- 15 Offbeat Digital Nomad Destinations You Need to Visit Now

- Cancun vs. Tulum - Which Should You Visit Next?

- How to Play Video Games as You Travel the World

- 21 Unusual Places to Visit in Poland You Must See

- The Best Cenotes in the Riviera Maya

- The 7 Best Vacation Destinations for Nature Lovers

- Work With Us

Can I Buy Travel Insurance If I’m Already Abroad?

Already overseas and forgot to buy travel insurance before you left?

Has your travel insurance run out while you’re on vacation and you want to extend your stay or, heading to an area where it might be a really, really good idea to have travel insurance and you never bothered to buy any before? No matter the reason, buying travel insurance while you’re already abroad happens a lot more often than you’d think.

If you find yourself without travel insurance, and you’re already on the open road, don’t worry, we have the solution.

Can I buy travel insurance if I’m already abroad?

Whether you’re a classic procrastinator and forgot, or if your travel plans have changed: the good news is you can probably get travel insurance when already abroad for the remainder of your trip. Even better, the coverage you get will likely be similar to a policy you’d have purchased before you left.

This is important : No matter which policy you buy, you won’t be covered for injuries or accidents that happened before you buy your policy. So waiting until you’re on the way to the hospital isn’t the best time to buy travel insurance.

Not all travel insurance companies offer travel insurance if you’re already out of the country. In fact, many require that you haven’t already left on your trip. That said, there are some companies that let you get travel insurance after departure.

World Nomads

Safetywing nomads insurance.

SafetyWing Nomad Insurance offers flexible medical insurance while traveling.

If you’re on a budget, SafetyWing lets travelers pay for insurance on a monthly basis, as opposed to all at once in the beginning.

Travel medical coverage starts from $42/4 weeks.

You can buy Nomad Insurance from SafetyWing in 180 countries. You can also by it while already traveling, in case you forgot to purchase insurance before leaving on your trip.

Learn more about SafetyWing Nomad Insurance here.

Waiting periods before coverage starts

Some insurers have a waiting period before coverage starts, which is usually just a few days, before your travel insurance coverage takes effect. This is more common for Australian and New Zealand companies, but we’ve also heard it happens with Canadian, UK and US companies. So, the answer to “Can you get travel insurance when already abroad?” is yes, but you may have to wait a few days.

If you get sick or have an accident during this waiting period, you likely won’t be covered. Insurance companies add this waiting period to protect themselves from fraud from people who’ve gotten sick or injured, and then buy insurance to cover the now existing injury or illness.

That said, check your policy because some insurers have a waiting period, but they’ll also cover you for emergency overseas medical expenses and emergency transport expenses for a sudden illness or serious injury that results from an accident during that waiting period. Every travel insurance company handles the waiting period differently, so talk with your travel insurance agent to see what they do and don’t cover during this waiting period.

Travel insurance coverage for people already abroad

Just like regular travel insurance, the costs and what’s covered under your policy varies a lot for travel insurance if you’re already overseas.

The exact eligibility requirements to buy travel insurance after departure, and cover you get, will depend on the specific insurer you choose for post departure travel insurance. Talk to an insurance agent to make sure you’re covered for every activity you plan on doing while you travel. The best travel insurance for backpackers can include insurance for standard backpacker activities like snorkeling, and hiking, but always make sure your plan includes the activities you’re interested in!

Depending on the travel insurance company you choose, age limits may apply. This is common for both standard travel insurance, as well as health insurance you buy when already on a trip. There are some travel insurance policies with no age limit, but some insurance policies have age limits as low as under 60 years of age. Read the fine print to make sure you qualify.

Pre-existing medical conditions

Just like standard travel insurance, depending on the plan you choose, you may also not be covered for pre-existing medical conditions. Of course this depends on your policy, as some travel insurance policies do cover some pre-existing medical conditions like stable high blood pressure.

It’s very important that no matter whether you’re buying your travel insurance before you leave or while you’re already on the road, to always tell your travel insurer about any pre-existing medical conditions when you buy your policy. Otherwise, you might be surprised when you submit your bills that they’re declined.

If you’re over the age of 60, pre-existing conditions get more common, and also more complex. We get a lot of questions from Canadian seniors heading south in the winter (called snowbirds) about pre-existing conditions and travel insurance. However, any good snowbird travel insurance coverage should include pre-existing conditions – just be sure to check your policy to make sure that you’re covered.

Tip: Always check your travel insurance policy to know exactly what your coverage offers, and if there are any exemptions. At the end of the day, your policy is your contract and generally supersedes everything else.

It’s probably non-refundable

Of course, each insurer is different, buy many travel insurers don’t offer you a cooling off period if you buy travel insurance once you’ve already left your home country. Instead, these policies are typically non-refundable. If you have any doubt, check your own policy to make sure.

Need some more help?

Have you ever wondered “ do I need travel insurance “?

If you’re a Canadian, and looking for travel insurance, check out our Canadian travel insurance review .

Have you bought travel insurance whilst already abroad? Let us know in the comments – we’d love to hear from you!

Super helpful info! I wonder why companies make it so difficult to get insurance once your’re abroad. Sadly could have saved over $100CAD by getting it when I was still in Canada, but plans change. Thanks for this info 🙂

Lynne, they probably do that to make sure you aren’t already hurt once abroad. They know that if you’re still in Canada you’ll likely get it taken care of here for free but they have no way of knowing that you didn’t hurt yourself once you were gone and wanted to now get travel insurance to cover you not getting it in the first place.

Hello, I am a healthy 70 year old Canadian and forgot to get travel health insurance before flying to Florida. I would like to get insurance for approximately 46 days. Can you please recommend companies that will do this. Many thanks

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Plan Your Trip

- Safety & Insurance

How To Get Travel Insurance When Already Abroad

Published: December 18, 2023

Modified: December 28, 2023

by Kellsie Ayala

- Sustainability

- Travel Tips

Introduction

Traveling abroad can be an exhilarating experience, offering the opportunity to explore new cultures, savor exotic cuisines, and create lasting memories. However, unforeseen circumstances such as medical emergencies, trip cancellations, or lost luggage can disrupt the joy of traveling. This is where travel insurance comes to the rescue, providing peace of mind and financial protection against unexpected events.

Whether you forgot to purchase travel insurance before embarking on your journey or your current policy is about to expire, acquiring travel insurance while already abroad is indeed possible. While the process may seem daunting, with the right approach and understanding, you can secure the coverage you need to continue your travels with confidence.

In this guide, we will delve into the intricacies of obtaining travel insurance while already abroad. From understanding the nuances of travel insurance to researching and comparing available options, contacting insurance providers, and ultimately purchasing the most suitable policy, we will navigate through the essential steps to help you safeguard your travels.

So, if you find yourself in need of travel insurance while already abroad, fear not. By following the guidance outlined in this article, you can effectively address this need and ensure that your adventures continue to unfold smoothly and securely.

Understanding Travel Insurance

Before delving into the process of obtaining travel insurance while abroad, it’s crucial to grasp the fundamental concepts of travel insurance. Travel insurance is designed to mitigate financial risks associated with traveling, offering coverage for a wide array of unforeseen events. These may include medical emergencies, trip cancellations or interruptions, lost or delayed baggage, and even emergency evacuation and repatriation.

When seeking travel insurance, it’s essential to consider the different types of coverage available. Medical coverage ensures that you receive necessary medical treatment in the event of illness or injury while traveling. Trip cancellation and interruption coverage provides reimbursement for non-refundable trip expenses if your trip is canceled or cut short due to covered reasons, such as illness, severe weather, or other unforeseen events. Additionally, baggage and personal belongings coverage offers protection against loss, damage, or theft of luggage and personal items during your travels.

Furthermore, it’s imperative to understand the limitations and exclusions of travel insurance policies. Pre-existing medical conditions, high-risk activities, and travel to certain countries may not be covered by standard policies. Therefore, carefully reviewing the policy details and consulting with insurance providers is crucial to ensure that you have a comprehensive understanding of the coverage you require.

By comprehending the intricacies of travel insurance, you can make informed decisions when evaluating available options and selecting the most suitable policy for your specific needs. With this foundational knowledge, you can confidently proceed to the next steps of researching and acquiring travel insurance while already abroad.

Researching and Comparing Options

When seeking travel insurance while already abroad, thorough research and comparison are essential to identify the most suitable coverage for your specific requirements. Begin by exploring reputable insurance providers that offer policies designed for individuals in your current situation. Online resources, including insurance company websites and independent insurance comparison platforms, can serve as valuable tools for gathering information and comparing available options.

As you delve into your research, consider the following factors to guide your decision-making process:

- Coverage Benefits: Evaluate the extent of coverage offered by each policy, considering aspects such as medical expenses, trip cancellation/interruption, baggage loss/delay, and emergency assistance services.

- Policy Exclusions: Take note of any exclusions or limitations within the policies, ensuring that the coverage aligns with your specific travel circumstances and activities.

- Claims Process: Review the claims process for each policy, including the ease of filing a claim and the responsiveness of the insurance provider in handling claims.

- Customer Reviews: Seek insights from other travelers by reading customer reviews and testimonials regarding their experiences with the insurance providers and the effectiveness of the coverage provided.

Furthermore, consider reaching out to fellow travelers or expatriates who may have encountered similar situations and can offer recommendations based on their firsthand experiences. Their insights can provide valuable guidance in navigating the complexities of obtaining travel insurance while abroad.

By diligently researching and comparing the available options, you can make an informed decision that aligns with your specific needs and preferences. This proactive approach lays the groundwork for securing the most suitable travel insurance policy to safeguard your adventures while abroad.

Contacting Insurance Providers

Once you’ve identified potential insurance options through thorough research, the next step is to initiate direct contact with the insurance providers. While this may seem daunting, especially when navigating different time zones and language barriers, it is a pivotal stage in the process of obtaining travel insurance while already abroad.

When reaching out to insurance providers, consider the following approaches to streamline the communication and gather essential information:

- Utilize Online Communication Channels: Many insurance providers offer online chat support or email correspondence, enabling you to initiate contact regardless of your current location. Utilizing these channels can facilitate efficient communication and provide written documentation of the exchange for future reference.

- Seek Clarification on Policy Details: Engage in detailed discussions with the insurance representatives to gain clarity on policy inclusions, exclusions, coverage limits, and any additional considerations specific to your situation. This ensures that you have a comprehensive understanding of the policy before making a purchase decision.

- Inquire About Documentation and Payment Options: Seek guidance on the documentation required to purchase the policy while abroad, as well as the available payment methods that align with your accessibility and preferences.

- Request Assistance in Multiple Languages: If language barriers pose a challenge, inquire about the availability of multilingual support to facilitate effective communication and ensure that all policy details are clearly understood.

By proactively contacting insurance providers and engaging in open dialogue, you can address any concerns or uncertainties related to obtaining travel insurance while abroad. This direct communication also allows you to assess the responsiveness and customer service quality of the insurance providers, which can be indicative of the support you may receive throughout the coverage period.

Ultimately, by establishing clear and effective communication with the insurance providers, you can navigate the process of acquiring travel insurance while already abroad with confidence and clarity.

Purchasing Travel Insurance

After conducting thorough research, comparing available options, and establishing direct communication with insurance providers, the final step is to proceed with the purchase of travel insurance while already abroad. This pivotal stage requires careful consideration and attention to detail to ensure a seamless and secure acquisition of the desired coverage.

When preparing to purchase travel insurance while abroad, consider the following essential steps:

- Review and Confirm Policy Details: Prior to making the purchase, meticulously review the policy details provided by the insurance provider, ensuring that it aligns with your specific travel needs and offers the desired level of coverage.

- Verify Documentation Requirements: Clarify the documentation required to complete the purchase process, such as identification documents, proof of travel itinerary, and any additional forms or declarations necessary for policy issuance.

- Secure Payment and Confirmation: Explore the available payment methods accepted by the insurance provider and ensure that the transaction can be securely processed from your current location. Upon completing the payment, obtain confirmation of the policy purchase and retain the documentation for your records.

- Accessible Policy Information: Ensure that you have convenient access to the policy details, including coverage documents, emergency contact information, and relevant policy numbers, through digital or printed formats for easy reference during your travels.

Additionally, it’s advisable to maintain open communication with the insurance provider throughout the purchase process, seeking clarification on any uncertainties and confirming the effective date and duration of the coverage to align with your travel plans.

By diligently adhering to these steps and exercising vigilance in the purchase process, you can secure the necessary travel insurance while already abroad, providing invaluable peace of mind and protection against unforeseen events throughout your journey.

Acquiring travel insurance while already abroad may initially seem like a complex endeavor, but with a systematic approach and understanding of the essential steps involved, it becomes an achievable task. Throughout this guide, we have explored the intricacies of obtaining travel insurance in such circumstances, from understanding the fundamental aspects of travel insurance to researching, comparing options, contacting insurance providers, and ultimately making the purchase.

By comprehending the nuances of travel insurance and the diverse coverage options available, you can make informed decisions that align with your specific travel needs and preferences. Thorough research and comparison of insurance policies enable you to identify the most suitable coverage, while direct communication with insurance providers ensures that you have a comprehensive understanding of the policy details and purchase process.

As you navigate the process of purchasing travel insurance while already abroad, it’s essential to remain vigilant and proactive, seeking clarity on policy inclusions, exclusions, documentation requirements, and payment processes. This proactive approach not only facilitates a smooth acquisition of travel insurance but also instills confidence in the coverage obtained, allowing you to focus on enjoying your travels without undue worry.

Ultimately, the ability to secure travel insurance while already abroad empowers travelers to address unforeseen risks and unexpected events with resilience and financial protection. By following the guidance outlined in this article, individuals can navigate this process with confidence, ensuring that their adventures continue to unfold smoothly and securely.

So, whether you find yourself amidst the bustling streets of a foreign city or amidst the serene landscapes of a distant land, remember that obtaining travel insurance while already abroad is indeed feasible, and with the right approach, it can enhance your travel experiences with peace of mind and security.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Best overall

- Best for exotic trips

- Best for trip interruption

- Best for family coverage

- Best for long trips

How we reviewed international travel insurance companies

Best international travel insurance for april 2024.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

If you're planning your next vacation or trip out of the country, be sure to factor in travel insurance. Unexpected medical emergencies when traveling can drain your bank account, especially when you're traveling internationally. The best travel insurance companies for international travel can step in to provide you with peace of mind and financial protection while you're abroad.

Best overall: Allianz

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good option for frequent travelers thanks to its annual multi-trip policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Doesn't increase premium for trips longer than 30 days, meaning it could be one of the more affordable options for a long trip

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans include free coverage for children 17 and under

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Concierge included with some plans

- con icon Two crossed lines that form an 'X'. Coverage for medical emergency is lower than some competitors' policies

- con icon Two crossed lines that form an 'X'. Plans don't include coverage contact sports and high-altitude activities

- Single and multi-trip plans available

- Trip cancellation and interruption coverage starting at up to $10,000 (higher limits with more expensive plans)

- Preexisting medical condition coverage available with some plans

Allianz Travel Insurance offers the ultimate customizable coverage for international trips, whether you're a frequent jetsetter or an occasional traveler. You can choose from an a la carte of single or multi-trip plans, as well as add-ons, including rental car damage, cancel for any reason (CFAR) , adventure sport, and business travel coverage. And with affordable pricing compared to competitors, Allianz is a budget-friendly choice for your international travel insurance needs.

The icing on the cake is Allyz TraveSmart, Allainz's highly-rated mobile app, which has an average rating of 4.4 out of five stars on the Google Play store across over 2,600 reviews and 4.8 out of five stars from over 22,000 reviews on the Apple app store. So, you can rest easy knowing that you can access your policy and file claims anywhere in the world without a hassle.

Read our Allianz travel insurance review here.

Best for exotic trips: World Nomads

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

World Nomads Travel Insurance offers coverage for over 150 specific activities, so you can focus on the adventure without worrying about gaps in your coverage.

You can select its budget-friendly standard plan, starting at $79. Or if you're an adrenaline junkie seeking more thrills, you can opt for the World Nomads' Explorer plan for $120, which includes extra sports like skydiving, scuba diving, and heli-skiing. And World Nomads offers 24/7 assistance, so you can confidently travel abroad, knowing that help is just a phone call away.

Read our World Nomads travel insurance review here.

Best for trip interruption: C&F Travel Insured

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 2 major plans including CFAR coverage on the more expensive option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancellation for job loss included as a covered reason for trip cancellation/interruption (does not require CFAR coverage to qualify)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Frequent traveler reward included in both policies

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1 million in medical evacuation coverage available

- con icon Two crossed lines that form an 'X'. Medical coverage is only $100,000

- con icon Two crossed lines that form an 'X'. Reviews on claims processing indicate ongoing issues

- C&F's Travel Insured policies allow travelers customize travel insurance to fit their specific needs. Frequent travelers may benefit from purchasing an annual travel insurance plan, then adding on CFAR coverage for any portions of travel that may incur greater risk.

C&F Travel Insured offers 100% coverage for trip cancellation, up to 150% for trip interruption, and reimbursement for up to 75% of your non-refundable travel costs with select plans. This means you don't have to worry about losing your hard-earned money on non-refundable travel costs if your trip ends prematurely.

Travel Insured also stands out for its extensive "reasons for cancellation" coverage. Unlike many insurers, the company covers hurricane warnings from the National Oceanic and Atmospheric Administration (NOAA).

Read our Travel Insured review here.

Best for family coverage: Travelex

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Options to cover sports equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Option to increase medical coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Can cancel up to 48 hours before travel when CFAR option is purchased

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Affordable coverage for budget-conscious travelers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes generous baggage delay, loss and trip delay coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Optional "adventure sports" bundle available for riskier activities

- con icon Two crossed lines that form an 'X'. Only two insurance plans to choose from

- con icon Two crossed lines that form an 'X'. Medical coverage maximum is low at up to $50,000 per person

- con icon Two crossed lines that form an 'X'. Pricier than some competitors with lower coverage ceilings

- con icon Two crossed lines that form an 'X'. Some competitors offer higher medical emergency coverage

Travelex travel insurance is one of the largest travel insurance providers in the US providing domestic and international coverage options. It offers a basic, select, and America option. Read on to learn more.

- Optional CFAR insurance available with the Travel Select plan

- Trip delay insurance starting at $500 with the Travel Basic plan

- Emergency medical and dental coverage starting at $15,000

Travelex Travel Insurance offers coverage for your whole crew, perfect for when you're planning a family trip. Its family plan insures all your children 17 and under at no additional cost. The travel insurance provider also offers add-ons like adventure sports and car rental collision coverage to protect your family under any circumstance. Got pets? With Travelex's Travel Select plan, you can also get coverage for your furry friend's emergency medical and transportation expenses.

Read our Travelex insurance review here.

Best for long trips: Seven Corners

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

Seven Corners Travel Insurance offers specialized coverage that the standard short-term travel insurance policy won't provide, which is helpful if you're embarking on a long-term trip. You can choose from several plans, including the Annual Multi-Trip plan, which provides medical coverage for multiple international trips for up to 364 days. This policy also offers COVID-19 medical and evacuation coverage up to $1 million.

You also get the added benefit of incidental expense coverage. This policy will cover remote health-related services and information, treatment of injury or illness, and live consultations via telecommunication.

Read our Seven Corners travel insurance review here.

How to find the right international travel insurance company

Different travelers and trips require different types of insurance coverage. So, consider these tips if you're in the market to insure your trip.

Determine your needs

- Consider the nature of your travel (leisure, business, or adventure) and the associated risks (medical emergencies, trip cancellations, etc.).

- Determine your budget and the amount of coverage you require.

- Consider the duration of your trip and the countries you'll be visiting, as some policies won't cover specific destinations.

Research the reputation of the company

- Look for the company's reviews and ratings from reputable sources like consumer advocacy groups and independent website reviews.

- Check the provider's financial stability and credit ratings to ensure it can pay out claims reliably.

- Investigate the company's claims process to ensure it can provide timely support if you need to file a claim.

Compare prices

- Get quotes from multiple providers to compare rates and coverage options.

- See if the company provides discounts or special offers to lower your cost.

- Look at the deductible or any out-of-pocket expenses you may have to pay if you file a claim to determine if you can afford it.

Understanding international travel insurance coverage options

Travel insurance can be confusing, but we're here to simplify it for you. We'll break down the industry's jargon to help you understand what travel insurance covers to help you decide what your policy needs. Bear in mind that exclusions and limitations for your age and destination may apply.

Finding the best price for international travel insurance

Your policy cost will depend on several factors, such as the length of your trip, destination, coverage limits, and age. Typically, a comprehensive policy includes travel cancellation coverage costs between 5% and 10% of your total trip cost.

If you're planning an international trip that costs $4,500, you can expect to pay anywhere from $225 to $450 for your policy. Comparing quotes from multiple providers can help you find a budget-friendly travel insurance policy that meets your needs.

We ranked and assigned superlatives to the best travel insurance companies based on our insurance rating methodology . It focuses on several key factors, including:

- Policy types: We analyzed company offerings such as coverage levels, exclusions, and policy upgrades, taking note of providers that offer a range of travel-related issues beyond the standard coverages.

- Affordability: We recognize that cheap premiums don't necessarily equate to sufficient coverage. So, we seek providers that offer competitive rates with comprehensive policies and quality customer service. We also call out any discounts or special offers available.

- Flexibility: Travel insurance isn't one-size-fits-all. We highlight providers that offer a wide array of coverage options, including single-trip, multi-trip, and long-term policies.

- Claims handling: The claims process should be pain-free for policyholders. We seek providers that offer a streamlined process via online claims filing and a track record of handling claims fairly and efficiently.

- Quality customer service: Good customer service is as important as affordability and flexibility. We highlight companies that offer 24/7 assistance and have a strong record of customer service responsiveness.

We consult user feedback and reviews to determine how each company fares in each category. We also check the provider's financial rating and volume of complaints via third-party rating agencies.

The best insurance policy depends on your individual situation, including your destination and budget. However, popular options include Allianz Travel Insurance, World Nomads, and Travel Guard.

International health insurance and travel insurance serve different purposes. While both may cover medical expenses, international health insurance provides long-term health insurance for working abroad. Meanwhile, travel insurance offers short-term coverage for the duration of your trip.

Typically, your regular health insurance won't cover you out of the country, so you'll want to make sure your travel insurance has adequate medical emergency coverage. Depending on your travel plans, you may want to purchase add-ons, such as adventure sports coverage, if you're planning on doing anything adventurous like bungee jumping.

Travel insurance is worth the price for international travel because they're generally more expensive, so you have more to lose. Additionally, your regular health insurance won't cover you in other countries, so without travel insurance, you'll end up paying out of pocket for any emergency medical care you receive out of the US.

- Main content

- GENERAL TRAVEL

Health Insurance Abroad: The Complete Guide

The GoAbroad Writing Team is a collection of international travel writers with decades of experie...

- Before You Go

- Health & Safety Tips

- button]:border-none [&>button]:bg-white [&>button]:hover:cursor-pointer [&>button]:hover:text-cyan-400"> button]:hover:text-cyan-400 [&>button]:bg-white hover:cursor-pointer" height="1em" width="1em" xmlns="http://www.w3.org/2000/svg">

Going abroad for the first time without your family can be thrilling, yet simultaneously terrifying. The same can be said for the second, third, and tenth time. Are you 30 and planning for a volunteer trip overseas? It’s still scary, and that’s okay!

On the cusp of any international travel—short- or long-term—it’s normal to have an imminent feeling of the unknown and unexpected weighing down on your mind. As much as I’d love to tell any future adventurer to look to toward the horizon, ignore the risks and gallop off into the Icelandic sunset on a miniature fluffy horse, the fact is that that’s just awful advice to give. The better piece of advice is plain and simple: Cover your hiney with health insurance abroad.

Traveling to Asia? Get Covered with the Luma ASEAN Pass

No matter the adventure, don’t leave without securing medical insurance abroad!

No matter your age, international travel experience, destination, or purpose for venturing abroad—be it studying, volunteering, teaching, interning, or otherwise—there are very real risks that need to be acknowledged and properly prepared for before you head overseas. While packing your life away for a study abroad trip and raising funds for a volunteer stint abroad are pretty important, your medical insurance abroad carries the most significant weight. Forgetting a hairbrush or not having enough money for a daily gelato is a bummer, but not having health insurance coverage abroad when tragedy strikes can have lifelong consequences.

Travelers, parents, and other family members alike can be comforted by the knowledge that there are comprehensive coverage packages out there customizable for any type of travel abroad—from teaching in China to snorkeling at the Great Barrier Reef. And just like that, taking the first step out into the Barcelona cobblestoned street doesn’t seem so intimidating! You’re covered.

In this comprehensive guide to health insurance while abroad, you’ll learn the ins and outs of…

- An overview of medical insurance abroad

- How your destination influences your coverage

- Using an existing domestic plan overseas

- What’s covered in international health insurance

- Difference between travel insurance and international medical insurance

- What to do if an emergency happens abroad

- Insurance abroad considerations for types of travel

- Suggested insurance providers

If you’ve been ignoring the nitty-gritty logistics of traveling abroad, then this guide to health insurance abroad will cover everything you need to know. Let’s get started!

The rundown of medical insurance abroad

Even if you don’t plan on skiing in Austria—or anywhere—during your travels, stay safe by having health insurance coverage abroad.

In the unusual case that you’ve already mastered how your domestic insurance and healthcare system works at home, that’s great! It won’t be of much help here, however. With a spectrum of healthcare systems around the world and third-party insurance providers working as middlemen to make it all easier to understand, that Thai snack of grasshoppers isn’t the only foreign concept on the table.

Generally, medical insurance abroad covers whichever dates you want, ranging from a day to a year and more. As health and finances are inarguably some of the most important assets we have, finding the correct health insurance while abroad should be a priority. Because it’s a preventative service, it’s easy to consider it an afterthought and not budget sufficiently for an adequate policy. Just remember, insurance abroad should be one of the top items on your travel list!

All your insurance abroad travel questions answered

The world of insurance is complicated enough, and throwing “international” into the mix makes it all the more confusing. How’s one to know about insurance abroad without having spending hours making phone calls to countless companies and embassies? We got the answers to your questions.

1. Do I need health insurance while traveling internationally?

Just like at home, health insurance helps pays for medical attention ranging from emergency room visits to prescription drugs. Internationally, you may face additional challenges as a foreign national that health insurance coverage abroad will help face, such as emergency evacuation or exorbitant healthcare costs if not covered. Apart from the fact that many travel programs or visas require some degree of coverage, having a safety net while traveling is always a good idea .

Our recommendation is Lewerglobal . Whether traveling for business, pleasure, or education, Lewerglobal provides the protection and support you need to travel with confidence. Find peace of mind for your short-term holiday, year-long internship, or four-year degree program. Lewerglobal members can choose a variety of health, travel, and trip protection plans to meet any budget and itinerary!

[ Browse All Providers of Medical Coverage Abroad ]

2. does my travel destination make a difference.

Yes! Your destination country or countries can impact what kind of health insurance coverage abroad you need and if you need it at all. For example, U.S. citizens whose long-term travels take them to countries in the Schengen area will need a certain amount of insurance coverage to qualify for a visa after the 90-day tourist visa period is up. Most countries in Western Europe are in the Schengen area , including Spain, France, Germany, and Italy.

Those who aren’t U.S. citizens may need insurance coverage to apply for a visa just to enter the area to begin with. For either case, there are specific stipulations for the holiday health insurance abroad to qualify for a Schengen area visa. Amongst other requirements, the insurance must cover a certain amount of Euros and should be valid for the applicant’s length of stay.

Other countries requiring proof of health insurance before entry are Cuba, Antarctica, and the United Arab Emirates. Before securing a generic health insurance abroad, be absolutely sure that your destination countries’ insurance requirements are met. Otherwise, your coverage may be all for nothing!

[ Get 6 FREE Travel Program Recommendations ]

3. does my health insurance cover international travel.

Depending on your domestic insurance, you may have some coverage abroad for basic short-term trips in some countries. However, more often than not, you’re looking at limited coverage, higher deductibles, and higher minimums to pay if an emergency does arise. For Medicare recipients, there is generally no coverage outside of the U.S. and its territories.

Before purchasing insurance abroad, check in with your current health insurance provider to be sure you’re not getting double coverage!

Health insurance comes in handy if you need to visit a doctor or clinic on your travels.

4. What does insurance abroad cover?

Medical insurance abroad alone typically covers anything from emergency doctor visits to lab orders to emergency surgeries to dental care for pain relief. Although often included, emergency evacuation and repatriation of remains (return of a body if passed away) are considered separate line items. When reading through policy coverage, be sure these basic services are included, as well as others like emergency family travel arrangements in case a family member needs to fly out to the bedside.

For travelers with a chronic illness or preexisting conditions, its essential that a health insurance abroad covers all medical needs and provides for prescription drugs for longer trips. Otherwise, you may be looking at out-of-pocket expenses and that’s the last way anyone wants to remember their travels!

5. How much does insurance abroad cost?

Rule of thumb when when choosing an insurance abroad: Don’t shop for the cheapest. A low price isn’t reflective of a good deal, rather it may just hint at a bare boned policy with high deductibles and minimums. Policies can start at a little more than a dollar a day for shorter trips , but ultimately, travel health insurance cost is determined by these factors:

- Limit of coverage, amount of deductible, and add-ons (i.e. ski insurance)

- Traveler’s age

- Duration of travel

After you have an idea of the coverage your travels and your health condition requires, the fun part begins. Shopping! Medical insurance websites include an option for a free quote, so you can get a fairly good idea of cost and the policy breakdown before you commit.

[ Get Even More Travel Medical Insurance Advice ]

6. what’s the difference between travel insurance and medical insurance abroad.

After doing a bit of research you may have come across insurance abroad, travel insurance, and international medical coverage. What’s the difference? Sometimes these variations are combined into comprehensive packages. Let’s break down common types of coverages:

- Trip insurance or travel cancellation insurance: This type compensates for lost, stolen, or damaged luggage while in transit and for unplanned trip cancellations in stated circumstances, such as a relative passing away.

- Medical evacuation and repatriation: If you need to get transported to a hospital or even airlifted to seek special emergency care, then evacuation coverage has got your back. Repatriation also makes sure you can get paid to back home for special care in unforeseen circumstances.

- Emergency medical expenses: When generally thinking of medical insurance abroad, this kind of coverage is most commonly referenced. Avoid paying medical bills by making sure you have an adequate coverage for medical expenses.

Travel worry-free for flight delays, lost luggage, and other inconveniences—your insurance will have your back!

7. Who do you contact if you need medical attention?

First and foremost, after purchasing a suitable medical insurance abroad you need to print out your policy (if you don’t receive a physical card) and carry it on your person at all times. Having a claim form or two printed, saved and ready in a secure place will also save buckets of travel down the road if you’re unable to later. Participants of an organized travel program can also get assistance from program organizers, who may also have a good idea of how to approach medical emergencies in the country.

Every international insurance provider will have a hotline available to contact with country-specific protocol and instructions if you need to seek medical attention. Additionally, the country’s U.S. Embassy provides information on local doctors and hospitals available. Just look for the “American Citizens Services” tab on your country’s U.S. Embassy website .

8. What’s the right type of insurance for my travels (study/intern/work/etc)?

Not all health insurance coverage abroad is made equal. Meaningful travel comes in all lengths and varying degrees of adventure. While some adventure travel may involve extreme sports like scuba diving, a two week volunteer project in a large city is relatively low-key. Be aware of what risks and characteristics your travels entail and make sure you pick up the right plan to cover them.

- Study abroad . With durations ranging from a few weeks to a whole year, study abroad can be confusing when it comes to insurance. Luckily, most study abroad program providers offer comprehensive information on how to get covered, if they don’t already include a plan in the program. ( P.S. Studying abroad with a chronic illness? Read about what you need to know ! )

- Volunteer abroad . The unique characteristic of volunteering abroad is that your horizons are a lot wider, including stays in off-the-beaten path areas and more community integration. As such, infrastructure and access to comprehensive healthcare can be scarce. For volunteers with medical conditions relying on special treatment, look into plans that cover pre-existing conditions and prescription drugs abroad.

- Intern abroad . Organized internship abroad opportunities through third-party programs or universities will often offer insurance abroad for the duration of stay. These plans are already suggested with the internship and destination country in mind, so you don’t have to navigate the confusing world of coverage yourself.

- Teach abroad . One of the perks of teaching English abroad is the medical insurance abroad included in work compensation packages (or at least a partnership with a company to direct you too)! Included insurance policies are a sign of a well-rounded employer and saves a ton of leg-work in the relocation process. Whether the coverage is offered through a third-party recruiting organization or directly by the employing institution abroad, there’s bound to be a preplanned insurance policy available.

- TEFL courses abroad . TEFL courses abroad never last for more than a few months at a time, and as such are easily coverable by normal health insurance abroad. For the time spent abroad learning about grammar games and classroom management, a general international medical insurance should do!

- Gap year . Going abroad through an organization? Then you may already have international insurance coverage included! Students traveling independent can look into youth plans or student-targeted packages.

- Completing a degree abroad . Being a full-time student for multiple years as you complete a degree abroad looks similar to expat insurance. However, students may be able to qualify for a domestic insurance depending on your citizenship and the destination country. The best place to get information is the university’s international office or a health department that’s familiar with insurance for international students.

- High school abroad . Typically, high school students won’t be traveling internationally solo. Teen travel programs should offer insurance as a part of the deal, so check in with an advisor to be sure what the benefits are.

- Language school . Because many language school courses are short enough to fit into a tourist visa stay and students won’t theoretically be cliff diving, basic international insurance packages are a good fit. Depending on the program, you may be fit for a student insurance type of coverage, specially tailored to your needs.

- Adventure travel . Thinking of bungee jumping in Costa Rica or horseback riding in Mongolia? Because of the “living on the edge”, extreme sports aspect of adventure travel, you’ll need insurance that includes those kinds of riskier activities. Read into the find print and be certain that the kinds of activities you’re interested in are covered.

- Work abroad . Working abroad long-term means needing health insurance coverage abroad will almost certainly be a given. If your employer doesn’t provide it, then look into plans geared toward expats and working professionals.

9. How do I find international travel-specific insurance?

A quick search for “international medical insurance” can yield a good number of reliable sources. Ultimately, quality health insurance abroad comes down to reading the fine print and knowing exactly what you’re getting. The U.S. Department of State provides a list of recommended insurance providers for international travel that’s definitely worth checking out.

Take the scary out of travel abroad with the right international health insurance coverage!

Friends don’t let friends travel without having health insurance while abroad!

Securing a well-rounded health insurance coverage abroad should be one of the first items on that travel checklist ! Even if you don’t have a preexisting condition or need for medical attention while overseas, you can never anticipate emergencies and accidents. Because insurance is often a requirement for travel programs, international visas, and some types of employment abroad, it’s best to start researching ASAP to have a thorough understanding of it works and which plan fits best.

Remember: Even if a medical risk is 0.01%, it’s a real risk that can put you financially in a pickle for your entire life. Get all your ducks in a row, secure an insurance plan, and then go forth to have the time of your life abroad worry-free!

Sign up for GoAbroad’s newsletter for even MORE helpful travel advice

DISCLAIMER: While our site doesn’t feature every company or product available in the market, we aim to be the most comprehensive resource for meaningful travel and provide thoughtful, valuable resources—whether that's written content, programs and travel experiences, or products and services for purchase. Our partners compensate us to promote their products and services. This may influence where those products appear on our site, but the decision to purchase is up to you. We do not represent any of our partners directly, including insurance providers, program providers, and other service providers. For more information, please click here .

Explore Programs on GoAbroad.com

Related Articles

By Charleen Johnson Stoever | 47 minutes ago

By GoAbroad Writing Team | 5 days ago

By Raquel Thoesen | 5 days ago

Popular Searches

Study abroad programs in italy, study abroad programs in spain, marine biology study abroad programs, study environmental studies abroad, fall study abroad 2024, spring study abroad programs, recommended programs.

2566 reviews

International TEFL Academy

1682 reviews

International Volunteer HQ [IVHQ]

1905 reviews

MAXIMO NIVEL

563 reviews

Intern Abroad HQ

For Travelers

Travel resources, for partners.

© Copyright 1998 - 2024 GoAbroad.com ®

- Study Abroad

- Volunteer Abroad

- Intern Abroad

- Teach Abroad

- TEFL Courses

- Degrees Abroad

- High School Abroad

- Language Schools

- Adventure Travel

- Jobs Abroad

- Online Study Abroad

- Online Volunteer Programs

- Online Internships

- Online Language Courses

- Online Teaching Jobs

- Online Jobs

- Online TEFL Courses

- Online Degree Programs

Sunshine Seeker

Dream ◇ Create ◇ Travel

Popular categories, how to buy travel insurance when you’re already abroad (after departure).

By: Charlotte · Last updated 16. November 2023 · In: Travel

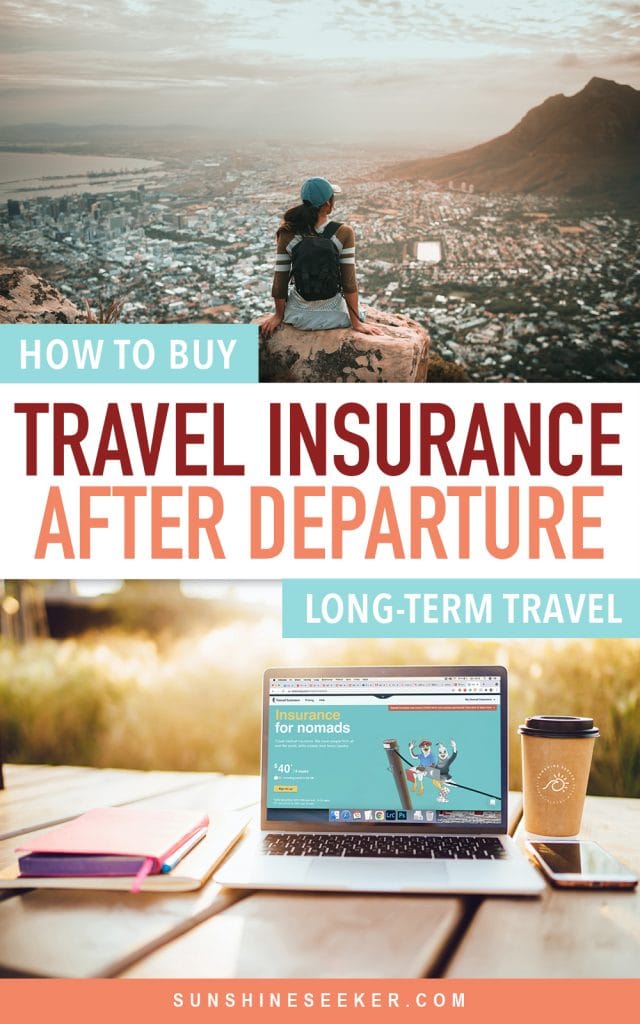

Are you wondering whether or not you can buy travel insurance when you’re already abroad ? Fear not, there are a few companies that offer travel insurance that you can buy or extend even after departure. Let’s take a look at a subscription-based travel insurance for digital nomads and long-term travelers.

Watching the sunrise over the clouds looking out the tiny airplane window, you are ecstatic that in just two hours you will reach your next pin on the map. The sun is bright, and the anticipation of all the new experiences your next adventure will bring is keeping you on the edge of your seat. There is just one problem. You can’t help feeling as if you are forgetting something.

Is it my phone? No. My extra camera battery? No. My Passport? No. A quick inspection of your carry-on bag eases your mind, but it’s a feeling that just won’t go away.

Then it finally hits you. You forgot to buy travel insurance before you left. The panic sets in and you think is it too late? I’m already halfway around the globe.

Or you might realize when you’re already abroad that your current insurance only covers a certain amount of days of travel. Been there done that!

Disclosure: I’ve written this SafetyWing Nomad Insurance review to the best of my knowledge and understanding, however, changes to insurance policy terms can happen. Use the information within this article at your own discretion. Before purchasing a policy do your own research and make sure all your personal travel needs are covered!

Article overview

Do I really need travel insurance?

How to choose the right travel insurance, purchase a policy with safetywing, remember to pin this for later 😉, travel insurance when you’re already abroad.

Travel plans can change very quickly. You might fall in love with a person or a place or discover that you’re supposed to live out of a backpack for at least another year.

The ability to make spontaneous decisions on the road is one of the main reasons why many of us love to travel. I live for the feeling of freedom when I don’t have any set plans and know I can go wherever I want whenever I want. However, deciding to extend your time overseas can sometimes be a bit tricky. Especially when it comes to travel insurance.

The good news is that it’s NEVER too late to buy or extend your travel insurance , even when you’re already abroad . The trick is finding the right company to suit you and your travel needs.

While many companies offer travel insurance, a select few let you buy a policy when you’re already abroad or if you don’t know the exact length of your trip. Some of these include World Nomads, True Traveller (for UK residents) and SafetyWing .

One travel insurance you can buy when you’re already abroad is SafetyWing Nomad Insurance . A travel and medical incident insurance built specifically for digital nomads by digital nomads.

At least, that’s my personal choice. SafetyWing is a Norwegian and United States-based company with remote team members all over the globe. They offer exactly the type of coverage needed for long-term travelers and digital nomads, even if you’re already abroad .

SafetyWing says “we’re here to remove the role of geographical borders as a barrier to equal opportunities and freedom for everyone.”

I’m so happy to now know that a company like SafetyWing exists as I’ve wasted so much money in the past on ridiculously expensive plans for long-term travel. When I moved to Indonesia at the beginning of 2019, I had so much trouble finding an insurance provider in Norway willing to cover me over the standard 70 days.

I could literally have saved hundreds of dollars and so much time had I known about SafetyWing back then!

You can find my full review of SafetyWing here .

For those of you who might be thinking, is travel insurance really all that necessary? I’m healthy, young and plan on taking in the sites at a leisurely pace. Or maybe not?

Maybe you are planning on ziplining over the Amazon Rainforest, sand surfing in the Sahara Desert, scuba diving on the Great Barrier Reef or riding in a hot air balloon over Turkey. Either way, the answer is YES!

Travel insurance is always a good idea because the reality is, anything can happen. With the SafetyWing Nomad Insurance (travel and medical insurance), you can have peace of mind that your next adventure is covered. Let’s put it this way if you can’t afford travel insurance you can’t afford to travel!

- Lost luggage: We’ve all known at least one person who has lost their luggage while traveling and what a true nightmare it can be. For a nomad, especially those without a permanent address, your luggage is your lifeline. When traveling away from home, your possessions are everything and being without them can be nerve-wracking. Don’t let the fear of losing luggage stop you from living out your dreams.

- Risky Business: Secretly an adrenaline junkie? If you have an adventure-seeking soul and plan to take in the sights with fast-paced, exhilarating thrill activities, medical coverage is definitely necessary. Safety Wing nomad insurance covers anything from ambulance rides to hospital stays (including intensive care). Some exclusions do apply so make sure to check the fine print on all SafetyWing nomad insurance policies .

- Cough, cough, achoo: Dancing in the rain in Tuscany was 100% worth it, but the cold you got in return will just not go away. In fact, it turns into pretty serious No problem. Safety Wing has you covered. As long as your medical issues do not stem from a pre-existing condition (see policies for more detailed information), you can receive medical care and get back to your adventures as a happy, healthy nomad.

- COVID-19: This is one we can not forget to mention. A new policy for COVID-19 coverage from SafetyWing can be found on their website. Their coverage may include testing and quarantine if deemed necessary by a medical professional. Please check all policies, terms, and conditions for more detailed information.

- Monkey or snake bite: Ok, that’s a little extreme, but you get the point. Anything can happen from natural disasters to political strife and serious injury. Sometimes what you least expect to happen, happens. No one ever wants their travel to abruptly come to an end, but sometimes in severe cases evacuation or relocation is necessary. Having nomad insurance in your back pocket (or your fanny pack) lets your breath easy, knowing that you will be covered if disaster strikes.

- Always read the small print before buying a policy and make sure that everything you might need is covered.

- When you need to renew make sure you are allowed to buy the policy when already traveling. With SafetyWing your insurance automatically extends every 28 days until you pick an end date. It’s just like a subscription so you never have to pay for coverage you don’t need.

- Medical coverage is the most important part of travel insurance, nothing else matters if you don’t have your health. Make sure the policy you buy includes emergency evacuation and repatriation.

- Are you covered in your home country as well? With SafetyWing you keep your medical coverage for 30 days in your home country after being abroad for 90 days. (15 days if your home country is the U.S.)

- Double-check which activities and sports your insurance covers, especially if you are going to be doing things like quad biking, spelunking and white water rafting. You might need to pay extra to include high-risk activities. You can find a list of the sports and activities covered by SafetyWing here .

- If you travel with expensive electronics like a camera or laptop you might need to buy additional coverage. The same goes for expensive clothes and accessories, make sure to check how much the policy you consider covers if your luggage is lost or destroyed.

- It’s often cheaper to exclude the US, so only choose a worldwide policy if you don’t know where you’ll be traveling to or you don’t want to limit yourself.

- Check the deductible (the amount of money that you are responsible for paying toward an insurance claim). The higher the deductible the cheaper the policy, but make sure you can actually afford the deductible.

Convinced yet that you need to acquire travel insurance?

If so, follow this link to the SafetyWing Nomad Insurance page. Here you can easily sign-up and find information on their current insurance policies including Nomad Insurance and Remote Health. Read through the Nomad Insurance specifics , even the small print and decide if SafetyWing covers everything you need in a travel insurance.

The best part about the SafetyWing Nomad Insurance is that it can be customizable to your needs as far as when to start and end. Like a subscription-based service, your insurance will be automatically extended every 28 days.

So, no trying to remember to re-enroll. You can keep exploring without having the nagging feeling that you have forgotten something yet again. Completely focus on your travels with peace of mind that you are covered with SafetyWing Nomad Insurance.

Again, you can find my complete SafetyWing review here where I talk about the positives but also the limitations of the Nomad Insurance.

Have you bought travel insurance when you were already abroad before?

About Charlotte

Charlotte is the passionate traveler and online business coach behind Sunshine Seeker. She started working as a content creator on Instagram in 2014, before social media was even a thing, and as a travel blogger in 2015. Over the past 14 years she has explored 45+ countries and lived in Oslo, Kraków, Bali and Lombok. Every month she helps more than 50,000 people plan their adventures and learn how to create more freedom by working online.

You’ll Also Love

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

12 hidden gems in Spain that aren’t on your bucket list (but should be)

Join the travel creator club.

Sign up to receive one of my favorite Lightroom presets + my tour/product collab pitch template!

By clicking "SEND" you confirm that you want to join our mailing list and that you have read our Privacy policy .

I’m social…sort of!

Join me on Instagram

- Privacy Policy

- Affiliate Disclosure

- Terms & Conditions

As an Amazon Associate, I earn from qualifying purchases.

Copyright © 2024 Sunshine Seeker

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Can I Buy Travel Insurance After Booking?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

When can you buy travel insurance?

When is the best time to buy travel insurance, when is it too late to buy travel insurance, if you want to buy travel insurance after booking.

When you’re planning a trip away from home, travel insurance provides peace of mind, especially for pricey vacations. Maybe you’ve already started booking a trip and only now realized travel insurance might be a good idea. You may be wondering, “Can I buy travel insurance after booking my trip or purchasing plane tickets?”

The short answer is: Yes, you can.

However, timing is everything when it comes to buying travel insurance — and some options won’t be available if you wait too long. Here's a look at buying travel insurance, the best times to purchase it and when it’s too late to get it.

Depending on what you’re doing, travel insurance can provide coverage for a variety of situations, including medical care, trip delays, lost luggage and even trip cancellation.

If travel insurance is something you’re considering, you’ll want to purchase it sooner rather than later — but not before booking your travel.

Many travel credit cards come with complimentary travel insurance .

Before booking

You won’t want to buy insurance before you book any travel, especially if you aren’t firm on your plans. Policies such as trip cancellation insurance are meant to protect you against nonrefundable losses that you have incurred. If you haven’t booked your travel yet, you won’t know your out-of-pocket costs or how much coverage you’ll need.

After booking

While it’s not recommended to purchase travel insurance before booking travel, you’ll want to do so as soon as your reservations are made. At this point, you can expect to see the greatest number of options to choose from, including Cancel For Any Reason insurance .

It is possible to purchase travel insurance up until the very last minute — most insurance companies will allow you to buy a policy until the day before departure. Keep in mind that your options will be limited if you wait, however, and some benefits such as trip cancellation and interruption may no longer be available.

» Learn more: How to find the best travel insurance

The best time to purchase travel insurance is as soon as your reservations have been made. Waiting a long period of time after booking your trip can make you ineligible for certain types of insurance. Examples of this include:

Pre-existing medical condition insurance. This is time-sensitive insurance and allows for treatment for existing medical conditions if they’re aggravated by travel. You’ll need to be medically fit to travel at the time you purchase this coverage. You must also insure 100% of your trip. Finally, the time period you have to buy the insurance will vary according to the provider; generally, you’ll be expected to purchase this 10 to 21 days after first putting down a deposit.

Cancel For Any Reason insurance. As the name suggests, this insurance allows you to cancel your trip and receive a portion of your nonrefundable costs back, no matter the reason why you’re canceling. Typically, you’ll need to purchase CFAR insurance 10 to 21 days after putting down your initial deposit. Providers may also require you to cancel your trip earlier than 48 to 72 hours before your scheduled departure.

Finally, your ability to buy travel insurance evaporates if you aren’t already covered when an event arises. Just like you are unable to buy cell phone insurance when you’ve already cracked your screen, you can’t buy most types of travel insurance if your trip has already been affected.

Let’s say that you booked a trip to France last June. You’ve been intending to buy trip cancellation insurance but have been putting it off. However, just two weeks before you’re set to leave, you slip down a set of stairs and break your leg. Now you’re rocking a set of crutches and there’s no way you’re fitting in that economy class seat you’d booked.

Trip cancellation insurance would have covered you for any nonrefundable purchases you’d made due to your unforeseen injury. But now that your leg is already broken, it’s no longer an option. Because trip cancellation insurance isn’t retroactive, you’ll just have to absorb the cost.

» Learn more: Trip cancellation insurance explained

How close to a trip can you buy insurance? We’ve outlined some specific situations above in which you’re no longer able to buy travel insurance, including time-sensitive policies that must be purchased soon after you make your reservations.

Otherwise, you’re able to buy most types of travel insurance all the way until the day before you begin traveling. Any time after that — even 12:01 a.m. on your departure date — and it’s too late to insure your trip.

Can you buy travel insurance at the airport?

No, you can’t buy travel insurance at the airport. You also can’t buy it when you’ve already boarded your cruise, you’ve chosen not to attend a tour or your flight is so late it causes you to miss your connection.

» Learn more: What does travel insurance cover?

Travel insurance can be a good idea for many reasons, especially if you’re worried about anything going wrong during your trip or if you’ve invested a lot of money into a vacation. Happily, for procrastinators, most types of travel insurance are available after you’ve already booked your travel. You’ll simply need to make the purchase at least one day before travel.

However, there are some types of coverage that you’ll need to buy soon after booking or they won’t be available. These include Cancel for Any Reason insurance as well as pre-existing medical condition insurance. So if you are interested in buying travel insurance, purchasing a policy soon after booking your trip is the best way to go.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Travel Insurance After Departure

Instant Policy Delivery

Secure Online Purchase

Range of Working Activities

Six Different Policies

Option to Extend Duration

Cover for UK Residents

Wide Range of Sports

24 Hr Medical Assistance

TRAVEL INSURANCE AFTER DEPARTURE

Are you looking for travel insurance but you’ve already left home? It is a condition of most travel insurance policies in the UK that you have to have purchased a policy before you’ve left home, with the start date of your trip needing to match your UK departure. However, there are many circumstances where travellers can find themselves already abroad with no travel insurance, and it can be a real problem to arrange cover when this happens.

The main reason that most travel insurance companies will not issue cover after a departure is that it is quite common for people to not purchase insurance but then encounter a problem on their travels. They will then try to put travel insurance cover in place in an attempt to make a fraudulent claim. Unfortunately, this makes it difficult for those who genuinely find themselves in a situation with no cover and a need to purchase immediate travel insurance.

But, have no fear, as here at Navigator Travel Insurance it is possible to purchase post-departure travel insurance in the UK. For those hoping to learn more about the conditions of buying travel insurance when already travelling, our experts have composed this article and are on hand to talk you through it.

POLICIES FOR TRAVEL INSURANCE AFTER DEPARTURE

The only already abroad travel insurance sales that we can make after you have left the UK (or EU) are the Single Trip Short Stay and Single Trip Long Stay versions of the Navigator Silver, Navigator Gold, and Navigator Diamond policies. This doesn’t apply to the Annual Multi-Trip option offered on these policies.

IMPORTANT CONSIDERATIONS WHEN PURCHASING POST-DEPARTURE TRAVEL INSURANCE IN THE UK

Whilst we do offer travel insurance for already travelling individuals on our aforementioned policies, several considerations need to be made before choosing the right policy for you:

THERE IS A 25% SUPPLEMENT FOR AFTER-DEPARTURE POLICIES

With our post-departure travel insurance policies, a 25% supplement will be added on top of the usual travel insurance policy fees. This will be applied automatically when you select “After-departure cover” on the options page of our website. We cannot offer cover if you are currently in a country against the Foreign, Commonwealth, and Development (FCDO) advice.

In the UK, you must consider the UK’s FCDO advice before you choose to travel to any destination. If the FCDO has travel advice in place which states that it “advises against all or all but essential travel”, our post-departure travel insurance policies are not valid. This same condition applies to many travel insurance policies from other providers.

HOW TO PURCHASE OUR AFTER-DEPARTURE TRAVEL INSURANCE POLICIES

When you’re purchasing our travel insurance policies, you will be offered a tick box option for “already departed cover”. You must tick this box to gain travel insurance whilst already travelling. When you tick this box, it will automatically increase the cost by 25%, which is the after-departure supplement that we previously mentioned.

If you are not offered this tick box option for “already departed cover”, you are not buying the right policy and it will be invalid. Navigator Silver, Navigator Gold, and Navigator Diamond Single Trip or Long Stay travel insurance policies are the only policies that will offer you this tick box and therefore offer you cover when you’re already travelling.

ANNUAL MULTI-TRIP POLICIES ARE INVALID IF PURCHASED AFTER DEPARTURE

If you are buying post-departure travel insurance online, you will be offered Annual Multi-Trip, Single Trip, and Long Stay policies to choose from. As previously mentioned, ignore the Annual Multi-Trip policy option as these can’t be purchased after departure.

Travel insurance policies issued after departure always exclude any claim that arises from any situation such as illness, theft, or otherwise that predates the date of inception of the policy. This seems obvious, but it is emphasised to ensure that it is understood that insurance cannot be arranged retrospectively or backdated in any way, and claims will not be considered if the incident or illness giving rise to the claim predates the policy issue.

POST DEPARTURE TRAVEL INSURANCE DURATIONS

The already travelling insurance policy that you buy must match the overall duration of the trip that you are on. The Single Trip option is only for trips that do not exceed 62 days from the date that you left home. If your overall trip is going to be longer than 62 days from the date that you left home, you must select our Long Stay policy option, otherwise, the policy will not be valid.

ALREADY DEPARTED TRAVEL INSURANCE COVER: THE CONDITIONS