United Kingdom Travel Insurance

What should your travel insurance cover for a trip to the united kingdom.

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is making sure your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

How Does Travel Insurance Work in the UK?

Picture this: You've planned a scenic road trip through the Scottish Highlands, a land of misty glens and ancient castles. You stumble upon the enchanting Fairy Pools on the Isle of Skye. Imagine, a misstep on the slippery terrain, and suddenly you've got a sprained ankle, not the souvenir you had in mind.

With AXA Travel Protection, you receive access to our 24/7 emergency hotline. Speak to a licensed multilingual travel assistance agent, they can help assist and direct emergency transportation if necessary to your location. With an AXA Travel Protection plan, we are here to assist and support you whenever and wherever you may be.

Here’s the entire list benefits travelers can have access to with an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation: In non-medical crisis situations (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Baggage Benefits:

- Luggage Delay: If your checked baggage is delayed by the airline, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you have to cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Additional Travel Benefits that are Optional

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policyholders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policyholders, this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policyholders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policyholders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for the United Kingdom?

Americans aren't required to purchase domestic or international travel insurance to visit United Kingdom. But it’s still highly recommended that you have a travel insurance plan before embarking on your next trip.

Why? There are several reasons:

Medical Emergencies: Your health is a top priority. If you face a sudden illness or injury in New York, travel insurance offers the means to receive prompt and quality medical care.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Flight Delays: Travel disruptions like flight delays can happen. If you miss a connecting flight or incur additional expenses due to delays, travel insurance can help cover the costs.

How Much Does Travel Insurance Cost for United Kingdom?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

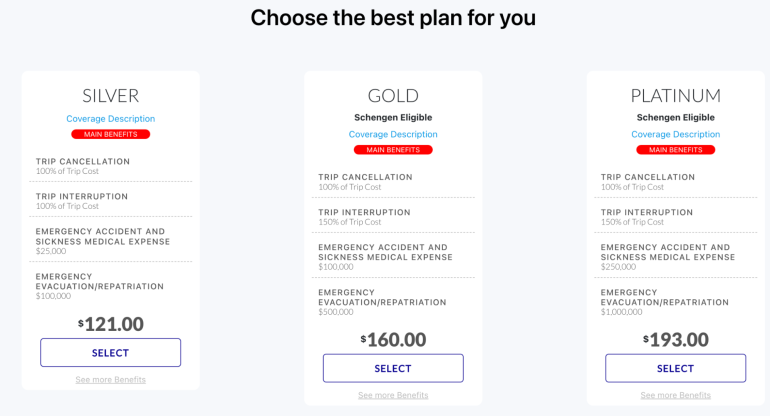

With AXA Travel Protection, travelers to United Kingdom will be offered three tiers of insurance: Silver, Gold and Platinum . Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that United Kingdom hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses.

The Platinum Plan is your go-to choice if you're looking for extra coverage aligned with the United Kingdom experience. " Cancel for Any Reason " offers greater flexibility for those unexpected twists in your travel plans and the " Rental Car (Collision Damage Waiver) " offers assistance when you're out exploring United Kingdom's stunning landscapes in a rental car.

Additionally, part of the Platinum Plan is the " Lost Skier Days " benefit, offering potential reimbursement if ski resorts unexpectedly close due to ever-changing snow conditions. These perks make the Platinum Plan an excellent option for anyone seeking comprehensive protection during their exciting United Kingdom adventures.

What if I have a preexisting medical condition?

Traveling with preexisting medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum Plans offer coverage for preexisting medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plan with a preexisting medical condition, so long as it’s within 14 days of placing your initial trip deposit and in our 60 day look back period. We're here to make sure you travel with ease, no matter your health situation.

Does the UK Have Any COVID-19 Restrictions for U.S. Visitors?

American visitors can breathe a sigh of relief that the UK no longer has any COVID-19 restrictions for visitors coming from the United States. You do not need to fret over getting a COVID test or submit proof of vaccination upon arrival in the UK.

Do You Need Car Insurance to Drive in the UK?

It’s illegal to drive in the UK without vehicle insurance. This also applies to those driving on an international license, even if it’s only for a brief period. If you are renting a car, however, we strongly recommend you purchase rental car insurance. AXA Travel Protection can help you with that by offering Rental Car Insurance (Collision Damage Waiver.) This coverage provides extra coverage for your rental car against damage and theft.

Are There Any Other Requirements for Traveling to the UK?

American citizens are considered non-visa nationals in the UK. Therefore, they neither require a visa (for short-term travel) nor need to fulfill any other conditions to visit and travel across the UK.

UK Travel Insurance FAQs

Can you buy travel insurance after booking a flight.

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.)

AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip.

Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14-days of making your initial trip deposit.

Do Americans need travel insurance for the UK?

UK law doesn’t require U.S. citizens visiting the UK for a short time (up to six months) to carry travel insurance. However, it’s a good idea to carry international travel insurance for the United Kingdom for unforeseen events.

What is needed to visit the United Kingdom from the USA?

U.S. citizens only need a passport and a ticket to travel to the UK. The passport must have at least one empty page and validity for the duration of your trip.

What happens if a tourist gets sick in the United Kingdom?

The UK has a National Health System (NHS) that provides medical care across the country. If a tourist gets sick in the UK, they can get medical care from an NHS center. However, it’s important to note that while the NHS services are free for the locals, tourists are charged about 150 percent of the cost of their treatment.

https://www.gov.uk/guidance/travel-to-england-from-another-country-during-coronavirus-covid-19 https://iasservices.org.uk/do-american-citizens-need-a-visa-for-uk/ https://www.uswitch.com/car-insurance/driving-in-the-uk-on-a-non-uk-licence/ https://www.forbes.com/advisor/travel-insurance/can-i-travel-to-the-uk-from-the-united-states/ https://www.forbes.com/advisor/travel-insurance/destinations/uk-trips/ https://www.gov.uk/guidance/foreign-travel-insurance https://travel.state.gov/content/travel/en/international-travel/International-Travel-Country-Information-Pages/UnitedKingdom.html https://www.gov.uk/take-medicine-in-or-out-uk https://travel.state.gov/content/travel/en/international-travel/International-Travel-Country-Information-Pages/UnitedKingdom.html#ExternalPopup

Image Credits

Photo by Robert Tudor on Unsplash

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

At your side, everyday

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Anya Kartashova is a freelance writer and full-time traveler based in Salt Lake City. She has written about travel rewards and personal finance for FrugalTravelGuy, Fodor's, FlyerTalk, 10xTravel and Reward Expert. Her goal is to visit every country in the world by offsetting the cost with points and miles.

Megan Lee joined the travel rewards team at NerdWallet with over 12 years of SEO, writing and content development experience, primarily in international education and nonprofit work. She has been published in U.S. News & World Report, USA Today and elsewhere, and has spoken at conferences like that of NAFSA: Association of International Educators. Megan has built and directed remote content teams and editorial strategies for websites like GoAbroad and Go Overseas. When not traveling, Megan adventures around her Midwest home base where she likes to attend theme parties, ride her bike and cook Asian food.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

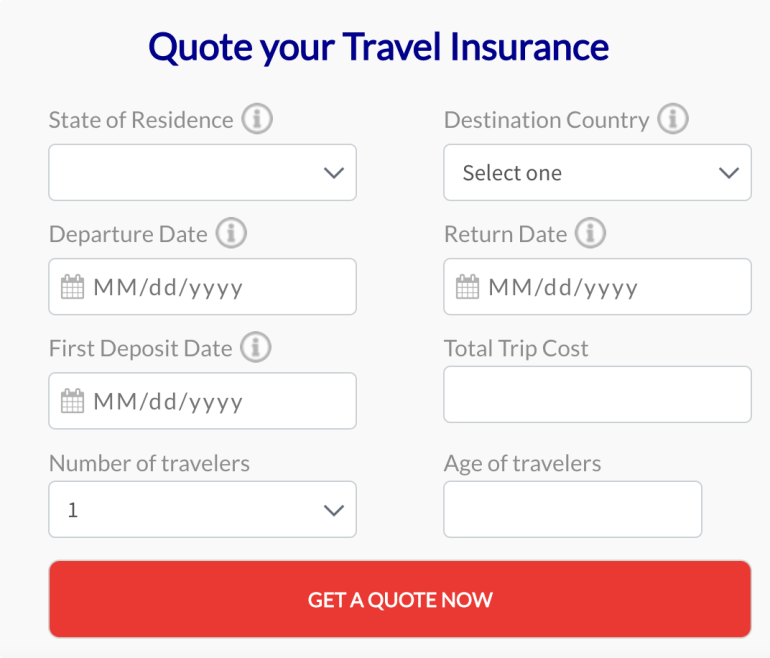

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

COVID Information | Click here to learn more about our COVID Travel Insurance

Why should I purchase Travel Insurance?

Whether you're embarking on a weekend getaway or a month-long adventure, unexpected events can happen. An AXA protection plan can help ease your mind and help safeguard your trip, offer reimbursement for covered medical costs, and provide travelers with 24/7 access to assistance services, among other benefits.

Need to cancel your trip due to an unforeseen event?

Get coverage for your trip against illnesses, injuries, and natural disasters. Travel insurance can reimburse you for your prepaid, non-refundable trip costs.

Was your luggage lost or stolen?

Our travel plans can offer reimbursement for the value of your belongings, up to the policy limit. This includes coverage for lost or stolen passports, visas, or other important travel documents, as well as any necessary expenses related to replacing these items.

Stranded due to unexpected travel delays?

Whether it’s rebooking your flight, finding alternative transportation, or providing a place to stay, our 24/7 travel assistance team is here to help!

Is domestic and international medical coverage provided?

Our travel plans can provide up to $250,000 in medical coverage domestically and internationally for emergencies and accidents while traveling.

SILVER PLAN

Best for Domestic Travel

- 100% of Insured Trip Cost for Trip Cancellation

- $25,000 Emergency Accident & Sickness Medical

- $750 Baggage & Personal Effects

Best for Cruise

- $100,000 Emergency Accident & Sickness Medical

- $1,500 Baggage & Personal Effects

PLATINUM PLAN

Optional Cancel For Any Reason Coverage

- $250,000 Emergency Accident & Sickness Medical

- $3,000 Baggage & Personal Effects

AXA Customer Reviews

4.8 base on 1111 reviews in

Compare Our Silver, Gold, Platinum Plans

Axa travel insurance benefits.

Medical Travel Benefit

AXA offers coverage for certain emergency medical expenses that result from an accidental injury or illness while traveling as well as emergency medical evacuation and repatriation. Learn more

Trip Cancellation

We can reimburse you up to the maximum benefit of your selected travel plan, that is due to an unforeseen event including illness and inclement weather and other covered reasons. Learn more

Emergency Evacuation

AXA Offers coverage for medically necessary evacuations and repatriation as directed by a physician to the nearest adequate medical facility or your home. Learn more

Baggage Loss

AXA offers reimbursement coverage in the event your baggage or personal effects are lost damaged or stolen during your trip. Learn more

Cancel For Any Reason

AXA offers coverage up to 75% of your prepaid nonrefundable trip costs if your trip is cancelled for any reason. Learn more

Trip Interruption

AXA offers coverage for your non-refundable trip costs in the event you cannot continue on your trip due to a covered reason. Learn more

MY TRIP COMPANION

Not just a travel app but a comprehensive travel assistant that enhances your travel experience.

Frequently asked questions about travel insurance, what is travel insurance, what does travel insurance cover on a cruise, why choose axa, how much does travel insurance cost, what is a pre-existing medical condition, does travel insurance have covid benefits.

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Make the most out of your travels. Get AXA Travel Insurance and travel worry free!

Over 20 Years of Experience | Located in 30+ Countries | 24/7 Travel Assistance

Common concerns about travel insurance.

- It is a clever idea to purchase travel insurance If you are willing to protect your trip from variety of common travel-related incidents, including trip cancellations, flight delays or cancellations, lost or stolen baggage, and medical emergencies.

- Travel insurance provides coverage against medical expenses, reimbursement for lost or stolen luggage, compensation for expenses incurred due to travel delays and more while you are travelling.

- Travel insurance is to provide financial protection to travelers in case of unexpected events. Without adequate insurance coverage, travelers may face significant financial losses and hardships if they encounter any unforeseen circumstances while traveling in the Schengen Territory.

- A good option for travelers who are concerned about unforeseeable events or who want the freedom to cancel their trip for any reason. When you purchase CFAR coverage, you can cancel the trip without losing your entire prepaid, nonrefundable vacation expenses. Exclusive to Platinum Package holders.

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may be eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a weeklong, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550

Premiums for AXA plans are between 6.5% and 9.2%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to Purchase and Manage Your AXA Policy

The process of purchasing an AXA policy is simple. After obtaining your quote, you'll need to decide which of AXA's three plans you want to buy. When you pay for your plan, be prepared to provide additional personal information, like your birthday, phone number, and address.

Once you finalize your purchase, you'll have a 10-day free-look period, in which you can cancel your policy and get your money back.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can email them to [email protected] or send them by mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

If you need assistance when filing claims, AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the U.S.). Office hours are 9:30 a.m.-5 p.m. ET on Thursdays and 8:30 a.m.-5 p.m. ET on all other weekdays.

AXA's U.S. branch has few reviews on Trustpilot and the Better Business Bureau — just over 20 between the two sites. Its UK branch has over 1,100 reviews, most of which are overwhelmingly negative. However, the quality of AXA Travel Insurance UK isn't necessarily indicative of its U.S. coverage.

In fact, on SquareMouth, where the majority of AXA U.S.'s reviews, reviews are generally positive. It received an average of 4.22 stars out of five across over 900 reviews. Customers reported that adjusting an AXA policy was easy and the customer service team was responsive. However, reviews on the claims process was more mixed, with spotty communication and long wait times.

See how AXA travel insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA to Travel Guard , we'll look at the coverage levels from their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

Read our AIG Travel Insurance review here.

AXA Assistance USA vs. Allianz Travel Insurance

Allianz Travel Insurance provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz Travel Insurance. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Read our Allianz Travel Insurance review here.

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research the terms of your credit card's travel protection before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policyholders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

Read more about how Business Insider rates insurance products here.

AXA Assistance USA FAQs

If you're diagnosed with COVID-19 before a trip and need to cancel, AXA may cover your expenses. Additionally, a COVID-19 diagnosis during a trip may be covered under AXA's medical expense, trip interruption, and trip delay benefits. Be sure to review your policy to ensure coverage details.

While you may extend your coverage in certain circumstances, such as extended hospitalization, and update your travel dates prior to your departure, you can't extend AXA travel insurance plans while you're traveling.

AXA's Gold and Platinum plans cover pre-existing medical conditions as long as you purchase your policy within 14 days of your initial trip deposit. AXA's Silver plan does not cover pre-existing conditions and has a 60-day look-back period.

You can download AXA claims forms on its website and email them to [email protected].

AXA isn't the most flexible travel insurance company and isn't great at specializing, but it offers comprehensive general coverage. Its prices aren't significantly more expensive or cheaper than its competitors.

- Main content

COMMENTS

In general, travel insurance to the United Kingdom costs about 3 - 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans: Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip.

Car insurance. Get AXA Car Insurance from as little as £316 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 March and 31 May 2024). We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023). Find out more

Online AXA Travel Insurance UK provides the most complete protection for you and your travel companions: Longstanding international r eputation and expertise: over 20 years of on-site experience and thorough knowledge of local cultures all over the world. Various types of comprehensive travel insurance policies: short-stays, multi-trip, low ...

If you become sick in Europe, travelers with AXA Travel Protection can contact the AXA Assistance hotline 855-327-1442. Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

How to get a Travel Protection Quote. Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time ... Get AXA Travel Insurance and travel worry free! Hidden. PLANS Gold Silver Platinum Compare Plans BENEFITS Cancel for Any Reason ...

With AXA travel insurance you benefit from assistance throughout your trip: before, during and after and everywhere in the world. Take advantage of our comprehensive guarantees: coverage of your medical expenses abroad, 24-hour medical assistance, teleconsultation, travel cancellation insurance, repatriation insurance and loss of luggage.

It's important to note that this doesn't make travel insurance unattainable for older individuals. With AXA Travel Protection, travelers to United Kingdom will be offered three tiers of insurance: Silver, Gold and Platinum. Each provides varying levels of coverage to cater to individual's preferences and travel needs.

Barclays - Aviva Travel Insurance (Travel Pack) 91% policy score - 1st out of 129 policies rated. We like: Barclays was the most consistently impressive policy we rated, scoring well in 61 of 66 areas we examined. In addition to high cover levels (for example, £10,000 cover for cancelling your trip), it has comparatively low compulsory ...

Single travel insurance is tailored for those who travel abroad once a year - the traditional holidaymaker. It will cover flight cancellations, lost luggage, damage of property and certain health issues. There's no guarantee your airline will reimburse you for a flight delay or cancellation, and your trusted credit card won't cover your ...

Despite the reviews we mentioned at the top of the page, AXA paid over 94.2% of travel insurance claims made between May 2018 and April 2019. The average amount paid was over £855. The Association of British Insurers (ABI) recently revealed that the average claim in 2018 reached £800, the highest amount on record.

Car insurance. Get AXA Car Insurance from as little as £316 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 March and 31 May 2024). We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023). Find out more

Get quotes for health & medical insurance in the UK with AXA - Global Healthcare. Our flexible plans support expat professionals, families & retirees abroad. ... Air travel: in-flight tips for a healthier you ... Get a quote today. Give us a call on +44 (0)1892 596418*.

Data based on the average price of travel insurance sold through MoneySuperMarket in May 2024. Based on an individual aged 30 taking European cover. Cover starts on 22nd April 2024. We compare travel insurance from 42 leading providers to find the right deal for you on your next holiday. Get rewarded when you compare quotes with us.

TUI UK Limited, trading as TUI and First Choice, arrange travel insurance underwritten by Inter Partner Assistance S.A, part of the AXA Group. If you are abroad and need urgent assistance please contact the Emergency Medical Assistance Service on +44 (0)203 093 0032

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

Compare AXA Travel Insurance Plans which includes benefits like trip cancellation, interruption, emergency medical expense, emergency evacuation and baggage delay to help give you peace of mind before and during your trip. ... GET A QUOTE 855-327-1441 Hidden. PLANS Gold Silver Platinum Compare Plans BENEFITS Cancel for Any Reason Trip ...

Car insurance. Get AXA Car Insurance from as little as £316 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 March and 31 May 2024).We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023).

Travel Insurance Expert. Updated: Jun 1, 2024, 9:47am. Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations ...

With our travel insurance we can take great care of you too. GET A QUOTE. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace ...

Car insurance. Get AXA Car Insurance from as little as £316 (10% of AXA Comprehensive Car Insurance customers paid this or less between 1 March and 31 May 2024). We pay out 99.8% of car insurance claims (Data relates to personal car insurance claims for policies underwritten by AXA Insurance UK plc from January to December 2023). Find out more

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

For those on a tighter budget or who want basic coverage, AXA provides Low Cost Schengen Area travel insurance that meets your visa requirements from as little as €22 per week. This will cover you for medical expenses up to €30,000 in all Schengen countries and offer you coverage in case of repatriation. A certificate proving you are ...

Lines are open Monday to Friday 9am to 5pm. Email [email protected]. Emergency Medical Assistance. +44 (0)147 335 6274. Lines are open 24/7 all year. AA Travel Insurance - a range of great value policies to suit your holiday or business trip, including medical expenses.

Introduction to AXA Travel Insurance. AXA Assistance USA is among the best travel insurance companies.It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical ...