STAY IN TOUCH

Things to Do

Accommodation, capetownmagazine.com, a traveller’s guide to money and currency in south africa.

- All Contact Details

Unwrapping Cape Town with you

There's something exciting going on in Cape Town every week. Be the first to know what's new with our newsletter:

Everything you need to know on foreign exchange, using cards, cash, and hiring a car

For those unfamiliar with the sunny nation of South Africa (SA), the task of figuring out finances while on holiday or business here can seem about as daunting and confusing as a higher-grade trigonometry paper.

First of all, there’s the issue of getting a handle on the local currency. In SA, we work in rand (R), with each rand being comprised of 100 cents (c). Both coins (5c, 10c, 20c, 50c, R1, R2 and R5) and notes (R10, R20, R50, R100 and R200) are available, and the exchange rate is generally quite favourable for those coming from foreign countries. ( Are you South African and interested in crypto arbitrage trading? Our team did a Q&A with KoinExpert about Arbitrage trading in South Africa explained, read more here )

Then of course, it’s necessary to figure out the best form of money to bring with you on your travels. Contrary to popular belief, SA has quite a well-developed financial system and extensive bank network and there are a number of different options available for tourists spending money here. Key alternatives include using your foreign credit or debit card (yes, there are ATMs everywhere in SA, even in rural towns), arranging a special travel money card or bringing cash to exchange or traveller’s cheques. Aside from these, there’s also the option of obtaining a URCard, a prepaid debit card that was developed by a reputable local travel company specifically to address the money-related challenges often faced by visitors here.

To help you make an informed decision, we’ve elaborated on these travel money alternatives below and highlighted the pros and cons of each so that you can get a feel for which would be the best fit for you.

TRAVEL MONEY OPTIONS IN SOUTH AFRICA

Debit and credit bank cards.

Ideal for creatures of habit who aren’t keen on mastering a new and unfamiliar money system, using your credit or debit card from home is a popular and handy, albeit potentially costly, option when travelling in SA. Major credit card brands, namely MasterCard and Visa, are widely accepted here, and debit cards and cheque cards, which give you access to your bank account in your home country, can generally be used over the counter and at ATMs wherever there’s a MasterCard or Visa sign. If choosing this option, there’s no need to pre-arrange travel money; though, there are, of course, issues associated with transacting in SA in foreign currency with foreign plastic.

Advantages:

- Using a bank card from home is very convenient, as you already have one on hand and do not need to deal with the hassle of pre-arranging and figuring out other more unfamiliar travel money alternatives.

- You have access to all of your funds back in your home country as well as to emergency cash advances in the case of a credit card, so you shouldn’t be out of pocket.

- Some banks do offer favourable overseas rates and charges for travellers using debit or cheque cards specifically (less so with credit cards).

- Credit cards can be used to book accommodation, plane tickets, activities and more online while you’re already in SA.

Disadvantages:

- Safety is a core concern. SA has had a major problem with debit, cheque and credit card fraud, and because these cards give holders direct access to all funds, if you fall victim to a scam or if they’re stolen, the loss could be major. What’s more, while there is generally a money-back guarantee to cover fraud, there are usually a number of conditions involved and there may be certain policies that limit how protected you are when travelling.

- If your bank card is lost, stolen or swallowed by an ATM, it can be a huge and costly hassle to get a replacement card from your overseas bank. It can take up to three or four weeks for the new card to arrive, which means you could be stranded without money for some time.

- Overseas card usage fees can be very high and are often not made very clear, so you might not be aware of them. Banks usually charge a percentage of the amount withdrawn on top of other fees, so at the end of the day, you could pay over R200 in charges for a single transaction.

- Because your money is still in foreign currency, you will pay a fee to convert it from this form to rand every time you use your card.

- Similarly, you will be vulnerable to a fluctuating exchange rate, and if this drops so that it’s not in your favour, you could lose a portion of your travel budget.

- Some debit and credit cards, especially new ones with advanced security features, may not be compatible with local ATMs and card machines.

- If you forget to notify your bank that you are travelling and they see foreign activity, they will most likely block your credit card.

TRAVEL MONEY CARDS

A modern, electronic form of the old traveller’s cheque, prepaid travel cards and cash passports, which are similar to URCard, are issued by financial institutions specifically for the purpose of using money overseas. There are a number of different types of these cards, but unlike the local URCard, they generally can only be pre-loaded with certain foreign currencies (usually US dollars, British pounds and euros) and not rand for SA. Regardless, they are ideal for those looking for a convenient option that boasts more security than standard credit and debit cards. It would be best to contact your bank or nearest foreign exchange store for more information on the specific options available.

- As a prepaid option, travel cards are not attached to all your funds in your home country and therefore are quite a secure option.

- Many travel cards come with a complimentary back-up card that can be used if the first is lost, swallowed by an ATM, stolen or broken.

- Usage fees are generally a little lower than those associated with credit or debit cards.

- Cash passports and other travel money cards lend themselves to budgeting, and it’s also generally possible to monitor your balance and your expenditure history easily online.

- Because you normally cannot load rand on a travel card, you will still be transacting in foreign currency, which means you will be affected by changing exchange rates and will have to pay conversion fees whenever you pull money from the card. What’s more, there are two conversions involved: you are charged once to convert from your home currency to the currency of the card and then every time you swipe or draw to convert from the card currency to rand.

- Organising a travel card can be an extra hassle, as you generally have to present a number of documents to qualify.

- While fees may look low, there are often a number of hidden costs, and card holders should note that they will generally be charged a percentage on ATM withdrawals rather than a fixed rate.

- Some travel cards are only valid for a short period of time and therefore must be cashed out on return, and you will have to go through the process of organising another one if you want to travel again.

- Many types can only be reloaded at the place from which they were purchased (i.e., back home), which means if your balance reaches zero in SA, adding more cash to the card will be very difficult.

- If you leave some money on the card after departing SA, you may be charged a monthly inactivity fee that will seriously dig into your remaining balance.

TRAVELLER'S CHEQUE

Once a popular travel money option, traveller’s cheques, which are pre-printed coupons of a specific denomination that can be used as a substitute for cold cash, are no longer widely used or recognised in SA. In fact, the use of these cheques has dropped significantly since the 90s due to the rise of credit, debit and travel money cards, and therefore they’re no longer a viable option for anyone visiting our nation.

- As a paper substitute for cash, traveller’s cheques are a very secure way to manage your money abroad.

- If accepted, they offer you all the convenience of cash.

- If lost, damaged or stolen, they can easily and quickly be cancelled and re-issued.

- Most importantly, you will be hard pressed to find an establishment in SA that will still accept traveller’s cheques as a form of payment. Even banks are phasing them out.

- There are occasionally issues with the validity of cheques or the clearing of money.

Certainly the most convenient option, carrying cold hard rand is ideal for those who aren’t keen to keep seeking out ATMs and who are looking for a sure-fire way to make hassle-free purchases fast. Cash can be used anywhere and is especially useful when travelling off the beaten path to more rural areas where electronic pay points may not be ubiquitous. However, while it’s always advisable to have some SA notes and coins on you, it’s certainly not wise to have all of your overseas spending money in this form.

- It’s a handy form of currency that you’ll be able to use widely in SA, even in rural areas, informal markets and tiny shops where ATMs might be scarce and card machines absent.

- Cash doesn’t come with any of the accompanying withdrawal fees or constant currency conversion surcharges typically attached to the international use of credit, debit or travel money cards.

- Cash is in no way linked back to your greater bank accounts, so if it’s lost or stolen, there’s no reason to be concerned about thieves or fraudsters having access to all of your funds.

- It’s not safe. Carrying a lot of cash makes you a target for thieves; not to mention, you’ll never be able to recover stolen cash in the same way that a bank will reimburse you for funds illegally taken from your account.

- Notes and coins are bulky, awkward to cart around and can be a cause of unnecessary anxiety.

- When converting foreign currency to cold cash, you will often get an unfavourable exchange rate and lose a lot in the process to admin and commission fees.

- With cash, you can easily lose track of how much is going out, which can result in huge overspending.

- In order to avoid carrying all your cash, you have to constantly estimate how much money to take out with you for activities and may find you sometimes come short.

- When hiring a car, making a hotel reservation or booking similarly expensive services, you’ll likely need to provide a credit card for security deposit purposes. Cash is generally not accepted, and if it is, an inordinately large deposit is required.

PLUS, SEE WHERE TO HIRE A CAR

Car rental services are an essential component for any international looking to experience Cape Town like a true local.

We sat down with AroundAboutCars, a car hire company whose been in the business for over 30 years, to get answers to your most common car hire questions. They offer unlimited kilometres, fully-inclusive rates with no hidden costs, 24-hour emergency service and there are 40 affiliated branches nationwide with AroundAboutCars .

Get your guide to tipping In South Africa .

NEW: A cut above the rest for less in Bree Street at Downtown Barbers .

Planning a visit to South Africa? Have a gander at our overview of must-dos in Cape Town .

Yoco are rocking it for small businesses around the country. Read more about their credit card machines .

Here's how you can help a small business in South Africa .

Use our events section for an up-to-date overview of happenings in Cape Town. Also, don’t forget to subscribe to our newsletter .

What’s more, follow us on Twitter , like us on Facebook , connect with us on LinkedIn , check out our photos on Instagram and follow our Pinterest boards for updates on what’s going down in and around the Mother City!

- Show Large Map

- Events Today

Join us in creating a DNA-changing impact on the province

Advertising on CapeTownMagazine.com

Beer olympics, wings & potjie fest, heritage tours and more

Alcohol-free bar, classic pub grub, dog museum and more

Khoisan art, film screenings, life drawing classes and more

18 of Cape Town’s most moving and unique museums

CapeTownMagazine.com in the Media

Everything you need to know on foreign exchange, using cards, cash, and hiring ...

A healing getaway in an ancient valley (cottages +

Annual music festivals

31 things to do with kids of all ages

Lower Kloof Street caters for all your lifestyle n

Everything on the menu is under R100!

7 DIY Wedding Tips from 7 Brides and Grooms

Cape Town loves real beer

Arthur’s Mini has loads of quirky details you’

What's Family Day all about?

KLM turns 30! Plus win 2 return tickets to Amsterd

Get more of MOLO

Every month something you do not want to miss.

- In the Media

- Work with us

- Submit events

- Advertising

- Privacy Policy

- Terms of use

© 2005 - 2024 Cape Town Magazine PTY Ltd. All rights strictly reserved [2005 - 2024].

Curious to make exciting discoveries in Cape Town every day? "LIKE" us for a daily hidden gem. ▼

- Home ›

- Travel Money ›

- South African Rand

Get the best South African rand exchange rate

Compare the latest South African rand exchange rates from the UK's best currency providers

Best South African rand exchange rate

If you're travelling to South Africa, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best South African rand exchange rate by comparing a wide range of UK travel money suppliers who have South African rand in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best South African rand exchange rate right now is 22.8396 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of South African rand for home delivery.

The best South African rand exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

South African rand rate trend

Over the past 30 days, the South African rand rate is up 0.8% from 22.8396 on 29 Jul to 23.0223 today. This means one pound will buy more South African rand today than it would have a month ago. Right now, £750 is worth approximately R17,266.73 which is R137.03 more than you'd have got on 29 Jul.

These are the average South African rand rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to South African rand currency chart .

Timing is key if you want to maximise your South African rand, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the South African rand rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the South African rand rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their South African rand as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your South African rand sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better South African rand rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your South African rand first before you collect them from the store so you benefit from the supplier's better online rate.

South African rand banknotes and coins

One South African rand (R) can be subdivded into 100 cents (c).

There are five denominations of South African rand banknotes in circulation: R10, R20, R50, R100 and R200; and six coin denominations: 10c, 20c, 50c, R1, R2 and R5.

There's no evidence to suggest that you'll get a better deal if you buy your South African rand in South Africa. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your South African rand in South Africa:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy South African rand when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in South Africa

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

5 Best Travel Cards for South Africa

Getting an international travel card before you travel to South Africa can make it cheaper and more convenient when you spend in South African Rand. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to ZAR for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to South Africa, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

5 best travel money cards for South Africa:

Let's kick off our roundup of the best travel cards for South Africa with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to South Africa.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in South Africa. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to South Africa or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in ZAR, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in ZAR when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in South Africa, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in South Africa with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to ZAR instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in South Africa and globally. Monzo accounts are designed for holding USD only - but you can spend in ZAR and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in South Africa. While these cards don’t usually let you hold a balance in ZAR, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to South Africa or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to South Africa. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for South Africa

We've picked out 5 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for South Africa include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in ZAR can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for South Africa

The best travel debit card for South Africa really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in ZAR.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for South Africa. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For South Africa in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in South Africa - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in South Africa

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In South Africa card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use ZAR?

If you have ZAR, you should be able to use it in a few countries. You may decide to keep your travel card topped up with a balance for this trip to South Africa or for the next time you’re headed somewhere which uses ZAR.

What should you be aware of when travelling to South Africa

You’re sure to have a great time in South Africa - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to South Africa before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to ZAR before you travel to South Africa if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to ZAR in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach South Africa to make an ATM withdrawal in ZAR if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for South Africa

Ultimately the best travel card for your trip to South Africa will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

How does a South African Rand card work?

Getting a South African Rand card can make managing your money easier when you travel to South Africa.

Your South African Rand card will be linked to a digital account you can manage from your phone, so you'll always be able to see your balance, get transaction notifications and manage your card no matter where you are. Just add money to your account in pounds, and - depending on your preferences and the specific card you pick - you can either convert your balance to South African Rand instantly, or just let the card do the conversion when you spend or make a withdrawal.

If your card gives you the option to hold a South African Rand balance, there's not normally any extra fee to spend the South African Rand you have in your account when you're in South Africa.

Can I withdraw South African Rand currency with my card in South Africa?

With some cards, you'll be able to add money to your card in United States Dollar, and then convert to South African Rand instantly online or in your card's app.

Once you have a balance in South African Rand you can spend with your card with no extra fees - just tap and pay as you would at home. You'll also be able to make cash withdrawals whenever you need to, with no extra conversion fee to pay. Your card - or the ATM operator - may charge a withdrawal fee, but this can still be a cheap, secure and convenient option for getting cash when you need it.

With other cards, you can't hold a balance in South African Rand on your card - but you can leave your money in United States Dollar and let the card convert your money for you when you spend and withdraw.

Some fees may apply here - including currency conversion or foreign transaction charges - so do compare a few different cards before you sign up, to make sure you're picking the one which best suits your specific spending needs.

Bear in mind though, that not all cards support all currencies - and the range of currencies available with any given card can change from time to time. If your card doesn't let you hold a balance in South African Rand you might find that fees apply when you spend in South Africa, so it's well worth double checking your card's terms and conditions - and comparing the options available from other providers - before you travel, just in case.

Why should I get a South African Rand card?

Getting a South African Rand card means you can spend like a local when you're in South Africa. You'll be able to check your South African Rand balance at a glance, add and convert money on the move, and use your card for secure spending and withdrawals whenever you need to. Best of all, South African Rand cards from popular providers often offer good exchange rates and low, transparent fees, which can mean your money goes further when you're on a trip abroad.

FAQ - best travel cards for South Africa

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in South Africa.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / ZAR rate to calculate how much South African Rand you would receive when exchanging / spending $4,000 USD. The card provider offering the most ZAR is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

Best ways to spend travel money in South Africa: Debit and prepaid cards

Learn more about the best card to use, if you should use a uk debit card and other ways to take spending money to south africa..

- Helping first-time buyers apply for a mortgage

- Comparing bank accounts and highlighting useful features

- Publishing easy-to-understand guides

In this guide

Low-cost travel money options for South Africa

How much rand should you bring on your trip, how travel cards, credit cards and debit cards work in south africa, how the different travel money products work in south africa, the south african rand, find cash and atms in south africa, what you need to know about withdrawing cash from a south african atm, frequently asked questions.

South Africa is home to about 10% of the world’s plant species and the South African constitution has officially recognised 12 different languages. However, the monetary system is a little less diverse. There’s only one currency in South Africa, the rand (ZAR), and travel money options are limited.

If you’re preparing for a trip to South Africa, whether it’s for pleasure or business, it pays to find a travel money product that’s going to let you spend and withdraw rand cheaply. Most British banking products charge high fees when you make purchases and withdrawals in South Africa.

Use this page about travel money for South Africa to find the right credit, debit or travel card to take with you. As well, you’ll find information about how to exchange your British pounds to South African rand for less. A little preparation before you leave can save you hundreds in bank fees and a whole lot of stress.

Best for cashback

- Rewards when you spend

- Easy access to your money

- No fees abroad from Chase

Promoted for low FX fees

- Open an account in minutes

- Use in more than 150 countries

- 2 free cash withdrawals per month

Promoted for global travel

- Fee-free spending on every card

- Free ATM withdrawals abroad

- Use any bank card

How we chose these accounts

Although plastic is widely accepted in South African towns and cities, it’s unrealistic to think you can get away with just making card payments in South Africa. ATM withdrawal fees should be a factor in your comparison of travel money options for South Africa.

- Tip: Make sure you tell your card issuer about your travel plans. Credit card fraud is common in South Africa and your bank may block your card if you make a card payment or withdrawal in South Africa.

High summer season premiums will add to the cost of your trip to South Africa, but the cost of living and travel varies depending on where you are in the country. In smaller towns, South Africa is surprisingly affordable. Further south and especially in touristic places like Cape Town and Johannesburg, it can be very expensive. If you go to South Africa during high season (December to February) expect to pay a premium for everything. Off-season, prices drop dramatically.

Find out some typical holiday prices in Cape Town

*Prices are approximate and are subject to change.

A quick summary of your travel money options in South Africa

This table is a general summary of the travel money products in the market. Features and benefits can vary between cards.

Using prepaid travel cards

If you use a prepaid multi-currency travel card, you can load it with British pounds and convert the funds to a supported overseas currency at a locked-in foreign exchange rate.

If you’re spending in a loaded and supported currency, you’ll save on currency conversion fees and be protected from fluctuating currency exchange rates. The currencies you can spend in will vary from card to card. You’ll most likely incur a currency conversion fee when you make an ATM withdrawal or purchase in South Africa.

Even if you don’t have the supported or local currency on your card, you should still be able to use your travel card wherever Visa or Mastercard is accepted. If you don’t have the funds loaded on your card, the travel card will usually use a dropdown sequence to deduct the funds from your available currency wallets. Depending on the card you’re using, the currency order will be either flexible or set in a default order.

If your card is running low on funds, you can top up via an online transfer or BPAY. It can take between 24 hours and 2 business days for funds to appear in your account, so avoid bleeding your account dry before topping it up again.

Travel cards can be used to make overseas purchases at shops and ATM withdrawals, minus the fee for currency conversion, so long as you have the local currency loaded on the card. You can usually top up the card online or with BPAY and move funds into different currency wallets through the app or by accessing your account online.

- No currency conversion fee. Find a travel card that lets you convert British pounds to South African Rand without paying extra for the currency conversion.

- Dual card account. You get two cards when you apply for a travel card account, which will come in handy if one is lost or stolen while you’re on holiday.

- Locked-in rate. The exchange rate is locked in when you transfer funds between currency wallets, protecting you from negative currency fluctuations.

- Rewards. Some travel cards reward you with frequent flyer points when you spend in a foreign currency.

- Exchange rate. Travel cards are subject to the card provider’s cash rate. This is higher than the exchange rate offered to Visa and Mastercard debit and credit cards. There are travel card providers that use the better-value interbank rate, but these products are not common.

- Fees. You pay fees when you use the card, either to load or reload funds, to withdraw from an ATM or to transact in a currency not already loaded on the card. Some accounts also charge an inactivity fee. Even if you use a travel card from a bank with an international ATM alliance, you could still incur an international ATM fee.

Using credit cards

A credit card can be a good way to access a higher line of credit, which can come in handy when making large or emergency purchases on your holiday. However, if the card isn’t designed for overseas use, you’re likely to rack up fees as you spend.

- Financial freedom. Unlike a prepaid card or debit card that deducts from your savings, a line of credit could come in handy when making large or emergency purchases overseas.

- Rewards. Some credit cards come linked with a frequent flyer or rewards program, meaning you can earn points as you spend. Some cards even offer bonus points for purchases overseas.

- Extra features. Credit cards often come with extra features such as complimentary insurance and purchase protection. If you’re travelling overseas, you’ll need insurance anyway, so getting complimentary cover through your credit card could save you time and money.

- Currency conversion fees . If you’re spending overseas with a British credit card, you’ll rack up currency conversion fees of around 3% per purchase. Look out for a credit card that doesn’t charge currency conversion or foreign transaction fees to keep your costs low.

- ATM fees. Credit cards aren’t designed for ATM withdrawals, so you’re likely to incur a high cash advance fee when using your card for withdrawals overseas. You might also be charged a separate ATM withdrawal fee and local ATM fee depending on your card and the ATM you use.

- Temptation to spend. Having access to a line of credit might give you a false sense of financial security that tempts you to make unnecessary purchases. Remember that you have to repay every purchase (plus interest, in most cases) charged to your card.

If you’re thinking of using a credit card overseas, opt for one with low or no currency conversion or foreign transaction fees as well as other features, such as rewards or complimentary insurance that will benefit you on your trip.

Using debit cards

Most ATMs and EFTPOS machines in South Africa accept Mastercard and Visa debit cards. While there are benefits to accessing your own funds overseas, there are some drawbacks that come with using your debit card in South Africa.

- Withdraw funds . Unlike a credit card, debit cards are designed for ATM withdrawals and won’t charge you a high cash advance fee. Unlike British banks, South African ATMs don’t charge you a local ATM fee.

- Access your own funds. A line of credit can be good financial security, but accessing your own funds in your debit card gives you a more realistic idea of how you need to manage your travel budget.

- Travel-friendly debit cards. While some British debit cards will incur currency conversion and foreign transaction fees, others are designed for overseas use and will avoid these costs.

- ATM withdrawal costs. While you won’t be charged a cash advance fee, you might be charged overseas ATM withdrawal costs. To avoid these costs, look out for cards that belong to an ATM alliance that won’t charge you when making withdrawals overseas.

- Currency conversion fees. If your card isn’t designed for overseas use, you’ll collect currency conversion fees when you spend or withdraw money in a foreign currency.

Using traveller’s cheques

Traveller’s cheques are safer than cash. They can be replaced if lost and you need photo identification to cash your cheques. The downside is convenience and cost: You need to visit a bank in South Africa to cash your cheques. Different banks charge different commissions and the exchange rate can vary from bank to bank as well.

South African banknotes come in denominations of 10 rand, 20 rand, 50 rand, 100 rand and 200 rand. The coins available are 1 rand, 2 rand and 5 rand. Small coins are 5, 10, 20 and 50 cents. Prices are rounded down to the nearest 5 cents and the notes are easily distinguished by colour.

The main banks in South Africa are:

- Standard Bank

South African banks do not charge you to use their ATMs. So you can save on ATM withdrawal fees altogether by choosing a card that doesn’t charge for international ATM withdrawals.

- ATM withdrawal limits The maximum amount you can withdraw from an ATM in South Africa is approximately 3,000 rand per withdrawal. You may be able to withdraw more than this if you visit a bank branch and supply photo identification to the teller. You can make multiple withdrawals up to your card provider’s daily withdrawal limit.

- Getting your money changed in South Africa You may be approached to get your money changed by a street vendor in South Africa. Although the rates they can give you may seem attractive, there’s a good chance you’re going to get ripped off. Plus, there’s an inherent danger in flashing large amounts of money around on the street. Get your money changed at currency exchange offices, banks or make withdrawals from a reputable ATM. You may want to get a sum of money changed to rand before you leave the UK so you at least have a little bit of cash on you at the airport. ZAR is a frequently traded international currency and you may be able to find rates at home that are comparable to the rates you can get when you change your money when you arrive. Arguably, the best way to get South African rand is to make an ATM withdrawal. This transaction is subject to the interbank rate, plus a small margin from the card issuer. The interbank rate is the exchange rate banks and large financial institution use to buy and sell foreign currency. Changing cash on the street will give you the tourist rate, whereas using an ATM gives you something close to the interbank rate.

- Use a mix of travel money options for the best result Take a mix of travel money options to transact in South Africa conveniently and cheaply. For example, take a credit card for emergencies, but keep your debit or prepaid card on hand for ATM withdrawals and day-to-day purchases. Transaction accounts cost nothing to open, so it’s not too much to ask to apply for a dedicated travel account. Consider your financial situation and how you’ll be spending your money on your trip to decide on the best combination.

What are the business hours for South African banks?

Generally, banks in South Africa have similar hours to banks in the UK. Banks open Monday to Friday, 8:30am to 3:30pm. On Saturday, banks usually open at 9am and shut at 11am. You may be able to find banks in shopping centres and airports with extended hours.

Is it compulsory to tip in South Africa and how much should I tip?

While it’s not compulsory to tip in South Africa, it’s common to give extra small change to people providing a service such as carrying bags or serving drinks. When you’re at a restaurant, it’s standard to give up to an extra 15% of the total bill. Tour guides and rangers in parks depend on tips to make a liveable income. A tip is common in these situations.

Is it better to use a card with no currency conversion fees or a card that doesn’t charge for ATM withdrawals?

This snapshot doesn’t factor in travel card load and reload fees nor card application fees and interest charges.

Assumptions

- The currency conversion fee is 3%

- The international ATM withdrawal fee is £5

- There is no local ATM operator fee

- The transaction amount is £300

- ZAR loaded onto the travel card

- 20 rand travel card ATM withdrawal fee

- 2% credit card cash advance fee

We show offers we can track - that's not every product on the market...yet. Unless we've said otherwise, products are in no particular order. The terms "best", "top", "cheap" (and variations of these) aren't ratings, though we always explain what's great about a product when we highlight it. This is subject to our terms of use . When you make major financial decisions, consider getting independent financial advice. Always consider your own circumstances when you compare products so you get what's right for you. Most of the data in Finder's comparison tables has the source: Moneyfacts Group PLC. In other cases, Finder has sourced data directly from providers.

Matthew Boyle

Matthew Boyle is a banking and mortgages publisher at Finder. He has a 7-year history of publishing helpful guides to assist consumers in making better decisions. In his spare time, you will find him walking in the Norfolk countryside admiring the local wildlife. See full bio

More guides on Finder

The government-backed Growth Guarantee Scheme aims to improve the terms of business loans on offer

If you need funding for your Scottish business we look at the type of business loans and financing available to you.

Compare different uni towns and cities with your home town and see the cost of living in each area.

Find out how to grow traffic to your small business website using an analytics tool. We’ve used Semrush as an example. Paid content.

Solicitors are pocketing millions in interest on their clients’ money. The watchdog has warned them to be fair. Here’s what you need to know.

Discover the Amazon Barclaycard: enjoy 0% interest on purchases, earn rewards and get Amazon gift vouchers. Is it the right card for you?

A survey from Finder revealed almost half (47%) of Britons are unaware of the tax-free benefits of Individual Savings Accounts (ISAs). This lack of knowledge is especially prevalent among younger generations, with 71% of Gen Z having no clue about ISA advantages.

New rules forcing banks to reimburse fraud victims may leave a quarter of victims empty-handed. While banks must reimburse fraud losses from October 7th, they can choose to make customers cover the first £100. Most banks remain silent despite the looming deadline.

Finder.com surveyed experts who predict a September base rate cut and two more before year-end, with the rate ending at 4.75%.

Ever wondered how to invest in IITU ETF? Learn more about iShares S&P 500 Information Technology Sector UCITS ETF now and find out where you can invest in it. Compare ETF brokers to start investing today.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

South Africa Travel Guide

Last Updated: November 10, 2023

Offering amazing safaris, rugged mountains, world-class wineries, an endless coastline, and lively cities like Cape Town , South Africa is a magical destination that is often overlooked by budget travelers.

Annexed by the Dutch and British before gaining independence in 1931, South Africa struggled with apartheid from 1948 all the way until 1990. The remnants of that dark time can still be seen around the country today, however, things have been improving and the country has been moving forward in leaps and bounds.

While South Africa still struggles with corruption and petty crime (be sure to watch your stuff while you’re here) , its rich but tumultuous history, incredible natural beauty, and international culture make it a worthwhile stop on any round-the-world itinerary. It also has the most UNESCO sites in all of Africa!

This travel guide to South Africa can help you plan the perfect trip without breaking the bank to ensure you make the most of your time in this incredible country.

Table of Contents

- Things to See and Do

- Typical Costs

- Suggested Budget

- Money-Saving Tips

- Where to Stay

- How to Get Around

- How to Stay Safe

- Best Places to Book Your Trip

- Related Blogs on South Africa

Top 5 Things to See and Do in South Africa

1. Enjoy Cape Town

Hike up Table Mountain, explore Kirstenbosch Botanical Gardens, tan on pristine beaches, visit Robben Island, and go on a wine tour. Cape Town has it all, so spend as much time as you can here. There’s also lots to see outside the city, including Boulders Beach ( where you can see penguins ) and Cape Point.

2. Learn about Apartheid’s tragic past

Gain a deeper understanding of South Africa by visiting the Apartheid Museum in Joburg, taking a tour of Robben Island (where Nelson Mandela spent 18 years in prison), and exploring Soweto (SOuth WEstern TOwnships), a township created by the Apartheid government in Gauteng. It’s a dark, eye-opening era to learn about.

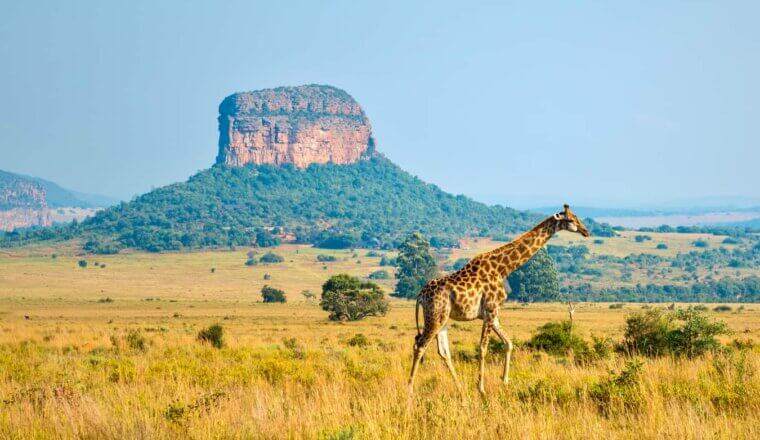

3. Explore Kruger National Park

Kruger National Park is the biggest, most popular, and busiest game reserve in the country. It’s a huge park with over 2 million hectares (almost 5 million acres) of space brimming with wildlife (including the Big 5). A basic three-day budget safari costs about 12,000 ZAR.

4. Drive the Garden Route

This route stretches along the Indian Ocean from Mossel Bay to St Francis, offering beautiful landscapes, serene beaches, picturesque towns, scenic wetlands, and sprawling wineries along the way. The journey is only about 200 kilometers (125 miles), but don’t rush — it’s best to spend a few days stopping and exploring as you go.

5. Day trip to Eswatini (formerly Swaziland)

Formerly called Swaziland, this tiny country was renamed in 2018 (Eswatini means “land of the Swazis”). There are several large game parks and reserves here, making it a great destination for more wildlife spotting. Be sure to visit Hlane Royal National Park. Borders can be a bit slow, so check the wait times before you go.

Other Things to See and Do in South Africa

1. partake in extreme sports.

South Africa offers over 100 extreme sports, including bungee jumping, sandboarding, skydiving, parasailing, jungle zip-lining, scuba diving, and more! Prices vary but expect skydiving to cost around 2,800-3,100 ZAR and bungee jumping to cost around 1,400 ZAR. The world’s third-highest bungee jump point, at Bloukrans Bridge, is here in South Africa (it’s 216 meters/708 feet). If you’re going to go cage diving with sharks, make sure you avoid companies that chum the waters to entice the sharks as that isn’t an ethical or sustainable practice.

2. Explore KwaZulu-Natal

People flock to the South African province of KwaZulu-Natal (KZN) on the east coast to relax, tan, ride the waves, eat amazing food, drink, and spot animals. KwaZulu-Natal’s game-rich Zululand and Elephant Coast in the north provide great wildlife spotting. This is also the birthplace of so many famous and powerful South Africans, including former presidents, the founder of the African National Congress, anti-apartheid leaders, and one of the most influential monarchs of the Zulu Kingdom, Shaka Zulu (1787-1828). KZN has diverse landscapes, interesting activities, and a mix of city life and rural-tribal life. One thing that’s consistent throughout the region is the level of pride in the Zulu culture.

3. Surf the waves

Dungeons Beach, near Cape Town, is a great place to spend some time if you have experience riding gigantic waves. Really — only surf here if you’re a seasoned professional, as the cold water and unpredictable waters are dangerous for new surfers. Beginners should visit Jeffreys Bay (J-Bay), about 75 kilometers (47 miles) west of Port Elizabeth, which is famous for its awesome right-hand point breaking waves. Muizenberg on False Bay is one of the best options for winter longboarding when the north-westerly wind picks up, and Durban has waves ideal for newbies and pro surfers alike. Group surfing lessons cost around 350 ZAR, including equipment.

4. Explore the Cango Caves

These caves, located in the Swartberg Mountains in the Western Cape Province, are 20 million years old and stretch for 4 kilometers (2.5 miles). You can see the exquisite stalagmite formations during the subterranean tours and learn about its history from the Interpretive Center. The standard tour costs 150 ZAR, while a more adventurous (and longer) tour is 220 ZAR, though you should only take this tour if you’re comfortable crawling through very tight spaces. Wear sensible footwear when visiting.

5. Hike Table Mountain

One of the best things in Cape Town is hiking up Table Mountain. It’s a steep, tiring climb that takes around two hours, but the views are worth it. There’s a nice little cafe and a cobblestoned area to walk around at the top so you can relax and admire the view when you’re done. Once you successfully reach the summit, you can take the cable car back down. A one-way ticket is 210 ZAR for adults or 320-390 ZAR for round-trip tickets. Be sure to dress appropriately and bring water as the weather can change quite quickly.

6. Admire the Big Tree in Tsitsikamma National Park

Estimated to be about 800 years old, this majestic Yellowwood tree is located in the Tsitsikamma National Park along South Africa’s Garden Route. This tree of epic proportions stands 36.6 meters (120 feet) high and has a trunk circumference of 9 meters (30 feet). There is a 500 meter (1,640 foot) wooden walkway through the indigenous forest leading to this tree, and from there, you can journey onto a 3-4 kilometer (1.5-2.5-mile) walk if you follow the Ratel Nature Walk signposts. Admission is 12 ZAR. While you’re here, you can also hike many of the other trails in the park, which stretches 80 kilometers (50 miles) along the coastline.

7. Sleep in Gandhi’s house

Did you know that Mahatma Gandhi spent 21 years in South Africa? While he was there, Gandhi’s close friend and German architect Hermann Kallenbach designed and built this farmhouse in 1907, which then served as Gandhi’s South African base from 1908-09. The house is called Satyagraha House and is situated in Orchards, Johannesburg. It’s the spot from which Gandhi developed his plan for passive resistance against the British Empire. It’s been beautifully restored and provides free day visits or overnight stays in one of its seven rooms (prices from 3,080 ZAR).

8. Drive the Namaqualand Flower Route

The Namaqualand Flower Route is a 650-kilometer (404-mile) drive from Yzerfontein to Richtersveld National Park. While you can drive it in one day, most people break it up into sections and take a few days to do it. This region bursts into a sea of color every spring (mainly mid-August and mid-September, peaking in August) when over 4,000 species of flowers bloom. Head north to Springbok, and then make your way down in a southerly direction so the flowers are facing you. The flowers are best viewed on non-overcast days between 10:30am-4pm, so plan your trip accordingly. The Goegap Nature Reserve provides picnic areas and overnight facilities as well. Expect to pay between 320-1,200 ZAR per night.

9. Visit the wineries

South Africa is one of the biggest wine exporters in the world, exporting over 300 million liters (80 million gallons) of wine each year. Visit the vineyards to taste some incredibly fresh wine against a serene, mountainous backdrop. Cape Town is most popular for these tours, but there are great wine regions all over the country, including the Coastal Region, Klein Karoo, Breede River Valley, Olifants River, and Cape South Coast. Jump on an 8-hour day tour that goes from winery to winery, sampling all sorts of wine while learning all about the history of winemaking in South Africa. Tours start at 950 ZAR for a half-day tour.

10. Drive the Sani Pass to the Roof of Africa

Drive the Sani Pass Mountain route in Lesotho — the only route over the Drakensberg escarpment into the mountainous Kingdom of Lesotho. Since it first opened in 1955, the Sani Pass has offered an exhilarating journey as it twists and turns upwards through rocky cliffs that peak at 2,873 meters (9,425 feet) above sea level (hence the name “the Roof of Africa”). Only 4×4 vehicles are allowed on the road, which is treacherous and has been the site of countless accidents. As an alternative to attempting the drive yourself, several tour operators offer day tours, generally costing 940 ZAR. Afterward, bask in your victory as you enjoy a drink at Sani Mountain Lodge, known for being the highest pub in Africa!

11. See the Durban Beachfront

For decades the Golden Mile beachfront in Durban has been popular with cyclists, joggers, and leisurely strollers. You can also explore the Indian District, where dealers in traditional kurtas and saris hawk incense, ornately embroidered fabrics, and aromatic spices. Other sights in the city include visiting the KwaMuhle Museum, the Durban Botanical Gardens, the Tala Game Reserve, the Inanda Heritage Trail, or seeing a Sharks rugby game. Surfing is another popular activity here thanks to the ideal oceanic conditions.

12. Tour Riemvasmaak Community Conservancy

In 1973, under apartheid, 1,500 people were forcibly removed from this area. After the elections in 1994, they were able to return and now welcome visitors to their community. The park is located in the Kalahari Desert, making for some stark — but beautiful — landscapes, with unique rock formations and translucent green fluorite mineral deposits. There are many 4×4, hiking, and mountain biking trails here, as well as plenty of hot springs. There are small guesthouses and camping plots if you’d like to stay overnight.

13. See the penguins

The African penguin is the only penguin to breed on the continent. You can see them at Boulders Beach or Stoney Point Nature Reserve at Betty’s Bay (both locations are a short drive from Cape Town). You don’t often get to see penguins outside of zoos, so it’s definitely worth the drive to see this colony of penguins living their best lives on the beach. Try to arrive before 11am to get the best view of the penguins with the fewest crowds around. Entrance fees range from 25-152 ZAR and full-day guided tours cost 780 ZAR.

14. Surf the waves at Muizenberg Beach

Known for its iconic multi-colored huts on the boardwalk, this is a laid-back neighborhood in Cape Town with a multi-cultural vibe. If you want to hit the waves, you can rent a board for as little as 250 ZAR and a wetsuit 150 ZAR for the day (also available for cheaper by the hour). If you don’t know how to surf, you can also register for SUP or surf lessons at one of the surf shops nearby. Group surf lessons are 235-310 ZAR.

15. Safari in other national parks

While Kruger gets all the love, check out Pilanesberg National Park, Addo National Park, Umfolozi National Park, and the St. Lucia Wetlands. Without the crowds of Kruger, you’ll have ample opportunity to get up close to elephants, lions, leopards, rhinos, and more. From Johannesburg, the Madikwe Game Reserve, Pilanesberg Game Reserve, and the Dinokeng Game Reserve are just some of the options for nearby safaris.

16. Go whale watching

South Africa is one of the best places in the world to go whale watching. If you’re visiting between June and November, there’s an excellent chance of spotting Southern right whales, Bryde’s whales, and orcas. The town of Hermanus, located 120 kilometers (75 miles) southeast of Cape Town, is the base for many of the best whale-watching companies in the country. Some reputable companies include Southern Right Charters, Hermanus Whale Cruises, and Xplora Tours. Expect to pay around 900-1,020 ZAR for a two-hour tour.

For more information on specific cities in South Africa, check out these guides:

- Cape Town Travel Guide

South Africa Travel Costs

Accommodation – A bed in a 4-8-bed hostel dorm costs 250-300 ZAR per night, and around 215-230 ZAR per night for a dorm with 10 or more beds. A private double room costs 600-935 ZAR. Free Wi-Fi is standard and many hostels also include free breakfast and/or have a kitchen, as well as a swimming pool.

For those traveling with a tent, campgrounds can be found all around the country. Expect to pay between 100-400 ZAR per night, depending on the facilities and location.

If you are looking for a hotel, budget hotels range from about 850-1,200 ZAR for a twin or double in big cities and get cheaper in more rural areas. Standard amenities include Wi-Fi, private bathrooms, and air-conditioning. For a hotel with amenities like free breakfast and a swimming pool, expect to pay at least 900 ZAR per night.

Generally, accommodation prices are higher in Cape Town and Johannesburg and inside of any national parks. If you want to cut your prices, think about staying away from the city center, in lesser visited towns, and outside of the national parks when you’re going on a safari.

In the low season, you can find hostels and hotels for 10-20% cheaper.

Airbnb is also an option around the country, though it’s most commonly available in larger urban areas. A private room costs 300-600 ZAR per night while an entire home or apartment costs at least 700-900 ZAR.

Food – Due to its history of colonization and immigration, South African cuisine is a mix of indigenous, Dutch, British, Indian, and Malaysian culinary traditions.

Above all, South Africa is known for its meaty meals. A favorite pastime of South Africans is the braai , an open-air barbeque that originated in the townships of Johannesburg. Often served with your plate of barbeque are chakalaka , a dish of onions, tomatoes, peppers, carrots, and beans, and pap, a maize porridge.

Other popular dishes include bobotie (a baked dish of curry-spiced minced meat with egg on top) and potjiekos (a stew with meat, veggies, and potatoes). Common desserts include melktert (a custard tart) and malva pudding (like sticky toffee pudding).

Overall, restaurants in South Africa are pretty affordable. At a café, some coffee and a small meal cost 100 ZAR. At a casual restaurant serving traditional South African cuisine, expect to pay around 150 ZAR for a meal.

In terms of traditional barbeque, prices for one person vary, but are usually between 100-220 ZAR. Be sure to try biltong (thinly sliced air-dried meat), droewors (air-dried sausage), and boerewors (farmers sausage) if you’re a meat-eater.

A delicious dish that originated in the Indian community is bunny chow, a spicy curry served in a bread bowl that can also be served vegetarian. This dish is usually found at street food and takeaway spots, costing around 65-90 ZAR. At a sit-down Indian restaurant, expect to pay 90-140 ZAR for a typical curry meal.

In terms of fast food, a meal at Nando’s or another fast-food chain costs about 60-85 ZAR per person. A Chinese takeout meal costs around 75-125 ZAR.

At a nicer restaurant, a three-course meal with wine costs 280-320 ZAR per person, though you can find some main dishes for around 120 ZAR. In the same types of restaurants, a burger is 100-130 ZAR, a whole pizza is 120-160 ZAR, and a pasta dish is 90-155 ZAR.

Expect to pay around 30-35 ZAR for a beer and 50-70 ZAR for a cocktail. A glass of wine is 45-60 ZAR, while a bottle costs 120-250 ZAR. A bottle of water is 11 ZAR, soda is 20 ZAR, and a cappuccino is 25 ZAR.

The low-cost alternative to eating out is to buy groceries. A week’s worth of basic groceries for one person costs around 400-550 ZAR. This gets you basic staples like rice or pasta, seasonal produce, and some meat or fish. If you want to keep costs low, avoid expensive items like chicken, beef, and cheese.

Backpacking South Africa Suggested Budgets

On a backpacker’s budget of 850 ZAR per day, you can stay in a hostel, cook most of your meals, limit your drinking, do mostly free activities (walking tours, enjoying nature), and use public transportation to get around.

On a mid-range budget of about 1,900 ZAR per day, you can stay in a private hostel or Airbnb room, eat out for most meals, enjoy a few drinks, take the occasional taxi to get around, and do more paid activities like going on a safari or taking surf lessons.

On a “luxury” budget of 3,600 ZAR or more per day, you can stay in a hotel, eat out anywhere you want, rent a car, do more safaris and adventure sports, drink more, and do whatever else you want. This is just the ground floor for luxury though. The sky is the limit!