Welcome to Online Banking

Sign in to online banking, help - client card or username.

Enter the 16-digit number from the card you use for debit and ATM transactions. If you don’t have a card, you can use the number you were given at the branch to access Online Banking.

If you have set up a username, you can enter it in this field to log in to Online Banking.

Help - Remember your client card or user name

Check this box if you’d like to save your Client Card number or username on this computer, so you don’t have to enter it again the next time you log in to Online Banking.

We don’t recommend this option if you’re using a public or shared computer.

If you delete the cookies on your computer, you’ll erase any saved Client Card numbers or usernames.

Help - RBC Security Guarantee

We’ll fully reimburse any unauthorized transactions made in RBC Royal Bank Online Banking.

New to Online Banking?

Discover Opens new tab what it can do for you.

Other Online Services Other Online Services RBC Direct Investing Dominion Securities Online RBC InvestEase Avion Rewards PH&N Investment Counsel RBC Royal Trust RBC Bank USA RBC Caribbean RBC Express RBC Global Trade Other Services

How can we help you.

Royal Bank of Canada Website, © 1995-2024

Skip to main content

Make It Yours.

It's your career. your life. where do you want to go , find your next job., your life is shaped by your ideas. you want a career that helps you realize those ideas and an employer that supports your aspirations. whether it's developing new skills, opportunities to innovate and grow, or the flexibility to enjoy moments that matter, rbc is a great place to build your career and life., perks & benefits, growth & development, mental health resources, modern & flexible benefits, perks & discounts, employee retirement & savings programs, choose your path, lorem ipsum.

- Find a Branch

- Call 1-800-769-2511

- Our Company

- Investor Relations

- News & Stories

- Thought Leadership

Our Leadership

Meet the team that’s helping build the RBC of the future.

Executive Officers

David McKay

President & Chief Executive Officer

Maria Douvas

Chief Legal and Administrative Officer

Graeme Hepworth

Chief Risk Officer

Michael Dobbins

Group Head, RBC Ventures & Corporate Development

Neil McLaughlin

Group Head, Personal & Commercial Banking

Kelly Pereira

Chief Human Resources Officer

Katherine Gibson

Interim Chief Financial Officer

Doug Guzman

Group Head, RBC Wealth Management & Insurance

Christoph Knoess

Chief Administrative & Strategy Officer

Derek Neldner

CEO and Group Head, RBC Capital Markets

Group Head, Technology and Operations

Board of Directors

The date appearing after the name of each director indicates the year in which the individual became a director. The term of office of each director will expire at the next Annual Meeting of Common Shareholders.

Travel Insurance

More coverage in more places ®.

Get out there and enjoy yourself knowing you have the right coverage and 24/7 access to a caring team who’s always on call—no matter how big or how small the emergency.

More Coverage In More Places™

- Coverage Types

- Submit Claim

Explore Your Coverage Options

Travel packages.

Coverage for the widest range of unexpected travel situations.

Travel Medical

Coverage to fill the gap left by my provincial health insurance.

Cancellation & Interruption

Coverage for non-refundable and/or non-transferable trip expenses if my trip is cancelled or interrupted.

Visitors to Canada

When visiting, immigrating to or studying in Canada and need emergency medical coverage.

Travel Insurance Advice by Trip Type

Choose from the topics below for some quick advice on the type of coverage that may be right for you:

Travel Insurance FAQs

Have a question about travel insurance? Get the answers you need here.

For questions about travel and COVID-19, please visit the COVID-19 page.

- Eligibility

- Emergencies

Our goal is to make affordable travel insurance coverage available to as many Canadians as possible. In general, any Canadian resident can purchase some form of coverage with us. Factors such as where you are travelling, your health and the length of your trip may affect the specific coverage(s) available to you.

Note : Non-residents travelling to Canada, immigrants to Canada or foreign students studying in Canada may be eligible to purchase one of our Visitors to Canada Plans.

Generally speaking, no. While your age can affect your eligibility for certain coverages, we have packages and plans that cover all age groups. If you are age 65 or older, we may ask you to answer a few questions about your health to make sure you have the most appropriate coverage.

Yes, you may purchase a policy for your parents. Simply call us at 1-866-896-8172 , buy online , or visit an RBC Insurance Store . Depending on their age, they may be required to complete health questions in order to obtain coverage. If this is not a requirement, please keep in mind that all terms and conditions apply to your parents, therefore we recommend that you review the insurance with them prior to purchase.

Possibly. Depending on your age, medical condition and, if applicable, your answers to our health questions, pre-existing medical conditions are covered if they are stable for a certain time period (as specified in your policy) before your policy's effective date.

Note: Please refer to the policy document for complete coverage details regarding pre-existing conditions.

Your answers to the health questions (if applicable) will be used to help determine the benefits you are eligible to receive under your insurance policy.

When answering the health questions:

- Take your time. The questions may take up to 10 minutes to complete.

- You (the applicant) should complete and sign the Medical Questionnaire. (If you have someone else complete the Medical Questionnaire on your behalf, it is still your responsibility to make sure the answers to the questions are correct.)

- Read and answer each question carefully and accurately. Review your answers to confirm they are correct. Incorrect answers may lead to your coverage being voided or your claim denied.

- Have your prescriptions or a description of your medications nearby for reference.

- If you are unsure about any questions regarding your medical condition or medications, please speak to your physician.

If necessary, a family member or close friend can complete the questions on your behalf. Please keep in mind, however, that it is still your responsibility to sign the form and make sure the answers are correct.

Yes, it is recommended that you buy coverage for your spouse as well.

This answer depends largely on your child's age.

- If your child is under 2 years old and you are purchasing the Deluxe Package or a TravelCare ® Package, then your child receives emergency medical coverage at no extra cost.

- If your child is 2 or older , you'll need to purchase emergency medical coverage for him or her.

- No matter how old your child is , if you've purchased an airline ticket or made a separate trip deposit for him or her, consider buying a travel insurance package or trip cancellation and interruption insurance .

The right coverage for your trip depends on several factors, including (but not limited to) where you're travelling to, how long you’ll be gone, the kind of transportation you'll be using and, in some instances, your overall health. View all of our travel insurance products now.

An accident, illness or medical emergency can happen anywhere, anytime. If you need medical care or treatment in another country, your government health plan may cover only a portion of the costs. Travel insurance starts where these plans leave off.

Plus, with our emergency medical coverage, you have access to the multilingual representatives of Allianz Global Assistance.

Yes, if you are travelling outside your home province or territory. There are several reasons why it's important to get travel medical insurance when you're travelling within Canada. One reason is that accidents can happen anywhere. Another is that government health insurance plans do have limits on reimbursement of emergency medical expenses incurred while you are in another province. For example, the ambulance, emergency dental treatment and prescription drugs might not be covered by some government health insurance plans.

You may extend your coverage if you extend your trip, subject to certain conditions of your policy.

If you've purchased a single trip plan, the following conditions apply:

- If you have not had a medical condition during your trip or while covered under your policy, you can request an extension by contacting us at 1-866-896-8172 before your original policy’s expiry date.

- If you have had a medical condition during your trip and while covered under your policy, you must request the extension by contacting Allianz Global Assistance before the expiry date of your original policy. Your extension is subject to the approval of Allianz Global Assistance.

- You must pay the required additional premium before your original policy’s expiry date.

- If we are unable to extend your particular policy's coverage due to the trip duration limits of your policy, you may be able to purchase a new policy from us.

If you've purchased a multi-trip annual plan, the following conditions apply:

You may purchase a top-up policy for the additional number of days beyond the duration covered by your multi-trip annual plan as follows:

- Before your effective date, you may contact us at 1-866-896-8172 to purchase top-up coverage.

- After your effective date and if you have not had a medical condition during your trip, you must contact us at 1-866-896-8172 before your original policy’s expiry date to purchase top-up coverage.

- After your effective date and if you have had a medical condition during your trip, you must contact Allianz Global Assistance before your original policy’s expiry date to request approval for and to purchase top-up coverage.

- The terms, conditions and exclusions of the new top-up policy apply to you.

- You must pay the required top-up premium on or before the effective date of the top-up period.

If you do NOT top-up your coverage for a trip, you will not be covered for any claims you make outside the period of insurance for that trip. If the top-up policy you are purchasing requires you to complete health questions, you must complete the health questions.

Please see the policy documents for complete coverage details regarding trip extensions.

It may, but not always. We recommend that you carefully review the travel insurance coverage provided by your credit card, as well as any special conditions or stipulations.

Do you have an RBC Royal Bank ® credit card?

To review the travel insurance coverage that comes with your RBC Royal Bank credit card, visit: www.rbcroyalbank.com/cards/documentation/index.html and click the "Insurance Certificate" link for your card.

We recommend that you carefully review your government health plan coverage. Government plans may not cover all emergency medical expenses once you leave your home province/territory and typically cover only a limited portion once you leave the country. In fact, the Canadian Government (Foreign Affairs, Trade and Development Canada) urges Canadians to purchase supplemental health insurance when leaving the country. They say:

Do not rely on your provincial or territorial health plan to cover costs if you get sick or are injured while abroad. Out-of-country health care can be costly, and your health plan may not cover any medical expenses abroad. It is your responsibility to seek information from your provincial or territorial health authority and to obtain supplementary travel insurance and understand the terms of your policy. 2

Plus, government health insurance plans don't guarantee coverage for special care (air ambulance or emergency dental services, for instance).

Unlike government health insurance plans, our insurance offers you:

- Unlimited coverage for eligible medical expenses 1

- Up-front payment of eligible medical expenses whenever possible

- 24-hour, multilingual emergency medical assistance—one toll-free phone call puts you in touch with a multilingual professional who will refer you to a local doctor or facility in order for you to receive the care you need

Government health insurance plans also don't provide coverage for situations such as lost, damaged or delayed baggage or trip cancellation and interruption. Our travel insurance can provide these coverages and more.

Yes, you do need travel insurance to protect yourself against the unexpected, even if you are going to the United States for a few days. An illness or accident can happen at any time, whether you're on the road for a few days, or a few months. And remember, the cost of health care is very expensive in the United States and very little of this cost would be covered by your government health insurance plan, credit card or company benefits plan. For a short trip, the cost of travel insurance is minimal, and it gives you the protection you need.

If you purchase trip cancellation and interruption insurance, it will help pay for your expenses to return home in the event of a covered emergency. There are a number of circumstances that qualify as an emergency (for example, the death or serious illness of a family member). The cost of cancelling a trip prior to departure can be very expensive, as most trips are non-refundable and/or non-transferable, especially if you have to cancel just before leaving on your trip. Having to return early from a trip can also be very expensive. Either way, trip cancellation and interruption insurance is very important to protect your travel investment.

You must purchase coverage before departing on your trip. You may benefit from purchasing coverage as soon as you make your initial trip deposit, especially if you are purchasing trip cancellation and interruption insurance —either as stand-alone coverage or as part of one of our insurance packages .

If you were to book your trip 6 months in advance, consider the unexpected situations that could occur in that time.

If you purchase travel insurance from RBC Insurance, we will pay the eligible bills directly to the hospital or physician whenever possible.

There are a number of sports that are not covered during your trip. For more details, see the Exclusions section of the individual policy document.

You may purchase a top-up policy for the extra number of days beyond the duration covered by your multi-trip annual plan. Here are the conditions:

- After your effective date and if you have had a medical condition during your trip, you must contact Allianz Global Assistance before your original policy’s expiry date to request approval for and purchase top-up coverage.

Please see the policy document for complete coverage details regarding top-up coverage.

If you purchase one of our travel medical insurance plans—either Classic Medical or TravelCare ® Medical—you can, subject to certain conditions:

- If you are travelling for more than 183 days, you may purchase single trip coverage for up to 365 days provided that you are covered under your government health plan for the full duration of your trip.

- If you are 40-74 years of age , you must also answer a few health questions, which will determine whether you are eligible to purchase coverage for trips beyond 183 days.

Yes, if you are travelling with your spouse/partner and children or other family members, you could save money with our family plan pricing.

The cost of a trip can be a significant financial investment. A lot can also happen in the time between booking your trip and departing—if a medical emergency or other unexpected event prevents you from going on your trip, you could potentially lose some (or possibly all) of the money you paid.

With trip cancellation and interruption insurance, you're protected when certain situations prevent you from travelling as planned. Examples include:

- You can't travel due to an illness, job loss or immediate family member's medical emergency

- You need to return home earlier than scheduled because of a family emergency or medical condition

Note : We strongly recommend that you purchase trip cancellation and interruption insurance at the time you pay your initial travel deposit. Please see the policy document for complete coverage details, including terms and conditions.

Yes! Tell them about our Visitors to Canada Plans , which offer affordable emergency medical protection to visitors, immigrants, foreign students and Canadians without government health plan coverage.

We strongly recommend you do. Your insurance policy is a valuable source of information and contains provisions that may limit or exclude coverage. Please read it before you go, keep it in a safe place and carry it with you when you travel.

RBC Insurance has appointed AZGA Service Canada Inc. (operating as “Allianz Global Assistance”) as the provider of all assistance and claims.

Whether you have a new claim or questions about an existing claim, representatives will work with you to make things as easy as possible. Visit the Travel Insurance Claims page for more details about how to submit a claim.

It's our goal to settle every claim as quickly as possible. While every claim is different, there are things you can do to speed things up:

- If you require emergency care on your trip , call our emergency contact number immediately, or at the earliest possible opportunity (someone else can call if you're unable to). If you do not, your coverage may be limited and your benefits could be reduced.

- If you need to cancel your trip prior to departing , call your travel agency, airline, tour company or the carrier immediately to cancel your trip no later than one business day after the cause of cancellation. Call Allianz Global Assistance the same day.

- For all claims , carefully read the instructions for submitting your claim. Make sure you fully complete any required claims forms and submit all required documentation at your earliest possible convenience. For example, you may need to provide information on your past health history if you are submitting an emergency medical claim or a trip cancellation claim due to a medical condition.

The documentation you need to provide will depend on the type of claim, the type of plan you purchased and the province/territory in which you live. Visit the Travel Insurance Claims page for more details about how to submit a claim.

No matter where in the world you are, we’ll be here for you. If you have an emergency, you can call Allianz Global Assistance toll-free 24 hours a day, 7 days a week at 1-855-947-1581 from the U.S. and Canada or (905) 816-2561 collect from anywhere in the world . Or as an alternative, you can email Allianz Global Assistance at: [email protected] . Disclaimer 3

The multilingual representatives of Allianz Global Assistance are ready 24 hours a day, seven days a week when you have a medical emergency. You can rely on them to refer you or (when medically appropriate) transfer you to one of the accredited medical service providers within the Allianz Global Assistance network, so you can receive the care you need as quickly as possible.

Because the representatives are multilingual and have 24-hour access to real-time translation services, they can provide the help you need in your own language—and also have someone to communicate on your behalf with medical personnel who may speak a different language.

Whenever possible, Allianz Global Assistance will also request for the medical service provider within the network to bill the covered medical expenses directly to us instead of you—reducing stress and hassle.

Yes, as soon as medically possible. There are several reasons to call the emergency contact number first:

The multilingual representatives of Allianz Global Assistance are experienced experts in coordinating emergency care for travellers in foreign lands.

They're available 24 hours a day, seven days a week.

If you don't call Allianz Global Assistance first, your benefits may be reduced and your coverage may be limited. As stated in your policy, if you do not contact Allianz Global Assistance at the time of your medical emergency or you choose to receive treatment from a medical service provider outside the Allianz Global Assistance network, you will be responsible for 30% of your medical expenses covered under your insurance and in excess of your medical expenses paid by your government health plan.

You can call Allianz Global Assistance toll-free 24 hours a day, 7 days a week at 1-855-947-1581 from the U.S. and Canada or (905) 816-2561 collect from anywhere in the world.

Of course, obtaining urgent care in an emergency is your #1 priority—and our representatives are here to help at our toll-free emergency contact number. However, if your medical condition Opens in new window prevents you from calling before seeking emergency treatment, then you must call as soon as medically possible.

Someone else (a family member, friend, hospital or physician's office staff, etc.) may call on your behalf–so it's a very good idea to carry your RBC Insurance travel insurance wallet card with you at all times.

They may call Allianz Global Assistance toll-free 24 hours a day, 7 days a week at 1-855-947-1581 from the U.S. and Canada or (905) 816-2561 collect from anywhere in the world.

Or as an alternative, they can email3 Allianz Global Assistance at: [email protected] .

We will pay your eligible medical bills directly to the medical provider or hospital for you whenever possible.

Travel together. Save together.

Travelling with a group of 10 or more? Save with a group discount and enjoy all the benefits of RBC ® Travel Insurance.

Reasons to Love RBC Travel Insurance

Coverage available for all ages.

If you are travelling with your spouse/partner and children or other family members, you could save money with our family plan pricing.

Simplified Medical Questionnaire

Age 65 or over? Buying travel insurance is faster than ever – no long, complicated medical questionnaires.

Variety of Coverages

Whether you’re going on an overseas adventure, or a quick jaunt to another province or state for the weekend, a variety of packages and plans are available to cover your travels.

24/7 Worldwide Emergency Medical Assistance

Experienced staff at the 24/7 assistance centre will provide:

- Caring, multilingual support

- Help finding local medical care

- Access to emergency air ambulances

- Access to expert medical professionals who will monitor your care

- Help with transportation to the nearest medical facility

For emergency medical and travel assistance

- See Emergency Contact Details

For questions about travel insurance or claims

- Speak to a Travel Advisor at 1-888-896-8172

- Get a Quote

View Legal Disclaimers Hide Legal Disclaimers

- Find a Branch

- Call 1-800-769-2511

Travel Insurance for RBC Clients 1

New more coverage options are now available..

As an RBC client, you now have more choice when it comes to the travel insurance you can purchase through RBC. Tell me more opens modal window

Get a Quote

Attention: getting medical or emergency assistance while travelling.

If you need help during your trip for a medical or other travel emergency, help is available 24/7.

Explore Your Coverage Options

Travel insurance packages.

Covers you for the widest range of unexpected travel situations.

Travel Medical Insurance

Helps to fill the gap left by your provincial health insurance.

Trip Cancellation and Interruption Insurance

Covers non-refundable and/or non-transferable trip expenses if your plans are cancelled or interrupted.

Travel Insurance Information for Trip Types

Choose from the topics below for some information on the type of coverage that may be right for you:

Reasons To RBC Travel Insurance

- 24/7 worldwide emergency medical assistance

- Multilingual assistance from caring professionals

Travel Insurance FAQs

Have a question about travel insurance? Get the answers you need here.

Eligibility

To be eligible for this insurance coverage, a traveller must be:

- A client of the RBC companies or a spouse or child of a client

- A Canadian resident (applicable for Emergency Medical Insurance Coverage)

Note: when you purchase travel insurance from us, you are enrolling in coverage under a group insurance master policy issued by RBC Insurance Company of Canada to RBC Royal Bank. Upon enrollment, a certificate of insurance will be issued to you together with the insurance application/confirmation of coverage and medical questionnaire (if applicable). The certificate of insurance contains the terms and conditions of your insurance coverage and together with the items listed above form part of your insurance contract.

Generally speaking, no. While your age can affect your eligibility for certain coverages, we have packages and plans that cover all age groups. If you are age 65 or older, we may ask you to answer a few questions about your health to make sure you have the most appropriate coverage.

Yes, you may purchase a policy for your parents. Simply call us at 1-800-565-3129 or get a quote online . Depending on their age, they may be required to complete health questions in order to obtain coverage. If this is not a requirement, please keep in mind that all terms and conditions apply to your parents, therefore we recommend that you review the insurance with them prior to purchase.

Possibly. Depending on your age, medical condition and, if applicable, your answers to our health questions, pre-existing medical conditions Definition opens in new window are covered if they are stable Definition opens in new window for a certain time period (as specified in your policy) before your policy's effective date.

Note: Please refer to the certificate of insurance document for complete coverage details regarding pre-existing conditions.

Your answers to the health questions (if applicable) will be used to help determine the benefits you are eligible to receive under your certificate of insurance.

When answering the health questions:

- Take your time. The questions may take up to 10 minutes to complete.

- You (the applicant) should complete the Medical Questionnaire. (If you have someone else complete the Medical Questionnaire on your behalf, it is still your responsibility to make sure the answers to the questions are correct.)

- Read and answer each question carefully and accurately. Review your answers to confirm they are correct. Incorrect answers may lead to your coverage being voided or your claim denied.

- Have your prescriptions or a description of your medications nearby for reference.

- If you are unsure about any questions regarding your medical condition Definition opens in new window or medications, please speak to your physician.

If necessary, a family member or close friend can complete the questions on your behalf. Please keep in mind, however, that it is still your responsibility to make sure the answers are correct.

Yes, it is recommended that you buy coverage for your spouse as well.

This answer depends largely on your child's age.

- If your child is under 2 years old and you are purchasing the Deluxe Package or a TravelCare ® Package, then your child receives emergency medical coverage at no extra cost.

- If your child is 2 or older , you'll need to purchase emergency medical coverage for him or her.

- No matter how old your child is , if you've purchased an airline ticket or made a separate trip deposit for him or her, consider buying a travel insurance package or trip cancellation and interruption insurance .

The right coverage for your trip depends on several factors, including (but not limited to) where you're travelling to, how long you’ll be gone, the kind of transportation you'll be using and, in some instances, your overall health. View all of our travel insurance products now.

An accident, illness or medical emergency can happen anywhere, anytime. If you need medical care or treatment in another country, your government health plan may cover only a portion of the costs. Travel insurance starts where these plans leave off.

Plus, with our emergency medical coverage, you have access to the multilingual representatives of Allianz Global Assistance.

Because our representatives are multilingual and have 24-hour access to real-time translation services, we can provide the help you need in your own language—and also have someone to communicate on your behalf with medical personnel who may speak a different language.

Whenever possible, Allianz Global Assistance will also request for the medical service provider within the network to bill the covered medical expenses directly to us instead of you—reducing your stress and hassle.

Yes, if you are travelling outside your home province or territory. There are several reasons why it's important to get travel medical insurance when you're travelling within Canada. One reason is that accidents can happen anywhere. Another is that government health insurance plans do have limits on reimbursement of emergency medical expenses incurred while you are in another province. For example, the ambulance, emergency dental treatment and prescription drugs might not be covered by some government health insurance plans.

You may extend your coverage if you extend your trip, subject to certain conditions of your certificate of insurance.

If you've purchased a single trip plan, the following conditions apply:

- If you have not had a medical condition Definition opens in new window during your trip or while covered under your policy, you can request an extension by contacting us at 1-800-565-3129 before your original policy’s expiry date.

- If you have had a medical condition Definition opens in new window during your trip and while covered under your certificate of insurance, you must request the extension by contacting Allianz Global Assistance. Your extension is subject to the approval of Allianz Global Assistance.

- You must pay the required additional premium before your original insurance expiry date.

- If we are unable to extend your particular coverage due to the trip duration limits of your certificate, you may be able to enroll in a new certificate from us.

If you've purchased a multi-trip annual plan, the following conditions apply:

You may purchase a top-up coverage for the additional number of days beyond the duration covered by your multi-trip annual plan as follows:

- Before your effective date, you may contact us at 1-800-565-3129 to enroll in top-up coverage.

- After your effective date and if you have not had a medical condition Definition opens in new window during your trip, you must contact us at 1-800-565-3129 before your original expiry date to purchase top-up coverage.

- After your effective date and if you have had a medical condition Definition opens in new window during your trip, you must contact Allianz Global Assistance before your original expiry date to request approval for and to enroll in top-up coverage.

- The terms, conditions and exclusions of the new top-up certificate apply to you.

- You must pay the required top-up premium on or before the effective date of the top-up period.

If you do NOT top-up your coverage for a trip, you will not be covered for any claims you make outside the period of insurance for that trip. If the top-up coverage you are purchasing requires you to complete health questions, you must complete the health questions.

Please see the insurance documents for complete coverage details regarding trip extensions.

It may, but not always. We recommend that you carefully review the travel insurance coverage provided by your credit card, as well as any special conditions or stipulations.

Do you have an RBC Royal Bank ® credit card?

Review the travel insurance coverage that comes with your RBC Royal Bank credit card .

We recommend that you carefully review your government health plan coverage. Government plans may not cover all emergency medical expenses once you leave your home province/territory and typically cover only a limited portion once you leave the country. In fact, the Canadian Government (Foreign Affairs, Trade and Development Canada) urges Canadians to purchase supplemental health insurance when leaving the country. They say:

Do not rely on your provincial or territorial health plan to cover costs if you get sick or are injured while abroad. Out-of-country health care can be costly, and your health plan may not cover any medical expenses abroad. It is your responsibility to seek information from your provincial or territorial health authority and to obtain supplementary travel insurance and understand the terms of your policy. 3

Plus, government health insurance plans don't guarantee coverage for special care (air ambulance or emergency dental services, for instance).

Unlike government health insurance plans, our insurance offers you:

- Unlimited coverage for eligible medical expenses 2

- Up-front payment of eligible medical expenses whenever possible

- 24-hour, multilingual emergency medical assistance—one toll-free phone call puts you in touch with a multilingual professional who will refer you to a local doctor or facility in order for you to receive the care you need

Government health insurance plans also don't provide coverage for situations such as lost, damaged or delayed baggage or trip cancellation and interruption. Our travel insurance can provide these coverages and more.

Yes, you do need travel insurance to protect yourself against the unexpected, even if you are going to the United States for a few days. An illness or accident can happen at any time, whether you're on the road for a few days, or a few months. And remember, the cost of health care is very expensive in the United States and very little of this cost would be covered by your government health insurance plan, credit card or company benefits plan. For a short trip, the cost of travel insurance is minimal, and it gives you the protection you need.

If you purchase trip cancellation and interruption insurance, it will help pay for your expenses to return home in the event of a covered emergency. There are a number of circumstances that qualify as an emergency (for example, the death or serious illness of a family member). The cost of cancelling a trip prior to departure can be very expensive, as most trips are non-refundable and/or non-transferable, especially if you have to cancel just before leaving on your trip. Having to return early from a trip can also be very expensive. Either way, trip cancellation and interruption insurance is very important to protect your travel investment.

You must purchase coverage before departing on your trip. You may benefit from purchasing coverage as soon as you make your initial trip deposit, especially if you are purchasing trip cancellation and interruption insurance —either as stand-alone coverage or as part of one of our insurance packages .

If you were to book your trip 6 months in advance, consider the unexpected situations that could occur in that time.

If you purchase travel insurance from us, we will pay the eligible bills directly to the hospital or physician whenever possible.

There are a number of sports that are not covered during your trip. For more details, see the Exclusions section of the certificate of insurance document.

You may purchase a top-up policy for the extra number of days beyond the duration covered by your multi-trip annual plan. Here are the conditions:

- After your effective date and if you have had a medical condition Definition opens in new window during your trip, you must contact Allianz Global Assistance before your original expiry date to request approval for and enroll in top-up coverage.

- The terms, conditions and exclusions of the new top-up insurance apply to you.

If you do NOT top-up your coverage for a trip, you will not be covered for any claims you make outside the period of insurance for that trip. If the top-up insurance you are purchasing requires you to complete health questions, you must complete the health questions.

Please see the certificate of insurance document for complete coverage details regarding top-up coverage.

If you purchase one of our travel medical insurance plans—either Classic Medical or TravelCare ® Medical—you can, subject to certain conditions:

- If you are travelling for more than 183 days, you may purchase single trip coverage for up to 365 days provided that you are covered under your government health plan for the full duration of your trip.

- If you are 40-74 years of age , you must also answer a few health questions, which will determine whether you are eligible to purchase coverage for trips beyond 183 days.

Yes, if you are travelling with your spouse/partner and children or other family members, you could save money with our family plan pricing.

The cost of a trip can be a significant financial investment. A lot can also happen in the time between booking your trip and departing—if a medical emergency or other unexpected event prevents you from going on your trip, you could potentially lose some (or possibly all) of the money you paid.

With trip cancellation and interruption insurance, you're protected when certain situations prevent you from travelling as planned. Examples include:

- You can't travel due to an illness, job loss or immediate family member's medical emergency

- You need to return home earlier than scheduled because of a family emergency or medical condition Definition opens in new window

Note : We strongly recommend that you purchase trip cancellation and interruption insurance at the time you pay your initial travel deposit. Please see the certificate of insurance document for complete coverage details, including terms and conditions.

We strongly recommend you do. Your certificate of insurance is a valuable source of information and contains provisions that may limit or exclude coverage. Please read it before you go, keep it in a safe place and carry it with you when you travel.

Make sure you have the right travel insurance—get an online quote or call the Enrollment Centre.

Have an RBC Royal Bank credit card with travel coverage?

If you’re using an RBC Royal Bank credit card to pay for your trip in full, see if your card provides enough coverage for your trip.

See If My Card Covers Me

View Legal Disclaimers Hide Legal Disclaimers

Travel HealthProtector Has Been Replaced with New and Improved Coverage!

On May 1, 2020, we replaced Travel HealthProtector insurance with a new travel insurance product lineup.

RBC clients 1 can now enjoy:

- More choice, including robust travel insurance packages and travel medical plans

- Trip cancellation and interruption insurance as part of a package or stand-alone plan

- A shorter and simpler medical questionnaire (for clients age 65 and older vs. age 60 and older)

1) RBC client is defined as a client of the RBC Companies or a spouse or child(ren) of a client.

- Mutual funds list

- About RBC mutual funds

- RBC Fixed Income Pools

- RBC Portfolio Solutions

- About RBC iShares ETFs

- ETF investment strategies

- Alternative investments list

- About RBC alternative investments

- All about mutual funds

- ETF Learning Centre

- See all results

- See results in Products

- See results in Insights

You are currently viewing the Canadian website. You can change your location here.

Terms and conditions for Canada

Welcome to the new RBC iShares digital experience.

Find all things ETFs here: investment strategies , products , insights and more.

RBC Global Asset Management Inc. re-opens Phillips, Hager & North High Yield Bond Fund to new investors

TORONTO, June 7, 2024 — RBC Global Asset Management Inc. (“RBC GAM Inc.”) today announced that Phillips, Hager & North High Yield Bond Fund (the “Fund”) will re-open to new investors on June 10, 2024.

The Fund, managed by Hanif Mamdani, Managing Director and Head of Alternative Investments at RBC GAM Inc., has a 20-year track record. It seeks to provide a high level of income and the opportunity for capital appreciation by investing primarily in a well-diversified portfolio of fixed income securities issued by Canadian, U.S. and foreign corporations and governments.

The Fund was capped to new investors on July 29, 2022. It currently has a limited amount of additional capacity, allowing for purchases by new investors as the portfolio manager and the team have identified attractive investment opportunities in fixed income markets. RBC GAM Inc. reserves the right to cap the Fund or otherwise restrict investment at a later date.

Please consult your advisor and read the prospectus or Fund Facts document before investing. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Funds, BlueBay Funds, PH&N Funds and RBC Private Pools are offered by RBC GAM Inc. and distributed through authorized dealers in Canada. RBC GAM Inc. is a member of the RBC GAM group of companies and an indirect wholly owned subsidiary of Royal Bank of Canada.

About RBC Global Asset Management

RBC Global Asset Management (RBC GAM) is the asset management division of Royal Bank of Canada (RBC). RBC GAM is a provider of global investment management services and solutions to institutional, high-net-worth and individual investors through separate accounts, pooled funds, mutual funds, hedge funds, exchange-traded funds and specialty investment strategies. RBC Funds, BlueBay Funds and PH&N Funds are offered by RBC Global Asset Management Inc. (RBC GAM Inc.) and distributed through authorized dealers in Canada. The RBC GAM group of companies, which includes RBC GAM Inc. (including PH&N Institutional) and RBC Indigo Asset Management Inc., manage approximately $625 billion in assets and have approximately 1,600 employees located across Canada, the United States, Europe and Asia.

This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers visit http://www.djreprints.com.

https://www.barrons.com/advisor/articles/rbc-wealth-management-recruits-advisors-from-truist-01bf1ffd

- Advisor Practice Management

- Advisor News

RBC Hires $915 Million Advisor Team From Truist

RBC Wealth Management recruited a former Truist Financial advisor team overseeing approximately $915 million in client assets.

The Brown-Brinkley Group joined RBC in Tysons, Va., a suburb of Washington, D.C., the company said Tuesday. “We chose to move our business to RBC Wealth Management for its supportive, client-first culture, as well as direct access to leadership and resources that are valuable to our clients,” said Alexander Brown, one of the advisors on the team.

In addition to Brown, the group includes advisors William Brinkley and his son Taylor Brinkley; senior business associates Lane Thomas and Victoria Roberts; senior financial associate Hunter Brammer; registered client associate Carly Kacvinsky; and client associates John Kim and Jan Conner.

Brown and William Brinkley are both industry veterans, with 22 and 36 years of experience in the business, according to BrokerCheck, a database maintained by industry self-regulatory organization Finra. Brown and Brinkley previously worked at BB&T Securities, a predecessor firm of Truist. Prior to that they worked at Wells Fargo .

From left to right: Alexander Brown, Lane Thomas, Carly Kacvinsky, Hunter Brammer, William Brinkley, Taylor Brinkley, Victoria Roberts, and John Kim.

Truist was formed in 2019 as a result of a merger between SunTrust Bank and BB&T. A representative did not respond to a request for comment on the departure of Brown and Brinkley’s team.

Their move to RBC builds on a series of hires at the Canadian-owned firm, including that of another former Truist team that joined RBC in January and which oversaw $610 million in client assets in Wilmington, N.C. RBC Wealth Management operates as a division of RBC Capital Markets in the U.S. The Canadian-owned firm has $583 billion in total client assets and more than 2,100 financial advisors operating in 42 states.

Write to Andrew Welsch at [email protected]

An error has occurred, please try again later.

This article has been sent to

- Cryptocurrencies

- Stock Picks

- Barron's Live

- Barron's Stock Screen

- Personal Finance

- Advisor Directory

Memberships

- Subscribe to Barron's

- Saved Articles

- Newsletters

- Video Center

Customer Service

- Customer Center

- The Wall Street Journal

- MarketWatch

- Investor's Business Daily

- Mansion Global

- Financial News London

For Business

- Corporate Subscriptions

For Education

- Investing in Education

For Advertisers

- Press & Media Inquiries

- Advertising

- Subscriber Benefits

- Manage Notifications

- Manage Alerts

About Barron's

- Live Events

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

The fine, frustrating U.S. equity rally

The U.S. stock market rally continues to outdo itself. But several factors make for a more nuanced narrative. We assess the backdrop framing the rally and how to position equity portfolios.

June 20, 2024

Kelly Bogdanova Vice President, Portfolio Analyst Portfolio Advisory Group – U.S.

The S&P 500 has continued to surge amid rather low volatility, making new high after new high—31 of them in 117 trading days so far this year.

It’s beautiful on the one hand. Who doesn’t like a year-to-date rally of 15.0 percent (15.8 percent including dividends) that has unfolded in less than six months? This is almost 1.5 times the average annual price gain of the past 40 years.

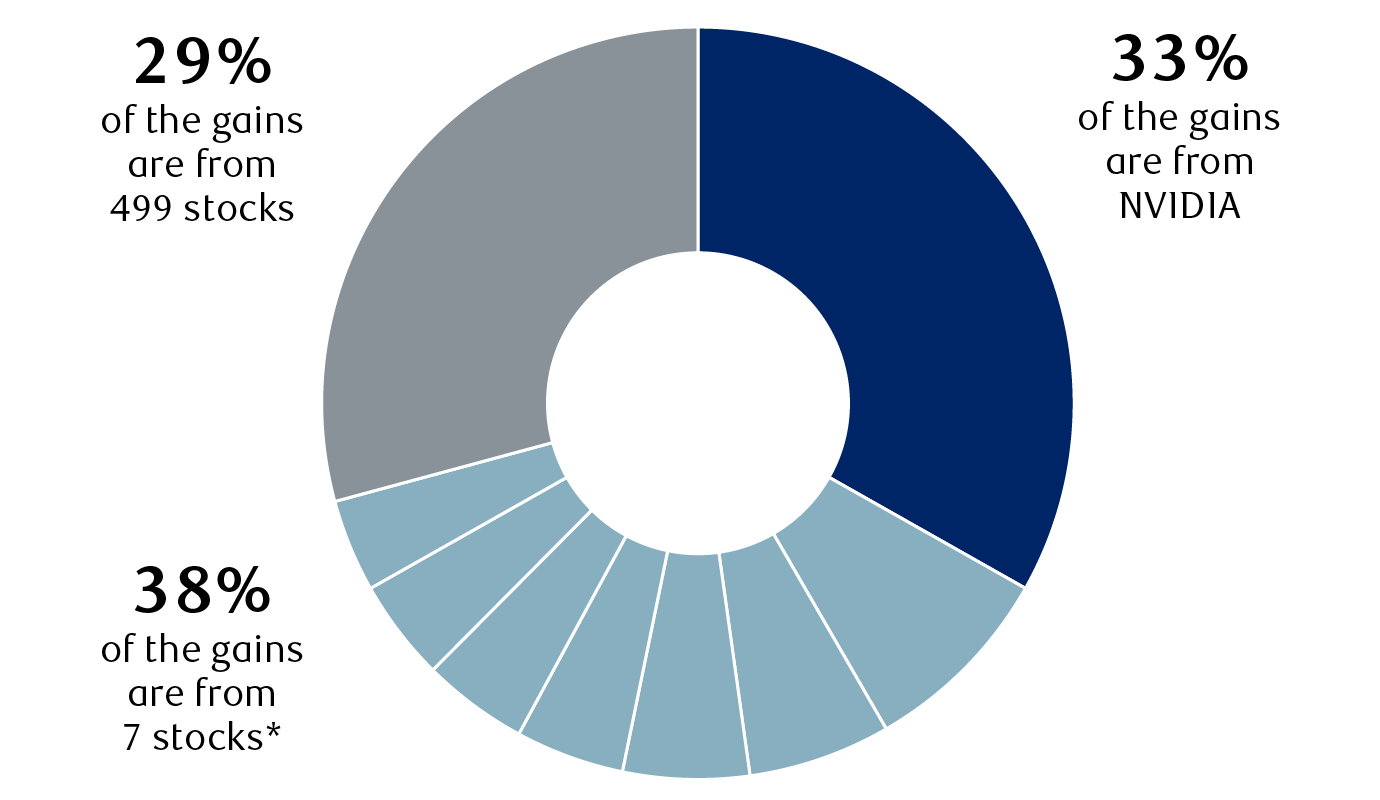

On the other hand, it’s frustrating for some holders of well-diversified portfolios that include individual U.S. equities. A small group of stocks has dominated, with the overwhelming proportion of them tied to artificial intelligence (AI) earnings optimism and hype:

- Just one stock, AI chipmaker NVIDIA, represents 33 percent of the S&P 500’s year-to-date gain.

- Seven stocks make up another 38 percent of the gain, six of which are also leveraged to AI (pharmaceutical company Eli Lilly being the exception).

- The other 499 stocks in the index during this period represent only 29 percent of the total return.

A small group of stocks has powered the S&P 500 higher

Contribution to the s&p 500’s year-to-date gain of 15.8 percent.

The circular chart shows categorized contributions to the S&P 500 year-to-date gain of 15.8 percent. NVIDIA represents 33 percent of the gains. Seven stocks represent 38 percent of the gains: (ranked from largest to smallest contribution) Microsoft, Alphabet (both share classes), Meta Platforms, Amazon.com, Broadcom, Apple, and Eli Lilly. The other 29 percent of gains are from 499 stocks.

* The seven stocks, from largest to smallest contribution to the S&P 500 total return, are Microsoft, Alphabet (both share classes), Meta Platforms, Amazon.com, Broadcom, Apple, and Eli Lilly.

Source – RBC Wealth Management, FactSet; year-to-date total return data (includes dividends) through 6/18/24. During the period, 507 stocks were in the S&P 500 (Alphabet counted once)

Other sides to the story

The complete group of Magnificent 7 stocks is no longer driving performance, as was the case much of last year.

Lately, the market has been driven by just four Magnificent 7 stocks (NVIDIA, Apple, Microsoft, Alphabet) and chipmaker Broadcom. Since the mid-April low, these five AI-leveraged companies have accounted for an outsized 67 percent of S&P 500 gains—a very lopsided rally.

In addition to the AI theme, we think the news associated with slower economic growth has played a role. Stocks with secular (long-term) growth characteristics have historically outperformed when economic growth is below average, mainly because their earnings growth prospects are viewed by investors as sturdier.

But at least since mid-April, we also perceive that “FOMO” has been powering these five AI-leveraged stocks—the psychological phenomenon known as the “fear of missing out.” This happens when some institutional and individual investors chase the biggest winners, especially when the hype about a particular investment theme becomes larger than life, like AI has.

While FOMO periods can last a lot longer than one might think is rational, they can also change shape or end when it’s least expected.

Pricey doesn’t necessarily mean problematic

The other knock against the rally is that it has pushed valuations back up. From our vantage point this isn’t as troubling as it might seem.

The S&P 500’s 21.3x forward price-to-earnings ratio is now well above the 18.5x average since early 2016. Statistically, this is around 1.2 standard deviations above the mean, according to Bloomberg Intelligence. This is a level we interpret as being stretched, although not yet near the 2.0 or above level that we would consider as being very excessive.

When the AI-leveraged Magnificent 7 stocks are stripped out, the valuation is lower at 18.4x, as the chart at right shows. We view this as less problematic and more reasonable as it is around 0.7 standard deviations above the mean.

S&P 500 valuation is more reasonable excluding the Magnificent 7 stocks

S&p 500 forward price-to-earnings ratios based on bloomberg consensus earnings forecast.

The line chart compares the forward price-to-earnings (P/E) ratios since January 2016 of the S&P 500 as a whole and the S&P 500 excluding the “Magnificent 7” stocks (Microsoft, Apple, NVIDIA, Alphabet, Amazon.com, Meta Platforms, and Tesla). The two data series are similar in 2016 and 2017, starting from around 15.8x and ending at about 18x. The two series started to separate after that, but the gap wasn’t very large through the early part of 2020. Then, starting in the spring of 2020, the P/E ratios of both jumped sharply and the gap between the full S&P 500 and the S&P 500 without the Magnificent 7 widened meaningfully. In August 2020, the S&P 500 P/E reached a peak of 22.9x, whereas the S&P 500 excluding the Magnificent 7 was 20.6x, also a peak. After that, even though P/E for both declined, the gap remained wide through much of 2021. Subsequently, P/E ratios declined further and the gap narrowed. The S&P 500 P/E reached 15.2x in August 2022; the S&P 500 excluding the Magnificent 7 reached a low of 14.0x; both were among the lowest levels on the chart. During that time and soon thereafter, the gap remained narrow into early 2023. But then the gap widened again as P/Es for both pushed higher. The most recent datapoint on June 18, 2024 has the S&P 500 P/E at 21.3x and the S&P 500 excluding the Magnificent 7 at 18.4x, which is among the widest gaps since 2016.

- S&P 500

- S&P 500 excluding “Magnificent 7” stocks*

* The Magnificent 7 stocks are Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

Source – Bloomberg Intelligence, RBC Wealth Management; month-end data except final data point from 6/18/24

Importantly, however, Bloomberg Intelligence points out that the valuation gap between the S&P 500 and S&P 500 ex-Magnificent 7 stocks is abnormally high at about 1.8 standard deviations above the mean. For us, this is getting too close for comfort to the 2.0 standard deviation level that we consider as excessive.

Remember, retreats are a normal part of rallies

We think the S&P 500 has gotten ahead of itself and the U.S. market is due for a normal pause or pullback in the coming weeks or months. Now is not the time to chase the biggest winners, in our view.

Heading into the Q2 earnings season, which will begin in mid-July, consensus earnings forecasts for this year and next seem dependent on average or better GDP growth, yet recession risks still linger . The U.S. presidential election campaign could stoke volatility as institutional investors start to focus on the debates and political party conventions this summer.

We recommend holding Market Weight exposure to U.S. equities. Amid what we perceive as FOMO activity, individual investors should stick to their long-term investment plan.

- Research resources

- Required disclosures

RBC Wealth Management, a division of RBC Capital Markets, LLC, registered investment adviser and Member NYSE/FINRA/SIPC.

Kelly Bogdanova

Let’s connect.

We want to talk about your financial future.

Related articles

The push and the pull of u.s. earnings, u.s. equity rally realities, 2024 earnings: the likely convergence of the “haves and have nots”.

Investment and insurance products offered through RBC Wealth Management are not insured by the FDIC or any other federal government agency, are not deposits or other obligations of, or guaranteed by, a bank or any bank affiliate, and are subject to investment risks, including possible loss of the principal amount invested.

- Newsletters

- Help Center

- Georgia Tech

Braves are without two members of travel party on road trip

ST. LOUIS – Two members of the Braves’ travel party have been absent from this road trip.

Hitting coach Kevin Seitzer and infielder/outfielder Brian Anderson are not with the team, manager Brian Snitker said following Monday’s loss to the Cardinals at Busch Stadium.

Seitzer is dealing with a family matter that arose before the Braves departed for New York, Snitker said. Anderson, the manager said, has a lower body bacterial infection.

“So, he hasn’t been with us the whole way, but we’re just hoping that at some point, we get him back,” Snitker said of Anderson.

Of Seitzer’s family matter, Snitker said “everything’s going good and he should meet us back in Atlanta.”

Neither have been on the road trip with the Braves. Anderson, however, did have a locker at Yankee Stadium.

Anderson is still on the active roster, so the Braves are playing a man down. But with the designated hitter and 26 roster spots, the Braves can get by with their current bench guys. Anderson has only had five plate appearances since the Braves signed him on June 4.

At this point, Ramón Laureano, Adam Duvall and Forrest Wall have split the outfield duties along with center fielder Jarred Kelenic.

Bobby Magallanes, Atlanta’s assistant hitting coach, has been on this road trip.

About the Author

Justin Toscano is the Braves beat writer for the Atlanta Journal-Constitution.

Credit: TNS

Credit: Ben Gray

Credit: Courtesy Development Authority of Fulton County

Credit: Douglas County

Credit: Blake Guthrie

IMAGES

VIDEO

COMMENTS

Today's top 2 Rbc Travel Manager jobs in United States. Leverage your professional network, and get hired. New Rbc Travel Manager jobs added daily.

34 RBC Travel Manager jobs. Search job openings, see if they fit - company salaries, reviews, and more posted by RBC employees.

RBC Travel is your one-stop destination for booking flights, hotels, cars and cruises with your Avion Rewards points. You can also find exclusive deals, travel tips and guides, and flexible options to suit your preferences. Discover the world with RBC Travel and Avion Rewards.

8,040 RBC reviews. A free inside look at company reviews and salaries posted anonymously by employees.

job openings at RBC. Apply to 1 - 10 (out of 1358) jobs at RBC.

Search 17 Rbc Travel Experience Manager jobs now available on Indeed.com, the world's largest job site.

8,034 RBC reviews. A free inside look at company reviews and salaries posted anonymously by employees.

Average salaries for RBC Travel Account Manager: $49,285. RBC salary trends based on salaries posted anonymously by RBC employees.

Search 33 Rbc Business Travel Manager jobs now available on Indeed.com, the world's largest job site.

Sign in with: RBC Online Banking. Business credit card. Commercial credit card. Email and Password.

RBC has supported my career by offering mentorship from great leaders, a diversity of challenging roles to apply for and training courses and programs to grow my skills. The world is really your oyster at this organization. Nicole Bacchus. Acting Director, Digital Workspace Solutions at RBC. Read More.

Meet the team that's helping build the RBC of the future. Skip to main content. Other Sites. Search RBC... Contact Us. Find a Branch; Call 1-800-769-2511; EN. Sign In. SIGN IN MENU. Ask your question. Our Company; ... RBC Wealth Management & Insurance . Read Bio. Derek Neldner. CEO and Group Head, RBC Capital Markets. Read Bio. Bruce Ross ...

To book a new flight using an airline travel credit. If you have an airline credit due to a flight cancellation that you'd like to use, contact the Avion Rewards Travel Call Centre at 1-877-636-2870.

When you book your travel through Avion Rewards, you may redeem Avion points at the rate of 100 points per CAD $1.00 to pay for any taxes and service fees (including sales, GST, departure and transportation taxes and fees, airport improvement fees, or other taxes), excess baggage charges, immigration fees, governmental fees and levies, customs charges and passenger facilities charges, health ...

Search 210 Rbc Travel Experience Manager $110,000 jobs now available on Indeed.com, the world's largest job site.

For questions about travel insurance or claims. Speak to a Travel Advisor at 1-888-896-8172. Get a Quote. View Legal Disclaimers. Hide Legal Disclaimers. Get an online quote and buy travel insurance online, or call 1-866-896-8172. We offer affordable packages, travel medical plans, trip cancellation coverage and more.

Create job alert. Today's top 1,000+ Travel Manager jobs in Canada. Leverage your professional network, and get hired. New Travel Manager jobs added daily.

At RBC Wealth Management, our commitment to helping clients reach their financial goals is at the heart of everything we do. As part of our team, you'll earn more than financial rewards. You'll receive career-advancing training, flexible benefits and a wealth of opportunities—in an environment that values diversity, inclusion and ...

4 RBC Travel Manager jobs in Los Angeles, CA. Search job openings, see if they fit - company salaries, reviews, and more posted by RBC employees.

Sign in to RBC Wealth Management and access your online account, financial tools, research, and more. Register or reset your password here.

A client of the RBC companies or a spouse or child of a client; A Canadian resident (applicable for Emergency Medical Insurance Coverage) Note: when you purchase travel insurance from us, you are enrolling in coverage under a group insurance master policy issued by RBC Insurance Company of Canada to RBC Royal Bank. Upon enrollment, a ...

TORONTO, June 7, 2024 — RBC Global Asset Management Inc. ("RBC GAM Inc.") today announced that Phillips, Hager & North High Yield Bond Fund (the "Fund") will re-open to new investors on June 10, 2024.. The Fund, managed by Hanif Mamdani, Managing Director and Head of Alternative Investments at RBC GAM Inc., has a 20-year track record.

Hello, I'm Leanne Kaufman and welcome to RBC Wealth Management Canada's Matters Beyond Wealth. With me today is Dr. Michael Roizen, an anesthesiologist, internist and the global chief wellness officer at the Cleveland Clinic-a global non-profit academic medical center. He has spent years on the faculty of prestigious post-secondary ...

RBC Wealth Management recruited a former Truist Financial advisor team overseeing approximately $915 million in client assets. The Brown-Brinkley Group joined RBC in Tysons, Va., a suburb of ...

Source - Bloomberg Intelligence, RBC Wealth Management; month-end data except final data point from 6/18/24 Importantly, however, Bloomberg Intelligence points out that the valuation gap between the S&P 500 and S&P 500 ex-Magnificent 7 stocks is abnormally high at about 1.8 standard deviations above the mean. For us, this is getting too close ...

6 RBC Travel Manager jobs in Blaine. Search job openings, see if they fit - company salaries, reviews, and more posted by RBC employees.

Like the crew at Kennedy Space Center counting "T minus …" to a launch, the Travel and Expense Management project team is carefully preparing for the July 1 go-live date for Concur expense management, the new travel and expense management system.. A big part of that preparation is finalizing the approach to training and educating the Rutgers community on how to use the new system.

ST. LOUIS - Two members of the Braves' travel party have been absent from this road trip. Hitting coach Kevin Seitzer and infielder/outfielder Brian Anderson are not with the team, manager ...

Outreach Calls are designed to inform and educate the DoD travel community on issues and topics related to Defense travel and DTS. Calls are conducted on the second and fourth Tuesday of each month at 0800 (8 AM) and 1300 (1 PM) ET.

Average salaries for RBC Travel Account Manager: $0. RBC salary trends based on salaries posted anonymously by RBC employees.