Tax-Free Shopping In Switzerland: A Quick Guide

There’s another reason to experience the magic of a European Christmas market this year. Tourists are eligible for VAT (value-added tax) tax refunds on many purchases while traveling in Switzerland. After browsing the market for handcrafted gifts, decor to take back home, and more, hit the shops to purchase high-end items like designer fashions, jewelry, or a luxury watch for someone special.

Use our quick guide to find out more about tax-free shopping in Switzerland.

Table of Contents

How to Get a VAT Refund in Switzerland

When you go shopping in Switzerland, you pay a VAT charge. You can reclaim the VAT by asking the shop staff for a Tax-Free Form at the shops where you make your purchases. The form is basically a refund check. Carefully fill in all of the fields on the form. Only complete or correct information will ensure you get a VAT refund.

Global Blue members can scan their digital barcodes at check-out and your data will auto-fill on the Tax Free Form.

The goods you purchase must fit into your luggage and be transported within 30 days after the purchase date. Upon leaving the country and before check-in at the airport, land border, or port, present your Tax-Free Form along with your original receipts to Customs for a validation stamp.

All of your items must be unused and sealed. Have your flight or travel ticket, purchases, and passport ready for inspection. Make sure you allow plenty of time for the validation process before your departure.

Take your stamped Tax Free Form, credit card, and passport to the nearest Refund Office for an immediate refund on your credit card or cash back if you prefer.

You can also avoid the VAT by having the retailer mail your purchases to you but remember that the postal fees may reduce the amount of money you save.

Shoppers Eligible for VAT Refund

Eligible shoppers for a VAT refund must be over 18 and a permanent resident of another country.

Products Eligible for VAT Refund

Items that qualify for a VAT refund are usually higher-end items like fine clothing, jewelry, and other luxury items. Hotels and services such as spas and taxis are not eligible. Neither are fuel and goods with a VAT rate reduced to 2.5 percent.

Minimum Purchase Amount

The minimum purchase amount for a VAT refund is CHF 300.00.

VAT Rates in Switzerland

The standard VAT rate in Switzerland is 7.7 percent. It’s 2.5 percent for books, food, plants, and medicine.

Tax-Free Shopping in Zurich

Zurich Airport’s tax and duty-free shops have an extensive selection of products including cosmetics, perfumes, tobacco products, and spirits. Airside Center, in the heart of the airport, features over 60 stores for shopping and restaurants, bars, and lounges for dining and shopping.

Look for shops with Duty-Free signs and shop for fine clothing from brands such as Hermes, Burberry, and more. Find deals on fine jewelry, watches from all the match luxury watch brands, and other luxury goods .

Tax-Free Shopping in Geneva

Do your last-minute shopping at the Duty-Free stores in Geneva’s Airport and enjoy prices up to 30 percent cheaper than downtown on items such as cosmetics and skincare products, tobacco, wine, champagne, liquor, confections, and gifts to take back home.

Aelia Duty-Free has teamed up with the airport and Inflyer to create an app to allow international passengers traveling to and from the airport to shop conveniently and enjoy special offers, exclusive prices, and loyalty rewards. Ordering is fast and easy with collection and delivery on your departure day. Tobacco and spirits are excluded.

Tax-Free Shopping in Bern

In Bern, the capital of Switzerland, shop for luxury goods on the main shopping streets of Spitalgasse and Marktgasse. You’ll find goods that qualify for a VAT refund ranging from luxury watches to fine jewelry, wines, art, and high-end clothing.

Find luxury watches and jewelry at the famous Bucherer, Marktgasse, 2. Globus on Spitalgasse is a popular department store that sells, fashions, cosmetics, and home accessories. Loeb on Spitalgasse sells high-end fashions.

If you buy goods costing CHF 300 or more, pick up a Tax-Free Form at Globus Department Store and follow the steps above for how to get a VAT refund in Switzerland at the airport you depart from in Switzerland.

Tax-Free Shopping in Lucerne

Lucerne has a magnificent Bucherer outlet store with a huge collection of men’s and women’s luxury watches. Casagrande Gift Shop sells watches and collectibles such as unique Swiss army knives, music boxes, and Mondaine Railway clocks. Find exclusive home decor items and everything Irish, even whiskey, at Daly’s Irish Shop on Lowengraben 4.

Ask the sales staff for the proper VAT form.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Get Our Free Swiss Tips Guide

Popular destinations, important pages, on social media, travel planning, certified swiss travel expert.

Switzerland Solved

Switzerland Tax Refund: All You Need To Know

Discovering you’re eligible for a tax refund in Switzerland can feel like finding a hidden treasure amidst the Alpine landscapes—a financial boon that’s not to be overlooked. Need assistance in navigating refund process? Fret Not! We’ve got you covered!

This guide offers a comprehensive look into the Swiss tax refund process, demystifying how individuals and businesses can claim back overpaid taxes . Whether it’s from withholding tax on employment income or reclaiming VAT for businesses, navigating your way to a Swiss tax refund can significantly bolster your financial health.

Let’s dive in!

What Is Tax Refund In Switzerland?

The circumstances of tax refund in Switzerland usually transpires because of overpaid taxes through withholding or estimated taxes, deductions or credits that result in the taxpayer being eligible for a reimbursement .

Some commuting expenses, tax free shopping, medical expenses or charitable contributions are also eligible for a tax refund .

The tax refund may be applicable to VAT and income tax , of which the nature of tax payment depends as well.

What Taxes Are Eligible For Tax Refund In Switzerland?

The taxes that are eligible for a tax refund are:

VAT (Value Added Tax) Tax

The federal government of Switzerland imposes a VAT, value added tax, on the purchase of products and services . This includes basic groceries, clothes you purchase, food, medicine, books, plants and medicine etc.

The standard VAT tax rate is set at 7.7% of which Switzerland can refund an amount that is between 4.5% and 5.4% of the amount you spend on products subjected to standard VAT rates during your trip.

The minimum purchase threshold is 300 CHF per invoice.

Refunds that are available for tax-free purchases in Switzerland are only valid for VAT . You cannot get reimbursement for expenses below this limit.

Tax-free refunds are available for foreigners and expats mostly, but if you overpaid taxes or are eligible for refund in any way, you will be reimbursed.

The above statement means that if you have a residence permit for the country you are visiting, then getting a refund will not be possible.

The eligibility criteria is just this:

- You must not be a resident of the country you are purchasing goods from

- You must be over 18

- Your purchased good should have a VAT rate of 7.7% on it.

The income tax refund is applicable when you overpay your taxes, meaning that you paid a higher income tax in your financial year than you are held liable to.

You are also eligible for tax refund when you have been paying the compulsory advance tax or have TDS deductions on your income.

You need to file an ITR (income tax refund) once you estimate the refund eligibility to get your tax refund. Once the process is complete and everything is verified, you can get your tax refund.

The eligibility criteria for an ITR according to our sources is:

- Your total advance tax payments are more than 100% of your actual tax liabilities for the financial year.

- Your TDS payments in the financial year exceed your final tax liability after regular assessment.

- If you have made last moment tax-saving investments .

- You have paid tax on your income in a foreign country that has double taxation avoidance agreement (DTAA) with India.

- You have paid excess tax under regular assessment due to an error in assessment.

How Does The Tax Refund Process Work?

The process to obtain a tax refund may be efficient, but it depends on your canton and the nature of refund.

Tax refunds for VAT is calculated as a combination of VAT rate in Switzerland and the VAT rate on the purchased product.

The amount refunded depends on the nature of your payment, either cash or bank transfer; crediting it in your bank is better because cash payment cannot be reimbursed sometimes. You may also earn store credits as well.

The first step to the process for tax refund is to make sure to choose shops that are tax free . Then you need to inform the store about being a tourist and ask for a VAT tax refund form. They’ll prepare the necessary documents and you need to fill the refund form .

Once the form is filled, verify the form and the receipts through customs office; they might want to check the goods as they are not to be opened before the process is complete.

Give at least a 1 hour waiting time for the process completion and then get your tax refund.

The process for the income tax refund is that you should file the correct income tax return before the due date given to you. During this process, check your total advance payments under the form 26AS.

After you file your income tax return and the tax officer verifies the income tax calculation of the form, your tax refund is approved if your balance of advance tax payment under form 26AS exceeds your tax liability under the filed ITR.

You can also file form 30 to request a review of your income tax payments against your liability. The process to receive your income tax refunds can be sped up if you provide your bank account details for direct transfer.

The waiting time for the process to claim an income tax refund is 12 months after the end of the relevant taxation year.

However, the following conditions apply to the tax refund claims:

- You can claim a tax refund on the income tax paid within six successive assessment years. CBDT will not accept tax refund claims older than this period.

- CBDT does not pay any interest on the tax refunds.

- The officers may accept delayed tax refund claims if it requires verification.

- The total claim amount for one assessment year should not be more than rs. 50 lakh.

Check the income tax refund status on your e-filing dashboard after filing and verifying the ITR and you’ll be able to see that you have received the tax refund.

In case a person is unable to claim an income tax refund, their legal representative may file for an income tax refund on their behalf, under Section 238 of the Income Tax Act, 1961.

The income Tax Department also pays an interest if the refund amount is equal to or above 10% of the total tax paid under section 244A of the Income Tax Act.

Therefore, a simple interest of 0.5% per month is imposed on the amount of tax refund and paid to you.

Crossing the finish line of the Swiss tax refund process can significantly impact your financial well-being, turning complex regulations into rewarding outcomes. Armed with the insights from this guide, you’re now poised to reclaim what’s rightfully yours, ensuring that every franc overpaid is returned to your pocket.

Embrace this opportunity to optimize your finances, reflecting the precision and efficiency that Switzerland is renowned for.

Refund Secured!

But wait! There’s lot more that you might be interested in following:

- Tax Number In Switzerland

- Tax Declaration In Switzerland

- Income Tax Brackets In Switzerland

Similar Posts

Income Tax Brackets In Switzerland: Explained

Navigating the financial landscape of Switzerland means understanding its unique tapestry of income tax brackets. Want to know more? Worry Not! We’ve got you covered! With rates varying by canton, city, and even your personal situation, decoding Swiss taxes can feel like unraveling a Swiss watch—complex yet fascinating. This guide aims to demystify the intricacies…

Tax Consulting In Switzerland: An Expats Guide

Switzerland is renowned for having lower taxes than European nations and the global community. However, your domicile also affects the amount of taxes levied against you. Navigating the Swiss tax system can be complex, especially for expats unfamiliar with local regulations. Whether you’re a business owner, an expat, or an individual navigating Swiss tax laws, join…

Tax Return Software In Switzerland: A Simple Guide

In Switzerland, a country known for its precision, the task of filing a tax return is no exception to the demand for accuracy. Want to know about best tax return software in Switzerland? Worry Not! We’ve got you covered! Thankfully, the era of digital innovation brings forth tax return software that promises to transform this…

Switzerland Tax System: How It Works

Switzerland’s tax system, renowned for its precision and decentralization, mirrors the country’s famed watchmaking expertise—complex yet impeccably designed. Need help in understanding tax complexities in Switzerland? Don’t Worry! We’ve got you covered! This guide aims to demystify the intricacies of the Swiss tax landscape, offering a clear overview for individuals and businesses alike. From understanding…

Radio Tax in Switzerland: A Simple Guide

In the heart of Europe, Switzerland stands out not just for its alpine beauty and multicultural richness but also for its unique approach to public broadcasting funding. If the term ‘Radio Tax’ has you scratching your head, fear not. Our simple guide is designed to shed light on this peculiar aspect of Swiss life, breaking…

Tax Number In Switzerland: An Expats Guide

In the heart of Europe, Switzerland stands as a beacon of financial stability and efficiency, and obtaining a Swiss tax number is a key step for anyone engaging in economic activities within its borders. Worry Not! We’ve got your back in this! This guide will walk you through the essentials of securing your tax number,…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Guide To Tax Refund In Switzerland

Updated on: March 17, 2019

- when you buy goods in Switzerland, make sure you get your tax refund before crossing the borders to Europe.

- when you go from Europe to Switzerland, make sure you tax refund the goods in Europe before crossing the borders to Switzerland. (Unless you go back to Europe afterwards).

What is VAT?

Who are eligible to apply for VAT Refund?

Minimum purchase, time limit for customs approval, how to claim your vat refund back in switzerland.

- The Tax Free Forms

- The original receipts

- Purchased goods (sealed)

- Your passport

- International travel ticket

- You can choose for credit card

- Or you can ask for an immediate refund in cash

VAT refund overview in Switzerland

You might also like:.

Guide To Tax Refund In Canada

Guide To Tax Refund In Czech Republic

Guide To Tax Refund In Malaysia

4 thoughts on “guide to tax refund in switzerland”.

What if I am an European citizen. Where in the best place for me to buy?

Even with VAT, Europe is still cheaper than most countries. You can also take advantage of tax-free offers, by purchasing a handbag at the airport while you are leaving the EU in Heathrow airport and CDG airport. You need to show your boarding pass to the SA that you’re actually leaving

Also would like to know in case i will do my shopping in Paris but still i have to travel to other EU countries and will leave from Rome going back in Dubai.

How to claim my tax refund for the goods i have purchased from Paris? Thanks, lea

So you buy all the goods anywhere in Europe. When you’re in Rome, go early to the airport. Show the custom all your documents and let them see the physical goods (so don’t put them in the luggage and check-in yet). Custom will give you a stamp on the doc. Then find a tax-refund counter/company that process the tax-refund form. You can choose cash or credit card. With cash its easier, with credit card it will take longer but the tax-refund rate is a big higher. See the link in your other comments for full guidance.

Leave a Comment Cancel reply

Louis Vuitton

Chanel Bag Prices

Louis Vuiton Bag Prices

Dior Bag Prices

Hermes Bag Prices

Goyard Bag Prices

Celine Bag Prices

Chanel Wallet Prices

Chanel Bag Collections

Hermes Wallet Prices

Tax-Refund Guide

Shopping Guide in Airports

Heathrow airport guide.

Leather Guides

© 2024 Bragmybag.com. All Rights Reserved.

Louis Vuitton Bag Prices

Chanel Collection Prices

Shopping Guide In Airports

Heathrow Airport Guide

PH +1 000 000 0000

24 M Drive East Hampton, NY 11937

© 2024 INFO

Tax refunds

VAT (Value-Added Tax) refund is possible for foreign customers who have received a tax refund form for their purchases.

VAT (value added tax) refund is possible for foreign customers who have received a tax refund form for their purchases. Tax Refund Procedures With a Swiss slip:

- If refund is requested in cash on the form => go to the Global Exchange counter.

- If refund is requested by credit-card => put the tax return slip in an OPEN envelope in the mailbox in front of the Global Exchange tax refund counter .

- Before registering your baggage, proceed to French Customs in the French Sector:

- If your tax refund slip has a barcode: You need a digital stamp from the PABLO machine

- If your tax refund slip does not have a barcode: Then you need a stamp from the French customs office

- Then register your baggage

- For the tax refund:

- Cash refund: Go to the Global Exchange office at the arrivals level of the terminal or to the Global Exchange tax refund office in the reserved international area

- Refund on credit card: send the slips in an envelope by mail. A mailbox is located on the arrivals level of the airport near the Visitors Center.

- Compliant and duly filled in tax refund slip: full name, full address, full address of residence, passport number, signature of the shop, signature of the customer, stamp of the European customs authorities for EU forms, original of the receipt.

- The refund is only possible in cash, in the currency of your choice.

- Global Exchange is a partner of the following tax refund companies: Solpay, Global Blue, Détaxe SA, Planet Payment.

Navigate to myswitzerland.com

Destinations

Your swiss holiday time.

Holiday destinations

- Summer holiday destinations

- Winter sports & ski resorts

- Family destinations

Attractions

- Top attractions

- UNESCO World Heritage sites / biospheres

- Travel by train, bus or boat

- Top museums

- Swiss Parks

- Scenic nature

Experiences

Additional content about subnavigation experiences.

- Family excursions

- Food & Wine

- Group excursions

- Guided tours

Summer & Autumn

- Bicycle & Mountain bike

- Adventure & Sports Summer

- Zoo & animal experiences

- Ski and snowboard

- Cross-country skiing

- Snowshoe and winter hiking

- Tobogganing

- Winter excursions

- Christmas in Switzerland

Cities & culture

- Parks, Gardens and Squares

- Architecture

Experience Tour

- Car, motorcycle - Grand Tour

- Train, bus, boat – Grand Train Tour

- Mountain excursions

Accommodation

- Typically Swiss Hotels

- Wellness & Spa

- Family Hotels

- Bike Hotels

- Boutique Hotels

- Inspiring Meeting Hotels

- Swiss Historic Hotels

- Luxury hotels

- Winter sports hotels

Other types of accommodation

- On the farm

- Bed and Breakfast

- Mountains huts

- Group accommodation

Transport & Stay

- Travel to Switzerland

- Barrier-free travel

- Tickets public transport

- Service & support

- Money and shopping

About Switzerland

- General facts

- Custom and tradition

- History of Switzerland

- The Swiss Art and Culture Scene

- Health Travel

- Sustainability

Weather & Climate

- Climate in Switzerland

- Snow Report

- Water and pool temperatures

- City offers

- Touring offers

- Wellness offers

- Nature and outdoor offers

- Offers for families

Where are you from?

- België (Nederlands)

- Belgique (Français)

- Deutschland

- Netherlands

- Russia (Россия)

- Schweiz (Deutsch)

- Suisse (Français)

- Svizzera (Italiano)

- Switzerland (English)

- United Kingdom

- Canada (English)

- Canada (Français)

- China 中文简体

- China 中文繁体

- Gulf countries العربية

- Japan 日本

- Korea 한국어

- United Arab Emirates

- New Zealand

- International

Language, region and important links

- Slovenština

Service Navigation

- Help & Contact

Tax free shopping

The VAT you pay on purchased goods in Switzerland is 7.7%. You may ask at the shops for your Tax Free Form and reclaim the VAT. Your total purchases in a shop must amount to more than CHF 300 (including VAT). You must be a resident outside Switzerland and the goods must be exported within 30 days. More information: Swiss Federal Tax Administration FTA

www.global-blue.com

Three easy steps to claiming your refund in Switzerland: Step 1: Tax Free Form (Refund Cheque) Ask the shop staff for a Tax Free Form (Refund Cheque) when paying for your purchases. Step 2: Customs Stamp When leaving Switzerland (before check-in), present your Tax Free form and the original receipt to Customs; they will export validate it. Have your passport, purchased goods and valid flight ticket ready for inspection; make sure the goods are sealed and unused. Customs is well signposted at all airports, land borders and ports. At the airport, please allow enough time for the export validation process before your flight departs. Step 3: Refund Office Show the stamped Tax Free Form (Refund Cheque), passport and credit card at a nearby Refund Office and ask for an Immediate Refund on your credit card. Alternatively, the refund can be paid in cash.

Please note that Switzerland remains with the Swiss franc, usually indicated as CHF. While Switzerland is not part of the European Union and thus is not obliged to convert to the Euro, many prices are nonetheless indicated in euros so that visitors...

Creditcards

The most commonly accepted payment options are cash, credit cards and debit cards. Credit cards and debit cards are accepted almost everywhere. The most common are Visa, Mastercard, American Express and Maestro. It is advisable to check in advance...

Prices and quality of life

Life in Swiss cities is quite expensive, but the quality of life is also correspondingly high. In this respect, Zurich and Geneva repeatedly come out on top in international studies. Prices vary depending on the area and tourist spots. For example,...

Money exchange places

You can change money at the following places: Banks Exchange offices Airport Major hotels Exchange offices usually offer better exchange rates than banks. At airports, the rates may be slightly higher than in the city...

Business Hours

Stores In general, most stores are open Monday through Friday between 9:00 a.m. and 6:30 p.m. and on Saturday from 9:00 a.m. to 5:00 p.m.. Many stores are closed on Sundays. However, stores are open at train stations, airports and gas...

Whether fashion or practical, boutique, small local store or shopping mall: Switzerland offers a lot for an extensive shopping trip. Of course, chocolate and watches are among the classics when in Switzerland. So is the wide range of cheese. In...

In Switzerland, the guest is not obliged to tip. In many restaurants, however, it is customary to pay a tip. This amounts to approximately 10 percent or it is rounded up to a round amount.

How do I get a refund if I'm exempt from the tourist tax in Switzerland?

Certain guests staying in Switzerland may be exempt from the tourist tax or qualify for a reduced rate. This exemption may include guests who are:

- Minors (exact age depends on city or region)

- Visitors at trade fairs

- Students and staff on school trips

- Staying overnight for professional, educational, or training purposes

To find out if you qualify for a refund or a reduction, visit the tourist tax website for the municipality where you’re staying, or contact their tax office.

If you’ve booked a stay on Airbnb in one of the locations in Switzerland where we automatically collect the tourism tax and you determine that you're due a refund, you can request a refund directly from the municipality where your accommodation is located.

You can find additional information about tourist taxes and exemptions in these areas on the following pages:

- Canton Basel City

- Canton Basel Landschaft

- Canton Geneva

- Canton Fribourg

- Canton Lucerne

- Canton Schaffhausen

Related articles

How do i get a refund if i’m exempt from the tourist tax in germany, how do i get a refund if i’m exempt from the tourist tax in portugal, how do i get a refund if i'm exempt from the tourist tax in lithuania.

- Main navigation

- Content area

Claim to refund of Swiss Withholding Tax – quite simply online | FTA

Service navigation.

Federal Tax Administration FTA

Main navigation.

- Federal tax administration FTA

- Withholding tax

Claim to refund of Swiss Withholding Tax

Context sidebar

Residents of other countries please use the forms for reimbursement for persons residing abroad .

Withholding tax Declaration and refund for Swiss residents (Form 21 / 25)

Withholding tax Refund for persons resident in Germany (Form 85)

As English is not one of Switzerland's official languages, only the most important information concerning the Administration is translated into English. This translation is provided for information purposes only and has no legal force. Please refer to the German , French or Italian original version.

Questions & Answers about reclaiming withholding tax

Your bank or your representative may have submitted an application for a withholding tax refund on your behalf. Please contact your bank or representative.

Individual persons domiciled in Switzerland must submit claims for a withholding tax refund to the tax authority of the canton in which they were domiciled at the end of the calendar year in which the taxable benefit fell due (art. 30 WTA).

Legal entities whose headquarters are in Switzerland apply for withholding tax refund with the FTA. Legal entities and individuals domiciled abroad may also apply for a withholding tax refund with the FTA, provided that a double taxation agreement (DTA) exists. You can apply for a withholding tax refund either online on our website or you can fill out the relevant form using the free software Snapform Viewer . If you use the software Snapform Viewer, you need to print out the form and send it to the FTA by postmail.

The forms available on our website are constantly being updated. Only the latest version is accepted, so please always ensure that you are using the latest version by consulting our site. If the FTA finds that a submitted form is not compliant, it will be rejected (art. 64 para 1 WTO).

In view of increasing digitalisation, paper forms are gradually being phased out. We therefore recommend you to use the electronic version whenever possible. You will find links to existing applications on our website (see address below).

In accordance with art. 29 para. 2 WTA, a request for reimbursement (form 25) may be submitted at the earliest after the end of the calendar year in which the taxable benefit fell due.

For the current year's income, only Swiss residents may apply for refund by instalments using Form 21 if this is sent to the FTA before the end of the third quarter of the year in question.

Please note, however, that in accordance with articles 65 and 65a WTO, certain conditions must be met. For example, the applicant must plausibly establish that he is entitled to a refund of at least CHF 4000 for the entire year. In addition, a person who has received refunds in instalments must, within three months of the end of the year in question, submit an application for the full amount of withholding tax, indicating the instalments received.

The receipt of the claims for refund of Swiss withholding tax is not confirmed. The length of processing the claims depends on the quality of the received claims as well as on the quantity received. Processing can take up to several months. We kindly ask you to be patient considering that more than 300 000 claims have to be processed every year. Thank you for your understanding.

You can check the status of your claims submitted online in the e-Portal.

Explanation of status:

In progress: the claim has not yet been fully completed by the applicant and therefore has not yet been submitted to the FTA.

Submitted: the claim has been received by the FTA and is awaiting processing.

Completed: the claim has been processed. The payment advice note can be downloaded.

If all the documents have been sent correctly, the claim can be processed. If this is not the case and additional documents and/or information are required, we will contact you.

All positions listed in your application need to be substantiated, either with a revenue statement, or a list of securities. If the securities are deposited at a foreign bank, you must also enclose the corresponding tax vouchers (see circular n. 21). A Tax Voucher is issued by the bank and confirms that the non-Swiss bank has actually delivered the Swiss WHT to the FTA (see circular no 21). Please note that your application cannot be processed if the required information and documents are not submitted to us in full. Depending on the situation, additional information may be requested if necessary.

In principle, the right to claim to a withholding tax refund expires if the application is not submitted within three years after expiry of the calendar year, in which the taxable benefit fell due (art. 32 WTA and art. 27 para. 1 LECF).

In the case of an inheritance, refund must be requested to the competent authority in the name of the deceased up to and including the date of death (for Swiss residents, this is the competent cantonal tax administration of the place of domicile). For due dates falling after the date of death, each heir must apply individually to the competent authority for refund of his or her share of the inheritance (art. 58 WTO).

In this regard, we refer you to art. 64 WTO: «As a general rule, a claim from the same person entitled to a refund will only be accepted once a year.» ... We would ask you to regroup the income together on the same claim and submit it only once a year.

If dividend income is claimed for the first time based on an investment of more than 10 %, a full copy of the purchase contract must be attached to the refund claim (in addition to the usual documents) (art. 48 WTA).

Contact form

Federal Tax Administration FTA Main Division FDT Eigerstrasse 65 3003 Berne

Last modification 18.04.2024

Top of page

Print contact

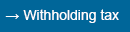

When do you have to pay customs duties? Open accordion

Importing goods into switzerland.

Goods can be imported into Switzerland free of charge if their total value does not exceed CHF 300. If the total value of goods is more than CHF 300, you will be charged Swiss VAT on the total value.

There is also a limit on the quantity of foodstuffs, alcohol and tobacco that can be imported. If you exceed the limit, you will be charged customs duties.

Examples of quantities allowed into Switzerland free of charge for:

Alcoholic beverages with an alcohol content of <18%: 5 litres per person per day

Alcoholic beverages with an alcohol content of >18%: 1 litre per person per day

Meat: 1kg per person per day

Cigarettes: 250 cigarettes per person per day

If you bring goods purchased abroad to Switzerland, you often have the option of claiming a refund of foreign VAT.

Transit of goods through Switzerland

Anyone travelling through Switzerland with personal goods must declare these goods when entering Switzerland. Any customs duties payable will be reimbursed to you (in Swiss francs) when you leave Switzerland.

If you are simply leaving Switzerland with personal goods, you do not need to complete any special customs export formalities . But don’t forget to check the import rules of your destination country.

Customs fees Open accordion

Customs fees vary depending on the goods. For foodstuffs, alcohol and tobacco, fees depend on how much the imported quantities exceed allowances.

Importation into Switzerland

The following information applies per person per day for goods that you import for private use or as a gift.

How to clear goods through customs Open accordion

Quickzoll app.

QuickZoll is an app provided by the Federal Office for Customs and Border Security for the importation of personal goods. The app allows you to declare your goods before you bring them into the country and to pay any customs fees directly. The goods cleared for import using QuickZoll can then be brought into Switzerland at any border crossing.

You can download the QuickZoll app to your mobile phone free of charge and do not need to register to use it.

Verbal customs declaration

If there are customs officials stationed at the Swiss border crossing, you need to spontaneously declare the goods you are carrying. In airports choose the red exit to declare your goods.

If you are travelling by rail , you can make a verbal declaration to a customs official on the train. If there are no customs officials on the train, you can declare your goods at any customs office during business hours within seven days of your arrival in Switzerland.

Written self-declaration

If you enter the country at an unmanned border crossing, you can fill out a self-declaration form. These forms are available in the declaration box . However, this option is not available for declaring goods that are to be sold or traded.

Refund of foreign VAT Open accordion

If you bring goods purchased abroad to Switzerland, you often have the option of having the foreign VAT refunded . The Federal Office for Customs and Border Security is not authorised to make this refund and is unable to provide any information on how to proceed.

Foreign VAT refunds are made by the seller abroad or by a VAT refund company. Different rules apply to VAT refunds in different countries. Sellers abroad generally provide you with a refund form on which the foreign customs authority can confirm the exportation of your purchase to Switzerland.

Swiss VAT must be paid on goods of a total value exceeding CHF 300 on import even if the foreign VAT is not refunded.

Further information Open accordion

The illustrated brochure Customs info: essential information at a glance provides basic information for individuals.

The Federal Office for Customs and Border Security provides detailed information on importation into Switzerland, allowances and duty-free limits .

For more information about customs declarations when you travel into Switzerland by train, click here .

When planning your trip to Switzerland, check the addresses and business hours of border crossings and customs offices beforehand.

For information on ordering goods abroad online, have a look at the ch.ch page on ordering goods abroad .

The Tax-Free Calculator for Switzerland

The standard VAT rate in Switzerland is 7.7 % . Switzerland will reimburse between 4.5 % and 5.4 % of the amount you spend during your trip on products subject to standard VAT rates. The minimum purchase threshold is 300 CHF .

On this page, by entering the amount you spent, you can find out approximately how much of a VAT refund you can get.

Note: Exact Switzerland tax-free refund calculations may vary according to the company you work with. Therefore, the values on this page are approximate.

Products Subject to Lower VAT Rates:

Items for which vat refunds do not apply:, who can benefit from tax-free shopping in switzerland .

- If you have permanent residence outside Switzerland.

- If you are older than 18.

- Only goods with 7,7% VAT rate are eligible for tax refunds.

- VAT Rate in Switzerland is lower than average. It means you can get potentially lower VAT refund as a tourist.

- Switzerland has one of the highest minimum spending requirements.

- If you live in Europe but do not have a Swiss residence permit, you are eligible for VAT refund.

With Glocalzone, earn money while traveling to Switzerland !

Glocalzone is a platform that brings together shoppers looking to buy products abroad and travelers visiting there.

How are Tax-free Refunds Calculated in Switzerland ?

It can be difficult to figure out exactly how much you will be reimbursed in Switzerland and other countries that offer tax-free shopping. We have created this page in an effort to help you navigate this topic. First of all, to find out how much your tax-free refund will be, there are 2 things you need to know:

- The VAT rate in Switzerland

- The VAT status of the product you purchased

We will use an example to try to explain how much your tax-free refund will be. Switzerland applies a 7.7 % VAT rate to its products. In other words, of a 1200 CHF purchase, 86 CHF of that purchase actually go towards tax.Therefore, you should theoretically get 86 / 1200 or 7.2 % of your tax-free purchase back; however it is not possible to fully recover this entire amount.

Another thing you need to know when calculating your tax-free refund in Switzerland is that you need to work with an intermediary refund agent in order to get your tax-free payment. Although throughout Europe Planet Payment and Global Blue are the 2 most popular companies in this regard, other companies may mediate local or smaller tax-free transactions and can vary by country.

The commission these intermediary companies receive may also affect the amount you can get back. These companies usually deduct a percentage from the total refund you will receive. The higher the prices of the products you buy, the lower the deduction percentage will be.

Since the commission received by tax-free refund agents can vary from company to company, this page will help guide you in how to calculate tax-free refunds in Switzerland . The total amount you receive back will depend on the company, whether you want your refund in cash, and whether the payout credited to your account will be subject to currency conversions.

The Tax-free Guide to Switzerland : How to Get a Tax-free Refund

The 4 steps necessary in Switzerland to get tax back on your shopping:

- Choose stores that offer tax-free shopping.

- Have the necessary tax-free forms filled out at the store.

- Get your tax-free form verified by customs at the airport.

- Visit the airport offices of the tax refund company you work with.

Once you have completed these 4 steps, you will be able to receive your tax-free refund from Switzerland . Thus, you will get the products you bought in Switzerland for even less. Let's take a look at each of these steps more closely.

Choosing a Shop that is Tax-free

Generally when you shop large, global brands, these brands will have tax-free agreements and the paperwork should be no problem. Our suggestion in this regard is to ask whether it is possible to get a VAT refund when you enter the store. You can make the process easier by choosing stores with the words "Tax-free" located on their showcases.

Completing the Required Tax-free Form at the Store

At this stage, all you have to do is mention that you are a visitor from abroad and would like to benefit from tax-free shopping. The store clerk will prepare the necessary documents to be filled out in the store. All you will have to do is sign the documents.

Get Your Form Verified by Customs at the Airport in Switzerland

You must have your tax-free form approved by customs before you leave the country. The customs officer may want to check the products you purchased. According to tax-free regulations, all products bought in Switzerland need to remain unused until they have left the country. It may take some time to process your tax-free refund at the airport. Therefore, we recommend that you be at the airport a minimum of 1 hour in advance of your usual arrival time.

Visit the Airport Offices of the Tax Refund Company You Work With

After your tax-free form has been approved, you need to go to the office of the tax refund company you are working with to receive your tax-free refund. If you are departing from a large airport, you can simply locate their offices via either the company’s or the airport’s website.

Here you will need to fill out a form stating how you want to receive your tax-free refund payment. You can get it refunded to your credit card once you return to your country, or you can ask to receive cash at the airport by paying extra commission. Cash tax-free refunds are not available at all airports. However, if using a heavily-trafficked airport in Switzerland , you should be able to receive payment in cash.

Other Things to Know About Tax-free Refunds in Switzerland

Tax-free refunds are available to people traveling to Switzerland for touristic purposes. In other words, if you have a residence permit for the country you are visiting, getting a refund will not be possible.

There is a minimum purchase threshold you need to reach to get a tax-free refund. You cannot get tax-free reimbursement for expenses below this limit. The minimum purchase threshold is calculated per invoice. That is to say, if you make multiple separate purchases below the minimum threshold, even if the total exceeds the minimum threshold, you will not be able to get tax-free compensation.

Refunds for tax-free purchases in Switzerland are only valid for VAT. You can also deduct the VAT fees applied to the commission charged by your tax refund company.

Tax-free for Tourists

Switzerland and Spain

Eda.base.components.templates.base.accesskeys.

- Attestations

Attestation of export documents in tourist traffic for shop sales

You have purchased various items during your stay as a tourist in Switzerland. Under certain conditions the Swiss VAT can be reimbursed. The website on value added tax (VAT) of the Swiss Federal Tax Administration (FTA) will provide you with information on the conditions and procedures to follow in order to obtain reimbursement.

"Exportation in tourist traffic for shop sales ("tax-free for tourists")"

If on leaving Swiss territory you have not been able to obtain the necessary attestation before passing through Swiss customs, the Swiss representation responsible for your place of domicile can certify the document in the context of tourist traffic with regard to shop sales (tax-free for tourists). It will not do so however unless you personally exhibit all the items mentioned on the export document, together with the original purchase receipts, proof of entering and leaving Swiss territory, and the identification document mentioned on the export document.

Please bear in mind that the reimbursement of VAT by the seller in Switzerland to the purchaser (yourself) is a matter of private law governing the two parties to a sales contract. Therefore the attestation provided by a Swiss representation does not constitute a guarantee by the Swiss authorities compelling the seller in Switzerland to reimburse the VAT.

Start of page Last update 09.06.2023

Awesome, you're subscribed!

Thanks for subscribing! Look out for your first newsletter in your inbox soon!

The best things in life are free.

Sign up for our email to enjoy your city without spending a thing (as well as some options when you’re feeling flush).

Déjà vu! We already have this email. Try another?

By entering your email address you agree to our Terms of Use and Privacy Policy and consent to receive emails from Time Out about news, events, offers and partner promotions.

- Things to Do

- Food & Drink

- Arts & Culture

- Time Out Market

- Coca-Cola Foodmarks

- Los Angeles

Get us in your inbox

🙌 Awesome, you're subscribed!

These are all the destinations you’ll need to pay extra to visit this year

More and more popular travel destinations are introducing tourist taxes to tackle problems caused by overtourism – here’s what you’ll have to pay

This year, international travel is forecast to bounce back to the highest levels since 2019 – and while that’s great news for the tourism industry in general, many cities, attractions and entire regions are suffering under the weight of overtourism .

The potential for damage to historic sites, unhinged tourist behaviour and the simple issue of overcrowding are all common consequences of overtourism. That’s why a growing list of popular travel destinations have introduced a tourist tax, with the hopes of controlling visitor numbers and improving local infrastructure to better cater to higher visitor capacity.

Many countries and cities introduced a tourist tax in 2023, and many more are due to launch theirs in 2024. Tourist taxes aren’t a new thing – you’ve probably paid one before, tied in with the cost of a plane ticket or the taxes you pay at a hotel.

However, more destinations than ever before are creating this fee for tourists, and many places have increased the cost of existing ones. Here’s a full list of all the destinations charging a tourist tax in 2024, including all the recently introduced and upcoming tourist taxes you need to know about.

Austria charges visitors a nightly accommodation tax which differs depending on province. In Vienna or Salzburg , you could pay 3.02 percent per person on top of the hotel bill.

Belgium , like Austria, has a nightly fee. Some hotels include it in the rate of the room and add it separately to your bill, so read it carefully.

The rate in Brussels is charged per room, and varies depending on the size and rating of your hotel, but is usually around €7.50. Antwerp also charges per room.

Bhutan has always been known for its steep tourist taxes and charges. In 2022, the Himalayan kingdom tripled the amount it charged visitors in tax to a minimum of $200 per day , but that amount has since been lowered. In 2024, the daily fee for the majority of visitors is $ 100, and that is due to continue until August 31, 2027.

Bulgaria applies a fee to overnight stays, but it reaches a maximum of only €1.50.

Caribbean Islands

The following Caribbean Islands charge a tourist tax, ranging from between €13 to €45: Antigua and Barbuda, Aruba, the Bahamas, Barbados, Bermuda, Bonaire, the British Virgin Islands, the Cayman Islands, Dominica, the Dominican Republic , Grenada, Haiti, Jamaica, Montserrat, St. Kitts and Nevis, St. Lucia, St. Maarten, St. Vincent and the Grenadines, Trinidad and Tobago, and the US Virgin Islands.

The tax tends to be tied into the cost of a hotel or a departure fee.

Croatia only charges its visitors a fee of 10 kuna (€1.33) per night during peak season.

Czechia (also known as Czech Republic)

Czechia only applies a fee to those travelling to Prague . It doesn’t apply to those under the age of 18, and is less than €1 per person, per night.

France ’s ‘taxe de séjour’ varies depending on city, and tends to be added to your hotel bill. It varies from €0.20 to €4 per person, per night.

Earlier this month, Paris announced it would be increasing its fee by up to 200 percent for those staying in hotels, Airbnbs, and campsites, but that it plans to put the funds towards improving the city’s services and infrastructure.

READ MORE: The cost of visiting Paris will soar this summer – here’s why

Germany charges visitors a ‘culture tax’ (kulturförderabgabe) and a ‘bed tax’ (bettensteuer) in certain cities, including Frankfurt , Hamburg and Berlin , which tends to be around five percent of your hotel bill.

Greece ’s tourist tax is based on numbers. Specifically, how many stars a hotel has, and the number of rooms you’re renting. The fee was introduced by the Greek Ministry of tourism to help pay off the country’s debt, and can be anything from €4 per room.

Hungary charges visitors four percent of the price of their room, but only in Budapest .

Iceland is introducing a tourist tax to protect its ‘unspoilt nature’ this year, which will cost between €4 to €7 per night. It comes after annual tourist numbers reached an estimated 2.3 million per year.

In Indonesia , the only destination which charges a tourist tax is Bali , and the fee is set to increase this February to $10 (£7.70, €8.90, IDR 150,000) – but is a one-time entry fee, not a nightly tax. It apparently goes towards protecting the island’s ‘environment and culture.’

Much like in France, Italy ’s tourist tax varies depending on your location. Rome ’s fee is usually between €3 to €7 per night, but some smaller Italian towns charge more.

Venice finally announced in September that its tourist tax, a €5 (£4.30, $5.40) fee which will be applicable on various days during high season, will launch in 2024. It only applies to day-trippers rather than those staying overnight, though.

Japan has a departure tax of around 1,000 yen (€8).

Malaysia has a flat-rate tax which it applies to each night you stay, of around €4 a night.

New Zealand

New Zealand ’s tax comes in the from of an International Visitor Conservation and Tourism Levy of around €21 which much be paid upon arrival, but that does not apply to people from Australia.

Netherlands

The Netherlands has both a land and water tax. Amsterdam is set to increase its fee by 12.5 percent in 2024, making it the highest tourist tax in the European Union.

Portugal has a low tourist tax of €2, which applies to all those over the age of 13. It’s only applicable on the first seven nights of your visit and applies in 13 Portuguese municipalities, including Faro, Lisbon and Porto.

Olhão became the latest area to start charging the fee between April and October. Outside of this period, it gets reduced to €1 and is capped at five nights all year round. The money goes towards minimising the impact of tourism in the Algarve town.

Slovenia also bases its tax on location and hotel rating. In larger cities and resorts, such as Ljubljana and Bled, the fee is higher, but still only around €3 per night.

Spain

Spain applies its Sustainable Tourism Tax to holiday accommodation in the Balearic Islands to each visitor over the age of sixteen. Tourists can be charged up to €4 per night during high season.

Barcelona ’s city authorities announced they plan to increase the city’s tourist tax over the next two years – the fee is set to rise to €3.25 on April 1, 2024. The council said the money would go towards improving infrastructure and services. This is in addition to regional Catalan tax.

Switzerland

Switzerland ’s tax varies depending on location, but the per person, per night cost is around €2.20. It tends to be specified as a separate amount on your accommodation bill.

Thailand

Thailand introduced a tourist tax to the price of flights in April 2022, in a similar effort to the Balinese aim of moving away from its rep as a ‘cheap’ holiday destination. The fee for all international visitors is 300 baht (£6.60, $9).

The US has an ‘occupancy tax’ which applies across most of the country to travellers renting accommodation such as hotels, motels and inns. Houston is estimated to be the highest, where they charge you an extra 17 percent of your hotel bill.

Hawaii could be imposing a ‘green fee’ – initially set at $50 but since lowered to $25 – which would apply to every tourist over the age of 15. It still needs to be passed by lawmakers, but if approved, it wouldn’t be instated until 2025.

The European Union

Finally, the European Union is planning on introducing a tourist visa , due to start in 2024. The €7 application will have to be filled out by all non-Schengen visitors between the ages of 18 and 70, including Brits and Americans.

READ MORE: Why sustainable tourism isn’t enough anymore

Stay in the loop: sign up to our free Time Out Travel newsletter for all the latest travel news.

- Liv Kelly Contributing Writer

Share the story

An email you’ll actually love

Discover Time Out original video

- Press office

- Investor relations

- Work for Time Out

- Editorial guidelines

- Privacy notice

- Do not sell my information

- Cookie policy

- Accessibility statement

- Terms of use

- Modern slavery statement

- Manage cookies

- Advertising

Time Out Worldwide

- All Time Out Locations

- North America

- South America

- South Pacific

- Main navigation

- Content area

Refund of French VAT: end of exemption

Service navigation.

Federal Office for Customs and Border Security FOCBS

Main navigation.

- Federal Office for Customs and Border Security

- Information individuals

- Travel and purchases, allowances and duty-free limit

- Importation into Switzerland

- Refund of foreign VAT

To date, a procedure has existed whereby France and Switzerland had arranged for part of the export formalities to be carried out by the destination country. Thus, the FOCBS processed the forms by stamping them to confirm that the goods had crossed the Swiss border, and then forwarded the forms to the French authorities.

As of 1 July 2023, neither the FOCBS nor the French customs will carry out the formalities for export from the other country for VAT refund purposes. Travellers who have purchased items in France and would like to have this tax refunded must travel via an attended French border crossing (see below). The reverse applies for travellers entering France and wishing to reclaim the equivalent Swiss tax.

When passing through an unattended border crossing, travellers must always place import declarations in the declaration boxes in Switzerland. Indeed, the fact that the destination countries no longer carry out the tax refund procedures does not exempt travellers from performing customs clearance for goods being imported. Goods can also be easily cleared through customs using the QuickZoll application. You can find more information about QuickZoll here .

Opening times of border crossings

- Delle-Boncourt: Monday to Sunday, 6am to 8pm

- Col France: Monday to Friday, 6am to 8pm; Saturday, 10am to 6pm

- La Ferrière-Sous-Jougne: Monday to Friday, 6am to 8pm; Saturday, 10am to 8pm; Sunday, 10am to 1pm

- La Cure: Monday to Friday, 9am to 12 noon and 1pm to 4.30pm; Saturday, 11am to 5pm

- Ferney-Voltaire road: every day, 6am to 8pm

- Ferney-Voltaire airport: every day, 6am to 11pm

- Genève-Cornavin station: every day, 6.30am to 6.30pm

- St-Julien/Bardonnex: every day, 24 hours a day

- Vallard-Thônex: every day, 6am to 8pm

- St-Gingolph: Monday to Friday, 7am to 6pm

- Basel St-Louis motorway: site B10 (tourist traffic): Monday to Friday, 9am to 8pm; Saturday, 12 noon to 8pm Site B8 (commercial traffic): Monday to Friday, 5am to 9am and 8pm to 10pm; Saturday, 5am to 1pm Traffic signals are in operation between B10 and B8.

- St-Gingolph (Valais): Monday to Sunday, 5am to 10pm

- Thônex-Vallard (Geneva): Monday to Friday, 7.30am to 5pm

- Bardonnex (Geneva): every day, 24 hours a day

- Ferney-Voltaire (Geneva): Monday to Friday, 7.30am to 5pm

- Vallorbe (VD): Monday to Friday, 8am to 12am and 13pm to 17pm

- Col France (Neuchâtel): Monday to Friday, 6am to 8pm; Saturday, 10am to 6pm

- Boncourt-Delle (Jura): every day, 24 hours a day

- Basel St-Louis motorway (Basel-Stadt): every day, 24 hours a day

Top of page

- International Taxation

VAT refunds

How to get a VAT refund for cross-border transactions

If you have paid VAT for a transaction in an EU Member State where you do not reside, you may be eligible for a VAT refund in certain circumstances.

Note: This page deals only with refunds for cross-border transactions. For ‘standard’ VAT refunds in which both vendor and customer are in the same country, please consult that Member State’s national tax authority .

There are 3 types of VAT refunds for cross-border transactions:

Cross-border VAT refunds to EU businesses

EU businesses that incur VAT in connection with their activities in a Member State where they do not habitually supply goods or services (and are thus not required to register there for VAT) are nevertheless entitled to obtain a refund from the Member State where they incurred the VAT. To qualify for a VAT refund, during the refund period a business must NOT have:

- been based in the refunding EU Member State, or

- supplied goods or services there, except

- exempted transport and ancillary services (Articles 144, 146, 148, 149, 151, 153, 159 or 160 of the VAT Directive ), or

- supplies to customers liable for payment of the related VAT under the reverse-charge mechanism (Articles 194-197 or 199 of the VAT Directive )

The claimant's home Member State will not forward the claim to the refunding Member State if the claimant:

- is not a taxable person for VAT purposes

- only makes exempt supplies without right of deduction

- is covered by the special scheme for small businesses

- is covered by the flat-rate scheme for farmers

To request a refund, claimants must send an electronic refund claim to their own national tax authorities, who will confirm the claimant's identity, VAT identification number and the validity of the claim. The request will then be forwarded to the Member State where VAT was incurred. If tax authorities are late in making the refund, claimants are paid interest.

For more information on the refund procedure, see the Summary of VAT refund procedure .

For the full rules, see Directive 2008/9/EC and Implementing Regulation 79/2012 .

More information

Links to country-specific information .

- Country-specific VAT guides (Vademecums) - limitations on the right to deduct VAT

- VAT refunds - country guide (Vademecums) - variations in the VAT refund rules in each Member State

- EU Member States using the business activity codes contained in Commission Regulation 79/2012

Links to other VAT guides

- Information requirements in EU country of refund

- eLearning modules on VAT refund

- Contact points of the competent national authorities

VAT refunds to non-EU businesses

Non-EU businesses that incur VAT in connection with their activities in an EU Member State where they do not habitually supply goods or services (and are thus not required to register for VAT) are nevertheless entitled to obtain a refund from the EU Member State where they incurred the VAT. To qualify for a VAT refund, during the refund period a business must NOT have:

- been based in any Member State, or

- supplied goods or services in the EU Member State where they incurred VAT, except

- exempted transport and ancillary services (Articles 144, 146, 148, 149, 151, 153, 159 or 160 of the VAT Directive ), or

- services to customers liable for payment of the related VAT under the reverse-charge mechanism (Articles 194, 196 or 199 of the VAT Directive )

In addition, any EU Member State may:

- refuse to refund VAT in this way if the claimant’s country/territory does not grant reciprocal refund rights for VAT or similar to businesses based in that Member State

- impose restrictions on the type of expenditure that qualify for refunds

- insist that the claimant appoint a tax representative

For the full rules of this refund procedure, see Directive 86/560/EEC

VAT refunds to non-EU travellers

VAT refunds for goods sold to non-EU tourists who bring them out of the EU in their personal luggage may be requested to EU retailers or specialised intermediaries, particularly in the following cases:

- Tourists whose permanent address or habitual residence (as stated in their passport or other recognised identity document) is not in the EU

- EU nationals living outside the EU (who can prove this with a residence permit or similar)

The following conditions apply:

- The customer must provide proof of residence outside the EU (e.g. non-EU passport or residence permit).

- The goods must be taken out of the EU within 3 months of their purchase. The tourist must provide a stamped VAT refund document proving this.

- The value of the goods purchased must be above a certain minimum (set by each EU Member State).

- Retailers can either refund the VAT directly or use an intermediary. One of these parties may charge a fee , which may be withheld from the refunded VAT amount.

More on VAT refunds for non-EU tourists on the Your Europe portal

Legal texts

- Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax

- Council Directive 2008/9/EC of 12 February 2008 laying down detailed rules for the refund of value added tax, provided for in Directive 2006/112/EC, to taxable persons not established in the Member State of refund but established in another Member State

- Council Implementing Regulation (EU) 79/2012 of 31 January 2012 laying down detailed rules for implementing certain provisions of Council Regulation (EU) No 904/2010 concerning administrative cooperation and combating fraud in the field of value added tax

- Thirteenth Council Directive 86/560/EEC of 17 November 1986 on the harmonisation of the laws of the Member States relating to turnover taxes - Arrangements for the refund of value added tax to taxable persons not established in Community territory

Share this page

A Guide to the Value Added Tax (VAT) Refund for Travelers

Posted: February 2, 2024 | Last updated: February 7, 2024

When it comes to VAT refunds, the more you spend, the more you can get back.

Photo by AboutLife/Shutterstock

If you’ve never heard of the VAT refund, get ready to see some serious financial returns the next time you go shopping abroad. If you’re looking for the best price on a high-end item, you might be able to save thousands of dollars by waiting to buy it overseas. (Discount luxury shopping: It’s not an oxymoron.) Here’s the breakdown on how to save money with VAT.

What is VAT?

VAT—sometimes redundantly called VAT tax—stands for value-added tax. This tax is associated with shopping in the European Union, though more than 160 countries around the world use value-added taxation. It’s a sales tax paid by consumers (not businesses), and it doesn’t exist in the United States. Only visitors—including U.S. tourists—are able to qualify for a VAT refund.

Keep in mind, VAT is often factored into the price of a product (so a €100 dress with a 20 percent VAT rate might have a price tag of €120). Other times, it is listed on the receipt. Ask a sales associate wherever you’re shopping if it’s unclear.

The rate of VAT in Europe varies depending on where you’re visiting and shopping, and it ranges from 7.7 percent in Switzerland (technically not an E.U. country, and it’s set to increase its VAT to 8.1 percent in 2024) to 27 percent in Hungary. The average VAT rate in the E.U. is 21.3 percent , and the minimum in the E.U. is 15 percent. Deloitte provides a very useful country-by-country breakdown .

But rates can also vary depending on what you’re buying. For example, food and pharmaceutical products are typically taxed at a lower rate than leather goods like shoes and handbags.

Can you get a VAT refund in the U.K.?

It depends: Travelers were allowed to do so throughout the U.K. up until December 31, 2020, but Brexit put an end to VAT refunds. Currently, the only country in the region that offers VAT refunds to overseas visitors is Northern Ireland.

What qualifies for a refund?

Almost all luxury goods—including clothes, shoes, cosmetics and skincare, jewelry, handbags, leather goods, and art—will have a value-added tax. Many items qualify for a VAT refund, but it’s important to note that only new goods (not used) can be claimed. Each transaction also has to be over a certain threshold, and this threshold varies by country. For instance, you have to spend over €100 per transaction in France to qualify for a VAT refund. This means you can buy several products at one store for a total of more than €100, but if you spread those same items out over multiple stores, you would not get to claim the refund. You can also make a single large purchase over €100 at many different stores and claim for each transaction.

Your items are supposed to be unused when you declare them. That said, you can typically get away with using your new handbag or coat. But you may want to hold off on breaking in those new leather slingbacks before you present them to customs. You also will want to ensure that items you are declaring are recent purchases because you must make your claim within three months of leaving the European Union.

Items that do not qualify for a VAT refund

- Vintage items —Those vintage Chanel clip-on earrings you bought from the Marché aux Puces de Saint-Ouen? The (probably very good) price you paid is final. No refunds here.

- Goods purchased in the tax-free zones of airports —because there is nothing to refund

- Transactions that do not meet the minimum threshold

- Services —including hotel stays, restaurant meals, and tour guide fees—because these are experienced abroad and not brought home

- Anything you aren’t bringing back to the United States . The goods have to come home with you.

- Cars — unless the vehicle is being used exclusively for business purposes, in which case you can get up to 50 percent back on your VAT

- Alcohol and tobacco

- Counterfeit items —This may seem obvious, but a faux Dior tote does not qualify for VAT (and in France, purchasing a counterfeit is a criminal offense).

What you need to do while shopping

- Make sure you have your passport with you before you start shopping —you’ll have to provide proof that you are a visitor . If you’re shopping specifically to get a discount, ask the shop if it participates in VAT refunds and if it has a specific purchase-amount threshold. On occasion, smaller shops and boutiques do not participate, therefore you will not be able to get a VAT refund on that purchase. It’s best to know before you start shopping.

- Ask for paperwork at each place you shop —the sales assistant, cashier, or store manager should have information. Occasionally, stores can process a refund for you on site (called “instant refund”), but most use Global Blue, Premier TaxFree, or another third-party to handle the refund process. [Author’s note: I shopped at some of the largest stores in Paris—Le Bon Marché, Liberty, Louis Vuitton, Chanel—and was unable to get the instant refund at any of them.]

- Don’t leave the store without signed, official documents. Many department stores have a VAT office, such as Galeries Lafayette Haussmann in Paris. These offices will help you get your paperwork sorted. Staple your receipts to your forms, and keep them in a safe place so you can access them when you’re claiming your refund.

- Ask for a second receipt. You may want this for U.S. customs upon your arrival home.

- Try to group purchases at boutiques into one transaction , because you may get a higher rate of return. Don’t buy a bag at Hermès and then come back later to get a scarf. If you can, buy them both at the same time.

How to collect your refund

When you’re ready leave the E.U.—your last port of departure—make sure you have your goods ready to declare and your paperwork completed, then head to the airport well in advance of your flight. Keep in mind, if you’re traveling around multiple European countries, you do not go through this process each time you leave and go somewhere new within the continent (even if you’re going to a non-E.U. country, like Norway or Switzerland).

The refund process is completed on your final departure when you’re headed home. Your forms should have instructions on what steps to take (and where to go), but here’s what to do.

- Find a VAT counter. You’ll want to identify your options in advance of your flight so tracking them down is easier on the day of your travel— Moneycorp , Planet , and Global Blue are fairly common. Check your individual airport’s website for more information; some will have detailed instructions specific to their location.

- Some airports may offer a dropbox when there’s no one there to check your paperwork. This is relatively rare, but you may run into a situation where there’s no one at the counter to take your paperwork. Look for a drop box where you can take your completed paperwork for processing. The downside here is that it can add time to the process if anything is filled out incorrectly or information is missing. So make sure to double-check everything before making the drop.

- Once you’ve arrived at the counter, present your completed forms and paperwork alongside your passport and boarding pass to the employee. You may need to present certain purchased goods, particularly if they’re over €1,000. At this point, if you do have a larger purchase, you will likely be sent to the local customs office to have an officer see your goods and give you a customs stamp. If that step doesn’t apply to you, an employee will stamp your documents at the refund counter and either mail them off or hand them to you to drop into a mailbox.

- Choose your refund delivery method. You receive your refund either in cash or as a direct credit back on your credit card. Cash refunds are faster but typically have a higher fee. Credit card refunds can be slower but usually get more money back. Sometimes the refund is instant, sometimes it takes five days, sometimes it takes months. Keep your paperwork in case you have to track down your refund. If you haven’t received information in six weeks, it’s time to contact the agency.

Now for the less fun news: You do not get the full 15–20 percent VAT refunded. There are unavoidable processing fees that unfortunately cut into the final refund amount, but typically it’s a small charge. You can get an estimate on the Global Blue website of what your refund might be.

How this affects your travel home

- Consider adding at least two hours to your travel time when declaring your goods at an airport VAT counter.

- Repack your items into your checked bag after you present them for your refund.

- In addition, you have to declare your goods when you come back to the United States , and a customs officer may want to see your items if you’ve spent over $800. You may also have to pay duty, depending on the value of your purchase and the size of your party. The first $800 (per person) is tax free, the $1,000 after that is taxed at 3 percent, and beyond that the rate is variable.

Can I just go to the duty-free airport shops?

Yes, but often the products are only slightly discounted from what you’d see outside the terminal. You’ll save more money if you go through the VAT refund process.

How to maximize VAT savings

At this point you may be thinking that’s way too much effort for a few bucks. To that end, you’d be right—sometimes this is too much if the rate of return is small. The best way to maximize your VAT refund is on larger purchases like luxury items or a group of items at one store.

- Buy something made in the country you’re visiting. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States.

- Travel with family. The United States allows $800 per person of duty-free goods. If you travel with a family of four, that’s $3,200 collectively of U.S. tax–free import.

- Don’t try to avoid U.S. customs tax authorities if your purchase is over $800. This is tax fraud, and you can be fined a major penalty and lose Global Entry status. Your VAT refund is connected to your passport number, so do yourself a favor and go through the process.

- Pay in euros or use a credit card with no foreign transaction fees so you don’t incur unnecessary charges.

Some travelers have managed to save substantial amounts on certain luxury goods. Others have had less success, despite following instructions to the letter. But if you’ve spent a lot on souvenirs in Europe, you’ll at least want to try to get that VAT back to offset the duty you’ll pay in the United States.

Is there any way to avoid paying the VAT?

Technically, yes. If a store offers home shipping services, you could opt to have your purchase sent directly to your place (thus saving precious packing space!). The shop won’t charge the VAT if you go this route. But there’s a catch: You’ll have to pay for the freight shipping, which can add up very quickly. So carefully weigh the pros and cons—what is the maximum shipping cost that will offset the inconvenience of dealing with the VAT refund paperwork?

This article originally appeared online in 2020; it was most recently updated on January 30, 2024 by Erika Owen, to include current information.

More for You

Stephen Hawking once gave a simple answer as to whether there was a God

Basketball HOFer had extreme response to Caitlin Clark flagrant foul

Dolly Parton says it was ‘bold’ of Beyonce to change ‘Jolene’ lyrics without telling her

This small U.S. town is considered the best place to retire. Here's why.

Scruffing a Cat: Why You Shouldn't Do It, According to Veterinarians

Hear retired US general’s response to Ukrainian soldiers who say US-issued tanks are underperforming

'Chopped'-winning celeb chef who didn't pay rent for over 4 years gets evicted

'Big Bang Theory' Fans Congratulate Kaley Cuoco as She Announces Career Milestone

JJ Redick Breaks Silence On Los Angeles Lakers Head Coaching Job

You Should Really Think Twice Before Killing That Earwig

Popular Mexican Chain Abruptly Closes 48 Locations in California, Citing $20 Minimum Wage as Cause

7 CDs You Probably Owned, Threw Out and Now Are Worth Bank

American Idol star Mandisa’s cause of death disclosed

Joe Biden Suddenly Leads Donald Trump in Multiple Battleground States

My family covered the bridesmaids' expenses at my daughters' weddings because it didn't seem right to ask the women to pay

What to Know About POTS, a Condition Marked by Dizziness and Fatigue That’s Often Misdiagnosed

Michael Jordan credits his mother for his billion-dollar shoe empire: "She made me get on that plane and listen"

Homeowner shares frustrating before-and-after photos after neighbor destroyed their decades-old tree: 'You need a lawyer'

Iconic Hollywood Party Photos From the Past

Buy These 5 Affordable Cars That Will Last Beyond 200,000 Miles

IMAGES

VIDEO

COMMENTS

Three easy steps to claiming your refund in Switzerland: Step 1: Tax Free Form (Refund Cheque) Ask the shop staff for a Tax Free Form (Refund Cheque) when paying for your purchases. Step 2: Customs Stamp. When leaving Switzerland (before check-in), present your Tax Free form and the original receipt to Customs; they will export validate it.

When you go shopping in Switzerland, you pay a VAT charge. You can reclaim the VAT by asking the shop staff for a Tax-Free Form at the shops where you make your purchases. The form is basically a refund check. Carefully fill in all of the fields on the form. Only complete or correct information will ensure you get a VAT refund.

Find out more about the so-called «Tax-free for tourists» here. The following explanations are based on the Ordinance of the Federal Department of Finance dated 24 March 2011 on the Tax Exemption of Domestic Supplies of Goods for the Purpose of Exportation in Tourist Traffic (SR 641.202.2; Exportation in Tourist Traffic Ordinance).

The standard VAT tax rate is set at 7.7% of which Switzerland can refund an amount that is between 4.5% and 5.4% of the amount you spend on products subjected to standard VAT rates during your trip. The minimum purchase threshold is 300 CHF per invoice. Refunds that are available for tax-free purchases in Switzerland are only valid for VAT.

Value added tax (VAT) is a multi-stage sales tax, the final burden of which is borne by the private consumer. VAT at the appropriate rate will be included in the price you pay for the goods you purchase. As a visitor to the EU who is returning home or going on to another non-EU country, you may be eligible to buy goods free of VAT in special shops.

Shop the best of Luxury in Switzerland, check the country rules and secure your refund with Global Blue. Tax Free Shopping in Switzerland. ... Printed Tax Free Forms validated by Customs and original receipt must be sent to: Standard and registered mail Global Blue P.O. Box 363, 810 00 Bratislava, ...