Fact Check: Amtrak Does NOT Offer $1 Card For All US Residents That Lets Them Ride Trains For A Year Without Extra Fees

- Aug 23, 2023

- by: Lead Stories Staff

Does Amtrak have a promotion for a $1 card that allows every U.S. resident to ride their trains with no extra charges for a year? No, that's not true: An Amtrak spokesperson told Lead Stories that the card is a scam offer.

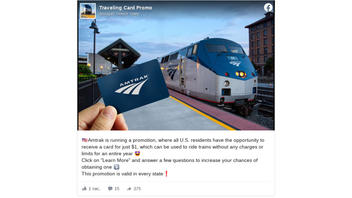

The claim appeared in a post (archived here ) on Facebook on August 16, 2023. The caption of the post read:

🇺🇸Amtrak is running a promotion, where all U.S. residents have the opportunity to receive a card for just $1, which can be used to ride trains without any charges or limits for an entire year 🤩 Click on "Learn More" and answer a few questions to increase your chances of obtaining one ⤵️ This promotion is valid in every state❗️

This is what the post looked like on Facebook at the time of writing:

(Source: Facebook screenshot taken on Wed Jul 23 14:54:03 2023 UTC)

There is no such Amtrak card

Lead Stories searched for information on a $1 card sponsored by Amtrak that allows all U.S. residents to take trips for a year without any extra charge. Amtrak's website did not show such a card on its deals , multi-ride and rail passes nor credit cards pages. We also did not find any credible results through Google search : There was mostly information about earning points on an Amtrak credit card for every dollar spent, which is not the same claim the post on Facebook is making.

Lead Stories reached out to Amtrak about the claim. In an email sent to us on August 23, 2023, Beth Toll , senior public relations manager for Amtrak's regional media relations office in Wilmington, Delaware, said:

Yes, this is a scam that was reported a few weeks ago and we are pursuing it with Facebook.

Post does not link to Amtrak's website

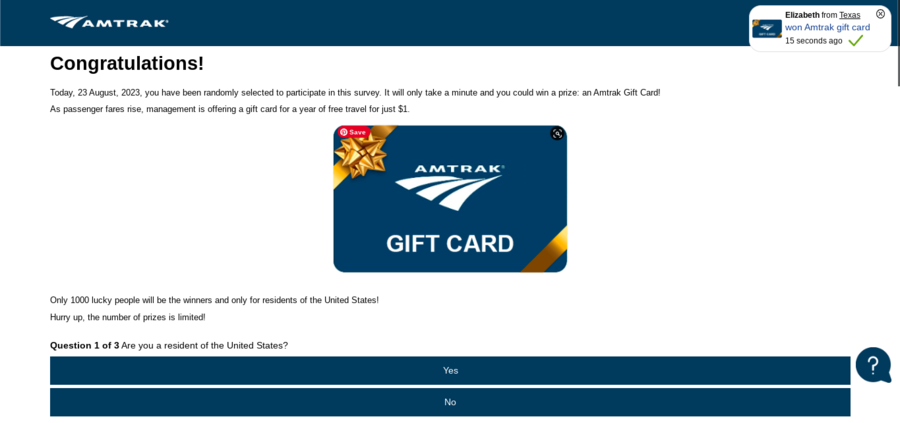

The post on Facebook that makes the claim includes a link that supposedly allows viewers to "Learn More" about the $1 card. The link does not lead viewers to an Amtrak webpage: Rather, it is a questionnaire page set up to appear like Amtrak's website. This is obvious when looking at the link's URL, which begins with https://siliconhill.info/ , a blog that appears to offer travel anecdotes and advice.

A screenshot of the webpage that the link leads to is included below:

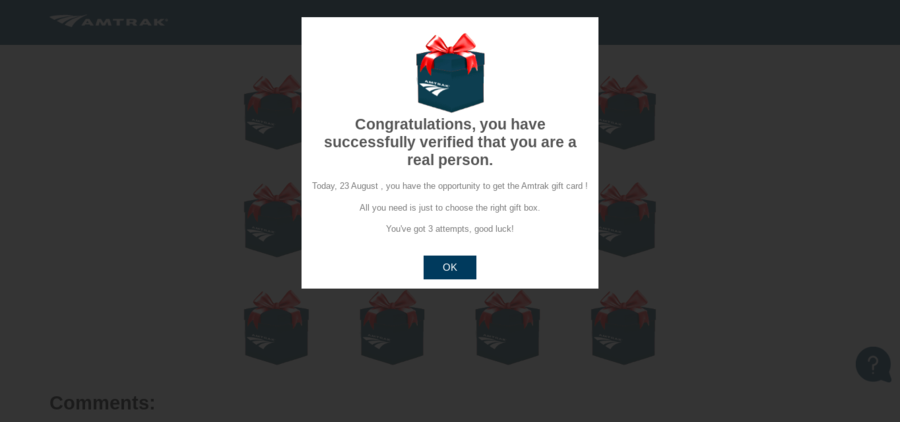

Lead Stories filled out the questionnaire to find out the end result. When we finished answering the three questions, we were led to a screen offering us three attempts to win an Amtrak gift card. A screenshot of that webpage is below:

This suggests that the card "promotion" is actually some sort of gift card giveaway or scheme seeking personal information, not a program actually sponsored by Amtrak.

Other Lead Stories fact checks about Amtrak can be found here .

Lead Stories is a fact checking website that is always looking for the latest false, deceptive or inaccurate stories (or media) making the rounds on the internet. Read more about or contact Lead Stories Staff

Lead Stories is a fact checking website that is always looking for the latest false, misleading, deceptive or inaccurate stories, videos or images going viral on the internet. Spotted something? Let us know! .

Lead Stories is a:

- Verified signatory of the IFCN Code of Principles

- Facebook Third-Party Fact-Checking Partner

- Member of the #CoronavirusFacts Alliance

@leadstories

Subscribe to our newsletter

Please select all the ways you would like to hear from Lead Stories LLC:

You can unsubscribe at any time by clicking the link in the footer of our emails. For information about our privacy practices, please visit our website.

We use Mailchimp as our marketing platform. By clicking below to subscribe, you acknowledge that your information will be transferred to Mailchimp for processing. Learn more about Mailchimp's privacy practices here.

Fact Check: 'The Great Reset' Is NOT A Secret Plan Masterminded By Global Elites To Limit Freedoms And Push Radical Policies

Fact Check: The Story of the Wooden Bombs Dropped by Allied Forces on German Decoy Airfields During WW2 is Likely True

Fact Check: Jon Voight, Angelina Jolie Did NOT Co-Create 'Non Woke Production Studio' -- It's AI-Generated Satire

Fact Check: Mel Gibson, Mark Wahlberg Did NOT Co-Create 'Non-Woke Film Production Studio' -- Satire Website Source

Fact Check: Roseanne Barr And Michael Richards Are NOT Developing 'New Non-Woke Sitcom Focused On Traditional Values' -- It's Satirical Article

Fact Check: Teen Did NOT Sleep With His Bullies' Mothers To 'Assert Dominance'

Fact Check: Facebook Did NOT Ban Posting Of The Lord's Prayer

Most recent.

Fact Check: Declassified 1957 CIA File Mentioning 'Tartar History' Does NOT Vindicate Tartarian Empire Conspiracy Theory

Fact Check: NGO Flyer Encouraging Migrants To Vote For Biden Is NOT Authentic; It's Fake

Fact Check: Marines Attending Event At Mar-A-Lago DID Have Permission To Wear Uniforms -- It Was Charity Event

Fact Check: NON Authentic Photo Of P. Diddy, Trump, Jeffrey Epstein Sitting With Young Women Shows Signs of AI Manipulation

Fact Check: Satirical Video Does NOT Show Actual Lesbian Mother Describing How She Sued Sperm Donor For 40% Of Paycheck

Fact Check: Photo Showing Trump, Epstein With Minor Girl Is NOT Authentic

Fact Check: Video Of Joe Rogan Talking About Extraterrestrial Life On Planet K2-18 B Is NOT Authentic

Share your opinion, lead stories.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

The best credit cards to use for all your amtrak and international train travels, whether you’re riding the rails at home or abroad, these cards will reward you for your train trips..

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more.

There's nothing like watching the world pass you by from a train window, seeing the landscapes change, contemplating the vast scenery around you and passing the time curled up with a good book or chatting with your fellow travelers in the dining car. There's an old-school sort of wonder to it all, whether you're traveling around the U.S. on Amtrak — some journeys are more scenic than others — or riding the rails internationally.

Of course, the whole experience feels a lot more magical when it's a free (or nearly free) one — or if you're earning rewards points or cash-back that you can use to fund even more of your travels.

Below, Select details the best credit cards to use for train travel wherever you are, plus a few tips for saving money on U.S. and international train trips.

Best credit cards for train travel

- Best overall : Chase Sapphire Reserve®

- Best for casual Amtrak travelers : Amtrak Guest Rewards® Mastercard®

- Best for frequent Amtrak travelers : Amtrak Guest Rewards® Preferred Mastercard®

- Best for international train travel : Chase Sapphire Preferred® Card

- Best for earning cash-back rewards on travel : Blue Cash Preferred® Card from American Express

- Best for earning flexible travel rewards points : Capital One Venture Rewards Credit Card (see rates and fees )

- Best business card : Ink Business Preferred® Credit Card

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign up here .

Best overall

Chase sapphire reserve®.

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

Regular APR

22.49% - 29.49% variable

Balance transfer fee

5%, minimum $5

Foreign transaction fee

Credit needed.

Terms apply.

Read our Chase Sapphire Reserve® review.

Who's this for? The Chase Sapphire Reserve® stands out for offering an up to $300 annual travel credit, which can be used to cover rail trips. Not only that, cardholders earn a generous 3X points per dollar on other travel, including train tickets.

Beyond that, cardholders can earn 5X points per dollar on flights and 10X points on hotels and rental cars when they're booked through Chase Travel℠ (after your first $300 in travel-related purchases), making it an ideal pick for frequent travelers. You'll also earn 10X points per dollar through Chase Dining, 10X points on Lyft rides through Mar. 31, 2025, 3X points per dollar for all other travel and dining purchases including takeout and delivery and 1X point per dollar for any other spending.

Points are worth 50% more when redeemed for travel through Chase Travel℠, meaning the 60,000-point welcome bonus you can earn after spending $4,000 in the first three months is worth at least $900 in travel.

While you can't use Ultimate Rewards® points to book train tickets, you can still transfer them to any of Chase's many airline and hotel partners such as Southwest Airlines, United Airlines, IHG, Marriott and Hyatt to enhance your travels, especially if you're flying to a particular country or locale to begin your rail adventure or need hotels to stay in — or a car rental — before or after your train trip.

There is a high $550 annual fee, but in turn, cardholders receive the $300 annual travel credit; a suite of travel and purchase protections; a Global Entry or TSA PreCheck application fee credit ; Priority Pass airport lounge access ; extra benefits when you book a rental car with Avis, National Car Rental or Silvercar; VIP access to events and experiences; and special perks such as free daily breakfast, late checkout and room upgrades when you book a stay through The Luxury Hotel & Resort Collection.

Best for casual Amtrak travelers

Amtrak guest rewards® mastercard®.

2X points on travel booked with Amtrak (including purchases made onboard), 2X points on dining and 1X points for all other purchases.

Earn 12,000 bonus points after spending at least $1,000 within the first three billing cycles of account membership.

25.24% to 27.49% (variable)

5% of the amount being transferred or $10, whichever is greater

Excellent/Good

See rates and fees, terms apply.

Who's this for? If you're someone who plans the occasional rail journey with Amtrak, the new Amtrak Guest Rewards® Mastercard® issued by First National Bank of Omaha makes a great choice, as it lets you earn 2X points on travel with Amtrak (including purchases made onboard) and dining and 1X points for all additional purchases. You'll also receive a 10% rebate on food and beverage purchases made onboard the train (as a statement credit) and a 5% points rebate when your points are redeemed for travel on Amtrak.

The card has no annual fee, no transaction fees and new cardholders can pick up 12,000 bonus points after spending $1,000 within the first three billing cycles after opening an account, giving you a great head start toward free (or nearly free) train rides considering that Amtrak reward travel starts at just 800 points.

Best for frequent Amtrak travelers

Amtrak guest rewards® preferred mastercard®.

3X points on travel booked with Amtrak (including purchases made onboard); 2X points on travel, dining, public transit and ride-share services; and 1X points for all other purchases.

Earn 30,000 bonus points after spending at least $1,000 within the first three billing cycles of account membership.

Who's this for? For those who travel frequently aboard Amtrak trains, the Amtrak Guest Rewards® Preferred Mastercard® offers similar benefits, but for a reasonable annual fee of $99 provides more perks. For starters, you'll be earning 3X points for Amtrak travel (including purchases made onboard); 2X points on travel, dining, public transit and ride-share services; and 1X points for all other purchases. You'll also score a 20% rebate on food and beverages purchased onboard, in the form of a statement credit, and a 5% points rebate whenever points are redeemed for travel on Amtrak.

As far as additional benefits, cardholders receive several special perks upon account opening as well as on their card's anniversary date, including a round-trip companion coupon, one-class upgrades and station lounge passes. You'll also earn 1,000 tier-qualifying points whenever you spend $5,000 in qualifying purchases with the card.

Now through Dec. 2, 2022, new card members can earn 30,000 bonus points (instead of the usual 20,000) after spending $1,000 within the first three billing cycles of account membership. If you've been a fan of U.S. train travel and are looking for a card that'll help you earn points towards more trips on the rails, this could be a great addition.

Best for international train travel

Chase sapphire preferred® card.

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

21.49% - 28.49% variable on purchases and balance transfers

Either $5 or 5% of the amount of each transfer, whichever is greater

Read our Chase Sapphire Preferred® Card review .

Who's this for? If your primary goal is to earn bonus points on train rides abroad and you don't want to pay a high annual fee, the Chase Sapphire Preferred® Card might be a good choice.

The card has no foreign transaction fees and lets you earn 2X points per dollar on general travel purchases, including train tickets. It also offers 5X points per dollar on travel booked via Chase Travel SM ; 5X points per dollar on Lyft rides now through Mar. 31, 2025; 3X points per dollar spent with certain streaming services, as well as on dining and online grocery shopping (except Target®, Walmart® and other wholesale clubs); and 1X point per dollar on all other purchases.

With a $95 annual fee, this card packs a punch, offering additional travel benefits such as a $50 Annual Chase Travel Hotel Credit, collision damage waivers for car rentals, trip cancellation and interruption insurance, baggage delay insurance, a 10% points boost to celebrate each card anniversary and special discounts for shopping with Instacart+ , DoorDash , and GoPuff, among other perks.

New cardholders can earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening, which is worth $750 toward travel when redeemed through Chase Travel SM .

Best for earning cash-back rewards on travel

Blue cash preferred® card from american express.

6% cash back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%), 6% cash back on select U.S. streaming subscriptions, 3% cash back at U.S. gas stations, 3% cash back on transit (including taxis/rideshare, parking, tolls, trains, buses and more) and 1% cash back on other purchases. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout.

Earn a $250 statement credit after you spend $3,000 in purchases on your new card within the first 6 months.

$0 intro annual fee for the first year, then $95.

0% for 12 months on purchases from the date of account opening

19.24% - 29.99% variable. Variable APRs will not exceed 29.99%.

Either $5 or 3% of the amount of each transfer, whichever is greater.

See rates and fees , terms apply.

Who's this for? If you're interested in earning cash-back rewards for your travel purchases and having a 0% intro APR for the first 12 months on purchases from the date of account opening (after, 19.24% - 29.99% see rates and fees ; variable APRs will not exceed 29.99%), consider applying for the Blue Cash Preferred® Card from American Express .

This card lets you earn 6% cash back for shopping at U.S. supermarkets (up to $6,000 per year, then 1%), 6% cash back on certain U.S. streaming subscriptions, 3% cash back on transit (including trains) and U.S. gas station purchases and 1% cash back on all other purchases, making it a great card to use during your travels and when you're using trains closer to home. Terms apply.

Three things to note about this card: While there is an $0 introductory annual fee for the first year, it'll be $95 after that ( see rates and fees ); the cash back you'll earn from using this card is offered to cardholders as Reward Dollars, which can be redeemed as statement credits; and unlike many cards on this list, you'll have to pay foreign transaction fees of 2.7% for using this card outside the U.S.

New cardholders also have an opportunity to earn a welcome bonus of a $250 statement credit after spending $3,000 within the first six months of account membership.

Best for earning flexible travel rewards points

Capital one venture rewards credit card.

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 2X miles per dollar on every other purchase

Earn 75,000 bonus miles once you spend $4,000 on purchases within 3 months from account opening

N/A for purchases and balance transfers

19.99% - 29.99% variable

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

See rates and fees , terms apply.

Who's this for? While most travel rewards cards focus heavily on earning points for flights and hotels, the Capital One Venture Rewards Credit Card (see rates and fees ) lets you earn 2X miles for every purchase — plus, 5X miles on hotels and rental cars when you book them directly with Capital One Travel — making it easier to rack up the rewards you'll need to book your train tickets by buying the things you need to buy anyway.

The welcome bonus is pretty decent, too — new cardholders can currently earn 75,000 bonus miles after spending $4,000 within the first three months of card membership — and the card's annual fee of $95 is quite reasonable considering you're also getting a statement credit up to $100 to cover Global Entry or TSA PreCheck® membership and two complimentary visits per year to any Capital One Lounges (or any of the more than 100+ Plaza Premium Lounges through the Partner Lounge Network)(see rates and fees ).

You'll also receive a range of travel-related benefits, including no foreign transaction fees, auto rental collision damage waivers for rental cars and travel accident insurance, as well as access to extra perks through Capital One Dining and Capital One Entertainment .

While you can't transfer miles to Amtrak, you can use them to "erase" recent travel purchases, including those made with Amtrak, at a fixed value of one cent per point. You can also use the miles to cover hotels, flights, rental cars, and other parts of your trip either by booking through Capital One Travel or transferring and redeeming them through any of Capital One's airline or hotel partners, including Accor, Aeroplan, Qantas, Etihad and Singapore Airlines, among others.

Best business card

Ink business preferred® credit card.

Earn 3X points per $1 on the first $150,000 spent in combined purchases in select categories each account anniversary year (travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines), 1X point per $1 on all other purchases

Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening.

21.24% - 26.24% variable

Good/Excellent

Read our Ink Business Preferred® Credit Card review.

Who's this for? Similar to the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card , the Chase Ink Business Preferred® Credit Card can be used to rack up Ultimate Rewards® points — 3X points per dollar on your first $150,000 worth of spending in business categories such as travel; shipping; cable, phone and internet services; and advertising expenses, then an unlimited 1X points per dollar for all other purchases.

You can then use those points to cover additional elements of your trip, such as flights, hotel stays or rental cars by booking travel directly through the Chase Travel SM — your points will be worth 25% more that way — or by transferring and redeeming them with any of Chase's many airline and hotel travel partners, including World of Hyatt, IHG, JetBlue and British Airways, among others.

New cardholders can currently earn a welcome bonus of 100,000 bonus points after spending $8,000 within the first three months of account opening, which translates to about $1,250 in travel when redeemed through Chase Travel SM . There is a modest annual fee of $95, but there are no foreign transaction fees for using it abroad. The card also offers fraud and purchase protections and additional employee cards to help you stay on top of all your business needs.

More ways to save money with Amtrak

In general, the earlier you can book your ticket, the better, especially on Amtrak, which releases its schedule 11 months in advance so you'll have plenty of time to plan. You can also save more by making some obvious choices, such as traveling in coach instead of business or first class, or toughing it out long-distance in a regular seat rather than splurging on private Roomette or Bedroom accommodations. Otherwise, here are some more things to be aware of if you're trying to stick to a budget-friendly ride.

Choose your fare class wisely

Amtrak offers several ticketing options depending on your route and what's available when you're booking (which is why buying your tickets early is so important), and each of them offers different perks and policies regarding changes and cancellations.

- Saver: Non-refundable fares, usually the cheapest, with fees that may apply for changing or canceling your ticket

- Value: Fares with refund options and no change fees; often second-cheapest

- Flexible: Fully refundable fares before departure, with no fees for changes or cancellations; typically the most expensive option

Depending on your travel needs and financial situation, it might be worth splurging for a more refundable ticket if you think there might be a need to change or cancel it. On the other hand, budget-conscious travelers might be more apt to risk it all for a cheaper, non-refundable Saver fare.

Take advantage of Amtrak Guest Rewards perks

Don't forget to sign up for Amtrak Guest Rewards , the train company's free loyalty program, which gives you access to perks such as a 25% points bonus on business class travel and Acela business class travel, a 50% points bonus on travel in Acela first class, the ability to earn 2X points per dollar on Amtrak purchases and points-earning opportunities through its partners.

From there, if you travel on Amtrak often and earn enough tier-qualifying points, you can earn status :

- Select: Starting at 5,000 tier-qualifying points, you'll score all the perks of being a regular member, plus a 25% bonus on Amtrak travel, two one-class upgrades, two 10% discount coupons, exclusive offers, priority call handling and two single-visit passes to Amtrak Lounges

- Select Plus: Starting at 10,000 tier-qualifying points, you'll get the same perks as the previous tier, with a few differences — a 50% points bonus on Amtrak travel, four one-class upgrades and two companion coupons.

- Select Executive: Starting at 20,000 tier-qualifying points, you'll have the same perks as the previous tier, but with a 100% points bonus on Amtrak travel, four one-class upgrades (plus another one every time you hit the 3,000 tier-qualifying points mark) and one coupon for Auto Train Priority Vehicle Offloading.

Unfortunately, most loyalty programs no longer let you transfer points to Amtrak Guest Rewards , so your only real option is to call 1-866-313-9635 and transfer Audience Rewards ShowPoints at a 1:1 ratio in 1,000-point increments.

Otherwise, you can earn more points by shopping through the Amtrak Guest Rewards shopping portal or booking hotels and rental cars through Amtrak's partners and, of course, booking Amtrak tickets or signing up for one of its co-branded credit cards. You can also pick up more points by shopping with a litany of retail partners including 1-800-Flowers, Teleflora, Apple, Survey Points Club, QVC, The Home Depot, eBags, NRG Home, Vinesse Wines, Audience Rewards or the Rail Passengers Association.

Find the best credit card for you by reviewing offers in our credit card marketplace or get personalized offers via CardMatch™ .

Keep an eye on Amtrak's deals and promotions

Amtrak is known for having sales, so it's a good idea to check its deals page from time to time, which lets you search for specials by region. Amtrak recently offered a double points promo on fall travel , for instance, while other deals are related to newly launched routes, buy-one-get-one-free specials on certain segments or 30% off Acela bookings made at least 14 days in advance, among others. In general, though, you'll typically save 20% by booking your tickets at least a week or two ahead.

Save with group or multi-ride rail passes

If you're going to be traveling in a group —with family members, friends or co-workers — you might be able to save by booking your tickets with Amtrak's Share Fares feature, which offers discounts ranging from 17% off for groups of three to 60% off for groups of eight when you book at least two days ahead.

Another option, if you're going to be doing several trips back and forth to the same place within a certain timeframe, is to opt for multi-ride passes — monthly, 10-ride or 6-ride — which allow you to pay a discounted fare and commute more often between two cities.

For those who want to go big or go home with Amtrak, the USA Rail Pass allows you to ride 10 segments over the course of 30 days on many of its most scenic routes for $499 per person. Use the pass to plan a few weekend getaways from your hometown or plan an epic rail journey from coast to coast with a few stops in between — it's up to you.

Another option, the California Rail Pass , offers access to The Golden State's most beautiful train rides for a flat rate of $159 per adult and $79.50 per child, letting you travel anytime for 7 days within a consecutive 21-day period.

How to save more on international train travel

When booking train rides abroad, remember to be flexible. In some places, rail lines frequented by locals might be slower-paced but can save you a few bucks compared to faster trains along popular tourist routes. Try to book in advance whenever you can and consider investing in a rail pass — it's worth checking websites such as Eurail or Rail Europe if you'll be visiting multiple European countries, for instance — if you know you're going to be spending a lot of time on trains during your trip.

Check for deals and discounts, especially if you're a student, senior or traveling with children, and see if regional passes are available if you're sticking to one country or a particular area within a country. Start by checking the tourism websites of the places you're going to see what is recommended since every destination is different.

Bottom line

Though not every travel rewards card allows you to transfer your points directly to Amtrak — except of course for the two Amtrak co-branded credit cards on this list — you can still use flexible rewards-earning cards to rack up enough points to pay for other portions of your trip, such as flights, hotel stays or rental cars. By using certain cards to pay for your Amtrak tickets, you'll be able to earn even more points to help fund future travels.

Before signing up for a new credit card, it's a good idea to check your credit score so you can identify any issues and get a better idea of what your chances are for approval. Make sure you're able to spend within your budget, especially if the card you're interested in has a steep annual fee and think about whether or not you'll be able to use all of its benefits enough to justify adding it.

Our methodology

To determine which cards offer the best value for train travel, Select analyzed 234 of the most popular credit cards available in the U.S. We compared each card on a range of features, including: rewards, welcome bonus, introductory and standard APR, balance transfer fee and foreign transaction fees, as well as factors such as required credit and customer reviews when available. We also considered additional perks, the application process and how easy it is for the consumer to redeem points.

Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date.

For rates and fees of the Blue Cash Preferred® Card from American Express, click here .

- 5 things to avoid if you’re applying for a mortgage Kelsey Neubauer

- Best sole proprietorship business credit cards Jason Stauffer

- This is the best budgeting app to help investors track their money Jasmin Suknanan

Amtrak's best-ever credit card offer can get you $1,400 in train travel

Update: Some offers mentioned below are no longer available. View the current offers here .

Points can go a long way with Amtrak's Guest Rewards program . With many fares, the U.S. rail provider's points are worth 2.8 cents apiece, though redemptions are based on the "value" category or above — deep-discount "saver" fares aren't available for awards.

Want more credit card news and advice? Sign up for TPG's daily newsletter.

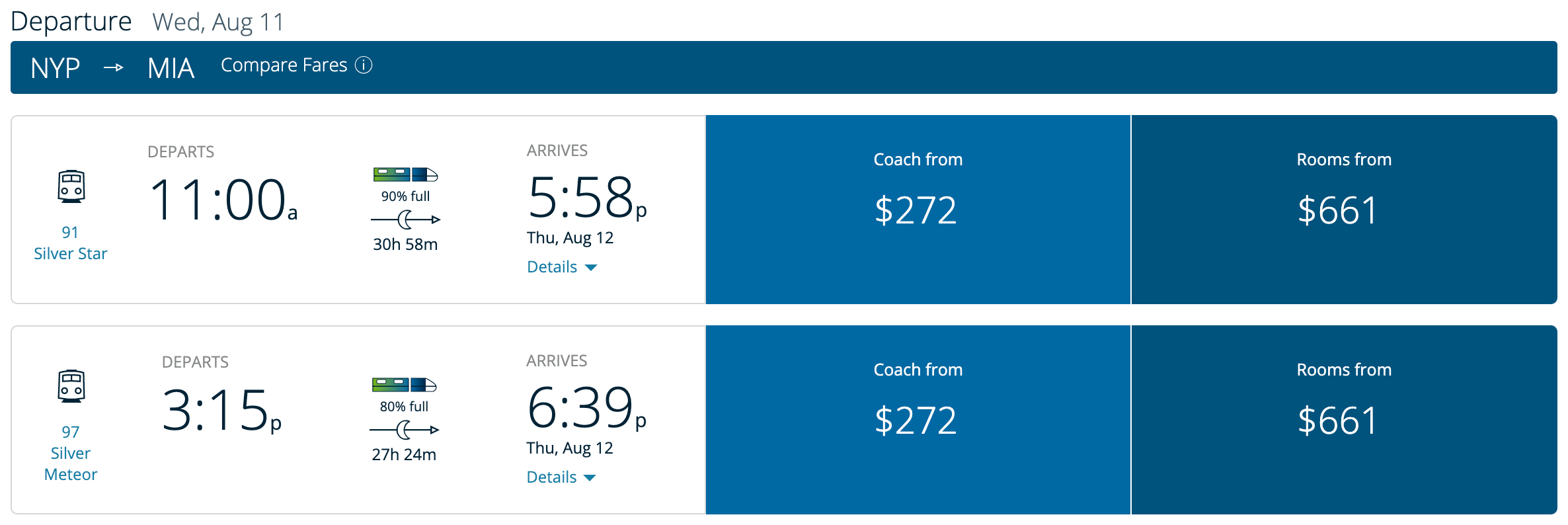

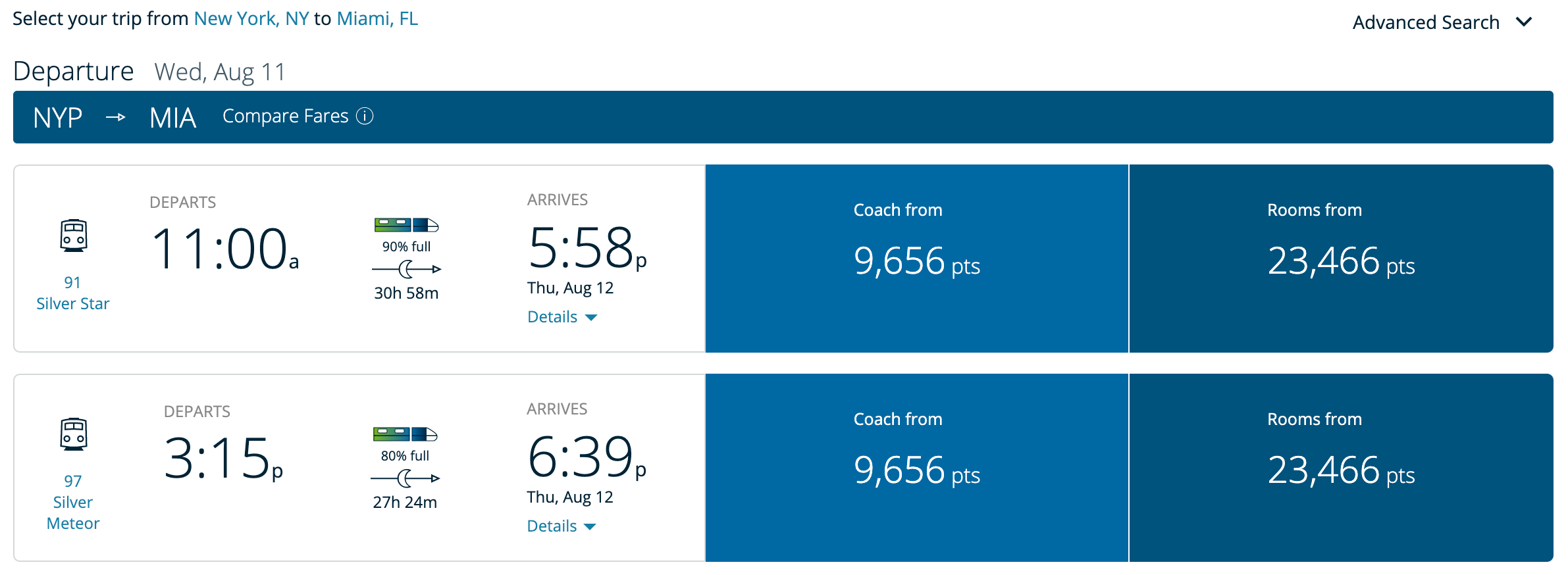

Still, there are plenty of opportunities to score great value, especially with last-minute tickets. Take a train from New York to Miami next week, for example. Paying cash, you'll need to fork over $272 for the one-way trip.

If you're booking at award, the same seat will cost you just 9,656 points, hitting that 2.8-cent-per-point sweet spot. The same redemption value applies to Roomette bookings, too.

Most recently, Amtrak was offering 20,000 points plus a $200 statement credit after spending at least $1,000 in the first 90 days with the Amtrak Guest Rewards® World Mastercard®. This week, the offer is significantly higher.

The information for the Amtrak Guest Rewards card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Best credit cards for train travel

In celebration of its 50th anniversary, Amtrak's now offering a whopping 50,000 points after making at least $2,500 in purchases within the first 90 days. You'll need to spend more to trigger the bonus, but this new offer can get you well over $1,000 in travel (according to TPG's valuations ) — as much as $1,400 with certain fares.

Beyond the incredible sign-up bonus, you'll also enjoy lucrative perks when you open your account and when you renew your card every anniversary, including an annual companion coupon (worth up to $300 in Amtrak travel) and an annual upgrade coupon (worth up to $150 in Amtrak travel). You'll receive all of these great Amtrak perks for a (more than) reasonable $79 annual fee.

Related: Your complete guide to Amtrak Guest Rewards

While 50,000 points might not sound especially impressive with so many cards offering 100k or more , Amtrak's bonus can take you further than even the 150,000-point offer after spending $4,000 on purchases within the first three months of card membership with the $450 Hilton Honors American Express Aspire Card (see rates & fees), since Amtrak's points are worth so much more.

The information for the Hilton Aspire Amex card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

An Amtrak spokesperson confirmed that the 50k offer is due to stick around until Sept. 30, 2021, but there's never any guarantee it'll last that long. It's the best U.S. rail offer we've ever seen, and I wouldn't expect a 50,000-point promo to pop up again anytime soon. So if you're hoping to take advantage, I'd grab it sooner rather than later.

For rates and fees of the Hilton Aspire card, click here.

Fact check: Claims of free one-year Amtrak passes for women 40 and older are scams

The claim: Amtrak is giving free one-year passes to women 40 and older

An April 11 Facebook post ( direct link , archive link ) claims a transportation giant is offering a promotion that would mean major savings for millions of Americans.

“Amtrak is giving away One-Year Free Train Passes to US women above 40 + y/o Fill in 4 questions & get your pass,” reads the post.

It was shared more than 150 times in two days. Another version was shared more than 600 times before it was deleted.

Follow us on Facebook! Like our page to get updates throughout the day on our latest debunks

Our rating: False

A spokesperson for Amtrak said the company is not offering any such promotion. The posts are scams that redirect users to a website where they answer a series of questions before submitting personal information. Neither the Facebook pages, nor the websites they link to, are affiliated with Amtrak.

No free passes, but Amtrak offers discounts for some

Kimberly Woods, a spokesperson for Amtrak, told USA TODAY the company "is not giving away free one-year fare passes to people ages 40 and above."

The page touting the promotion does not have a blue verified check mark , which Facebook uses to identify legitimate brand accounts and can be seen on Amtrak’s official Facebook page . The scam page was also created on the same day it made the post, another indication the offer is illegitimate.

More: Amtrak unveils new coaches that will eventually serve most East Coast routes and others

The promotion link takes users to a website not affiliated with Amtrak and prompts them to answer a series of questions. They are asked to select one of multiple gift boxes for a chance to win the prize and are then asked for personal information, including a phone number and email address, in order to claim it.

Though the Facebook posts claim the giveaway is for a free one-year pass, the fine print at the bottom of the website says the price to enter is $34.86.

Amtrak does offer discounts for certain people, including seniors over the age of 65, children between the ages of 2 and 12, and members of the military, according to its website . An infant under 2 years old can ride for free with the purchase of an adult ticket.

USA TODAY reached out to users who shared the claim for comment.

Our fact-check sources:

- Kimberly Woods, April 12, Email exchange with USA TODAY

- Amtrak, accessed April 12, Everyday Discounts

Thank you for supporting our journalism. You can subscribe to our print edition, ad-free app or electronic newspaper replica here .

Our fact-check work is supported in part by a grant from Facebook.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

The Most Valuable Card I Have In My Wallet Is From Amtrak

Victoria M. Walker

Senior Content Contributor

546 Published Articles 1 Edited Article

Countries Visited: 26 U.S. States Visited: 27

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3114 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

An Overview of the Amtrak Guest Rewards Card

Trading planes for trains from nyc to d.c., additional ways to earn amtrak guest rewards points, amtrak metropolitan lounge access, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The credit card in my wallet that gets the most use isn’t my American Express ® Gold Card or The Platinum Card ® from American Express , even though I just used points transferred from the Membership Rewards program to cover a round-trip Delta Air Lines flight to the Bahamas.

It’s not even my Chase Sapphire Preferred ® Card , a favorite among beginners and what I use to transfer points to the World of Hyatt program.

Nope, my favorite card (and points currency) is from Amtrak. Yes, you read that right, Amtrak.

Before you completely write me off, let me explain how I’ve been able to save hundreds, if not thousands, of dollars on pricey train rides in the year-plus I’ve had the Amtrak Guest Rewards ® World Mastercard ® , which is being rebranded as the Amtrak Guest Rewards ® Preferred Mastercard ® in October 2022. If you are fortunate enough to be a cardholder but aren’t using it to its fullest potential, let me convince you to dust it off and put it to work.

I personally value points from the Amtrak Guest Rewards loyalty program over transferrable currencies such as Amex Membership Rewards , Chase Ultimate Rewards , Citi ThankYou Rewards , and Capital One Miles .

It’s simple — I take the train almost as much as I fly, as most of my family are located along the East Coast where I’m based.

Initially, the generous welcome bonus of 50,000 points sold me on the card. And that bonus has come in handy given how expensive Amtrak cash fares can be, even for short distances.

I was also impressed by the numerous perks that came with the card, including:

- A modest $79 annual fee

- 3 points for every $1 spent on Amtrak travel, including onboard purchases

- 2 points for every $1 spent on other qualifying travel

- 1 point for every $1 spent on all other purchases

- A 20% rebate in the form of a statement credit on your onboard food and beverage purchases, which I’ve taken advantage of on several trips between New York and Washington

- A Companion Coupon you receive upon opening your account and each year on your card anniversary

- A 1-class upgrade upon account opening and each year on your card anniversary

- A complimentary single-visit Amtrak station lounge pass upon account opening

- 1,000 Tier Qualifying Points (TQPs) toward earning tier status each time your eligible spending reaches $5,000 in a calendar year (up to 4,000 TQPs per year)

- 5% point rebate when you book Amtrak reward travel

Hot Tip: The annual fee and earning structure will change in October 2022 when the card is rebranded as the Amtrak Guest Rewards Preferred card. Learn more about the facelift in our detailed article.

And as an Amtrak Guest Rewards Select member, I get a few more perks, including:

- 2 single-visit passes to Amtrak station lounges

- 2 1-class upgrade coupons

- 2 coupons for 10% off Amtrak travel

- 25% Select point bonus on Amtrak travel

- Priority call handling

- Select-exclusive discounts and bonus offers from Amtrak program partners

Plus, as an Amtrak Guest Rewards member, I’ll continue to earn 2 points per $1 spent on Amtrak travel, a 25% point bonus for business class travel, and 50% on Acela first class.

All of these perks are great, but how have I gotten outsized value while traveling? Well, I’ll tell you.

I live in New York City, which makes it easy to get just about anywhere around the country and globally.

But I don’t enjoy flying between my home in New York and Washington, D.C. , where many friends and extended family members are located and a city I visit at least once every 2 months. The planes are often cramped, there are often delays , and I’ve found short-haul flights — typically a 45-minute flight — to be generally uncomfortable. It’s also challenging to get work done on these quick hops, with Wi-Fi only being available for a short period or, sometimes, not at all.

So I decided to forgo flying between the 2 cities in favor of traveling by train, which can be a more comfortable and scenic route. Traveling by Amtrak has been my saving grace for traveling during popular times , such as this past Memorial Day weekend, when I visited the D.C. area.

The only problem? Amtrak tickets can be incredibly expensive, especially when booking less than 14 days before travel .

Just days before my trip to Washington, D.C., one-way coach tickets on the Northeast Regional, which runs between Boston and Newport News, Virginia, cost as much as $160. Amtrak’s Acela, a business and first-class only train that runs between Boston and Washington, D.C. priced at over $200 in business and a whopping $450 in first class. And, according to data compiled by the booking app Hopper, flying wasn’t much cheaper, with domestic round-trip fares topping nearly $400. ¹

But I wasn’t discouraged. After all, most of my daily spending — food, travel, rent — goes on my Amtrak Rewards card. And even after making several redemptions earlier this year, I had more than enough points in my bank to book a round-trip award.

Hot Tip: If you are slim on points and need to book with cash, consider our guide to the best ways to book cheap Amtrak train tickets .

Amtrak Guest Rewards points aren’t the easiest to earn, but aside from credit cards, here’s how you can amass a healthy balance:

Use the Amtrak Hotels & Cars portal to:

- Earn up to 10,000 points per night on stays at more than 350,000 hotels

- Earn up to 500 points per day on car rentals on car rentals at 29,000 locations across the world

Amtrak also has several retail partners , including:

- 1800Flowers.com — Earn 10 points for every $1 spent

- Apple, The Home Depot, QVC, and eBags — Earn 1 point for every $1 spent at Apple and The Home Depot, 3 points for every dollar spent at QVC, and 7 points for every $1 spent at eBags

- Audience Rewards — Earn 100 points or more for each ticket purchased to a participating Broadway show

- NRG Home — Earn 10,000 points when you select NRG Home as your electric supplier

- SurveyPointClub — Earn 250 points when you sign up and complete your first survey and get additional points for every survey you complete afterward

- Teleflora — Earn 750 points for every bouquet you order

- Vinesse Wines — Earn 2,000 points (and 6 wines) for only $6.99 per bottle, plus 3 points per $1 spent on all future wine purchases

New members of the Rail Passengers Association can earn up to 10,000 points, depending on which tier you purchase. The cheapest, an individual membership that costs $60, will earn you 125 points. The priciest is a Silver Rail PLUS ($2,500) membership that will net you a whopping 10,000 bonus points.

Like many airline programs, Amtrak also has a shopping portal: AmtrakGuestRewards.com . If you want to earn a ton of points, you can do your daily online shopping through the portal and get bonus points at merchants such as Macy’s (5 points per dollar), Restaurant.com (up to 18 points per dollar), and Bed Bath & Beyond (2 points per dollar spent).

Finally, you can also buy, gift, share, and transfer Amtrak Guest Rewards points. The company occasionally runs promotions where you’ll earn a bonus when you purchase points.

How I Redeemed Amtrak Guest Rewards Points for My Most Recent Trip

With a nice balance of points in my account, I started by searching for award availability (make sure to adjust the toggle to Use Points ), and ample trains were running between NYC and D.C. I was also covered in case I needed to cancel because Amtrak is waiving change fees for trips — including award trips — through July 31, 2022.

For the outbound route, I took the Silver Star train, a long-distance train that runs from New York all the way down to Miami. As it operates on a longer route, the recliner-style seats were a nice change from the stiffer seats on the Northeast Regional or Acela.

I opted for Amtrak Acela business class for the inbound portion of my trip as I wanted a quieter car. While I had barely functional Wi-Fi , after using my hotspot , I settled in comfortably with generous legroom to sit my bag and a nice-sized tray table.

The total cost? Just 12,840 points round-trip for a trip that could have cost an outrageous $600 . While we here at Upgraded Points do not have a valuation for Amtrak Guest Rewards points, the revenue-based currency can range from about 0.8 to 3 cents per point – on this trip, I received approximately 4.6 cents per point in value.

And as an Amtrak Guest Rewards cardholder, I also earned a 5% rebate of 642 points as part of my benefits. Plus, I received 20% back in the form of a statement credit when I used my card to purchase coffee and pretzels.

Hot Tip: Learn more about each service in our ultimate guide to Amtrak’s regional and long-distance routes .

But the benefits weren’t just while I was on the train — they extended before I even boarded.

On the morning of my trip, I arrived at the Moynihan Train Hall, a brand-new terminal that serves Amtrak and the Long Island Railroad.

It’s a pretty terminal, especially if you suffered through Penn Station , but the food isn’t cheap.

Because I have the Amtrak Guest Rewards card in my wallet, this meant that I had a couple of single-visit station lounge passes available, which I used to guest myself into the Amtrak Metropolitan Lounge , a $50 value compared to the cost of a day pass.

It’s a gorgeous lounge with a bright and airy design. Guests can take advantage of high-speed Wi-Fi and nosh on snacks in the lounge or on the balcony overlooking the main hall. There’s even a full-service bar with beer, wine, or cocktails (it wasn’t open when I arrived ahead of my 11 a.m. train), so I grabbed a cup of coffee, juice, and a lemon pound cake loaf.

I’m looking forward to repeating my Memorial Day trip with a July 4 trip back to D.C., which I also paid for using Amtrak Guest Rewards points.

Saving money is the key here, and on my most recent trip, I was able to avoid paying nearly $600 for a round-trip train to D.C. and get some free snacks in the process. And it wouldn’t have been possible without my favorite card … the Amtrak Guest Rewards card.

There’s a reason I use my Amtrak Guest Rewards card over a dozen (or so) other cards in my wallet. As someone who takes the train almost as often as I fly, getting the Amtrak Guest Rewards card was a no-brainer. And because you can no longer transfer Chase Ultimate Rewards points to the Amtrak Guest Rewards program, earning points is just a bit harder.

While the card will be open to new applicants again in late October 2022, there’s something to be said about picking a card that works for you and your travel plans — which is what I’ve done — versus picking a card solely because it’s popular.

While it may not work for everyone, using your Amtrak-specific card if you take the train regularly can make your journey on the train and in the station more comfortable — and cheaper.

The information regarding the Amtrak Guest Rewards ® World Mastercard ® and Amtrak Guest Rewards ® Platinum Mastercard ® was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Is the amtrak guest rewards® world mastercard® open to new applicants.

Neither the Amtrak Guest Rewards card nor the Amtrak Guest Rewards® Platinum Mastercard® is available to new customers at this time.

The cards will be rebranded and offered by FNBO starting in late October 2022, with the Amtrak Guest Rewards® Mastercard® replacing the Amtrak Guest Rewards Platinum card and the Amtrak Guest Rewards Preferred card replacing the Amtrak Guest Rewards card.

How can you earn Amtrak Guest Rewards points?

Amtrak points aren’t the easiest to earn because the program has no transfer partners, but there are several ways to earn Guest Rewards points:

- Earn 2 points per $1 spent on Amtrak travel, plus a 25% point bonus for business class travel and 50% for Acela first class

- Purchase Amtrak Guest Rewards points

- Use the Amtrak Hotels & Cars portal to earn up to 10,000 points per night

- Shop through Amtrak’s retail and specialty partners

- Shop through the Amtrak Guest Rewards shopping portal

How much are Amtrak points worth?

Amtrak Guest Rewards points are revenue-based — meaning the value of the program’s points can vary depending on many factors — but generally, the points can range between 0.8 cents up to 3 cents.

Does Amtrak have a lounge?

Yes, Amtrak has a lounge network. There are staffed lounges, which include:

- Boston, MA — South Station Metropolitan Lounge

- Chicago, IL — Union Station Metropolitan Lounge

- Los Angeles, CA — Union Station Metropolitan Lounge

- New York, NY — Moynihan Train Hall Metropolitan Lounge

- Philadelphia, PA — William H Gray III 30th Street Station Metropolitan Lounge

- Portland, OR — Union Station Metropolitan Lounge

- Washington, D.C. — Union Station ClubAcela

Amtrak also offers unattended separate waiting rooms in Minneapolis, New Orleans, and St. Louis.

Was this page helpful?

About Victoria M. Walker

Victoria holds a B.A. in Broadcast Journalism from the Howard University School of Communications and is an award-winning journalist, travel reporter, and the founder of the “Carrying On with Victoria M. Walker” newsletter.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

/static-assets/statics-12295/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

The best credit card for amtrak: ride the rails to rewards in 2024.

/authors/christy_rakoczy_updated.png)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

/images/2019/10/23/best_credit_card_for_amtrak.jpg)

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

Amtrak spans 46 states plus Washington D.C., has an estimated 21,000 miles of routes, and operates more than 300 different trains each day. Because you can take Amtrak to get to more than 500 different destinations across the U.S. — and even a few in Canada — it should come as no surprise that traveling on Amtrak is a popular transportation option.

Whether you take Amtrak to work on a daily basis or are taking it for the first time for a fun trip, it's important to consider what the best credit card for Amtrak is. Cards like the Bank of America ® Travel Rewards credit card card can help you earn miles that you can use for future travel on Amtrak or elsewhere.

By choosing a card that provides extra credit card points and miles or special perks for Amtrak trips, you can get rewarded for the spending you're doing as you enjoy a pleasant, safe, and energy-efficient journey.

Key Takeaways

The 5 best cards for amtrak, the 2 best business credit cards for amtrak, how to choose the best credit card for amtrak, methodology, bottom line on the best credit card for amtrak.

- If you want a well-rounded travel card, the Bank of America ® Travel Rewards credit card or the Chase Sapphire Preferred ® Card are good choices.

- Amtrak offers two cards. The Amtrak Guest Rewards ® Preferred Mastercard ® offers significantly more benefits for a relatively low annual fee of $99.

Bank of America ® Travel Rewards credit card

The Bank of America Travel Rewards credit card offers a $0 annual fee. Where it really stands out, though, is with its simple rewards structure: 1.5 points per $1 spent on all purchases.

With the Travel Rewards card, you can earn 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

The advantage of the Travel Rewards card is that you don’t have to worry about specific earning categories, and you can earn more if you’re a Bank of America Preferred Rewards® member.

Read our Bank of America Travel Rewards card review .

Easy-to-Earn Unlimited Rewards

/images/2023/08/22/boa-travel-rewards-credit-card.png)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Earn 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases

- Earn 1.5 points per $1 spent on all purchases

- Longer intro APR on qualifying purchases and balance transfers

- No foreign transaction fees

- Best for Bank of America customers

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

Wells Fargo Autograph℠ Card

The Autograph Card has a generous welcome offer where you can earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months (that’s a $200 cash redemption value), which is especially impressive for a $0-annual-fee card.

It’s a great fit for frequent Amtrak travelers because you earn 3X on restaurants, travel, gas stations, transit, popular streaming services, and phone plans along with 1X on other purchases.

Read our Wells Fargo Autograph Card review .

Awesome Rewards Rates + Intro APR

/images/2022/11/10/autograph-no-fee-card-rgb-72dpi.png)

Current Offer

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value

Rewards Rate

- Earn unlimited 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans; plus earn 1X points on other purchases

- Intro APR on purchases

- $0 annual fee

- No intro APR on balance transfers

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 20.24%, 25.24%, or 29.99% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Chase Sapphire Preferred ® Card

The Chase Sapphire Preferred Card is a great card if you travel on Amtrak but also want to earn rewards for other trips you take. In addition to offering 5X points on travel purchased through Chase Travel℠, it offers 2X points on other travel purchases, and also 3X points on dining, select streaming services, and online groceries. So you'll get bonus rewards both for buying your train tickets as well as for any food you purchase on the train.

New cardmembers can earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. Each year on your card anniversary, you will also earn bonus points equal to 10% of the total purchases you made in the previous year.

Make sure to check out our Chase Sapphire Preferred Card Review .

Great for Flexible Travel Rewards

/images/2024/03/28/chase_sapphire_preferred_032824.png)

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

5X points on travel purchased through Chase Travel℠; 3X points on dining, select streaming services, and online groceries; 2X points on all other travel purchases, and 1X points on all other purchases

- 5X points on travel purchased through Chase Travel℠

- 25% more value when redeeming rewards for travel through Chase Travel℠

- 10% anniversary point bonus each year

- $50 annual credit on hotel stays booked through Chase Travel℠

- Premium travel protection benefits

- Has annual fee

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Chase Sapphire Reserve ®

This Chase Sapphire Reserve Card comes with a $550 annual fee, so it’s best used by those who will fully take advantage of its benefits — including travel not only with Amtrak but also other travel purchases including plane tickets, hotels, cruises, rental cars, and more.

This premium travel card is ideal for Amtrak users because you get 5X points on flights and 10X points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually; 3X points on other travel and dining & 1X points per dollar on all other purchases.

The Chase Sapphire Reserve also opens up the door to airport lounges in more than 500 cities with complimentary lounge access. So if you fly as well as take the train, you can relax in style at the airport.

You'll also earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. This alone is worth up to $900 in free travel when booked through Chase Travel℠.

Get more details at our Chase Sapphire Reserve Card Review .

Premium Travel Benefits

/images/2024/02/13/chase_sapphire_reserve_02132024.png)

5X points on flights and 10X points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually; 3X points on other travel and dining & 1X points per dollar on all other purchases

- Earn 10X points on hotels and car rentals purchased through Chase Travel℠ (after the first $300 is spent on travel purchases annually)

- Priority Pass airport lounge access

- $300 annual travel credit

- 1:1 point transfer to leading airline and hotel loyalty programs

- High annual fee

- Excellent credit required

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

Amtrak Guest Rewards ® Mastercard ®

The Amtrak Guest Rewards Mastercard is a co-branded card issued by First National Bank of Omaha (FNBO). It has a $0 annual fee and a welcome offer that allows you to earn 12,000 bonus points after making $1,000 in purchases within 3 billing cycles.

You also earn 2X Amtrak Guest Rewards points specifically on Amtrak travel, including onboard purchases, and dining along with 1X everywhere else. You also get a 10% rebate on onboard food and beverage purchases in the form of a statement credit.

Get more details in our Amtrak Guest Rewards Mastercard review .

Earn Rewards Toward Train Travel

/images/2023/07/07/amtrak_guest_rewards_mastercard_7oXoNJO.jpg)

- Earn 12,000 bonus points after making $1,000 in purchases within 3 billing cycles

- 2X points per $1 spent on Amtrak travel, including onboard purchases; 2X points on dining; and 1X points per $1 spent everywhere else

- Earn a 10% rebate on onboard food and beverage purchases in the form of a statement credit

- No intro APR offer

Amtrak Guest Rewards ® Preferred Mastercard ®

For a higher annual fee of $99 you can earn significantly more with the Preferred Amtrak credit card than the Guest Rewards Mastercard. You can earn 3X points per $1 spent on Amtrak travel, including onboard purchases; 2X points per $1 spent on dining, travel, transit, and rideshare; and 1X points per $1 spent everywhere else.

There’s also a more generous welcome offer that allows you to earn 40,000 bonus points after making $2,000 in purchases within 3 billing cycles.

You also get a 20% rebate on onboard food and beverage purchases in the form of a statement credit, a round-trip companion coupon, a station lounge pass, and a one-class upgrade coupon on account opening and on your card anniversary.

And the Amtrak Guest Rewards Preferred Mastercard also allows you to earn 1,000 Tier Qualifying Points (TQPs) each time you make $5,000 in qualifying purchases so you can get to the next tier status faster.

Find out more in our Amtrak Guest Rewards Preferred Mastercard review .

Train Lovers Can Earn Rewards

/images/2023/07/16/amtrak_guest_rewards.png)

- Earn 40,000 bonus points after making $2,000 in purchases within 3 billing cycles

- 3X points per $1 spent on Amtrak travel, including onboard purchases; 2X points per $1 spent on dining, travel, transit, and rideshare; and 1X points per $1 spent everywhere else

- 3X rebate in the form of statement credit on Amtrak travel, including onboard purchases and 2X points on dining, travel, transit, and rideshare

- Earn a 20% rebate on onboard food and beverage purchases in the form of a statement credit

- $99 annual fee

If you're an entrepreneur, using Amtrak can help keep commuting costs down for you and your employees — and a train trip is an excellent time to get work done. There are also plenty of great business cards that will help you score additional rewards for your Amtrak purchases.

Two of the best business credit cards to consider include the following.

- Ink Business Preferred ® Credit Card : This card offers 100,000 points for new cardmembers who spend $8,000 in the first 3 months. You can also earn 3X points per dollar on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year — so you can earn ample bonus points for buying Amtrak tickets. Free employee cards also enable your staff to book their train travel with their cards and supersize your rewards. The $95 annual fee is well worth these perks, especially as you get a 25% bonus when redeeming points for travel-related purchases through Chase Ultimate Rewards.

- Bank of America ® Business Advantage Travel Rewards World Mastercard ® credit card : With this card, you earn 3 points per $1 on travel booked through the Bank of America® Travel Center and 1.5 points per $1 on all other purchases. You can also earn 30,000 online bonus points after you make at least $3,000 in purchases in the first 90 days of your account opening. With a $0 annual fee and a 0% APR on purchases for the first 9 billing cycles (then 18.49% - 28.49% Variable), this Business Advantage Travel Rewards credit card is one of the most affordable business cards you can use to earn points on Amtrak purchases as well as trips you take via plane or rental car.

When choosing which credit card to use for an Amtrak purchase, you'll likely want to focus on a card that rewards you for transportation or travel spending. Train tickets are typically classified by credit card issuers as travel spending, and your ticket purchase will account for the bulk of your Amtrak-related expenditure.

That said, you can get even more bang for your buck if the card you choose provides bonus points for spending on dining, in addition to travel. This can help you maximize the points you earn if you eat on the train and your food purchase is categorized as restaurant spending.

But it's not just the chance to earn bonus credit card rewards that makes a particular card a good choice for Amtrak. You also want to look at the cardholder perks. These perks can include free companion tickets, travel rebates for Amtrak spending, and other Amtrak-specific benefits. Cards that offer special perks are more common for airline travel, but there are options for those who prefer to ride the rails.

If you're a regular commuter , you take the train every day, and you spend a fortune with Amtrak, then it might make sense to get an Amtrak-focused card for the rewards program. But if Amtrak is just one of many means of transportation you use, a broader general purpose travel card may be a better bet.

We looked for credit cards that offered special benefits for Amtrak riders, as well as cards that rewarded travel and dining purchases since your Amtrak train tickets and on-rail purchases would fit within these categories.

We also looked for cards that provided enough perks to justify their annual fees — if they charge for being a cardholder — and offer generous signup bonuses so you'll be rewarded for becoming a cardmember.

Picking the best travel credit cards for Amtrak isn't always easy with so many good options out there. You should consider your lifestyle and spending priorities when you pick which card is right for you.

If you only or primarily travel on Amtrak, one of the Amtrak-focused cards might be a better bet — but if you also fly or drive, then consider one of the broader travel credit cards that rewards you for every type of trip you take no matter how you get to your destination.

Card Details

/images/2023/08/22/boa-travel-rewards-credit-card.png)

on Bank of America’s secure website

Intro Offer

Why we like it

The Bank of America ® Travel Rewards credit card is great for individuals who enjoy earning rewards and traveling.

Cardholders will enjoy the flexibility to redeem points with no blackout dates and receive a statement credit to pay for travel and dining purchases.

Earn 1.5X points on all purchases everywhere, every time.

Author Details

/authors/christy_rakoczy_updated.png)

- Credit Cards

- Best Credit Cards

- Side Hustles

- Savings Accounts

- Pay Off Debt

- Travel Credit Cards

Want to learn how to make an extra $200?

Get proven ways to earn extra cash from your phone, computer, & more with Extra.

You will receive emails from FinanceBuzz.com. Unsubscribe at any time. Privacy Policy

- Vetted side hustles

- Exclusive offers to save money daily

- Expert tips to help manage and escape debt

Hurry, check your email!

The Extra newsletter by FinanceBuzz helps you build your net worth.

Don't see the email? Let us know.

Best no annual fee travel credit cards of April 2024

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Travel rewards cards are a lot like gyms. The best ones may come with tons of added benefits (saunas, yoga class, etc.) but they also cost a lot, usually with a big financial commitment upfront.

As a result, whether you’re considering a Chase Sapphire Preferred ® Card (with its $95 annual fee) or a CrossFit membership, you probably have the same question on your mind: will I really use it enough to justify paying for it?

While there aren’t any free gyms we know of, there thankfully are plenty of no-annual-fee travel rewards cards that require essentially zero commitment. And just like an ab roller or a Richard Simmons DVD, you can simply use them a few times, forget about them, and put them in a drawer until beach season. Or, you can stick with it and make them part of your daily routine—whatever works for you.

You’re also far more likely to see “instant results” with these cards, too. From 100,000-point welcome bonuses to rewards for paying rent, free travel insurance to 3X on gas, these cards offer way more than you’d expect for a fee of $0 per year.

The best no-annual-fee travel cards for April 2024

Best overall: bilt mastercard, best for hotel rewards: ihg one rewards traveler credit card, best for airline rewards: united gateway℠ card, best for travel earnings: wells fargo autograph℠ card, best for flat-rate earnings: capital one ventureone rewards credit card.

The Bilt Mastercard allows you to earn points from paying rent and transfer them 1:1 to well over a dozen different travel partners including United MileagePlus and Marriott Bonvoy. Toss in some surprisingly robust travel insurance and you have our unconventional—yet logical—choice for the best overall no-annual-fee travel card of 2024.

Bilt Mastercard®

Special feature.

Rewards Rates

- 1x Earn 1X points on rent payments without the transaction fee, up to 100,000 points each calendar year

- 1x Earn 3X points on dining

- 2x Earn 2X points on travel

- 1x Earn 1X points on other purchases

- Use the card 5 times each statement period to earn points.

- Uniquely earns points on rent

- Rent Day bonus every first of the month offers double points (excluding rent)

- Robust travel transfer partners

- Cash redemption rate is poor

- No traditional welcome bonus

- Travel perks: Trip Cancellation and Interruption Protection, Trip Delay Reimbursement, Auto Rental Collision Damage Waiver

- See this page for details

- Foreign Transaction Fee: None