Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Book a Flight

Where are you going, when are you going.

Best American Express credit cards

American Express credit cards are about more than just Airpoints. We assess all available cards and help you decide if an AMEX card is right for you.

The breakdown

- The AMEX Airpoints Platinum has the best Airpoints earn rate of any credit card and comes with 300 bonus points on sign up.

- Its little brother, the basic Airpoints card, has no annual fee and the third-best Airpoints earn rate.

- The AMEX Charge card has a tonne of benefits and rewards, but has a huge annual fee of $1,250.

Author: Kevin McHugh, Head of Publishing at Banked.

In New Zealand, American Express (AMEX) credit cards have been synonymous with Airpoints. AMEX cards have generally offered the best earn rates plus they are the only cards that offer bonus Airpoints on sign-up (up to 300 in the case of the Airpoints Platinum card).

But since late 2022, when other credit card companies started weakening their rewards schemes due to the introduction of interchange fee caps for Visa and Mastercard payments , AMEX credit cards have become even more appealing.

In this guide, we look at all American Express credit cards available in NZ, break down their pros and cons, and help you decide if one of them is the right choice for you.

You might also be interested in our guide on choosing the best credit card for Airpoints or our guide to all of the best credit cards in NZ .

Best for earning Airpoints: The American Express Airpoints Platinum card

The AMEX Airpoints Platinum card has a lot going for it, but there is one feature that really makes it stand out: it has the best Airpoints earn rate in New Zealand — and it’s not even close.

Every $59 spent on the AMEX Airpoints Platinum will earn you one Airpoints Dollar. The closest competition is the Westpac Airpoints World Mastercard, which requires a significantly higher $95 spend to earn one Airpoints Dollar. The Westpac card also has a much higher annual fee.

On top of that, the Airpoints Platinum card comes with 300 bonus Airpoints on sign-up (but only if you spend at least $1,500 on the card in the first three months).

Our Head of Publishing switched from an ANZ Airpoints Visa Platinum to the AMEX Airpoints Platinum and found he earned more Airpoints on his spend with the AMEX card.

Read our full review of the American Express Airpoints Platinum card .

Other pros of the AMEX Airpoints Platinum

- Travel insurance (domestic and international): As long as you pay the full fare for your trip on either your credit card or with Airpoints, your travel will be insured — both aboard and within New Zealand. This is a plus because some credit card travel insurance schemes (such as that offered on the ANZ Airpoints Visa Platinum) only cover international travel).

- Free Priority Pass airport lounge access: Get free access to two VIP airport lounges per year. Access is available to over 1,200 airport lounges around the world, including the Strata Lounge at Auckland Airport .

- Smartphone screen cover: Repairs to fix your phone’s screen will be covered automatically. As long as you bought the phone outright with your card, or you use it to pay for your phone plan, you’ll be covered up to $500.

- Earn Status Points: For every $250 spent on the card, you’ll earn 1 Status Point. Status points can be used for travel benefits including lounge access, priority service, seat upgrades, and more.

Cons of the AMEX Airpoints Platinum

- High annual fee: At $195, the card has one of the higher annual fees out there. Therefore it’s not a suitable choice for people who won’t take advantage of its benefits or won’t use it regularly.

Key card details

- Annual fee: $195

- Purchase interest rate: 22.95%

- Interest-free period: 55 days

Best for no annual fee: The American Express Airpoints card

For many people, the AMEX Airpoints card will be the sweet spot for a rewards card: it has the third-best Airpoints earn rate of any credit combined with no annual fee .

Cardholders can spend $100 to earn one Airpoints Dollar, which is only bettered by its big brother the AMEX Airpoints Platinum ($59 spend required) and the Westpac Airpoints World Mastercard ($95 spend required).

Plus don’t forget that the AMEX Airpoints card also comes with a bonus 50 Airpoints on sign-up (when you spend a minimum of $750 in the first three months of having it).

So, as the only rewards credit card in New Zealand with no annual fee, along with one of the best for earning Airpoints, the AMEX Airpoints card will be an easy choice for some.

Read our full review of the AMEX Airpoints credit card .

Other pros of the AMEX Airpoints card

- 6 months interest-free purchases: Take out the card and your purchases will be interest free for six months from the date the account is opened. If you have an outstanding balance on your account after that time, the regular interest rate will apply.

Cons of the AMEX Airpoints card

- Lower Airpoints earning potential: We’re quibbling a little as 1 Airpoints Dollar per $100 spent is still the third-best earn rate for a credit card and there is no annual fee. However, the earn rate is still significantly lower than that of the Airpoints Platinum card (which requires just $59 spend to earn 1 Airpoints Dollar).

- Annual fee: $0

Best for Membership Rewards: The American Express Gold Rewards card

In New Zealand, many people associate American Express credit cards with Airpoints, but the card provider has its very own rewards scheme: Membership Rewards. And with 2 Membership Rewards points earned per dollar spent, the Gold Rewards card has the best earn rate available.

Membership Rewards points can be used for a range of purposes, from travel (points can be transferred to other loyalty schemes such as Airpoints Dollars, Qantas Points, and Skywards Miles) to gift cards, and cinema tickets.

In terms of value, 150 Membership Rewards points can be transferred for 1 Airpoints Dollar. That means that if you theoretically always chose to transfer earned Membership Rewards Points for Airpoints Dollars, the Gold Card would have an equivalent Airpoints earn rate of 1 Airpoints dollar per $75 spent.

Read our full review of the American Express Gold Rewards card .

Other pros of the AMEX Gold Rewards Card

- $200 back: If you spend at least $1,500 dollars on the first three months, you’ll get $200 back to your account.

- $200 dining credit: For each year you have the card, you’ll get 2x $100 dining credits that can be used at a number of restaurants across the country. Note that most eligible restaurants are in Auckland and a number of regions don’t have any. See the full list of eligible restaurants .

- Free travel insurance (domestic and international): Just like the AMEX Airpoints Platinum, the Gold Rewards card also comes with travel insurance that covers travel both aboard and here in New Zealand.

- Metal card: The card is literally made of metal, with the choice of either gold or rose gold colour. This serves no practical purpose, but a metal card is undeniably pretty cool.

Cons of the Gold Rewards card

- Higher than average annual fee: The Gold Rewards card does come with a lot of benefits, but they are not without a cost and the annual fee of $200 is higher than that of most available credit cards.

- Dining credit is limited: If you live in Auckland, you will have no shortage of options where you can use the annual $200 dining credit. But the choice is much more limited outside of New Zealand’s largest city.

- Annual fee: $200

Best for prestige: The American Express Platinum Charge card

For the card with the most rewards and added bells and whistles, look no further than the AMEX Platinum Charge card.

As the name suggests, it’s not actually a credit card. A charge card lets you make purchases without incurring interest, as long as the balance is paid in full each month, plus there is no spending limit.

There are a whole bunch of benefits to having the Platinum Charge card, most of which we’ll cover in the following ‘Pros’ section, but let’s talk about Membership Rewards points. If you sign up for the card and spend at least $1,500 in the first three months, you’ll get 100,000 points .

To give you a better sense of value, if you were to transfer those Membership Rewards points to Airpoints Dollars (which you can choose to do), you would get 667 Airpoints Dollars. That number of points also has a value of $750 when used at American Express Travel.

Plus, the Platinum Charge card also has the highest Membership Rewards points earn rate of any AMEX card (along with the Gold Rewards card) — every dollar spent will earn you 2 points.

Other pros of the Platinum Charge card

(Takes a deep breath…)

- Annual $300 dining credit: Spend $150 or more in one transaction on your card at a participating Dining Collection restaurant and you’ll get a $150 credit. You can do this up to twice a year for a total of $300 that can be earned.

- Annual $200 travel credit: Make a travel booking of at least $200 through American Express Travel and you’ll get $200 credited back to your card.

- Free international and domestic travel insurance: As long as you pay for your travel fare on your card, you’ll be covered both in New Zealand and abroad. See our guide to NZ credit cards with travel insurance to see how the Platinum Charge compares with the competition.

- Concierge service: You’ll have a personal concierge available that can help you buy gifts, find meeting venues, and so on.

- Smartphone screen cover: If you pay for your phone and/or your monthly bill on your card, you’ll benefit from screen insurance up to a value of $500.

- Fine hotel and resort programme benefits: Get a range of benefits such as daily breakfast, room upgrades, noon check-in, late check-out, and so on at more than 1,300 properties around the globe.

- VIP lounge access: Complimentary access for you and a guest to 1,400 airport lounges around the world.

- Accor Plus membership: As an Accor Plus member you’ll get a range of benefits, including a complimentary night’s stay at an Accor hotel each year.

- A metal card: Just like the Gold Rewards card the Platinum Charge is fully metal for that ultra-prestige look.

Cons of the Platinum Charge card

- A whopping annual fee: All of the card’s many benefits come at a cost — a pretty huge annual fee of $1,250. No New Zealand credit card even comes close in terms of annual fee size.

- Annual fee: $1,250

- Purchase interest rate: N/A

- Cash flow period (the period during which you must pay the outstanding amount in full): 44 days

Best for people who don’t pay their balance in full each month: The AMEX Low Rate card

On the other end of the spectrum to the Platinum Charge card is the Low Rate card.

But while the Low Rate card doesn’t have a lot of rewards and additional benefits, it does have a low-interest rate of 12.69%. This makes it a better option for those who don’t expect to pay off the full balance of their credit card in full each month, meaning that they would be charged interest on that outstanding balance.

However, bear in mind that the AMEX Low Rate card does come with an annual fee of $59. While this fee isn’t huge, there are other low-rate credit cards (such as the ANZ Low Rate Visa) that have a similarly low-interest rate but don’t charge an annual fee.

Combine this with the fact that American Express credit cards are not accepted as widely in New Zealand as Visa or Mastercard, and there aren’t many compelling reasons to choose the AMEX Low Rate card over the competition.

Other pros of the AMEX Low Rate card

- 2.99% interest for the first 6 months: For 6 months from when the account is opened, you be charged a lower rate of 2.99%. Once the six months is up, the outstanding balance will revert to the standard interest rate.

Cons of the AMEX Low Rate card

- Annual fee: Having an annual fee for a credit card is not uncommon, but when there are other low-rate cards out there without one, it’s hard to recommend one that has one.

- Annual fee: $59

- Purchase interest rate: 12.69%

Are American Express credit cards widely accepted?

Yes, American Express credit cards are widely accepted. However, they are still not accepted in as many places as a Visa or a Mastercard.

American Express has made great strides in terms of where it is accepted in New Zealand and boasts that 46,000 new places have signed up to accept the card since 2019 alone.

In a recent article, our Head of Publishing used an AMEX Platinum card for over a month to find out how widely accepted it was and whether it was still worth it for earning Airpoints. The article also includes a great list of stores and other outlets that accept the card, as well as those that currently don’t.

He found that the card was widely accepted at larger stores, subscription services, utility companies, and similar. But when it came to smaller, independent stores and cafes, it was important to have a back-up card handy as acceptance was less certain.

What is the eligibility criteria for an American Express card?

America Express plays its cards (geddit?) close to its chest in terms of eligibility criteria.

Not long ago the card provider used to list more specific information, such as income requirements. For example, it used to state that $60,000 was the minimum annual income for the Airpoints Platinum card while it doesn’t any more (note that we contacted AMEX directly and can confirm that that is still the case).

However, now it lists the same criteria for each card, which are as follows:

- You must be aged 18 or over

- You must have no history of bad debt or payment default

- You must have the right to work in New Zealand

- If you’re self-employed, you must have been trading for at least 18 months (or 12 months if you already hold an existing AMEX card).

You will also need to have:

- An NZ Driver’s Licence number (or an alternative suitable form of ID)

- Details of your income (and possibly expenses and debts)

- Proof of income (e.g. payslips)

But meeting these criteria does not automatically mean you will be approved. For example, you can expect that the card provider will want applicants of the Platinum Charge card (which has a hefty $1,250 annual fee) to have more disposable income than someone interested in the basic Airpoints card.

Kevin McHugh

Credit cards, share trading, money transfers, about banked.

- Terms of use

- Privacy policy

Discover. Compare. Save.

Our website is completely free to use. We may make money if you click a link on our website to another that offers a product or service. This is how our visitors support the work we do and it does not affect what we write about or how. Learn more on our about us page .

Our goal at Banked is to give you the information you need to make the best decision for you. We do not provide financial advice and all information is general in nature. Consider your own financial circumstances and goals before making any decision. Learn more in our terms of use .

Banked is a proud winner of the ‘Best Plain Language Website — Private Sector’ award 2023. Learn more .

How to get to (and stay in) a reopened New Zealand on points and miles

Update : Some offers mentioned below are no longer available. View the current offers here .

After more than two years, New Zealand has finally reopened to vaccinated tourists from visa waiver countries, including the United States. And it will open to the rest of the world beginning July 31. This is terrific news for travelers eager to either return to one of the world's most beautiful countries or finally visit for the first time.

Much like Australia, New Zealand is a trek to get to. Nonstop flight options are limited, but there are many one-stop options from most major U.S. cities. Getting there will be easier come September when Air New Zealand launches its highly anticipated nonstop service to New York's John F. Kennedy International Airport (JFK) . And, of course, you have plenty of hotels to choose from, ranging from budget to ultra-luxe, once you arrive in New Zealand.

Today, we're going to look at how you can book some of these flights and hotels using your points and miles. No matter what airline, hotel or transferable rewards you have at your disposal, you should be able to find at least one or two good ways to book an award trip to New Zealand.

For more TPG news, deals and points and miles tips delivered each morning to your inbox, subscribe to our daily newsletter .

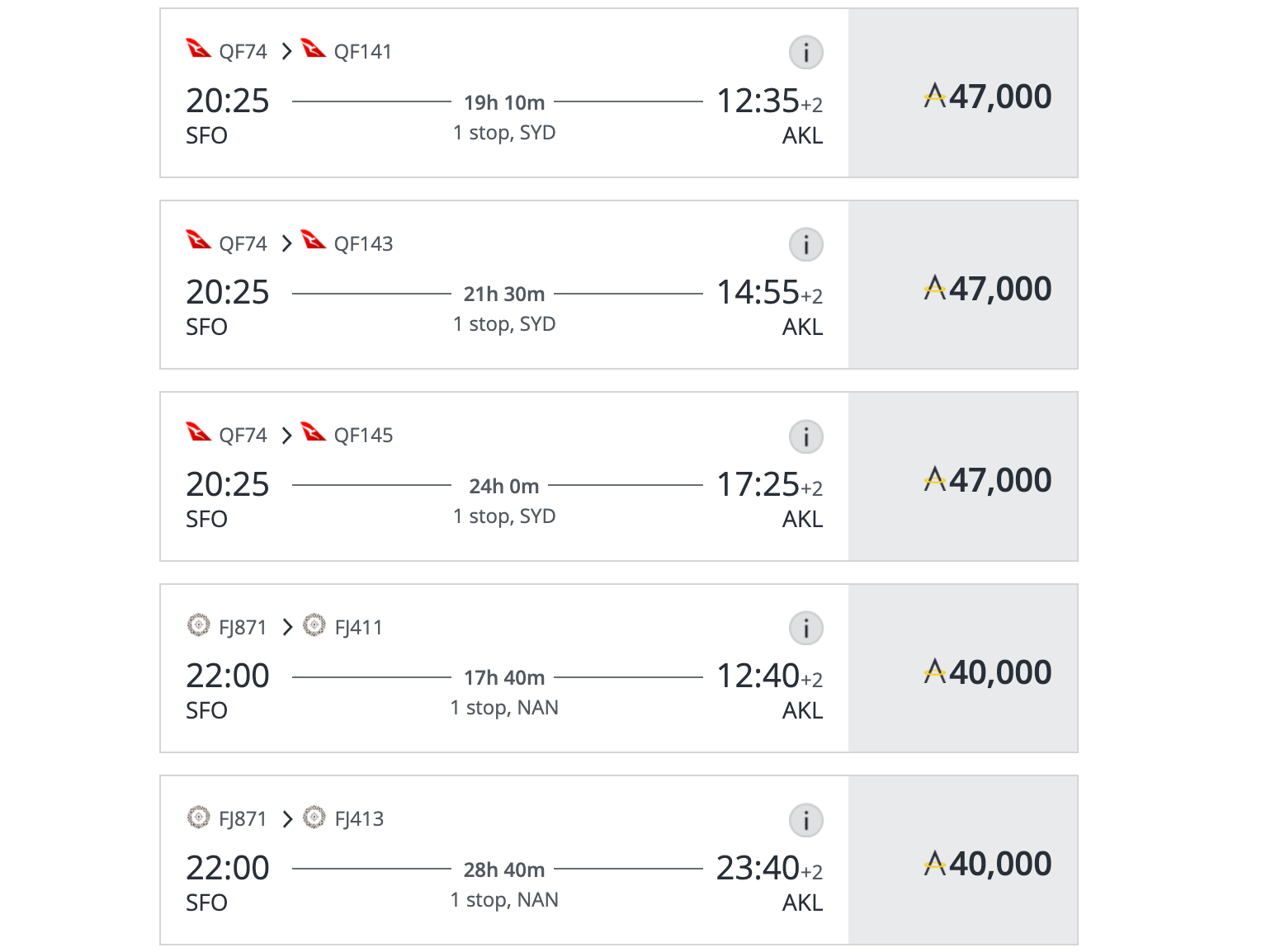

Flying to New Zealand with points and miles

Naturally, Air New Zealand offers the most flights to the island nation. This year, the airline will operate flights to Auckland Airport (AKL) from Chicago 's O'Hare International Airport (ORD), Los Angeles International Airport (LAX), San Francisco International Airport (SFO), Honolulu's Daniel K. Inouye International Airport (HNL) and Houston 's George Bush Intercontinental Airport (IAH). Starting Sept. 17, 2022, it will also offer thrice-weekly service to JFK.

Air New Zealand is a Star Alliance member, so you can easily connect from a partner flight (like those offered by United Airlines ) and book awards through Star Alliance partner programs . Alternatively, United offers its own nonstop flights between Auckland and San Francisco .

Related: A review of Air New Zealand's 777-300ER in business class

Oneworld flyers can normally fly to Auckland nonstop from Los Angeles on American Airlines , though American suspended that route through fall 2022. Alternatively, there are many one-stop options with Qantas Airways and Oneworld Connect member Fiji Airways. Although Fiji Airways isn't a full-fledged member of the alliance, you can still book awards using American, Alaska Airlines , British Airways , Cathay Pacific Airways and Qantas miles and enjoy some Oneworld elite benefits.

Unfortunately, the SkyTeam alliance doesn't offer nonstop service between the U.S. and New Zealand. There are some one-stop options with airlines like China Airlines , China Eastern Airlines and Korean Air , but they are limited compared to the other alliances.

Related: 9 reasons New Zealand should be on your bucket list

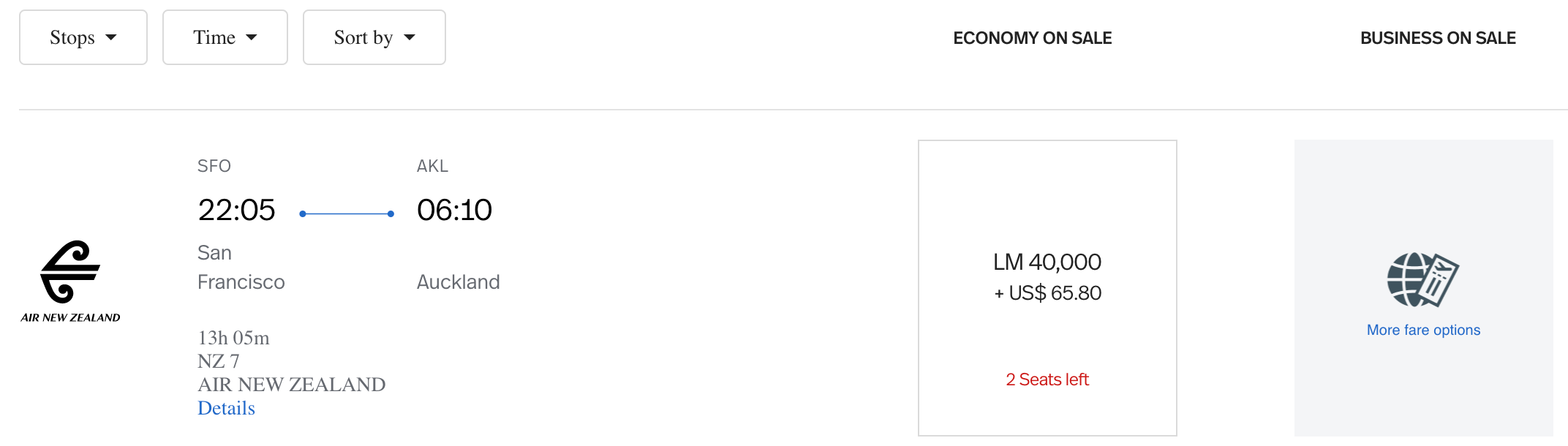

Booking Star Alliance flights to New Zealand

Finding award availability on Air New Zealand's U.S. routes is notoriously difficult, especially in business class . However, if you are lucky enough to come across these unicorns, you'll have some terrific redemption possibilities.

The cheapest way to book these awards is through Avianca LifeMiles . The program charges 40,000 miles each way in economy or 80,000 miles each way in business class from anywhere in the U.S. You can transfer points or miles to Avianca LifeMiles from American Express Membership Rewards , Capital One Travel and Citi ThankYou Rewards .

Related: The easiest airline miles to earn and why you want them

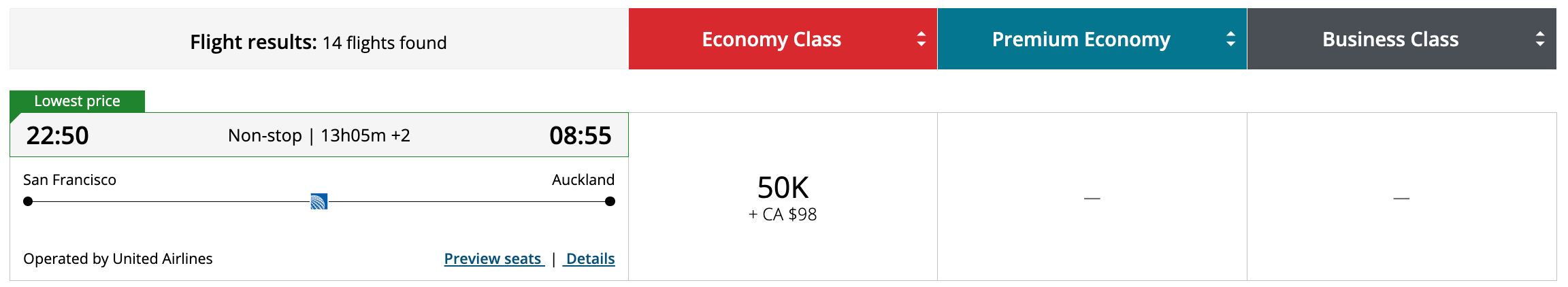

Alternatively, Air Canada Aeroplan charges around 50,000 to 60,000 miles each way in economy or 75,000 to 85,000 miles in business class, depending on the distance. That's a bit more expensive, but this option is useful for those looking to transfer Chase Ultimate Rewards points earned with a card like the Chase Sapphire Preferred Card.

If you have a stockpile of United MileagePlus miles, you could book United-operated flights from 40,000 miles each way in economy or 90,000 miles in business class. Of course, these rates could be much higher if there's no saver space availability or you're booking close in . Meanwhile, partner awards start at 44,000 miles for economy and 99,000 miles for business class. If you're short on United miles, you can boost your balance with a cobranded United card or by transferring Chase Ultimate Rewards points.

Related: How to book multiple trips for the price of one by maximizing United's routing rules

Another option to consider is Virgin Atlantic Flying Club . The program partners with Air New Zealand and charges 40,000 miles each way for economy awards or just 62,500 miles for business class, which is a steal. For flights from Hawaii, expect to redeem just 30,000 miles or 45,000 miles, respectively. However, Virgin only allows you to book nonstop flights, and you must call to book.

Related: Unlock incredible value with Virgin Atlantic Flying Club

Booking Oneworld flights to New Zealand

If you're looking to fly American, Qantas or Fiji Airways, your top three options are through American AAdvantage , the Alaska Airlines Mileage Plan and Cathay Pacific Asia Miles .

Asia Miles is ideal for those looking to spend transferable credit card points, as its a partner of American Express Membership Rewards, Capital One Travel and Citi ThankYou Rewards. Awards start at 40,000 miles each way for economy, 50,000 miles for premium economy and 75,000 miles for business class.

When there's saver space, American charges 40,000 AAdvantage miles one-way in economy, 65,000 in premium economy and 80,000 in business class.

Related: How to earn miles in the American Airlines AAdvantage program

But here's where things get interesting: The Alaska Airlines Mileage Plan charges the same rates as AAdvantage for American-operated flights, while Fiji Airways and Qantas awards cost just 55,000 miles each way in business class. Economy Fiji Airways awards will set you back 40,000 miles, economy Qantas awards come in at 42,500 miles and premium economy Qantas awards cost 47,500 miles. Alaska will let you add a free stopover in Fiji or Australia, so you can essentially take two trips for the price of one.

Related: See two cities for the price of one with stopovers

Booking SkyTeam flights to New Zealand

Given the limited flight options, finding SkyTeam award availability to New Zealand is very difficult.

If you're able to find availability, Delta SkyMiles offers awards from 55,000 each way in economy and 120,000 miles in business class. But again, these awards are rare, so you are usually better off sticking to Star Alliance or Oneworld programs.

Where to stay in New Zealand with points and miles

While New Zealand isn't home to as many points hotels from the major chains as Australia , there's still a nice mix of options, including some that recently opened .

Redeeming World of Hyatt points in New Zealand

One of the most luxurious options is the Park Hyatt Auckland, which opened in September 2020. It has a terrific waterfront location and an array of amenities, including a sumptuous spa and an infinity pool. Plus, local culture is incorporated throughout. As a Category 5 property in the World of Hyatt program , award nights will set you back 17,000 to 23,000 points per night.

Related: What is World of Hyatt elite status worth?

For a luxurious escape in nature, redeem your World of Hyatt points at Eichardt's Private Hotel in Queenstown. It's located right on the shores of Lake Wakatipu and offers breathtaking views. Rooms here don't come cheap, ranging from 35,000 to 45,000 points per night. However, as a Small Luxury Hotels of the World property, all World of Hyatt members get extra perks like free breakfast, early check-in, late checkout and a room upgrade.

If you're short on World of Hyatt points, you can quickly boost your balance by transferring points from Chase Ultimate Rewards or picking up the World of Hyatt Credit Card or World of Hyatt Business Credit Card.

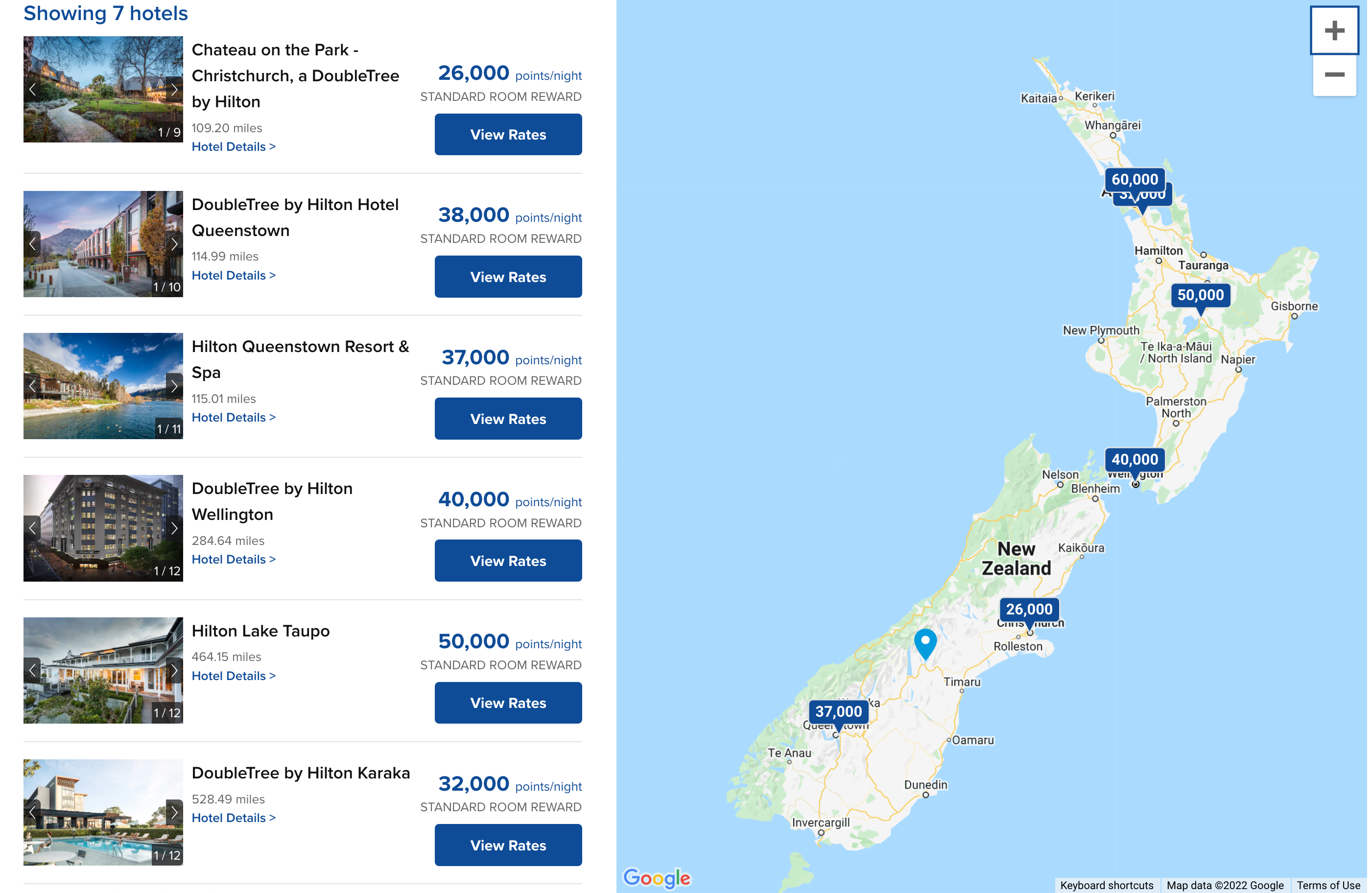

Redeeming Hilton Honors points in New Zealand

Hilton Honors loyalists have seven hotels to choose from across the island nation. If you're looking to stay in the heart of the action, check in to the Hilton Auckland . Located right along the water on Princes Wharf, the hotel is nautically decorated and features an outdoor lap pool with a unique underwater viewing window. Award nights typically range between 40,000 and 60,000 points per night.

Alternatively, you can stay about 30 minutes south of the city at the beautiful, new DoubleTree by Hilton in Karaka, an idyllic town known for its horse stud and sheep farms. Award nights here max out at 50,000 points per night.

Other great options include the Hilton Lake Taupo, the DoubleTree by Hilton Wellington, the Hilton Queenstown Resort & Spa, the DoubleTree by Hilton Hotel Queenstown and Chateau on the Park - Christchurch, a DoubleTree by Hilton.

Related: 8 ways to maximize Hilton Honors redemptions

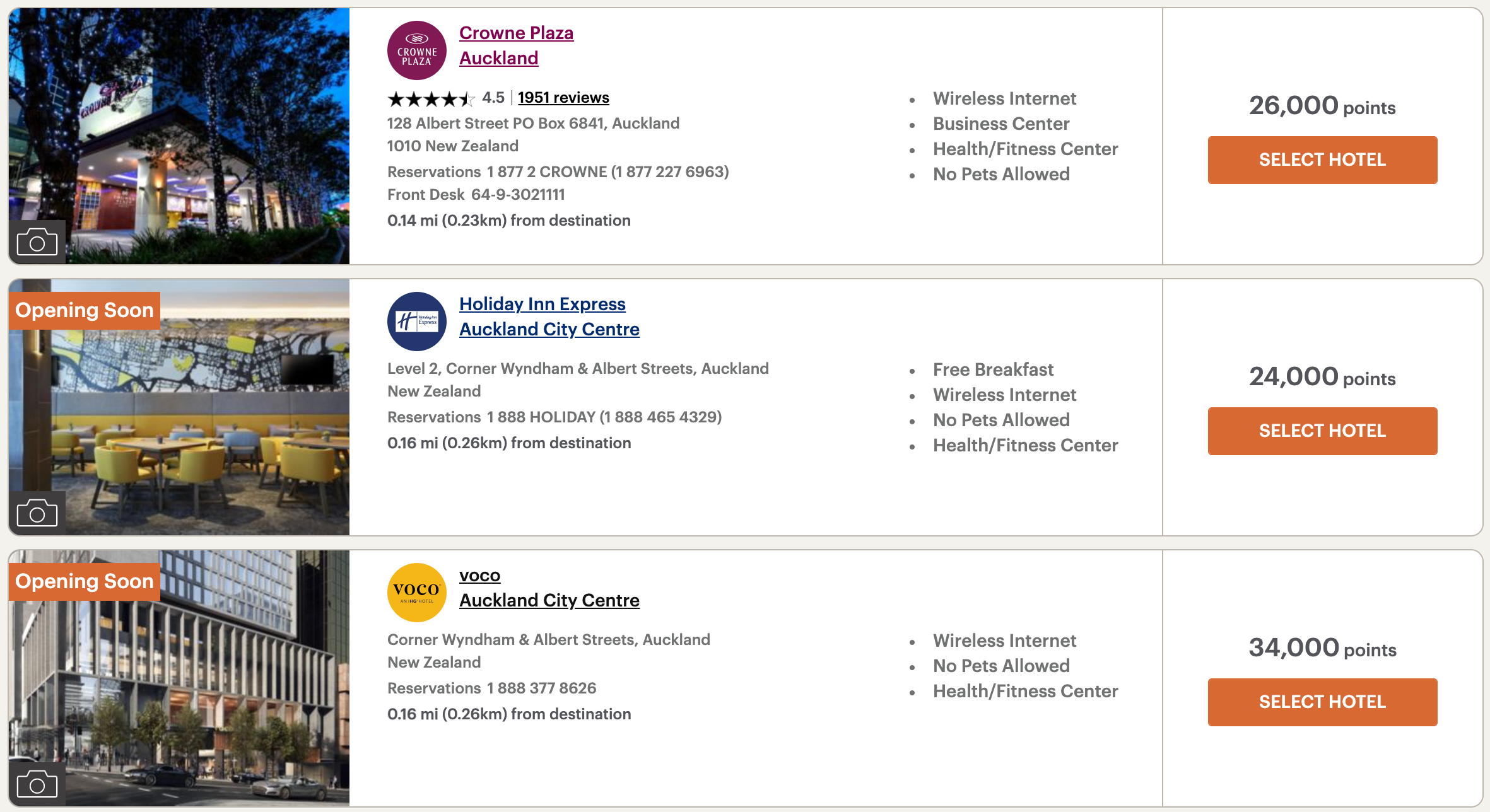

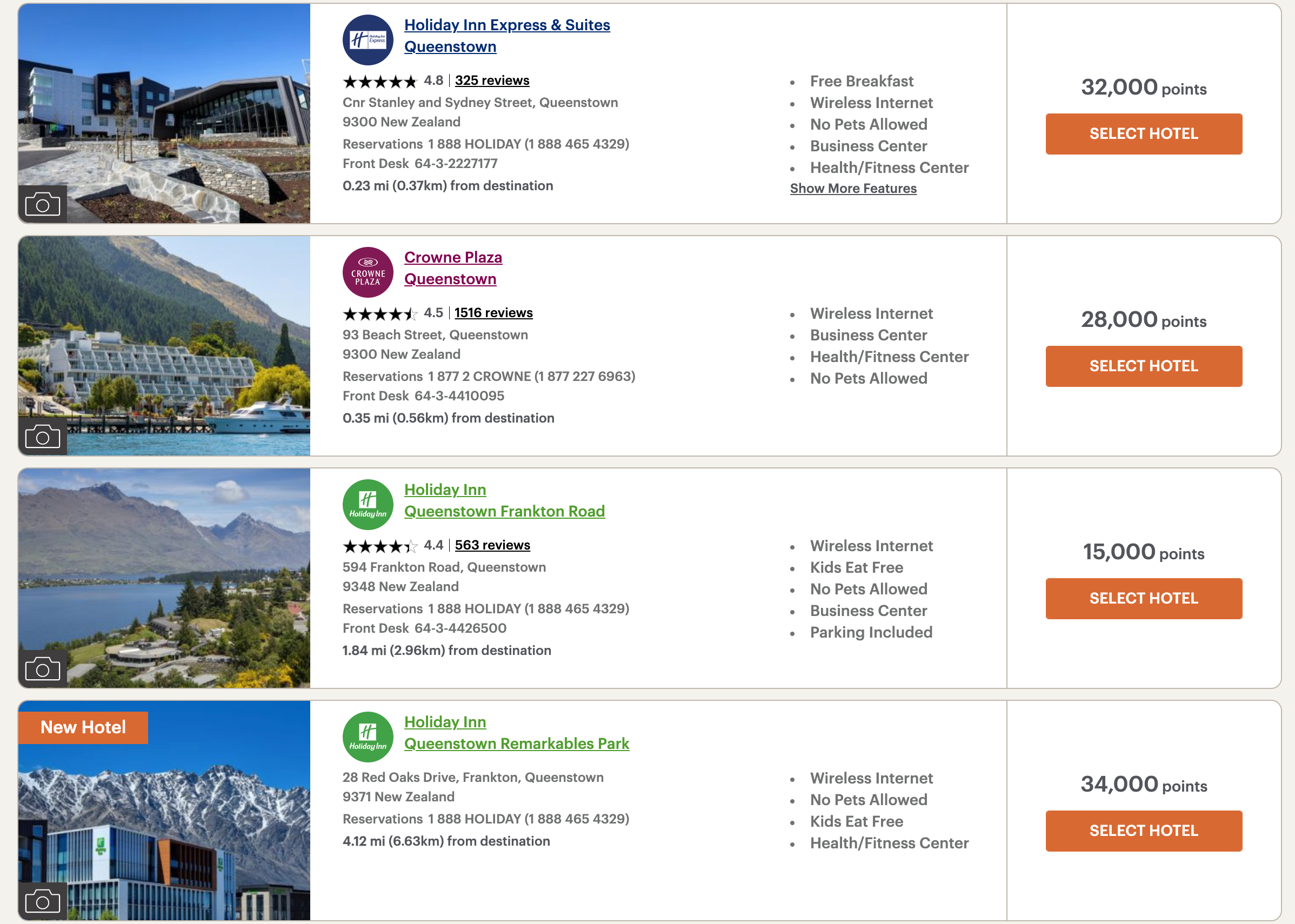

Redeeming IHG points in New Zealand

IHG offers a whopping 25 options in New Zealand, including chic new constructions like Voco Auckland City Centre, several Holiday Inns for those on a budget and several ultra-luxurious Mr & Mrs Smith properties .

Rooms at the new Voco typically hover around 36,000 points per night but can climb to 60,000 points during high season. Meanwhile, the new Holiday Inn Express Auckland City Centre (located in the same building as the Voco) and the Crowne Plaza Auckland tend to stay below 30,000 points per night. Farther south, the InterContinental Wellington usually costs around 30,000 points per night.

Related: How to use the IHG hotel award night certificate

In Queenstown, options include several Holiday Inns and a Crowne Plaza. Rooms at these properties usually range from 20,000 to 35,000 points per night.

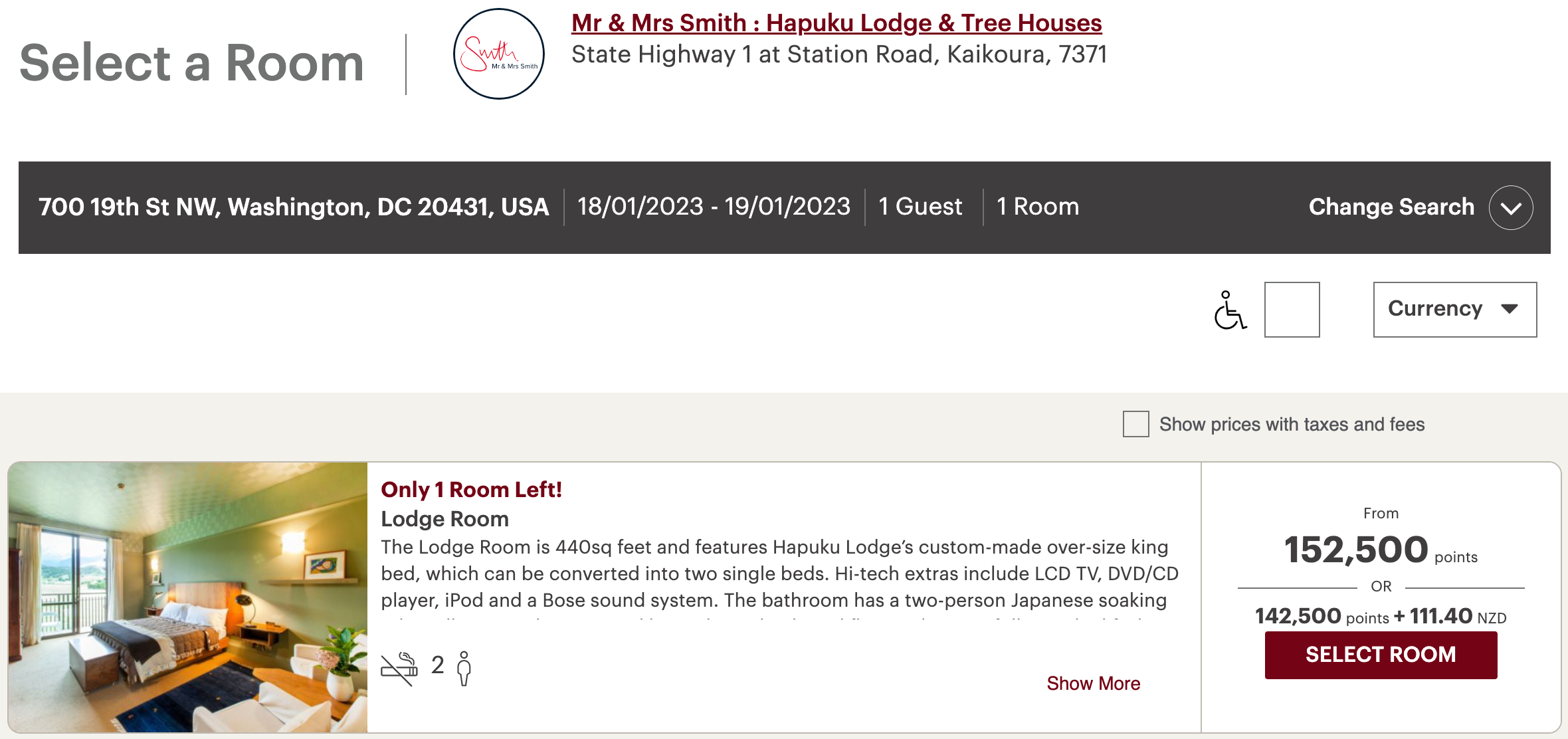

If you're looking to stay in the more unique, remote lodges that New Zealand is known for, the Mr & Mrs Smith collection is for you. These properties can retail for more than $1,000 per night, so award nights are priced accordingly. You could easily spend 150,000-plus points per night if you find availability.

Related: How to earn IHG Rewards points

Redeeming Marriott Bonvoy points in New Zealand

Marriott Bonvoy 's only option in New Zealand is the Four Points by Sheraton Auckland. Award nights here range between 20,000 and 30,000 points per night for stays through the end of 2022.

Related: 7 ways to maximize Marriott Bonvoy award night redemptions

Getting around New Zealand

Auckland has an extensive public transportation system, including buses, trains and ferries (though taking the ferry is more of an experience than a quick way to get around). Depending on how long you'll be in town, it could be worth purchasing and loading money onto an AT HOP card to save on your public transport rides. Ride-hailing services like Uber, Ola Cabs and Zoomy are also available.

If you plan to venture outside the city, you'll be best off renting a car for maximum flexibility. Just note that some credit cards that typically offer rental car coverage exclude protection in New Zealand. Also, remember that Kiwis drive on the left side of the road.

Whichever way you get around, make sure to pay for your travel expenses with a card that earns bonus points on travel. Two of our favorites include the Chase Sapphire Reserve and the Chase Sapphire Preferred Card, which earn 3 and 2 points per dollar spent on all travel purchases, respectively. These small purchases can add up during a long trip, so you may as well earn points on them.

Related: Best credit cards for rental car coverage

Bottom line

No matter where you go in New Zealand, you'll be spoiled by breathtaking scenery and plenty of activities to keep you busy.

Although it may seem like you're a world away from home, it's getting easier to visit the country using your hard-earned points and miles.

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

< American Express Global Lounge Collection® Programs & Partners

.css-6fedjl{cursor:pointer;padding:15px 20px;text-align:left;-webkit-transition:background-color 0.25S ease-in-out;transition:background-color 0.25S ease-in-out;width:100%;word-wrap:break-word;word-break:break-word;overflow-wrap:anywhere;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:flex-start;-webkit-box-align:flex-start;-ms-flex-align:flex-start;align-items:flex-start;}.css-6fedjl:hover:not(.expandableLink){background-color:rgba(151,153,155,0.08);}.css-6fedjl:focus{outline:dashed 1px #53565a;outline-offset:-3px;}.css-6fedjl:not(:last-of-type){border-bottom:0.0625rem solid #ecedee;} .css-ht06v4{color:inherit;font-family:inherit;font-size:inherit;line-height:inherit;cursor:pointer;min-width:0;max-width:none;padding:0;margin:0;border-radius:0;border:0;background-color:transparent;touch-action:manipulation;overflow-x:visible;overflow-y:visible;white-space:normal;cursor:pointer;padding:15px 20px;text-align:left;-webkit-transition:background-color 0.25S ease-in-out;transition:background-color 0.25S ease-in-out;width:100%;word-wrap:break-word;word-break:break-word;overflow-wrap:anywhere;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-align-items:flex-start;-webkit-box-align:flex-start;-ms-flex-align:flex-start;align-items:flex-start;}.css-ht06v4:focus{outline:dashed 1px #53565a;outline-offset:3px;}.css-ht06v4:hover{background:inherit;}.css-ht06v4:active{background:inherit;}.css-ht06v4:hover:not(.expandableLink){background-color:rgba(151,153,155,0.08);}.css-ht06v4:focus{outline:dashed 1px #53565a;outline-offset:-3px;}.css-ht06v4:not(:last-of-type){border-bottom:0.0625rem solid #ecedee;} .css-1qpimwg{display:inline-block;line-height:1;vertical-align:middle;font-size:1rem;color:#53565a!important;fill:#53565a!important;padding-right:0.625rem;vertical-align:text-top;display:inline-block;}.css-1qpimwg::before{font-size:1rem;}.css-1qpimwg svg{-webkit-transform:rotate(0deg);-moz-transform:rotate(0deg);-ms-transform:rotate(0deg);transform:rotate(0deg);-webkit-transition:-webkit-transform 0.25S ease-out;transition:transform 0.25S ease-out;vertical-align:middle;}@media (prefers-reduced-motion){.css-1qpimwg svg{-webkit-transition:color 0.25S ease-out,-webkit-transform 0s;transition:color 0.25S ease-out,transform 0s;}} .css-8jm638{-webkit-flex-basis:100%;-ms-flex-preferred-size:100%;flex-basis:100%;} Terms & Conditions

The american express global lounge collection®.

U.S Consumer and Business Platinum Card Members and any Additional Platinum Card Members on the Account are eligible for access to the participating lounges in the American Express Global Lounge Collection. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Global Lounge Collection benefit. All lounge access is subject to space availability. Each lounge program within the Global Lounge Collection has its own policies and access to any of the participating lounges is subject to the applicable rules and policies. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. To be eligible for this benefit, Card Account must not be cancelled. Please refer to each program’s terms and conditions to learn more.

The Centurion® Lounge

U.S. Platinum Card Members have unlimited complimentary access to all locations of The Centurion Lounge. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for access to The Centurion Lounge. All access to The Centurion Lounge is subject to space availability. To access The Centurion Lounge, Platinum Card Members must arrive within 3 hours of their departing flight and present The Centurion Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier and a government-issued I.D. Note that select lounges allow access to Card Members with a confirmed reservation for any same-day travel (departure or arrival). Refer to the specific location’s access policy for more information. Failure to present this documentation may result in access being denied. Card Members must be at least 18 years of age to enter without a parent or legal guardian. All Centurion Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from the Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive or violent. Soliciting other Card Members for access into our Lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among The Centurion Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates or policies. In addition to the complimentary services and amenities in the Lounge, certain services, products or amenities may be offered for sale. You are responsible for any purchases and/or servicing charges you make in The Centurion Lounge or authorize our Member Services Professionals to make on your behalf. Services available at the Member Services Desk are based on the type of American Express Card used to enter the Lounge. American Express will not be liable for any articles lost or stolen or damages suffered by visitors to The Centurion Lounge. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with Lounge access in any way or that you intend to do so, we may remove access to The Centurion Lounge from the Platinum Account. Use of The Centurion Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice. U.S. Platinum Card Members, U.S. Business Platinum Card Members and Additional U.S. Platinum Card Members on the Account will be charged a $50 fee for each guest (or $30 for children aged 2 through 17, with proof of age) unless they have qualified for Complimentary Guest Access. U.S. Platinum Card and U.S. Business Platinum Card Members may qualify for Complimentary Guest Access for up to two (2) guests per visit to locations of The Centurion Lounge in the U.S., Hong Kong International Airport and London Heathrow Airport (“Complimentary Guest Access”), after spending $75,000 or more on eligible purchases on the Platinum Account in a calendar year. Once effective, Complimentary Guest Access will be available for the remainder of the calendar year in which it became effective, the following calendar year, and until January 31 of the next calendar year (for example, if Complimentary Guest Access became effective on May 1, 2023, it would remain effective until January 31, 2025). Eligible purchases made by any Additional Card Members on the Platinum Account will contribute to the purchase requirement. Complimentary Guest Access is limited to two (2) guests per Card Member per visit, regardless of whether you are eligible for complimentary guest access through multiple Platinum Accounts or through other Amex Cards. Guest access policies may vary internationally by location and are subject to change. Eligibility for Complimentary Guest Access will typically be processed within a week of the Platinum Account’s meeting the purchase requirement, but may take up to 12 weeks to become effective. Complimentary Guest Access status will be reflected in the Benefits tab of your online Account and in the American Express App. Eligible purchases to meet the purchase requirement are for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, cash advances, purchases of travelers checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or other cash equivalents. If a Card Member upgrades or downgrades from a different American Express Card to a Platinum Account, eligible purchases made on that Card Account will count toward meeting the purchase requirement to achieve Complimentary Guest Access on the new Platinum Account.

Escape Lounges

This benefit is available to U.S. Platinum Card Members. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for access to Escape Lounges. Card Members receive complimentary access to all US locations of the Escape Lounges. Card Member must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Escape Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. The eligible flight must be booked on a U.S. issued American Express credit card and Card Members may bring up to two complimentary guests per visit. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Escape Lounge customers, including access to purchase non-complimentary items. Some product features may be subject to additional charges. Escape Lounge locations are subject to change without notice. Additional restrictions may apply.

Delta Sky Club

This benefit is available to U.S. Platinum Card Members and Additional Platinum Card Members on the Account (each, an “Eligible Platinum Card Member”). Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Delta Sky Club benefit. Platinum Card Members must present their valid American Express Card, government-issued I.D., and boarding pass to the Delta Sky Club ambassador. Boarding pass must show a reservation for a same-day Delta-operated flight (Delta or Delta connection) departing from or arriving at the airport in which the Delta Sky Club is located. Name on boarding pass must match name on the Card. Eligible Platinum Card Members on departing flights can only access the Delta Sky Club or the Delta Sky Club “Grab and Go” feature within 3 hours of their flight's scheduled departure time. During a layover between Delta-operated flights on the same ticket, you may use the Delta Sky Club in your connecting airport at any time during the layover. Delta reserves the right to limit access for non-revenue flyers at any Delta Sky Club. Individuals must be at least 18 years of age to access Delta Sky Club, and 21 years of age to access locations with a self-service bar, unless accompanied by a responsible, supervising adult who has access to the Delta Sky Club. Benefit valid only at Delta Sky Club. Partner lounges are not included. Note that amenities may vary among Delta Sky Club locations. Participating airport clubs and locations subject to change without notice. Eligible Platinum Card Members may bring guests into the Delta Sky Club subject to the most current Delta Sky Club access and pricing policies and must use their valid Platinum Card as the payment method for guest access. Guests also must be flying on a same-day Delta-operated flight. Guest access and fees subject to terms and conditions of participating airport clubs. Access is subject to Delta Sky Club rules. To review the rules, please visit delta.com/skyclub . Benefit and rules subject to change without notice. Additional restrictions may apply. Effective January 1, 2024: Eligible Platinum Card Members traveling on a same-day Delta-operated flight with Basic Economy (E) fare tickets will not have access to the Delta Sky Club or to Grab and Go. Effective September 14, 2023 through January 31, 2025: Eligible Platinum Card Members receive complimentary access to the Delta Sky Club or to Grab and Go when traveling on a same-day Delta-operated flight. Eligible Platinum Card Members may bring either up to two guests, or their immediate family (spouse/domestic partner and children under 21) to the Club at a per-visit rate of $50 per person, per location or to Grab and Go at a per-visit rate of $25 per person, per location. The Eligible Platinum Card must be used as the payment method to purchase guest access. Guests must also be flying on a same-day Delta-operated flight. Children under 2 years of age may accompany the Eligible Platinum Card Member for free. Effective February 1, 2025: Eligible Platinum Card Members will receive 10 Visits per Eligible Platinum Card per year to the Delta Sky Club or to Grab and Go when traveling on a same-day Delta-operated flight. Visits are non-transferable and may only be used by the Eligible Platinum Card Member. Visits issued from February 1, 2025 through January 31, 2026 will expire on January 31, 2026, and Visits issued in subsequent years will expire on January 31 of each calendar year thereafter. A “Visit” is an entry to one or more Delta Sky Clubs or usage of the Delta Sky Club “Grab and Go” feature, at one or more airports, for a period of up to 24 hours starting upon the first Delta Sky Club entry or Grab and Go usage, during an Eligible Platinum Card Member’s travel on a same-day Delta-operated flight. A single Visit permits usage of Delta Sky Club(s) in multiple airports during the 24-hour period. For example, if you visit a Delta Sky Club in different airports on a trip, entry into one or more of these Clubs will be considered part of the same Visit as long as these additional entries occur within 24 hours of the first Delta Sky Club entry. If travel exceeds 24 hours from the first Delta Sky Club, then a second Visit will be deducted if entering the Delta Sky Club or using Grab and Go more than 24 hours after the first entry. Eligible Platinum Card Members may not access the Club or a Grab and Go location in the three hours from the time of previous Grab and Go usage at the same airport. Once all 10 Visits have been used, Eligible Card Members may purchase additional Delta Sky Club Visits (including Grab and Go) at a per-Visit rate of $50 per person. Visits cannot be used for guest entry. During a Visit, Eligible Platinum Card Members may bring either up to two (2) guests, or their immediate family (spouse/domestic partner and children under 21) to the Club (including Grab and Go) at a per-Visit rate of $50 per person. The Eligible Platinum Card must be used as the payment method to purchase Card Member and guest access. Guests must also be flying on a same-day Delta-operated flight and be accompanied by the Eligible Platinum Card Member. Children under 2 years of age may accompany the Eligible Platinum Card Member for free. To earn an unlimited number of Visits (“Unlimited Delta Sky Club Access”) starting on February 1, 2025, the total eligible purchases on the Eligible Platinum Card Account must equal or exceed $75,000 (the “Purchase Requirement”) between January 1, 2024 and December 31, 2024 and in each calendar year thereafter. Unlimited Delta Sky Club Access will be provided to all Eligible Platinum Card Members once the Account has reached the Purchase Requirement. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Unlimited Delta Sky Club Access benefit. All entry requirements set forth above will continue to apply with respect to Unlimited Delta Sky Club Access. Unlimited Delta Sky Club Access will be processed within a week of the Eligible Platinum Card Account’s satisfying the Purchase Requirement in most instances but may take up to 12 weeks to become effective. Once effective, Unlimited Delta Sky Club Access will be available for the remainder of the calendar year in which it became effective, the following calendar year and through January 31 of the next calendar year (for example, if Unlimited Delta Sky Club Access becomes effective on May 1, 2025, it will remain effective through January 31, 2027). Eligible purchases made by any Additional Card Members on the Eligible Platinum Card Account will contribute to the Purchase Requirement. Eligible purchases to meet the Purchase Requirement are for goods and services minus returns and other credits. Eligible purchases do NOT include fees, interest charges, cash advances, purchases of travelers’ checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or other cash equivalents. If a Card Member upgrades or downgrades from a different American Express Card to an Eligible Platinum Card, eligible purchases made on the prior Card Account will count toward the Purchase Requirement. Delta reserves the right to revoke Unlimited Delta Sky Club Access if you return, reverse or charge back eligible purchases in a way that reduces your eligible spend below the Purchase Requirement for the calendar year. If Delta and/or American Express determine that you have engaged in abuse, misuse, or gaming in connection with this Delta Sky Club Access Benefit in any way or that you intend to do so, Visits may be deducted from your account and/or Unlimited Delta Sky Club Access revoked.

This benefit is available to U.S. Platinum Card Members. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Lufthansa lounges benefit. Platinum Card Members have complimentary access to select Lufthansa Business Lounges (regardless of ticket class) and Lufthansa Senator Lounges (when flying business class) when flying on a Lufthansa Group flight. To access the Lufthansa lounges, a Platinum Card Member must present their valid Platinum Card, a government issued I.D., and a same-day departure boarding pass showing confirmed reservation on a Lufthansa Group flight (Lufthansa, SWISS and Austrian airlines). Card Members must adhere to all rules of participating lounges. Participating lounges and locations subject to change without notice. Additional guest access and fees subject to terms and conditions of participating lounges. In some Lounges the Platinum Card Member must be at least 18 years of age to enter without a parent or guardian. Must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. For the most current list of Lufthansa lounges, guest access requirements, rules, and pricing policy, please visit https://www.lufthansa.com/de/en/lounges .

Plaza Premium Lounges

This benefit is available to U.S. Platinum Card Members. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Plaza Premium Lounges benefit. Card Members receive complimentary access to any global location of Plaza Premium Lounges. To access Plaza Premium Lounges, Card Member must present their valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. In some cases, Card Member must be 21 years of age to enter without a parent or guardian. Card Members may bring up to two (2) companions into Plaza Premium Lounges as complimentary guests. Must be of legal drinking age to consume alcohol. Please drink responsibly. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Plaza Premium Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Plaza Premium Lounge locations are subject to change.

Priority Pass Select

This benefit is available to U.S. Platinum Card Members. Platinum Card Members and Additional Platinum Card Members must enroll in the Priority Pass™ Select program through the benefits section of their americanexpress.com account or by calling the number on the back of their Card to receive the benefit. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Priority Pass Select benefit. Priority Pass is an independent airport lounge access program. You acknowledge and agree that American Express will verify your Card Account number and provide updated Card Account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass Select program and may use this information for marketing related to the program. Once enrolled, Platinum Card Members with a valid Card Account may access participating Priority Pass Select lounges by presenting their Priority Pass Select card and airline boarding pass. If the Card Account is canceled, you will not be eligible for Priority Pass Select and your enrollment will be canceled. When visiting a Priority Pass Select lounge that admits guests, Platinum Card Members receive complimentary access for up to two accompanying guests. After two guests, the Card Account on file with Priority Pass Select will be automatically charged the guest visit fee of the Priority Pass Standard program for each additional guest after you have signed up for the additional guest visit and it has been reported to Priority Pass by the participating lounge. Some lounges limit the number of guests or do not admit guests. In some lounges, Priority Pass Select members must be 21 years of age to enter without a parent or guardian. Priority Pass Select members must adhere to all house rules of participating lounges and access to participating lounges is subject to all rules, terms and conditions of the applicable lounge. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a nominal fee. Priority Pass Select lounge partners and locations are subject to change. All Priority Pass Select members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package, and can be viewed at www.prioritypass.com . Upon receipt of your enrollment information, Priority Pass will send your Priority Pass Select card and membership package which you should receive within 10–14 business days. If you have not received the Priority Pass card after 14 days, please contact American Express using the number on the back of your American Express® Card. To receive immediate access to lounges after your enrollment in Priority Pass Select has been processed, you can activate your membership online by using your Priority Pass Select membership details to receive a Digital Membership Card. For a step-by-step guide on the activation process, visit prioritypass.com/activation .

Additional Global Lounge Collection Partner Lounges

American Express offers access to additional lounges in the Global Lounge Collection where U.S. Platinum Card Members have unlimited complimentary access to participating locations. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for access to participating locations. Card Members must present their valid Platinum Card, a government-issued I.D., and a boarding pass showing a confirmed reservation for same-day travel on any carrier. Guest access and associated fees are subject to the terms and conditions of the participating lounge provider. Participation, locations, rates, and policies of lounges are subject to change without notice, and Card Members and their guests will not be compensated for such changes. Amenities, services, and hours may vary by participating lounge and are subject to change without notice. American Express and the participating lounge will not be liable for any articles lost or stolen, or damages suffered by the Card Member or guests inside the participating lounge. For participating lounges with a self-service bar, the Card Member may be required to be of legal drinking age in the participating lounge jurisdiction to enter without a parent or legal guardian. All Card Members and their guests must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. Each participating lounge may have their own policy allowing for children under a certain age to enter for free with the Card Member who is a parent or legal guardian. Card Member must adhere to all house rules of participating lounges. If American Express, in its sole discretion, determines that the Card Member or their guests have engaged in abuse, misuse, or gaming in connection with access to participating lounges in any way, or that the Card Member or their guests intend to do so, we may remove access to the Additional Lounges from the Account. American Express and the participating lounge reserve the right to revise the rules at any time without notice. For the most current list of participating lounges and access requirements, please use the Lounge Finder feature in the American Express App or visit www.americanexpress.com/findalounge .

- Personal Loans

- GST Calculator

- Personal Credit Cards

- Savings Accounts

- Term Deposits

- Buy Now Pay Later

- Kiwisaver - Coming Soon

- Travel Insurance

- Car Insurance

- House Insurance

- Contents Insurance

- Money Transfers

- Business Credit Cards

- Business Loans

- Business Overdrafts

- Mobile Phone Plans

- Personal Finance

Recent Posts

American Express Credit Cards in New Zealand

American Express has become a household name for credit card users across the world, primarily because it’s a reliable brand with generous rewards. With tens of thousands of businesses accepting American Express payments in New Zealand, now is the time to join the millions of users taking advantage of the convenience and perks offered by American Express.

The American Express Platinum Card

The Amex Express Platinum Card is a charge card with incredible perks.

Best Rewards Rate

If rewards are what you want, the Platinum Card can help you reach them faster. With 2 points for every $1 spent, this is the best reward earn rate among all Amex cards.

Enhanced Lifestyle

If you enjoy travel and fine dining, use your card to earn up to $300 Dining Credits for the best New Zealand restaurants and $200 to spend toward travel each year with Fine Hotels + Resorts and The Hotel Collection.

Personal Concierge

With the Platinum Card, you get your very own Personal Concierge to help out with anything you need! A Concierge can take care of things like travel arrangements, organising tickets to sold-out events, sourcing the perfect gift for a loved one, or any other task you need help with.

Free Insurance

Use your card to pay for a return trip or your smartphone costs and you can receive complimentary travel insurance or smartphone screen repair insurance.

Transfer Points

When you’re earning points at such a high rate, it’s handy to know they can be transferred to use towards airline and hotel programmes. There are 7 airline rewards and 2 hotel programs available for points transfers.

Travel Benefits

You and a friend get complimentary VIP access to 1,200 airport lounges around the world. Upgrade your car hire and hotel with loyalty programmes including Hilton, Marriott, Bonvoy, Radisson Rewards and Accor Hotels.

Luxury Resort and Hotel Bonuses

Use your Amex Platinum Card to access amazing perks at 5-star accommodation venues around the world. Improve your trip by enjoying breakfast daily, early check-in, late check-out, room upgrades and more.

The American Express Airpoints Platinum Card

The Amex Airpoints Platinum Card is for the credit-savvy traveller.

Complimentary Travel Insurance

All travellers know how expensive travel insurance can be over a number of trips. But in this day and age, travel insurance is one of those essentials many don’t leave home without. When you book your return trip with your Amex card, you’ll receive complimentary Travel Insurance.

Phone Screen Insurance

Use your credit card to purchase a smartphone or pay for your monthly mobile bill (including SIM-only plans) to get complimentary smartphone screen repair insurance. This free insurance covers claims of up to $500 for screen repairs, with a 10% excess.

Fastest Airpoints Dollar Earner

Anyone who likes to travel will be excited to know that for every $59 spent, you earn 1 Airports Dollar. The Airpoints Platinum Card is the fastest way to earn Airpoints Dollars with a platinum card in New Zealand.

Free Additional Cards

With up to four additional cards completely free, you can quickly earn Airpoints Dollars by getting the family involved.

Earn Upgrades

Every $250 spent earns status points for you to put towards airport benefits such as seat upgrades, increased baggage, lounge access and priority service. You also qualify for a Koru Lounge discount on your sign up fee and for your annual fee for each year you hold the card.

The American Express Airpoints Card

The Amex Express Airpoints Card is a cost-effective credit card with Airpoints Dollar rewards

No Card Fee

One of the great things about this credit card is the absence of an annual free. So you can earn rewards without having to worry about paying for the privilege.

Six months interest-free

All purchases for the first six months are interest-free. If you’re looking to consolidate credit card debt, you’ll have a six-month interest-free period — which could mean a significant cost saving if you have a large existing credit card balance. After six months, the interest-free period reverts to 55 days.

Earn Airpoints Dollars

For every $100 spent, you earn 1 Airpoints Dollar. So you can build rewards to go towards your next trip simply by using your Amex card for your everyday spending.

Online Fraud Protection

Any unauthorised charges on your card will be covered when you swiftly report the fraudulent transaction. So you don’t need to worry about

Up to 4 Cards Free

To make the most of the reward building potential of this fee-free credit card, you can get up to four cards for free for your family members to use.

The American Express Gold Rewards Card

If rewards are what you’re looking for, the Amex Gold Rewards Card won’t disappoint.

Fast Rewards

With 2 Membership Rewards points for every dollar you spend, there is no better AMEX card for earning rewards at this rate. The points can be redeemed for gift cards, travel bookings or used to pay off eligible purchases.

Welcome Offers

If you’re a new Amex customer, you might be lucky enough to claim an introductory offer. American Express often have welcome offers, including cash back or bonus points for new customers who meet the criteria. Check out our comparison tables for more information on the latest welcome offers.

55 Days Interest-free

If you pay your balance within the interest-free period, you’ll enjoy up to 55 days of interest-free credit card purchases.

Earn Dining Credits

With participating restaurants across New Zealand, you can indulge in fine cuisine while earning up to $200 back each year. Simply spend $100 to qualify for a $100 credit.

To boost your reward earning potential, AMEX offers additional cards for free, so you can get the rest of your family equipped to build up those rewards points with their very own sleek metal AMEX card (available in gold or rose gold).

Benefits of using an American Express card

With a huge range of benefits, there’s an Amex card to add value to anyone’s lifestyle.

One of the best features of Amex cards is the generous rewards programs that let you use your rewards points for purchases, travel or gift cards.

- Purchases. Your points can be used for purchases with participating retailers such as Ticketmaster and Harvey Norman. Your points convert to cash that can be spent on products, concerts, sporting events and other attractions. You can also use points for your charges on eligible items, which basically means you redeem them and spend it as though it’s cash.

- Travel. If you’ve been bitten by the travel bug, your reward points can be used to pay for travel through American Express Travel Online, Helloworld, travel agency gift cards, or transfer your points to participating Airline Rewards and Guest Partner Programmes.

- Gift cards. The Amex gift card collection has lots to choose from, so you’re bound to find something for everyone. Choose from retail, travel and entertainment gift cards. American Express Experiences If you’ve ever wanted to be treated like a VIP at big-ticket events, Amex makes it possible. Access pre-sale tickets, exclusive events, and kick back in Entertainment Lounges at selected venues worldwide (Entertainment Lounges are yet to be introduced in New Zealand).

American Express Experiences

If you’ve ever wanted to be treated like a VIP at big-ticket events, Amex makes it possible. Access pre-sale tickets, exclusive events, and kick back in Entertainment Lounges at selected venues worldwide (Entertainment Lounges are yet to be introduced in New Zealand).

Perks and Upgrades

Amex provides a huge range of benefits for dining, travel and entertainment. Airport lounge passes, dining credit, accommodation upgrades, and even a personal concierge, Amex makes any experience one to remember

Depending on the card you choose, there are different types of complimentary insurance available:

- Travel Insurance is available for domestic and international travel. To access the cover, you’ll generally need to use your card to pay for an eligible item or your trip.

- Smartphone Screen Repair Insurance is available when you use your card to pay for your phone expenses. You can claim up to $500 for screen repairs with a 10% excess.

Amex Eligibility Criteria

If you’d like to apply for an American Express Card, these are the criteria that must be met:

Aged 18 or over. Have no bad debt history or payment defaults. Have the right to work in New Zealand. Have a pre-tax income of at least $35,000 per year (this amount may be more depending on which card you are applying for). If self-employed, you must have been trading for at least 18 months (12 months for existing Amex Card holders).

Compare Personal Credit Cards

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

[Expired] Air New Zealand Amex Offer: Spend $1,250, Get $225 Back

James Larounis

Senior Content Contributor

557 Published Articles 1 Edited Article

Countries Visited: 30 U.S. States Visited: 35

Stella Shon

News Managing Editor

98 Published Articles 701 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

![amex travel nz [Expired] Air New Zealand Amex Offer: Spend $1,250, Get $225 Back](https://upgradedpoints.com/wp-content/uploads/2023/03/Air-New-Zealand-business-seats.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Air new zealand amex offer details, how to access amex offers, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Update: The offer mentioned below has expired and is no longer available.

There’s a new Amex Offer out that will save you quite a bit of money if you need to purchase a new ticket on Air New Zealand. Amex Offers are free to all American Express cardholders, and if you’re targeted, you can save $225 if you spend $1,250 or more on Air New Zealand airfare.

When you spend $1,250 or more on qualifying airfare through Air New Zealand through March 16, 2024, you’ll receive a $225 statement credit back.

There are a number of restrictions, however:

Like most Amex Offers, your purchase can be made in multiple transactions, though if you’re originating in the U.S. to fly down to New Zealand, your airfare will likely exceed $1,250 anyways.

- You must purchase your airfare on the Air New Zealand website , the Air NZ mobile app , or over the phone at 800-262-1234 . Make sure your purchase is not done on any of Air New Zealand’s other country websites — your purchase must be from the U.S. version of the website to trigger the offer. In addition, purchases done at a ticket office, at an airport, or via a third party are not eligible. This includes travel agents.

- Your flight needs to begin in the U.S ., so for those living in Australia and starting your journey from there, this offer won’t be as useful for you.

- Air New Zealand Cargo

- Air New Zealand Explorer Pass

- Koru membership

- Koru guest passes

- Tandem Travel

- Bookings of events, tours, activities, hotels, cars, campervan rentals, or airport transfers through Air New Zealand

To access Amex Offers , open up your American Express app or website and click the Offers tab. Search and see if you see an offer for Air New Zealand and then add it to your card. Keep in mind, the offer may show up on multiple cards — or no cards at all — and you’ll need to add it to your account in order for the savings to apply.

Hot Tip: Check out our definitive guide to Air New Zealand’s direct routes from the U.S. for inspiration on planning your next flight.

If you’re anticipating traveling down to New Zealand, book before March 16, so you can take advantage of this generous offer to get a $225 statement credit after spending $1,250 or more on airfare with Air New Zealand.

Was this page helpful?

About James Larounis

James (Jamie) started The Forward Cabin blog to educate readers about points, miles, and loyalty programs. He’s spoken at Princeton University and The New York Times Travel Show and has been quoted in dozens of travel publications.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- My Account My Account

- Cards Cards

- Travel Travel

- Insurance Insurance

- Rewards & Benefits Rewards & Benefits

- Business Business

IMAGES

COMMENTS

To earn or redeem Membership Rewards points, Cards must be enrolled to the American Express Membership Rewards program, and your Card Account must be in good standing. To redeem Membership Rewards Points with American Express Travel Online, you need to have available limit on your Card for the full transaction amount of the booking.

To redeem Membership Rewards Points with American Express Travel Online, you need to have available limit on your Card for the full transaction amount of the booking. ... Travel services provided by American Express International (NZ), Inc. Incorporated with limited liability in Delaware, USA. Licenced Travel Agent, 600 Great South Road ...

All travel bookings are subject to availability. Subject to the American Express Travel Online standard booking Terms and Conditions. 7. Partner terms and conditions apply. Available to New Zealand enrollees who reside in New Zealand only. Enrolment in the New Zealand American Express Membership Rewards Programme is required. A fee may apply.

American Express has your back with our range of Credit Cards, from Low Rate Cards to Travel and Insurance and more. Find the right one for you or your business today. American Express New Zealand - Credit Cards: Offers, Low Rate & Travel Insurance

Browse our Customer Service Centre today to find answers to specific questions about American Express Travel, such as Travel Credit and Insurance. Click now. ... For General Credit or Charge Card and Travel Enquiries Call 0800 656 660 (or +64 9 583 8300 if outside New Zealand) Charges may apply.

American Express Travel New Zealand. Jarden House, Level 5, 21 Queen Street. Auckland 1010. New Zealand. Business Hours . Monday to Friday. 09:00 - 20:00. Travel services provided by American Express International (NZ), Inc. Incorporated with limited liability in Delaware, USA. Licenced Travel Agent, 600 Great South Road, Greenlane, Auckland ...

American Express Travel Insurance is issued and underwritten by Chubb Insurance New Zealand Limited (Chubb) Company No. 104656, FSP No. 35924 and distributed by American Express International (NZ) Inc. Company Number 867929, Financial Services Provider Number 43608 (American Express). American Express receives a commission from Chubb for ...

To modify a reservation, you can cancel and rebook your reservation on amextravel.com or by calling a representative of amextravel.com at 1-800-297-2977. To be eligible for the 3X Membership Rewards® points, any changes to an existing reservation must be made through the same method as your original booking.

Travel services provided by American Express International (NZ), Inc. Incorporated with limited liability in Delaware, USA. Licensed Travel Agent, Jarden House, 21 Queen Street, Auckland 1010 TAANZ Licence No. 3282, IATA Licence No. 24 3 44725 ... (THC) bookings of two or more consecutive nights made through Platinum Travel service or American ...

Lastly, Air New Zealand offers a few nonstop routes between the U.S. and New Zealand: Los Angeles (LAX) - Auckland (AKL) ... Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ...

Book fine hotels and resorts with American Express Travel and enjoy exclusive benefits, such as room upgrades, complimentary breakfast and more.

The right travel credit card can mean you avoid annoying FX fees or save hundreds or thousands of dollars by activating comprehensive travel insurance. And best of all, the leading Travel Credit Cards are useful for everyday spending in New Zealand and earn meaningful rewards. New Zealanders have, for the most part, historically been ripped off ...

With the AMEX Gold Rewards Card and AMEX Platinum Card, which both earn 2 AMEX points for every $1 spent, to acquire 126,500 Qantas points, you'd need to spend $126,500 on your card (given the earning rate of 2 per $1 spent and the transfer rate to Qantas of 2:1). Given the estimated $5,000 value of the flight, every $1 spent on your AMEX Card ...

AMEX Travel portal: 1 cent (when booking travel through American Express' travel portal). Redeeming for statement credit: The value is around 0.45 cents to 0.52 cents (the more you redeem, the better the value). Redeeming for AMEX fees (such as card renewals): 0.50 cents (based on the flat rate of 1,000 Membership Rewards points equaling 5 ...

The best credit cards with travel insurance. We look at some of the best credit cards that include complimentary travel insurance as standard. 1. American Express Airpoints Platinum. The AMEX Airpoints Platinum has a number of advantages over other credit cards when it comes to travel insurance. Firstly, the cover it offers applies to both ...

Best for earning Airpoints: The American Express Airpoints Platinum card. The AMEX Airpoints Platinum card has a lot going for it, but there is one feature that really makes it stand out: it has the best Airpoints earn rate in New Zealand — and it's not even close. Every $59 spent on the AMEX Airpoints Platinum will earn you one Airpoints ...

If you're looking to stay in the more unique, remote lodges that New Zealand is known for, the Mr & Mrs Smith collection is for you. These properties can retail for more than $1,000 per night, so award nights are priced accordingly. You could easily spend 150,000-plus points per night if you find availability.

Valid only for new The Hotel Collection (THC) bookings of two or more consecutive nights made through Platinum Travel service or American Express Travel Online. Available for: Consumer Platinum Card® Members and Consumer Gold Card Members. Booking must be made using an eligible American Express® Card in the eligible Cardmember's name.

The American Express Membership Rewards Program Review for New Zealand Cardholders. The American Express Membership Rewards programme offers travel, shopping, cashback and many other options for cardholders earning points whilst spending. This guide explains what you need to know about earning and using your points to maximise their value.

As a Platinum Card Member, you can enjoy access to the Strata Lounge at Auckland International Airport, where you can relax and refresh before your flight. The lounge offers complimentary food and drinks, Wi-Fi, showers, and more. Find out how to enter and what to expect from this premium lounge.

If you've been bitten by the travel bug, your reward points can be used to pay for travel through American Express Travel Online, Helloworld, travel agency gift cards, ... (Entertainment Lounges are yet to be introduced in New Zealand). American Express Experiences. If you've ever wanted to be treated like a VIP at big-ticket events, Amex ...

To earn or redeem Membership Rewards points, Cards must be enrolled to the American Express Membership Rewards program, and your Card Account must be in good standing. To redeem Membership Rewards Points with American Express Travel Online, you need to have available limit on your Card for the full transaction amount of the booking.

When you spend $1,250 or more on qualifying airfare through Air New Zealand through March 16, 2024, you'll receive a $225 statement credit back. There are a number of restrictions, however: Like most Amex Offers, your purchase can be made in multiple transactions, though if you're originating in the U.S. to fly down to New Zealand, your ...

You may contact the insurer at 1-888-877-1710 in Canada and the U.S. or visit rsagroup.ca. In this outline, we have given a brief description of just some of the benefits available under Amex® Travel Insurance. All insurance coverage is subject to the terms and conditions of the Group Policy issued to Amex Bank of Canada and the applicable ...