- Argentina

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Best Euro cards in the US [2024]

If you’re planning a trip to Europe you might be wondering about the best way to get a EUR card before you head off to make it easier and cheaper to spend euros while you’re away. Using a EUR card can also help you manage your travel money budget and access better exchange rates – but which euro cards are best to pick?

This guide walks through all you need to know, including a look at how EUR cards from providers like Wise and Revolut can help you get a better deal on your overseas spending.

Go to Wise Go to Revolut

Quick summary: Best euro cards comparison

Wise debit card : Great for multi-currency management, the Wise card offers free spending in currencies held in your multi-currency account, including euros, alongside low currency conversion fees and two free monthly ATM withdrawals.

Revolut debit card : Offers a range of account options, some with no fees, with physical and virtual card options. All account plans allow you to hold and exchange EUR and feature some no-fee euro currency conversion. However, there are fees for currency conversion outside of these limits.

Bluebird AmEX Prepaid : While the card doesn’t support holding euros, it’s useful for US travelers in Europe thanks to no foreign transaction fees on USD balances. You can order the card for free online, but it comes with an annual fee.

Capital One Venture Rewards : Offers no foreign transaction fees on euro purchases and a low cash advance fee when taking cash out of European ATMs. You can also earn travel rewards on spending and get extras like free travel insurance, but it comes with an annual fee.

4 best Euro currency cards in the US: A comparison

The good news is that there’s a pretty wide choice of Euro cards you can get from the US. Let’s look at our top 4 picks so you can decide which is right for you. We’ll cover 2 Euro debit cards as Wise and Revolut as well as 2 prepaid Euro cards from BlueBird AmEx and Capital One. First, a quick overview:

2 great Euro debit cards

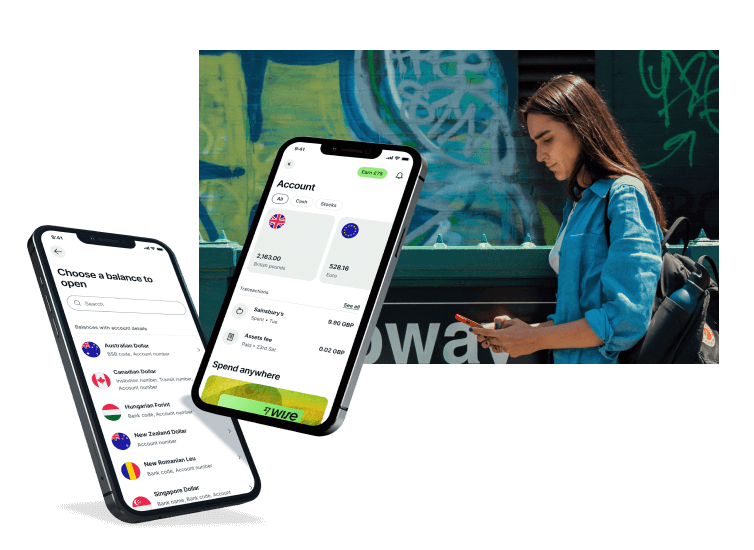

Open your Wise account online or in-app, to hold and exchange 40+ currencies . Order your Wise card for a low one time fee, and top up for free in USD.

Then convert to EUR using the mid-market rate and low, transparent fees for simple spending when you travel. You can get local account details for Euro and a selection of other currencies to get paid like a local with Wise account , and you can also send payments to 160+ countries with Wise money transfer , and spend with Wise card in over 150 countries.

Get Wise card

Read our Wise card review or Wise Euro Account review to learn more.

Revolut card

You can open a Revolut account or choose to upgrade to an account with more features, for a monthly fee of up to 16.99 USD. All accounts come with the option to hold and exchange EUR, and linked physical and virtual cards for easy spending.

Depending on the account you hold you can get some no-fee currency conversion, too, with relatively low fees once your plan allowance is exhausted – 0.5% in most cases. A couple of other charges might apply, including an out of hours conversion fee of 1% which you’ll want to watch out for.

Go to Revolut

2 great prepaid Euro cards

As for prepaid Euro card options, Bluebird AmEx and Capital One Venture Rewards cards:

Bluebird American Express prepaid debit card

You can order a Bluebird prepaid debit card for free online. You’ll then be able to top up in cash or from a bank account. You can also add checks or have funds deposited by others – fees apply for some top up methods. While this card doesn’t allow you to hold foreign currencies, you won’t pay a foreign transaction fee to spend your USD balance abroad, which makes it a good choice when you’re in Europe.

Capital One Venture Rewards

The Capital One Venture Rewards card has no foreign transaction fees when you spend overseas. There’s also a comparatively low cash advance fee when you use an ATM, at 5 USD or 5% whichever is higher. You’ll need to repay your bill in full every month to avoid fees and interest, but can earn travel rewards and miles on your day to day spending.

What is a euro card?

A Euro currency card is a card that can be used conveniently for spending and withdrawals in euros. These cards are also called multi-currency cards and they usually come with other currencies available too. You’ll be able to top up your account in USD or the currency of your choice based on the specific provider’s options, and convert to euros before you travel. That means you can plan your budget in advance, and lock in exchange rates before spending.

How do Euro travel cards work? 🇪🇺

When you get a Euro card from digital platforms like Wise and Revolut , they’ll usually be linked to a foreign currency account like a euro account , letting you hold and manage multiple currencies, including euros. These cards allow you to spend euros abroad while traveling to Eurozone countries easily and often provide competitive exchange rates alongside reduced fees to everyday bank cards, making them a popular choice for travelers.

Benefits of Euro currency cards

Getting a Euro currency card is a great bet if you’re headed to any of the 20 European countries which use the euro .

It can make it safer for spending while you’re away as you won’t need to carry a lot of cash – and your travel money account isn’t linked to your regular bank account so even if you were unlucky enough to have your card stolen, the thieves won’t have access to your main bank account.

Using a euro card while you’re away can also cut the costs of currency conversion, and allow you to get a better exchange rate. You’ll be able to add money in USD and switch to euros when you spot a good rate – and some card providers also offer better rates compared to the banks, as well.

Is there a euro debit card?

Yes, euro debit cards like the Wise and Revolut debit cards are widely available for US residents. These cards are designed to make spending in euros more convenient, especially for travelers going to the Eurozone.

Users can add money to their card in USD and convert it into euros either before or during their trip as needed for extra flexibility. Euro debit cards can also help manage travel expenses more efficiently, ensuring travelers always have easy access to finds in the local currency.

Is it better to take euros in cash or use a debit card in Europe?

Taking cash in euros or using a debit card when on your European travels will largely depend on what you personally find more convenient. While cash guarantees you can pay everywhere, especially in smaller establishments or rural areas, carrying large amounts of money can be risky. It also doesn’t leave a spending trail, meaning you can’t go back and check what you spent your money on or manage your finances as easily.

A debit card is a secure and convenient way of managing your money abroad, allowing you to easily track your expenses on the mobile app, and offers security features like card freezing or replacement options in case of theft or loss. You also have the added convenience of contactless payments and paying with your phone with Google and Apple Pay for extra convenience.

Is it better to pay with euros or dollars on a card?

It’s usually always cheaper to pay in the local EU currency for countries that use the euro when you’re abroad in Europe. While you can pay in US dollars using your US card, you’ll have to pay currency conversion fees, which could be high. Plus, exchange rates on your US card may not be great. That’s because your US card is linked to dollars, so they’ll need to be converted into euros. When you do this, your card’s network will apply their exchange rate, which might not always be the best one.

That’s why, to save money, you should make all your purchases in the local currency. Plus, travel money cards for Euro offer great advantages to keep the costs down. Luckily, Wise offers a convenient alternative, allowing you to hold and exchange over 40 currencies with the Wise card . Top up easily in US dollars and convert to euros using the mid-market exchange rate alongside low, transparent fees for low-cost spending across the continent.

Where can I use a Euro card?

A currency card allows you to pay in the local currency when you travel, without incurring extra costs. A EUR card is perfect if you’re headed off to any of the 20 countries which use euros, as you can top up in USD and buy Euros in advance so you know your budget in the local currency. Some cards also offer the option to convert at the point of payment, which means you don’t need to worry about getting set up in advance.

- Wise debit card : Can be used globally, including in all Eurozone countries and supports spending and cash withdrawals in over 150 countries.

- Revolut debit card: Designed for international use, you can make payments with your Revolut card in all European countries that accept Mastercard or Visa.

- Bluebird AmEx prepaid card: Good for global use, the card uses the Visa network and can be used anywhere where AmEx cards are accepted.

Capital One Venture Rewards card: Also on the Visa network, this card can be used anywhere Europe where Visa cards are accepted.

EUR card in the US

All of the EUR cards we have profiled above can be used in the US too – but you might find that fees apply. If you don’t hold an USD balance in your account and you use your EUR card here at home, for example, you might pay a conversion fee to switch back from euros to dollars.

Related: Best EUR account in the US

Costs of getting a Euro card in the US

Each provider will have their own fees for euro cards – which can vary pretty widely. With prepaid cards, it’s important to review the costs in detail before you pick a card as the charges applied may be quite different to using a regular debit card. You might find fees to top up, for example, and different charges for spending and withdrawing in different currencies. With credit cards, as you’d expect, there may be costs and interest charges if you don’t repay your bills in full every month.

Learn more about Wise fees here.

Euro card fees

Here’s an overview of the fees applied on the EUR cards we picked out earlier, to give you a bit of a picture. Other charges may also apply, so do check out the provider you’re choosing carefully.

What exchange rate will be used?

You’ll likely need to convert currencies at some point when you use your EUR card, so the exchange rate you get matters. If you top up in USD and convert to EUR, getting a bad rate will mean less to spend in the end. Different providers have their own approaches to calculating the exchange rate.

Wise exchange rate : Wise offers mid-market rates, and has a transparent fee which is split out, starting from 0.43%, for example.

Go to Wise

Revolut account holders can all convert some funds no-fee, but the amount you can convert might be limited depending on your account tier. Once you’ve exhausted your allowance you’ll pay a fair usage fee of 0.5%, plus 1% out of hours costs if relevant. Other providers may take a different approach, adding a markup or foreign transaction fee when you convert or spend in a foreign currency.

Go to Revolut Bluebird AmEx : Cards like Bluebird often use American Express exchange rates when it comes to currency conversion. The card features no foreign transaction fees, but network rates will apply, usually 2.5% of the converted amount, of which American Express retains 1%.

Capital One: Capital One doesn’t charge foreign transaction fees for purchases made in Europe and internationally, but Capital One network exchange rates may apply for currency conversions.

Check out this page to find the best Euro exchange rates .

Best euro card in the US with no fees

When choosing a euro card in the US, it’s important to understand that they usually have varying fee structures. Some may have monthly fees, while others might charge for transactions, including ATM withdrawals.

Wise debit card : The Wise card links to your multi-currency account and lets you hold and exchange over 40 currencies, including Euros, with no annual or monthly charges. Spend using the mid-market rate with no markups or sneaky fees and take out up to 100 USD in cash from European ATMs for free before paying low fees for additional withdrawals. Order a card in just five minutes and pay a one-time fee of 9 USD.

Revolut debit card : Revolut offers various account tiers, including options with no monthly fees and a plan for 16.99 USD with more features. Each plan has a linked physical and virtual card that can hold and exchange in euros, with some no-fee currency conversion for easy spending. However, fees apply once you’ve used up your plan allowance, around 0.5%, as well as 1% out-of-hours conversion fees.

Bluebird AmEx prepaid card: Bluebird AmEx prepaid cards can be ordered online for free and topped up in multiple ways with USD. There’s no foreign transaction fee for overseas spending, but it does have a $2.5 ATM withdrawal fee when using abroad. You’ll also need to check coverage before traveling, as American Express cards aren’t always accepted internationally. Capital One Venture Rewards card: With no foreign transaction fees and a low cash advance fee of 5 USD or 5% (whichever is higher) when using an ATM, this card is a convenient option for international travel. It has a 95 USD annual fee and variable interest rates that apply if you don’t pay off your bill in full every month, but it offers travel rewards on spending and extras like lounge access and free travel insurance.

Can I use my US debit card in Europe?

Debit cards from most US banks and major card networks will work in Europe, meaning you can use your US debit to make purchases and take cash out from European ATMs. However, you should be aware that you may not get the best exchange rates, and, depending on your bank and card, there might be some considerable foreign transaction fees, usually ranging from 1% to 3% of the transaction, as well as international ATM fees. Always check with your bank for specific fees and inform them about your travel plans to avoid any issues when using your card abroad.

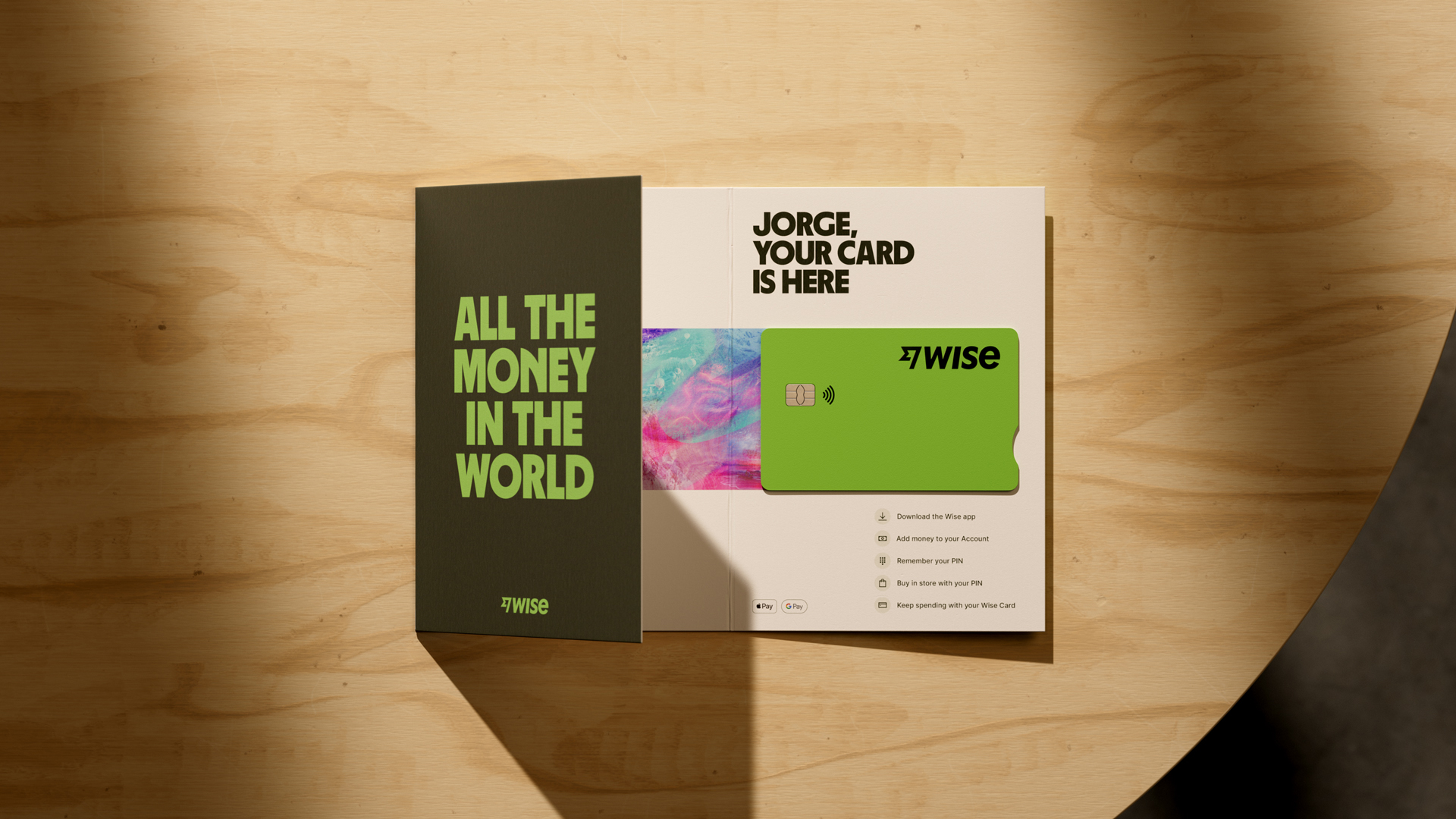

How to get a Euro card in the US

All the providers we’ve looked at above allow you to order an EUR card online or through an app. You’ll need to have a suitable form of ID to get your card – usually a passport or driving license, and you might be asked to provide your proof of address as well. Once you’ve ordered your card it’ll arrive in the mail shortly after.

Check out the EUR card order process for the provider you prefer, so you can prepare everything that’s needed.

Related: How to get a Wise card

Check out our other travel money guides from this series:

- Best AUD cards

- Best Mexican Pesos cards

- Best GBP cards

- Best travel cards for Europe

- Best ways to take money to Europe

Conclusion: What is the best card to use for Euros?

EUR cards are extremely useful for travelers – and can also be handy for people who shop online with retailers based in Europe. Get your euro card in advance from the US, add USD and convert to euros so you’ve got your travel money sorted and can see and manage your budget easily.

Depending on the provider you pick you might also find you get better exchange rates and lower overall costs compared to using your standard bank card overseas. Options like Wise and Revolut offer easy ways to hold and convert dozens of currencies, to make travel cheaper and easier.

Get Wise card Get Revolut card

Best Euro cards FAQs

What are the benefits of using a euro travel money card.

Using a EUR card when you’re in any of the 20 euro countries can mean you get a better exchange rate and lower overall fees. You’ll also be able to manage your budget in euros easily.

Are Euro money cards available in the US?

Yes. You can get a card with low or no foreign transaction fees from a bank like Capital One, a network like Amex – or pick an online specialist provider like Wise or Revolut for a card and account that offers even more features.

How much does a Euro travel money card cost?

Most EUR cards have low or no initial fees, but you’ll need to look at the transaction costs that apply when you use your card. These costs include fees for topping up, ATM withdrawal charges and inactivity or closure fees.

The Backpacker Network

Travel Cards for Europe – The Best Options for Travellers!

Choosing the right travel card for Europe can be complicated. There are a lot of factors to consider: exchange rates, fees for spending or withdrawing, type of card, payment processors, plus travel rewards and perks.

Get it right and you’ll be a budgeting ninja – you’ll know exactly how much you’ve spent and how you’re going to pay for everything you need. Get it wrong and you’ll be more clumsy clown than ninja! Hefty bank fees, poor exchange rates and potentially being unable to access your hard-earned money are all risks you take when you pick the wrong bank card for European travel.

We’ve trawled the internet for information about travel money cards, so you don’t have to. This research, combined with our own experiences and recommendations from our backpacking community on the ground, has helped us put together this shortlist of the best travel money cards for Europe.

Top Three European Travel Cards

Disclosure: Some links on this page are affiliate links. We always write our articles before checking if affiliate links are available.

- Available to European Economic Area residents.

- Limited fee-free withdrawals.

- Use the interbank exchange rate.

- Only available to UK residents.

- Unlimited fee-free withdrawals

- Use the Mastercard exchange rate.

- Fee-free withdrawals depending on the country the card was issued in.

- Multi-currency accounts.

- Low fees when transferring money.

Related: (links open in a new tab)

- Cheapest Cities in Europe

- Cheapest Countries in Europe

- Europe Budget Guide

Types of Travel Card for Europe

Debit cards for travel .

You’re bound to be familiar with debit cards. They’re provided with almost every current account as standard. The idea is that money is taken from your account as soon as it’s spent, making it easy to keep track and avoid spending more than you can afford. But not all debit cards are created equal.

Many traditional banks charge ridiculous fees for using your card abroad or withdrawing money from foreign ATMs. On top of this, they often deliver a poor exchange rate, meaning the bank profits from you swapping your money into a foreign currency.

Travel debit cards from digital or challenger banks tend to be much better for use in Europe. There are very few charges and you can usually withdraw at least some cash without paying foreign withdrawal fees. The exchange rate at challenger banks tends to be better too, often sticking to the official Mastercard or interbank rate. This means you can be sure the bank isn’t profiting from you needing some euros!

Prepaid Travel Cards for Europe

A prepaid travel card is essentially a debit card that needs to be topped up from your bank account. You can top them up using online banking, via an app or in certain stores and establishments. When the funds are loaded, you can use the card as a regular debit card.

Until the relatively recent rise of digital banks, prepaid euro cards were an excellent choice for anyone travelling the continent. While they still have plenty of fees attached, they’re cheaper than traditional banks. However, with the swell of challenger banks offering excellent debit cards for travel, there’s no real need to use a prepaid card anymore.

If you do opt for a prepaid euro card, ensure you understand the fees and exchange rates. Prepaid cards that take multiple currencies may offer a fantastic exchange rate if you convert the money to euros straight away. But, if you load the card with your home currency, the exchange rate for each foreign transaction is generally much worse. It’s also worth noting that some even charge you to a small fee to top up!

Credit Cards for Travel in Europe

Travel credit cards are an excellent way to save money in Europe – but only if you’re careful! Make sure you pay off the balance each month. If you don’t, the interest you’ll need to pay will negate any savings you’d otherwise make.

Most credit cards for travel offer fee-free transactions, no matter where you are in Europe. However, very few offer fee-free cash withdrawals – and even if they do, there is usually a higher interest rate attached to withdrawing cash on a credit card.

As well as fee-free transactions, travel credit cards tend to offer points for every pound, dollar or euro you spend. These points add up over time and can be redeemed for air miles, hotel stays and a range of other incentives, including cold hard cash! Exactly what is on offer will depend on your credit card provider, so shop around to make sure you get the best deal!

Direct Debit Travel Card

Direct debit travel cards offer a unique way to save money in Europe: simpler than opening a new bank account, easier than getting a new credit card and far less faff than choosing a good prepaid euro card, direct debit travel cards are changing the game.

They connect to your normal bank account and you use them as a traditional debit card. The only difference is that the transaction goes through the travel card provider who act as an intermediary between your bank and the card machine you’re using. This step means your bank won’t charge you foreign transaction fees, saving you a small fortune!

The Best Money Cards for Europe!

- Available to customers from the European Economic Area as well as many more countries!

- Multi-currency accounts on offer

- Limited free foreign withdrawals

Available to customers from many countries – As well as being available to anyone with an address in the European Economic Area , Revolut offer accounts to anyone from Australia, New Zealand, Singapore, Switzerland, UK, USA, Japan and Brazil. Revolut also offer ‘lite’ accounts to customers from other countries too!

Visa or Mastercard – Whether you get a Mastercard or Visa Revolut debit card will depend on where you live and where your account is registered. Both Visa and Mastercard work across Europe, so you won’t have an issue with either!

Spending and Withdrawals – Revolut allow you to withdraw £200GBP ( the exact amount may be slightly different in your local currency ), or make five withdrawals per month fee-free. After this, a 2% cash withdrawal fee kicks in. You also get limited fee-free card transactions each month. The first £1000GBP spent on your card (not including cash withdrawals) comes with no additional fees. After the first £1000GBP, a 0.5-1% fee applies to every transaction. With Revolut’s paid accounts, the withdrawal and spending limits are higher.

App-Based – Revolt offer full control of your account through the app. You can open a current account, multi-currency account, lock the card and create single-use digital debit cards all from the comfort of your sofa – no more needing to queue up at the bank to tell them you’re going travelling!

Accommodation Bookings – Revolut Stays allows you to book accommodation through the Revolut app and get 3-10% cashback!

You must be 18 and over to open a Revolut account. Read the full T&Cs .

- Free foreign withdrawals

- Deluxe accounts available for an additional fee

- Uses the interbank exchange rate

- Free withdrawals are limited to a certain amount of money each month

- Exchange rate changes at the weekend

- Fee-free foreign spending is limited

Starling Bank

- Fee-free foreign withdrawals and transactions

- Uses the Mastercard exchange rate

- Account set-up is quick and easy

Withdrawals – Starling allow you to withdraw up to £300GBP or make six withdrawals per day . There are no foreign withdrawal fees and Starling uses the Mastercard exchange rate with no markup. There are also no fees for using your card to pay directly when in Europe!

Ethical Banking – Starling seem determined to do things differently. They have clear ethical and environmental goals laid out on their website . While your typical high street bank is investing your money in firearms, tobacco, alcohol and fossil fuels, Starling opt for ethical investing!

Works Across Europe – Starling Bank provide a Mastercard with their accounts. This works almost everywhere in Europe!

Helps You Budget – Thanks to spending notifications, spending categories, saving spaces and goals, Starling helps you accurately budget before and during your trip. You can create a virtual debit card for each saving space, allowing you to closely monitor your spending while you travel in Europe!

- No fees on foreign spending or withdrawals

- Easily replaces your traditional bank

- Full control from your phone

- Only available to those with a UK address

- No fee for foreign transactions

- Multi-currency account – hold up to 50 currencies at once

- Some free foreign withdrawals – the exact amount depends on where you live and where the account is registered

Perfect for Digital Nomads – If your work involves clients in multiple countries, Wise has you covered. A Wise account allows you to be paid in and store multiple currencies.

Visa or Mastercard – Wise provide either a Visa or Mastercard depending on where you live and where your account is registered. However, not all Wise customers are eligible for a debit card with their account, this also depends where you live. See the full list of card-eligible countries here .

Fees for Withdrawing Cash – Wise offer some free cash withdrawals each month. The exact amount you can withdraw before incurring fees depends on where you live and where the account the registered.

Fees for Foreign Transactions – Wise allow you to spend money on your card fee-free but only if you have the correct currencies stored in your account. If not, they charge a small conversion fee for each transaction.

- Available to residents of almost every country

- Can store and spend multiple currencies with one account

- Low international transfer fees

- Not all accounts come with a debit card (it depends on where you live)

- The card doesn’t work in every country

- No foreign transaction fees

- Uses Visa’s live exchange rate

- Works in all European countries

Fees – Although you can access a network of over 60,000 ATMs fee-free in the USA, you’ll need to pay a $2.50USD fee to withdraw money abroad with your Chime debit card. However, there are no international transaction fees with Chime, so you can pay for things on your card without having to stump up for an additional fee.

Exchange Rate – When spending abroad with your Chime debit card, you’ll get the live Visa exchange rate. While fractionally worse than the Mastercard exchange rate, it’s still much better than using a money changer or letting traditional banks dictate the exchange rate. Remember to always pay in the local currency if you see the option on an ATM or card terminal!

App and Website – Both Chime’s smartphone app and website give you an excellent level of control of your account. Make sure you enable international spending either through the app or website, so you can use the card abroad! Failure to do so will prevent the card from working and could see Chime block the card due to suspicious activity!

Withdrawal Limit – Chime offer a generous $500USD daily withdrawal limit. If you’re withdrawing money abroad, you should withdraw the maximum possible to reduce the frequency you’ll be paying the $2.50USD foreign withdrawal fee!

- No rolling monthly fee

- High daily withdrawal limits

- Easy to control your account through the app or website

- Only available to customers in the USA

- No contactless card payments possible (does work with Apple and Google Pay though)

- Not all online payments are supported by Chime

- Connects with your traditional bank account

- Use the Currensea card as you would a normal debit card

- Removes foreign transaction fees usually levied from your bank

Easy to Use – While getting another travel card or opening a new bank account can feel like a hassle, Currensea making spending money in Europe easy! Thanks to open banking laws, a Currensea direct debit travel card hooks straight into your bank account, allowing you to spend money with reduced fees while abroad. Simply use the card as you would your normal debit card and Currensea handle the rest!

Different Plans – Currensea offer three different plans. The free plan offers everything you need for a shorter trip but if you travel a lot, getting either the Premium or Elite plan gives you access to better exchange rates, larger fee-free withdrawals and a range of other perks such as hire car discounts, hotel bonuses and even airport lounge access with the Elite card!

Mastercard – The Currensea direct debit travel card is powered by Mastercard. This means you can use it anywhere that accepts Mastercard (almost everywhere in Europe)!

- No need to set up a new account

- Up to £500GBP fee-free withdrawal each month

- Different plans available depending on your needs

- Small fees for foreign withdrawals after the £500GBP limit is reached

- 0.5% foreign transaction fee with the free account (no transaction fee with paid accounts)

- Still leaves you reliant on your major high street bank

Prepaid Euro Cards

While not necessary in the age of digital banks and FinTech companies, prepaid euro cards are still relatively popular – more popular than they deserve to be, honestly.

Prepaid travel cards tend to have lower fees than your traditional high street bank but the costs are higher than opting for a digital bank or even a direct debit travel card. Some prepaid cards also have nasty hidden fees, such as a fee for loading money onto the card, or a fee for getting any leftover money back after your trip.

We don’t like to recommend prepaid travel cards because they serve little purpose in today’s digital world but in case you’ve already made up your mind, these are the most popular options among travellers to Europe!

- Travelex – Best for Travellers from the USA

- Monese – Top Choice for Travellers from the UK

- Fair FX – Top Choice for Travellers from the EU

- PayPal Prepaid Mastercard – Another Good Option for Travellers from The USA

Travel Money Cards for Europe – Your Questions Answered!

Which cards are accepted in europe.

Mastercard and Visa cards are widely accepted throughout Europe and the rest of the world. You may have a hard time using an American Express card in Europe, although they’re more common than they used to be. Discover cards are less accepted than American Express. If you only have a Discover or American Express card, we recommend supplementing your wallet with a Mastercard or Visa as well!

What is a Travel Card?

Travel cards allow you to access your money, either via card transactions or an ATM, abroad, without incurring high fees from your traditional bank. They come in different forms:

– Travel Credit Cards – Usually just regular credit cards with low or no foreign use fees and often include travel-based incentives like air miles or discounts on hotel stays. – Travel Debit Cards – Can be used like a normal debit card. Often travel debit cards are supplied by a travel-friendly bank but you can also get prepaid travel debit cards that you top up from your traditional bank. You can also get direct debit travel cards which connect to your traditional bank and allow you to bypass your bank’s fees.

Travel Cards for Europe – A Round-Up

Getting the right travel card for Europe won’t make or break your trip but it can mean the difference of a few hundred dollars, even over a couple of weeks of travelling! For a longer adventure, the savings you’ll make will allow you to upgrade your accommodation choices or treat yourself to good restaurants while you travel!

It really is a no-brainer! Grab your travel card, book your flight and head to Europe for a backpacking trip to remember! Have we missed your favourite travel card from our list? Let us know in the comments below!

Tim Ashdown | Writer and Gear Specialist

After a life-changing motorcycle accident, Tim decided life was too short to stay cooped up in his home county of Norfolk, UK. Since then, he has travelled Southeast Asia, walked the Camino de Santiago and backpacked South America. His first book, From Paralysis to Santiago, chronicles his struggle to recover from the motorcycle accident and will be released later this year.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

The 6 Best Travel Money Cards for Europe

If you’re travelling to Europe, a travel money card can make spending and withdrawing cash when you’re away cheaper and more convenient. Different types of travel money cards, including travel debit cards, prepaid travel cards and travel credit cards, are available to support different customer needs. The right one for you will depend on your personal preference and how you like to manage your money.

Read on for all you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

Wise - our pick for travel money card for Europe

Before we get into details about different travel money card options, let’s start with the Wise card as a good all-round option that allows you to hold and spend euros, as well as a diverse range of other European and world currencies.

Wise accounts have the flexibility to hold and exchange more than 50 currencies, plus you can get a linked Wise card for a one-time delivery fee. You can either top up your account in pounds and switch to EUR, RON, HUF, NOK, DKK, SEK or any of the other supported European currencies before you travel.

Click here to read a full Wise review.

Here are some of the advantages and disadvantages of using the Wise travel money debit card, to help you decide if it's suitable for you.

Hold and exchange 50+ currencies including EUR and a selection of other European and world currencies

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

7 GBP delivery fee

No option to earn points or rewards

What is a travel money card?

Similar to your standard bank card, a travel money card is accepted for online and in-store transactions, as well as cash withdrawals - but the features and fees you’ll get are tailored for international usage. That can lead to benefits such as improved exchange rates and reduced fees compared to your regular card.

If you’re headed to Europe, you could find a travel money card which supports the currency or currencies in the destinations you’re visiting is a good idea. While much of Europe uses the euro, there are actually 29 different European currencies, so you’ll need to double check what’s needed wherever you’re headed.

6 travel money cards for Europe compared

Before we get into each card option in more depth, here’s a summary of how six of the best travel money cards for Europe compare to each other.

The features of various travel money cards can differ significantly. Typically, travel debit cards are cost-effective and convenient, while travel credit cards offer advantages such as cashback or rewards, but may result in interest and late payment fees, depending on how you choose to pay.

Travel debit cards usually allow you to easily add funds online or via a mobile app, which helps you stick to your budget and avoid overspending. Conversely, travel credit cards enable you to spend up to your credit limit, and you can pay off the balance over several months. The choice between the two will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Generally, UK customers are able to select a travel money card from either a regular bank or a specialist provider, with card types available including travel debit cards, travel prepaid cards or travel credit cards. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Travel debit cards from specialist providers have linked digital accounts you can use to hold and convert a currency balance. It’s common to find a good selection of major currencies supported, including euros, Norwegian or Danish kroner, Swedish kronor, Romanian lei and more. While different cards have their own features, travel debit cards can usually be topped up easily online and through an app, with the option to see your balance and get transaction notifications through your phone too. That makes it easier to keep on top of your money, even when you’re away from home.

Travel debit card Option 1: Wise

Wise is our best value travel money debit card for Europe. There’s no fee to open a Wise account, and just a small delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent transaction fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account, no minimum balance requirement

7 GBP one time fee to get your Wise card

2 withdrawals, to 200 GBP value per month for free, then 0.5 GBP + 1.75%

Hold EUR and 50+ other currencies, convert between them with the mid-market rate

Get local account details to receive EUR, HUF, RON and 7 other currencies for free

Travel debit card Option 2: Revolut

Revolut has a selection of different account tiers, so you can simply pick the account you prefer - from free Standard plans to the 12.99 GBP/month Metal plan. All Revolut accounts have linked cards, although exactly what type of card you get depends on your account tier. You can hold around 25 currencies including EUR, PLN, DKK, SEK and a selection of other major European currencies, and convert between them with the mid-market rate to your plan’s allowance.

No fee to open a Standard Revolut account, or upgrade for up to 12.99 GBP/month

Card delivery fees may apply depending on your account tier

All accounts have some fee free currency conversion with 0.5% fair usage fees after that

Standard plan holders can withdraw 200 GBP (up to 5 withdrawals in total) per month for free

Hold EUR and around 25 other currencies

Click here to read a full Revolut review

Pros and cons of using debit travel cards in Europe

Avoid interest costs and late payment fees

Hold and exchange currencies in advance or at the time of spending

Accounts can be topped up, viewed and managed using just your phone

Safe to use, as accounts aren’t linked to your main UK bank account

Travel debit cards are issued on popular global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

How to choose the best travel debit card for Europe?

The best travel debit card for Europe really depends on your personal preferences and how you like to manage your money. If you’ll be travelling widely it makes sense to look for an account with mid-market currency exchange and a large selection of supported currencies as well as EUR, like Wise. Other providers like Revolut can also be a good pick, particularly if you’ll use your account very frequently and would prefer to pay a monthly fee to unlock lots of fee free transactions and extra perks.

Is there a spending limit with a travel debit card in Europe?

Card use limits are determined by individual providers and can vary depending on the transaction type. Limits may apply on a daily, weekly or monthly basis. For instance, there may be a cap on the number or value of ATM withdrawals allowed per day or a limit on the value of contactless payments you can make. These limits are set for security reasons and can often be adjusted using the provider's app.

2. Prepaid Travel Cards

With a prepaid travel card you’ll usually need to first order a card and then add funds in the supported currency of your choice. Once you have a balance you may then be able to switch to the currency you need, to pay merchants and make cash withdrawals. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - not all cards support all currencies, so you may find you pay a foreign transaction fee if you pick a card which doesn’t support all the currencies you use.

Prepaid travel card option 1: Post Office

You can pick up a Post Office prepaid travel money card in a Post Office branch or order one online. You’ll then be able to top up in pounds or one of the 22 supported currencies, which includes EUR alongside other major European currencies like NOK, DKK and SEK. There’s no fee to spend a currency you hold in your account when you’re in Europe, but if you don’t have a balance in the currency required - or if your balance isn’t high enough for the transaction, you’ll pay a 3% foreign transaction fee.

Hold and exchange 22 currencies including EUR

No fee to spend a balance in a supported currency

3% foreign transaction fee when spending a currency you don’t hold on the card

Variable ATM withdrawal fees - 2 EUR for use in Eurozone countries, for example

No interest to pay

Prepaid travel card option 2: Monese

Monese accounts can be opened by UK residents to hold GBP, EUR and RON. There are several different types of accounts, from the Simple account which has no monthly fees, to fee paying account tiers which have more features. It’s free to spend a balance you hold, so getting a EUR or RON account makes sense if you’re headed to Romania or any of the Eurozone countries. If not, you may find you pay a foreign transaction fee of 2% when you’re spending in Europe. Foreign transaction fees may be waived for higher tier account holders.

Hold a balance in GBP, EUR or RON

Choose a free Simple account, or upgrade to an account with monthly fees

Foreign transaction fees of 2% may apply if you don’t hold a EUR/RON balance, depending on your account tier

ATM withdrawal fees may apply, depending on the value of withdrawals and the account tier you hold

Track and spend Avios reward points within your account

Pros and cons of using prepaid travel cards in Europe

Manage your account, add more money or convert funds online or with an app

Accounts with no monthly fees are available

Selection of supported currencies, with no fee to spend a currency you hold

ATM withdrawals supported globally

Some accounts have extras like options to earn reward points

Typically not a huge range of currencies supported

Transaction fees apply to most accounts

How to choose the best travel prepaid card for Europe?

There’s no single best travel prepaid card for Europe - it’ll come down to your personal preference. If you hold a Monese account that supports the currency wherever you’re headed, or a Monese Classic or Premium account which waives foreign transaction fees, you might find it’s cheaper to stick with Monese when in Europe compared to using your regular bank card. The Post Office card can also be a strong pick as you can hold a balance in euros and a large selection of other major European currencies, plus you can get a card instantly by walking into a Post Office branch.

Is there a spending limit with a prepaid card in Europe?

Different prepaid travel cards set their own limits for spending and withdrawals, which can vary between currencies. You’ll need to check your card’s terms and conditions carefully to make sure you pick a provider which suits your needs.

3. Travel Credit Cards

Travel credit cards typically offer some extra international features compared to regular credit cards, such as low or no foreign transaction fees or extra option to earn rewards when you’re abroad. In general, travel credit cards are safe and convenient but can be more expensive compared to using a debit card option. Before you select the right card for you it’s important to check the fees, rates, eligibility rules and interest rates which apply, so you can make sure it’s a good fit for you.

Travel credit card option 1: Barclaycard Rewards Visa

The Barclaycard Rewards Visa card doesn't charge foreign transaction fees or international ATM fees. Instead, your spending abroad is converted into pounds using the Visa exchange rate and added to your monthly bill. To avoid fees and interest charges, you must pay your bill in full every month. However, you can earn cashback on your everyday purchases.

No foreign transaction or foreign ATM fee

Earn cashback at 0.25% on spending

Protection on purchases over 100 GBP

International spending uses the Visa exchange rate

Variable interest rates which apply if you don’t pay off your bill in full

Travel credit card option 2: Halifax Clarity Mastercard

When you check your eligibility for the Halifax Clarity Mastercard, you'll be able to see the variable interest rate that’s available to you. No matter what rate’s offered, you won't have to pay any foreign transaction or foreign ATM fees, and all currency conversions are done using the Mastercard exchange rate.

Variable interest rates

Check your eligibility and order a card online easily

No foreign transaction fee

No ATM fee - but interest will accrue instantly when you make a withdrawal

Mastercard exchange rates apply

Pros and cons of using credit cards in Europe

Spending from 100 GBP has extra consumer protection

Spread the cost of your travel over several months

Check eligibility for a card online with no impact on your credit score

You may pay no foreign transaction fee and no ATM fee

Network exchange rates usually apply, which are usually pretty fair

Interest charged if you don’t repay in full every month

Eligibility rules apply

How to choose the best travel credit card for Europe?

Selecting the best travel credit card for Europe largely depends on individual preferences. If you aim to earn rewards and cashback on your foreign transactions, the Barclaycard Rewards Visa may be a suitable option as it does not have a foreign transaction fee and provides cashback on all purchases. Whichever card you’re considering you’ll want to weigh up the potential fees you’ll need to pay against the rewards you can earn to make sure it’s worthwhile.

If you regularly travel to Europe, getting a travel money card which supports the currencies you need frequently can help you save money. Travel money cards have different features, and can be picked up via regular banks, online specialists and even the Post Office.

You could opt for a low cost travel debit card which comes with a linked account to hold a selection of currencies - like the Wise account. Or you might prefer a prepaid travel money card like the Monese card which can be linked to either a fee free account or an account which has monthly fees in exchange for lower transaction charges. Finally, another option is to get a travel credit card either to earn cashback and rewards, or to avoid foreign transaction fees.

The good news is that the UK market is well served for all types of travel money cards - use this guide to start your research and pick the right option for your specific needs.

FAQ - Best travel cards for Europe

You can usually make cash withdrawals with a credit card in Europe at any ATM that supports your card network. You’ll often find that a fee applies, and you may start to accumulate interest on the withdrawn amount immediately. Travel money debit cards from providers like Wise and Revolut can be a lower cost option for cash withdrawals overseas.

You can use your debit card anywhere you see the card network’s logo displayed. Visa and Mastercard networks are very well supported globally, including in Europe, making these good options to look out for when you pick your travel debit card for Europe.

Prepaid cards from reputable providers are safe to use at home and abroad. They aren’t linked to your main bank account which can offer extra peace of mind, and may also make it easier to manage your travel budget. However, you’ll need to check the card features and fees carefully to make sure you're getting the best match for your needs.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

The 6 Best Travel Money Cards for Europe - 2024

If you’re travelling to Europe, a travel money card can make spending and withdrawing cash when you’re away cheaper and more convenient. Different types of travel money cards, including travel debit cards, prepaid travel cards and travel credit cards, are available to support different customer needs. The right one for you will depend on your personal preference and how you like to manage your money.

Read on for all you need to know, including a closer look at travel money card types, some great options to consider, and the sorts of fees you need to think about when you choose.

Wise - our pick for travel debit card for Europe

Before we get into details about different travel money card options, let’s start with the Wise card as a good all-round option that allows you to hold and spend euros, as well as a diverse range of other European and world currencies.

Here are some of the advantages and disadvantages of using the Wise travel money debit card , to help you decide if it's suitable for you.

Hold and exchange 50+ currencies including EUR and a selection of other European and world currencies

No fee to spend any currency you hold, low conversion fees from 0.41%

Mid market exchange rate on all currency conversion

Some fee free ATM withdrawals every month

No ongoing fees and no interest to pay

ATM fees apply once you exceed your plan limits

No option to earn points or rewards

Click here to read a full Wise review

What is a travel money card?

Similar to your standard bank card, a travel money card is accepted for online and in-store transactions, as well as cash withdrawals - but the features and fees you’ll get are tailored for international usage. That can lead to benefits such as improved exchange rates and reduced fees compared to your regular card.

If you’re headed to Europe, you could find a travel money card which supports the currency or currencies in the destinations you’re visiting is a good idea. While much of Europe uses the euro, there are actually 29 different European currencies, so you’ll need to double check what’s needed wherever you’re headed.

6 travel money cards for Europe compared

Before we get into each card option in more depth, here’s a summary of how six of the best travel money cards for Europe compare to each other.

The features of various travel money cards can differ significantly. Typically, travel debit cards are cost-effective and convenient, while travel credit cards offer advantages such as cashback or rewards, but may result in interest and late payment fees, depending on how you choose to pay.

Travel debit cards usually allow you to easily add funds online or via a mobile app, which helps you stick to your budget and avoid overspending. Conversely, travel credit cards enable you to spend up to your credit limit, and you can pay off the balance over several months. The choice between the two will come down to how you like to manage your money - we’ll dive into a few more details about each card type, next.

What are different types of travel cards?

Generally, Canadian customers are able to select a travel money card from either a regular bank or a specialist provider, with card types available including travel debit cards, travel prepaid cards or travel credit cards. We’ll walk through what each travel money card type is, and pick out a couple of good card options, so you can compare and choose.

1. Travel debit cards

2. Travel prepaid cards

3. Travel credit cards

1. Travel Debit Cards

Travel debit cards from specialist providers have linked digital accounts you can use to hold and convert a currency balance. It’s common to find a good selection of major European currencies supported, including euros and British pounds. Some more flexible card options, like Wise, also support other European currencies like Norwegian or Danish kroner, Swedish kronor, Romanian lei and more. While different cards have their own features, travel debit cards can usually be topped up easily online and through an app, with the option to see your balance and get transaction notifications through your phone too. That makes it easier to keep on top of your money, even when you’re away from home.

Travel debit card Option 1: Wise

Wise is our pick for travel debit card for Europe . There’s no fee to open a Wise account, and no delivery fee for your Wise card, with no minimum balance and no monthly charge. You just pay low Wise fees from 0.41% when you convert currencies, and transparent ATM fees when you exhaust the monthly free transactions available with your account.

No fee to open a Wise account, no minimum balance requirement

No fee to get your Wise card, free to spend any currency you hold

2 withdrawals, to 350 CAD value per month for free, then 1.5 CAD + 1.75%

Hold EUR and 50+ other currencies, convert between them with the mid-market rate

Get local account details to receive EUR, HUF, RON and 6 other currencies for free

Travel debit card Option 2: Canada Post Cash Passport

You can pick up a Canada Post Cash Passport in your local Post Office, and top up your account in CAD. You can then switch your balance to any of the 7 supported major currencies - or you can just allow the card to convert to the currency you need, although there is a foreign exchange fee of 3.25% for doing so. You can use your Canada Post Cash Passport card in ATMs and wherever the network is supported. ATM fees apply which vary by currency.

Supports 7 major currencies, including euros and pounds

No fee to spend currencies you hold in your account

Variable ATM fee, 1.9 EUR when in the the Eurozone for example

1.5% fee for using your card in Canada - plus any applicable fee to convert funds back to CAD if you hold a foreign currency

Pros and cons of using debit travel cards in Europe

Avoid interest costs and late payment fees

Hold and exchange currencies in advance or at the time of spending

Accounts can be topped up, viewed and managed using just your phone

Safe to use, as accounts aren’t linked to your main Canadian bank account

Travel debit cards are issued on popular global payment networks

Transaction and currency conversion fees may apply

Cash back and rewards may not be available

How to choose the best travel debit card for Europe?

The best travel debit card for Europe really depends on your personal preferences and how you like to manage your money. If you’ll be travelling widely it makes sense to look for an account with mid-market currency exchange and a large selection of supported currencies as well as EUR, like Wise. Other providers like Canada Post also support EUR and GBP for your trip to Europe, and the Cash Passport can be conveniently collected in your local Post Office.

Is there a spending limit with a travel debit card in Europe?

Card use limits are determined by individual providers and can vary depending on the transaction type. Limits may apply on a daily, weekly or monthly basis. For instance, there may be a cap on the number or value of ATM withdrawals allowed per day or a limit on the value of contactless payments you can make. These limits are set for security reasons and can often be adjusted using the provider's app.

2. Prepaid Travel Cards

With a prepaid travel card you’ll usually need to first order a card and then add funds in the supported currency of your choice. Once you have a balance you can then pay merchants and make cash withdrawals at home and abroad. While prepaid travel cards are usually issued on large global networks - and can therefore be used pretty widely - you may find you pay a foreign transaction fee when overseas, depending on the specific card you select.

Prepaid travel card option 1: BMO Reloadable Mastercard

The BMO Reloadable Mastercard can be topped up in CAD and used when you travel in Europe. You’ll pay a 2.5% foreign transaction fee when overseas, but you’ll still have the advantage that - as with other prepaid and travel cards - this card is not linked to your primary bank account, so it can increase security when spending abroad. There’s a 6.95 CAD annual fee, but as this is a purchase card rather than a credit card, there’s no interest to worry about. You just top up and you can spend up to your account balance freely.

6.95 CAD annual fee, 2.5% foreign transaction fee

5 CAD ATM fee

No interest to worry about

Manage your card online or using your phone, to top up and view balance

Add funds from BMO or other Canadian banks directly

Prepaid travel card option 2: Koho Premium Mastercard

You can get up to 2% cash back with the Koho Premium Mastercard, and there’s no foreign transaction fee to worry about. Instead, you pay a monthly card fee of 9 CAD. The basic card is free to get, or you can upgrade to a Koho metal card for 159 CAD if you want a fancier way to pay when you’re at home and abroad.

9 CAD/month premium fee

No foreign transaction fee

Earn cash back on your spending

Pros and cons of using prepaid travel cards in Europe

Manage your account, add more money or convert funds online or with an app

Accounts with no monthly fees are available

Issued on globally popular networks for good coverage

ATM withdrawals supported globally

Some accounts have extras like options to earn cash back or reward points

Typically only CAD supported - watch out for foreign transaction charges

Transaction fees apply to most accounts

How to choose the best travel prepaid card for Europe?

There’s no single best travel prepaid card for Europe - it’ll come down to your personal preference. If you don’t mind paying a monthly fee you might like the Koho Premium card which waives foreign transaction fees, and other charges like ATM withdrawal fees. Otherwise, if you just want a simple prepaid card and don’t mind the foreign transaction fee when you’re in Europe, the BMO prepaid card might suit you.

Is there a spending limit with a prepaid card in Europe?

Different prepaid travel cards set their own limits for spending and withdrawals, which can vary between currencies. You’ll need to check your card’s terms and conditions carefully to make sure you pick a provider which suits your needs.

3. Travel Credit Cards

Travel credit cards typically offer some extra international features compared to regular credit cards, such as low or no foreign transaction fees or extra option to earn rewards when you’re abroad. In general, travel credit cards are safe and convenient but can be more expensive compared to using a debit card option. Before you select the right card for you it’s important to check the fees, rates, eligibility rules and interest rates which apply, so you can make sure it’s a good fit for you.

Travel credit card option 1: HSBC World Elite Mastercard

The HSBC World Elite Mastercard has been optimised for overseas use, with extra rewards on international spending and travel, plus no foreign transaction fees to pay. There are lots of ways to earn rewards, including variable new customer bonus offers - the downside is that there’s an annual fee of 149 CAD, so you’ll need to check if the benefits outweigh the costs. As with any other credit card, you’ll also need to pay off your bill in full every month to avoid interest charges.

149 CAD annual fee, 5 CAD ATM withdrawal fee

Variable interest rate

Options to earn rewards, including enhanced benefits for travel spending

Travel credit card option 2: Home Trust Preferred Visa Card

The Home Trust Preferred Visa Card is a credit card with a variable interest rate, no foreign exchange fees and 1% cash back on all eligible purchases. There’s no annual fee to pay, although the ATM withdrawal fees can run pretty high - 1% or 1.5% depending on the ATM type, and the maximum cap is 15 CAD for some withdrawals.

No annual fee, no foreign transaction fee

1% cash back on all eligible purchases

ATM fees apply, which are set as a percentage, and can run pretty high

Pros and cons of using credit cards in Europe

Some cards offer zero liability policies, for extra consumer protection

Spread the cost of your travel over several months

You may pay no foreign transaction fee

Network exchange rates typically apply, which are usually pretty fair

Some cards offer cash back and rewards on spending

Interest charged if you don’t repay in full every month

Eligibility rules apply

How to choose the best travel credit card for Europe?

Selecting the best travel credit card for Europe largely depends on individual preferences. If you aim to earn rewards and cashback on your foreign transactions, the Home Trust Preferred Visa may be a suitable option as it does not have a foreign transaction fee and provides cash back on all purchases. Whichever card you’re considering you’ll want to weigh up the potential fees you’ll need to pay against the rewards you can earn to make sure it’s worthwhile.

If you regularly travel to Europe, getting a travel money card which supports the currencies you need frequently can help you save money. Travel money cards have different features, and can be picked up via regular banks, online specialists and even the Post Office.

You could opt for a low cost travel debit card which comes with a linked account to hold a selection of currencies - like the Wise account. Or you might prefer a prepaid travel money card like the Koho Premium Mastercard which has monthly fees in exchange for lower transaction charges - handy if you use it abroad often. Finally, another option is to get a travel credit card either to earn cashback and rewards, or to avoid foreign transaction fees.

The good news is that the Canadian market is well served for all types of travel money cards - use this guide to start your research and pick the right option for your specific needs.

FAQ - Best travel cards for Europe

You can usually make cash withdrawals with a credit card in Europe at any ATM that supports your card network. You’ll often find that a fee applies, and you may start to accumulate interest on the withdrawn amount immediately. Travel money debit cards from providers like Wise and Canada Post can be a lower cost option for cash withdrawals overseas.

You can use your debit card anywhere you see the card network’s logo displayed. Visa and Mastercard networks are very well supported globally, including in Europe, making these good options to look out for when you pick your travel debit card for Europe.

Prepaid cards from reputable providers are safe to use at home and abroad. They aren’t linked to your main bank account which can offer extra peace of mind, and may also make it easier to manage your travel budget. However, you’ll need to check the card features and fees carefully to make sure you're getting the best match for your needs.

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.3

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 8.0

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.5

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.4

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

- Customer Satisfaction 8.2

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.