- Subscriber Services

- For Authors

- Publications

- Archaeology

- Art & Architecture

- Bilingual dictionaries

- Classical studies

- Encyclopedias

- English Dictionaries and Thesauri

- Language reference

- Linguistics

- Media studies

- Medicine and health

- Names studies

- Performing arts

- Science and technology

- Social sciences

- Society and culture

- Overview Pages

- Subject Reference

- English Dictionaries

- Bilingual Dictionaries

Recently viewed (0)

- Save Search

- Share This Facebook LinkedIn Twitter

Related Content

More like this.

Show all results sharing these subjects:

- Earth Sciences and Geography

travel-to-work area

Quick reference.

In theory, a self-contained labour market area is one in which all commuting occurs within the boundary of the area. In practice, there are entirely separate labour market areas. For those involved in labour market analysis and planning, it is useful to be able to define zones in which the bulk of the resident population also work, so, by applying a multi-stage allocation process, the UK Office for National Statistics has defined ‘Travel to Work Areas’ as approximations of self-contained labour markets. The basic criteria used for defining a TTWA are that, of the resident economically active population, • at least 75% actually work in the area, • of everyone working in the area, at least 75% actually live in the area.The definitive minimum working population in a TTWA is 3 500, but many are much larger—indeed, the whole of London and surrounding area forms one TTWA.

• at least 75% actually work in the area,

• of everyone working in the area, at least 75% actually live in the area.

For the methodology, see appendix 1, Office for National Statistics 1991 Travel-to-Work Areas, and for an update, see M. Coombes, S. Raybould, and C. Wymer (2005).

http://www.ncl.ac.uk/curds/publications/pdf/ONSMC98.pdf Office for National Statistics 1991-based Travel to Work Areas.

http://www.statistics.gov.uk/geography/ttwa.asp National Statistics, Travel to Work Areas.

From: travel-to-work area in A Dictionary of Geography »

Subjects: Science and technology — Earth Sciences and Geography

Related content in Oxford Reference

Reference entries.

View all related items in Oxford Reference »

Search for: 'travel-to-work area' in Oxford Reference »

- Oxford University Press

PRINTED FROM OXFORD REFERENCE (www.oxfordreference.com). (c) Copyright Oxford University Press, 2023. All Rights Reserved. Under the terms of the licence agreement, an individual user may print out a PDF of a single entry from a reference work in OR for personal use (for details see Privacy Policy and Legal Notice ).

date: 17 June 2024

- Cookie Policy

- Privacy Policy

- Legal Notice

- Accessibility

- [66.249.64.20|185.80.149.115]

- 185.80.149.115

Character limit 500 /500

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

Cookies on GOV.UK

We use cookies to collect information about how you use data.gov.uk. We use this information to make the website work as well as possible.

You can change your cookie settings at any time.

Travel to Work Areas 2011

Travel to Work Areas (TTWAs) are zones defined where the bulk of their resident population work within the same area. TTWAs are aggregations of Super Output Areas, and were created based on the 2011 Census, which collected information on the place of residence and work (if applicable).

More from this publisher

Related datasets.

- Method of travel to work - Resident population (2001 Census)

- Travel to Work Areas (2011) Guidance and Information

- Method of travel to work - Daytime Population (2001 Census)

- Travel to work flows

Open Data Team

Study at Cambridge

About the university, research at cambridge.

- Undergraduate courses

- Events and open days

- Fees and finance

- Postgraduate courses

- How to apply

- Postgraduate events

- Fees and funding

- International students

- Continuing education

- Executive and professional education

- Courses in education

- How the University and Colleges work

- Term dates and calendars

- Visiting the University

- Annual reports

- Equality and diversity

- A global university

- Public engagement

- Give to Cambridge

- For Cambridge students

- For our researchers

- Business and enterprise

- Colleges & departments

- Email & phone search

- Museums & collections

- Current & Recent Research

- Research Projects by Starting Year

- Refining the recent release of the ONS ‘Travel-To-Work Areas’ for housing planning purposes

Cambridge Centre for Housing & Planning Research

- About CCHPR overview

- Jobs overview

- We Are Recruiting

- Our Team overview

- Centre Director

- Researchers

- Associate Members

- Advisory Group

- Administrator

- PhD Students

- Current & Recent Research overview

- Current Research

- Research Projects by Starting Year overview

- 2022 overview

- TAPPI 2 Evaluation and Learning Partner overview

- TAPPI Evaluation Workshop

- MMC-based housebuilding: Towards a roadmap for customer-centred approaches to POE in the social housing sector

- The role of hostels in ending homelessness: assessing what works?

- Are modular homes a good temporary housing solution for people experiencing homelessness? overview

- The role of modular homes in addressing homelessness: Cambridge’s modular homes

- Digital poverty in the UK overview

- Digital Poverty in the UK Literature Review

- Digital Poverty and Housing Inequality Report

- The relationship between housing inequality and digital exclusion in the UK

- Other publications overview

- Demarginalising’ a territorially stigmatised neighbourhood?: The relationship between governance configurations and trajectories of urban change

- 2021 overview

- Other Publications overview

- Housing for highly mobile transnational professionals: evolving forms of housing practices in Moscow and London

- Converging interests to protect urban greenery

- International technology transfer through projects: A social construction of technology perspective

- Landguardism in Ghana - examining public perceptions about the driving factors

- The role of housing providers and intermediaries in migrant access to (in)formal housing markets in the New York City

- Towards a well-informed rental housing policy in Ghana

- Walls within walls: examining the variegated purposes for walling in Ghanaian gated communities

- A review of Ageing in place: design, planning and policy response in the Western Asia- Pacific

- Housing for Highly Mobile Transnational Professionals: ’New’ Forms of Housing Practices in Moscow and London

- Housing characteristics and households' experiences with COVID-19 protocols in Ghana

- Using modular housing to address acute housing needs overview

- Insights into the use of modular housing in addressing homelessness: Report

- Insights into the use of modular housing in addressing homelessness: Launch presentation

- Insights into the use of modular and container temporary housing to address homelessness: HSA conference presentation

- 2020 overview

- Tackling digital exclusion: identifying policy and practitioner responses to support digitally excluded households overview

- Cryptocurrency and the Digital Divide

- Beyond Digital: Planning for a Hybrid World

- Mind the gap: the digital divide is getting bigger

- Closing the digital divide: panel presentation

- BBC Look North

- The Quarantini Podcast

- The Shared Ownership Sector in 2020 overview

- SO Resi Shared Ownership 2020

- Modular homes for the homeless overview

- Housing Studies Association Conference 2022

- Modular housing for the homeless: CHIRN presentation

- Modular Homes: resident experiences

- Modular Housing Project: preliminary findings overview

- Modular Housing Project: preliminary findings

- Small-scale modular housing could provide a lifeline for people experiencing homelessness overview

- Download Template

- Housing transformation, rent gap and gentrification in Ghana's traditional houses: Insight from compound houses in Bantama, Ghana

- The Influence of the Belt and Road Initiative in Europe

- Urban informality in the Global North: (il)legal status and housing strategies of Ghanaian migrants in New York City

- Exploring the Financial Implications of Advance Rent Payment and Induced Furnishing of Rental Housing in Ghanaian Cities: The Case of Dansoman, Accra-Ghana

- Residential trajectories of high-skilled transnational migrants in a global city: Exploring the housing choices of Russian and Italian professionals in London

- 2019 overview

- The housing market and the wider economy overview

- Healthy Communities: Place-based built environment interventions to reduce health inequalities by increasing physical activity

- Net zero ready new build housing: benefits and barriers to delivery

- Self-build and custom housebuilding in the UK

- Deploying modular housing in the UK: exploring the benefits and risks for the housebuilding industry overview

- Deploying modular housing in the UK: industry roundtable

- Understanding supply, demand and investment in the market for retirement housing communities in England (Report)

- Infrastructure, placemaking and sustainability

- How can smart technologies meet the demand of an ageing population? overview

- The promises and reality of smart telecare

- Can smart homes meet the needs of our ageing population? The challenges of implementation

- How does the provision of advanced, predictive telecare and smart home technology for older people affect its outcomes? overview

- How does the provision of advanced, predictive telecare and smart home technology for older people affect its outcomes?

- What is the goal of advanced telecare provision for older people? How we define its success will affect how we view its outcomes

- CSaP Impact Hunting overview

- Exploring CSaP's impact

- Understanding the socio-economic inhibitors to the take up of digital innovation in construction overview

- Pre-Manufactured Value: A critical examination of PMV as a performance evaluation metric for the adoption and use of modern methods of construction

- Pre-Manufactured Value: a performance evaluation metric for the adoption and use of MMC

- Final Report: Analysing the social context to transforming construction through digital innovation and offsite construction

- Projects as vehicles for widespread adoption of digital manufacturing technologies in the AEC sector

- Enablers for the adoption and use of BIM in main contractor companies in the UK

- Offsite manufacturing research: A systematic review of methodologies used

- Industry guidance: Successful adoption and use of BIM and OSM

- How countries achieve greater use of offsite manufacturing to build new housing: identifying typologies through institutional theory

- Transforming the construction sector: an institutional complexity perspective

- CamFest 2021: Tackling the housing crisis by transforming construction

- UK Construction Industry: The Transformation Agenda

- Homes UK 2020

- Homes UK 2020: Challenges of BIM implementation

- ARCOM Conference Paper : OSM & Construction Industry Transformation overview

- Conference paper: OSM & Construction Industry Transformation

- 2020 Industry Webinar overview

- Presentation: Enabling factors for the adoption and use of OSM

- Presentation: Socio-cultural and individual inhibitors to the take up of digital innovation and off-site manufacturing in construction

- Presentation: Defining and delivering a digital strategy in a large organisation

- Exploring ways to tackle the challenges of the need for skills and training in the implementation of Building Information Modelling: a case study of two leading UK construction companies overview

- Presentation: Exploring new ways to tackle the challenges of the need for skills and training in the implementation of BIM

- How could better use of data and digital technologies improve the planning system? overview

- Presentation: How could better use of data and digital technologies improve the planning system?

- Tackling the housing crisis through digital technologies and OSM

- State of the nation: sector report (OSM) overview

- Report: State of the nation: sector report (OSM)

- State of the nation: sector report (Digital Innovation) overview

- Report: State of the nation: sector report (DI)

- Blog for CDBB - October 2019 overview

- Blog: Blog for CDBB October 2019

- How using Modern Methods of Construction and digital technologies affects stakeholder management in housing development projects: ENHR Conference

- Research Profile - Understanding the social context to transforming construction through digital innovation overview

- Creating positive economic communities overview

- Creating positive economic communities (draft report)

- Achieving local economic change: what works?

- Valuing Planning Obligations 2018-19 overview

- Gated communities and land administration challenges in Ghana: reappraising the reasons why people move into gated communities

- 2018 overview

- Construction Innovation Hub overview

- Beyond Smart Cities

- Levelling up and the Modernisation of the Construction Industry in the UK: Geographies of the Offsite Construction of Housing, at the ENHR Conference

- Smart city governance and the ethical dimension of smart city decision-making in Cambridge, UK

- Customer experience in the housebuilding industry: the post-occupancy evaluation of MMC-delivered homes in the social housing sector

- Ethically making Smart Cities

- The ethical underpinnings of Smart City governance

- Problem Framing in UK Smart Cities

- Towards a co-creative stakeholder framework for Smart City projects

- Podcast: How to unlock MMC at scale

- Built environment of Britain in 2040: Scenarios and strategies

- Locating OSM: Offsite construction is firmly on the agenda, but where exactly is ‘offsite’? overview

- Blog: Locating OSM: Offsite construction is firmly on the agenda, but where exactly is ‘offsite’?

- Four Futures, One Choice

- Towards a co-creative Stakeholder engagement framework for Smart City projects overview

- Presentation: Towards a co-creative Stakeholder engagement framework for Smart City projects

- Tackling the housing crisis through digital technologies and OSM overview

- Presentation: Whitehall & Industry Group

- Stakeholder Engagement for Smart Cities and DIPs: National Guidance Document overview

- Stakeholder Engagement for Smart Cities and DIPs: National Guidance Document

- Stakeholder Engagement Plan: West Cambridge Digital Twin Research Facility overview

- Report: Stakeholder Engagement Plan: West Cambridge Digital Twin Research Facility

- Engaging stakeholders in digital infrastructure projects overview

- Report: Stakeholder engagement review

- Flourishing Systems

- Digital technologies: presentation at 2019 Homes UK overview

- Presentation: Digital technologies, HOMES UK 2019

- Stakeholder engagement in Smart City initiatives overview

- Offsite construction: is it the answer to the housing crisis? overview

- Presentation: Offsite construction, NHF Asset Management Conference 2019

- Reinventing Renting overview

- Report: Reinventing Renting

- BIM in the UK house building industry overview

- Presentation: BIM in the UK house building industry

- Is co-living a housing solution for vulnerable older people? overview

- Households of the Future: will sharing our home become the new norm? overview

- Presentation: Households of the Future

- Co-living for vulnerable older people: Literature review overview

- Ageing well - meeting the needs of the next generation of older adults

- Report: Is co-living a housing solution for vulnerable older people? Literature review

- Co-living for vulnerable older people: Stakeholder views overview

- Co-living for older people - stakeholder views

- Is co-living a housing solution for vulnerable older people?

- Is co-living a housing solution for vulnerable older people? Summary Report

- Is co-living a good choice to support healthy, happy ageing at home? overview

- Is co-living a good choice to support healthy happy ageing at home?

- Digital Nomads overview

- Reinventing Renting

- Leasehold and Freehold Charges overview

- Parenting in a house share (ESRC IAA) overview

- Housing issues facing non-resident fathers overview

- Housing issues facing non-resident fathers: recommendations for policy and practice

- Digital Built Britain Housing Network overview

- Digital Built Britain Housing Network: Final Report overview

- Digital Built Britain Housing Network: Final Report

- Position paper 1: How can digital tools and technologies support independent living for older people, now and into the future? overview

- How can digital tools and technologies support independent living for older people, now and into the future?

- Position Paper 2: What is the role of off-site housing manufacture in a Digital Built Britain? overview

- What is the role of off-site housing manufacture in a Digital Built Britain?

- Position Paper 3: How will the UK govern, manage and maintain housing stock in a Digital Built Britain? overview

- How will the UK govern, manage and maintain housing stock in a Digital Built Britain?

- Position Paper 4: How could better use of data and digital technologies improve housing delivery through the UK planning system? overview

- Seminar 1: What are the key things we need to know in order to deliver affordable, sustainable housing in a Digital Built Britain? overview

- Seminar 1: What are the key things we need to know in order to deliver affordable, sustainable housing in a Digital Built Britain?

- Seminar 2: Will digital transformations solve our housing crisis? overview

- Nigel Walley, Chimni: Data passports

- Nissa Shahid, Future Cities Catapult: The future of planning

- Tom Lowry, Plymouth City Council: Digital planning in Plymouth

- Gemma Burgess & Valentine Quinio, CCHPR: Digital innovation

- Planning for Affordable Housing (PLANAFFHO) overview

- Divergence in planning for affordable housing: A comparative analysis of England and Portugal overview

- Planning for Affordable Housing: A comparative analysis of Portugal, England and Denmark overview

- Planning for Affordable Housing: A comparative analysis of Portugal, England and Denmark

- Understanding the relationship between land use planning and housing overview

- Understanding the relationship between land use planning and housing

- The challenges of gentrification overview

- The challenges of gentrification

- Land-use planning and housing: issues of supply and affordability overview

- Land-use planning and housing - issues of supply and affordability in England and Portugal

- Land Economy Seminar Series Presentation overview

- International comparative analysis of housing and land use planning

- Cross-comparative analysis of Portugal, England and Denmark overview

- Cross-comparative analysis of Portugal, England and Denmark: Presentation

- Cross-comparative analysis of Portugal, England and Denmark: Conference Paper

- Outcomes of Urban Requalification under Neoliberalism overview

- Outcomes of Urban Requalification under Neoliberalism

- Housing and Urban Planning Policies Presentation overview

- Housing and Urban Planning Policies Presentation

- Advanced Sociology Seminars Presentation overview

- Interdiscplinary approaches to housing research

- HSA Presentation: Conceptualising the differences overview

- Conceptualising the differences

- PLPR 2018 Presentation: Evora overview

- PLPR 2018 Presentation: Evora

- ICS Lisbon: Blog

- Planning for Affordable Housing: Roundtable overview

- Planning for Affordable Housing: Roundtable

- Evaluation of the Reimagining Rent Programme overview

- Uptake of digital tools in the UK house building sector overview

- Uptake of digital tools in the UK house building sector - reports overview

- Executive Summary - BIM and UK House Building

- Final Report - BIM and UK House Building

- BIM4Housing Presentation: BIM in the UK house building industry overview

- BIM in the UK house building industry: opportunities and barriers to adoption

- Wylfa Newydd Housing Study overview

- Purpose built student accommodation overview

- The Edge Debate: OxMKCam growth corridor symposium overview

- The Edge Debate: Housing for the OxMKCam growth corridor symposium

- Structure and agency: variations in planning outcomes and the delivery of affordable housing in England overview

- Structure and agency: variations in planning outcomes and the delivery of affordable housing in England

- Assessing the evidence on rent control from an international perspective

- Michael Oxley: Urban Renewal Policy conference, NRU Moscow overview

- Affordable Housing: three versions

- Affordable Housing: national housing policies

- Affordable Housing: the European picture

- CIH UK Housing Review 2018 Autumn Briefing Paper

- Evaluation of Help to Buy equity loan scheme

- Performative knowledge and marketplace exclusion overview

- Using performative knowledge production to explore marketplace exclusion

- Mortgage markets and access to owner occupation for younger households overview

- Mortgage markets and access to owner occupation for younger households

- Universalism vs Particularism overview

- Universalism vs Particularism

- CIH UK Housing Review 2018

- Structural change in the housing & mortgage markets?

- Assessing the evidence on Rent Control from an international perspective

- Construction Innovation Hub with Accordion

- 2017 overview

- Modelling the impact of taxation reform on the PRS overview

- The impact of taxation reform on the private rented sector: Final report overview

- The impact of taxation reform on the private rented sector

- Developing income-linked rents for CHS Group overview

- Developing income-linked rents for CHS Group final report overview

- Developing income-linked rents for CHS Group: Final report

- Shared housing for non-resident parents overview

- Non-resident parents and shared housing - final report & executive summary overview

- Non-resident parents and shared housing - executive summary

- Non-resident parents and shared housing - final report

- Presentation of findings to Housing Studies Association overview

- Presentation of Commonweal Findings to HSA

- Landlord portfolio management - past and future overview

- Landlord portfolio management - past and future

- Research into Letting Agents Fees to Tenants in Wales overview

- Welsh Letting Agents Fees: Final Reports overview

- Welsh letting agents fees: final report

- Welsh letting agents fees: summary report

- Using incentives to improve the private rented sector for people in poverty overview

- JRF PRS Landlord Incentives: International Policy Review overview

- International Policy Review

- JRF PRS Landlord Incentives: Three Costed Solutions overview

- JRF PRS Landlord Incentives: Three Costed Solutions

- Building Better Opportunities - New Horizons overview

- Cost of Living Report

- Cost of Living Presentation

- Digital exclusion and poverty in the UK: How structural inequality shapes experiences of getting online

- Digital exclusion and the importance of getting online

- Homelessness Prevention through One-to-One Coaching overview

- New Horizons: Long term impact of coaching & the wider context of structural poverty overview

- New Horizons: Long term impact of coaching & the wider context of structural poverty

- The Digital Divide: what does the research tell us? overview

- The Digital Divide: what does the research tell us?

- Beyond the pandemic: tackle the digital divide overview

- Tackle the Digital Divide

- Coronavirus has highlighted the UK's digital divide overview

- Coronavirus has highlighted the UK's digital divide

- Working together to respond to poverty in Cambridgeshire and Peterborough overview

- Plenary presentation November 2019

- Workshop presentation November 2019

- ITV News Anglia report on New Horizons

- Tackling social and digital exclusion overview

- Tackling social and digital exclusion

- Tackling digital, financial and employment exclusion overview

- Final Report July 2019

- Living on the edge

- Looking into Cambridge's future overview

- Looking into Cambridge's future

- New Horizons Evaluation: Findings from the first two years overview

- Evaluation findings 1

- University of Cambridge Housing Needs overview

- Valuing Planning Obligations overview

- The Incidence, Value and Delivery of Planning Obligations and Community Infrastructure Levy in England in 2016-17 overview

- Published report

- The Incidence, Value and Delivery of Planning Obligations and Community Infrastructure Levy in England in 2016-17 (Inquiry)

- Virtuous or vicious circles?

- Private rented sector and buy to let mortgage market: five year outlook overview

- London Strategic Housing Initiative Evaluation overview

- LSHI Evaluation Report overview

- LSHI Evaluation Report

- Decision maker interactions with Citizens UK overview

- Decision maker interactions with Citizens UK

- Community Currencies overview

- What is the potential for community currencies to deliver positive public health outcomes?

- Housing in young adulthood overview

- Housing, poverty and young people

- The Case for Social Housing overview

- Housing Policy and Market Failure overview

- Private housing sector: The UK and ideas from other countries overview

- Private Rented Housing Sector: UK and ideas from other countries

- Rebuilding the Rented Sector in the UK overview

- Thames Valley Housing Fizzy Update overview

- Thames Valley Housing Fizzy Update

- Housing Policy: Some Alternative Views overview

- Housing Policy: Some Alternative Views

- Challenges for our home ownership safety net overview

- Challenges for our home ownership safety net

- Access to mortgages and home ownership for young people; International perspectives

- 2016 overview

- Consultancy input into Evaluation of the JRF’s Housing and Poverty Programme overview

- Feasibility study of the prospect of developing a viable housing model for those entitled only to access the shared accommodation rate overview

- Final Report

- Shared Ownership: Ugly sister or Cinderella? overview

- Shared ownership: Ugly Sister or Cinderella? The role of mortgage lenders in growing the shared ownership market overview

- Shared ownership: Ugly Sister or Cinderella? The role of mortgage lenders in growing the shared ownership market

- Using household income data at micro-level to aid social housing providers’ decisions on affordable rents levels, ‘pay-to-stay’ and other market-based policies overview

- Household income distribution estimates: The example of Pay to Stay impacts in Local Authority areas in two English regions overview

- New housing, business space and infrastructure in London overview

- Poverty, evictions and forced moves overview

- Poverty, evictions and forced moves

- Provision of expert advice on UK Housing Statistics overview

- Government Policy and the Profile of Housing Provision in England overview

- A better quality PRS: the role of SME investment overview

- Shared Ownership Plus: a review of progress and potential overview

- Assessment of Student Housing Demand and Supply for Cambridge City Council and Oxford City Council overview

- Assessment of Student Housing Demand and Supply for Cambridge City Council overview

- copy_of_DownloadTemplate

- The impacts of family support on access to homeownership for young people in the UK overview

- The impacts of family support on access to homeownership for young people in the UK

- The Prevalence of Rough Sleeping and Sofa Surfing Amongst Young People in the UK overview

- The Prevalence of Rough Sleeping and Sofa Surfing Amongst Young People in the UK

- 2015 overview

- Designing compliance into regulatory codes

- Downsizing and moving in later life - new build housing or existing stock? overview

- Last-time buyers

- Unpicking the downsizing discourse

- Moving insights from the over-55s - source document overview

- Source Document

- Estimated net income distribution of working households by household type and locality overview

- Evaluating the public health outcomes of the Cambridgeshire Time Credits Scheme overview

- Community Exchange and Time Currencies: A systematic and in-depth thematic review of impact on public health outcomes

- Reciprocity in the co-production of public services

- Cambridgeshire Time Credits in Wisbech: three short films

- Wisbech Time Credits – Final Report overview

- Time Credits Project: Summary and Conclusions overview

- Time Credits Project: Summary and Conclusions

- Time Credits Research Findings: Launch Event overview

- Dr Gemma Burgess, CCHPR

- Dr Louise Lafortune, Cambridge Insitute for Public Health

- Yannick Auckland, Spice

- Val Thomas, Cambridgeshire County Council

- Festival of Ideas event - The potential for Time Credits to generate public health outcomes overview

- Public health outcomes of complex community interventions: Volunteering and Time Credits in Wisbeach

- Emerging findings paper 2 - Wisbech Time Credits Partner Organisation Case Studies overview

- DownloadTemplate

- Working paper 7 Littleport and Ely Timebank overview

- Working paper 7 The impact of timebanking on individuals, communities and wider society

- Using Ethnographic Methodologies to Evaluate Time Credits – working paper overview

- Wisbeach Time Credits Evaluation: Working Paper 6

- Time Credits in Wisbech – working paper overview

- Wisbeach Time Credits Evaluation: Working Paper 5

- Wisbech Time Credits – Interim Report overview

- Interim Report

- Wisbech Time Credits – individual member case studies overview

- Emerging Findings 1_Time Credits member case studies

- Health outcomes of place based approaches to building community cohesion: Time Credits in England – research presented by Dr Burgess at AAG conference in San Francisco overview

- Presentation

- The potential for Time Credits to generate public health outcomes – a conceptual model – working paper overview

- Working Paper 4

- Evaluating the Public Health Outcomes of the Cambridgeshire Time Credits Project – conference poster overview

- Co-production in research and public services – working papers overview

- Working Paper 2 - Research

- Working Paper 3 - Services

- Introduction to time banking and time credits overview

- Working Paper 1

- Identifying housing need in the horseracing industry overview

- Identifying housing need in the horseracing industry - Report overview

- Racing Welfare Response

- Multi generational living: potential opportunities for the house building sector? overview

- Final Report overview

- Multigenerational Living: an opportunity for house builders?

- The Increase in Multigenerational Households in the UK

- The private rented sector in North Hertfordshire overview

- Research on the effect of rent stabilisation measures in London overview

- The effects of rent controls on supply and markets overview

- Understanding the likely poverty impacts of the extension of Right to Buy to housing association tenants overview

- Refining the recent release of the ONS ‘Travel-To-Work Areas’ for housing planning purposes overview

- Experimental review of the Cambridge Travel to Work Area (TTWA) as a tool for informing local housing policy - including a study of the Ely housing market in the context of the Cambridge TTWA overview

- Housing, Planning and Peter Hall; Unfinished Business

- Affordable housing and institutional investment in Australia overview

- Tax credits for affordable housing in the USA: could they work elsewhere?

- 2014 overview

- Baseline Study for Intermediate Housing Market in and around Cambridge City overview

- Benefit Cap: In-depth interviews with affected claimants overview

- In-depth interviews with people affected by the benefit cap overview

- In-depth interviews with people affected by the Benefit Cap

- Estimating the scale of youth homelessness in the UK overview

- Full Report

- Evaluation of support services in Kingston Royal Eye Clinic overview

- Evaluation of Visual Impairment Parliament in Kingston

- Housing need and demand in Wales overview

- Managing Money Better: Evaluation overview

- Performance bonds for highways and water supplies for new housing developments overview

- Road and sewer bonds in England and Wales – report to the NHBC overview

- NHBC Road and Sewer Bonds: Final Report

- Promoting policy change to boost the supply of affordable housing overview

- Affordable Housing Film

- Variations in house building rates between local authorities in England overview

- Prospects for investment in social housing overview

- Provision of information on London’s development overview

- Research into potential solutions for business data sharing between regulators overview

- Encouraging inter-regulator data sharing: the perceptions of regulators overview

- Research on the nature of planning constraints overview

- Increasing housing supply: Research to support Lloyds Banking Group’s Housing Commission overview

- Sight loss is not life loss: Evaluation overview

- Sight loss is not life loss: Evaluation for Southampton Sight overview

- Evaluation Report

- The role of housing and housing providers in tackling poverty experienced by young people in the UK overview

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Summary and Conclusions overview

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Summary and Conclusions

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Overview overview

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Overview

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Moving in and out of poverty overview

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Moving in and out of poverty

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - New evidence from housing providers overview

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - New evidence from housing providers

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Literature review overview

- The role of housing and housing providers in tackling poverty experienced by young people in the UK - Literature review

- Presentations from the launch event - November 2016 overview

- Young People and Poverty: A presentation of key findings

- Presentation from Rock Trust

- Presentation from Hyde Moneyhouse

- Presentation from EMH Group traineeships

- Validation of an objectively assessed housing need for West Oxfordshire Council overview

- ESRC Seminar Series on Marketplace Exclusion: Representations, Resistances and Responses

- Estimated net income distribution for eight household types in the London Borough of Bromley at mid-Super Output Area (SOA) level overview

- Housing finance and the housing market; lessons from the UK? overview

- Journal Article

- Housing need and effective demand in England overview

- Housing Supply– challenges for policy makers. Presentation by Dr Gemma Burgess to the All-Party Parliamentary Group for Social Science and Policy, 21 October 2014, House of Commons overview

- Local public finance and housing policy conference. Presentation by Dr Gemma Burgess - Case Study UK: rising house prices and under supply overview

- Looking into the future: How many homes do we need and what happens if we do not build them? overview

- Review of “Young people and housing: transitions, trajectories and generational fractures”

- The role of policy in influencing differences between countries in the size of the private rented housing sector overview

- 2013 overview

- Analysing the experience of vulnerable groups with hearing loss in Cambridgeshire overview

- Managing hearing loss in vulnerable groups of the Cambridgeshire D/deaf communities overview

- An economic and spatial analysis of the future development of Wisbech in Cambridgeshire overview

- Economic analysis of the Wisbech travel to work area overview

- Main Report

- Evaluation of the Removal of the Spare Room Subsidy and household Benefit Cap overview

- Evaluation of Removal of the Spare Room Subsidy: Final Report overview

- Evaluation of Removal of the Spare Room Subsidy: Interim Report

- Supporting households affected by the Benefit Cap: Impact on Local Authorities, local services and social landlords overview

- Supporting households affected by the Benefit Cap: Impact on Local Authorities, local services and social landlords

- Housing costs, affordability and rent setting overview

- Value for money assessment of Lincolnshire Home Improvement Agency's housing options service overview

- Analysis of the potential value for money to the public purse of the Lincolnshire Home Improvement Agency Housing Options Advice service overview

- Mechanisms to increase housing supply in England overview

- Mechanisms to increase housing land supply in England and Wales

- Increasing land supply for housing overview

- Poverty focused review of housing organisations’ strategic and business plans overview

- How do landlords address poverty? A poverty-focused review of the stratetgies of local authorities, landlords and letting agents in England overview

- Landlords’ written strategies to address poverty and disadvantage overview

- Poverty focussed review of housing organisations’ strategic and business plans - Initial Report overview

- Understanding the role of private renting: a four country case study overview

- The Changing Role of Private Renting in Europe overview

- The Changing Role of Private Renting in Europe

- Reselling shared ownership properties after improvements overview

- Review of Affordable Housing Gateway in Jersey overview

- Understanding private landlord financial and regulatory incentives for property investment

- Understanding recent changes in household formation rates and their implications for planning for housing overview

- Update of UK Housing Finance entry overview

- Building an effective safety net for home owners and the housing market

- 2012 overview

- Supporting assumptions used in planning for housing overview

- Analysis of the private rented sector in Richmond upon Thames and surrounding areas overview

- Building social capital through community timebanking: an evaluation of the Cambridgeshire timebanking project overview

- Building Social Capital through Community Timebanking: an interim evaluation of the Cambridgeshire timebanking project overview

- Evaluation of the Cambridgeshire Timebanks overview

- Housing markets in the Channel Islands overview

- Dementia and sight loss: Developing social care practice in different housing settings overview

- Evaluation of new lighting intervention schemes being undertaken by benevolent trusts overview

- Evaluation of new lighting intervention schemes being undertaken by benevolent trusts - Project Report overview

- Early support for sight loss in Essex: Evaluation overview

- Evaluation of Early Support in Essex overview

- Evaluation of Stourbridge lighting intervention overview

- Evaluation of lighting interventions in Stourbridge overview

- Fundamental review of housing allocations policy in Northern Ireland overview

- Housing in transition: Understanding the dynamics of tenure change overview

- Housing wealth and wellbeing: understanding who uses housing equity release products and the impact they have on older people’s lives - scoping study overview

- Equity release amongst older home owners overview

- Nuffield Presentation

- Note on Round Table Event

- Equity release round table event November 7th Nuffield Foundation overview

- Note on Discussion

- International review of land supply and planning systems overview

- Making best use of a scarce asset: Can we use social housing more efficiently? overview

- Mapping the number of extra housing units needed for young people overview

- Mapping the number of extra housing units needed for young people, Report overview

- Maximising the performance of the new Section 106 and Community Infrastructure Levy Planning Framework with Local Authorities: Developing a planning gain model overview

- The changing delivery of planning gain through Section 106 and the Community Infrastructure Levy overview

- NewBuy; a review of mortgage pricing overview

- Research into the future of the social rented sector overview

- Social housing in the East: Challenges for the region and implications for the UK overview

- Rural housing at a time of economic change overview

- Service use by Cambridgeshire deaf communities overview

- Scoping study on service use by the Cambridgeshire D/deaf communities overview

- Support in the preparation of a housing strategy for Jersey overview

- The role of the private rented sector in preventing homelessness: identifying good practice and the impact of policy change overview

- The role of the private rented sector in preventing homelessness: Identifying good practice and the impact of policy change overview

- Unfinished business, building an effective safety net for home owners and the housing market overview

- Unfinished Business Final Reports overview

- Unfinished Business Full Report

- Unfinished Business Summary Report

- Welfare Reform Impact Assessment overview

- Impact of welfare reform on housing associations – 2012 Baseline report overview

- 2012 Baseline Report

- Intended and unintended consequences? A case study survey of housing associations and welfare reforms overview

- Reality dawns – the impact of welfare reform on housing associations: a mid-2014 view overview

- Changing the profile of social housing: The impact of prioritising working applicants on letting patterns - Working Note overview

- Working Note

- Freedom to succeed: liberating the potential of housing associations overview

- Tackling housing market volatility in the UK: A progress report overview

- The implications of the 2008-based household projections for estimates of housing need overview

- Household Projections in England: their history and uses overview

- Book review by Dr Gemma Burgess published in Journal of Social Policy

- 2011 overview

- Affordable Rents assessment for Cambridge City overview

- Cost benefit analysis of lighting adaptations overview

- Estimating the impacts of the changes in S106 with the introduction of CIL on the quantity of affordable housing delivered overview

- Facing the future: The future role and financing of social housing overview

- Under-occupation and the housing benefit reforms: Four local case studies overview

- Under-occupation and the new policy framework overview

- Future investment in affordable housing overview

- Funding future homes overview

- Executive Summary

- Helping inform the Labour Party Housing Review overview

- Market-pegged rents in the social sector overview

- Market-pegged social rents & local income distributions overview

- North West Cambridge rent policy overview

- Older people’s views of service provision in Cambridge overview

- Market Intelligence toolkit for Orbit Housing Group overview

- Providing the evidence base for housing needs assessments overview

- Providing the evidence base for local housing demand and need assessments, Report

- Qualitative study on the impact of welfare reforms on Riverside tenants overview

- Challenging times, changing lives overview

- The citizen in regulation overview

- The Citizen in Regulation: Final Report overview

- The contribution and potential of the private residential rental market in New Zealand overview

- The impact of the recent financial crisis on planning for affordable housing in England overview

- Capturing planning gain – The transition from Section 106 to the Community Infrastructure Levy overview

- The role of the planning system in delivering housing choice for older Londoners overview

- The role of the planning system in delivering housing choice for older Londoners, Report overview

- Understanding the second-hand market for shared ownership properties overview

- Cambridge University staff housing survey 2011 overview

- Memorandum submitted to the House of Commons Communities & Local Government Select Committee inquiry into the financing of new housing supply

- When the personal becomes political: using legal reform to combat violence against women in Ethiopia in Gender Place & Culture

- Opportunities for institutional investment in affordable housing overview

- The Uneven Geography of Participation at the Global Level: Ethiopian Women Activists at the Global Periphery

- Complete List of Research

- Research Themes overview

- About our research themes

- Housing Policy, Regulation & Evaluation

- Planning Obligations & the Planning System

- Housing Need and Supply

- Affordability

- The Digital Agenda

- Modern Methods of Construction & Offsite Manufacturing

- Building Information Modelling

- Social Housing

- Private Rented Sector

- Alternative Models of Housing

- Housing in Older Age

- Moving House in Older Age

- Smart Homes for Older Age

- Equality & Improving Outcomes

- Communities & Engagement

- Publications overview

- Journal Articles

- Presentations

- All by Year of Publication overview

- Staff Projects and Publications overview

- Dr Gemma Burgess overview

- Latest Projects

- Latest Publications and Presentations

- All Projects

- All Publications and Presentations

- Dr Richmond Ehwi overview

- Publications and Presentations

- Dr Hannah Holmes overview

- Dr Katy Karampour overview

- Dr Sabina Maslova overview

- Dr Reyhaneh Shojaei overview

- Our Services

- Keep in touch with us

Experimental review of the Cambridge Travel to Work Area (TTWA) as a tool for informing local housing policy - including a study of the Ely housing market in the context of the Cambridge TTWA

- Cambridge Centre for Housing & Planning Research

- Current & Recent Research

Travel To Work Areas are used primarily to understand local labour markets, but are also used in housing planning. However, TTWAs do not allow for overlap. Taking Cambridge as their example, Chihiro Udagawa and Dr Paul Sanderson identified commuting areas for Cambridge that lie within the boundaries of other employment hubs. Their study suggested that care should be taken when using TWAs for housing planning purposes.

A Travel-to-work Area (TTWA) theoretically represents a self-contained labour market area in which all commuting occurs within the boundary of that area. It has been re-defined once a decade when analyses on commuting patterns drawn from the UK Censuses were completed. In December 2015, the Office of National Statistics (ONS) published TTWAs based on the 2011 Census results.

TTWAs are used primarily to aid understanding of labour markets across the UK. However, residential location and commuting patterns can also contribute to understanding local housing markets. The conventional assumption is that local labour markets are spatial proxies for housing markets. Indeed, housing professionals have been employing TTWAs in this way in their strategic plans.

One of the issues in using existing TTWA s in this way is that they do not allow for overlap. Consider a household with two earners, one of whom is commuting within the TTWA while the other is commuting to a business hub outside their TTWA. For example, Cambridge TTWA has now expanded as far south as Hertford and Harlow - settlements containing many London commuters.

Taking Cambridge as our example we attempt in this paper to experimentally identify commuting areas for Cambridge that lie within the boundaries of other employment hubs, such as Ely. In this way we can start to address the reality that TTWAs, certainly in terms of local housing markets, are not discrete - they overlap.

Paul Sanderson

Chihiro Udagawa

Publication Date

© 2024 University of Cambridge

- Contact the University

- Accessibility

- Freedom of information

- Privacy policy and cookies

- Statement on Modern Slavery

- Terms and conditions

- University A-Z

- Undergraduate

- Postgraduate

- Research news

- About research at Cambridge

- Spotlight on...

Data science for the public good

Estimation of travel to work matrices.

- Data Science Campus

- June 23, 2023

Travel to work matrices show movement of people from their home location (origin) to their place of work (destination) at an aggregated level. Information on travel to work provides a basis for transport planning, for example, whether new public transport routes or changes to existing routes are needed. Additionally, it allows the measurement of environmental impacts of commuting, for example traffic congestion and pollution, and how these might change over time, for example because of changes in commuting modes, such as a shift from car to bicycle. The Office for National Statistics (ONS) collects travel to work data from the census every ten years, with the most recent being 2021. This travel to work data helps us generate travel to work matrices for census years, for instance, at 10-year intervals with no updates for years in-between.

Using aggregate spatial modelling approaches, the Data Science Campus has produced an alternative estimation of the travel to work matrices which bridges this gap. We have produced experimental data for each year from 2012 to 2021 and have published modelled estimates for 2021 . When new data becomes available, the model can be updated to include 2022 onwards. This will provide complementary statistics to the 2021 Census travel to work data collected during the coronavirus (COVID-19) pandemic which contains a mixture of pandemic and pre-pandemic behaviours . These modelled estimates for 2021 are the first release in a planned work programme of incremental improvements to the model and outputs.

This blog briefly introduces the methods used, initial results, limitations and next steps. For a more detailed methodology, refer to the technical report . You can download our estimated travel to work matrices from the ONS website. We do not recommend that these data are used to inform decisions, and are publishing the statistics to enable feedback and input into methods. We welcome feedback from stakeholders on methods and outputs.

We have developed a gravity model, calibrated using the 2011 Census travel to work data, to estimate travel to work matrices. A gravity model at its most basic level assumes that the number of trips made between two areas can be estimated by the number of resident workers at the origin (residential end), the number of employees working at the destination (workplace end) and the cost, such as travel time, travel distance or monetary cost (or a combination of these factors referred to as a generalised cost) of travelling between these two locations.

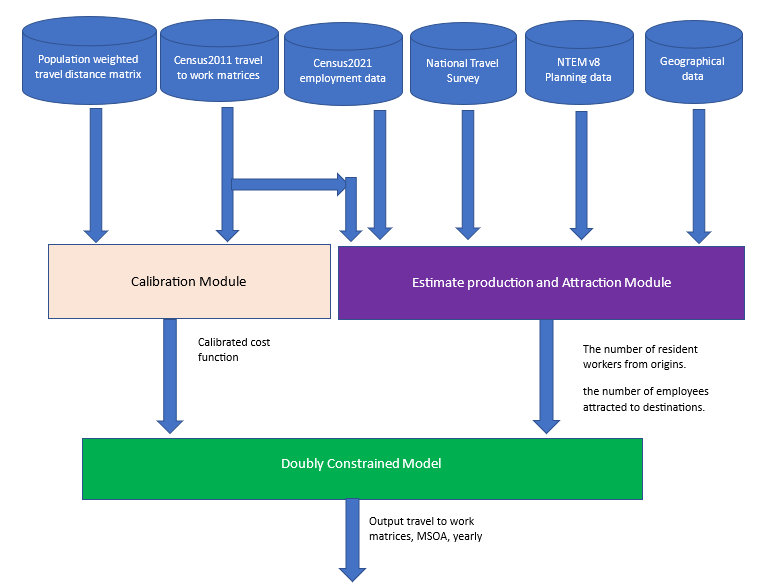

Figure 1 shows the processing pipeline, that is, how the different sources of data feed into the model and generate the estimation of travel to work matrices. The pipeline consists of three core modules: Production and Attraction Estimation Module, Calibration Module and Doubly Constrained Model.

Figure 1: The processing pipeline of the gravity model

The Production and Attraction Estimation Module estimates the number of resident workers travelling to a fixed workplace at each origin, and the number of employees working in each destination, using these assumptions:

- the number of resident workers for years 2012 to 2020 is estimated using growth factors in workers taken from Department for Transport’s (DfT) National Trip Ends Model (NTEM) , applied to 2011 Census values to estimate future year resident workers

- the number of resident workers for the year 2021 is estimated using Census 2021 resident employment data

- the proportion of resident workers travelling to a fixed workplace is estimated from DfT’s National Travel Survey (NTS), 2011 to 2021 , segmented by latent geographical clusters defined by land use characteristics (refer to Jahanshahi and Jin and our technical report for more detail).

- the number of employees at each destination is estimated using growth factors in jobs from NTEM, applied to 2011 Census values as Census 2021 workplace employment data is not available at the time of writing

In the Calibration Module, the cost of travelling between the origin and destination is currently estimated using straight-line distance. The model is calibrated using a cost function that aims to replicate the relationship between distance between home and work and the number of commuters, as seen in the 2011 Census travel to work matrices. In later versions of the model, we plan to replace distance with better estimations of costs, in terms of time and money, of travelling between home and work.

An iterative process, called the Doubly Constrained Model, then ensures that the estimated number of resident workers at all origins matches the number of employees working at all destinations.

Our gravity model estimates the travel to work matrices of the usual residents aged 16 and above and in employment with a fixed workplace at the Middle Layer Super Output Area (MSOA) for England and Wales, annually from 2012 to 2021. It also provides estimations of resident workers with a fixed workplace, and employees working in each MSOA in England and Wales, annually from 2012 to 2021. Please note that the 2021 estimates that we have published are the experimental results and should not be used for decision making purposes.

The model combines pre-coronavirus (COVID-19) pandemic commuting behaviour (for example, the proportion of employees travelling to a fixed place of work) from the NTS (2018 to 2019) and 2021 population and employment estimates to provide a counterfactual of travel to work matrices in 2021, assuming pre-pandemic commuting behaviour.

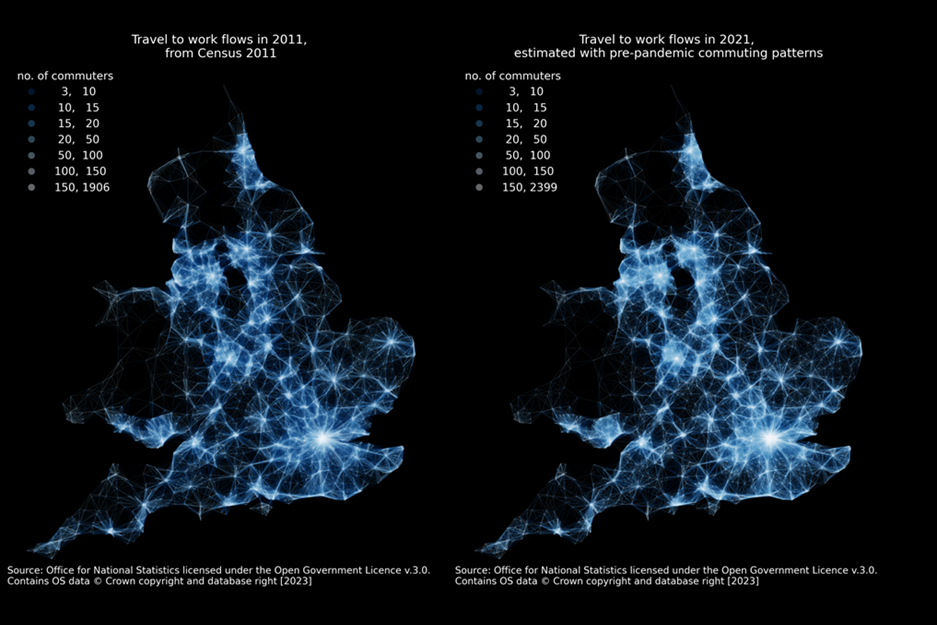

Figure 2 illustrates the estimated travel to work matrices for 2011 (from 2011 Census) and 2021 (under the assumption of the pre-pandemic commuting behaviours) respectively. The maps represent commuting flow between all home and work locations at MSOA level in England and Wales, with lighter lines indicating more commuters travelling to fixed workplaces. The maps provide a sense check on the estimated travel to work matrices for 2021, produced by the model. This is because, over time we would not expect commuting behaviour to change dramatically at aggregate level, so we would expect a similar picture to emerge from the travel to work matrices estimated for 2021, as we observe in 2011.

Figure 2: Travel to work flow map, MSOA, England and Wales, 2021 assuming pre-pandemic travel behaviour

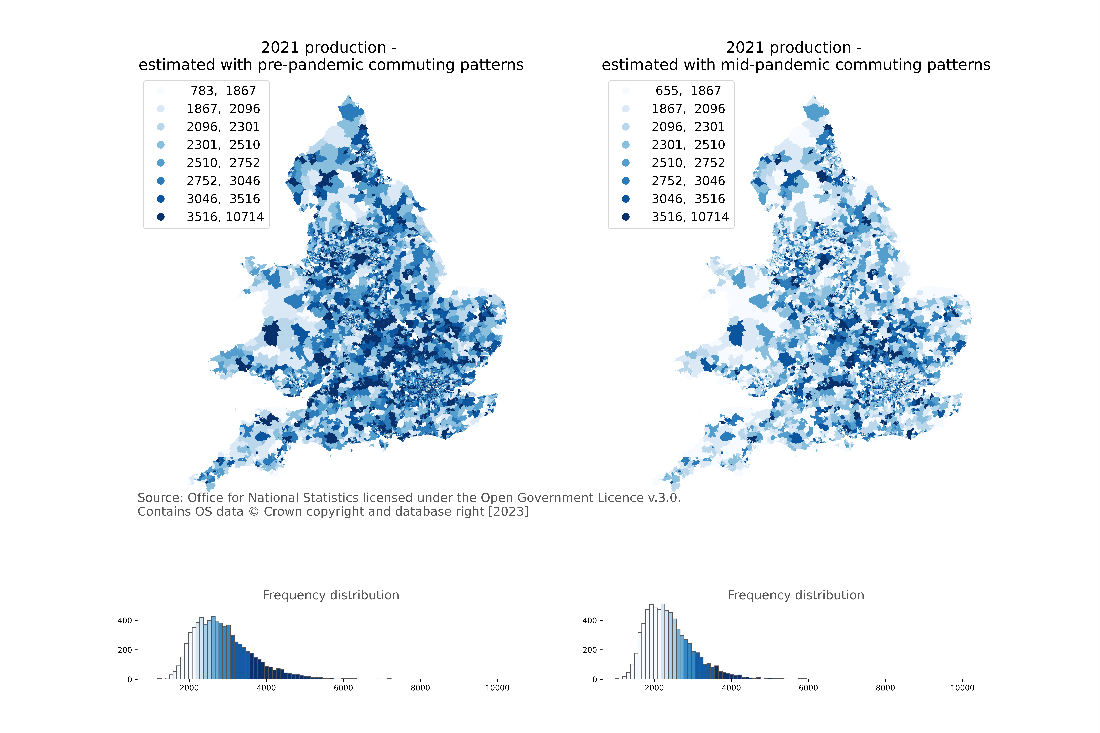

While our initial experimental results provide a counterfactual of travel to work matrices assuming pre-pandemic commuting behaviour, the model can also estimate travel to work matrices assuming mid-pandemic commuting behaviour. This is achieved using mid-pandemic commuting behaviour from the NTS (2020 to 2021) and 2021 population and employment estimates. Figure 3 presents maps showing the number of workers who travel to a fixed workplace for MSOAs in England and Wales in 2021 under these two conditions, for instance, assuming commuting patterns pre- and mid-pandemic, respectively.

Figure 3: Maps of production (the number of workers living in an area who travel to a fixed workplace), MSOAs in England and Wales, 2021 under the conditions of pre- and mid-pandemic travel behaviours, respectively

According to the 2011 Census, 21.6 million (81%) people travelled to a fixed workplace in England and Wales. The 2021 Census reports that 15.1 million (54%) people travelled to a fixed workplace, a significant reduction over 2011. This is because at the time of the 2021 Census many people were working from home or furloughed,. Our initial experimental estimations using commuting behaviour pre and mid-pandemic are in line with plausible expectations. Our model estimates that in 2021 76% (21.1 million out of 27.8 million working adults) travel to a fixed workplace under the assumption of pre-pandemic travel behaviours, and 63% (17.6 million out of 27.8 million working adults) travel to a fixed workplace under the assumption of mid-pandemic travel behaviours.

Limitations and next steps

One major shortcoming of the estimated travel to work matrices is the lack of validation, which has not been possible in the absence of a representative survey of travel to work for 2021, because the Census 2021 contains a mixture of pandemic and pre-pandemic responses on travel behaviours . To help validate the model, we are working on obtaining alternative data sources including mobile phone data.

In addition, there are limitations relating to some of the input datasets we have used in the model, particularly at finer spatial granularities. For example, the NTS cannot be relied upon at geographies lower than region, because of survey sample size, response rate and spatial coverage. We therefore make assumptions about travel behaviour trends for aggregations of areas based on rural-urban area type, densities, and accessibility measures (see our technical report for further details). Similar issues affect NTEM because of assumptions made regarding the distribution of growth in employment and workers. This will affect the reliability of the estimated travel to work matrices.

We plan to address these issues in future versions of the model by working with stakeholders, and through model enhancements, for example through segmentation by transport modes, industry, occupancy, and socioeconomic characteristics. This segmentation will allow us to make better assumptions about travel behaviour trends by different types of commuters and allow the estimation of travel to work matrices by these segmentation groups.

Our longer-term goals involve developing predictive models, to allow testing of ‘what-if’ policy questions and scenario-based analysis to enable decision making under uncertainties on future housing market, jobs market, economy, and technology developments. For example, by estimating and comparison of travel to work patterns under high or low growth in housing supply, jobs or economic performance.

Share this post

Related links.

- Data: Estimation of travel to work matrices, England and Wales

- Technical report: Estimation of travel to work matrices

Recent Posts

- Ship Traffic in Critical Maritime Passages

- Developing a Privacy Preserving Record Linkage toolkit

- Showcasing our collaborative community

- Transformation in the Ghana Statistical Service

- Enabling Data Access through Privacy Preserving Synthetic Data

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Register to vote Register by 18 June to vote in the General Election on 4 July.

Labour market and travel to work: Census 2021 in England and Wales

Data and supporting commentary about labour market and travel to work from Census 2021 in England and Wales. It includes univariate data (one variable only) down to Output Area (OA) level, where possible. This is part of topic summaries from Census 2021 results. Multivariate data (more than one variable) will be released in early 2023.

Applies to England and Wales

https://www.ons.gov.uk/releases/labourmarketandtraveltoworkcensus2021inenglandandwales

Official statistics are produced impartially and free from political influence.

Is this page useful?

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

Is flying hundreds of miles to commute to work worth it? Definitely, according to these 3 supercommuters.

- Supercommuters travel at least 75 miles or three hours to get to their jobs.

- Business Insider spoke with three supercommuters about the reasons they supercommute to work.

- One commuter said she has the best of both worlds when traveling from NYC to Michigan.

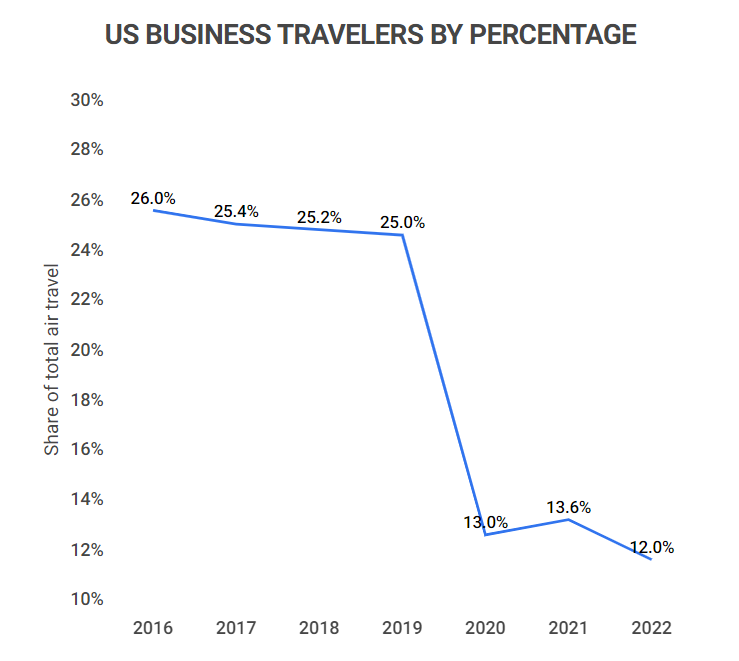

Over the last few years, many US workers have found themselves traveling farther to get to work but going into the office less often, thanks to hybrid work models.

They routinely wake up before sunrise to venture at least 75 miles to their workplace or spend at least three hours commuting to their job. Some of these supercommuters could move closer to their office, but they choose not to.

Business Insider spoke with three commuters who have traveled through multiple states to get to work each week. They shared the main reason they refused to move closer to their jobs.

Flying to Michigan weekly for work gave this New Yorker the best of both worlds

When BI spoke with Susan Miller in April, she had already been supercommuting for over two years.

The college professor shared how she lived in New York City but was flying to Ann Arbor, Michigan, weekly to teach at the University of Michigan Ross School of Business.

The 500-mile flight only takes two hours each way and costs her between $120 and $250 for a roundtrip ticket. The school doesn't cover her commute, but Miller uses her airline credit card to rack up miles and discounts.

"I enjoy the fresh air from the lakes and the nature of the Midwest, as opposed to city life," Miller told BI.

Related stories

At the same time, the professor said she loves returning home to take advantage of everything that makes New York City exciting and interesting.

Living in the Delaware suburbs on an NYC salary made this four-state commute worth it

Kyle Rice started traveling from Wilmington, Delaware, to NYC every morning for work in February.

Even though Rice traveled 125 miles through four states to reach his project manager job at an EMS software company, it only took him two hours to get to work each day on the Amtrak and subway.

"I'd never consider relocating to NYC because it wouldn't be smart financially," Rice told BI.

His new six-figure job allowed him to double his salary, but he was spending $1,510 monthly on commuting. First, he'd drive eight minutes to Amtrak and catch the 6:30 a.m. train from Wilmington to Newark, New Jersey. That ride took an hour and 37 minutes.

Then Rice would hop on the PATH in Newark and ride that railway for 30 minutes into NYC. Despite the traveling expense and time, Rice said his home in Delaware is way more affordable than living in New York City.

When BI interviewed Rice in May, his job had shifted his in-office schedule from daily to twice a week.

Traveling from LA to New York four times a month made this flight attendant happier

In 2023, flight attendant Malick Mercier moved to Los Angeles to live in a place with more creatives. But he was still a New York crew member.

"I knew that there'd be more creative people in Los Angeles, and I was finding myself really happy here on layovers," Mercier told BI.

Four times a month, he'd spend between five and eight hours commuting from LA to New York , and he said it wasn't easy. The airline worker would sometimes have to take three buses just to get to the Los Angeles International Airport before starting his 2,400-mile flight to work. And he'd book his ticket the night before or the day of his commute.

Mercier said occasionally getting to work on time was risky, but he always made it. His love and passion for his job made it all worth it.

"Plenty of people are like, 'Is it worth it?' And I feel like, yes, because this is my dream."

If you're a supercommuter or tried supercommuting and want to share your story, email Manseen Logan at [email protected].

Watch: While Delta's business is 'extremely robust,' the airline's marketing chief stays focused on the data

- Main content

- Updated Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

Traveling for business? 5 tips for working better from the hotel room

Career challenge of working on the road can be smoother with these smart tips.

Millennials, Gen Z workers call out boomers' annoying work habits

'Outnumbered' panel discusses a new report about younger workers complaining about their older co-workers.

If you’re on the road these days for business, most likely you’re working in your hotel room between meetings, sales calls, conferences and trade shows.

Participating in video conference calls, laboring over proposals, drafting emails and chatting with clients on your phone while in your hotel room all should be done in an environment that's most conducive for business .

There are pitfalls to avoid, however, and insights to know.

CAREER CORRECTION NEEDED? THIS BEHAVIOR MAY BE HURTING YOU AT WORK

Job experts and travel pros shared their best tips of the trade for working effectively and securely from a hotel room.

Let's dive right in …

1. Pick the right hotel and room

A well-appointed hotel in a central location at your destination is the smart move for business travelers.

"Business travelers should select at least a 3-star hotel or better in a safe and centrally located part of town," said Tim Hentschel, the Florida-based CEO of HotelPlanner, a travel-technology company powered by proprietary artificial intelligence.

"If having peace and quiet is the most important thing, then request a corner room far from the elevators," suggested the CEO of HotelPlanner about finding the perfect hotel room for working. (iStock / iStock)

The location, he said, should be "ideally the business district, where the hotels are likely to have robust security, as well as the services and amenities corporate travelers need, such as a printer or scanner, strong Wi-Fi and professional business meeting space — as well as nearby restaurants that are always good networking opportunities for business travelers."

CHATTY COWORKERS CAN HURT YOUR CAREER: HERE'S HOW TO FIX THE ISSUE

In your selected hotel, opt to request a location of your room for creating the backdrop for a productive work experience.

"If having peace and quiet is the most important thing, then request a corner room far from the elevators, where people talking may distract you," Hentschel told Fox Business.

If budget allows, consider a suite with more room. You may find the extra living space a better place to work.

2. Use the desk

It might be tempting to sit in bed with your laptop, but a far better idea is to use the work station set-up in your hotel room.

Sitting at the desk will foster a better work experience.

"Most hotels have too much stuff and collateral on the working desk. It’s the first thing I get rid of. Stick to bare essentials," said one expert about working from a hotel room while on the road for business. (iStock / iStock)

"Work from the desk, not the bed or couch," said Travel + Leisure Co.’s senior vice president of global brands, Renu Snehi, who is based in Orlando Florida.

"Work from a desk and create a serene, clean environment to focus," she said.

Another tip is to remove any extra items from the desk that aren’t needed.

GHOSTED AFTER A JOB INTERVIEW? EXPERTS REVEAL HOW TO HANDLE THE EXPERIENCE

"Most hotels have too much stuff and collateral on the working desk. It’s the first thing I get rid of. Stick to bare essentials," Snehi said.

3. Stage your room for video conferencing calls

Conducting a Zoom call from your hotel room is easy to do with a few simple tips.

First, be sure to put the "Do Not Disturb" sign on the door.

After dressing professionally for the call, create a scene for success.

"Make sure the room is well lit, with no outside glare from windows, and use the desk lamp in your hotel room to illuminate your face so you look your best on screen," said Hentschel.

Portrait of a happy man taking notes. (iStock / iStock)

In addition, be sure not to have laundry, your private belongings or your suitcases show up in the background during your video calls.

4. Understand IT security implications

Having free Wi-Fi is a hotel is convenient for checking email or streaming while on vacation — but if you’re traveling on business and there is confidential material you’re working on, IT security could be a concern .

"There is inherent risk any time you use a public Wi-Fi, whether you’re at Starbucks or a hotel. So log on at your own risk," cautioned Hentschel.

CAREER CHALLENGE: HOW TO NAIL YOUR SECOND JOB INTERVIEW AND LAND THAT DREAM JOB

"You can use a personal hotspot from your smartphone, but nothing is failsafe from potential cyber hackers," he also said.

For added security, you may want to use a VPN for your wireless connection.

If you’re traveling on business and there is confidential material you’re working on, IT security could be a concern.

A VPN is a "virtual private network" that’s established as a protected and encrypted connection when on a public Wi-Fi network.

"A VPN or virtual private network is designed to keep your online activity safe and secure from the prying world," said Andreas Grant, a network security engineer in San Diego, California.

To break up the grind of working in your hotel room, venture out to other spaces in the hotel, suggested one professional. (iStock / iStock)

"When you turn on the VPN, you are creating a private connection with another computer in another location that you may or may not know. This involves encapsulation and tunneling."

Grant said all the data that goes through gets encrypted, so your ISP won't have any idea the types of site you are browsing.

REMOTE WORKERS RESIST MONDAY OFFICE HOURS, BUT BUILDING ORGANIZATIONAL CULTURE IS KEY, SAYS EXECUTIVE

"You keep your data safe," he added.

5. Change up your work setting

To break up the grind of working in your hotel room, venture out to other spaces in the hotel, said Snehi.

"Go work from the lobby or executive lounge," she said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"It gives me a fresh perspective and at times [a chance] to eavesdrop into what other executives are doing. I've often met some great people while working from a business lounge and at breakfast."

Security Alert May 17, 2024

Worldwide caution, update may 10, 2024, information for u.s. citizens in the middle east.

- Travel Advisories |

- Contact Us |

- MyTravelGov |

Find U.S. Embassies & Consulates

Travel.state.gov, congressional liaison, special issuance agency, u.s. passports, international travel, intercountry adoption, international parental child abduction, records and authentications, popular links, travel advisories, mytravelgov, stay connected, legal resources, legal information, info for u.s. law enforcement, replace or certify documents.

Tourism & Visit

Study & Exchange

Other Visa Categories

U.S. Visa: Reciprocity and Civil Documents by Country

Share this page:

Temporary Worker Visas

Visas for Members of the Foreign Media, Press, and Radio

Treaty Trader & Treaty Investor and Australians in Specialty Occupations

Visas for Canadian and Mexican USMCA Professional Workers

A citizen of a foreign country who wishes to work in the United States must first get the right visa. If the employment is for a fixed period, the applicant can apply for a temporary employment visa. There are 11 temporary worker visa categories. Most applicants for temporary worker visas must have an approved petition. The prospective employer must file the petition on behalf of the applicant. U.S. Citizenship and Immigration Services (USCIS) reviews the petition.

Temporary worker visa categories

Labor certification.

Certain visa categories need an approved labor certification. First, the prospective employer must apply for the labor certification with the Department of Labor . Then, the prospective employer can file the Petition for a Nonimmigrant Worker, Form I-129, with USCIS. Please refer to the Instructions for Form I-129 on the USCIS website to confirm if you need the labor certification.

Petition Approval

Some temporary worker categories are limited in the total number of petitions which can be approved on a yearly basis. Before an applicant can apply for a temporary worker visa, USCIS must first approve the Petition for a Nonimmigrant Worker, Form I-129 . For more information about the petition process, see Working in the U.S. and Temporary (Nonimmigrant) Workers on the USCIS website. Once USCIS approves the petition, it will send the prospective employer a Notice of Action, Form I-797.

Important Notice: Same-sex Marriage

Effective immediately, U.S. Embassies and Consulates will adjudicate visa applications that are based on a same-sex marriage in the same way that we adjudicate applications for opposite gender spouses. Please reference the specific guidance on the visa category for which you are applying for more details on documentation required for derivative spouses. For further information, please see our FAQ’s .

How to Apply

You may apply for a visa when USCIS has approved your petition. There are several steps in the visa application process. The order of these steps and how you complete them may vary at the U.S. embassy or consulate where you apply. Please visit the embassy or consulate website for instructions on how to apply.

Complete The Online Visa ApplicationComplete The Online Visa Application

- Online Nonimmigrant Visa Application, Form DS-160 – Learn more about completing the DS-160 . You must: 1) complete the online visa application and 2) print the application form confirmation page to bring to your interview.

- Photo –You will upload your photo while completing the online Form DS-160. Your photo must be in the format explained in the Photograph Requirements .

Schedule an Interview