWing recognises this and can offer open-ended cover.

What we LOVE about SafetyWing is that their insurance operates like a monthly subscription that you can stop and start as and when you need it. They are also one of the few providers who may be able to cover some pre-existing conditions and provide assistance with “routine” health stuff.

We’ve tested countless backpacks over the years, but there’s one that has always been the best and remains the best buy for adventurers: the broke backpacker-approved Osprey Aether and Ariel series.

Want more deetz on why these packs are so damn perfect? Then read our comprehensive review for the inside scoop!

By this point, you may well know which travel insurance is best for you. Maybe it’s Allianz travel insurance, or maybe it’s one of the others.

The question now then is, when should you buy travel insurance?

You can buy travel insurance up until the start date of your trip for most insurers. Many will not cover a trip that has already begun – with the exception of World Nomads and SafetyWing.

Note : if you ever do make a claim, you may well be asked to provide evidence of the start date. So I do not recommend trying to hoodwink insurers. Be totally honest or it will come back on you.

However, in our experience, the earlier you book your travel insurance, the better. This is for a number of reasons:

- Things sometimes go wrong before the trip even starts. For example, if the airline goes bust. This happens to 1000s of people every year. Or what if you get very sick a week before flying and have to cancel?! If you have the right travel insurance in place, your insurer may cover you in these scenarios.

- The vast majority of policies include a cooling off period . This is a period of time (usually 28 days) when you can cancel the policy and get all of your money back. We suggest using the cooling period to read through the policy documents and ensure that the cover fully meets your needs. Upon a closer look, if it does not suit you, you have time to contact the insurer and amend the policy, or cancel it and obtain more suitable travel insurance.

Personally, I usually book my travel insurance the very same day I book my flight. The only exception is if I already have long term or an annual plan. In these scenarios, instead, be sure to check the last date on your annual/long-term cover and make sure it covers your whole trip.

First up, it is unlikely you will ever need to make a travel insurance claim. Yipee!

In case you do though, you will be very pleased to hear that the process is pretty straightforward as long as you are dealing with a reputable company. If you are not then it may be a lot harder.

To initiate a travel insurance claim, all you need to do is contact (call) Allianz Global Assistance and chat with their 24-hour multilingual staff. You should do this as soon as possible or as soon as you know you will need to make a claim .

You will need to tell them about your claim including details of what has gone wrong, and what the damage seems to be. You can also initiate the process online by signing into your account.

If you are claiming lost or stolen items, you will need to write up a formal sworn statement of events, detailing what happened and what was lost. You will also need to have an official police report made up – it is highly important that you obtain this even if it means paying a fee/bribe or hassling the police to do it. Try to get it in both the native language and in English if possible.

The Insurance company may contact you to discuss your claim further. You may even be subjected to a an anti-fraud interview and your call may even be run through voice detection software designed to spot deceit! However, you have nothing to worry about if your claim is legitimate and in order.

It is very helpful to get all of your receipts and invoices together first and submit all expenses at once. Do keep copies of every expense, bill, invoice, and report as you will need to provide these to the claims team. They may pay out small amounts without a bill, but in the case of extra hotels, flights, or electronics, the rule is usually “no proof = no payment”.

After that is sorted, you upload all of your information and documents, review the claim and submit. The Allianz team will get cracking and stay in contact with you throughout this process. Note that resolution time does vary from case to case. It may be days, weeks, or sometimes months depending on the details of your claim.

I hope you found this Allianz Travel Insurance Review to be informative – it certainly took a lot of work on our part to put it together! Comprehensive travel insurance is important to safe travel and you need to carefully choose the best provider for your needs.

We really care about the safety of our readers. That’s why we do recommend travel insurance so strongly. We’ve seen ourselves what can go wrong – and we wouldn’t wish it on anyone.

So check for trip interruption coverage, get your gadgets covered, but most importantly, make sure any potential medical expenses are covered, especially emergency medical expenses. Shop around different providers to find the right one for you. Once again, we wish you an awesome and safe trip!

Aiden Freeborn

![allianz travel insurance gold Brutally HONEST Allianz Travel Insurance Review – [Updated 2023] Pinterest Image](https://www.thebrokebackpacker.com/wp-content/uploads/fly-images/716330/Allianz-travel-insurance-review-pin-260x337.jpg)

Share or save this post

The author did a very nice job explaining the different types of insurance Allianz offers. But, until you have experienced their VERY POOR customer service and actual reimbursement procedures, you will not have the complete Allianz story.

I would never use Allianz Global Assistance for your trip insurance needs During a Viking River Cruise June, 2023, my husband came down with COVID. VIKING handled their end of any claims and taking care of us beautifully, BUT Allianz Global Assistance was a completely different story. We had Trip Interruption insurance (which included coming down with COVID) and trying to get reimbursement for all our medical expenses and a post trip to Amsterdam we had planned (not with Viking, but through our travel agent) has been one of the most frustrating ordeals I have ever dealt with. We are asking for approximately a $2,000 reimbursement and we have received $300.

If you need to file a claim, here is what you can expect after you complete the on-line claim form on Allianz’s website : 1. They will tell you they can’t read your receipts (even though you can read them on the email you send or they are PDFs from Viking or your TA). One Allianz customer service rep (probably the 7th person I talked to), told me to download a $50 app that makes receipts readable, which I did, and they still couldn’t read them. I finally snail-mailed copies of the receipts and they still declined 75% of them. 2. Phone calls with wait times of over an hour. This has happened to me 10+ times (not just a random occurrence), and I have tried all times of the day – same thing. 3. When you do talk to a rep, the call will always, and I mean always, disconnect before the issue is handled.

I could go on and on, but bottom line, I will NEVER use Allianz again or recommend them to anyone. We are out $2,000 + $1,000 we paid for the Trip Insurance. It is a big deal, but I can’t imagine if we had to rely on Allianz for the total trip reimbursement. Thank goodness Viking stepped up and provided the level of customer service they did.

Of course, we are aware that some customers sometimes have insurance claims denied. We also appreciate that others have bad customer service experiences with all kinds of different companies.

However are not privy to the finer details of your situation, and Allianz are not here to put across their side of the story either – furthermore this is not really the legitimate forum to air complaints about them. Still in the interest of openness and transparency we will let your comment stand.

Best of luck with your next trip.

Yes agreed – your statement about Allianz not offering unlimited medical cover is complete BS and misleading to readers. Are you paid to promote World Nomads Insurance? Please provide full disclosure to your readers.

I have just rechecked the Allianz policy information available on their website and what we have said appears to remain correct. If you feel we have missed something then please elaborate.

As for World Nomads, we have made it clear that some of the links in this post are affiliated.

Hi there, I found your article very informative, but I just wanted to make a couple of corrections. Im not affiliated with Allianz, but Ive been researching which insurance to buy and they have provided me with a quote and their PDS, which Ive read in full. The amounts that Allianz offers for overseas emergency assistance and overseas medical and hospital expenses under their comprehensive plan are both unlimited, and they do offer insurance for pre-existing medical conditions, you just have to pay an additional premium.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of followup comments via e-mail.

- Single Trip

- Annual Multi-Trip

- Winter Sports & Ski

- Collision Damage Waiver

- Sport & Leisure

- Medical Conditions

- Travel Insurance for Non-UK Residents

- Group Travel Insurance

- Travel Insurance for Couples

- Covid-19 travel insurance

- About Our Travel Insurance

- Holiday Cancellation Insurance

- Emergency Medical Assistance Cover

- Emergency Medical Cover for Travel Insurance

- Repatriation Insurance

- Baggage Cover

- Travel Insurance for Under 18s

- Comprehensive

- What's Covered

- Excluded Vehicles

- Range Rover

- Car Hire Excess Insurance

- Policy Information

- File a Claim

- Insurance Glossary

- Coronavirus - Annual Multi-trip Policy

Worldwide Travel Insurance

- Full access to HealthHero - a 24/7 GP via telephone and video based in the UK

- Up to £10m Emergency Medical expenses covered

- Personal liability covered over £1m on all policies

- Over 23,000 UK travellers covered in 2022 for trips worldwide

What is worldwide travel insurance?

From the historic temples of Japan to Australia's Great Barrier Reef, there's so much to see and experience in the world. You can take the kids on the holiday of a lifetime to Walt Disney World Resort in Florida, relax surrounded by luxury and romance on a Caribbean island or even go backpacking around East Asia. Seeing the world is a great thrill and, no matter where you visit; your eyes will be opened to new experiences and adventures. Sadly though, even on the holiday of a lifetime, problems can arise. But thankfully, our worldwide travel insurance will help cover you when things don't go to plan.

Worldwide travel insurance cover is slightly different to European travel insurance because it takes into account the higher cost of medical treatment outside of Europe. The cost of treatment is particularly high in America, where residents have private medical insurance. This means that, if you suffer an injury or fall ill and need medical treatment while on your holiday and you don't have international travel insurance, you could find yourself tens of thousands of pounds out of pocket. But, by choosing the right multi-country travel insurance, you can be protected against these medical costs, so an accident doesn't have to cost you an arm and a leg.

On top of this, world travel insurance can also provide cover if you need to cancel or curtail your trip, if your flights are delayed, or if your luggage is lost or stolen. To get the best protection, you should take out international travel insurance as soon as you can – ideally as soon as you've booked your holiday. This ensures you will be protected with cancellation cover in the event your trip is cancelled.

Below is some more information about our insurance products, for which Terms and Conditions apply. Please visit the policy information hub for full details.

Join us in 3 minutes

What does worldwide travel insurance from Allianz Assistance cover?

Our Single Trip , Annual and Backpacker policies are designed to keep you protected while you travel. We can provide worldwide travel insurance to suit your trip and the level of cover you need.

Single Trip and Annual travel insurance policies also offer three levels of cover: Bronze, Silver and Gold. Depending on the policy you choose, you’ll be covered for:

- Cancelling or curtailing your trip

- Emergency medical and associated expenses

- Loss of passport*

- Delayed personal possessions

- Lost, stolen or damaged personal possessions*

- Loss of personal money*

- Personal accident cover

- Missed departures

- Delayed departures

- Personal liability

- Legal expenses

- End-supplier failure**

- *Not available with Bronze level cover

- **Only available with Gold level cover

- Terms and Conditions apply.

Frequently Asked Questions

Travel insurance for multiple countries.

With our Annual worldwide travel insurance policies, you can choose between two different Worldwide areas of cover: ‘Worldwide (excluding USA and Canada)' and ‘Worldwide (including USA and Canada).' Both of these options provide travel insurance for multiple countries.

If you choose ‘Worldwide (excluding USA and Canada),' the area of cover is anywhere in the world except the USA and Canada. This means you can get cover for an Australian adventure, a tour of Vietnam's history or a Kenyan safari in the Maasai Mara National Reserve.

If you choose ‘Worldwide (including USA and Canada),' the area of cover is anywhere in the world. This means you can enjoy the beaches of Miami, the theme parks of Florida, the city sights of New York and the thrill of Las Vegas, as you tour the USA and beyond.

There are some exclusions that you should be aware of, and you can find these in your policy documents .

For example, you will not be covered if you travel outside the policy area you have chosen. This is clearly shown on your confirmation email, so please check this if you're unsure. You can also contact us on 0371 200 0428. We're open Monday to Friday, from 9am to 5pm.

You will also not be covered if you travel to a country or region that the Foreign, Commonwealth and Development Office has advised against all travel or against all but essential travel.

Which sports and leisure activities are included?

With our worldwide travel insurance, you’re covered for activities such as safari trekking, camel riding, parachuting, trekking and hiking. If you’re looking to really get the adrenaline pumping, then you’re also covered for selected water sports such as scuba diving, snorkelling, surfing and waterskiing.

If you’re looking to try winter sports while you’re away, you’ll also need our Winter Sports and Ski add-on to make sure you’re protected. With this optional extra, you’re covered for activities like skiing, snowboarding and tobogganing.

To understand exactly which sports and leisure activities are covered by your policy, and where any exclusions may apply, please take a look at your policy handbook and our sports and leisure activities list.

From 5th May 2021 we have not been able to offer travel insurance policies to cover people's pre-existing medical conditions. This is only a temporary measure while we make improvements to our online booking engine. Please keep an eye on the Allianz Assistance website in the future so you are aware when we are able to offer this additional worldwide cover again.

Once the updates have been made, you'll need to disclose your medical history, including recurring injuries or illnesses, on-going or lifelong conditions, previous surgeries and any conditions you are currently suffering from. This includes any pre-existing condition that you have received treatment for, including surgery, tests or investigations by a doctor or a consultant/specialist, and conditions you have been prescribed drugs or medication for. This also includes both conditions you're successfully managing and conditions you're unable to manage.

Once pre-existing medical conditions cover is available it's very important that you tell us about any pre-existing medical conditions you have when you apply for worldwide travel insurance. This is because it's unlikely that we will pay any claim for medical expenses, trip cancellation or cutting a trip short if it relates to a medical condition that you have not told us about.

It won't be too long before we're back offering worldwide travel insurance with pre-existing medical condition cover.

Insurance options for worldwide travellers

Annual Multi-Trip Travel Insurance

Single Trip Travel Insurance

Backpacker Travel Insurance

Sports & Leisure Insurance

Winter Sports & Ski Travel Insurance

More information about the insurance we offer.

Travel Insurance for people with Medical Conditions

Travel Insurance for the USA

Travel guides and advice.

Best travel books to read

Travelling whilst pregnant

Essential advice for mums-to-be on how to keep yourself and baby safe whilst travelling.

How to stay safe abroad

Best alternative city breaks

Policy documents

You'll need your policy number to submit your claim to us. This is available in your certificate of insurance which is sent to you when you take out cover.

It's a good idea to take your policy information with you on your trip so you can provide us with all the necessary details in order for us to help.

Claims assessment

Once we receive your claim, it'll be assessed by our experienced team.

To speed up the assessment of your claim please make sure to include all applicable information and evidence such as receipts, booking confirmations, hotel reservations and crime reference numbers. If you fail to provide all the necessary information this will cause a delay in processing your claim.

Your claims outcome

Once our team has assessed your claim we'll be in touch with you via your preferred contact method to confirm the outcome and inform you of any next steps.

Make A Claim?

Policy documents.

If you have a pre-existing medical condition that we are unable cover under our own policies, you may be able to obtain an alternative travel insurance policy through one of the providers featured in the MoneyHelper directory of specialist travel insurance providers for people with serious medical conditions. Do take time to study and compare the terms and conditions to ensure you have the cover you need. To contact the Money Advice Service for further details of the directory

Call: 0800 138 7777 (lines are open Monday to Friday, 8am to 6pm) or Email: [email protected]

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may be eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a weeklong, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550

Premiums for AXA plans are between 6.5% and 9.2%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to Purchase and Manage Your AXA Policy

The process of purchasing an AXA policy is simple. After obtaining your quote, you'll need to decide which of AXA's three plans you want to buy. When you pay for your plan, be prepared to provide additional personal information, like your birthday, phone number, and address.

Once you finalize your purchase, you'll have a 10-day free-look period, in which you can cancel your policy and get your money back.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can email them to [email protected] or send them by mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

If you need assistance when filing claims, AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the U.S.). Office hours are 9:30 a.m.-5 p.m. ET on Thursdays and 8:30 a.m.-5 p.m. ET on all other weekdays.

AXA's U.S. branch has few reviews on Trustpilot and the Better Business Bureau — just over 20 between the two sites. Its UK branch has over 1,100 reviews, most of which are overwhelmingly negative. However, the quality of AXA Travel Insurance UK isn't necessarily indicative of its U.S. coverage.

In fact, on SquareMouth, where the majority of AXA U.S.'s reviews, reviews are generally positive. It received an average of 4.22 stars out of five across over 900 reviews. Customers reported that adjusting an AXA policy was easy and the customer service team was responsive. However, reviews on the claims process was more mixed, with spotty communication and long wait times.

See how AXA travel insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA to Travel Guard , we'll look at the coverage levels from their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

Read our AIG Travel Insurance review here.

AXA Assistance USA vs. Allianz Travel Insurance

Allianz Travel Insurance provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz Travel Insurance. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Read our Allianz Travel Insurance review here.

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research the terms of your credit card's travel protection before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policyholders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

Read more about how Business Insider rates insurance products here.

AXA Assistance USA FAQs

If you're diagnosed with COVID-19 before a trip and need to cancel, AXA may cover your expenses. Additionally, a COVID-19 diagnosis during a trip may be covered under AXA's medical expense, trip interruption, and trip delay benefits. Be sure to review your policy to ensure coverage details.

While you may extend your coverage in certain circumstances, such as extended hospitalization, and update your travel dates prior to your departure, you can't extend AXA travel insurance plans while you're traveling.

AXA's Gold and Platinum plans cover pre-existing medical conditions as long as you purchase your policy within 14 days of your initial trip deposit. AXA's Silver plan does not cover pre-existing conditions and has a 60-day look-back period.

You can download AXA claims forms on its website and email them to [email protected].