Galapagos Travel Regulations

Before you travel

No vaccination is required to travel to Ecuador and the Galapagos Islands. However, it is recommended to receive Yellow Fever, Hepatitis A and Typhoid vaccines especially if you are planning to take tours outside of the cities of Quito and Guayaquil (like the the Amazon and coastal regions ) before of after your Galapagos tour. Please consult a health specialist for further recommendations.

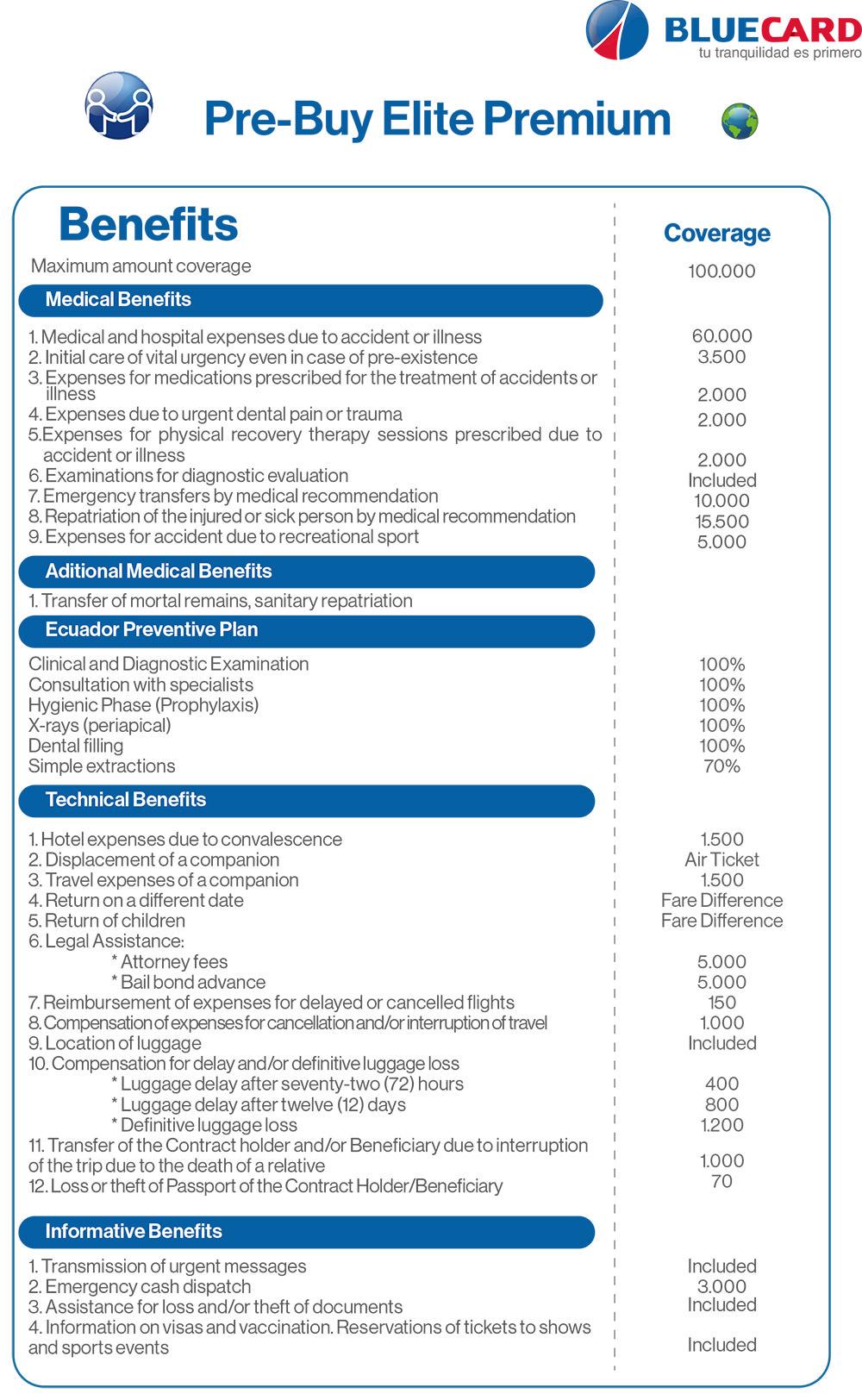

As of June 2018, a Health Insurance has become mandatory for all travelers entering Ecuador. This insurance must be acquired in your country of residency prior to your departure.

Travel Insurance , while not being mandatory, is highly recommended to have, as it will protect you against unforeseen problems with your flight connections and the possibility of missing your cruise/tour. Please refer to our Terms and Policies section to review our refund policies.

International Flights

The Galapagos Islands do not receive international flights. The airports from the mainland cities of Quito or Guayaquil receive all international flights in Ecuador.

It is recommended to stay in either of these cities at least for night prior and after your cruise. You could even take part of one of our amazing add-on tours and trip extensions in continental Ecuador. The Andes countryside and the Amazon rainforest are just few hours away!

Passports & Visas

Citizens of the United States, Canada and most European countries do not require a visa to travel to Ecuador unless they expect to stay for more than 90 days over the couse of one year. All travelers are required to have passports with a remaining validity of at least 6 months beyond their travel dates.

Traveling with kids

There is no age restriction for visiting the Galapagos Islands. However, some cruises , specially yachts and small boats, do not accept children under the age of 6 years old. Larger boats and cruise ships may be more accommodating to younger guests, some even offering special activities and services for them.

Please consult with your trip advisor if you have any boat in mind for your Galapagos cruise and are planning to go with small children. Hotels in Galapagos don't have age restrictions.

Traveling to the Islands

Local flights.

All travellers must come from the mainland cities of Quito or Guayaquil in local flights that take from 2 to 2.5 hours. Most cruise operators rely on particular flights that match the time of their itineraries for a seamless service.

Please consult your trip advisor if you are planning to buy your Galapagos flights by your own. To learn more about flights to and from Galapagos click here.

Transit Control Card

The acquisition of the TCC is mandatory to enter the Galapagos Islands. It has a value of US$20.00* payable only in cash at the airports of Quito or Guayaquil, before embarking your Galapagos flight . After acquiring the card you must pass your luggage through a security point where it will be inspected for items not allowed into the islands, such as fruits and vegetables.

National Park entrance fee

Once at the airports of Galapagos (in the islands of Baltra or San Cristobal), international travelers are required to pay a National Park entrance fee of US$100* per person. This one-time-only amount helps the Ecuadorian government on the conservancy and protection of this pristine environment.

*Fees are subject to change without prior notice.

On the Islands

Boat regulations.

All boats cruising the Galapagos Islands must endure a rigorous process of approval on many technical and logistical aspects to be allowed to operate in the National Park.

The sites visited, time of the day and activities allowed, and even the maximum number of passengers, is regulated in order to make the least impact on this fragile ecosystem. Private owned yachts are not allowed to visit the Island's points of interest but are allowed to dock on the main ports with an official approval.

National Park rules

All travelers must obey the following regulations while in the Galapagos Islands National Park . Failure to comply with these rules may result in sanctions by the Ecuadorian government.

- Keep a distance of 2 meters from wildlife including your cameras.

- Do not touch or feed the fauna.

- Do not remove elements from the ecosystem.

- Do not smoke, drink alcohol or make campfires.

- Walk on marked trails only.

- Take pictures without flash. Professional shootings and drones need authorization.

- Camping is only allowed in authorized areas.

- Use authorized sport fishing boats.

- Do not introduce external elements to the ecosystem.

- Motorised water-crafts, submarines, and air tourism is prohibited.

Please remember:

- To visit protected areas with a specialized guide only.

- Do not vandalize the National Park

- Use authorized tourism services only.

- Classify your trash.

The Ecuadorian government has implemented regulations to restrict the consumption of single-use plastics in the Galapagos region, including plastic straws, single-use plastic bags (t-shirt type), polythene containers (such as those used for takeout), and plastic bottles.

Therefore, all passengers visiting the islands will not be allowed to take along with them, or in their luggage, any of the type of objects described above. This regulation is effective as of June 2018.

Partners & Sponsors:

Payment Options:

Call the Galapagos Experts

- 1-877-260-5552

- 0800-098-8940

- 593-2-6009-554

- Contact us on WhatsApp

- View more phone numbers

- Request a Call-back

Galapagos Island health insurance

An ounce of prevention is worth a pound of cure. That phrase can summarize our recommendations when it comes to health insurance before traveling to the Galápagos Islands. Everyday we get a lot of questions about the Galapagos Entry Requirements and the health insurance is the most frequent one.

G alápgos is a unique destination and that’s what caughs the attention of all tourist. Not for nothing they are called “ The enchanted Islands ” and to keep its uniqueness the Galápagos government has a set of rules and requirements tourists have to comply with in order to enjoy the islands.

Galápagos is also an adventure destination and that means most activities and daily tours are outdoors, doing snorkeling in open water with sharks, rays, climbing to the top of a volcano , relaxing on an isolated paradisiac beach, hiking and so on. To live this is an amazing experience but it also carries a bit of risk. Saying this we don’t want to scare you away. Most activities are safe and you are always in the company of a well experience certified guide and its really unlikely that something happens to you during your trip.

However, even a small accident can be a bit more complicated in Galápagos because of the location of the tours. Imagine you are hiking on a small islet and you twist your ankle. In any other destination it would be an easy call to an ambulance but in Galápagos you’ll probably need a helicopter ambulance to get you because that would be faster and more efficient and also, a bit expensive. This specially if you had to take a boat ride to reach there.

Must have items for your Galapagos Trip

Do i need health insurance for my galapagos trip.

The short answer is yes. Given the covid 19 situation, health and travel insurance is now a mandatory requirement for the Galápagos Islands.

Even if it wasn’t mandatory, we highly advise you to get one. They are as cheap as $3 a day and can save you a lot of money for even the slightest accident or a bug bite for example. It’s always better to be prepared. We recommend Mondo Health Insurance and if you book following this link you’ll get a 5% discount. Click here to get 5% on insurance discount.

Galapagos Health Insurance Price

You can get health and travel insurance for your trip to the Galapagos Islands for as low as $3 a day. The final price always depends on the coverage and how long are you staying on the islands (the more days, the cheaper it gets). Get a free insurace quote with 5% discount here . If you would like a quote or help with your Galapagos itinerary feel free to drop us a line and we’ll be happy to help you.

You may also like

Galapagos Covid Restrictions

Galápagos entry requirements

Santa Cruz Galapagos – Things to do, free activities and must do tours

What’s the best health insurance for my galapagos trip.

There’s plenty of insurance companies offering different plans, we recommend you to get the one that fits better your needs and your budget. In Galapagos Low Cost we work with Mondo Health Insurance but any authorized company will work to comply with the entry requirements, so make sure you pick the one of your preference and make sure it covers covid 19 as Mondo does.

Let us plan your trip!

Let us build you a personalized itinerary to travel Galápagos on a budget. Drop us a line with the amount of days you plan to travel, dates & things you would like to do and we’ll get back to you with a proposal built specially for you.

¿Te ha parecido útil?

¡Danos 5 estrellas!

Puntuación promedio 5 / 5. Votos 2

Sé el primero en calificar este post

Compartelo con tus compañeros de viaje y comienza a planificarlo

Related posts.

One Comment

Hello 4 of us might be traveling to guayaquil Dec 16, Galapagos Dec 17 to 21 / 2020. From USA. What kind of health insurance we need, and will cover covid19, too. Please coverage plan and price. Thank you. Erick

Leave A Comment Cancel reply

Privacy overview.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Destination Guide: Galápagos Islands

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

Ecuador, including the Galápagos Islands Traveler View

Travel health notices, vaccines and medicines, non-vaccine-preventable diseases, stay healthy and safe.

- Packing List

After Your Trip

Be aware of current health issues in Ecuador. Learn how to protect yourself.

Level 1 Practice Usual Precautions

- New Global Dengue June 20, 2024 Dengue is a year-round risk in many parts of the world, with outbreaks commonly occurring every 2–5 years. Travelers to risk areas should prevent mosquito bites. Destination List: Argentina, Brazil, Burkina Faso, Cambodia, Colombia, Costa Rica, Curaçao, Ecuador, including the Galápagos Islands, Ethiopia, Fiji, French Guiana (France), Guadeloupe, Guatemala, Guyana, Honduras, Indonesia, Laos, Mali, Martinique (France), Mauritius, Mexico, Nicaragua, Panama, Paraguay, Peru, Samoa, Singapore, Sri Lanka, Sudan, Uruguay

⇧ Top

Check the vaccines and medicines list and visit your doctor at least a month before your trip to get vaccines or medicines you may need. If you or your doctor need help finding a location that provides certain vaccines or medicines, visit the Find a Clinic page.

Routine vaccines

Recommendations.

Make sure you are up-to-date on all routine vaccines before every trip. Some of these vaccines include

- Chickenpox (Varicella)

- Diphtheria-Tetanus-Pertussis

- Flu (influenza)

- Measles-Mumps-Rubella (MMR)

Immunization schedules

All eligible travelers should be up to date with their COVID-19 vaccines. Please see Your COVID-19 Vaccination for more information.

COVID-19 vaccine

Chikungunya

There has been evidence of chikungunya virus transmission in Ecuador within the last 5 years. Chikungunya vaccination may be considered for the following travelers:

- People aged 65 years or older, especially those with underlying medical conditions, who may spend at least 2 weeks (cumulative time) in indoor or outdoor areas where mosquitoes are present in Ecuador, OR

- People planning to stay in Ecuador for a cumulative period of 6 months or more

Chikungunya - CDC Yellow Book

Hepatitis A

Recommended for unvaccinated travelers one year old or older going to Ecuador.

Infants 6 to 11 months old should also be vaccinated against Hepatitis A. The dose does not count toward the routine 2-dose series.

Travelers allergic to a vaccine component or who are younger than 6 months should receive a single dose of immune globulin, which provides effective protection for up to 2 months depending on dosage given.

Unvaccinated travelers who are over 40 years old, immunocompromised, or have chronic medical conditions planning to depart to a risk area in less than 2 weeks should get the initial dose of vaccine and at the same appointment receive immune globulin.

Hepatitis A - CDC Yellow Book

Dosing info - Hep A

Hepatitis B

Recommended for unvaccinated travelers younger than 60 years old traveling to Ecuador. Unvaccinated travelers 60 years and older may get vaccinated before traveling to Ecuador.

Hepatitis B - CDC Yellow Book

Dosing info - Hep B

CDC recommends that travelers going to certain areas of Ecuador take prescription medicine to prevent malaria. Depending on the medicine you take, you will need to start taking this medicine multiple days before your trip, as well as during and after your trip. Talk to your doctor about which malaria medication you should take.

Find country-specific information about malaria.

Malaria - CDC Yellow Book

Considerations when choosing a drug for malaria prophylaxis (CDC Yellow Book)

Malaria information for Ecuador.

Cases of measles are on the rise worldwide. Travelers are at risk of measles if they have not been fully vaccinated at least two weeks prior to departure, or have not had measles in the past, and travel internationally to areas where measles is spreading.

All international travelers should be fully vaccinated against measles with the measles-mumps-rubella (MMR) vaccine, including an early dose for infants 6–11 months, according to CDC’s measles vaccination recommendations for international travel .

Measles (Rubeola) - CDC Yellow Book

Dogs infected with rabies are sometimes found in Ecuador.

Rabies is also present in bats.

If rabies exposures occur while in Ecuador, rabies vaccines may only be available in larger suburban/urban medical facilities.

Rabies pre-exposure vaccination considerations include whether travelers 1) will be performing occupational or recreational activities that increase risk for exposure to potentially rabid animals and 2) might have difficulty getting prompt access to safe post-exposure prophylaxis.

Please consult with a healthcare provider to determine whether you should receive pre-exposure vaccination before travel.

For more information, see country rabies status assessments .

Rabies - CDC Yellow Book

Recommended for most travelers, especially those staying with friends or relatives or visiting smaller cities or rural areas.

Typhoid - CDC Yellow Book

Dosing info - Typhoid

Yellow Fever

Required for travelers ≥1 year old arriving from Brazil, Democratic Republic of the Congo, or Uganda; this includes >12-hour airport transits or layovers in any of these countries .

Recommended for travelers ≥9 months old going to areas <2,300 m (≈7,550 ft) elevation, east of the Andes Mountains, in the provinces of Morona-Santiago, Napo, Orellana, Pastaza, Sucumbíos, Tungurahua,* and Zamora-Chinchipe. Generally not recommended for travel limited to areas <2,300 m (≈7,550 ft) elevation, west of the Andes Mountains, in the provinces of Esmeraldas,* Guayas, Los Ríos, Manabí, Santa Elena, Santo Domingo de los Tsáchilas, and designated areas in the provinces of Azuay, Bolívar, Cañar, Carchi, Chimborazo, Cotopaxi, El Oro, Imbabura, Loja, and Pichincha. Not recommended for travel limited to areas >2,300 m (≈7,550 ft) elevation, the cities of Guayaquil or Quito (the capital), or the Galápagos Islands *CDC recommendations differ from those published by WHO .

Yellow Fever - CDC Yellow Book

Avoid contaminated water

Leptospirosis

How most people get sick (most common modes of transmission)

- Touching urine or other body fluids from an animal infected with leptospirosis

- Swimming or wading in urine-contaminated fresh water, or contact with urine-contaminated mud

- Drinking water or eating food contaminated with animal urine

- Avoid contaminated water and soil

- Avoid floodwater

Clinical Guidance

Avoid bug bites, chagas disease (american trypanosomiasis).

- Accidentally rub feces (poop) of the triatomine bug into the bug bite, other breaks in the skin, your eyes, or mouth

- From pregnant woman to her baby, contaminated blood products (transfusions), or contaminated food or drink.

- Avoid Bug Bites

Chagas disease

- Mosquito bite

Leishmaniasis

- Sand fly bite

- An infected pregnant woman can spread it to her unborn baby

Airborne & droplet

- Breathing in air or accidentally eating food contaminated with the urine, droppings, or saliva of infected rodents

- Bite from an infected rodent

- Less commonly, being around someone sick with hantavirus (only occurs with Andes virus)

- Avoid rodents and areas where they live

- Avoid sick people

Tuberculosis (TB)

- Breathe in TB bacteria that is in the air from an infected and contagious person coughing, speaking, or singing.

Learn actions you can take to stay healthy and safe on your trip. Vaccines cannot protect you from many diseases in Ecuador, so your behaviors are important.

Eat and drink safely

Food and water standards around the world vary based on the destination. Standards may also differ within a country and risk may change depending on activity type (e.g., hiking versus business trip). You can learn more about safe food and drink choices when traveling by accessing the resources below.

- Choose Safe Food and Drinks When Traveling

- Water Treatment Options When Hiking, Camping or Traveling

- Global Water, Sanitation and Hygiene (WASH)

- Avoid Contaminated Water During Travel

You can also visit the Department of State Country Information Pages for additional information about food and water safety.

Prevent bug bites

Bugs (like mosquitoes, ticks, and fleas) can spread a number of diseases in Ecuador. Many of these diseases cannot be prevented with a vaccine or medicine. You can reduce your risk by taking steps to prevent bug bites.

What can I do to prevent bug bites?

- Cover exposed skin by wearing long-sleeved shirts, long pants, and hats.

- Use an appropriate insect repellent (see below).

- Use permethrin-treated clothing and gear (such as boots, pants, socks, and tents). Do not use permethrin directly on skin.

- Stay and sleep in air-conditioned or screened rooms.

- Use a bed net if the area where you are sleeping is exposed to the outdoors.

What type of insect repellent should I use?

- FOR PROTECTION AGAINST TICKS AND MOSQUITOES: Use a repellent that contains 20% or more DEET for protection that lasts up to several hours.

- Picaridin (also known as KBR 3023, Bayrepel, and icaridin)

- Oil of lemon eucalyptus (OLE) or para-menthane-diol (PMD)

- 2-undecanone

- Always use insect repellent as directed.

What should I do if I am bitten by bugs?

- Avoid scratching bug bites, and apply hydrocortisone cream or calamine lotion to reduce the itching.

- Check your entire body for ticks after outdoor activity. Be sure to remove ticks properly.

What can I do to avoid bed bugs?

Although bed bugs do not carry disease, they are an annoyance. See our information page about avoiding bug bites for some easy tips to avoid them. For more information on bed bugs, see Bed Bugs .

For more detailed information on avoiding bug bites, see Avoid Bug Bites .

Stay safe outdoors

If your travel plans in Ecuador include outdoor activities, take these steps to stay safe and healthy during your trip.

- Stay alert to changing weather conditions and adjust your plans if conditions become unsafe.

- Prepare for activities by wearing the right clothes and packing protective items, such as bug spray, sunscreen, and a basic first aid kit.

- Consider learning basic first aid and CPR before travel. Bring a travel health kit with items appropriate for your activities.

- If you are outside for many hours in heat, eat salty snacks and drink water to stay hydrated and replace salt lost through sweating.

- Protect yourself from UV radiation : use sunscreen with an SPF of at least 15, wear protective clothing, and seek shade during the hottest time of day (10 a.m.–4 p.m.).

- Be especially careful during summer months and at high elevation. Because sunlight reflects off snow, sand, and water, sun exposure may be increased during activities like skiing, swimming, and sailing.

- Very cold temperatures can be dangerous. Dress in layers and cover heads, hands, and feet properly if you are visiting a cold location.

Stay safe around water

- Swim only in designated swimming areas. Obey lifeguards and warning flags on beaches.

- Practice safe boating—follow all boating safety laws, do not drink alcohol if driving a boat, and always wear a life jacket.

- Do not dive into shallow water.

- Do not swim in freshwater in developing areas or where sanitation is poor.

- Avoid swallowing water when swimming. Untreated water can carry germs that make you sick.

- To prevent infections, wear shoes on beaches where there may be animal waste.

Leptospirosis, a bacterial infection that can be spread in fresh water, is found in Ecuador. Avoid swimming in fresh, unchlorinated water, such as lakes, ponds, or rivers.

Keep away from animals

Most animals avoid people, but they may attack if they feel threatened, are protecting their young or territory, or if they are injured or ill. Animal bites and scratches can lead to serious diseases such as rabies.

Follow these tips to protect yourself:

- Do not touch or feed any animals you do not know.

- Do not allow animals to lick open wounds, and do not get animal saliva in your eyes or mouth.

- Avoid rodents and their urine and feces.

- Traveling pets should be supervised closely and not allowed to come in contact with local animals.

- If you wake in a room with a bat, seek medical care immediately. Bat bites may be hard to see.

All animals can pose a threat, but be extra careful around dogs, bats, monkeys, sea animals such as jellyfish, and snakes. If you are bitten or scratched by an animal, immediately:

- Wash the wound with soap and clean water.

- Go to a doctor right away.

- Tell your doctor about your injury when you get back to the United States.

Consider buying medical evacuation insurance. Rabies is a deadly disease that must be treated quickly, and treatment may not be available in some countries.

Reduce your exposure to germs

Follow these tips to avoid getting sick or spreading illness to others while traveling:

- Wash your hands often, especially before eating.

- If soap and water aren’t available, clean hands with hand sanitizer (containing at least 60% alcohol).

- Don’t touch your eyes, nose, or mouth. If you need to touch your face, make sure your hands are clean.

- Cover your mouth and nose with a tissue or your sleeve (not your hands) when coughing or sneezing.

- Try to avoid contact with people who are sick.

- If you are sick, stay home or in your hotel room, unless you need medical care.

Avoid sharing body fluids

Diseases can be spread through body fluids, such as saliva, blood, vomit, and semen.

Protect yourself:

- Use latex condoms correctly.

- Do not inject drugs.

- Limit alcohol consumption. People take more risks when intoxicated.

- Do not share needles or any devices that can break the skin. That includes needles for tattoos, piercings, and acupuncture.

- If you receive medical or dental care, make sure the equipment is disinfected or sanitized.

Know how to get medical care while traveling

Plan for how you will get health care during your trip, should the need arise:

- Carry a list of local doctors and hospitals at your destination.

- Review your health insurance plan to determine what medical services it would cover during your trip. Consider purchasing travel health and medical evacuation insurance.

- Carry a card that identifies, in the local language, your blood type, chronic conditions or serious allergies, and the generic names of any medications you take.

- Some prescription drugs may be illegal in other countries. Call Ecuador’s embassy to verify that all of your prescription(s) are legal to bring with you.

- Bring all the medicines (including over-the-counter medicines) you think you might need during your trip, including extra in case of travel delays. Ask your doctor to help you get prescriptions filled early if you need to.

Many foreign hospitals and clinics are accredited by the Joint Commission International. A list of accredited facilities is available at their website ( www.jointcommissioninternational.org ).

In some countries, medicine (prescription and over-the-counter) may be substandard or counterfeit. Bring the medicines you will need from the United States to avoid having to buy them at your destination.

Malaria is a risk in some parts of Ecuador. If you are going to a risk area, fill your malaria prescription before you leave, and take enough with you for the entire length of your trip. Follow your doctor’s instructions for taking the pills; some need to be started before you leave.

Select safe transportation

Motor vehicle crashes are the #1 killer of healthy US citizens in foreign countries.

In many places cars, buses, large trucks, rickshaws, bikes, people on foot, and even animals share the same lanes of traffic, increasing the risk for crashes.

Be smart when you are traveling on foot.

- Use sidewalks and marked crosswalks.

- Pay attention to the traffic around you, especially in crowded areas.

- Remember, people on foot do not always have the right of way in other countries.

Riding/Driving

Choose a safe vehicle.

- Choose official taxis or public transportation, such as trains and buses.

- Ride only in cars that have seatbelts.

- Avoid overcrowded, overloaded, top-heavy buses and minivans.

- Avoid riding on motorcycles or motorbikes, especially motorbike taxis. (Many crashes are caused by inexperienced motorbike drivers.)

- Choose newer vehicles—they may have more safety features, such as airbags, and be more reliable.

- Choose larger vehicles, which may provide more protection in crashes.

Think about the driver.

- Do not drive after drinking alcohol or ride with someone who has been drinking.

- Consider hiring a licensed, trained driver familiar with the area.

- Arrange payment before departing.

Follow basic safety tips.

- Wear a seatbelt at all times.

- Sit in the back seat of cars and taxis.

- When on motorbikes or bicycles, always wear a helmet. (Bring a helmet from home, if needed.)

- Avoid driving at night; street lighting in certain parts of Ecuador may be poor.

- Do not use a cell phone or text while driving (illegal in many countries).

- Travel during daylight hours only, especially in rural areas.

- If you choose to drive a vehicle in Ecuador, learn the local traffic laws and have the proper paperwork.

- Get any driving permits and insurance you may need. Get an International Driving Permit (IDP). Carry the IDP and a US-issued driver's license at all times.

- Check with your auto insurance policy's international coverage, and get more coverage if needed. Make sure you have liability insurance.

- Avoid using local, unscheduled aircraft.

- If possible, fly on larger planes (more than 30 seats); larger airplanes are more likely to have regular safety inspections.

- Try to schedule flights during daylight hours and in good weather.

Medical Evacuation Insurance

If you are seriously injured, emergency care may not be available or may not meet US standards. Trauma care centers are uncommon outside urban areas. Having medical evacuation insurance can be helpful for these reasons.

Helpful Resources

Road Safety Overseas (Information from the US Department of State): Includes tips on driving in other countries, International Driving Permits, auto insurance, and other resources.

The Association for International Road Travel has country-specific Road Travel Reports available for most countries for a minimal fee.

For information traffic safety and road conditions in Ecuador, see Travel and Transportation on US Department of State's country-specific information for Ecuador .

Maintain personal security

Use the same common sense traveling overseas that you would at home, and always stay alert and aware of your surroundings.

Before you leave

- Research your destination(s), including local laws, customs, and culture.

- Monitor travel advisories and alerts and read travel tips from the US Department of State.

- Enroll in the Smart Traveler Enrollment Program (STEP) .

- Leave a copy of your itinerary, contact information, credit cards, and passport with someone at home.

- Pack as light as possible, and leave at home any item you could not replace.

While at your destination(s)

- Carry contact information for the nearest US embassy or consulate .

- Carry a photocopy of your passport and entry stamp; leave the actual passport securely in your hotel.

- Follow all local laws and social customs.

- Do not wear expensive clothing or jewelry.

- Always keep hotel doors locked, and store valuables in secure areas.

- If possible, choose hotel rooms between the 2nd and 6th floors.

Healthy Travel Packing List

Use the Healthy Travel Packing List for Ecuador for a list of health-related items to consider packing for your trip. Talk to your doctor about which items are most important for you.

Why does CDC recommend packing these health-related items?

It’s best to be prepared to prevent and treat common illnesses and injuries. Some supplies and medicines may be difficult to find at your destination, may have different names, or may have different ingredients than what you normally use.

If you are not feeling well after your trip, you may need to see a doctor. If you need help finding a travel medicine specialist, see Find a Clinic . Be sure to tell your doctor about your travel, including where you went and what you did on your trip. Also tell your doctor if you were bitten or scratched by an animal while traveling.

If your doctor prescribed antimalarial medicine for your trip, keep taking the rest of your pills after you return home. If you stop taking your medicine too soon, you could still get sick.

Malaria is always a serious disease and may be a deadly illness. If you become ill with a fever either while traveling in a malaria-risk area or after you return home (for up to 1 year), you should seek immediate medical attention and should tell the doctor about your travel history.

For more information on what to do if you are sick after your trip, see Getting Sick after Travel .

Map Disclaimer - The boundaries and names shown and the designations used on maps do not imply the expression of any opinion whatsoever on the part of the Centers for Disease Control and Prevention concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Approximate border lines for which there may not yet be full agreement are generally marked.

Other Destinations

If you need help finding travel information:

Message & data rates may apply. CDC Privacy Policy

File Formats Help:

- Adobe PDF file

- Microsoft PowerPoint file

- Microsoft Word file

- Microsoft Excel file

- Audio/Video file

- Apple Quicktime file

- RealPlayer file

- Zip Archive file

Exit Notification / Disclaimer Policy

- The Centers for Disease Control and Prevention (CDC) cannot attest to the accuracy of a non-federal website.

- Linking to a non-federal website does not constitute an endorsement by CDC or any of its employees of the sponsors or the information and products presented on the website.

- You will be subject to the destination website's privacy policy when you follow the link.

- CDC is not responsible for Section 508 compliance (accessibility) on other federal or private website.

- Global travel destinations

- Ecuador and the Galapagos Islands

International travel insurance for Ecuador and the Galapagos Islands

Compare and buy travel insurance, what does visitor travel insurance cover, health care expenses, doctor visit, pharmacy drugs, pre-existing conditions, medical evacuation, repat of remains, travel medical insurance ecuador galapagos islands.

Schengen Visa Insurance

US Expatriates Insurance

Ecuador Travel insurance

USA traveler insurance

Testimonials - from our customers.

After rigorous searching for suitable student health insurances online, I stumbled upon the American visitor Insurance. Know more »

We really thank American insurance team for providing great assistance in taking the insurance. We were successfully. Know more »

Thank you American Visitor Insurance customer service for meticulously following through. I truly appreciate it. Know more »

The Galapagos Islands are an amazing island group in the eastern Pacific Ocean that is administered by Ecuador. The Galapagos islands is an ecologist’s dream destination and is popular for plenty of fearless wildlife, wonderful beaches, rich blue seas, magnificent underwater seascapes and a natural green landscape. The area around the island has some of the active volcanoes in the world. It has one of the unique backdrops with rare species like Giant Tortoise, Galapagos Fur Seal and Darwin’s Finches.

Travelers to the Galapagos can visit all year round however the ideal time to visit the Island is during the summers when the weather is hot and the ocean is clear between December to May. There are several cruise lines that travel to Galapagos however the most popular one is the Celebrity Cruise that has several ships sailing to Galapagos.An average price of a 5-day Galapagos cruise would cost about $3000. The cheapest Galapagos cruises for a 4 day trip begins at $1000 and can go up to $10,000 per person for an 8 day luxury cruise.

Select the type of travel health insurance for visiting Ecuador Galapagos Islands...

travel insurance with quarantine coverage, travel insurance for quarantine coverage.

- Travel insurance for US Citizens and US Residents traveling outside USA

- Provides minimum coverage of $3,000 for potential or extended quarantine lodging expenses due to Covid19.

- Provides guaranteed travel insurance for Covid19 for medical expenses of at least USD $50,000.

- Covid-19 is covered as any other sickness

- Safe Travels Voyager plan's trip delay benefit can be upgraded.

- The base benefit is $3,000 (which is $250 per day). Traveler’s can choose $4000 ($300 per day) or $7000 ($500 per day).

- Travel insurance for American citizens and US Residents traveling outside USA

- Provides minimum coverage of $2,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid-19 is covered as any other sickness.

- Covid Quarantine Benefit: Coverage for accommodations due to a covered Trip Delay $2,000/$150 per person per day (6 hours or more) is included in the basic coverage.

- Optional Quarantine Benefit Upgrade at additional price Trip Delay Max Upgrade - including Accommodations (6 Hours or more) $4000 ($300/day) or $7000 ($500 per day)

- Travel insurance for Non US Citizens and Non US Residents traveling outside their home country

- Travel insurance for US Citizens and US Residents

- Provides minimum coverage of $1,000 for potential or extended quarantine lodging expenses due to Covid19.

- Covid19 medical expenses are covered and treated the same as any other sickness

- Offers coverage of $50,000 for emergency medical expenses

- Offers comprehensive trip cancellation coverage

- Travel medical insurance coverage outside USA

- Atlas insurance offers $50 per day for each day that travelers are quarantined abroad for a maximum of 10 days.

- Coverage must be bought for a minimum of 30 days. Proof of quarantine mandated by physician needed.

- Quarantine must be due to you testing positive for COVID-19/SARS-CoV2.

- Travel insurance for US Citizens and US Residents traveling outside US

- Trip cancellation up to $50,000

- Trip interruption up to 200% of trip cost

- $500,000 medical for sickness and injury/$1,000,000 medical transportation

- Include $2000 in travel delay benefits for quarantine/lodging.

Covid Quarantine insurance for US citizens

Despite the removal of the Covid-19 restrictions both in the US and around the globe, it is prudent for US citizens to purchase international travel insurance which will make the whole trip worry free and provide good protection for any medical or travel related expenses in case of unexpected situations.

US travelers can either buy US Covid quarantine coverage trip insurance (includes coverage for cost of the trip), or Covid quarantine travel health insurance (insures only the health of the traveler and is cheaper than trip insurance).

Travel medical insurance to emergency medical expenses

Best travel insurance, best international travel insurance for us citizens.

- Travel medical insurance for US Citizens and US Residents traveling outside USA

- Available up to 180 days

- Offers emergency sickness coverage up to $500,000

- Covid-19 covered as any other sickness

- Coverage for travelers traveling outside their home country whose destination excludes the U.S. and its territories.

- Deductible options from $0 to $2,500

- Policy Maximum from $50,000 to $2,000,000

- Renewable upto 24 continuous months

- Covers COVID-19/SARS-CoV-2 as any other Illness or Injury.

- Patriot Platinum Insurance is best suited for travelers expecting first-class medical coverage; vacationing families; individuals up to $8 million.

- Deductible options from $0 to $25,000

- Policy Maximum from $1,000,000 to $8,000,000

- USA travel medical insurance coverage outside USA for US citizens

- Available up to 365 days

- Offers maximum coverage up to $2,000,000

- Offers insurance coverage for Covid expenses

- US travel health insurance for US citizens outside USA

- Available from 5 days to 364 days

- Offers maximum coverage up to $5,000,000

- Travel Medical Choice insurance offers coverage for expenses related to COVID-19

- Short term fixed benefit cheap travel insurance USA for US citizens outside USA

- Plan maximum options available up to $130,000 for medical expenses

- Offers coverage outside the US

- Deductible options from $0 to $1,000

- Policy Maximum from $50,000 to $150,000

- Offers emergency medical evacuation coverage up to $500,000

- Offers coverage for travelling outside your home country

- It includes coverage for Covid-19 is covered as any other illness under the medical expense maximum.

- Testing for Covid-19 will only be covered if deemed medically necessary by a physician. The antibody test and prescreening test are not covered, as they are not medically necessary. Maximum age for plan eligibility is 64.

Expatriate heath insurance for living outside home country

Best expat insurance, best expatriate insurance, expat insurance plans.

- Ideal for US expatriates and for those global citizens living and working outside their home country.

- Xplorer Premier Insurance provides unlimited annual and lifetime medical maximum.

- It covers pre-existing conditions with creditable coverage

Trip cancellation insurance for trip investment expenses

Best trip cancellation insurance, best trip protection insurance, best trip cancellation insurance.

- Trip Cancellation: Up to 100% of insured trip cost

- US Residents on domestic and worldwide trips

- Travel SE Covid Quarantine Benefit : Travel SE plan offers Coverage for accommodations due to a covered Trip Delay $2,000/$125 per person per day is included in the basic coverage.

- Travel LX Covid Quarantine Benefit : Travel LX plan offers Coverage for accommodations due to a covered Trip Delay $2,500/$250 per person per day is included in the basic coverage.

- Inexpensive coverage for trip cancellation & interruption

- Travel Lite Covid Quarantine Benefit : Travel Lite plan offers Coverage for accommodations due to a covered Trip Delay $500/$125 per person per day is included in the basic coverage.

- Trip Cancellation: Up to 100% of Trip Cost Insured

- Up to 100% of Trip Cost Insured

- It covers Trip Cancellation coverage from $150 to $10,000.

- Trip Cancellation: Trip Cost: Up to a Maximum of $30,000.

- Maximum Trip Length 90 Days

- Offered by Trawick International and is highly rated.

- You can add a "Cancel for Any Reason" waiver onto the plan.

- It can cover trips up to 90 days long.

- Cancellation of policy must be purchased within 10 days of the initial trip deposit date.

- Trip Cancellation: Basic - $15,000 Max

- Trip Cancellation: Plus - $100,000 Max

- Trip Cancellation: Elite - $100,000 Max

- Trip Cancellation: 100% of trip cost up to $30,000

- Provides coverage for U.S. residents travelling outside their home country

- Trip Cancellation: 100% of trip cost up to $100,000

Trip cancellation insurance for Cancel for any reason

Cancel for any reason trip cancellation insurance, cancel for any reason plans.

- Cancel For Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Tour cost to a maximum of $100,000

- Cancel for Any Reason: Up to 75% of trip cost insured

- Trip Cancellation: Up to 100% of Trip Cost

- Cancel for Any Reason: 75% of non-refundable trip cost

- Trip Cancellation: Up to a Maximum of $50,000. ($30,000 for travellers above 80 years)

- Cancellation for Any Reason: 75% of the Insured Trip Cost within 21 days of trip deposit - some restrictions apply. Not available in NY or WA.

US seniors traveler insurance, Medicare supplement international travel insurance

Usa senior citizen travel insurance, us seniors travel insurance, travel insurance for older us travelers.

- The GlobeHopper Senior plan is available either as the GlobeHopper Single-Trip plan for single trips with coverage from 5 days to 365 days

- The GlobeHopper Multi-trip plan which covers a period of 12 months with a maximum of 30 days for each overseas trip

- It is an affordable international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses for short trips.

- It is available up to 12 months

- It is an renewable long term international travel health insurance for US citizens.

- It offers coverage for medical and evacuation expenses.

- It is available up to 12 months.

Annual travel insurance, Yearly travel insurance

Best annual travel insurance, best yearly travel insurance, annual travel plans.

- Patriot Multi Trip is designed by IMG to cover travelers taking multiple trips in a year.

- Covers non US Citizens travelling multiple times annually outside their home country

- Trekker Essential Insurance offers maximum coverage of $50,000 for sickness and accidents.

- Available for both US and Non US citizens up to 75 years

- Maximum trip length is 30 or 45 days per trip

- Available for US residents only up to age 81 years

- Maximum trip length is 30 days per trip

- Voyager Annual (offered by USI Travel Insure) covers US citizens in and out of the US at least 100 miles away from home.

- It does not cover trip cancellation but can be used for 90 days at a time within a year and is great for frequent travelers.

- Take an unlimited number of Covered Trips during the 364 day Policy period

- Covers domestic and international trips - up to 90 days each

- Offers two plan levels namely Silver and Gold offer options for different needs and budgets

- Provides coverage for Emergency Accident and Sickness, Emergency Medical Evacuation, Baggage & Personal Effects, Baggage Delay, and Accidental Death and Dismemberment.

- The Gold plan includes additional benefits like Trip Interruption and Political Natural Disaster Evacuation

Review and compare the best Annual insurance.

Types of US travel insurance

Single trip travel insurance.

Compare and Buy Best US Single trip travel Insurance for travel within the US and overseas

Single Trip vs MultiTrip Travel Insurance

Compare Single trip vs multi trip insurance plans offered by US insurers.

Ecuador Galapagos Islands travel medical insurance

Trip cancellation insurance.

Trip cancellation insurance insure trip cancellation related emergencies while in Ecuador Galapagos Islands.

Student insurance

Ecuador Galapagos Islands students studying overseas.

Annual multi-trip insurance

Annual travel insurance for frequent travelers to and from Ecuador Galapagos Islands.

Group Travel insurance

Group travel insurance for Ecuador Galapagos Islands covers five or more travelers on same itinerary.

Resourceful tourist insurance USA information

Find the best travel insurance, how does travel insurance work, how to buy travel insurance, travel insurance glossary, travel insurance for specific groups, compare travel insurance plans, travel health insurance ecuador galapagos islands – faqs, 01. does ecuador galapagos islands travel insurance cover covid19 illness.

There are some USA Covid travel insurance plans available for travel to the Ecuador Galapagos Islands that cover Covid19 as a new illness. It is important to buy the Ecuador Galapagos Islands Covid19 travel insurance before you start your journey.

At present the following USA insurance providers - Safe Travels Outbound insurance and Safe Travels International insurance from Trawick International and Diplomat Long term Insurance from Global Underwriters provide US Covid19 travel insurance coverage in the Ecuador Galapagos Islands.

These covid travel insurance plans are available for US citizens and US residents traveling to Ecuador Galapagos Islands as well as non US travelers traveling outside their home country.

02. How does find the best travel insurance for USA? How to find the best international travel health insurance?

There are different factors for buying best health insurance for USA visitors. Visitors should compare fixed benefits and comprehensive visitor insurance plans. Foreign visitors to USA travel insurance customers should understand the concepts of deductibles and co-insurance and Pre-existing conditions travel health insurance. A prudent and well informed traveler will make the correct choice while buying tourist insurance in USA for his or her unique needs.

There are many international US travel health insurance plans for coverage both in the USA as well as around the world. Given the several international travel insurance options, it can be confusing to find the best health insurance for international travel. What is very useful in making this decision is to compare US visitor travel insurance available on American Visitor Insurance.

The compare US travel insurance tool allows travelers compare prices as well as coverage benefits in an objective manner. The traveler can change relevant factors like the medical maximum coverage and the deductible and coverage for pre-existing ailments or hazardous sports. After finding the best travel insurance for your needs, travelers can buy it by completing an online application and paying using a credit card. One completing the purchase the travel insurance plan is emailed to the customer.

03. Why is travel insurance for USA so expensive?

There is no denying that travel insurance to USA is unfortunately very expensive. The main reason for this is simply because the cost of healthcare in the USA is very expensive and the travel insurance USA costs are directly related to the healthcare costs. One more factor for some USA travel insurance plans to be very expensive is that there are specially designed travel insurance for USA plans available for older travelers, with higher medical coverage as well as some plans with coverage for pre-existing ailments.

04. What are the factors to consider for travel health insurance to USA?

The best travel insurance for USA depends these factors:

- The coverage for accident and sickness related medical expenses

- The coverage for medical and evacuation expenses

- The coverage for pre-existing conditions

- The deductible and co-payment options

- The network of hospitals and providers

- The customer service and claim process

Ecuador - General Information

Ecuador, officially known as the Republic of Ecuador, is a country located in northwestern South America. Ecuador is situated on the equator, which is how it got its name. The country is bordered by Colombia to the north, Peru to the east and south, and the Pacific Ocean to the west. Ecuador encompasses diverse geographical regions, including the Amazon rainforest, the Andes Mountains, and the Galapagos Islands, which are located about 1,000 kilometers (620 miles) off the mainland. The capital city of Ecuador is Quito. It is the second-highest capital city in the world and is renowned for its well-preserved historic center, which is a UNESCO World Heritage site. The official language of Ecuador is Spanish. The official currency of Ecuador is the United States dollar (USD). Ecuador adopted the US dollar as its official currency in the year 2000.

United States Dollar

Around 17 million

South America

Quito, Galapagos Province, Cuenca, Guayaquil , Santa Cruz Island, Banos de Agua Santa, Isabela Island, San Cristobal Island, Otavalo, Baltra Island.

Popular tourist destinations in Ecuador Galapagos Islands

The Galápagos Islands

Galápagos Islands have intrigued and inspired visitors from around the globe. Named for the giant tortoises on the islands, this UNESCO World Heritage Site is home to a unique ecosystem.

High in the Andes, Quito, the capital of Ecuador, is filled with colonial architecture and is the largest historic center in South America.

The beautiful city center of Cuenca, officially known as Santa Ana de los cuatro ríos de Cuenca, is in southern Ecuador and is a delightful city to explore on foot.

The Hot Springs of Baños

At the western edge of the Amazon basin, Baños is nestled among dense jungle-like forests and offers numerous recreational opportunities including hiking and mountain biking.

Ecuador Galapagos Islands travel insurance information

Travel insurance Ecuador Galapagos Islands resources

International travel insurance resources for Ecuador Galapagos Islands visa holders.

Factors for travel insurance Ecuador Galapagos Islands online

Important factors while deciding on the best travel insurance to Ecuador Galapagos Islands.

Types of Ecuador Galapagos Islands travel insurance online

Different types of Ecuador Galapagos Islands visa travel insurance options.

Ecuador Galapagos Islands travel insurance claims procedure

Ecuador Galapagos Islands travel insurance claims process for medical care.

Compare and buy best Galapagos Islands cruise travel insurance.

US health insurance for travelers from Ecuador and the Galapagos Islands

New immigrant insurance for ecuadorians in the usa.

The immigration of the Ecuadorians to the US was very limited until 1960’s. Between the year 1930 to 1960 there were 11,025 Ecuadorians who got permanent resident status in the US. It was during the late 1960’s that several waves of migration started. The first immigration was because of the changed Immigration law in the 1960’s. After changes in US immigration laws many Latin Americans emigrated to US for political freedom and economic opportunities.

In 1986 the Immigration Reform and Control Act brought 17,000 Ecuadorian immigrants legal residency status in the US. This then became a main source of family-sponsored Ecuadorian migration to the US. There were several waves which came to the US. 60% of the Ecuadorians are living in New York. During the great Recession in 2008 there was a decline in Ecuadorian emigration. In the year 2000 there were 400,000 Ecuadorians came to U S. Ecuadorians are the 3rd largest Latin American group in New York City and New Jersey and they are the 8th largest Latino group in the US. According to the U.S. Census of 2000 there were 600,000 Ecuadorians in the New York City.

Migrating to a new country for better economic opportunities and to begin a new life is very challenging, however it is crucial that all new immigrants to the USA have good health insurance on arrival, especially given the Covid19 pandemic. Healthcare in the US is very expensive and proper US immigrant insurance will provide coverage for medical expenses incurred in case of any injury or illness.

Buying new US immigrant insurance is easy at American Visitor Insurance and new Ecuadorian immigrant can compare several plans for prices and benefits according to their specific needs. The 24/7 customer support service by licensed agents will provide answers to all questions by the customers with instant policy documents by Email. Feel free to give a call or email and one of the customer support licensed agents will be able to support further.

Travel health insurance for family, friends and tourists from Ecuador visiting the USA

The US is one of the most desired tourist destinations all around the world. The diverse culture, cosmopolitan social life and several natural wonders makes the country a popular tourist destination. Given the strong Socio-economic connection between Ecuador and the US the relationship is expanding through tourism, strong commercial activities and academic exchange program.

On 26 March 2021, the US government announced that, the validity of the new U.S tourist visa for Ecuadorians under the category B1 and B2 will have an extended validity for 10 years. This extension of the US tourist visa has brought more Ecuadorians to the US. Many Ecuadorians visit US each year to meet friends, family and as tourists. The people to people connections between Ecuador and the US have grown stronger now.

Traveling on a vacation to the US brings in a lot of excitement, however while on a holiday visitors should keep in mind the risks that can occur. Traveling long distance to the US with many changes to one’s normal routine can give a chance for unexpected risks. Travel insurance is important during the Covid19 pandemic for safe travel to the US. In particular when old parents are traveling .International travel insurance provides the coverage for unexpected medical emergencies along with insure the trip costs of the traveler and health.

American visitor insurance has best US insurance travel insurance choices. They work with US insurance providers to offer the best prices along with acute onset of pre-existing conditions and Covid19 travel insurance coverage. Ecuadorian travelers can compare several plans for prices and benefits and get answers to FAQ's from the 24/7 customer support available with licensed US insurance agents. Buying US travel medical insurance is easy at American visitor insurance online and get instant policy documents via email.

Medical insurance for Ecuadorian professionals in the USA

The United States is a country with great innovations, technology and one which offers excellent career opportunities for professionals to work in the US. Skilled professionals from all over the world and from different occupations aspire to experience the “Dream of America”. Ecuadorians have a long and strong history of connectivity and exchange with the US. In an continuous effort to strengthen relations between the two countries, the U.S government on March 26, 2021 announced that all new visa issued to a Ecuadorian for tourist and business purposes under categories B1 and B2 will be extended from 5years to 10 years effective 8th April 2021.

There are several Ecuadorian professionals currently working in the USA. While living away from home in the US, it is crucial that one should have good health insurance with and with Covid19 coverage. The US health care system is expensive and in case of a medical emergency, visiting an US hospital without insurance is scary. A good immigrant medical insurance plan will provide coverage for unexpected medical emergencies that may occur while staying away from home.

American visitor insurance offers to their customers with some of the finest US travel insurance plans with Covid19 and acute onset of pre-existing conditions coverage. Buying US visitor medical insurance is easy on American visitor insurance for Ecuadorian professionals .Visitors can answer a few questions and get instant policy documents by email while being sure of guaranteed best price. The 24/7 customer support team of licensed agents will provide answers to FAQ's by customers related to the coverage.

What is the best travel insurance from Ecuador Galapagos Islands to USA?

1. Atlas America offered by WorldTrips is considered one of the best travel insurance options offers coverage up to $2,000,000. This plan offers coverage for Hospitalization, Prescription drugs, Trip cancellation, Trip Interruption, covid19,Travel delay and Evacuation and much more!. This also offers coverage for acute onset of pre-existing conditions up to 79 years.

2. Patriot America Plus Insurance is another best travel insurance for visiting the USA offers coverage up to $1,000,000. It offers comprehensive medical insurance for non US citizens traveling individually or in groups to the USA. This also offers optional riders provide additional coverage for a minimal charge. This also offers coverage for acute onset of pre-existing conditions up to 70 years.

3. Visitor Secure insurance is fixed benefits plan and an affordable scheduled benefit plan for visitors to USA. It offers coverage up to chosen plan maximum for acute onset of pre-existing conditions up to 70 years. This plan covers Inpatient and Outpatient treatment facilities and price varies between the types of plans.

4. Safe Travels USA Comprehensive offers excellent medical coverage for Non-US Citizens and Non-US Residents while visiting the USA. This includes coverage for acute onset of pre-existing conditions, well doctor visit, emergency medical evacuation, repatriation and security evacuation benefits. This plan offers coverage up to $1,000,000.

5. Safe Travels USA is a cheap travel medical insurance plan that covers Non-US Citizens and Non-US Residents while visiting the USA. It offers comprehensive US Covid19 insurance coverage for illness and accident and offer a Well Doctor Visit which pays up to $125.Coevrs Unexpected Recurrence of a pre-existing conditions. This plan offers coverage up to $1,000,000.

6. Travel Medical Insurance from seven corners offers coverage for non-U.S. Residents and non-U.S. Citizens while traveling outside of your Home Country. This comprehensive insurance starts from $50,000 and provides up to $5,000,000. For people above age 80 years, they get a policy maximum of $10,000. This offers acute onset of pre-existing conditions up to 79 years and Adventure Activities up to medical maximum.

Confused whether to buy trip, travel or global health insurance? Understand the differences!

International travel Insurance for Ecuador Galapagos Islands residents

Select the best health insurance for visitors to usa..., covid travel health insurance for usa, coronavirus health insurance for foreigners in usa.

Most countries have opened their borders now for international tourism. Unfortunately, even years after the pandemic started in China, Covid is again making a comeback with new immune-evasive variants.

The Covid situation is made even more complicated with influenza and the respiratory syncytial virus (RSV) which is also spreading across the globe. Though there is a risk with the new variants, authorities have relaxed their strict controls thanks to improved vaccination coverage.

However, while Covid appears to be less virulent and no longer as dangerous thanks to a large percentage of the population having vaccinations and booster shots, Covid

Budget travel insurance with covid19 coverage for visiting USA

Trawick international travel insurance.

Trawick International offers visitor medical insurance for coronavirus with their Safe Travels USA Insurance . The Safe Travels USA Comprehensive plan is ideal for travelers with pre-existing medical conditions even for travelers older than 70 years. You can compare Safe Travels USA Covid19 travel insurance plans and buy it online to get coverage as early as the following day. After buying the Trawick travel insurance, travelers can download a visa letter which indicates that Safe travels USA visitors insurance covers covid19 illness.

- Safe Travels USA

- Compare and Buy Safe Travels USA insurance

- Safe Travels USA comprehensive

- Compare and Buy Safe Travels USA cost saver insurance

- Safe Travels Elite

- Compare and Buy Safe Travels Elite insurance

Seven Corners visitors medical insurance

International medical group (img) coronavirus insurance.

International Medical Group (IMG) travel insurance offers coronavirus insurance for USA. IMG's Patriot America Plus , Patriot Platinum insurance , Visitors Protect insurance and Visitors Care insurance plans cover COVID-19 like any other illness. The Patriot America Plus Insurance and Patriot America Platinum insurance include COVID coverage up to the policy maximum.

- Patriot America Plus insurance

- Compare and Buy Patriot America Plus insurance

- Visitors Protect insurance

- Compare and Buy Visitors Protect insurance

- Visitors Care insurance

- Compare and Buy Visitors Care insurance

- Patriot America Platinum insurance

- Compare and Buy Patriot America Platinum insurance

INF travel insurance

INF travel insurance offers coverage for coronavirus as any other new sickness. It is available for Non-US citizens or residents travelling to the US. INF Premier and INF Elite plans covers pre-existing complications from COVID-19.

- INF Premier insurance

- Compare and Buy INF Premier insurance

- INF Elite insurance

- Compare and Buy INF Elite insurance

- INF Elite 90 insurance

- Compare and Buy INF Elite 90 insurance

- INF Elite Plus insurance

- Compare and Buy INF Elite Plus insurance

- INF Traveler USA 90 insurance

- Compare and Buy INF Traveler USA 90 insurance

- INF Standard insurance

- Compare and Buy INF Standard insurance

- INF Traveler USA insurance

- Compare and Buy INF Traveler USA insurance

Global Underwriters US visitor insurance

Diplomat America visitors insurance by Global Underwriters offers coverage for covid-19 as a new sickness. It is available for Non-US citizens or residents travelling to the US. Diplomat Long term Covid19 medical insurance must be bought for a minimum of 3 months and has a plan maximum options of $500,000 and $1,000,000 for medical expenses. You can compare Diplomat insurance for visitors to USA.

- Diplomat America

- Compare and Buy Diplomat America insurance

- Diplomat LongTerm

- Compare and Buy Diplomat LongTerm insurance

WorldTrips insurance

Atlas travel insurance coverage will cover eligible medical expenses resulting from COVID-19/SARS-CoV-2.

- Atlas America

- Compare and Buy Atlas America insurance

- Atlas Premium

- Compare and Buy Atlas Premium insurance

- Atlas Essential

- Compare and Buy Atlas Essential insurance

- Atlas Multitrip

- Compare and Buy Atlas Multitrip insurance

Travel Insurance Services travel insurance

- If you are traveling to the US : Visit USA coronavirus insurance offers coverage for COVID-19 as a covered medical expense.

- Compare and Buy Visit USA insurance

Best health insurance for visitors to USA, Best travel insurance for USA

- Patriot America Plus Covid insurance offers coverage for coronavirus illness.

- Covers acute onset of pre-existing conditions till maximum limit (up to 70 years).

- Available for US citizens visiting USA

- Visitors Protect Covid insurance offers coverage for coronavirus illness.

- This plan covers pre existing conditions for age 69 and below up to $25,000 and for ages 70 and above it covers up to $20,000 with deductible up to $1,500.

- Atlas America Covid insurance offers coverage for coronavirus illness.

- Covers acute onset of pre-existing conditions till maximum limit (up to 79 years).

- Diplomat America Covid insurance offers coverage for coronavirus sickness

- Covers acute onset of pre-existing conditions up to policy maximum for age up to 69 years.

- It offers coverage for visitors up to 89 years.

- Covers Covid insurance offers coverage for coronavirus sickness

- Covers treatment of acute onset of pre-existing conditions (up to 79 years)

- INF Elite Covid19 insurance offers coverage for coronavirus.

- Treats Coronavirus/covid19 as a new sickness & covered by the plan

- Best comprehensive plan that covers all pre-existing conditions up to 99 years.

- Comprehensive plan with full pre existing condition coverage which is unique.

- Covers 90% of eligible medical expenses.

- There is a minimum purchase of 90 days required to buy this plan

- Covers Preventive & maintenance care and coverage for full body physicals.

- Coverage for TDAP, Flu, etc Vaccines

- INF Traveler USA 90 covers 90% of elgibile medical expenses

- Minimum purchase of 30 days is required for this plan.

- This is a comprehensive plan too but does not cover pre existing condition

- INF Traveler USA Covid insurance offers coverage for coronavirus illness.

- This plan is available for Non-US Citizens. Anyone visiting USA, Canada and Mexico can enroll in this plan.

- Optional pre-existing conditions rider offers coverage for Stroke or Myocardial Infarction (heart attack) for travelers of any age.

- Plan can be renewed up to 2 year.

- It offers coverage for acute onset of pre-existing conditions up to 70 years.

- Plan can be renewed up to 364 days.

- Safe Travels Elite Covid insurance covers coronavirus illness.

- Covers acute onset of pre-existing conditions up to 89 years.

- This plan is not available to any individual who has been residing within the United States for more than 365 days prior to their Effective Date

- INF Premier Covid insurance covers coronavirus illness.

- Covers all pre-existing conditions, this means doctors, appointments, blood tests & labs, specialist care, urgent care visits, & hospital stays are all covered for pre-existing conditions.

- Renewable up to 364 days

- INF Standard Covid insurance covers Coronavirus illness.

- This is a fixed plan and is available for both US and Non US citizens visiting the US.

Best travel insurance for pre-existing conditions, Best Visitors insurance with pre-existing conditions coverage

- Covers acute onset of pre-existing conditions up to chosen maximum limit (aged up to 70 years).

- The plan is available for individuals traveling outside their country of residence and traveling to the US, Mexico, or Canada.

- Covers acute onset of pre-existing conditions up to chosen maximum limit (aged up to 79 years).

- Covers Acute Onset of a Pre-Existing Condition: Up to 69 years the limit is up to the Medical Maximum purchased per Period of Coverage. For any coverage related to cardiac disease, coverage is limited to $25,000 up to age 69 years, with a $25,000 Maximum Lifetime Limit for Emergency Medical Evacuation. Any repeat recurrence within the same policy period will no longer be considered Acute Onset of a Pre-Existing Condition and will not be eligible for additional coverage.

- Covers Up to $1,000 for sudden, unexpected recurrence of a Pre-existing Condition

- Safe travel USA Covid insurance offers coverage for coronavirus.

- Covers unexpected recurrence of a pre-existing medical conditions up to $1000

- Eligible for foreign residents visiting USA and worldwide

- Covers expenses for treatment of acute onset of pre-existing conditions

- For the acute onset of pre-existing condition coverage with cardiac condition and/or stroke for age range of 14 days to 69 years, $50k coverage is available and for age range of 70 to 79 years, $5k coverage is available .

- For the acute onset of pre-existing condition coverage other than cardiac condition and/or stroke for age range of 14 days to 69 years, $75k coverage is available and for age range of 70 to 79 years, $7,500 coverage is available .

- The policy maximum for this comprehensive insurance starts from $50,000 and provides up to $1,000,000. For people above age 80 years, they get a policy maximum of $10,000

- Acute onset of pre-existing conditions are covered up to $25k for age under 69 years and a coverage of $2,500 for age of 70-79.

- This is a comprehensive plan with excellent coverage.

- Elite plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years.

- Policy maximum $75,000 covers pre-existing condition coverage up to $20,000 maximum with deductible $1,500 for age 70 to 99 years.

- This plan need to be purchased for a minimum of 3 months.

- This is a comprehensive plan with full pre existing condition coverage which is unique.

- Pre-existing complications from covid-19 covered

- Elite 90 plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years $1,500 for age 0 to 69 years.

- Covers accident & sickness while traveling to USA, Canada, and Mexico and covers 90% of eligible medical expenses

- Elite Plus plan with policy maximum $150,000 covers pre-existing condition coverage up to $25,000 maximum with deductible $1,500 for age 0 to 69 years $1,500 for age 0 to 69 years.

- Policy maximum $75,000 covers pre-existing condition coverage up to $20,000 maximum with deductible $1,500 for age 70 to 99 years. Coverage for TDAP, Flu, etc Vaccines.

- Visit USA Insurance is an excellent medical insurance for tourists and holiday travelers, parents of students studying in the United States, new immigrants and visiting scholars in the USA.

- Visit USA offers 3 plans to satify your requirements and budget.

Senior Citizen travel insurance for above 60 years

- The best travel health insurance for 60 year old travelling to the US is Atlas America .

- With the best travel insurance plans for people under 70 years, you get covered up to policy maximum for acute onset of pre-existing conditions for people up to age 79.

- Atlas Premium is another version of this plan with higher coverage available for some of the benefits as compared to Atlas America.

- You can compare Atlas Travel insurance plans .

- Travel Medical Basic offers acute onset of pre-existing conditions up to $25k for age under 69 years and a coverage of $2,500 for age of 70-79.

- Patriot America Plus Plan offer coverage upto choosen plan maximum for travelers under 70 years. This is a comprehensive plan from IMG and is is similar to the Patriot America with the unique difference in the benefit that covers acute onset of pre existing conditions up to the age of 70

- Visitors Protect plan offer maximum limits from $50,000 to $250,000.

- Covers medical evacuation, emergency reunion, repatriation of remains, Accidental Death & Dismemberment, etc.

- Patriot Platinum Plan covers acute onset of pre existing condition up to the age of 70 for up to $1,000,000. $25,000 maximum limit for medical evacuation.

- This is a comprehensive plan and is the plan with excellent coverage.

- This plan covers all pre existing conditions including blood tess, doctor appointments, specialist care...for US and NON US citizens coming to the US, which is unheard of, when it comes to visitor insurance plans.

- This plan provides a maximum of $25,000 for pre existing conditions up to age 69 subjected to a deductible of $1,500.

- Pre-Existing complications from Covid-19 covered.

- This is a comprehensive plan with full pre existing condition coverage which is unique. This includes doctor appointments, blood tests and lab, specialist care, urgent care visits and hospital stays are covered for pre existing condition

- Covid-19 medically necessary testing & treatment covered 100% as any other new sickness with no cost sharing.

- Covers 90% of elgibile medical expenses

- This plan covers eligible accident & sickness (excluding pre-existing conditions) while traveling to USA, Canada, and Mexico

- Minimum purchase of 30 days is required for this plan

- This is a comprehensive plan too but does not cover pre existing condition.

- This is another comprehensive plan from INF.

- This plan differs from the other INF comprehensive plans where it does not cover pre existing conditions.

Older traveler medical insurance for above 70 years

- Safe Travels USA Comprehensive is a very popular option for coverage of acute onset of pre-existing condition for people above 70.

- Seniors travel insurance plan provides a coverage of $25,000 for acute onset of pre- existing condition.

- Atlas America plans from WorldTrips have upgraded their benefits for acute onset of pre-existing conditions up to age 80.

- There is also a higher policy maximum option available for people above 70 up to the age of 79.

- Atlas Premium plans from WorldTrips have upgraded their benefits for acute onset of pre-existing conditions up to age 80.

- The highest maximum that can be purchased for a comprehensive plan is Patriot Platinum which offers pre-existing condition coverage up to $2,500 for any condition.

- In the $50,000 range there are many fixed benefit and comprehensive plan options available