- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

Review: HSBC TravelOne Card

The HSBC TravelOne Card is an excellent general spending card that's missing one important puzzle piece: points pooling.

Here’s The MileLion’s review of the HSBC TravelOne Card, which shook up the miles game when it launched back in May this year with 12 transfer partners, instant, free conversions, a generous lounge benefit and a competitive sign-up bonus. Feature-wise, it’s as strong a general spending card as you could hope for.

And there’s more still to come. That transfer partner list, already the longest in Singapore, is set to grow to more than 20 by the end of 2023. Points pooling is in the pipeline. The TravelOne Card is not the finished article yet, but it’s moving in the right direction.

If nothing else, it’s at least worth hopping onboard for the first year.

Overview: HSBC TravelOne Card

Let’s start this review by looking at the key features of the HSBC TravelOne Card.

Fun fact: the HBSC TravelOne Card continues the trend towards “portrait-style” credit cards, designed vertically instead of horizontally. This supposedly allows for a smoother user experience, as it mimics how customers typically handle their cards when they tap to pay or dip the card into a chip reader. It’s even got a notch at the bottom, a thoughtful touch that’s designed as an accessibility feature for the visually-impaired (so they know which end they insert into the card reader).

But Apple and Google Pay wallets don’t support vertical card faces, so if you add it to your phone you’ll see the secondary design that HSBC created, in landscape.

Despite its silver Mastercard logo, do note that the HSBC TravelOne Card is a World Mastercard and not a World Elite Mastercard.

How much must I earn to qualify for a HSBC TravelOne Card

The HSBC TravelOne Card has an income requirement of S$30,000 p.a. , the MAS-mandated minimum to hold a credit card.

If you do not meet the minimum income requirement, you may apply for a secured version of this card by depositing at least S$10,000 in a fixed deposit account. The application form can be found here.

How much is the HSBC TravelOne Card’s annual fee?

The HSBC TravelOne Card has an annual fee of S$194.40 for principal cardholders. At the moment, HSBC is not offering a first year fee waiver; you must pay the annual fee (which also lets you enjoy the 20,000 miles sign-up bonus).

In subsequent years, the annual fee can be waived with a minimum spend of S$25,000 in a membership year. As this is a new credit card, I can’t say at the moment whether HSBC will strictly enforce this- though I think it’d be very hard for them to do so, given that most other competitors offer fee waivers fairly easily.

All supplementary cards are free for life.

What sign-up bonus or gifts are available?

From 1 September to 31 December 2023 , customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$1,000 by the end of the month following approval

- Opt-in for marketing communications during the sign-up (don’t forget this step- it’s just as important as the first two)

This offer is valid for both new and existing HSBC cardholders.

The qualifying spending period is as follows:

20,000 miles for S$1,000 spend and a S$194.40 annual fee is a tidy return; put it another way, you’re paying about 0.97 cents per mile (S$194.40/20,000 miles), which is a great price especially when you factor in transfer partner variety.

The terms and conditions for the HSBC offer can be found here.

How many miles do I earn?

Sgd/fcy spend.

HSBC TravelOne Card cardholders will earn:

- 3X HSBC points per S$1 (1.2 mpd) on local spend

- 6X HSBC points per S$1 (2.4 mpd) on foreign currency spend

These are among the highest earn rates for any general spending card in Singapore, especially when you consider HSBC’s relatively favourable rounding policy (more on that below).

All FCY transactions are subject to a 3.25% fee, which is par the course for the market.

With a 2.4 mpd earn rate and a 3.25% FCY fee, using the HSBC TravelOne Card overseas represents buying miles at 1.35 cents apiece.

There is also the option of pairing the HSBC TravelOne Card with Amaze in order to enjoy better conversion rates, but you’ll earn 1.2 mpd instead of 2.4 mpd in that case since transactions will be converted into SGD.

Bonus Spend

Unfortunately, the HSBC TravelOne Card does not have a bonus earn category. To be fair, not all general spending cards offer one, but it’s a particular problem for the TravelOne because points don’t pool.

This means that you can’t take advantage of the HSBC Revolution ’s excellent 4 mpd earn rate, nor can the HSBC Revolution ’s points be used for the TravelOne’s new transfer partners.

HSBC says they’re working on adding points pooling, but until they do, your earn rates will be relatively underpowered compared to other 4-6 mpd earning specialised spending cards.

When are HSBC Rewards Points credited?

HSBC Rewards Points are credited when the transactions posts, usually in 1-3 days.

How are HSBC Rewards Points calculated?

Here’s how you can work out the HSBC Rewards Points earned on your HSBC TravelOne Card.

The minimum spend required to earn points is S$0.25 (SGD) and S$0.10 (FCY) respectively.

This means that the HSBC TravelOne Card (1.2 mpd) can outperform the ostensibly higher earning UOB PRVI Miles Card (1.4 mpd) in certain circumstances, depending on transaction size.

If you’re an Excel geek, here’s the formulas you need to calculate points:

HSBC previously only displayed total points balances, but with the launch of the TravelOne Card they’re now providing transaction-level points breakdowns.

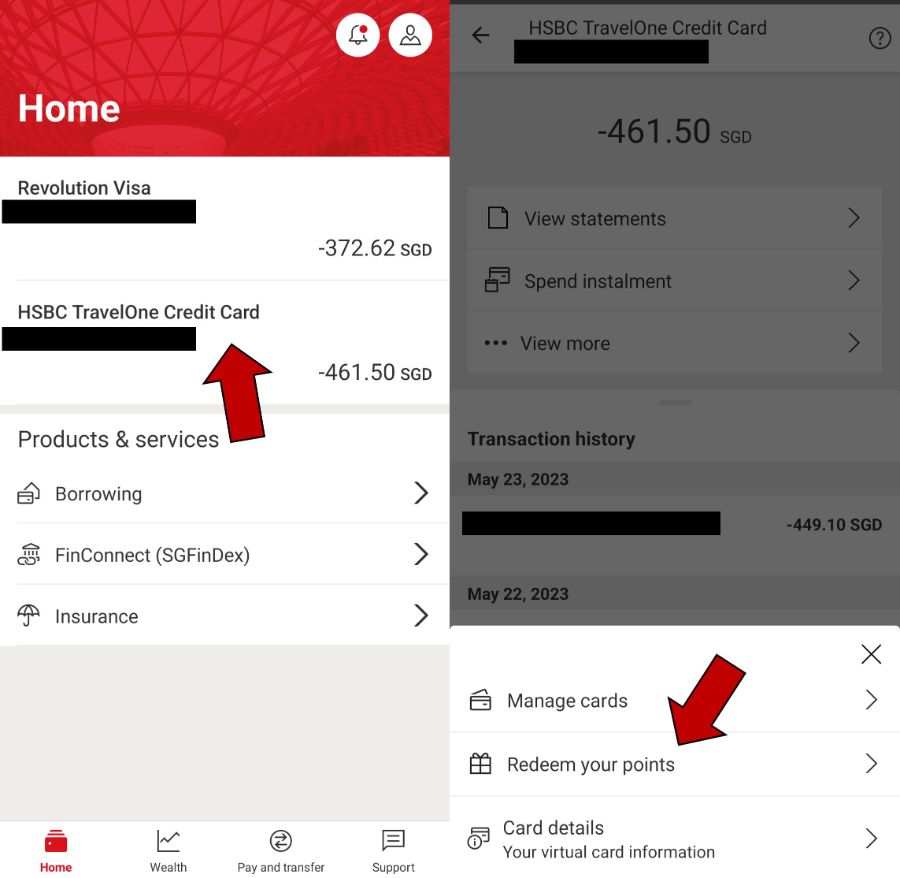

To view this, login to the HSBC mobile app and tap on your HSBC TravelOne Credit Card > View More > Redeem Your Points

On the next screen, tap ‘Show points history’, and you’ll see a breakdown of points earned per transaction.

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

- General Spending Cards

- Specialised Spending Cards

What transactions aren’t eligible for HSBC Rewards Points?

A full list of transactions that do not earn HSBC Points can be found in the T&Cs (at Point 3).

I’ve highlighted a few noteworthy categories below:

- Charitable Donations

- Government Services

- GrabPay top-ups

- Professional services provides (e.g. Google & Facebook Ads, AWS)

- Real Estate Agents & Managers

HSBC also excludes CardUp, ipaymy and RentHero transactions from earning points. In a way, this does compound the lack of a bonus category problem, since you can’t even buy additional TravelOne points via these payments services if you were so inclined.

What do I need to know about HSBC Rewards Points?

HSBC Points expire at the end of 37 months following the time they were earned.

For example, any points awarded in August 2022 will expire on 30 September 2025.

HSBC Points do not pool across cards. If you have 10,000 HSBC Points on the HSBC TravelOne Card, and 15,000 HSBC Points on the HSBC Revolution Card, for example, you won’t be able to combine the two when redeeming.

However, HSBC tells me that points pooling is on the roadmap, so hopefully this will no longer be the case soon.

In the meantime, since points do not pool, you will have to transfer all your HSBC Points before cancelling the HSBC TravelOne Card, or else forfeit them.

Transfer Partners & Fees

The HSBC TravelOne Card stole a march on Citibank when it launched with 12 airline and hotel partners, replacing them as the bank with the most transfer partners in Singapore.

In addition to KrisFlyer and Asia Miles, there’s also opportunities to leverage sweet spots with British Airways Executive Club (and Qatar Privilege Club by extension, since the two programmes are linked ), and EVA Air Infinity MileageLand’s sometimes-better Singapore Airlines award space.

HSBC says they plan to scale up the number of partners to 20 by the end of 2023, and based on the partners the Malaysia and Hong Kong versions have, I’d expect to see Air Canada Aeroplan, JAL Mileage Bank and Turkish Airlines Miles&Smiles added to the mix.

Do note that only HSBC TravelOne Cardholders can access the abovementioned transfer partners; if you have a HSBC Revolution or HSBC Visa Infinite Card, you are still limited to KrisFlyer and Asia Miles for the moment.

Regarding minimum conversion blocks, cardholders will need to convert a minimum of 25,000 points (10,000 miles). However, the subsequent conversion block drops to just 5 points (2 miles), which means you could convert 10,002 miles, or 200,006 miles if you so desired. That’s great, because it helps avoid the problem of orphan miles. So long as you keep at least 10,000 miles in your account, you can cash out your entire balance with almost no miles left behind.

HSBC normally charges a S$43.20 annual fee for unlimited conversions, but as part of the TravelOne’s launch campaign, all transfers are free-of-charge till 31 December 2023. It remains to be seen what model HSBC adopts after that, but my sense is that we can expect a ~S$25 fee per conversion.

Transfer Time

HSBC says that with the exception of Accor Live Limitless, TravelOne points transfers are processed “instantly or within one business day”.

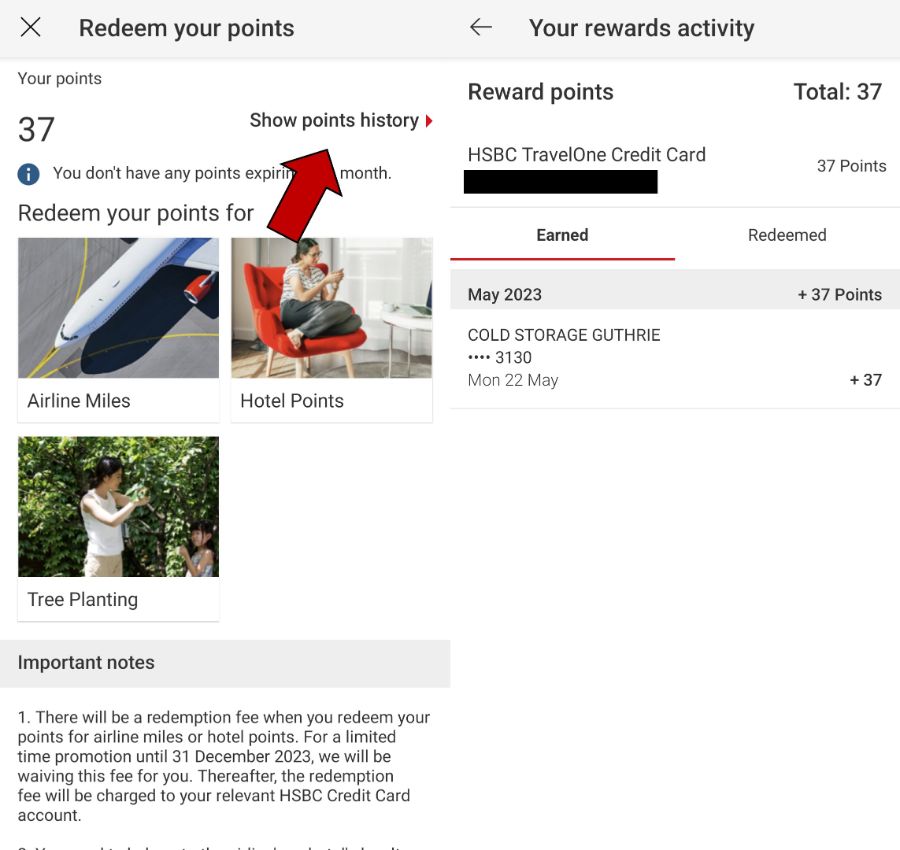

I’m pleased to report that all transfers actually process instantly. This is possible because HSBC uses Ascenda Loyalty’s platform, which has API integration with the airlines.

Here’s an example showing an instant transfer from TravelOne to British Airways Executive Club. There are also successful data points of instant transfers to Singapore Airlines KrisFlyer.

Other card perks

Four complimentary lounge visits.

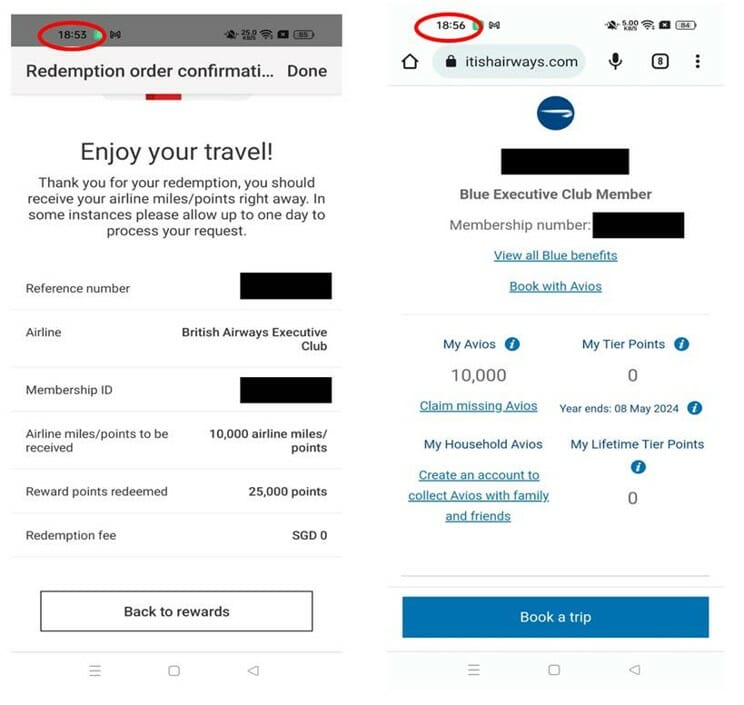

Principal HSBC TravelOne Cardholders enjoy four complimentary lounge visits per year, provided via DragonPass.

Allowances are awarded by calendar year , which means you basically enjoy eight visits in your first membership year. For example, if your card is approved in June 2023, you will be awarded:

- On date of approval: 4 visits (expires 31 December 2023)

- On 1 January 2024: 4 visits (expires 31 December 2024)

Allowances cannot be rolled over, so be sure to fully utilise your visits by the end of the calendar year.

Here’s how to start enjoying the benefit:

- Step 1: Download Mastercard Travel Pass app ( Android | iOS )

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

Four visits is relatively generous for an entry-level credit card, double what most of the competition is offering. The main catch is that these visits cannot be shared with a guest.

Entertainer with HSBC

HSBC TravelOne Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

You’ll need an activation key to start using your ENTERTAINER membership. This should have been emailed to you; if not you’ll need to call 1800 4722 669 to get it from customer service.

HSBC Everyday Global Account

HSBC TravelOne Cardholders can earn an additional 1% cashback on all eligible transactions when they open an HSBC Everyday Global Account (EGA) and meet the qualifying criteria for the Everyday+ Rewards programme.

This involves:

- HSBC Personal Banking: S$2,000

- HSBC Premier: S$5,000

- Performing at least five eligible transactions of any amount each calendar month on their card

Eligible transactions simply refer to anything not on the exclusions list (Point 3 of T&Cs ), such as GrabPay top-ups, government transactions, insurance premiums, utilities bills. All other retail spend (e.g. dining, groceries, clothing and apparel) is fair game.

Cardholders who meet the eligibility criteria will earn 1% cashback, capped at S$300 per month for HSBC Personal Banking and S$500 per month for HSBC Premier.

This means your effective return for spending will be:

- Local Spend: 1.2 mpd + 1 % cashback

- Overseas Spend: 2.4 mpd + 1% cashback

All this requires is a one-time setup of the EGA, plus a recurring instruction to transfer the minimum fresh funds every month.

Complimentary travel insurance

HSBC TravelOne Cardholders receive complimentary travel insurance when they:

- Use their TravelOne Card to purchase air tickets, or

- Use their TravelOne Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This includes coverage of up to US$100,000 for both the cardholder and their family. COVID-19 related medical treatment and trip cancellation is also provided for.

Summary Review: HSBC TravelOne Card

The HSBC TravelOne Card has a lot going for it: the widest range of transfer partners in Singapore, with more soon to come. Instant conversions, with no fees till 31 December 2023. Double the lounge visits of its closest competitors. A minimum transfer block of 10,000 miles that reduces to just 2 miles subsequently, making it easier to avoid orphan miles in your account.

It feels like an exciting puzzle that’s missing one big piece: points don’t pool. Because of this, you can’t tap into the superior earning power of the HSBC Revolution, and even though the HSBC TravelOne Card’s earn rates are objectively good for a general spending card, 1.2/2.4 mpd is not going to challenge a 4 mpd card anytime soon.

There could be a silver lining though, because HSBC has points pooling on its roadmap. They’ve not committed to a specific timeframe, but when this happens, I get the sense that a lot of things will fall into place.

In the meantime, I certainly don’t see the harm of signing up for at least a year, in order to grab the sign-up bonus that’s open to both new and existing customers, as well as up to eight lounge visits.

What do you make of the HSBC TravelOne Card?

- card review

- credit cards

Similar Articles

Dbs adds cardup and ipaymy to rewards exclusion list (update: exclusion removed), complete faqs: uob lady’s savings account.

anyone know if AXS pay+earn also contributes to the $800 spend offer?

Hi Milelion! Thanks for the solid write-up. By the way, in the above section “What sign-up bonus or gifts are available?”, the minimum qualifying spend seems to have increased to SGD1,000, from SGD800. As it is mentioned in HSBC’s “Terms and Conditions for the HSBC TravelOne Credit Card Sign up Promotion for 1 September 2023 to 31 December 2023”. Raising this up to prevent confusion among readers. Cheers~

thanks! will get that updated.

When will the TravelOne card annual fee for the bonus points be charged? I don’t see the annual fee showing on my statement yet after 2 months. If so how do I qualified for the bonus points? Any Idea?

hi Milelion, would u be in the know on whether the pooling would still happen by year end (aka 123123)?

i don’t have any info on this at the moment.

Hi Aaron, this is a great article! Quick questions for the EGA cashback eligibility, referring to HSBC EGA T&C art 5a (i)

Eligible Customers shall receive a cashback of 1% of the spend amount for successful posted: (i) transactions (excluding Excluded Transactions) in SGD made with a HSBC personal Credit Card

From above T&C, it seems only transactions in SGD are eligible for 1% cashback, not the FCY transactions. Kindly advise. Thank you!

Aaron, I think there’s something missing from your review: HSBC T1 is, in a vacuum, technically, the best non-SGD general spend card in the market, because it earns the same non-SGD rate as UOB PRVI Miles and it has much better rounding. This is currently irrelevant because you only get orphan miles, but it would become useful if T1 and Revolution miles suddenly pool. If you took Milelion advice and got T1 for the signup bonus miles, should you cancel the card then consider reapplying if pooling is implemented? In practice, most people will still get UOB PRVI Miles because … Read more »

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

- Credit Cards

First Impressions: HSBC TravelOne Credit Card

HSBC just announced their latest travel credit card offering, the HSBC TravelOne (T1) Credit Card.

This is probably one of the most exciting credit card launches in Singapore in recent years. There haven’t been many revolutions or improvements, even with the recent lacklustre launch of the DBS Vantage Card.

As such, when HSBC suddenly released their much-awaited travel card, many travellers (including us!) in Singapore were really excited about it.

This post is my first impression of the HSBC TravelOne Credit Card .

Sign up bonus

This bonus applies to new-to-bank customers only! To be eligible for the promotion, you’ll need to activate and spend S$500 and pay the annual fee of S$196.20.

Miles Earn Rates

The HSBC TravelOne Card has a fairly standard travel credit card earning rate. It is comparable to other general spend cards in the market such as the DBS Altitude Card and the Citi Premiermiles Card.

Free Lounge Access

As a travel credit card, the HSBC TravelOne Credit Card provides complimentary lounge access via the DragonPass lounge membership (also known as the Mastercard Travel Pass).

The 4 yearly complimentary limit is much better than many of its counterparts. However, this limit only applies to the primary cardholder. Supplementary cardholders and guests have to purchase their lounge access through the mobile app.

The membership provided is DragonPass instead of the typical Priority Pass provided by other cards. The downside of this is that there are fewer lounges in the network.

In Singapore’s Changi Airport, you can access almost every lounge that Priority Pass members have access to. In addition, you can also access the Plaza Premium Lounge in Terminal 1 which is one of our favourite lounges in the terminal.

Instant Points Transfers

Perhaps the biggest selling point of the HSBC TravelOne Card is its ability to instantly transfer points to its various transfer partners. HSBC promises that points transfers will go through instantly or latest within 1 business day.

This can come in very useful whenever people are booking high in demand seats. Although I don’t think by itself, this perk is applicable to people most of the time.

Huge Range of Transfer Partners

Another big selling point of the HSBC TravelOne Credit Card is its huge number of transfer partners.

There is a lot of value in having a lot of travel transfer partners to choose from. The value of each mile in different loyalty programs varies widely. Different loyalty programs have different award availabilities, and sometimes you can get only book certain redemptions on one program and not on another.

For travellers who prefer luxury hotels to business class flights, the HSBC TravelOne also provides 3 hotel partners which is unheard of in Singapore.

From the initial list of partners, there aren’t any that stand out in particular in terms of great value. Hotel redemptions are also usually of lower value than flight redemptions. However, we remain hopeful while the list of partners expands as promised by HSBC.

Requirements

The HSBC TravelOne credit card has a typical “entry-level” credit card requirement.

For Singaporeans , a minimum of S$30,000 annual income. For foreigners or permanent residents, a minimum of S$40,000 annual income.

Our Thoughts

The HSBC TravelOne Credit Card is certainly an interesting new addition to the travel hacking space in Singapore. Its headline features are very intriguing and the benefits can really only be verified after using the card for a while.

However, I wouldn’t be using the card, in general, to earn miles as it doesn’t have the highest earning rates. For that, I’ll be using my trusty HSBC Revolution Card or the Citi Rewards Card .

Overall, I think that this is a good sign for what’s to come from both HSBC and the other banks!

- Telegram icon Telegram

- Facebook icon Facebook

- Pinterest icon Pinterest

Filed under

- Credit Cards 26

- credit-cards

- travel-hacking

Related posts

HSBC Revolution will have 21 Transfer Partners and Points Pooling

Citi Rewards Great Sign-Up Bonus for February 2024

Amazing HSBC Credit Card Sign Up Offers

There are 4 comments.

can the annual fee be waived on first year?

Yes, you can request to have the annual fee waived. However, in that case you won’t be able to get the welcome bonus of 20,000 miles.

You wrote 4 lounge visits are also applicable guest but it’s only for cardholders.

Also, how does this compare with DBS Altitude? If I value different airlines I should definitely take the HSBC card, correct? And assuming we don’t need to guest any visits to the lounge. (Also ignoring the points expiry because we always use it before 3 years is up since miles devaluation can happen anytime)

Thank you for catching it! Yes, the 4 lounge visits by HSBC TravelOne are only applicable to primary cardholders.

I would say it really depends when comparing the DBS Altitude Card. Since DBS points can be pooled, and if you have the DBS Woman’s World Card, you can actually rack up points pretty fast and redeem them in 1 go.

The HSBC Card only has free redemptions until the end of 2023. If you do not spend a lot of money, earning just 1.2/2.4 mpd might not be fast enough to redeem anything meaningful.

Personally, I would still go for the DBS Altitude Card given that I have the WWMC.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Username or Email Address

Remember Me

You may have missed…

Uob evol card review | what you need to know, dcs ultimate platinum card review | what you need to know, credit cards sign up deals, view all deals.

Credit card sign up promotions are usually for new-to-bank credit cardholders and those who has not cancelled any of the bank's credit cards in the last 12 months, unless otherwise stated. Kindly refer to the T&Cs for details.

ⓒ Copyright IJUSTTRYLAH 2024

Discover more from I JUST TRY LAH

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Is the HSBC TravelOne Card the One and Only Travel Card You Need?—MoneySmart Review 2023

Let’s talk about the HSBC TravelOne card’s name—“Travel One”. It aims to be the 1 travel card you need. HSBC says so as well: “Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.”

But does the HSBC TravelOne card (literally) live up to its name? If I only have 1 travel card, I want good miles earn rates, low (or no!) annual fees, and a slew of travel benefits and privileges.

Let’s take a look at how the HSBC TravelOne Card fares. We review the card’s earn rates, travel rewards, privileges, and more.

See our credit card ranking rubric to find out how we rank credit cards.

- HSBC TravelOne Card: Summary

- HSBC TravelOne Card: Eligibility

- HSBC TravelOne Card: Annual fees

- HSBC TravelOne Card: Earn rates

- HSBC TravelOne Card: Bonus earn categories

- HSBC TravelOne Card: Rewards points redemption

- HSBC TravelOne Card: Benefits and privileges

- HSBC TravelOne Card: Sign-up promotion

- Should I get the HSBC TravelOne Card?

- Alternatives to the HSBC TravelOne Card

1. HSBC TravelOne Card: Summary

HSBC TravelOne Card

Earn 5,040 SmartPoints or S$200 Cash via PayNow when you apply and spend a min. of S$1,000 from Card Account Opening Date to end of the following calendar month. T&Cs apply . Use 5,040 SmartPoints to fully redeem a product from our Rewards Store . If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$110 on top of your earned SmartPoints.

Key Features

Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app

Accelerated earn rate: up to 2.4 miles for your spending

Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more

Split flexibly: Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The HSBS TravelOne card is an entry-level air miles card that’s good for general spending. It doesn’t come with any bonus earn categories, but does come with a good mix of travel benefits and privileges. These include travel perks (such as cashback and discounts when you shop overseas) and travel protection in the form of complimentary travel insurance.

Back to top

2. HSBC TravelOne Card: Eligibility

Let’s first talk about who’s eligible for the HSBC TravelOne Card.

An entry-level miles card, the HSBC TravelOne Card has pretty typical age and minimum income requirements:

- Age requirement: 21 years old

- For Singaporean and PR salaried workers: $30,000

- For Singaporeans and PRs who are self-employed or commission-based: $40,000

- For foreigners: $40,000

3. HSBC TravelOne Card: Annual fees

The HSBC TravelOne Card comes with a pretty standard annual fee of S$194.40 . Generally, this is the standard annual fee for most entry-level credit cards, barring credit cards with $0 annual fee .

Of course, the annual fee doesn’t matter if a fee waiver is available. HSBC doesn’t say anything about the first year’s annual fee (you can always try your luck requesting a fee waiver !). However, they will waive the annual fee for the second year onwards if you spend over S$25,000 per year. That’s about $2083 per month.

4. HSBC TravelOne Card: Earn rates

Here’s a quick look at how the HSBC Travel One Card’s earn rates compare to other entry-level miles cards:

The HSBC TravelOne Card local spend earn rates are average at best —there are miles cards with lower local earn rates, such as the BOC Elite Miles World Mastercard , which clocks in at just 1 mile per dollar (mpd).

However, the HSBC TravelOne Card’s foreign spend earn rates are above average . The only other miles credit card out there with a comparable rate is the UOB PRVI MASTERCARD Miles Card, which comes with a $5 minimum spend caveat—you need to spend S$5 to earn UNI$6/2.4 miles.

5. HSBC TravelOne Card: Bonus earn categories

At its heart, the HSBC TravelOne Card is meant for everyday, general spending. That comes with 1 downside: it doesn’t have any bonus earn categories . These refer to specific spend categories with which you can earn a greater number of miles per dollar.

Bonus earn rates are miles credit cards are usually between 3 mpd to 10 mpd. Here are some examples:

- Standard Chartered Journey Credit Card : 3 mpd on online transactions in Transportation, Grocery and Food Delivery Merchants categories

- UOB PRVI MASTERCARD Miles Card : 6 mpd (UNI$15 per S$5 spend) on major airlines and hotels booked through Expedia, UOB Travel, and Agoda

- Citi PremierMiles Card : Up to 10 mpd on online travel bookings via Kaligo and Agoda

- DBS Altitude Visa Signature Card : Up to 10 mpd on hotel transactions at Kaligo (capped at S$5,000/month); up to 6 miles per S$1 on flight, hotel and travel packages at Expedia (capped at S$5,000/month)

Is it a big disadvantage that the HSBC TravelOne card doesn’t have bonus earn categories? We would say not necessarily. It really depends on if you’d spend more on those bonus earn categories in the first place. For example, if you don’t want to book via Kaligo, Expedia or Agoda, the Citi PremierMiles Card and DBS Altitude Visa Signature Card bonus earn rates are basically made defunct.

6. HSBC TravelOne Card: Rewards points redemption

HSBC rewards you with Rewards points for each dollar of your spending—they don’t just give you miles directly. Here’s a breakdown of the points earn rates:

- 2.4 miles (6 Reward points) per S$1 foreign spending

- 1.2 miles (3 Reward points) per S$1 local spending

The good news is that from now till 31 Dec 2023, HSBC won’t charge you any conversion fee for redeeming your points for air miles or hotel points. Usually, you have to pay an annual HSBC Mileage Programme fee of S$40, subject to GST.

On top of that, HSBC rewards redemptions are fast . According to HSBC’s TraveIOne Card page, they’ll complete redemptions for air miles and hotel points instantly or in 1 business day.

Do note that HSBC Reward points expire after 37 months . 3+ years sounds like a lot of time, but you know how these expiry dates can creep up on us without us realising—fellow points hoarders, you know what I mean.

Prefer a rewards system with points/miles that never expire? Consider the Standard Chartered Journey Credit Card for 360 Rewards Points that never expire, or the Citi PremierMiles Card for Citi Miles that never expire.

7. HSBC TravelOne Card: Benefits and privileges

Although the HSBC TravelOne Card doesn’t have any bonus point categories, it does come with a generous slew of travel benefits and privileges. Broadly, these fall into 2 categories: travel perks, and travel protection.

HSBC TravelOne Card travel perks

- Airport lounge access : As the primary cardholder, you get 4 complimentary lounge visits per year to over 1,300 airport lounges around the world.

- Travel rewards : With the HSBC TravelOne Card, you get to enjoy cashback and discounts when you travel and do your shopping overseas under the Mastercard Travel Rewards catalogue . These apply to both in-store and online merchants across over 25 countries, including Daimaru Matsuzakaya Department Stores in Japan and Bloomingdale’s in the United States.

- Mastercard Priceless™ Specials : This is another MasterCard rewards programme that you get with the HSBC TravelOne card, but this one is a bit more upmarket. It offers privileged access to benefits across travel, culinary, shopping, sports, entertainment, and arts and culture.

HSBC TravelOne Card travel protection

- Travel insurance : If you charge your air ticket (in full) to your HSBC TravelOne Card, you’ll get complimentary travel insurance coverage (including COVID-19) of up to USD100,000.

- ID Theft Protection™ : The HSBC TravelOne Card doesn’t just want to give you peace of mind while on holiday—it also aims to do so while you’re browsing and making purchases online. You can register for Mastercard ID Theft Protection™ to ensure your personal data is safe and secure, protecting you from identity theft and fraud.

- Checking travel and health restrictions : It is such a chore to check for travel and health restriction/documentation. The HSBC TravelOne gives you access to Sherpa, a travel advisory tool that tells you what Visa requirements, travel documents, and even if COVID-19 tests are needed prior to your trip.

Hungry for more benefits? Even if you aren’t travelling, the HSBC TravelOne Card comes with a dining perk you can use right here in Singapore. You’ll get complimentary access to ENTERTAINER with HSBC , which comes with tons of 1-1 deals on dining, lifestyle and travel. These deals are available worldwide, but there are plenty to choose from locally too.

ALSO READ : Best Food Discount and Rewards Apps in Singapore—Chope, Burpple, Entertainer & More

8. HSBC TravelOne Card: Sign-up promotion

From now till 31 Aug 2023, you can get up to 20,000 Miles (in the form of 50,000 Rewards Points) when you apply for the HSBC TravelOne Card.

The downside is that you need to pay the card’s annual fee of S$194.40 (GST already included), as well as spend at least S$800 in qualifying transactions within 1 month. Depending on your lifestyle, this minimum spend could be easily doable, or a tall order.

9. Should I get the HSBC TravelOne Card?

If you’re looking for a general spending travel card (that means no bonus earn categories!), the HSBC TravelOne Card is a decent choice. Its earn rates are average or slightly above average (especially when it comes to foreign spending), and we like that you earn Rewards points per dollar spent. For some other cards with similar earn rates, you need to spend say $5 before you chalk up any points. This means that the HSBC TravelOne Card can help you earn points on even the smallest purchases.

Don’t forget that the HSBC Reward points expire after a 37-month period. This could be a pro or a con, depending on how much of a points hoarder you are.

The HSBC TravelOne Card does live up to its name as the 1 and only travel card you’ll need…if you’re looking for a general spending miles card. We suggest you get the HSBC TravelOne Card if you want a general spend card, if you value travel benefits, and if you’re looking for a higher than average earn rate for foreign spending. This card isn’t for you if you want a high bonus earn rate on selected categories, or if you want miles that never expire.

10. Alternatives to the HSBC TravelOne Card

Here are some other entry-level miles cards for you to consider. These rewards points/miles never expire:

Standard Chartered Journey Credit Card : This card rewards you with a bonus earn rate of 3 miles for online transactions on transport, food delivery, and groceries. The best part is that the 360 Rewards Points you earn never expire.

Standard Chartered Journey Credit Card (No Annual Fee)

Up to 3 miles for every $1 spent

2 complimentary visits to Priority Pass lounges around the world each year

S$0 foreign transaction fee for overseas spend made and posted in June-July, November-December 2023

Complimentary travel insurance coverage of up to S$500,000.

360 Rewards Points do not expire

S$10 off Grab rides to or from Changi Airport

Citi PremierMiles Card : Citi Miles never expire! Plus, earn up to 10 miles per $1 spent on selected hotel bookings.

Citi PremierMiles Card

S$1 = 1.2 Citi Miles on Local spend (no min. spend)

S$1 = 2 Citi Miles on Foreign currency spend

Earn 10,000 Citi Miles upon renewal of annual membership and payment of annual fee

Citi Miles never expire

Principal Cardholder gets to enjoy 2 complimentary visits every year to over 1,300 airport lounges worldwide.

OCBC 90 N Card : Travel$ never expire. You’ll also get up to 7 miles per $1 spent on Agoda accommodations worldwide.

OCBC 90°N Card

Designed with an LED light feature, the 90°N MasterCard Card lights up whenever you make a contactless payment.

Travel$ that do not expire - Convert Travel$ to loyalty points at 9 airline and hotel partner programmes.

Get cash rebates at up to 2.1% from your earned Travel$. No minimum spend and no caps

All online purchases on your OCBC 90°N Card come with e-Commerce Protection, which safeguards you against non-delivery or defective goods or if the seller fails to reimburse you.

Check out and easily compare the other air miles credit cards in Singapore .

P.S. Here’s our MoneySmart credit card ranking rubric

In case you’re wondering, here’s how we decide on our credit card rankings.

Don’t miss our ultimate list of credit card reviews for the low-down on credit cards in Singapore.

Found this article useful? Share it with a fellow traveller considering a miles card!

Related Articles

Air Miles vs Cashback vs Rewards – Which is the Best Credit Card Type to Use?

9 Best Air Miles Credit Cards in Singapore (May 2024)

7 Best Rewards Credit Cards in Singapore (2024): Citibank, OCBC, DBS & More

Best Credit Card Promotions in Singapore (Jun – Jul 2024): Citibank, DBS, HSBC, UOB, and More

HSBC TravelOne Credit Card

Refined points metric (rpm): 11.8, recommendation: poor, annual fee , annual income, airport lounge access.

6X access per year

International Lounges

Supplementary Access

RM60,000 per annum

Airline Miles Earn Rate

Local: 1 Airline Mile = RM21.00

Overseas: 1 Airline Mile = RM2.62

Dining/Travel = 1 Airline Mile = RM4.20

Payment Network

Review | HSBC TravelOne Mastercard Credit Card

HSBC Malaysia recently unveiled its HSBC TravelOne Mastercard Credit Card, in line with a parallel launch in Singapore. For the purposes of this discussion, we'll focus solely on the Malaysian iteration.

The launch was accompanied by significant fanfare, underscored by HSBC Malaysia's extensive promotional efforts. This included roadshows in major Klang Valley malls like Mid Valley and collaborations with digital content creators and influencers. Commendably, their marketing approach was pervasive, leading many within my circle to seek my perspective on the card's value proposition.

However, it's imperative to delve deeper than the surface-level allure. A notable aspect that catches the eye is the promotion of "8x reward points" on HSBC's official site. Many, understandably, may misconstrue this to mean 8x air miles, which is a significant misunderstanding.

Airline Miles Conversion

The distinction between reward points and air miles is crucial. To provide a straightforward assessment: if one were to critically evaluate the conversion rate of these reward points to air miles, the HSBC TravelOne might not rank among the best credit card options in Malaysia for those prioritizing air miles accumulation.

The information above shows how many airline miles you get when you use HSBC's "Reward Points". To get one Enrich air mile, you need to spend RM2.62 overseas, but if you spend locally and specifically on dining or travel, it costs more, RM4.20, to get the same one mile.

Any other transactions with the HSBC TravelOne credit card only earns you 1X points.

Here's a simpler way to see it:

For regular spending in Malaysia, you need to spend RM21.00 to get 1 airline mile.

If you spend money on dining or travel in Malaysia, you need to spend RM4.20 to get 1 airline mile.

When you spend money in other countries, you need to spend RM2.62 to get 1 airline mile.

Compared to other banks that focus on travel, HSBC's rates don't look as good. For example, the CIMB Travel Platinum Credit Card gives you 1 airline mile for every RM2.50 you spend in other countries, and you only need to earn RM24,000 a year to get this card.

Likewise, the Alliance Bank Visa Infinite credit card grants you 1 Airline Mile for every RM1.875 spent when strategically topping up your E-Wallets and spending using your E-Wallets.

You can choose to convert HSBC points into miles with other programs, not just Enrich Miles, but these rates aren't great either. For those who fly a lot from Malaysia, finding the best way to turn spending into miles is very important.

For example, to turn your points into JAL Mileage Bank miles, it costs RM7.50 for one JAL mile. This rate is high, but not many people might use their HSBC Reward Points for JAL miles anyway.

Be sure to check out my Ultimate Guide, KrisFlyer Ultimate Guide and Asia Miles Ultimate Guide for comparisons on the airline miles earning rates for various credit cards.

I know how important it is to obtain information about lounge access at a glance, so if you're queuing up to enter a lounge in ASEAN, here's the important details about the HSBC TravelOne Mastercard credit card:

Number of Lounge Access Passes: 6X per year

Supplementary Access: Yes, quota is shared with principal cardholder

Spend Conditions: No spend conditions

Lounge Access List by HSBC TravelOne Mastercard credit card:

Plaza Premium Lounge KLIA Terminal 1 Main Terminal Building

Plaza Premium Lounge Singapore Changi Terminal 1

TGM & Root98 Singapore Changi Terminal 1

BLOSSOM - SATS & Plaza Premium Lounge Singapore Changi Terminal 4

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 1)

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 35)

Plaza Premium Lounge Hong Kong International Airport Terminal 1 (Gate 60)

HSBC may update it's list from time to time, so be sure to check out their list here if you don't see your lounge on the list above and in the table below.

Lounge access by the HSBC TravelOne Mastercard are the only nominal advantages to the credit card on the whole, as the airline miles accrual package is underwhelming. The accompanying table above underscores that the HSBC TravelOne Credit Card provides lounge access to merely three airports: Kuala Lumpur International Airport, Singapore Changi Airport, and Hong Kong International Airport.

Interestingly, the provisions at Singapore Changi Airport are confined to the Plaza Premium Lounge in Terminal 1 and the Blossom Lounge in Terminal 4. Given that Terminal 4 isn't seamlessly connected via the skytrain, cardholders departing from Terminals 2 and 3 are left with the sole option of the Terminal 1 lounge.

Another detail of note is the shared access between principal and supplementary cardholders, capped at six visits per annum. This isn't really a big issue, as generally you'll find it difficult to enter 6 lounges in an entire year, unless you travel frequently for work. Nevertheless, the shortcoming in this case is that you'll only be able to enter the lounges a limited number of times if you are travelling with your partner or spouse.

Be sure to check out my Airport Lounge Ultimate Guide to compare the best credit cards for airport lounge access in Malaysia.

Final Thoughts

In assessing the HSBC TravelOne Credit Card, it's challenging to pinpoint any commendable features. While their marketing strategy was indeed captivating, given the card's increased visibility in Klang Valley, this might be more indicative of consumers not diligently scrutinizing the details and not undertaking necessary conversion assessments prior to application.

It's crucial to note that other perks, such as the Mastercard Concierge, Priceless, and associated Mastercard benefits, are far from exclusive to the HSBC TravelOne offering.

To be eligible for the HSBC TravelOne credit card, a minimum annual income of RM60,000 is stipulated, averaging to approximately RM5,000 monthly. For individuals within this income bracket, it might be disconcerting to recognize that alternative credit cards in the market offer a far more comprehensive suite of benefits, particularly in the domain of air miles and travel.

Join the Mailing List

Subscribe to our newsletter to stay on top of the latest credit card updates and news.

Thank you for subscribing!

We're Now on Social Media!

To celebrate reaching 100,000 views, we're officially launching our social media pages!

Follow us on social media to stay up to date on the latest and greatest from Refined Points.

Credit Card News

Hong Leong Bank Discontinues Emirates Credit Cards | An Expected Move

Refined Points Presents | The Ultimate Guide to Earning Asia Miles in Malaysia

HSBC Premier Elite & Travel Mastercard | Everything You Need to Know

Credit Card Updates

CIMB Revamps Its Visa Infinite & Visa Signature Credit Cards

Alliance Bank Credit Cards Devalued Again? Not Really

HSBC TravelOne Card

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

Earn 5,040 SmartPoints or S$200 Cash via PayNow when you apply and spend a min. of S$1,000 from Card Account Opening Date to end of the following calendar month. T&Cs apply . Use 5,040 SmartPoints to fully redeem a product from our Rewards Store . If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$110 on top of your earned SmartPoints.

Are you eligible?

Promotion is valid from 06-June-2024 to 20-June-2024

Applicable for New-to-HSBC cardholders only.

Customers need to apply through MoneySmart to be eligible

Applicants need to p rovide HSBC their consent to receive marketing and promotional materials from HSBC at the time of submitting their application.

What you need to know

Log into your MoneySmart account and submit your claim by 20th July 2024

Receive either S$200 Cash via PayNow or 5,040 SmartPoints when you apply and charge a min. of S$1,000 in Qualifying Transactions from card account opening date to end of the following month.

Use 5,040 SmartPoints to fully redeem a product from our Rewards Store . If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints. Enjoy flexible redemption and get the rewards you want!

With 5,040 SmartPoints* earned, you can redeem: - Apple iPad (10th Gen) | Top up $110 more only - Apple 13-inch MacBook Air M2 | Top up $920 more only - Apple iPad Wi-Fi (9th Gen) 64GB | Redeem in full - Sony WH-1000XM5 Wireless Noise Cancelling Headphones | Redeem in full - OR many other options available at our Rewards Store today. - For more information regarding SmartPoints, refer to our FAQ here.

SmartPoints will be credited into your points wallet, with a validity period of 1 year . You can choose to redeem any reward, or accumulate your points for future redemptions.

Please note that all rewards (Cash or SmartPoints) will typically be fulfilled approximately 5 months after the end of the campaign month (30 June 2024).

MoneySmart exclusive rewards do not stack with external or third party promotions unless otherwise stated. See T&Cs for details.

*Instantly Activate Your Virtual Card for Google Pay and Apple Pay Shopping! T&Cs apply.

Quick Facts

Instant Rewards Redemption

Categories to maximise this card

What people use it for.

Frequent travellers who are looking for more flexibility & choices in redeeming miles and good earn rate

You are looking for a miles credit card with high earn rate and fast redemption

All Details

Key features.

- Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app

Accelerated earn rate: up to 2.4 miles for your spending

Travel privileges: Complimentary travel insurance coverage (including COVID-19), 4 x complimentary airport lounge visits for primary cardholders and more

Split flexibly: Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Air Miles Excellent

Overseas spending excellent, annual interest rate and fees, minimum income requirements, documents required, card association, wireless payment, moneysmart promotions.

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

HSBC TravelOne Credit Card Review 2024

Introduced in early 2023, the HSBC TravelOne credit card represents HSBC's newest addition to its credit card lineup, specifically designed for those passionate about travel. It offers enhanced flexibility, ease, and appealing rewards.

Notable highlights include fee-free miles transfers with 9 frequent flyer partners and the integration with the HSBC mobile app, allowing users to effortlessly redeem travel rewards and handle their payments with utmost convenience. If you're considering whether to get the HSBC TravelOne Credit Card, let's find out if this card is suitable for you as we consider the requirements, pros and cons and more.

Pros and Cons of HSBC TravelOne Card

- 20,000 welcome bonus miles (50,000 reward points) upon payment of annual fee

- Up to 2.4 miles for every S$1 spent overseas

- No cap on miles/points earned

- Up to 1.2 miles for every S$1 spent locally

- No redemption fee when you redeem for air miles or hotel points

- Annual fee waiver available (from 2nd year onwards)

- Exclusive access to HSBC ENTERTAINER with HSBC Singapore mobile app, enjoy over 1,000 worldwide 1-for-1 deals on dining, lifestyle and travel

- Flexibility to split your purchases across a range of flexible tenors that suits your needs with HSBC credit card Instalment Plans at 0% interest fee

- Complimentary travel insurance

- Complimentary airport lounge visits per year for primary cardholders

- Interest rate of 26.90%, which is lower than some cashback credit cards (as per MoneySmart's Credit Cards comparison tool)

- Min. spend of S$1,000 to qualify for the 20,000 welcome bonus miles

- Min. spend of S$25,000 per year to qualify for the annual fee waiver

Compare HSBC TravelOne vs. Citi PremierMiles Card vs. SCB Journey Credit Card

Currently, the HSBC TravelOne Card offers the lowest minimum interest rate chargeable as compared to the Citi PremierMiles Card and Standard Chartered Journey Card.

In terms of annual fee, you'll definitely save more with the Standard Chartered Journey Card as compared to the HSBC TravelOne Card and Citi PremierMiles Card, as you wouldn't have to pay any annual fees for it.

When it comes to air miles benefits, the Citi PremierMiles Card comes up on top with the most attractive perks as compared to the HSBC TravelOne Card and Standard Chartered Journey Card, offering the highest air miles per S$1 spent on online travel bookings via Kaligo and Agoda.

However, the Citi PremierMiles Card requires a minimum spend of $800 per month for the first-year fee waiver, unlike the Standard Chartered Journey Card which does not have minimum spend requirements. HSBC TravelOne Card requires an even higher minimum spending of S$25,000 annually to be eligible for the second-year annual fee waiver.

In a nutshell, the HSBC TravelOne Card is worth getting if you're after its fee-free miles transfers with 9 frequent flyer partners, no cap on miles/points earned, plus the instant reward redemption with its extensive selection of airline and hotel partners via the HSBC Singapore mobile app.

Find Out More In Our HSBC TravelOne Blog Review

Hsbc travelone card application.

Here are 3 simple steps to apply for the HSBC TravelOne Credit Card:

Apply via MoneySmart’s credit cards page

You may begin your application by clicking on our HSBC TravelOne Card application link.

When you choose to apply online or through the HSBC mobile app and via SingPass MyInfo, HSBC will pull your identity and income data from SingPass (which is already verified), thus cutting short the processing time. The approval-in-principle page will appear within minutes of submitting your MyInfo.

Provide all documentation required

You'll need to provide all the necessary documentation in order for HSBC to approve your credit card application. This list of documents include:

- NRIC or other identification details

- Latest computerised payslip

- Latest 12 months' CPF Contribution History Statement

- Latest Income Tax Notice of Assessment (NOA)

Receive your HSBC TravelOne Credit Card

You’ll be able to activate your HSBC TravelOne Card instantly through the HSBC mobile app, and enter a One-Time Password (OTP) after keying in your 6-digit Online Banking PIN to secure all your credit card transactions. Thereafter, it’s ready for you to use on any of your purchases and you can track your air miles and other rewards with your HSBC mobile app!

Frequently Asked Questions

Are there any fees if i apply for the hsbc travelone credit card, am i eligible for the hsbc travelone credit card, if i’m late for my monthly hsbc travelone credit card bill payment, how much do i have to pay.

HSBC TravelOne Review: Uncover the Benefits and Nuances for Your Future Trips

🌍uncover the benefits & nuances of hsbc travelone for your future trips✈️. read our review & plan your travel smarter🧳 👍.

Introduction to HSBC TravelOne

Brief overview of hsbc.

HSBC is a multinational banking and financial services organization headquartered in London, UK. It’s one of the largest banking institutions worldwide, offering services such as retail, commercial, and private banking, asset management, and treasury services. Since its establishment in 1865, it has grown into a global network spanning over 64 countries.

In this article, we will be conducting an in-depth review of HSBC TravelOne, a product designed to offer special benefits to frequent travelers. This review intends to provide potential users with all the necessary information on the pros, cons, and key features of this service. With that in mind, it’s important to delve into the hsbc travelone review to understand its offerings fully. The HSBC TravelOne service is crafted by the renowned banking and financial services organization HSBC, making it a popular choice among travelers seeking convenience and value. Whether you are a leisure traveler or travel frequently for business purposes, this review of HSBC TravelOne can be beneficial in helping you make an informed decision.

Features of HSBC TravelOne

Explanation of hsbc travelone features.

HSBC TravelOne is a credit card tailored specifically for frequent travelers. It offers users the ability to earn air miles for every purchase, exclusive travel discounts, and complimentary airport lounge access worldwide. Additionally, it provides comprehensive travel insurance coverage, travel emergency services, and no foreign transaction fees making international travel more convenient and secure.

Detailed description of benefits offered

Benefits offered by companies typically include medical, dental, and vision insurance, providing security for employees regarding their health. Employees might also profit from retirement plans such as 401(k) matching, boosting their financial stability in the long term. Further, perks like paid time off and flexible work schedules enhance work-life balance.

Understanding the Benefits

Travel insurance cover.

Travel insurance coverage is an essential part of planning a trip. It provides financial protection against unforeseen circumstances such as medical emergencies, trip cancellations, lost luggage, and other unexpected incidents. Many policies also offer 24/7 assistance services. It’s a small investment that facilitates stress-free travel.

Travel discounts and offers

Travel discounts and offers provide a cost-effective way for individuals to explore the world. These financial incentives, which can apply to things like flights, accommodation, and tour packages, allow people to visit their dream destinations at a reduced price. They stimulate tourism, make travel more accessible, and make vacations more enjoyable.

Complimentary airport lounge access

Complimentary airport lounge access is a luxury perk often provided to first and business-class passengers. It offers an exclusive and serene space for relaxation or work before flight departure. Amenities typically include comfortable seating areas, premium food and beverage options, private meeting rooms, high-speed Wi-Fi, and sometimes spa services.

Earn points on travel and leisure spending

Earn points on travel and leisure spending with various reward programs offered by airlines, hotels, and credit card companies. These reward programs allow you to accumulate points for every dollar spent on flights, accommodation, dining, and other leisure activities. These points can later be redeemed for exciting rewards or discounts.

Eligibility and Application Process for HSBC TravelOne

Explanation of eligibility criteria for hsbc travelone.

HSBC TravelOne is designed for frequent travelers. Eligibility depends on age (18-65), HSBC account holder status, and steady income. Applicants must be account holders for at least one year and prove a satisfactory income level. The specific income requirement varies, so contacting HSBC for more detailed information is recommended.

Step-by-step guide for the application process

A step-by-step guide for the application process involves understanding the submission requirements, filling out forms correctly, and gathering necessary supplementary materials. Candidates should start with careful research, and then meticulously complete the application, ensuring they meet specifications. Deadlines and proofreading are crucial for successful submissions. Following these steps increases your chances of a successful application.

Using HSBC TravelOne for Future Trips

Case scenarios on the use of hsbc travelone for trips.

HSBC TravelOne offers customers an efficient solution for their travel needs. Consider a couple planning their honeymoon. They book flights and hotels through TravelOne and enjoy discounted rates and valuable reward points. Unexpectedly, a flight gets canceled – thanks to TravelOne’s travel insurance, they’re compensated, ensuring their dream trip remains stress-free.

Understanding the benefits based on specific trip needs

Understanding the benefits based on specific trip needs can enhance your overall travel experience. Proper planning allows one to maximize budget, time, and enjoyment. Benefits may include stress reduction, exploration of new cultures, increased knowledge, and improved health. Each trip offers unique opportunities based on individual needs and interests.

Nuances of HSBC TravelOne

Identifying the hidden terms and conditions.

Identifying hidden terms and conditions requires careful reading of any contract or agreement. Often fine prints and unclear wording mask crucial details. Hidden clauses may cause unexpected obligations or costs. Vigilance and understanding in these matters are therefore essential to protect oneself from potential pitfalls and unwanted surprises.

Analyzing potential drawbacks and limitations

Analyzing potential drawbacks and limitations is a key step in decision-making processes. It involves foreseeing possible obstacles, constraints, or negative impacts of a particular plan or project. This process facilitates risk management, promotes efficiency, and supports strategic planning. However, it may limit innovation and risk-taking if not balanced with a solution-oriented approach.

Comparison with Other Travel Cards

Comparative study of hsbc travelone with other travel cards.

The HSBC TravelOne card stands out in a comparative study against other travel cards by offering a plethora of advantages. It provides worldwide acceptance, comprehensive travel insurance, and impressive rewards programs. However, other cards may offer lower fees or specific airline partnerships, making a thorough comparison essential for potential users.

Evaluation consolidating HSBC TravelOne’s standing among competitors

HSBC TravelOne has consolidated its standing among competitors through an impressive evaluation process. Its robust assessment focuses on affordability, efficiency, and customer satisfaction, fostering transparency and reliability. This strategy has strengthened TravelOne’s competitive edge while bolstering trust and credibility among its clientele in the strenuous travel industry.

Final Review Summary

Final thoughts about the strengths and weaknesses of hsbc travelone.

In conclusion, HSBC TravelOne offers strength in its comprehensive travel benefits, including impressive travel points and insurance, adding value for frequent travelers. However, its weakness lies in high eligibility requirements, which limits accessibility for average-income earners. The limited access to non-travel-related rewards may leave some prospective customers wanting more.

Summary of how HSBC TravelOne can support future trips

HSBC TravelOne is designed to make future travel smoother, providing services such as airfare and hotel discounts, travel insurance, and airport lounge access. By catering to all your travel-related financial needs, this service simplifies your transactions and takes care of unforeseen circumstances, making your trip worry-free.

HSBC TravelOne User Reviews

Sharing customers’ feedback about hsbc travelone.

HSBC TravelOne continuously strives to improve its services as a result of customer feedback. Customers rate the automated booking process highly, praising its convenience and simplicity. However, they suggest improving the policy on changing booked trips. Many appreciate the variety of travel options, competitive rates, and efficient customer service.

Assessing the card’s reputation based on user experiences

Customer reviews provide an excellent platform to evaluate a card’s reputation. This assessment strategy uses first-hand experiences to identify any regular issues, service quality, and usability. User experiences highlight the card’s benefits and drawbacks, offering valuable insights into the card’s operational efficiency and overall reliability.

HSBC Travel One review FAQs

What is the earning rate for hsbc travel one.

HSBC Travel One offers a high earning rate for travel-loving customers. For every KD 1 spent overseas, customers earn 2.25 air miles. While for local expenditures of the same amount, the earn rate is 1.5 miles. These miles can be redeemed for a wide range of travel-related rewards.

Is the HSBC credit card good?

HSBC credit card offers a variety of benefits, including competitive rewards programs, low introductory APR, and no foreign transaction fees. Building a good credit history is also manageable with HSBC’s helpful tools and customer service. However, customer experience varies, and some people may encounter issues with their customer service.

Does HSBC Revolution miles expire?

Yes, HSBC Revolution miles do expire. As per their policy, the miles accumulated through the HSBC Revolution Credit Card are valid for three years from the quarter in which they are earned. If not redeemed within this period, these accumulated miles will automatically expire and be removed from the account.

What is the age limit for an HSBC credit card?

HSBC has set a minimum age limit of 18 years for a primary credit card holder. However, they also require an established employment or income history. For supplementary cardholders, the minimum age limit varies depending on the specific type of card but is typically around 16 years.

Related Posts

savvyglobetrotter

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Currently you have JavaScript disabled. In order to post comments, please make sure JavaScript and Cookies are enabled, and reload the page. Click here for instructions on how to enable JavaScript in your browser.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Review: HSBC TravelOne Card Singapore

The HSBC TravelOne Card has emerged as a notable option for travelers in Singapore, catering to those seeking a mix of travel perks and rewards. As a comprehensive miles card, it joins the competitive market with promises of seamless miles accumulation, an array of travel benefits, and the flexibility of multiple transfer partners, distinguishing itself within a crowded field. The card targets a broad audience, from frequent flyers to occasional vacationers, aiming to enhance their travel experience with benefits like lounge access and travel insurance coverage.

Our analysis of the HSBC TravelOne Card covers its core attributes, from the application process to the day-to-day user experience. We assess the rewards system, which includes the card’s earn rate on local and overseas expenditure, and evaluate the practicality of benefits against its fee structure. Comparisons with other travel cards in the market are essential to gauge where the HSBC TravelOne stands, and determine whether it offers competitive advantages to warrant its place in a traveler’s wallet.

Key Takeaways

- The HSBC TravelOne Card is tailored for travelers, with benefits such as travel insurance and lounge access.

- It offers a competitive miles earn rate and has a wide range of transfer partners.

- The card’s varied perks should be weighed against its fees to assess overall value.

Key Features of HSBC TravelOne Card

We observe that the HSBC TravelOne Card is equipped with a variety of features tailored for travel and general expenses. Here, we discuss some of its key attributes.

- Lounge Access : Cardholders are entitled to four lounge visits per calendar year, effectively providing eight visits in the first year of membership due to the way the allowance is structured annually.

- Points Conversion : Users enjoy instant points conversions. Additionally, there are no conversion fees for this service until the end of the year 2023.

- Complimentary travel insurance coverage is included with the card.

- Exclusive cashback and discount offers are available globally across dining, lifestyle, and more.

- Miles Earn Rate : The card offers a decent earn rate for miles accumulated through purchases, which can then be redeemed with a selection of 12 travel partners including airlines and hotels.

- Welcome offers or promotional rewards are periodically available for new users who meet certain spending requirements.

- The card lacks a bonus earn category, which means that all expenses are rewarded at the same rate without any special boosts for certain categories of spending.

Our insights emphasize that the HSBC TravelOne Card is a compelling choice for individuals who frequently travel and wish to accrue travel-related rewards, although it is important to be aware of the lack of points pooling feature. The absence of this can affect how rewards are managed between different cards from the same issuer.

Eligibility and Application Process

Our HSBC TravelOne Card targets a specific clientele, ensuring eligibility criteria are met and applicants are informed about the necessary documentation and procedure to smoothly apply for the card.

Eligibility Criteria

To apply for the HSBC TravelOne card, there are certain prerequisites you must meet:

- Age : You must be at least 21 years of age.

- For Singaporean or Permanent Residents : A minimum annual income of SGD30,000.

- For Self-employed or Commission-based Singaporeans or Permanent Residents : A minimum annual income of SGD40,000.

Application Procedure

To get started with your application for an HSBC TravelOne card, follow these steps:

- Visit the Official Website : Go to the HSBC Singapore website dedicated to the HSBC TravelOne credit card.

- Fill Application : Complete the online application form with all the required personal and financial details.

- Submit Application : Review your details for accuracy and submit your application online.

Required Documents

When you apply for the HSBC TravelOne Card, you need these documents:

- Proof of Identity : A copy of your NRIC or passport.

- For salaried employees: Latest 3 months’ payslip or latest Notice of Assessment (NOA).

- For self-employed: Last 2 years’ NOA and bank statements.

Rewards and Benefits

In our comprehensive review, we cover the various rewards and benefits that the HSBC TravelOne Card offers. Specifically focusing on travel rewards, complementary travel insurance, and lifestyle benefits that enhance the cardholders’ experiences.

Travel Rewards System

The HSBC TravelOne Card comes without designated bonus point categories, but it offers a substantial travel rewards system. Cardholders earn points for every dollar spent, which can be redeemed for flights, hotel stays, and other travel-related expenses. Additionally, points can be redeemed instantly through HSBC’s mobile banking app in Singapore.

Complimentary Travel Insurance

When traveling, cardholders can have peace of mind knowing that the HSBC TravelOne Card includes complimentary travel insurance. This coverage extends to various travel-related mishaps and includes benefits such as:

- Medical and Personal Accident : Coverage for medical expenses and personal accidents while abroad.

- Travel Inconveniences : Compensation for travel delays, lost baggage, and other inconveniences.

Lifestyle Benefits

Beyond travel, the HSBC TravelOne Card enriches users’ lifestyles with additional advantages:

- Dining Privileges : Exclusive dining offers at selected restaurants.

- Entertainment Perks : Special deals at entertainment venues, including movie theaters and live events.

By offering these hotel, dining, and entertainment benefits, the card transcends just travel-focused rewards, making it versatile in its appeal.

Fees and Charges

In this section, we’ll outline the specifics of fees and charges associated with the HSBC TravelOne Card. Understanding these costs is vital for effective financial management.

Annual Fees

The HSBC TravelOne Card carries an annual fee of S$194.40 . It’s a common fee range for entry-level credit cards in Singapore. However, in the second year and thereafter, if you spend over SGD25,000 annually , this fee may be waived.

Foreign Transaction Fees

For transactions made in foreign currencies, the HSBC TravelOne Card typically includes additional costs. While specific percentages are not listed, such fees typically range from 2.5% to 3.5% of the transaction amount.

Other Associated Costs

There are several other potential costs to consider:

- Late payment fees

- Overlimit fees

- Cash advance fees

Each of these will vary based on the actual usage and the terms of service defined by HSBC. It’s crucial to review the cardholder agreement for the most accurate figures.

Interest Rates and Financial Charges

When considering the HSBC TravelOne Card, it’s essential for us to understand the various interest rates and financial charges that apply. We’ll cover the specific rates for purchases, cash advances, and the costs associated with late payments to ensure clear and accurate financial planning.

Interest on Purchases

With the HSBC TravelOne Card , the interest rate on purchases is calculated if the outstanding balance is not paid in full by the due date. The effective interest rate is 25.9% per annum. It’s critical to pay the balance promptly to avoid these charges.

Interest on Cash Advances

For cash advances, a higher interest rate is typically charged from the date of the transaction until the amount is paid in full. As of the latest update, the effective interest rate for cash advances on the HSBC TravelOne Card is set at 26.9% per annum, but with effect from January 8, 2024, this will increase to 27.8% per annum.

Late Payment Charges

We must also note that late payments incur charges. For the HSBC TravelOne Card, if the minimum payment isn’t received by the due date, a late payment charge of S$55 is levied. Ensuring timely payments is crucial to avoid these additional costs.

Cardholder User Experience

In reviewing the HSBC TravelOne Card, we focus on the aspects of customer service, the online banking platform, and mobile app functionality, as these are critical components that impact the daily usage and satisfaction levels for cardholders.

Customer Service

We find that the customer service provided for HSBC TravelOne cardholders is efficient and responsive. Assistance is available through multiple channels, including phone support and email, which offers convenience and ease in addressing any concerns or questions that may arise.

- Phone Support: Quick response times with knowledgeable representatives.

- Email: Clear and timely communication, typically within standard business hours.

Online Banking Platform

HSBC’s online banking platform for the TravelOne card is designed to be user-friendly and secure. Our experiences include:

- Dashboard: Intuitive and easy-to-navigate interface.

- Transactions: Real-time tracking and monthly statement breakdowns are readily accessible.

Mobile App Functionality

The HSBC Singapore mobile app enhances the user experience by offering robust features for TravelOne cardholders.

- Mobile Payments: Seamless integration with digital wallets for contactless payments.

- Account Management: Real-time alerts, card blocking, and simple transaction categorization.

Comparison with Other Travel Cards

In comparing the HSBC TravelOne Card with its peers, we find distinct advantages and areas where it may not measure up. Points accrual, transfer options, and lounge access are primary factors we consider.

- Points Accrual: The HSBC TravelOne Card offers a competitive earn rate on general spending, and though it may not lead the pack, the absence of conversion fees (until the end of 2023) improves the overall value proposition.

- Transfer Partners: Our card stands out with a wide range of transfer partners, a feature particularly important for travelers seeking flexibility in redeeming miles across various airlines and hotels.

- Lounge Access: Compared to competitors, the HSBC TravelOne Card provides a notable number of lounge visits, which enhances the travel experience for cardholders without the need for a premium card.

We also emphasize the travel insurance benefits included with the HSBC TravelOne Card. While travel insurance is relatively common across travel cards, the coverage specifics can vary, and we believe our cardholders appreciate the assurance that comes with comprehensive coverage.

Here’s a brief comparison with two major competitors:

In essence, the HSBC TravelOne Card is tailored for travelers who value a balance between earn rates and travel perks. While it may not outshine in every category, its broad list of partners and travel benefits make it a formidable option within our market.

Pros and Cons

When considering the HSBC TravelOne Card, we identify a range of features that will appeal to frequent travelers as well as some limitations that need to be taken into account.

- Mileage Earn Rates : The card offers respectable miles earn rates, which can be beneficial for individuals who spend regularly and wish to accumulate travel miles.

- Annual Fees : We note that the card may offer low or no annual fees, easing the cost burden for cardholders.

- Travel Benefits : A variety of travel-related benefits are attached to the card, including lounge access that enhances the airport experience.

- Partnerships : With a suite of travel partners, cardholders can enjoy increased flexibility and options for using their earned miles.

- Sustainability Initiatives : An alliance with One Tree Planted allows for environmental contributions, letting cardholders use points to make a positive impact.

Disadvantages

- Points Pooling Feature : The card currently does not offer points pooling, potentially limiting the value for those who manage multiple accounts.

- Travel Insurance : Details regarding travel insurance coverage are not provided, it’s recommended to verify if the coverage meets one’s personal requirements.

- Lounge Access : While some lounge visits are included, limitations apply which may not satisfy all users’ needs.

Final Verdict