Destination Germany provides an attractive setting for successful business

- Why Germany?

- #MeetConnectDiscover

- GCB Recovery Compass

- Plan Your Business Event with the GCB's Network

- Germany.Expertise

- Destination Germany

The secret to Destination Germany’s success as a popular international travel destination for holidaymakers and business travellers is its strong brand.

The Elbe Philharmonic Hall in Hamburg

Since 2020, the coronavirus crisis has accelerated the shift in customer expectations, the implementation of new technologies and the reorganization of business models in international tourism. The GNTB is working with actors in the domestic tourism industry to meet these challenges and further enhance Germany’s appeal as a travel destination in the future. They are laying the foundations for a safe travel experience for all customers, for example through hygiene protocols, digital visitor management, contactless check-in and other professional safety measures, as well as infrastructure for hybrid events.

Germany is in a strong position in the international market

The Weishaupt Art Gallery in Ulm

The top spot in the highly respected Ipsos Anholt Nation Brands Index, which compares 50 leading economies worldwide, demonstrates the strength of Germany’s brand, even in the pandemic-hit year of 2020. Thanks to its very good tourism and transport infrastructure, its excellent hotel price index and the high standing of its natural and cultural resources, Germany is ranked third in a comparison of 140 countries in the World Economic Forum’s Travel & Tourism Competitiveness Report (last version: 2019).

The organic hotel Friedrichshoehle in Hayingen

Consistently high marks in the Quality Monitor survey of the German tourism industry attest to the high level of customer satisfaction among international holidaymakers and business travellers during their stay. Germany is also very well positioned in the area of sustainability, ranking fifth out of the 166 nations surveyed in the Sustainable Development Report. These factors are the foundation for the successful long-term development of Germany as a travel destination in the international market.

Successful long-term development

Berlin, Alexanderplatz with world clock and television tower

Germany’s popularity as a travel destination has grown continuously among international visitors since reunification. From the early 1990s to 2019, the number of trips to Germany rose from 34.4 million to 89.9 million. Germany also occupies top positions in international comparisons: the most popular cultural and city break destination for Europeans, the top international trade fair location, no. 1 in Europe for conferences, the leading European destination for inbound luxury travel and the second-most popular travel destination for young Europeans.

A couple riding their bicycles at Chiemsee

The coronavirus pandemic that began in 2020 and the resulting stop to international travel had a huge impact on inbound tourism to Germany.

Despite heavy losses, Germany was able to gain a greater share of the European travel market during the coronavirus crisis in 2020, becoming the top travel destination for Europeans. And as the strongest economy at the heart of mainland Europe, Germany remains by far the region’s leading business travel destination.

Wittmund: A family explores the Wadden Sea with a mudflat guide from the Ostfriesland Mudflat Hiking Center

Germany – Simply Inspiring

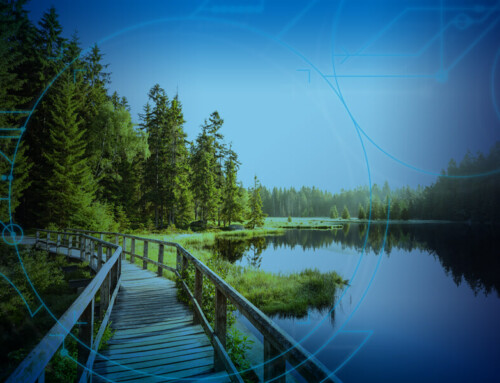

Culture and nature are the two central elements at the core of the Destination Germany brand, and this is reflected in the tourism offering. Germany’s 46 UNESCO World Heritage sites include masterpieces of architecture and art, landscapes steeped in history and culture, areas of incredible natural beauty and monuments to societal and technological progress. Visitors to Germany can look forward to 6,000-plus museums, acclaimed theatres and orchestras, high-calibre events and a buzzing creative scene.

More than a third of the country’s land area is under some form of protection. With a total of 16 national parks, 15 UNESCO biosphere reserves and over 100 nature parks, there are more than 130 preserved national landscapes just waiting to be explored. Tourists can experience Germany’s nature at close hand and in an authentic and environmentally friendly way along some 200,000 kilometres of dedicated walking trails and 70,000 kilometres of cycle routes.

Stuttgart: People relax in front of the art museum on "Kleiner Schlossplatz"

Germany offers a wide range of options for sustainable travel. Research such as the 2020 Destination Brand study highlights the growing importance of this segment. Germany’s leafy towns and cities boast excellent public transport networks and good cycling infrastructure. Hotels and restaurants support the use of regional produce within a lively culinary scene that will delight anyone who enjoys good food. Many attractions and amenities also cater to disabled guests through the ‘Tourism for all’ project.

Thanks to its cultural tourism offerings, a wide range of options for nature lovers and active holidaymakers, and consistent focus on sustainable tourism, Germany is also a ready-made market for the growing bleisure travel segment.

More Impressions from Destination Germany

In this area

More from the categories.

- Press and general public

- Business meetings destination Germany

- Next Stop Germany

Path to page

- Members area

- Change language

- #SafeBusinessTrips

- Impact of Coronavirus on Europe’s Convention Sector

- The GCB's Members

- H World International

- darmstadtium

- Frankfurt Airport Marriott Hotel I Sheraton Frankfurt Airport Hotel & Conference Center

- Tourismus-Agentur Schleswig-Holstein

- Thüringer Tourismus GmbH

- German National Tourist Board GNTB

- Deutsche Bahn

- Deutsche Lufthansa

- Strategic Exhibition Partner: IMEX

- Business Partners

- EVVC European Association of Event Centres e.V.

- VDVO - Association of German Event Planners

- GCB Event Platform

- Pre-IMEX Educational Trip Düsseldorf

- Post-IMEX Educational Trip Dresden

- IMEX America

- Exhibitor Information

- Business Boulevard 2024 - German Booth

- 2024: Business Events in a Transformative Era

- 2023: Creating Meaningful Events in Challenging Times

- Statements Research Partners 2022

- 2021: Challenges of the Post-Corona Era

- 2019/20: The Future Role and Purpose of Events

- Research Phase 2017/18

- Research Phase 2015/16

- Meeting- & EventBarometer

- Thought Leader Panel

- Response Room

- BOCOM - Experience Borderless Communication

- Platform Economy

- Destination Europe

- Meetings and Conventions 2030

- Net Zero Carbon Events

- right and fair

- Green Globe

- Diversity, Equity & Inclusion

- Compliance System

- MICE Think Tank

- Meetings - Hands On

- Let's Talk GCB

- Careers at GCB

- Marketing Committee

- Information for Members and Interested Parties

- Our Members

- Mitgliederversammlung

- Press releases archive

- Video Library

- Image Gallery

- Newsletter Archive

Not found suitable content yet? Use our search function to browse the entire GCB website for your keywords.

Login to member's area

Direct access to exclusive information for our members.

You don't have a login yet or are interested in GCB membership? Contact us!

Switch language

You are currently viewing our page in English. But just one click takes you to our German content.

前往德国会议促进局(GCB)中文网站

您正在浏览德国会议促进局(GCB)的德文网站。您只需点击一下就可以访问我们的中文页面。(DE)

Share this content

Do you like our content? Then share it with others - easily via social media or email.

GCB in English

Unfortunately, this page is only available in German at the moment. You can find information about GCB in English at the english gcb site .

GCB auf Deutsch

Leider ist diese Seite zur Zeit nur in englischer Sprache verfügbar. Informationen über das GCB in deutscher Sprache finden Sie unter der deutschen GCB-Website .

- Mobility and Travel

“Less travel, but longer stays”

Sustainability expert Wolfgang Strasdas explains how sustainable travel can work, and what the Covid pandemic has changed.

Professor Strasdas, how has the Covid pandemic affected tourism? In some respects, nature has managed to recover a bit. We saw this especially during the lockdowns. But tourism in protected areas is also having positive effects in many countries. Tourism is the best way to utilize big game in African national parks, because it promotes wildlife conservation by giving economic value to the live animals. During the pandemic there was an increase in poaching. Over-tourism became a problem in countries, such as Germany, because of the increase in domestic tourism, especially in conservation areas close to large cities. Otherwise, things appear to have settled down again in many places and are almost the same as before the pandemic. It’s understandable that people have a need to catch up again.

So the pandemic has been a wake-up call for us to travel more sustainably in the future? There has certainly been an increase in awareness as far as sustainability is concerned. But the prime concern of people in the tourist industry is to make up for the losses incurred during the pandemic. At the moment, strategic sustainability aims are being overshadowed by the shortages resulting from the war on Ukraine . People are reluctant to save on resources. The situation is similar amongst tourists: Many of them think that sustainability is important, but they want to travel again without restrictions. And when people do exercise restraint, it’s usually because many are on a tighter budget. Of course, it would be much better if people were to change their way of thinking as a result of insights, rather than as a consequence of crises.

How do you think tourists should travel in the future? The crises are clearly illustrating that people in western industrialized countries need to rethink their consumer behaviour patterns as far as multiple and cheap holiday travel is concerned. Current data on travel show that the average length of stays has been constantly declining worldwide. The result of this trend is that tourism is constantly intensifying traffic movements and travel is becoming more stressful in general. I think it would be best to return to older travel patterns, where we embark on less journeys and opt for longer stays instead. Discussions surrounding sustainability have been calling for this type of travel for decades, and now it may well become a necessity due to rising energy costs.

Professor Wolfgang Strasdas is head of the Centre for Sustainable Tourism in Eberswalde.

© www.deutschland.de

You would like to receive regular information about Germany? Subscribe here:

- Newsletter #UpdateGermany

Related content

- Destinations

- Restaurants

Select Page

Germany’s sustainable tourism strategy boosts competitiveness and attracts international travellers

Posted by CEO Destinations | Apr 18, 2023 | Destinations , World News

Germany’s strong position as a travel destination has been confirmed with the lifting of most pandemic-related travel restrictions in 2022. Despite difficult general conditions, market segments and international source markets where Germany is already established as a top destination are experiencing growing demand.

Studies commissioned by the German National Tourist Board (GNTB) confirm the effectiveness of the recovery strategy. GNTB CEO Petra Hedorfer stated that international travel from Europe and the USA has significantly recovered, with Germany now ranking as the second most popular destination behind Spain.

The international travel industry is optimistic about the incoming tourism business to Germany in the first half of 2023. According to the GNTB Travel Industry Expert Panel from Q1/2023, the incoming business climate has improved significantly from Q1/2022. An optimistic assessment of future business expectations is also supported by 75% of around 250 CEOs and key accounts surveyed for the panel, who expect their Germany business to develop positively in the next six months.

In 2022, the number of international overnight stays in Germany rose by 120% compared to the previous year, from 31 to 68.1 million. This represents 76% of the record level of 2019. The USA, as the most important overseas market, generated 5.4 million overnight stays.

Germany remains one of the preferred travel destinations worldwide. According to the IPK International survey commissioned by the GNTB exclusively for the ITB, 71% of travellers worldwide had already made a firm decision to travel across borders in the next twelve months, with Germany ranking third as a travel destination worldwide.

According to the IPK, potential travellers to Germany are primarily interested in city trips, with 61% wanting to visit cities. 29% want to go on round trips, and 21% are planning nature-oriented holidays in the countryside or mountains. The trend towards combining town and country continues.

Sustainability is a strong argument for Germany as a travel destination. 62% of the international CEOs and key accounts of the GNTB Travel Industry Expert Panel see a shift towards sustainable products in booking behaviour. More than three-quarters already see Germany as a sustainable travel destination, and almost 60% specifically market this aspect. Around 71% of the experts expect that sustainable offers will be booked even more in the next three years.

About The Author

Ceo destinations, related posts.

The rising popularity of medical tourism

Navigating rising costs: Business travel thrives amidst price Increases

Bali: Unveiling the serenity of work-life balance

Qatar Airways to Recommence Flight Operations to 11 Additional International Destinations

Subscribe here.

Subscribe to our mailing list and get access to the CEO Destinations magazine and updates to your email inbox.

Thank you for subscribing.

Something went wrong.

We respect your privacy and take protecting it seriously

Recent Posts

- Entertainment

How sustainable online retail works in Würzburg, Germany

News publ. 20. Jun 2024

Sustainable tourism in Germany: status quo and future developments

- Share by mail

Project region

- Federal Environment Agency (UBA)

Tourism in Germany is of great economic importance while also making a particularly important contribution to rural areas. Although the tourism industry has recently been focusing more and more on sustainable tourism, it is not yet widely available and its share of overall tourism cannot be reliably demonstrated. Against the background of the implementation of the Sustainable Development Goals (SDGs), the expansion of sustainable tourism services is also becoming increasingly important at the national level. In view of the high resource intensity of tourism, it is in the political interest to examine the relationship between sustainable tourism and the tourism industry as a whole, to strengthen existing sustainability efforts and to develop strategies to further increase the share of sustainable tourism.

The project looked at the actual share of sustainable tourism in the overall sector, the areas of the tourism industry where there is a need for action, and recommendations for action can be made for both the tourism industry and politics. To begin, a criteria-based definition for sustainable tourism has been developed. The tourism industry itself needs clear and action-relevant indicators in order to strategically implement the transformation process to sustainable tourism. In this way, the industry can therefore benefit from the project results. An important component of the project was to cultivate cooperation with industry representatives and to promote networking and cooperation within the sector.

The project partners, led by the Centre for Sustainable Tourism at the Eberswalde University of Applied Sciences (ZENAT), developed a concept and a method for collecting empirical information on the share of sustainable tourism in Germany. This was then applied as an example. The basis for this was the linking of the Tourism Satellite Account (TSA) with the Environmental Economic Accounts (UGR). Several workshops and conferences with experts from science, practice, and politics have discussed the results and identified the fields requiring action. In various discussions and strategy papers, recommendations for the further development of sustainable tourism as well as improved documentation of tourism statistics have been determined.

adelphi was leading the development of the indicators for determining sustainable tourism on the sector level as well as on the company level. The work was based on a comprehensive inventory and subsequent evaluation of existing accounting approaches as well as the identification of potential data sources.

By creating a uniform evaluation grid and evaluating the relevant data sources, it is possible for the to examine the status quo of tourism in Germany in the three dimensions of sustainability (ecology, economy, and society). This creates the basis for continuous monitoring and the accompanying further strengthening of sustainable tourism.

Jan Christian Polanía Giese

Always stay informed

Our latest adelphi insights straight to your inbox via our newsletter.

What We Think

This decade is crucial for the future of the planet.

adelphi is Europe’s leading independent think-and-do tank for climate, environment and development.

Follow us on:

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

WTTC Predicts Germany’s Travel & Tourism Sector to Rebound to 95% of Pre-pandemic Levels

Travel & Tourism contributes one in eight jobs International visitor spend up more than 60%

London, UK: The World Travel & Tourism Council’s ( WTTC ) 2023 Economic Impact Research (EIR) today reveals Germany’s Travel & Tourism sector is recovering at pace to recover to within 95% of pre-pandemic levels. The sector is set to contribute €355BN to the national economy this year, getting to within 95% of the 2019 highpoint, and representing 9.3% of the economy. WTTC is also forecasting that the sector will create more than 168,000 jobs this year, recovering most of the jobs lost due to the COVID 19 pandemic to reach 5.6MN. A look back on last year Last year, the Travel & Tourism sector’s GDP contribution grew by 43.4% to reach more than €338BN, representing 8.8% of the economy, edging closer to the 2019 high of €374BN. Last year the sector also created 550,000 more jobs from the previous year to reach 5.4MN jobs nationally – one in eight jobs across Germany. The sector has now recovered over 50% of the 1MN jobs lost during the pandemic. Last year also saw the return of international travellers heading to Germany with spending from overseas visitors growing 61% to reach almost €31BN. Domestic visitor spend is within touching distance of the pre-pandemic level of €307.8BN and is currently €304.4BN, a year-on-year increase of 49%.

Julia Simpson, WTTC President & CEO, said: “The Travel & Tourism sector in Germany is making a strong recovery. It will contribute €355BN to the German economy this year and employ one in eight jobs across the country. “Germany is forecast to remain the fifth most popular tourism destination in Europe over the next decade, demonstrating its enduring appeal.” What does the next decade look like? The global tourism body is forecasting that the sector will grow its GDP contribution to more than €440BN by 2033, 10.3% of the overall economy and will employ almost 6.1MN people across the country, with one in seven Germans working in the sector. Europe In 2022, the European Travel & Tourism sector contributed €1.9TN to the regional economy, just 7% below the 2019 peak. WTTC forecasts the region’s GDP contribution from the sector will reach more than €2TN in 2023 - within touching distance of the 2019 highpoint. The sector employed almost 35MN people across the region in 2022, an increase of 2.9MN from the previous year but still 3.2MN behind pre-pandemic levels. WTTC forecasts the sector will fully recover the jobs lost during the pandemic by the end of 2024. Download Press Release

.jpg)

Contribuirá el sector de viajes y turismo con más de 264 mil millones de dólares al PIB de México durante 2024: WTTC

.jpg)

Australia’s Tourism Sector Set to Contribute Record-Breaking $265BN to the Economy

.jpg)

France’s Travel & Tourism Broke All Records Last Year, WTTC Research Reveals

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

- Market Overview

- Market Challenges

- Market Opportunities

- Market Entry Strategy

- Agricultural Sector

- Aerospace/Defense/Security

- Advanced Manufacturing

- Healthcare and Medical Technology

- Information and Communications Technology (ICT)

- Smart Cities

- Travel & Tourism

- Trade Barriers

- Import Tariffs

- Import Requirements and Documentation

- Labeling and Marking Requirements

- U.S. Export Controls

- Temporary Entry

- Prohibited and Restricted Imports

- Customs Regulations

- Standards for Trade

- Trade Agreements

- Licensing Requirements for Professional Services

- Distribution & Sales Channels

- Selling Factors and Techniques

- Trade Financing

- Protecting Intellectual Property

- Selling to the Public Sector

- Business Travel

- Investment Climate Statement

Travel and tourism are critical drivers of economic growth and employment in the United States, accounting for nearly 3% of U.S. gross domestic product (GDP). With one domestic job stemming from every 69 international visits to the U.S., and 9.9 million American jobs paying more than $322 billion in employee compensation, approximately 1 in every 20 jobs in the nation is contingent upon continued travel and tourism.

Germans are well-known for visiting second and third tier destinations within the United States, not just the major gateways and attractions, thus playing a critical role in the wellbeing of American tourism. All data points to the fact that Germany will remain a significant source market and partner.

Most German visitors to the United States book their travel through German tour operators and/or travel agencies, thus availing themselves of German travel package laws safeguarding their vacation investment. Whereas these packages are typically purchased early, however, the length of time between booking and travel has shortened considerably since the Pandemic. The reversal of this trend may transpire in the course of a “return to normalcy.”

The United States welcomed 1,481,000 visitors from Germany in 2022. Already in the first three months of 2023, over 318,000 travelers from Germany have arrived in the U.S, with this figure ranking among the highest for foreign travel to the U.S. Summer months are the most popular for German travel, so it is likely that this number will rise before the end of the year (ADIS/I-94 Visitor Arrivals Monitor).

For summer 2023, there are more than 400 direct daily flights (or 70 weekly flights) from Germany to the U.S. (with American Airlines, Condor, Delta Airlines, Euro wings Discover, Lufthansa, Singapore Airlines, United Airlines).

German Travel Sector: Germany’s 9,000+ travel agencies have experienced significant losses due to uncertainty, but as restrictions have been loosened, many have seen an uptick in their business.

Opportunities

The Visit USA Committee Germany e.V. plans to continue its successful series of in-person and online training opportunities for members to present to German travel industry partners and consumers. Here is a link to their extensive business plan for 2023/2024:

https://vusa.travel/business/

Contact [email protected] for details on how to sign up.

ITB Berlin, the Internationale Tourismus Boerse, one of the world’s largest travel trade shows, is scheduled for March 5-7, 2024 and will have a USA Welcome Pavilion for U.S. tourism suppliers and partners.. See https://www.itb.com/en/.

Policy Objectives and Challenges

The recovery of business travel remains ‘sticky,’ with gradual resumption of normal services; as companies have pivoted towards virtual communications, staff availability remains challenging and resulting upwards pressure on employee hours remains a concern to be addressed. High inflation, the energy crisis, and ongoing war in Ukraine are of particular worry to German consumers, and rising prices along with the connected drop in demand could present a challenge for U.S. companies. However, as of right now, demand from German travelers remains high.

Trade Events

- Oohh! The LeisureWorlds – holiday and leisure, Hamburg, February 7-11, 2024

- CMT – tourism and leisure, Stuttgart, January 13-21, 2024

- f.re.e – leisure and travel, Munich, February 14-18, 2024

- ITB – travel, Berlin, March 5-7, 2024

- IMEX – meetings and events industry, Frankfurt, May 14-16, 2024

Entry and visa regulations information

U.S. Embassy and Consulates in Germany

Official ESTA Application Website, U.S. Customs and Border Protection (dhs.gov)

Visa Navigators

Official site of the Visit USA Committee Germany

Brand USA’s consumer website in German

German landing page for Recreation.Gov (http://www.natuerlichusa.de/)

Germany - Travel & Tourism (trade.gov)

Visa Unit at the U.S. Embassy in Berlin (google.com)

U.S. Consulate in Munich (google.com)

- OPEN DATA GERMANY

The future of data management for inbound tourism to Germany

I am happy to announce that the German tourism industry’s biggest ever data infrastructure project is now live! Today, in conjunction with all project participants, we finally brought the GNTB Knowledge Graph on stream. Over the past three years, we have put in a lot of hard work – and shown great agility and vision – in order to get this collaborative project up and running. At this point, I would like to thank my team and all the various partners, the 16 regional marketing organisations for the federal states, the Magic Cities marketing association, the travel technology company Amadeus, the German Convention Bureau, representatives from academia and other tourism partners. My thanks also go to all those who have provided funding and other support for this project, above all the Federal Ministry for Economic Affairs and Climate Action. Now that the Knowledge Graph has gone live, the critical phase of creating new business models begins . The digital guest in the digital destination will be better informed and will be able to make their trip smoother, more memorable and more sustainable. I would like to take today’s launch of the Knowledge Graph as an opportunity to share some thoughts on the current state of play, the positioning and the tasks that lie ahead.

1. Strategic positioning

The GNTB is contributing to key areas of action in the German government’s data strategy through the project. It is putting in place high-performance, sustainable data structures, it is making data use innovative and responsible, it is improving data literacy and it is establishing a data culture. The project, part of the German government’s national tourism strategy , will be pivotal to the process of digital transformation in Germany, particularly for the tourism industry and its predominantly SME businesses. By launching the Knowledge Graph, we have successfully brought the tourism industry’s biggest ever data infrastructure project to fruition. The sharing of data across organisations, federal states and industries using this kind of system can already be seen as a pioneering achievement within the German economy. It is also sending a clear signal as to the innovative capabilities of our sector.

2. Key challenges

Digital touchpoints already feature throughout the customer journey – from the initial inspiration via virtual reality, the research, planning and booking stage (e.g. with the aid of conversational interfaces), to the travel experience itself, with traveller IDs, digital guest cards and real-time management of visitor flows to smooth out peaks during the high season. Digital analysis and the profiling of travellers, on the other hand, are facilitating the development of products for future trips and enabling capacity to be planned in line with demand. And those are just some of a long list of current and potential applications. The proportion of bookings made online by our international guests has gone up from just under 70 per cent to nearly 90 per cent over the past decade. So it is all the more important for destinations to ensure that their data is included on the digital platforms and services where these bookings are made. The digital transformation is progressing in ever shorter cycles. It took social media platforms such as Facebook and Instagram years to become established, for example, whereas technological innovations such as OpenAI’s chatGPT have secured significant market penetration within a matter of weeks. Competitors have recognised this too. The number of AI-supported applications, whether for processing text, generating images or providing customer service, is growing on what seems like an hourly basis. Of course, you can’t just install AI like an Office programme and leave it to its own devices. To make the most efficient and effective use of AI, we need to have at least a basic grasp of how AI-supported applications work and what the algorithms and learning mechanisms are actually doing.

3. The status quo in June 2023

The Open Data project is our response to the supply- and demand-led disruption of the travel market worldwide . It is enabling us and our partners to tap into the commercial potential of tourism-related data using AI applications. It should be kept in mind here that the flow of data is more important than the channel used to transmit it. What matters most for the user is that the data they need actually reaches them. The paths it takes are, for them, immaterial. By focusing our strategy on digital technologies, we are securing the competitiveness of Destination Germany in the international market. Now that the Knowledge Graph has gone live, all stakeholders – from global sales platforms and tourism service providers to start-ups – have access to more than 200,000 up-to-date and high-quality data sets that are generally available for download. These data sets – as things stand – cover 100,000 tourism assets (POIs, tours, events, restaurants, cafés, hotels etc.) and a further 100,000 infrastructure components. Drawing on tourism data from all 16 federal states, the Knowledge Graph serves as a central database for Germany’s tourism industry. Other project partners include the Magic Cities marketing association, travel technology company Amadeus, the German Convention Bureau and representatives from academia. The technical infrastructure put in place so far also offers many other partners in both the public and private sectors the opportunity to seamlessly link their reservoirs of data to the Knowledge Graph via their regional marketing organisation.

4. The potential today

A key asset of the Knowledge Graph, besides actually collecting the data in one place, lies in ensuring that the data is structured, licensed, integrated and made accessible in an enhanced form. Data of this unprecedented quality, which is available to all market players, means that even less well-known tourism offerings are able to be found by AI applications. This will allow SMEs and start-ups to develop their own intelligent, customer-centric services and secure a foothold for them in the market. The Knowledge Graph provides a basis for developing innovative applications that utilise the power of AI. Such an application might analyse, forecast and manage visitor flows , for example, helping to avoid congestion, relieve the pressure on tourism hotspots during peak times, protect sensitive natural habitats and ensure a better quality of stay. We can use open data to which semantic meaning has been added to accelerate the learning capabilities of voice and other virtual assistants . The number of these virtual assistants is already growing at an exponential rate. From the navigation systems found in cars to the self-learning chatbots used in customer service hotlines, conversational interfaces are increasingly becoming the norm in more and more parts our lives. The effects are also being felt in the world of work. The shortage of skilled workers will likely only get worse thanks to demographic change. But if AI-driven systems are able to take on routine tasks on a 24/7 basis, skilled employees will be able to spend more of their time on specialist or complex tasks.

5. Open data is a collaborative matter

At the go-live, the Knowledge Graph presents itself as a federal project coordinated by the GNTB and supported by all federal states. To mark the occasion of the go-live, the managing directors of the 16 regional tourism organisations have reiterated this commitment.

6. Next Steps

I cannot stress highly enough that today’s launch should be seen as a milestone in our digital journey, not the end point. The associated technological leap will enable us to open up more and more content-based dialogues with the guest at increasing numbers of touchpoints. To achieve this, we have set out key tasks for the GNTB over the coming weeks and months. And we are not alone. Many tourism partners have also recognised the opportunities and challenges presented by the project and are forging concrete plans for their own next steps. I am pleased to be able to share with you here some of the initiatives that are planned and what they will be doing with the data. Meanwhile, we at the GNTB will be redoubling our efforts on the data distribution side by building and expanding contacts to potential data users. Rail services are also planning to provide data for the Knowledge Graph, which will help others to improve their services along the customer journey. And by promoting train travel as a climate-friendly transport option, we are clearly addressing the need to make tourism in Destination Germany more sustainable. We will also be using data from the Knowledge Graph to train our AI-assisted chatbot Anja at www.germany.travel .

7. A look ahead to the future

The Knowledge Graph facilitates a level of innovation that extends far beyond the day-to-day business of the tourism industry. Among other things, this is drawing back the curtain on the increasingly close relationship between a destination’s appeal from a tourism perspective and its appeal as a centre of commerce and industry . In an increasingly agile and mobile world of work, digital nomads are already leading the way here. On the academia and research side, open data and the interoperability of the data model will allow stakeholders to use tourism data to develop and implement visitor management systems. This data is also a boon for the design of smart cities. We are already engaged in intensive dialogue at various levels, and the networks we are building to this end are growing steadily in both reach and granularity. Going forward, we will need to engage in closer dialogue with representatives from academia and with others such as the chambers of industry and commerce in order to initiate appropriate training programmes and set up research projects. The question of data sovereignty is often brought up in this context. Here too, the Open Data project can be seen as a positive development. After all, the destinations and service providers at the various levels retain control over their own data and content and can still use it for their own purposes. They decide how the data is collected, stored, processed and used. This gives them greater autonomy over the delivery of services and/or offerings that are based on their data and over the visibility of their own products and services. The portability of the data is a closely related topic. Having an independent data management tool means that data can be transferred much more easily between different systems, platforms and applications. The destinations are therefore able to move their data from one service provider or product vendor to another or to put it to use in other spaces, such as smart city projects , without loss or restriction. This gives them the freedom to choose service providers and distribution channels that will make best use of their data in related areas and prevent them from becoming overly reliant on individual providers. It will also be important to link up with the many digital projects at European Level such as the European Data Space for Tourism (DATES). Technological innovations in data management go hand in hand with criteria such as data protection, data sovereignty, data ethics and d ata culture . The launch of the Open Data/Knowledge Graph project is a milestone in making international tourism – and therefore inbound tourism to Germany – sustainable, competitive and fit for the future. The regional marketing organisations are also telling us about projects that make specific use of the Knowledge Graph and that are set to be implemented over the course of this year. Here are some examples from our project partners in the federal states:

Bavaria: Barbara Radomski, Managing Director of Bayern Tourismus Marketing GmbH

“We will soon have access to a range of sensor data that can deliver real-time information about capacity utilisation and facilitate forecasts. We are also working on attractive modules, covering aspects such as winter sports and events, that will enable us to offer our guests the best possible information. Services via BayernCloud Tourismus, including widgets that provide a website construction kit and a bespoke app, will add value by making the best use of the available information.”

Baden-Württemberg: Andreas Braun, Managing Director of Tourismus Marketing GmbH Baden-Württemberg

“We are currently looking at how AI can simplify data management in our mein.toubiz system, and are continuing our training programme of webinars, discussions and specialist seminars on legal matters. We hope this will dispel any doubts, enable us to keep any barriers to adoption to a minimum and encourage those responsible for data to make it available. One way of achieving this is by including topics that are relevant and current in our database, such as mobility, sustainability and accessibility.”

Hessen Herbert Lang, Head of Tourism, HA Hessen Agentur GmbH

“This year, we will be rolling out our content hub as part of the modular Tourismus-Hub Hessen, a central database for all non-bookable tourism information from Hessen’s ten main destinations. The technology allows the various players to collate and link tourism-related data, such as content on points of interest, places to visit and places to eat, and make it available in one central location. Data from across Hessen is pooled in the content hub, either by entering it directly or via an interface with an existing destination database system. The graph-based database allows for the information to be passed on to the GNTB’s Knowledge Graph.”

Lower Saxony Meike Zumbrock, Managing Director of Tourismus Marketing Niedersachsen GmbH

“We plan to link more databases – including TOMAS for accommodation providers, plus experiences and guided tours – in order to expand our range of data. We are also looking into linking open-data content from the Niedersachsen Hub via the Knowledge Graph with data sets that are not directly related to tourism, such as traffic and infrastructure data, real-time geo data, public transport timetable information, parking space availability, POI capacity, information on nature conservation areas, real-time water quality and levels, air quality and more. This will establish the Knowledge Graph as the central repository for tourism-related open-data content in Germany, and enable many useful applications that offer added value for visitors.”

North Rhine-Westphalia Dr. Heike Döll-König, Managing Director of Tourismus NRW e.V.

“We aim to improve the quality of the data in the Data Hub NRW by the end of the year by adopting the standards of the Open Data Tourism Alliance and tightening our quality criteria. Working with data users, we will identify new use cases and develop innovative solutions. We will also press ahead with skills training in order to promote a broad data mindset across the North Rhine-Westphalia tourism landscape. Adding sustainable travel experiences and transport options will also allow us to further customise and expand our tourism offering.”

Saxony Veronika Hiebl, Managing Director of Tourismus Marketing Gesellschaft Sachsen mbH

“We have launched a new ‘Open Data Offensive’ format with our DMOs to support the transfer of knowledge and the implementation in collaboration with data managers across Saxony. The two-hour webinar was launched in May as a joint event with Tourismusverband Erzgebirge, and we now plan to roll it out to other regions in Saxony. We are also working on expanding the stationary and mobile use cases for our SaTourN system. In May, two further output channels from Leipzig Tourismus und Marketing GmbH were added to SaTourN, the state-wide digital architecture for tourism data in Saxony. These two digital information terminals and a number of displays in Leipzig’s main train station and the refurbished tourist information office provide travellers with recommendations and information on places of interest, offers and events for their stay in Leipzig. The data relating to Leipzig is delivered to a progressive web app via the SaTourN system and displayed in German and English at the information points and on the displays.”

Thuringia Christoph Gösel, Managing Director of Thüringer Tourismus GmbH

“With the help of funding from Thuringia’s State Chancellery, we have established three interactive digital exhibitions – one in Weimar, one at Wartburg Castle and one as part of the German National Garden Show in Erfurt – to provide information about leisure activities in Thuringia. The exhibitions use data from ThüCat and thematic links to promote Thuringia’s tourism hotspots in an engaging way. They have been designed to inspire visitors and locals to explore more of Thuringia. After its stint at the German National Garden Show, the exhibition in Erfurt will move to Altenburg. The modular construction of the stands ensures that their use is sustainable.”

International

As a member of the Open Data Tourism Alliance (ODTA), the GNTB is stepping up its international dialogue aimed at developing further common tourism data standards. Three national tourist organisations and 20 partners at federal level are already on board. The ODTA uses the experiences we have gained from our use cases, among other things, in its work on data ontology. This ensures that the data standards needed in tourism are continuously refined and submitted to the schema.org consortium by the ODTA.

8. Conclusion

The delivery of the Open Data/Knowledge Graph projec t is of huge significance from a political, economic and technological perspective, and also in respect of more sustainable forms of tourism. We have put ourselves on the right track for the future with our launch today. It is now a question of gaining momentum so that Destination Germany can continue to stand strong in the international market for many years to come.

Petra Hedorfer

Chairwoman of the GNTB

Share this post, please choose a provider:

Related posts.

Intelligent language applications in tourism

Going-live Knowledge Graph

Access for data retrieval

Speak, not type

How the largest digital infrastructure project in tourism is taking shape

Shaping tourism with data diversity

Viewpoints – AI Applications in Use at Regional Marketing Organisations

Better linked, easier sell

Digital Guest Information and Visitor Guidance in the Bay of Lübeck

Pandemic. Open Data engine.

- Travel, Tourism & Hospitality ›

- Leisure Travel

Tourism industry in Germany - statistics & facts

Germany is one of the most visited countries in Europe . Its sixteen states are all distinctive in their own way, differing in terms of population, landscapes, architecture, history and even local dialect. Both for domestic and international arrivals, Germany is well-connected in terms of travel routes and options. This is, after all, the home of the Deutsche Bahn . In general, Germans go on a variety of travels both in and outside of the country. While the trip is the end goal, planning for it is considered a serious activity in itself, with travelers usually devoting time and attention to pre-holiday organizing and booking. In most cases, holiday components taken care of in advance involve booking a package or customized tour, as well as arranging accommodation. Making travel plans has changed enormously because of the internet. The rising use of various online travel websites among consumers, both for research and for bookings, has contributed to losses for traditional travel agencies. The modern traveler can often circumvent an agency entirely and plan the whole trip independently, since virtually any travel activity, tickets and accommodation can be booked online. Travel accommodation is a vital part of the German tourist industry, with the country offering various types of places to stay for tourists and visitors. Online platforms such as Airbnb, where residential property owners can put up their apartments or houses for short-term rent, are also an option for visiting guests, thus introducing additional competition on the travel market. All the same, the travel accommodation industry had been recording encouraging annual growth levels, at least, before the pandemic. As of 2021, total revenue from tourist accommodation in the country amounted to around 20.4 billion euros. This text provides general information. Statista assumes no liability for the information given being complete or correct. Due to varying update cycles, statistics can display more up-to-date data than referenced in the text. Show more Published by Statista Research Department , Mar 15, 2024

Key insights

Detailed statistics

German hospitality industry revenues 2013-2022

Tourist arrivals in German travel accommodation in 1992-2023

Tourist overnight stays in Germany 1992-2023

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Ranking of the most popular types of travel in Germany 2018-2021

Travel, Tourism & Hospitality

Travel and tourism's total contribution to GDP in Germany 2019-2034

Number of hotels in Germany 1992-2023

Related topics

Recommended.

- Accommodation industry in Germany

- Travel and tourism in Europe

- Inbound tourism in Europe

- Chinese tourism in Europe

- Travel and tourism in Czechia

- Travel and tourism in the metaverse

Recommended statistics

- Premium Statistic Revenue in the travel industry in Germany 2005-2022

- Premium Statistic German hospitality industry revenues 2013-2022

- Premium Statistic Hospitality industry revenue by type of business in Germany 2019-2022

- Premium Statistic Tourist arrivals in German travel accommodation in 1992-2023

- Basic Statistic Tourist overnight stays in Germany 1992-2023

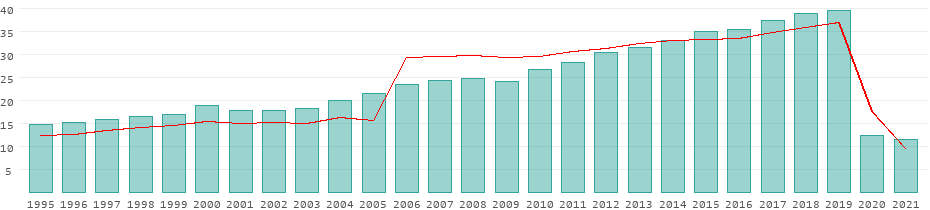

Revenue in the travel industry in Germany 2005-2022

Development of annual revenues in the travel industry in Germany from 2005 to 2022 (in billion euros)

Revenue in the hospitality industry in Germany from 2013 to 2022 (in billion euros)

Hospitality industry revenue by type of business in Germany 2019-2022

Revenue in the hospitality industry in Germany from 2019 to 2022, by type of business (in billion euros)

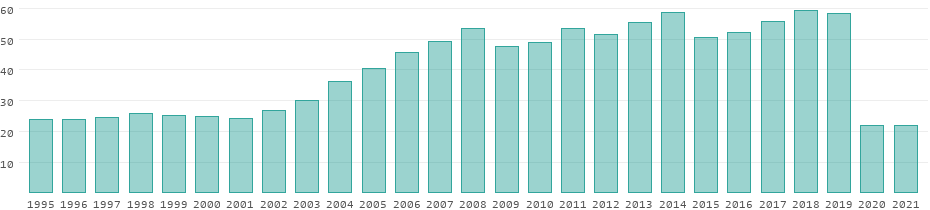

Number of tourist arrivals in travel accommodation in Germany from 1992 to 2023 (in millions)

Number of overnight stays at travel accommodation in Germany from 1992 to 2023 (in millions)

Tour operators, travel agencies and industry employees

- Premium Statistic Total revenue of German tour operators 2004-2023

- Premium Statistic Total revenue of German travel agencies 2002-2023

- Premium Statistic Online travel agencies with the best service in Germany 2023

- Premium Statistic Gross annual earnings of travel agency employees in Germany from 2010 to 2022

- Premium Statistic Employees at accommodation establishments in Germany 2021-2023

- Premium Statistic Number of employees in the hospitality industry in Germany 2004-2023

- Premium Statistic Number of tour operator and travel agency employees in Germany 2008-2023

- Premium Statistic Employees at accommodation establishments in Germany 2012-2022

Total revenue of German tour operators 2004-2023

Total revenue of tour operators in Germany from 2004 to 2023 (in billion euros)

Total revenue of German travel agencies 2002-2023

Total revenue of travel agencies in Germany from 2005 to 2023 (in billion euros)

Online travel agencies with the best service in Germany 2023

Online travel agencies in Germany in 2023, ranked by best service

Gross annual earnings of travel agency employees in Germany from 2010 to 2022

Average annual gross earnings of full-time travel agency and other travel booking service employees in Germany from 2010 to 2022 (in euros)

Employees at accommodation establishments in Germany 2021-2023

Number of employees at tourist accommodation in Germany from 2021 to 2023, by type of establishment

Number of employees in the hospitality industry in Germany 2004-2023

Number of employees subject to social security payments in the hospitality industry in Germany from 2004 to 2023

Number of tour operator and travel agency employees in Germany 2008-2023

Number of employees subject to social security deductions in the tourism industry in Germany from 2008 to 2023

Employees at accommodation establishments in Germany 2012-2022

Number of employees liable to social insurance contributions at accommodation establishments in Germany from 2012 to 2022

Transport and accommodation

- Premium Statistic Number of passengers in German airports 2001-2023

- Premium Statistic Capacity utilisation of long-distance trains of Deutsche Bahn AG until 2023

- Premium Statistic Cruise passenger numbers from Germany 2004-2023

- Premium Statistic Accommodation revenues in Germany 2012 to 2022

- Premium Statistic Tourist accommodation open in Germany 1992-2023

- Basic Statistic Distribution of hotels in Germany by number of stars 2024

- Premium Statistic Average hotel RevPAR in selected German cities in 2022

- Premium Statistic Open campgrounds in Germany 1992-2020

- Premium Statistic Youth hostels in Germany 1991-2023

- Premium Statistic Guest arrivals in Germany by origin and accommodation type 2023

- Premium Statistic Overnight stays in Germany by accommodation type and origin 2023

Number of passengers in German airports 2001-2023

Number of passengers in German airports from 2001 to 2023 (in millions)

Capacity utilisation of long-distance trains of Deutsche Bahn AG until 2023

Capacity utilisation of long-distance trains of the Deutsche Bahn AG in Germany from 2006 to 2023

Cruise passenger numbers from Germany 2004-2023

Number of cruise passengers* from Germany from 2004 to 2023 (in 1,000)

Accommodation revenues in Germany 2012 to 2022

Revenue of the travel accommodation industry in Germany from 2012 to 2022 (in billion euros)

Tourist accommodation open in Germany 1992-2023

Number of open tourist accommodation establishments in Germany from 1992 to 2023

Distribution of hotels in Germany by number of stars 2024

Distribution of hotels in Germany as of January 2024, by number of stars

Average hotel RevPAR in selected German cities in 2022

Average revenue per available room (RevPAR*) in hotels in selected German cities in 2022 (in euros)

Open campgrounds in Germany 1992-2020

Number of open campgrounds in Germany from 1992 to 2020

Youth hostels in Germany 1991-2023

Number of youth hostels in Germany from 1991 to 2023

Guest arrivals in Germany by origin and accommodation type 2023

Guest arrivals in Germany in 2023, by origin and accommodation type (in millions)

Overnight stays in Germany by accommodation type and origin 2023

Number of overnight stays in Germany by accommodation type and origin in 2023 (in millions)

Travel destinations and activities

- Premium Statistic Most popular vacation destinations among Germans 2021-2023

- Premium Statistic Most popular vacation activities among Germans in Germany in 2023

- Premium Statistic Popular regions for bike travel in Germany 2023

- Premium Statistic Vacations in Germany by type of planning in 2023

- Premium Statistic Booking channel preferences for vacation travel in Germany 2024

Most popular vacation destinations among Germans 2021-2023

Leading vacation destinations among Germans from 2021 to 2023

Most popular vacation activities among Germans in Germany in 2023

Most popular activities among Germans during vacation in Germany in 2023

Popular regions for bike travel in Germany 2023

Most popular regions for bike travel in Germany in 2023

Vacations in Germany by type of planning in 2023

Vacation trips in Germany in 2023, by type of planning

Booking channel preferences for vacation travel in Germany 2024

Preferred channels used for booking vacation trips in Germany in 2023/24

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Schengen News

- Liechtenstein

- Netherlands

- Switzerland

- Borders & Security

- Policy Changes

- ETIAS Travel Authorization

- Restrictions & Entry Bans

- Golden Visa

- Romania – Schengen

- Bulgaria – Schengen

Germany’s Tourism Industry Reports Significant Increase in Int’l Demand

BLS International Opens New Visa Application Center in Mumbai Due to High Demand for Spanish Schengen Visas

Increasing number of foreign workers in poland is “threatening” local employees, trade unions says, us begins procedures to grant visa-free travel to cypriots, your chances to get an austrian work visa are higher if you belong to one of these professions, italy’s capri island lifts ban on tourist arrivals after ordering so due to water crisis.

German tourism has experienced an incremental growth in international demand for tourism, the German National Tourist Board (GNTB) report reveals.

Furthermore, the Site Minder’s World Hotel Index has revealed that about 30.8 per cent of all 400 global hotel bookings for October 2021 are registered in German hotels, .

Moreover, the top market research company, Ipsos, announced that Germany has been once again selected as the top spot on the Anholt-Ipsos Nation Brands Index (NBI) 2021, gaining 71.06 points, about 1.94 more than in 2020.

For this year’s NBI, more than 60,000 population-representative interviews were carried out over 18-year-olds in 20 countries from July 6 to August 13, 2021.

The NBI essentially is a multinational market research and consulting service provider based in France in 1975 and now widely spread across other nations, including Spain, the United Kingdom, Italy and Central Europe.

According to Forward Keys, international flight arrivals in Germany increased to about a quarter compared to 2019 levels by July 2021. Moreover, it returned to about a third of pre-COVID levels in August and September 2021.

In addition, the sales of international train tickets to Germany through Deutsche Bahn’s e-commerce sales channels were 37.0 per cent of 2019. On the other hand, from January through July 2021, 41.5 per cent through August, and 44.3 per cent through September 2021.

“ The latest news demonstrates the direct link between Germany’s excellent reputation, growing willingness to travel in our source markets, our countercyclical marketing activities and a successful recovery strategy for restarting incoming tourism, as well as positioning Germany as a travel destination in the increasingly fierce competition among destinations,” Petra Hedorfer, Chief Executive Officer, German National Tourist Board, said.

In 2021, Germany was ranked for the fifth time in a row as first, whereas overall, the county has been ranked first for the seventh time in the NBI, finally meeting United States ranks. On the other hand, the United Kingdom has dropped from second to the fifth position in 2021.

Japan and Italy have climbed the ranking, with Japan making its debut in the top three for the first time since 2018. It also climbed from fourth in 2020 to third this year with a positive outcome on Exports, Tourism, Culture, and People. On the other hand, Italy progresses from sixth to fourth place with strong opinions on its Culture, Tourism, and People.

Furthermore, the report shows that Germany is ranked in the top ten list of five categories that make up the Nation Brands Index: Exports, Government, Culture, Tourism, and Immigration/Investment.

Survey participants estimate Germany at 73.24 points in the tourism sector, about 2.65 points higher than in the previous year, ranking the country in tenth place globally. In the subcategories of tourism, respondents rate tourism location above-average, especially for the “Historic Buildings” and “Vibrant Cities” subcategories, which rank Germany as the 7 th in each.

Top Stories

Frontex warns travellers of risks posed by unofficial etias websites, 1.4 billion people will have to apply for an etias authorisation before travelling to eu by mid-2025, is your flight cancelled or delayed in 2024 get to know your compensation rights in eu, germany remains your best option for obtaining a multiple-entry schengen visa in 2024, data show, barcelona to end all holiday rentals by 2028 in effort to reduce housing crisis, paris raises eiffel tower ticket prices by 20% in attempt to save the iconic landmark, france’s travel & tourism sector broke records in 2023, aims to surpass them this year, germany issued nearly 54,000 family reunification visas so far this year, foreigners make up for 58% of prisoners in some germany states, germany introduces new migration measures that will allow romania’s full accession to schengen, china & brazil are the 2 biggest sources of tourists to eu in 2024, survey reveals, germany working to speed up visa process for non-eu skilled workers, minister baerbock says, 300 turks were unable to enter rhodes island due to visa system collapse, german police detects irregular entries & visa fraud in light of european championship, chinese became 2nd largest nationality of germany schengen visa applicants in 2023, 15% of brits less likely to travel to eu once entry/exit system comes into force, number of resident migrants in portugal surges by 130%, surpassing 1 million in 2023, 8 eu countries push for free movement restrictions against russian diplomats, number of immigrants in hungary saw a notable surge, reaching over 403,000 in 2023, lithuania revokes about 1,500 residence permits, bans over 1,200 foreigners from entering country, dominican republic working to reach visa-free travel agreement with eu, schengen visa appointments in uae fully booked until early september.

- Editorial Policy

- Privacy Policy

- Cookie Policy

- Terms & Conditions

Ready for check-in? Lessons from the German travel recovery

With the opening of borders and the relaxation of travel restrictions in most of Europe in mid-June, we are seeing an initial restart of the travel industry. Hotels are reopening, and airlines are resuming flights on a reduced but regular schedule. Majorca, one of the most popular destinations for German vacationers, was allowing a limited number of German tourists as a part of its trial reopening.

The restart of travel after the COVID-19 lockdown raises many questions:

- What are the post-lockdown consumer trends shaping the industry?

- What will the changes in consumer behavior entail for major tourism players and stakeholders?

- What are the near-term and long-term business risks and opportunities for individual industry players?

- Tourism has historically rebounded to its precrisis way of operating following an economic crisis. Given that the current economic crisis was precipitated by a public-health crisis, might we see changes to the industry that persist long into the future?

These myriad open questions reveal the intense uncertainty associated with both what post-COVID-19 vacation travel patterns will look like and how companies in the industry, such as public tourism authorities or accommodations and transportation providers, should respond to the changing tourism landscape.

Our already available reports bring together lessons learned from other countries, especially China , analyze scenarios for the recovery of US hotel occupancy , and together with IATA provide ways to track and understand demand recovery .

In this report, we draw upon the insights from our proprietary travel dashboard, developed in partnership with trivago. We identify and quantify key emerging travel trends, discuss their impact on vacation travel patterns, and provide guidance on how travel industry players can utilize data insights to manage the resulting situations. There is no doubt about ambiguity within the industry and the limited data transparency to understand demand development. At the same time, the travel industry needs to look beyond the challenge and see the opportunity.

Eight trends shaping the post-COVID-19 travel market

While there are several individual anecdotes and even more opinions about how the crisis has shaped the travel market, data and empirical evidence have been limited so far. That said, observations from recovering travel markets may demonstrate early patterns, giving travel players a head start. We chose Germany as a reference point due to its position as the largest European and third-largest global international travel market, and the fact that its metrics are commonly seen as leading the recovery curve.

Eight important—and, in part, mutually reinforcing—trends that have emerged during the COVID-19 crisis can be observed.

1. Travelers are showing increasing appetite for and confidence in travel

During the lockdown, search volume dropped to only about 10 percent of the pre-pandemic volume, and actual click-outs (redirections to provider websites) dropped even more sharply. Today, search volume is up to 55 percent of where it was at the beginning of the year, and the conversion rate has been almost fully restored: about 99 percent of the rate from the beginning of the year.

2. Domestic travel is outperforming international travel for the first time

Historically, search volumes from January to July favored international destinations about 27 percent higher than domestic ones. The earlier opening of the domestic market while international restrictions remained has reversed this trend, giving domestic travel the lead. In fact, June showed about 36 percent higher domestic demand than international.

3. Last-minute bookings are gaining in importance

Potentially due to the uncertain epidemiological situation at the peak of the crisis (April to May), travelers had been planning both their domestic and international travel for later in the summer. The lifting of restrictions, which went into effect on June 15 for European countries, appears to be behind a surge in last-minute bookings. This year’s share of June and early-July travel bookings with a start date within 30 days after booking has exceeded the respective share of June and July 2019 bookings by 7 percent.

4. German travelers stick to their favorite pre-COVID-19 destinations abroad

Two of Germany’s neighbors, Austria and the Netherlands, are among the most popular international destinations as travel resumes. Search volumes and conversion rates for both countries have been growing since May. This may be due to the ease and perceived relative safety of travel to these countries. Nevertheless, German travelers’ current list of top vacation destinations extends well beyond the border and even includes countries severely hit by COVID-19 such as Italy, Spain, and France.

5. Travelers are turning to German seaside alternatives

Among domestic destinations, the attractiveness of Germany’s coastal regions (Mecklenburg-Western Pomerania, Schleswig Holstein) has increased significantly. Along with mountain and other nature-focused regions, domestic coastal destinations have been considerably more in demand since the outbreak of the crisis.

6. Longer trips gain in popularity

Demand for longer trips (more than seven days) has not only recovered but has exceeded precrisis levels. Demand for one- to two-day travel, despite a dramatic recovery since May, is still around 63 percent of where it was at the beginning of 2020. Considering the financial impact of the crisis, it is possible that travelers are choosing to skip weekend getaways in favor of longer summer holidays with their families.

7. Demand for vacation homes nearly doubled during the crisis

The total demand for vacation rentals increased during the crisis, up approximately 78 percent from March 2020 to its peak in May. For domestic travel, the demand even more than doubled during its peak in May 2020 versus March 2020. We saw the overall share of vacation rentals begin to decline in June as many hotels resumed operation, but the share remains significantly higher than it was precrisis.

8. Despite a drop in prices, travelers’ willingness to pay for nature-oriented destinations remained almost unchanged

An analysis of price development since March determined that though travelers were mostly offered lower prices, they were still willing to pay 2019-level prices or higher for mountain, coastal, and other nature-oriented destinations. By contrast, travelers headed to city destinations, which are more dependent on a mix of business and leisure travel, were more price sensitive. These travelers paid less than they did last year.

The current COVID-19-related developments and dynamics in the travel industry are unprecedented, but there is little empirical data to point to the drivers of these shifts in the market. However, analysis shows that certain patterns and “industry rules” still seem to be valid when combined appropriately. It goes without saying that many players in the industry are currently being forced to rethink their business models and improve their adaptivity to quickly changing external events. Those that can do so will be well positioned to identify, utilize, and benefit from new opportunities.

Understanding destination attractiveness can help industry players navigate these uncertain and continuously changing times. Our approach in this analysis could extend to other countries of origin (for example, the United States), destinations, detail levels (for example, the US at state level), as well as additional time frames and circumstances even beyond the here and now of the COVID-19 crisis.

Lorraine Ehrlichmann is a consultant in McKinsey’s Munich office, where Nina Wittkamp is an associate partner; Evgeni Kochman is a consultant in the Frankfurt office; and Jürgen Schröder is a senior partner in the Düsseldorf office.

The authors wish to thank Dilip Bhattacharjee, Christian Dominka, Alicja Mokwinska, and Sarah Stohrer for their contributions to this report, as well as trivago and its members for their continued support and data provision.

Explore a career with us

Related articles.

Make it better, not just safer: The opportunity to reinvent travel

A new approach in tracking travel demand

Tourism in Germany

Development of the tourism sector in germany from 1995 to 2021.

The top travel destinations in Germany

Revenues from tourism.

All data for Germany in detail

- Comparison Tool

Decentralization Index

Policies Area

Germany - summary.

- Social Policy

- Vocational Training

- Youth and Sport

- Public Health

- Trans-European Networks

- Economic, Social and Territorial Cohesion

- Environment & the Fight against Climate Change

- Water management

- Agriculture

- Immigration and Asylum

- Civil Protection

Toggle menu

- Limited legal role, covering contract law, tax policy, labour market policy and SME policy in relation to the tourism sector

- Practically, due to the relationship between tourism and the other fields with federal competences which have to be taken into account, the position of the federal government plays an important role

- Dialogue with the Länder via the “Bund-Länder-Ausschuss Tourismus" which is led by the Federal Ministry for the Economy. Due to the voluntary nature of participation in this body, there are written division of competences.

- Federal funding for the German National Tourist Board and for projects to enhance the performance of the tourism industry

- Main legislative and policy responsibility, for actual planning, development and direct promotion of tourism

- Dialogue with the Länder via the “Bund-Länder-Ausschuss Tourismus" which is led by the federal ministry. Due to the voluntary nature of participation in this body, there are written division of competences.

- Information and advice service

- Funding tourism research

Intermediate level - Kreise

- Marketing and tourism promotion

Local

- Diverse activities

- Some municipalities cooperate to form tourism associations

- Marketing and tourism promotion

- Local registration

Responsible ministries/bodies

Federal Ministry for Economic Affairs and Energy

Deutsche Zentrale für Tourismus (German Centre for Tourism)

Kahlenborn, W. & Kraack, M. & Carius, A. & Turmann, A. (1997). Umweltpolitik & Tourismuspolitik: Strukturen, Instrumenten und Akteure der Umweltpolitik und anderer tourismusrelevanter Fachpolitiken.

Tourism Policy

Related Information

- Systems of multilevel governance

- Relations with the EU/Representation at EU level

- Subsidiarity

- Bibliography

- Fiscal Powers

- Monitoring reports of the Congress of Local and Regional Authorities (Council of Europe)

An interactive tool with perspective on different dimensions of decentralisation (political, administrative and fiscal) across the 27 EU Member States

Where travel agents earn, learn and save!

No data found

News / germany's tourism industry thrives: 25.8% increase in international overnight stays in 2023.

Photo: Berlin © Lookphotos/Sabine Lubenow

During the peak summer months, Germany's tourism industry has experienced significant growth. In July, international overnight stays in Germany increased by 8.3 percent year-on-year, followed by a 6.3 percent rise in August.. The Federal Statistical Office recorded a total of 54.6 million international overnight stays in hotels and lodging establishments with at least ten beds from January to August, marking a 25.8 percent increase compared to the same period in 2022. As Germany recovers from the pandemic, inbound tourism has reached almost 89 percent of the record figures seen in 2019.

Petra Hedorfer, Chairwoman of the German National Tourist Board’s (GNTB) Executive Board, stated, " Our recovery strategy, focusing on qualitative growth, is showing results. Germany's appeal as a travel destination is increasing, drawing more international travellers. European markets continue to drive the recovery, the business travel sector is rebounding, with a 91 percent demand from the U.S. in the first seven months of 2023. Additionally, inbound tourism from Asian overseas markets to Germany is picking up in the second half of the year. "

The international travel industry representatives also confirm this upward trend in Germany's incoming business. In a survey conducted among more than 250 CEOs and key accounts of the international travel industry in the GNTB Travel Industry Expert Panel, the current business situation for Germany in Q3 2023 was rated at +34 points on a scale of -100 to +100, significantly better than the previous year (Q3 2022: +14 points). Business expectations for the next six months stand at +58 points, despite challenging conditions. It is worth noting that business expectations have slightly decreased from +75 points in Q1 2023 to +58 points in Q3 when viewed over the course of the year.

Latest News

Jet2.com and Jet2CityBreaks put Ic...

Ryanair adds extra Dublin flights ...

AVA Resort Cancun opens its doors ...

Contiki launches nine new trips wo...

Latest post.

- GNTB concludes 50th German Travel Mart

- Cultural tourism and sustainability at the centre of the GNTB's global marketing in 2024

- Share of international guests in German tourism on the rise

- Germany is gearing up for the upcoming travel season with direct flights, new destination campaigns, sustainability experiences and more!

- Germany 2024 highlights - A year of celebrations!

- Here's why you should visit Germany this holiday season

- GNTB relaunches its global lead campaign for sustainability

- German National Tourist Office reveals Top 100 Ranking 2023

- Revolutionizing German Tourism: Launching the Knowledge Graph

- From Bach to medieval and sailing - here are some of the best festivals in Germany this summer

- What’s on in 2023 - Classical music and cultural event highlights in Germany in 2023

- Germany celebrates 274 Michelin-starred restaurants 2023

- Incoming tourism for Germany shows clear recovery

- Carnival Celebrations in Germany: Here's how it's done

- Germany focuses its brand communication on sustainability

- Momentum to continue for Germany tourism in 2023

- Top 5 Christmas Markets in Germany

- Stunning wine hikes not only for connoisseurs

- Germany tightens COVID rules for travel during fall, winter

- The GNTB presents the 100 most popular tourist attractions in Germany

- Explore the whole of Germany: 9-euro ticket for local and regional public transport

- German National Tourist Board organizes Germany Travel Mart for the first time after two years in presence in Oberammergau and the Zugspitz region

- GNTB launches global campaign 'Embrace German Nature'

- Green Globe recertification confirms GNTB's successful commitment to sustainability

- Covid restrictions lift in Germany

- German National Tourist Board launches its 2021 Christmas campaign

- Germany's strong brand image supports recovery of incoming tourism

Subscribe to our newsletter

Germany's China Strategy Needs Updating, Economy Minister Says

Germany's China Strategy Needs Updating, Economy Minister Says

FILE PHOTO: German Economy and Climate Minister Robert Habeck attends a press conference about the spring economic forecasts in Berlin, Germany April 24, 2024. REUTERS/Liesa Johannssen/File Photo

By Maria Martinez

BEIJING (Reuters) -Germany's strategy on China needs to be updated to include a longer-term plan and take account of Europe's approach, German Economy Minister Robert Habeck said on Friday on the first day of a visit to Beijing.

Europe's largest economy has long faced accusations by some European analysts of taking an overly bilateral approach towards China, its top trade partner for eight years until 2024, motivated by its own short-term commercial interests.

That started to shift slightly when Berlin last year agreed its first ever strategy on China, which urged a de-risking of the two countries' economic relationship, calling Beijing a "partner, competitor and systemic rival".

The 64-page document urged German firms to reduce their dependence on China – the country's most important trade partner - but was light on any binding targets and requirements.

"Sooner or later the China strategy needs an update," Habeck said at a reception at the German embassy in Beijing.

Habeck said the China strategy lacks direction on how Germany sees the medium-term relationship between the two countries.

"I am saying this because I am sure the Chinese have it (a medium-term plan)," Habeck said.

The German government did not immediately reply to a request for comment.